Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HEALTHCARE REALTY TRUST INC | exhibit991thirdquarter2017.htm |

| 8-K - 8-K - HEALTHCARE REALTY TRUST INC | hr-2017930xearnings8xk.htm |

3Q | 2017

Supplemental Information

FURNISHED AS OF NOVEMBER 1, 2017 (UNAUDITED)

Forward looking statements and risk factors:

This Supplemental Information report contains disclosures that are “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts and can be identified by the use of words and phrases such as “can,” “may,” “payable,” “indicative,” “annualized,” “expect,” “expected,” “future cash or NOI,” “deferred revenue,” “rent increases,” “range of expectations,” "budget," “components of expected 2017 FFO,” and other comparable terms in this report. These forward-looking statements are made as of the date of this report and are not guarantees of future performance. These statements are based on the current plans and expectations of Company management and are subject to a number of unknown risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from those described in this release or implied by such forward-looking statements. Such risks and uncertainties include, among other things, the following: changes in the economy; increases in interest rates; the availability and cost of capital at expected rates; changes to facility-related healthcare regulations; competition for quality assets; negative developments in the operating results or financial condition of the Company's tenants, including, but not limited to, their ability to pay rent and repay loans; the Company's ability to reposition or sell facilities with profitable results; the Company's ability to re-lease space at similar rates as vacancies occur; the Company's ability to renew expiring long-term single-tenant net leases; the Company's ability to timely reinvest proceeds from the sale of assets at similar yields; government regulations affecting tenants' Medicare and Medicaid reimbursement rates and operational requirements; unanticipated difficulties and/or expenditures relating to future acquisitions and developments; changes in rules or practices governing the Company's financial reporting; the Company may be required under purchase options to sell properties and may not be able to reinvest the proceeds from such sales at rates of return equal to the return received on the properties sold; uninsured or underinsured losses related to casualty or liability; the incurrence of impairment charges on its real estate properties or other assets; and other legal and operational matters. Other risks, uncertainties and factors that could cause actual results to differ materially from those projected are detailed under the heading “Risk Factors,” in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) for the year ended December 31, 2016 and other risks described from time to time thereafter in the Company's SEC filings. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

HEALTHCARE REALTY 2 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Table of Contents |

4 | Highlights | ||

6 | Quick Facts | ||

7 | Corporate Information | ||

8 | Balance Sheet Information | ||

9 | Statements of Income Information | ||

10 | FFO, Normalized FFO & FAD | ||

11 | Capital Funding and Commitments | ||

12 | Debt Metrics | ||

13 | Investment Activity | ||

14 | Portfolio by Market | ||

15 | Square Feet by Health System | ||

16 | Square Feet by Proximity | ||

17 | Lease Maturity, Lease and Building Size | ||

18 | Occupancy Information | ||

20 | Same Store Leasing Statistics | ||

21 | Same Store Properties | ||

22 | Reconciliation of NOI | ||

23 | Reconciliation of EBITDA | ||

24 | Components of Net Asset Value | ||

25 | Components of Expected 2017 FFO | ||

Copies of this report may be obtained at www.healthcarerealty.com or by contacting Investor Relations at 615.269.8175 or communications@healthcarerealty.com. | |||

HEALTHCARE REALTY 3 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Highlights |

QUARTERLY HIGHLIGHTS

• | Normalized FFO for the third quarter totaled $45.2 million, or $0.38 per share. |

• | For the trailing twelve months ended September 30, 2017, same store revenue grew 2.8%, operating expenses increased 0.9%, and same store NOI grew 3.9%: |

• | Same store revenue per average occupied square foot increased 2.0%. |

• | Average same store occupancy increased to 89.6% from 88.9%. |

• | Four predictive growth measures in the same store multi-tenant portfolio: |

• | In-place contractual rent increases averaged 2.8%, up from 2.7% a year ago. |

• | Cash leasing spreads were 4.6% on 385,000 square feet renewed: |

◦ | 1% (<0% spread) |

◦ | 11% (0-3%) |

◦ | 52% (3-4%) |

◦ | 36% (>4%) |

• | Tenant retention was 80.5%. |

• | The average yield on renewed leases increased 60 basis points. |

• | Leasing activity in the third quarter totaled 558,000 square feet related to 147 leases: |

• | 421,000 square feet of renewals |

• | 137,000 square feet of new and expansion leases |

• | Acquisitions totaled $141.1 million since the end of the second quarter: |

• | In July 2017, the Company purchased a medical office building on HCA's West Hills Hospital and Medical Center campus in Los Angeles for $16.3 million. The building is 43,000 square feet, 93% leased, and immediately adjacent to the West Hills Medical Center MOB that Healthcare Realty acquired in May 2016. |

• | In November 2017, the Company closed on four of the eight medical office buildings from the previously announced Atlanta portfolio transaction for an aggregate purchase price of $112.1 million. The four properties are 96% leased and include two buildings totaling 151,000 square feet on the WellStar Paulding Hospital campus, one building totaling 118,000 square feet on the WellStar Kennestone Hospital campus, and one off-campus building totaling 20,000 square feet that is 100% leased to Piedmont Healthcare. The four remaining properties are expected to close in mid-December 2017, subject to timing of loan assumptions. |

• | In November 2017, the Company purchased a medical office building adjacent to the Overlake Hospital Medical Center campus in Seattle for $12.7 million. The building is 26,000 square feet, 96% leased, and is adjacent to the Overlake Medical Pavilion which Healthcare Realty developed in October 2011. |

• | On August 14, 2017, the Company completed the sale of 8.3 million shares of common stock for net proceeds of $247.1 million to fund investment activity and repay debt obligations. |

• | On November 1, 2017, the Company redeemed $100.0 million of its $400.0 million outstanding 5.75% Senior Notes due 2021. |

• | A dividend of $0.30 per common share was declared, which is equal to 78.9% of normalized FFO per share. |

OTHER ITEMS OF NOTE

• | In October, the Company received notice from a tenant of its intent to exercise a fixed-price purchase option on seven properties in Roanoke, Virginia for approximately $45.2 million. The Company recognized approximately $4.7 million of NOI from these properties during the nine months ended September 30, 2017. The sale of these properties is expected to occur in April 2018. Additional information is available on page 26 of the Company's 2016 Form 10-K and page 20 of the Company's third quarter 2017 Form 10-Q. |

HEALTHCARE REALTY 4 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Highlights |

OTHER ITEMS OF NOTE (CONTINUED)

• | On November 1, 2017, the Company redeemed $100.0 million of its 5.75% unsecured senior notes due 2021 and paid a make-whole premium of $11.7 million. The bonds have an effective rate of 5.97% including the original discount, and the redemption has an effective interest rate savings of 5.34% including the make-whole premium. |

• | The August equity offering, the Atlanta portfolio transaction, and the partial bond redemption have the following sequential impact on quarterly FFO per share: |

◦ | Second quarter to third quarter 2017: Third quarter FFO decreased by approximately $0.01 per share compared to the second quarter due to the following changes: |

• | The August 14th equity offering of 8.3 million shares added 4.4 million shares to the weighted average shares outstanding for the third quarter. |

• | No NOI contribution from the Atlanta portfolio (closings throughout the fourth quarter). |

• | No interest savings from the partial bond redemption (closed November 1st). |

◦ | Third quarter to fourth quarter 2017: There is no expected sequential increase in FFO per share in the fourth quarter from these transactions due to the following changes: |

• | 3.9 million shares added to the weighted average shares outstanding from the August equity offering (the full 8.3 million shares are reflected). |

• | Atlanta portfolio NOI contribution of $1.2 million (properties owned only for partial quarter). |

• | Interest savings of $0.9 million from the November 1st bond redemption, partially offset by the interest on assumed Atlanta mortgages. |

◦ | Fourth quarter 2017 to first quarter 2018: First quarter 2018 FFO is expected to increase by $0.01 per share due to the following changes: |

• | No increase in the weighted average shares outstanding from the August equity offering (full 8.3 million shares). |

• | Additional Atlanta portfolio NOI contribution of $1.4 million ($2.6 million NOI for full quarter). |

• | Interest expense of $0.1 million from interest on the assumed Atlanta mortgages, partially offset by the November 1st bond redemption. |

HEALTHCARE REALTY 5 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Quick Facts |

