Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL REALTY INVESTMENT TRUST | frt-09302017x8kdoc.htm |

FEDERAL REALTY INVESTMENT TRUST | |||

SUPPLEMENTAL INFORMATION | |||

September 30, 2017 | |||

TABLE OF CONTENTS | |||

1 | Third Quarter 2017 Earnings Press Release | ||

2 | Financial Highlights | ||

Consolidated Income Statements | |||

Consolidated Balance Sheets | |||

Funds From Operations / Summary of Capital Expenditures | |||

Market Data | |||

Components of Rental Income | |||

Comparable Property Information | |||

3 | Summary of Debt | ||

Summary of Outstanding Debt and Capital Lease Obligations | |||

Summary of Debt Maturities | |||

4 | Summary of Redevelopment Opportunities | ||

5 | Assembly Row, Pike & Rose, and Santana Row | ||

6 | Future Redevelopment Opportunities | ||

7 | 2017 Significant Acquisitions and Dispositions | ||

8 | Real Estate Status Report | ||

9 | Retail Leasing Summary | ||

10 | Lease Expirations | ||

11 | Portfolio Leased Statistics | ||

12 | Summary of Top 25 Tenants | ||

13 | Reconciliation of FFO Guidance | ||

14 | Glossary of Terms | ||

1626 East Jefferson Street | |||

Rockville, Maryland 20852-4041 | |||

301/998-8100 | |||

1

Safe Harbor Language

Certain matters discussed within this Supplemental Information may be deemed to be forward-looking statements within the meaning of the federal securities laws. Although Federal Realty believes the expectations reflected in the forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. These factors include, but are not limited to, the risk factors described in our Annual Report on Form 10-K filed on February 13, 2017, and include the following:

• | risks that our tenants will not pay rent, may vacate early or may file for bankruptcy or that we may be unable to renew leases or re-let space at favorable rents as leases expire; |

• | risks that we may not be able to proceed with or obtain necessary approvals for any redevelopment or renovation project, and that completion of anticipated or ongoing property redevelopment or renovation projects that we do pursue may cost more, take more time to complete or fail to perform as expected; |

• | risk that we are investing a significant amount in ground-up development projects that may be dependent on third parties to deliver critical aspects of certain projects, requires spending a substantial amount upfront in infrastructure, and assumes receipt of public funding which has been committed but not entirely funded; |

• | risks normally associated with the real estate industry, including risks that occupancy levels at our properties and the amount of rent that we receive from our properties may be lower than expected, that new acquisitions may fail to perform as expected, that competition for acquisitions could result in increased prices for acquisitions, that costs associated with the periodic maintenance and repair or renovation of space, insurance and other operations may increase, that environmental issues may develop at our properties and result in unanticipated costs, and, because real estate is illiquid, that we may not be able to sell properties when appropriate; |

• | risks that our growth will be limited if we cannot obtain additional capital; |

• | risks associated with general economic conditions, including local economic conditions in our geographic markets; |

• | risks of financing, such as our ability to consummate additional financings or obtain replacement financing on terms which are acceptable to us, our ability to meet existing financial covenants and the limitations imposed on our operations by those covenants, and the possibility of increases in interest rates that would result in increased interest expense; and |

• | risks related to our status as a real estate investment trust, commonly referred to as a REIT, for federal income tax purposes, such as the existence of complex tax regulations relating to our status as a REIT, the effect of future changes in REIT requirements as a result of new legislation, and the adverse consequences of the failure to qualify as a REIT. |

Given these uncertainties, readers are cautioned not to place undue reliance on any forward-looking statements that we make, including those in this Supplemental Information. Except as required by law, we make no promise to update any of the forward-looking statements as a result of new information, future events, or otherwise. You should review the risks contained in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 13, 2017.

2

NEWS RELEASE | www.federalrealty.com |

FOR IMMEDIATE RELEASE | |

Investor Inquiries: | Media Inquiries: |

Leah Andress | Andrea Simpson |

Investor Relations Associate | Vice President, Marketing |

301.998.8265 | 617.684.1511 |

landress@federalrealty.com | asimpson@federalrealty.com |

Federal Realty Investment Trust Announces Third Quarter 2017 Operating Results

ROCKVILLE, Md. (November 1, 2017) - Federal Realty Investment Trust (NYSE:FRT) today reported operating results for its third quarter ended September 30, 2017. Highlights of the quarter and recent activity include:

• | Generated earnings per diluted share of $1.47 for the quarter compared to $0.82 in third quarter 2016. |

• | Generated FFO per diluted share of $1.50 for the quarter compared to $1.41 in third quarter 2016. |

• | Generated same center property operating income growth of 4.4%. |

• | Signed leases for 399,619 sf of comparable space at an average rent of $38.24 psf and achieved cash basis rollover growth on comparable spaces of 14%. |

• | Opportunistically issued $150.0 million of 5.0% Series C Cumulative Redeemable Preferred Shares. |

• | Narrowed 2017 FFO per diluted share guidance range to $5.89 to $5.92. |

"Solid performance all around this quarter," said Donald C. Wood, President and Chief Executive Officer of Federal Realty. "Thoughtful positioning of our portfolio and company over the last decade empowers us to continue to excel during this transitional time in the retail real estate space. The balance of owning the best real estate in flexible formats combined with our A rated balance sheet sets us apart and allows us to focus on the future."

Financial Results

Net income available for common shareholders was $106.6 million and earnings per diluted share was $1.47 for third quarter 2017 versus $58.8 million and $0.82, respectively, for third quarter 2016. Year-to-date Federal Realty reported net income available for common shareholders of $238.8 million and earnings per diluted share of $3.30. This compares to net income available for common shareholders of $191.5 million and earnings per diluted share of $2.70 for the nine months ended September 30, 2016.

In the third quarter 2017, Federal Realty generated funds from operations available for common shareholders (FFO) of $110.0 million, or $1.50 per diluted share. This compares to FFO of $101.7 million, or $1.41 per diluted share, in third quarter 2016. For the nine months ended September 30, 2017, FFO was $324.5 million, or $4.45 per diluted share, compared to $301.4 million, or $4.21 per diluted share for the same nine month period in 2016.

3

FFO is a non-GAAP supplemental earnings measure which the Trust considers meaningful in measuring its operating performance. A reconciliation of FFO to net income is attached to this press release.

Portfolio Results

In third quarter 2017, same-center property operating income increased 4.4% over the prior year when including properties that are being redeveloped and 2.6% when excluding those properties.

The overall portfolio was 94.9% leased as of September 30, 2017, compared to 94.3% on September 30, 2016. Federal Realty’s same center portfolio was 96.0% leased on September 30, 2017, compared to 95.7% on September 30, 2016.

During third quarter 2017, Federal Realty signed 90 leases for 424,492 square feet of retail space. On a comparable space basis (i.e., spaces for which there was a former tenant), Federal Realty leased 399,619 square feet at an average cash basis contractual rent increase per square foot (i.e., excluding the impact of straight-line rents) of 14%. The average contractual rent on this comparable space for the first year of the new leases is $38.24 per square foot compared to the average contractual rent of $33.43 per square foot for the last year of the prior leases. The previous average contractual rent was calculated by including both the minimum rent and any percentage rent actually paid during the last year of the lease term for the re-leased space. On a GAAP basis (i.e., including the impact of straight-line rents), rent increases per square foot for comparable retail space averaged 27% for third quarter 2017.

Dividend Declarations

Federal Realty’s Board of Trustees declared a regular quarterly cash dividend of $1.00 per share, resulting in an indicated annual rate of $4.00 per share. The regular common dividend will be payable on January 16, 2018 to common shareholders of record as of January 2, 2018.

Federal Realty’s Board of Trustees also declared quarterly cash dividends with respect to the Trust’s Series C Preferred Shares. All dividends on the preferred shares will be payable on January 16, 2018 to preferred shareholders of record as of January 2, 2018.

Summary of Other Quarterly Activities and Recent Developments

• | October 12, 2017 - Federal Realty received the inaugural Best Sustainability Program award from the NAIOP DC | MD Chapter. The award is given to an organization that "demonstrates a strong commitment to sustainable business practices and solutions that contribute to environmental responsibility and economic success." |

4

• | September 25, 2017 - Federal Realty issued 6,000 5.0% Series C Cumulative Redeemable Preferred Shares, par value $0.01 per share at the liquidation preference of $25,000 per share in an underwritten public offering. The Series C Preferred Shares accrue dividends at a rate of 5.0% per year and are redeemable at our option on or after September 29, 2022. |

• | August 31, 2017 - Federal Realty announced the sale of 150 Post Street, a seven-story, 105,000 square foot retail and office building located in the Union Square district of San Francisco, for $69.3 million. |

Guidance

Federal Realty narrowed its guidance for 2017 FFO per diluted share to a range of $5.89 to $5.92 and adjusted 2017 earnings per diluted share guidance to a range of $4.02 to $4.05.

Federal Realty will provide preliminary expectations for 2018 FFO per diluted share on the Trust’s third quarter 2017 earnings conference call.

Conference Call Information

Federal Realty’s management team will present an in-depth discussion of the Trust’s operating performance on its third quarter 2017 earnings conference call, which is scheduled for Thursday, November 2, 2017 at 11:00AM ET. To participate, please call 877-445-3230 five to ten minutes prior to the call start time and use the passcode 84997180 (required). Federal Realty will also provide an online webcast on the Company’s web site, http://www.federalrealty.com, which will remain available for 30 days following the call. A telephonic replay of the conference call will also be available through November 9, 2017 by dialing 855.859.2056; Passcode: 84997180.

About Federal Realty

Federal Realty is a recognized leader in the ownership, operation and redevelopment of high-quality retail based properties located primarily in major coastal markets from Washington, D.C. to Boston as well as San Francisco and Los Angeles. Founded in 1962, our mission is to deliver long term, sustainable growth through investing in densely populated, affluent communities where retail demand exceeds supply. Our expertise includes creating urban, mixed-use neighborhoods like Santana Row in San Jose, California, Pike & Rose in North Bethesda, Maryland and Assembly Row in Somerville, Massachusetts. These unique and vibrant environments that combine shopping, dining, living and working provide a destination experience valued by their respective communities. Federal Realty's 104 properties include over 2,900 tenants, in approximately 24 million square feet, and over 2,000 residential units.

5

Federal Realty has paid quarterly dividends to its shareholders continuously since its founding in 1962, and has increased its dividend rate for 50 consecutive years, the longest record in the REIT industry. Federal Realty shares are traded on the NYSE under the symbol FRT. For additional information about Federal Realty and its properties, visit www.FederalRealty.com.

