Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Veritex Holdings, Inc. | vbtx-8kearningsreleasex930.htm |

| EX-99.1 - EXHIBIT 99.1 - Veritex Holdings, Inc. | vbtx-ex991x93017.htm |

V E R I T E X

Earnings Presentation

Third Quarter 2017

2

Safe Harbor Statement

ABOUT VERITEX HOLDINGS, INC.

Headquartered in Dallas, Texas, Veritex Holdings, Inc. (“VBTX”, “Veritex” or the “Company”) is a bank holding company that conducts banking activities

through its wholly-owned subsidiary, Veritex Community Bank, with locations throughout the Dallas/Fort Worth (“DFW”) metroplex and in the Houston

and Austin metropolitan areas. Veritex Community Bank is a Texas state chartered bank regulated by the Texas Department of Banking and the Board of

Governors of the Federal Reserve System. For more information, visit www.veritexbank.com.

NO OFFER OR SOLICITATION

This communication does not constitute an offer to sell, a solicitation of an offer to sell, the solicitation or an offer to buy any securities or a solicitation

of any vote or approval. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirement of Section 10 of the Securities Act of 1933, as amended.

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

In connection with the proposed merger of Veritex and Liberty Bancshares, Inc. (“Liberty”), Veritex filed with the Securities and Exchange Commission

(the “SEC”) a registration statement on Form S-4 that includes a proxy statement of Liberty and a prospectus of Veritex, as well as other relevant

documents concerning the proposed merger. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4

AND THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THESE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VERITEX, LIBERTY AND THE MERGER. Investors and security holders may obtain free

copies of the registration statement on Form S-4 and the related proxy statement/prospectus, as well as other documents filed with the SEC by Veritex

through the web site maintained by the SEC at www.sec.gov. Documents filed with the SEC by Veritex are available free of charge by directing a written

request to Veritex Holdings, Inc., 8214 Westchester Drive, Suite 400, Dallas, Texas 75225 Attn: Investor Relations. Veritex’s telephone number is (972)

349-6200.

NON-GAAP FINANCIAL MEASURES

Veritex reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that

certain non-GAAP performance measures used in managing the business may provide meaningful information about underlying trends in its business.

Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Veritex’s reported results prepared in accordance with

GAAP. Please see Reconciliation of Non-GAAP Measures at the end of this presentation for a reconciliation to the nearest GAAP financial measure.

PARTICIPANTS IN THE TRANSACTION

Veritex, Liberty and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the

shareholders of Liberty in connection with the proposed merger. Certain information regarding the interests of these participants and a description of

their direct and indirect interests, by security holdings or otherwise, are included in the proxy statement/prospectus regarding the proposed transaction.

Additional information about Veritex and its directors and officers may be found in the definitive proxy statement of Veritex relating to its 2017 Annual

Meeting of Stockholders filed with the SEC on April 10, 2017. The definitive proxy statement can be obtained free of charge from the sources described

above.

3

Forward Looking Statements

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This presentation may contain certain forward-looking statements

within the meaning of the securities laws that are based on various facts and derived utilizing important assumptions, current expectations, estimates

and projections about the Company and its subsidiaries. Forward-looking statements include information regarding the Company’s future financial

performance, business and growth strategy, projected plans and objectives, and related transactions, integration of the acquired businesses, ability to

recognize anticipated operational efficiencies, and other projections based on macroeconomic and industry trends, which are inherently unreliable due

to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise

include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs

such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking

statements include the foregoing. Further, certain factors that could affect our future results and cause actual results to differ materially from those

expressed in the forward-looking statements include, but are not limited to whether the Company can: successfully implement its growth strategy,

including identifying acquisition targets and consummating suitable acquisitions; continue to sustain internal growth rate; provide competitive products

and services that appeal to its customers and target market; continue to have access to debt and equity capital markets; and achieve its performance

goals. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Special Cautionary Note

Regarding Forward-Looking Statements” and “Risk Factors” in Veritex’s Annual Report on Form 10-K filed with the SEC on March 10, 2017 and any

updates to those risk factors set forth in Veritex’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events

related to these or other risks or uncertainties materialize, or if Veritex’s underlying assumptions prove to be incorrect, actual results may differ

materially from what Veritex anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking

statement speaks only as of the date on which it is made, and Veritex does not undertake any obligation to publicly update or review any forward-

looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it

is not possible for us to predict those events or how they may affect us. In addition, Veritex cannot assess the impact of each factor on Veritex’s business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this

cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking

statements that Veritex or persons acting on Veritex’s behalf may issue. Annualized, pro forma, projected and estimated numbers are used for

illustrative purpose only, are not forecasts and may not reflect actual results.

Executive

Management

C. Malcolm Holland, III

Chairman of the Board,

Chief Executive Officer

34 years of Texas banking experience, all in the

Dallas metropolitan area

Former CEO of Texas region for Colonial Bank,

which grew from $625 million to $1.6 billion

Former President of First Mercantile Bank

Noreen E. Skelly

Chief Financial Officer

30 years of banking experience

Former CFO of Highlands Bancshares, Inc.

