UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2017

BLACK CREEK DIVERSIFIED PROPERTY FUND INC.

(Exact Name of Registrant as Specified in its Charter)

Maryland | 000-52596 | 30-0309068 | ||

(State or other jurisdiction of incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) | ||

518 Seventeenth Street, 17th Floor, Denver CO | 80202 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code (303) 228-2200

Not applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Repayment of Mortgage Note

On October 25, 2017, Black Creek Diversified Property Fund Inc. (referred to herein as "the Company," "we," "our" or "us") repaid a $75.0 million mortgage note secured by Centerton Square (defined below), subject to an interest rate spread of 2.25% over one-month LIBOR and a maturity date of July 10, 2019, with proceeds from the disposition of Centerton Square.

Dispositions of Real Property

On October 17, 2017, we disposed of an office property in Silicon Valley, CA comprising 143,000 net rentable square feet ("Jay Street") to an unrelated third party. We sold Jay Street, which had a net basis of approximately $30.9 million as of September 30, 2017, for a total sales price of $44.9 million. Jay Street was 100% leased as of September 30, 2017.

On October 25, 2017, we disposed of a retail property in Philadelphia, PA comprising 426,000 net rentable square feet ( "Centerton Square") to an unrelated third party. We sold Centerton Square, which had a net basis of approximately $75.8 million as of September 30, 2017, for a total sales price of $129.6 million. Centerton Square was 100% leased as of September 30, 2017.

After giving effect to the disposition transactions above and other real property acquisition and disposition activity during the three months ended September 30, 2017, the following summarizes our investments in real properties as of October 26, 2017:

Geographic Markets | Number of Properties | Net Rentable Square Feet | Aggregate Fair Value (1) | |||||||||

Office properties | 12 | 15 | 3,286 | $ | 1,144,650 | |||||||

Industrial properties | 4 | 4 | 1,389 | 86,550 | ||||||||

Retail properties | 8 | 32 | 3,325 | 877,850 | ||||||||

Real properties | 19 (2) | 51 | 8,000 | $ | 2,109,050 | |||||||

(1) | Aggregate fair value based on our estimated fair value of these investments as of September 30, 2017. |

(2) | The total number of our geographic markets does not equal the sum of the number of geographic markets by segment, as we have more than one segment in certain geographic markets. |

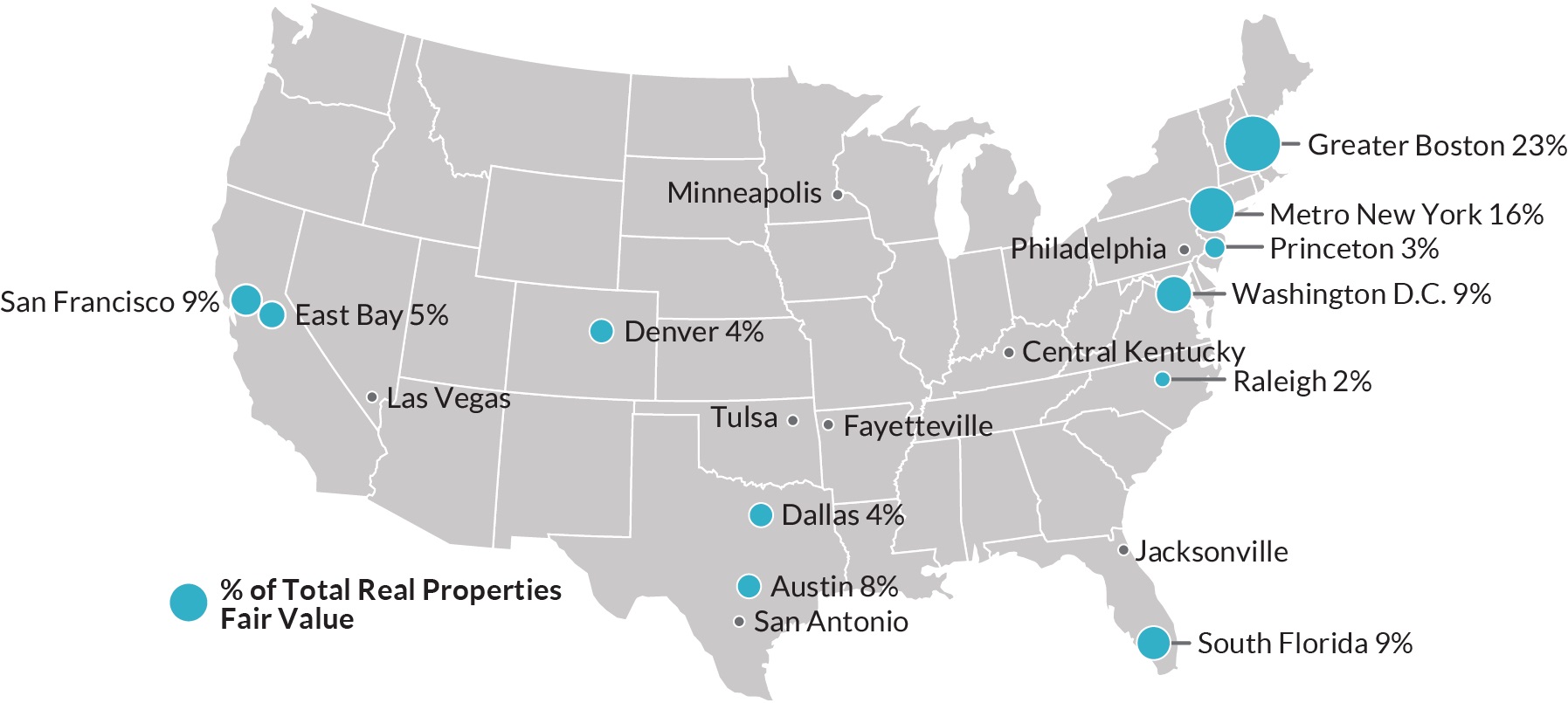

The chart below shows the allocations of our real property investments across geographic regions within the continental United States as of October 26, 2017. Percentages in the chart correspond to our fair value as of September 30, 2017. Any market for which we do not show a corresponding percentage of our total fair value comprises 1% or less of the total fair value of our real property portfolio.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Black Creek Diversified Property Fund Inc. | ||

October 31, 2017 | ||

By: | /s/ M. KIRK SCOTT | |

M. Kirk Scott | ||

Managing Director, Chief Financial Officer and Treasurer | ||