Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Q3 EARNINGS RELEASE, SUPPLEMENT & SLIDES - KAR Auction Services, Inc. | form8-kxearningsreleasesup.htm |

| EX-99.2 - EXHIBIT 99.2 - Q3 2017 SUPPLEMENTAL FINANCIAL INFORMATION - KAR Auction Services, Inc. | exhibit992-q32017ersupplem.htm |

| EX-99.1 - EXHIBIT 99.1 - Q3 2017 EARNINGS RELEASE - KAR Auction Services, Inc. | exhibit991-q32017earningsr.htm |

Q3 2017 & Year-to-Date Earnings Slides

October 31, 2017

Forward-Looking Statements

This presentation includes forward-looking statements as that term is

defined in the Private Securities Litigation Reform Act of 1995. Such forward

looking statements are subject to certain risks, trends, and uncertainties that

could cause actual results to differ materially from those projected,

expressed or implied by such forward-looking statements. Many of these

risk factors are outside of the company’s control, and as such, they involve

risks which are not currently known to the company that could cause actual

results to differ materially from forecasted results. Factors that could cause

or contribute to such differences include those matters disclosed in the

company’s Securities and Exchange Commission filings. The forward-

looking statements in this document are made as of the date hereof and the

company does not undertake to update its forward-looking statements.

2

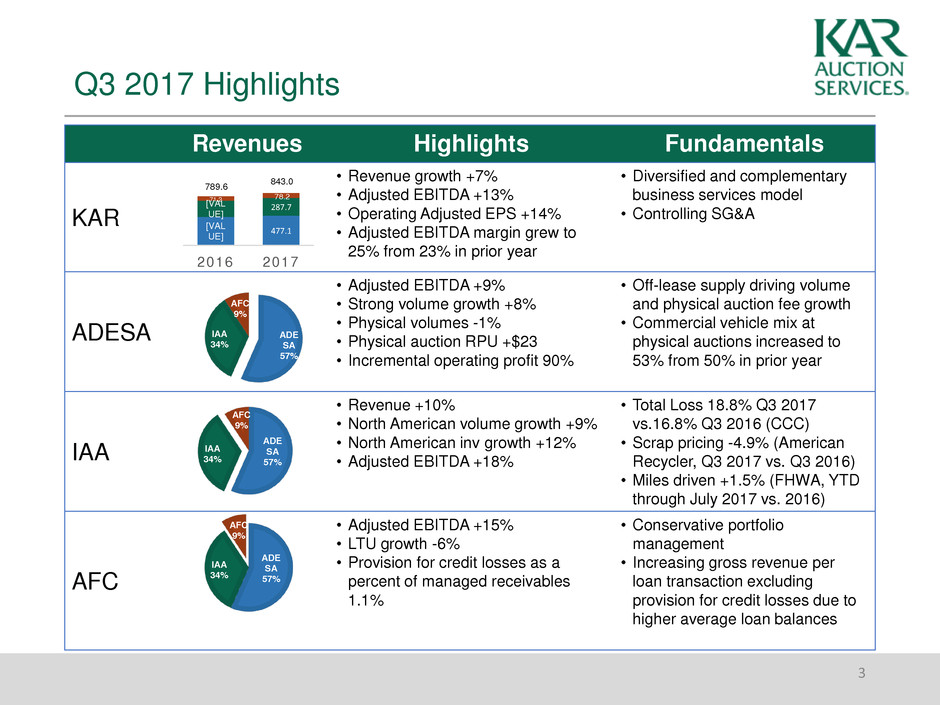

Q3 2017 Highlights

3

Revenues Highlights Fundamentals

KAR

• Revenue growth +7%

• Adjusted EBITDA +13%

• Operating Adjusted EPS +14%

• Adjusted EBITDA margin grew to

25% from 23% in prior year

• Diversified and complementary

business services model

• Controlling SG&A

ADESA

• Adjusted EBITDA +9%

• Strong volume growth +8%

• Physical volumes -1%

• Physical auction RPU +$23

• Incremental operating profit 90%

• Off-lease supply driving volume

and physical auction fee growth

• Commercial vehicle mix at

physical auctions increased to

53% from 50% in prior year

IAA

• Revenue +10%

• North American volume growth +9%

• North American inv growth +12%

• Adjusted EBITDA +18%

• Total Loss 18.8% Q3 2017

vs.16.8% Q3 2016 (CCC)

• Scrap pricing -4.9% (American

Recycler, Q3 2017 vs. Q3 2016)

• Miles driven +1.5% (FHWA, YTD

through July 2017 vs. 2016)

AFC

• Adjusted EBITDA +15%

• LTU growth -6%

• Provision for credit losses as a

percent of managed receivables

1.1%

• Conservative portfolio

management

• Increasing gross revenue per

loan transaction excluding

provision for credit losses due to

higher average loan balances

[VAL

UE]

477.1

[VAL

UE]

287.7

71.2 78.2

2016 2017

789.6

843.0

ADE

SA

57%

IAA

34%

AFC

9%

ADE

SA

57%

IAA

34%

AFC

9%

ADE

SA

57%

IAA

34%

AFC

9%

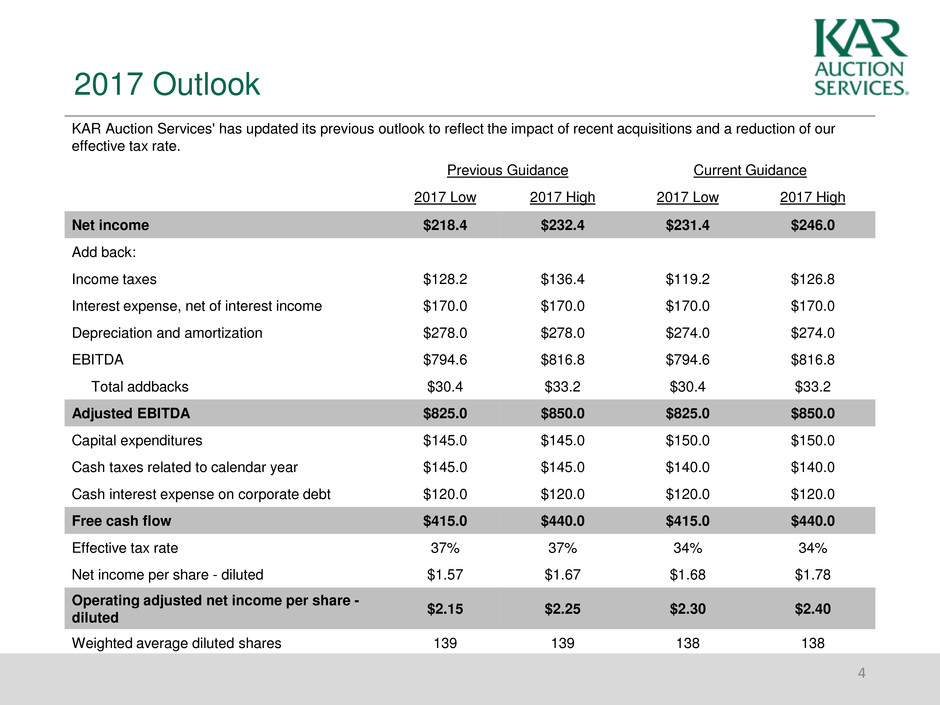

2017 Outlook

4

KAR Auction Services' has updated its previous outlook to reflect the impact of recent acquisitions and a reduction of our

effective tax rate.

