Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kearny Financial Corp. | d679819d8k.htm |

Annual Meeting of Stockholders Nasdaq: KRNY October 26, 2017 Exhibit 99.1

This presentation may include certain “forward-looking statements,” which are made in good faith by Kearny Financial Corp. (the “Company”) pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties, such as statements of the Company’s plans, objectives, expectations, estimates and intentions that are subject to change based on various important factors (some of which are beyond the Company’s control). In addition to the factors described under Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K, the following factors, among others, could cause the Company’s financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements: the strength of the United States economy in general and the strength of the local economy in which the Company conducts operations, the effects of and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rates, market and monetary fluctuations, the impact of changes in financial services laws and regulations (including laws concerning taxation, banking, securities and insurance), changes in accounting policies and practices, as may be adopted by regulatory agencies, the Financial Accounting Standards Board (“FASB”) or the Public Company Accounting Oversight Board, technological changes, competition among financial services providers and, the success of the Company at managing the risks involved in the foregoing and managing its business. The Company cautions that the foregoing list of important factors is not exclusive. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company. Forward Looking Statements

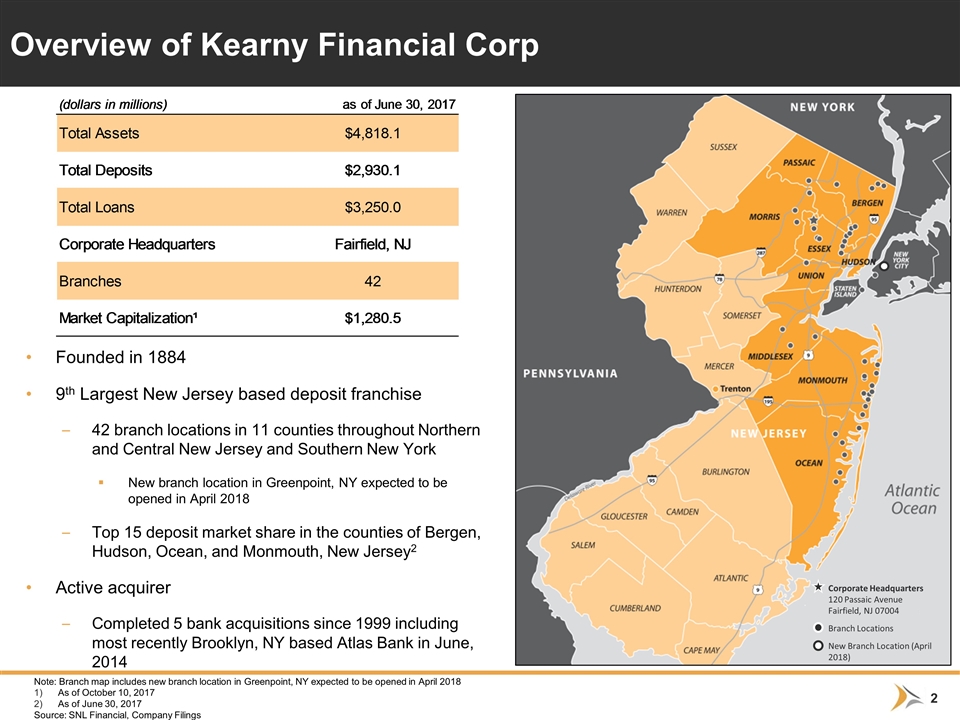

Founded in 1884 9th Largest New Jersey based deposit franchise 42 branch locations in 11 counties throughout Northern and Central New Jersey and Southern New York New branch location in Greenpoint, NY expected to be opened in April 2018 Top 15 deposit market share in the counties of Bergen, Hudson, Ocean, and Monmouth, New Jersey2 Active acquirer Completed 5 bank acquisitions since 1999 including most recently Brooklyn, NY based Atlas Bank in June, 2014 Overview of Kearny Financial Corp Note: Branch map includes new branch location in Greenpoint, NY expected to be opened in April 2018 As of October 10, 2017 As of June 30, 2017 Source: SNL Financial, Company Filings Corporate Headquarters 120 Passaic Avenue Fairfield, NJ 07004 Branch Locations New Branch Location (April 2018)

Kearny Bank Mission Statement Kearny Bank is dedicated to providing professional service and sound financial advice to our client and stockholder base. This is successfully accomplished through deep-rooted guiding principles of strong values consisting of ethics and integrity, and by giving back to the communities we serve. Through our financial expertise, strong leadership, and loyal relationships, we help our clients achieve their financial goals both for today and for tomorrow.

