Attached files

| file | filename |

|---|---|

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh99019-30x2017.htm |

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | form8k9-30x17.htm |

Third Quarter 2017

Earnings Conference Call

November 1, 2017

2

Safe Harbor Statement

This presentation includes statements that are forward-looking statements made pursuant to the safe harbor provisions of the Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding

the issuance of a final order by the Public Utility Commission of Texas in the 2017 Texas retail rate case; statements regarding expected

capital expenditures; and statements regarding expected dividends. This information may involve risks and uncertainties that could cause

actual results to differ materially from such forward-looking statements. Additional information concerning factors that could cause actual

results to differ materially from those expressed in forward-looking statements is contained in EE's most recently filed periodic reports and in

other filings made by made by EE with the U.S. Securities and Exchange Commission (the "SEC"), and includes, but is not limited to:

Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased

costs to customers or to recover previously incurred fuel costs in rates

Full and timely recovery of capital investments and operating costs through rates in Texas and New Mexico

Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability

Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and

technologies, including distributed generation

Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant

Unanticipated maintenance, repair, or replacement costs for generation, transmission, or distribution facilities and the recovery of

proceeds from insurance policies providing coverage for such costs

The size of our construction program and our ability to complete construction on budget and on time

Potential delays in our construction schedule due to legal challenges or other reasons

Costs at Palo Verde Nuclear Generating Station

Deregulation and competition in the electric utility industry

Possible increased costs of compliance with environmental or other laws, regulations and policies

Possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities

Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets

Possible physical or cyber attacks, intrusions or other catastrophic events

Other factors of which we are currently unaware or deem immaterial

EE’s filings are available from the SEC or may be obtained through EE’s website, http://www.epelectric.com. Any such forward-looking

statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. Management cautions

against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior

earnings levels. Forward-looking statements speak only as of the date of this news release, and EE does not undertake to update any forward-

looking statement contained herein.

3

Recent Highlights

In November 2017, EE anticipates filing the 2017 Texas rate

case settlement documents with the Administrative Law

Judges, along with a request that they return the case to the

Public Utility Commission of Texas (PUCT) for approval

A final order is expected in the fourth quarter of 2017(1)

On October 13, 2017, EE filed for a 19 percent reduction in

the Texas fixed fuel factor effective November 1, 2017

Construction of the Holloman Air Force Base Solar Project

(5MW) will begin this month and is expected to be

commercially operational in July 2018

(1) New rates will relate back to consumption on

or after July 18, 2017

4

Future Power Generation Needs

Issued an all-source request for proposal (RFP) on June

30, 2017

In October, received proposals for various resource options

for 370 MW of new generation resources by 2023

Approximately 50 MW of capacity is expected to be needed

by 2022 and an additional capacity of 320 MW by 2023

Anticipate decision by the end of Q2 2018

Will seek regulatory approval as necessary with the PUCT

and the New Mexico Public Regulatory Commission

Capital expenditures plan may vary until a final decision is

rendered and regulatory approvals are obtained

5

Q3 & YTD Financial Results

Reported Q3 2017 net income of $59.7 million (or $1.47 per

share), compared to Q3 2016 net income of $74.6 million

(or $1.84 per share) (1)

Reported YTD 2017 net income of $91.8 million (or $2.26

per share), compared to YTD 2016 net income of $91.1

million (or $2.25 per share)

(1) Q3 2016 includes approximately $12.6 million, or $0.31 per

share, from the financial impacts of the 2015 Texas rate case

relating back to January 12, 2016 through June 30, 2016.