Previous Guidance Current Guidance

2017 Low 2017 High 2017 Low 2017 High

Net income $218.4 $232.4 $231.4 $246.0

Add back:

Income taxes $128.2 $136.4 $119.2 $126.8

Interest expense, net of interest income $170.0 $170.0 $170.0 $170.0

Depreciation and amortization $278.0 $278.0 $274.0 $274.0

EBITDA $794.6 $816.8 $794.6 $816.8

Total addbacks $30.4 $33.2 $30.4 $33.2

Adjusted EBITDA $825.0 $850.0 $825.0 $850.0

Capital expenditures $145.0 $145.0 $150.0 $150.0

Cash taxes related to calendar year $145.0 $145.0 $140.0 $140.0

Cash interest expense on corporate debt $120.0 $120.0 $120.0 $120.0

Free cash flow $415.0 $440.0 $415.0 $440.0

Effective tax rate 37% 37% 34% 34%

Net income per share - diluted $1.57 $1.67 $1.68 $1.78

Operating adjusted net income per share -

diluted

$2.15 $2.25 $2.30 $2.40

Weighted average diluted shares 139 139 138 138

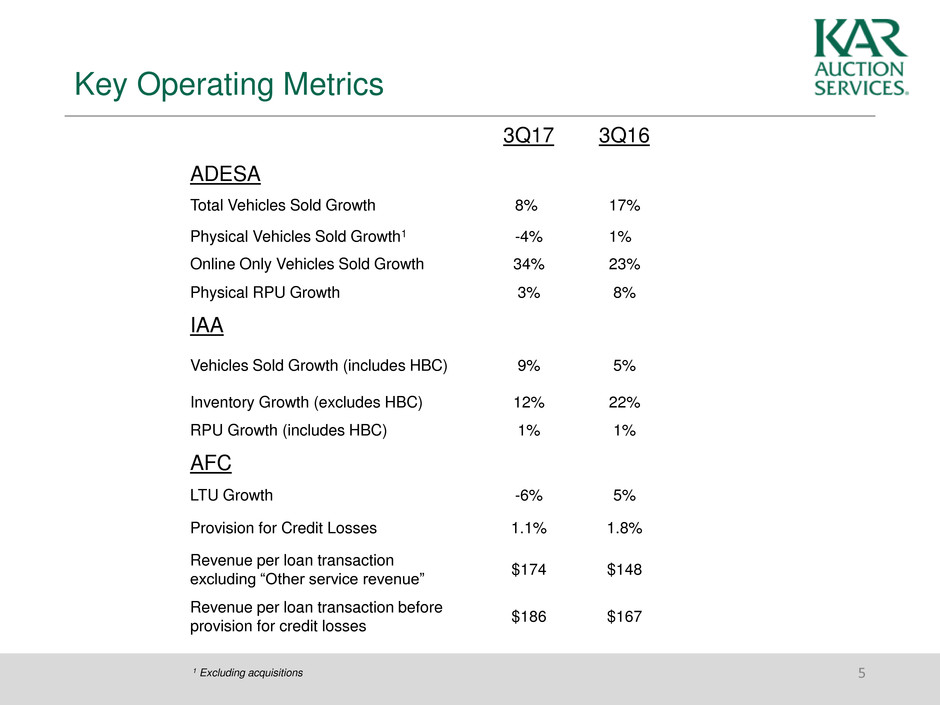

Key Operating Metrics

5

3Q17 3Q16

ADESA

Total Vehicles Sold Growth

Physical Vehicles Sold Growth1

8%

-4%

17%

1%

Online Only Vehicles Sold Growth 34% 23%

Physical RPU Growth 3% 8%

IAA

Vehicles Sold Growth (includes HBC) 9% 5%

Inventory Growth (excludes HBC) 12% 22%

RPU Growth (includes HBC) 1% 1%

AFC

LTU Growth -6% 5%

Provision for Credit Losses 1.1% 1.8%

Revenue per loan transaction

excluding “Other service revenue”

$174 $148

Revenue per loan transaction before

provision for credit losses

$186 $167

1 Excluding acquisitions

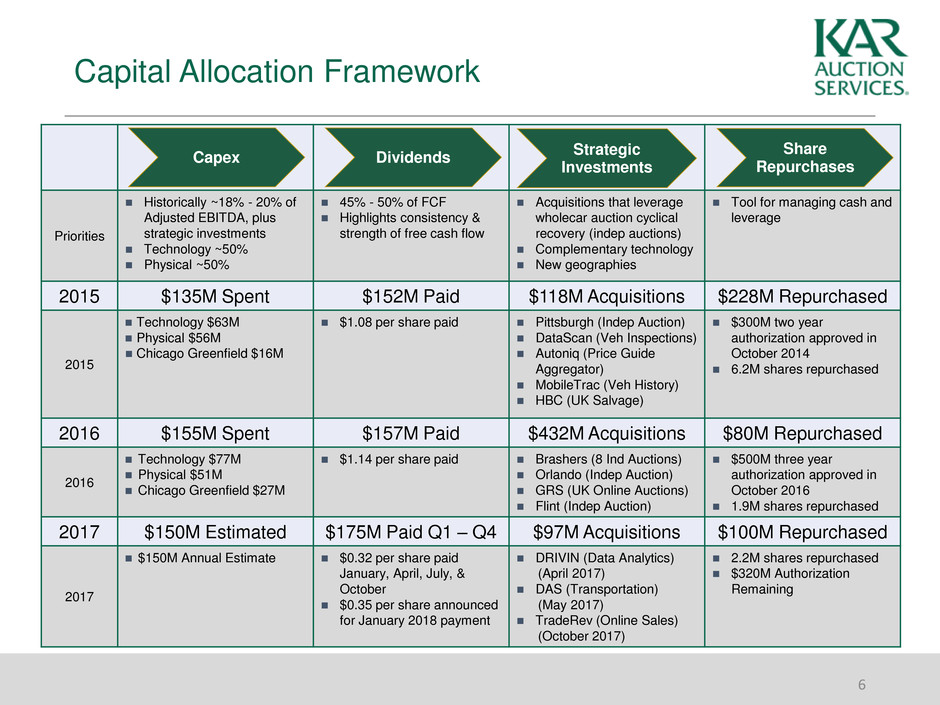

Capital Allocation Framework

6

Priorities

Historically ~18% - 20% of

Adjusted EBITDA, plus

strategic investments

Technology ~50%

Physical ~50%

45% - 50% of FCF

Highlights consistency &

strength of free cash flow

Acquisitions that leverage

wholecar auction cyclical

recovery (indep auctions)

Complementary technology

New geographies

Tool for managing cash and

leverage

2015 $135M Spent $152M Paid $118M Acquisitions $228M Repurchased

2015

Technology $63M

Physical $56M

Chicago Greenfield $16M

$1.08 per share paid

Pittsburgh (Indep Auction)

DataScan (Veh Inspections)

Autoniq (Price Guide

Aggregator)

MobileTrac (Veh History)

HBC (UK Salvage)

$300M two year

authorization approved in

October 2014

6.2M shares repurchased

2016 $155M Spent $157M Paid $432M Acquisitions $80M Repurchased

2016

Technology $77M

Physical $51M

Chicago Greenfield $27M

$1.14 per share paid Brashers (8 Ind Auctions)

Orlando (Indep Auction)

GRS (UK Online Auctions)

Flint (Indep Auction)

$500M three year

authorization approved in

October 2016

1.9M shares repurchased

2017 $150M Estimated $175M Paid Q1 – Q4 $97M Acquisitions $100M Repurchased

2017

$150M Annual Estimate $0.32 per share paid

January, April, July, &

October

$0.35 per share announced

for January 2018 payment

DRIVIN (Data Analytics)

(April 2017)

DAS (Transportation)

(May 2017)

TradeRev (Online Sales)

(October 2017)