Core Values People Our significant stakeholders, including employees, current and future customers, stockholders, and the communities we serve. Relationships Delivery of superior service, a keen understanding of clients’ needs, and a welcoming environment has resulted in high levels of customer satisfaction, loyalty, and strong long-lasting relationships. Performance A strong resolve to remain true to sound, conservative practices, and superior customer service which has led to steady progress and growth throughout the years

Kearny Value Chain Optimization of asset mix Grow and diversify our commercial real estate lending portfolio Expand our commercial lending business into new markets Increase residential mortgage lending Reinvest cash flows from the investment portfolio into loans while still maintaining a diverse composition and allocation to reduce exposure to long term interest rate risk Focus on core deposit growth: noninterest and interest bearing Expand existing fee based business lines (Mortgage Banking & SBA Lending) Control noninterest expense Use technology to improve the customer experience Significant opportunities to grow in market and in contiguous markets Conservative lending policies and strong credit culture Focused and disciplined approach to M&A

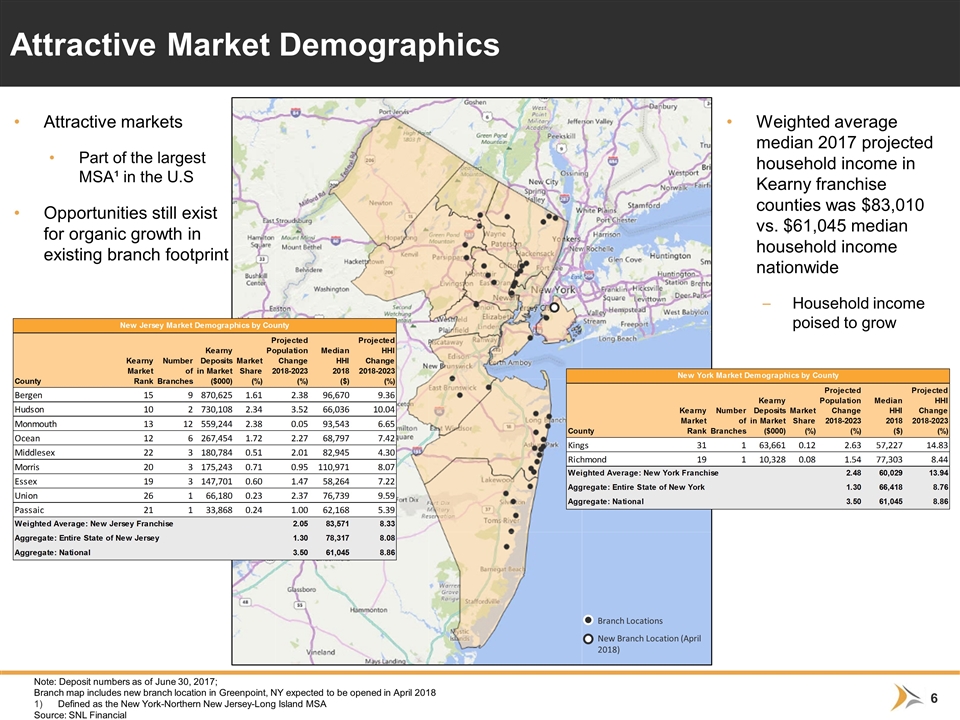

Attractive Market Demographics Note: Deposit numbers as of June 30, 2017; Branch map includes new branch location in Greenpoint, NY expected to be opened in April 2018 Defined as the New York-Northern New Jersey-Long Island MSA Source: SNL Financial Attractive markets Part of the largest MSA¹ in the U.S Opportunities still exist for organic growth in existing branch footprint Weighted average median 2017 projected household income in Kearny franchise counties was $83,010 vs. $61,045 median household income nationwide Household income poised to grow Branch Locations New Branch Location (April 2018)

