Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CAPELLA EDUCATION CO | d483142dex991.htm |

| 8-K - 8-K - CAPELLA EDUCATION CO | d483142d8k.htm |

Exhibit 99.2

|

Creating a National Leader in Education Innovation

October 30, 2017

|

Forward Looking Statements

This communication contains certain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). Such statements

may be identified by the use of words such as “expect,” “estimate,” “assume,” “believe,” “anticipate,” “will,” “forecast,” “outlook,” “plan,”

“project,” or similar words and may include statements with respect to, among other things, the proposed merger of a wholly-owned subsidiary of Strayer with and into Capella, including the expected timing of completion of the merger; the

anticipated benefits of the merger, including estimated synergies; the combined company’s plans, objectives and expectations; future financial and operating results; and other statements that are not historical facts. The statements are based

on Strayer’s and Capella’s current expectations and are subject to a number of assumptions, uncertainties and risks. In connection with the safe-harbor provisions of the Reform Act, Strayer and Capella have identified important factors

that could cause Strayer’s or Capella’s actual results to differ materially from those expressed in or implied by such statements. The assumptions, uncertainties and risks include:

the risk that the merger may not be completed in a timely manner or at all due to the failure to obtain the approval of Strayer’s or Capella’s stockholders or the failure

to satisfy other conditions (including obtaining required regulatory and educational agency approvals) to completion of the merger;

the occurrence of any event,

change or other circumstance that could give rise to the termination of the merger agreement;

the outcome of any legal proceeding that may be instituted against

Strayer, Capella and others following the announcement of the merger; the amount of the costs, fees, expenses and charges related to the merger; the risk that the benefits of the merger, including expected synergies, may not be fully realized or may

take longer to realize than expected;

the risk that the merger may not advance the combined company’s business strategy and growth strategy;

the risk that the combined company may experience difficulty integrating Strayer’s and Capella’s employees or operations; the potential diversion of Strayer’s and

Capella’s management’s attention resulting from the proposed merger; and other risks and uncertainties identified in Strayer’s and Capella’s filings with the Securities and Exchange Commission.

Actual results may differ materially from those projected in the forward-looking statements. Strayer and Capella undertake no obligation to update or revise forward-looking

statements. 2

|

Additional Information and Where to Find It

Investors and security holders are urged to carefully review and consider each of Strayer’s and Capella’s public filings with the Securities and Exchange

Commission (the “SEC”), including but not limited to their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their

Quarterly Reports on Form 10-Q.

In connection with the proposed transaction, Strayer intends to file a registration

statement on Form S-4 with the SEC which will include a joint proxy statement of Strayer and Capella and a prospectus of Strayer, and each party will file other documents regarding the proposed transaction

with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF Strayer AND Capella ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. A definitive joint proxy statement/prospectus will be sent

to the stockholders of each party seeking the required shareholder approval. Investors and security holders will be able to obtain the registration statement and the joint proxy statement/prospectus free of charge from the SEC’s website or from

Strayer or Capella as described below. The contents of the websites referenced are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus.

STRAYER EDUCATION, INC.

2303 Dulles Station Blvd. Herndon, VA 20171 Attention: Investor

Relations 708.247.2507 investor.relations@strayereducation.com

CAPELLA EDUCATION COMPANY

Capella Tower

225 South Sixth Street, 9th Floor Minneapolis, MN 55402 Attention: Heide

Erickson 612.977.5172 investor.relations@capella.edu

3

|

Certain Information Regarding Participants

Strayer, Capella and their respective directors and executive officers may be deemed participants in the solicitation of proxies in connection with the proposed

transaction. You can find information about Strayer’s directors and executive officers in its definitive proxy statement for the 2017 Annual Meeting of Stockholders, which was filed with the SEC on March 16, 2017, and in other documents

filed with the SEC by Strayer and its directors and executive officers. You can find information about Capella’s directors and executive officers in its definitive proxy statement for the 2017 Annual Meeting of Stockholders, which was filed

with the SEC on March 23, 2017, and in other documents filed with the SEC by Capella and its directors and executive officers. Additional information regarding the interests of these directors and executive officers in the proposed transaction

will be included in the registration statement, joint proxy statement/prospectus or other documents filed with the SEC, if any, when they become available. You may obtain these documents (when they become available) free of charge at the SEC’s

web site at www.sec.gov and from Strayer or Capella as described above.