Former Senior Vice President responsible for

finance functions at Comerica Bank and

LaSalle Bank

Clay Riebe

Chief Credit Officer

34 years of banking experience

Former Chief Lending Officer of American

Momentum Bank

Former senior executive responsible for

various credit and lending functions at

Citibank and First American Bank Texas

Today’s Presenters

4

5

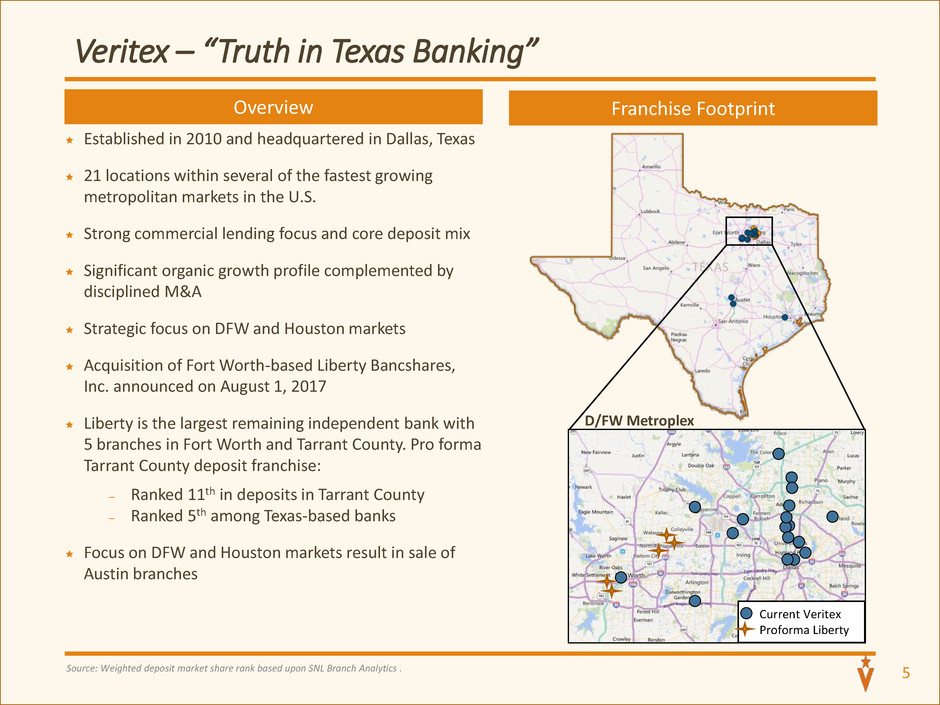

Established in 2010 and headquartered in Dallas, Texas

21 locations within several of the fastest growing

metropolitan markets in the U.S.

Strong commercial lending focus and core deposit mix

Significant organic growth profile complemented by

disciplined M&A

Strategic focus on DFW and Houston markets

Acquisition of Fort Worth-based Liberty Bancshares,

Inc. announced on August 1, 2017

Liberty is the largest remaining independent bank with

5 branches in Fort Worth and Tarrant County. Pro forma

Tarrant County deposit franchise:

̶ Ranked 11th in deposits in Tarrant County

̶ Ranked 5th among Texas-based banks

Focus on DFW and Houston markets result in sale of

Austin branches

Overview

Veritex – “Truth in Texas Banking”

Source: Weighted deposit market share rank based upon SNL Branch Analytics .