as of 9/30/17 |

Properties | |||

$3.6B | Invested in 197 properties | ||

14.4M SF | Owned in 26 states | ||

11.2M SF | Managed internally | ||

93 | % | Medical office and outpatient | |

86 | % | On/adjacent to hospital campuses | |

3.9 | % | Same store NOI growth (TTM) | |

Capitalization | |||

$5.2B | Enterprise value as of 10/27/17 | ||

$4.0B | Market capitalization as of 10/27/17 | ||

124.9 | Shares outstanding | ||

$0.30 | Quarterly dividend | ||

BBB/Baa2 | Credit rating | ||

22.5 | % | Debt to enterprise value | |

3.8x | Net debt to EBITDA | ||

MOB PROXIMITY TO HOSPITAL (% of SF) | ||||

On campus | 68 | % | ||

Adjacent to campus | 18 | % | ||

Total on/adjacent | 86 | % | ||

Anchored | 8 | % | ||

Off campus | 6 | % | ||

Total | 100 | % | ||

HEALTH SYSTEM BY RANK (% of SF) | ||||

MOB/OUTPATIENT | TOTAL | |||

Top 25 | 52 | % | 50 | % |

Top 50 | 70 | % | 68 | % |

Top 75 | 78 | % | 76 | % |

Top 100 | 81 | % | 79 | % |

MSA BY RANK (% of SF) | ||||

MOB/OUTPATIENT | TOTAL | |||

Top 25 | 61 | % | 58 | % |

Top 50 | 84 | % | 80 | % |

Top 75 | 88 | % | 83 | % |

Top 100 | 92 | % | 89 | % |

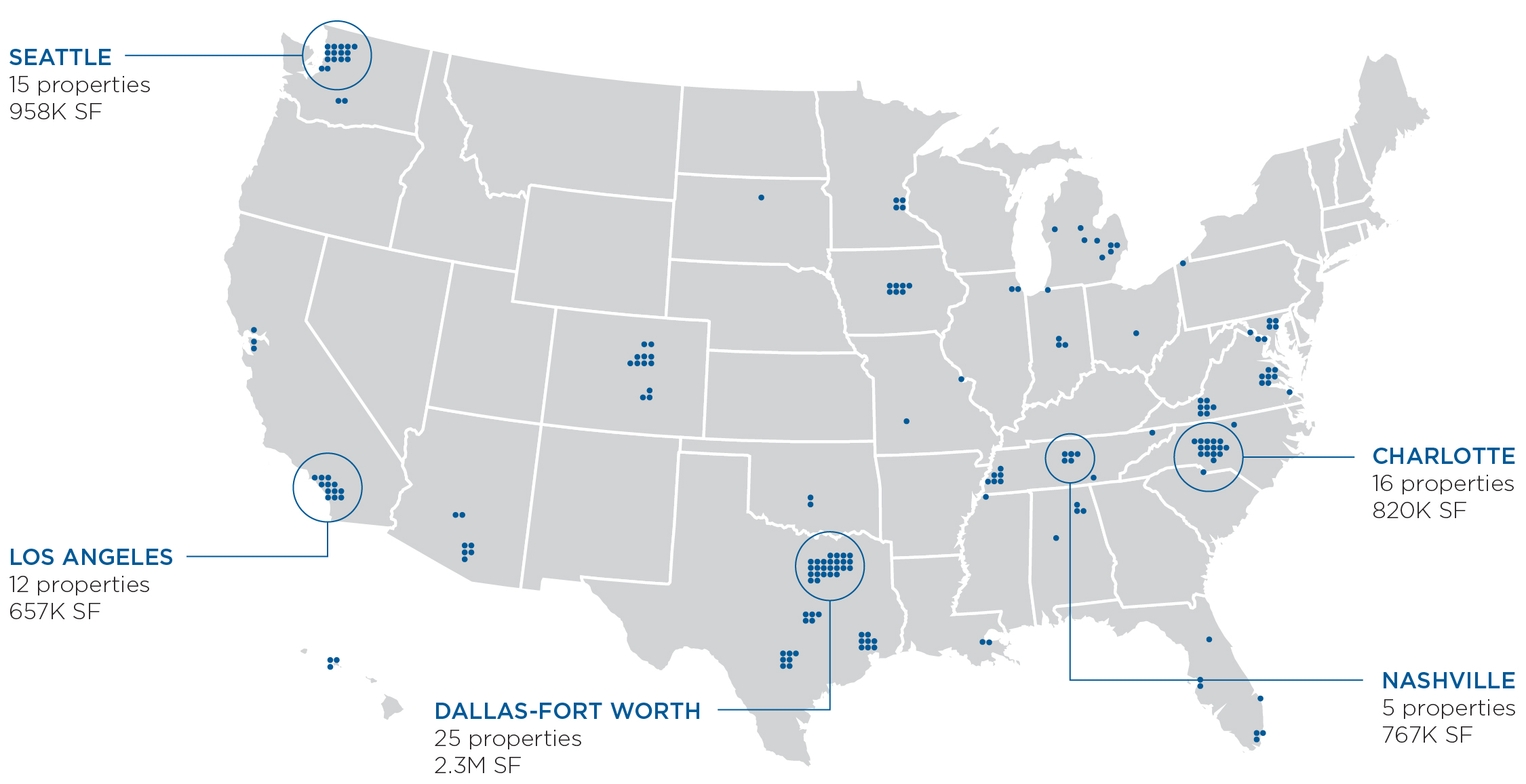

HEALTHCARE REALTY'S TOP MARKETS | ||||

HEALTHCARE REALTY 6 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Corporate Information |

Healthcare Realty Trust is a real estate investment trust that integrates owning, managing, financing and developing income-producing real estate properties associated primarily with the delivery of outpatient healthcare services throughout the United States. As of September 30, 2017, the Company owned 197 real estate properties in 26 states totaling 14.4 million square feet and was valued at approximately $5.2 billion. The Company provided leasing and property management services to 11.2 million square feet nationwide.

CORPORATE HEADQUARTERS

Healthcare Realty Trust Incorporated

3310 West End Avenue, Suite 700

Nashville, Tennessee 37203

Phone 615.269.8175 Fax 615.269.8461

communications@healthcarerealty.com

www.healthcarerealty.com

Executive Officers | ||

David R. Emery | Executive Chairman of the Board | |

Todd J. Meredith | President and Chief Executive Officer | |

John M. Bryant, Jr. | Executive Vice President and General Counsel | |

J. Christopher Douglas | Executive Vice President and Chief Financial Officer | |

Robert E. Hull | Executive Vice President - Investments | |

B. Douglas Whitman, II | Executive Vice President - Corporate Finance | |

Board of Directors | ||

David R. Emery | Executive Chairman of the Board, Healthcare Realty Trust Incorporated | |

Nancy H. Agee | President and Chief Executive Officer, Carilion Clinic | |

C. Raymond Fernandez, M.D. | Retired Chief Executive Officer, Piedmont Clinic | |

Peter F. Lyle | Vice President, Medical Management Associates, Inc. | |

Todd Meredith | President and Chief Executive Officer, Healthcare Realty Trust Incorporated | |

Edwin B. Morris III | Managing Director, Morris & Morse Company, Inc. | |

J. Knox Singleton | President and Chief Executive Officer, Inova Health System | |

Bruce D. Sullivan | Retired Audit Partner, Ernst & Young LLP | |

Christann M. Vasquez | President, Dell Seton Medical Center at University of Texas, Seton Medical Center Austin and Seton Shoal Creek Hospital | |

Analyst Coverage | ||||

BMO Capital Markets | J.P. Morgan Securities LLC | Mizuho Securities USA Inc. | ||

BTIG, LLC | Jefferies LLC | Stifel, Nicolaus & Company, Inc. | ||

Cantor Fitzgerald, L.P. | JMP Securities LLC | SunTrust Robinson Humphrey, Inc. | ||

Green Street Advisors, Inc. | Morgan Stanley | Wells Fargo Securities, LLC | ||

J.J.B. Hilliard W.L. Lyons, LLC | KeyBanc Capital Markets Inc. | |||

HEALTHCARE REALTY 7 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Balance Sheet Information |

(dollars in thousands, except per share data) |

ASSETS | ||||||||||||||||

2017 | 2016 | |||||||||||||||

Real estate properties: | Q3 | Q2 | Q1 | Q4 | Q3 | |||||||||||

Land | $196,217 | $193,072 | $193,101 | $199,672 | $206,647 | |||||||||||

Buildings, improvements and lease intangibles | 3,400,224 | 3,388,734 | 3,327,529 | 3,386,480 | 3,322,293 | |||||||||||

Personal property | 10,300 | 10,155 | 9,998 | 10,291 | 10,124 | |||||||||||

Construction in progress | 1,138 | — | 16,114 | 11,655 | 45,734 | |||||||||||

Land held for development | 20,123 | 20,123 | 20,123 | 20,123 | 17,438 | |||||||||||

Total real estate properties | 3,628,002 | 3,612,084 | 3,566,865 | 3,628,221 | 3,602,236 | |||||||||||

Less accumulated depreciation and amortization | (888,875 | ) | (864,573 | ) | (841,296 | ) | (840,839 | ) | (835,276 | ) | ||||||

Total real estate properties, net | 2,739,127 | 2,747,511 | 2,725,569 | 2,787,382 | 2,766,960 | |||||||||||

Cash and cash equivalents | 196,981 | 2,033 | 1,478 | 5,409 | 12,649 | |||||||||||

Restricted cash | — | 9,151 | 104,904 | 49,098 | — | |||||||||||

Assets held for sale and discontinued operations, net | 8,772 | 8,767 | 15,111 | 3,092 | 14,732 | |||||||||||

Other assets | 200,824 | 191,036 | 192,174 | 195,666 | 197,380 | |||||||||||

Total assets | $3,145,704 | $2,958,498 | $3,039,236 | $3,040,647 | $2,991,721 | |||||||||||

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||||

Liabilities: | ||||||||||||||||

Notes and bonds payable | $1,166,060 | $1,203,146 | $1,278,662 | $1,264,370 | $1,239,062 | |||||||||||

Accounts payable and accrued liabilities | 69,918 | 62,121 | 62,746 | 78,266 | 71,052 | |||||||||||

Liabilities of properties held for sales and discontinued operations | 59 | 398 | 93 | 614 | 572 | |||||||||||

Other liabilities | 45,405 | 46,556 | 44,444 | 43,983 | 46,441 | |||||||||||

Total liabilities | 1,281,442 | 1,312,221 | 1,385,945 | 1,387,233 | 1,357,127 | |||||||||||

Commitments and contingencies | ||||||||||||||||

Stockholders' equity: | ||||||||||||||||

Preferred stock, $.01 par value; 50,000 shares authorized | — | — | — | — | — | |||||||||||

Common stock, $.01 par value; 300,000 shares authorized | 1,249 | 1,165 | 1,165 | 1,164 | 1,160 | |||||||||||

Additional paid-in capital | 3,173,167 | 2,923,519 | 2,920,839 | 2,917,914 | 2,916,816 | |||||||||||

Accumulated other comprehensive loss | (1,274 | ) | (1,316 | ) | (1,358 | ) | (1,401 | ) | (1,443 | ) | ||||||

Cumulative net income attributable to common stockholders | 1,055,499 | 1,052,326 | 1,027,101 | 995,256 | 942,819 | |||||||||||

Cumulative dividends | (2,364,379 | ) | (2,329,417 | ) | (2,294,456 | ) | (2,259,519 | ) | (2,224,758 | ) | ||||||

Total stockholders' equity | 1,864,262 | 1,646,277 | 1,653,291 | 1,653,414 | 1,634,594 | |||||||||||

Total liabilities and stockholders' equity | $3,145,704 | $2,958,498 | $3,039,236 | $3,040,647 | $2,991,721 | |||||||||||

HEALTHCARE REALTY 8 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Statements of Income Information |

(dollars in thousands) |

2017 | 2016 | 2015 | ||||||||||||||||||||||||

Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | |||||||||||||||||||

Revenues | ||||||||||||||||||||||||||

Rental income | $106,561 | $104,869 | $104,088 | $104,736 | $102,534 | $101,472 | $98,740 | $97,466 | ||||||||||||||||||

Other operating | 392 | 376 | 481 | 573 | 1,125 | 1,170 | 1,281 | 1,116 | ||||||||||||||||||

106,953 | 105,245 | 104,569 | 105,309 | 103,659 | 102,642 | 100,021 | 98,582 | |||||||||||||||||||

Expenses | ||||||||||||||||||||||||||

Property operating | 40,626 | 38,184 | 37,834 | 37,285 | 37,504 | 36,263 | 35,406 | 36,758 | ||||||||||||||||||

General and administrative | 8,021 | 8,005 | 8,694 | 7,622 | 7,859 | 7,756 | 8,072 | 5,975 | ||||||||||||||||||

Acquisition and pursuit costs (1) | 507 | 785 | 586 | 1,085 | 865 | 373 | 2,174 | 1,241 | ||||||||||||||||||

Depreciation and amortization | 35,873 | 34,823 | 34,452 | 34,022 | 31,985 | 31,290 | 30,393 | 29,575 | ||||||||||||||||||

Bad debts, net of recoveries | 14 | 105 | 66 | (13 | ) | (47 | ) | 78 | (39 | ) | 9 | |||||||||||||||

85,041 | 81,902 | 81,632 | 80,001 | 78,166 | 75,760 | 76,006 | 73,558 | |||||||||||||||||||

Other income (expense) | ||||||||||||||||||||||||||

Gain on sales of real estate properties | (7 | ) | 16,124 | 23,403 | 41,037 | — | 1 | — | 9,138 | |||||||||||||||||

Interest expense | (14,107 | ) | (14,315 | ) | (14,272 | ) | (13,839 | ) | (13,759 | ) | (14,815 | ) | (14,938 | ) | (14,885 | ) | ||||||||||

Pension termination | — | — | — | — | — | (4 | ) | — | — | |||||||||||||||||

Impairment of real estate assets | (5,059 | ) | (5 | ) | (323 | ) | — | — | — | — | (1 | ) | ||||||||||||||

Interest and other income, net | 426 | 77 | 113 | 74 | 123 | 93 | 86 | 78 | ||||||||||||||||||

(18,747 | ) | 1,881 | 8,921 | 27,272 | (13,636 | ) | (14,725 | ) | (14,852 | ) | (5,670 | ) | ||||||||||||||

Income from continuing operations | 3,165 | 25,224 | 31,858 | 52,580 | 11,857 | 12,157 | 9,163 | 19,354 | ||||||||||||||||||

Discontinued Operations | ||||||||||||||||||||||||||

Income (loss) from discontinued operations | 8 | — | (18 | ) | (22 | ) | (23 | ) | (19 | ) | (7 | ) | (10 | ) | ||||||||||||

Impairments of real estate assets | — | — | — | (121 | ) | — | — | — | (686 | ) | ||||||||||||||||

Gain on sales of real estate properties | — | — | 5 | — | — | 7 | — | — | ||||||||||||||||||

