Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - AgEagle Aerial Systems Inc. | tv477264_ex99-3.htm |

| EX-99.2 - EXHIBIT 99.2 - AgEagle Aerial Systems Inc. | tv477264_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - AgEagle Aerial Systems Inc. | tv477264_ex99-1.htm |

| EX-23.1 - EXHIBIT 23.1 - AgEagle Aerial Systems Inc. | tv477264_ex23-1.htm |

| EX-10.1 - EXHIBIT 10.1 - AgEagle Aerial Systems Inc. | tv477264_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - AgEagle Aerial Systems Inc. | tv477264_ex2-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 19, 2017

EnerJex Resources, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 001-36492 | 88-0422242 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 4040 Broadway, Suite 425, San Antonio, Texas | 78209 | |||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (210) 592-1670

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry Into a Material Definitive Agreement. |

MERGER

Merger Agreement

On October 19, 2017, EnerJex Resources, Inc., a Nevada corporation (the “Company” or “EnerJex”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with AgEagle Aerial Systems, Inc., a Nevada corporation (“AgEagle”), which designs, develops, produces, and distributes technologically advanced small unmanned aerial vehicles (UAV or drones) that are supplied to the agriculture industry, and AgEagle Merger Sub, Inc., a Nevada corporation and wholly-owned subsidiary of the Company (“Merger Sub”). Pursuant to the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will be merged with and into AgEagle, Merger Sub will cease to exist and AgEagle will survive as a wholly-owned subsidiary of the Company (the “Merger”). The respective boards of directors of EnerJex and AgEagle have approved the Merger Agreement and the transactions contemplated thereby.

At the effective time of the Merger (the “Effective Time”), the shares of AgEagle capital stock will be automatically converted into the right to receive that number of shares of Company common stock as determined pursuant to the exchange ratio described in the Merger Agreement (the “Exchange Ratio”). In addition, at the Effective Time: (i) all outstanding options and warrants to purchase shares of AgEagle common stock will be assumed by the Company and converted into options and warrants to purchase shares of Company common stock. No fractional shares of Company common stock will be issued in the Merger but will be rounded to the nearest whole share. Following the consummation of the Merger, former stockholders of AgEagle with respect to the Merger are expected to own 85% of the combined company (inclusive of the AgEagle assumed stock options and warrants), and current common and Series A Preferred stockholders of the Company are expected to own 15% of the combined company, excluding shares of common stock that may be issued in connection with the conversion of the Company’s Series B Preferred Stock and Series C Preferred Stock, and also not including any additional shares which may be issued in connection with the Company’s closing obligation to provide up to $4 million in new working capital and the elimination of all liabilities currently on the Company’s balance sheet.

In connection with the Merger, the Company will also file a proxy statement seeking stockholder approval to: (a) amend the terms of its Series A Preferred Stock (as discussed below); (b) approve the issuance of the Company’s shares in connection with the Merger to the AgEagle shareholders and new investors, in excess of 19.9% of the Company’s total issued and outstanding shares of common stock; (c) approve the issuance of shares to current Company management and directors in lieu of deferred salary and fees, a majority of which will be held in escrow to secure the Company’s indemnity obligations under the Merger Agreement; and (d) change the name of the Company to “AgEagle Aerial Resources, Inc.”

The Merger Agreement provides that, immediately following the Effective Time, the existing board of directors and officers of the Company will resign and new directors and officers will be appointed by AgEagle.

The Company intends to dispose of its principal assets, consisting primarily of its Kansas oil and gas properties, concurrently with the closing of the Merger. In the event the Merger is not consummated the Company does not have a present intention to dispose of the above described assets.

The completion of the Merger is subject to various customary conditions, including, among other things: (a) the approval of the stockholders of the Company and AgEagle; (b) the accuracy of the representations and warranties made by each of the Company and AgEagle and the compliance by each of the Company and AgEagle with their respective obligations under the Merger Agreement; (c) approval of the stockholders of the Company for the issuance of its common stock and any other securities (x) to the AgEagle stockholders in connection with the Merger and (y) in connection with the financing transactions contemplated by the Merger Agreement; (d) approval for the listing of shares of the Company’s common stock to be issued in the Merger and other related transactions on the NYSE American; and (e) all of the Company’s assets as disclosed shall have been sold, transferred or otherwise disposed of and the corresponding debt and liabilities shall have been extinguished. The Company’s existing cash resources are insufficient to satisfy all of its outstanding liabilities. Accordingly, in order to satisfy the condition and consummate the Merger, the Company will be required to raise additional funding prior to the closing of the Merger, the failure of which could result in the Company’s failure to consummate the Merger Agreement.

| 2 |

The Merger Agreement contains customary representations, warranties and covenants, including covenants obligating each of the Company and AgEagle to continue to conduct its respective business in the ordinary course, to provide reasonable access to each other’s information and to use reasonable best efforts to cooperate and coordinate to make any filings or submissions that are required to be made under any applicable laws or requested to be made by any government authority in connection with the Merger. The Merger Agreement also contains a customary “no solicitation” provision pursuant to which, prior to the completion of the Merger, neither the Company nor AgEagle may solicit or engage in discussions with any third party regarding another acquisition proposal unless, in the Company’s case, it has received an unsolicited, bona fide written proposal that the recipient’s board of directors determines is or would reasonably be expected to result in a superior proposal. The Company has paid AgEagle a $50,000 non-refundable fee at the signing of the Merger Agreement. The Merger Agreement contains certain termination rights in favor of each of the Company and AgEagle.

In addition, the Merger Agreement contains provisions for indemnification in the event of any damages suffered by either party as a result of breaches of representations and warranties contained therein. The aggregate maximum indemnification obligation of any indemnifying party for damages with respect to breaches of representations and warranties set forth in the Merger Agreement shall not exceed, in the aggregate, $350,000, other than fraud, intentional misrepresentation or willful breach. An indemnifying party shall satisfy its indemnification obligations with shares of Company common stock equal to the aggregate amount of losses of the indemnified party, calculated based upon the greater of (i) the value of the Company common stock as of the closing of the Merger; and (ii) the average closing price of the Company common stock on the NYSE American for the five trading days immediately prior to the date such a claim is made. The Company has agreed to deposit an aggregate of 1,215,278 shares of common stock to be issued to current officers and directors of the Company in lieu of deferred salary and fees into escrow to secure its indemnification obligations, the issuance of such shares requiring the approval of the Company’s common stockholders.

The foregoing summary of the Merger Agreement and the Merger does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1 and is incorporated by reference herein.

The Merger Agreement has been provided pursuant to applicable rules and regulations of the SEC in order to provide investors and stockholders with information regarding its terms. However, it is not intended to provide any other factual information about the Company, AgEagle, their respective subsidiaries and affiliates or any other party. In particular, the representations, warranties and covenants contained in the Merger Agreement have been made only for the purpose of the Merger Agreement and, as such, are intended solely for the benefit of the parties to the Merger Agreement. In many cases, the representations, warranties and covenants are subject to limitations agreed upon by the parties and are qualified by certain disclosures exchanged by the parties in connection with the execution of the Merger Agreement. Furthermore, many of the representations and warranties in the Merger Agreement are the result of a negotiated allocation of contractual risk among the parties and, taken in isolation, do not necessarily reflect facts about the Company, AgEagle, their respective subsidiaries and affiliates or any other party. Likewise, any reference to materiality contained in the representations and warranties may not correspond to concepts of materiality applicable to investors or stockholders. Finally, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement and these changes may not be fully reflected in the Company’s public disclosures.

