Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CVR Refining, LP | cvrr8-kq32017earningsprese.htm |

3rd Quarter 2017 Earnings Report

November 1, 2017

Forward Looking Statements

2

This presentation should be reviewed in conjunction with CVR Refining, LP’s Third Quarter earnings conference call

held on November 1, 2017. The following information contains forward-looking statements based on management’s

current expectations and beliefs, as well as a number of assumptions concerning future events. These statements are

subject to risks, uncertainties, assumptions and other important factors. You are cautioned not to put undue reliance

on such forward-looking statements (including forecasts and projections regarding our future performance) because

actual results may vary materially from those expressed or implied as a result of various factors, including, but not

limited to those set forth under “Risk Factors” in CVR Refining, LP’s Annual Report on Form 10-K, Quarterly Reports

on Form 10-Q and any other filings CVR Refining, LP makes with the Securities and Exchange Commission. CVR

Refining, LP assumes no obligation to, and expressly disclaims any obligation to, update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise, except to the extent required by law.

All information in this earnings report is unaudited other than the consolidated statement of operations data for the

years ended December 31, 2014 through 2016 and the balance sheet data as of December 31, 2014 through 2016.

Consolidated Financial Results Third Quarter Year to Date

(In millions, except for throughput and market data)

9/30/2017 9/30/2016 9/30/2017 9/30/2016

Net Income $ 70.0 $ 15.9 $ 117.8 $ 26.0

Gross Profit $ 118.7 $ 47.1 $ 217.7 $ 117.8

Refining Margin(1)(2)(3) $ 256.5 $ 183.7 $ 624.6 $ 480.5

Operating Income $ 98.7 $ 28.4 $ 157.3 $ 62.5

Adjusted EBITDA(4)(5) $ 138.6 $ 75.3 $ 296.2 $ 195.1

NYMEX 2-1-1 Crack Spread $ 20.73 $ 14.03 $ 17.49 $ 14.64

PADD II Group 3 2-1-1 Crack Spread $ 20.57 $ 14.78 $ 16.09 $ 12.65

Refining Margin (per crude oil throughput barrel)(1)(2)(6) $ 13.72 $ 10.09 $ 10.87 $ 8.99

Direct Operating Expenses excluding Major Scheduled Turnaround Expenses (per

crude oil throughput barrel)(7) $ 5.31 $ 5.33 $ 4.73 $ 5.00

Consolidated Selected Financials and Key Performance Indicators

Balance Sheet and Cash Flow Data Third

Quarter(In millions, except per unit data)

9/30/2017

Cash and Cash Equivalents $ 560.4

Total Debt, including current portion(8) $ 545.5

Partners' Capital $ 1,414.5

Cash Flow from Operations $ 63.0

Available Cash for Distribution(5)(9) $ 138.6

Available Cash for Distribution, per unit(9) $ 0.94

(1) Adjusted for FIFO impact

(2) Definition on slide 12

(3) Non-GAAP reconciliation on slide 13

3

(4) Non-GAAP reconciliation on slide 18

(5) Definition on slide 11

(6) Non-GAAP reconciliation on slide 16

(7) Non-GAAP reconciliation on slide 17

(8) Amounts presented are gross debt not net of unamortized debt issuance costs

(9) Non-GAAP reconciliation on slide 19

Q3 2017 Q3 2016 YTD 2017 YTD 2016

128.5 130.4 131.0 121.4

Q3 2017 Q3 2016 YTD 2017 YTD 2016

136.8 140.3 142.2 133.7

Refinery Crude Throughput

(mbpd)

(1) Adjusted for FIFO impact

(2) Definition on slide 12

(3) Non-GAAP reconciliation on slide 16

(4) Non-GAAP reconciliation on slide 17

Barrels Sold

(mbpd)

Q3 2017 Q3 2016 YTD 2017 YTD 2016

$13.66

$10.19 $11.25 $9.27

Refining Margin(1)(2)(3)