Safe Harbor Language

Certain matters discussed within this press release may be deemed to be forward-looking statements within the meaning of the federal securities laws. Although Federal Realty believes the expectations reflected in the forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. These factors include, but are not limited to, the risk factors described in our Annual Report on Form 10-K filed on February 13, 2017, and include the following:

• | risks that our tenants will not pay rent, may vacate early or may file for bankruptcy or that we may be unable to renew leases or re-let space at favorable rents as leases expire; |

• | risks that we may not be able to proceed with or obtain necessary approvals for any redevelopment or renovation project, and that completion of anticipated or ongoing property redevelopments or renovation projects that we do pursue may cost more, take more time to complete, or fail to perform as expected; |

• | risks that we are investing a significant amount in ground-up development projects that may not perform as planned, may be dependent on third parties to deliver critical aspects of certain projects, requires spending a substantial amount upfront in infrastructure, and assumes receipt of public funding which has been committed but not entirely funded; |

• | risks normally associated with the real estate industry, including risks that occupancy levels at our properties and the amount of rent that we receive from our properties may be lower than expected, that new acquisitions may fail to perform as expected, that competition for acquisitions could result in increased prices for acquisitions, that costs associated with the periodic maintenance and repair or renovation of space, insurance and other operations may increase, that environmental issues may develop at our properties and result in unanticipated costs, and, because real estate is illiquid, that we may not be able to sell properties when appropriate; |

• | risks that our growth will be limited if we cannot obtain additional capital; |

• | risks associated with general economic conditions, including local economic conditions in our geographic markets; |

• | risks of financing, such as our ability to consummate additional financings or obtain replacement financing on terms which are acceptable to us, our ability to meet existing financial covenants and the limitations imposed on our operations by those covenants, and the possibility of increases in interest rates that would result in increased interest expense; and |

• | risks related to our status as a real estate investment trust, commonly referred to as a REIT, for federal income tax purposes, such as the existence of complex tax regulations relating to our status as a REIT, the effect of future changes in REIT requirements as a result of new legislation, and the adverse consequences of the failure to qualify as a REIT. |

Given these uncertainties, readers are cautioned not to place undue reliance on any forward-looking statements that we make, including those in this press release. Except as may be required by law, we make no promise to update any of the forward-looking statements as a result of new information, future events or otherwise. You should carefully review the risks and risk factors included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 13, 2017.

6

Federal Realty Investment Trust | |||||||||||||||

Consolidated Income Statements | |||||||||||||||

September 30, 2017 | |||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

(in thousands, except per share data) | |||||||||||||||

(unaudited) | |||||||||||||||

REVENUE | |||||||||||||||

Rental income | $ | 212,048 | $ | 197,469 | $ | 620,741 | $ | 585,712 | |||||||

Other property income | 5,171 | 2,759 | 10,429 | 8,559 | |||||||||||

Mortgage interest income | 734 | 929 | 2,221 | 3,211 | |||||||||||

Total revenue | 217,953 | 201,157 | 633,391 | 597,482 | |||||||||||

EXPENSES | |||||||||||||||

Rental expenses | 41,250 | 38,588 | 119,487 | 118,385 | |||||||||||

Real estate taxes | 27,492 | 24,973 | 79,104 | 71,164 | |||||||||||

General and administrative | 9,103 | 8,232 | 26,013 | 25,278 | |||||||||||

Depreciation and amortization | 55,611 | 48,903 | 159,656 | 145,137 | |||||||||||

Total operating expenses | 133,456 | 120,696 | 384,260 | 359,964 | |||||||||||

OPERATING INCOME | 84,497 | 80,461 | 249,131 | 237,518 | |||||||||||

Other interest income | 79 | 105 | 253 | 285 | |||||||||||

Interest expense | (26,287 | ) | (24,313 | ) | (73,952 | ) | (71,143 | ) | |||||||

(Loss) income from real estate partnerships | (182 | ) | — | (296 | ) | 41 | |||||||||

INCOME FROM CONTINUING OPERATIONS | 58,107 | 56,253 | 175,136 | 166,701 | |||||||||||

Gain on sale of real estate and change in control of interests, net | 50,775 | 4,945 | 69,949 | 32,458 | |||||||||||

NET INCOME | 108,882 | 61,198 | 245,085 | 199,159 | |||||||||||

Net income attributable to noncontrolling interests | (2,105 | ) | (2,221 | ) | (5,827 | ) | (7,286 | ) | |||||||

NET INCOME ATTRIBUTABLE TO THE TRUST | 106,777 | 58,977 | 239,258 | 191,873 | |||||||||||

Dividends on preferred shares | (177 | ) | (136 | ) | (448 | ) | (406 | ) | |||||||

NET INCOME AVAILABLE FOR COMMON SHAREHOLDERS | $ | 106,600 | $ | 58,841 | $ | 238,810 | $ | 191,467 | |||||||

EARNINGS PER COMMON SHARE, BASIC: | |||||||||||||||

Net income available for common shareholders | $ | 1.47 | $ | 0.82 | $ | 3.31 | $ | 2.70 | |||||||

Weighted average number of common shares | 72,091 | 71,319 | 71,983 | 70,626 | |||||||||||

EARNINGS PER COMMON SHARE, DILUTED: | |||||||||||||||

Net income available for common shareholders | $ | 1.47 | $ | 0.82 | $ | 3.30 | $ | 2.70 | |||||||

Weighted average number of common shares | 72,206 | 71,489 | 72,110 | 70,804 | |||||||||||

7

Federal Realty Investment Trust | |||||||

Consolidated Balance Sheets | |||||||

September 30, 2017 | |||||||

September 30, | December 31, | ||||||

2017 | 2016 | ||||||

(in thousands, except share and per share data) | |||||||

(unaudited) | |||||||

ASSETS | |||||||

Real estate, at cost | |||||||

Operating (including $1,666,691 and $1,226,918 of consolidated variable interest entities, respectively) | $ | 6,758,728 | $ | 6,125,957 | |||

Construction-in-progress | 769,882 | 599,260 | |||||

Asset held for sale | — | 33,856 | |||||

7,528,610 | 6,759,073 | ||||||

Less accumulated depreciation and amortization (including $236,391 and $209,239 of consolidated variable interest entities, respectively) | (1,828,845 | ) | (1,729,234 | ) | |||

Net real estate | 5,699,765 | 5,029,839 | |||||

Cash and cash equivalents | 22,850 | 23,368 | |||||

Accounts and notes receivable, net | 200,878 | 116,749 | |||||

Mortgage notes receivable, net | 30,429 | 29,904 | |||||

Investment in real estate partnerships | 23,925 | 14,864 | |||||

Prepaid expenses and other assets | 243,290 | 208,555 | |||||

TOTAL ASSETS | $ | 6,221,137 | $ | 5,423,279 | |||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||

Liabilities | |||||||

Mortgages payable (including $461,873 and $439,120 of consolidated variable interest entities, respectively) | $ | 493,240 | $ | 471,117 | |||

Capital lease obligations | 71,565 | 71,590 | |||||

Notes payable | 320,718 | 279,151 | |||||

Senior notes and debentures | 2,377,939 | 1,976,594 | |||||

Accounts payable and accrued expenses | 206,441 | 201,756 | |||||

Dividends payable | 73,466 | 71,440 | |||||

Security deposits payable | 16,698 | 16,285 | |||||

Other liabilities and deferred credits | 175,464 | 115,817 | |||||

Total liabilities | 3,735,531 | 3,203,750 | |||||

Commitments and contingencies | |||||||

Redeemable noncontrolling interests | 151,815 | 143,694 | |||||

Shareholders’ equity | |||||||

Preferred shares, authorized 15,000,000 shares, $.01 par: | |||||||

5.0% Series C Cumulative Redeemable Preferred Shares, (stated at liquidation preference $25,000 per share), 6,000 and 0 shares issued and outstanding, respectively | 150,000 | — | |||||

5.417% Series 1 Cumulative Convertible Preferred Shares, (stated at liquidation preference $25 per share), 399,896 shares issued and outstanding | 9,997 | 9,997 | |||||

Common shares of beneficial interest, $.01 par, 100,000,000 shares authorized, 72,542,909 and 71,995,897 shares issued and outstanding, respectively | 728 | 722 | |||||

Additional paid-in capital | 2,773,890 | 2,718,325 | |||||

Accumulated dividends in excess of net income | (724,919 | ) | (749,734 | ) | |||

Accumulated other comprehensive loss | (742 | ) | (2,577 | ) | |||

Total shareholders’ equity of the Trust | 2,208,954 | 1,976,733 | |||||

Noncontrolling interests | 124,837 | 99,102 | |||||

Total shareholders’ equity | 2,333,791 | 2,075,835 | |||||

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 6,221,137 | $ | 5,423,279 | |||

8

Federal Realty Investment Trust | ||||||||||||||||

Funds From Operations / Summary of Capital Expenditures | ||||||||||||||||

September 30, 2017 | ||||||||||||||||

Three Months Ended | Nine Months Ended | |||||||||||||||

September 30, | September 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

(in thousands, except per share data) | ||||||||||||||||

Funds from Operations available for common shareholders (FFO) (1) | ||||||||||||||||

Net income | $ | 108,882 | $ | 61,198 | $ | 245,085 | $ | 199,159 | ||||||||

Net income attributable to noncontrolling interests | (2,105 | ) | (2,221 | ) | (5,827 | ) | (7,286 | ) | ||||||||

Gain on sale of real estate and change in control of interests, net | (50,775 | ) | (4,706 | ) | (69,659 | ) | (31,133 | ) | ||||||||

Depreciation and amortization of real estate assets | 48,796 | 42,779 | 139,112 | 126,806 | ||||||||||||

Amortization of initial direct costs of leases | 4,780 | 4,260 | 14,530 | 12,729 | ||||||||||||

Funds from operations | 109,578 | 101,310 | 323,241 | 300,275 | ||||||||||||

Dividends on preferred shares (2) | (41 | ) | (136 | ) | (41 | ) | (406 | ) | ||||||||

Income attributable to operating partnership units | 788 | 750 | 2,355 | 2,397 | ||||||||||||

Income attributable to unvested shares | (357 | ) | (263 | ) | (1,064 | ) | (826 | ) | ||||||||

FFO | $ | 109,968 | $ | 101,661 | $ | 324,491 | $ | 301,440 | ||||||||

Weighted average number of common shares, diluted | 73,089 | 72,254 | 73,001 | 71,642 | ||||||||||||

FFO per diluted share | $ | 1.50 | $ | 1.41 | $ | 4.45 | $ | 4.21 | ||||||||

Summary of Capital Expenditures | ||||||||||||||||

Non-maintenance capital expenditures | ||||||||||||||||

Development, redevelopment and expansions | $ | 110,861 | $ | 130,312 | $ | 326,508 | $ | 295,533 | ||||||||

Tenant improvements and incentives | 9,482 | 8,976 | 31,219 | 24,404 | ||||||||||||

Total non-maintenance capital expenditures | 120,343 | 139,288 | 357,727 | 319,937 | ||||||||||||

Maintenance capital expenditures | 8,021 | 8,949 | 17,919 | 16,130 | ||||||||||||

Total capital expenditures | $ | 128,364 | $ | 148,237 | $ | 375,646 | $ | 336,067 | ||||||||

Dividends and Payout Ratios | ||||||||||||||||

Regular common dividends declared | $ | 72,503 | $ | 70,301 | $ | 213,954 | $ | 203,890 | ||||||||

Dividend payout ratio as a percentage of FFO | 66 | % | 69 | % | 66 | % | 68 | % | ||||||||

Notes:

1) | See Glossary of Terms. |

2) | For the three and nine months ended September 30, 2017, dividends on our Series 1 preferred stock are not deducted in the calculation of FFO, as the related shares are dilutive and included in "weighted average common shares, diluted." |

9

Federal Realty Investment Trust | |||||||||

Market Data | |||||||||

September 30, 2017 | |||||||||

September 30, | |||||||||

2017 | 2016 | ||||||||

(in thousands, except per share data) | |||||||||

Market Data | |||||||||

Common shares outstanding and operating partnership units (1) | 73,331 | 72,547 | |||||||