D/FW Metroplex

Current Veritex

Proforma Liberty

Franchise Footprint

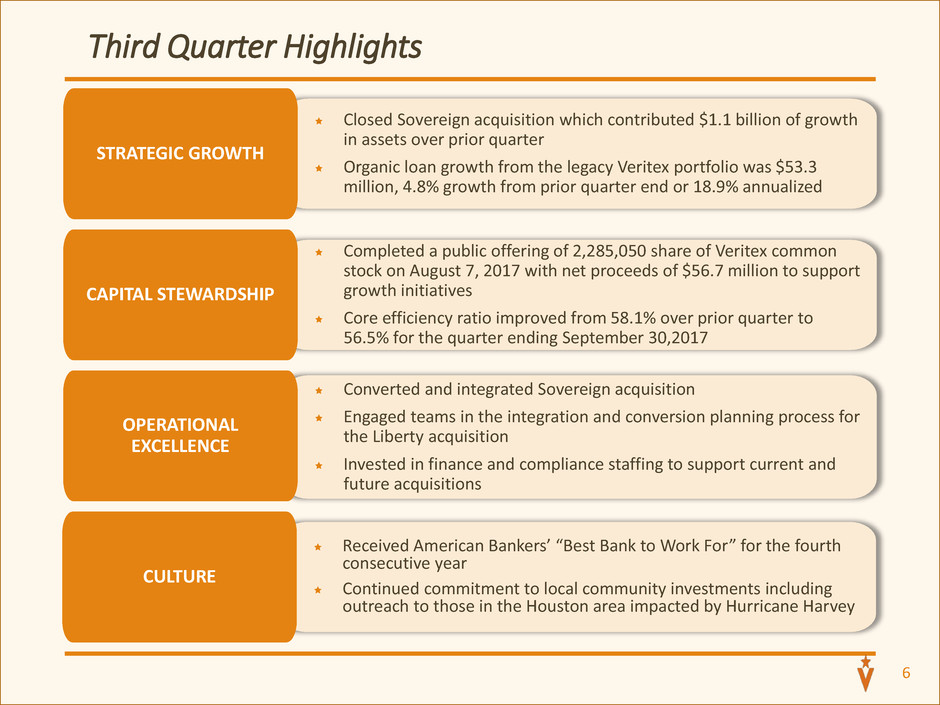

Completed a public offering of 2,285,050 share of Veritex common

stock on August 7, 2017 with net proceeds of $56.7 million to support

growth initiatives

Core efficiency ratio improved from 58.1% over prior quarter to

56.5% for the quarter ending September 30,2017

CAPITAL STEWARDSHIP

6

Converted and integrated Sovereign acquisition

Engaged teams in the integration and conversion planning process for

the Liberty acquisition

Invested in finance and compliance staffing to support current and

future acquisitions

OPERATIONAL

EXCELLENCE

Closed Sovereign acquisition which contributed $1.1 billion of growth

in assets over prior quarter

Organic loan growth from the legacy Veritex portfolio was $53.3

million, 4.8% growth from prior quarter end or 18.9% annualized

STRATEGIC GROWTH

Received American Bankers’ “Best Bank to Work For” for the fourth

consecutive year

Continued commitment to local community investments including

outreach to those in the Houston area impacted by Hurricane Harvey

CULTURE

Third Quarter Highlights

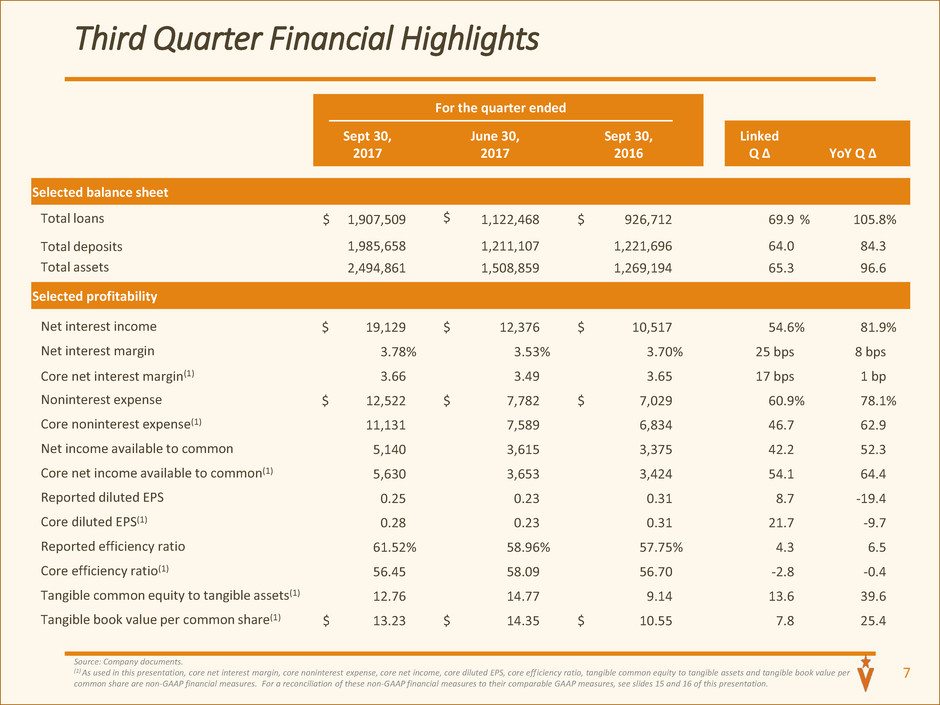

Third Quarter Financial Highlights

Source: Company documents.

(1) As used in this presentation, core net interest margin, core noninterest expense, core net income, core diluted EPS, core efficiency ratio, tangible common equity to tangible assets and tangible book value per

common share are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures to their comparable GAAP measures, see slides 15 and 16 of this presentation.