As a result of the foregoing, investors are encouraged not to rely on the representations, warranties and covenants contained in the Merger Agreement, or on any descriptions thereof, as accurate characterizations of the state of facts or condition of the company or any other party. Investors and stockholders are likewise cautioned that they are not third-party beneficiaries under the Merger Agreement and do not have any direct rights or remedies pursuant to the Merger Agreement.

Voting Agreement

On October 19, 2017, concurrently with the execution of the Merger Agreement, a principal stockholder of AgEagle (the “Key AgEagle Stockholder”) entered into a voting agreement in favor of EnerJex (the “EnerJex Voting Agreement”). Pursuant to the EnerJex Voting Agreement, the Key AgEagle Stockholder has agreed, among other things, to vote all shares of capital stock of AgEagle beneficially owned by him in favor of the Merger and the adoption of the Merger Agreement and the approval of the transactions contemplated by the Merger Agreement, and any actions required in furtherance thereof. The AgEagle Voting Agreement will terminate upon the earliest to occur of: (i) the termination of the Merger Agreement in accordance with its terms; or (ii) the date on which the Merger becomes effective.

| 3 |

The foregoing summary of the EnerJex Voting Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the form of EnerJex Voting Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

Preferred Stock Amendment

In connection with, and as a condition to the closing of the Merger, the Company is seeking the consent of the holder of its Series A Preferred Stock (“Series A Preferred Stock”) to amend the terms thereof to: (i) allow the Company to pay all accrued but unpaid dividends up to September 30, 2017 in additional shares Series A Preferred Stock based on the value of the liquidation preference thereof, (ii) eliminate the right of the Series A Preferred Stock holders to receive any dividends accruing after September 30, 2017, and (iii) convert each share of Series A Preferred Stock into 10 shares of Company common stock. An affirmative vote of 66.7% of all shares of Series A Preferred Stock voting as a class as of the record date of the proxy statement is required to amend the terms of the Certificate of Designation to provide for these changes, as required under the Merger Agreement.

As of September 30, 2017, the Series A Preferred Stock had accrued a total of $6,039,972 in accrued but unpaid dividends, which would result in an additional 241,599 shares of Series A Preferred Stock being issued by the Company to satisfy these accrued dividends. As of the date of this Form 8-K, there were 928,238 shares of Series A Preferred Stock issued and outstanding; however, the Company is authorized under the Certificate of Designation to issue up to 2,000,000 shares of Series A Preferred Stock, and the Board of Directors has approved the issuance of additional shares of Series A Preferred Stock in the event the Company requires it to raise additional capital required for closing the Merger Agreement.

Risk Factors

The Merger, including the possibility that the Merger may not be completed, poses a number of risks to each company and its respective stockholders, including the following:

| · | the issuance of shares of EnerJex common stock to AgEagle shareholders in connection with the Merger will substantially dilute the voting power of current EnerJex stockholders; |

| · | EnerJex stockholders may not realize a benefit from the Merger commensurate with the ownership dilution they will experience in connection with the Merger; |

| · | the lack of a public market for AgEagle shares makes it difficult to determine the fair market value of AgEagle, and the Merger consideration to be issued to AgEagle shareholders may exceed the actual value of AgEagle; |

| · | EnerJex stockholders will have a reduced ownership and voting interest in, and will exercise less influence over the management of, the combined company following the completion of the Merger; |

| · | the announcement and pendency of the Merger could have an adverse effect on EnerJex’s or AgEagle’s financial condition or business prospects; |

| · | failure to complete the Merger may adversely affect EnerJex’s and AgEagle’s financial results, future business and operations, as well as the market price of EnerJex common stock; |

| · | some of the directors and executive officers of EnerJex and AgEagle have interests in the Merger that are different from, or in addition to, those of the other EnerJex stockholders and AgEagle shareholders; |

| · | EnerJex and AgEagle will incur substantial transaction-related costs in connection with the Merger; |

| 4 |

| · | if EnerJex fails to continue to meet all applicable NYSE American requirements and the NYSE American determines to delist EnerJex common stock, the delisting would impair EnerJex’s ability to complete the Merger; |

| · | failure to complete the Merger may result in EnerJex having insufficient funds to satisfy its existing trade payables and other liabilities, and may result in its petitioning for bankruptcy court protection; and |

| · | even if the Merger is consummated, EnerJex and AgEagle may fail to realize the anticipated benefits of the Merger. |

In addition, EnerJex, AgEagle, and the combined company are subject to various risks associated with their businesses. These risks will be discussed in greater detail under the section entitled “Risk Factors” in the proxy statement. EnerJex encourages you to read and consider all of these risks carefully.

| 5 |

PRO-FORMA CAPITALIZATION TABLE

The following table provides the ownership of the common stock of the combined Company following the closing of the Merger, assuming the conversion of all convertible securities, as determined as of the date of the filing of this Form 8-K. The following table does not provide information on any new shares that may need to be issued in connection with a capital funding in an amount up to $4,000,000, which is a condition to closing under the Merger Agreement, and for which terms have not yet been determined by the Company or any investor.

| Number of Shares of Common Stock | % at Closing | % Fully Diluted (9) | |

| EnerJex Shareholders | |||

| Common Stock Holders (1) | 14,498,753 | 8.3% | 7.9% |

| Series A Preferred Stock Holders (2) | 11,798,369 | 6.7% | 6.4% |

| Series B Preferred Stock Holders (3) | 5,879,941 | - | 3.2% |

| Series C Preferred Stock Holders (4) | 999,990 | - | 0.5% |

| EnerJex stockholders as a group | 34,177,043 | 15% | 18.2% |

| AgEagle Shareholders | |||

| Bret Chilcott (5) | 87,488,853 | 49.9 | 48.0% |

| Raven Industries | 4,999,363 | 2.9 | 2.7% |

| Greenblock Capital (6) | 12,498,408 | 7.1 | 6.9% |

| Convertible Debt Holders (7) | 16,906,356 | 9.6 | 9.3% |

| Stock Options and Warrants (8) | 27,124,044 | 15.5 | 14.9% |

| AgEagle stockholders as a group | 149,017,024 | 85% | 81.8% |

| (1) | Common stock of the Company is inclusive of: 10,321,397 shares of common stock currently outstanding; 1,771,428 shares of common stock underlying warrants; 157,664 shares of common stock underlying employee options; and 2,248,264 shares of common stock issuable to the officers and directors of the Company in lieu of deferred salary and fees, and of which 1,215,278 will be held in escrow under the indemnity provisions of the Merger Agreement. Common stock excludes any shares of Series B Preferred Stock which may be converted into to common stock prior to the closing of the Merger. |