Income (loss) from discontinued operations | 8 | — | (13 | ) | (143 | ) | (23 | ) | (12 | ) | (7 | ) | (696 | ) | ||||||||||||

Net income | $3,173 | $25,224 | $31,845 | $52,437 | $11,834 | $12,145 | $9,156 | $18,658 | ||||||||||||||||||

(1) | Includes third party and travel costs related to the pursuit of acquisitions and developments. |

HEALTHCARE REALTY 9 | 3Q 2017 SUPPLEMENTAL INFORMATION |

FFO, Normalized FFO & FAD (1)(2) |

(amounts in thousands, except per share data) |

2017 | 2016 | 2015 | ||||||||||||||||||||||||

Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | |||||||||||||||||||

Net income | $3,173 | $25,224 | $31,845 | $52,437 | $11,834 | $12,145 | $9,156 | $18,658 | ||||||||||||||||||

Gain on sales of real estate properties | 7 | (16,124 | ) | (23,408 | ) | (41,037 | ) | — | (8 | ) | — | (9,138 | ) | |||||||||||||

Impairments of real estate assets | 5,059 | 5 | 323 | 121 | — | — | — | 687 | ||||||||||||||||||

Real estate depreciation and amortization | 36,478 | 35,421 | 35,555 | 34,699 | 32,557 | 31,716 | 30,800 | 29,907 | ||||||||||||||||||

Total adjustments | 41,544 | 19,302 | 12,470 | (6,217 | ) | 32,557 | 31,708 | 30,800 | 21,456 | |||||||||||||||||

FFO attributable to common stockholders | $44,717 | $44,526 | $44,315 | $46,220 | $44,391 | $43,853 | $39,956 | $40,114 | ||||||||||||||||||

Acquisition and pursuit costs (3)(4) | 507 | 785 | 586 | 915 | 649 | 232 | 1,618 | 1,068 | ||||||||||||||||||

Write-off of deferred financing costs upon amendment of line of credit facility | — | — | — | — | 81 | — | — | — | ||||||||||||||||||

Pension termination | — | — | — | — | — | 4 | — | — | ||||||||||||||||||

Reversal of restricted stock amortization upon director / officer resignation | — | — | — | — | — | — | — | (40 | ) | |||||||||||||||||

Revaluation of awards upon retirement | — | — | — | — | — | — | 89 | — | ||||||||||||||||||

Normalized FFO attributable to common stockholders | $45,224 | $45,311 | $44,901 | $47,135 | $45,121 | $44,089 | $41,663 | $41,142 | ||||||||||||||||||

Non-real estate depreciation and amortization | 1,388 | 1,369 | 1,355 | 1,339 | 1,386 | 1,360 | 1,390 | 1,341 | ||||||||||||||||||

Provision for bad debt, net | 4 | 105 | 66 | (13 | ) | (47 | ) | 78 | (39 | ) | 9 | |||||||||||||||

Straight-line rent receivable, net | (1,156 | ) | (1,623 | ) | (1,595 | ) | (1,595 | ) | (1,684 | ) | (1,907 | ) | (1,948 | ) | (1,741 | ) | ||||||||||

Stock-based compensation | 2,429 | 2,453 | 2,614 | 1,949 | 1,851 | 1,850 | 1,859 | 1,511 | ||||||||||||||||||

Non-cash items | 2,665 | 2,304 | 2,440 | 1,680 | 1,506 | 1,381 | 1,262 | 1,120 | ||||||||||||||||||

2nd Generation TI | (4,481 | ) | (3,680 | ) | (5,277 | ) | (7,918 | ) | (6,013 | ) | (5,559 | ) | (4,202 | ) | (3,081 | ) | ||||||||||

Leasing commissions paid | (1,826 | ) | (984 | ) | (1,584 | ) | (1,030 | ) | (1,514 | ) | (1,587 | ) | (1,079 | ) | (1,856 | ) | ||||||||||

Capital additions | (4,203 | ) | (5,667 | ) | (2,520 | ) | (4,283 | ) | (5,088 | ) | (5,653 | ) | (2,098 | ) | (3,918 | ) | ||||||||||

Funds Available for Distribution | $37,379 | $37,284 | $37,960 | $35,584 | $34,012 | $32,671 | $35,546 | $33,407 | ||||||||||||||||||

FFO per Common Share - diluted | $0.37 | $0.38 | $0.38 | $0.40 | $0.39 | $0.42 | $0.39 | $0.40 | ||||||||||||||||||

Normalized FFO Per Common Share - diluted | $0.38 | $0.39 | $0.39 | $0.41 | $0.39 | $0.42 | $0.41 | $0.41 | ||||||||||||||||||

FAD Per Common Share - diluted | $0.31 | $0.32 | $0.33 | $0.31 | $0.30 | $0.31 | $0.35 | $0.33 | ||||||||||||||||||

FFO weighted average common shares outstanding - diluted (5) | 120,081 | 115,674 | 115,507 | 115,408 | 115,052 | 104,770 | 102,165 | 100,474 | ||||||||||||||||||

(1) | Funds from operations (“FFO”) and FFO per share are operating performance measures adopted by the National Association of Real Estate Investment Trusts, Inc. (“NAREIT”). NAREIT defines FFO as the most commonly accepted and reported measure of a REIT’s operating performance equal to “net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus depreciation and amortization (including amortization of leasing commissions), and after adjustments for unconsolidated partnerships and joint ventures.” |

(2) | FFO, Normalized FFO and Funds Available for Distribution ("FAD") do not represent cash generated from operating activities determined in accordance with accounting principles generally accepted in the United States of America and is not necessarily indicative of cash available to fund cash needs. FFO, Normalized FFO and FAD should not be considered alternatives to net income attributable to common stockholders as indicators of the Company's operating performance or as alternatives to cash flow as measures of liquidity. |

(3) | Acquisition and pursuit costs include third party and travel costs related to the pursuit of acquisitions and developments. Beginning in 2017, FFO and FAD are normalized for all acquisition and pursuit costs. Prior to 2017, FFO and FAD were normalized for acquisition and pursuit costs associated with only those acquisitions that closed in the period. These changes coincided with the Company's adoption of ASU 2017-01 which was effective January 1, 2017. |

(4) | For the first quarter of 2017, acquisition and pursuit costs were reduced by $24 thousand from what was previously reported to remove personnel costs. |

(5) | Diluted weighted average common shares outstanding for the three months ended September 30, 2017 includes the dilutive effect of nonvested share-based awards outstanding of 899,733 shares. |

HEALTHCARE REALTY 10 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Capital Funding and Commitments |

(dollars in thousands, except per square foot data) |

ACQUISITION AND RE/DEVELOPMENT FUNDING | ||||||||||

2017 | 2016 | |||||||||

Q3 | Q2 | Q1 | Q4 | Q3 | ||||||

Acquisitions | $16,300 | $50,786 | $13,513 | $63,775 | $98,290 | |||||

Re/development | 7,196 | 8,940 | 12,159 | 9,567 | 10,939 | |||||

1st generation TI & planned capital expenditures for acquisitions (1) | 1,586 | 1,380 | 1,212 | 4,807 | 4,471 | |||||

MAINTENANCE CAPITAL EXPENDITURES | ||||||||||

$ Spent | ||||||||||

2nd generation TI | $4,481 | $3,680 | $5,277 | $7,918 | $6,013 | |||||

Leasing commissions paid | 1,826 | 984 | 1,584 | 1,030 | 1,514 | |||||

Capital expenditures | 4,203 | 5,667 | 2,520 | 4,283 | 5,088 | |||||

Total | $10,510 | $10,331 | $9,381 | $13,231 | $12,615 | |||||

% of NOI | ||||||||||

2nd generation TI | 6.9 | % | 5.6 | % | 8.1 | % | 11.9 | % | 9.4 | % |

Leasing commissions paid | 2.8 | % | 1.5 | % | 2.4 | % | 1.6 | % | 2.4 | % |

Capital expenditures | 6.5 | % | 8.7 | % | 3.8 | % | 6.5 | % | 7.9 | % |

Total | 16.2 | % | 15.8 | % | 14.3 | % | 19.9 | % | 19.7 | % |

LEASING COMMITMENTS | ||||||||||

Renewals | ||||||||||

Square feet | 420,603 | 279,738 | 332,527 | 234,641 | 399,263 | |||||

2nd generation TI / square foot / lease year | $1.38 | $2.30 | $1.93 | $1.84 | $0.95 | |||||

Leasing commissions / square foot / lease year | $0.28 | $0.39 | $0.28 | $0.50 | $0.44 | |||||

New leases | ||||||||||

Square feet | 109,038 | 134,590 | 73,285 | 82,417 | 119,463 | |||||

2nd generation TI / square foot / lease year | $3.92 | $2.10 | $4.78 | $4.91 | $5.55 | |||||

Leasing commissions / square foot / lease year | $0.46 | $0.47 | $1.10 | $1.36 | $0.94 | |||||

All | ||||||||||

Square feet | 529,641 | 414,328 | 405,812 | 317,058 | 518,726 | |||||

2nd generation TI / square foot / lease year | $2.22 | $2.18 | $2.69 | $3.10 | $2.84 | |||||

Leasing commissions / square foot / lease year | $0.34 | $0.44 | $0.50 | $0.85 | $0.65 | |||||

% of annual net rent | 12.3 | % | 12.8 | % | 15.6 | % | 18.7 | % | 16.6 | % |

(1) | Planned capital expenditures for acquisitions include expected near-term fundings that were contemplated as part of the acquisition. |

HEALTHCARE REALTY 11 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Debt Metrics |

(dollars in thousands) |

SUMMARY OF INDEBTEDNESS | |||||||

Q3 2017 Interest Expense | Balance as of 9/30/2017 (1) | Weighted Months to Maturity | Effective Interest Rate | ||||

Senior Notes due 2021 (2) | $5,836 | $397,653 | 40 | 5.97 | % | ||

Senior Notes due 2023 | 2,393 | 247,601 | 67 | 3.95 | % | ||

Senior Notes due 2025 (3) | 2,469 | 247,987 | 91 | 4.08 | % | ||

Total Senior Notes Outstanding | $10,698 | $893,241 | 61 | 4.89 | % | ||

Unsecured credit facility due 2020 | 105 | — | 34 | 2.23 | % | ||

Unsecured term loan facility due 2019 | 931 | 149,667 | 17 | 2.43 | % | ||

Mortgage notes payable, net | 1,597 | 123,152 | 72 | 5.06 | % | ||

Total Outstanding Notes and Bonds Payable | $13,331 | $1,166,060 | 57 | 4.59 | % | ||

Interest cost capitalization | (197) | ||||||

Unsecured credit facility fee and deferred financing costs | 973 | ||||||

Total Quarterly Consolidated Interest Expense | $14,107 | ||||||

SELECTED FINANCIAL DEBT COVENANTS (4) | ||||||

Calculation | Requirement | TTM Ended 9/30/2017 | Pro-forma (5) | |||

Revolving credit facility and term loan | ||||||

Leverage ratio | Total debt / total capital | Not greater than 60% | 29.9 | % | 30.2 | % |

Secured leverage ratio | Total secured debt / total capital | Not greater than 30% | 3.1 | % | ||

Unencumbered leverage ratio | Unsecured debt / unsecured real estate | Not greater than 60% | 31.8 | % | ||

Fixed charge coverage ratio | EBITDA / fixed charges | Not less than 1.50x | 3.9x | |||

Unsecured coverage ratio | Unsecured EBITDA / unsecured interest | Not less than 1.75x | 4.3x | |||

Construction and development | CIP / total assets | Not greater than 15% | 0.0 | % | ||

Asset investments | Mortgages & unimproved land / total assets | Not greater than 20% | 0.6 | % | ||

