Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HollyFrontier Corp | pressrelease-idrtransactio.htm |

| EX-2.1 - EXHIBIT 2.1 - HollyFrontier Corp | exhibit21-equityrestructur.htm |

| 8-K - 8-K - HollyFrontier Corp | hfc_-xformx8xkxidrxelimina.htm |

IDR Simplification

October 19, 2017

Management Call: 8:30am EST

Title Blue:

23,55,94

Orange:

230,175,109

Grey:

127,127,127

Light Blue:

114,164,183

Brown:

148,126,103

https://event.webcasts.com/starthere.jsp?ei=1166751&tp_key=6c5a60ca42

The following is a “safe harbor” statement under the Private Securities Litigation Reform Act of 1995: The

statements made during the course of this presentation relating to matters that are not historical facts are

“forward-looking statements” based on management’s beliefs and assumptions using currently available

information and expectations as of the date hereof, are not guarantees of future performance and involve

certain risks and uncertainties, including those contained in our filings with the Securities and Exchange

Commission. Although we believe that the expectations reflected in these forward-looking statements are

reasonable, we cannot assure you that our expectations will prove correct. Therefore, actual outcomes and

results could materially differ from what is expressed, implied or forecast in such statements. Any

differences could be caused by a number of factors, including, but not limited to, failure of Holly Energy

Partners and HEP Logistics Holdings, L.P. to successfully close the transaction, failure to receive required

governmental approvals to close the transaction, the possibility of inefficiencies, curtailments or shutdowns

in refinery operations or pipelines, effects of governmental and environmental regulations and policies, the

availability and cost of financing to HollyFrontier and Holly Energy Partners, HollyFrontier’s and Holly Energy

Partners’ operational efficiency in carrying out routine operations and capital construction projects, the

possibility of terrorist attacks and the consequences of any such attacks, general economic conditions and

other financial, operational and legal risks and uncertainties detailed from time to time in HollyFrontier’s and

Holly Energy Partners’ Securities and Exchange Commission filings. The forward-looking statements speak

only as of the date made and, other than as required by law, we undertake no obligation to publicly update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

HOLLYFRONTIER DISCLOSURE STATEMENT

2

3

IDR restructuring is expected to improve the long-term cost of capital, simplify HEP’s corporate

structure, and provide stronger alignment of the GP and LP interests

• Eliminates IDR “drag,” which lowers the cost of equity

• Decreases HEP cost of equity from 11% to 7.5% pro forma 1

• Enhances ability to pursue both organic projects and potential acquisitions

• Allows for accelerated growth and improved valuation levels over time

• Provides more transparent valuation of HFC’s ownership in HEP

• Eliminates ambiguity in calculating the value of the IDRs

• Provides stronger alignment of GP and LP Interests

Strategic Rationale

1) Assumes cost of equity is equal to current annualized distribution yield based on latest annualized quarterly distribution. Unit

price and distribution information as of 10/18/17.

4

IDR RESTRUCTURING

• At closing, HEP will issue 37,250,000 HEP common units to its general partner, a wholly-

owned subsidiary of HFC in exchange for the elimination of HEP’s IDRs held by the general

partner and conversion of the 2% GP interest in HEP into a non-economic interest

• Pro forma HFC will own approximately 59% of HEP’s outstanding common units

DISTRIBUTION WAIVER

• The general partner will waive $2.5 million a quarter in LP distributions for a period of 12

consecutive quarters

VALUATION

• Total equity value of approximately $1.25 billion, representing 14.0x expected 2018 GP

Cash flow based on closing price on October 18, 2017

CLOSING

• The transaction has been approved by the Audit Committee and Board of Directors of HFC

and the Conflicts Committee and the Board of Directors of Holly Logistic Services, L.L.C., the

ultimate general partner of HEP.

• We expect to close the transaction in the fourth quarter of 2017, subject to customary

closing conditions

Transaction Details

5

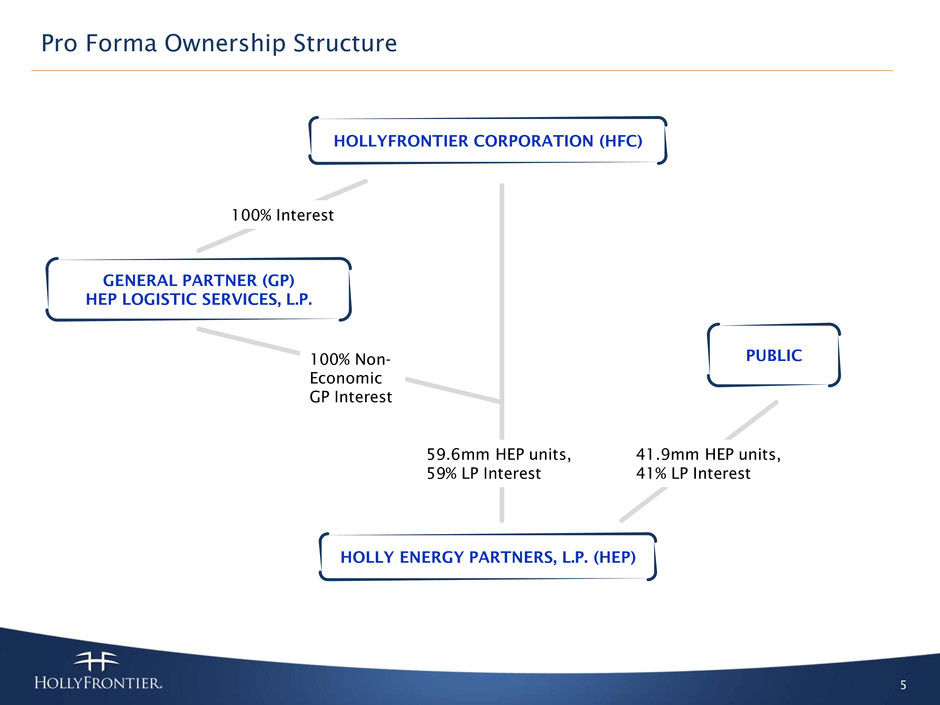

Pro Forma Ownership Structure

HOLLY ENERGY PARTNERS, L.P. (HEP)

PUBLIC

GENERAL PARTNER (GP)

HEP LOGISTIC SERVICES, L.P.

HOLLYFRONTIER CORPORATION (HFC)

100% Interest

100% Non-

Economic

GP Interest

41.9mm HEP units,

41% LP Interest

59.6mm HEP units,

59% LP Interest

HollyFrontier Corporation

(NYSE: HFC)

Holly Energy Partners, L.P.

(NYSE: HEP)

2828 N. Harwood, Suite 1300

Dallas, Texas 75201

www.hollyfrontier.com

www.hollyenergy.com

Craig Biery | Director, Investor Relations

investors@hollyfrontier.com

214-954-6510

Jared Harding | Investor Relations

investors@hollyfrontier.com

214-954-6510