Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Rosehill Resources Inc. | s107914_ex99-1.htm |

| 8-K - 8-K - Rosehill Resources Inc. | s107914_8k.htm |

Exhibit 99.2

| Acquisition | Update October 2017 |

Safe Harbor Statement 2 Forward - Looking Statements This communication includes certain statements that may constitute “forward - looking statements” for purposes of the federal secu rities laws. All statements, other than statements of historical fact included in this communication, regarding our opportunities in the Delaware Basin, o ur strategy, future operations, financial position, estimated results of operations, future earnings, future capital spending plans, prospects, plans and obj ect ives of management are forward - looking statements. When used in this communication, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expec t,” “project,” “guidance,” “forecast” and similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words. You should not place undue reliance on these forward - looking statements. Although the Company believes that the plans, intention s and expectations reflected in or suggested by the forward - looking statements in this communication are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved or occur, and actual results could differ materially and adversely from those anticipated or implied by the forwa rd - looking statements. Some factors that could cause actual results to differ include, but are not limited to, our ability to consummate the proposed acquisition , o ur ability to obtain acquisition financing on desirable terms, if at all, the risk that conditions to closing of the proposed acquisition may not be satisfied or that the closing otherwise does not occur, the diversion of management’s time on acquisition - related matters, the ultimate timing, outcome and results of integratin g the acquired assets into our business, and our ability to realize the anticipated benefits, commodity price volatility, inflation, lack of availability of dr illing and completion equipment and services, environmental risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating oi l and natural gas reserves and in projecting future rates of production, cash flow and access to capital, the timing of development expenditures and the other ri sks and uncertainties discussed under Risk Factors in the Company’s Registration Statement on Form S - 3, as amended, filed with the SEC on June 14, 2017, and in other public filings with the Securities and Exchange Commission (the “SEC”) by the Company. The Company’s SEC filings are available publicly on the SEC’s web site at www.sec.gov. These forward - looking statements are based on management's current expectations and assumptions about future events and are based on c urrently available information as to the outcome and timing of future events. All forward - looking statements speak only as of the date of this comm unication. Except as otherwise required by applicable law, the Company disclaims any duty to update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this communication. Cautionary Statement Regarding Hydrocarbon Quantities Terms such as “resource potential,” “estimated ultimate recovery” and EUR” are used to describe estimates of potentially reco ver able hydrocarbons remaining in the applicable reservoir. These resources are not proved reserves in accordance with SEC regulations and SEC guidelines rest ric t us from including these measures in filings with the SEC. These have been estimated by Rosehill without review by independent engineers. Actual recovery of the se potential resource volumes is inherently more speculative than recovery of estimated reserves and any such recovery will be dependent upon future design an d i mplementation of a successful development plan and the actual geologic characteristics of the reservoir. Actual quantities that may be ultimately recovered may differ substantially from the estimates in this presentation. Factors af fecting ultimate recovery include the scope of our ongoing drilling program, which will be directly affected by commodity prices, the availability of capital, regu lat ory approvals, drilling and production costs, availability of services and equipment, drilling results, lease expirations, transportation constraints and other fact ors , actual drilling results, which may be affected by geological, mechanical and other factors that determine recovery rates, and budgets based upon our future evaluat ion of risk, returns and the availability of capital.

ROSEHILL STRATEGY Deliver Strong, Profitable Growth Through Operational Excellence and Accretive Acquisitions 3 • Continue improvements to drilling and completion techniques to improve EUR, minimize costs and improve F&D metrics • Drive down cash operating costs and improve margins to grow cash flow Optimize Operations • Strong balance sheet allows for organic leasing and bolt - on deals • Explore strategic, accretive acquisitions Expand Delaware Footprint • Capital expenditures focused on highest return benches and funded within operational cash flow and credit facility availability • Opportunistically add hedges to minimize downside exposure Maintain Financial Discipline • Sustainable growth in net income and cash flow • Operate safely and efficiently to maximize margins Deliver Value to Shareholders