Senior notes | ||||||

Incurrence of total debt | Total debt / total assets | Not greater than 60% | 29.1 | % | 29.5 | % |

Incurrence of debt secured by any lien | Secured debt / total assets | Not greater than 40% | 3.0 | % | ||

Maintenance of total unsecured assets | Unencumbered assets / unsecured debt | Not less than 150% | 351.9 | % | ||

Debt service coverage | EBITDA / interest expense | Not less than 1.5x | 4.3x | |||

Other | ||||||

Net debt to adjusted EBITDA (6) | Net debt (debt less cash) / adjusted EBITDA | Not required | 3.8x | 4.5x | ||

Debt to enterprise value (7) | Debt / enterprise value | Not required | 22.5 | % | 22.8 | % |

(1) | Balances are reflected net of discounts and deferred financing costs and include premiums. |

(2) | On November 1, 2017, the Company redeemed $100.0 million of its outstanding Senior Notes due 2021. |

(3) | The effective interest rate includes the impact of the $1.7 million settlement of a forward-starting interest rate swap that is included in accumulated other comprehensive income on the Company's Condensed Consolidated Balance Sheets. |

(4) | Does not include all financial and non-financial covenants and restrictions that are required by the Company's various debt agreements. |

(5) | Includes the completion of the acquisition of $193.8 million of real estate assets and the partial bond redemption. |

(6) | Adjusted EBITDA is based on the current quarter results, annualized. See page 23 for a reconciliation of adjusted EBITDA. |

(7) | Based on the closing price of $32.34 on September 29, 2017 and 124,889,969 shares outstanding. |

HEALTHCARE REALTY 12 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Investment Activity |

(dollars in thousands) |

ACQUISITION ACTIVITY | ||||||||||

Location | Property Type (1) | Miles to Campus | Health System Affiliation | Closing | Purchase Price | Square Feet | Leased % | Cap Rate (2) | ||

St. Paul, MN (3) | MOB | 0.00 | Fairview Health | 3/6/2017 | $13,513 | 34,608 | 100 | % | 5.9 | % |

San Francisco, CA | MOB | 0.00 | Sutter Health | 6/12/2017 | 26,786 | 75,649 | 100 | % | 5.3 | % |

Washington, DC | MOB | 0.00 | Trinity Health | 6/13/2017 | 24,000 | 62,379 | 100 | % | 5.4 | % |

Los Angeles, CA | MOB | 0.00 | HCA | 7/31/2017 | 16,300 | 42,780 | 93 | % | 5.4 | % |

Atlanta, GA | MOB | 0.00 | WellStar Health | 11/1/2017 | 25,451 | 76,944 | 93 | % | 5.2 | % |

Atlanta, GA | MOB | 0.00 | WellStar Health | 11/1/2017 | 30,256 | 74,024 | 100 | % | 5.1 | % |

Atlanta, GA | MOB | 0.00 | WellStar Health | 11/1/2017 | 49,746 | 118,180 | 94 | % | 5.0 | % |

Atlanta, GA (3) | MOB | 13.00 | Piedmont | 11/1/2017 | 6,667 | 19,732 | 100 | % | 6.5 | % |

Seattle, WA | MOB | 0.10 | Overlake Health | 11/1/2017 | 12,700 | 26,345 | 96 | % | 5.4 | % |

2017 Acquisition Activity | $205,419 | 530,641 | 97 | % | 5.3 | % | ||||

DISPOSITION ACTIVITY | ||||||||||

Evansville, IN (3) | OTH | NA | NA | 3/6/2017 | $6,375 | 29,500 | 100 | % | 8.9 | % |

Columbus, GA | MOB | 0.22 | Columbus Reg | 3/7/2017 | 625 | 12,000 | 0 | % | (6.4 | )% |

Las Vegas, NV | MOB | 1.38 | NA | 3/30/2017 | 5,500 | 18,147 | 100 | % | 6.7 | % |

Texas (3 properties) (3) | IRF | NA | NA | 3/31/2017 | 69,500 | 169,722 | 100 | % | 7.3 | % |

Chicago, IL | MOB | 0.40 | NA | 6/16/2017 | 450 | 5,100 | 0 | % | (9.1 | )% |

San Antonio, TX (3) | IRF | NA | NA | 6/29/2017 | 14,500 | 39,786 | 100 | % | 7.3 | % |

Roseburg, OR | MOB | 0.00 | CHI | 6/29/2017 | 23,200 | 62,246 | 100 | % | 6.6 | % |

St. Louis, MO | MOB | 2.90 | NA | 9/7/2017 | 2,550 | 79,980 | 41 | % | 4.5 | % |

2017 Disposition Activity | $122,700 | 416,481 | 85 | % | 7.0 | % | ||||

RE/DEVELOPMENT ACTIVITY | |||||||||||

Location | Type (4) | Campus Location | Square Feet | Budget | Amount Funded Q3 2017 | Total Through 9/30/2017 | Estimated Remaining Fundings | Aggregate Leased % | Estimated Completion Date | ||

Same store redevelopment | |||||||||||

Charlotte, NC (5) | Redev | ON | 204,000 | $12,000 | $835 | $1,138 | $10,862 | 85 | % | Q1 2019 | |

Pre-construction activity (6) | |||||||||||

Seattle, WA | Dev | ON | 151,000 | 64,120 | 841 | 2,101 | 62,019 | 60 | % | Q1 2019 | |

Total Re/development activity | 355,000 | $76,120 | $1,676 | $3,239 | $72,881 | 74 | % | ||||

HISTORICAL INVESTMENT ACTIVITY | |||||||||||||

Acquisitions (7) | Mortgage Funding | Construction Mortgage Funding | Re/Development Funding | Total Investments | Dispositions | ||||||||

2013 | $216,956 | $— | $58,731 | $— | $275,687 | $101,910 | |||||||

2014 | 85,077 | 1,900 | 1,244 | 4,384 | 92,605 | 34,840 | |||||||

2015 | 187,216 | — | — | 27,859 | 215,075 | 157,975 | |||||||

2016 | 241,939 | — | — | 45,343 | 287,282 | 94,683 | |||||||

2017 | 205,419 | — | — | 28,295 | 233,714 | 122,700 | |||||||

Total | $936,607 | $1,900 | $59,975 | $105,881 | $1,104,363 | $512,108 | |||||||

% of Total | 84.8 | % | 0.2 | % | 5.4 | % | 9.6 | % | 100.0 | % | |||

(1) | MOB = Medical Office Building; IRF = Inpatient Rehabilitation Facility; OTH = Other |

(2) | For acquisitions, cap rate represents the forecasted first year NOI / purchase price plus acquisition costs and expected capital additions. For dispositions, cap rate represents the next twelve month forecasted NOI / sales price. |

(3) | Single-tenant net lease property. |

(4) | Redev = Redevelopment; Dev = Development |

(5) | Redevelopment project is a 38,000 square foot expansion to an existing medical office building. |

(6) | Includes projects that are in the design phase, but are expected to begin construction once permits and final contracts are executed. |

(7) | Net of mortgage notes receivable payoffs upon acquisition. |

HEALTHCARE REALTY 13 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Portfolio by Market |

(dollars in thousands) |

BY MARKET | ||||||||||||||||||

SQUARE FEET | ||||||||||||||||||

MOB/OUTPATIENT (92.9%) | INPATIENT (3.7%) | OTHER (3.4%) | ||||||||||||||||

MSA Rank | Investment(1) | Multi-tenant | Single-tenant Net | Rehab | Surgical | Multi-tenant | Single-tenant Net | Total | % of Total | |||||||||

Dallas - Fort Worth, TX | 4 | $473,675 | 2,149,939 | 156,245 | 2,306,184 | 16.0 | % | |||||||||||

Seattle - Bellevue, WA | 15 | 405,951 | 890,222 | 67,510 | 957,732 | 6.5 | % | |||||||||||

Charlotte, NC | 22 | 167,714 | 820,457 | 820,457 | 5.6 | % | ||||||||||||

Nashville, TN | 36 | 151,520 | 766,523 | 766,523 | 5.3 | % | ||||||||||||

Los Angeles, CA | 2 | 181,691 | 594,163 | 63,000 | 657,163 | 4.6 | % | |||||||||||

Houston, TX | 5 | 129,585 | 591,027 | 591,027 | 4.1 | % | ||||||||||||

Richmond, VA | 45 | 145,967 | 548,801 | 548,801 | 3.8 | % | ||||||||||||

Des Moines, IA | 89 | 133,184 | 233,413 | 146,542 | 152,655 | 532,610 | 3.7 | % | ||||||||||

Memphis, TN | 42 | 93,075 | 515,876 | 515,876 | 3.6 | % | ||||||||||||

San Antonio, TX | 24 | 94,787 | 483,811 | 483,811 | 3.4 | % | ||||||||||||

Denver, CO | 19 | 137,202 | 446,292 | 34,068 | 480,360 | 3.3 | % | |||||||||||

Roanoke, VA | 160 | 49,011 | 334,454 | 126,427 | 460,881 | 3.2 | % | |||||||||||

Indianapolis, IN | 34 | 74,900 | 382,695 | 382,695 | 2.7 | % | ||||||||||||

Austin, TX | 31 | 101,128 | 354,481 | 12,880 | 367,361 | 2.5 | % | |||||||||||

Washington, DC | 6 | 100,430 | 348,998 | 348,998 | 2.4 | % | ||||||||||||

Honolulu, HI | 54 | 141,466 | 298,427 | 298,427 | 2.1 | % | ||||||||||||

San Francisco, CA | 11 | 117,168 | 286,270 | 286,270 | 2.0 | % | ||||||||||||

Oklahoma City, OK | 41 | 109,111 | 68,860 | 200,000 | 268,860 | 1.9 | % | |||||||||||

Miami, FL | 8 | 55,640 | 241,980 | 241,980 | 1.7 | % | ||||||||||||

Colorado Springs, CO | 79 | 51,037 | 241,224 | 241,224 | 1.7 | % | ||||||||||||

Chicago, IL | 3 | 56,563 | 238,391 | 238,391 | 1.7 | % | ||||||||||||

Other (26 markets) | 630,347 | 1,840,048 | 322,482 | 90,123 | 186,000 | 196,672 | 2,635,325 | 18.2 | % | |||||||||

Total | $3,601,152 | 12,341,898 | 1,070,988 | 187,191 | 342,245 | 291,962 | 196,672 | 14,430,956 | 100.0 | % | ||||||||

Number of Properties | 168 | 14 | 3 | 2 | 4 | 6 | 197 | |||||||||||

Percent of Square Feet | 85.5 | % | 7.4 | % | 1.3 | % | 2.4 | % | 2.0 | % | 1.4 | % | 100.0 | % | ||||

Investment (1) | $3,007,265 | $262,575 | $45,454 | $208,725 | $56,150 | $20,983 | $3,601,152 | |||||||||||

% of Investment | 83.5 | % | 7.3 | % | 1.3 | % | 5.8 | % | 1.5 | % | 0.6 | % | 100.0 | % | ||||

BY TENANT TYPE | ||||||||

MOB Total | Multi-tenant | Single-tenant Net | Total | |||||

Number of Properties | 182 | 172 | 25 | 197 | ||||

Square Feet | 13,412,886 | 12,633,860 | 1,797,096 | 14,430,956 | ||||

Percent of Square Feet | 92.9 | % | 87.5 | % | 12.5 | % | 100.0 | % |

Investment (1) | $3,269,840 | $3,063,415 | $537,737 | $3,601,152 | ||||

% of Investment | 90.8 | % | 85.0 | % | 15.0 | % | 100.0 | % |

(1) | Excludes gross assets held for sale, land held for development, construction in progress and corporate property. |