No Offer or Solicitations

This document shall not constitute an offer to sell or buy or the solicitation of an offer to buy or sell any securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933. 4

|

Today’s Participants

ROBERT SILBERMAN

Executive Chairman

KARL MCDONNELL

Chief Executive Officer

DANIEL JACKSON

Chief Financial Officer

KEVIN GILLIGAN

Chairman and Chief Executive Officer

STEVEN POLACEK

Chief Financial Officer

5

|

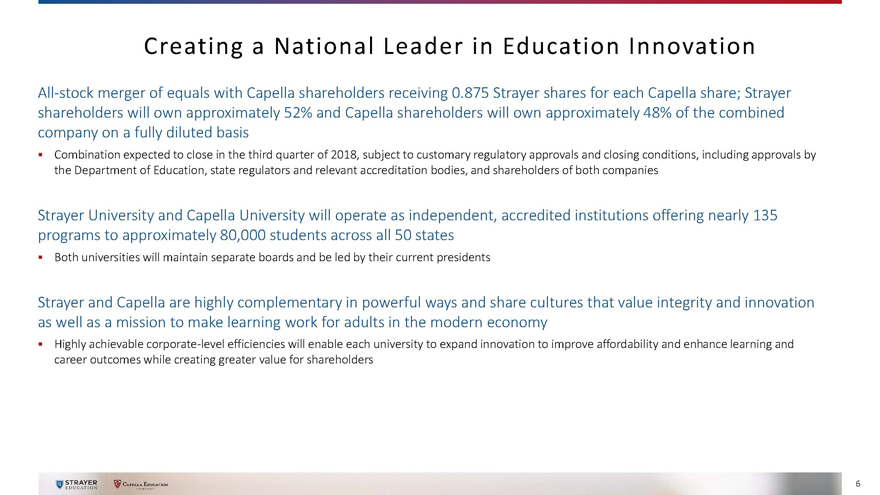

Creating a National Leader in Education Innovation

All-stock merger of equals with Capella shareholders receiving 0.875 Strayer shares for each Capella share; Strayer

shareholders will own approximately 52% and Capella shareholders will own approximately 48% of the combined company on a fully diluted basis

Combination expected

to close in the third quarter of 2018, subject to customary regulatory approvals and closing conditions, including approvals by the Department of Education, state regulators and relevant accreditation bodies, and shareholders of both companies

Strayer University and Capella University will operate as independent, accredited institutions offering nearly 135 programs to approximately 80,000 students across

all 50 states

Both universities will maintain separate boards and be led by their current presidents

Strayer and Capella are highly complementary in powerful ways and share cultures that value integrity and innovation as well as a mission to make learning work for adults in the

modern economy

Highly achievable corporate-level efficiencies will enable each university to expand innovation to improve affordability and enhance learning and

career outcomes while creating greater value for shareholders

6

|

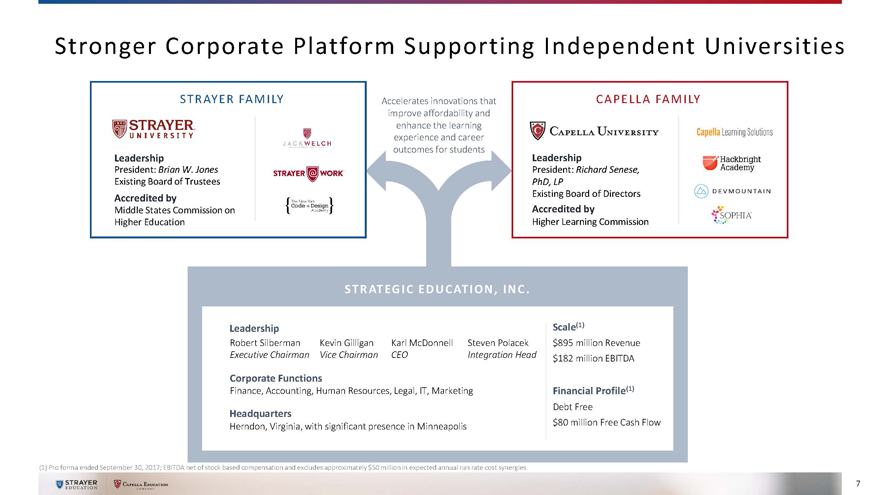

Stronger Corporate Platform Supporting Independent

Universities

STRAYER FAMILY

Leadership

President: Brian W. Jones

Existing Board of Trustees

Accredited by

Middle States Commission on Higher Education

Accelerates innovations that improve affordability and enhance the learning experience and career outcomes for students

CAPELLA FAMILY

Leadership

President: Richard Senese, PhD, LP

Existing Board of Directors

Accredited by

Higher Learning Commission

STRATEGIC EDUCATION, INC.

