Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Simpson Manufacturing Co., Inc. | q32017ex991pressrelease.htm |

| 8-K - 8-K - Simpson Manufacturing Co., Inc. | ssdq320178kpressrelease.htm |

October 30, 2017

Q3 2017 Earnings Conference Call

Supplemental 2020 Plan Details

Karen Colonias

CEO

Brian Magstadt

CFO

Safe Harbor

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, based on numerous assumptions and subject to risks and uncertainties

(some of which are beyond our control), such as statements above regarding the Company’s 2020 Plan, the Company’s efforts and costs to implement

the 2020 Plan, and the effects of the 2020 Plan; the Company's products, market share, enterprise resource planning ("ERP") implementation and its

effects, software implementation (including its costs), profitability and profit margin outlook, working capital, balance sheet, inventory, net sales, net

sales growth rate, operating (including R&D) expenses, cost reduction measures, capital return, capital expenditures, dividends and share

repurchases. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions of the

forward-looking statements we furnish will not materialize or will vary significantly from actual results. Although the Company believes that these

forward-looking statements are reasonable, it does not and cannot give any assurance that its beliefs and expectations will prove to be correct, and

our actual results might differ materially from results suggested by any forward-looking statement in this document. Many factors could significantly

affect the Company's operations and cause the Company's actual results to differ substantially from the Company's expectations. Those factors

include, but are not limited to: (i) general business cycles and construction business conditions; (ii) customer acceptance of the Company's products;

(iii) product liability claims, contractual liability, engineering and design liability and similar liabilities or claims, (iv) relationships with key

customers; (v) materials and manufacturing costs; (vi) the financial condition of customers, competitors and suppliers; (vii) technological

developments including software development; (viii) increased competition; (ix) changes in industry practices or regulations; (x) litigation risks and

actions by activist shareholders, (xi) changes in capital and credit market conditions; (xii) governmental and business conditions in countries where

the Company's products are manufactured and sold; (xiii) changes in trade regulations; (xiv) the effect of acquisition activity; (xv) changes in the

Company's plans, strategies, objectives, expectations or intentions; (xvi) natural disasters and other factors that are beyond the Company’s reasonable

control; and (xvii) other risks and uncertainties indicated from time to time in the Company's filings with the U.S. Securities and Exchange

Commission including in the Company's most recent Annual Report on Form 10-K under the heading "Item 1A - Risk Factors." Actual results might

differ materially from results suggested by any forward-looking statements in this document. Except as required by law, the Company undertakes no

obligation to publicly release any update or revision to these forward-looking statements, whether as a result of the receipt of new information, the

occurrence of future events or otherwise. The information in this document speaks as of the date hereof and is subject to change. Any distribution of

this document after the date hereof is not intended and should not be construed as updating or confirming such information. In light of the foregoing,

investors are urged not to rely on our forward-looking statements in making an investment decision about our securities. We further do not accept any

responsibility for any projections or reports published by analysts, investors or other third parties.

2

2020 Plan

3

KEY OBJECTIVES FY 2016A 2020 TARGETS

FOCUS ON ORGANIC

GROWTH

• $861 M Net Sales

(1) Based on FY 2016 reported net sales of $861 million.

(2) Operating income margin refers to consolidated income from operations as a percentage of net sales.

(3) See appendix for Return on Invested Capital (ROIC) definition.

• ~8% Organic Net Sales CAGR(1)

RATIONALIZE COST

STRUCTURE TO

INCREASE

PROFITABILITY

• 31.8% Operating Expenses as

a % of Net Sales

• 16.2% Operating Income

Margin(2)

• ~26% - 27% Operating Expenses as a % of

Net Sales

• ~21% - 22% Operating Income Margin(2)

• Initiating work with leading management

consultant to identify additional opportunities

IMPROVE WORKING

CAPITAL MANAGEMENT

& BALANCE SHEET

DISCIPLINE

• 2x Inventory Turn Rate

• 4x Inventory Turn Rate

• Engaged external consultant to identify

further improvements to inventory

management

IMPROVE RETURN ON INVESTED CAPITAL(3)

