Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ANNALY CAPITAL MANAGEMENT INC | a51708422ex99_1.htm |

| 8-K - ANNALY CAPITAL MANAGEMENT, INC. 8-K - ANNALY CAPITAL MANAGEMENT INC | a51708422.htm |

Third Quarter 2017Financial Summary November 1, 2017

This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Actual results could differ materially from those set forth in forward looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of our assets; changes in business conditions and the general economy; our ability to grow our commercial business; our ability to grow our residential mortgage credit business; our ability to grow our middle market lending business; credit risks related to our investments in credit risk transfer securities, residential mortgage-backed securities and related residential mortgage credit assets, commercial real estate assets and corporate debt; risks related to investments in mortgage servicing rights; our ability to consummate any contemplated investment opportunities; changes in government regulations and policy affecting our business; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes; and our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. We do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law.Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. Non-GAAP Financial MeasuresThis presentation includes certain non-GAAP financial measures, including core earnings metrics, which are presented both inclusive and exclusive of the premium amortization adjustment (“PAA”). The Company believes its non-GAAP financial measures are useful for management, investors, analysts, and other interested parties in evaluating the Company’s performance but should not be viewed in isolation and are not a substitute for financial measures computed in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, the Company may calculate its non-GAAP metrics, which include core earnings and the PAA, differently than its peers making comparative analysis difficult. Please see the section entitled “Non-GAAP Reconciliations” in the attached Appendix for a reconciliation to the most directly comparable GAAP financial measures. 1 Safe Harbor Notice

Unaudited, dollars in thousands except per share amounts Note: The endnotes for this page appear in the section entitled “Endnotes for Page 2” in the Appendix. Core earnings (excluding PAA) per average share, core earnings per average common share, annualized core return on average equity (excluding PAA), net interest margin (excluding PAA), average yield on interest earning assets (excluding PAA) and net interest spread (excluding PAA) represent non-GAAP measures. This presentation also includes additional non-GAAP measures, including interest income (excluding PAA), economic interest expense and economic net interest income (excluding PAA). See the section titled “Non-GAAP Reconciliations” in the Appendix for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. A reconciliation of GAAP net income (loss) to non-GAAP core earnings and non-GAAP core earnings (excluding PAA) is provided on page 8 of this financial summary. 2 Q3 2017 Financial Snapshot For the quarters ended September 30, June 30, 2017 2017 Income Statement GAAP net income per average common share (1) $0.31 ($0.01) Core earnings (excluding PAA) per average common share (1)(2) $0.30 $0.30 Core earnings per average common share (1)(2) $0.26 $0.23 PAA cost (benefit) per average common share 0.04 0.07 Annualized GAAP return on average equity 10.98% 0.46% Annualized core return on average equity (excluding PAA) 10.57% 10.54% Balance Sheet Book value per common share $11.42 $11.19 Leverage at period-end (3) 5.4x 5.6x Economic leverage at period-end (4) 6.9x 6.4x Capital ratio at period-end (5) 12.3% 13.2% Portfolio Agency mortgage-backed securities $85,889,131 $73,963,998 Mortgage servicing rights 570,218 605,653 Residential credit portfolio (6) 2,706,092 2,619,564 Commercial real estate investments (7) 5,321,786 5,375,251 Corporate debt 856,110 773,957 Total residential and commercial investments $95,343,337 $83,338,423 Net interest margin (8) 1.33% 1.23% Net interest margin (excluding PAA) (8) 1.47% 1.53% Average yield on interest earning assets (9) 2.79% 2.58% Average yield on interest earning assets (excluding PAA) (9) 2.97% 2.93% Net interest spread 0.97% 0.84% Net interest spread (excluding PAA) 1.15% 1.19% Other Information Annualized operating expenses as a % of average assets 0.25% 0.25% Annualized operating expenses as a % of average equity 1.70% 1.71%

Unaudited, dollars in thousands 3 Last Five Quarters Summary Data Includes consolidated VIEs and loans held for sale. For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Portfolio-Related Data: Agency mortgage-backed securities $85,889,131 $73,963,998 $72,708,490 $75,589,873 $73,476,105 Mortgage servicing rights 570,218 605,653 632,166 652,216 492,169 Residential credit portfolio 2,706,092 2,619,564 2,778,452 2,468,318 2,439,704 Commercial real estate investments (1) 5,321,786 5,375,251 5,550,464 5,881,236 6,033,576 Corporate debt 856,110 773,957 841,265 773,274 716,831 Total residential and commercial investments $95,343,337 $83,338,423 $82,510,837 $85,364,917 $83,158,385 Total assets $97,574,181 $84,976,578 $84,658,957 $87,905,046 $86,909,306 Average TBA position $19,291,834 $14,206,869 $10,655,785 $14,613,149 $17,280,237 Residential Investment Securities: % Fixed-rate 89% 86% 85% 83% 81% % Adjustable-rate 11% 14% 15% 17% 19% Weighted average experienced CPR for the period 10.3% 10.9% 11.5% 15.6% 15.9% Weighted average projected long-term CPR at period end 10.4% 10.6% 10.0% 10.1% 14.4% Net premium and discount balance in Residential Investment Securities $5,745,022 $5,164,105 $5,149,099 $5,318,376 $4,920,750 Net premium and discount balance as % of stockholders' equity 40.60% 40.98% 40.74% 42.32% 37.13%

