Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Vyant Bio, Inc. | exh992vivopharmproforma.htm |

| EX-23.1 - EXHIBIT 23.1 - Vyant Bio, Inc. | exh231connectconsent.htm |

| 8-K/A - 8-K/A - Vyant Bio, Inc. | a8-kvivopharmproforma.htm |

INDEPENDENT AUDITOR'S REPORT

Level 6,

488 Bourke Street,

Melbourne.

VIC 3000

Tel : +613 8080 1525

Web: www.connectaudit.com.au

TO THE MEMBERS OF VIVOPHARM PTY LTD & CONTROLLED ENTITIES

Opinion

We have audited the financial report of VivoPharm Pty Ltd & Controlled Entities (the Group), which

comprises the statement of financial position as at 30 June 2017, the statement of profit or loss and

other comprehensive income, the statement of cash flows and the statement of changes in equity for

the year then ended, and notes to the financial statements, including a summary of significant

accounting policies, and the directors ' declaration.

In our opinion, the accompanying financial report of the Group, is in accordance with the Corporations

Act 2001, including:

a) giving a true and fair view of the Group's financial position as at 30 June 2017, 30 June 2016 and 1

July 2015 and of its financial performance for the years ended 30 June 2017 and 30 June 2016; and

b) complying with International Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB).

Basis for opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States

of America (GAAS). Our responsibilities under those standards are further described in the Auditor's

Responsibilities for the Audit of the Financial Report section of our report. We are independent of the

Group in accordance with the auditor independence requirements of the Corporations Act 2001 and the

ethical requirements of the Accounting Professional and Ethical Standards Board's APES 110 Code of

Ethics for Professional Accountants (the Code) that are relevant to our audit of the financial report in

Australia. We have also fulfilled our other ethical responsibilities in accordance with the Code.

We confirm that the independence declaration required by the Corporations Act 2001, which has been

given to the directors of the Group, would be in the same terms if given to the directors as at the time

of this auditor's report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for

our opinion .

Responsibilities of the directors for the financial report

The directors of the Group are responsible for the preparation of the financial report that gives a true

and fair view in accordance with International Financial Reporting Standards. The directors'

responsibility also includes such internal control as the directors determine is necessary to enable the

preparation of a financial report that gives a true and fair view and is free from material misstatement,

whether due to fraud or error.

In preparing the financial report, the directors are responsible for assessing the Group's ability to

continue as a going concern, disclosing, as applicable, matters related to going concern and using the

going concern basis of accounting unless the directors either intend to liquidate the Group or to cease

operations, or have no realistic alternative but to do so.

CH AR TERED ACCO U NTANTS

Auditor 's responsibilities for the audit of the financial report

Our objectives are to obtain reasonable assurance about whether the financial report as a whole is free

from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes

our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit

conducted in accordance with the auditing standards generally accepted in the United States of America

(GAAS) will always detect a material misstatement when it exists. Misstatements can arise from fraud

or error and are considered material if, individually or in the aggregate, they could reasonably be

expected to influence the economic decisions of users taken on the basis of this financial report.

An audit involves performing procedures to obtain audit evidence about the amounts and the

disclosures in the financial statements. The procedures selected depend on the auditor's judgement,

including the assessment of the risks of material misstatement of the financial statements, whether due

to fraud or error. In making those risk assessments, the auditor considers internal control relevant to

the entity's preparation and fair presentation of the financial statements in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion

on the effectiveness of the entity's internal control. Accordingly, we express no such opinion. An audit

also includes evaluating the appropriateness of accounting policies used and the reasonableness of

significant accounting estimates made by management, as well as evaluating the overall presentation

of the financial statement.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a

reasonable basis for our audit opinion

George Georgiou FCA

ASIC Reg No 10310

27th October 2017

Melbourne Victoria

· V/VOPHARM PTY LTD

and controlled entities

ABN 97 106 101 615

V/VOPHARM PTY LTD

ABN 97 106 101 615

ANNUAL FINANCIAL STATEMENTS

FOR THE YEAR ENDED

30 JUNE 2017

- 1 -

V/VOPHARM PTY LTD

ABN 97 106 101 615

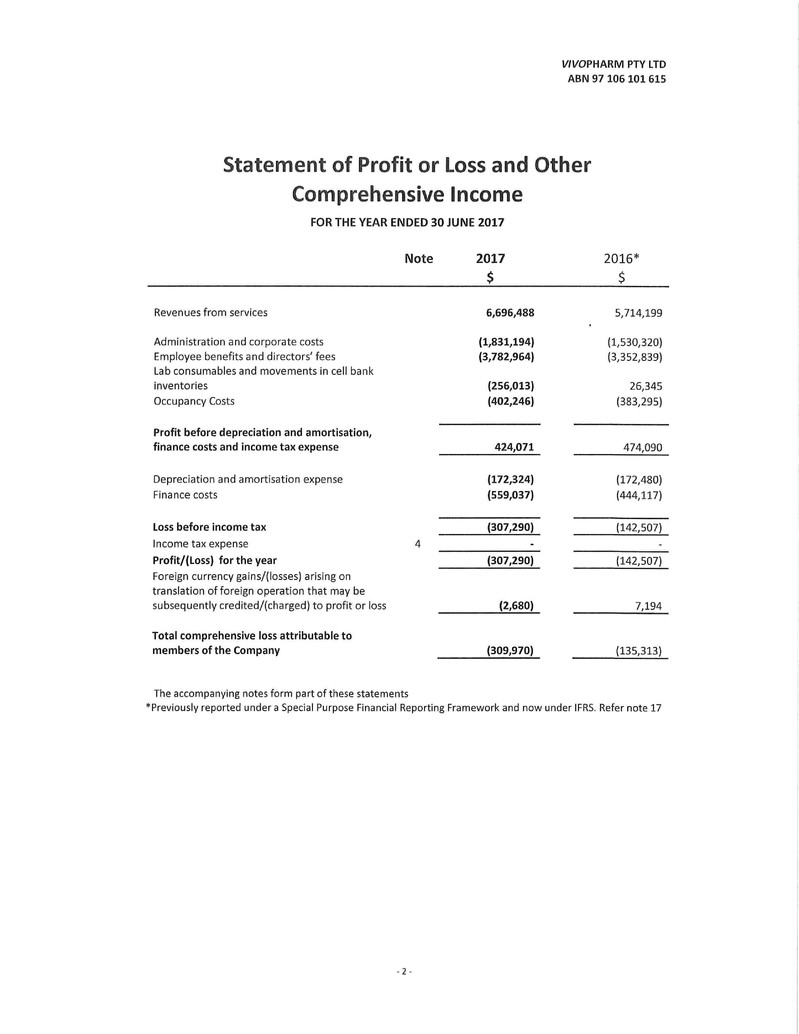

Statement of Profit or Loss and Other

Comprehensive Income

FOR THE YEAR ENDED 30 JUNE 2017

Revenues from services

Administration and corporate costs

Employee benefits and directors' fees

Lab consumables and movements in cell bank

inventories

Occupancy Costs

Profit before depreciation and amortisation,

finance costs and income tax expense

Depreciation and amortisation expense

Finance costs

Loss before income tax

Income tax expense

Profit/{Loss) for the year

Foreign currency gains/(losses) arising on

translation of foreign operation that may be

subsequently credited/(charged) to profit or loss

Total comprehensive loss attributable to

members of the Company

Note

4

The accompanying notes form part of these statements

2017

$

6,696,488

{1,831,194)

(3,782,964)

{256,013)

{402,246)

424,071

{172,324)

{559,037)

{307,290)

(307,290)

{2,680)

(309,970)

2016*

$

5,714,199

(1,530,320)

(3,352,839)

26,345

(383,295)

474,090

(172,480)

(444,117)

(142,507)

(142,507)

7,194

(135,313)

* Previously reported under a Special Purpose Financial Reporting Framework and now under IFRS. Refer note 17