• Execution on the 2020 Plan is expected to substantially enhance ROIC

• Expect to achieve 17% to 18% ROIC target by FY 2020, up from 10.5% in FY 2016

INCREASE CAPITAL RETURN TO SHAREHOLDERS

• Committed to returning 50% of cash flow from operations to shareholders

• Utilize capital from inventory reductions and balance sheet efficiency improvements to repurchase shares

• Review properties for potential sale / sale-leaseback options; capital release to be used for repurchases

• Deploy additional capital from a potential tax holiday or corporate tax rate reduction to repurchase shares

1

2

3

Net Sales Correlation to U.S. Housing Starts

4

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

H

o

u

s

in

g

S

tar

ts

(M

)

($

M

)

North America Net Sales Total Net Sales Gross Profit Income from Operations Housing Starts

Gross

Margin:

42.1% 39.8% 40.3% 35.1% 44.0% 44.9% 43.0% 44.5% 45.5% 45.2% 47.9%

Our investments in adjacent products and markets have helped mitigate our exposure

to a cyclical U.S. housing market over time...

Strategic Growth Initiatives Rationale

5

SOFTWARE

• Preserves market share of

core connector business

through availability of end-

to-end product and software

solution

• Development of best-in-

class truss software

solution, specifically,

enhances technological

capabilities to remain

competitive

• Over 40%+ of our core

connector business is tied

to customers with software

needs

EUROPE

• Attractive opportunity to

grow wood connectors,

fasteners and concrete

products with tailwinds from

improved economic

conditions

• Helps diversify from

significant exposure to U.S.

housing starts

• Expands trusted brand

reputation through

extensive testing and

education capabilities

CONCRETE

• Sharpening focus on

higher-margin product lines

to drive profitability and

increase market share from

10% to 14% by fiscal 2020

• Complementary to wood

offering

• Able to perform throughout

all industry cycles given

less reliance on U.S.

housing starts for growth

…while also allowing us to provide a complete product solution to our customers and

to improve sales and margins in our core wood connector business.

Focus on Organic Growth

6

• Steady growth in North America and

Europe

• Estimate YOY growth in U.S.

housing starts in mid single-digit

range

• Improved economic conditions

in Europe

• Concrete market share improvement

from approximately 10% to 14% of

~$1.3 B addressable market

• Deemphasize acquisition activity

• Strategic capital investments

• ~⅓ maintenance CapEx

• ~⅔ CapEx to support organic

growth, primarily in core

connector business, and

efficiency improvements in our

initiatives

ORGANIC GROWTH DRIVERS

FY 2016A FY 2020E

$861 M

ORGANIC GROWTH TARGET

~$1.2 B

Addressable Market Opportunity(1)

7(1) Note: Market sizes and market shares based on internal estimates. Includes North America, Europe and Pacific Rim.

Addressable Market

$1.3 B (9%)

Addressable Market

$730 M (13%)

Addressable Market:

$1.5 B (100%)

$15.0 B

$5.8 B

$1.5 B

Fasteners (Addressable) Concrete (Addressable) Wood Connectors & Truss (Addressable)

Simpson’s Market Share(1)

8(1) Note: Market sizes based on internal estimates. Includes North America, Europe and Pacific Rim.

SSD’s Share

$106 M (15%)

$1.3 B

Fasteners (SSD Share) Concrete (SSD Share) Wood Connectors & Truss (SSD Share)

$730 M

$1.5 B

SSD’s Share

$128 M (10%)

SSD’s Share

$626 M (43%)

