Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KEMPER Corp | kmpr20170930178-kreleasean.htm |

| EX-99.2 - THIRD QUARTER 2017 INVESTOR SUPPLEMENT OF KEMPER CORPORATION - KEMPER Corp | kmpr2017093017ex992supplem.htm |

| EX-99.1 - REGISTRANTS PRESS RELEASE DATED OCTOBER 30, 2017 - KEMPER Corp | kmpr2017093017ex991release.htm |

Third Quarter

2017 Earnings

October 30, 2017

2 Earnings Call Presentation – 3Q 2017

Preliminary Matters

Caution Regarding Forward-Looking Statements

This presentation may contain or incorporate by reference information that includes or is based on

forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events,

and can be identified by the fact that they relate to future actions, performance or results rather than

strictly to historical or current facts.

Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned

not to place undue reliance on such statements, which speak only as of the date of this presentation.

Forward-looking statements involve a number of risks and uncertainties that are difficult to predict, and are

not guarantees of future performance. Among the general factors that could cause actual results and

financial condition to differ materially from estimated results and financial condition are those listed in

periodic reports filed by Kemper Corporation with the Securities and Exchange Commission (SEC). No

assurances can be given that the results and financial condition contemplated in any forward-looking

statements will be achieved or will be achieved in any particular timetable. Kemper assumes no obligation

to publicly correct or update any forward-looking statements as a result of events or developments

subsequent to the date of this presentation. The reader is advised, however, to consult any further

disclosures Kemper makes on related subjects in its filings with the SEC.

Non-GAAP Financial Measures:

This presentation contains non-GAAP financial measures that the company believes are meaningful to

investors. Non-GAAP financial measures have been reconciled to the most comparable GAAP financial

measure.

All data in this presentation is as of and for the periods ending September 30, 2017 unless otherwise stated.

3 Earnings Call Presentation – 3Q 2017

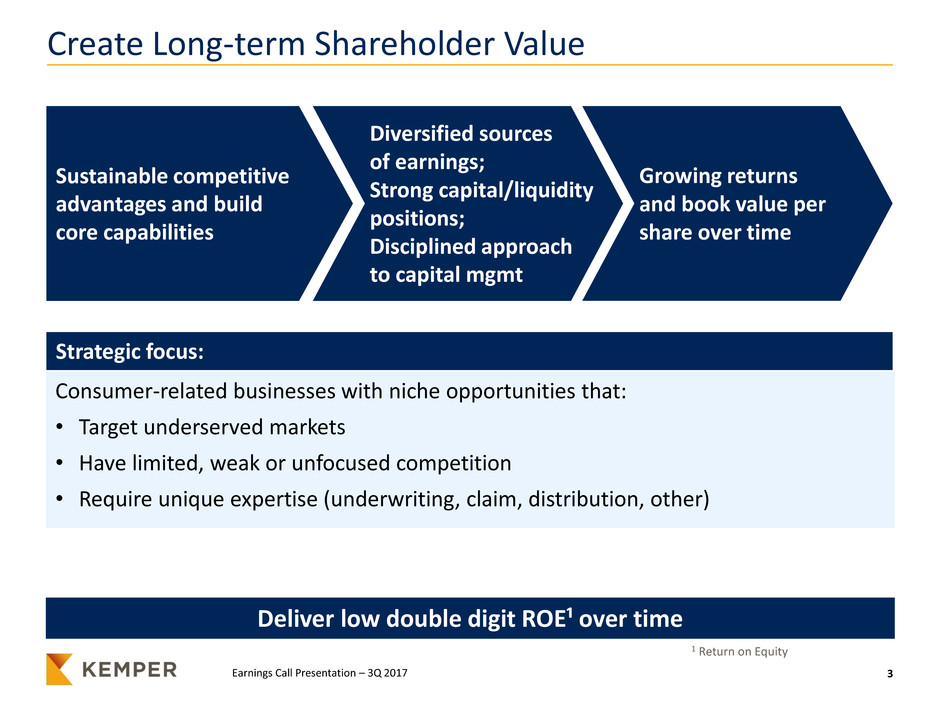

Create Long-term Shareholder Value

Sustainable competitive

advantages and build

core capabilities

Growing returns

and book value per

share over time

Diversified sources

of earnings;

Strong capital/liquidity

positions;

Disciplined approach

to capital mgmt

Deliver low double digit ROE¹ over time

1 Return on Equity

Consumer-related businesses with niche opportunities that:

• Target underserved markets

• Have limited, weak or unfocused competition

• Require unique expertise (underwriting, claim, distribution, other)

Strategic focus:

4 Earnings Call Presentation – 3Q 2017

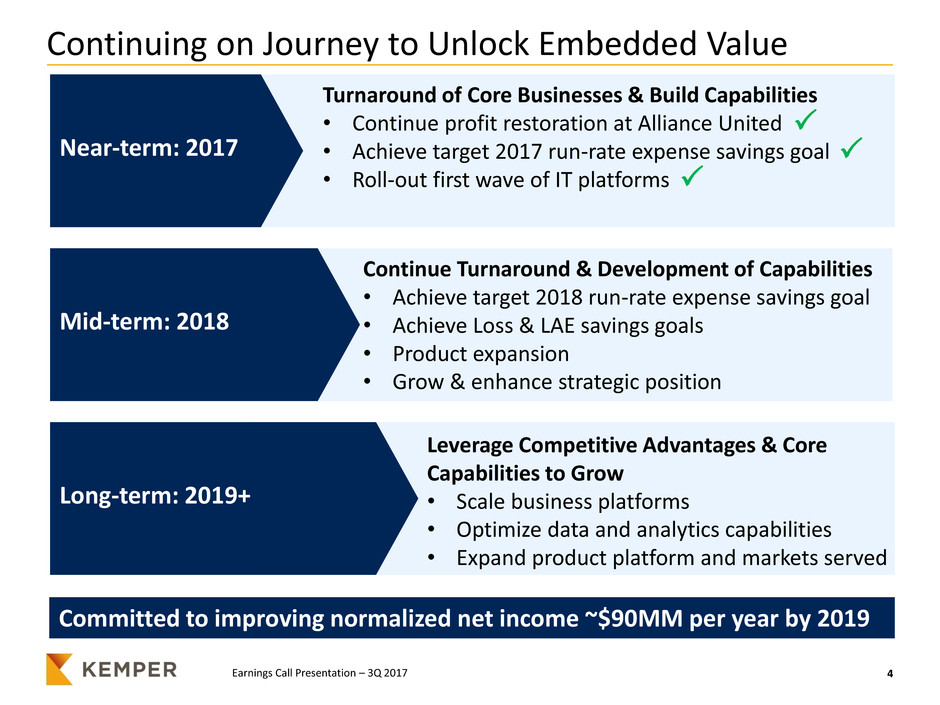

Turnaround of Core Businesses & Build Capabilities

• Continue profit restoration at Alliance United

• Achieve target 2017 run-rate expense savings goal

• Roll-out first wave of IT platforms

Continuing on Journey to Unlock Embedded Value

Near-term: 2017

Leverage Competitive Advantages & Core

Capabilities to Grow

• Scale business platforms

• Optimize data and analytics capabilities

• Expand product platform and markets served

Continue Turnaround & Development of Capabilities

• Achieve target 2018 run-rate expense savings goal

• Achieve Loss & LAE savings goals

• Product expansion

• Grow & enhance strategic position

Mid-term: 2018

Long-term: 2019+

Committed to improving normalized net income ~$90MM per year by 2019

P

P

P

5 Earnings Call Presentation – 3Q 2017

Third Quarter 2017 Highlights – Strong Results

¹Non-GAAP financial measure; Please see reconciliation in

the appendix

Key metrics improved in 3Q and year-to-date — Earned Premium, Operating

EPS and BVPS (excluding unrealized gains on Fixed Maturities)

(Dollars in millions, except per Sept. 30, Sept. 30, Variance Sept. 30, Sept. 30, Variance

share amounts) 2017 2016 2017 2016

Net Income (Loss) Per Share - Diluted 0.92$ (0.32)$ 1.24$ 1.62$ (0.27)$ 1.89$

Net Operating Income (Loss) Per Share - Diluted¹ 0.85$ (0.40)$ 1.25$ 1.19$ (0.31)$ 1.50$

Earned Premiums 598.2$ 558.9$ 39.3$ 1,744.1$ 1,658.6$ 85.5$

Net Investment Income 85.9 77.7 8.2 244.6 218.4 26.2

Net Realized Gains (Losses) & Other Income 6.2 4.1 2.1 37.4 2.2 35.2

To al Reven es 690.3$ 640.7$ 49.6$ 2,026.1$ 1,879.2$ 146.9$

Book Value Per Share 40.48$ 40.51$ (0.03)$ 40.48$ 40.51$ (0.03)$

Book Value Per Share Excluding Net Unrealized

Gains on Fixed Maturities¹ 35.87$ 34.27$ 1.60$ 35.87$ 34.27$ 1.60$

Nine Months EndedThree Months Ended

6 Earnings Call Presentation – 3Q 2017

Improving Underlying Operating Performance

¹Non-GAAP financial measure; Please see reconciliation in

the appendix

Delivered a fifth consecutive quarter of improved underlying performance

Dollars per Unrestricted Share - Diluted Sept. 30, June 30, Mar. 31, Dec. 31, Sept. 30, Variance

2017 2017 2017 2016 2016 QoQ

Income (Loss) from Continuing Operations 0.92$ 0.71$ (0.01)$ 0.56$ (0.36)$ 1.28

Net Realized Gains and Impairments 0.07 0.30 0.07 - 0.04 0.03

Net Operating Income (Loss)¹ 0.85 0.41 (0.08) 0.56 (0.40) 1.25

Sources of Volatility:

Catastrophes (0.41) (0.44) (0.83) (0.16) (0.16) (0.25)

Prior Year Reserve Development (0.01) (0.10) (0.14) (0.04) 0.02 (0.03)

Alternative Investment Income 0.21 0.12 0.19 0.14 0.12 0.09

Voluntary Outreach Efforts - - - - (0.98) 0.98

Total from Sources of Volatility (0.21)$ (0.42)$ (0.78)$ (0.06)$ (1.00)$ 0.79$

Underlying Operating Performance¹ 1.06$ 0.83$ 0.70$ 0.62$ 0.60$ 0.46$

Three Months Ended

7 Earnings Call Presentation – 3Q 2017

$21 $23 $22 $21

$24

3Q16¹ 4Q16 1Q17 2Q17 3Q17

Net Operating Income

Stable and Predictable Life & Health Earnings

$152 $152 $153 $153 $155

$55 $54 $53 $55 $56

3Q16 4Q16 1Q17 2Q17 3Q17

Revenues

Earned Premiums Net Investment Income

(M

M

)

(M

M

)

• Comparing 3Q16 to 3Q17, earned

premiums increased $3 million driven by

higher A&H earned premiums

• Net investment income increased $1

million over 3Q16, primarily from higher

returns from alternative investments

• Comparing 3Q16 to 3Q17, net income

increased to $24 million primarily from

lower expenses and higher net investment

income

• Results remain stable and continue to

provide strong predictable cash flows

• Continue to focus on increasing

distribution capabilities

Revenues

Net Operating Income

¹Excludes $50.5 million after-tax charge from implementing voluntary use of death verification databases