Leadership

Robert Silberman Kevin Gilligan Karl McDonnell Steven Polacek

Executive Chairman Vice Chairman

CEO Integration Head

Corporate Functions

Finance, Accounting, Human

Resources, Legal, IT, Marketing

Headquarters

Herndon, Virginia, with

significant presence in Minneapolis

Scale(1) $895 million Revenue $182 million EBITDA

Financial Profile(1)

Debt Free $80 million Free Cash Flow

(1) Pro forma ended September 30, 2017; EBITDA net of stock based compensation and excludes approximately $50 million in expected annual run rate cost synergies

7

|

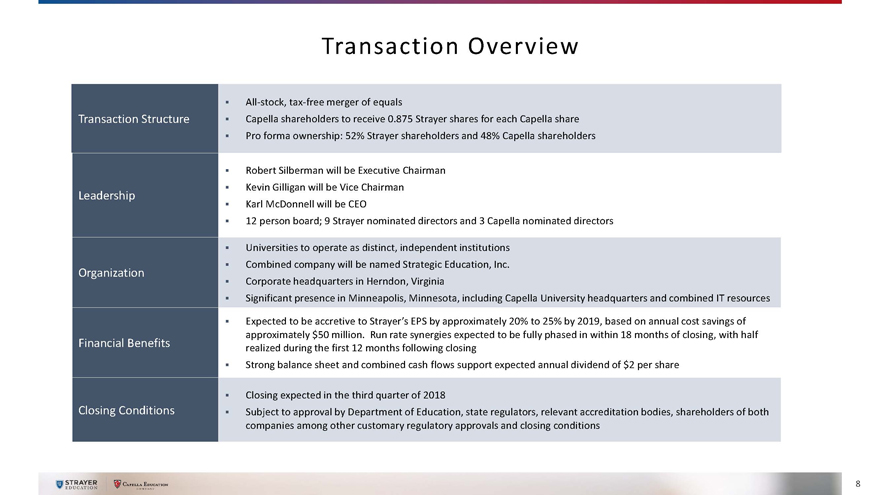

Transaction Overview

Transaction Structure

All-stock, tax-free merger of equals

Capella shareholders to receive 0.875 Strayer shares for each Capella share

Pro forma ownership: 52% Strayer shareholders and 48% Capella shareholders

Leadership

Robert Silberman will be Executive Chairman

Kevin Gilligan will be Vice

Chairman

Karl McDonnell will be CEO

12 person board; 9 Strayer nominated

directors and 3 Capella nominated directors

Organization

Universities to

operate as distinct, independent institutions

Combined company will be named Strategic Education, Inc.

Corporate headquarters in Herndon, Virginia

Significant presence in Minneapolis, Minnesota,

including Capella University headquarters and combined IT resources

Financial Benefits

Expected to be accretive to Strayer’s EPS by approximately 20% to 25% by 2019, based on annual cost savings of approximately $50 million. Run rate synergies expected to

be fully phased in within 18 months of closing, with half realized during the first 12 months following closing

Strong balance sheet and combined cash flows

support expected annual dividend of $2 per share

Closing Conditions

Closing

expected in the third quarter of 2018

Subject to approval by Department of Education, state regulators, relevant accreditation bodies, shareholders of both

companies among other customary regulatory approvals and closing conditions

8

|

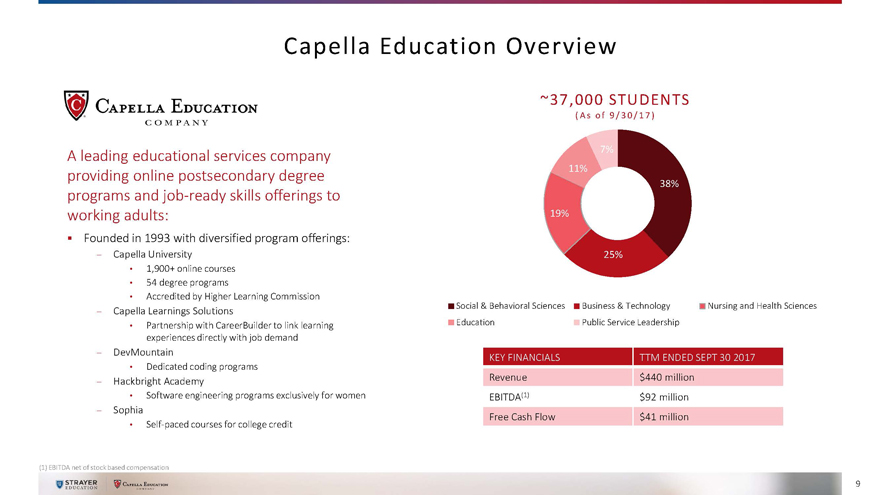

Capella Education Overview

A leading educational services company providing online postsecondary degree programs and job-ready skills offerings to working adults:

Founded in 1993 with diversified program offerings:

Capella University

1,900+ online courses

54 degree programs

Accredited by Higher Learning Commission

Capella Learnings Solutions

Partnership with CareerBuilder to link learning experiences directly with job demand

DevMountain

Dedicated coding programs

Hackbright Academy

Software engineering programs exclusively for women

Sophia

Self-paced courses for college credit

(1) EBITDA net of stock based compensation

~37,000 STUDENTS

( A s o f 9 / 3 0 / 1 7 )

7% 11% 19% 38% 25%

Social & Behavioral Sciences

Education

Business & Technology

Public Service Leadership

Nursing and Health Sciences

KEY FINANCIALS TTM ENDED SEPT 30 2017

Revenue $440 million

EBITDA(1) $92 million

Free Cash Flow $41 million

9

|

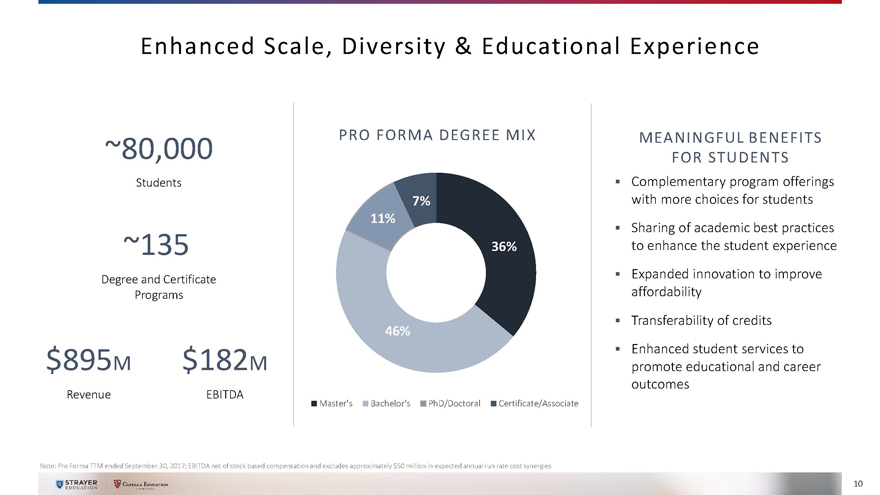

Enhanced Scale, Diversity & Educational

Experience

~80,000

Students

~135

Degree and Certificate Programs

$895M $182M

Revenue EBITDA

Note: Pro Forma TTM ended September 30, 2017; EBITDA net of stock based compensation and excludes approximately $50 million in expected annual run rate cost synergies

PRO FORMA DEGREE MIX

7% 11% 36% 46%

Master’s Bachelor’s PhD/Doctoral Certificate/Associate

MEANINGFUL BENEFITS FOR

STUDENTS

Complementary program offerings with more choices for students

Sharing of academic best practices to enhance the student experience

Expanded

innovation to improve affordability

Transferability of credits

Enhanced

student services to promote educational and career outcomes

10

|

A Compelling Platform for Students

11

|

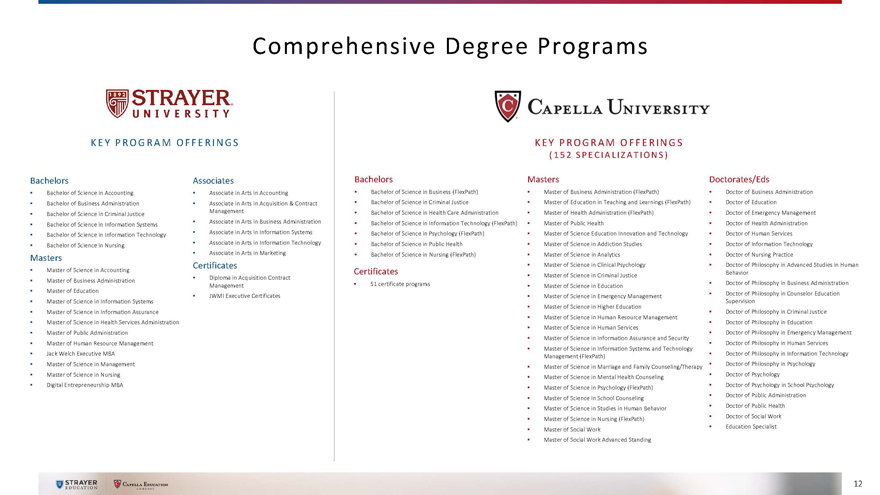

Comprehensive Degree Programs

KEY P ROGRAM OFFERIN GS Bachelors Associates

Bachelor of Science in Accounting Bachelor of

Business Administration Bachelor of Science in Criminal Justice Bachelor of Science in Information Systems Bachelor of Science in Information Technology Bachelor of Science in Nursing