Market price per common share | $ | 124.21 | $ | 153.93 | |||||

Common equity market capitalization including operating partnership units | $ | 9,108,444 | $ | 11,167,160 | |||||

Series C preferred shares outstanding | 6 | — | |||||||

Liquidation price per Series C preferred share | $ | 25,000.00 | — | ||||||

Series C preferred equity market capitalization | $ | 150,000 | $ | — | |||||

Series 1 preferred shares outstanding (2) | 400 | 400 | |||||||

Liquidation price per Series 1 preferred share | $ | 25.00 | $ | 25.00 | |||||

Series 1 preferred equity market capitalization | $ | 10,000 | $ | 10,000 | |||||

Equity market capitalization | $ | 9,268,444 | $ | 11,177,160 | |||||

Total debt (3) | 3,263,462 | 2,809,564 | |||||||

Total market capitalization | $ | 12,531,906 | $ | 13,986,724 | |||||

Total debt to market capitalization at market price per common share | 26 | % | 20 | % | |||||

Fixed rate debt ratio: | |||||||||

Fixed rate debt and capital lease obligations (4) | 99 | % | 100 | % | |||||

Variable rate debt | 1 | % | <1% | ||||||

100 | % | 100 | % | ||||||

Notes:

1) | Amounts include 787,962 and 763,797 operating partnership units outstanding at September 30, 2017 and 2016, respectively. |

2) | These shares, issued March 8, 2007, are unregistered. |

3) | Total debt includes capital leases, mortgages payable, notes payable, senior notes and debentures, net of premiums and discounts from our consolidated balance sheet. |

4) | Fixed rate debt includes our $275.0 million term loan as the rate is effectively fixed by two interest rate swap agreements. |

10

Federal Realty Investment Trust | |||||||||||||||

Components of Rental Income | |||||||||||||||

September 30, 2017 | |||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

(in thousands) | |||||||||||||||

Minimum rents (1) | |||||||||||||||

Retail and commercial | $ | 147,971 | $ | 137,009 | $ | 434,390 | $ | 409,027 | |||||||

Residential | 13,837 | 12,886 | 40,781 | 36,476 | |||||||||||

Cost reimbursements | 43,602 | 40,565 | 124,997 | 119,004 | |||||||||||

Percentage rents | 2,304 | 2,315 | 7,524 | 7,866 | |||||||||||

Other | 4,334 | 4,694 | 13,049 | 13,339 | |||||||||||

Total rental income | $ | 212,048 | $ | 197,469 | $ | 620,741 | $ | 585,712 | |||||||

Notes:

1) | Minimum rents include $3.9 million and $1.5 million for the three months ended September 30, 2017 and 2016, respectively, and $11.3 million and $6.2 million for the nine months ended September 30, 2017 and 2016, respectively, to recognize minimum rents on a straight-line basis. In addition, minimum rents include $0.9 million and $0.5 million for the three months ended September 30, 2017 and 2016, respectively, and $3.3 million and $1.2 million for the nine months ended September 30, 2017 and 2016, respectively, to recognize income from the amortization of in-place leases. |

11

Federal Realty Investment Trust | |||||||||

Comparable Property Information | |||||||||

September 30, 2017 | |||||||||

The following information is being provided for “Comparable Properties.” Comparable Properties represents our consolidated property portfolio other than those properties that distort comparability between periods in two primary categories: (1) assets that were not owned for the full quarter in both periods presented and (2) assets currently under development or being repositioned for significant redevelopment and investment. The assets excluded from Comparable Properties in Q3 include: 500 Santana Row, Assembly Row - Phase 2, CocoWalk, Pike & Rose, The Point at Plaza El Segundo, The Shops at Sunset Place, Towson Residential, and all properties acquired or disposed of from Q3 2016 to Q3 2017. Comparable Property property operating income (“Comparable Property POI”) is a non-GAAP measure used by management in evaluating the operating performance of our properties period over period. | |||||||||

Reconciliation of GAAP operating income to Comparable Property POI | |||||||||

Three Months Ended | |||||||||

September 30, | |||||||||

2017 | 2016 | ||||||||

(in thousands) | |||||||||

Operating Income | $ | 84,497 | $ | 80,461 | |||||

Add: | |||||||||

Depreciation and amortization | 55,611 | 48,903 | |||||||

General and administrative | 9,103 | 8,232 | |||||||

Property operating income (POI) | 149,211 | 137,596 | |||||||

Less: Non-comparable POI - acquisitions/dispositions | (5,174 | ) | (948 | ) | |||||

Less: Non-comparable POI - redevelopment, development & other | (12,928 | ) | (9,304 | ) | |||||

Comparable Property POI | $ | 131,109 | $ | 127,344 | |||||

Additional information regarding the components of Comparable Property POI | |||||||||

Three Months Ended | |||||||||

September 30, | |||||||||

2017 | 2016 | % Change | |||||||

(in thousands) | |||||||||

Rental income | $ | 184,020 | $ | 180,513 | |||||

Non-rental income | 3,144 | 2,436 | |||||||

187,164 | 182,949 | ||||||||

Rental expenses | (32,435 | ) | (32,665 | ) | |||||

Real estate taxes | (23,620 | ) | (22,940 | ) | |||||

(56,055 | ) | (55,605 | ) | ||||||

Comparable Property POI | $ | 131,109 | $ | 127,344 | 3.0 | % | |||

Comparable Property POI as a percentage of total POI | 88 | % | 93 | % | |||||

Comparable Property - Occupancy Statistics (1) | |||||||||

At September 30, | |||||||||

2017 | 2016 | ||||||||

Leased % - comparable retail properties | 95.4 | % | 94.6 | % | |||||

Occupancy % - comparable retail properties | 94.1 | % | 93.4 | % | |||||

Comparable Property - Summary of Capital Expenditures (2) | |||||||||

Three Months Ended | |||||||||

September 30, | |||||||||

2017 | 2016 | ||||||||

(in thousands) | |||||||||

Redevelopment and tenant improvements and incentives | $ | 23,114 | $ | 36,918 | |||||

Maintenance capital expenditures | 7,702 | 8,316 | |||||||

$ | 30,816 | $ | 45,234 | ||||||

Notes: | |

(1) | See page 28 for entire portfolio occupancy statistics. |

(2) | See page 9 for "Summary of Capital Expenditures" for our entire portfolio. |

12

Federal Realty Investment Trust | ||||||||||||||

Summary of Outstanding Debt and Capital Lease Obligations | ||||||||||||||

September 30, 2017 | ||||||||||||||

As of September 30, 2017 | ||||||||||||||

Stated maturity date | Stated interest rate | Balance | Weighted average effective rate (3) | |||||||||||

(in thousands) | ||||||||||||||

Mortgages Payable | ||||||||||||||

Secured fixed rate | ||||||||||||||

The Grove at Shrewsbury (West) | 3/1/2018 | 6.38% | $ | 10,608 | ||||||||||

Rollingwood Apartments | 5/1/2019 | 5.54% | 20,939 | |||||||||||

The Shops at Sunset Place | 9/1/2020 | 5.62% | 67,124 | |||||||||||

29th Place | 1/31/2021 | 5.91% | 4,395 | |||||||||||

Sylmar Towne Center | 6/6/2021 | 5.39% | 17,448 | |||||||||||

Plaza Del Sol | 12/1/2021 | 5.23% | 8,621 | |||||||||||

THE AVENUE at White Marsh | 1/1/2022 | 3.35% | 52,705 | |||||||||||

Montrose Crossing | 1/10/2022 | 4.20% | 71,478 | |||||||||||

Azalea | 11/1/2025 | 3.73% | 40,000 | |||||||||||

Bell Gardens | 8/1/2026 | 4.06% | 13,245 | |||||||||||

Plaze El Segundo | 6/5/2027 | 3.83% | 125,000 | |||||||||||

The Grove at Shrewsbury (East) | 9/1/2027 | 3.77% | 43,600 | |||||||||||

Brook 35 | 7/1/2029 | 4.65% | 11,500 | |||||||||||

Chelsea | 1/15/2031 | 5.36% | 6,346 | |||||||||||

Subtotal | 493,009 | |||||||||||||

Net unamortized premium and debt issuance costs | 231 | |||||||||||||

Total mortgages payable | 493,240 | 4.11% | ||||||||||||

Notes payable | ||||||||||||||

Unsecured fixed rate | ||||||||||||||

Term loan (1) | 11/21/2018 | LIBOR + 0.90% | 275,000 | |||||||||||

Various | Various through 2028 | 11.31% | 4,908 | |||||||||||

Unsecured variable rate | ||||||||||||||

Revolving credit facility (2) | 4/20/2020 | LIBOR + 0.825% | 41,500 | |||||||||||

Subtotal | 321,408 | |||||||||||||

Net unamortized debt issuance costs | (690 | ) | ||||||||||||

Total notes payable | 320,718 | 2.86% | (4) | |||||||||||

Senior notes and debentures | ||||||||||||||

Unsecured fixed rate | ||||||||||||||

5.90% notes | 4/1/2020 | 5.90% | 150,000 | |||||||||||

2.55% notes | 1/15/2021 | 2.55% | 250,000 | |||||||||||

3.00% notes | 8/1/2022 | 3.00% | 250,000 | |||||||||||

2.75% notes | 6/1/2023 | 2.75% | 275,000 | |||||||||||

3.95% notes | 1/15/2024 | 3.95% | 300,000 | |||||||||||

7.48% debentures | 8/15/2026 | 7.48% | 29,200 | |||||||||||

3.25% notes | 7/15/2027 | 3.25% | 300,000 | |||||||||||

6.82% medium term notes | 8/1/2027 | 6.82% | 40,000 | |||||||||||

4.50% notes | 12/1/2044 | 4.50% | 550,000 | |||||||||||

3.625% notes | 8/1/2046 | 3.625% | 250,000 | |||||||||||

Subtotal | 2,394,200 | |||||||||||||

Net unamortized discount and debt issuance costs | (16,261 | ) | ||||||||||||

Total senior notes and debentures | 2,377,939 | 3.93% | ||||||||||||

Capital lease obligations | ||||||||||||||

Various | Various through 2106 | Various | 71,565 | 8.04% | ||||||||||

Total debt and capital lease obligations | $ | 3,263,462 | ||||||||||||

Total fixed rate debt and capital lease obligations | $ | 3,221,962 | 99 | % | 3.96% | |||||||||

Total variable rate debt | 41,500 | 1 | % | 2.06% | (4) | |||||||||

Total debt and capital lease obligations | $ | 3,263,462 | 100 | % | 3.94% | (4) | ||||||||

13

Three Months Ended | Nine Months Ended | ||||||

September 30, | September 30, | ||||||

2017 | 2016 | 2017 | 2016 | ||||

Operational Statistics | |||||||

Ratio of EBITDA to combined fixed charges and preferred share dividends (5) | 5.65x | 4.56x | 5.10x | 4.87x | |||

Ratio of adjusted EBITDA to combined fixed charges and preferred share dividends (5) | 4.14x | 4.39x | 4.34x | 4.49x | |||

Notes:

1) | We entered into two interest rate swap agreements to fix the variable rate portion of our $275.0 million term loan at 1.72% through November 1, 2018. The swap agreements effectively fix the rate on the term loan at 2.62% and thus, the loan is included in fixed rate debt. |