$211 $206 $206 $207 $208

8 Earnings Call Presentation – 3Q 2017

102.8 99.7 97.9 94.5

91.3

3Q16 4Q16 1Q17 2Q17 3Q17

Underlying Combined Ratio¹

Profitably Growing Nonstandard Personal Auto

• Comparing 3Q16 to 3Q17, earned

premiums increased $40 million driven by

higher volume and higher premium rates

in California

• Underlying combined ratio improved 11.5

points in 3Q17 compared to 3Q16, driven

by rate, claims and underwriting actions

• Business is looking to expand market share

in core geographies

$207 $211 $216 $234

$247

3Q16 4Q16 1Q17 2Q17 3Q17

Earned Premiums

(%

)

(M

M

)

Revenues

Underwriting Results

¹Non-GAAP financial measure; Please see reconciliation in the appendix

Strong nonstandard auto franchise focused on profitable growth

9 Earnings Call Presentation – 3Q 2017

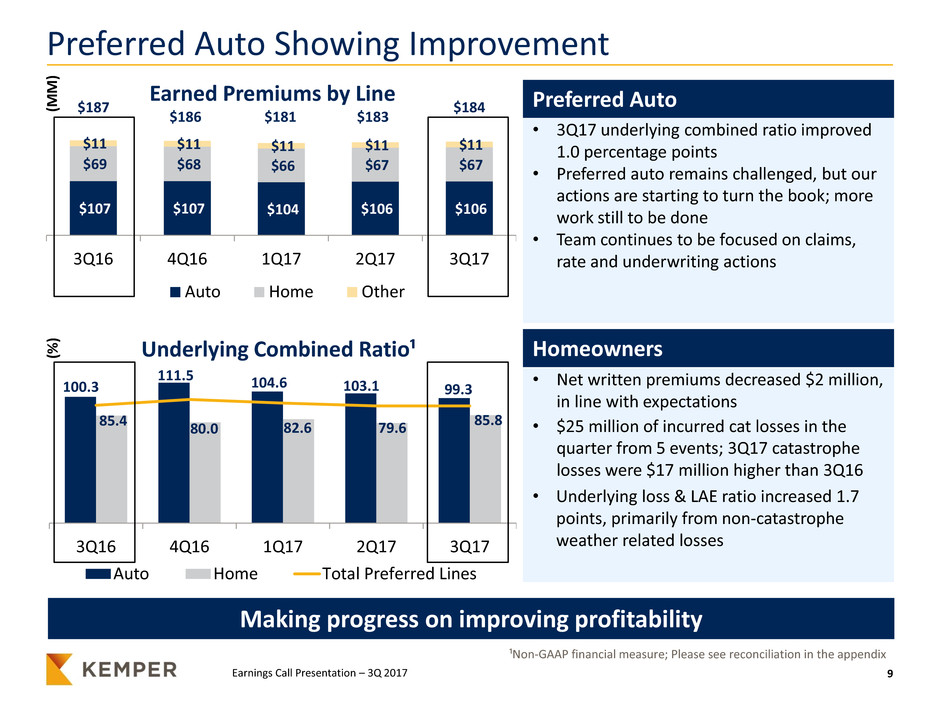

Preferred Auto Showing Improvement

• 3Q17 underlying combined ratio improved

1.0 percentage points

• Preferred auto remains challenged, but our

actions are starting to turn the book; more

work still to be done

• Team continues to be focused on claims,

rate and underwriting actions

100.3

111.5 104.6 103.1 99.3

85.4

80.0 82.6 79.6

85.8

3Q16 4Q16 1Q17 2Q17 3Q17

Underlying Combined Ratio¹

Auto Home Total Preferred Lines

• Net written premiums decreased $2 million,

in line with expectations

• $25 million of incurred cat losses in the

quarter from 5 events; 3Q17 catastrophe

losses were $17 million higher than 3Q16

• Underlying loss & LAE ratio increased 1.7

points, primarily from non-catastrophe

weather related losses

$107 $107 $104 $106 $106

$69 $68 $66 $67 $67

$11 $11 $11 $11 $11

3Q16 4Q16 1Q17 2Q17 3Q17

Earned Premiums by Line

Auto Home Other

(%

)

(M

M

)