6

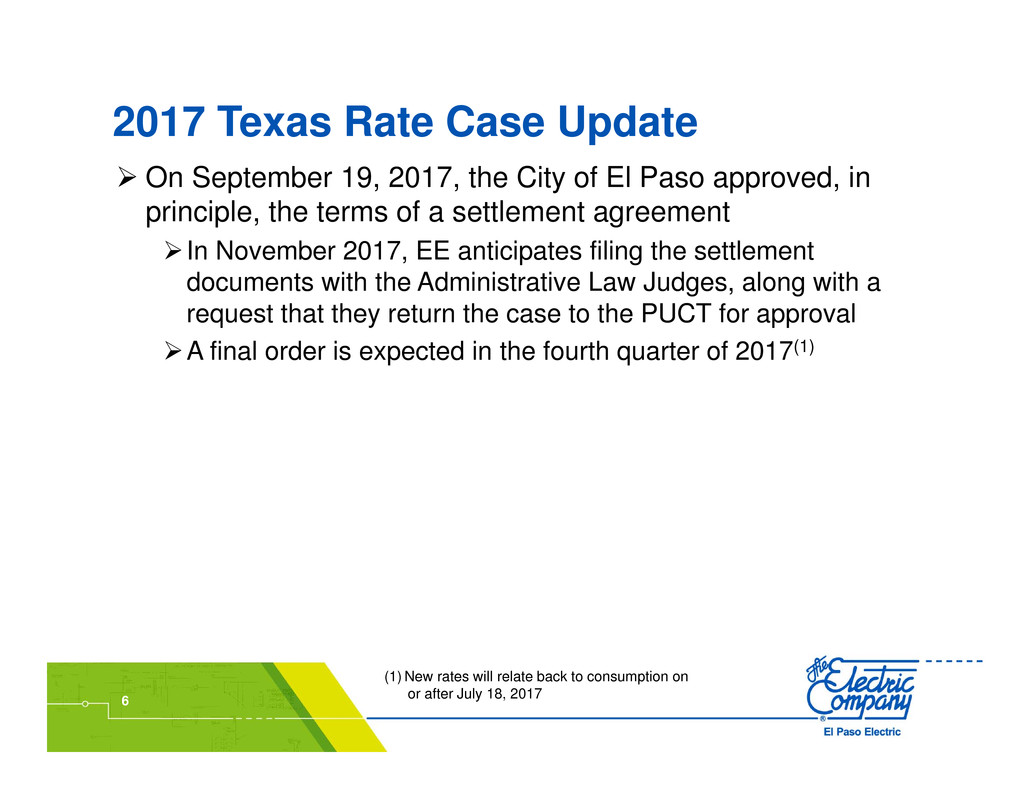

2017 Texas Rate Case Update

On September 19, 2017, the City of El Paso approved, in

principle, the terms of a settlement agreement

In November 2017, EE anticipates filing the settlement

documents with the Administrative Law Judges, along with a

request that they return the case to the PUCT for approval

A final order is expected in the fourth quarter of 2017(1)

