Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - WESTAR ENERGY INC /KS | a20171031ex994.htm |

| EX-99.2 - EXHIBIT 99.2 - WESTAR ENERGY INC /KS | wr-09302017x8xkexhibit992.htm |

| EX-99.1 - EXHIBIT 99.1 - WESTAR ENERGY INC /KS | wr-09302017x8xkexhibit991.htm |

| 8-K - 8-K - WESTAR ENERGY INC /KS | wr-09302017xearningsreleas.htm |

Westar Energy

Investor Update – October 31, 2017

Exhibit 99.3

Forward-Looking Disclosures

OCTOBER 31, 2017 INVESTOR UPDATE 2

Forward Looking Statements

Certain matters discussed in this presentation are “forward-looking statements.” The Private Securities Litigation Reform Act of 1995 has

established that these statements qualify for safe harbors from liability. Forward-looking statements may include words like “believe,”

“anticipate,” “target,” “expect,” “pro forma,” “estimate,” “intend,” “guidance” or words of similar meaning. Forward-looking statements describe

future plans, objectives, expectations or goals. Although Westar Energy believes that its expectations are based on reasonable assumptions, all

forward-looking statements involve risk and uncertainty. The factors that could cause actual results to differ materially from these forward-looking

statements include those discussed herein as well as (1) those discussed in the company’s Annual Report on Form 10-K for the year ended Dec.

31, 2016 (a) under the heading, “Forward-Looking Statements,” (b) in ITEM 1. Business, (c) in ITEM 1A. Risk Factors, (d) in ITEM 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (e) in ITEM 8. Financial Statements and

Supplementary Data: Notes 3, 14 and 16; (2) those discussed in the company’s Quarterly Reports on Form 10-Q filed on May 9, 2017, Aug. 8,

2017 and Oct. 31, 2017, (a) under the heading “Forward-Looking Statements,” (b) in ITEM 2. Management’s Discussion and Analysis of

Financial Condition and Results of Operations, (c) in Part I, Financial Information, ITEM 1. Financial Statements: Notes 3, 11, 12 (in the Form

10-Q filed on May 9, 2017), and 13 (in the Form 10-Q filed on Aug. 8, 2017 and Oct. 31, 2017), and (d) ITEM 1A. Risk Factors; and (3) other

factors discussed in the company’s filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the

date such statement was made, and the company does not undertake any obligation to update any forward-looking statement to reflect events or

circumstances after the date on which such statement was made.

Additional Information

The information in this investor update is not complete, and is intended to be read in conjunction with Westar Energy, Inc.’s full earnings package

for the quarter ended September 30, 2017 as well as other information regarding the company that is filed with the Securities and Exchange

Commission. The full earnings package is available is available under Supplemental Materials within the investor section of the company website

at www.WestarEnergy.com, and the company’s filings with the Securities and Exchange Commission can be found in the same section under SEC

Filings.

Company Update

3 OCTOBER 31, 2017 INVESTOR UPDATE

Recent Announcements & Focus

Reported Q3 2017 EPS of $1.11

Compared to Q3 2016 EPS of $1.09

Upcoming Rate Review

Expect to file for general rate review in 1st quarter 2018

Merger with Great Plains Energy

100% stock-for-stock, tax-free exchange

Westar: exchange 1 WR share for 1 share of new company stock

Great Plains: exchange 1 GXP share for .5981 shares of new company stock

Targeted EPS CAGR at 6-8% (off WR’s ’16 EPS of $2.43)