-2 -

V/VOPHARM PTY LTD

ABN 97 106 101 615

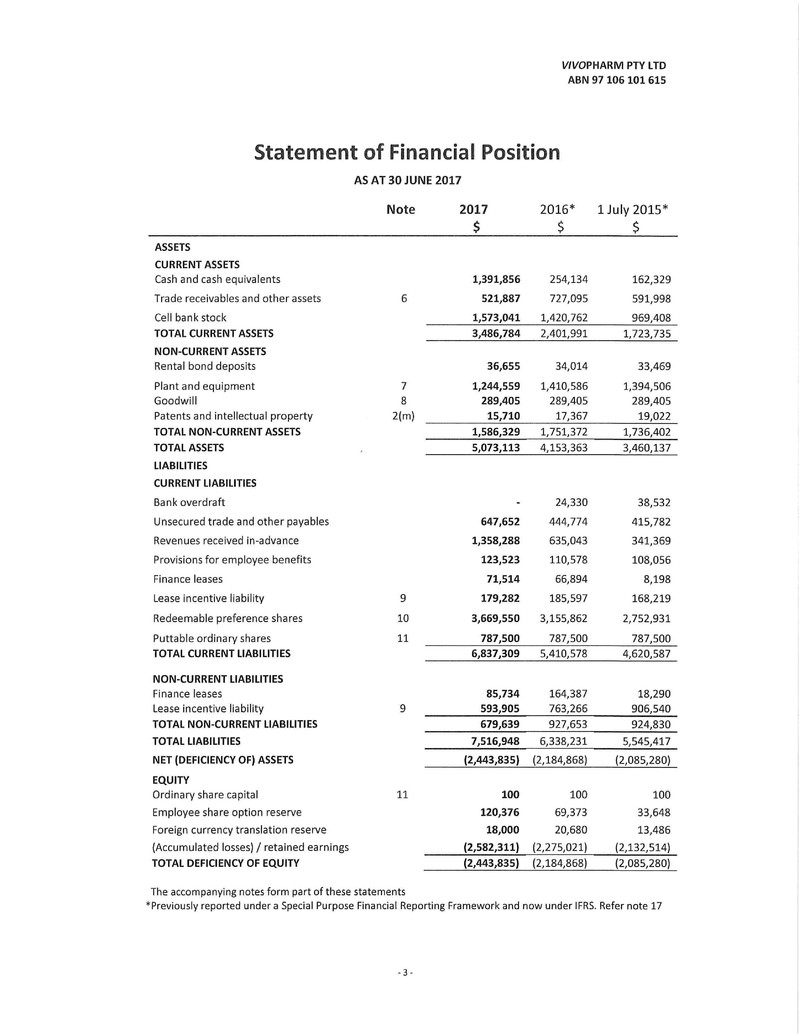

Statement of Financial Position

AS AT 30 JUNE 2017

Note 2017 2016* 1 July 2015*

$ $ $

ASSETS

CURRENT ASSETS

Cash and cash equivalents 1,391,856 254,134 162,329

Trade receivables and other assets 6 521,887 727,095 591,998

Cell bank stock 1,573,041 1,420,762 969,408

TOTAL CURRENT ASSETS 3,486,784 2,401,991 1,723,735

NON-CURRENT ASSETS

Rental bond deposits 36,655 34,014 33,469

Plant and equipment 7 1,244,559 1,410,586 1,394,506

Goodwill 8 289,405 289,405 289,405

Patents and intellectual property 2(m) 15,710 17,367 19,022

TOTAL NON-CURRENT ASSETS 1,586,329 1,751,372 1,736,402

TOTAL ASSETS 5,073,113 4,153,363 3,460,137

LIABILITIES

CURRENT LIABILITIES

Bank overdraft 24,330 38,532

Unsecured trade and other payables 647,652 444,774 415,782

Revenues received in-advance 1,358,288 635,043 341,369

Provisions for employee benefits 123,523 110,578 108,056

Finance leases 71,514 66,894 8,198

Lease incentive liability 9 179,282 185,597 168,219

Redeemable preference shares 10 3,669,550 3,155,862 2,752,931

Puttable ordinary shares 11 787,500 787,500 787,500

TOTAL CURRENT LIABILITIES 6,837,309 5,410,578 4,620,587

NON-CURRENT LIABILITIES

Finance leases 85,734 164,387 18,290

Lease incentive liability 9 593,905 763,266 906,540

TOTAL NON-CURRENT LIABILITIES 679,639 927,653 924,830

TOTAL LIABILITIES 7,516,948 6,338,231 5,545,417

NET (DEFICIENCY OF) ASSETS (2,443,835) (2,184,868) (2,085,280)

EQUITY

Ordinary share capital 11 100 100 100

Employee share option reserve 120,376 69,373 33,648

Foreign currency translation reserve 18,000 20,680 13,486

(Accumulated losses)/ retained earnings (2,582,311) (2,275,021) (2,132,514)

TOTAL DEFICIENCY OF EQUITY (2,443,835) (2,184,868) (2,085,280)

The accompanying notes form part of these statements

*Previously reported under a Special Purpose Financial Reporting Framework and now under IFRS. Refer note 17

- 3 -

V/VOPHARM PTY LTD

ABN 97 106 101 615

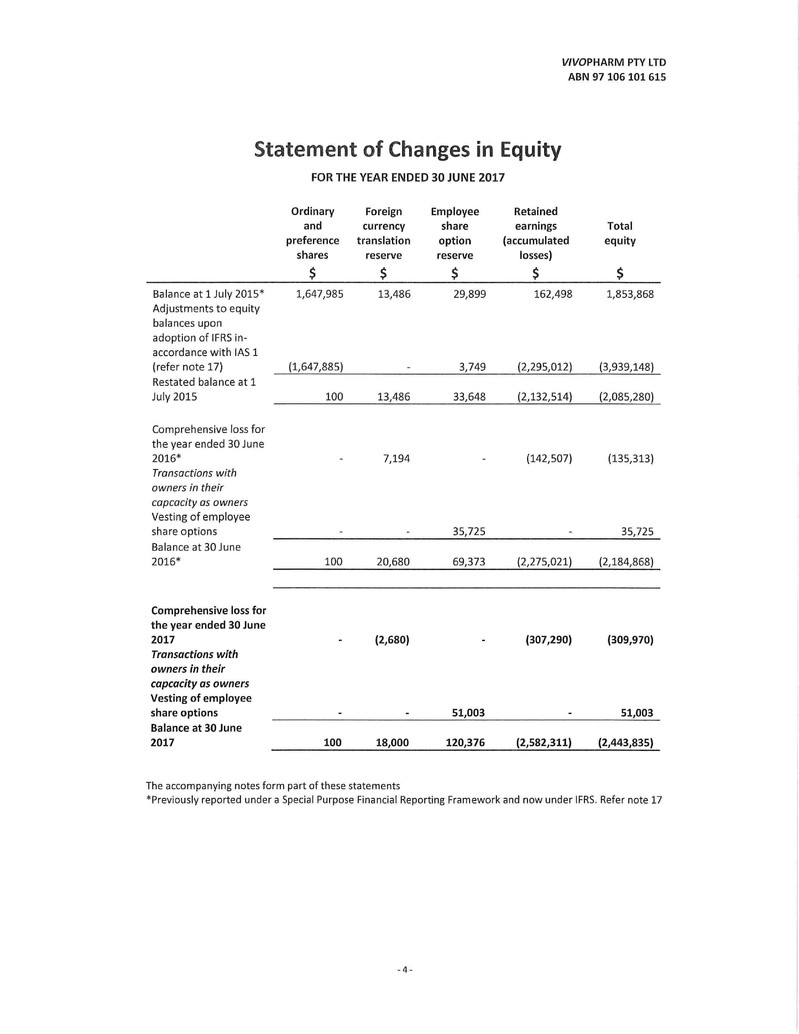

Statement of Changes in Equity

FOR THE YEAR ENDED 30 JUNE 2017

Ordinary Foreign Employee Retained

and currency share earnings Total

preference translation option (accumulated equity

shares reserve reserve losses)

$ $ $ $ $

Balance at 1 July 2015* 1,647,985 13,486 29,899 162,498 1,853,868

Adjustments to equity

balances upon

adoption of IFRS in-

accordance with IAS 1

(refer note 17) (1,647,885) 3,749 (2,295,012) (3,939,148)

Restated ba la nee at 1

July 2015 100 13,486 33,648 (2,132,514) (2,085,280)

Comprehensive loss for

the year ended 30 June

2016* 7,194 (142,507) (135,313)

Transactions with

owners in their

capcacity as owners

Vesting of employee

share options 35,725 35,725

Balance at 30 June

2016* 100 20,680 69,373 (2,275,021) (2,184,868)

Comprehensive loss for

the year ended 30 June

2017 (2,680) (307,290) (309,970)

Transactions with

owners in their

capcacity as owners

Vesting of employee

share options 51,003 51,003

Balance at 30 June

2017 100 18,000 120,376 (2,582,311) (2,443,835)

The accompanying notes form part of these statements

*Previously reported under a Special Purpose Financial Reporting Framework and now under IFRS. Refer note 17

- 4 -

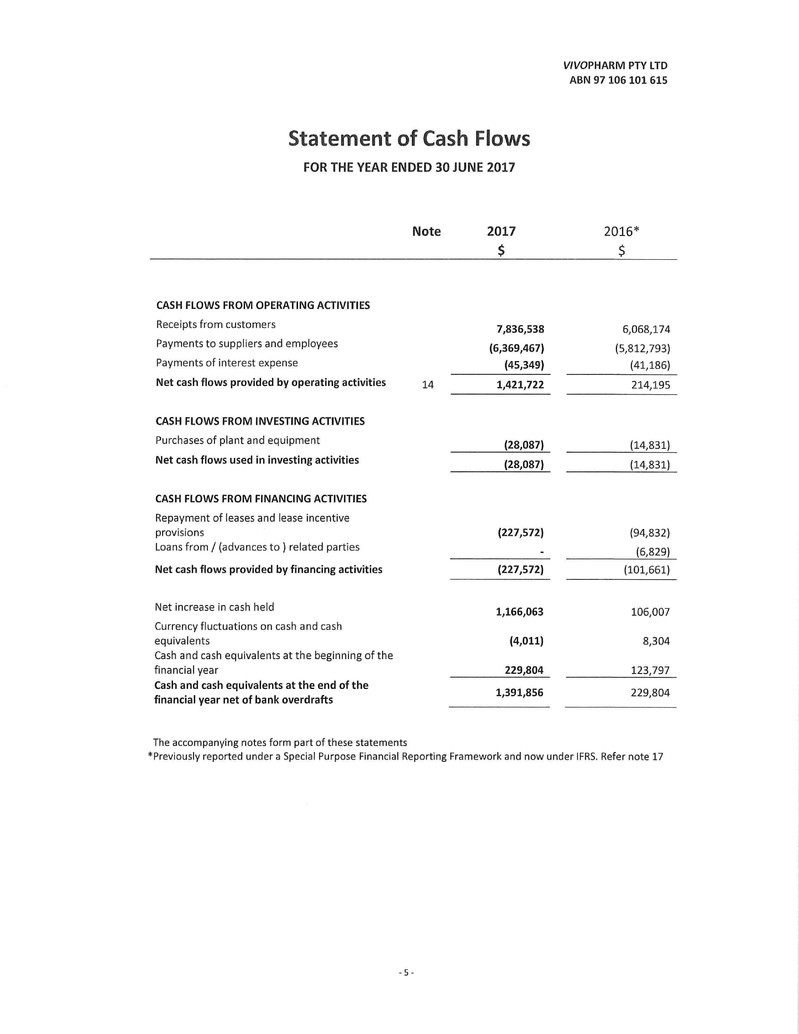

Statement of Cash Flows

FOR THE YEAR ENDED 30 JUNE 2017

CASH FLOWS FROM OPERATING ACTIVITIES

Receipts from customers

Payments to suppliers and employees

Payments of interest expense

Note

Net cash flows provided by operating activities 14

CASH FLOWS FROM INVESTING ACTIVITIES

Purchases of plant and equipment

Net cash flows used in investing activities

CASH FLOWS FROM FINANCING ACTIVITIES

Repayment of leases and lease incentive

provisions

Loans from/ (advances to) related parties

Net cash flows provided by financing activities

Net increase in cash held

Currency fluctuations on cash and cash

equivalents

Cash and cash equivalents at the beginning of the

financial year

Cash and cash equivalents at the end of the

financial year net of bank overdrafts

The accompanying notes form part of these statements

2017

$

7,836,538

{6,369,467)