| (2) | Series A Preferred Stock includes the conversion of 938,238 plus 241,599 additional preferred shares payable in satisfaction of accrued dividends as of September 30, 2017, convertible into a total of 11,798,369 shares of common stock, assuming such amendment to the Certificate of Designation is approved by two-thirds of the Series A Preferred Stock holders. Such number excludes up to 1,061,762 additional shares of Series A Preferred Stock which the Company’s Board is authorized to issue, which would be convertible into 10,617,620 shares of common stock. |

| (3) | Series B Preferred Stock includes the conversion of 1,704 preferred shares into 5,879,941 shares of common stock. Per the terms of the Merger Agreement, such shares are not required, but have the right, to be converted into common shares prior to closing. |

| (4) | Series C Preferred Stock includes the conversion of 300 preferred shares into 999,990 shares of common stock. Per the terms of the Merger Agreement, such shares are not required, but have the right, to be converted into shares of common stock prior to closing. |

| (5) | Mr. Chilcott is the Chairman & CEO of AgEagle. |

| (6) | Excludes 125,000 shares of common stock that are underlying the stock options and warrants set forth below, which would convert into options to acquire 3,124,602 shares of the Company after the Merger closing. |

| (7) | Shares convertible from promissory notes in the aggregate amount of $935,000, held by Alpha Capital Anstalt (“Alpha”) and an affiliate of Alpha. |

| 6 |

| (8) | Stock options include 14,000,716 shares underlying options issued to directors and key employees of AgEagle, which vest 50% six months after closing and the balance 12 months after closing; 3,124,602 shares underlying options issued to Greenblock Capital which vest 50% six months after closing and the balance 12 months after closing; and 9,998,726 shares underlying warrants issued to one of AgEagle’s lenders. The options have an exercise of $0.10 per share and the warrants convert at $2.50 per share of AgEagle common stock. |

| (9) | Fully diluted shares include the conversion of Series B and C Preferred Shares, which have the right to convert to common stock prior to closing, but are not required to do so. Excludes any shares issuable in connection with the Company’s requirement to raise up to $4,000,000 in funding as a condition to closing, and the triggering of any anti-dilution provisions set forth in the Series B and C Preferred Share terms, including up to 200 additional shares of Series C Preferred which are authorized but not issued. Fully diluted also excludes any fees payable in shares of common stock or common stock equivalents to service providers and/or bankers in connection with the closing of the Merger. |

| 7 |

AGEAGLE’S BUSINESS

Organizational History

AgEagle Aerial Systems, Inc. (“AgEagle,” “we” or us”), headquartered in Neodesha, Kansas, is a leading manufacturer of unmanned aerial vehicles focused on providing actionable data to the precision agriculture industry. AgEagle was founded in 2010 by Bret Chilcott, its President and Chief Executive Officer, as Solutions by Chilcott, LLC, a Kansas limited liability company. In April 2015, Solutions by Chilcott was converted into a corporation and then merged into AgEagle, a newly-formed Nevada corporation.

Our history is rooted in advanced composite parts manufacturing, first for commercial trucks and then as a vendor to the government manufacturing micro wind turbine blades. Around 2011, we also began applying our expertise in composite parts manufacturing on a research project at Kansas State University that was attempting to use model airplanes to monitor and analyze crops. After several months, Mr. Chilcott and the university agreed to continue the commercialization phase of this project under the auspices of AgEagle, and in 2012, we completed the first prototype of our UAV. Over the next year, Mr. Chilcott traveled throughout the mid-western United States meeting with farmers and agronomists, compiling test data, operating history, market information, and then in early 2014 AgEagle sold its first commercial UAV.

Our Products and Services

We design, develop, produce, distribute and support technologically-advanced small unmanned aerial vehicles (UAVs or drones) that we supply to the precision agriculture industry. Historically, we have derived the majority of our revenue from the sale of our AgEagle Classic and RAPID Systems. However, as a result of the development of our new product, the RX-60, we phased-out the previous two systems. In February 2016, we signed a worldwide, distribution agreement with Raven Industries, Inc. (“Raven”) under which Raven has provided and will continue to provide private label and purchase the RX-60 exclusively for the agriculture markets for resale through their network of dealers worldwide. Raven and its network of dealers offer the RX-60 system to the public, including a subscription for a software package that is provided by our strategic partner, Aerobotic Innovations, LLC, d/b/a Botlink (“Botlink”), for flight control, image processing and data delivery. The subscription for the Botlink software package is purchased by our customers directly from Botlink. Our agreement with Botlink provides that Botlink will make available for use in our drones the necessary hardware and software at least until December 30, 2020 and will provide aerial map processing and hosting to our customers who maintain a subscription at least until December 30, 2020. The first shipment of our RX-60 system to Raven occurred in March 2016.

The success we have achieved with our products, which we believe has carried over into the new RX-60, stems from our ability to invent and deliver advanced solutions utilizing our proprietary technologies and trade secrets that help farmers, agronomists and other precision agricultural professionals operate more effectively and efficiently. Our core technological capabilities, developed over five years of innovation, include a lightweight laminated shell that allows the UAV platform to perform under challenging flying conditions, a camera with a Near Infrared (NIR) filter, a rugged foot launcher, and high end software provided by Botlink that automates drone flights and provides geo-referenced data.

Our UAV, often referred to as a “flying wing,” is an advanced fixed wing model UAV whose design is based upon the years of experience our management has with aircraft and composite parts construction. We design all of our UAVs to be man-portable, thereby allowing one person to launch and operate them through a hand-held control unit or tablet. All of our UAVs are electrically powered, weigh approximately six pounds fully loaded, are capable of flying over approximately 400 acres (roughly 60 minutes of airtime) per flight from their launch location, and are configured to carry a camera with our NIR filter that uses near infrared images to capture crop data. We believe that these characteristics make our UAVs well suited for providing a complete aerial view of a farmer’s field to help precisely identify crop health and field conditions faster than any other method available.

Our UAVs were specifically designed to help farmers increase profits by pinpointing areas where nutrients or chemicals need to be applied, as opposed to traditional widespread land application processes, thus decreasing input costs and increasing yields. The RX-60 system, based on our AgEagle RAPID system, was designed for busy agriculture professionals who do not have the time to process images on their computers, which some of our competitors require, and our first generation product, the AgEagle Classic, used to do. Through a relationship with our strategic partner, Botlink, our UAV can be programmed using a tablet device to overlay a flight path over a farmer’s specific crop area. The software can automatically take pictures from the camera, stitch the photos together through the cloud, and deliver a geo-referenced, high quality aerial map to the user’s desktop or tablet device using specialty precision agriculture software such as SST or SMS. The result is a prescription or zone map that can then be used on a Raven field computer, that can typically be found in a sprayer or applicator that has been designed to drive through fields to precisely apply the amount of nutrients or chemicals required to continue or restore the production of healthy yields for farmers.

| 8 |

Figure 1: AgEagle Prescription Map Powered by Botlink

Partnership with Raven

In February 2016, we signed a worldwide, exclusive distribution agreement with Raven. Under this initial three-year distribution agreement, Raven private labels and purchases our fixed wing UAVs, exclusively for the agriculture markets over the initial term, for resale through their network of dealers worldwide. Raven has the right to renew the agreement after the expiration of the initial term. In 2017, we amended our agreement with Raven to make it non-exclusive and to allow us to sell our products directly into the market. The agreement contains other standard termination provisions, covenants and warranties, as more fully set forth therein.