Immediate 15% WR dividend boost at closing

Adjustment maintains GXP dividend

Targeted dividend CAGR at 6-8% thereafter

Improved credit profile; strong investment grade credit

Continued focus on clean, affordable, reliable and safe power

4 OCTOBER 31, 2017 INVESTOR UPDATE

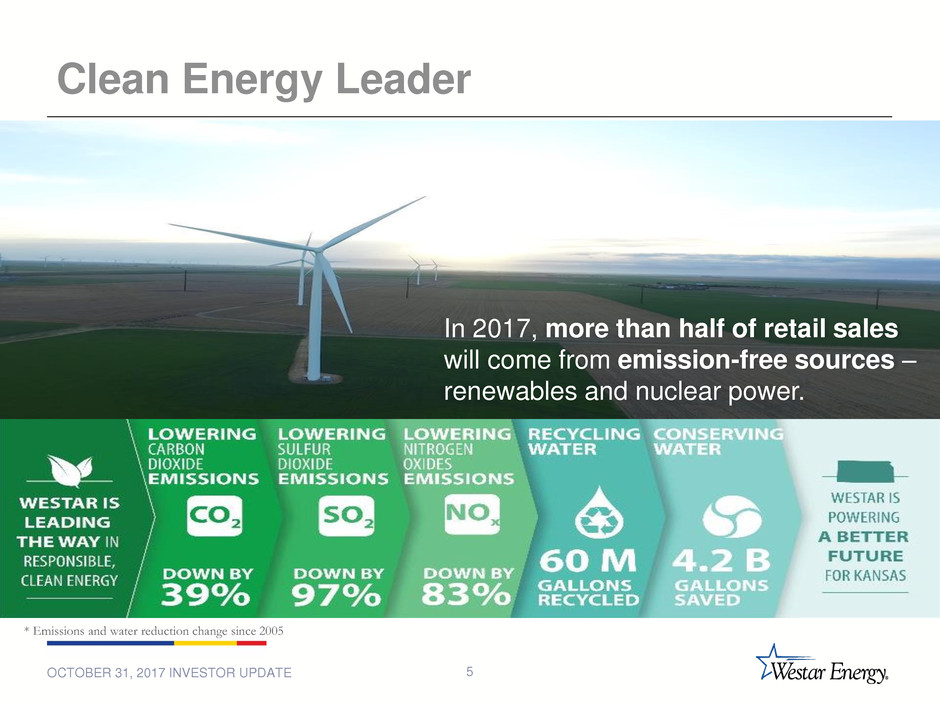

Clean Energy Leader

5 OCTOBER 31, 2017 INVESTOR UPDATE

In 2017, more than half of retail sales

will come from emission-free sources –

renewables and nuclear power.

* Emissions and water reduction change since 2005

Earnings Update

6 OCTOBER 31, 2017 INVESTOR UPDATE

Year Over Year Earnings Variance

$1.09 $1.11

$2.06 $2.03

3Q16 3Q17 YTD 16 YTD 17

EPS

2016 vs 2017

7

Q3 Variance Drivers

Lower income tax expense ~ $25M

Lower O&M~ $7M

11% decrease in CDD

Higher depreciation expense ~ ($10M)

Decrease in COLI benefit ~ ($10M)

Increase in merger-related expenses ~ ($6M)

YTD Variance Drivers

12% decrease in CDD

Higher depreciation expense ~ ($24M)

Lower COLI benefit ~ ($17M)

Higher interest expense ~ ($7M)

Lower income tax expense ~ $48M

Lower property tax amortization expense ~ $19M

Lower O&M/SG&A ~ $12M

Full Earnings Package is available under Supplemental

Materials within the investor section of the company

website at www.WestarEnergy.com.

OCTOBER 31, 2017 INVESTOR UPDATE

Additional Earnings Detail

Merger Expenses

2016 – $10.2M

Q3 2017 – $7.8M

YTD 2017 – $8.6M

Expected total upon closing – $40M to 45M

Weather EPS Estimate

Q3 – $0.05 unfavorable to 2016 – $0.03 unfavorable to normal

2017 – $0.09 unfavorable to 2016 – $0.09 unfavorable to normal

COLI

Actual:

Q3 – $0M

2017 – $0M

2017 annual assumption – $20M

Transmission Margin Increase

2017 annual assumption – $18M

8 OCTOBER 31, 2017 INVESTOR UPDATE

Merger Update

9 OCTOBER 31, 2017 INVESTOR UPDATE

Merger Value

10 OCTOBER 31, 2017 INVESTOR UPDATE

Expected stronger EPS growth

New company EPS CAGR of 6-8%1 vs

WR stand-alone EPS CAGR of 4-6%2

Merger savings – Improve “slope” of EPS growth

Share buybacks – Upward “shift” of EPS growth

Immediate ≈15% dividend increase

Not at expense of credit or payout ratio

Tax-free exchange

Structured to address regulatory order

Not as dependent on future ongoing

rate relief

2016 2022e

Westar Stand Alone Plan, Guidance 4%-6%, Middle of Range

Merger, Opportunities for Additional Synergies/Buy-back Shares

Merger, Modest Synergies

Merger, No Synergies, Excess Cash Used to Buy-back Approximately 30 Million

Shares

EPS Growth Targets

6%

7%

8%

Merger Close

2018e

1New company expected EPS CAGR based off ‘16 WR EPS of $2.43/sh.