2) | The maximum amount drawn under our revolving credit facility during the three and nine months ended September 30, 2017, was $281.5 million and $344.0 million, respectively. The weighted average interest rate on borrowings under our revolving credit facility, before amortization of debt fees, for the three and nine months ended September 30, 2017, was 2.1% and 1.9%, respectively. |

3) | The weighted average effective interest rate includes the amortization of any debt issuance costs and discounts and premiums, if applicable, except as described in Note 4. |

4) | The weighted average effective interest rate excludes $0.5 million in quarterly financing fees and quarterly debt fee amortization on our revolving credit facility which had $41.5 million outstanding on September 30, 2017. In addition, the weighted average effective interest rate is calculated using the fixed rate on our term loan of 2.62% as the result of the interest rate swap agreements discussed in Note 1. The term loan is included in fixed rate debt. |

5) | Fixed charges consist of interest on borrowed funds (including capitalized interest), amortization of debt discount/premium and debt costs, and the portion of rent expense representing an interest factor. EBITDA includes a gain on sale of real estate and change in control of interests of $51.1 million and $4.9 million for the three months ended September 30, 2017 and 2016, respectively, and $71.9 million and $32.5 million for the nine months ended September 30, 2017 and 2016, respectively. Adjusted EBITDA is reconciled to net income in the Glossary of Terms. |

14

Federal Realty Investment Trust | |||||||||||||||||||||

Summary of Debt Maturities | |||||||||||||||||||||

September 30, 2017 | |||||||||||||||||||||

Year | Scheduled Amortization | Maturities | Total | Percent of Debt Maturing | Cumulative Percent of Debt Maturing | Weighted Average Rate (4) | |||||||||||||||

(in thousands) | |||||||||||||||||||||

2017 | $ | 1,561 | $ | — | $ | 1,561 | 0.1 | % | 0.1 | % | — | % | |||||||||

2018 | 6,299 | 285,502 | (1) | 291,801 | 8.9 | % | 9.0 | % | 2.9 | % | |||||||||||

2019 | 6,269 | 20,160 | 26,429 | 0.8 | % | 9.8 | % | 5.7 | % | ||||||||||||

2020 | 5,621 | 252,093 | (2) | 257,714 | 7.9 | % | 17.7 | % | 4.8 | % | (5) | ||||||||||

2021 | 3,746 | 277,546 | 281,292 | 8.6 | % | 26.3 | % | 3.0 | % | ||||||||||||

2022 | 1,529 | 366,323 | 367,852 | 11.2 | % | 37.5 | % | 3.5 | % | ||||||||||||

2023 | 1,541 | 330,010 | 331,551 | 10.1 | % | 47.6 | % | 3.9 | % | ||||||||||||

2024 | 1,320 | 300,000 | 301,320 | 9.2 | % | 56.8 | % | 4.2 | % | ||||||||||||

2025 | 873 | 40,000 | 40,873 | 1.2 | % | 58.0 | % | 3.9 | % | ||||||||||||

2026 | 688 | 39,886 | 40,574 | 1.2 | % | 59.2 | % | 6.6 | % | ||||||||||||

Thereafter | 19,115 | 1,320,100 | 1,339,215 | 40.8 | % | 100.0 | % | 4.2 | % | ||||||||||||

Total | $ | 48,562 | $ | 3,231,620 | $ | 3,280,182 | (3) | 100.0 | % | ||||||||||||

Notes:

1) | Our $275.0 million unsecured term loan matures on November 21, 2018, subject to a one-year extension at our option. |

2) | Our $800.0 million revolving credit facility matures on April 20, 2020, subject to two six-month extensions at our option. As of September 30, 2017, there was $41.5 million balance outstanding under this credit facility. |

3) | The total debt maturities differs from the total reported on the consolidated balance sheet due to the unamortized net premium/(discount) and debt issuance costs on certain mortgage loans, notes payable, and senior notes as of September 30, 2017. |

4) | The weighted average rate reflects the weighted average interest rate on debt maturing in the respective year. |

5) | The weighted average rate excludes $0.5 million in quarterly financing fees and quarterly debt fee amortization on our revolving credit facility. |

15

Federal Realty Investment Trust | |||||||||||

Summary of Redevelopment Opportunities | |||||||||||

September 30, 2017 | |||||||||||

The following redevelopment opportunities have received or will shortly receive all necessary approvals to proceed and are actively being worked on by the Trust. (1) | |||||||||||

Property | Location | Opportunity | Projected ROI (2) | Projected Cost (1) | Cost to Date | Anticipated Stabilization (3) | |||||

(in millions) | (in millions) | ||||||||||

The Point | El Segundo, CA | Addition of 90,000 square feet of retail and 25,000 square feet of office space | 7 | % | $88 | $87 | 2017 | ||||

Cocowalk | Coconut Grove, FL | Shopping center redevelopment to include demolition of three story east wing of the property and construction of a 77,000 square foot 5-story office building with an additional 13,000 square feet of ground floor retail | 6%-7% | $73 - $77 | $7 | 2020 | |||||

Towson Residential | Towson, MD | New 105 unit 5-story apartment building with above grade parking | 6 | % | $20 | $20 | 2018 | ||||

Tower Shops | Davie, FL | Addition of 50,000 square foot pad building | 12 | % | $15 | $14 | Stabilized | ||||

Plaza Del Mercado | Silver Spring, MD | Demolition of former grocery anchor space to construct spaces for new grocery anchor and fitness center tenants | 8 | % | $15 | $15 | Stabilized | ||||

Del Mar Village | Boca Raton, FL | Demolition of small shop spaces and relocation of tenants to accommodate new 37,000 square foot fitness center tenant | 7 | % | $11 | $6 | 2018 | ||||

Montrose Crossing | Rockville, MD | Demolition of 10,000 square foot restaurant building to construct an 18,000 square foot multi-tenant pad building | 11 | % | $10 | $4 | 2018 | ||||

Pike 7 Plaza | Vienna, VA | Addition of 8,300 square foot multi-tenant retail pad building | 7 | % | $10 | $4 | 2019 | ||||

Willow Lawn | Richmond, VA | Demolition of small shop and mini anchor spaces to construct new 49,000 square foot anchor space to accommodate new sporting goods retailer and new 17,000 square foot building for relocation of existing tenant | 7 | % | $10 | $4 | 2018 | ||||

Mercer Mall | Lawrenceville, NJ | Redevelopment of recently acquired office building pre-leased to a single tenant user | 7 | % | $9 | $4 | 2018 | ||||

The AVENUE at White Marsh | White Marsh, MD | Addition of two new pad sites totaling 13,000 square feet, a new 3,600 square foot restaurant building, and a drive up ATM | 10 | % | $5 | $4 | 2017 | ||||

Santana Row | San Jose, CA | Addition of two retail kiosks and open air plaza upgrades | 8 | % | $5 | $5 | Stabilized | ||||

Free State Shopping Center | Bowie, MD | Demolition of 26,000 square foot vacant building to allow for construction of new 12,500 square foot pad building for new daycare tenant | 8 | % | $4 | $4 | Stabilized | ||||

Eastgate Crossing | Chapel Hill, NC | New 7,400 square foot multi-tenant pad building on site of existing gas station | 9 | % | $3 | $3 | Stabilized | ||||

Dedham Plaza | Dedham, MA | New 4,000 square foot pad site for restaurant tenant | 8 | % | $2 | $1 | 2018 | ||||

Willow Lawn | Richmond, VA | Conversion of vacant 5,000 square foot pad building to retail use to accommodate new 3,500 square foot fast casual restaurant tenant. Remainder of pad building to be demolished to construct new 2,200 square foot Starbucks pad site. | 8 | % | $2 | $0 | 2019 | ||||

Total Active Redevelopment projects (4) | 8 | % | $282-$286 | $182 | |||||||

Notes:

(1) | There is no guarantee that the Trust will ultimately complete any or all of these opportunities, that the Projected Return on Investment (ROI) or Projected Costs will be the amounts shown or that stabilization will occur as anticipated. The projected ROI and Projected Cost are management's best estimate based on current information and may change over time. |

(2) | Projected ROI for redevelopment projects generally reflects only the deal specific cash, unleveraged incremental Property Operating Income (POI) generated by the redevelopment and is calculated as Incremental POI divided by incremental cost. Incremental POI is the POI generated by the redevelopment after deducting rent being paid or management's estimate of rent to be paid for the redevelopment space and any other space taken out of service to accommodate the redevelopment. Projected ROI for redevelopment projects does NOT include peripheral impacts, such as the impact on future lease rollovers at the property or the impact on the long-term value of the property. |

(3) | Stabilization is generally the year in which 95% physical occupancy of the redeveloped space is achieved. Economic stabilization may occur at a later point in time. |

(4) | All subtotals and totals reflect cost weighted-average ROIs. |

16

Federal Realty Investment Trust | |||||||||||||

Assembly Row, Pike & Rose, and Santana Row | |||||||||||||

September 30, 2017 | |||||||||||||

Projected POI Delivered (as a % of Total) | |||||||||||||

Projected | Total | Costs to | For Year Ended December 31, (2) | ||||||||||

Property (1) | Location | Opportunity | ROI (3) | Cost (4) | Date | 2017 | 2018 | 2019 | Expected Opening Timeframe | ||||

