Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - CINCINNATI FINANCIAL CORP | cinf-2017930xex32.htm |

| EX-31.B - EXHIBIT 31.B - CINCINNATI FINANCIAL CORP | cinf-2017930xex31b.htm |

| EX-31.A - EXHIBIT 31.A - CINCINNATI FINANCIAL CORP | cinf-2017930xex31a.htm |

| 10-Q - 10-Q - CINCINNATI FINANCIAL CORP | cinf-2017930x10q.htm |

1

CINCINNATI FINANCIAL CORPORATION BOARD OF DIRECTORS

AUGUST 18, 2017

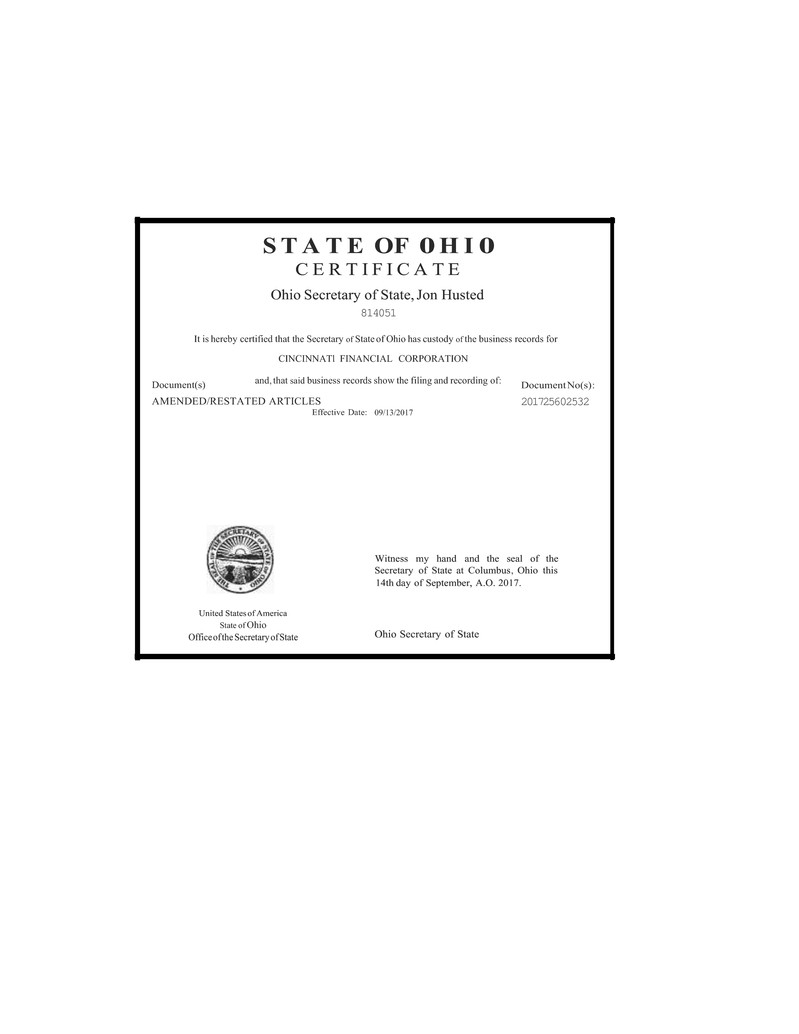

RESOLUTION TO APPROVE AMENDED AND RESTATED ARTICLES OF INCORPORATION

WHEREAS, the company's current Articles of Incorporation consist of the Amended Articles of Incorporation of Cincinnati Financial Corporation , adopted by resolution of the Board of Directors on November 19, 2010 , along with an Amendment to the Amended Articles of Incorporation of Cincinnati Financial Corporation , adopted at an annual meeting of shareholders held on April 30,

2016.

WHEREAS , the Amended Articles of Incorporation of Cincinnati Financial Corporation and the Amendment to the Amended Articles of Incorporation of Cincinnati Financial Corporation have been previously filed with the Secretary of State of the State of Ohio;

WHEREAS , it is advantageous to consolidate the documents which jointly constitute the current Articles of Incorporation applicable to the corporation in a single document; and

WHEREAS, the document entitled Amended and Restated Articles of Incorporation of Cincinnati Financial Corporation attached hereto as Exhibit A accurately consolidates the Amended Articles of Incorporation and the Amendment thereto;

RESOLVED, the board of directors approves the Amended and Restated Articles of Incorporation of Cincinnati Financial Corporation (as of August 18, 2017), as set forth in Exhibit A, and instructs the Secretary to file a copy of the Amended and Restated Articles of Incorporation (as of August 18, 2017) with the Secretary of State of the State of Ohio.

2

AMENDED AND RESTATED ARTICLES OF INCORPORATION OF

CINCINNATI FINANCIAL CORPORATION

(as of August 18, 2017)

FIRST: The name of the corporation is CINCINNATI FINANCIAL CORPORATION (the "Corporation").

SECOND: The principal office of the Corporation in the State of Ohio shall be located in the City of Fairfield, County of Butler.