On the date we entered into the distribution agreement with Raven, we also simultaneously entered into a stock purchase agreement with Raven whereby we sold 200,000 shares of our common stock to Raven for an aggregate purchase price of $500,000. In connection with the financing, Raven was entitled to designate one director to serve on the board. In March 2016, Raven exercised this right and we appointed Lindsay Edwards to the board. In addition, at any time until the consummation of the first public offering, Raven has the first right to participate in any offer or sale of new securities in an amount up to 50% of such securities that we may issue, which issuance excludes (a) shares or options to purchase shares under our Stock Option Plan, (b) securities upon the exercise, exchange or conversion of securities issued and outstanding as of the date of the stock purchase agreement and (c) securities issued pursuant to acquisitions or strategic transactions approved by a majority of our disinterested directors. Pursuant to the stock purchase agreement, during the term of the distribution agreement, Raven has a right of first refusal on any sale of all or substantially all of our assets or a sale of AgEagle in any transaction in which there is a change in control in the holders of a majority of the voting securities after the transaction, or on an exclusive license of all of our intellectual property.

Raven is a publicly traded corporation (NASDAQ: RAVN) based in Sioux Falls, South Dakota that is a leading provider of precision agriculture products designed to reduce operating costs, decrease inputs, and improve yields of farmers through their Applied Technology division.

| 9 |

Consumer Products and Services

UAV Market Overview

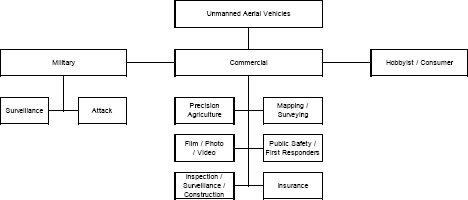

Unmanned aerial vehicles, or UAVs, have been in use for decades, whether it be a drone for military surveillance by the U.S. Government, a commercial UAV used to scan and survey property, or by hobbyists who fly their personal devices simply to get a different view of the world. All three fall under the same burgeoning industry, one that is increasing in number and effectiveness as aircrafts, sensors and automation technologies mature. As the potential benefits of UAV technology extend beyond its traditional military use, commercial customers have started to shift resources into the drone opportunity so as to reach levels of efficiency not previously experienced. Despite the obstacles the industry will continue to face and be required to maneuver through, the first operational rules for routine commercial use of UAVs went into effect on August 20, 2016. The current landscape and targeted industries in the UAV marketplace can be seen below:

Figure 2: Industries in the UAV Marketplace

The military uses of drones are recognized and have been around for many years. The participants in this market are well entrenched at this point, with companies such as Boeing, Lockheed Martin and AeroVironment providing surveillance and attack drones to the U.S. military and Department of Defense. The growth of unmanned systems for military and civil use is projected to continue through the next decade. It is estimated that UAV spending in the civil market will increase substantially over the next decade, from $2.8 billion worldwide in 2017 to $11.8 billion in 2026, and the segment is expected to generate $73.5 billion over the next 10 years, according to The Teal Group. Commercial use is expected to be the fastest growing civil segment, rising more than twelvefold from $512 million in 2017 to $6.5 billion in 2026. This growth is forecasted to be fueled, in part, by the estimated $1.3 billion in investments in the sector by technology companies and venture capitalists since 2013.

As compared to the relatively mature military drone sector, the hobbyist and consumer market has been growing steadily over the past five plus years. Market leaders include companies such as Dajiang Innovation Technology (“DJI”), Parrot EPA and 3D Robotics, with many more players jumping into the fray. Should consumers continue to adopt this technology, not only do we believe the industry will experience its projected growth, but it will provide for a significant number of purchasing options as competition increases.

The segment of the UAV industry that has received the most attention recently is the commercial market, which was brought into the spotlight in early 2015 when the FAA released its new proposed guidelines for commercial UAV use, and then in June 2016, when the FAA announced it had finalized the first operational rules for routine commercial use of UAVs, which rules went into effect on August 20, 2016. According to CB Insights, 2016 saw a record number of investments in the drone industry, topping $454 million across 100 deals, due to venture firms and technology companies moving into the drone space with sizable investments. In Q1 of 2017, the sector saw a quarterly deals record of 32 investments worth $113 million, giving 2017 a funding run-rate of 122 deals worth over $506 million, both new records. While regulatory uncertainty has kept many on the sidelines, the new clarity from the FAA has started to help investors get more comfortable. The primary segments in the commercial market, as seen in the above chart, include Precision Agriculture, Inspection/Surveillance, Mapping/Surveying, Film/Photo/Video and Public Safety/First Responders. AgEagle falls under the precision agriculture space, which as an industry is relatively new and ripe with opportunity for those innovative solutions that solve today’s current problems.

| 10 |

Figure 3: Global UAV Investment History

Precision Agriculture Industry Overview

Precision agriculture is a farming management concept based on observing, measuring, and responding to inter- and intra-field variability in crops. Over the years, as farmers have been increasingly under pressure to increase profit margins and comply with new governmental regulations, entrepreneurs have been searching for solutions that present the prospect of new operational efficiencies. This has led to a number of changes in the agricultural industry, with precision agriculture being recognized by some as one of the largest technological opportunities in agriculture since the introduction of hydraulics in the 1940’s. As agriculture and technology companies realize the potential benefits from this new space, many are introducing innovative products and services to the agriculture arena, focused on helping farmers capitalize upon this new found technology.

Precision agriculture technologies provide the information and systems that allow a farmer to optimize and customize the timing, amount, and placement of inputs (seed, fertilizer, pesticides, irrigation, etc.) for any given section of a field. This allows the farmer to produce the maximum yield from the entire field at the lowest possible cost. The concept has been enabled by technologies that include:

| · | Crop yield monitors mounted on GPS-equipped combines; | |

| · | variable rate technology, like seeders, sprayers, etc.; | |

| · | an array of real-time vehicle mountable sensors that measure everything from chlorophyll levels to plant water status; and | |

| · | multi- and hyper-spectral aerial and satellite imagery, from which products like Normalized Difference Vegetation Index (“NDVI”) maps can be made. |

The total value of U.S. crops in 2014 was estimated at $195 billion. While 2015 and 2016 saw slight downturns due to commodity pricing, even a modest improvement in yield would have a substantial aggregate economic impact for the roughly $200 billion industry. There are a few trends that drive where we believe the precision agriculture marketplace is heading: the increased use of auto steering and variable rate controls for inputs, advanced sensors and Big Data, and customers who are realizing their return on investment.

| 11 |

The first trend is possibly the most important. Guidance and auto steering have provided farmers with significant benefits by reducing costly application overlaps by field equipment. This, combined with variable rate application equipment, will allow farmers to break their fields into specific sections based on criteria such as soil type and historical yield. With this information available on a section by section basis, farmers are then able to minimize their costs and increase profitability across the farm as a whole.