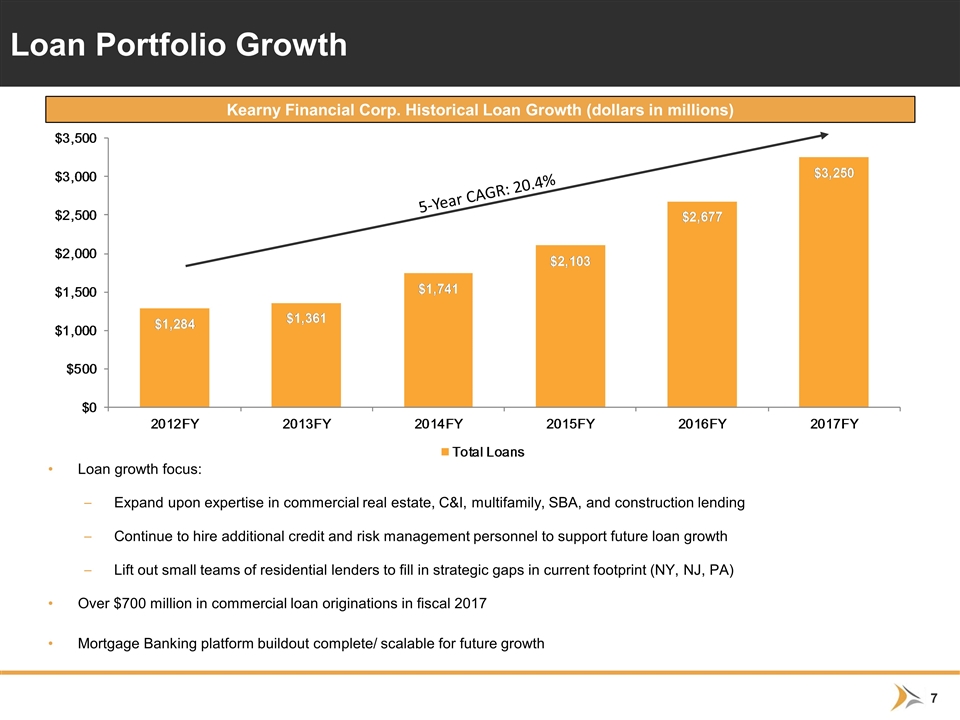

Loan Portfolio Growth Kearny Financial Corp. Historical Loan Growth (dollars in millions) 5-Year CAGR: 20.4% Loan growth focus: Expand upon expertise in commercial real estate, C&I, multifamily, SBA, and construction lending Continue to hire additional credit and risk management personnel to support future loan growth Lift out small teams of residential lenders to fill in strategic gaps in current footprint (NY, NJ, PA) Over $700 million in commercial loan originations in fiscal 2017 Mortgage Banking platform buildout complete/ scalable for future growth

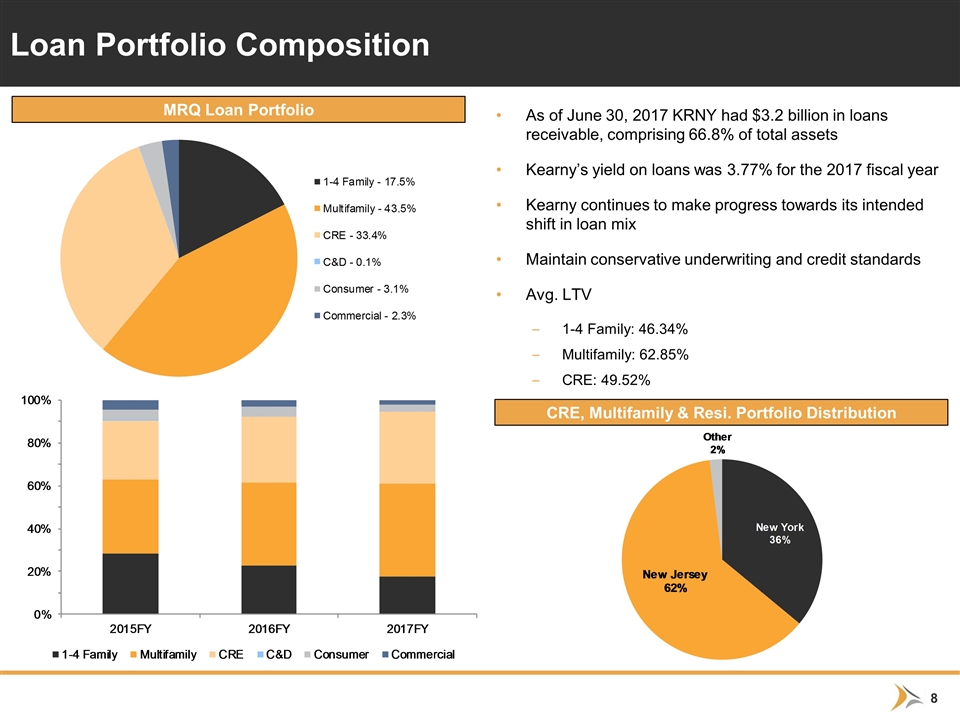

Loan Portfolio Composition As of June 30, 2017 KRNY had $3.2 billion in loans receivable, comprising 66.8% of total assets Kearny’s yield on loans was 3.77% for the 2017 fiscal year Kearny continues to make progress towards its intended shift in loan mix Maintain conservative underwriting and credit standards Avg. LTV 1-4 Family: 46.34% Multifamily: 62.85% CRE: 49.52% MRQ Loan Portfolio CRE, Multifamily & Resi. Portfolio Distribution