(1) New rates will relate back to consumption on

or after July 18, 2017

7

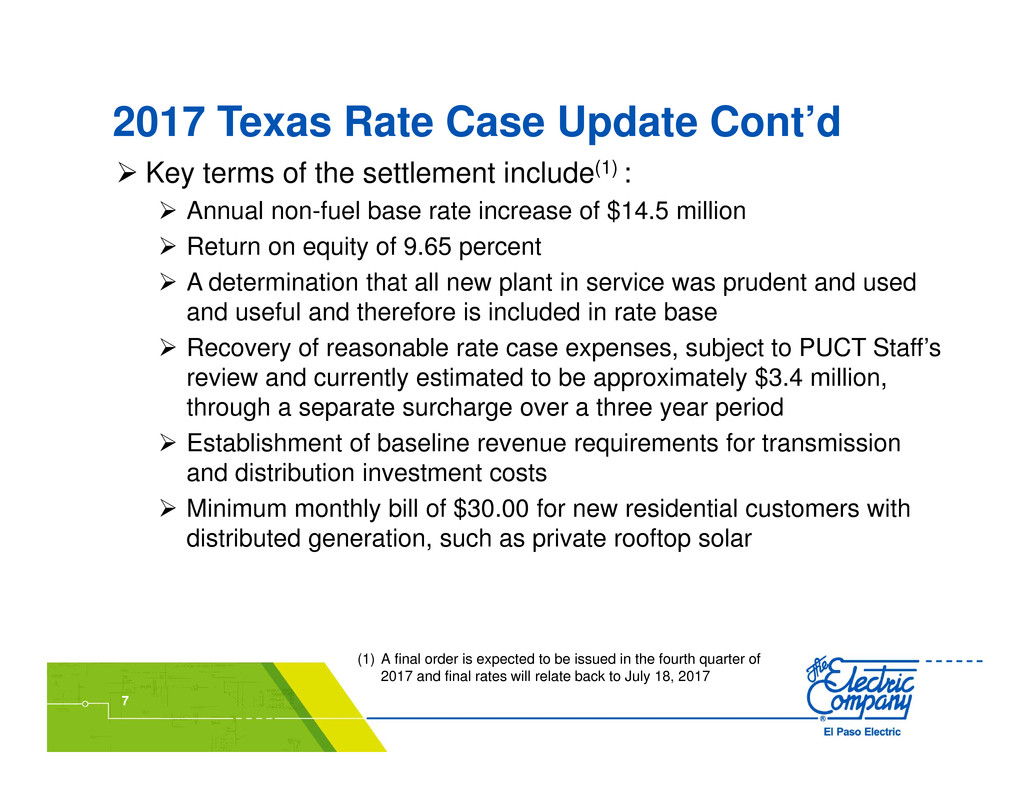

2017 Texas Rate Case Update Cont’d

Key terms of the settlement include(1) :

Annual non-fuel base rate increase of $14.5 million

Return on equity of 9.65 percent

A determination that all new plant in service was prudent and used

and useful and therefore is included in rate base

Recovery of reasonable rate case expenses, subject to PUCT Staff’s

review and currently estimated to be approximately $3.4 million,

through a separate surcharge over a three year period

Establishment of baseline revenue requirements for transmission

and distribution investment costs

Minimum monthly bill of $30.00 for new residential customers with

distributed generation, such as private rooftop solar

(1) A final order is expected to be issued in the fourth quarter of

2017 and final rates will relate back to July 18, 2017

8

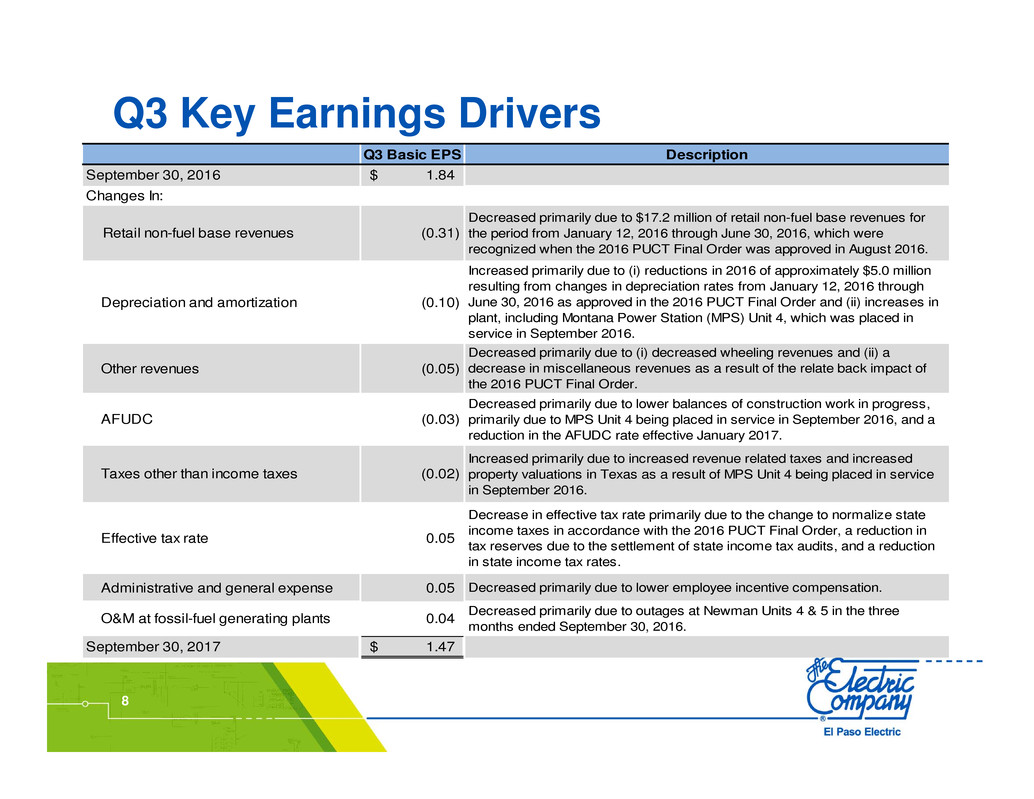

Q3 Key Earnings Drivers

Q3 Basic EPS Description

September 30, 2016 1.84$

Changes In:

Retail non-fuel base revenues (0.31)

Decreased primarily due to $17.2 million of retail non-fuel base revenues for

the period from January 12, 2016 through June 30, 2016, which were

recognized when the 2016 PUCT Final Order was approved in August 2016.