Associate in Arts in Accounting

Associate in Arts in Acquisition & Contract

Management Associate in Arts in Business Administration Associate in Arts in Information Systems Associate in Arts in Information Technology Associate in Arts in Marketing

Masters

Certificates

Master of Science in Accounting Master of Business Administration Master of Education Master of Science in Information Systems Master of Science in Information Assurance Master of

Science in Health Services Administration Master of Public Administration Master of Human Resource Management Jack Welch Executive MBA

Master of Science in

Management Master of Science in Nursing Digital Entrepreneurship MBA

Diploma in Acquisition Contract Management JWMI Executive Certificates

KEY P ROGRAM OFFERIN GS

( 1 5 2 S P E C I A L I Z A T I O N S)

Bachelors

Bachelor of Science in Business (FlexPath) Bachelor of Science in Criminal Justice

Bachelor of Science in Health Care Administration Bachelor of Science in Information Technology (FlexPath) Bachelor of Science in Psychology (FlexPath) Bachelor of Science in Public Health Bachelor of Science in Nursing (FlexPath)

Certificates

51 certificate programs

Masters Doctorates/Eds

Master of Business Administration (FlexPath)

Master of Education in Teaching and Learnings (FlexPath) Master of Health Administration (FlexPath) Master of Public Health Master of Science Education Innovation and Technology

Master of Science in Addiction Studies Master of Science in Analytics Master of Science in Clinical Psychology Master of Science in Criminal Justice Master of Science in Education Master of Science in Emergency Management Master of Science in Higher

Education Master of Science in Human Resource Management Master of Science in Human Services Master of Science in Information Assurance and Security Master of Science in Information Systems and Technology Management (FlexPath) Master of Science in

Marriage and Family Counseling/Therapy Master of Science in Mental Health Counseling Master of Science in Psychology (FlexPath) Master of Science in School Counseling Master of Science in Studies in Human Behavior Master of Science in Nursing

(FlexPath) Master of Social Work Master of Social Work Advanced Standing

Doctor of Business Administration Doctor of Education Doctor of Emergency Management

Doctor of Health Administration Doctor of Human Services Doctor of Information Technology Doctor of Nursing Practice

Doctor of Philosophy in Advanced Studies in

Human Behavior Doctor of Philosophy in Business Administration Doctor of Philosophy in Counselor Education Supervision Doctor of Philosophy in Criminal Justice Doctor of Philosophy in Education Doctor of Philosophy in Emergency Management Doctor of

Philosophy in Human Services Doctor of Philosophy in Information Technology Doctor of Philosophy in Psychology Doctor of Psychology Doctor of Psychology in School Psychology Doctor of Public Administration Doctor of Public Health Doctor of Social

Work Education Specialist

12

|

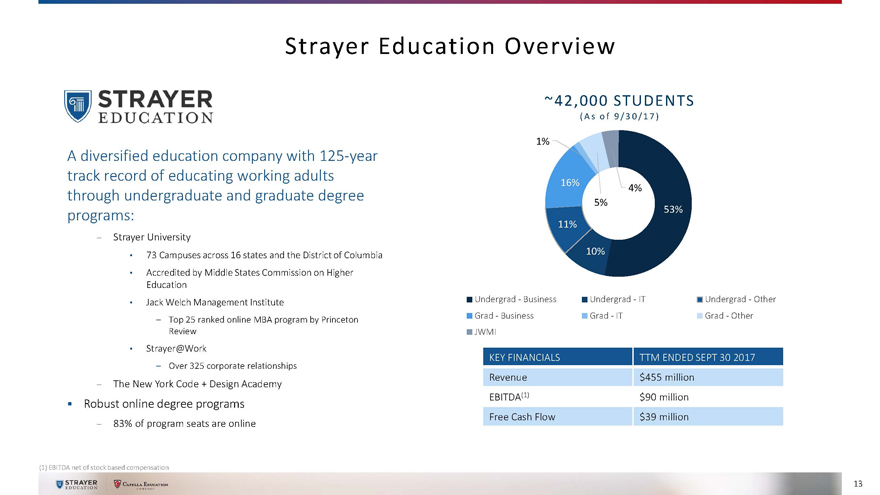

Strayer Education Overview

A diversified education company with 125-year track record of educating working adults through undergraduate and graduate degree programs:

Strayer University

73 Campuses across 16 states and the District of Columbia

Accredited by Middle States Commission on Higher Education

Jack Welch

Management Institute

Top 25 ranked online MBA program by Princeton Review

Strayer@Work

Over 325 corporate relationships

The New York Code + Design Academy

Robust online degree programs

83% of program seats are online

(1) EBITDA net of stock based compensation

~42,000 STUDENTS

( A s o f 9 / 3 0 / 1 7 )

1% 5% 4% 16% 11% 10% 53%

Undergrad—Business Grad—Business JWMI

Undergrad—IT Grad – IT

Undergrad—Other Grad – Other

KEY FINANCIALS TTM ENDED SEPT 30 2017

Revenue $455 million

EBITDA(1) $90 million

Free Cash Flow $39 million

13

|

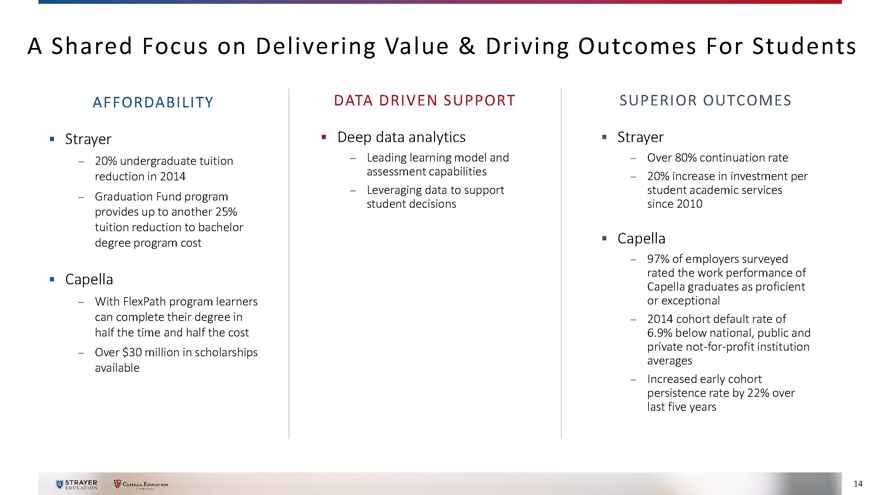

A Shared Focus on Delivering Value &

Driving Outcomes For Students

AFFORDABILITY

Strayer

20% undergraduate tuition reduction in 2014

Graduation Fund program provides up to another 25%

tuition reduction to bachelor degree program cost

Capella

With FlexPath

program learners can complete their degree in half the time and half the cost

Over $30 million in scholarships available

DATA DRIVEN SUPPORT

Deep data analytics

Leading learning model and assessment capabilities

Leveraging data to support student

decisions

SUPERIOR OUTCOMES

Strayer

Over 80% continuation rate

20% increase in investment per student academic services since 2010

Capella

97% of employers surveyed rated the work performance of Capella

graduates as proficient or exceptional

2014 cohort default rate of 6.9% below national, public and private not-for-profit institution averages

Increased early cohort persistence rate by 22% over last five years

14

|

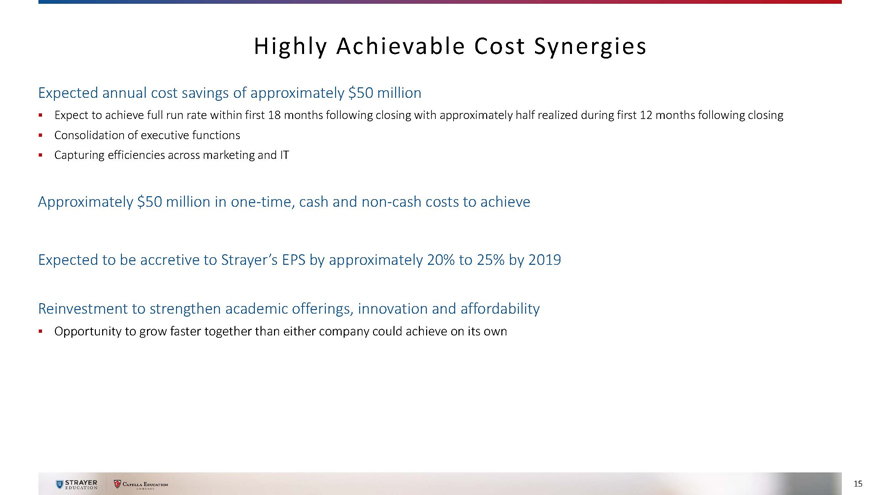

Highly Achievable Cost Synergies

Expected annual cost savings of approximately $50 million

Expect to achieve full run rate

within first 18 months following closing with approximately half realized during first 12 months following closing Consolidation of executive functions Capturing efficiencies across marketing and IT

