Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - C. H. ROBINSON WORLDWIDE, INC. | ex991earningsrelease.htm |

| 8-K - 8-K - C. H. ROBINSON WORLDWIDE, INC. | chrw93017earnings8-k.htm |

1

Earnings Conference Call – Third Quarter 2017

November 1, 2017

John Wiehoff, Chairman & CEO

Andrew Clarke, CFO

Tim Gagnon, Director, Investor Relations

2

Safe Harbor Statement

Except for the historical information contained herein, the matters set forth in

this presentation and the accompanying earnings release are forward-looking

statements that represent our expectations, beliefs, intentions or strategies

concerning future events. These forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to differ materially

from our historical experience or our present expectations, including, but not

limited to such factors as changes in economic conditions, including uncertain

consumer demand; changes in market demand and pressures on the pricing for

our services; competition and growth rates within the third party logistics

industry; freight levels and increasing costs and availability of truck capacity or

alternative means of transporting freight, and changes in relationships with

existing truck, rail, ocean and air carriers; changes in our customer base due to

possible consolidation among our customers; our ability to integrate the

operations of acquired companies with our historic operations successfully; risks

associated with litigation and insurance coverage; risks associated with

operations outside of the U.S.; risks associated with the potential impacts of

changes in government regulations; risks associated with the produce industry,

including food safety and contamination issues; fuel prices and availability;

changes to our share repurchase activity; risk of unexpected or unanticipated

events or opportunities that might require additional capital expenditures; the

impact of war on the economy; and other risks and uncertainties detailed in our

Annual and Quarterly Reports.

2

3

Results Q3 2017

Three Months Ended September 30

in thousands, except per share amounts and headcount

▪ Total revenues increased as a result of volume increases across nearly all transportation services in the third

quarter of 2017 when compared to the third quarter of 2016.

▪ Net revenues increase of 6.3 percent was primarily the result of net revenues growth in Global Forwarding

partially offset by lower truckload net revenues. APC added approximately 2 percent to total company net

revenues in the third quarter of 2017.

▪ Average headcount increased 8.7 percent when compared to the third quarter of 2016. The acquisitions of APC

and Milgram increased headcount 5 percent.

3

Nine Months Ended September 30

2017 2016 % Change 2017 2016 % Change

Total Revenues $3,784,451 $3,355,754 12.8% $10,909,594 $9,729,438 12.1%

Total Net Revenues $593,846 $558,462 6.3% $1,736,201 $1,716,012 1.2%

Net Revenue Margin % 15.7% 16.6% 15.9% 17.6%

Income from Operations $194,465 $211,267 (8.0%) $564,243 $643,966 (12.4%)

Operating Margin % 32.7% 37.8% 32.5% 37.5%

Net Income $119,186 $129,028 (7.6%) $352,337 $391,081 (9.9%)

Earnings Per Share (Diluted) $0.85 $0.90 (5.6%) $2.49 $2.73 (8.8%)

Weighted Average Shares

Outstanding (Diluted) 141,022 142,883 (1.3%) 141,403 143,245 (1.3%)

Depreciation and Amortization $23,963 $17,657 35.7% $69,340 $52,716 31.5%

Total Assets $4,175,588 $3,664,062 14.0% $4,175,588 $3,664,062 14.0%

Average Headcount(1) 14,903 13,706 8.7% 14,590 13,478 8.3%

Ending Headcount(1) 14,998 13,710 9.4% 14,998 13,710 9.4%

(1) Q3 2016 headcount metrics do not include employees of APC Logistics acquired on September 30, 2016.

‹#›

Summarized Income Statement

▪ Personnel expenses increased as a result of headcount additions and an increase

in variable compensation in the third quarter of 2017 when compared to the third

quarter of 2016.

▪ SG&A expenses increased as a result of costs related to the addition of APC and

Milgram, higher allowance for doubtful accounts, claims, and warehouse expenses

in the third quarter of 2017 when compared to the third quarter of 2016.

