Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SunCoke Energy Partners, L.P. | d482294dex991.htm |

| 8-K - 8-K - SunCoke Energy Partners, L.P. | d482294d8k.htm |

SunCoke Energy Partners, L.P. Q3 2017 Earnings Conference Call October 26, 2017 Exhibit 99.2

Forward-Looking Statements This slide presentation should be reviewed in conjunction with the Third Quarter 2017 earnings release of SunCoke Energy Partners, L.P. (SXCP) and conference call held on October 26, 2017 at 10:00 a.m. ET. Some of the information included in this presentation constitutes “forward-looking statements.” All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke Energy, Inc. (SXC) or SXCP, in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions. Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law. This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. SXCP Q3 2017 Earnings Call

2017 Key Initiatives Drive strong operational & safety performance across fleet Deliver Operations Excellence Implement gas sharing technology project to drive improved environmental performance Execute Granite City Gas Sharing Project Continue to seek opportunities to drive incremental coke and logistics volumes Optimize Cokemaking and Coal Logistics Asset Base Achieve $210M – $220M Adjusted EBITDA attributable to SXCP guidance Accomplish 2017 Financial Objectives SXCP Q3 2017 Earnings Call

Q3 2017 Highlights SXCP Q3 2017 Earnings Call Achieved strongest ever quarterly operating performance across coke and logistics fleet Expanded CMT’s product and customer mix during Q3; continue to aggressively pursue opportunities to secure further new business and enhance Convent’s capabilities Declared quarterly distribution of $0.5940/unit Delivered strong Q3 2017 Distributable Cash Flow and cash coverage Well positioned to achieve top end of FY 2017 Adjusted EBITDA attrib. SXCP guidance range of $210M to $220M

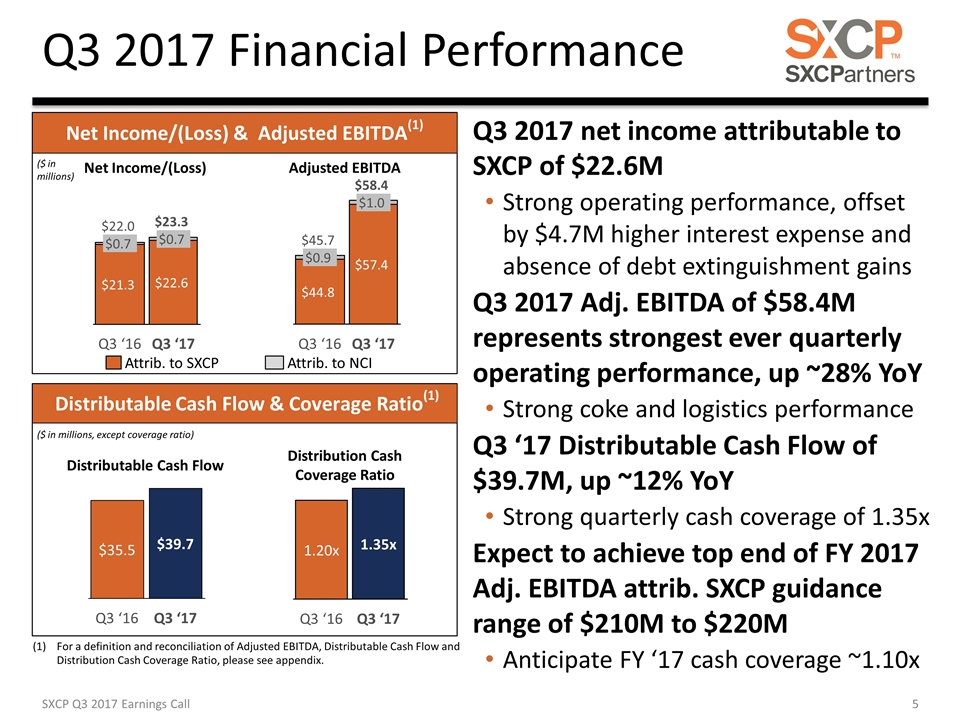

Q3 2017 Financial Performance Q3 2017 net income attributable to SXCP of $22.6M Strong operating performance, offset by $4.7M higher interest expense and absence of debt extinguishment gains Q3 2017 Adj. EBITDA of $58.4M represents strongest ever quarterly operating performance, up ~28% YoY Strong coke and logistics performance Q3 ‘17 Distributable Cash Flow of $39.7M, up ~12% YoY Strong quarterly cash coverage of 1.35x Expect to achieve top end of FY 2017 Adj. EBITDA attrib. SXCP guidance range of $210M to $220M Anticipate FY ‘17 cash coverage ~1.10x For a definition and reconciliation of Adjusted EBITDA, Distributable Cash Flow and Distribution Cash Coverage Ratio, please see appendix. SXCP Q3 2017 Earnings Call ($ in millions, except coverage ratio) x x Distributable Cash Flow Distribution Cash Coverage Ratio ($ in millions) Net Income/(Loss) Adjusted EBITDA Attrib. to NCI Attrib. to SXCP