Consists of common stock, additional paid-in capital, accumulated other comprehensive income (loss) and accumulated deficit.Measures total notional balances of interest rate swaps, interest rate swaptions and futures relative to repurchase agreements, other secured financing and to be announced (“TBA”) notional outstanding. Unaudited, dollars in thousands except per share amounts 4 Last Five Quarters Summary Data (cont’d) For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Liabilities, Capital and Hedging Data: Repurchase agreements $69,430,268 $62,497,400 $62,719,087 $65,215,810 $61,784,121 Other secured financing 3,713,256 3,785,543 3,876,150 3,884,708 3,804,742 Securitized debt of consolidated VIEs 3,357,929 3,438,675 3,477,059 3,655,802 3,712,821 Participation sold - - 12,760 12,869 12,976 Mortgages payable 311,886 311,810 311,707 311,636 327,632 Total debt $76,813,339 $70,033,428 $70,396,763 $73,080,825 $69,642,292 Total liabilities $83,418,963 $72,367,153 $72,011,608 $75,329,074 $73,647,503 Cumulative redeemable preferred stock $1,720,381 $1,200,559 $1,200,559 $1,200,559 $1,200,559 Common equity(1) 12,428,377 11,401,955 11,439,467 11,367,621 12,053,103 Total Annaly stockholders' equity 14,148,758 12,602,514 12,640,026 12,568,180 13,253,662 Non-controlling interests 6,460 6,911 7,323 7,792 8,141 Total equity $14,155,218 $12,609,425 $12,647,349 $12,575,972 $13,261,803 Weighted average days to maturity of repurchase agreements 65 88 88 96 128 Weighted average rate on repurchase agreements, at period-end 1.38% 1.38% 1.15% 1.07% 1.07% Weighted average rate on repurchase agreements, for the quarter 1.34% 1.25% 1.07% 1.01% 0.97% Leverage at period-end 5.4x 5.6x 5.6x 5.8x 5.3x Economic leverage at period-end 6.9x 6.4x 6.1x 6.4x 6.1x Capital ratio at period-end 12.3% 13.2% 13.8% 13.1% 13.3% Book value per common share $11.42 $11.19 $11.23 $11.16 $11.83 Total common shares outstanding 1,088,084 1,019,028 1,018,971 1,018,913 1,018,858 Hedge ratio(2) 67% 67% 63% 56% 52% Weighted average pay rate on interest rate swaps 2.27% 2.26% 2.25% 2.22% 2.25% Weighted average receive rate on interest rate swaps 1.35% 1.28% 1.15% 1.02% 0.88% Weighted average net rate on interest rate swaps 0.92% 0.98% 1.10% 1.20% 1.37%

Includes interest expense on interest rate swaps used to hedge cost of funds. Excludes interest expense on interest rate swaps used to hedge TBA dollar roll transactions.Net of dividends on preferred stock, including cumulative and undeclared dividends on the Company’s Series F Preferred stock of $8.3 million for the quarter ended September 30, 2017. Unaudited, dollars in thousands except per share amounts 5 Last Five Quarters Summary Data (cont’d) For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Performance-Related Data: Total interest income $622,550 $537,426 $587,727 $807,022 $558,668 Total interest expense 268,937 222,281 198,425 183,396 174,154 Net interest income $353,613 $315,145 $389,302 $623,626 $384,514 Total economic interest expense (1) $347,501 $306,533 $287,391 $276,237 $277,254 Economic net interest income (1) $275,049 $230,893 $300,336 $530,785 $281,414 Total interest income (excluding PAA) $662,449 $610,126 $605,597 $568,081 $562,559 Economic net interest income (excluding PAA) (1) $314,948 $303,593 $318,206 $291,844 $285,305 GAAP net income (loss) $367,315 $14,522 $440,408 $1,848,483 $730,880 GAAP net income (loss) available (related) to common shareholders (2) $337,192 ($8,849) $417,038 $1,825,097 $708,413 GAAP net income (loss) per average common share (2) $0.31 ($0.01) $0.41 $1.79 $0.70 Core earnings (excluding PAA) $353,546 $332,601 $335,898 $326,999 $312,893 Core earnings (excluding PAA) available to common shareholders (2) $323,191 $309,128 $312,425 $303,526 $290,090 Core earnings (excluding PAA) per average common share (2) $0.30 $0.30 $0.31 $0.30 $0.29 Core earnings $313,647 $259,901 $318,028 $565,940 $309,002 Core earnings available to common shareholders (2) $283,292 $236,428 $294,555 $542,467 $286,199 Core earnings per average common share (2) $0.26 $0.23 $0.29 $0.53 $0.29 PAA cost (benefit) $39,899 $72,700 $17,870 ($238,941) $3,891 PAA cost (benefit) per average common share $0.04 $0.07 $0.02 ($0.23) $0.00

Excludes undeclared dividends on the Company’s Series F Preferred stock of $8.3 million for the quarter ended September 30, 2017.Includes interest expense on interest rate swaps used to hedge cost of funds. Unaudited, dollars in thousands except per share amounts 6 Last Five Quarters Summary Data (cont’d) For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Performance-Related Data (continued): Dividends declared per common share $0.30 $0.30 $0.30 $0.30 $0.30 Total common and preferred dividends declared (1) $348,479 $329,182 $329,164 $329,147 $325,091 Annualized GAAP return (loss) on average equity 10.98% 0.46% 13.97% 57.23% 23.55% Annualized GAAP return (loss) on average equity per unit of economic leverage 1.59% 0.07% 2.29% 8.94% 3.86% Annualized core return on average equity (excluding PAA) 10.57% 10.54% 10.66% 10.13% 10.09% Annualized core return on average equity per unit of economic leverage (excluding PAA) 1.53% 1.65% 1.75% 1.58% 1.65% Net interest margin 1.33% 1.23% 1.47% 2.49% 1.40% Net interest margin (excluding PAA) 1.47% 1.53% 1.55% 1.53% 1.42% Average yield on interest earning assets 2.79% 2.58% 2.74% 3.81% 2.70% Average yield on interest earning assets (excluding PAA) 2.97% 2.93% 2.83% 2.68% 2.72% Average cost of interest bearing liabilities (2) 1.82% 1.74% 1.59% 1.53% 1.57% Net interest spread 0.97% 0.84% 1.15% 2.28% 1.13% Net interest spread (excluding PAA) 1.15% 1.19% 1.24% 1.15% 1.15%