(per crude throughput barrel)

Q3 2017 Q3 2016 YTD 2017 YTD 2016

$4.80 $4.23 $4.33 $4.34

Direct Operating Expenses Excluding Major Scheduled

Turnaround Expenses(4)

(per crude throughput barrel)

Coffeyville Refinery

4

Q3 2017 Q3 2016 YTD 2017 YTD 2016

74.6

67.6

79.4

73.5

Q3 2017 Q3 2016 YTD 2017 YTD 2016

73.2

69.0

80.7

74.5

Refinery Crude Throughput

(mbpd)

Barrels Sold

(mbpd)

Q3 2017 Q3 2016 YTD 2017 YTD 2016

$13.63

$9.71 $10.08 $8.38

Refining Margin(1)(2)(3)

(per crude throughput barrel)

Q3 2017 Q3 2016 YTD 2017 YTD 2016

$6.18

$7.45

$5.40 $6.10

Direct Operating Expenses Excluding Major Scheduled

Turnaround Expenses(4)

(per crude throughput barrel)

Wynnewood Refinery

5

(1) Adjusted for FIFO impact

(2) Definition on slide 12

(3) Non-GAAP reconciliation on slide 16

(4) Non-GAAP reconciliation on slide 17

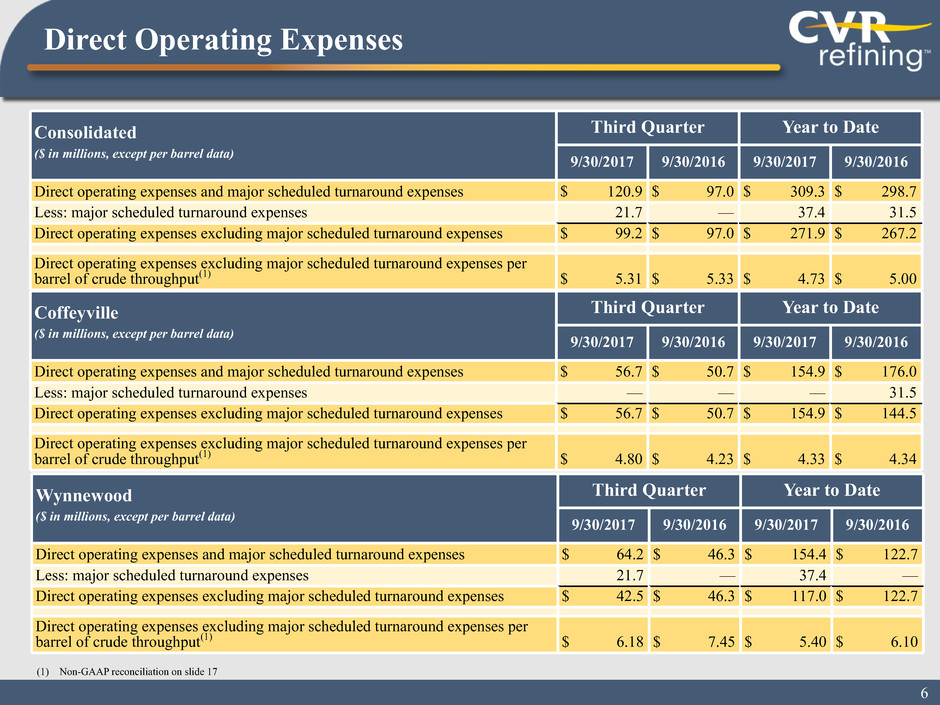

Consolidated Third Quarter Year to Date

($ in millions, except per barrel data) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Direct operating expenses and major scheduled turnaround expenses $ 120.9 $ 97.0 $ 309.3 $ 298.7

Less: major scheduled turnaround expenses 21.7 — 37.4 31.5

Direct operating expenses excluding major scheduled turnaround expenses $ 99.2 $ 97.0 $ 271.9 $ 267.2