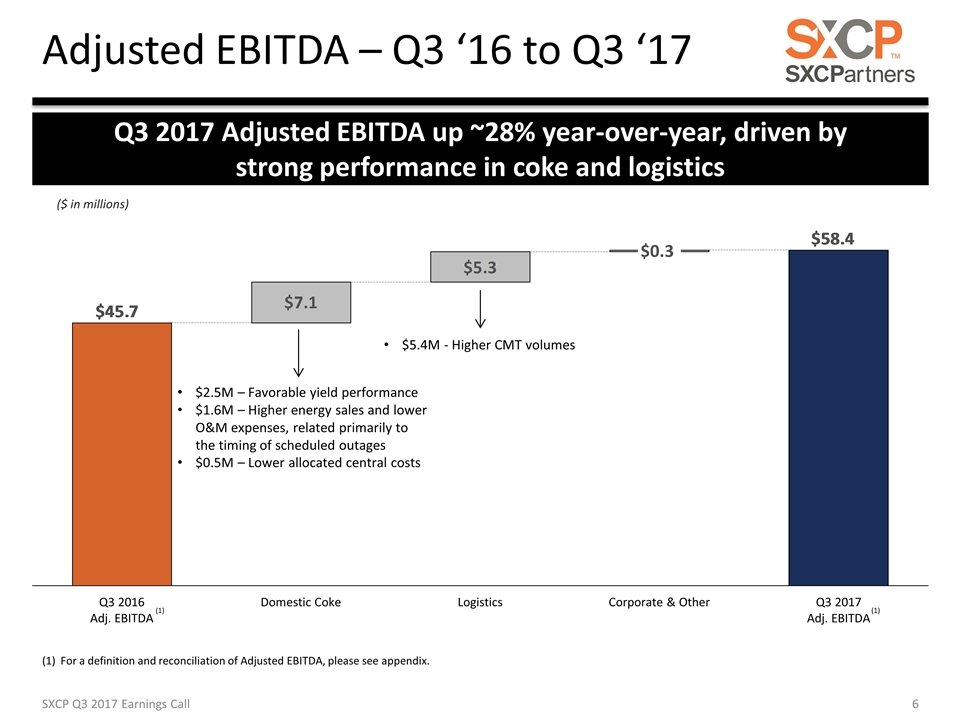

Adjusted EBITDA – Q3 ‘16 to Q3 ‘17 ($ in millions) For a definition and reconciliation of Adjusted EBITDA, please see appendix. (1) (1) $2.5M – Favorable yield performance $1.6M – Higher energy sales and lower O&M expenses, related primarily to the timing of scheduled outages $0.5M – Lower allocated central costs $5.4M - Higher CMT volumes SXCP Q3 2017 Earnings Call Q3 2017 Adjusted EBITDA up ~28% year-over-year, driven by strong performance in coke and logistics

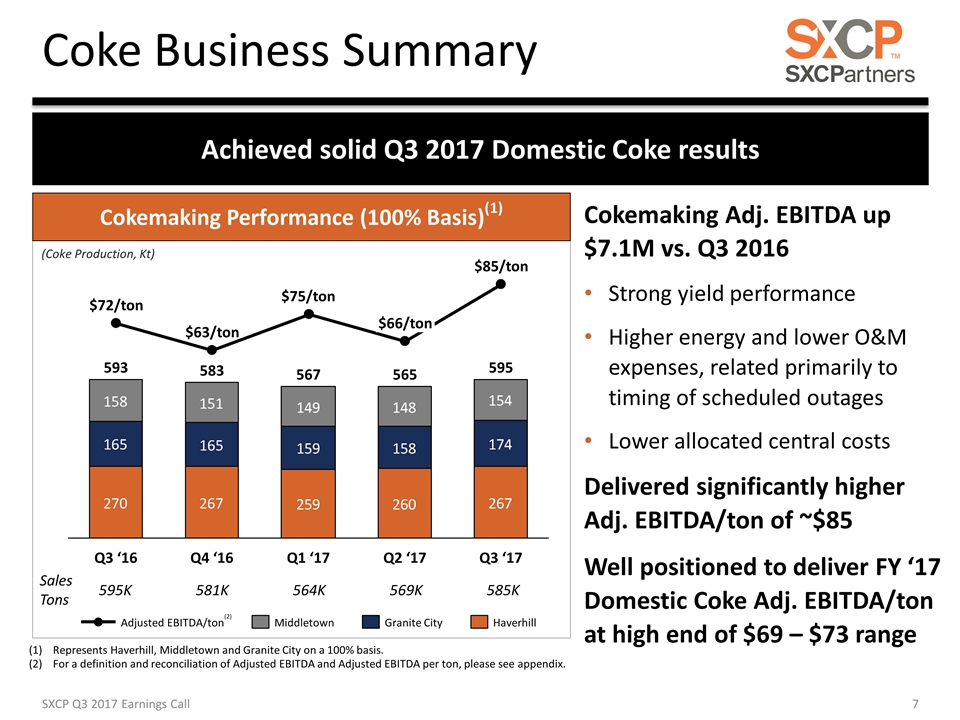

Coke Business Summary Cokemaking Performance (100% Basis)(1) /ton /ton /ton /ton /ton 595K 581K 564K 569K Sales Tons 585K Represents Haverhill, Middletown and Granite City on a 100% basis. For a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton, please see appendix. Cokemaking Adj. EBITDA up $7.1M vs. Q3 2016 Strong yield performance Higher energy and lower O&M expenses, related primarily to timing of scheduled outages Lower allocated central costs Delivered significantly higher Adj. EBITDA/ton of ~$85 Well positioned to deliver FY ‘17 Domestic Coke Adj. EBITDA/ton at high end of $69 – $73 range (2) SXCP Q3 2017 Earnings Call (Coke Production, Kt) Achieved solid Q3 2017 Domestic Coke results