Commercial Lending Success Continues

Industry Leadership Recognized

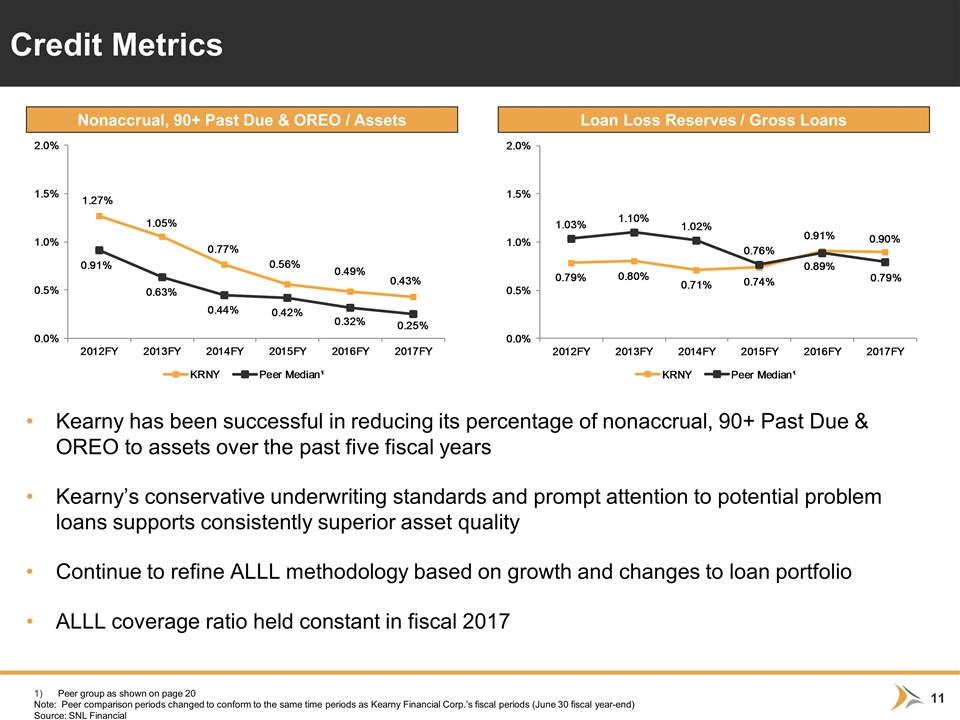

Kearny has been successful in reducing its percentage of nonaccrual, 90+ Past Due & OREO to assets over the past five fiscal years Kearny’s conservative underwriting standards and prompt attention to potential problem loans supports consistently superior asset quality Continue to refine ALLL methodology based on growth and changes to loan portfolio ALLL coverage ratio held constant in fiscal 2017 Credit Metrics Peer group as shown on page 20 Note: Peer comparison periods changed to conform to the same time periods as Kearny Financial Corp.’s fiscal periods (June 30 fiscal year-end) Source: SNL Financial Nonaccrual, 90+ Past Due & OREO / Assets Loan Loss Reserves / Gross Loans

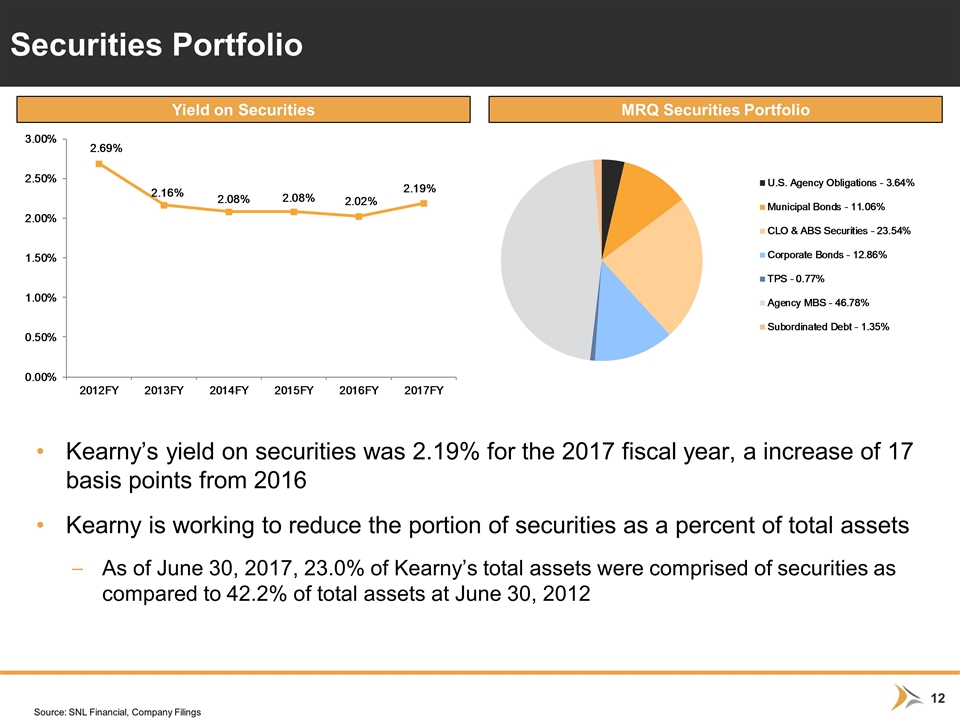

Securities Portfolio Source: SNL Financial, Company Filings Kearny’s yield on securities was 2.19% for the 2017 fiscal year, a increase of 17 basis points from 2016 Kearny is working to reduce the portion of securities as a percent of total assets As of June 30, 2017, 23.0% of Kearny’s total assets were comprised of securities as compared to 42.2% of total assets at June 30, 2012 MRQ Securities Portfolio Yield on Securities