2.2M shares repurchased

$320M Authorization

Remaining

Capex Dividends

Strategic

Investments

Share

Repurchases

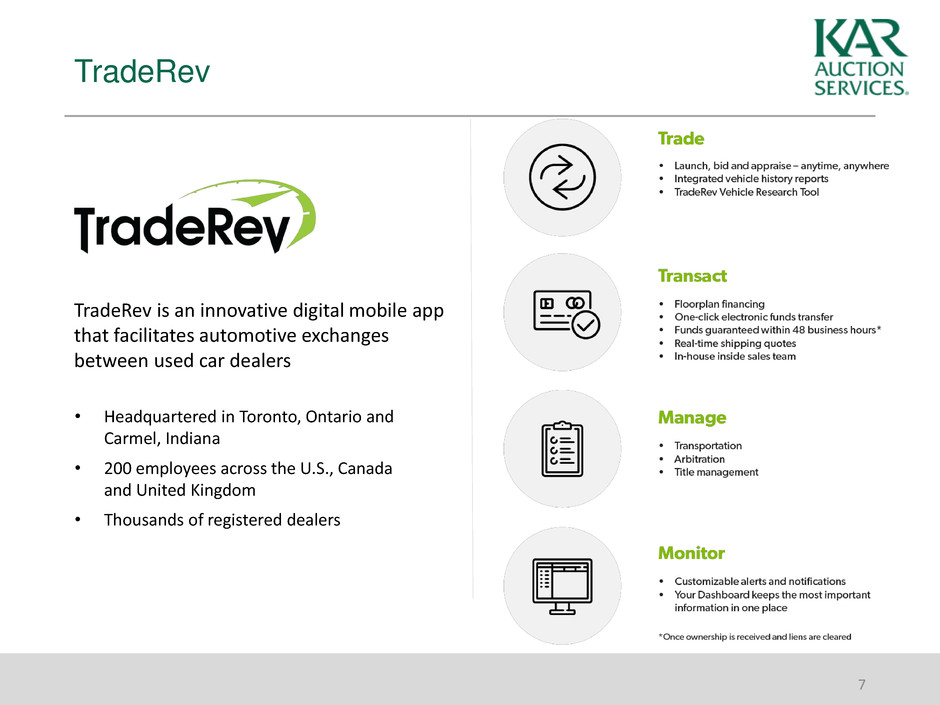

TradeRev

7

TradeRev is an innovative digital mobile app

that facilitates automotive exchanges

between used car dealers

• Headquartered in Toronto, Ontario and

Carmel, Indiana

• 200 employees across the U.S., Canada

and United Kingdom

• Thousands of registered dealers

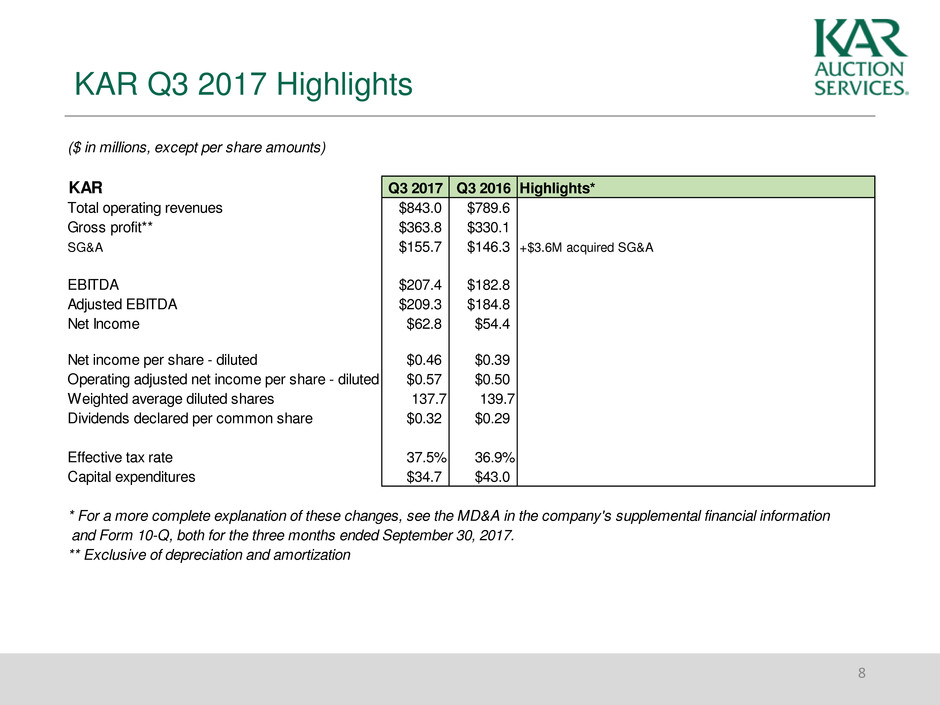

KAR Q3 2017 Highlights

8

($ in millions, except per share amounts)

KAR Q3 2017 Q3 2016 Highlights*

Total operating revenues $843.0 $789.6

Gross profit** $363.8 $330.1

SG&A $155.7 $146.3 +$3.6M acquired SG&A

EBITDA $207.4 $182.8

Adjusted EBITDA $209.3 $184.8

Net Income $62.8 $54.4

Net income per share - diluted $0.46 $0.39

Operating adjusted net income per share - diluted $0.57 $0.50

Weighted average diluted shares 137.7 139.7

Dividends declared per common share $0.32 $0.29

Effective tax rate 37.5% 36.9%

Capital expenditures $34.7 $43.0

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-Q, both for the three months ended September 30, 2017.

** Exclusive of depreciation and amortization

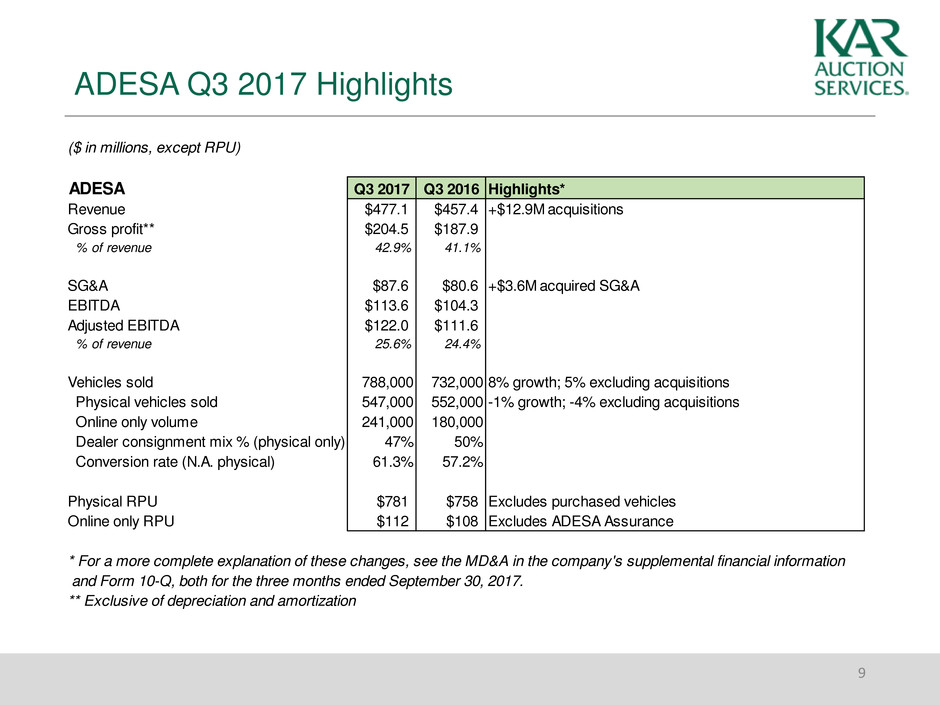

ADESA Q3 2017 Highlights

9

($ in millions, except RPU)

ADESA Q3 2017 Q3 2016 Highlights*

Revenue $477.1 $457.4 +$12.9M acquisitions

Gross profit** $204.5 $187.9

% of revenue 42.9% 41.1%

SG&A $87.6 $80.6 +$3.6M acquired SG&A

EBITDA $113.6 $104.3

Adjusted EBITDA $122.0 $111.6

% of revenue 25.6% 24.4%

Vehicles sold 788,000 732,000 8% growth; 5% excluding acquisitions

Physical vehicles sold 547,000 552,000 -1% growth; -4% excluding acquisitions

Online only volume 241,000 180,000

Dealer consignment mix % (physical only) 47% 50%

Conversion rate (N.A. physical) 61.3% 57.2%

Physical RPU $781 $758 Excludes purchased vehicles

Online only RPU $112 $108 Excludes ADESA Assurance

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-Q, both for the three months ended September 30, 2017.

** Exclusive of depreciation and amortization

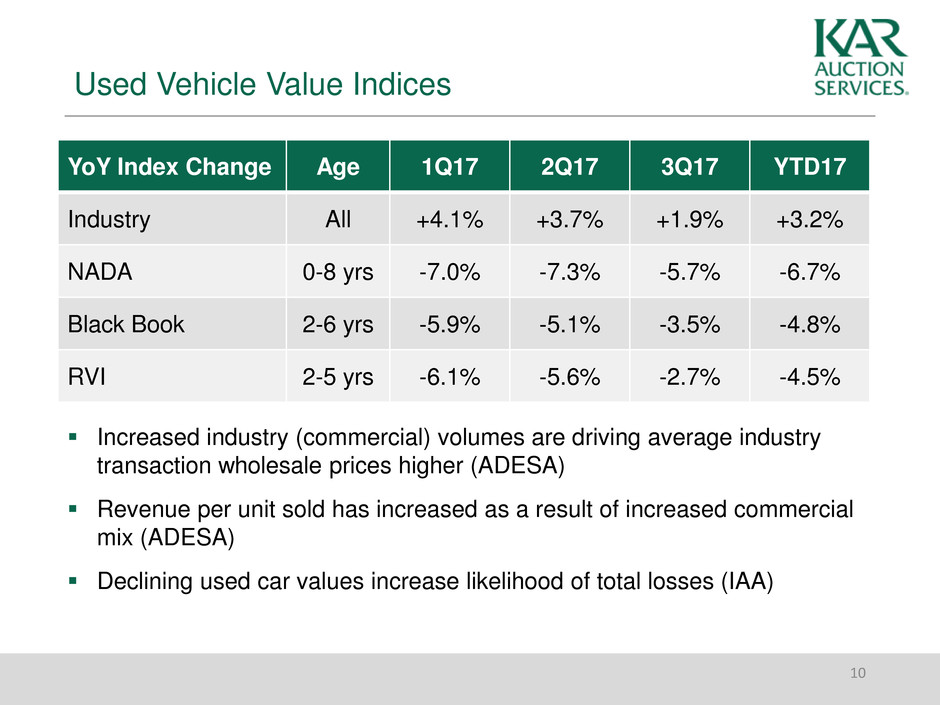

Used Vehicle Value Indices

10

YoY Index Change Age 1Q17 2Q17 3Q17 YTD17

Industry All +4.1% +3.7% +1.9% +3.2%

NADA 0-8 yrs -7.0% -7.3% -5.7% -6.7%

Black Book 2-6 yrs -5.9% -5.1% -3.5% -4.8%

RVI 2-5 yrs -6.1% -5.6% -2.7% -4.5%

Increased industry (commercial) volumes are driving average industry

transaction wholesale prices higher (ADESA)