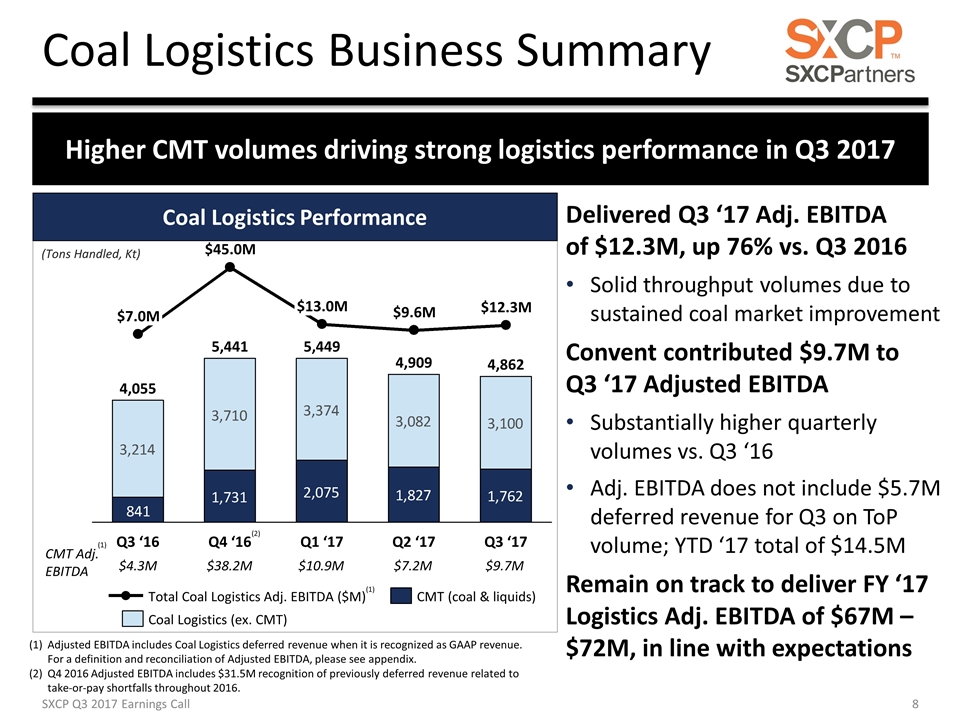

Coal Logistics Business Summary M M M M M (Tons Handled, Kt) Delivered Q3 ‘17 Adj. EBITDA of $12.3M, up 76% vs. Q3 2016 Solid throughput volumes due to sustained coal market improvement Convent contributed $9.7M to Q3 ‘17 Adjusted EBITDA Substantially higher quarterly volumes vs. Q3 ‘16 Adj. EBITDA does not include $5.7M deferred revenue for Q3 on ToP volume; YTD ‘17 total of $14.5M Remain on track to deliver FY ‘17 Logistics Adj. EBITDA of $67M – $72M, in line with expectations $4.3M $38.2M $10.9M $7.2M CMT Adj. EBITDA $9.7M (1) (1) Adjusted EBITDA includes Coal Logistics deferred revenue when it is recognized as GAAP revenue. For a definition and reconciliation of Adjusted EBITDA, please see appendix. Q4 2016 Adjusted EBITDA includes $31.5M recognition of previously deferred revenue related to take-or-pay shortfalls throughout 2016. (2) SXCP Q3 2017 Earnings Call Higher CMT volumes driving strong logistics performance in Q3 2017 Coal Logistics Performance