Direct operating expenses excluding major scheduled turnaround expenses per

barrel of crude throughput(1) $ 5.31 $ 5.33 $ 4.73 $ 5.00

6

Direct Operating Expenses

Coffeyville Third Quarter Year to Date

($ in millions, except per barrel data) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Direct operating expenses and major scheduled turnaround expenses $ 56.7 $ 50.7 $ 154.9 $ 176.0

Less: major scheduled turnaround expenses — — — 31.5

Direct operating expenses excluding major scheduled turnaround expenses $ 56.7 $ 50.7 $ 154.9 $ 144.5

Direct operating expenses excluding major scheduled turnaround expenses per

barrel of crude throughput(1) $ 4.80 $ 4.23 $ 4.33 $ 4.34

Wynnewood Third Quarter Year to Date

($ in millions, except per barrel data) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Direct operating expenses and major scheduled turnaround expenses $ 64.2 $ 46.3 $ 154.4 $ 122.7

Less: major scheduled turnaround expenses 21.7 — 37.4 —

Direct operating expenses excluding major scheduled turnaround expenses $ 42.5 $ 46.3 $ 117.0 $ 122.7

Direct operating expenses excluding major scheduled turnaround expenses per

barrel of crude throughput(1) $ 6.18 $ 7.45 $ 5.40 $ 6.10

(1) Non-GAAP reconciliation on slide 17

$500

$400

$300

$200

$100

$0

-$100

2014 2015 2016 Q3 2017

$211.2

$392.7

$232.8

$(14.9)

Note: Refer to slide 20 for metrics used in calculations

Debt Metrics

7

Financial Metrics 2014 2015 2016 Q3 2017 LTM

w Debt to Capital 29% 31% 30% 28%

w Debt to Adj. EBITDA 0.9 1.0 2.5 1.7

w Net Debt to Adj. EBITDA 0.3 0.7 1.0 —

Net Debt (Cash)

($ in millions)

Coffeyville

($ in millions)

Note: Refer to slide 22 for metrics used in calculations

Wynnewood

($ in millions)

Capital Spending

8

n Environmental & Maintenance n Growth

$150

$100

$50

$0

2014 2015 2016 2017 E

$150

$100

$50

$0

2014 2015 2016 2017 E

Consolidated Capital Spending Summary

2014 2015 2016 2017 Estimate

Environmental & Maintenance $140.3 $103.4 $63.6 $95.0

Growth 51.0 91.3 38.7 15.0

Total Capital Spending $191.3 $194.7 $102.3 $110.0

n Environmental & Maintenance n Growth

Commodity Swaps

Distillate Gasoline 2-1-1 Total

Barrels Fixed Price(2) Barrels Fixed Price(2) Barrels Fixed Price(2) Barrels Fixed Price(2)

Fourth Quarter 2017 2,175,000 $ 20.98 2,175,000 $ 14.41 2,700,000 $ 17.98 7,050,000 $ 17.80

First Quarter 2018 2,325,000 20.66 2,325,000 16.71 2,400,000 18.61 7,050,000 18.66

Second Quarter 2018 375,000 20.52 375,000 21.70 1,200,000 21.08 1,950,000 21.09

Third Quarter 2018 — — — — 150,000 19.22 150,000 19.22

Total 4,875,000 $ 20.79 4,875,000 $ 16.07 6,450,000 $ 18.82 16,200,000 $ 18.59

(1) As of September 30, 2017

(2) Weighted-average price of all positions for period indicated

9

Hedging Position(1)

Appendix

Non-GAAP Financial Measures

11

To supplement the actual results in accordance with GAAP for the applicable periods, the Partnership also uses

non-GAAP financial measures as discussed below, which are reconciled to GAAP-based results. These non-GAAP

financial measures should not be considered an alternative for GAAP results. The adjustments are provided to

enhance an overall understanding of the Partnership’s financial performance for the applicable periods and are

indicators management believes are relevant and useful for planning and forecasting future periods.