Approximately $50 million in one-time, cash and non-cash costs to achieve

Expected to be accretive to Strayer’s EPS by approximately 20% to 25% by 2019

Reinvestment to strengthen academic offerings, innovation and affordability

Opportunity to grow faster together than either company could achieve on its own

15

|

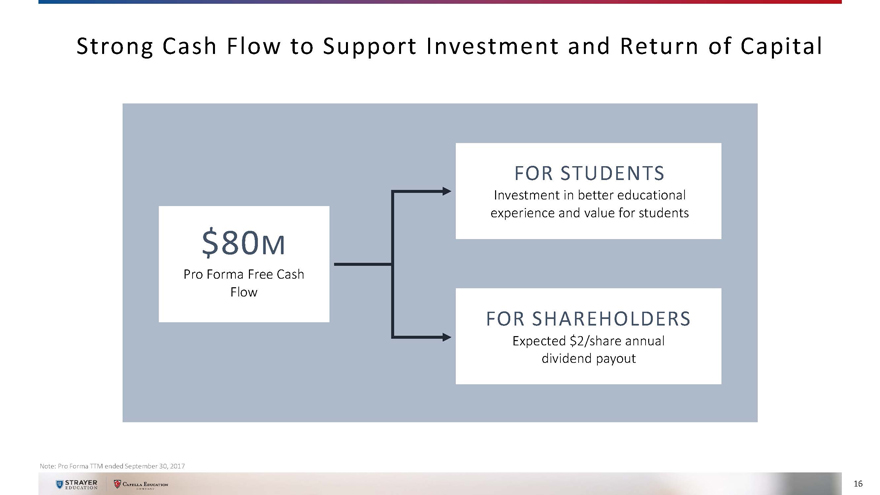

Strong Cash Flow to Support Investment and Return of

Capital

$80M

Pro Forma Free Cash Flow

FOR STUDENTS

Investment in better educational experience and value for students

FOR SHAREHOLDERS

Expected $2/share annual dividend payout

Note: Pro Forma TTM ended September 30, 2017

16

|

Creating a National Leader in Education Innovation

Two regionally accredited independent universities

Combined platform

facilitates accelerated investment in student experience and affordability

Highly achievable corporate cost synergies and strong cash flow drive shareholder value

creation 17

|

18

|

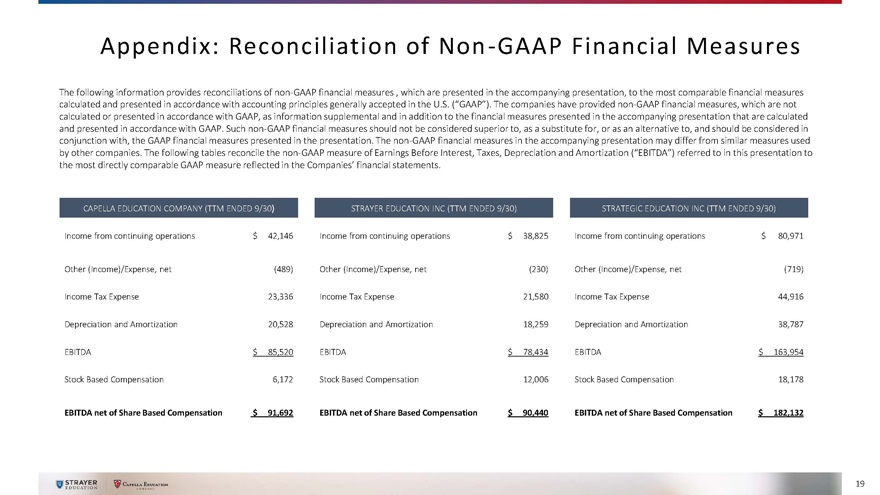

Appendix: Reconciliation of Non-GAAP Financial Measures

The following information provides reconciliations of

non-GAAP financial measures , which are presented in the accompanying presentation, to the most comparable financial measures calculated and presented in accordance with accounting principles generally

accepted in the U.S. (“GAAP”). The companies have provided non-GAAP financial measures, which are not calculated or presented in accordance with GAAP, as information supplemental and in addition to

the financial measures presented in the accompanying presentation that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a

substitute for, or as an alternative to, and should be considered in conjunction with, the GAAP financial measures presented in the presentation. The non-GAAP financial measures in the accompanying

presentation may differ from similar measures used by other companies. The following tables reconcile the non-GAAP measure of Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”)

referred to in this presentation to the most directly comparable GAAP measure reflected in the Companies’ financial statements.