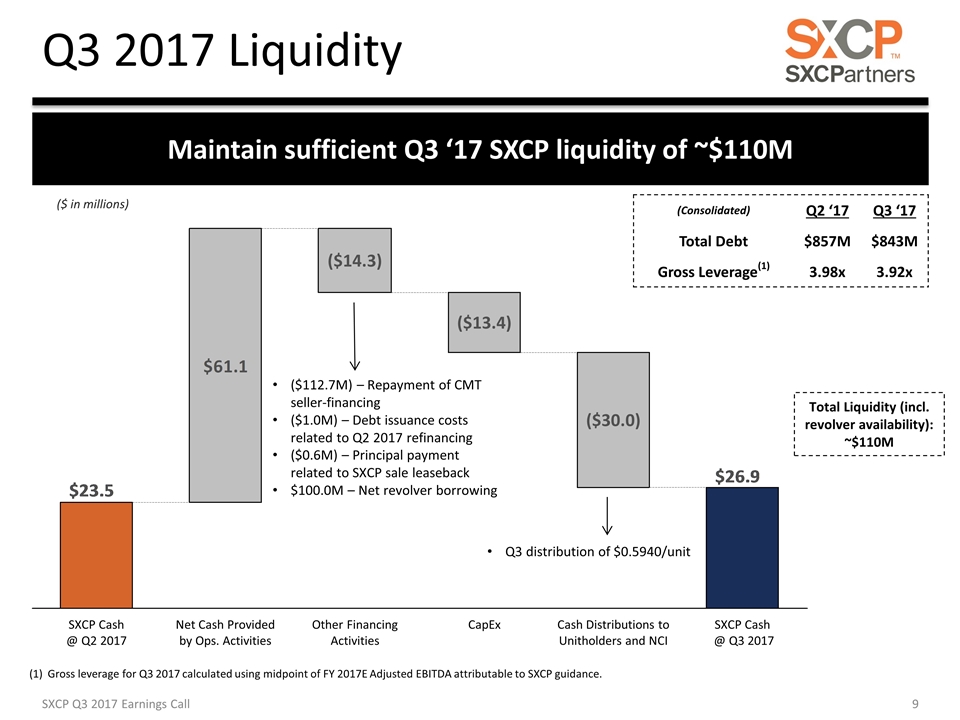

Q3 2017 Liquidity ($ in millions) Total Liquidity (incl. revolver availability): ~$110M SXCP Q3 2017 Earnings Call Gross leverage for Q3 2017 calculated using midpoint of FY 2017E Adjusted EBITDA attributable to SXCP guidance. Q3 distribution of $0.5940/unit ($112.7M) – Repayment of CMT seller-financing ($1.0M) – Debt issuance costs related to Q2 2017 refinancing ($0.6M) – Principal payment related to SXCP sale leaseback $100.0M – Net revolver borrowing (Consolidated) Q2 ‘17 Q3 ‘17 Total Debt $857M $843M Gross Leverage(1) 3.98x 3.92x Maintain sufficient Q3 ‘17 SXCP liquidity of ~$110M

Capital Priorities and 2017 Outlook Declared Q3 2017 cash distribution of $0.5940/unit Expect to generate Distributable Cash Flow of $119M – $130M in FY 2017(1) Includes ~$8M repayment to SXC for IDR/corporate cost reimbursement deferral during 1H ‘17 and revised cash interest accrual for new capital structure Anticipate FY 2017 cash coverage of ~1.10x Continue to evaluate most efficient uses of SXCP cash Believe prudent to reduce long-term gross leverage to target ~3.5x over time Currently, limited cash flow after distributions(2) due to GCO gas sharing capex requirements in 2017 & 2018(3) SXCP Q3 2017 Earnings Call Revised Q2 2017 from $126 million to $136 million to reflect revised cash interest accrual for SXCP’s new capital structure. Represents distributable cash flow less estimated distributions plus non-cash replacement capex accrual. Anticipate Granite City gas sharing capex requirements of ~$25M per year for both 2017 and 2018, or ~$50M total. Recently declared Q3 2017 distribution of $0.5940; Continue to evaluate most efficient uses of SXCP cash

CMT New Business Wins SXCP Q3 2017 Earnings Call Developed new domestic thermal coal business in Q3 ‘16 U.S. utility shipping thermal coal destined for Florida Expect to handle volumes throughout 2018 Recently secured new aggregates customer (via water to ground storage) Multi-year contract with firm use commitments and upside Began handling volumes in Q3 2017 Successfully handled first trial shipments of rail-borne petcoke for two refinery customers Expect these incremental volumes will contribute $1M – $2M to FY ‘17 Adj. EBITDA Recent Wins Continue to diversify product and customer mix at CMT with recent aggregates and petcoke shipments in Q3 2017

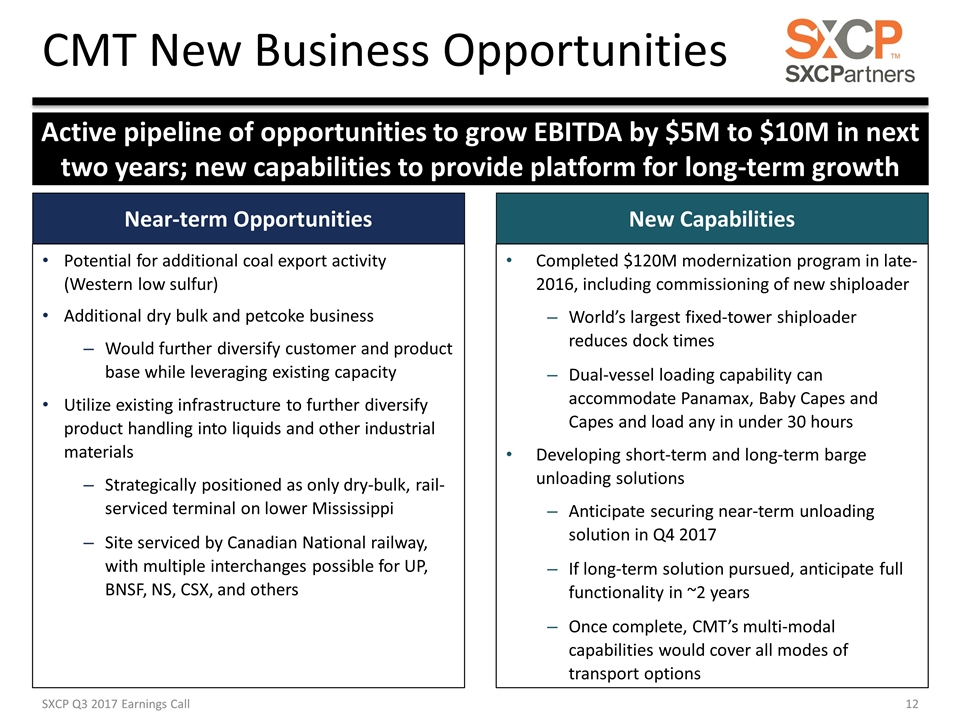

CMT New Business Opportunities Near-term Opportunities New Capabilities Completed $120M modernization program in late-2016, including commissioning of new shiploader World’s largest fixed-tower shiploader reduces dock times Dual-vessel loading capability can accommodate Panamax, Baby Capes and Capes and load any in under 30 hours Developing short-term and long-term barge unloading solutions Anticipate securing near-term unloading solution in Q4 2017 If long-term solution pursued, anticipate full functionality in ~2 years Once complete, CMT’s multi-modal capabilities would cover all modes of transport options Potential for additional coal export activity (Western low sulfur) Additional dry bulk and petcoke business Would further diversify customer and product base while leveraging existing capacity Utilize existing infrastructure to further diversify product handling into liquids and other industrial materials Strategically positioned as only dry-bulk, rail-serviced terminal on lower Mississippi Site serviced by Canadian National railway, with multiple interchanges possible for UP, BNSF, NS, CSX, and others Active pipeline of opportunities to grow EBITDA by $5M to $10M in next two years; new capabilities to provide platform for long-term growth SXCP Q3 2017 Earnings Call