HEALTHCARE REALTY 14 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Square Feet by Health System (1) |

MOB SQUARE FEET | ||||||||||||||

System Rank (3) | Credit Rating | ASSOCIATED 94.3% (2) | Total MOB SF | % of Total MOB SF | ||||||||||

Top Health Systems | On | Adjacent (4) | Anchored (5) | Off | ||||||||||

Baylor Scott & White Health | 20 | AA-/Aa3 | 1,834,256 | 129,879 | 163,188 | — | 2,127,323 | 15.9 | % | |||||

Ascension Health | 3 | AA+/Aa2 | 1,017,085 | 148,356 | 30,096 | — | 1,195,537 | 8.9 | % | |||||

Catholic Health Initiatives | 7 | BBB+/Baa1 | 807,182 | 180,125 | 95,486 | — | 1,082,793 | 8.1 | % | |||||

HCA | 2 | BB/B1 | 432,711 | 177,155 | 157,388 | — | 767,254 | 5.7 | % | |||||

Carolinas HealthCare System | 31 | AA-/Aa3 | 353,537 | 98,066 | 313,513 | — | 765,116 | 5.7 | % | |||||

Tenet Healthcare Corporation | 5 | B/B2 | 570,264 | 67,790 | — | — | 638,054 | 4.8 | % | |||||

Bon Secours Health System | 61 | A/A2 | 548,801 | — | — | — | 548,801 | 4.1 | % | |||||

Baptist Memorial Health Care | 109 | BBB+/-- | 424,306 | — | 39,345 | — | 463,651 | 3.5 | % | |||||

Indiana University Health | 26 | AA/Aa2 | 280,129 | 102,566 | — | — | 382,695 | 2.9 | % | |||||

University of Colorado Health | 76 | AA-/Aa3 | 150,291 | 161,099 | 33,850 | — | 345,240 | 2.6 | % | |||||

Trinity Health | 8 | AA-/Aa3 | 267,952 | 73,331 | — | — | 341,283 | 2.5 | % | |||||

Providence Health & Services | 9 | AA-/Aa3 | 176,854 | 129,181 | — | — | 306,035 | 2.3 | % | |||||

University of Washington | 40 | AA+/Aaa | 194,536 | 69,712 | — | — | 264,248 | 2.0 | % | |||||

Medstar Health | 36 | A/A2 | 241,739 | — | — | — | 241,739 | 1.8 | % | |||||

Advocate Health Care | 33 | AA+/Aa2 | 142,955 | 95,436 | — | — | 238,391 | 1.8 | % | |||||

Memorial Hermann | 42 | A+/A1 | — | 206,090 | — | — | 206,090 | 1.5 | % | |||||

Community Health | 4 | B-/B3 | 201,574 | — | — | — | 201,574 | 1.5 | % | |||||

Mercy (St. Louis) | 35 | AA-/Aa3 | — | — | 200,000 | — | 200,000 | 1.5 | % | |||||

Overlake Health System | 333 | A/A2 | 191,051 | — | — | — | 191,051 | 1.4 | % | |||||

Sutter Health | 13 | AA-/Aa3 | 175,591 | — | — | — | 175,591 | 1.3 | % | |||||

Other (19 credit rated systems) | 1,028,985 | 560,499 | 90,607 | — | 1,680,091 | 12.4 | % | |||||||

Subtotal - credit rated (6) | 9,039,799 | 2,199,285 | 1,123,473 | — | 12,362,557 | 92.2 | % | |||||||

Non-credit rated | 136,155 | 144,910 | — | 769,264 | 1,050,329 | 7.8 | % | |||||||

Total | 9,175,954 | 2,344,195 | 1,123,473 | 769,264 | 13,412,886 | 100.0 | % | |||||||

% of Total | 68.4 | % | 17.5 | % | 8.4 | % | 5.7 | % | ||||||

LEASED SQUARE FEET | |||||||||||||

LEASED SQUARE FEET | |||||||||||||

Top Health Systems | System Rank (3) | Credit Rating | # of Buildings | # of Leases | MOB | Inpatient / Other | Total | % of Total Leased SF | % of Total Revenue | ||||

Baylor Scott & White Health | 20 | AA-/Aa3 | 20 | 155 | 1,007,708 | 156,245 | 1,163,953 | 9.2 | % | 9.8 | % | ||

Mercy (St. Louis) | 35 | AA-/Aa3 | 2 | 2 | 200,000 | 186,000 | 386,000 | 3.1 | % | 4.3 | % | ||

Carolinas HealthCare System | 31 | AA-/Aa3 | 16 | 80 | 595,641 | — | 595,641 | 4.7 | % | 4.3 | % | ||

Catholic Health Initiatives | 7 | BBB+/Baa1 | 14 | 72 | 519,014 | — | 519,014 | 4.1 | % | 3.7 | % | ||

Bon Secours Health System | 61 | A/A2 | 7 | 60 | 262,498 | — | 262,498 | 2.1 | % | 2.1 | % | ||

Ascension Health | 3 | AA+/Aa2 | 14 | 59 | 326,516 | — | 326,516 | 2.6 | % | 2.1 | % | ||

HCA | 2 | BB/B1 | 13 | 17 | 409,642 | — | 409,642 | 3.2 | % | 2.1 | % | ||

Indiana University Health | 26 | AA/Aa2 | 3 | 39 | 261,159 | — | 261,159 | 2.1 | % | 1.9 | % | ||

Tenet Healthcare Corporation | 5 | B/B2 | 10 | 36 | 124,227 | 63,000 | 187,227 | 1.5 | % | 1.6 | % | ||

Baptist Memorial Health Care | 109 | BBB+/-- | 6 | 16 | 125,796 | — | 125,796 | 1.0 | % | 1.3 | % | ||

Total | 33.6 | % | 33.2 | % | |||||||||

(1) | Excludes mortgage notes receivable, construction in progress and assets classified as held for sale. |

(2) | Includes total square feet of buildings located on-campus, adjacent and off-campus/anchored by healthcare systems. |

(3) | Ranked by revenue based on Modern Healthcare's Healthcare Systems Financials Database. |

(4) | The Company defines an adjacent property as being no more than 0.25 miles from a hospital campus. |

(5) | Includes buildings where health systems lease 40% or more of the property. |

(6) | Based on square footage, 79.7% is associated with an investment-grade rated healthcare provider. |

HEALTHCARE REALTY 15 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Square Feet by Proximity (1)(2) |

MEDICAL OFFICE BUILDINGS BY LOCATION | |||||||||||||

2017 | 2016 | ||||||||||||

Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | ||||||||

On campus | 68.4 | % | 67.9 | % | 67.4 | % | 67.4 | % | 66.6 | % | 66.0 | % | |

Adjacent to campus (3) | 17.5 | % | 17.4 | % | 17.7 | % | 17.7 | % | 18.1 | % | 18.2 | % | |

Total on/adjacent | 85.9 | % | 85.3 | % | 85.1 | % | 85.1 | % | 84.7 | % | 84.2 | % | |

Off campus - anchored by hospital system (4) | 8.4 | % | 8.4 | % | 8.5 | % | 8.5 | % | 8.6 | % | 8.7 | % | |

Off campus | 5.7 | % | 6.3 | % | 6.4 | % | 6.4 | % | 6.7 | % | 7.1 | % | |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||

MEDICAL OFFICE BUILDINGS BY DISTANCE TO HOSPITAL CAMPUS | ||||||||||||

Ground Lease Properties | ||||||||||||

Greater than | Less than or equal to | Number of Buildings | Square Feet | % of Total | Cumulative % | Campus Proximity | Square Feet | % of Total | ||||

0.00 | 116 | 9,175,954 | 68.4 | % | 68.4 | % | On campus | 7,060,583 | 90.6 | % | ||

0.00 | 250 yards | 18 | 1,222,987 | 9.1 | % | 77.5 | % | Adjacent (3) | 80,525 | 1.0 | % | |

250 yards | 0.25 miles | 19 | 1,121,208 | 8.4 | % | 85.9 | % | 120,036 | 1.5 | % | ||

0.25 miles | 0.50 | 1 | 124,925 | 0.9 | % | 86.8 | % | Off campus | - | — | % | |

0.50 | 1.00 | 3 | 304,993 | 2.3 | % | 89.1 | % | - | — | % | ||

1.00 | 2.00 | 6 | 590,339 | 4.4 | % | 93.5 | % | 319,446 | 4.1 | % | ||

2.00 | 5.00 | 9 | 396,653 | 3.0 | % | 96.5 | % | 13,818 | 0.2 | % | ||

5.00 | 10.00 | 6 | 332,359 | 2.5 | % | 99.0 | % | 205,631 | 2.6 | % | ||

10.00 | 4 | 143,468 | 1.0 | % | 100.0 | % | - | — | % | |||

Total | 182 | 13,412,886 | 100.0 | % | 7,800,039 | 100.0 | % | |||||

(1) | Excludes mortgage notes receivable, construction in progress and assets classified as held for sale. |

(2) | Proximity to hospital campus includes acute care hospitals with inpatient beds. The Company does not consider inpatient rehab hospitals (IRFs), skilled nursing facilities (SNFs) or long-term acute care hospitals (LTACHs) to be hospital campuses for distance calculations. |

(3) | The Company defines an adjacent property as being no more than 0.25 miles from a hospital campus. |

(4) | Includes buildings where health systems lease 40% or more of the property. |

HEALTHCARE REALTY 16 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Lease Maturity, Lease and Building Size (1) |

LEASE MATURITY SCHEDULE | ||||||||||||||||

MULTI-TENANT | SINGLE-TENANT NET LEASE | TOTAL | ||||||||||||||

Number of Leases | Square Feet | % of Square Feet | Number of Leases | Square Feet | % of Square Feet | Number of Leases | Square Feet | % of Total Square Feet | % of Base Revenue (2) | |||||||

2017 (3) | 200 | 574,428 | 5.3 | % | 5 | 334,454 | 18.6 | % | 205 | 908,882 | 7.2 | % | 6.3 | % | ||

2018 | 517 | 1,706,920 | 15.8 | % | — | — | — | % | 517 | 1,706,920 | 13.5 | % | 13.5 | % | ||

2019 | 511 | 2,093,762 | 19.4 | % | 8 | 342,305 | 19.0 | % | 519 | 2,436,067 | 19.3 | % | 18.5 | % | ||

2020 | 395 | 1,507,950 | 13.9 | % | 1 | 83,318 | 4.7 | % | 396 | 1,591,268 | 12.6 | % | 12.7 | % | ||

2021 | 295 | 1,097,852 | 10.1 | % | — | — | — | % | 295 | 1,097,852 | 8.7 | % | 8.5 | % | ||

2022 | 218 | 993,561 | 9.2 | % | 1 | 58,285 | 3.2 | % | 219 | 1,051,846 | 8.3 | % | 8.3 | % | ||

2023 | 144 | 766,585 | 7.1 | % | — | — | — | % | 144 | 766,585 | 6.1 | % | 6.2 | % | ||

2024 | 133 | 744,484 | 6.9 | % | — | — | — | % | 133 | 744,484 | 5.9 | % | 5.4 | % | ||

2025 | 65 | 498,547 | 4.6 | % | 2 | 91,561 | 5.1 | % | 67 | 590,108 | 4.7 | % | 4.5 | % | ||

2026 | 61 | 209,875 | 1.9 | % | — | — | — | % | 61 | 209,875 | 1.7 | % | 1.7 | % | ||

Thereafter | 102 | 622,326 | 5.8 | % | 8 | 887,173 | 49.4 | % | 110 | 1,509,499 | 12.0 | % | 14.4 | % | ||