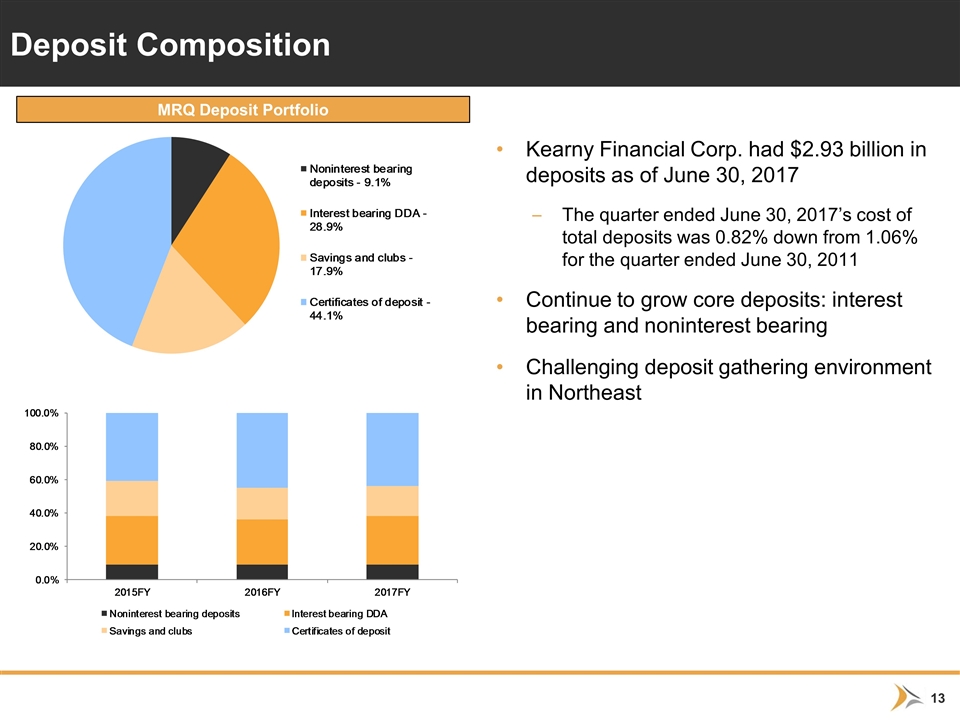

Deposit Composition MRQ Deposit Portfolio Kearny Financial Corp. had $2.93 billion in deposits as of June 30, 2017 The quarter ended June 30, 2017’s cost of total deposits was 0.82% down from 1.06% for the quarter ended June 30, 2011 Continue to grow core deposits: interest bearing and noninterest bearing Challenging deposit gathering environment in Northeast