$184

$181 $186

$187

$183

Preferred Auto

Homeowners

¹Non-GAAP financial measure; Please see reconciliation in the appendix

Making progress on improving profitability

10 Earnings Call Presentation – 3Q 2017

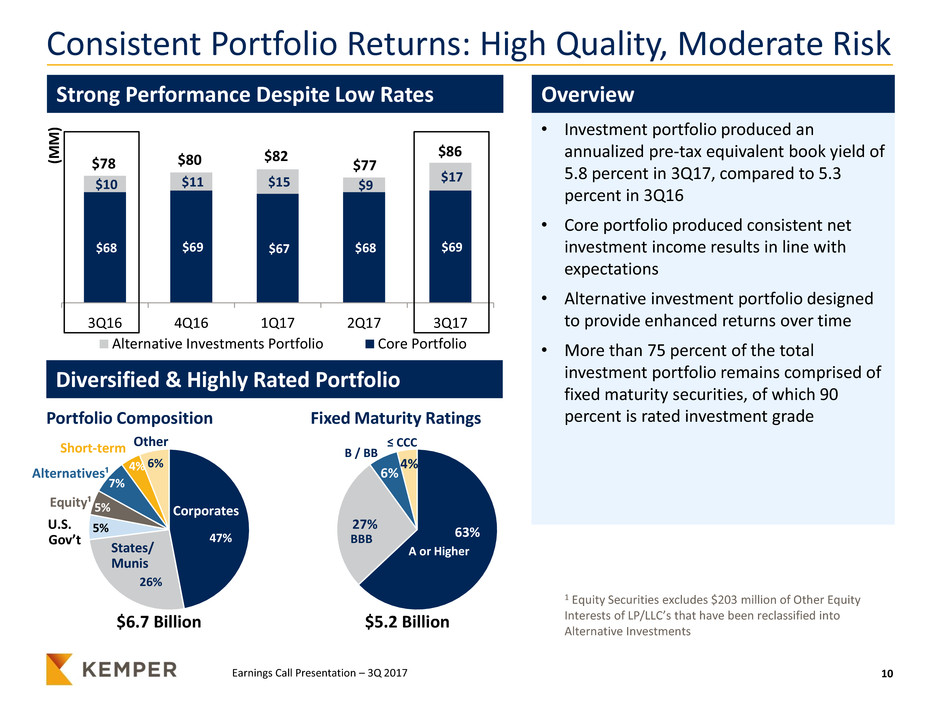

Consistent Portfolio Returns: High Quality, Moderate Risk

63%

27%

6%

4%

47%

26%

5%

5%

7%

4% 6%

Short-term

Diversified & Highly Rated Portfolio

Portfolio Composition Fixed Maturity Ratings

$5.2 Billion $6.7 Billion

A or Higher

≤ CCC

B / BB

BBB

Other

Alternatives¹

Equity¹

U.S.

Gov’t

States/

Munis

Corporates

• Investment portfolio produced an

annualized pre-tax equivalent book yield of

5.8 percent in 3Q17, compared to 5.3

percent in 3Q16

• Core portfolio produced consistent net

investment income results in line with

expectations

• Alternative investment portfolio designed

to provide enhanced returns over time

• More than 75 percent of the total

investment portfolio remains comprised of

fixed maturity securities, of which 90

percent is rated investment grade

1 Equity Securities excludes $203 million of Other Equity

Interests of LP/LLC’s that have been reclassified into

Alternative Investments

$68 $69 $67 $68 $69

$10 $11 $15 $9

$17

3Q16 4Q16 1Q17 2Q17 3Q17

Alternative Investments Portfolio Core Portfolio

Strong Performance Despite Low Rates

(M

M

)

$78

$86

$77

$82 $80

Overview

11 Earnings Call Presentation – 3Q 2017

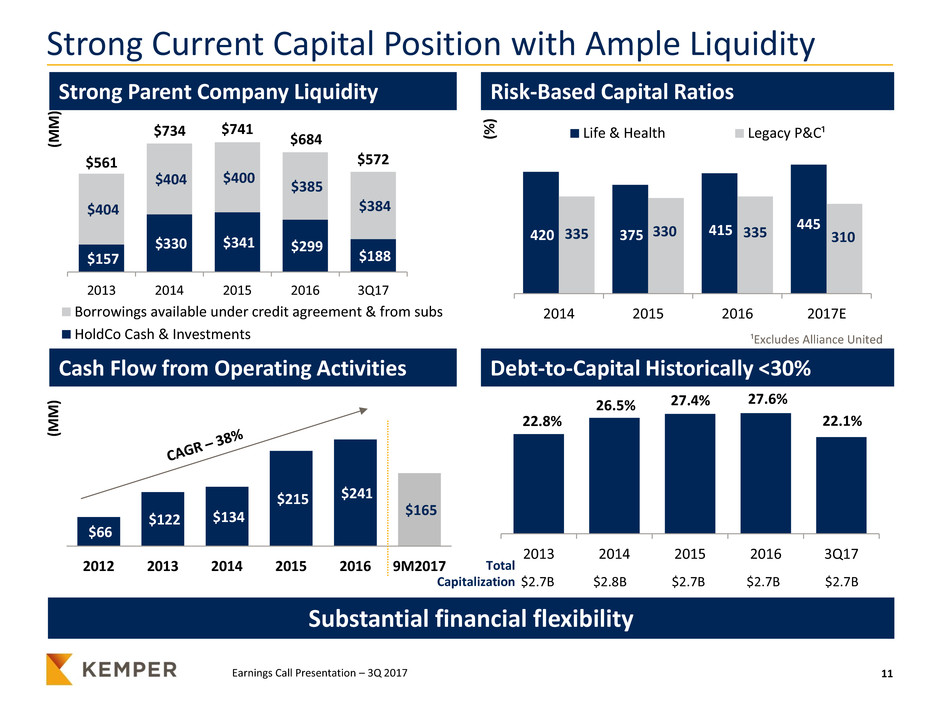

Strong Current Capital Position with Ample Liquidity

Debt

Cash Flow from Operating Activities Debt-to-Capital Historically <30%

2013 2014 2015 2016 3Q17

22.8%

$2.7B

22.1%

$2.7B

27.6%

$2.7B

27.4%

$2.7B

26.5%

$2.8B

Total

Capitalization

Strong Parent Company Liquidity Risk-Based Capital Ratios

$157

$330 $341 $299

$188

$404

$404 $400 $385

$384

2013 2014 2015 2016 3Q17

Borrowings available under credit agreement & from subs

HoldCo Cash & Investments

(M

M

)

420 375 415

445

335 330 335 310

2014 2015 2016 2017E

Life & Health Legacy P&C¹(%

)

$561 $572

$684

$741 $734

(M

M

)