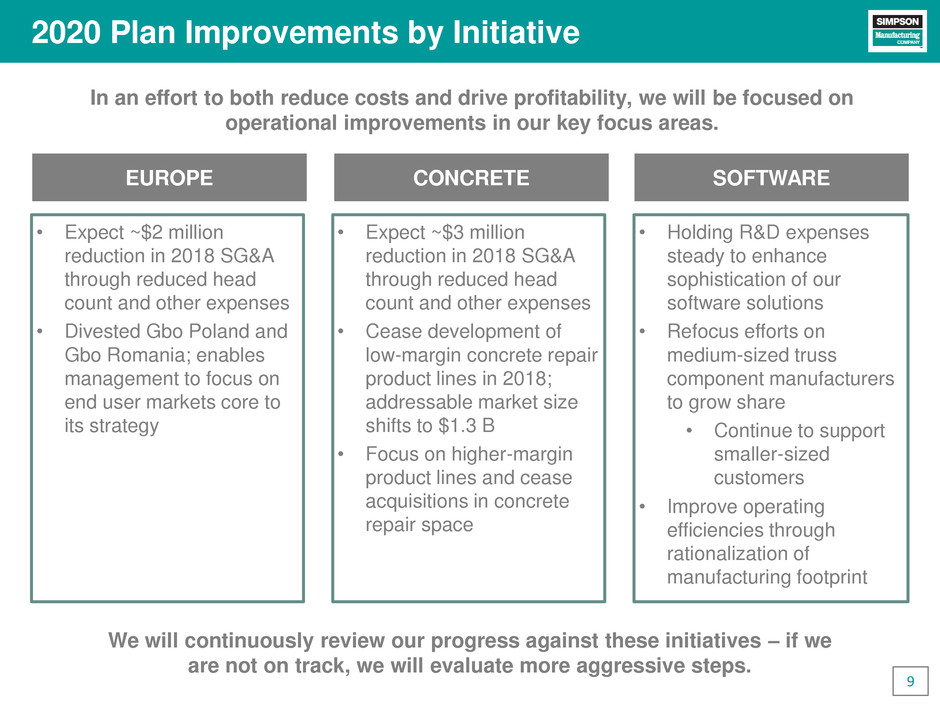

2020 Plan Improvements by Initiative

9

In an effort to both reduce costs and drive profitability, we will be focused on

operational improvements in our key focus areas.

• Holding R&D expenses

steady to enhance

sophistication of our

software solutions

• Refocus efforts on

medium-sized truss

component manufacturers

to grow share

• Continue to support

smaller-sized

customers

• Improve operating

efficiencies through

rationalization of

manufacturing footprint

• Expect ~$2 million

reduction in 2018 SG&A

through reduced head

count and other expenses

• Divested Gbo Poland and

Gbo Romania; enables

management to focus on

end user markets core to

its strategy

• Expect ~$3 million

reduction in 2018 SG&A

through reduced head

count and other expenses

• Cease development of

low-margin concrete repair

product lines in 2018;

addressable market size

shifts to $1.3 B

• Focus on higher-margin

product lines and cease

acquisitions in concrete

repair space

We will continuously review our progress against these initiatives – if we

are not on track, we will evaluate more aggressive steps.

SOFTWAREEUROPE CONCRETE

31.8%

~1%

<1%

~1%

~3%

~26% - 27%

2016A Truss R&D Europe Concrete Zero-based

Budgeting &

Operational

Efficiencies

2020E

Path to Improved Operating Leverage

10

FY 2018 consolidated SG&A

dollars will be less than FY

2017, on an absolute dollar

basis (inclusive of ~$8 M of

SAP expenses)

~$3 M reduction in operating

expenses from headcount and

other professional service fees

~$2 M planned FY 2018

reduction in operating

expenses from headcount and

other expenses

$8 M per year annual

R&D expense will be

held flat; will achieve

improved operating

leverage due to

growing share in truss

Initiating work with a

leading management

consultant to help

identify additional

savings beyond plan

We plan to reduce our consolidated operating expenses as a percent of net

sales by approximately 530 basis points from 31.8% in 2016 to be in the range of

26% to 27% by the end of 2020.

TOTAL OPERATING EXPENSES AS A PERCENT OF SALES

Path to Improved Profitability in Europe

11

In Europe, we are reducing total operating expense dollars by $2 million in 2018,

contributing to ~700 basis points of operating margin improvement in 2018 through

reductions in both headcount and other expenses.

0.8%

~2-3%

~2%

~7% ~12%+

2016A Gross Profit Margin

Improvements

Operating Expense

Reductions

Operating Expense

Leverage

2020E

TOTAL OPERATING EXPENSES AS A PERCENT OF SALES

Focus on Higher-Margin Markets in Concrete

35%

~38% - 39%

~42%+

2016A 2018E 2020E

12

CONCRETE GROSS MARGIN TARGETCONCRETE STRATEGY

• Reprioritizing efforts in the concrete space

to drive improved profitability

• Effective immediately, ceasing

development of lower-margin concrete

repair lines (excluding bridge & marine)

• Reduces our addressable market to $1.3

billion from $3.5 billion previously

SIX KEY FOCUS AREAS

Software Critical to Preserve & Grow Core Business

Over 40% of our core wood connector business is tied to customers with software needs.