However, it is the data behind this equipment that is going to drive this industry forward. Advanced sensors and filters allow the farmer to not only view weather and soil data, but through use of a device such as a drone, it would allow that information to be coupled with real time plant health data for in-depth analysis. This analysis supports real time predictive decision-making to drive costs lower and improve crop yields.

Finally, as farmers have begun to adopt this new technology, we believe the returns on their investments are beginning to materialize. By having this increased functionality and the expanded offerings of precision agriculture devices, integrated software, analytics, and cloud services, the hope is that the adoption rates of these new solutions continue to grow over the coming years.

Figure 4: AgEagle Crop Health Map

As the demographic for farmers shifts to a younger, more technologically-minded group, many are forecasting an increase in the rate of growth of precision agriculture. A current estimate of the precision agriculture market by Markets and Markets projects a roughly $7.9 billion global marketplace by 2022, with an estimated compound annual growth rate of 13.5% from 2016 to 2022. The growth rate outside the U.S., including developing countries where the need to improve productivity is even greater, is expected to be even higher. More and more companies, ranging from large public companies (e.g., Monsanto (biotech, seeds, chemicals) and John Deere (equipment)) to small privately owned or venture backed companies, are expected to begin focusing on this opportunity with the goal of providing specialty farm management software, cloud services, sensors, data analytics, and even drone imaging services.

Precision Agriculture UAV Market

While precision agriculture is beginning to transform traditional farming methods, we believe that the commercial UAV market is strategically placed to play a substantial role in this transformation. UAVs have many commercial applications, as described above, and many industry experts now expect one of the biggest impacts to be on the agriculture industry. Drone technology, if executed properly, can make farming more efficient, lower operating costs and reduce farming’s environmental impact. Current estimates from Zion Market Research expect the industry for drones used in agriculture to reach more than $3.0 billion by 2021, up from approximately $674 million in 2015. These estimates are in spite of the ban that was previously in place by the FAA prior to the announcement in June 2016 that the FAA finalized the first operational rules for routine commercial use of UAVs, which rules went into effect on August 20, 2016.

The use of drones for agriculture can add real time high definition imagery collected on demand, to help farmers see what is happening in the field without having to walk through the field. UAVs costs a fraction of what an airplane or a satellite costs, and at the same time, they can provide a superior set of images with a potential resolution equivalent to standing next to the plant. These small, unmanned rotary and fixed wing aircrafts can fly at low altitudes and be programmed to fly a certain pattern using a variety of software. They can take high definition images with visual and multi spectral cameras, providing specific plant health information in real time. This new imagery would need to be integrated with all the other data a farmer collects to increase productivity. Successful entrants in the UAV space will be the ones who can integrate the existing data and the science of agronomy into the images through partnering or acquisitions.

| 12 |

Market Size

We believe that the precision agriculture sector of the UAV market presents robust opportunities for our products. The United Nations Food and Agriculture Organization (“FAO”) projects that the world will require 70% more food production by 2050 in order to keep up with population growth. That number is nearly 100% when looking at just developing counties. To accomplish this, the agriculture sector will need to become more efficient, producing an average of 250 bushels per acre (“bpa”), possibly as much as 300, from the approximately 200 bpa that are currently produced. Farmers and agronomists are seeking ways to increase yields while lowering input costs and overall environmental impact of chemicals and water consumption. In collaboration with the precision agriculture products already available today, we believe our UAVs can accomplish this goal with the actionable data we provide them.

Recent estimates from a report published by Goldman Sachs in March 2016 further estimates the total addressable market for precision agriculture to be $1.4 billion in the U.S. and $5.9 billion globally over the next five years. Such market size translates to approximately 47,000 UAV units in the U.S. and 197,400 UAV units around the world. In addition, Goldman Sachs suggests that the commercial UAV industry has a $21 billion total addressable market with an estimated triple-digit compound annual growth rate from 2016 to 2020.

Other research firms have published their estimates for the precision agriculture market over the last couple years as well. PricewaterhouseCoopers pegs the addressable market for agriculture drones to be worth $32.4 billion, second only to the infrastructure sector. Global Market Insights sees the market surpassing $1.0 billion by 2024, with global shipments exceeding 200,000 UAV units by 2024. Markets and Markets expects the agriculture drone market to grow from $864 million in 2016 to $4.2 billion in 2022, representing a 30%+ CAGR during that period.

Our Growth Strategy

We intend to grow our business by establishing our leadership position in the growing precision agriculture marketplace for UAVs through our partnership with Raven and by creating new, easier to use and higher value products that enable us to remain a leading platform available to our customers. We may also elect to pursue additional opportunities in different industries outside of agriculture and its related areas. Key components of this strategy include the following:

Build a strong worldwide distribution network with Raven and organically to offer a best-in-class precision ag platform.

We believe we can establish our flying wing product and systems as leading technologies in the precision agriculture marketplace. Under Raven’s distribution platform, we will have access to dealers and customers in key agricultural regions worldwide, which will help make it possible for every farmer in those markets to have access to the AgEagle platform. Raven’s distributors are spread across six continents, covering a majority of the world’s major regions including the U.S., Canada, South America, Eastern and Western Europe, Southeast Asia, and Oceania. We are also building our own distribution channels in parallel with Raven, both in the US and internationally.

Continue to explore partnerships with companies that can expand our offerings.

We intend to expand our product offerings by building relationships, partnerships and possibly acquisitions of companies that have vertical, synergistic technologies. Our first venture into this concept has been and will continue to be to work with Raven to integrate our UAV system with its current precision agriculture products in order to connect the data and improve the effectiveness and efficiency of this data for farmers. In addition, other technology alliances may include the acquisition or development of other electronics, software, sensors or more advanced aerial platforms. We are constantly meeting and in discussions with groups that could fill these roles and help with additional development ideas. We see the potential to acquire such synergistic companies to be an exciting potential growth strategy for AgEagle, especially as player in the market start to consolidate over the following years.

| 13 |

Deliver new and innovative solutions in the precision ag space.

Our research and development efforts are the foundation of AgEagle, and we plan to continue to invest in R&D. We plan to continue innovating new and enhanced products that enable us to satisfy our customers through better, more capable products and services, both in response to and in anticipation of their needs. We believe that by investing in research and development, we can be a leader in delivering innovative products that address market needs within our current target markets, enabling us to create new opportunities for growth.

Pursue the expansion of the AgEagle platform of products into other industries besides agriculture.

We may investigate and pursue opportunities outside of agriculture as we continue to expand and grow the AgEagle platform. We are confident in the UAV product we have today, and believe that this product could provide other industries the same kind of optimization we are currently providing the agriculture industry. These industries have yet to be identified by the AgEagle team, but may include verticals such as land surveying and scanning, insurance, inspections, and search and rescue.

Competitive Strengths

We believe the following attributes and capabilities provide us with long-term competitive advantages:

Partnership with Raven. Our partnership with Raven has provided and will continue to provide broader access to our products for customers around the world through Raven and its network of dealers. Raven is a leading provider of precision agricultural products in the world, with a loyal customer base and global outreach. We will work together with Raven to provide actionable data to assist customers in making informed input and variable rate decisions. We also intend to capitalize on Raven’s expertise and knowledge within the precision agriculture industry to continue improving and advancing our products offerings.

