Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - EAST WEST BANCORP INC | ewbc9918k09302017.htm |

| 8-K - 8-K - EAST WEST BANCORP INC | ewbc8k09302017.htm |

EWBC Earnings Results

Third Quarter 2017

October 19, 2017

Forward-Looking Statements

2

Certain matters set forth herein (including any exhibits hereto) constitute “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, including forward-looking statements relating to the Company’s current business plans and expectations regarding future

operating results. Forward-looking statements may include, but are not limited to, the use of forward-looking language, such as “likely result in,”

“expects,” “anticipates,” “estimates,” “forecasts,” “projects,” “intends to,” or may include other similar words or phrases, such as “believes,” “plans,”

“trend,” “objective,” “continues,” “remains,” or similar expressions, or future or conditional verbs, such as “will,” “would,” “should,” “could,” “may,” “might,”

“can,” or similar verbs. These forward-looking statements are subject to risks and uncertainties that could cause actual results, performance or

achievements to differ materially from those projected. These risks and uncertainties, some of which are beyond our control, include, but are not limited

to, our ability to compete effectively against other financial institutions in our banking markets; changes in the commercial and consumer real estate

markets; changes in our costs of operation, compliance and expansion; changes in the U.S. economy, including inflation, employment levels, rate of

growth and general business conditions; changes in government interest rate policies; changes in laws or the regulatory environment including regulatory

reform initiatives and policies of the U.S. Department of Treasury, the Board of Governors of the Federal Reserve Board System, the Federal Deposit

Insurance Corporation, the U.S. Securities and Exchange Commission, the Consumer Financial Protection Bureau and California Department of

Business Oversight — Division of Financial Institutions; heightened regulatory and governmental oversight and scrutiny of the Company’s business

practices, including dealings with retail customers; changes in the economy of and monetary policy in the People’s Republic of China; changes in income

tax laws and regulations; changes in accounting standards as may be required by the Financial Accounting Standards Board or other regulatory agencies

and their impact on critical accounting policies and assumptions; changes in the equity and debt securities markets; future credit quality and

performance, including our expectations regarding future credit losses and allowance levels; fluctuations of our stock price; fluctuations in foreign

currency exchange rates; success and timing of our business strategies; our ability to adopt and successfully integrate new technologies into our

business in a strategic manner; impact of reputational risk from negative publicity, fines and penalties and other negative consequences from regulatory

violations and legal actions; impact of potential federal tax changes and spending cuts; impact of adverse judgments or settlements in litigation or of

regulatory enforcement actions; changes in our ability to receive dividends from our subsidiaries; impact of political developments, wars or other

hostilities that may disrupt or increase volatility in securities or otherwise affect economic conditions; impact of natural or man-made disasters or

calamities or conflicts or other events that may directly or indirectly cause unanticipated declines in the Company’s financial performance; continuing

consolidation in the financial services industry; our capital requirements and our ability to generate capital internally or raise capital on favorable terms;

impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act on our business, business practices and cost of operations; impact of

adverse changes to our credit ratings from the major credit rating agencies; impact of failure in, or breach of, our operational or security systems or

infrastructure, or those of third parties with whom we do business, including as a result of cyber attacks; and other similar matters which could result in,

among other things, confidential and/or proprietary information being disclosed or misused; adequacy of our risk management framework, disclosure

controls and procedures and internal control over financial reporting; the effect of the current low interest rate environment or changes in interest rates on

our net interest income and net interest margin; the effect of changes in the level of checking or savings account deposits on our funding costs and net

interest margin; a recurrence of significant turbulence or disruption in the capital or financial markets, which could result in, among other things, a

reduction in the availability of funding or increased funding costs, reduced investor demand for mortgage loans and declines in asset values and/ or

recognition of other-than-temporary impairment on securities held in our available-for-sale investment securities portfolio; and other factors set forth in the

Company’s public reports including its Annual Report on Form 10-K for the year ended December 31, 2016, and particularly the discussion of risk factors

within that document. If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to

be incorrect, the Company’s results could differ materially from those expressed in, implied or projected by such forward-looking statements. The

Company assumes no obligation to update such forward-looking statements.

Net

income

$132.7

million

Adj. net

income1,2

$130.4

million

Diluted

EPS

$0.91

Adj. diluted

EPS1,2

$0.89

Tangible equity2/share

$22.71

Record loans

$28.5 billion

Record deposits

$31.3 billion

Highlights of Third Quarter 2017 Results

Strong earnings results.

Net income increased 12% Q-o-Q and diluted EPS increased 12% Q-o-Q.

Net interest income growth: 3Q17 NII of $303mm was up 5% Q-o-Q, driven

by strong loan growth.

NIM expansion: 3Q17 NIM of 3.52% was up by 3 bps and adj.* NIM of 3.46%

was up by 5 bps Q-o-Q.

Sale of insurance brokerage business, East West Insurance Services, Inc.

(“EWIS”): pre-tax gain of $4mm, or $0.02 per share after tax.

Adj.1,2 pre-tax, pre-provision income of $210mm grew by 6% Q-o-Q.

Solid balance sheet growth.

Total loans grew 19% linked quarter annualized (“LQA”).

Total deposits grew 2% LQA.

Core grew 7% LQA, reflecting strong growth in demand deposits.

Steady credit quality.

Annualized net charge-off of 6 bps in 3Q17.

NPAs decreased by $16mm, or 12%, Q-o-Q to $117mm; equivalent to 0.32%

of total assets as of 09.30.17.

3

1. Adjusted pre-tax, pre-provision income, adjusted net income and adjusted diluted EPS exclude the gain on sale of business.