Substantial financial flexibility

$66

$122 $134

$215 $241

$165

2012 2013 2014 2015 2016 9M2017

¹Excludes Alliance United

12 Earnings Call Presentation – 3Q 2017

Capital Deployment Priorities

1. Investment in the business

• Fund profitable organic growth at appropriate risk-adjusted returns

• Strategic investments and acquisitions that enhance our business and meet or

exceed our ROE targets over time

2. Return capital to shareholders

• Repurchase shares opportunistically

• Maintain competitive dividends

Capital deployment & management focused on maximizing shareholder value

13 Earnings Call Presentation – 3Q 2017

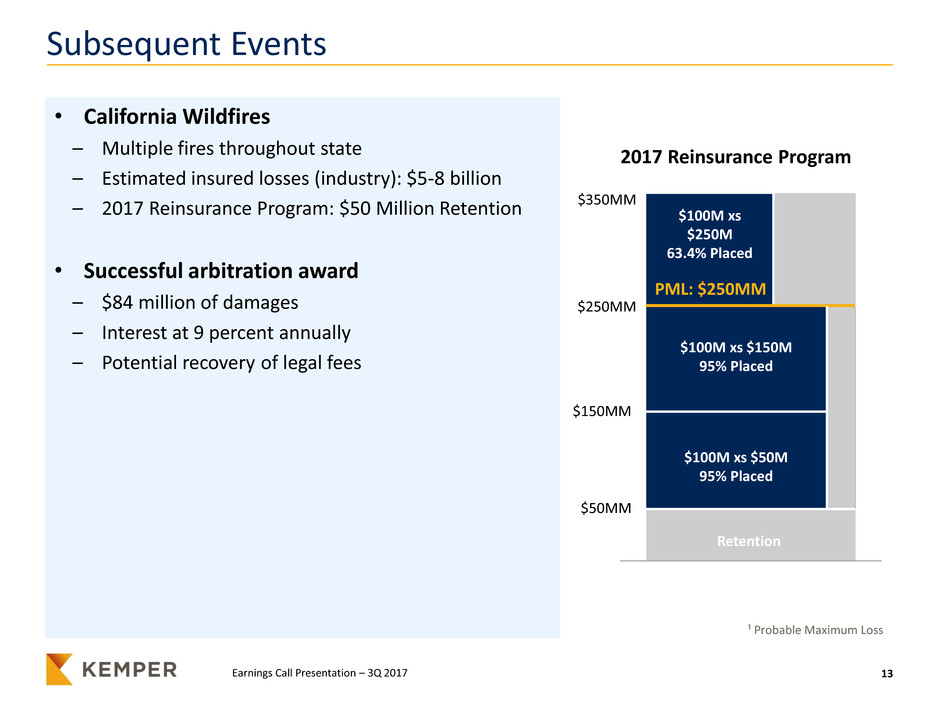

Subsequent Events

¹ Probable Maximum Loss

2017 Reinsurance Program

Retention

$150MM

$350MM

$50MM

Retention

$100M xs $150M

95% Placed

$100M xs $50M

95% Placed

$250MM

$100M xs

$250M

63.4% Placed

PML: $250MM

• California Wildfires

– Multiple fires throughout state

– Estimated insured losses (industry): $5-8 billion

– 2017 Reinsurance Program: $50 Million Retention

• Successful arbitration award

– $84 million of damages

– Interest at 9 percent annually

– Potential recovery of legal fees

Appendix

16 Earnings Call Presentation – 3Q 2017

Non-GAAP Financial Measures

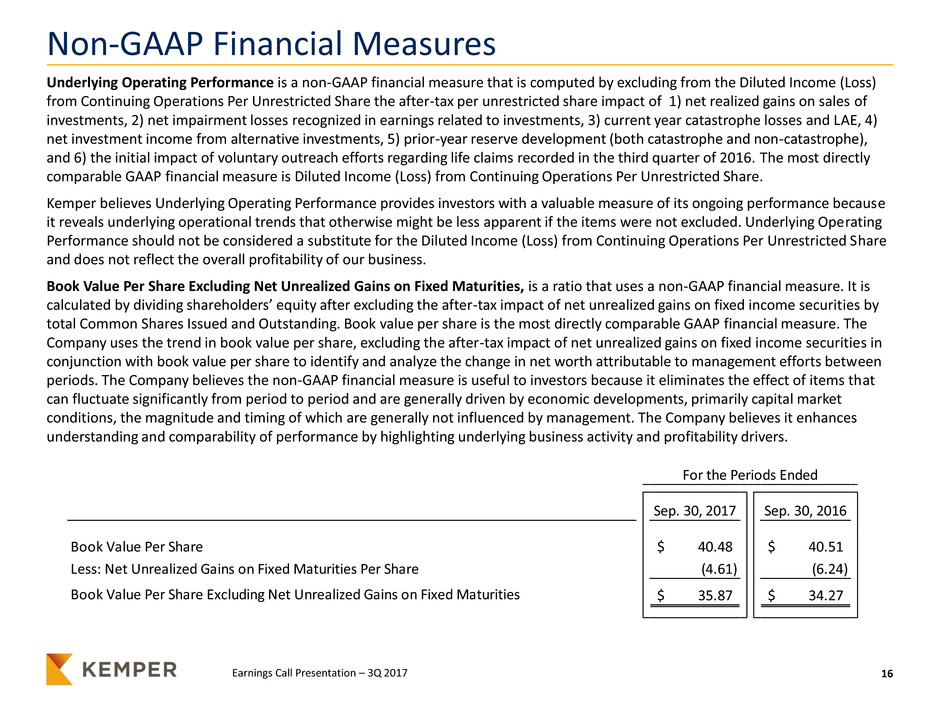

Underlying Operating Performance is a non-GAAP financial measure that is computed by excluding from the Diluted Income (Loss)

from Continuing Operations Per Unrestricted Share the after-tax per unrestricted share impact of 1) net realized gains on sales of

investments, 2) net impairment losses recognized in earnings related to investments, 3) current year catastrophe losses and LAE, 4)

net investment income from alternative investments, 5) prior-year reserve development (both catastrophe and non-catastrophe),

and 6) the initial impact of voluntary outreach efforts regarding life claims recorded in the third quarter of 2016. The most directly

comparable GAAP financial measure is Diluted Income (Loss) from Continuing Operations Per Unrestricted Share.

Kemper believes Underlying Operating Performance provides investors with a valuable measure of its ongoing performance because

it reveals underlying operational trends that otherwise might be less apparent if the items were not excluded. Underlying Operating

Performance should not be considered a substitute for the Diluted Income (Loss) from Continuing Operations Per Unrestricted Share

and does not reflect the overall profitability of our business.

Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities, is a ratio that uses a non-GAAP financial measure. It is

calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains on fixed income securities by

total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The

Company uses the trend in book value per share, excluding the after-tax impact of net unrealized gains on fixed income securities in

conjunction with book value per share to identify and analyze the change in net worth attributable to management efforts between

periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that

can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market

conditions, the magnitude and timing of which are generally not influenced by management. The Company believes it enhances

understanding and comparability of performance by highlighting underlying business activity and profitability drivers.

Sep. 30, 2017 Sep. 30, 2016

Book Value Per Share 40.48$ 40.51$

Less: Net Unrealized Gains on Fixed Maturities Per Share (4.61) (6.24)

Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities 35.87$ 34.27$

For the Periods Ended

17 Earnings Call Presentation – 3Q 2017

Non-GAAP Financial Measures

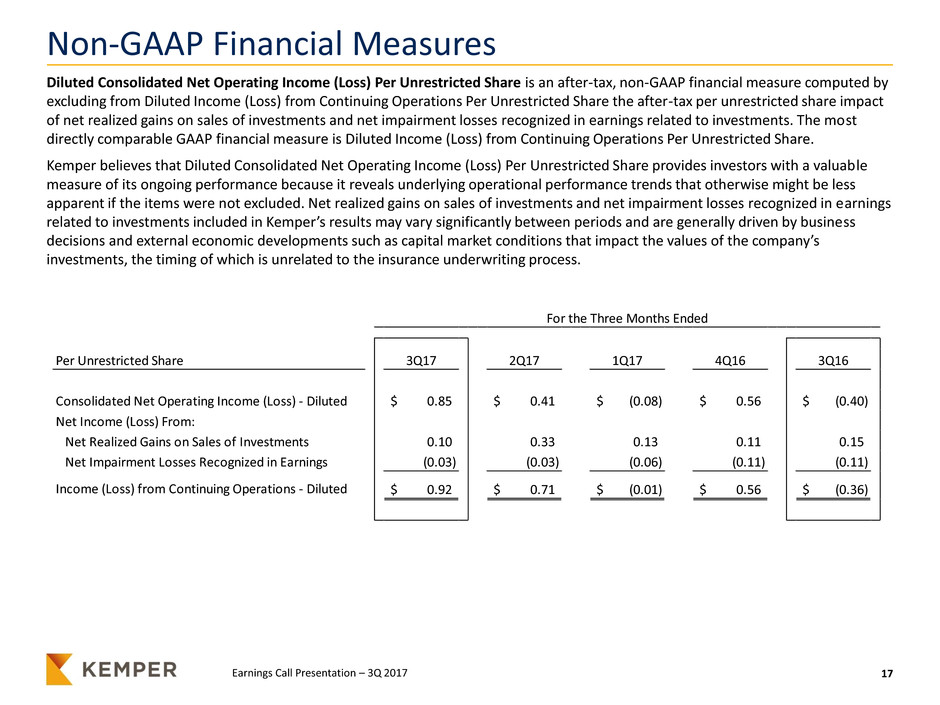

Diluted Consolidated Net Operating Income (Loss) Per Unrestricted Share is an after-tax, non-GAAP financial measure computed by

excluding from Diluted Income (Loss) from Continuing Operations Per Unrestricted Share the after-tax per unrestricted share impact

of net realized gains on sales of investments and net impairment losses recognized in earnings related to investments. The most

directly comparable GAAP financial measure is Diluted Income (Loss) from Continuing Operations Per Unrestricted Share.

Kemper believes that Diluted Consolidated Net Operating Income (Loss) Per Unrestricted Share provides investors with a valuable

measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less

apparent if the items were not excluded. Net realized gains on sales of investments and net impairment losses recognized in earnings

related to investments included in Kemper’s results may vary significantly between periods and are generally driven by business

decisions and external economic developments such as capital market conditions that impact the values of the company’s

investments, the timing of which is unrelated to the insurance underwriting process.

Per U es ricte Share 3Q17 2Q17 1Q17 4Q16 3Q16

C solidated Net Operating Income (Loss) - Diluted 0.85$ 0.41$ (0.08)$ 0.56$ (0.40)$

Net In ome (Loss) From:

Net Realized Gains on Sales of Investments 0.10 0.33 0.13 0.11 0.15

Net Impairment Losses Recognized in Earnings (0.03) (0.03) (0.06) (0.11) (0.11)

Income (Loss) from Continuing Operations - Diluted 0.92$ 0.71$ (0.01)$ 0.56$ (0.36)$