Revenue per unit sold has increased as a result of increased commercial

mix (ADESA)

Declining used car values increase likelihood of total losses (IAA)

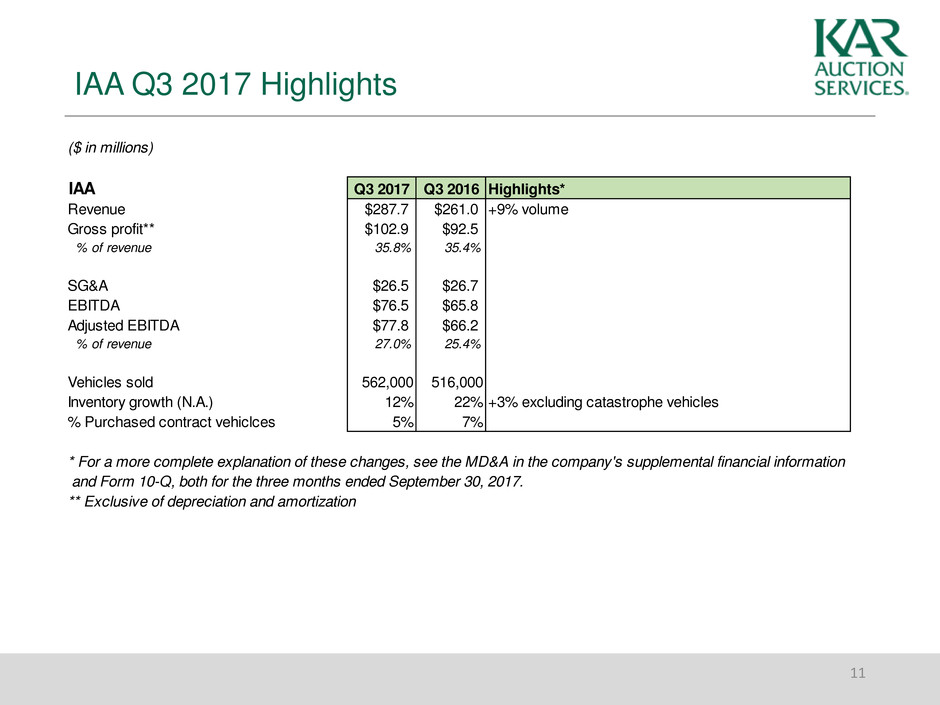

IAA Q3 2017 Highlights

11

($ in millions)

IAA Q3 2017 Q3 2016 Highlights*

Revenue $287.7 $261.0 +9% volume

Gross profit** $102.9 $92.5

% of revenue 35.8% 35.4%

SG&A $26.5 $26.7

EBITDA $76.5 $65.8

Adjusted EBITDA $77.8 $66.2

% of revenue 27.0% 25.4%

Vehicles sold 562,000 516,000

Inventory growth (N.A.) 12% 22% +3% excluding catastrophe vehicles

% Purchased contract vehiclces 5% 7%

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-Q, both for the three months ended September 30, 2017.

** Exclusive of depreciation and amortization

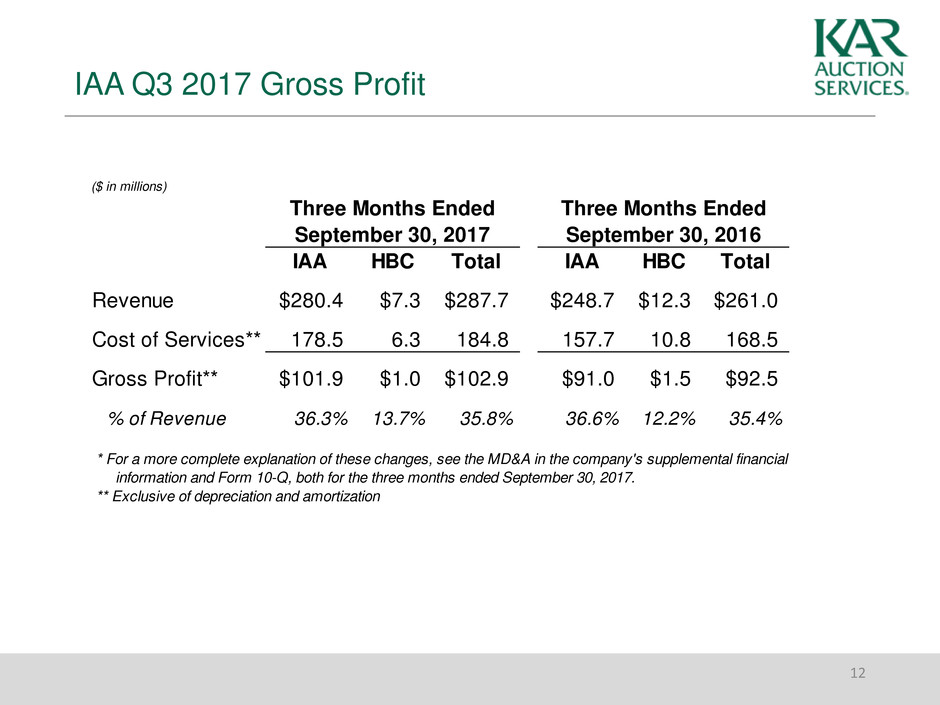

IAA Q3 2017 Gross Profit

12

($ in millions)

IAA HBC Total IAA HBC Total

Revenue $280.4 $7.3 $287.7 $248.7 $12.3 $261.0

Cost of Services** 178.5 6.3 184.8 157.7 10.8 168.5

Gross Profit** $101.9 $1.0 $102.9 $91.0 $1.5 $92.5

% of Revenue 36.3% 13.7% 35.8% 36.6% 12.2% 35.4%

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial

information and Form 10-Q, both for the three months ended September 30, 2017.

** Exclusive of depreciation and amortization

Three Months Ended

September 30, 2017

Three Months Ended

September 30, 2016

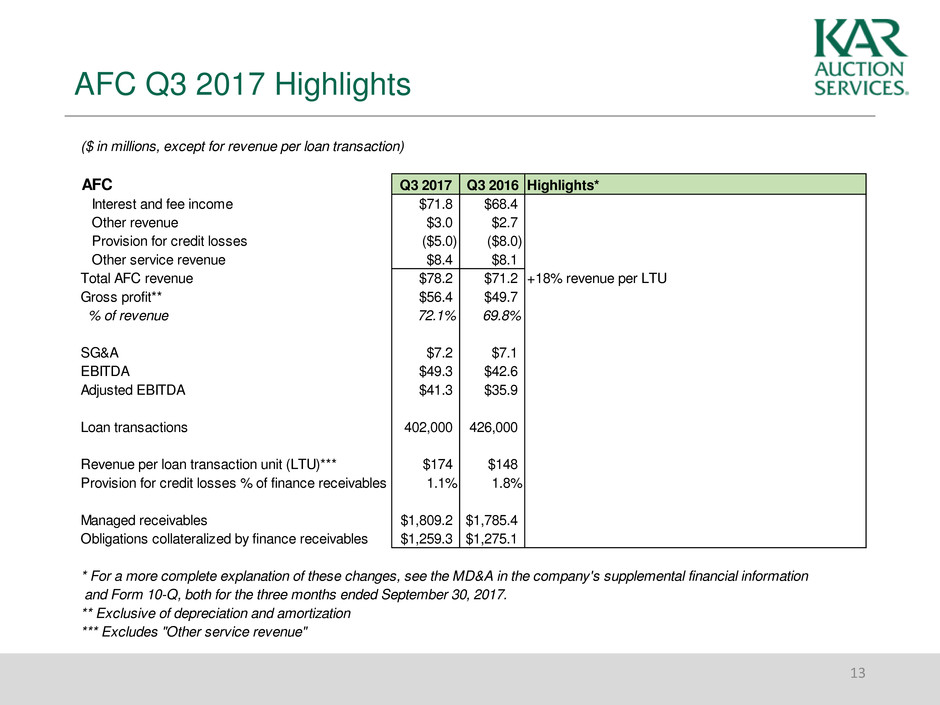

AFC Q3 2017 Highlights

13

($ in millions, except for revenue per loan transaction)

AFC Q3 2017 Q3 2016 Highlights*

Interest and fee income $71.8 $68.4

Other revenue $3.0 $2.7

Provision for credit losses ($5.0) ($8.0)

Other service revenue $8.4 $8.1

Total AFC revenue $78.2 $71.2 +18% revenue per LTU

Gross profit** $56.4 $49.7

% of revenue 72.1% 69.8%

SG&A $7.2 $7.1

EBITDA $49.3 $42.6

Adjusted EBITDA $41.3 $35.9

Loan transactions 402,000 426,000

Revenue per loan transaction unit (LTU)*** $174 $148

Provision for credit losses % of finance receivables 1.1% 1.8%

Managed receivables $1,809.2 $1,785.4

Obl gations collateralized by finance receivables $1,259.3 $1,275.1

*** Excludes "Other service revenue"

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-Q, both for the three months ended September 30, 2017.