EBITDA and Adjusted EBITDA. EBITDA represents net income before (i) interest expense and other financing costs,

net of interest income, (ii) income tax expense and (iii) depreciation and amortization. Adjusted EBITDA represents

EBITDA adjusted for (i) FIFO impact (favorable) unfavorable; (ii) major scheduled turnaround expenses (that many

of our competitors capitalize and thereby exclude from their measure of EBITDA and adjusted EBITDA); (iii) (gain)

loss on derivatives, net and (iv) current period settlements on derivative contracts. We present Adjusted EBITDA because

it is the starting point for our calculation of available cash for distribution. EBITDA and Adjusted EBITDA are not

recognized terms under GAAP and should not be substituted for net income or cash flow from operations. Management

believes that EBITDA and Adjusted EBITDA enable investors to better understand our ability to make distributions to

our common unitholders, help investors evaluate our ongoing operating results and allow for greater transparency in

reviewing our overall financial, operational and economic performance. EBITDA and Adjusted EBITDA presented by

other companies may not be comparable to our presentation, since each company may define these terms differently.

Available cash for distribution is not a recognized term under GAAP. Available cash should not be considered in

isolation or as an alternative to net income or operating income as a measure of operating performance. In addition,

available cash for distribution is not presented as, and should not be considered, an alternative to cash flows from

operations or as a measure of liquidity. Available cash as reported by the Partnership may not be comparable to

similarly titled measures of other entities, thereby limiting its usefulness as a comparative measure.

Non-GAAP Financial Measures (cont'd)

12

Refining margin per crude oil throughput barrel is a measurement calculated as the difference between net sales and

cost of material and other. Refining margin is a non-GAAP measure that we believe is important to investors in evaluating

our refineries' performance as a general indication of the amount above our cost of materials and other at which we

are able to sell refined products. Each of the components used in this calculation (net sales and cost of materials and

other) can be taken directly from our Statements of Operations. Our calculation of refining margin may differ from

similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. In

order to derive the refining margin per crude oil throughput barrel, we utilize the total dollar figures for refining margin

as derived above and divide by the applicable number of crude oil throughput barrels for the period. We believe that

refining margin is important to enable investors to better understand and evaluate our ongoing operating results and

allow for greater transparency in the review of our overall financial, operational and economic performance.

Refining margin per crude oil throughput barrel adjusted for FIFO impact is a measurement calculated as the difference

between net sales and cost of materials and other adjusted for FIFO impact. Refining margin adjusted for FIFO impact

is a non-GAAP measure that we believe is important to investors in evaluating our refineries’ performance as a general

indication of the amount above our cost of materials and other (taking into account the impact of our utilization of

FIFO) at which we are able to sell refined products. Our calculation of refining margin adjusted for FIFO impact may

differ from calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure.

Under our FIFO accounting method, changes in crude oil prices can cause fluctuations in the inventory valuation of

our crude oil, work in process and finished goods, thereby resulting in a favorable FIFO impact when crude oil prices

increase and an unfavorable FIFO impact when crude oil prices decrease.

Calculation of Consolidated Refining Margin adjusted for FIFO

impact(1) Third Quarter Year to Date

($ in millions) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Net sales $ 1,385.8 $ 1,163.5 $ 4,147.5 $ 3,161.9

Cost of materials and other 1,114.4 987.5 3,523.7 2,651.7

Direct operating expenses (exclusive of depreciation and amortization and major

scheduled turnaround expenses as reflected below) 99.2 97.0 271.9 267.2

Major scheduled turnaround expenses 21.7 — 37.4 31.5

Depreciation and amortization 31.8 31.9 96.8 93.7

Gross profit 118.7 47.1 217.7 117.8

Add:

Direct operating expenses (exclusive of depreciation and amortization and major

scheduled turnaround expenses as reflected below) 99.2 97.0 271.9 267.2

Major scheduled turnaround expenses 21.7 — 37.4 31.5

Depreciation and amortization 31.8 31.9 96.8 93.7

Refining margin(1) 271.4 176.0 623.8 510.2

FIFO impact, (favorable) unfavorable (14.9) 7.7 0.8 (29.7)

Refining margin adjusted for FIFO impact(1) $ 256.5 $ 183.7 $ 624.6 $ 480.5

Consolidated Non-GAAP Financial Measures

(1) Definition on slide 12

13

Calculation of Coffeyville Refinery Refining Margin adjusted for

FIFO impact(1) Third Quarter Year to Date

($ in millions) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Net sales $ 939.3 $ 788.1 $ 2,750.5 $ 2,094.1

Cost of materials and other 767.7 669.9 2,349.7 1,763.3

Direct operating expenses (exclusive of depreciation and amortization and major

scheduled turnaround expenses as reflected below) 56.7 50.7 154.9 144.5

Major scheduled turnaround expenses — — — 31.5

Depreciation and amortization 17.4 17.7 53.8 51.2

Gross profit 97.5 49.8 192.1 103.6

Add:

Direct operating expenses (exclusive of depreciation and amortization and major

scheduled turnaround expenses as reflected below) 56.7 50.7 154.9 144.5

Major scheduled turnaround expenses — — — 31.5

Depreciation and amortization 17.4 17.7 53.8 51.2

Refining margin(1) 171.6 118.2 400.8 330.8

FIFO impact, (favorable) unfavorable (10.1) 4.0 1.5 (22.4)

Refining margin adjusted for FIFO impact(1) $ 161.5 $ 122.2 $ 402.3 $ 308.4

Coffeyville Non-GAAP Financial Measures

(1) Definition on slide 12

14

Calculation of Wynnewood Refinery Refining Margin adjusted for

FIFO impact(1) Third Quarter Year to Date

($ in millions) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Net sales $ 445.3 $ 374.3 $ 1,393.7 $ 1,064.4

Cost of materials and other 346.9 317.7 1,174.6 888.5

Direct operating expenses (exclusive of depreciation and amortization and major

scheduled turnaround expenses as reflected below) 42.5 46.3 117.0 122.7

Major scheduled turnaround expenses 21.7 — 37.4 —

Depreciation and amortization 12.9 12.7 38.5 37.9

Gross profit (loss) 21.3 (2.4) 26.2 15.3

Add:

Direct operating expenses (exclusive of depreciation and amortization and major

scheduled turnaround expenses as reflected below) 42.5 46.3 117.0 122.7

Major scheduled turnaround expenses 21.7 — 37.4 —

Depreciation and amortization 12.9 12.7 38.5 37.9

Refining margin(1) 98.4 56.6 219.1 175.9

FIFO impact, (favorable) unfavorable (4.8) 3.8 (0.7) (7.3)

Refining margin adjusted for FIFO impact(1) $ 93.6 $ 60.4 $ 218.4 $ 168.6

(1) Definition on slide 12

Wynnewood Non-GAAP Financial Measures

15

16

Non-GAAP Financial Measures

Calculation of Consolidated Refining Margin adjusted for FIFO

impact per crude oil throughput barrel(1) Third Quarter Year to Date

($ in millions except per barrel data) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Total crude oil throughput barrels per day 203,093 197,955 210,393 194,893

Days in the period 92 92 273 274

Total crude oil throughput barrels 18,684,556 18,211,860 57,437,289 53,400,682

Refining margin adjusted for FIFO impact(1)(2) $ 256.5 $ 183.7 $ 624.6 $ 480.5

Divided by: crude oil throughput barrels (in millions) 18.7 18.2 57.4 53.4

Refining margin adjusted for FIFO impact per crude oil throughput barrel(1) $ 13.72 $ 10.09 $ 10.87 $ 8.99