Depreciation and amortization (0.10)

Increased primarily due to (i) reductions in 2016 of approximately $5.0 million

resulting from changes in depreciation rates from January 12, 2016 through

June 30, 2016 as approved in the 2016 PUCT Final Order and (ii) increases in

plant, including Montana Power Station (MPS) Unit 4, which was placed in

service in September 2016.

Other revenues (0.05)

Decreased primarily due to (i) decreased wheeling revenues and (ii) a

decrease in miscellaneous revenues as a result of the relate back impact of

the 2016 PUCT Final Order.

AFUDC (0.03)

Decreased primarily due to lower balances of construction work in progress,

primarily due to MPS Unit 4 being placed in service in September 2016, and a

reduction in the AFUDC rate effective January 2017.

Taxes other than income taxes (0.02)

Increased primarily due to increased revenue related taxes and increased

property valuations in Texas as a result of MPS Unit 4 being placed in service

in September 2016.

Effective tax rate 0.05

Decrease in effective tax rate primarily due to the change to normalize state

income taxes in accordance with the 2016 PUCT Final Order, a reduction in

tax reserves due to the settlement of state income tax audits, and a reduction

in state income tax rates.

Administrative and general expense 0.05 Decreased primarily due to lower employee incentive compensation.

O&M at fossil-fuel generating plants 0.04 Decreased primarily due to outages at Newman Units 4 & 5 in the three months ended September 30, 2016.

September 30, 2017 1.47$

9

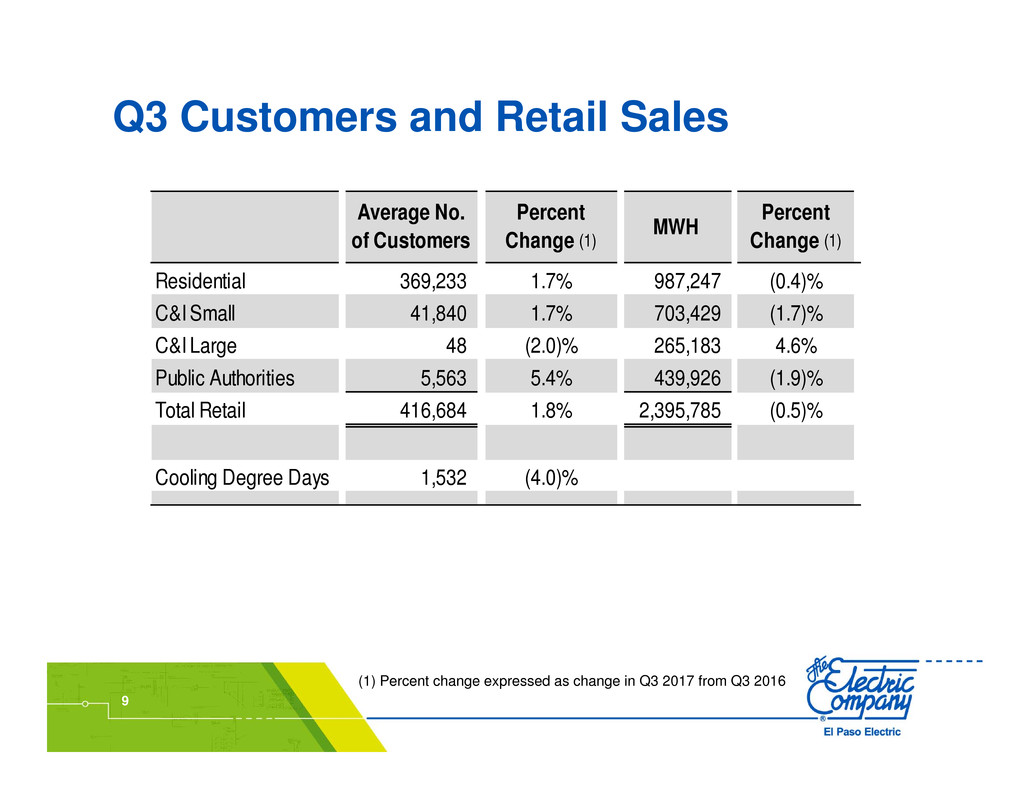

Q3 Customers and Retail Sales

Average No.