▪ The effective tax rate was 35.2 percent in the third quarter.

in thousands

4

Three Months Ended September 30 Nine Months Ended September 30

2017 2016 % Change 2017 2016 % Change

Total Revenues $3,784,451 $3,355,754 12.8% $10,909,594 $9,729,438 12.1%

Total Net Revenues $593,846 $558,462 6.3% $1,736,201 $1,716,012 1.2%

Personnel Expenses $293,204 $256,883 14.1% $867,928 $804,631 7.9%

Selling, General, and Admin $106,177 $90,312 17.6% $304,030 $267,415 13.7%

Total Operating Expenses $399,381 $347,195 15.0% $1,171,958 $1,072,046 9.3%

Income from Operations $194,465 $211,267 (8.0%) $564,243 $643,966 (12.4%)

% of Net Revenue 32.7% 37.8% 32.5% 37.5%

Net Income $119,186 $129,028 (7.6%) $352,337 $391,081 (9.9%)

‹#›

Other Financial Information

▪ Total debt balance $1.47 billion

▪ $500 million long-term debt,

4.28% average coupon

▪ $719 million drawn on revolver,

2.36% current rate as of

September 30, 2017

▪ $250 million accounts receivable

securitization debt facility, 1.97%

as of September 30, 2017

in thousands

5

Three Months Ended September 30 Nine Months Ended September 30

Cash Flow Data 2017 2016 % Change 2017 2016 % Change

Net Cash Provided by

Operating Activities $68,338 $129,567 (47.3%) $218,349 $376,828 (42.1%)

Capital Expenditures $13,448 $27,135 (50.4%) $46,418 $71,111 (34.7%)

Balance Sheet Data September 30, 2017

Cash & Cash Equivalents $297,307

Current Assets $2,454,846

Total Assets $4,175,588

Debt $1,469,000

Stockholders' Investment $1,354,875

‹#›

Capital Distribution

▪ Capital returned to shareholders during the quarter

▪ $64.0 million cash dividends

▪ $60.6 million in cash for share repurchase activity

▪ 893,249 shares repurchased in the third quarter

▪ Average price of $70.66 for the shares repurchased in the third quarter

▪ Target is to return approximately 90% of net income to shareholders annually.

(a) 2012 Net Income is adjusted to excluded transaction related gains and expenses. A reconciliation of adjusted

results appears in Appendix A. 2012 Dividends exclude the fifth dividend payment made during the year.

(b) Includes a $500 million accelerated share repurchase.

in thousands

6

2012 (a) 2013 2014 2015 2016 Q3 2017 YTD 2017

Net Income $447,007 $415,904 $449,711 $509,699 $513,384 $119,186 $352,337

Capital Distribution

Cash Dividends Paid $219,313 $220,257 $215,008 $235,615 $245,430 $63,959 $192,765

Share Repurchases $255,849 $807,449 $176,645 $241,231 $209,603 $60,617 $129,991

Subtotal $475,162 $1,027,706 $391,653 $476,846 $455,033 $124,576 $322,756

Percent of Net Income

Cash Dividends Paid 49.1% 53.0% 47.8% 46.2% 47.8% 53.7% 54.7%

Share Repurchases 57.2% 194.1% 39.3% 47.3% 40.8% 50.9% 36.9%

Subtotal 106.3% 247.1% 87.1% 93.6% 88.6% 104.5% 91.6%

(b)

‹#›

Three Months Ended September 30 Nine Months Ended September 30

Net Revenue by Service Line Q3 2017

▪ Net revenues by service line for the enterprise (all segments).

in thousands

7

Net Revenue by

Service Line

2017 2016 % Change 2017 2016 % Change

Truckload $301,025 $309,027 (2.6%) $887,865 $960,451 (7.6%)

LTL $101,870 $96,447 5.6% $301,706 $287,518 4.9%

Intermodal $7,478 $7,676 (2.6%) $23,278 $25,961 (10.3%)

Ocean $81,182 $56,506 43.7% $217,495 $175,243 24.1%

Air $25,529 $19,897 28.3% $73,166 $58,424 25.2%

Customs $17,421 $12,320 41.4% $49,810 $34,649 43.8%

Other Logistics Services $29,580 $26,771 10.5% $87,563 $76,965 13.8%

Sourcing $29,761 $29,818 (0.2%) $95,318 $96,801 (1.5%)

Total $593,846 $558,462 6.3% $1,736,201 $1,716,012 1.2%

‹#›

T

R

A

NS

P

ORT

A

TION

NE

T

REVEN

U

E

M

A

R

G

I

N

▪ North America Truckload cost and price change chart

represents truckload shipments from all North America

segments. Transportation net revenue margin represents

total Transportation results from all segments.