(45,349)

1,421,722

{28,087)

(28,087)

{227,572)

(227,572)

1,166,063

{4,011)

229,804

1,391,856

V/VOPHARM PTY LTD

ABN 97 106 101 615

2016*

$

6,068,174

(5,812,793)

(41,186)

214,195

(14,831)

(14,831)

(94,832)

(6,829)

(101,661)

106,007

8,304

123,797

229,804

*Previously reported under a Special Purpose Financial Reporting Framework and now under IFRS. Refer note 17

- 5 -

Notes to the financial statements

V/VOPHARM PTY LTD

ABN 97 106 101 615

Throughout these notes to the financial statements, the application of an asterix (*) means that the results are

previously reported under a Special Purpose Financial Reporting Framework, as discussed in note 17.

1. CORPORATE INFORMATION

These are the financial statements of vivoPharm Pty Ltd (the company) and its 100% owned subsidiaries, including

RDDT, a vivoPharm Company Pty Ltd (incorporated and domiciled in Victoria, Australia), vivoPharm Europe Limited

(incorporated and domiciled in Munich, Germany) and vivoPharm LLC (incorporated in Delaware and domiciled in

Hummelstown, Pennsylvania, USA) (together, the group) . Unless otherwise stated, all amounts are presented in

$AUD. These financial statements were authorised for issue by the directors on 18'h October 2017.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of accounting

The directors have prepared these financial statements in compliance with the International Financial Reporting

Standards (IFRS) as issued by the International Accounting Standards Board ('IASB') .

This is the first time that these financial statements have been applied under IFRS. The directors have applied a

transition date on the statement of financial position effective 30 June 2015. All adjustments applied to this

transition date statement of financial position are discussed and set out in note 17, applying the accounting policies

set out below.

These financial statements, except for the cash flow information, have been prepared on an accruals basis and are

based on historical costs unless otherwise stated in the notes. The amounts presented in the financial statements

have been rounded to the nearest dollar.

{b) Principles of Consolidation

These consolidated financial statements comprise the financial statements of the company and its controlled

entities throughout reporting period . The group controls an entity when it is exposed to, or has rights to, variable

returns from its involvement with the entity and has the ability to affect those returns through its power to direct

the activities of the entity.

The financial statements of the controlled entities used in the preparation of the consolidated financial statements

are prepared for the same reporting date as the company. Consistent accounting policies are applied to like

transactions and events in similar circumstances.

All intra-group balances, income and expenses and unrealised gains and losses resulting from intra-group

transactions and dividends are eliminated in full.

- 6 -

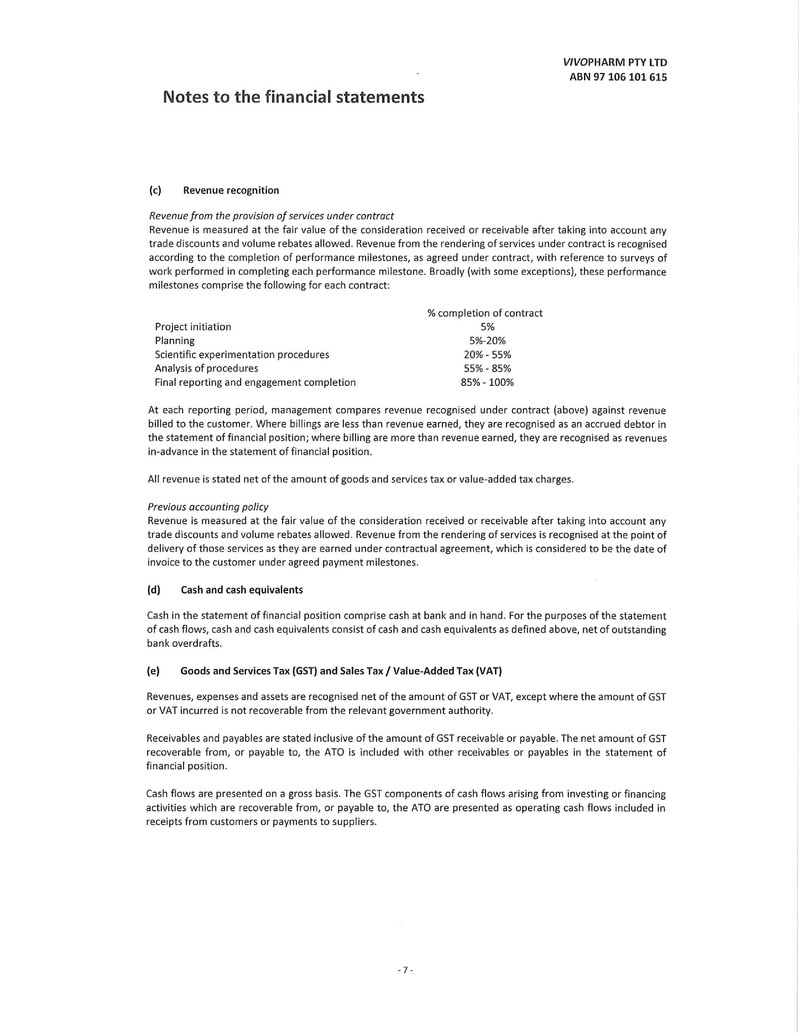

Notes to the financial statements

(c) Revenue recognition

Revenue from the provision of services under contract

V/VOPHARM PTY LTD

ABN 97 106 101 615

Revenue is measured at the fair value of the consideration received or receivable after taking into account any

trade discounts and volume rebates allowed. Revenue from the rendering of services under contract is recognised

according to the completion of performance milestones, as agreed under contract, with reference to surveys of

work performed in completing each performance milestone. Broadly (with some exceptions), these performance

milestones comprise the following for each contract:

Project initiation

Planning

Scientific experimentation procedures

Analysis of procedures

Final reporting and engagement completion

% completion of contract

5%

5%-20%

20%- 55%

55%- 85%

85%-100%

At each reporting period, management compares revenue recognised under contract (above) against revenue

billed to the customer. Where billings are less than revenue earned, they are recognised as an accrued debtor in

the statement of financial position; where billing are more than revenue earned, they are recognised as revenues

in-advance in the statement of financial position.

All revenue is stated net of the amount of goods and services tax or value-added tax charges.

Previous accounting policy

Revenue is measured at the fair value of the consideration received or receivable after taking into account any

trade discounts and volume rebates allowed. Revenue from the rendering of services is recognised at the point of

delivery of those services as they are earned under contractual agreement, which is considered to be the date of

invoice to the customer under agreed payment milestones.

(d) Cash and cash equivalents

Cash in the statement of financial position comprise cash at bank and in hand . For the purposes of the statement

of cash flows, cash and cash equivalents consist of cash and cash equivalents as defined above, net of outstanding

bank overdrafts.

(e) Goods and Services Tax (GST) and Sales Tax/ Value-Added Tax (VAT)

Revenues, expenses and assets are recognised net of the amount of GST or VAT, except where the amount of GST

or VAT incurred is not recoverable from the relevant government authority.

Receivables and payables are stated inclusive of the amount of GST receivable or payable. The net amount of GST

recoverable from, or payable to, the ATO is included with other receivables or payables in the statement of

financial position .

Cash flows are presented on a gross basis. The GST components of cash flows arising from investing or financing

activities which are recoverable from, or payable to, the ATO are presented as operating cash flows included in

receipts from customers or payments to suppliers.

- 7 -

Notes to the financial statements

(f) Cell Bank Stock

V/VOPHARM PTY LTD

ABN 97 106 101 615

Cell bank stock is held at the lower of cost or net realisable value . The cost of cell bank stock is determined based

upon estimations of the total cost of generating the cell bank line up until the point that is ready and available to

be ensembled into the models which are the base for delivering services to customers, and includes an estimation

for accrued labour.

(g) Trade and other payables

Trade payables and other payables are carried at amortised cost and represent liabilities for goods and services

provided to the group prior to the end of the financial year that are unpaid and arise when the group becomes

obliged to make future payments in respect of the purchase of these goods and services.

(h) Trade and other receivables

Trade and other receivables include amounts due from customers for goods sold and services performed in the

ordinary course of business. Receivables expected to be collected within 12 months of the end of the reporting

period are classified as current assets. All other receivables are classified as non-current assets.

Trade and other receivables are initially recognised at fair value and subsequently measured at amortised cost

using the effective interest method, less any provision for impairment.

(i) Financial Instruments

Financial assets and financial liabilities are recognised when the entity becomes a party to the contractual

provisions of the instrument. For financial assets, this is equivalent to the date that the group commits itself to

either purchase or sell the asset (ie trade date accounting is adopted) .

Classification and subsequent measurement

Financial instruments are subsequently measured at amortised cost using the effective interest method, or cost.

Amortised cost is calculated as the amount at which the financial asset or financial liability is measured at initial

recognition less principal repayments and any reduction for impairment, and adjusted for any cumulative

amortisation of the difference between that initial amount and the maturity amount calculated using the

effective interest method .