of Customers

Percent

Change (1)

MWH

Percent

Change (1)

Residential 369,233 1.7% 987,247 (0.4)%

C&I Small 41,840 1.7% 703,429 (1.7)%

C&I Large 48 (2.0)% 265,183 4.6%

Public Authorities 5,563 5.4% 439,926 (1.9)%

Total Retail 416,684 1.8% 2,395,785 (0.5)%

Cooling Degree Days 1,532 (4.0)%

(1) Percent change expressed as change in Q3 2017 from Q3 2016

10

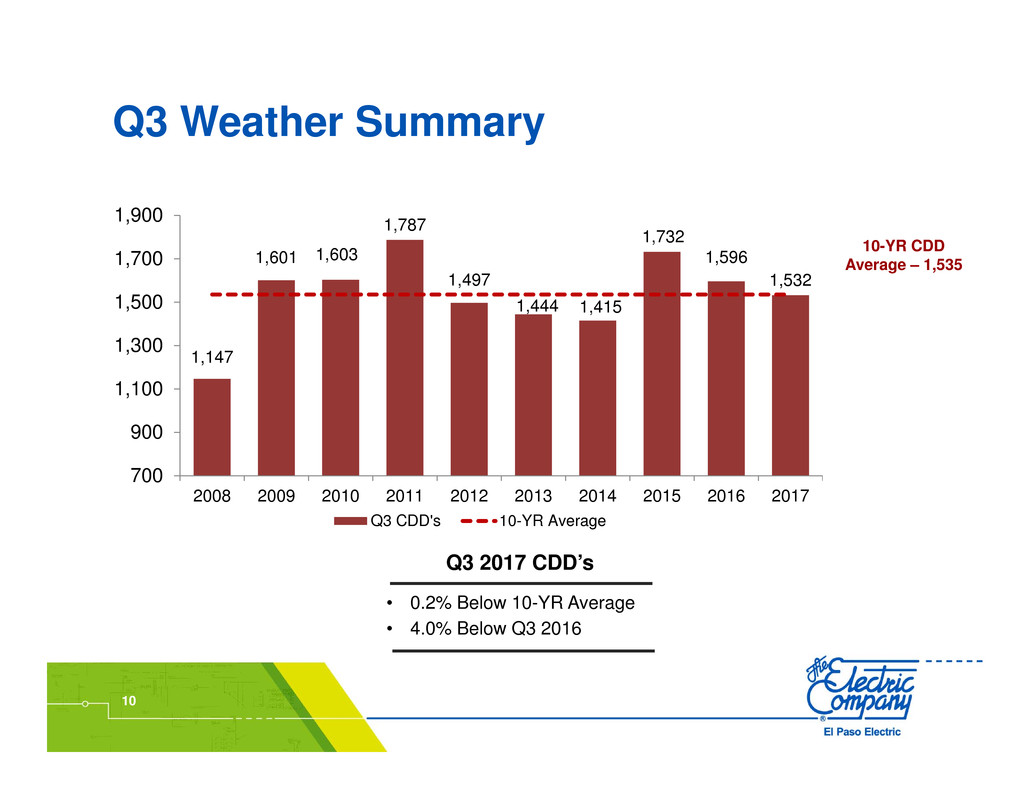

Q3 Weather Summary

10-YR CDD

Average – 1,535

Q3 2017 CDD’s

• 0.2% Below 10-YR Average

• 4.0% Below Q3 2016

1,147

1,601 1,603

1,787

1,497

1,444 1,415

1,732

1,596

1,532

700

900

1,100

1,300

1,500

1,700

1,900

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Q3 CDD's 10-YR Average

11

Capital Requirements and Liquidity

On September 30, 2017, EE had liquidity of $189.1 million, including

cash and cash equivalents of $7.1 million and unused capacity under

the Revolving Credit Facility (RCF)