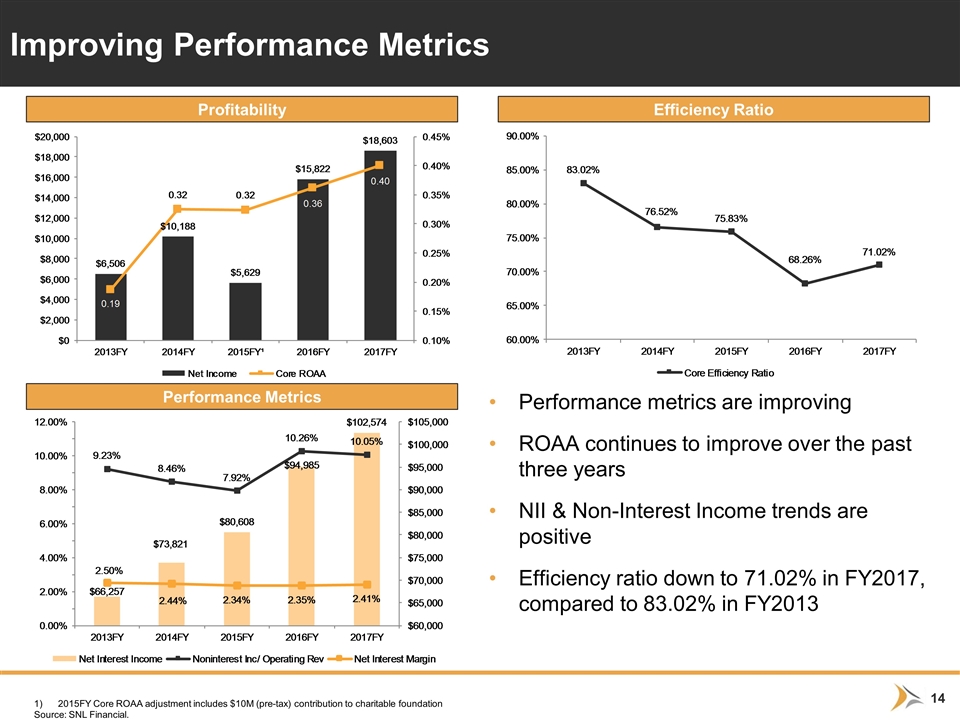

Improving Performance Metrics Profitability Efficiency Ratio Performance Metrics Performance metrics are improving ROAA continues to improve over the past three years NII & Non-Interest Income trends are positive Efficiency ratio down to 71.02% in FY2017, compared to 83.02% in FY2013 2015FY Core ROAA adjustment includes $10M (pre-tax) contribution to charitable foundation Source: SNL Financial.

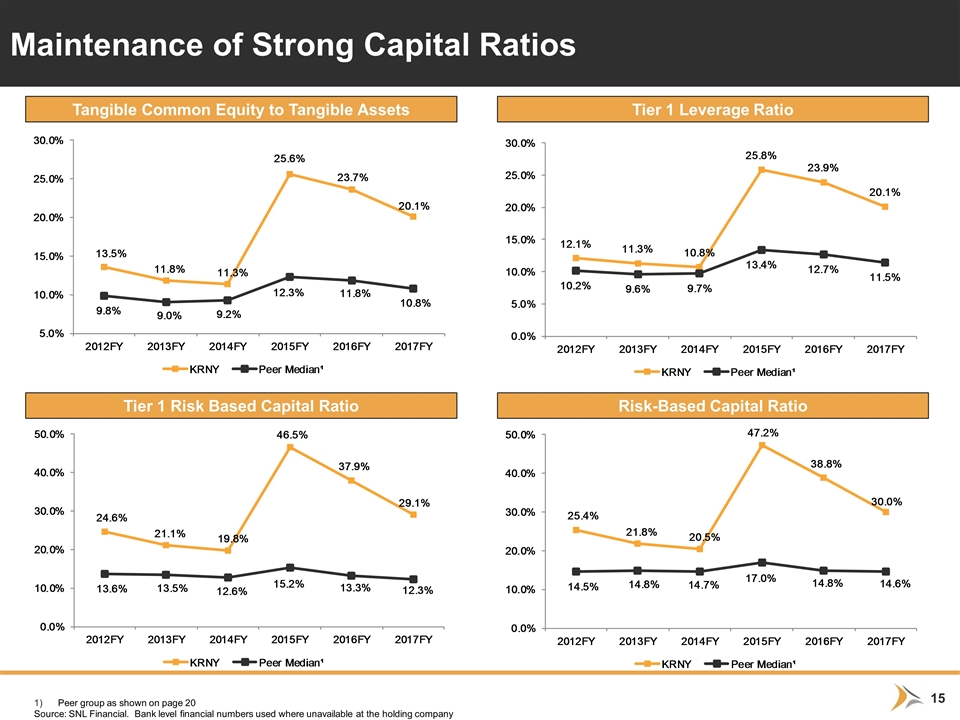

Maintenance of Strong Capital Ratios Peer group as shown on page 20 Source: SNL Financial. Bank level financial numbers used where unavailable at the holding company Tangible Common Equity to Tangible Assets Tier 1 Leverage Ratio Tier 1 Risk Based Capital Ratio Risk-Based Capital Ratio