** Exclusive of depreciation and amortization

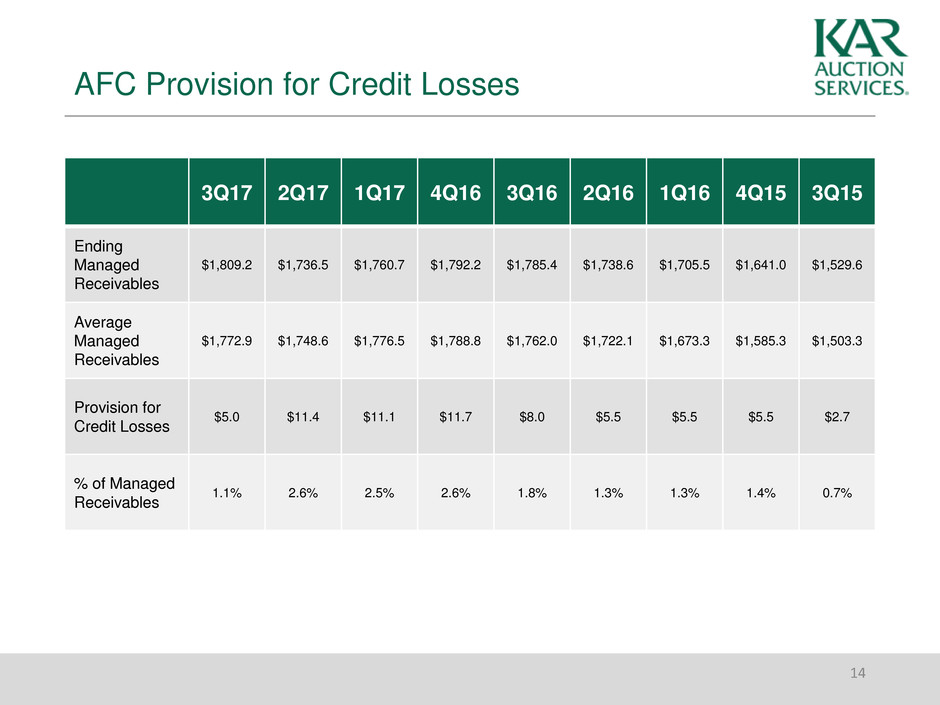

AFC Provision for Credit Losses

14

3Q17 2Q17 1Q17 4Q16 3Q16 2Q16 1Q16 4Q15 3Q15

Ending

Managed

Receivables

$1,809.2 $1,736.5 $1,760.7 $1,792.2 $1,785.4 $1,738.6 $1,705.5 $1,641.0 $1,529.6

Average

Managed

Receivables

$1,772.9 $1,748.6 $1,776.5 $1,788.8 $1,762.0 $1,722.1 $1,673.3 $1,585.3 $1,503.3

Provision for

Credit Losses

$5.0 $11.4 $11.1 $11.7 $8.0 $5.5 $5.5 $5.5 $2.7

% of Managed

Receivables

1.1% 2.6% 2.5% 2.6% 1.8% 1.3% 1.3% 1.4% 0.7%

Year-to-Date Slides

KAR Nine Months Ended September 30, 2017

Highlights

16

($ in millions, except per share amounts)

KAR YTD 2017 YTD 2016 Highlights*

Total operating revenues $2,567.6 $2,336.4

Gross profit** $1,105.5 $997.3

SG&A $467.7 $434.3 +$16.8M acquired SG&A

EBITDA $610.9 $559.5

Adjusted EBITDA $643.4 $571.4

Net Income $189.2 $176.9

Net income per share - diluted $1.37 $1.27

Operating adjusted net income per share - diluted $1.85 $1.61

Weighted average diluted shares 138.3 139.4

Dividends declared per common share $0.96 $0.87

Effective tax rate 35.8% 37.5%

Capital expenditures $110.1 $118.5

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-Q, both for the nine months ended September 30, 2017.

** Exclusive of depreciation and amortization

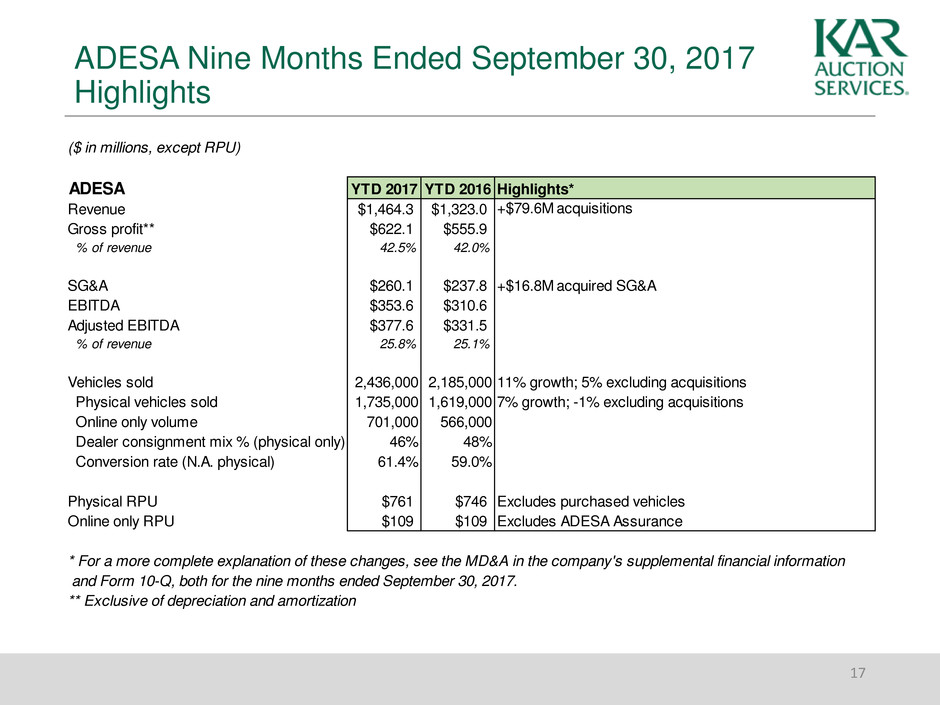

ADESA Nine Months Ended September 30, 2017

Highlights

17

($ in millions, except RPU)

ADESA YTD 2017 YTD 2016 Highlights*

Revenue $1,464.3 $1,323.0 +$79.6M acquisitions

Gross profit** $622.1 $555.9

% of revenue 42.5% 42.0%

SG&A $260.1 $237.8 +$16.8M acquired SG&A

EBITDA $353.6 $310.6

Adjusted EBITDA $377.6 $331.5

% of revenue 25.8% 25.1%

Vehicles sold 2,436,000 2,185,000 11% growth; 5% excluding acquisitions

Physical vehicles sold 1,735,000 1,619,000 7% growth; -1% excluding acquisitions

Online only volume 701,000 566,000

Dealer consignment mix % (physical only) 46% 48%

Conversion rate (N.A. physical) 61.4% 59.0%

Physical RPU $761 $746 Excludes purchased vehicles

Online only RPU $109 $109 Excludes ADESA Assurance

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-Q, both for the nine months ended September 30, 2017.