Questions

Investor Relations 630-824-1987 www.suncoke.com

Appendix

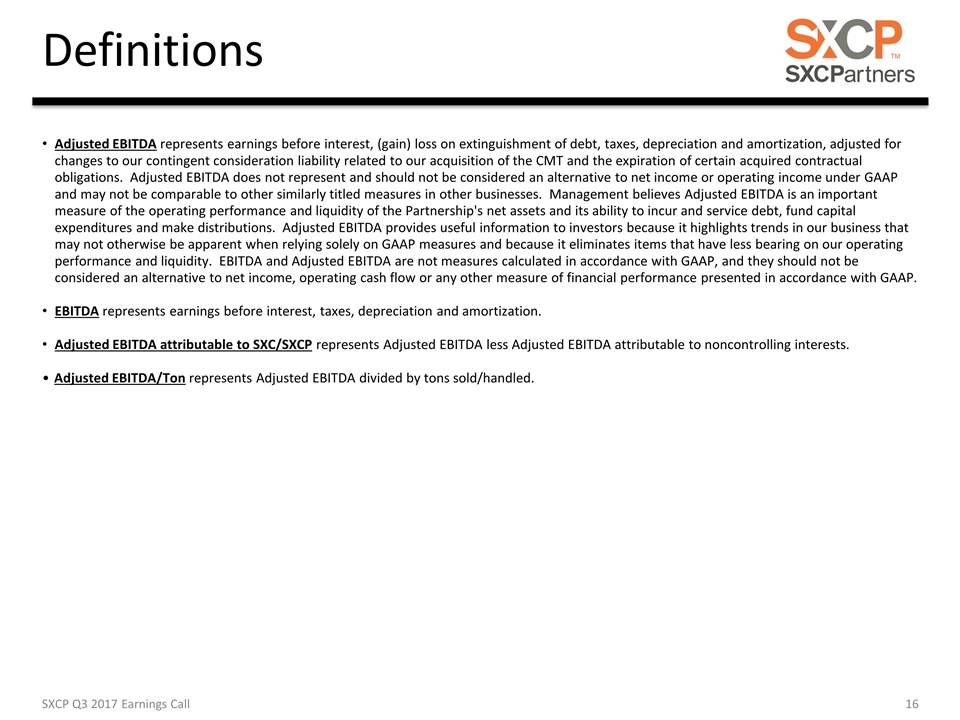

Definitions Adjusted EBITDA represents earnings before interest, (gain) loss on extinguishment of debt, taxes, depreciation and amortization, adjusted for changes to our contingent consideration liability related to our acquisition of the CMT and the expiration of certain acquired contractual obligations. Adjusted EBITDA does not represent and should not be considered an alternative to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Partnership's net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered an alternative to net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA attributable to SXC/SXCP represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. •Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. SXCP Q3 2017 Earnings Call