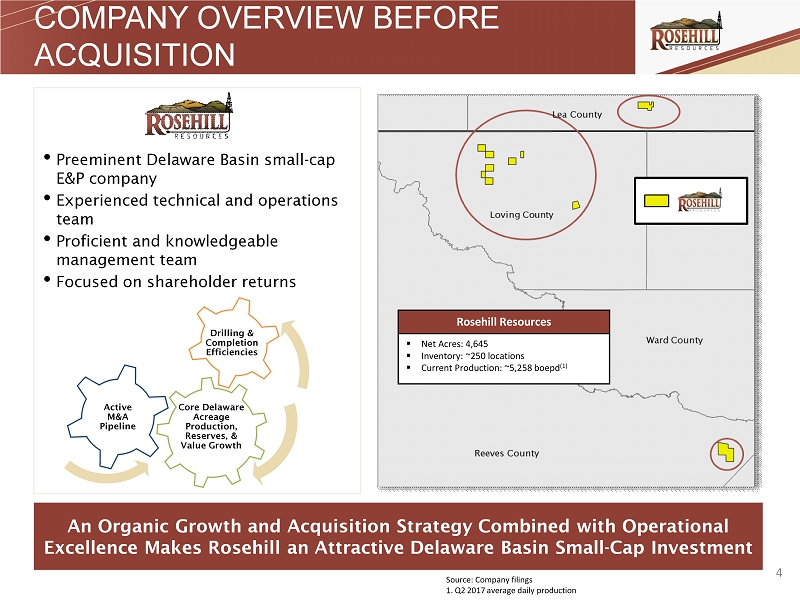

COMPANY OVERVIEW BEFORE ACQUISITION • Preeminent Delaware Basin small - cap E&P company • Experienced technical and operations team • Proficient and knowledgeable management team • Focused on shareholder returns Core Delaware Acreage Production, Reserves, & Value Growth Drilling & Completion Efficiencies Active M&A Pipeline An Organic Growth and Acquisition Strategy Combined with Operational Excellence Makes Rosehill an Attractive Delaware Basin Small - Cap Investment 4 Rosehill Resources ▪ Net Acres: 4,645 ▪ Inventory: ~250 locations ▪ Current Production: ~5,258 boepd (1) Source: Company filings 1. Q2 2017 average daily production

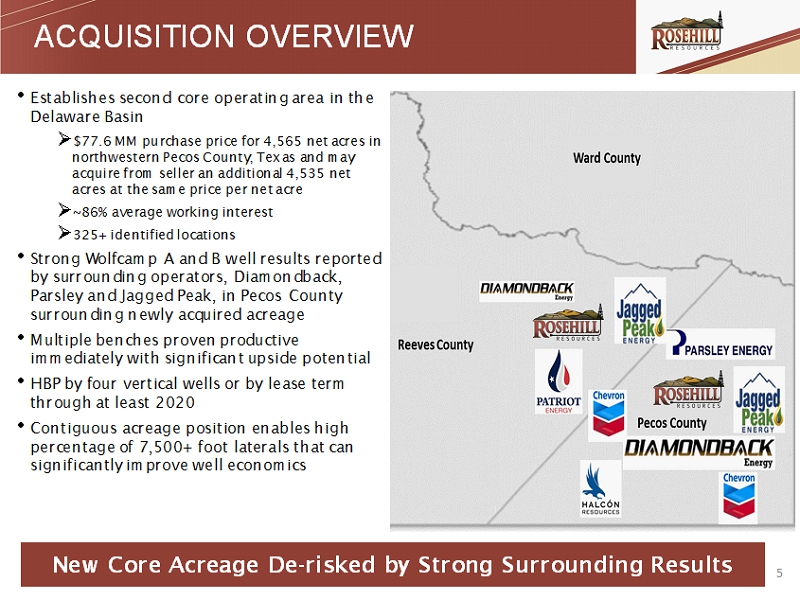

ACQUISITION OVERVIEW 5 • Establishes second core operating area in the Delaware Basin » $77.6 MM purchase price for 4,565 net acres in northwestern Pecos County, Texas and may acquire from seller an additional 4,535 net acres at the same price per net acre » ~86% average working interest » 325+ identified locations » Net resource potential >130 MMBOE • Strong Wolfcamp A and B well results reported by surrounding operators, Diamondback, Parsley and Jagged Peak, in Pecos County surrounding newly acquired acreage • Multiple benches proven productive immediately with significant upside potential • HBP by four vertical wells or by lease term through at least 2020 • Contiguous acreage position enables high percentage of 7,500+ foot laterals that can significantly improve well economics New Core Acreage De - risked by Strong Surrounding Results