Included within realized losses on interest rate swaps. Excludes interest expense on interest rate swaps used to hedge TBA dollar roll transactions. Unaudited, dollars in thousands 7 Components of Economic Net Interest Income For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Interest income: Residential Investment Securities $540,436 $459,308 $515,910 $740,664 $493,226 Residential mortgage loans 8,509 7,417 3,864 2,539 1,608 Commercial investment portfolio 67,790 68,153 64,345 61,431 61,240 Reverse repurchase agreements 5,815 2,548 3,608 2,388 2,594 Total interest income $622,550 $537,426 $587,727 $807,022 $558,668 Economic interest expense: Repurchase agreements $237,669 $197,151 $173,090 $162,676 $154,083 Interest expense on swaps used to hedge cost of funds(1) 78,564 84,252 88,966 92,841 103,100 Securitized debt of consolidated VIEs 16,072 11,977 14,850 12,087 12,046 Participation sold - 42 153 155 157 Other 15,196 13,111 10,332 8,478 7,868 Total economic interest expense $347,501 $306,533 $287,391 $276,237 $277,254 Economic net interest income $275,049 $230,893 $300,336 $530,785 $281,414 PAA cost (benefit) 39,899 72,700 17,870 (238,941) 3,891 Economic net interest income (excluding PAA) $314,948 $303,593 $318,206 $291,844 $285,305

Represents transaction costs incurred in connection with the Hatteras Acquisition.Represents a component of Net gains (losses) on trading assets.Represents the portion of changes in fair value that is attributable to the realization of estimated cash flows on the Company’s mortgage servicing rights (“MSR”) portfolio and is reported as a component of Net unrealized gains (losses) on investments measured at fair value. Unaudited, dollars in thousands 8 GAAP Net Income to Core Earnings Reconciliation For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Core earnings reconciliation GAAP net income (loss) $367,315 $14,522 $440,408 $1,848,483 $730,880 Less: Realized (gains) losses on termination of interest rate swaps - 58 - 55,214 (1,337) Unrealized (gains) losses on interest rate swaps (56,854) 177,567 (149,184) (1,430,668) (256,462) Net (gains) losses on disposal of investments 11,552 5,516 (5,235) (7,782) (14,447) Net (gains) losses on trading assets (154,208) 14,423 (319) 139,470 (162,981) Net unrealized (gains) losses on investments measured at fair value through earnings 67,492 (16,240) (23,683) (110,742) (29,675) Bargain purchase gain - - - - (72,576) Corporate acquisition related expenses(1) - - - - 46,724 Net (income) loss attributable to noncontrolling interest 232 102 103 87 336 Plus: TBA dollar roll income(2) 94,326 81,051 69,968 98,896 90,174 MSR amortization(3) (16,208) (17,098) (14,030) (27,018) (21,634) Core earnings 313,647 259,901 318,028 565,940 309,002 Less: PAA cost (benefit) 39,899 72,700 17,870 (238,941) 3,891 Core earnings (excluding PAA) $353,546 $332,601 $335,898 $326,999 $312,893