The effective interest method is used to allocate interest income or interest expense over the relevant period

and is equivalent to the rate that exactly discounts estimated future cash payments or receipts (including fees,

transaction costs and other premiums or discounts) through the expected life (or when this cannot be reliably

predicted, the contractual term) of the financial instrument to the net carrying amount of the financial asset or

financial liability. Revisions to expected future net cash flows will necessitate an adjustment to the carrying

amount with a consequential recognition of an income or expense item in profit or loss.

Redeemable preference shares

Redeemable preference shares and puttable ordinary shares, which feature an obligation to repay the shareholder

cash consideration for the original share investment, including any accrued interest or other fixed entitlements of

those shares are recognised as financial liabilities in the statement of financial position .

Previous accounting policy far redeemable preference shares and puttab/e ordinary shares

When a financial liability, including redeemable preference shares and puttable ordinary shares, feature an equity

conversion feature, upon initial recognition it is measured at cost and accounted for as equity in the statement of

financial position . Subsequent to initial recognition, this instrument is carried at cost. When such a liability is

redeemed for cash consideration, the difference between the cash paid for the redemption of the liability and its

historical cost is adjusted for in the profit and loss. When such a liability is converted into ordinary shares, the

-8-

Notes to the financial statements

V/VOPHARM PTY LTD

ABN 97 106 101 615

difference between the fair value of the shares granted and issued and its historical cost is also adjusted in the

profit and loss.

(j) Plant and Equipment

Each class of plant and equipment is carried at cost less any accumulated depreciation and impairment losses.

The carrying amount of plant and equipment is reviewed annually by directors to ensure it is not in excess of the

recoverable amount from these assets. The recoverable amount is assessed on the basis of the expected net cash

flows that will be received from the asset's employment and subsequent disposal. The expected net cash flows

have been discounted to their present values in determining recoverable amounts.

The cost of fixed assets constructed within the group includes the cost of materials, direct labour, borrowing costs

and an appropriate proportion of fixed and variable overheads.

Depreciation

The depreciable amount of all fixed assets including capitalised lease assets is depreciated on a diminishing value

basis over the asset's useful life to the group commencing from the time the asset is held ready for use.

Leasehold improvements are depreciated over the shorter of either the unexpired period of the lease or the

estimated useful lives of the improvements.

The depreciation rates used for each class of assets were between 10% and 30%. The assets' residual values and

useful lives are reviewed, and adjusted if appropriate, at the end of each reporting period . Gains and losses on

disposal are determined by comparing proceeds with the carrying amount. These gains and losses are included in

the Statement of Profit or Loss and Other Comprehensive Income.

(m) Intangible assets

Intangible assets are recorded at cost less accumulated impairment losses and amortisation charges. Intangible

assets consist of goodwill, which has an indefinite useful life, and patents, which have useful lives between 3 and

20 years. Goodwill is assessed annually for impairment using either discounted cashflow techniques or estimations

of the selling value (less costs) of the group's cash-generating unit, which is defined in note 5.

(n) Impairment of Assets

At each reporting date, the group's directors review the carrying values of the group's tangible and intangible

assets to determine whether there is any indication that those assets have been impaired. If such an indication

exists, the recoverable amount of the asset, being the higher of the asset's fair value less cost to sell and value in

use, is compared to the assets carrying value. Any excess of the asset's carrying value over its recoverable amount

is expensed to the income statement.

(o) Equity-settled employee share plan options

Equity-settled share-based compensation benefits are provided to employees. Equity-settled transactions are

awards of shares, or options over sh.ares, that are provided to employees in exchange for the rendering of services.

The cost of equity-settled transactions are measured at fair value on grant date. Fair value is independently

determined using the Binomial option pricing model that takes into account the exercise price, the term of the

option, the impact of dilution, the share price at grant date and expected price volatility of the underlying share,

the expected dividend yield and the risk free interest rate for the term of the option .

The cost of equity-settled transactions are recognised as an expense with a corresponding increase in equity over

the service vesting period. The cumulative charge to profit or loss is calculated based on the grant date fair value

- 9-

Notes to the financial statements

V/VOPHARM PTY LTD

ABN 97 106 101 615

of the award, the best estimate of the number of awards that are likely to vest and the expired portion of the

vesting period . The amount recognised in profit or loss for the period is the cumulative amount calculated at each

reporting date less amounts already recognised in previous periods.

{p) New Accounting Standards

During the year the group adopted for the first time International Financial Reporting Standards as issued by the

International Accounting Standards Board {'IASB') including those that became mandatory during the year. In

addition, the group adopted IFRS 15 Revenue from Contracts with Customers, which is only mandatory from

financial periods commencing on or after 1 January 2018. The effects of the adoption of those standards are set

out in note 17.

With the exception of IFRS 15, the group has not yet adopted IFRS and Interpretations that are yet to become

mandatory. The standard yet to be adopted which is expected to materially impact these financial statements

includes the following:

IFRS 16 Leases

This standard is applicable to annual reporting periods beginning on or after 1 January 2019. The standard replaces

IAS 117 'Leases' and for lessees will eliminate the classifications of operating leases and finance leases. Subject to

exceptions, a 'right-of-use' asset will be capitalised in the statement of financial position, measured at the present

value of the unavoidable future lease payments to be made over the lease term. The exceptions relate to short

term leases of 12 months or less and leases of low-value assets (such as personal computers and small office

furniture) where an accounting policy choice exists whereby either a 'right-of-use' asset is recognised or lease

payments are expensed to profit or loss as incurred. A liability corresponding to the capitalised lease will also be

recognised, adjusted for lease prepayments, lease incentives received, initial direct costs incurred and an estimate

of any future restoration, removal or dismantling costs. Straight-line operating lease expense recognition will be

replaced with a depreciation charge for the leased asset (included in operating costs) and an interest expense on

the recognised lease liability (included in finance costs) . In the earlier periods of the lease, the expenses associated

with the lease under IFRS 16 will be higher when compared to lease expenses under IAS 117. However EBITDA

(Earnings Before Interest, Tax, Depreciation and Amortisation) results will be improved as the operating expense

is replaced by interest expense and depreciation in profit or loss under IFRS 16. For classification within the

statement of cash flows, the lease payments will be separated into both a principal (financing activities) and

interest (either operating or financing activities) component. A preliminary assessment of this standard has been

undertaken by the group and based upon the significant leasing activities impacting the group, it is anticipated

that adoption of this standard will materially impact the measurement of transactions and balances.

(q) Critical Accounting Estimates and Judgments

The directors evaluate estimates and judgments incorporated into the financial statements based on historical

knowledge and best available current information. Estimates assume reasonable expectation of future events and

are based on current trends and economic data, obtained both externally and within the entity.

Assessment of revenues earned under contract by reference to surveys of work performed

Revenue is earned according to references to surveys of work performed. This involves a degree of subjectivity

relating to the progress of the project and the completion of performance milestones which drive the revenue

recognised under contract.

Assessment of preference shares and puttable ordinary shares as equity

The group's redeemable preference shares and puttable ordinary shares are classified as equity in the statement

of financial position and measured at their historical cost plus any accrued fixed entitlements .

Assessment of standard costs for the valuation of the cell bank inventory

The group's cell bank has been assessed based on the costs incurred by the group to generate the cell bank, which

is used by group in rendering services to customers. The standard costs were assessed by Dr. Michael Terence

- 10-

Notes to the financial statements

V/VOPHARM PTY LTD

ABN 97 106 101 615

O'Reilly, an independent consultant specialising in Pharma Research from the Swiss-based company, Novartis

Pharma AG. The directors have assessed that this valuation is appropriate for the valuation of the cell bank as at

30 June 2017.

Accounting for lease incentives

The group has received lease incentives as part of its lease with the Hershey Centre for Applied Research . These

lease incentives are recognised as liabilities in the statement of financial position, which will be repaid over the

duration of the entire lease term of 10 years. For further information refer to note 9.

Goodwill

The group tests annually, whether or not goodwill have suffered any impairment. Goodwill is assessed annually

for impairment using either discounted cashflow techniques or estimations of the selling value of the group's cash

generating unit, being the toxicology and bioanalytical services which are open and utilized by the global market.

Non-recognition of deferred tax assets

As set out in Note 4, the group has not recognised deferred tax assets arising from its carry-forward tax losses in

all of its taxable jurisdictions.

Assumptions used in the employee share plan option model

As stated above, a Binomial model has been used for valuing the group's employee share plan options. The

following significant judgments were made in the model for options granted in the year ended 30 June 2017:

a) Share price: for option tranch packages granted in the last 3 years, the share price of $2.47 used in

the model is based upon due diligence arising from proposed sale transactions for the entire group,

discounted by approximately 10% for the uncertainty of whether or not those sale transactions

would successfully complete;

b) Risk-free rate : determined at 1.99%, based upon prevailing government bond rates in Australia;

c) Dividend yield : nil% based upon historical performance and likelihood of future dividend payments;

and

d) Volatility: set at 60%, which comparable to other like-for-like non-listed Australian enterprises

servicing the Biotechnology sector.