For the Three Months Ended

18 Earnings Call Presentation – 3Q 2017

Non-GAAP Financial Measures

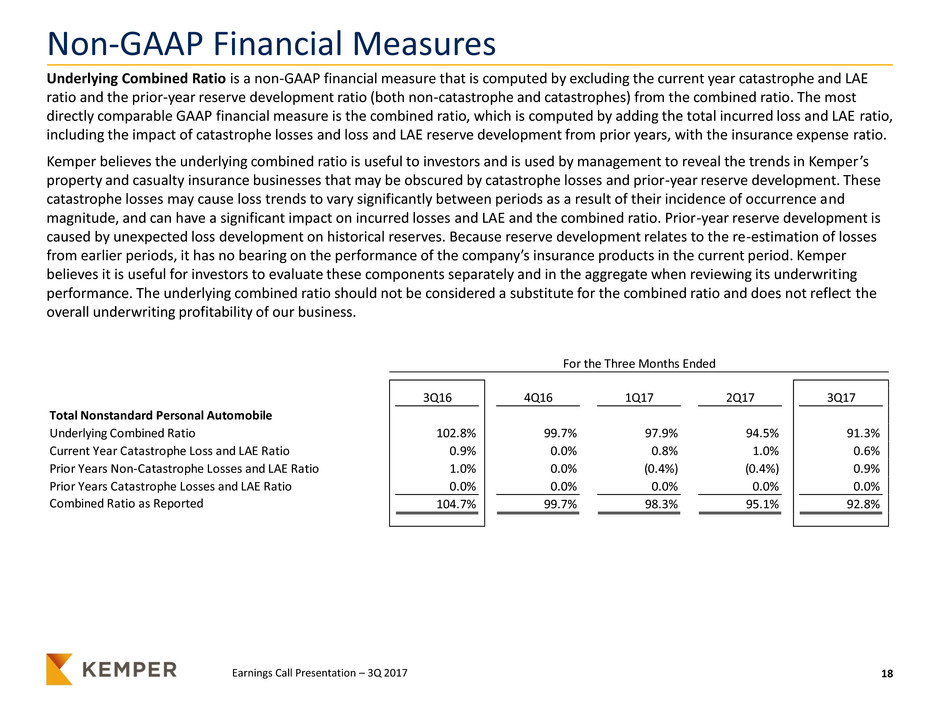

Underlying Combined Ratio is a non-GAAP financial measure that is computed by excluding the current year catastrophe and LAE

ratio and the prior-year reserve development ratio (both non-catastrophe and catastrophes) from the combined ratio. The most

directly comparable GAAP financial measure is the combined ratio, which is computed by adding the total incurred loss and LAE ratio,

including the impact of catastrophe losses and loss and LAE reserve development from prior years, with the insurance expense ratio.

Kemper believes the underlying combined ratio is useful to investors and is used by management to reveal the trends in Kemper ’s

property and casualty insurance businesses that may be obscured by catastrophe losses and prior-year reserve development. These

catastrophe losses may cause loss trends to vary significantly between periods as a result of their incidence of occurrence and

magnitude, and can have a significant impact on incurred losses and LAE and the combined ratio. Prior-year reserve development is

caused by unexpected loss development on historical reserves. Because reserve development relates to the re-estimation of losses

from earlier periods, it has no bearing on the performance of the company’s insurance products in the current period. Kemper

believes it is useful for investors to evaluate these components separately and in the aggregate when reviewing its underwriting

performance. The underlying combined ratio should not be considered a substitute for the combined ratio and does not reflect the

overall underwriting profitability of our business.

3Q16 4Q16 1Q17 2Q17 3Q17

U d rlying Combined Ratio 102.8% 99.7% 97.9% 94.5% 91.3%

Current Year Catastrophe Loss and LAE Ratio 0.9% 0.0% 0.8% 1.0% 0.6%

Prior Years Non-Catastrophe Losses and LAE Ratio 1.0% 0.0% (0.4%) (0.4%) 0.9%

Prior Years Catastrophe Losses and LAE Ratio 0.0% 0.0% 0.0% 0.0% 0.0%

Combined Ratio as Reported 104.7% 99.7% 98.3% 95.1% 92.8%

For the Three Months Ended

To al N s a dard Personal Automobile

19 Earnings Call Presentation – 3Q 2017

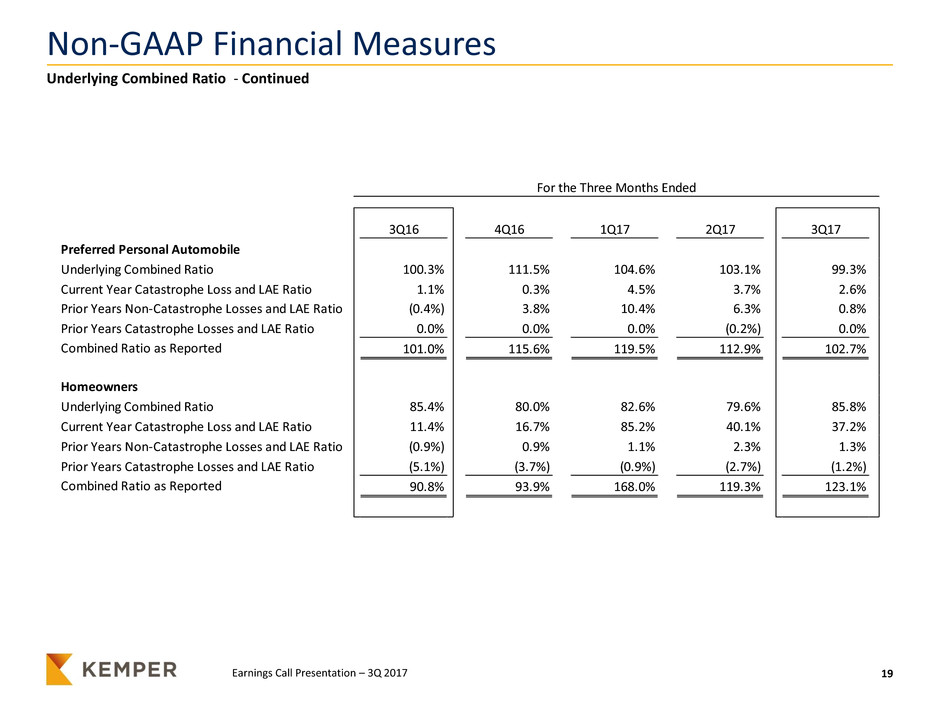

3Q16 4Q16 1Q17 2Q17 3Q17

Preferred Personal Automobile

Underlying Combined Ratio 100.3% 111.5% 104.6% 103.1% 99.3%

Current Year Catastrophe Loss and LAE Ratio 1.1% 0.3% 4.5% 3.7% 2.6%

Prior Years Non-Catastrophe Losses and LAE Ratio (0.4%) 3.8% 10.4% 6.3% 0.8%

Prior Years Catastrophe Losses and LAE Ratio 0.0% 0.0% 0.0% (0.2%) 0.0%

Combined Ratio as Reported 101.0% 115.6% 119.5% 112.9% 102.7%

Homeowners

Underlying Combined Ratio 85.4% 80.0% 82.6% 79.6% 85.8%

Current Year Catastrophe Loss and LAE Ratio 11.4% 16.7% 85.2% 40.1% 37.2%

Prior Years Non-Catastrophe Losses and LAE Ratio (0.9%) 0.9% 1.1% 2.3% 1.3%

Prior Years Catastrophe Losses and LAE Ratio (5.1%) (3.7%) (0.9%) (2.7%) (1.2%)