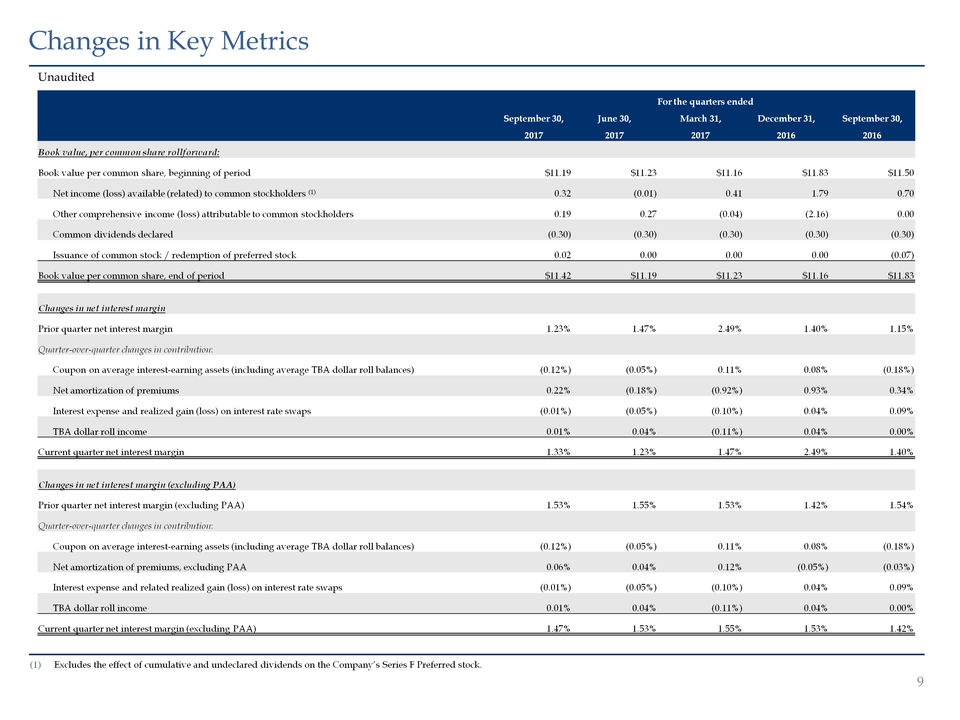

Unaudited 9 Changes in Key Metrics Excludes the effect of cumulative and undeclared dividends on the Company’s Series F Preferred stock. For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Book value, per common share rollforward: Book value per common share, beginning of period $11.19 $11.23 $11.16 $11.83 $11.50 Net income (loss) available (related) to common stockholders (1) 0.32 (0.01) 0.41 1.79 0.70 Other comprehensive income (loss) attributable to common stockholders 0.19 0.27 (0.04) (2.16) 0.00 Common dividends declared (0.30) (0.30) (0.30) (0.30) (0.30) Issuance of common stock / redemption of preferred stock 0.02 0.00 0.00 0.00 (0.07) Book value per common share, end of period $11.42 $11.19 $11.23 $11.16 $11.83 Changes in net interest margin Prior quarter net interest margin 1.23% 1.47% 2.49% 1.40% 1.15% Quarter-over-quarter changes in contribution: Coupon on average interest-earning assets (including average TBA dollar roll balances) (0.12%) (0.05%) 0.11% 0.08% (0.18%) Net amortization of premiums 0.22% (0.18%) (0.92%) 0.93% 0.34% Interest expense and realized gain (loss) on interest rate swaps (0.01%) (0.05%) (0.10%) 0.04% 0.09% TBA dollar roll income 0.01% 0.04% (0.11%) 0.04% 0.00% Current quarter net interest margin 1.33% 1.23% 1.47% 2.49% 1.40% Changes in net interest margin (excluding PAA) Prior quarter net interest margin (excluding PAA) 1.53% 1.55% 1.53% 1.42% 1.54% Quarter-over-quarter changes in contribution: Coupon on average interest-earning assets (including average TBA dollar roll balances) (0.12%) (0.05%) 0.11% 0.08% (0.18%) Net amortization of premiums, excluding PAA 0.06% 0.04% 0.12% (0.05%) (0.03%) Interest expense and related realized gain (loss) on interest rate swaps (0.01%) (0.05%) (0.10%) 0.04% 0.09% TBA dollar roll income 0.01% 0.04% (0.11%) 0.04% 0.00% Current quarter net interest margin (excluding PAA) 1.47% 1.53% 1.55% 1.53% 1.42%

Includes interest expense on interest rate swaps used to hedge cost of funds. Unaudited 10 Changes in Key Metrics (cont’d) For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Changes in net interest spread Prior quarter net interest spread 0.84% 1.15% 2.28% 1.13% 0.80% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets 0.00% 0.09% (0.03%) (0.01%) (0.19%) Net amortization of premiums 0.21% (0.25%) (1.04%) 1.12% 0.41% Average cost of interest bearing liabilities(1) (0.08%) (0.15%) (0.06%) 0.04% 0.11% Current quarter net interest spread 0.97% 0.84% 1.15% 2.28% 1.13% Changes in net interest spread (excluding PAA) Prior quarter net interest spread (excluding PAA) 1.19% 1.24% 1.15% 1.15% 1.27% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets 0.00% 0.09% (0.03%) (0.01%) (0.19%) Net amortization of premiums, excluding PAA 0.04% 0.01% 0.18% (0.03%) (0.04%) Average cost of interest bearing liabilities(1) (0.08%) (0.15%) (0.06%) 0.04% 0.11% Current quarter net interest spread (excluding PAA) 1.15% 1.19% 1.24% 1.15% 1.15%

Includes other income (loss), general and administrative expenses and income taxes.Includes other income (loss), MSR amortization (a component of Net unrealized gains (losses) on financial instruments measured at fair value through earnings), general and administrative expenses (excluding corporate acquisition related expenses) and income taxes. Unaudited 11 Changes in Key Metrics (cont’d) For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Changes in GAAP return on average equity Prior quarter GAAP return on average equity 0.46% 13.97% 57.23% 23.55% (9.60%) Quarter-over-quarter changes in contribution: Coupon income 0.24% (0.14%) 0.68% (0.46%) 0.02% Net amortization of premiums and accretion of discounts 1.35% (1.48%) (7.02%) 7.44% 2.24% Interest expense and realized gain (loss) on interest rate swaps (0.58%) (0.50%) (0.70%) 0.73% 0.14% Realized (gains) losses on termination of interest rate swaps 0.00% 0.00% 1.71% (1.75%) 2.11% Unrealized (gains) / losses on interest rate swaps 7.32% (10.36%) (39.57%) 36.03% 21.12% Realized and unrealized (gains) / losses on investments and trading assets 2.36% (1.04%) 1.58% (7.32%) 5.29% Bargain purchase gain 0.00% 0.00% 0.00% (2.34%) 2.34% Other(1) (0.17%) 0.01% 0.06% 1.35% (0.11%) Current quarter GAAP return on average equity 10.98% 0.46% 13.97% 57.23% 23.55% Changes in core return on average equity (excluding PAA) Prior quarter core return on average equity (excluding PAA) 10.54% 10.66% 10.13% 10.09% 9.73% Quarter-over-quarter changes in contribution: Coupon income 0.24% (0.14%) 0.68% (0.46%) 0.02% Net amortization of premiums (excluding PAA) 0.24% 0.26% 0.93% (0.08%) (0.59%) Economic interest expense and other swaps expense (0.58%) (0.50%) (0.70%) 0.73% 0.14% TBA dollar roll income 0.25% 0.35% (0.84%) 0.16% 0.17% Other(2) (0.12%) (0.09%) 0.46% (0.31%) 0.62% Current quarter core return on average equity (excluding PAA) 10.57% 10.54% 10.66% 10.13% 10.09%