THIRD: The purpose for which the Corporation is formed is to engage in any lawful act or activity for which corporations may be organized under the Ohio General Corporation Law specifically including acting as a control entity in an insurance holding company system under Chapter 3901 of the Ohio Revised Code. The Corporation is hereby expressly authorized to repurchase and to redeem its outstanding securities to the maximum extent now or hereafter permitted by applicable law.

FOURTH: The total number of shares of stock which the Corporation shall have authority to issue is Five Hundred Million (500,000,000) and the par value of each share shall be Two ($2.00) Dollars.

FIFTH: No holder of shares of any class of the Corporation shall have any preemptive right to acquire shares of the Corporation and the preemptive rights described in Ohio Revised Code §1701.15 are hereby specifically denied to the holders of shares of any class of the Corporation.

SIXTH: (a) Subject to the provisions of part (c) of this Article SIXTH, the Board of Directors shall be divided into three (3) classes, each class consisting of one-third (as nearly as possible but in no event may any one class have greater than one more director than any other class) of the total number of directors. At each annual meeting of the shareholders, the successors to the class of directors whose term shall then expire shall be elected to hold office for a term expiring at the third succeeding annual meeting. Subject to the right of the shareholders to fix the number of directors at a meeting called for the purpose of electing directors, the Board of Directors may change the number of directors constituting the Board of Directors by resolution.

(b) Directors of the Corporation shall only be removed by the shareholders for cause. "Cause" for the removal of a director shall exist only upon the occurrence of one

(1)of the following events: (1) the conviction of a director of a felony; or (2) a finding by a court of law that the director has been or is guilty of negligence or misconduct in the performance of his duties as a director of the Corporation. Vacancies in the Board of Directors, whether arising through death, resignation or removal of a director, or newly created directorships resulting from any increase in the authorized number of directors, shall be filled by a majority of the directors then in office, or by a sole remaining director,

3

and the directors so chosen shall hold office until the next annual meeting of shareholders and until his or her successor has been duly elected and qualified. No decrease in the number of authorized directors shall shorten the term of any incumbent director .

(c) Notwithstanding anything contained in part (a) of this Article SIXTH to the contrary, beginning at the 2011 annual meeting of shareholders , directors shall be elected annually for terms of one year, except that any director whose term expires at the 2012 annual meeting of shareholders or the 2013 annual meeting of shareholders shall continue to hold office until the end of the term for which such director was elected or appointed and until such director's successor shall have been elected and qualified , subject, however, to prior death, resignation, retirement, disqualification or removal from office. Accordingly , (i) at the 2010 annual meeting of shareholders, the directors whose terms expire at that meeting shall be elected to hold office for a three-year term expiring at the 2013 annual meeting of shareholders ; (ii) at that 2011 annual meeting of shareholders , the directors whose terms expire at that meeting shall be elected to hold office for a one year term expiring at the 2012 annual meeting of shareholders ; and (iii) at the 2012 annual meeting of shareholde rs, the directors whose terms expire at that meeting shall be elected to hold office for a one-year term expiring at the 2013 annual meeting of shareholders .

SEVENTH: In furtherance and not in limitation of the powers conferred by statute, the Board of Directors is expressly authorized:

To authorize and cause to be executed mortgages and liens upon the real and personal property of the corporation ;

To set apart out of any of the funds of the Corporation available for dividends a reserve or reserves for any proper purpose and to abolish any such reserve in the manner in which it was created;

By a majority of the whole board, to designate one or more committees, each committee to consist of at least three of the directors of the corporation. The board may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of the committee. Any such committee, to the extent provided in the resolution or in the regulations of the corporation , shall have and may exercise the powers of the Board of Directors in the management of the business and affairs of the corporation, and may authorize the seal of the corporation to be affixed to all papers which may require it.

EIGHTH: (a) Unless the conditions set forth in this Article are satisfied, the affirmative vote of the holders of seventy-five (75) percent of all shares of the corporation entitled to vote in elections of Directors, shall be required for the adoption or authorization of a business combination (as hereinafter defined) with any other entity (as hereinafter defined) if, as of the record date for the determination of shareholders entitled to notice thereof and to vote thereon, the other entity is the beneficial owner, directly or indirectly, of more than ten (10) percent of the outstanding shares of the Corporation entitled to vote in elections of Directors. The seventy-five (75) percent voting requirement set forth in the foregoing sentence shall not be applicable if:

4

The cash, or fair market value of other consideration, to be received per share by holders of common shares of the Corporation in the business combination is not less than the greater of: (A) the highest per-share price (including brokerage commissions , soliciting dealers' fees, dealer-management compensation, and other expenses, including, but not limited to, costs of newspaper advertisements, printing expenses, and attorney fees) paid by the other entity in acquiring any of its holdings of the common shares of the Corporation or, (B) an amount which bears the same or a greater percentage relationship to the market value price of the Corporation's common stock immediately prior to the announcement of such business combination as the highest per-share price determined in

(A)above bears to the market price of the Corporation's common stock immediately prior to the commencement of acquisition of the Corporation's common stock by the other entity but in no event in excess of two times the highest per-share price determined in (A) above;

The provisions of this Article shall also apply to a business combination with any other entity that at any time has been the beneficial owner, directly or indirectly, of more than ten (10) percent of the outstanding shares of the Corporation entitled to vote in elections of Directors, notwithstanding the fact that the other entity has reduced its shareholdings below ten (10) percent if, as of the record date for the determination of shareholders entitled to notice of and to vote on the business combination, the other entity is an "affiliate" of the Corporation (as hereinafter defined) .