7

For the quarter ended

Sept 30,

2017

June 30,

2017

Sept 30,

2016

Linked

Q Δ YoY Q Δ

Selected balance sheet

Total loans $ 1,907,509 $ 1,122,468 $ 926,712 69.9 % 105.8%

Total deposits 1,985,658 1,211,107 1,221,696 64.0 84.3

Total assets 2,494,861 1,508,859 1,269,194 65.3 96.6

Selected profitability

Net interest income $ 19,129 $ 12,376 $ 10,517 54.6% 81.9%

Net interest margin 3.78% 3.53% 3.70% 25 bps 8 bps

Core net interest margin(1) 3.66 3.49 3.65 17 bps 1 bp

Noninterest expense $ 12,522 $ 7,782 $ 7,029 60.9% 78.1%

Core noninterest expense(1) 11,131 7,589 6,834 46.7 62.9

Net income available to common 5,140 3,615 3,375 42.2 52.3

Core net income available to common(1) 5,630 3,653 3,424 54.1 64.4

Reported diluted EPS 0.25 0.23 0.31 8.7 -19.4

Core diluted EPS(1) 0.28 0.23 0.31 21.7 -9.7

Reported efficiency ratio 61.52% 58.96% 57.75% 4.3 6.5

Core efficiency ratio(1) 56.45 58.09 56.70 -2.8 -0.4

Tangible common equity to tangible assets(1) 12.76 14.77 9.14 13.6 39.6

Tangible book value per common share(1) $ 13.23 $ 14.35 $ 10.55 7.8 25.4

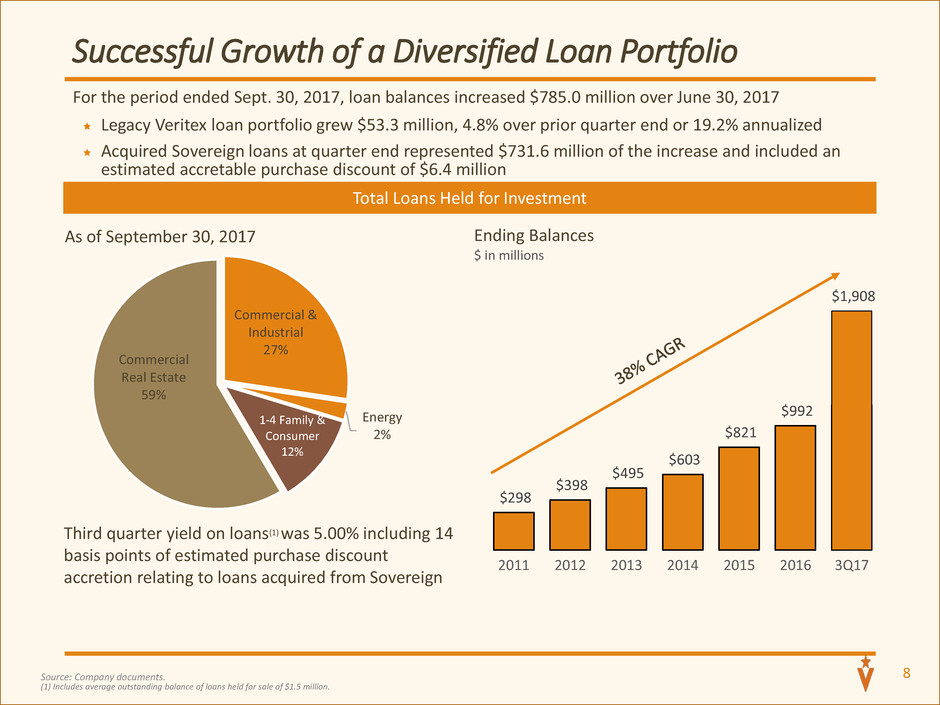

Successful Growth of a Diversified Loan Portfolio

Total Loans Held for Investment

Source: Company documents.

Commercial &

Industrial

27%

Energy

2%

1-4 Family &

Consumer

12%

Commercial

Real Estate

59%

As of September 30, 2017

$298

$398

$495

$603

$821

$992

$1,908

2011 2012 2013 2014 2015 2016 3Q17

Ending Balances

$ in millions

Third quarter yield on loans(1) was 5.00% including 14

basis points of estimated purchase discount

accretion relating to loans acquired from Sovereign

For the period ended Sept. 30, 2017, loan balances increased $785.0 million over June 30, 2017

Legacy Veritex loan portfolio grew $53.3 million, 4.8% over prior quarter end or 19.2% annualized

Acquired Sovereign loans at quarter end represented $731.6 million of the increase and included an

estimated accretable purchase discount of $6.4 million

8

(1) Includes average outstanding balance of loans held for sale of $1.5 million.

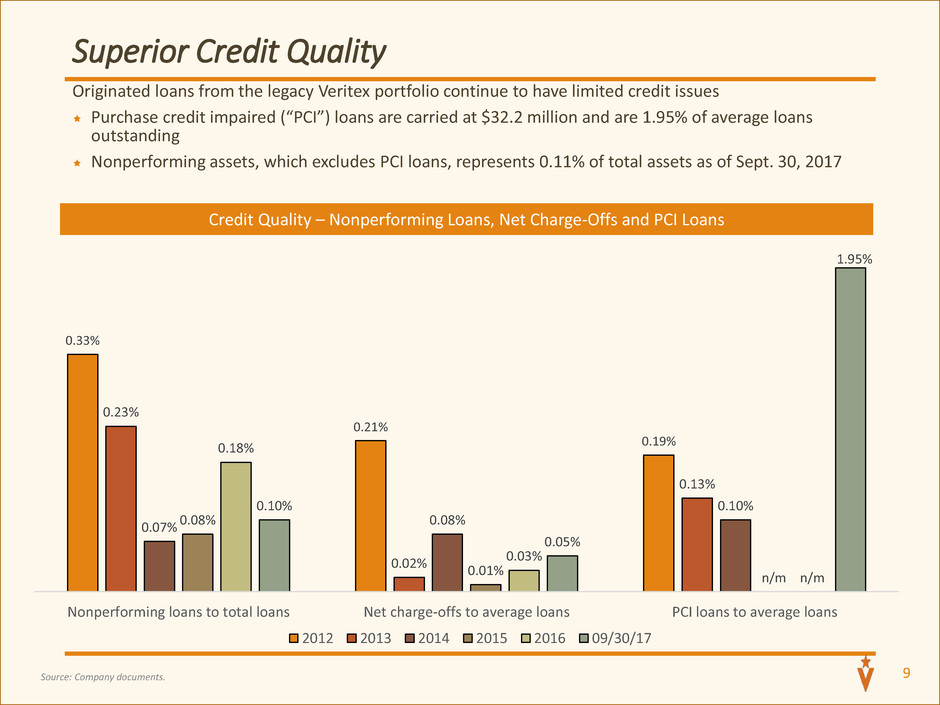

Superior Credit Quality

Credit Quality – Nonperforming Loans, Net Charge-Offs and PCI Loans

Source: Company documents.

0.33%

0.21%

0.19%

0.23%

0.02%

0.13%

0.07% 0.08%

0.10%

0.08%

0.01% n/m

0.18%

0.03%

n/m

0.10%

0.05%

1.95%

Nonperforming loans to total loans Net charge-offs to average loans PCI loans to average loans

2012 2013 2014 2015 2016 09/30/17

Originated loans from the legacy Veritex portfolio continue to have limited credit issues

Purchase credit impaired (“PCI”) loans are carried at $32.2 million and are 1.95% of average loans

outstanding

Nonperforming assets, which excludes PCI loans, represents 0.11% of total assets as of Sept. 30, 2017