Coffeyville

Total crude oil throughput barrels per day 128,461 130,393 131,004 121,422

Days in the period 92 92 273 274

Total crude oil throughput barrels 11,818,412 11,996,156 35,764,092 33,269,628

Refining margin adjusted for FIFO impact(1)(3) $ 161.5 $ 122.2 $ 402.3 $ 308.4

Divided by: crude oil throughput barrels (in millions) 11.8 12.0 35.8 33.3

Refining margin adjusted for FIFO impact per crude oil throughput barrel(1) $ 13.66 $ 10.19 $ 11.25 $ 9.27

Wynnewood

Total crude oil throughput barrels per day 74,632 67,562 79,389 73,471

Days in the period 92 92 273 274

Total crude oil throughput barrels 6,866,144 6,215,704 21,673,197 20,131,054

Refining margin adjusted for FIFO impact(1)(4) $ 93.6 $ 60.4 $ 218.4 $ 168.6

Divided by: crude oil throughput barrels (in millions) 6.9 6.2 21.7 20.1

Refining margin adjusted for FIFO impact per crude oil throughput barrel(1) $ 13.63 $ 9.71 $ 10.08 $ 8.38

(1) Definition on slide 12

(2) Non-GAAP reconciliation on slide 13

(3) Non-GAAP reconciliation on slide 14

(4) Non-GAAP reconciliation on slide 15

17

Non-GAAP Financial Measures

Calculation of Consolidated Direct Operating Expenses excluding

Major Scheduled Turnaround expenses per crude oil throughput barrel Third Quarter Year to Date

($ in millions except per barrel data) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Total crude oil throughput barrels per day 203,093 197,955 210,393 194,893

Days in the period 92 92 273 274

Total crude oil throughput barrels 18,684,556 18,211,860 57,437,289 53,400,682

Direct operating expenses excluding major scheduled turnaround expenses(1) $ 99.2 $ 97.0 $ 271.9 $ 267.2

Divided by: crude oil throughput barrels (in millions) 18.7 18.2 57.4 53.4

Direct operating expenses excluding major scheduled turnaround expenses per crude oil

throughput barrel $ 5.31 $ 5.33 $ 4.73 $ 5.00

Coffeyville

Total crude oil throughput barrels per day 128,461 130,393 131,004 121,422

Days in the period 92 92 273 274

Total crude oil throughput barrels 11,818,412 11,996,156 35,764,092 33,269,628

Direct operating expenses excluding major scheduled turnaround expenses(1) $ 56.7 $ 50.7 $ 154.9 $ 144.5

Divided by: crude oil throughput barrels (in millions) 11.8 12.0 35.8 33.3

Direct operating expenses excluding major scheduled turnaround expenses per crude oil

throughput barrel $ 4.80 $ 4.23 $ 4.33 $ 4.34

Wynnewood

Total crude oil throughput barrels per day 74,632 67,562 79,389 73,471

Days in the period 92 92 273 274

Total crude oil throughput barrels 6,866,144 6,215,704 21,673,197 20,131,054

Direct operating expenses excluding major scheduled turnaround expenses(1) $ 42.5 $ 46.3 $ 117.0 $ 122.7

Divided by: crude oil throughput barrels (in millions) 6.9 6.2 21.7 20.1

Direct operating expenses excluding major scheduled turnaround expenses per crude oil

throughput barrel $ 6.18 $ 7.45 $ 5.40 $ 6.10

(1) Non-GAAP reconciliation on slide 6

Financials Third Quarter Year to Date

($ in millions) 9/30/2017 9/30/2016 9/30/2017 9/30/2016

Net income $ 70.0 $ 15.9 $ 117.8 $ 26.0

Interest expense and other financing costs, net of interest income 11.8 10.8 34.8 31.7

Income tax expense — — — —

Depreciation and amortization 33.0 32.5 99.5 95.6

EBITDA(1) 114.8 59.2 252.1 153.3

FIFO impact, (favorable) unfavorable (14.9) 7.7 0.8 (29.7)

Major scheduled turnaround expenses 21.7 — 37.4 31.5

Loss on derivatives, net 17.0 1.7 4.8 4.8

Current period settlements on derivative contracts(2) — 6.7 1.1 35.2

Adjusted EBITDA(1) $ 138.6 $ 75.3 $ 296.2 $ 195.1

(1) Definition on slide 11

(2) Represents the portion of loss on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of

the derivative contracts and upon settlement, there is no cost recovery associated with these contracts.