(a)As used in this Article, (1) the term "other entity" shall include any corporation, person, or other entity and any other entity with which it or its "affiliate" or "associate" (as defined below) has any agreement , arrangement, or understanding, directly or indirectly , for the purpose of acquiring, holding, voting or disposing of shares of the Corporation, or that is its "affiliate" or "associate" as those terms are defined in Rule 12b-2 of the general rules and regulations under the Securities Exchange Act of 1934, together with the successors and assigns of those persons in any transaction or series of transactions not involving a public offering of the Corporation's shares within the meaning of the Securities Act of 1933; (2) an other entity shall be deemed to be the beneficial owner of any shares of the Corporation that the other entity has the right to acquire pursuant to any agreement or upon exercise of conversion rights, warrants , or options or otherwise ; (3) the outstanding shares of any class of the Corporation shall include shares deemed owned through application of clause (2) above but shall not include any other shares that may be issuable pursuant to any agreement or upon exercise of conversion rights, warrants , or options or otherwise; (4) the term "business combination" shall include (A) the sale, exchange , lease, transfer or other disposition by the Corporation of all, or substantially all, of its assets or business to any other entity, (B) the consolidation of the Corporation with or its merger into any other entity, (C) the merger into the Corporation of any other entity, or

(D) a "combination " or "majority share acquisition" in which the Corporation isthe "acquiring corporation" (as those terms are defined in Section 1701.01 of the Ohio Revised Code or any similar provision hereafter enacted) and its voting shares are issued or transferred to any other entity or to the shareholders of any other entity, and the term "business combination " shall also include any agreement , contract, or other arrangement with another entity providing for any of the transactions described in (A) through (D) of this clause (4); and (5) for the purposes of clause (a)(1) of this Article, the term "other consideration to be received" shall mean common shares of the Corporation retained by its existing public

5

shareholders in the event of a business combination with the other entity in which the Corporation is the surviving corporation.

(a)Nothing contained in this Article shall be construed to relieve any other entity from any fiduciary obligation imposed by law.

NINTH: Meetings of stockholders may be held within or without the State of Ohio. The books of the Corporation may be kept (subject to any provision contained in the statutes) outside the State of Ohio at such place or places as may be designated from time to time by the Board of Directors or in the Regulations of the Corporation. Elections of directors need not be by written ballot unless the Regulations of the Corporation shall so provide.

TENTH: The Corporation reserves the right to amend, alter, change or repeal any provision contained in these Articles of Incorporation, in the manner now or hereafter prescribed by statute, and all rights conferred upon shareholders herein are granted subject to this reservation. Notwithstanding the foregoing, this Article and Articles SIXTH and EIGHTH of the Corporation' s Articles of Incorporation may be altered, amended or repealed only if seventy-five (75) percent of the outstanding stock of each class entitled to vote thereon as a class have been voted in favor of such action.

ELEVENTH: Each person who is or was a director or officer of the Corporation shall be indemnified by the Corporation to the full extent permitted by the General Corporation Law of the State of Ohio against any liability, cost or expense incurred by him in his capacity as a director or officer or arising out of his status as a director or officer. The Corporation may, but shall not be obligated to, maintain insurance, at its expense, to protect itself and any such person against any such liability, cost or expense. The indemnification authorized by this Article ELEVENTH shall not be exclusive of, and shall be in addition to, any other rights granted to a person seeking indemnification or advancement of expenses under any statute, the Regulations or any agreement, vote of shareholders or disinterested directors or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office.

TWELFTH: No action required to be taken or which may be taken at any annual or special meeting of shareholders of the Corporation may be taken without a meeting, and the power of shareholders to consent in writing, without a meeting, to the taking of any action, including (without limitation) the power of shareholders to adopt or amend the Regulations by written consent, is hereby specifically denied.

Special meetings of the shareholders of the Corporation may be called only by the Board of Directors or the Chief Executive Officer of the Corporation or by persons who hold fifty (50) percent of all shares of the Corporation outstanding and entitled to vote at such special meeting.

No holder of shares of any class of the Corporation shall have the right to cumulate his voting power in the election of the Board of Directors and the right to cumulative voting

6

described in Ohio Revised Code §1701.55 is hereby specifically denied to the holders of shares of any class of the Corporation.

THIRTEENTH: At each meeting of shareholders at which directors are to be elected, a candidate for director shall be elected only if the votes "for" the candidate exceed the votes "against" the candidate. Abstentions and broker nonvotes shall not be counted as votes "for" or "against" a candidate. Notwithstanding the foregoing, if the Board of Directors determines that the number of candidates exceeds the number of Directors to be elected, then in that election the candidates receiving the greatest number of votes shall be elected.

7