9

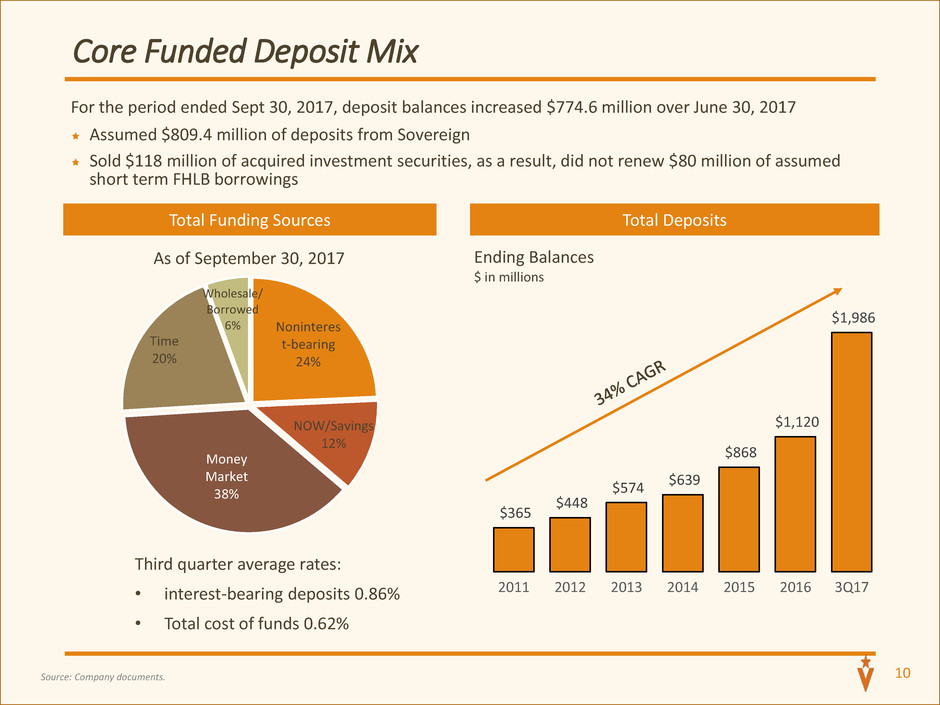

Core Funded Deposit Mix

Total Funding Sources

Source: Company documents.

Noninteres

t-bearing

24%

NOW/Savings

12%

Money

Market

38%

Time

20%

Wholesale/

Borrowed

6%

As of September 30, 2017

$365

$448

$574 $639

$868

$1,120

$1,986

2011 2012 2013 2014 2015 2016 3Q17

Ending Balances

$ in millions

Third quarter average rates:

• interest-bearing deposits 0.86%

• Total cost of funds 0.62%

Total Deposits

For the period ended Sept 30, 2017, deposit balances increased $774.6 million over June 30, 2017

Assumed $809.4 million of deposits from Sovereign

Sold $118 million of acquired investment securities, as a result, did not renew $80 million of assumed

short term FHLB borrowings

10

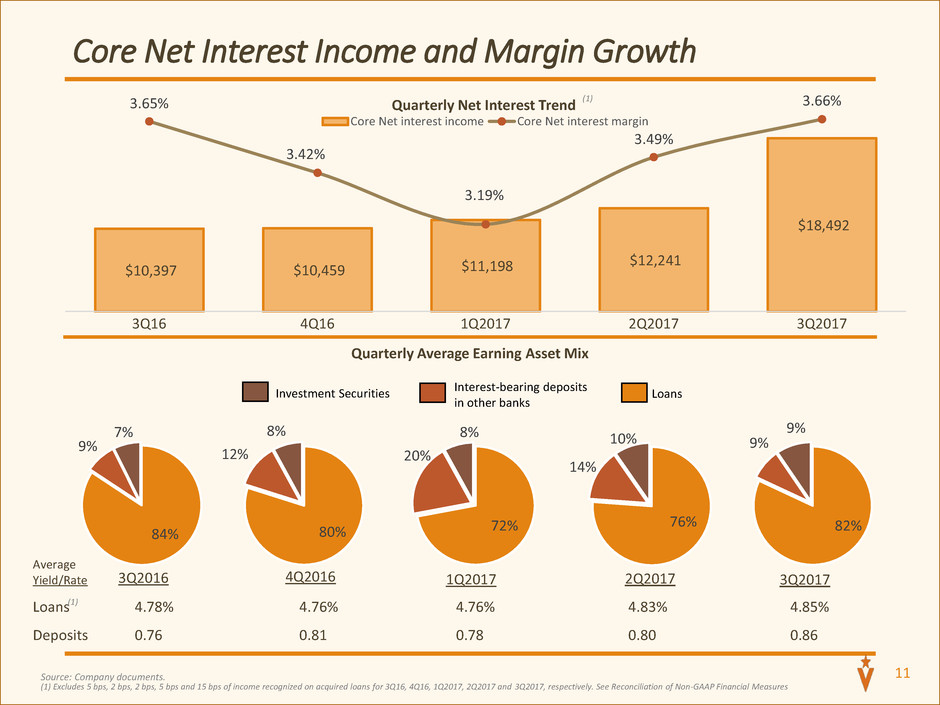

Core Net Interest Income and Margin Growth

Source: Company documents.

$10,397 $10,459 $11,198

$12,241

$18,492

3.65%

3.42%

3.19%

3.49%

3.66%

3Q16 4Q16 1Q2017 2Q2017 3Q2017

Quarterly Net Interest Trend

Core Net interest income Core Net interest margin

(1)

72%

20%

8%

1Q2017

76%

14%

10%

2Q2017

82%

9%

9%

3Q2017

84%

9%

7%

3Q2016

80%

12%

8%

4Q2016

Interest-bearing deposits

in other banks

Investment Securities Loans

Average

Yield/Rate

Loans 4.78% 4.76% 4.76% 4.83% 4.85%

Deposits 0.76 0.81 0.78 0.80 0.86

Quarterly Average Earning Asset Mix

(1) Excludes 5 bps, 2 bps, 2 bps, 5 bps and 15 bps of income recognized on acquired loans for 3Q16, 4Q16, 1Q2017, 2Q2017 and 3Q2017, respectively. See Reconciliation of Non-GAAP Financial Measures

(1)