Includes Agency-backed multifamily securities with an estimated fair value of $411.5 million.Weighted by current face value.Weighted by notional value. Unaudited, dollars in thousands 12 Residential Investments and TBA Derivative Overview as of September 30, 2017 Agency Fixed-Rate Securities (Pools) Weighted Avg. Current Weighted Avg. Weighted Avg. Weighted Avg. Weighted Avg. Estimated Years to Maturity Face Value % (2) Coupon Amortized Cost Fair Value 3-Month CPR Fair Value <=15 years (1) $6,955,526 9.4% 3.23% 103.9% 103.4% 9.7% $7,192,052 20 years 4,699,704 6.4% 3.48% 104.6% 104.4% 12.0% 4,904,998 >=30 years 61,944,725 84.2% 3.80% 106.1% 105.2% 9.0% 65,166,403 Total/Weighted Avg. $73,599,955 100.0% 3.73% 105.8% 105.0% 9.2% $77,263,453 TBA Purchase Contracts Weighted Avg. Implied Cost Implied Market Type Notional Value % (3) Coupon Basis Value 15-year $2,345,000 11.7% 2.89% $2,405,109 $2,398,602 30-year 17,615,000 88.3% 3.81% 18,439,271 18,427,543 Total/Weighted Avg. $19,960,000 100.0% 3.70% $20,844,380 $20,826,145 Agency Adjustable-Rate Securities Weighted Avg. Current Weighted Avg. Weighted Avg. Weighted Avg. Weighted Avg. Estimated Months to Reset Face Value % (2) Coupon Amortized Cost Fair Value 3-Month CPR Fair Value 0 - 24 months $4,950,651 68.1% 2.95% 104.2% 103.6% 23.4% $5,129,640 25 - 40 months 1,259,903 17.3% 2.53% 103.4% 102.1% 7.9% 1,286,162 41 - 60 months 89,102 1.2% 3.34% 103.2% 103.3% 17.9% 92,027 61 - 90 months 600,548 8.3% 3.03% 103.5% 102.4% 17.1% 614,968 >90 months 374,010 5.1% 2.96% 102.3% 101.9% 12.3% 381,009 Total/Weighted Avg. $7,274,214 100.0% 2.89% 103.9% 103.2% 19.6% $7,503,806

Weighted by current notional value.Weighted by estimated fair value. Unaudited, dollars in thousands 13 Residential Investments & TBA Derivative Overview as of September 30, 2017 (cont’d) Agency Interest-Only Collateralized Mortgage-Backed Obligations Current Notional Weighted Avg. Weighted Avg. Weighted Avg. Weighted Avg. Estimated Type Value % (1) Coupon Amortized Cost Fair Value 3-Month CPR Fair Value Interest-only $2,987,168 43.8% 3.34% 14.0% 12.0% 9.6% $359,476 Inverse Interest-only 3,834,807 56.2% 4.87% 23.6% 19.9% 12.1% 762,396 Total/Weighted Avg. $6,821,975 100.0% 4.20% 19.4% 16.4% 11.0% $1,121,872 Mortgage Servicing Rights Unpaid Excess Weighted Avg. Principal Weighted Avg. Servicing Loan Age Estimated Type Balance Coupon Spread (months) Fair Value Total/Weighted Avg. $50,993,133 3.83% 0.24% 18.4 $570,218 Residential Credit Portfolio Current Face / Weighted Avg. Weighted Avg. Weighted Avg. Estimated Sector Notional Value % (2) Coupon Amortized Cost Fair Value Fair Value Credit Risk Transfer $534,608 21.5% 5.32% 103.2% 109.0% $582,938 Alt-A 200,757 6.6% 4.43% 83.5% 89.5% 179,725 Prime 235,851 8.2% 4.43% 85.8% 93.6% 220,641 Prime Interest-only 334,298 0.0% 0.10% 0.3% 0.3% 912 Subprime 597,658 21.0% 2.57% 87.2% 95.0% 567,890 NPL/RPL 104,936 3.9% 4.20% 99.9% 100.3% 105,273 Prime Jumbo 135,669 5.0% 3.59% 97.5% 98.9% 134,171 Prime Jumbo Interest-only 1,037,547 0.7% 0.46% 1.6% 1.8% 18,623 Residential Mortgage Loans 878,574 33.1% 4.35% 101.9% 102.0% 895,919 Total/Weighted Avg. $4,059,898 100.0% 2.85% $2,706,092