Expended $140.4 million for additions to utility plant, net of insurance

proceeds, for the nine months ended September 30, 2017

Capital expenditures for utility plant in 2017 are expected to be

approximately $223.3 million, net of insurance proceeds

On October 26, 2017, the Board declared a quarterly cash dividend of

$0.335 per share of common stock payable on December 29, 2017 to

shareholders of record as of December 15, 2017

EE used funds borrowed under the RCF to repay two tranches of debt

that matured or was subject to mandatory tender for purchase on

August 15, 2017 and September 1, 2017 for $50 million and $33.3

million, respectively

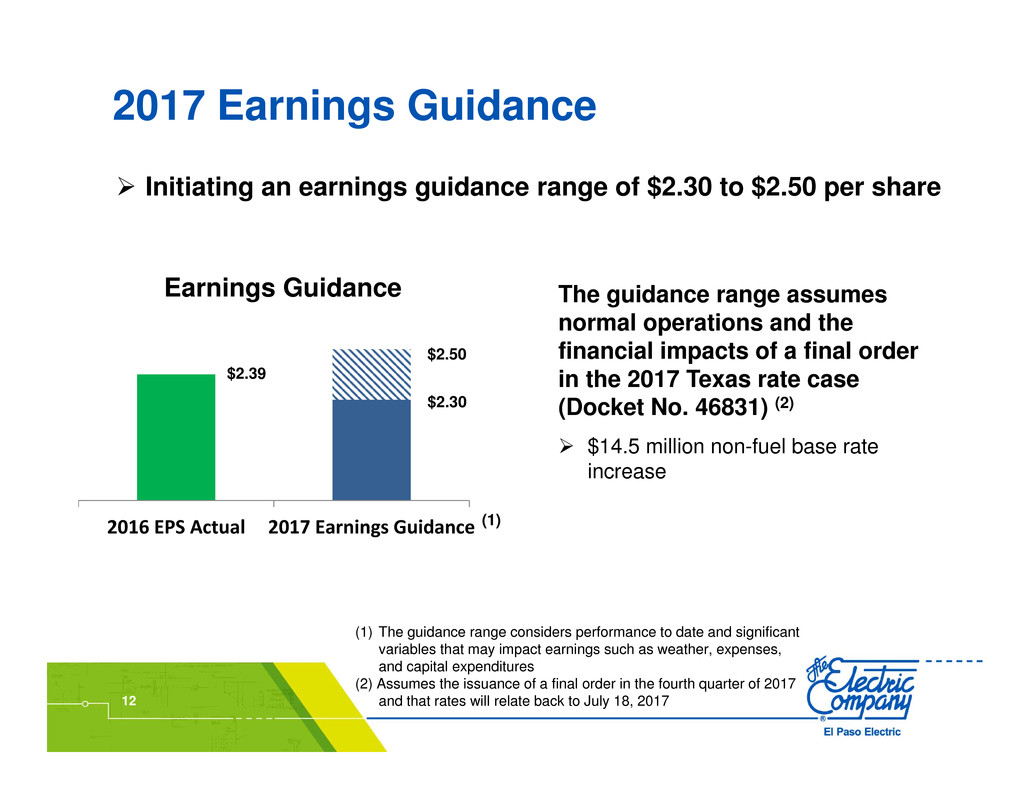

(1) The guidance range considers performance to date and significant

variables that may impact earnings such as weather, expenses,

and capital expenditures

(2) Assumes the issuance of a final order in the fourth quarter of 2017

and that rates will relate back to July 18, 201712

2017 Earnings Guidance

2016 EPS Actual 2017 Earnings Guidance

Earnings Guidance

$2.39

$2.50

$2.30

The guidance range assumes

normal operations and the

financial impacts of a final order

in the 2017 Texas rate case

(Docket No. 46831) (2)

$14.5 million non-fuel base rate

increase

(1)

Initiating an earnings guidance range of $2.30 to $2.50 per share

13

Q & A