** Exclusive of depreciation and amortization

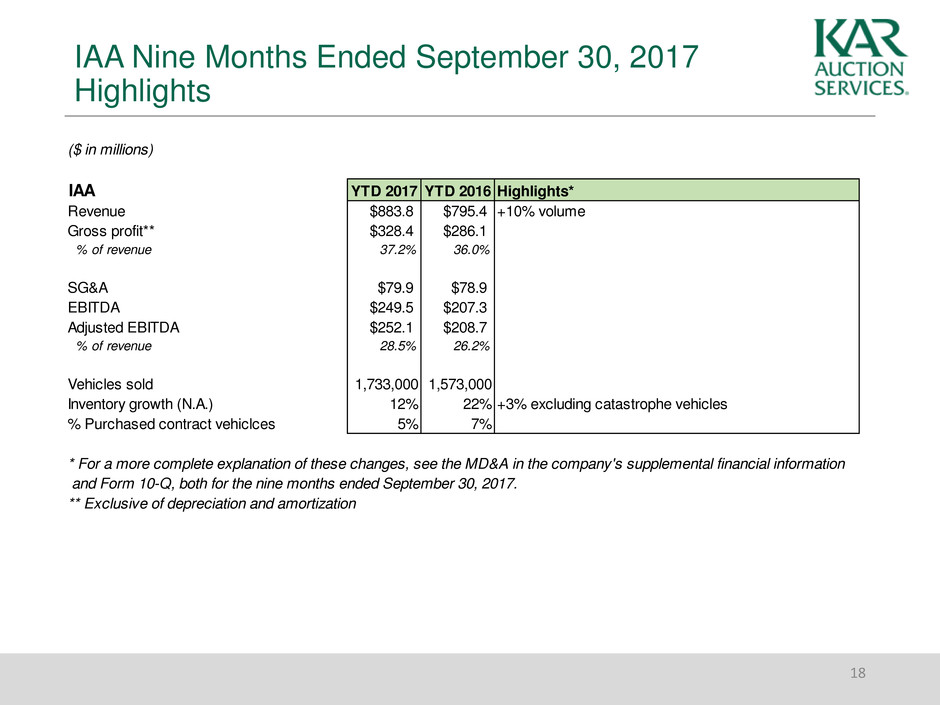

IAA Nine Months Ended September 30, 2017

Highlights

18

($ in millions)

IAA YTD 2017 YTD 2016 Highlights*

Revenue $883.8 $795.4 +10% volume

Gross profit** $328.4 $286.1

% of revenue 37.2% 36.0%

SG&A $79.9 $78.9

EBITDA $249.5 $207.3

Adjusted EBITDA $252.1 $208.7

% of revenue 28.5% 26.2%

Vehicles sold 1,733,000 1,573,000

Inventory growth (N.A.) 12% 22% +3% excluding catastrophe vehicles

% Purchased contract vehiclces 5% 7%

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-Q, both for the nine months ended September 30, 2017.

** Exclusive of depreciation and amortization

IAA Nine Months Ended September 30, 2017

Gross Profit

19

($ in millions)

IAA HBC Total IAA HBC Total

Revenue $853.5 $30.3 $883.8 $755.8 $39.6 $795.4

Cost of Services** 529.3 26.1 555.4 473.6 35.7 509.3

Gross Profit** $324.2 $4.2 $328.4 $282.2 $3.9 $286.1

% of Revenue 38.0% 13.9% 37.2% 37.3% 9.8% 36.0%

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial

information and Form 10-Q, both for the nine months ended September 30, 2017.

** Exclusive of depreciation and amortization

Nine Months Ended

September 30, 2017

Nine Months Ended

September 30, 2016

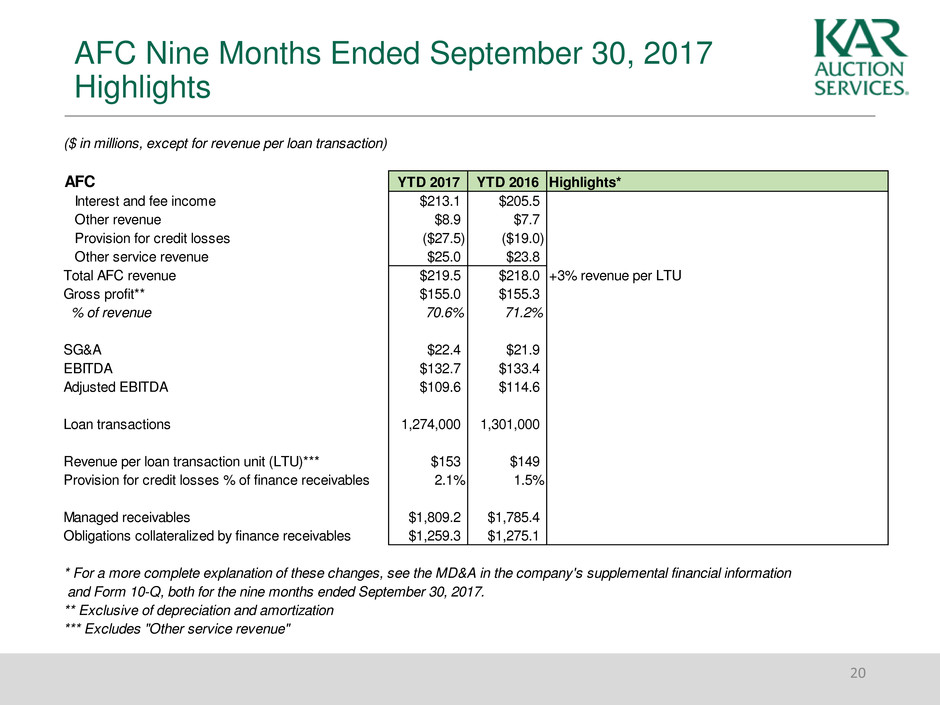

AFC Nine Months Ended September 30, 2017

Highlights

20

($ in millions, except for revenue per loan transaction)

AFC YTD 2017 YTD 2016 Highlights*

Interest and fee income $213.1 $205.5

Other revenue $8.9 $7.7

Provision for credit losses ($27.5) ($19.0)

Other service revenue $25.0 $23.8

Total AFC revenue $219.5 $218.0 +3% revenue per LTU

Gross profit** $155.0 $155.3

% of revenue 70.6% 71.2%

SG&A $22.4 $21.9

EBITDA $132.7 $133.4

Adjusted EBITDA $109.6 $114.6

Loan transactions 1,274,000 1,301,000

Revenue per loan transaction unit (LTU)*** $153 $149

Provision for credit losses % of finance receivables 2.1% 1.5%

Managed receivables $1,809.2 $1,785.4

Obligations collateralized by finance receivables $1,259.3 $1,275.1

*** Excludes "Other service revenue"

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-Q, both for the nine months ended September 30, 2017.

** Exclusive of depreciation and amortization

Appendix

Non-GAAP Financial Measures

22

EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit),

depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and

expected incremental revenue and cost savings as described in the company's senior secured credit agreement

covenant calculations. Free cash flow is defined as Adjusted EBITDA less cash interest expense on corporate debt

(Credit Facility), capital expenditures and cash taxes related to the calendar year. Management believes that the

inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide

additional information to investors about one of the principal measures of performance used by the company’s creditors.

In addition, management uses EBITDA, Adjusted EBITDA and free cash flow to evaluate the company’s performance.

Depreciation expense for property and equipment and amortization expense of capitalized internally developed

software costs relate to ongoing capital expenditures; however, amortization expense associated with acquired

intangible assets, such as customer relationships, software, tradenames and noncompete agreements are not

representative of ongoing capital expenditures, but have a continuing effect on our reported results. Non-GAAP

financial measures of operating adjusted net income and operating adjusted net income per share, in the opinion of the

company, provide comparability to other companies that may not have incurred these types of non-cash expenses or

that report a similar measure. In addition, net income and net income per share have been adjusted for certain other

charges, as seen in the following reconciliation.

EBITDA, Adjusted EBITDA, free cash flow, operating adjusted net income and operating adjusted net income per share

have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of the

results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other

companies.