Proprietary Technology and Trade Secrets. We believe our unique design and assembly process differentiates our product from any competition. We are confident that our UAVs are industry-leading in durability due to the lightweight laminated shell of the wing, which is made using a proprietary manufacturing process developed by our President and CEO over five years of innovating. This process, which hardens the material used to build the shell, allows the UAV to perform in harsh weather conditions (with wind speeds up to 30 miles per hour) and bring itself to an unassisted landing, all at a total weight of about six pounds. This design is an important trade secret, and we have non-disclosure agreements with our employees in order to keep it unique to AgEagle.

Product Has Global Appeal. We believe that our technology addresses a need for better data in the agriculture industry worldwide. With our new global distribution platform, we believe that we are well-positioned for our advanced products to be a viable solution for farmers worldwide.

Increased Margins for Farmers. We believe our UAVs will directly enhance margins of our customers by reducing the amount of nutrients and chemicals needed to manage their farms. The software equipped on our UAVs will deliver a high-quality aerial map upon completion of the flight, allowing the user to accurately identify the specific areas that are malnourished. This software is compatible with precision applicator tractors, which assist users in applying a precise amount of nutrients in only the necessary areas.

Empower Customers Through Our Self-Serve Platform. Our UAVs are specially designed to provide users with a portable and easy to operate device, which can be controlled with a hand-held unit or tablet. Through our partnership with Botlink, users will be able to plan and track an efficient flight path for their UAV. The UAVs are equipped with a camera and near infrared filter whose images provide a holistic aerial view of the fields along with meaningful data that is uploaded and delivered to the user within a very short time frame. As a result, this platform allows users to quickly detect any issues in their fields, which enables them to address such issues in a timely manner before any damage, or further damage affects their fields.

All Manufacturing of our Products is Completed in the United States. As of today, we manufacture all of our products at our manufacturing facility in Neodesha, Kansas, which allows us to avoid many of the potential difficulties that may arise if our manufacturing facilities were otherwise located outside the U.S. In addition, all of our research and development activities are performed in the U.S.

| 14 |

Government Regulation

Our products are subject to regulations of the FAA. On June 21, 2016, the FAA announced it has finalized the first operational rules for routine commercial use of small UAS, which for purposes of the regulations are unmanned aircraft weighing less than 55 pounds that are conducting non-hobbyist operations. UAS operators-for-hire will have to pass a written test and be vetted by the TSA, but no longer need to be airplane pilots as current law requires. The rules went into effect on August 20, 2016. Among other things, the new regulations require:

| · | preflight inspection by the remote pilot in command; | |

| · | minimum weather visibility of 3 miles from the control station; | |

| · | visual line-of-sight to the aircraft from the pilot and person manipulating the controls; | |

| · | prohibit flying the aircraft over any persons not directly participating in the operation, not under a covered structure or not inside a covered stationary vehicle; | |

| · | daylight or civil twilight operations (30 minutes before official sunrise to 30 minutes after official sunset, local time); | |

| · | maximum groundspeed of 100 mph (87 knots); and | |

| · | maximum altitude of 400 feet above ground level or, if higher than 400 feet above ground level, the aircraft must remain within 400 feet of a structure. |

The new regulations also establish a remote pilot in command position. A person operating a small unmanned aircraft must either hold a remote pilot airman certificate with a small unmanned aircraft system rating or be under the direct supervision of a person who does hold a remote pilot certificate (remote pilot in command). A pilot’s license is no longer required. To qualify for a remote pilot certificate, a person must: demonstrate aeronautical knowledge by either passing an initial aeronautical knowledge test at an FAA-approved knowledge testing center, or hold a part 61 pilot certificate other than student pilot, complete a flight review within the previous 24 months, and complete a small UAS online training course provided by the FAA. The person must also be vetted by the TSA and be at least 16 years old. Applicants will obtain a temporary remote pilot certificate upon successful completion of TSA security vetting. The FAA anticipates that it will be able to issue a temporary remote pilot certificate within 10 business days after receiving a completed remote pilot certificate application.

The regulations do not require the use of a visual observer. In addition, FAA airworthiness certification is not required. However, the remote pilot in command must conduct a preflight check of the small UAS to ensure that it is in a condition for safe operation.

Most of the restrictions are waivable if the applicant demonstrates that his or her operation can safely be conducted under the terms of a certificate of waiver. The FAA announced it will make an online portal available to apply for these waivers in the months ahead.

Manufacturing

As of today, we manufacture all of our products at our manufacturing facility in Neodesha, Kansas. We believe our current facilities are sufficient to adapt to our growth plans for the next two to three years and we have no current plans to expand our manufacturing capabilities.

Suppliers

Currently, we have strong relationships established with companies that provide many of the parts and services necessary to construct our advanced fixed wing product, such as Botlink, GoPro and 3DR. We have relationships with these suppliers and hope to continue to build and find new relationships from which we can source cheaper and better supplies to stay ahead of the needs of the market.

| 15 |

Our flight planning and photo stitching software is provided by Botlink, a private company in North Dakota. We have worked closely with Botlink to optimize their software to work with our platforms. We consider our relationship with Botlink to be good; however, a loss of this relationship could have a materially adverse effect on our product offerings and results of operations.

Research and Development

Research and development activities are integral to our business and we follow a disciplined approach to investing our resources to create new technologies and solutions. A fundamental part of this approach is a well-defined screening process that helps us identify commercial opportunities that support current desired technological capabilities in the precision agriculture space. Our research includes the expansion of our wing products so as to build a portfolio of UAVs, as well as other solutions to problems with which agriculture professionals struggle.

Employees

As of September 30, 2017, we had a total of 5 employees of which are all full-time except for one which is part-time. We have not experienced a work stoppage since we commenced operations. None of such employees are represented by employee union(s). We believe relations with all of our employees are good.

Legal Proceedings

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations. We may become involved in material legal proceedings in the future.

Property

We have one leased facility located at 117 South 4th Street, Neodesha, Kansas 66757. This serves as the corporate headquarters and manufacturing facility. The facility is a lease of 4,000 square feet at a cost of $200 per month. Monthly rent increases by $100 every year until the expiration of the lease in 2018.

| 16 |

AGEAGLE RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below and the other information in this Current Report on Form 8-K and other filings with the SEC before investing in our securities. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

AgEagle Aerial Systems, Inc. (“AgEagle,” “we” or us”) has a limited operating history and there can be no assurance that we can achieve or maintain profitability.

We have been in operation for approximately eight years. However, we have only been in the UAV business for half of that time. We are currently in the business development stage and have limited commercial sales of our products and, accordingly, we cannot guarantee that we will become profitable. Moreover, even if we achieve profitability, given the competitive and evolving nature of the industry in which we operate, we may be unable to sustain or increase profitability and our failure to do so would adversely affect our business, including our ability to raise additional funds.