(in millions) | (in millions) | ||||||||||||

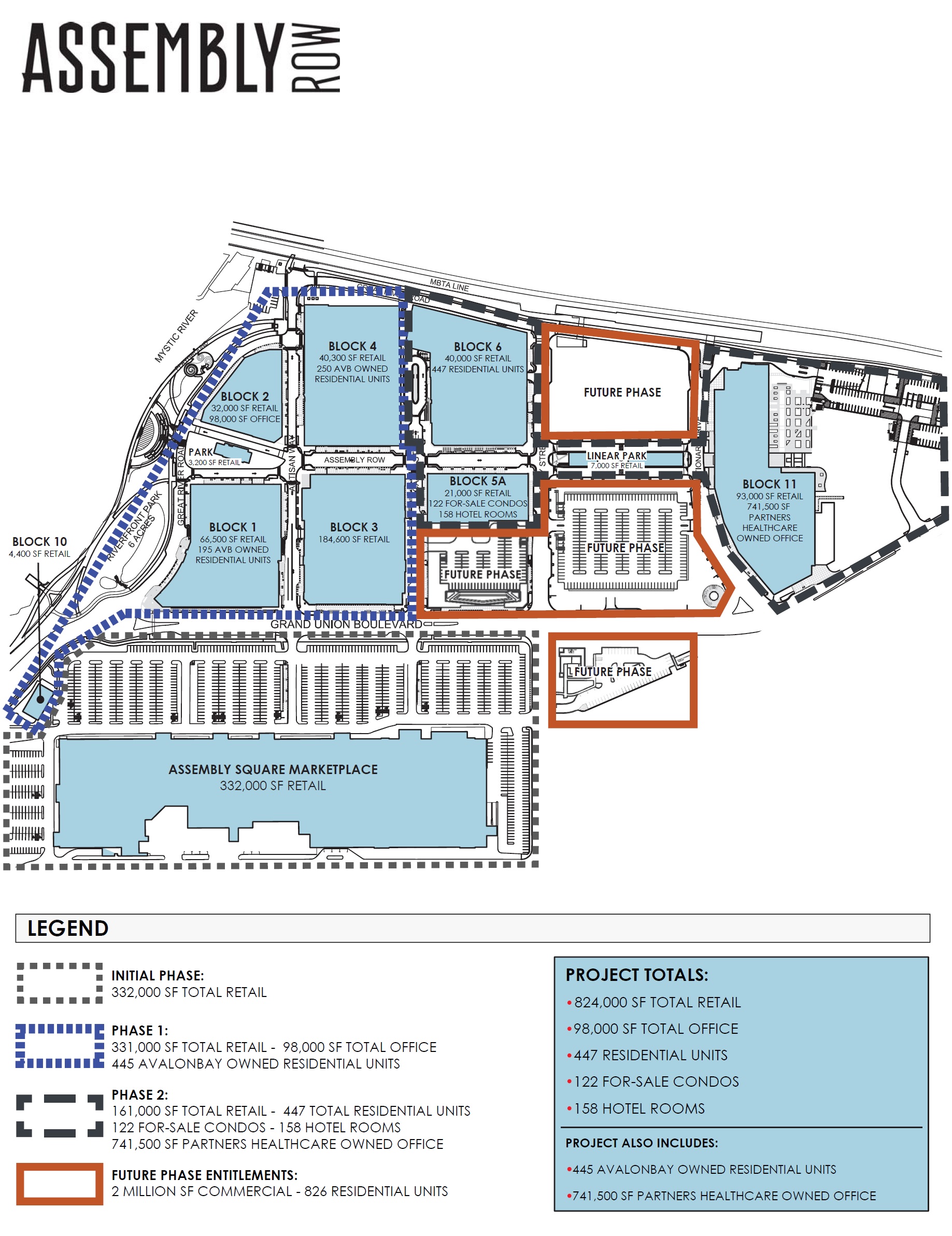

Assembly Row | Somerville, MA | ||||||||||||

Phase II | - 161,000 SF of retail | 7% | (5) | $280 - 295 | $246 | — | 50% | 90% | 36,000 square feet of retail has opened, remaining tenants projected to open through 2018 | ||||

- 447 residential units | |||||||||||||

- 158 boutique hotel rooms | Residential building opened in September 2017 with deliveries expected through 2Q 2018 | ||||||||||||

741,500 SF Partners Healthcare office space (built by Partners) opened in 2016 | |||||||||||||

- 122 for-sale condominium units | — | (6) | $74 - 79 | $61 | Projected closings to commence 2Q 2018 | ||||||||

Future Phases | - 2M SF of commercial | TBD | TBD | ||||||||||

- 826 residential units | |||||||||||||

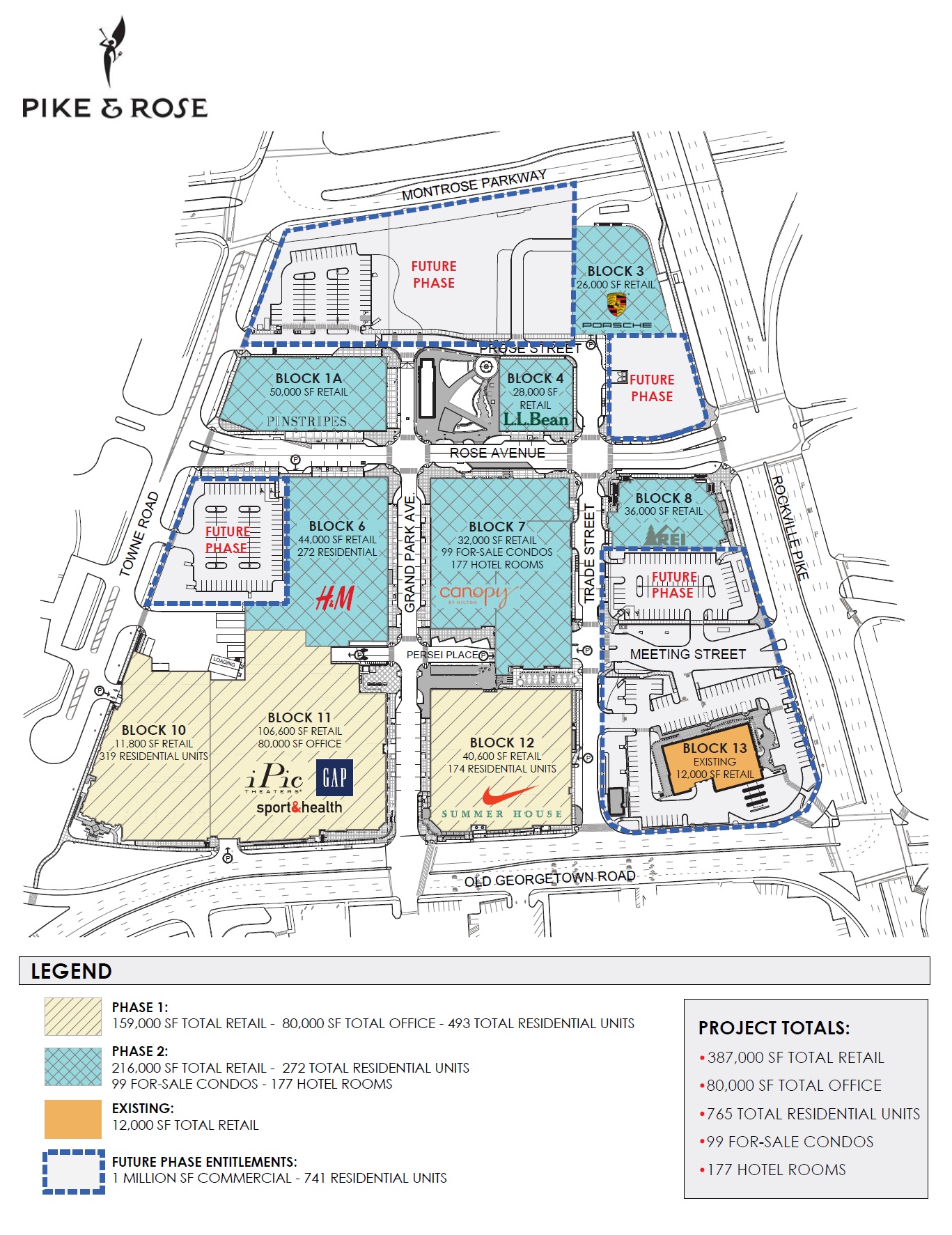

Pike & Rose | North Bethesda, MD | ||||||||||||

Phase I | - 159,000 SF of retail | 6-7% | (7) | $265 - 270 | $267 | 75% | 90% | 100% | Retail & office open | ||||

- 80,000 SF of office | Residential opened in 2014 (174 units) and | ||||||||||||

- 493 residential units | 2015/16 (319 units) | ||||||||||||

Phase II | - 216,000 SF of retail | 6-7% | (5) | $200 - 207 | $168 | — | 65% | 85% | 102,000 square feet of retail has opened, remaining tenants projected to open through 2018 | ||||

- 272 residential units | |||||||||||||

- 177 boutique hotel rooms | Residential building opened in August 2017 with deliveries expected through 2Q 2018 | ||||||||||||

- 99 for-sale condominium units | — | (6) | $53 - 58 | $49 | Projected closings to commence 2Q 2018 | ||||||||

Future Phases | - 1M SF of commercial | TBD | TBD | ||||||||||

- 741 residential units | |||||||||||||

Santana Row | San Jose, CA | ||||||||||||

700 Santana Row | - 284,000 SF of office | 7% | $205 - 215 | $45 | — | — | TBD | Commenced construction 4Q 2016 | |||||

- 29,000 SF of retail & 1,300 parking spaces | Opening projected 2019 | ||||||||||||

Future Phases | - 321,000 SF of commercial | TBD | TBD | ||||||||||

- 395 residential units | |||||||||||||

(1) | Anticipated opening dates, total cost, projected return on investment (ROI), and projected POI percentages are subject to adjustment as a result of factors inherent in the development process, some of which may not be | |||||

under the direct control of the Company. Refer to the Company's filings with the Securities and Exchange Commission on Form 10-K and Form 10-Q for other risk factors. | ||||||

(2) | Percentage figures reflect (i) the projected POI (herein defined) for the stated year divided by (ii) the current projected annual stabilized POI for the Property. These percentages are projections only and we cannot give any | |||||

assurances that these amounts will actually be achieved. | ||||||

(3) | Projected ROI for development projects reflects the unleveraged Property Operating Income (POI) generated by the development and is calculated as POI divided by cost. | |||||

(4) | Projected costs for Assembly Row and Pike & Rose include an allocation of infrastructure costs for the entire project. | |||||

(5) | Costs are net of expected reimbursement by third parties and land sale proceeds from expected exercise of option. Phase II total costs include our share of the costs in the hotel. | |||||

(6) | Condominiums shown at cost; the projected ROI for Phase II does not assume any incremental profit on the sale of condominium units; for return calculation purposes, condominiums are assumed to be sold at cost. | |||||

(7) | Excludes approximately $9 million of costs incurred to date of which we have claims for recovery against 3rd parties. | |||||

17

Federal Realty Investment Trust

Assembly Row Site Plan

September 30, 2017

18

Federal Realty Investment Trust

Pike & Rose Site Plan

September 30, 2017

19

Federal Realty Investment Trust | |||||||

Future Redevelopment Opportunities | |||||||

September 30, 2017 | |||||||

We have identified the following potential opportunities to create future shareholder value. Executing these opportunities could be subject to government approvals, tenant consents, market conditions, etc. Work on many of these new opportunities is in its preliminary stages and may not ultimately come to fruition. This list will change from time to time as we identify hurdles that cannot be overcome in the near term, and focus on those opportunities that are most likely to lead to the creation of shareholder value over time. | |||||||

Pad Site Opportunities - Opportunities to add both single tenant and multi-tenant stand alone pad buildings at existing retail properties. Many of these opportunities are "by right" and construction is awaiting appropriate retailer demand. | |||||||

Bethesda Row | Bethesda, MD | Melville Mall | Huntington, NY | ||||

Escondido Promenade | Escondido, CA | Mercer Mall | Lawrenceville, NJ | ||||

Federal Plaza | Rockville, MD | Pan Am | Fairfax, VA | ||||

Flourtown | Flourtown, PA | Wildwood | Bethesda, MD | ||||

Fresh Meadows | Queens, NY | ||||||

Property Expansion or Conversion - Opportunities at successful retail properties to convert previously underutilized land into new GLA and to convert other existing uses into more productive uses for the property. | |||||||

Barracks Road | Charlottesville, VA | Fresh Meadows | Queens, NY | ||||

Bethesda Row | Bethesda, MD | Hastings Ranch | Pasadena, CA | ||||

Brick Plaza | Brick, NJ | Northeast | Philadelphia, PA | ||||

Crossroads | Highland Park, IL | Riverpoint Center | Chicago, IL | ||||

Darien | Darien, CT | The Shops at Sunset Place | South Miami, FL | ||||

Dedham Plaza | Dedham, MA | Third Street Promenade | Santa Monica, CA | ||||

Fourth Street | Berkeley, CA | Wildwood | Bethesda, MD | ||||

Residential Opportunities - Opportunity to add residential units to existing retail and mixed-use properties. | |||||||

Barracks Road | Charlottesville, VA | Graham Park Plaza | Falls Church, VA | ||||

Bala Cynwyd | Bala Cynwyd, PA | Village at Shirlington | Arlington, VA | ||||

Longer Term Mixed-Use Opportunities | |||||||

Assembly Row (1) | Somerville, MA | San Antonio Center | Mountain View, CA | ||||