- 11-

Notes to the financial statements

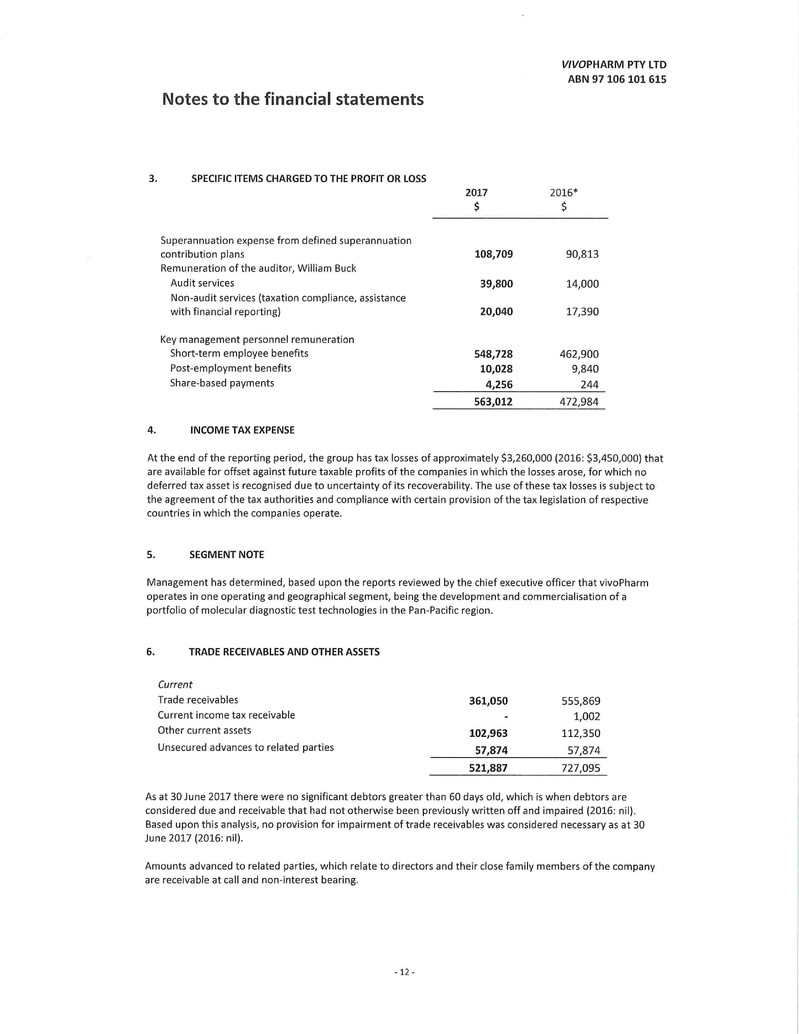

3. SPECIFIC ITEMS CHARGED TO THE PROFIT OR LOSS

Superannuation expense from defined superannuation

contribution plans

Remuneration of the auditor, William Buck

Audit services

Non-audit services (taxation compliance, assistance

with financial reporting)

Key management personnel remuneration

Short-term employee benefits

Post-employment benefits

Share-based payments

4. INCOME TAX EXPENSE

2017

$

108,709

39,800

20,040

548,728

10,028

4,256

563,012

V/VOPHARM PTY LTD

ABN 97 106 101 615

2016*

$

90,813

14,000

17,390

462,900

9,840

244

472,984

At the end of the reporting period, the group has tax losses of approximately $3,260,000 (2016: $3,450,000) that

are available for offset against future taxable profits of the companies in which the losses arose, for which no

deferred tax asset is recognised due to uncertainty of its recoverability. The use of these tax losses is subject to

the agreement of the tax authorities and compliance with certain provision of the tax legislation of respective

countries in which the companies operate.

5. SEGMENT NOTE

Management has determined, based upon the reports reviewed by the chief executive officer that vivoPharm

operates in one operating and geographical segment, being the development and commercialisation of a

portfolio of molecular diagnostic test technologies in the Pan-Pacific region.

6. TRADE RECEIVABLES AND OTHER ASSETS

Current

Trade receivables

Current income tax receivable

Other current assets

Unsecured advances to related parties

361,050 555,869

1,002

102,963 112,350

57,874 57,874

521,887 727,095

As at 30 June 2017 there were no significant debtors greater than 60 days old, which is when debtors are

considered due and receivable that had not otherwise been previously written off and impaired (2016: nil) .

Based upon this analysis, no provision for impairment of trade receivables was considered necessary as at 30

June 2017 (2016: nil).

Amounts advanced to related parties, which relate to directors and their close family members of the company

are receivable at call and non-interest bearing.

- 12 -

Notes to the financial statements

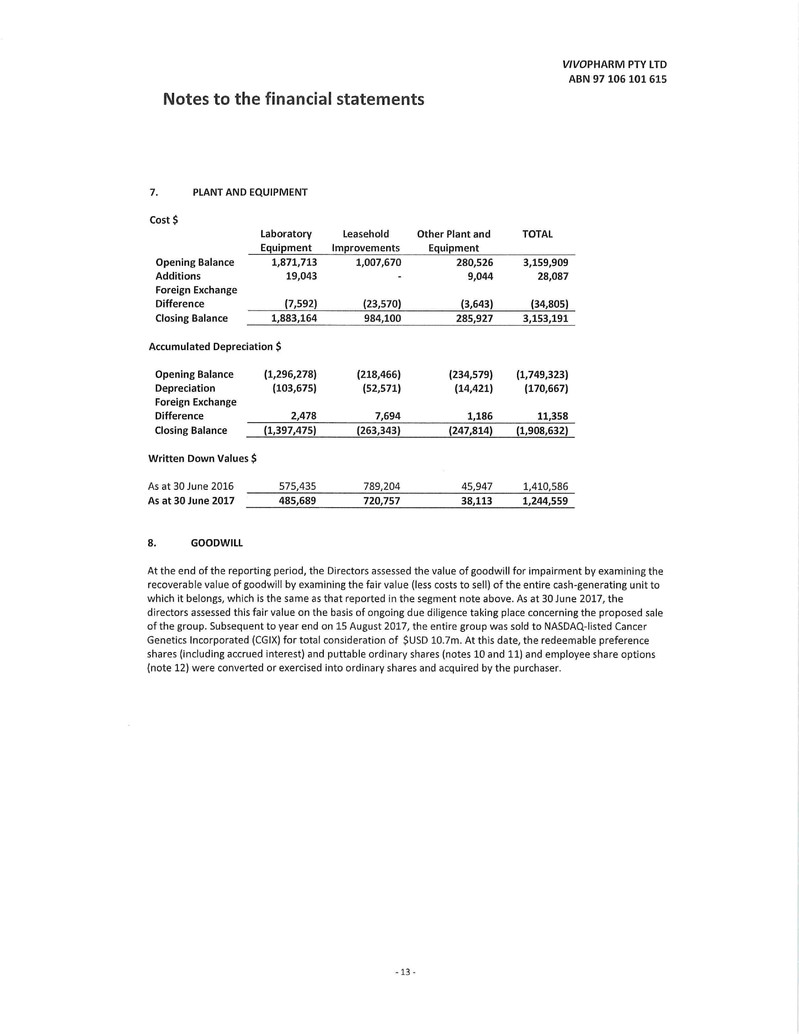

7. PLANT AND EQUIPMENT

Cost$

Laboratory Leasehold Other Plant and

Equipment Improvements Equipment

Opening Balance 1,871,713 1,007,670 280,526

Additions 19,043 9,044

Foreign Exchange

Difference (7,592) (23,570) (3,643)

Closing Balance 1,883,164 984,100 285,927

Accumulated Depreciation $

Opening Balance (1,296,278) {218,466) (234,579)

Depreciation (103,675) (52,571) {14,421)

Foreign Exchange

Difference 2,478 7,694 1,186

Closing Balance (1,397,475) (263,343) (247,814)

Written Down Values$

As at 30 June 2016 575,435 789,204 45,947

As at 30 June 2017 485,689 720,757 38,113

8. GOODWILL

TOTAL

V/VOPHARM PTY LTD

ABN 97 106 101 615

3,159,909

28,087

(34,805)

3,153,191

(1,749,323)

(170,667)

11,358

(1,908,632)

1,410,586

1,244,559

At the end of the reporting period, the Directors assessed the value of goodwill for impairment by examining the

recoverable value of goodwill by examining the fair value (less costs to sell) of the entire cash-generating unit to

which it belongs, which is the same as that reported in the segment note above. As at 30 June 2017, the

directors assessed this fair value on the basis of ongoing due diligence taking place concerning the proposed sale

of the group. Subsequent to year end on 15 August 2017, the entire group was sold to NASDAQ-listed Cancer

Genetics Incorporated (CGIX) for total consideration of $USO 10.7m . At this date, the redeemable preference

shares (including accrued interest) and puttable ordinary shares (notes 10 and 11) and employee share options

(note 12) were converted or exercised into ordinary shares and acquired by the purchaser.

- 13 -

Notes to the financial statements

9. LEASE INCENTIVE LIABILITY

Current

Lease incentive liability - leasehold improvements

Lease incentive - cash

Non-Current

Lease incentive liability - leasehold improvements

Lease incentive - cash

2017

$

119,882

59,400

179,282

384,994

208,911

593,905

773,187

V/VOPHARM PTY LTD

ABN 97 106 101 615

2016

$

125,135

60,462

185,597

486,550

276,716

763,266

948,863

The above lease incentive liabilities represent the straight-lining of the following leasing arrangements:

Cash Portion

In December 2010 the group began a contractual relationship with the Hershey Centre for Applied Research . As

an incentive for signing up to a rental arrangement at the Hershey Centre, the Centre agreed to pay USO

$450,000 in instalments to vivoPharm LLC. In return, vivoPharm LLC agreed to enter into a ten year lease. The

cash sum total has been deferred on the statement of financial position and is offset against payments made

under the lease for the 10 year period .

Leasehold Improvements

In addition to the cash portion, $USD750,000 in leasehold improvements were provided as an incentive and

were completed by the commencement of the rental agreement. The total lease term is 10 years with a further

two 5-year options attached to the lease agreement, which, if exercised, will extend the initial 10 year lease by a

further 10 years.