Combined Ratio as Reported 90.8% 93.9% 168.0% 119.3% 123.1%

For the Three Months Ended

Non-GAAP Financial Measures

Underlying Combined Ratio - Continued

20 Earnings Call Presentation – 3Q 2017

Non-GAAP Financial Measures

Normalized Earnings is an after-tax, non-GAAP financial measure that is most directly comparable to the GAAP financial measure of

Income from Continuing Operations. Normalized Earnings is calculated by 1) excluding the after-tax impact of net realized gains on

sales of investments, net impairment losses recognized in earnings related to investments and loss from early extinguishment of

debt, 2) normalizing catastrophe losses and LAE by removing the GAAP-reported amounts (including development) and including the

Company’s planned load for catastrophe losses and LAE, 3) excluding investment income in 2014 from one company that had sold

substantially all of its operations, 4) excluding an adjustment recorded in 2015 to correct deferred premium reserves on certain

limited pay life insurance policies and 5) excluding write-offs of long-lived assets in 2015 and 2014. Kemper believes Normalized

Earnings provides investors with a valuable measure of its ongoing performance because it reveals underlying operational trends that

otherwise might be less apparent if the items were not excluded or normalized.

21 Earnings Call Presentation – 3Q 2017

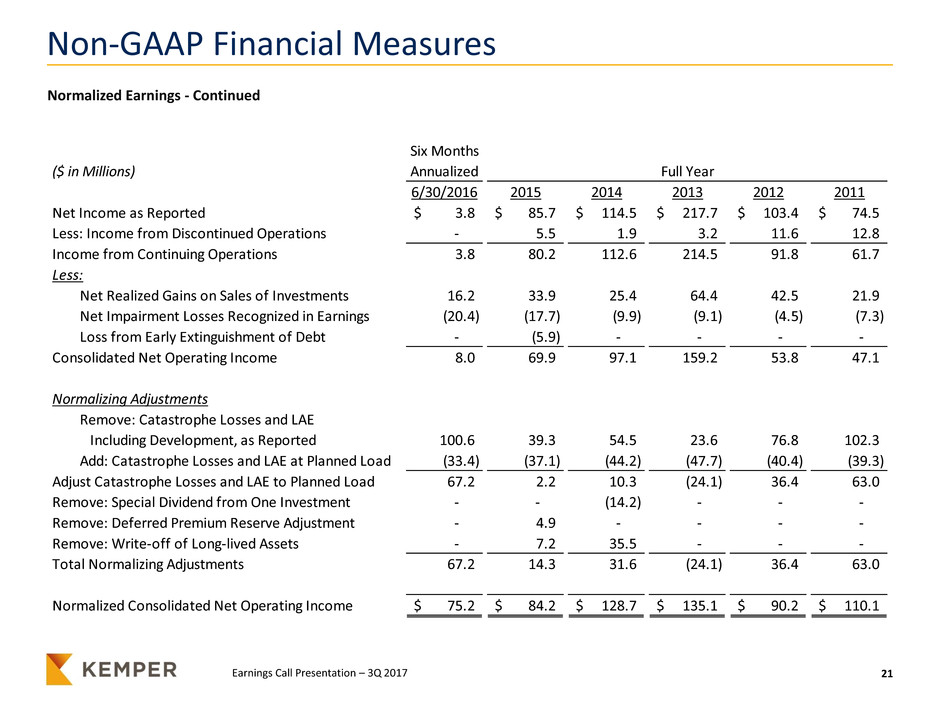

Non-GAAP Financial Measures

Normalized Earnings - Continued

Six Months

($ in Millions) Annualized

6/30/2016 2015 2014 2013 2012 2011

Net Income as Reported 3.8$ 85.7$ 114.5$ 217.7$ 103.4$ 74.5$

Less: Income from Discontinued Operations - 5.5 1.9 3.2 11.6 12.8

Income from Continuing Operations 3.8 80.2 112.6 214.5 91.8 61.7

Less:

Net Realized Gains on Sales of Investments 16.2 33.9 25.4 64.4 42.5 21.9

Net Impairment Losses Recognized in Earnings (20.4) (17.7) (9.9) (9.1) (4.5) (7.3)

Loss from Early Extinguishment of Debt - (5.9) - - - -

Consolidated Net Operating Income 8.0 69.9 97.1 159.2 53.8 47.1

Normalizing Adjustments

Remove: Catastrophe Losses and LAE

Including Development, as Reported 100.6 39.3 54.5 23.6 76.8 102.3

Add: Catastrophe Losses and LAE at Planned Load (33.4) (37.1) (44.2) (47.7) (40.4) (39.3)

Adjust Catastrophe Losses and LAE to Planned Load 67.2 2.2 10.3 (24.1) 36.4 63.0

Remove: Special Dividend from One Investment - - (14.2) - - -

Remove: Deferred Premium Reserve Adjustment - 4.9 - - - -

Remove: Write-off of Long-lived Assets - 7.2 35.5 - - -

Total Normalizing Adjustments 67.2 14.3 31.6 (24.1) 36.4 63.0

Normalized Consolidated Net Operating Income 75.2$ 84.2$ 128.7$ 135.1$ 90.2$ 110.1$

Full Year