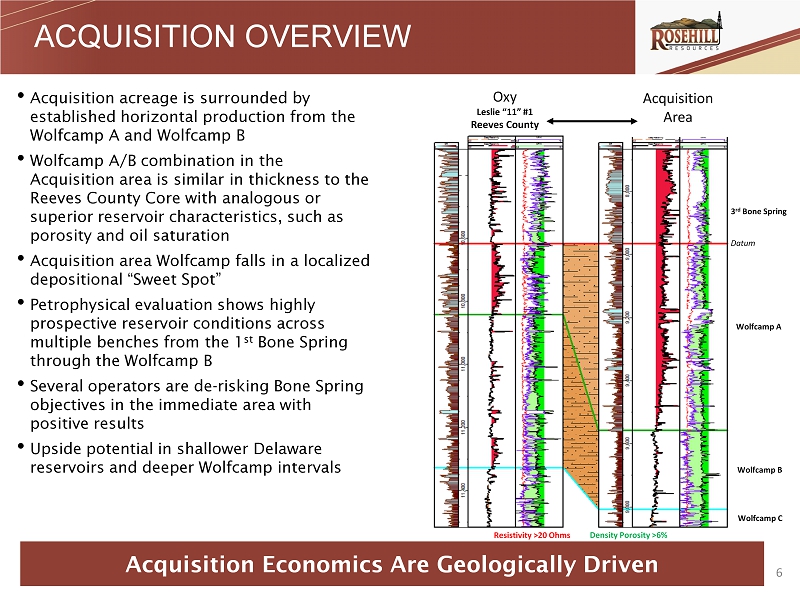

ACQUISITION OVERVIEW 6 • Acquisition acreage is surrounded by established horizontal production from the Wolfcamp A and Wolfcamp B • Wolfcamp A/B combination in the Acquisition area is similar in thickness to the Reeves County Core with analogous or superior reservoir characteristics, such as porosity and oil saturation • Acquisition area Wolfcamp falls in a localized depositional “Sweet Spot” • Petrophysical evaluation shows highly prospective reservoir conditions across multiple benches from the 1 st Bone Spring through the Wolfcamp B • Several operators are de - risking Bone Spring objectives in the immediate area with positive results • Upside potential in shallower Delaware reservoirs and deeper Wolfcamp intervals Acquisition Economics Are Geologically Driven Acquisition Area Resistivity >20 Ohms Density Porosity >6% 3 rd Bone Spring Wolfcamp A Wolfcamp B Wolfcamp C Datum Oxy Leslie “11” #1 Reeves County

COMBINED ROSEHILL OVERVIEW Pure Play Delaware Basin Operator with Significant Potential 7 • Two strong Delaware Basin core operating areas » Loving County, TX and Lea County, NM » Pecos and Reeves Counties, TX » 9,210 net acres in the Basin and may acquire from seller an additional 4,535 net acres » 500+ gross potential locations » ~92% average working interest » Multi stacked benches with primary targets in multiple Wolfcamp A, Wolfcamp B and Bone Spring benches with upside in deeper Wolfcamp horizons and shallower Avalon horizons on some of the acreage • Enhanced size and scale allows for operational efficiencies » High degree of operational control » Apply improvements to drilling and completion techniques to maximize EUR, minimize costs and improve F&D metrics • Strong, sustainable growth of production, reserves and returns enhances the value proposition for stockholders

FOCUSED ON THE FUTURE Increase Shareholder Value Conservative Financial Management Maintain Strong Balance Sheet Grow Cash Flow to Support Drilling and Acquisitions Expand Liquidity and Borrowing Base Profitable Growth Drill and Complete Existing Inventory of 500+ Locations Organic Leasing Accretive Acquisitions 8