10. REDEEMABLE PREFERENCE SHARES

As at 30 June 2017 the group had on issue 900,000 (2016: 900,000) redeemable shares, arising from a first

tranche issued to Terra Rossa Capital (now MH Carnegie) in 2008. As at 30 June 2017 a second tranche to invest

a further maximum amount of $1,000,000, subject to an option subscription price calculated accor°ding to

formula of 1.7 * (the average audited sales, excluding grants and other income)/ (the aggregate number of

ordinary+ preference shares on issue), remained unissued and unsubscribed . The option agreement, exercisable

in the hands of MH Carnegie, is exercisable and expires January 2018. In addition to a calculation of the

subscription price, in order to activate the second tranche, the following is required :

A business plan to be adopted by the board pursuant to the shareholders' agreement,

The board to be reconstituted in accordance with the shareholders' agreement,

The company to complete a review of pricing and service provision costs, and

A remuneration committee to be established.

The preference shares have voting rights commensurate with voting rights of ordinary shareholders (on a 1:1

basis), however they rank above the ordinary shareholders on winding up and they do not have any dividend

entitlements. The preference shares have been redeemable in the hands of the shareholder since January 2013

but subject to the following limitations, as required in the Corporations Act s.254K:

The group must accrue sufficient retained profits to repay the preference shares and accrued interest; or

The group has accumulated proceeds from the issue of new shares specifically made for the purposes of

the redemption.

- 14 -

Notes to the financial statements

V/VOPHARM PTY LTD

ABN 97 106 101 615

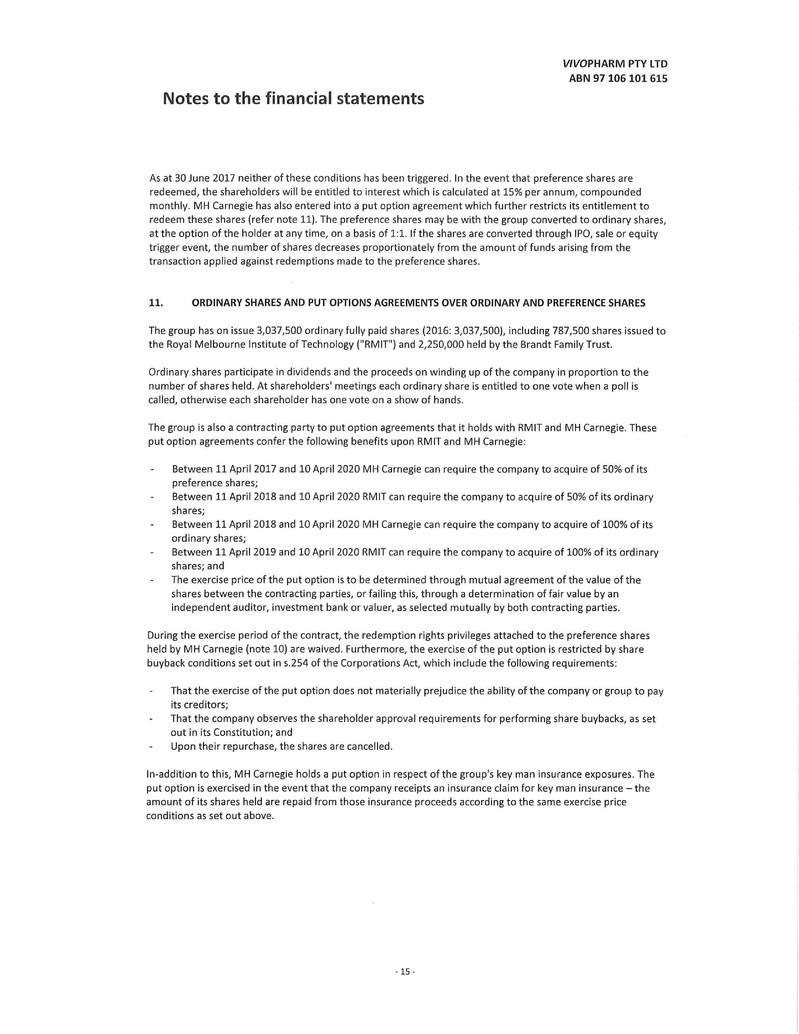

As at 30 June 2017 neither of these conditions has been triggered . In the event that preference shares are

redeemed, the shareholders will be entitled to interest which is calculated at 15% per annum, compounded

monthly. MH Carnegie has also entered into a put option agreement which further restricts its entitlement to

redeem these shares (refer note 11). The preference shares may be with the group converted to ordinary shares,

at the option of the holder at any time, on a basis of 1:1. If the shares are converted through IPO, sale or equity

trigger event, the number of shares decreases proportionately from the amount of funds arising from the

transaction applied against redemptions made to the preference shares.

11. ORDINARY SHARES AND PUT OPTIONS AGREEMENTS OVER ORDINARY AND PREFERENCE SHARES

The group has on issue 3,037,500 ordinary fully paid shares (2016: 3,037,500), including 787,500 shares issued to

the Royal Melbourne Institute of Technology ("RMIT") and 2,250,000 held by the Brandt Family Trust.

Ordinary shares participate in dividends and the proceeds on winding up of the company in proportion to the

number of shares held. At shareholders' meetings each ordinary share is entitled to one vote when a poll is

called, otherwise each shareholder has one vote on a show of hands.

The group is also a contracting party to put option agreements that it holds with RMIT and MH Carnegie. These

put option agreements confer the following benefits upon RMIT and MH Carnegie:

Between 11 April 2017 and 10 April 2020 MH Carnegie can require the company to acquire of 50% of its

preference shares;

Between 11 April 2018 and 10 April 2020 RMIT can require the company to acquire of 50% of its ordinary

shares;

Between 11 April 2018 and 10 April 2020 MH Carnegie can require the company to acquire of 100% of its

ordinary shares;

Between 11 April 2019 and 10 April 2020 RMIT can require the company to acquire of 100% of its ordinary

shares; and

The exercise price of the put option is to be determined through mutual agreement of the value of the

shares between the contracting parties, or failing this, through a determination of fair value by an

independent auditor, investment bank or valuer, as selected mutually by both contracting parties.

During the exercise period of the contract, the redemption rights privileges attached to the preference shares

held by MH Carnegie (note 10) are waived. Furthermore, the exercise of the put option is restricted by share

buyback conditions set out in s.254 of the Corporations Act, which include the following requirements:

That the exercise of the put option does not materially prejudice the ability of the company or group to pay

its creditors;

That the company observes the shareholder approval requirements for performing share buybacks, as set

out in its Constitution; and

Upon their repurchase, the shares are cancelled.

In-addition to this, MH Carnegie holds a put option in respect of the group's key man insurance exposures . The

put option is exercised in the event that the company receipts an insurance claim for key man insurance - the

amount of its shares held are repaid from those insurance proceeds according to the same exercise price

conditions as set out above.

-15 -

12.

Notes to the financial statements

EMPLOYEE SHARE PLAN OPTIONS

V/VOPHARM PTY LTD

ABN 97 106 101 615

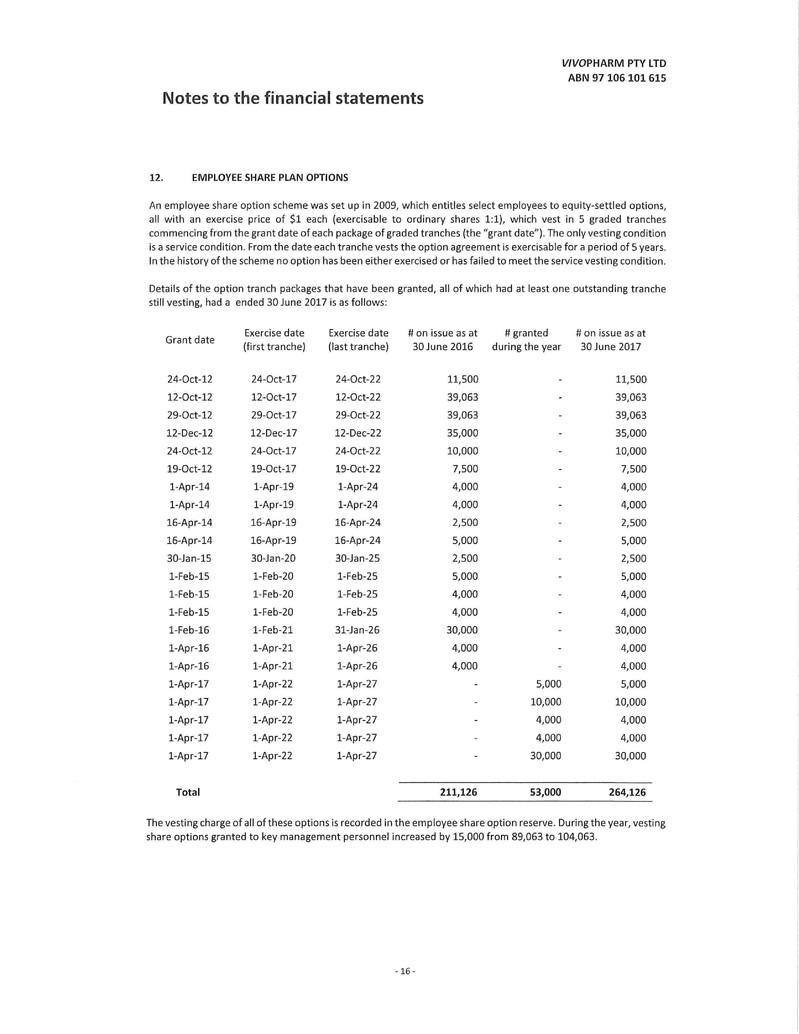

An employee share option scheme was set up in 2009, which entitles select employees to equity-settled options,

all with an exercise price of $1 each (exercisable to ordinary shares 1:1), which vest in 5 graded tranches

commencing from the grant date of each package of graded tranches (the "grant date") . The only vesting condition

is a service condition . From the date each tranche vests the option agreement is exercisable for a period of 5 years.

In the history of the scheme no option has been either exercised or has failed to meet the service vesting condition .