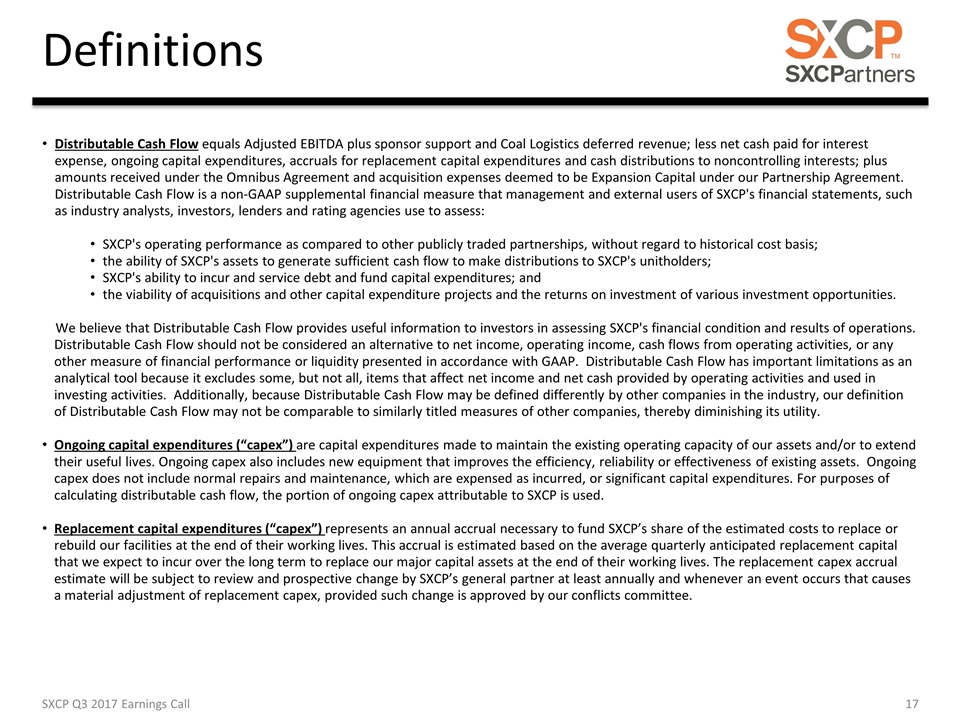

Definitions Distributable Cash Flow equals Adjusted EBITDA plus sponsor support and Coal Logistics deferred revenue; less net cash paid for interest expense, ongoing capital expenditures, accruals for replacement capital expenditures and cash distributions to noncontrolling interests; plus amounts received under the Omnibus Agreement and acquisition expenses deemed to be Expansion Capital under our Partnership Agreement. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of SXCP's financial statements, such as industry analysts, investors, lenders and rating agencies use to assess: SXCP's operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; the ability of SXCP's assets to generate sufficient cash flow to make distributions to SXCP's unitholders; SXCP's ability to incur and service debt and fund capital expenditures; and the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. We believe that Distributable Cash Flow provides useful information to investors in assessing SXCP's financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with GAAP. Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities. Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, our definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. Ongoing capital expenditures (“capex”) are capital expenditures made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also includes new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used. Replacement capital expenditures (“capex”) represents an annual accrual necessary to fund SXCP’s share of the estimated costs to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will be subject to review and prospective change by SXCP’s general partner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee. SXCP Q3 2017 Earnings Call

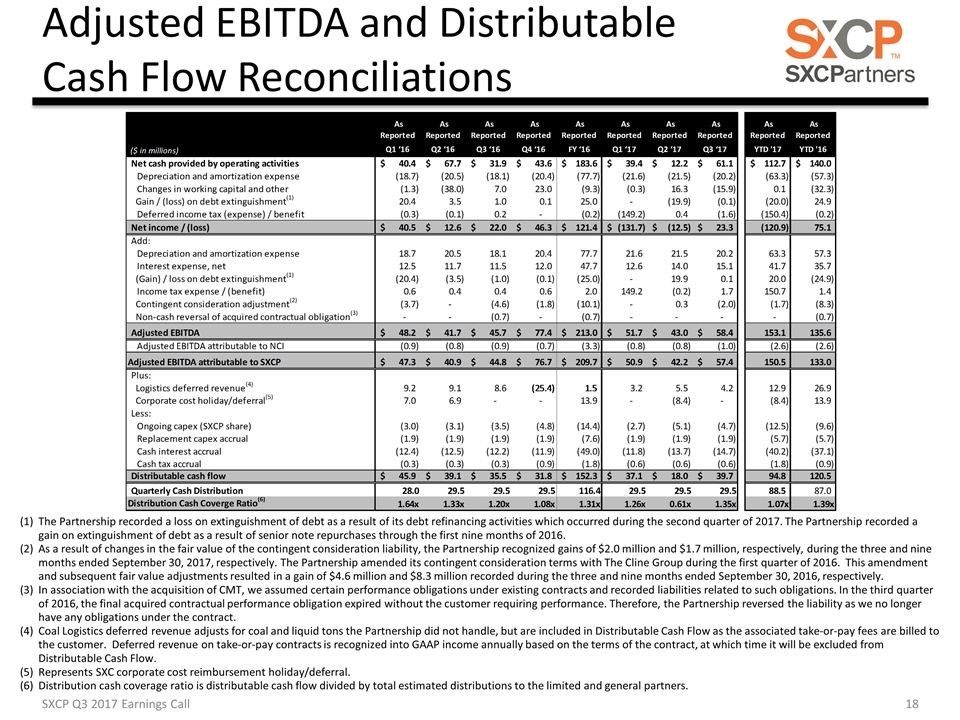

Adjusted EBITDA and Distributable Cash Flow Reconciliations The Partnership recorded a loss on extinguishment of debt as a result of its debt refinancing activities which occurred during the second quarter of 2017. The Partnership recorded a gain on extinguishment of debt as a result of senior note repurchases through the first nine months of 2016. As a result of changes in the fair value of the contingent consideration liability, the Partnership recognized gains of $2.0 million and $1.7 million, respectively, during the three and nine months ended September 30, 2017, respectively. The Partnership amended its contingent consideration terms with The Cline Group during the first quarter of 2016. This amendment and subsequent fair value adjustments resulted in a gain of $4.6 million and $8.3 million recorded during the three and nine months ended September 30, 2016, respectively. In association with the acquisition of CMT, we assumed certain performance obligations under existing contracts and recorded liabilities related to such obligations. In the third quarter of 2016, the final acquired contractual performance obligation expired without the customer requiring performance. Therefore, the Partnership reversed the liability as we no longer have any obligations under the contract. Coal Logistics deferred revenue adjusts for coal and liquid tons the Partnership did not handle, but are included in Distributable Cash Flow as the associated take-or-pay fees are billed to the customer. Deferred revenue on take-or-pay contracts is recognized into GAAP income annually based on the terms of the contract, at which time it will be excluded from Distributable Cash Flow. Represents SXC corporate cost reimbursement holiday/deferral. Distribution cash coverage ratio is distributable cash flow divided by total estimated distributions to the limited and general partners. SXCP Q3 2017 Earnings Call