Bala Cynwyd | Bala Cynwyd, PA | Santana Row (3) | San Jose, CA | ||||

Pike 7 Plaza | Vienna, VA | Santana Row - Winchester Theater site | San Jose, CA | ||||

Pike & Rose (2) | North Bethesda, MD | ||||||

Notes: | |||||||

(1) | Assembly Row | Remaining entitlements after Phase II include approximately 2 million square feet of commercial-use buildings and 826 residential units. | |||||

(2) | Pike & Rose | Remaining entitlements after Phase II include 1 million square feet of commercial-use buildings and 741 residential units. | |||||

(3) | Santana Row | Remaining entitlements include approximately 321,000 square feet of commercial space and 395 residential units. | |||||

20

Federal Realty Investment Trust | |||||||||||||

2017 Significant Acquisitions and Dispositions | |||||||||||||

September 30, 2017 | |||||||||||||

2017 Significant Acquisitions | |||||||||||||

Date | Property | City/State | GLA | Purchase Price | Principal Tenants | ||||||||

(in square feet) | (in millions) | ||||||||||||

February 1, 2017 | Hastings Ranch Plaza | Pasadena, California | 274,000 | $ | 29.5 | Marshalls / HomeGoods / CVS / Sears | (1) | ||||||

March 31, 2017 | Riverpoint Center | Chicago, Illinois | 211,000 | $ | 107.0 | Jewel Osco / Marshalls / Old Navy | |||||||

May 19, 2017 | Fourth Street | Berkeley, California | 71,000 | $ | 23.9 | CB2 / Ingram Book Group | (2) | ||||||

(1) | We acquired the leasehold interest in Hastings Ranch Plaza. The land is controlled under a long-term ground lease that expires on April 30, 2054. |

(2) | The acquisition was completed through a newly formed entity for which we own a 90% interest. |

On August 2, 2017, we acquired an approximately 90% interest in a joint venture that owns six shopping centers in Los Angeles County, California based on a gross value of $357 million, including the assumption of approximately $79.4 million of mortgage debt. That joint venture also acquired a 24.5% interest in La Alameda, a shopping center in Walnut Park, California for $19.8 million. The property has $41 million of mortgage debt, of which the joint venture's share is approximately $10 million. Additional information on the properties is listed below:

Property | City/State | GLA | Principal Tenants | |||

(in square feet) | ||||||

Azalea | South Gate, CA | 222,000 | Marshalls / Ross Dress for Less / Ulta / CVS | |||

Bell Gardens | Bell Gardens, CA | 330,000 | Marshalls / Ross Dress for Less / Petco / Food4Less | |||

La Alameda | Walnut Park, CA | 245,000 | Marshalls / Ross Dress for Less / CVS / Petco | |||

Olivo at Mission Hills (1) | Mission Hills, CA | 155,000 | Pre-leased to: Target (opened 10/2017) / Ross Dress for Less / 24 Hour Fitness | |||

Plaza Del Sol | South El Monte, CA | 48,000 | Marshalls / Starbucks | |||

Plaza Pacoima | Pacoima, CA | 204,000 | Costco / Best Buy | |||

Sylmar Towne Center | Sylmar, CA | 148,000 | CVS / Food4Less | |||

1,352,000 | ||||||

(1) | Property is currently being redeveloped. GLA reflects approximate square footage once the property is open and operating. |

2017 Significant Dispositions

On April 4, 2017 and June 28, 2017, the sale transactions at our Assembly Row property in Somerville, Massachusetts related to the purchase options on our Partners HealthCare and AvalonBay ground lease parcels, respectively, closed. The total sales price was $53.3 million, which resulted in a gain of $15.4 million. During the third quarter of 2017, the following sale transactions closed:

Date | Property | City/State | GLA | Sales Price | Total Gain | ||||

(in square feet) | (in millions) | (in millions) | |||||||

August 25, 2017 | 150 Post Street | San Francisco, California | 105,000 | $ | 69.3 | $ | 45.2 | ||

September 25, 2017 | North Lake Commons | Lake Zurich, Illinois | 129,000 | $ | 15.6 | $ | 4.9 | ||

21

Federal Realty Investment Trust | |||||||||||||||||||||||

Real Estate Status Report | |||||||||||||||||||||||

September 30, 2017 | |||||||||||||||||||||||

Property Name | MSA Description | Real Estate at Cost | Mortgage and/or Capital Lease Obligation (1) | Acreage | GLA (2) | % Leased (2) | Residential Units | Grocery Anchor GLA | Grocery Anchor | Other Retail Tenants | |||||||||||||

(in thousands) | (in thousands) | ||||||||||||||||||||||

Washington Metropolitan Area | |||||||||||||||||||||||

Barcroft Plaza | Washington, DC-MD-VA | $ | 44,090 | 10 | 115,000 | 88 | % | 46,000 | Harris Teeter | ||||||||||||||

Bethesda Row | Washington, DC-MD-VA | 227,099 | 17 | 534,000 | 97 | % | 180 | 40,000 | Giant Food | Apple / Equinox / Barnes & Noble / Multiple Restaurants | |||||||||||||

Congressional Plaza | (3) | Washington, DC-MD-VA | 101,710 | 21 | 325,000 | 97 | % | 194 | 25,000 | The Fresh Market | Buy Buy Baby / Saks Fifth Avenue Off 5th / Container Store / Last Call Studio by Neiman Marcus | ||||||||||||

Courthouse Center | Washington, DC-MD-VA | 4,954 | 2 | 35,000 | 66 | % | |||||||||||||||||

Falls Plaza/Falls Plaza-East | Washington, DC-MD-VA | 13,949 | 10 | 144,000 | 95 | % | 51,000 | Giant Food | CVS / Staples | ||||||||||||||

Federal Plaza | Washington, DC-MD-VA | 69,003 | 18 | 249,000 | 99 | % | 14,000 | Trader Joe's | TJ Maxx / Micro Center / Ross Dress For Less | ||||||||||||||

Free State Shopping Center | Washington, DC-MD-VA | 64,624 | 29 | 265,000 | 92 | % | 73,000 | Giant Food | TJ Maxx / Ross Dress For Less / Office Depot | ||||||||||||||

Friendship Center | Washington, DC-MD-VA | 37,853 | 1 | 119,000 | 100 | % | Marshalls / Nordstrom Rack / DSW / Maggiano's | ||||||||||||||||

Gaithersburg Square | Washington, DC-MD-VA | 27,418 | 16 | 207,000 | 96 | % | Bed, Bath & Beyond / Ross Dress For Less / Ashley Furniture HomeStore | ||||||||||||||||

Graham Park Plaza | Washington, DC-MD-VA | 34,999 | 19 | 260,000 | 89 | % | 58,000 | Giant Food | Stein Mart | ||||||||||||||

Idylwood Plaza | Washington, DC-MD-VA | 16,839 | 7 | 73,000 | 97 | % | 30,000 | Whole Foods | |||||||||||||||

Laurel | Washington, DC-MD-VA | 56,876 | 26 | 389,000 | 85 | % | 61,000 | Giant Food | Marshalls / L.A. Fitness | ||||||||||||||

Leesburg Plaza | Washington, DC-MD-VA | 36,128 | 26 | 236,000 | 93 | % | 55,000 | Giant Food | Petsmart / Gold's Gym / Office Depot | ||||||||||||||

Montrose Crossing | (3) | Washington, DC-MD-VA | 157,889 | 71,478 | 36 | 364,000 | 94 | % | 73,000 | Giant Food | Marshalls / Old Navy / Barnes & Noble / Bob's Discount Furniture | ||||||||||||

Mount Vernon/South Valley/7770 Richmond Hwy | (5) | Washington, DC-MD-VA | 84,593 | 29 | 570,000 | 96 | % | 62,000 | Shoppers Food Warehouse | TJ Maxx / Home Depot / Bed, Bath & Beyond / Gold's Gym | |||||||||||||

Old Keene Mill | Washington, DC-MD-VA | 7,709 | 10 | 92,000 | 100 | % | 24,000 | Whole Foods | Walgreens / Planet Fitness | ||||||||||||||

Pan Am | Washington, DC-MD-VA | 29,231 | 25 | 227,000 | 98 | % | 65,000 | Safeway | Micro Center / CVS / Michaels | ||||||||||||||

Pentagon Row | Washington, DC-MD-VA | 100,784 | 14 | 299,000 | 86 | % | 45,000 | Harris Teeter | TJ Maxx / Bed, Bath & Beyond / DSW | ||||||||||||||

Pike & Rose | (4) | Washington, DC-MD-VA | 568,891 | 24 | 353,000 | 97 | % | 546 | iPic Theater / Sport & Health / H&M / REI / Pinstripes / Multiple Restaurants | ||||||||||||||

Pike 7 Plaza | Washington, DC-MD-VA | 43,271 | 13 | 164,000 | 100 | % | TJ Maxx / DSW / Crunch Fitness / Staples | ||||||||||||||||

Plaza del Mercado | Washington, DC-MD-VA | 46,194 | 10 | 117,000 | 93 | % | 18,000 | Aldi | CVS / L.A. Fitness | ||||||||||||||

Quince Orchard | Washington, DC-MD-VA | 38,628 | 16 | 267,000 | 97 | % | 19,000 | Aldi | HomeGoods / L.A. Fitness / Staples | ||||||||||||||

Rockville Town Square | (6) | Washington, DC-MD-VA | 50,677 | 4,460 | 12 | 187,000 | 95 | % | 25,000 | Dawson's Market | CVS / Gold's Gym / Multiple Restaurants | ||||||||||||

Rollingwood Apartments | Washington, DC-MD-VA | 10,699 | 20,939 | 14 | N/A | 97 | % | 282 | |||||||||||||||

Sam's Park & Shop | Washington, DC-MD-VA | 12,759 | 1 | 49,000 | 83 | % | Petco | ||||||||||||||||

Tower Shopping Center | Washington, DC-MD-VA | 22,047 | 12 | 112,000 | 90 | % | 26,000 | L.A. Mart | Talbots / Total Wine & More | ||||||||||||||

Tyson's Station | Washington, DC-MD-VA | 4,643 | 5 | 50,000 | 87 | % | 11,000 | Trader Joe's | |||||||||||||||

Village at Shirlington | (6) | Washington, DC-MD-VA | 64,505 | 6,632 | 16 | 266,000 | 90 | % | 28,000 | Harris Teeter | AMC / Carlyle Grand Café | ||||||||||||

Wildwood | Washington, DC-MD-VA | 20,303 | 12 | 83,000 | 100 | % | 20,000 | Balducci's | CVS | ||||||||||||||

Total Washington Metropolitan Area | 1,998,365 | 451 | 6,151,000 | 94 | % | ||||||||||||||||||

California | |||||||||||||||||||||||

Azalea | (3) | Los Angeles-Long Beach-Anaheim, CA | 107,422 | 40,000 | 22 | 222,000 | 100 | % | Marshalls / Ross Dress for Less / Ulta / CVS | ||||||||||||||

Bell Gardens | (3) | Los Angeles-Long Beach-Anaheim, CA | 100,485 | 13,245 | 29 | 330,000 | 100 | % | 67,000 | Food 4 Less | Marshalls / Ross Dress for Less / Petco | ||||||||||||

Colorado Blvd | Los Angeles-Long Beach-Anaheim, CA | 19,517 | 1 | 69,000 | 100 | % | Pottery Barn / Banana Republic | ||||||||||||||||