~$500 M

13

• Without software solutions, we believe a meaningful portion of our market share in our core wood

connector products would be at risk

• Enhances technological capabilities to remain competitive in wood construction space

Proprietary Truss Software

• Ongoing development to support truss

component manufacturers

• Small and medium-sized component

manufacturers represent >40% of truss market

• Focused on converting medium-sized

customers

• Enabled by increased software

capabilities and sophistication of our

solutions

Acquired CG Visions (January 2017)

• Provides expertise and resources to offer

software solutions and services to builders

and lumber building material dealers

• Supports efforts to further develop integrated

software component solutions for the building

industry

STRATEGIC RATIONALE

INVESTMENTS IN SOFTWARE

FY 2016A FY 2020E

Improve Working Capital & Balance Sheet Discipline

14

• Established internal team to better

manage inventory without impacting

product availability standards

• Delivering products typically

within 24 hours is a key

competitive factor

• Eliminating ~25% - 30% of SKU’s

• Expect enhanced operating efficiencies

upon completion of ERP system

implementation in 2019

• Engaged external consultant with a

specialization in Lean principles to

opine on additional methods to

enhance efficiency

• Identified ~30% of additional raw

materials and finished goods to

eliminate over the next three

years

DRIVERS OF CAPITAL RELEASEINVENTORY TURN IMPROVEMENT

2x

4x

Return on Invested Capital(1) Improvement

15

Through execution on the 2020 Plan, we expect to substantially increase our return on

invested capital above our weighted average cost of capital which will drive enhanced

shareholder value.

10.5%

~3%

~3%

~1%

~17% - 18%

2016A Operating Expense

Reductions

Share Repurchases Inventory Turns 2020E

(1) See appendix for Return on Invested Capital (ROIC) definition.

Cash Flow from

Operations

Share Repurchases

Organic Growth

Investments

Dividends

Disciplined Capital Allocation Strategy

16

• Improve cash flow through better

management of working capital and

overall balance sheet discipline

• Committed to return 50% of cash flow

from operations to shareholders

• Focus primarily on organic

growth opportunities through

strategic capital investments in

the business

• Longer-term, we intend to use the

proceeds from the following

toward future share repurchases:

• A review of owned real

estate for potential sale or

sale lease-back

opportunities

• A potential tax holiday or

corporate rate reduction

• Maintain regular quarterly

dividends

Given our confidence the 2020 Plan will drive improved operational performance

in our business, we plan to be more aggressive in repurchasing shares of our

stock in the near-term.

Summary

17

Now → 2020:

Focusing on organic growth

Rationalizing our cost structure to improve Company-wide profitability

Improving working capital management and balance sheet discipline

Increasing capital return to shareholders

Working with external management and Lean consultants to perform independent, in-

depth analyses of our operations to identify incremental opportunities for improvement

beyond the 2020 Plan

We expect these objectives will result in an improved ROIC(1) target

to approximately 17% to 18% by FY 2020.

We believe our execution on the 2020 Plan will create substantial value for all

shareholders of Simpson Manufacturing Company.

(1) See appendix for Return on Invested Capital (ROIC) definition.

APPENDIX

Return on Invested Capital (“ROIC”) Definition

When referred to in this presentation, the Company’s return on invested capital (“ROIC”)

for a fiscal year is calculated based on (i) the net income of that year as presented in the

Company’s consolidated statements of operations prepared pursuant to generally

accepted accounting principles in the U.S. (“GAAP”), as divided by (ii) the average of the

sum of the total stockholders’ equity and the total long-term liabilities at the beginning of

and at the end of such year, as presented in the Company’s consolidated balance sheets

prepared pursuant to GAAP for that applicable year. As such, the Company’s ROIC, a

ratio or statistical measure, is calculated using exclusively financial measures presented

in accordance with GAAP.

19