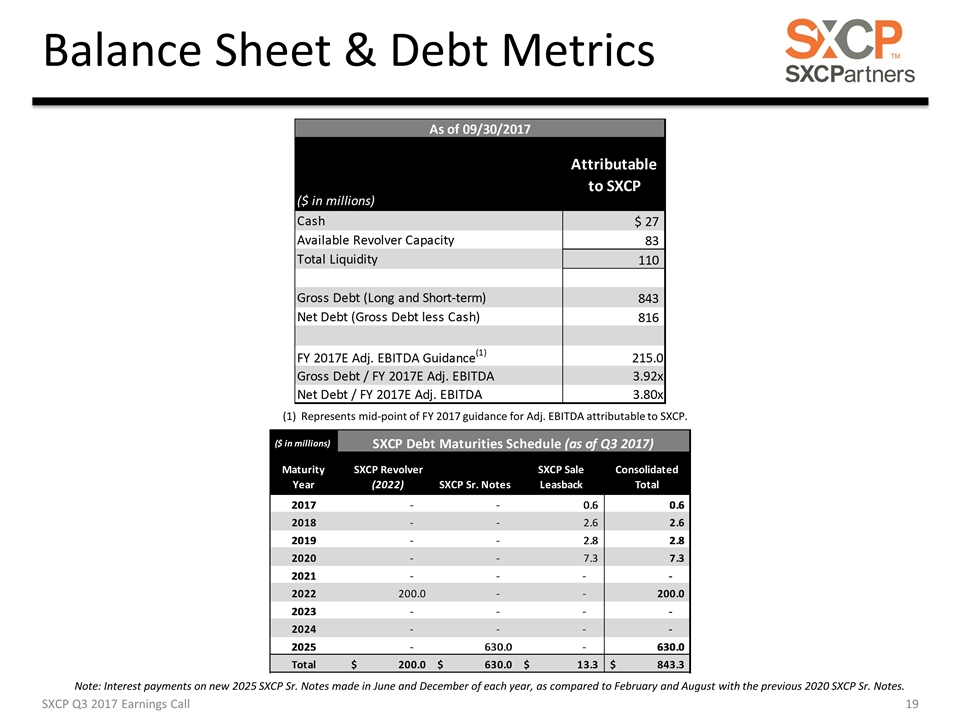

Balance Sheet & Debt Metrics SXCP Q3 2017 Earnings Call Represents mid-point of FY 2017 guidance for Adj. EBITDA attributable to SXCP. Note: Interest payments on new 2025 SXCP Sr. Notes made in June and December of each year, as compared to February and August with the previous 2020 SXCP Sr. Notes.

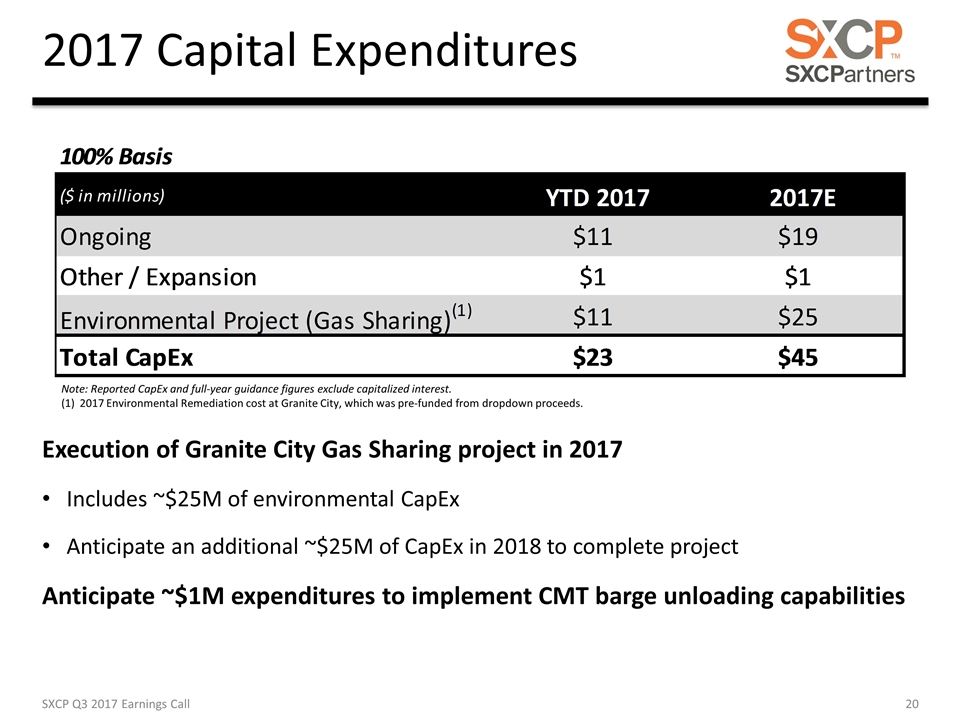

2017 Capital Expenditures Note: Reported CapEx and full-year guidance figures exclude capitalized interest. 2017 Environmental Remediation cost at Granite City, which was pre-funded from dropdown proceeds. SXCP Q3 2017 Earnings Call Execution of Granite City Gas Sharing project in 2017 Includes ~$25M of environmental CapEx Anticipate an additional ~$25M of CapEx in 2018 to complete project Anticipate ~$1M expenditures to implement CMT barge unloading capabilities