▪ Purchase transportation costs increased throughout the

third quarter, negatively impacting the margins on

contractual truckload shipments.

(1) Cost and price change exclude the estimated impact of fuel.

North America Truckload Cost and Price Change(1)

8

Transportation Net Revenue Margin

YoY Price Change

YoY Cost Change

North America

Truckload Q3 YTD

Volume 1% 7%

Price 6.5% 1%

Cost 8.5% 3.5%

Net Revenue

Margin

‹#›

Transportation Results Q3 2017(1)

in thousands

(1) Includes results across all segments.

9

▪ Transportation net revenue margin decline in the third quarter of 2017 when

compared to the third quarter of 2016 was primarily the result of lower net

revenue margins in NAST.

Three Months Ended September 30 Nine Months Ended September 30

Transportation 2017 2016 % Change 2017 2016 % Change

Total Revenues $3,433,701 $2,998,583 14.5% $9,855,739 $8,593,767 14.7%

Total Net Revenues $564,085 $528,644 6.7% $1,640,883 $1,619,211 1.3%

Net Revenue Margin % 16.4% 17.6% 16.6% 18.8%

Transportation Net

Revenue Margin %

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Q1 18.2% 22.6% 17.4% 17.2% 16.9% 16.3% 15.3% 16.8% 19.7% 17.3%

Q2 15.4% 20.6% 15.8% 16.2% 14.9% 15.4% 16.0% 17.5% 19.3% 16.2%

Q3 15.9% 19.8% 16.6% 16.4% 15.6% 15.0% 16.2% 18.4% 17.6% 16.4%

Q4 19.0% 18.3% 17.6% 16.3% 15.8% 15.1% 15.9% 19.0% 17.2%

Total 17.0% 20.2% 16.8% 16.5% 15.8% 15.4% 15.9% 17.9% 18.4%

‹#›

North American Surface Transportation (“NAST”) Results Q3 2017

▪ Net revenues decreased primarily as a result of lower truckload margins when

compared to the third quarter of 2016. September 2017 NAST net revenues

increased when compared to September 2016 NAST net revenues.

▪ NAST operating expenses increased 9.5 percent in the third quarter of 2017

when compared to the third quarter of 2016. This increase was due to increases

in both personnel and SG&A expenses.

▪ NAST headcount increased 1.9 percent when compared to the third quarter of

2016 and was down 5 employees sequentially from the second quarter of 2017.

in thousands, except headcount

10

(1) Does not include intersegment revenues.

Three Months Ended September 30 Nine Months Ended September 30

2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $2,469,420 $2,252,187 9.6% $7,110,223 $6,456,281 10.1%

Total Net Revenues $377,403 $378,073 (0.2%) $1,109,749 $1,161,074 (4.4%)

Net Revenue Margin % 15.3% 16.8% 15.6% 18.0%

Income from Operations $151,392 $171,733 (11.8%) $447,553 $516,805 (13.4%)