Details of the option tranch packages that have been granted, all of which had at least one outstanding tranche

still vesting, had a ended 30 June 2017 is as follows:

Grant date Exercise date Exercise date # on issue as at # granted # on issue as at (first tranche) (last tranche) 30 June 2016 during the year 30 June 2017

24-0ct-12 24-0ct-17 24-0ct-22 11,500 11,500

12-0ct-12 12-0ct-17 12-0ct-22 39,063 39,063

29-0ct-12 29-0ct-17 29-0ct-22 39,063 39,063

12-Dec-12 12-Dec-17 12-Dec-22 35,000 35,000

24-0ct-12 24-0ct-17 24-0ct-22 10,000 10,000

19-0ct-12 19-0ct-17 19-0ct-22 7,500 7,500

1-Apr-14 1-Apr-19 1-Apr-24 4,000 4,000

1-Apr-14 1-Apr-19 1-Apr-24 4,000 4,000

16-Apr-14 16-Apr-19 16-Apr-24 2,500 2,500

16-Apr-14 16-Apr-19 16-Apr-24 5,000 5,000

30-Jan-15 30-Jan-20 30-Jan-25 2,500 2,500

1-Feb-15 1-Feb-20 1-Feb-25 5,000 5,000

1-Feb-15 1-Feb-20 1-Feb-25 4,000 4,000

1-Feb-15 1-Feb-20 1-Feb-25 4,000 4,000

1-Feb-16 1-Feb-21 31-Jan-26 30,000 30,000

1-Apr-16 1-Apr-21 1-Apr-26 4,000 4,000

1-Apr-16 1-Apr-21 1-Apr-26 4,000 4,000

1-Apr-17 1-Apr-22 1-Apr-27 5,000 5,000

1-Apr-17 1-Apr-22 1-Apr-27 10,000 10,000

1-Apr-17 1-Apr-22 1-Apr-27 4,000 4,000

1-Apr-17 1-Apr-22 1-Apr-27 4,000 4,000

1-Apr-17 1-Apr-22 1-Apr-27 30,000 30,000

Total 211,126 53,000 264,126

The vesting charge of all of these options is recorded in the employee share option reserve . During the year, vesting

share options granted to key management personnel increased by 15,000 from 89,063 to 104,063.

- 16 -

Notes to the financial statements

13. RELATED PARTIES

V/VOPHARM PTY LTD

ABN 97 106 101 615

During the year ended 30 June 2017 the group's related parties were its key management personnel and

their associated entities and close family members, which were its directors Ralf Brandt, Brenton Wright, Ian

Nisbet.The following members of key management personnel ceded their directorships of vivoPharm Pty

Ltd upon the sale of the group on 15 August 2017 :

Ralf Brandt

Brenton Wright

On the same date the following directors were appointed to vivoPharm Pty Ltd :

John Roberts

Panna Sharma

With the exception of key management personnel remuneration (note 3}, the loans to related parties (note

6} and the share options granted to key management personnel (note 12} there were no other noted

transactions with related parties for the year.

14. CASH FLOW INFORMATION

Reconciliation of net loss after tax to net cash flows

from operations

Profit/ (Loss) for the year

Non-cash flows in profit

Depreciation and amortisation

Vesting of employee share options

Interest accrued on redeemable preference shares

Movements in working capital

Decrease/ (Increase) in trade receivables and other

assets

Decrease/ (Increase) in cell bank inventories

Increase in trade and other payables

Increase in revenue received in advance

Increase in provisions

Net cash outflows from operating activities

Reconciliation of cash and cash equivalents to

statement of cash flows

Cash and cash equivalents

Bank overdrafts

Per statement of cash flows

- 17 -

2017

$

(307,290)

172,324

51,003

513,688

205,208

(152,279)

202,878

723,245

12,945

1,421,722

1,391,856

1,391,856

2016

$

(142,507)

172,480

35,725

402,931

(128,268)

(451,354)

28,992

2,522

293,674

214,195

254,134

(24,330)

229,804

Notes to the financial statements

15. FINANCIAL INSTRUMENTS

V/VOPHARM PTY LTD

ABN 97 106 101 615

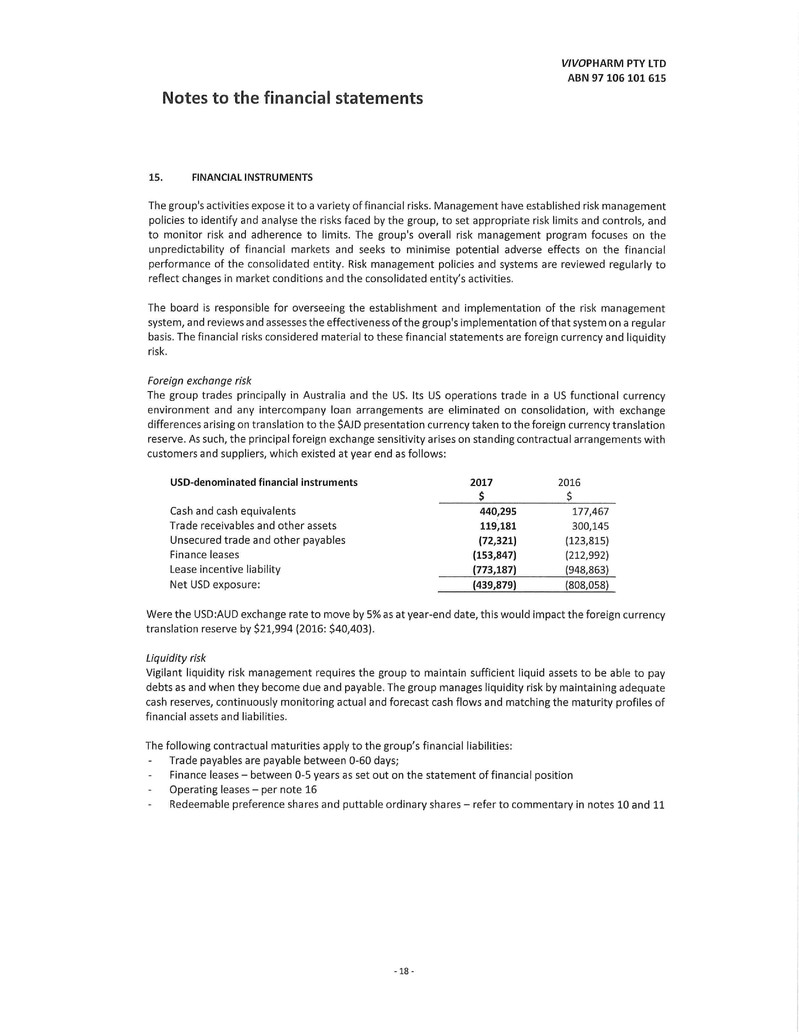

The group's activities expose it to a variety of financial risks. Management have established risk management

policies to identify and analyse the risks faced by the group, to set appropriate risk limits and controls, and

to monitor risk and adherence to limits. The group's overall risk management program focuses on the

unpredictability of financial markets and seeks to minimise potential adverse effects on the financial

performance of the consolidated entity. Risk management policies and systems are reviewed regularly to

reflect changes in market conditions and the consolidated entity's activities.

The board is responsible for overseeing the establishment and implementation of the risk management

system, and reviews and assesses the effectiveness of the group's implementation of that system on a regular

basis. The financial risks considered material to these financial statements are foreign currency and liquidity

risk.

Foreign exchange risk

The group trades principally in Australia and the US. Its US operations trade in a US functional currency

environment and any intercompany loan arrangements are eliminated on consolidation, with exchange

differences arising on translation to the $AJD presentation currency taken to the foreign currency translation

reserve. As such, the principal foreign exchange sensitivity arises on standing contractual arrangements with

customers and suppliers, which existed at year end as follows :

USO-denominated financial instruments 2017 2016

$ $

Cash and cash equivalents 440,295 177,467

Trade receivables and other assets 119,181 300,145

Unsecured trade and other payables (72,321) (123,815)

Finance leases (153,847) (212,992)

Lease incentive liability {773,187) (948,863)

Net USO exposure: {439,879) (808,058)

Were the USD:AUD exchange rate to move by 5% as at year-end date, this would impact the foreign currency

translation reserve by $21,994 (2016: $40,403) .

Liquidity risk

Vigilant liquidity risk management requires the group to maintain sufficient liquid assets to be able to pay

debts as and when they become due and payable. The group manages liquidity risk by maintaining adequate

cash reserves, continuously monitoring actual and forecast cash flows and matching the maturity profiles of

financial assets and liabilities.