2 WR stand-alone expected EPS CAGR based off normalized ‘15 WR EPS of $2.21/sh.

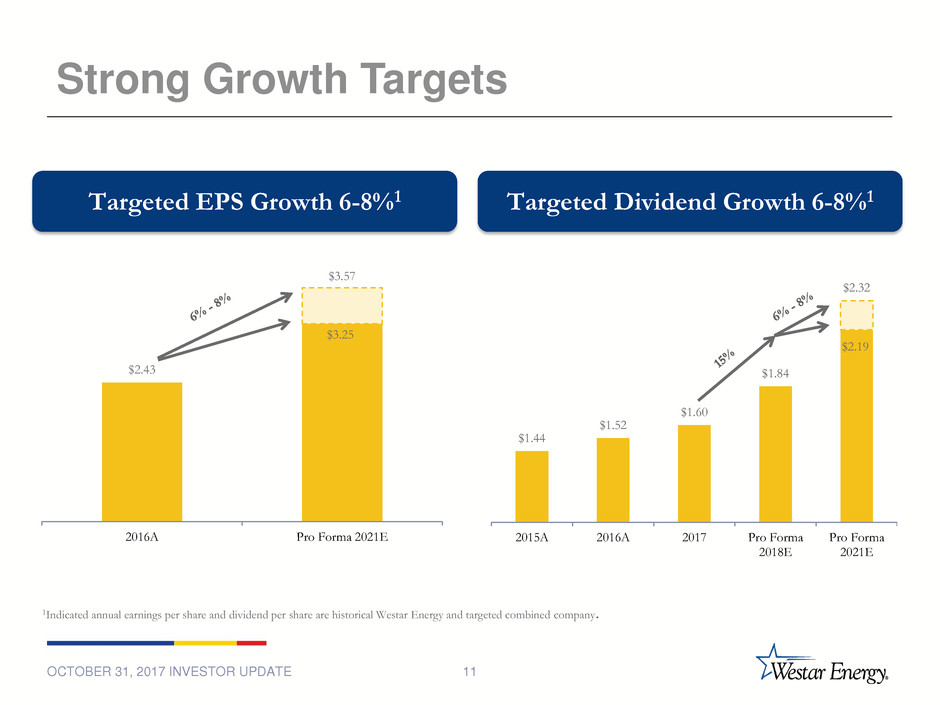

Strong Growth Targets

11 OCTOBER 31, 2017 INVESTOR UPDATE

$2.19

$1.44

$1.52

$1.60

$1.84

$2.32

2015A 2016A 2017 Pro Forma

2018E

Pro Forma

2021E

$2.43

$3.57

2016A Pro Forma 2021E

$3.25

Targeted EPS Growth 6-8%1 Targeted Dividend Growth 6-8%1

1Indicated annual earnings per share and dividend per share are historical Westar Energy and targeted combined company.

Merger Expected To Close In 1st Half 2018

12 OCTOBER 31, 2017 INVESTOR UPDATE

STAKEHOLDER FILED

APPROVAL

ANTICIPATED ADDITIONAL INFO.