Operating Margin % 40.1% 45.4% 40.3% 44.5%

Depreciation and Amortization $5,808 $5,547 4.7% $17,104 $16,551 3.3%

Total Assets $2,297,980 $2,115,467 8.6% $2,297,980 $2,115,467 8.6%

Average Headcount 6,998 6,869 1.9% 6,921 6,767 2.3%

‹#›

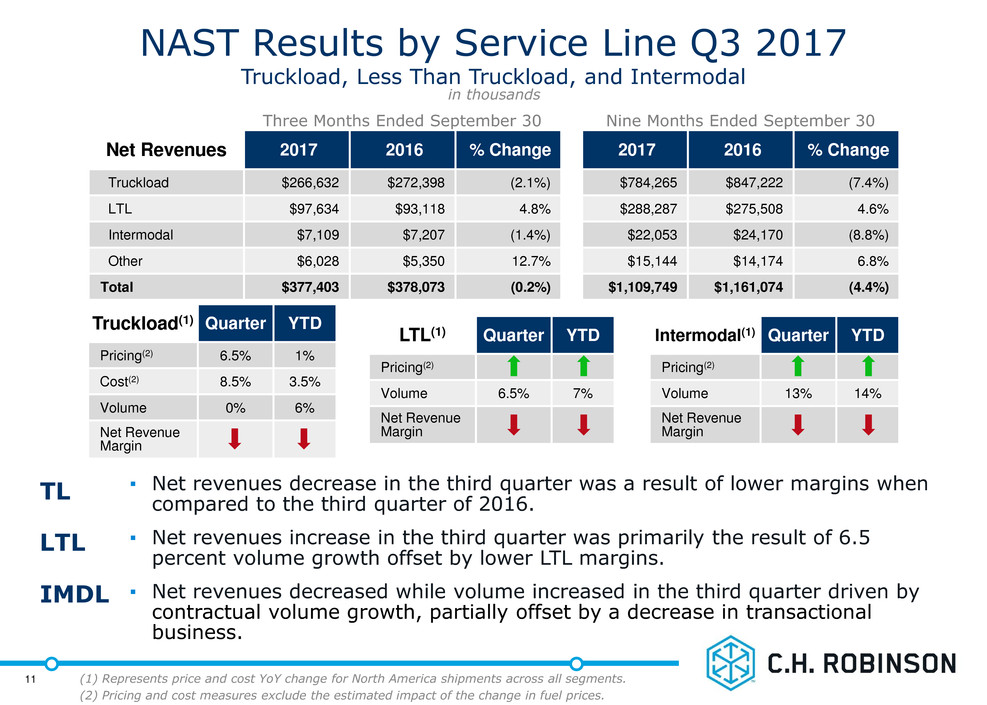

NAST Results by Service Line Q3 2017

Truckload, Less Than Truckload, and Intermodal

▪ Net revenues decrease in the third quarter was a result of lower margins when

compared to the third quarter of 2016.

▪ Net revenues increase in the third quarter was primarily the result of 6.5

percent volume growth offset by lower LTL margins.

▪ Net revenues decreased while volume increased in the third quarter driven by

contractual volume growth, partially offset by a decrease in transactional

business.

in thousands

TL

LTL

IMDL

11 (1) Represents price and cost YoY change for North America shipments across all segments.

(2) Pricing and cost measures exclude the estimated impact of the change in fuel prices.

Three Months Ended September 30 Nine Months Ended September 30

Net Revenues 2017 2016 % Change 2017 2016 % Change

Truckload $266,632 $272,398 (2.1%) $784,265 $847,222 (7.4%)

LTL $97,634 $93,118 4.8% $288,287 $275,508 4.6%

Intermodal $7,109 $7,207 (1.4%) $22,053 $24,170 (8.8%)

Other $6,028 $5,350 12.7% $15,144 $14,174 6.8%

Total $377,403 $378,073 (0.2%) $1,109,749 $1,161,074 (4.4%)

Truckload(1) Quarter YTD

Pricing(2) 6.5% 1%

Cost(2) 8.5% 3.5%

Volume 0% 6%

Net Revenue

Margin

LTL(1) Quarter YTD

Pricing(2)

Volume 6.5% 7%

Net Revenue

Margin

Intermodal(1) Quarter YTD

Pricing(2)

Volume 13% 14%

Net Revenue

Margin

‹#›

Global Forwarding Results Q3 2017

▪ The acquisitions of APC Logistics and Milgram added approximately 18 percent

to net revenues and 18 percent to average headcount when compared to the

third quarter of 2016.

▪ Global Forwarding operating expenses increased 29.3 percent when compared

to the third quarter of 2016.

in thousands, except headcount

12

(1) Does not include intersegment revenues.