Total leased | 2,641 | 10,816,290 | 85.6 | % | 25 | 1,797,096 | 100.0 | % | 2,666 | 12,613,386 | 87.4 | % | 100.0 | % | ||

Total building | 12,633,860 | 100.0 | % | 1,797,096 | 100.0 | % | 14,430,956 | 100.0 | % | |||||||

BY LEASE SIZE | ||||

NUMBER OF LEASES | ||||

Leased Square Feet | Multi-Tenant Properties (4) | Single-Tenant Net Lease Properties | ||

0 - 2,500 | 1,417 | — | ||

2,501 - 5,000 | 647 | — | ||

5,001 - 7,500 | 208 | 1 | ||

7,501 - 10,000 | 122 | — | ||

10,001 + | 247 | 24 | ||

Total Leases | 2,641 | 25 | ||

BY BUILDING SIZE | |||||

Building Square Feet | % of Total | Total Square Footage | Average Square Feet | Number of Properties | |

>100,000 | 44.3 | % | 6,395,112 | 148,724 | 43 |

<100,000 and >75,000 | 23.9 | % | 3,448,763 | 86,219 | 40 |

<75,000 and >50,000 | 16.6 | % | 2,390,775 | 62,915 | 38 |

<50,000 | 15.2 | % | 2,196,306 | 28,899 | 76 |

Total | 100.0 | % | 14,430,956 | 73,254 | 197 |

(1) | Excludes mortgage notes receivable, land held for development, construction in progress, corporate property and assets classified as held for sale. |

(2) | Represents the current annualized minimum rents on in-place leases, excluding the impact of potential lease renewals and sponsor support payments under financial support arrangements and straight-line rent. |

(3) | The Company received notice in October 2017 that a tenant is exercising its purchase option on seven buildings, five single-tenant net leased buildings that were scheduled to expired on December 31, 2017 and two multi-tenant buildings. The seven properties are covered by one purchase option with a stated purchase price of approximately $45.2 million, subject to certain contractual adjustments. The Company's aggregate net book value for these properties was $24.0 million at September 30, 2017. The Company recognized net operating income of approximately $4.7 million for the nine months ended September 30, 2017 from these properties. The closing is expected to occur in April 2018. |

(4) | The average lease size in the multi-tenant properties is 4,096 square feet. |

HEALTHCARE REALTY 17 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Historical Occupancy (1) |

(dollars in thousands) |

2017 | 2016 | |||||||||

Q3 | Q2 | Q1 | Q4 | Q3 | ||||||

Same store properties | ||||||||||

Multi-tenant | ||||||||||

Investment | $2,547,282 | $2,492,031 | $2,493,309 | $2,438,564 | $2,300,520 | |||||

Number of properties | 138 | 137 | 138 | 139 | 136 | |||||

Total building square feet | 10,937,805 | 10,764,672 | 10,801,498 | 10,690,819 | 10,288,750 | |||||

% occupied | 88.0 | % | 88.0 | % | 87.7 | % | 87.3 | % | 87.8 | % |

Single-tenant | ||||||||||

Investment | $524,444 | $524,444 | $524,268 | $617,908 | $677,171 | |||||

Number of properties | 24 | 24 | 24 | 30 | 34 | |||||

Total building square feet | 1,762,488 | 1,762,488 | 1,762,488 | 2,080,227 | 2,284,747 | |||||

% occupied | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

Total same store properties | ||||||||||

Investment | $3,071,726 | $3,016,475 | $3,017,577 | $3,056,472 | $2,977,691 | |||||

Number of properties | 162 | 161 | 162 | 169 | 170 | |||||

Total building square feet | 12,700,293 | 12,527,160 | 12,563,986 | 12,771,046 | 12,573,497 | |||||

% occupied | 89.7 | % | 89.7 | % | 89.4 | % | 89.3 | % | 90.0 | % |

Acquisitions (2) | ||||||||||

Investment | $428,579 | $445,164 | $405,975 | $431,859 | $402,267 | |||||

Number of properties | 18 | 19 | 18 | 18 | 15 | |||||

Total building square feet | 1,056,118 | 1,113,659 | 1,011,189 | 1,087,260 | 1,003,876 | |||||

% occupied | 92.3 | % | 94.0 | % | 93.0 | % | 94.4 | % | 95.0 | % |

Development Completions (3) | ||||||||||

Investment | $30,537 | $26,967 | $5,353 | $5,353 | $5,057 | |||||

Number of properties | 2 | 2 | 1 | 1 | 1 | |||||

Total building square feet | 112,837 | 112,837 | 12,880 | 12,880 | 12,880 | |||||

% occupied | 22.7 | % | 11.4 | % | 100.0 | % | 100.0 | % | 100.0 | % |

% leased | 45.4 | % | 42.4 | % | 100.0 | % | 100.0 | % | 100.0 | % |

Reposition (4) | ||||||||||

Investment | $70,310 | $97,766 | $96,134 | $97,176 | $148,489 | |||||

Number of properties | 15 | 15 | 14 | 14 | 16 | |||||

Total building square feet | 561,708 | 714,500 | 704,362 | 709,462 | 951,568 | |||||

% occupied | 39.7 | % | 53.5 | % | 52.5 | % | 52.8 | % | 59.3 | % |

Total | ||||||||||

Investment | $3,601,152 | $3,586,372 | $3,525,039 | $3,590,860 | $3,533,504 | |||||

Number of properties | 197 | 197 | 195 | 202 | 202 | |||||

Total building square feet | 14,430,956 | 14,468,156 | 14,292,417 | 14,580,648 | 14,541,821 | |||||

% occupied | 87.4 | % | 87.6 | % | 87.8 | % | 87.9 | % | 88.4 | % |

(1) | Excludes mortgage notes receivable, land held for development, construction in progress, corporate property and assets classified as held for sale. |

(2) | Acquisition include properties acquired within the last 8 quarters of the period presented and are excluded from same store. |

(3) | Development completions consist of two properties, with the core and shell of one property reaching completion in June 2017 that is 38% leased and 13% occupied as of September 30, 2017. |

(4) | Reposition includes properties that meet any of the Company-defined criteria: properties having less than 60% occupancy that is expected to last at least two quarters; properties that experience a loss of occupancy over 30% in a single quarter; properties with negative net operating income that is expected to last at least two quarters; or condemnation. |

HEALTHCARE REALTY 18 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Occupancy Reconciliation |

SEQUENTIAL | ||||||||||||

PORTFOLIO | SAME STORE | |||||||||||

Occupied Square Feet | Total Square Feet | Occupancy | Occupied Square Feet | Total Square Feet | Occupancy | |||||||

Beginning June 30, 2017 | 12,677,514 | 14,468,156 | 87.6 | % | 11,235,981 | 12,527,160 | 89.7 | % | ||||

Portfolio Activity | ||||||||||||

Acquisitions | 39,953 | 42,780 | 93.4 | % | NA | NA | NA | |||||

Re/Development completions | — | — | — | % | — | — | — | % | ||||

Dispositions (1) | (32,423 | ) | (79,980 | ) | 40.5 | % | — | — | — | % | ||

Reclassifications to same store: | ||||||||||||

Acquisitions | NA | NA | NA | 89,012 | 100,321 | 88.7 | % | |||||

Development completions | NA | NA | NA | — | — | — | % | |||||

Reposition to same store | NA | NA | NA | 145,365 | 145,365 | 100.0 | % | |||||

Reposition from same store | NA | NA | NA | (46,754 | ) | (72,553 | ) | 64.4 | % | |||

Subtotal | 12,685,044 | 14,430,956 | 87.9 | % | 11,423,604 | 12,700,293 | 89.9 | % | ||||

Leasing Activity | ||||||||||||

New leases/expansions | 137,077 | NA | NA | 116,080 | NA | NA | ||||||

Move-outs/contractions | (208,735 | ) | NA | NA | (149,660 | ) | NA | NA | ||||

Net Absorption | (71,658 | ) | NA | NA | (33,580 | ) | NA | NA | ||||

Ending September 30, 2017 | 12,613,386 | 14,430,956 | 87.4 | % | 11,390,024 | 12,700,293 | 89.7 | % | ||||

YEAR-OVER-YEAR | ||||||||||||

PORTFOLIO | SAME STORE | |||||||||||

Occupied Square Feet | Total Square Feet | Occupancy | Occupied Square Feet | Total Square Feet | Occupancy | |||||||

Beginning September 30, 2016 | 12,852,759 | 14,541,821 | 88.4 | % | 11,322,274 | 12,573,497 | 90.0 | % | ||||

Portfolio Activity | ||||||||||||

Acquisitions | 404,618 | 427,821 | 94.6 | % | NA | NA | NA | |||||

Re/Development completions (2) | — | 149,046 | — | % | 49,089 | — | % | |||||

Dispositions (1) | (635,075 | ) | (687,732 | ) | 92.3 | % | (602,652 | ) | (602,652 | ) | 100.0 | % |

Reclassifications to same store: | ||||||||||||

Acquisitions | NA | NA | NA | 351,198 | 375,579 | 93.5 | % | |||||

Development completions | NA | NA | NA | — | — | — | % | |||||

Reposition to same store | NA | NA | NA | 330,704 | 387,471 | 85.3 | % | |||||

Reposition from same store | NA | NA | NA | (59,064 | ) | (82,691 | ) | 71.4 | % | |||

Subtotal | 12,622,302 | 14,430,956 | 87.5 | % | 11,342,460 | 12,700,293 | 89.3 | % | ||||

Leasing Activity | ||||||||||||

New leases/expansions | 526,873 | NA | NA | 445,363 | NA | NA | ||||||

Move-outs/contractions | (535,789 | ) | NA | NA | (397,799 | ) | NA | NA | ||||

Net Absorption | (8,916 | ) | NA | NA | 47,564 | NA | NA | |||||

Ending September 30, 2017 | 12,613,386 | 14,430,956 | 87.4 | % | 11,390,024 | 12,700,293 | 89.7 | % | ||||

(1) | Includes properties reclassified as held for sale. |

(2) | Includes the completion of 70,000 square feet vertical expansion that was completed in the fourth quarter of 2016. The net increase to total square feet was 49,089 due to a portion of the original building that was demolished to begin construction of the expansion. |

HEALTHCARE REALTY 19 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Same Store Leasing Statistics (1) |

2017 | 2016 | 2015 | ||||||||||||||

Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | |||||||||

Contractual rent increases occurring in the quarter | ||||||||||||||||

Multi-tenant properties | 2.9 | % | 3.0 | % | 2.9 | % | 2.9 | % | 2.8 | % | 2.9 | % | 2.9 | % | 3.0 | % |

Single-tenant net lease properties | 2.1 | % | 2.3 | % | 2.1 | % | 2.5 | % | 1.7 | % | 2.2 | % | 1.0 | % | 1.6 | % |

Total | 2.7 | % | 2.8 | % | 2.8 | % | 2.9 | % | 2.5 | % | 2.7 | % | 2.5 | % | 2.8 | % |

Multi-tenant renewals | ||||||||||||||||

Cash leasing spreads | 4.6 | % | 9.5 | % | 4.5 | % | 3.9 | % | 4.3 | % | 6.3 | % | 7.2 | % | 3.7 | % |

Tenant retention rate | 80.5 | % | 90.3 | % | 79.2 | % | 88.5 | % | 90.1 | % | 81.2 | % | 87.2 | % | 91.2 | % |

AVERAGE IN-PLACE CONTRACTUAL INCREASES (2) | ||||||||||||

MULTI-TENANT | SINGLE-TENANT NET LEASE | TOTAL | ||||||||||

% Increase | % of Base Rent | % Increase | % of Base Rent | % Increase | % of Base Rent | |||||||