GXP and WR shareholders √ 4Q17

Special shareholder meetings for Westar and

Great Plains to be held on November 21, 2017

KCC √ 2Q18 Docket: 18-KCPE-095-MER

MPSC √ 2Q18 Docket: EM-208-0012

FERC √ 1Q18 – 2Q18 Docket: EC-171-000

NRC √ 1Q18 – 2Q18 Docket: 50-482

U.S. DOJ/FTC (HSR) 4Q17 4Q17 – 1Q18

FCC 1Q18 – 2Q18 1Q18 – 2Q18

Merger Summary

13 OCTOBER 31, 2017 INVESTOR UPDATE

Transaction

Structure

• All stock merger of equals (100% stock-for-stock, tax-free exchange); combined equity value of

~$14 billion

• New company to be jointly named prior to close

Exchange Ratio

• Westar Energy: 1:1

• Great Plains Energy: 0.5981:1

Approximate Pro

Forma Ownership

• Westar Energy 52.5%

• Great Plains Energy 47.5%

Pro Forma Dividend

• Results in 15% dividend uplift for Westar Energy

• Adjust to maintain current Great Plains Energy dividend

Termination Fee

• Reverse break-up fee of $190 million in favor of Westar Energy

• Mutual fiduciary out break-up fees of $190 million in favor of the other

• Great Plains Energy no-vote fee of $80 million in favor of Westar Energy

Governance

• Mark Ruelle, Westar Energy CEO to become non-executive chairman

• Terry Bassham, Great Plains Energy President & CEO to remain President & CEO

• Tony Somma (Westar Energy CFO) to be CFO; Kevin Bryant (Great Plains Energy CFO) to be COO

• Equal board representation from each company, including Bassham and Ruelle

Headquarters

• Corporate Headquarters – Kansas City, Missouri

• Operating Headquarters – Topeka, Kansas; Kansas City, Missouri

Timing / Approvals

• Expected to close first half 2018

• Shareholders, federal and state regulators

Additional Information

OCTOBER 31, 2017 INVESTOR UPDATE 14

Additional Information and Where to Find It

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy, vote or approval,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. In connection with the proposed transactions, Monarch Energy has filed with the SEC a Registration

Statement on Form S-4 (Registration No. 333-220465), which was declared effective by the SEC, Great Plains Energy and Westar Energy have each

filed a definitive joint proxy statement, which also constitutes a prospectus of Monarch Energy, each of which is publicly available, and Great Plains

Energy, Westar Energy and Monarch Energy have filed and may file other documents regarding the proposed transactions with the SEC. Great Plains

Energy and Westar Energy mailed the definitive joint proxy statement/prospectus in connection with the transactions to their respective shareholders on

or around October 13, 2017. WE URGE INVESTORS TO READ THE REGISTRATION STATEMENT AND DEFINITIVE JOINT PROXY

STATEMENT/PROSPECTUS AND THESE OTHER MATERIALS CAREFULLY BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT GREAT PLAINS ENERGY, WESTAR ENERGY, MONARCH ENERGY AND THE PROPOSED TRANSACTIONS.

Investors can obtain free copies of the Registration Statement and definitive joint proxy statement/prospectus and other documents filed by Monarch

Energy, Great Plains Energy and Westar Energy with the SEC at http://www.sec.gov, the SEC’s website. These documents filed by Great Plains Energy

and Monarch Energy are also available free of charge from Great Plains Energy’s website (http://www.greatplainsenergy.com) under the tab, “Investor

Relations” and then under the heading “SEC Filings,” or by contacting Great Plains Energy’s Investor Relations Department at 1-800-245-5275. These

documents filed by Westar Energy are also available free of charge from Westar Energy’s website (http://www.westarenergy.com) under the tab

“Investors” and then under the heading “SEC Filings,” or by contacting Westar Energy’s Investor Relations Department at 785-575-8227.

Participants in Proxy Solicitation

Great Plains Energy, Westar Energy and their respective directors and certain of their executive officers and employees may be deemed, under SEC

rules, to be participants in the solicitation of proxies from Great Plains Energy’s and Westar Energy’s shareholders with respect to the proposed

transactions. Information regarding the officers and directors of Great Plains Energy is included in its definitive proxy statement for its 2017 annual

meeting filed with the SEC on March 23, 2017. Information regarding the officers and directors of Westar Energy is included in its definitive proxy

statement for its 2017 annual meeting filed with the SEC on September 14, 2017. Additional information regarding the identity of potential participants,

and their direct or indirect interests, by securities, holdings or otherwise, is set forth in the Registration Statement and definitive joint proxy

statement/prospectus and other materials filed with SEC in connection with the proposed merger. Free copies of these documents may be obtained as

described in the paragraphs above.