11

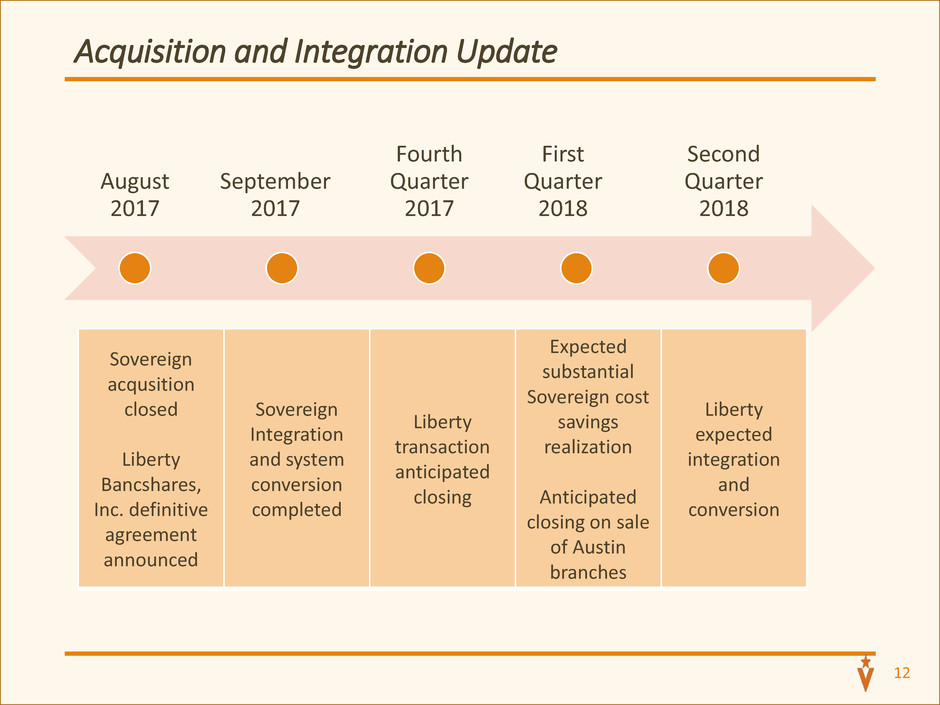

12

Acquisition and Integration Update

August

2017

September

2017

Fourth

Quarter

2017

First

Quarter

2018

Second

Quarter

2018

Sovereign

acqusition

closed

Liberty

Bancshares,

Inc. definitive

agreement

announced

Sovereign

Integration

and system

conversion

completed

Liberty

transaction

anticipated

closing

Expected

substantial

Sovereign cost

savings

realization

Anticipated

closing on sale

of Austin

branches

Liberty

expected

integration

and

conversion

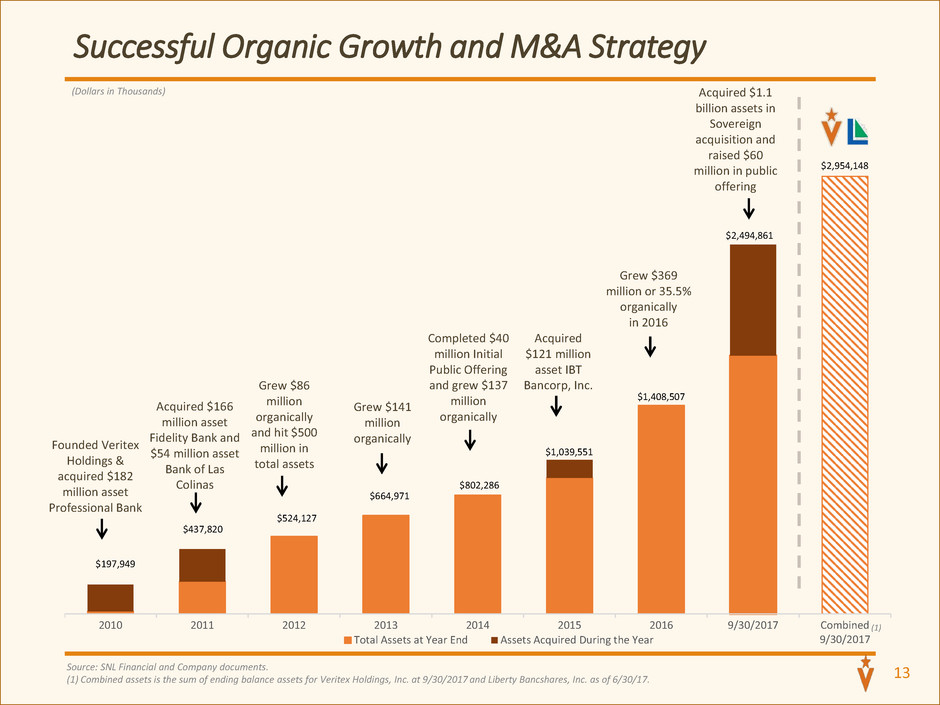

Successful Organic Growth and M&A Strategy

Source: SNL Financial and Company documents.

(1) Combined assets is the sum of ending balance assets for Veritex Holdings, Inc. at 9/30/2017 and Liberty Bancshares, Inc. as of 6/30/17. 13

Founded Veritex

Holdings &

acquired $182

million asset

Professional Bank

Acquired $166

million asset

Fidelity Bank and

$54 million asset

Bank of Las

Colinas

Grew $86

million

organically

and hit $500

million in

total assets

Grew $141

million

organically

Completed $40

million Initial

Public Offering

and grew $137

million

organically

Acquired

$121 million

asset IBT

Bancorp, Inc.