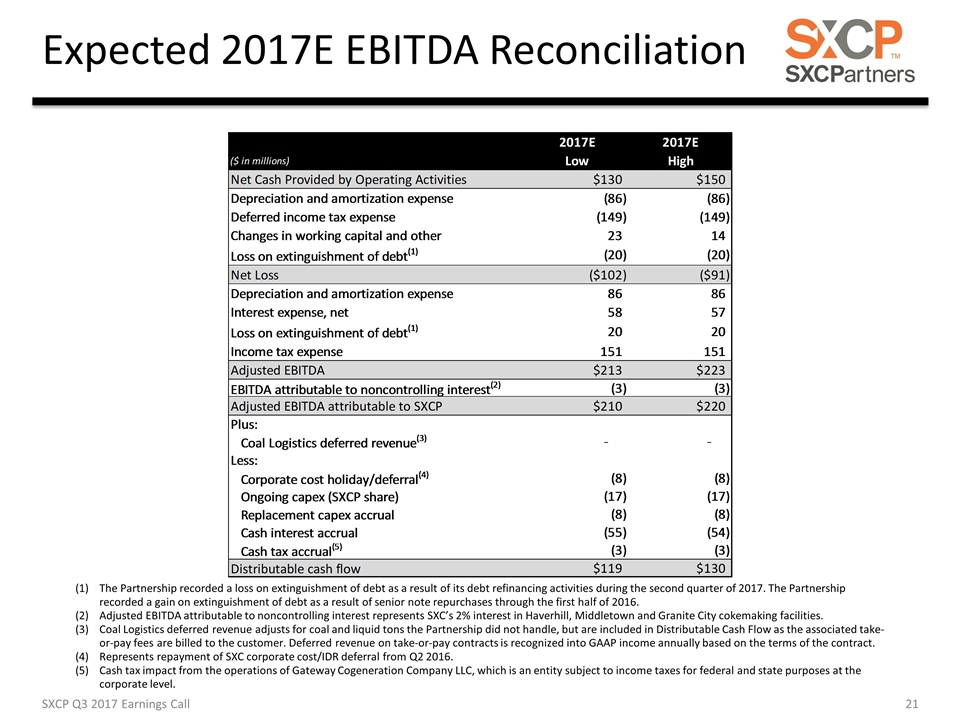

Expected 2017E EBITDA Reconciliation The Partnership recorded a loss on extinguishment of debt as a result of its debt refinancing activities during the second quarter of 2017. The Partnership recorded a gain on extinguishment of debt as a result of senior note repurchases through the first half of 2016. Adjusted EBITDA attributable to noncontrolling interest represents SXC’s 2% interest in Haverhill, Middletown and Granite City cokemaking facilities. Coal Logistics deferred revenue adjusts for coal and liquid tons the Partnership did not handle, but are included in Distributable Cash Flow as the associated take-or-pay fees are billed to the customer. Deferred revenue on take-or-pay contracts is recognized into GAAP income annually based on the terms of the contract. Represents repayment of SXC corporate cost/IDR deferral from Q2 2016. Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level. SXCP Q3 2017 Earnings Call

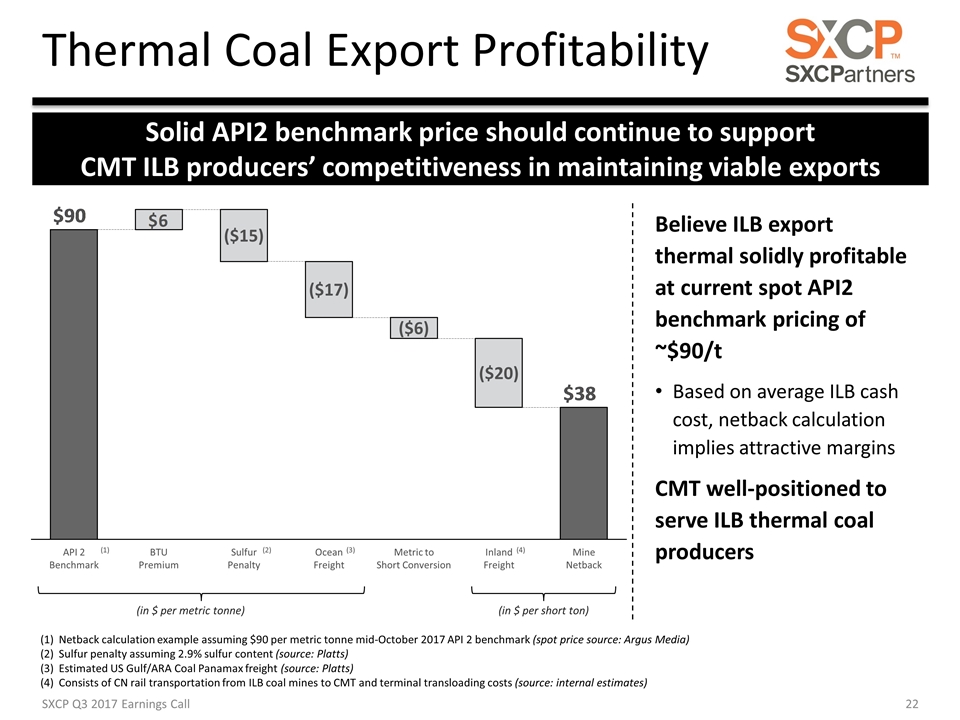

Thermal Coal Export Profitability (in $ per metric tonne) Netback calculation example assuming $90 per metric tonne mid-October 2017 API 2 benchmark (spot price source: Argus Media) Sulfur penalty assuming 2.9% sulfur content (source: Platts) Estimated US Gulf/ARA Coal Panamax freight (source: Platts) Consists of CN rail transportation from ILB coal mines to CMT and terminal transloading costs (source: internal estimates) (1) (3) Believe ILB export thermal solidly profitable at current spot API2 benchmark pricing of ~$90/t Based on average ILB cash cost, netback calculation implies attractive margins CMT well-positioned to serve ILB thermal coal producers (in $ per short ton) (4) SXCP Q3 2017 Earnings Call (2) Solid API2 benchmark price should continue to support CMT ILB producers’ competitiveness in maintaining viable exports