Annual increase | ||||||||||||

CPI | 2.04 | % | 1.34 | % | 2.02 | % | 64.01 | % | 2.02 | % | 12.47 | % |

Fixed | 2.95 | % | 90.88 | % | 2.39 | % | 13.91 | % | 2.93 | % | 77.20 | % |

Non-annual increase | ||||||||||||

CPI | 0.97 | % | 1.60 | % | 0.50 | % | 2.16 | % | 0.86 | % | 1.70 | % |

Fixed | 1.38 | % | 3.79 | % | 2.32 | % | 19.92 | % | 1.88 | % | 6.66 | % |

No increase | ||||||||||||

Term > 1 year | — | % | 2.39 | % | — | % | — | % | — | % | 1.97 | % |

Total (2) | 2.78 | % | 100.00 | % | 2.10 | % | 100.00 | % | 2.65 | % | 100.00 | % |

TYPE AND OWNERSHIP STRUCTURE | ||||||

% OF LEASED SQUARE FEET | ||||||

Multi-tenant | Single-tenant Net Lease | Total | ||||

Tenant Type | ||||||

Hospital | 45.2 | % | 79.1 | % | 50.5 | % |

Physician and other | 54.8 | % | 20.9 | % | 49.5 | % |

Lease Structure | ||||||

Gross | 14.6 | % | — | % | 12.3 | % |

Modified gross | 30.0 | % | — | % | 25.3 | % |

Net | 55.4 | % | 100.0 | % | 62.3 | % |

Ownership Type | ||||||

Ground lease | 61.7 | % | 10.3 | % | 54.6 | % |

Fee simple | 38.3 | % | 89.7 | % | 45.4 | % |

(1) | Excludes recently acquired or disposed properties, mortgage notes receivable, construction in progress, land held for development, corporate property, reposition properties and assets classified as held for sale. |

(2) | Excludes leases with terms of one year or less. |

HEALTHCARE REALTY 20 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Same Store Properties (1) |

(dollars in thousands, except per square foot data) |

QUARTERLY | ||||||||||||||||

Q3 2017 | Q2 2017 | Q1 2017 | Q4 2016 | Q3 2016 | Q2 2016 | Q1 2016 | Q4 2015 | |||||||||

Multi-tenant | ||||||||||||||||

Revenues | $79,988 | $78,887 | $77,514 | $76,654 | $77,198 | $76,146 | $74,951 | $74,583 | ||||||||

Expenses | 33,722 | 32,196 | 31,897 | 31,870 | 33,055 | 31,533 | 30,970 | 32,995 | ||||||||

NOI | $46,266 | $46,691 | $45,617 | $44,784 | $44,143 | $44,613 | $43,981 | $41,588 | ||||||||

Margin | 57.8 | % | 59.2 | % | 58.9 | % | 58.4 | % | 57.2 | % | 58.6 | % | 58.7 | % | 55.8 | % |

Occupancy | 88.0 | % | 88.3 | % | 87.9 | % | 87.6 | % | 87.6 | % | 87.3 | % | 87.3 | % | 87.2 | % |

Number of properties | 138 | 138 | 138 | 138 | 138 | 138 | 138 | 138 | ||||||||

Single-tenant net lease | ||||||||||||||||

Revenues | $12,957 | $12,613 | $13,001 | $12,655 | $12,924 | $12,802 | $12,836 | $12,837 | ||||||||

Expenses | 409 | 362 | 430 | 404 | 373 | 343 | 401 | 439 | ||||||||

NOI | $12,548 | $12,251 | $12,571 | $12,251 | $12,551 | $12,459 | $12,435 | $12,398 | ||||||||

Margin | 96.8 | % | 97.1 | % | 96.7 | % | 96.8 | % | 97.1 | % | 97.3 | % | 96.9 | % | 96.6 | % |

Occupancy | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

Number of properties | 24 | 24 | 24 | 24 | 24 | 24 | 24 | 24 | ||||||||

Total | ||||||||||||||||

Revenues | $92,945 | $91,500 | $90,515 | $89,309 | $90,122 | $88,948 | $87,787 | $87,420 | ||||||||

Expenses | 34,131 | 32,558 | 32,327 | 32,274 | 33,428 | 31,876 | 31,371 | 33,434 | ||||||||

NOI | $58,814 | $58,942 | $58,188 | $57,035 | $56,694 | $57,072 | $56,416 | $53,986 | ||||||||

Margin | 63.3 | % | 64.4 | % | 64.3 | % | 63.9 | % | 62.9 | % | 64.2 | % | 64.3 | % | 61.8 | % |

Occupancy | 89.7 | % | 89.9 | % | 89.6 | % | 89.3 | % | 89.3 | % | 89.1 | % | 89.1 | % | 89.0 | % |

Number of properties | 162 | 162 | 162 | 162 | 162 | 162 | 162 | 162 | ||||||||

% NOI year-over-year growth | 3.7 | % | 3.3 | % | 3.1 | % | 5.6 | % | ||||||||

TRAILING TWELVE MONTHS | ||||||

Twelve Months Ended September 30, | ||||||

2017 | 2016 | % Change | ||||

Multi-tenant | ||||||

Revenues | $313,043 | $302,878 | 3.4 | % | ||

Expenses | 129,685 | 128,553 | 0.9 | % | ||

NOI | $183,358 | $174,325 | 5.2 | % | ||

Revenue per average occupied square foot | $32.56 | $31.79 | 2.4 | % | ||

Average occupancy | 87.9 | % | 87.1 | % | ||

Number of properties | 138 | 138 | ||||

Single-tenant net lease | ||||||

Revenues | $51,226 | $51,399 | (0.3 | %) | ||

Expenses | 1,605 | 1,556 | 3.1 | % | ||

NOI | $49,621 | $49,843 | (0.4 | %) | ||

Revenue per average occupied square foot | $29.07 | $29.17 | (0.3 | %) | ||

Average occupancy | 100.0 | % | 100.0 | % | ||

Number of properties | 24 | 24 | ||||

Total | ||||||

Revenues | $364,269 | $354,277 | 2.8 | % | ||

Expenses | 131,290 | 130,109 | 0.9 | % | ||

Same Store NOI | $232,979 | $224,168 | 3.9 | % | ||

Revenue per average occupied square foot | $32.02 | $31.38 | 2.0 | % | ||

Average occupancy | 89.6 | % | 88.9 | % | ||

Number of Properties | 162 | 162 | ||||

(1) | Excludes recently acquired or disposed properties, mortgage notes receivable, development completions, construction in progress, land held for development, corporate property, reposition properties and assets classified as held for sale. |

HEALTHCARE REALTY 21 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Reconciliation of NOI |

(dollars in thousands) |

BOTTOM UP RECONCILIATION | ||||||||||||||||||||||||

Q3 2017 | Q2 2017 | Q1 2017 | Q4 2016 | Q3 2016 | Q2 2016 | Q1 2016 | Q4 2015 | |||||||||||||||||

Net income | $3,173 | $25,224 | $31,845 | $52,437 | $11,834 | $12,145 | $9,156 | $18,658 | ||||||||||||||||

Loss (income) from discontinued operations | (8 | ) | — | 13 | 143 | 23 | 12 | 7 | 696 | |||||||||||||||

Income from continuing operations | 3,165 | 25,224 | 31,858 | 52,580 | 11,857 | 12,157 | 9,163 | 19,354 | ||||||||||||||||

Other income (expense) | 18,747 | (1,881 | ) | (8,921 | ) | (27,272 | ) | 13,636 | 14,725 | 14,852 | 5,670 | |||||||||||||

General and administrative expense | 8,021 | 8,005 | 8,694 | 7,622 | 7,859 | 7,756 | 8,072 | 5,975 | ||||||||||||||||

Depreciation and amortization expense | 35,873 | 34,823 | 34,452 | 34,022 | 31,985 | 31,290 | 30,393 | 29,575 | ||||||||||||||||

Other expenses (1) | 1,932 | 2,204 | 1,979 | 2,431 | 1,488 | 1,696 | 3,351 | 2,375 | ||||||||||||||||

Straight-line rent revenue | (1,332 | ) | (1,783 | ) | (1,751 | ) | (1,754 | ) | (1,223 | ) | (2,091 | ) | (2,132 | ) | (1,929 | ) | ||||||||

Other revenue (2) | (1,353 | ) | (1,211 | ) | (794 | ) | (1,228 | ) | (1,422 | ) | (1,465 | ) | (1,417 | ) | (1,432 | ) | ||||||||

NOI | $65,053 | $65,381 | $65,517 | $66,401 | $64,180 | $64,068 | $62,282 | $59,588 | ||||||||||||||||

Acquisitions / development completions | (5,964 | ) | (5,588 | ) | (4,986 | ) | (5,074 | ) | (2,662 | ) | (2,128 | ) | (1,048 | ) | (594 | ) | ||||||||

Reposition | (343 | ) | (421 | ) | (376 | ) | (337 | ) | (380 | ) | (248 | ) | (234 | ) | (298 | ) | ||||||||

Dispositions / other | 68 | (430 | ) | (1,967 | ) | (3,955 | ) | (4,444 | ) | (4,620 | ) | (4,584 | ) | (4,710 | ) | |||||||||

Same store NOI | $58,814 | $58,942 | $58,188 | $57,035 | $56,694 | $57,072 | $56,416 | $53,986 | ||||||||||||||||

TOP DOWN RECONCILIATION | ||||||||||||||||||||||||

Q3 2017 | Q2 2017 | Q1 2017 | Q4 2016 | Q3 2016 | Q2 2016 | Q1 2016 | Q4 2015 | |||||||||||||||||

Property operating | $92,424 | $90,360 | $88,067 | $87,362 | $85,264 | $83,283 | $80,501 | $79,466 | ||||||||||||||||

Single-tenant net lease | 12,805 | 12,726 | 14,270 | 15,620 | 16,047 | 16,098 | 16,107 | 16,071 | ||||||||||||||||

Straight-line rent revenue | 1,332 | 1,783 | 1,751 | 1,754 | 1,223 | 2,091 | 2,132 | 1,929 | ||||||||||||||||

Rental income | 106,561 | 104,869 | 104,088 | 104,736 | 102,534 | 101,472 | 98,740 | 97,466 | ||||||||||||||||

Property lease guaranty income | 168 | 153 | 225 | 354 | 817 | 885 | 1,002 | 851 | ||||||||||||||||

Exclude straight-line rent revenue | (1,332 | ) | (1,783 | ) | (1,751 | ) | (1,754 | ) | (1,223 | ) | (2,091 | ) | (2,132 | ) | (1,929 | ) | ||||||||

Exclude other revenue (3) | (1,129 | ) | (988 | ) | (538 | ) | (1,009 | ) | (1,114 | ) | (1,180 | ) | (1,138 | ) | (1,167 | ) | ||||||||

Revenue | 104,268 | 102,251 | 102,024 | 102,327 | 101,014 | 99,086 | 96,472 | 95,221 | ||||||||||||||||

Property operating expense | (40,626 | ) | (38,184 | ) | (37,834 | ) | (37,285 | ) | (37,504 | ) | (36,263 | ) | (35,406 | ) | (36,758 | ) | ||||||||

Exclude other expenses (4) | 1,411 | 1,314 | 1,327 | 1,359 | 670 | 1,245 | 1,216 | 1,125 | ||||||||||||||||

NOI | $65,053 | $65,381 | $65,517 | $66,401 | $64,180 | $64,068 | $62,282 | $59,588 | ||||||||||||||||

Acquisitions / development completions | (5,964 | ) | (5,588 | ) | (4,986 | ) | (5,074 | ) | (2,662 | ) | (2,128 | ) | (1,048 | ) | (594 | ) | ||||||||