Grew $369

million or 35.5%

organically

in 2016

(Dollars in Thousands) Acquired $1.1

billion assets in

Sovereign

acquisition and

raised $60

million in public

offering

(1)2010 2011 2012 2013 2014 2015 2016 9/30/2017 Combined

9/30/2017Total Assets at Year End Assets Acquired During the Year

$2,954,148

$2,494,861

$1,408,507

$1,039,551

$802,286

$197,949

$437,820

$524,127

$664,971

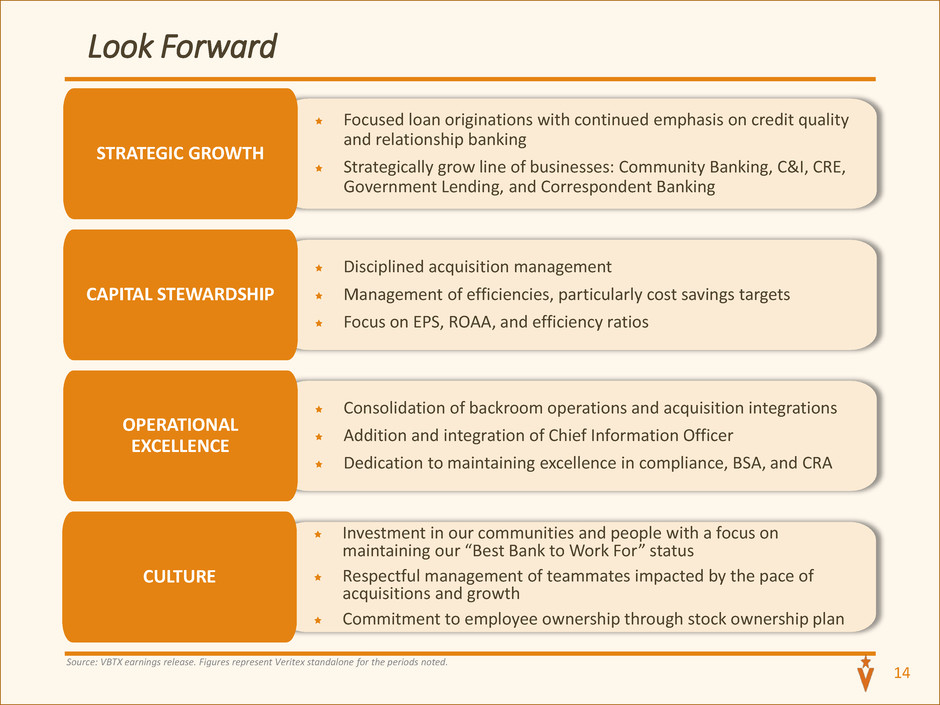

Disciplined acquisition management

Management of efficiencies, particularly cost savings targets

Focus on EPS, ROAA, and efficiency ratios

CAPITAL STEWARDSHIP

14

Consolidation of backroom operations and acquisition integrations

Addition and integration of Chief Information Officer

Dedication to maintaining excellence in compliance, BSA, and CRA

OPERATIONAL

EXCELLENCE

Focused loan originations with continued emphasis on credit quality

and relationship banking

Strategically grow line of businesses: Community Banking, C&I, CRE,

Government Lending, and Correspondent Banking

STRATEGIC GROWTH

Investment in our communities and people with a focus on

maintaining our “Best Bank to Work For” status

Respectful management of teammates impacted by the pace of

acquisitions and growth

Commitment to employee ownership through stock ownership plan

CULTURE

Source: VBTX earnings release. Figures represent Veritex standalone for the periods noted.

Look Forward

15

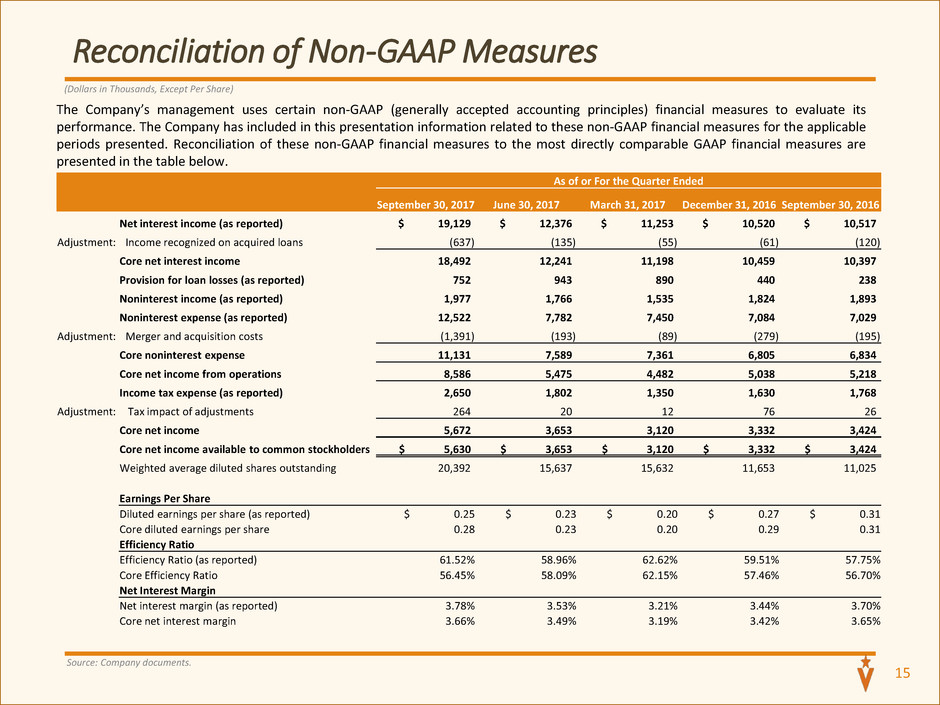

Reconciliation of Non-GAAP Measures

The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to evaluate its

performance. The Company has included in this presentation information related to these non-GAAP financial measures for the applicable

periods presented. Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are

presented in the table below.

(Dollars in Thousands, Except Per Share)

Source: Company documents.