Crow Canyon Commons | San Ramon, CA | 90,371 | 22 | 241,000 | 96 | % | 32,000 | Sprouts | Orchard Supply Hardware / Rite Aid / Total Wine & More | ||||||||||||||

East Bay Bridge | San Francisco-Oakland-Fremont, CA | 178,870 | 32 | 439,000 | 100 | % | Pak-N-Save | Home Depot / Target / Nordstrom Rack | |||||||||||||||

22

Federal Realty Investment Trust | |||||||||||||||||||||||

Real Estate Status Report | |||||||||||||||||||||||

September 30, 2017 | |||||||||||||||||||||||

Property Name | MSA Description | Real Estate at Cost | Mortgage and/or Capital Lease Obligation (1) | Acreage | GLA (2) | % Leased (2) | Residential Units | Grocery Anchor GLA | Grocery Anchor | Other Retail Tenants | |||||||||||||

(in thousands) | (in thousands) | ||||||||||||||||||||||

Escondido Promenade | (3) | San Diego, CA | 48,887 | 18 | 299,000 | 99 | % | TJ Maxx / Dick’s Sporting Goods / Ross Dress For Less / Toys R Us | |||||||||||||||

Fourth Street | (3) | San Francisco-Oakland-San Jose, CA | 23,838 | 3 | 71,000 | 55 | % | CB2 / Ingram Book Group | |||||||||||||||

Hastings Ranch Plaza | Los Angeles-Long Beach-Anaheim, CA | 22,472 | 15 | 273,000 | 98 | % | Marshalls / HomeGoods / CVS / Sears | ||||||||||||||||

Hermosa Avenue | Los Angeles-Long Beach-Anaheim, CA | 6,030 | <1 | 23,000 | 81 | % | |||||||||||||||||

Hollywood Blvd | Los Angeles-Long Beach-Anaheim, CA | 46,761 | 3 | 180,000 | 91 | % | Marshalls / DSW / L.A. Fitness / La La Land | ||||||||||||||||

Kings Court | (5) | San Jose, CA | 11,667 | 8 | 79,000 | 100 | % | 31,000 | Lunardi's Super Market | CVS | |||||||||||||

Old Town Center | San Jose, CA | 37,169 | 8 | 98,000 | 100 | % | Anthropologie / Banana Republic / Gap | ||||||||||||||||

Olivo at Mission Hills | (3) (8) | Los Angeles-Long Beach-Anaheim, CA | 66,802 | 12 | 20,000 | 100 | % | Fallas Stores | |||||||||||||||

Plaza Del Sol | (3) | Los Angeles-Long Beach-Anaheim, CA | 17,936 | 8,621 | 4 | 48,000 | 100 | % | Marshalls | ||||||||||||||

Plaza Pacoima | (3) | Los Angeles-Long Beach-Anaheim, CA | 50,362 | 18 | 204,000 | 100 | % | Costco / Best Buy | |||||||||||||||

Plaza El Segundo / The Point | (3) | Los Angeles-Long Beach-Anaheim, CA | 280,533 | 125,000 | 50 | 495,000 | 94 | % | 66,000 | Whole Foods | Anthropologie / HomeGoods / Dick's Sporting Goods / Multiple Restaurants | ||||||||||||

Santana Row | San Jose, CA | 842,293 | 45 | 885,000 | 98 | % | 662 | Crate & Barrel / H&M / Container Store / Multiple Restaurants | |||||||||||||||

San Antonio Center | (5) | San Francisco-Oakland-San Jose, CA | 73,592 | 33 | 376,000 | 97 | % | 11,000 | Trader Joe's | Wal-mart / Kohl's / 24 Hour Fitness | |||||||||||||

Sylmar Towne Center | (3) | Los Angeles-Long Beach-Anaheim, CA | 43,205 | 17,448 | 12 | 148,000 | 94 | % | 43,000 | Food 4 Less | CVS | ||||||||||||

Third Street Promenade | Los Angeles-Long Beach-Anaheim, CA | 78,296 | 2 | 209,000 | 96 | % | Banana Republic / Old Navy / J. Crew / Abercrombie & Fitch | ||||||||||||||||

Westgate Center | San Jose, CA | 152,784 | 44 | 647,000 | 99 | % | 38,000 | Walmart Neighborhood Market | Target / Nordstrom Rack / Nike Factory / Burlington | ||||||||||||||

Total California | 2,299,292 | 381 | 5,356,000 | 97 | % | ||||||||||||||||||

NY Metro/New Jersey | |||||||||||||||||||||||

Brick Plaza | Monmouth-Ocean, NJ | 74,853 | 46 | 422,000 | 69 | % | AMC / Barnes & Noble / Ulta / DSW | ||||||||||||||||

Brook 35 | (3) (5) | New York-Northern New Jersey-Long Island, NY-NJ-PA | 47,387 | 11,500 | 11 | 99,000 | 100 | % | Banana Republic / Gap / Coach / Williams-Sonoma | ||||||||||||||

Darien | New Haven-Bridgeport-Stamford-Waterbury | 49,872 | 9 | 95,000 | 96 | % | 45,000 | Stop & Shop | Equinox | ||||||||||||||

Fresh Meadows | New York, NY | 88,067 | 17 | 404,000 | 99 | % | 15,000 | Island of Gold | AMC / Kohl's / Michaels | ||||||||||||||

Greenlawn Plaza | Nassau-Suffolk, NY | 31,702 | 13 | 106,000 | 96 | % | 46,000 | Greenlawn Farms | Tuesday Morning | ||||||||||||||

Greenwich Avenue | New Haven-Bridgeport-Stamford-Waterbury | 14,127 | 1 | 36,000 | 100 | % | Saks Fifth Avenue | ||||||||||||||||

Hauppauge | Nassau-Suffolk, NY | 29,067 | 15 | 134,000 | 100 | % | 61,000 | Shop Rite | A.C. Moore | ||||||||||||||

Huntington | Nassau-Suffolk, NY | 47,080 | 21 | 279,000 | 99 | % | Nordstrom Rack / Bed, Bath & Beyond / Buy Buy Baby / Michaels | ||||||||||||||||

Huntington Square | Nassau-Suffolk, NY | 12,179 | 18 | 74,000 | 85 | % | Barnes & Noble | ||||||||||||||||

Melville Mall | Nassau-Suffolk, NY | 87,076 | 21 | 251,000 | 95 | % | Marshalls / Dick's Sporting Goods / Field & Stream / Macy's Backstage | ||||||||||||||||

Mercer Mall | (6) | Trenton, NJ | 125,863 | 55,566 | 50 | 530,000 | 98 | % | 75,000 | Shop Rite | TJ Maxx / Nordstrom Rack / Bed, Bath & Beyond / REI | ||||||||||||

The Grove at Shrewsbury | (3) (5) | New York-Northern New Jersey-Long Island, NY-NJ-PA | 124,647 | 54,208 | 21 | 193,000 | 100 | % | Lululemon / Anthropologie / Pottery Barn / Williams-Sonoma | ||||||||||||||

Troy | Newark, NJ | 35,279 | 19 | 211,000 | 98 | % | L.A. Fitness / Michaels | ||||||||||||||||

Total NY Metro/New Jersey | 767,199 | 262 | 2,834,000 | 94 | % | ||||||||||||||||||

23

Federal Realty Investment Trust | |||||||||||||||||||||||

Real Estate Status Report | |||||||||||||||||||||||

September 30, 2017 | |||||||||||||||||||||||

Property Name | MSA Description | Real Estate at Cost | Mortgage and/or Capital Lease Obligation (1) | Acreage | GLA (2) | % Leased (2) | Residential Units | Grocery Anchor GLA | Grocery Anchor | Other Retail Tenants | |||||||||||||

(in thousands) | (in thousands) | ||||||||||||||||||||||

Philadelphia Metropolitan Area | |||||||||||||||||||||||

Andorra | Philadelphia, PA-NJ | 25,865 | 22 | 264,000 | 89 | % | 24,000 | Acme Markets | Kohl's / L.A. Fitness / Staples | ||||||||||||||

Bala Cynwyd | Philadelphia, PA-NJ | 41,002 | 23 | 294,000 | 100 | % | 45,000 | Acme Markets | Lord & Taylor / Michaels / L.A. Fitness | ||||||||||||||

Ellisburg | Philadelphia, PA-NJ | 34,371 | 28 | 268,000 | 93 | % | 47,000 | Whole Foods | Buy Buy Baby / Stein Mart | ||||||||||||||

Flourtown | Philadelphia, PA-NJ | 16,945 | 24 | 156,000 | 98 | % | 75,000 | Giant Food | Movie Tavern | ||||||||||||||

Langhorne Square | Philadelphia, PA-NJ | 22,100 | 21 | 227,000 | 98 | % | 55,000 | Redner's Warehouse Mkts. | Marshalls / Planet Fitness | ||||||||||||||

Lawrence Park | Philadelphia, PA-NJ | 35,131 | 29 | 373,000 | 97 | % | 53,000 | Acme Markets | TJ Maxx / HomeGoods / Barnes & Noble | ||||||||||||||

Northeast | Philadelphia, PA-NJ | 29,895 | 19 | 288,000 | 86 | % | Marshalls / Burlington / A.C. Moore | ||||||||||||||||

Town Center of New Britain | Philadelphia, PA-NJ | 15,259 | 17 | 124,000 | 90 | % | 36,000 | Giant Food | Rite Aid / Dollar Tree | ||||||||||||||

Willow Grove | Philadelphia, PA-NJ | 30,208 | 13 | 211,000 | 96 | % | Marshalls / HomeGoods / Barnes & Noble | ||||||||||||||||

Wynnewood | Philadelphia, PA-NJ | 42,886 | 14 | 251,000 | 100 | % | 98,000 | Giant Food | Bed, Bath & Beyond / Old Navy / DSW | ||||||||||||||

Total Philadelphia Metropolitan Area | 293,662 | 210 | 2,456,000 | 95 | % | ||||||||||||||||||

New England | |||||||||||||||||||||||

Assembly Row / Assembly Square Marketplace | (4) | Boston-Cambridge-Quincy, MA-NH | 666,581 | 65 | 797,000 | 98 | % | 27 | 18,000 | Trader Joe's | TJ Maxx / AMC / LEGOLAND Discovery Center / Multiple Restaurants & Outlets | ||||||||||||

Atlantic Plaza | Boston-Worcester-Lawrence-Lowell-Brockton, MA | 25,653 | 13 | 123,000 | 96 | % | 64,000 | Stop & Shop | |||||||||||||||

Campus Plaza | Boston-Worcester-Lawrence-Lowell-Brockton, MA | 30,514 | 15 | 116,000 | 98 | % | 46,000 | Roche Bros. | Burlington | ||||||||||||||

Chelsea Commons | Boston-Cambridge-Quincy, MA-NH | 42,880 | 6,346 | 37 | 222,000 | 99 | % | 56 | 16,000 | Sav-A-Lot | Home Depot / Planet Fitness | ||||||||||||

Dedham Plaza | Boston-Cambridge-Quincy, MA-NH | 38,796 | 19 | 241,000 | 91 | % | 80,000 | Star Market | Planet Fitness | ||||||||||||||

Linden Square | Boston-Cambridge-Quincy, MA-NH | 148,653 | 19 | 223,000 | 96 | % | 50,000 | Roche Bros. | CVS | ||||||||||||||