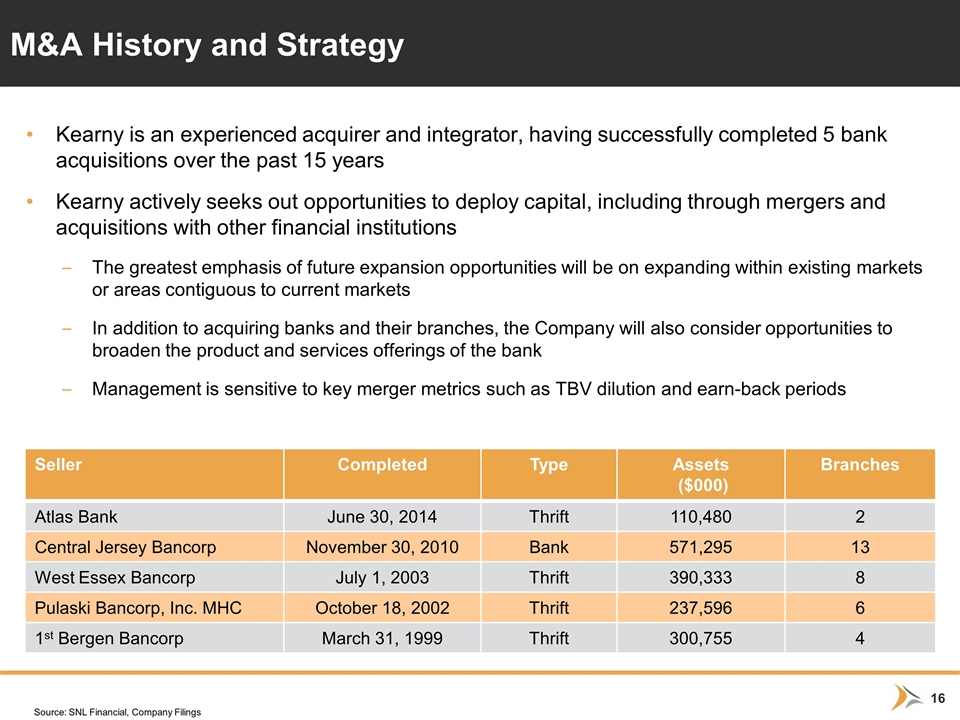

M&A History and Strategy Source: SNL Financial, Company Filings Seller Completed Type Assets ($000) Branches Atlas Bank June 30, 2014 Thrift 110,480 2 Central Jersey Bancorp November 30, 2010 Bank 571,295 13 West Essex Bancorp July 1, 2003 Thrift 390,333 8 Pulaski Bancorp, Inc. MHC October 18, 2002 Thrift 237,596 6 1st Bergen Bancorp March 31, 1999 Thrift 300,755 4 Kearny is an experienced acquirer and integrator, having successfully completed 5 bank acquisitions over the past 15 years Kearny actively seeks out opportunities to deploy capital, including through mergers and acquisitions with other financial institutions The greatest emphasis of future expansion opportunities will be on expanding within existing markets or areas contiguous to current markets In addition to acquiring banks and their branches, the Company will also consider opportunities to broaden the product and services offerings of the bank Management is sensitive to key merger metrics such as TBV dilution and earn-back periods

Robust capital to support continued growth The second step offering allows Kearny to pursue organic and strategic growth opportunities that will continue Kearny’s historically strong loan growth Facilitates future mergers and acquisitions Allows for increased flexibility to use common stock while bidding for potential strategic targets Potential to make Kearny a more attractive participant in the mergers and acquisitions market, particularly in the NY, NJ, and PA market places Larger public float and strong liquidity results in an active market for Kearny’s common stock. Average daily trading volume 384,771 shares¹ Index membership ABA Nasdaq Indices (ABAQ, ABQI, QABA, XABQ) Nasdaq Bank Index Russel 2000 One-year average daily trading volume as of October 10, 2017 Update A Stronger Kearny Financial

Traditional Community Banking Growth/ Diversification of loan mix: CRE/Multifamily/C&I/SBA/Residential/Construction/Consumer Grow funding through traditional deposit sources utilizing a technological focus: mobile banking/ online account opening/ Intelligent ATMs Growth/Opportunities Mortgage banking platform (Fee income) SBA (Fee Income) Government & Small Business Banking Relationship Banking Extraordinary service Competitively priced products and services Improve the customer experience Utilize Traditional Capital Market Strategies Dividends (Quarterly & Special) Buybacks (2nd Buyback announced on 5/24/2017) M&A Control operating expenses Business line profitability analysis Branch rationalization vs new branching opportunities People Talent acquisition Seasoned bankers with a entrepreneurial spirit 2017 Strategic Focus