As of or For the Quarter Ended

September 30, 2017 June 30, 2017 March 31, 2017 December 31, 2016 September 30, 2016

Net interest income (as reported) $ 19,129 $ 12,376 $ 11,253 $ 10,520 $ 10,517

Adjustment: Income recognized on acquired loans (637) (135) (55) (61) (120)

Core net interest income 18,492 12,241 11,198 10,459 10,397

Provision for loan losses (as reported) 752 943 890 440 238

Noninterest income (as reported) 1,977 1,766 1,535 1,824 1,893

Noninterest expense (as reported) 12,522 7,782 7,450 7,084 7,029

Adjustment: Merger and acquisition costs (1,391) (193) (89) (279) (195)

Core noninterest expense 11,131 7,589 7,361 6,805 6,834

Core net income from operations 8,586 5,475 4,482 5,038 5,218

Income tax expense (as reported) 2,650 1,802 1,350 1,630 1,768

Adjustment: Tax impact of adjustments 264 20 12 76 26

Core net income 5,672 3,653 3,120 3,332 3,424

Core net income available to common stockholders $ 5,630 $ 3,653 $ 3,120 $ 3,332 $ 3,424

Weighted average diluted shares outstanding 20,392 15,637 15,632 11,653 11,025

Earnings Per Share

Diluted earnings per share (as reported) $ 0.25 $ 0.23 $ 0.20 $ 0.27 $ 0.31

Core diluted earnings per share 0.28 0.23 0.20 0.29 0.31

Efficiency Ratio

Efficiency Ratio (as reported) 61.52% 58.96% 62.62% 59.51% 57.75%

Core Efficiency Ratio 56.45% 58.09% 62.15% 57.46% 56.70%

Net Interest Margin

Net interest margin (as reported) 3.78% 3.53% 3.21% 3.44% 3.70%

Core net interest margin 3.66% 3.49% 3.19% 3.42% 3.65%

16

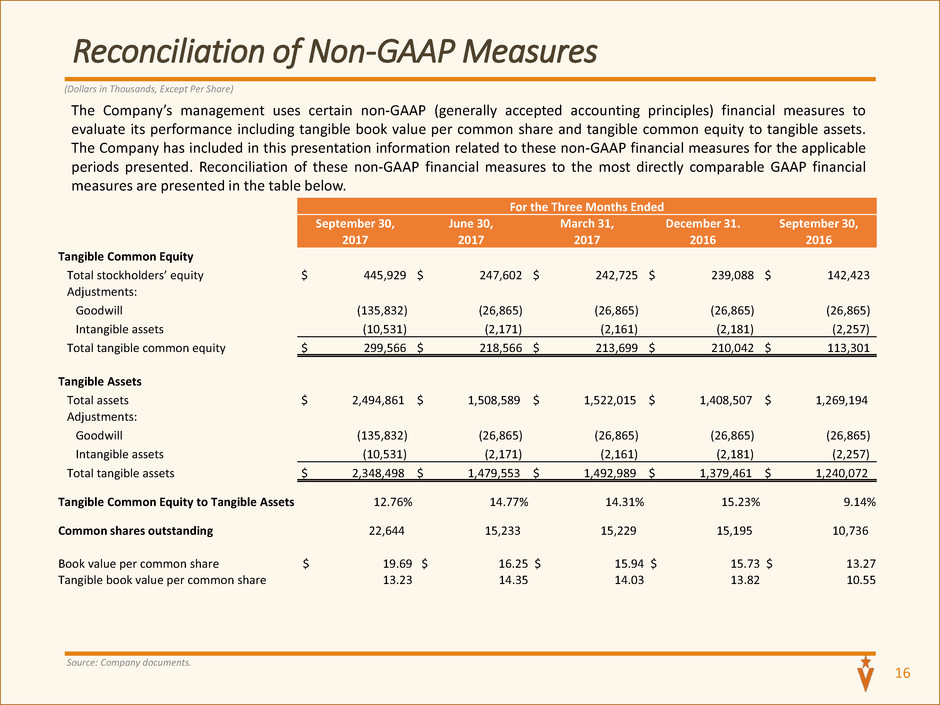

Reconciliation of Non-GAAP Measures

The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to

evaluate its performance including tangible book value per common share and tangible common equity to tangible assets.

The Company has included in this presentation information related to these non-GAAP financial measures for the applicable

periods presented. Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial

measures are presented in the table below.

(Dollars in Thousands, Except Per Share)

Source: Company documents.

For the Three Months Ended

September 30, June 30, March 31, December 31. September 30,

2017 2017 2017 2016 2016

Tangible Common Equity

Total stockholders’ equity $ 445,929 $ 247,602 $ 242,725 $ 239,088 $ 142,423

Adjustments:

Goodwill (135,832) (26,865) (26,865) (26,865) (26,865)

Intangible assets (10,531) (2,171) (2,161) (2,181) (2,257)

Total tangible common equity $ 299,566 $ 218,566 $ 213,699 $ 210,042 $ 113,301

Tangible Assets

Total assets $ 2,494,861 $ 1,508,589 $ 1,522,015 $ 1,408,507 $ 1,269,194

Adjustments:

Goodwill (135,832) (26,865) (26,865) (26,865) (26,865)

Intangible assets (10,531) (2,171) (2,161) (2,181) (2,257)

Total tangible assets $ 2,348,498 $ 1,479,553 $ 1,492,989 $ 1,379,461 $ 1,240,072

Tangible Common Equity to Tangible Assets 12.76% 14.77% 14.31% 15.23% 9.14%

Common shares outstanding 22,644 15,233 15,229 15,195 10,736

Book value per common share $ 19.69 $ 16.25 $ 15.94 $ 15.73 $ 13.27

Tangible book value per common share 13.23 14.35 14.03 13.82 10.55

17