North Dartmouth | Boston-Cambridge-Quincy, MA-NH | 9,368 | 28 | 48,000 | 100 | % | 48,000 | Stop & Shop | |||||||||||||||

Queen Anne Plaza | Boston-Cambridge-Quincy, MA-NH | 18,295 | 17 | 149,000 | 100 | % | 50,000 | Big Y Foods | TJ Maxx / HomeGoods | ||||||||||||||

Saugus Plaza | Boston-Cambridge-Quincy, MA-NH | 15,260 | 15 | 168,000 | 100 | % | 55,000 | Super Stop & Shop | Kmart | ||||||||||||||

Total New England | 996,000 | 228 | 2,087,000 | 98 | % | ||||||||||||||||||

South Florida | |||||||||||||||||||||||

Cocowalk | (3) (7) | Miami-Ft Lauderdale | 113,636 | 3 | 200,000 | 74 | % | Gap / Cinepolis Theaters / Youfit Health Club | |||||||||||||||

Del Mar Village | Miami-Ft Lauderdale | 64,806 | 17 | 196,000 | 91 | % | 44,000 | Winn Dixie | CVS | ||||||||||||||

The Shops at Sunset Place | (3) | Miami-Ft Lauderdale | 122,361 | 67,124 | 10 | 523,000 | 77 | % | AMC / L.A. Fitness / Barnes & Noble / Restoration Hardware Outlet | ||||||||||||||

Tower Shops | Miami-Ft Lauderdale | 97,413 | 67 | 426,000 | 98 | % | 12,000 | Trader Joe's | TJ Maxx / Ross Dress For Less / Best Buy / DSW | ||||||||||||||

Total South Florida | 398,216 | 97 | 1,345,000 | 85 | % | ||||||||||||||||||

Baltimore | |||||||||||||||||||||||

Governor Plaza | Baltimore, MD | 27,289 | 24 | 243,000 | 98 | % | 16,500 | Aldi | Dick's Sporting Goods / A.C. Moore | ||||||||||||||

Perring Plaza | Baltimore, MD | 31,022 | 29 | 396,000 | 100 | % | 58,000 | Shoppers Food Warehouse | Home Depot / Micro Center / Burlington | ||||||||||||||

THE AVENUE at White Marsh | (5) | Baltimore, MD | 112,684 | 52,705 | 35 | 315,000 | 100 | % | AMC / Ulta / Old Navy / Barnes & Noble | ||||||||||||||

The Shoppes at Nottingham Square | Baltimore, MD | 17,528 | 4 | 32,000 | 100 | % | |||||||||||||||||

24

Federal Realty Investment Trust | |||||||||||||||||||||||

Real Estate Status Report | |||||||||||||||||||||||

September 30, 2017 | |||||||||||||||||||||||

Property Name | MSA Description | Real Estate at Cost | Mortgage and/or Capital Lease Obligation (1) | Acreage | GLA (2) | % Leased (2) | Residential Units | Grocery Anchor GLA | Grocery Anchor | Other Retail Tenants | |||||||||||||

(in thousands) | (in thousands) | ||||||||||||||||||||||

Towson Residential (Flats @ 703) | Baltimore, MD | 19,924 | 1 | 4,000 | 100 | % | 105 | ||||||||||||||||

White Marsh Plaza | Baltimore, MD | 25,472 | 7 | 80,000 | 98 | % | 54,000 | Giant Food | |||||||||||||||

White Marsh Other | Baltimore, MD | 36,261 | 21 | 69,000 | 97 | % | |||||||||||||||||

Total Baltimore | 270,180 | 121 | 1,139,000 | 99 | % | ||||||||||||||||||

Chicago | |||||||||||||||||||||||

Crossroads | Chicago, IL | 32,260 | 14 | 168,000 | 83 | % | L.A. Fitness / Binny's / Guitar Center | ||||||||||||||||

Finley Square | Chicago, IL | 37,730 | 21 | 278,000 | 87 | % | Bed, Bath & Beyond / Buy Buy Baby / Petsmart / Portillo's | ||||||||||||||||

Garden Market | Chicago, IL | 14,330 | 2 | 140,000 | 99 | % | 63,000 | Mariano's Fresh Market | Walgreens | ||||||||||||||

Riverpoint Center | Chicago, IL | 119,997 | 17 | 211,000 | 97 | % | 86,000 | Jewel Osco | Marshalls / Old Navy | ||||||||||||||

Total Chicago | 204,317 | 54 | 797,000 | 91 | % | ||||||||||||||||||

Other | |||||||||||||||||||||||

Barracks Road | Charlottesville, VA | 66,552 | 40 | 498,000 | 98 | % | 99,000 | Harris Teeter / Kroger | Anthropologie / Nike / Bed, Bath & Beyond / Old Navy | ||||||||||||||

Bristol Plaza | Hartford, CT | 31,553 | 22 | 266,000 | 97 | % | 74,000 | Stop & Shop | TJ Maxx | ||||||||||||||

Eastgate Crossing | Raleigh-Durham-Chapel Hill, NC | 32,975 | 17 | 158,000 | 97 | % | 13,000 | Trader Joe's | Ulta / Stein Mart / Petco | ||||||||||||||

Gratiot Plaza | Detroit, MI | 19,821 | 20 | 217,000 | 100 | % | 69,000 | Kroger | Bed, Bath & Beyond / Best Buy / DSW | ||||||||||||||

Lancaster | (6) | Lancaster, PA | 13,905 | 4,907 | 11 | 127,000 | 98 | % | 75,000 | Giant Food | Michaels | ||||||||||||

29th Place | Charlottesville, VA | 40,948 | 4,395 | 15 | 169,000 | 97 | % | HomeGoods / DSW / Stein Mart / Staples | |||||||||||||||

Willow Lawn | Richmond-Petersburg, VA | 95,625 | 37 | 463,000 | 97 | % | 66,000 | Kroger | Old Navy / Ross Dress For Less / Gold's Gym / DSW | ||||||||||||||

Total Other | 301,379 | 162 | 1,898,000 | 98 | % | ||||||||||||||||||

Grand Total | $ | 7,528,610 | $ | 564,574 | 1,966 | 24,063,000 | 95 | % | 2,052 | ||||||||||||||

Notes: | |

(1) | The mortgage or capital lease obligations differ from the total reported on the consolidated balance sheet due to the unamortized discount, premium, and/or debt issuance costs on certain mortgages payable. |

(2) | Represents the GLA and the percentage leased of the commercial portion of the property. Some of our properties include office space which is included in this square footage. Excludes newly created redevelopment square footage not yet in service, as well as residential and hotel square footage. |

(3) | The Trust has a controlling financial interest in this property. |

(4) | Portion of property is currently under development. See further discussion in the Assembly Row and Pike & Rose schedules. |

(5) | All or a portion of the property is owned in a "downREIT" partnership, of which a wholly owned subsidiary of the Trust is the sole general partner, with third party partners holding operating partnership units. |

(6) | All or a portion of property subject to capital lease obligation. |

(7) | This property includes interests in five buildings in addition to our initial acquisition. |

(8) | Property under redevelopment; see further discussion on page 21. |

25

Federal Realty Investment Trust | |||||||||||||||||||||||||||||||||||||||

Retail Leasing Summary (1) | |||||||||||||||||||||||||||||||||||||||

September 30, 2017 | |||||||||||||||||||||||||||||||||||||||

Total Lease Summary - Comparable (2) | |||||||||||||||||||||||||||||||||||||||

Quarter | Number of Leases Signed | % of Comparable Leases Signed | GLA Signed | Contractual Rent (3) Per Sq. Ft. | Prior Rent (4) Per Sq. Ft. | Annual Increase in Rent | Cash Basis % Increase Over Prior Rent | Straight-lined Basis % Increase Over Prior Rent | Weighted Average Lease Term (5) | Tenant Improvements & Incentives (6) | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||

3rd Quarter 2017 | 82 | 100 | % | 399,619 | $ | 38.24 | $ | 33.43 | $ | 1,922,439 | 14 | % | 27 | % | 7.4 | $ | 10,411,714 | $ | 26.05 | ||||||||||||||||||||

2nd Quarter 2017 | 100 | 100 | % | 397,555 | $ | 45.55 | $ | 40.16 | $ | 2,144,347 | 13 | % | 27 | % | 9.6 | $ | 18,524,282 | $ | 46.60 | ||||||||||||||||||||

1st Quarter 2017 | 102 | 100 | % | 523,869 | $ | 34.91 | $ | 31.31 | $ | 1,884,636 | 11 | % | 23 | % | 8.1 | $ | 19,672,170 | $ | 37.55 | (7) | |||||||||||||||||||

4th Quarter 2016 | 77 | 100 | % | 274,622 | $ | 37.10 | $ | 32.27 | $ | 1,325,040 | 15 | % | 27 | % | 7.2 | $ | 9,874,657 | $ | 35.96 | (7) | |||||||||||||||||||

Total - 12 months | 361 | 100 | % | 1,595,665 | $ | 38.77 | $ | 34.21 | $ | 7,276,462 | 13 | % | 26 | % | 8.2 | $ | 58,482,823 | $ | 36.65 | ||||||||||||||||||||

New Lease Summary - Comparable (2) | |||||||||||||||||||||||||||||||||||||||

Quarter | Number of Leases Signed | % of Comparable Leases Signed | GLA Signed | Contractual Rent (3) Per Sq. Ft. | Prior Rent (4) Per Sq. Ft. | Annual Increase in Rent | Cash Basis % Increase Over Prior Rent | Straight-lined Basis % Increase Over Prior Rent | Weighted Average Lease Term (5) | Tenant Improvements & Incentives (6) | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||

3rd Quarter 2017 | 36 | 44 | % | 165,289 | $ | 40.97 | $ | 33.19 | $ | 1,285,427 | 23 | % | 36 | % | 8.4 | $ | 8,563,714 | $ | 51.81 | ||||||||||||||||||||

2nd Quarter 2017 | 37 | 37 | % | 161,605 | $ | 34.63 | $ | 29.36 | $ | 850,568 | 18 | % | 31 | % | 8.9 | $ | 10,708,134 | $ | 66.26 | ||||||||||||||||||||

1st Quarter 2017 | 45 | 44 | % | 288,388 | $ | 35.45 | $ | 30.21 | $ | 1,509,806 | 17 | % | 31 | % | 10.2 | $ | 19,226,044 | $ | 66.67 | (7) | |||||||||||||||||||

4th Quarter 2016 | 28 | 36 | % | 115,640 | $ | 45.50 | $ | 34.45 | $ | 1,278,167 | 32 | % | 53 | % | 9.6 | $ | 9,592,450 | $ | 82.95 | (7) | |||||||||||||||||||

Total - 12 months | 146 | 40 | % | 730,922 | $ | 38.11 | $ | 31.37 | $ | 4,923,968 | 21 | % | 36 | % | 9.4 | $ | 48,090,342 | $ | 65.79 | ||||||||||||||||||||

Renewal Lease Summary - Comparable (2) (9) | |||||||||||||||||||||||||||||||||||||||

Quarter | Number of Leases Signed | % of Comparable Leases Signed | GLA Signed | Contractual Rent (3) Per Sq. Ft. | Prior Rent (4) Per Sq. Ft. | Annual Increase in Rent | Cash Basis % Increase Over Prior Rent | Straight-lined Basis % Increase Over Prior Rent | Weighted Average Lease Term (5) | Tenant Improvements & Incentives (6) | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||