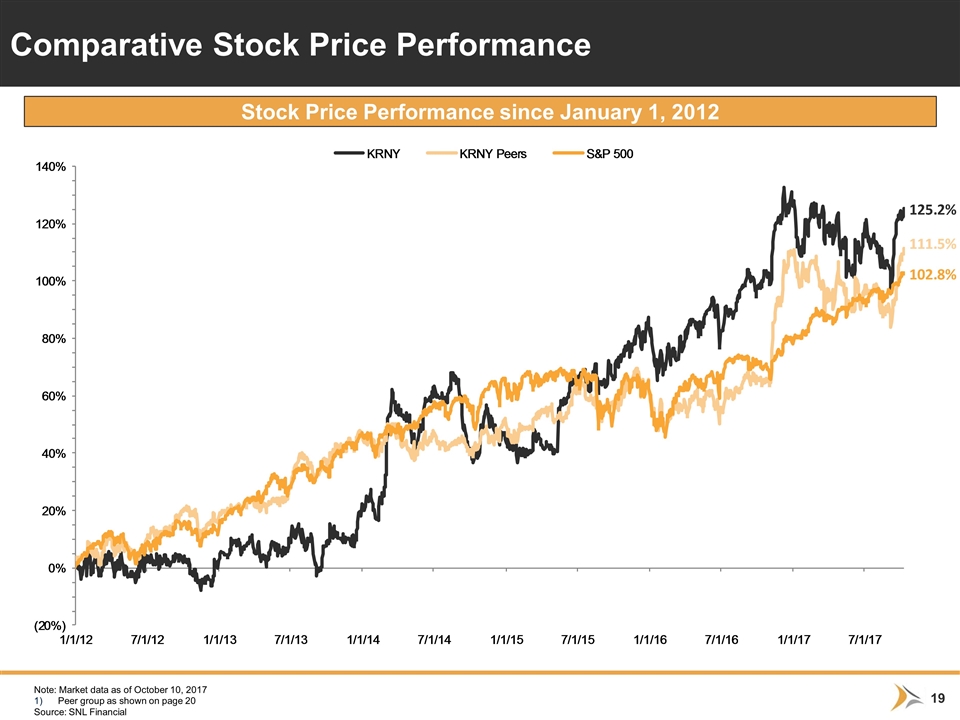

Comparative Stock Price Performance Note: Market data as of October 10, 2017 Peer group as shown on page 20 Source: SNL Financial Stock Price Performance since January 1, 2012

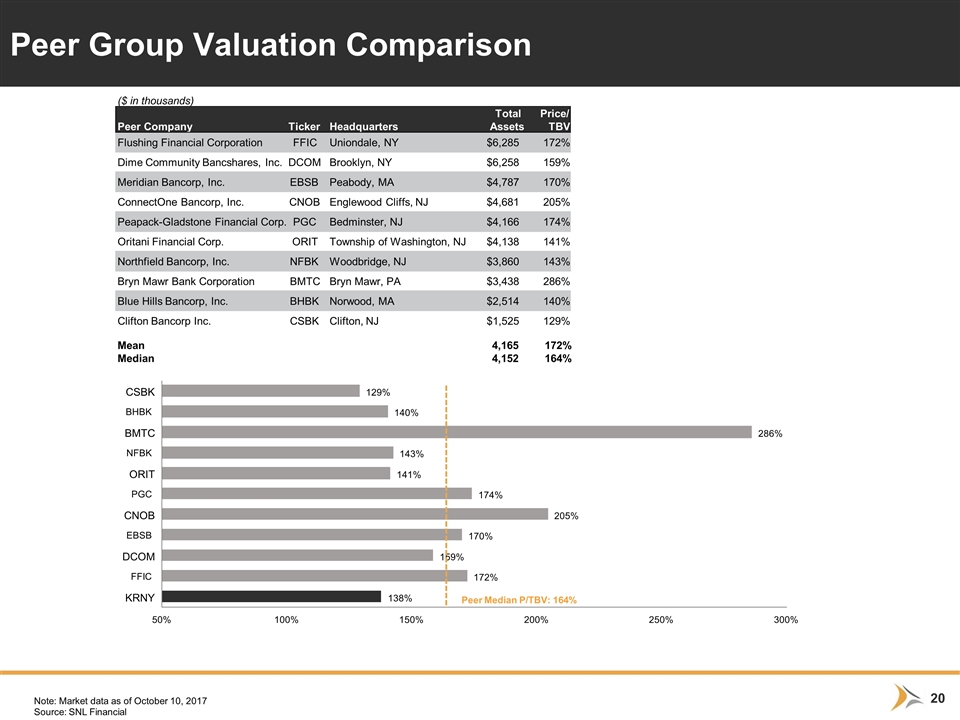

($ in thousands) Total Price/ Peer Company Ticker Headquarters Assets TBV Flushing Financial Corporation FFIC Uniondale, NY $6,285 172% Dime Community Bancshares, Inc. DCOM Brooklyn, NY $6,258 159% Meridian Bancorp, Inc. EBSB Peabody, MA $4,787 170% ConnectOne Bancorp, Inc. CNOB Englewood Cliffs, NJ $4,681 205% Peapack-Gladstone Financial Corp. PGC Bedminster, NJ $4,166 174% Oritani Financial Corp. ORIT Township of Washington, NJ $4,138 141% Northfield Bancorp, Inc. NFBK Woodbridge, NJ $3,860 143% Bryn Mawr Bank Corporation BMTC Bryn Mawr, PA $3,438 286% Blue Hills Bancorp, Inc. BHBK Norwood, MA $2,514 140% Clifton Bancorp Inc. CSBK Clifton, NJ $1,525 129% Mean 4,165 172% Median 4,152 164% 138% 172% 159% 170% 205% 174% 141% 143% 286% 140% 129% 50% 100% 150% 200% 250% 300% KRNY FFIC DCOM EBSB CNOB PGC ORIT NFBK BMTC BHBK CSBK Peer Median P/TBV: 164% Peer Group Valuation Comparison Note: Market data as of October 10, 2017 Source: SNL Financial