Excludes residential mortgage loans. Unaudited, dollars in thousands 14 Residential Credit Investments Detail as of September 30, 2017 (1) By Sector Product Product Market Value Coupon Credit Enhancement 60+ Delinquencies 3M VPR Alt-A $179,725 4.43% 11.39% 12.29% 12.32% Prime 220,641 4.43% 1.15% 9.42% 16.33% Prime Interest-only 912 0.10% 0.00% 3.91% 19.96% Subprime 567,890 2.57% 20.30% 19.36% 7.44% Prime Jumbo (>=2010 Vintage) 134,171 3.59% 14.11% 0.05% 10.03% Prime Jumbo (>=2010 Vintage) Interest-only 18,623 0.46% 0.00% 0.00% 8.73% Re-Performing Loan Securitizations 50,289 3.99% 47.97% 27.75% 6.27% Agency Credit Risk Transfer 544,105 5.18% 1.25% 0.18% 11.46% Private Label Credit Risk Transfer 38,833 7.19% 6.44% 2.30% 14.61% Non-Performing Loan Securitizations 54,984 4.39% 52.83% 70.06% 2.93% Total $1,810,173 2.44% 7.15% 7.23% 10.87% Market Value By Sector and Payment Structure Product Senior Subordinate Total Alt-A $101,654 $78,071 $179,725 Prime 26,759 193,882 220,641 Prime Interest-only 912 - 912 Subprime 250,955 316,935 567,890 Prime Jumbo (>=2010 Vintage) 107,539 26,632 134,171 Prime Jumbo (>=2010 Vintage) Interest-only 18,623 - 18,623 Re-Performing Loan Securitizations 50,289 - 50,289 Agency Credit Risk Transfer - 544,105 544,105 Private Label Credit Risk Transfer - 38,833 38,833 Non-Performing Loan Securitizations 47,147 7,837 54,984 Total $603,878 $1,206,295 $1,810,173 Market Value By Sector and Bond Coupon Product ARM Fixed Floater Interest Only Total Alt-A $52,029 $99,846 $27,850 $0 $179,725 Prime 114,435 106,206 - - 220,641 Prime Interest-only - - - 912 912 Subprime - 86,179 481,711 - 567,890 Prime Jumbo (>=2010 Vintage) - 134,171 - - 134,171 Prime Jumbo (>=2010 Vintage) Interest-only - - - 18,623 18,623 Re-Performing Loan Securitizations - 50,289 - - 50,289 Agency Credit Risk Transfer - - 544,105 - 544,105 Private Label Credit Risk Transfer - - 38,833 - 38,833 Non-Performing Loan Securitizations - 54,984 - - 54,984 Total $166,464 $531,675 $1,092,499 $19,535 $1,810,173

Unaudited, dollars in thousands Book values net of unamortized net origination fees.Total weighted based on carrying value.Based on an internal valuation or the most recent third party appraisal, which may be prior to loan origination/purchase date or at the time of underwriting.Maturity dates assume all of the borrowers' extension options are exercised.Levered Return – Represents the current coupon plus accretion and amortization of origination fees and premium/discounts over investment economic interest.Equity levered returns are calculated based on trailing twelve months cash-on-cash returns, updated quarterly and on a one month lag.Includes investment in unconsolidated debt fund of $17.8 million. 15 Commercial Real Estate Overview as of September 30, 2017 GAAP Non-GAAP Mortgage Debt & Preferred Equity Investments Number of Investments Book Values (1) % of Respective Portfolio Weighted Avg LTV (2) (3) Weighted Avg Life (years) (4) Economic Interest Levered Return(5) Financeable First Mortgages 13 580,609 59.1% 69.4% 3.81 245,783 8.7% Mezzanine Loan Investments 22 392,159 40.0% 70.2% 3.42 369,743 9.7% Preferred Equity Investments 1 8,980 0.9% 95.6% 1.19 8,980 11.2% Total Mortgage Debt & Preferred Equity Investments 36 $ 981,748 100.0% 69.9% 3.63 $ 624,506 9.3% Securitized Debt Investments Number of Investments Fair Value % of Respective Portfolio Weighted Avg LTV Weighted Avg Life (years) Economic Interest Levered Return(5) Securitized Whole Loans 63 3,578,631 92.5% 69.7% 5.05 259,250 9.9% AAA CMBS 10 247,508 6.4% 28.8% 1.43 33,545 11.8% Credit CMBS 3 42,971 1.1% 68.4% 9.13 17,184 14.3% Total Securitized Debt Investments 76 $ 3,869,110 100.0% 67.1% 4.86 $ 309,979 10.4% Total Debt & Preferred Equity Investments 112 $ 4,850,858 100.0% 67.7% 4.61 $ 934,485 9.7% Equity Investments Number of Properties Book Value % of Respective Portfolio Economic Interest Levered Return(6) Real Estate Held for Investment 26 396,624 84.2% 147,454 10.3% Investment in Unconsolidated Joint Ventures(7) 14 74,304 15.8% 84,376 8.8% Total Equity Investments 40 $ 470,928 100.0% $ 231,830 9.6% Total $ 5,321,786 $ 1,166,315 9.7%

Unaudited, dollars in thousands 16 Middle Market Lending Overview as of September 30, 2017 Industry Dispersion Industry Fixed Rate Floating Rate Total Aircraft and Parts $ - $ 34,846 $ 34,846 Coating, Engraving and Allied Services - 63,643 63,643 Computer Programming, Data Processing & Other Computer Related Services - 149,005 149,005 Drugs - 33,431 33,431 Electronic Components & Accessories - 23,885 23,885 Groceries and Related Products - 14,803 14,803 Grocery Stores - 23,560 23,560 Home Health Care Services - 23,893 23,893 Insurance Agents, Brokers and services 4,604 72,555 77,159 Management and Public Relations Services - 94,608 94,608 Medical and Dental Laboratories - 25,990 25,990 Miscellaneous Business Services - 19,754 19,754 Miscellaneous Equipment Rental and Leasing - 19,651 19,651 Miscellaneous Health and Allied Services, not elsewhere classified - 25,982 25,982 Miscellaneous Nonmetallic Minerals, except Fuels - 25,931 25,931 Miscellaneous Plastic Products - 9,978 9,978 Motor Vehicles and Motor Vehicle Parts and Supplies - 12,230 12,230 Offices and Clinics of Doctors of Medicine - 59,991 59,991 Offices and Clinics of Other Health Practitioners - 7,397 7,397 Public Warehousing and Storage - 40,900 40,900 Research, Development and Testing Services - 17,732 17,732 Schools and Educational Services, not elsewhere classified - 20,941 20,941 Surgical, Medical, and Dental Instruments and Supplies - 12,961 12,961 Telephone Communications - 17,839 17,839 Total $ 4,604 $ 851,506 $ 856,110 Size Dispersion Position Size Amount Percentage $0 - $20 million $ 242,885 28.4% $20 - $40 million 293,665 34.3% $40 - $60 million 182,328 21.3% Greater than $60 million 137,232 16.0% Total $ 856,110 100.0% Tenor Dispersion Remaining Term Amount Percentage One year or less $ - 0.0% One to three years 23,126 2.7% Three to five years 307,421 35.9% Greater than five years 525,563 61.4% Total $ 856,110 100.0% Lien Position Amount First lien loans $ 542,776 63.4% Second lien loans 308,730 36.1% Subordinated notes 4,604 0.5% Total $ 856,110 100.0%