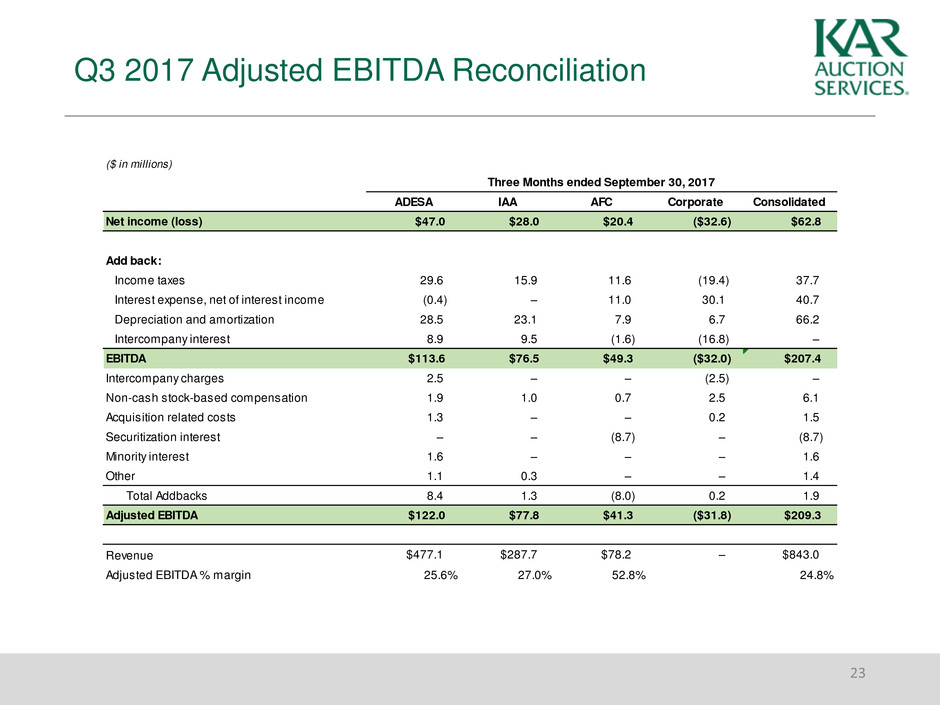

Q3 2017 Adjusted EBITDA Reconciliation

23

($ in millions)

Three Months ended September 30, 2017

ADESA IAA AFC Corporate Consolidated

Net income (loss) $47.0 $28.0 $20.4 ($32.6) $62.8

Add back:

Income taxes 29.6 15.9 11.6 (19.4) 37.7

Interest expense, net of interest income (0.4) – 11.0 30.1 40.7

Depreciation and amortization 28.5 23.1 7.9 6.7 66.2

Intercompany interest 8.9 9.5 (1.6) (16.8) –

EBITDA $113.6 $76.5 $49.3 ($32.0) $207.4

Intercompany charges 2.5 – – (2.5) –

Non-cash stock-based compensation 1.9 1.0 0.7 2.5 6.1

Acquisition related costs 1.3 – – 0.2 1.5

Securitization interest – – (8.7) – (8.7)

Minority interest 1.6 – – – 1.6

Other 1.1 0.3 – – 1.4

Total Addbacks 8.4 1.3 (8.0) 0.2 1.9

Adjusted EBITDA $122.0 $77.8 $41.3 ($31.8) $209.3

Revenue $477.1 $287.7 $78.2 – $843.0

Adjusted EBITDA % margin 25.6% 27.0% 52.8% 24.8%

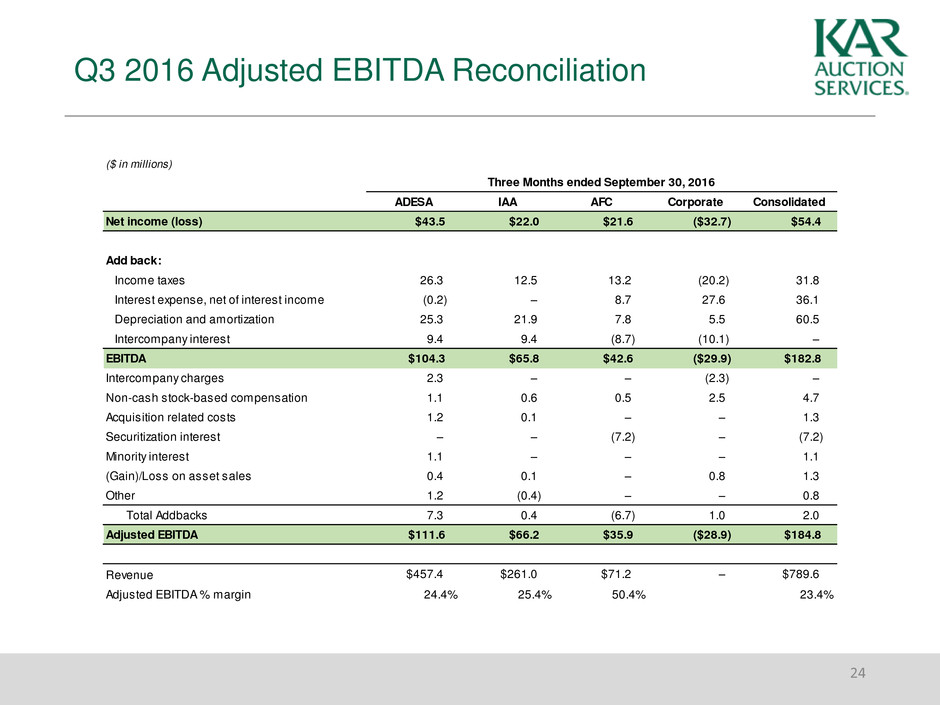

Q3 2016 Adjusted EBITDA Reconciliation

24

($ in millions)

Three Months ended September 30, 2016

ADESA IAA AFC Corporate Consolidated

Net income (loss) $43.5 $22.0 $21.6 ($32.7) $54.4

Add back:

Income taxes 26.3 12.5 13.2 (20.2) 31.8

Interest expense, net of interest income (0.2) – 8.7 27.6 36.1

Depreciation and amortization 25.3 21.9 7.8 5.5 60.5

Intercompany interest 9.4 9.4 (8.7) (10.1) –

EBITDA $104.3 $65.8 $42.6 ($29.9) $182.8

Intercompany charges 2.3 – – (2.3) –

Non-cash stock-based compensation 1.1 0.6 0.5 2.5 4.7

Acquisition related costs 1.2 0.1 – – 1.3

Securitization interest – – (7.2) – (7.2)

Minority interest 1.1 – – – 1.1

(Gain)/Loss on asset sales 0.4 0.1 – 0.8 1.3

Other 1.2 (0.4) – – 0.8

Total Addbacks 7.3 0.4 (6.7) 1.0 2.0

Adjusted EBITDA $111.6 $66.2 $35.9 ($28.9) $184.8

Revenue $457.4 $261.0 $71.2 – $789.6

Adjusted EBITDA % margin 24.4% 25.4% 50.4% 23.4%

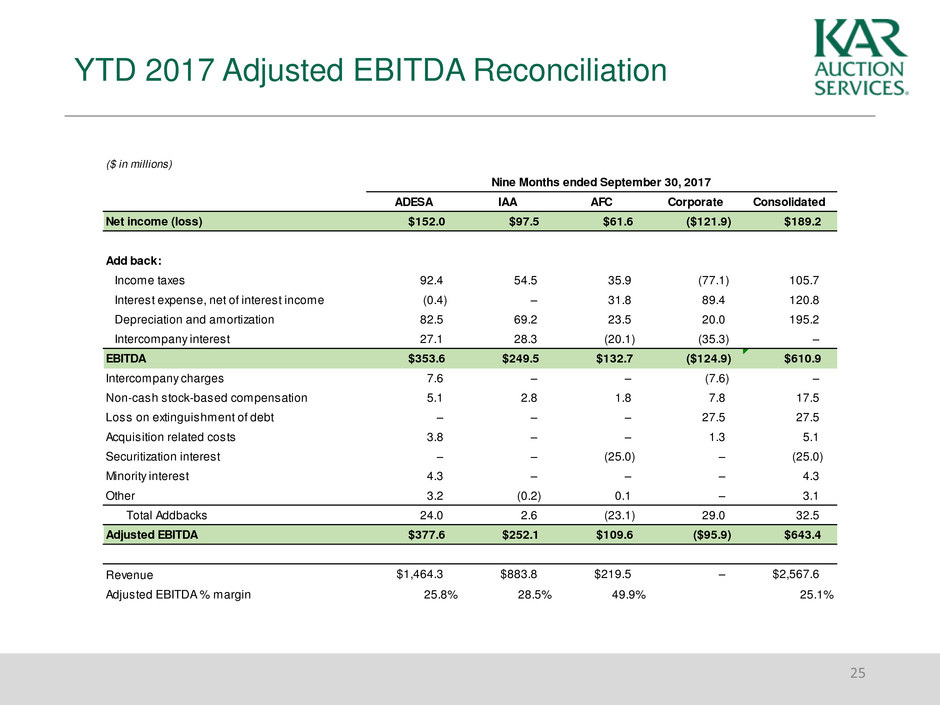

YTD 2017 Adjusted EBITDA Reconciliation

25

($ in millions)

Nine Months ended September 30, 2017

ADESA IAA AFC Corporate Consolidated

Net income (loss) $152.0 $97.5 $61.6 ($121.9) $189.2

Add back:

Income taxes 92.4 54.5 35.9 (77.1) 105.7

Interest expense, net of interest income (0.4) – 31.8 89.4 120.8

Depreciation and amortization 82.5 69.2 23.5 20.0 195.2

Intercompany interest 27.1 28.3 (20.1) (35.3) –

EBITDA $353.6 $249.5 $132.7 ($124.9) $610.9

Intercompany charges 7.6 – – (7.6) –

Non-cash stock-based compensation 5.1 2.8 1.8 7.8 17.5

Loss on extinguishment of debt – – – 27.5 27.5

Acquisition related costs 3.8 – – 1.3 5.1

Securitization interest – – (25.0) – (25.0)

Minority interest 4.3 – – – 4.3

Other 3.2 (0.2) 0.1 – 3.1

Total Addbacks 24.0 2.6 (23.1) 29.0 32.5

Adjusted EBITDA $377.6 $252.1 $109.6 ($95.9) $643.4

Revenue $1,464.3 $883.8 $219.5 – $2,567.6

Adjusted EBITDA % margin 25.8% 28.5% 49.9% 25.1%

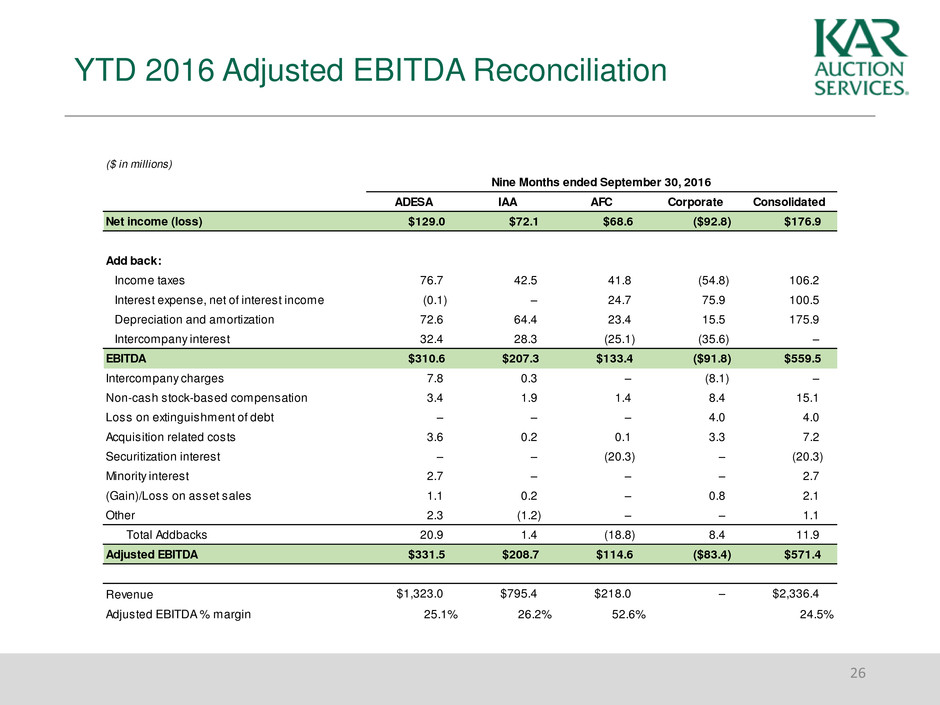

YTD 2016 Adjusted EBITDA Reconciliation

26

($ in millions)

Nine Months ended September 30, 2016

ADESA IAA AFC Corporate Consolidated

Net income (loss) $129.0 $72.1 $68.6 ($92.8) $176.9

Add back:

Income taxes 76.7 42.5 41.8 (54.8) 106.2

Interest expense, net of interest income (0.1) – 24.7 75.9 100.5

Depreciation and amortization 72.6 64.4 23.4 15.5 175.9

Intercompany interest 32.4 28.3 (25.1) (35.6) –

EBITDA $310.6 $207.3 $133.4 ($91.8) $559.5

Intercompany charges 7.8 0.3 – (8.1) –

Non-cash stock-based compensation 3.4 1.9 1.4 8.4 15.1

Loss on extinguishment of debt – – – 4.0 4.0

Acquisition related costs 3.6 0.2 0.1 3.3 7.2

Securitization interest – – (20.3) – (20.3)

Minority interest 2.7 – – – 2.7

(Gain)/Loss on asset sales 1.1 0.2 – 0.8 2.1

Other 2.3 (1.2) – – 1.1

Total Addbacks 20.9 1.4 (18.8) 8.4 11.9

Adjusted EBITDA $331.5 $208.7 $114.6 ($83.4) $571.4

Revenue $1,323.0 $795.4 $218.0 – $2,336.4

Adjusted EBITDA % margin 25.1% 26.2% 52.6% 24.5%

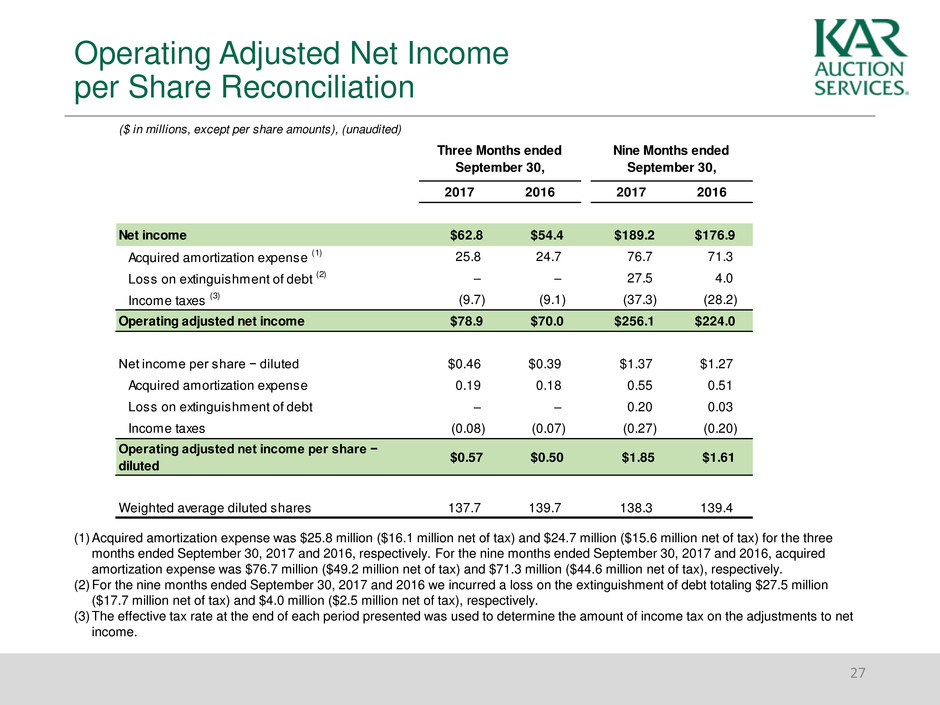

Operating Adjusted Net Income

per Share Reconciliation

27

($ in millions, except per share amounts), (unaudited)

2017 2016 2017 2016

Net income $62.8 $54.4 $189.2 $176.9

Acquired amortization expense

(1) 25.8 24.7 76.7 71.3

Loss on extinguishment of debt

(2) – – 27.5 4.0

Income taxes

(3) (9.7) (9.1) (37.3) (28.2)

Operating adjusted net income $78.9 $70.0 $256.1 $224.0

Net income per share − diluted $0.46 $0.39 $1.37 $1.27

Acquired amortization expense 0.19 0.18 0.55 0.51

Loss on extinguishment of debt – – 0.20 0.03

Income taxes (0.08) (0.07) (0.27) (0.20)

Operating adjusted net income per share −

diluted

$0.57 $0.50 $1.85 $1.61

Weighted average diluted shares 137.7 139.7 138.3 139.4

Three Months ended

September 30,

Nine Months ended

September 30,

(1)Acquired amortization expense was $25.8 million ($16.1 million net of tax) and $24.7 million ($15.6 million net of tax) for the three

months ended September 30, 2017 and 2016, respectively. For the nine months ended September 30, 2017 and 2016, acquired

amortization expense was $76.7 million ($49.2 million net of tax) and $71.3 million ($44.6 million net of tax), respectively.

(2)For the nine months ended September 30, 2017 and 2016 we incurred a loss on the extinguishment of debt totaling $27.5 million

($17.7 million net of tax) and $4.0 million ($2.5 million net of tax), respectively.

(3)The effective tax rate at the end of each period presented was used to determine the amount of income tax on the adjustments to net

income.