Reposition | (343 | ) | (421 | ) | (376 | ) | (337 | ) | (380 | ) | (248 | ) | (234 | ) | (298 | ) | ||||||||

Dispositions/other | 68 | (430 | ) | (1,967 | ) | (3,955 | ) | (4,444 | ) | (4,620 | ) | (4,584 | ) | (4,710 | ) | |||||||||

Same store NOI | $58,814 | $58,942 | $58,188 | $57,035 | $56,694 | $57,072 | $56,416 | $53,986 | ||||||||||||||||

TRAILING TWELVE MONTHS NOI | ||||||||

Twelve Months Ended September 30, | ||||||||

2017 | 2016 | % Change | ||||||

Same store NOI | $232,979 | $224,168 | 3.9 | % | ||||

Reposition | 1,477 | 1,160 | 27.3 | % | ||||

Subtotal | $234,456 | $225,328 | 4.1 | % | ||||

Acquisitions / development completions | 21,612 | 6,432 | 236.0 | % | ||||

Dispositions/other | 6,284 | 18,358 | (65.8 | %) | ||||

NOI | $262,352 | $250,118 | 4.9 | % | ||||

(1) | Includes acquisition and development expense, bad debt, above and below market ground lease intangible amortization, leasing commission amortization, and ground lease straight-line rent. |

(2) | Includes management fee income, storage income, interest, mortgage interest income, above and below market lease intangible amortization, lease inducement amortization, lease terminations and tenant improvement overage amortization. |

(3) | Includes above and below market lease intangibles, lease inducements, lease terminations and TI amortization. |

(4) | Includes above and below market ground lease intangible amortization, leasing commission amortization, and ground lease straight-line rent. |

HEALTHCARE REALTY 22 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Reconciliation of EBITDA |

(dollars in thousands) |

EBITDA | |||||||||||||||

Q3 2017 | Q2 2017 | Q1 2017 | Q4 2016 | TTM | |||||||||||

Net income | $3,173 | $25,224 | $31,845 | $52,437 | $112,679 | ||||||||||

Interest expense | 14,107 | 14,315 | 14,272 | 13,839 | 56,533 | ||||||||||

Depreciation and amortization | 35,873 | 34,823 | 34,452 | 34,022 | 139,170 | ||||||||||

EBITDA | $53,153 | $74,362 | $80,569 | $100,298 | $308,382 | ||||||||||

EBITDA | $53,153 | $74,362 | $80,569 | $100,298 | $308,382 | ||||||||||

Other amortization expense (1) | 1,994 | 1,965 | 2,459 | 2,015 | 8,433 | ||||||||||

Gain on sales of real estate properties | 7 | (16,124 | ) | (23,408 | ) | (41,037 | ) | (80,562 | ) | ||||||

Impairments on real estate assets | 5,059 | 5 | 323 | 121 | 5,508 | ||||||||||

EBITDAre (2) | $60,213 | $60,208 | $59,943 | $61,397 | $241,761 | ||||||||||

EBITDA | $53,153 | $74,362 | $80,569 | $100,298 | $308,382 | ||||||||||

Acquisition and development expense | 507 | 785 | 586 | 1,085 | 2,963 | ||||||||||

Gain on sales of real estate properties | 7 | (16,124 | ) | (23,408 | ) | (41,037 | ) | (80,562 | ) | ||||||

Impairments on real estate assets | 5,059 | 5 | 323 | 121 | 5,508 | ||||||||||

Debt Covenant EBITDA | $58,726 | $59,028 | $58,070 | $60,467 | $236,291 | ||||||||||

Debt Covenant EBITDA | $58,726 | $59,028 | $58,070 | $60,467 | $236,291 | ||||||||||

Other amortization expense | 1,994 | 1,965 | 2,459 | 2,015 | 8,433 | ||||||||||

Timing impact of acquisitions and dispositions (3) | 559 | (90 | ) | (1,260 | ) | (901 | ) | (1,692 | ) | ||||||

Stock based compensation | 2,429 | 2,453 | 2,614 | 1,949 | 9,445 | ||||||||||

Adjusted EBITDA | $63,708 | $63,356 | $61,883 | $63,530 | $252,477 | ||||||||||

(1) | Includes leasing commission amortization, above and below market lease intangible amortization, deferred financing costs amortization and the amortization of discounts and premiums on debt. |

(2) | Earnings before interest, taxes, depreciation and amortization for real estate ("EBITDAre") is an operating performance measure adopted by NAREIT. NAREIT defines EBITDAre equal to “net income (computed in accordance with GAAP) plus interest expense, income tax expense, depreciation and amortization, impairments and minus gains on the disposition of depreciated property.” |

(3) | Adjusted to reflect quarterly EBITDA from properties acquired or disposed in the quarter. |

HEALTHCARE REALTY 23 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Components of Net Asset Value |

(dollars in thousands, except per share data) |

NOI BY PROPERTY TYPE | ||||||||||||||||||||

Q3 2017 | ||||||||||||||||||||

Asset Type | Same Store NOI(1) | Acquisitions/Development Completions NOI (2) | Reposition NOI(3) | Timing Adjustments(4) | Adjusted NOI | Annualized Adjusted NOI | % of Adjusted NOI | |||||||||||||

MOB/Outpatient | $51,140 | $5,863 | $423 | $1,370 | $58,796 | $235,184 | 88.2 | % | ||||||||||||

Inpatient rehab | 1,433 | — | — | — | 1,433 | 5,732 | 2.2 | % | ||||||||||||

Inpatient surgical | 4,522 | — | — | — | 4,522 | 18,088 | 6.8 | % | ||||||||||||

Other | 1,719 | 100 | 27 | — | 1,846 | 7,384 | 2.8 | % | ||||||||||||

Total NOI | $58,814 | $5,963 | $450 | $1,370 | $66,597 | $266,388 | 100.0 | % | ||||||||||||

DEVELOPMENT PROPERTIES | |||

Land held for development | $20,123 | ||

Construction in progress | 1,138 | ||

Unstabilized development (5) | 25,184 | ||

Subtotal | $46,445 | ||

OTHER ASSETS | |||

Assets held for sale (6) | $8,699 | ||

Reposition properties (net book value) (3) | 3,473 | ||

Cash and other assets (7) | 261,225 | ||

Subtotal | $273,397 | ||

DEBT | |||

Unsecured credit facility | $— | ||

Unsecured term loan | 150,000 | ||

Senior notes | 900,000 | ||

Mortgage notes payable | 122,353 | ||

Other liabilities (8) | 78,533 | ||

Subtotal | $1,250,886 | ||

TOTAL SHARES OUTSTANDING | |||

As of October 27, 2017 | 124,890,077 | ||

IMPLIED CAP RATE | |||||

Stock Price | Implied Cap Rate | ||||

As of 10/27/2017 | $32.33 | 5.36 | % | ||

Q3 2017 high | $34.65 | 5.07 | % | ||

Q3 2017 low | $31.78 | 5.44 | % | ||

(1) | See Same Store Properties schedule on page 21 for details on same store NOI. |

(2) | Adjusted to reflect quarterly NOI from properties acquired or developments completed during the full eight quarter period that are not included in same store NOI. |

(3) | Reposition properties includes 15 properties which comprise 561,708 square feet. The NOI table above includes 12 of these properties comprising 410,473 square feet that have generated positive NOI totaling approximately $0.5 million. The remaining 3 properties, comprising 151,235 square feet, have generated negative NOI of approximately $0.1 million and are reflected at a net book value of $3.5 million in the table above. |

(4) | Timing adjustments related to current quarter acquisitions and the difference between leased and occupied square feet on previous re/developments. |

(5) | Unstabilized development includes one property that was completed on June 30, 2017. The building is 38% leased and 13% occupied as of September 30,2017. |

(6) | Assets held for sale includes one real estate property that is excluded from same store NOI and reflects net book value. |

(7) | Includes cash of $197.0 million and prepaid assets of $64.2 million that are expected to generate future cash or NOI and assets that are currently causing non-cash reductions to NOI. |

(8) | Includes only liabilities that are expected to reduce future cash or NOI and that are currently producing non-cash benefits to NOI. Included are accounts payable and accrued liabilities of $70.0 million, security deposits of $6.5 million and deferred operating expense reimbursements of $2.0 million. Also, excludes deferred revenue of $33.5 million. |

HEALTHCARE REALTY 24 | 3Q 2017 SUPPLEMENTAL INFORMATION |

Components of Expected 2017 FFO |

(amounts in thousands, except per square foot data) |

SAME STORE QUARTERLY RANGE OF EXPECTATIONS | ||||||

Low | High | Q3 2017 | ||||

Occupancy | ||||||

Multi-Tenant | 87.5 | % | 89.0 | % | 88.0 | % |

Single-Tenant Net Lease | 95.0 | % | 100.0 | % | 100.0 | % |

TTM Revenue per Occupied Square Foot | ||||||

Multi-Tenant | $31.00 | $33.00 | $32.56 | |||

Single-Tenant Net Lease | $28.50 | $29.50 | $29.07 | |||

Multi-Tenant NOI Margin | 57.0 | % | 59.0 | % | 57.8 | % |

Multi-Tenant Contractual Rent Increases by Type (% of base rent) | ||||||

Annual Increase | 90.0 | % | 94.0 | % | 92.2 | % |

Non-annual Increase | 5.0 | % | 6.0 | % | 5.4 | % |

No Increase (term > 1 year) | 2.0 | % | 3.0 | % | 2.4 | % |

Multi-Tenant Cash Leasing Spreads | 3.0 | % | 6.0 | % | 4.6 | % |

Multi-Tenant Lease Retention Rate | 75.0 | % | 90.0 | % | 80.5 | % |

TTM NOI Growth | ||||||

Multi-Tenant (1) | 4.5 | % | 6.0 | % | 5.2 | % |

Single-Tenant Net Lease | (0.5 | %) | 1.0 | % | (0.4 | %) |

ANNUAL RANGE OF EXPECTATIONS | ||||||

Low | High | YTD | ||||

Normalized G&A (2) | $33,000 | $34,000 | $24,720 | |||

Funding Activity | ||||||

Acquisitions | $275,000 | $325,000 | $205,419 | |||

Dispositions | (120,000) | (125,000) | (122,700) | |||

Re/Development | 25,000 | 40,000 | 28,295 | |||

1st Generation TI and Planned Capital Expenditures for Acquisitions | 9,000 | 12,000 | 4,178 | |||

2nd Generation Tenant Improvements | 20,000 | 25,000 | 13,438 | |||

Leasing Commissions | 4,000 | 7,000 | 4,394 | |||

Capital Expenditures | 11,000 | 22,000 | 12,390 | |||

Cash Yield | ||||||

Acquisitions | 5.25 | % | 6.00 | % | 5.29 | % |

Dispositions | 7.00 | % | 7.25 | % | 7.04 | % |

Re/development (stabilized) | 6.75 | % | 8.00 | % | NA | |

Leverage (Debt/Cap) (3) | 30.0 | % | 35.0 | % | 30.2 | % |

Net Debt to Adjusted EBITDA (3) | 5.0x | 5.5x | 4.5x | |||

(1) | Long-term same store NOI Growth, excluding changes in occupancy, is expected to range between 2% and 4%. |

(2) | Normalized G&A excludes acquisition expenses and includes amortization of non-cash share-based compensation awards of $8.5 million inclusive of $4.3 million related to 2016 performance and transition awards. |

(3) | Year-to-date debt metrics reflect proforma calculations on page 12. |

HEALTHCARE REALTY 25 | 3Q 2017 SUPPLEMENTAL INFORMATION |