Weighted average years to maturity for futures positions are based off of the Treasury contracts cheapest to deliver.Approximately 8% of the total repurchase agreements and other secured financing have a remaining maturity over one year. Determined based on estimated weighted-average lives of the underlying debt instruments. Unaudited, dollars in thousands 17 Hedging and Liabilities as of September 30, 2017 Principal Weighted Average Rate Balance At Period End For the Quarter Days to Maturity (3) Repurchase agreements $69,430,268 1.38% 1.34% 65 Other secured financing 3,713,256 1.49% 1.63% 1,190 Securitized debt of consolidated VIEs 3,287,374 1.87% 1.92% 2,150 Mortgages payable 314,811 4.24% 4.34% 2,661 Total indebtedness $76,745,709 Interest Rate Swaps Current Weighted Avg. Weighted Avg. Weighted Avg. Maturity Notional Pay Rate Receive Rate Years to Maturity 0 to 3 years $8,617,000 1.72% 1.36% 2.45 >3 to 6 years 10,609,050 2.17% 1.31% 4.59 > 6 to 10 years 9,805,000 2.41% 1.40% 7.74 Greater than 10 years 3,826,400 3.65% 1.28% 18.72 Total / Weighted Avg. $32,857,450 2.27% 1.35% 6.44 Futures Positions Notional Notional Weighted Avg. Long Short Years to Type Positions Positions Maturity(1) 2-year Swap Equivalent Eurodollar Contracts - (17,080,875) 2.00 U.S. Treasury Futures - 5 year - (4,217,400) 4.41 U.S. Treasury Futures - 10 year & Greater - (4,646,000) 7.03 Total - ($25,944,275) 3.29 Interest Rate Swaptions Current Weighted Avg. Weighted Avg. Weighted Avg. Weighted Avg. Underlying Underlying Underlying Underlying Months to Type Notional Pay Rate Receive Rate Years to Maturity Expiration Long $4,000,000 2.57% 3M LIBOR 9.96 6.88 Repurchase Agreements & Other Secured Financing Weighted Avg. Principal Rate Maturity Balance At Period End Within 30 days $33,176,429 1.34% 30 to 59 days 6,588,239 1.34% 60 to 89 days 15,873,458 1.39% 90 to 119 days 3,306,328 1.40% Over 120 days(2) 14,199,070 1.48% Total / Weighted Avg. $73,143,524 1.38%

Interest rate and MBS spread sensitivity are based on results from third party models in conjunction with inputs from our internal investment professionals. Actual results could differ materially from these estimates.Scenarios include Residential Investment Securities, residential mortgage loans, MSRs and derivative instruments.Net asset value (“NAV”) represents book value of common equity. Unaudited 18 Quarter-Over-Quarter Interest Rate and MBS Spread Sensitivity Assumptions:The interest rate sensitivity and MBS spread sensitivity are based on the portfolios as of September 30, 2017 and June 30, 2017.The interest rate sensitivity reflects instantaneous parallel shifts in rates.The MBS spread sensitivity shifts MBS spreads instantaneously and reflects exposure to MBS basis risk.All tables assume no active management of the portfolio in response to rate or spread changes. Interest Rate Sensitivity (1) As of September 30, 2017 As of June 30, 2017 Interest Rate Change (bps) Estimated Percentage Change in Portfolio Value(2) Estimated Change as a % of NAV(2)(3) Estimated Percentage Change in Portfolio Value(2) Estimated Change as a % of NAV(2)(3) (75) 0.4% 2.8% 0.3% 2.0% (50) 0.4% 2.9% 0.4% 2.4% (25) 0.3% 2.1% 0.3% 1.7% 25 (0.4%) (3.1%) (0.4%) (2.6%) 50 (1.0%) (6.9%) (0.9%) (6.0%) 75 (1.6%) (11.4%) (1.5%) (9.9%) MBS Spread Sensitivity (1) As of September 30, 2017 As of June 30, 2017 MBS Spread Shock (bps) Estimated Change in Portfolio Market Value (2) Estimated Change as a % of NAV(2)(3) Estimated Change in Portfolio Market Value (2) Estimated Change as a % of NAV(2)(3) (25) 1.6% 11.7% 1.6% 10.4% (15) 1.0% 7.0% 0.9% 6.2% (5) 0.3% 2.3% 0.3% 2.1% 5 (0.3%) (2.3%) (0.3%) (2.1%) 15 (1.0%) (6.9%) (0.9%) (6.1%) 25 (1.6%) (11.4%) (1.5%) (10.2%)