(2) Q3 2016 average headcount does not include employees of APC Logistics acquired on September 30, 2016.

Three Months Ended September 30 Nine Months Ended September 30

2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $552,134 $390,830 41.3% $1,549,742 $1,098,715 41.1%

Total Net Revenues $129,842 $93,368 39.1% $357,411 $283,458 26.1%

Net Revenue Margin % 23.5% 23.9% 23.1% 25.8%

Income from Operations $31,125 $17,047 82.6% $75,006 $56,300 33.2%

Operating Margin % 24.0% 18.3% 21.0% 19.9%

Depreciation and Amortization $8,455 $5,073 66.7% $24,574 $15,231 61.3%

Total Assets $840,762 $625,267 34.5% $840,762 $625,267 34.5%

Average Headcount(2) 4,301 3,559 20.8% 4,113 3,523 16.7%

‹#›

Three Months Ended September 30 Nine Months Ended September 30

Global Forwarding Results by Service Line Q3 2017

Ocean, Air, and Customs

▪ APC and Milgram acquisitions added approximately 17 percent to ocean net revenues,

15 percent to air net revenues and 30 percent to customs net revenues.

▪ Achieved organic volume growth in each of the global forwarding services in the third

quarter of 2017 when compared to the third quarter of 2016.

in thousands

13

Net Revenues 2017 2016 % Change 2017 2016 % Change

Ocean $81,110 $56,309 44.0% $217,768 $174,907 24.5%

Air $23,992 $18,075 32.7% $68,850 $54,142 27.2%

Customs $17,419 $12,318 41.4% $49,804 $34,638 43.8%

Other $7,321 $6,666 9.8% $20,989 $19,771 6.2%

Total $129,842 $93,368 39.1% $357,411 $283,458 26.1%

Ocean Quarter YTD

Pricing

Volume

Net Revenue

Margin

Air Quarter YTD

Pricing

Volume

Net Revenue

Margin

‹#›

▪ Robinson Fresh results include revenues from sourcing and transportation

services.

▪ Net revenues decrease was primarily the result of lower truckload margin

when compared to the third quarter of 2016.

▪ Robinson Fresh operating expenses increased 8.6 percent when compared to

the third quarter of 2016. The increase was the result of an increase in both

personnel and SG&A expenses.

in thousands, except headcount

Robinson Fresh Results Q3 2017

14

(1) Does not include intersegment revenues.

Three Months Ended September 30 Nine Months Ended September 30

2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $613,646 $590,385 3.9% $1,821,094 $1,814,682 0.4%

Total Net Revenues $54,253 $57,036 (4.9%) $171,936 $183,041 (6.1%)

Net Revenue Margin % 8.8% 9.7% 9.4% 10.1%

Income from Operations $11,586 $17,733 (34.7%) $40,487 $62,777 (35.5%)

Operating Margin % 21.4% 31.1% 23.5% 34.3%

Depreciation and Amortization $1,190 $983 21.1% $3,534 $2,590 36.4%

Total Assets $413,520 $405,832 1.9% $413,520 $405,832 1.9%

Average Headcount 970 956 1.5% 966 939 2.9%

‹#›

Robinson Fresh Results Q3 2017

Sourcing

▪ Sourcing total revenues decrease was primarily the result of slightly lower

sourcing commodity pricing when compared to the third quarter of 2016.

▪ Sourcing net revenues were virtually flat when compared to last year's third

quarter. A slight increase in net revenue margin was offset by a case volume

decrease of 1 percent compared to the third quarter of 2016.

in thousands

15

(1) Does not include intersegment revenues.