We will need substantial additional funding and may be unable to raise capital when needed, which would force us to delay, curtail or eliminate one or more of our research and development programs or commercialization efforts.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts on product development. We will require additional funds to support our continued research and development activities, as well as the costs of commercializing, marketing and selling any new products resulting from those research and development activities. We have based this estimate, however, on assumptions that may prove to be wrong, and we could spend our available financial resources much faster than we currently expect.

Until such time, if ever, as we can generate a sufficient amount of product revenue and achieve profitability, we expect to seek to finance future cash needs through equity or debt financings or corporate collaboration and strategic arrangements. We currently have no other commitments or agreements relating to any of these types of transactions and we cannot be certain that additional funding will be available on acceptable terms, or at all. If we are unable to raise additional capital, we might have to delay, curtail or eliminate commercializing, marketing and selling one or more of our products.

Product development is a long, expensive and uncertain process.

The development of both UAV software and hardware is a costly, complex and time-consuming process, and investments in product development often involve a long wait until a return, if any, can be achieved on such investment. We might face difficulties or delays in the development process that will result in our inability to timely offer products that satisfy the market, which might allow competing products to emerge during the development and certification process. We anticipate making significant investments in research and development relating to our products and services, but such investments are inherently speculative and require substantial capital expenditures. Any unforeseen technical obstacles and challenges that we encounter in the research and development process could result in delays in or the abandonment of product commercialization, may substantially increase development costs, and may negatively affect our results of operations.

Successful technical development of our products does not guarantee successful commercialization.

Although we have successfully completed the technical development of our two original UAV systems, as well as the new RX-60 and RX-48 systems, we may still fail to achieve commercial success for a number of reasons, including, among others, the following:

| · | failure to obtain the required regulatory approvals for their use; | |

| · | prohibitive production costs; |

| 17 |

| · | competing products; | |

| · | rapid evolvement of the product due to new technologies; | |

| · | lack of product innovation; | |

| · | unsuccessful distribution and marketing through our sales channels; | |

| · | insufficient cooperation from our supply and distribution partners; and | |

| · | product development that does not align with or meet customer needs. |

Our success in the market for the products and services we develop will depend largely on our ability to properly demonstrate their capabilities. Upon demonstration, the AgEagle platform of systems may not have the capabilities they were designed to have or that we believed they would have. Furthermore, even if we do successfully demonstrate our products’ capabilities, potential customers may be more comfortable doing business with a competitor, or may not feel there is a significant need for the products we develop. As a result, significant revenue from our current and new product investments may not be achieved for a number of years, if at all.

If we fail to protect our intellectual property rights, we could lose our ability to compete in the marketplace.

Our intellectual property and proprietary rights are important to our ability to remain competitive and successful in the development of our products and our business. Patent protection can be limited and not all intellectual property can be patented. We expect to rely on a combination of patent, trademark, copyright, and trade secret laws as well as confidentiality agreements and procedures, non-competition agreements and other contractual provisions to protect our intellectual property, other proprietary rights and our brand. As we currently do not have any granted patent, trademark or copyright protections, we must rely on trade secrets and nondisclosure agreements, which provide limited protections. Our intellectual property rights may be challenged, invalidated or circumvented by third parties. We may not be able to prevent the unauthorized disclosure or use of our technical knowledge or other trade secrets by employees or competitors.

Furthermore, our competitors may independently develop technologies and products that are substantially equivalent or superior to our technologies and products, which could result in decreased revenues. Litigation may be necessary to enforce our intellectual property rights, which could result in substantial costs to us and substantial diversion of management attention. If we do not adequately protect our intellectual property, our competitors could use it to enhance their products. Our inability to adequately protect our intellectual property rights could adversely affect our business and financial condition, and the value of our brand and other intangible assets.

Other companies may claim that we infringe their intellectual property, which could materially increase our costs and harm our ability to generate future revenue and profit.

We do not believe that our technologies infringe on the proprietary rights of any third party, but claims of infringement are becoming increasingly common and third parties may assert infringement claims against us. It may be difficult or impossible to identify, prior to receipt of notice from a third party, the trade secrets, patent position or other intellectual property rights of a third party, either in the United States or in foreign jurisdictions. Any such assertion may result in litigation or may require us to obtain a license for the intellectual property rights of third parties. If we are required to obtain licenses to use any third party technology, we would have to pay royalties, which may significantly reduce any profit on our products. In addition, any such litigation could be expensive and disruptive to our ability to generate revenue or enter into new market opportunities. If any of our products were found to infringe other parties’ proprietary rights and we are unable to come to terms regarding a license with such parties, we may be forced to modify our products to make them non-infringing or to cease production of such products altogether.

| 18 |

The nature of our business involves significant risks and uncertainties that may not be covered by insurance or indemnification.

We have developed and sold products and services in circumstances where insurance or indemnification may not be available; for example, in connection with the collection and analysis of various types of information. In addition, our products and services raise questions with respect to issues of civil liberties, intellectual property, trespass, conversion and similar concepts, which may create legal issues. Indemnification to cover potential claims or liabilities resulting from the failure of any technologies that we develop or deploy may be available in certain circumstances but not in others. Currently, the unmanned aerial systems industry lacks a formative insurance market. We may not be able to maintain insurance to protect against all operational risks and uncertainties that our customers confront. Substantial claims resulting from an accident, product failure, or personal injury or property liability arising from our products and services in excess of any indemnity or insurance coverage (or for which indemnity or insurance coverage is not available or is not obtained) could harm our financial condition, cash flows and operating results. Any accident, even if fully covered or insured, could negatively affect our reputation among our customers and the public, and make it more difficult for us to compete effectively.

We may incur substantial product liability claims relating to our products.

As a manufacturer of UAV products, and with aircraft and aviation sector companies under increased scrutiny, claims could be brought against us if use or misuse of one of our UAV products causes, or merely appears to have caused, personal injury or death. In addition, defects in our products may lead to other potential life, health and property risks. Any claims against us, regardless of their merit, could severely harm our financial condition, strain our management and other resources. We are unable to predict if we will be able to obtain or maintain product liability insurance for any products that may be approved for marketing.

We rely heavily on the industry relationships and expertise of our President and CEO, Bret Chilcott, and if he were to leave the company, our business may suffer.

Mr. Bret Chilcott is essential to our ability to continue to grow our business. Mr. Chilcott has established relationships within the industry in which we operate. We do not maintain, or intend to maintain, key man life insurance for Mr. Chilcott. If he was to leave the company, our growth strategy might be hindered, which could limit our ability to increase revenue.

If we are unable to recruit and retain key management, technical and sales personnel, our business would be negatively affected.

For our business to be successful, we need to attract and retain highly qualified technical, management and sales personnel. The failure to recruit additional key personnel when needed, with specific qualifications, on acceptable terms and with an ability to maintain positive relationships with our partners, might impede our ability to continue to develop, commercialize and sell our products and services. To the extent the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting and training costs in order to attract and retain such employees. The loss of any members of our management team may also delay or impair achievement of our business objectives and result in business disruptions due to the time needed for their replacements to be recruited and become familiar with our business. We face competition for qualified personnel from other companies with significantly more resources available to them and thus may not be able to attract the level of personnel needed for our business to succeed.

If our proposed marketing efforts are unsuccessful, we may not earn enough revenue to become profitable.