Appendix

20 Endnotes for Page 2 Net of dividends on preferred stock, including cumulative and undeclared dividends on the Company’s Series F Preferred stock of $8.3 million for the quarter ended September 30, 2017.Core earnings and core earnings per average common share are non-GAAP measures defined as net income (loss) excluding gains or losses on disposals of investments and termination of interest rate swaps, unrealized gains or losses on interest rate swaps and investments measured at fair value through earnings, net gains (losses) on trading assets, impairment losses, net income (loss) attributable to noncontrolling interest, corporate acquisition related expenses and certain other non-recurring gains or losses, and inclusive of TBA dollar roll income (a component of Net gains (losses) on trading assets) and realized amortization of MSRs. Core earnings (excluding PAA) excludes the PAA representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities. Computed as the sum of repurchase agreements, other secured financing, securitized debt, participation sold and mortgages payable divided by total equity. Securitized debt, participation sold and mortgages payable are non-recourse to the Company. Computed as the sum of recourse debt, TBA derivative notional outstanding and net forward purchases of investments divided by total equity. Recourse debt consists of repurchase agreements and other secured financing. Securitized debt, participation sold and mortgages payable are non-recourse to the Company and are excluded from this measure.Computed as the ratio of total equity to total assets (inclusive of total market value of TBA derivatives and exclusive of consolidated VIEs associated with B Piece commercial mortgage-backed securities).Comprised of non-Agency MBS, credit risk transfer securities and residential mortgage loans (includes securitized residential mortgage loans of a consolidated VIE).Includes consolidated VIEs and loans held for sale.Represents the sum of the Company’s annualized economic net interest income (inclusive of interest expense on interest rate swaps used to hedge cost of funds) plus TBA dollar roll income (less interest expense on swaps used to hedge TBA dollar roll transactions) divided by the sum of its average interest-earning assets plus average outstanding TBA derivative balances.Represents annualized interest income divided by average interest earning assets. Interest earning assets reflects the average amortized cost of our investments during the period. Annualized yield on interest earning assets (excluding PAA) is calculated using annualized interest income (excluding PAA).

To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company provides non-GAAP financial measures. These measures should not be considered a substitute for, or superior to, financial measures computed in accordance with GAAP. While intended to offer a fuller understanding of the Company’s results and operations, non-GAAP financial measures also have limitations. For example, the Company may calculate its non-GAAP metrics, such as core earnings or the PAA, differently than its peers making comparative analysis difficult. Additionally, in the case of non-GAAP measures that exclude the PAA, the amount of amortization expense excluding the PAA is not necessarily representative of the amount of future periodic amortization nor is it indicative of the term over which the Company will amortize the remaining unamortized premium. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both GAAP and non-GAAP results. These non-GAAP measures provide additional detail to enhance investor understanding of the Company’s period-over-period operating performance and business trends, as well as for assessing the Company’s performance versus that of industry peers. Additional information pertaining to the Company’s use of these non-GAAP financial measures, including discussion of how each such measure is useful to investors, and reconciliations to their most directly comparable GAAP results are provided below. A reconciliation of GAAP net income (loss) to non-GAAP core earnings for the quarters ended September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016, and September 30, 2016 is provided on page 8 of this financial summary. Unaudited, dollars in thousands 21 Non-GAAP Reconciliations For the quarters ended September 30, June 30, March 31, December 31, September 30, 2017 2017 2017 2016 2016 Premium Amortization Reconciliation Premium amortization expense $220,636 $251,084 $203,634 ($19,812) $213,241 Less: PAA cost (benefit) 39,899 72,700 17,870 (238,941) 3,891 Premium amortization expense (excluding PAA) $180,737 $178,384 $185,764 $219,129 $209,350 Interest Income (excluding PAA) Reconciliation GAAP interest income $622,550 $537,426 $587,727 $807,022 $558,668 PAA cost (benefit) 39,899 72,700 17,870 (238,941) 3,891 Interest Income (excluding PAA) $662,449 $610,126 $605,597 $568,081 $562,559 Economic Interest Expense Reconciliation GAAP interest expense $268,937 $222,281 $198,425 $183,396 $174,154 Add: Interest expense on interest rate swaps used to hedge cost of funds 78,564 84,252 88,966 92,841 103,100 Economic interest expense $347,501 $306,533 $287,391 $276,237 $277,254 Economic Net Interest Income (excluding PAA) Reconciliation Interest income (excluding PAA) $662,449 $610,126 $605,597 $568,081 $562,559 Less: Economic interest expense 347,501 306,533 287,391 276,237 277,254 Economic net interest Income (excluding PAA) $314,948 $303,593 $318,206 $291,844 $285,305 Economic Metrics (excluding PAA) Interest income (excluding PAA) $662,449 $610,126 $605,597 $568,081 $562,559 Average interest earning assets $89,253,094 $83,427,268 $85,664,151 $84,799,222 $82,695,270 Average yield on interest earning assets (excluding PAA) 2.97% 2.93% 2.83% 2.68% 2.72% Economic interest expense $347,501 $306,533 $287,391 $276,237 $277,254 Average interest bearing liabilities $76,382,315 $70,486,779 $72,422,968 $72,032,600 $70,809,712 Average cost of interest bearing liabilities 1.82% 1.74% 1.59% 1.53% 1.57% Net interest spread (excluding PAA) 1.15% 1.19% 1.24% 1.15% 1.15% Net interest margin (excluding PAA) 1.47% 1.53% 1.55% 1.53% 1.42%