Three Months Ended September 30 Nine Months Ended September 30

Sourcing 2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $350,750 $357,171 (1.8%) $1,053,855 $1,135,671 (7.2%)

Net Revenues $29,761 $29,818 (0.2%) $95,318 $96,801 (1.5%)

Net Revenue Margin % 8.5% 8.3% 9.0% 8.5%

‹#›

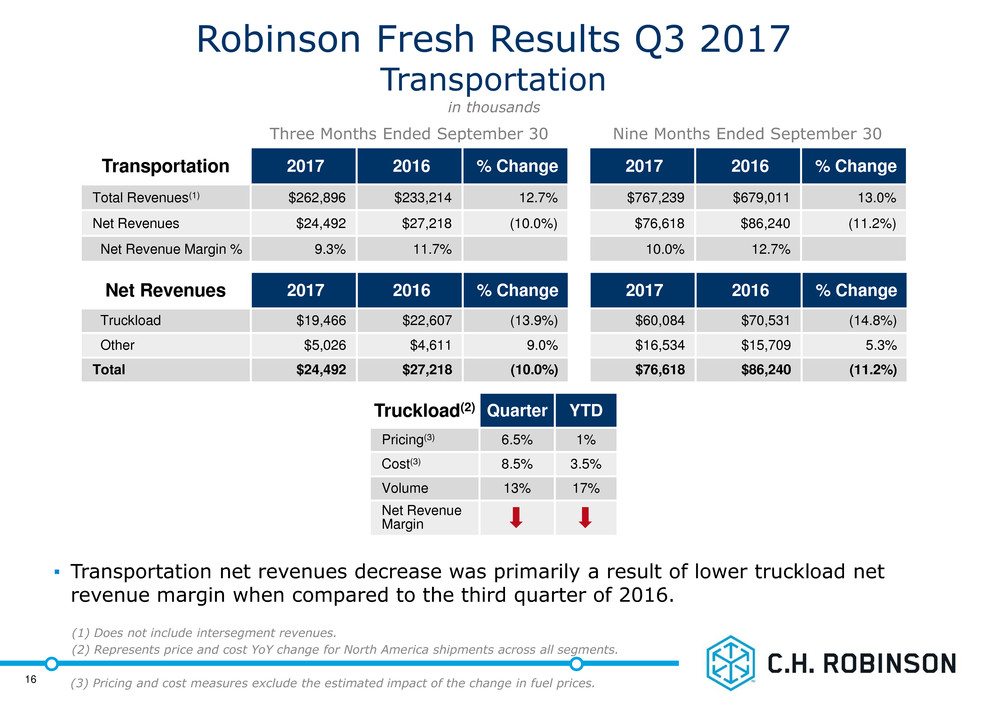

Robinson Fresh Results Q3 2017

Transportation

▪ Transportation net revenues decrease was primarily a result of lower truckload net

revenue margin when compared to the third quarter of 2016.

in thousands

16

(1) Does not include intersegment revenues.

(2) Represents price and cost YoY change for North America shipments across all segments.

(3) Pricing and cost measures exclude the estimated impact of the change in fuel prices.

Three Months Ended September 30 Nine Months Ended September 30

Transportation 2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $262,896 $233,214 12.7% $767,239 $679,011 13.0%

Net Revenues $24,492 $27,218 (10.0%) $76,618 $86,240 (11.2%)

Net Revenue Margin % 9.3% 11.7% 10.0% 12.7%

Net Revenues 2017 2016 % Change 2017 2016 % Change

Truckload $19,466 $22,607 (13.9%) $60,084 $70,531 (14.8%)

Other $5,026 $4,611 9.0% $16,534 $15,709 5.3%

Total $24,492 $27,218 (10.0%) $76,618 $86,240 (11.2%)

Truckload(2) Quarter YTD

Pricing(3) 6.5% 1%

Cost(3) 8.5% 3.5%

Volume 13% 17%

Net Revenue

Margin

‹#›

▪ Results represent business from Managed Services, Other Surface

Transportation outside of North America, and other miscellaneous

operations.

▪ Headcount includes personnel from shared services, Managed Services,

Other Surface Transportation, and other miscellaneous operations.

All Other and Corporate Results Q3 2017

in thousands, except headcount

17

(1) Does not include intersegment revenues.