The following contractual maturities apply to the group's financial liabilities:

Trade payables are payable between 0-60 days;

Finance leases - between 0-5 years as set out on the statement of financial position

Operating leases - per note 16

Redeemable preference shares and puttable ordinary shares - refer to commentary in notes 10 and 11

-18 -

Notes to the financial statements

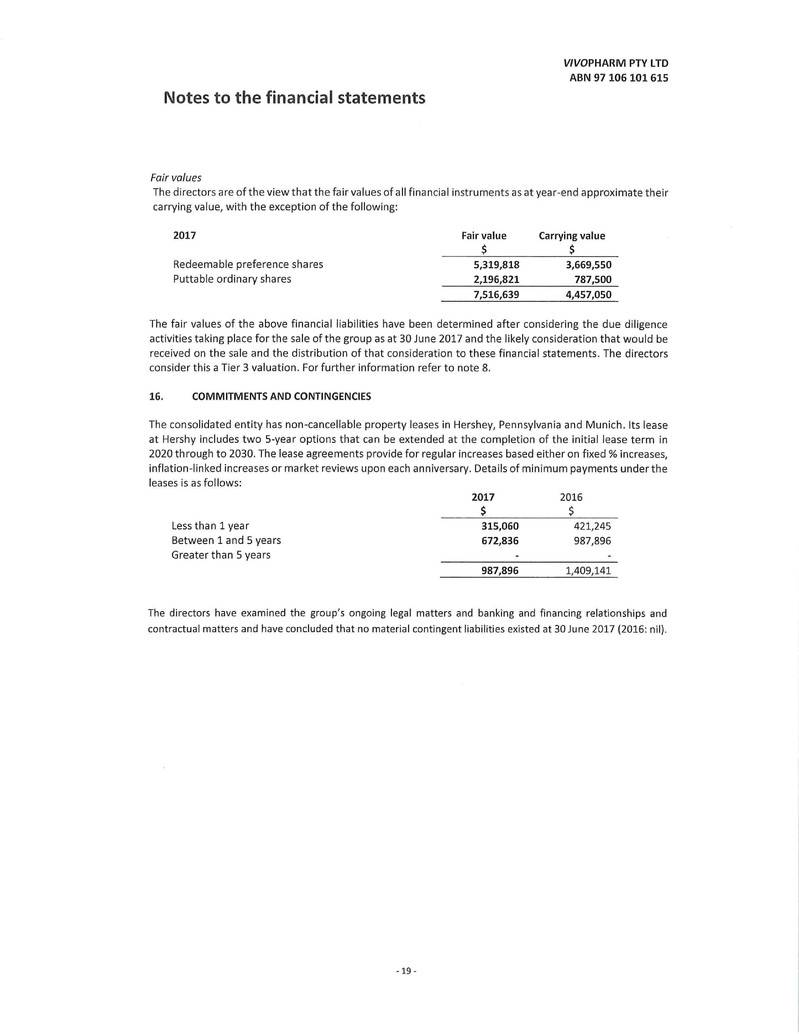

Fair values

V/VOPHARM PTY LTD

ABN 97 106 101 615

The directors are of the view that the fair values of all financial instruments as at year-end approximate their

carrying value, with the exception of the following:

2017 Fair value Carrying value

$ $

Redeemable preference shares 5,319,818 3,669,550

Puttable ordinary shares 2,196,821 787,500

7,516,639 4,457,050

The fair values of the above financial liabilities have been determined after considering the due diligence

activities taking place for the sale of the group as at 30 June 2017 and the likely consideration that would be

received on the sale and the distribution of that consideration to these financial statements. The directors

consider this a Tier 3 valuation. For further information refer to note 8.

16. COMMITMENTS AND CONTINGENCIES

The consolidated entity has non-cancellable property leases in Hershey, Pennsylvania and Munich . Its lease

at Hershy includes two 5-year options that can be extended at the completion of the initial lease term in

2020 through to 2030. The lease agreements provide for regular increases based either on fixed% increases,

inflation-linked increases or market reviews upon each anniversary. Details of minimum payments under the

leases is as follows:

2017 2016

$ $

Less than 1 year 315,060 421,245

Between 1 and 5 years 672,836 987,896

Greater than 5 yea rs

987,896 1,409,141

The directors have examined the group's ongoing legal matters and banking and financing relationships and

contractual matters and have concluded that no material contingent liabilities existed at 30 June 2017 (2016: nil) .

-19 -

Notes to the financial statements

17. ADOPTION OF IFRS

V/VOPHARM PTY LTD

ABN 97 106 101 615

The following adjustments occurred upon the first-time adoption of IFRS in this financial report at the

transition date of 30 June 2015:

Included in Net Assets

Cell bank stock

Revenues received in -advance

Redeemable preference shares

Puttable ordinary shares

Equity

Redeemable preference shares

Ordinary share capital

Employee share option reserve

(Accumulated losses)/ retained earnings

Note

a)

b)

c)

d)

c)

d)

e)

f)

2015*

$

1,026,756

860,385

787,600

29,899

162,498

Adjustment

(57,348)

(341,369)

(2,752,931)

(787,500)

(860,385)

(787,500)

3,749

(2,295,012)

2015

$

969,408

(341,369)

(2,752,931)

(787,500)

100

33,648

(2,132,514)

This also required a restatement of the statement of the results as at 30 June 2016 (previously authorised

for issue under a special purpose financial reporting framework in December 2016) :

Note 2016* Adjustment 2016

Included in Net Assets $ $

Cell bank stock a) 1,483,724 (62,962) 1,420,762

Revenues received in -advance b) (635,043) (635,043)

Redeemable preference shares c) (3,155,862) (3,155,862)

Puttable ordinary shares d) (787,500) (787,500)

Equity

Redeemable preference shares c) 860,385 (860,385)

Ordinary share capital d) 787,600 (787,500) 100

Employee share option reserve e) 33,231 36,142 69,373

(Accumulated losses)/ retained earnings f) 754,603 (3,029,624) (2,275,021)

The accounting policies driving these adjustments are described in full in note 2.

a) Adjustment to cell bank stock

This immaterial adjustment is an adjustment for standard costs applied in the capitalisation of the cell bank

in line with IAS 102.

b} Recognition of revenue according to surveys of work performed

Previously revenue was recognised upon invoice. Upon transition, management have assessed the

recognition of revenue with referen ce to surveys of work performed. This complies with IFRS 15.

c) Classification of redeemable preference shares as liabilities, including accrued interest charges

- 20-

Notes to the financial statements

V/VOPHARM PTY LTD

ABN 97 106 101 615

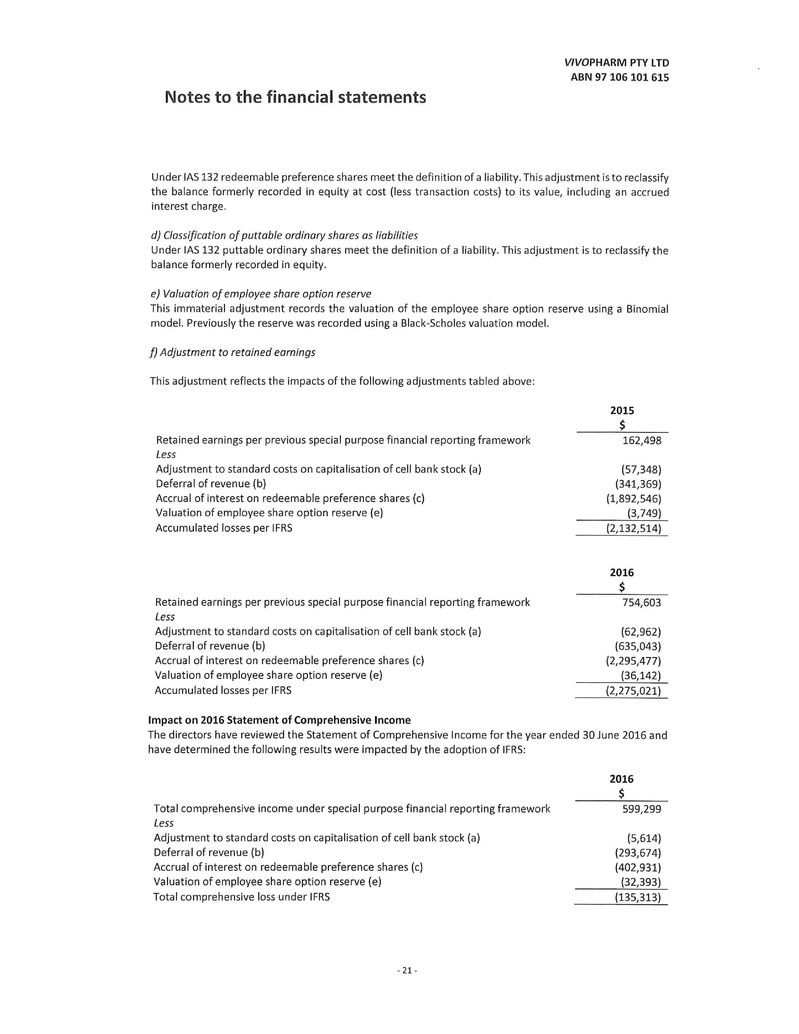

Under IAS 132 redeemable preference shares meet the definition of a liability. This adjustment is to reclassify

the balance formerly recorded in equity at cost (less transaction costs) to its value, including an accrued

interest charge .

d) Classification of puttable ordinary shares as liabilities

Under IAS 132 puttable ordinary shares meet the definition of a liability. This adjustment is to reclassify the

balance formerly recorded in equity.

e) Valuation of employee share option reserve

This immaterial adjustment records the valuation of the employee share option reserve using a Binomial

model. Previously the reserve was recorded using a Black-Scholes valuation model.

f) Adjustment to retained earnings

This adjustment reflects the impacts of the following adjustments tabled above:

Retained earnings per previous special purpose financial reporting framework

Less

Adjustment to standard costs on capitalisation of cell bank stock (a)

Deferral of revenue (b)

Accrual of interest on redeemable preference shares (c)

Valuation of employee share option reserve (e)

Accumulated losses per IFRS

Retained earnings per previous special purpose financial reporting framework

Less

Adjustment to standard costs on capitalisation of cell bank stock (a)

Deferral of revenue (b)

Accrual of interest on redeemable preference shares (c)

Valuation of employee share option reserve (e)

Accumulated losses per IFRS

Impact on 2016 Statement of Comprehensive Income

2015

$

162,498

(57,348)

(341,369)

(1,892,546)

(3,749)

(2,132,514)

2016

$

754,603

(62,962)

(635,043)

(2,295,477)

(36,142)

(2,275,021)

The directors have reviewed the Statement of Comprehensive Income for the year ended 30 June 2016 and

have determined the following results were impacted by the adoption of IFRS:

Total comprehensive income under special purpose financial reporting framework

Less

Adjustment to standard costs on capitalisation of cell bank stock (a)

Deferral of revenue (b)

Accrual of interest on redeemable preference shares (c)

Valuation of employee share option reserve (e)

Total comprehensive loss under IFRS

- 21-

2016

$

599,299

(5,614)

(293,674)

(402,931)

(32,393)

(135,313)