CAPELLA EDUCATION COMPANY (TTM

ENDED 9/30) STRAYER EDUCATION INC (TTM ENDED 9/30) STRATEGIC EDUCATION INC (TTM ENDED 9/30)

Income from continuing operations $ 42,146

Income from continuing operations $ 38,825 Income from continuing operations $ 80,971

Other (Income)/Expense, net (489) Other (Income)/Expense, net (230) Other (Income)/Expense, net (719) Income Tax Expense 23,336 Income Tax Expense 21,580 Income Tax

Expense 44,916 Depreciation and Amortization 20,528 Depreciation and Amortization 18,259 Depreciation and Amortization 38,787 EBITDA $ 85,520 EBITDA $ 78,434 EBITDA $ 163,954 Stock

Based Compensation 6,172 Stock Based Compensation 12,006 Stock Based Compensation 18,178

EBITDA net of Share Based Compensation $ 91,692

EBITDA net of Share Based Compensation $ 90,440 EBITDA net of Share Based Compensation $ 182,132

19

|

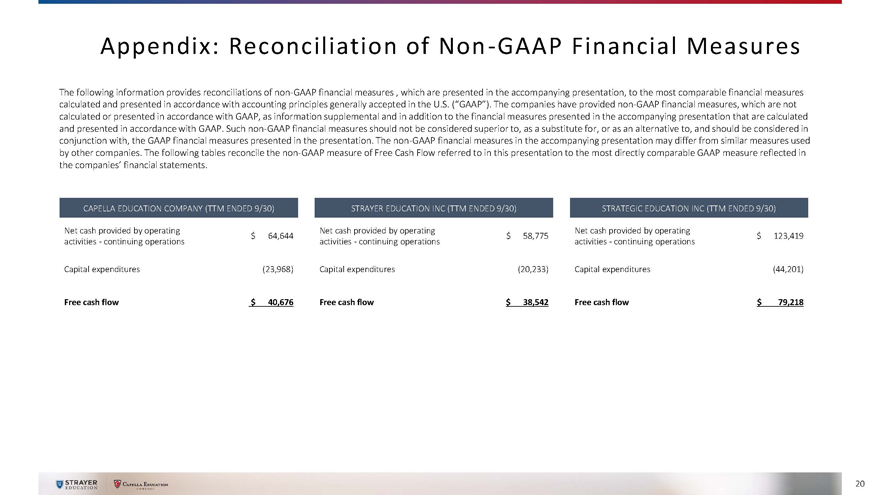

Appendix: Reconciliation of Non-GAAP Financial Measures

The following information provides reconciliations of

non-GAAP financial measures , which are presented in the accompanying presentation, to the most comparable financial measures calculated and presented in accordance with accounting principles generally

accepted in the U.S. (“GAAP”). The companies have provided non-GAAP financial measures, which are not calculated or presented in accordance with GAAP, as information supplemental and in addition to

the financial measures presented in the accompanying presentation that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a

substitute for, or as an alternative to, and should be considered in conjunction with, the GAAP financial measures presented in the presentation. The non-GAAP financial measures in the accompanying

presentation may differ from similar measures used by other companies. The following tables reconcile the non-GAAP measure of Free Cash Flow referred to in this presentation to the most directly comparable

GAAP measure reflected in the companies’ financial statements.

CAPELLA EDUCATION COMPANY (TTM ENDED 9/30) STRAYER EDUCATION INC (TTM ENDED 9/30) STRATEGIC

EDUCATION INC (TTM ENDED 9/30)

Net cash provided by operating Net cash provided by operating Net cash provided by operating

$ 64,644 $ 58,775

$ 123,419 activities—continuing operations activities—continuing operations activities—continuing operations

Capital expenditures (23,968) Capital expenditures (20,233) Capital expenditures (44,201)

Free

cash flow $ 40,676 Free cash flow $ 38,542 Free cash flow

$ 79,218

20