18

Consolidated Non-GAAP Financial Measures

Financials

Third

Quarter

(In millions, except for per unit data)

9/30/2017

Adjusted EBITDA(1) $ 138.6

Less:

Cash needs for debt service (10.0)

Reserves for environmental and maintenance capital expenditures (25.0)

Reserves for major scheduled turnaround expenses (15.0)

Add:

Release of previously established cash reserves 50.0

Available cash for distribution(1) $ 138.6

Available cash for distribution, per unit $ 0.94

Common units outstanding 147.6

(1) Definition on slide 11

19

Consolidated Non-GAAP Financial Measures

Financials Full Year LTM

($ in millions) 2014 2015 2016 Q3 2017

n Cash $ 370.2 $ 187.3 $ 314.1 $ 560.4

n Total debt, including current portion(1) 581.4 580.0 546.9 545.5

n Net debt (cash) 211.2 392.7 232.8 (14.9)

n Partners' capital 1,450.1 1,281.4 1,296.7 1,414.5

n Adjusted EBITDA(2)(3) $ 621.6 $ 602.0 $ 222.8 $ 323.9

(1) Amounts presented are gross debt not net of unamortized debt issuance costs

(2) Non-GAAP reconciliation on slide 21

(3) Definition on slide 11

20

Capital Structure

Financials Full Year LTM

($ in millions) 2014 2015 2016 Q3 2017

Net income $ 358.7 $ 291.2 $ 15.3 $ 107.1

Interest expense and other financing costs, net of interest income 33.9 42.2 43.3 46.4

Income tax expense — — — —

Depreciation and amortization 122.5 130.2 129.0 132.9

EBITDA(1) 515.1 463.6 187.6 286.4

FIFO impact, (favorable) unfavorable 160.8 60.3 (52.1) (21.6)

Share-based compensation, non-cash 2.3 0.6 — —

Major scheduled turnaround expenses 6.8 102.2 31.5 37.4

(Gain) loss on derivatives, net (185.6) 28.6 19.4 19.4

Current period settlements on derivative contracts(2) 122.2 (26.0) 36.4 2.3

Flood insurance recovery(3) — (27.3) — —

Adjusted EBITDA(1) $ 621.6 $ 602.0 $ 222.8 $ 323.9

(1) Definition on slide 11

(2) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at

inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts.

(3) Represents an insurance recovery from environmental insurance carriers as a result of the flood and crude oil discharge at the Coffeyville refinery on June/July 2007.

21

Consolidated Non-GAAP Financial Measures

Financials

($ in millions) 2014 2015 2016 2017 Estimate

Coffeyville refinery

Environmental and Maintenance $ 74.8 $ 69.7 $ 39.1 $ 45.0

Growth 5.5 73.2 37.2 10.0

Coffeyville refinery total capital $ 80.3 $ 142.9 $ 76.3 $ 55.0

Wynnewood refinery

Environmental and Maintenance $ 58.5 $ 25.6 $ 20.6 $ 45.0

Growth 38.9 6.4 0.5 5.0

Wynnewood refinery total capital $ 97.4 $ 32.0 $ 21.1 $ 50.0

Other Petroleum

Environmental and Maintenance $ 7.0 $ 8.1 $ 3.9 $ 5.0

Growth 6.6 11.7 1.0 —

Other petroleum total capital $ 13.6 $ 19.8 $ 4.9 $ 5.0

Total capital spending $ 191.3 $ 194.7 $ 102.3 $ 110.0

22

Capital Spending