Three Months Ended September 30 Nine Months Ended September 30

2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $149,251 $122,352 22.0% $428,535 $359,760 19.1%

Total Net Revenues $32,348 $29,985 7.9% $97,105 $88,439 9.8%

Income from Operations $362 $4,754 NM $1,197 $8,084 NM

Depreciation and Amortization $8,510 $6,054 40.6% $24,128 $18,344 31.5%

Total Assets $623,326 $517,496 20.5% $623,326 $517,496 20.5%

Average Headcount 2,634 2,322 13.4% 2,590 2,249 15.2%

‹#›

All Other and Corporate Results by Service Line Q3 2017

Managed Services and Other Surface Transportation

▪ Managed Services net revenues growth was driven by new business

with new and existing customers.

▪ Other Surface Transportation includes surface transportation

outside of North America.

▪ Other Surface Transportation net revenues increase was primarily

the result of volume growth partially offset by margin compression

in the Surface Transportation business in Europe.

in thousands

18

Three Months Ended September 30 Nine Months Ended September 30

Net Revenues 2017 2016 % Change 2017 2016 % Change

Managed Services $18,487 $16,680 10.8% $53,844 $47,034 14.5%

Other Surface

Transportation

$13,861 $13,305 4.2% $43,261 $41,405 4.5%

Total $32,348 $29,985 7.9% $97,105 $88,439 9.8%

‹#›

Final Comments

▪ October to date total company net revenue per day has

increased approximately 8 percent when compared to

October 2016.

▪ Truckload volume growth is virtually flat on a year-over-year

basis in October

▪ Q4 priorities

▪ Milgram integration continues

▪ Price volatility will likely continue into 2018

▪ Account management disciplines will be critical to our success

▪ Focus on efficiency and operating expense control

▪ Continued focus on growth

19

‹#›

Appendix A: 2012 Summarized Adjusted Income Statement

To assist investors in understanding our financial performance, we supplement the financial results that are generated in accordance with the accounting principles

generally accepted in the United States, or GAAP, with non-GAAP financial measures, including non-GAAP operating expenses, non-GAAP income from operations,

non-GAAP net income and non-GAAP diluted net income per share. We believe that these non-GAAP measures provide meaningful insight into our operating

performance excluding certain event-specific charges, and provide an alternative perspective of our results of operations. We use non-GAAP measures to assess our

operating performance for the quarter. Management believes that these non-GAAP financial measures reflect an additional way of analyzing aspects of our ongoing

operations that, when viewed with our GAAP results, provides a more complete understanding of the factors and trends affecting our business.

1) The adjustment to personnel consists of $33 million of incremental vesting expense of our equity awards triggered by the gain on the divestiture

of T-Chek. The balance consists of transaction related bonuses.

2) The adjustments to other operating expenses reflect fees paid to third parties for:

a) Investment banking fees related to the acquisition of Phoenix

b) External legal and accounting fees related to the acquisitions of Apreo and Phoenix and the divestiture of T-Chek.

3) The adjustment to investment and other income reflects the gain from the divestiture of T-Chek.

4) The adjustment to diluted weighted average shares outstanding relates to the shares of C.H. Robinson stock issued as consideration paid to the

sellers in the acquisition of Phoenix.

5) The adjustment to diluted weighted average shares outstanding relates to the additional vesting of performance-based restricted stock as a result

of the gain on sale recognized from the divestiture of T-Chek.

in thousands, except per share amounts

20

2012 Actual Non-Recurring Acquisition Impacts

Non-Recurring

Divestiture Impacts Adjusted

Total Net Revenues $1,717,571 $1,717,571

Personnel Expenses(1) 766,006 (385) (34,207) 731,414

Other Operating Expenses(2) 276,245 (10,225) (379) 265,641

Total Operating Expenses 1,042,251 (10,610) (34,586) 997,055

Income from Operations 675,320 10,610 34,586 720,516

Investment & Other Income(3) 283,142 (281,551) 1,591

Income before Taxes 958,462 10,610 (246,965) 722,107

Provision for Income Taxes 364,658 2,745 (92,303) 275,100

Net Income $593,804 $7,865 ($154,662) $447,007

Net Income Per Share (Diluted) $3.67 $2.76

Weighted Average Shares (Diluted) 161,946 185 (4) 92 (5) 161,669

21