Our future growth depends on our gaining market acceptance and regular production orders for our products and services. While we believe we will have an advantage in the marketplace during the term of our strategic partnership with Raven, we will need to heavily invest in marketing resources for the successful implementation of our marketing plan. Our marketing plan includes attendance at trade shows, making private demonstrations, advertising, promotional materials and advertising campaigns in print and/or broadcast media. In the event we are not successful in obtaining a significant volume of orders for our products and services, we will face significant obstacles in expanding our business. We cannot give any assurance that our marketing efforts will be successful. If they are not, revenue may not be sufficient to cover our fixed costs and we may not become profitable.

| 19 |

Our operating margins may be negatively impacted by reduction in sales or products sold.

Expectations regarding future sales and expenses are largely fixed in the short term. We maintain raw materials and finished goods at a volume we feel is necessary for anticipated distribution and sales. Therefore, we may not be able to reduce costs in a timely manner to compensate for any unexpected shortfalls between forecasted and actual sales.

We face a significant risk of failure because we cannot accurately forecast our future revenues and operating results.

The rapidly changing nature of the markets in which we compete makes it difficult to accurately forecast our revenues and operating results. Furthermore, we expect our revenues and operating results to fluctuate in the future due to a number of factors, including the following:

| · | the timing of sales of our products; | |

| · | unexpected delays in introducing new products; | |

| · | increased expenses, whether related to sales and marketing, or administration; and | |

| · | costs related to possible acquisitions of businesses. |

Rapid technological changes may adversely affect the market acceptance of our products and could adversely affect our business, financial condition and results of operations.

The market in which we compete is subject to technological changes, introduction of new products, change in customer demands and evolving industry standards. Our future success will depend upon our ability to keep pace with technological developments and to timely address the increasingly sophisticated needs of our customers by supporting existing and new technologies and by developing and introducing enhancements to our current products and new products. We may not be successful in developing and marketing enhancements to our products that will respond to technological change, evolving industry standards or customer requirements. In addition, we may experience difficulties internally or in conjunction with key vendors and partners that could delay or prevent the successful development, introduction and sale of such enhancements and such enhancements may not adequately meet the requirements of the market and may not achieve any significant degree of market acceptance. If release dates of our new products or enhancements are delayed or, if when released, they fail to achieve market acceptance, our business, operating results and financial condition may be adversely affected.

Our products are subject to regulations of the Federal Aviation Administration (the “FAA”).

In August 2016, regulations from the FAA relating to the commercial use of UAVs in the United States became law. As a result, users of systems like AgEagle are only required to take a knowledge exam at an approved FAA testing station similar to an automobile driver’s license exam. Prior to the new law, users had to hold a pilot’s license, have an observer present and file various documents before flights. We saw a decrease in revenues of approximately 52% during 2016, which we believe may have been partially due to the uncertainty of the FAA regulations prior to the enactment of the new law. In the event new FAA rules or regulations are promulgated or current rules are revised that may negatively affect commercial usage of our UAVs, such rules and laws could adversely disrupt our operations and overall sales.

Our future results may be affected by various legal and regulatory proceedings and legal compliance risks, including those involving product liability, antitrust, intellectual property, environmental, regulations of the FAA, the U.S. Foreign Corrupt Practices Act and other anti-bribery, anti-corruption, or other matters.

The outcome of any future legal proceedings may differ from our expectations because the outcomes of litigation, including regulatory matters, are often difficult to reliably predict. Various factors or developments can lead us to change current estimates of liabilities and related insurance receivables where applicable, or make such estimates for matters previously not susceptible of reasonable estimates, such as a significant judicial ruling or judgment, a significant settlement, significant regulatory developments or changes in applicable law. A future adverse ruling, settlement or unfavorable development could result in future charges that could have a material adverse effect on our results of operations or cash flows in any particular period. We are not currently involved in or subject to any such legal or regulatory proceedings, but we cannot guarantee that such proceedings may not occur in the future.

| 20 |

If we do not receive the governmental approvals necessary for the sales or export of our products, or if our products are not compliant in other countries, our sales may be negatively impacted. Similarly, if our suppliers and partners do not receive government approvals necessary to export their products or designs to us, our revenues may be negatively impacted and we may fail to implement our growth strategy.

A license may be required in the future to initiate marketing activities. We may also be required to obtain a specific export license for any hardware exported. We may not be able to receive all the required permits and licenses for which we may apply in the future. If we do not receive the required permits for which we apply, our revenues may be negatively impacted. In addition, if government approvals required under these laws and regulations are not obtained, or if authorizations previously granted are not renewed, our ability to export our products could be negatively impacted, which may have a negative impact on our revenues and a potential material negative impact on our financial results.

Our global distribution agreement with Raven leaves open the possibility that we may be left without an effective distribution platform in the event the Raven agreement is terminated or is not renewed upon completion of the initial term of the agreement.

In the event our agreement with Raven is terminated or modified, whether by triggering an early termination or reaching the completion of the initial term, we may be left without an effective platform through which we can immediately distribute our products. If there is an early termination, this could substantially impact the global rollout and market acceptance of our products. This may result in our business, operating results and financial condition being adversely affected.

Currently, Raven has a non-exclusive worldwide right to distribute our products in the agriculture market. Our agreement with Raven covers our fixed wing product, with a right of first opportunity for us to provide multirotor and other format UAVs. If we cannot provide such extended product offerings, Raven may use other suppliers for such requirements, which would compete with our market share.

In addition, upon the commencement of our agreement with Raven, we terminated other distribution arrangements with existing dealers in the agriculture industry. As a result, we may be required to repurchase any or all unsold drones in the impacted dealers’ inventory or in transit to the dealer on the effective date of termination, pursuant to those terminated dealer agreements.

On February 22, 2016, we entered into a dealer termination agreement with a certain dealer in relation to its exclusive distributor agreement for Canada. The parties mutually agreed that we will pay the dealer installments through September 1, 2016, totaling $100,000, for the termination of the dealer’s exclusive distributor agreement. As of December 31, 2016, we recorded the termination costs of $100,000 in other expense and have accrued a remaining payment due to the dealer of $20,000.

As of December 31, 2016, we determined that three UAVs have been returned and seventeen units have been converted to include components from the newer models. As a result, termination costs for the year ended December 31, 2016 of $74,715 was recorded in other expense. We believe that all the former dealers based on their right of return clause are properly accrued and at this time one dealer has the right to return one unit and convert one unit and a second dealer will upgrade four units, which would be equal to approximately $18,000, and we have included this amount in our accrued expenses.

| 21 |

We may pursue additional strategic transactions in the future, which could be difficult to implement, disrupt our business or change our business profile significantly.

We intend to consider additional potential strategic transactions, which could involve acquisitions of businesses or assets, joint ventures or investments in businesses, products or technologies that expand, complement or otherwise relate to our current or future business. We may also consider, from time to time, opportunities to engage in joint ventures or other business collaborations with third parties to address particular market segments. Should our relationships fail to materialize into significant agreements or should we fail to work efficiently with these companies, we may lose sales and marketing opportunities and our business, results of operations and financial condition could be adversely affected.