2. See reconciliation of GAAP to non-GAAP financials on slides 15-18 and in the Company’s 3Q17 Earnings Press Release.

$110.1 $110.7 $128.2

$118.3

$130.5

$41.5

$2.2

13.1% 12.9%

14.9%

13.0%

13.8%

15.5% 15.3%

17.6%

15.3% 16.1%

10%

13%

16%

19%

22%

25%

$0

$40

$80

$120

$160

$200

3Q16 4Q16 1Q17* 2Q17 3Q17*

$ in

m

illi

on

s

Net Income & ROE and Tangible ROE*

Net income (LH axis) Gain on sale of assets (LH axis)

Return on avg. equity (RH axis) Return on avg. tang. eq. (RH axis)

$110.1 $110.7

$128.2

$118.3

$130.5

$41.5

$2.2

1.33%

1.27%

1.49%

1.36%

1.44%

1.0%

1.2%

1.4%

1.6%

1.8%

2.0%

$0

$40

$80

$120

$160

$200

3Q16 4Q16 1Q17* 2Q17 3Q17*

$ in

m

illi

on

s

Net Income & ROA

Net income (LH axis) Gain on sale of assets (LH axis) Return on avg. assets (RH axis)

$0.76 $0.76

$0.88

$0.81

$0.89

$0.28

$0.02

0

10%

20%

30%

40%

$0.40

$0.6

$0.80

$1.00

$1.20

3Q16 4Q16 1Q17* 2Q17 3Q17*

$ p

er

sh

ar

e

Diluted EPS & EPS Growth

Diluted EPS (LH axis) Gain on sale of assets (LH axis) Diluted EPS growth

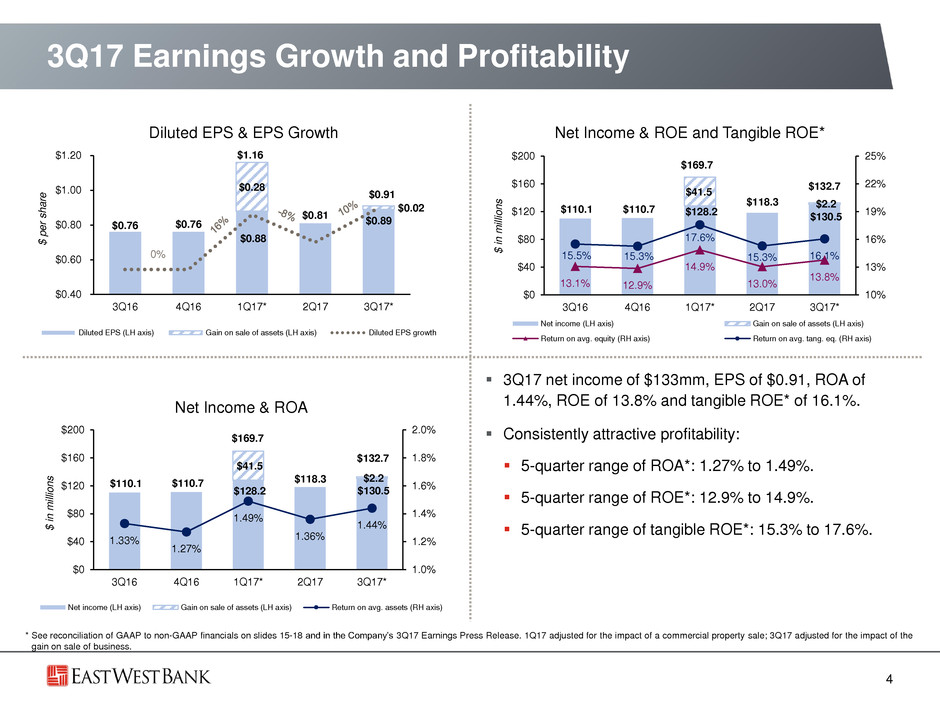

3Q17 Earnings Growth and Profitability

4

3Q17 net income of $133mm, EPS of $0.91, ROA of

1.44%, ROE of 13.8% and tangible ROE* of 16.1%.

Consistently attractive profitability:

5-quarter range of ROA*: 1.27% to 1.49%.

5-quarter range of ROE*: 12.9% to 14.9%.

5-quarter range of tangible ROE*: 15.3% to 17.6%.

* See reconciliation of GAAP to non-GAAP financials on slides 15-18 and in the Company’s 3Q17 Earnings Press Release. 1Q17 adjusted for the impact of a commercial property sale; 3Q17 adjusted for the impact of the

gain on sale of business.

$1.16

$169.7

$169.7

0%

$0.91

$132.7

$132.7

9.3 9.6 10.0

10.2 10.6

8.5 8.7

9.0 9.1

9.5

1.5

1.6

1.7 1.8

1.93.4

3.5

3.7

4.0

4.4

2.1

2.1

2.1

2.1

2.1

0%

20%

40%

60%

80%

$0

$10

$20

$30

3Q16 4Q16 1Q17 2Q17 3Q17

$

in

b

il

li

o

n

s

Total Loans*

C&I CRE MFR

SFR Consumer LQA growth rate

3Q17 Record Loans of $28.5 billion

5

* Total loans held for investment and held for sale, with HFS by category. CRE = CRE, construction and land. Consumer = predominantly HELOCs.

Q-o-Q Difference

Total loans increased $1.3bn or 5% (+19% LQA).

C&I: +4.5%, or +18% LQA.

CRE: +4.4%, or +18% LQA.

SFR: +8.9%, or +35% LQA.

MFR: +5.9%, or +24% LQA.

Consumer: flat.

Average loan growth of 3.1% or 12% LQA.

Broad-based commercial loan growth across

industries.

CRE growth reflects slower pace of paydowns and

payoffs in 3Q.

Stable loan portfolio mix, balanced between

commercial, commercial real estate, and consumer

categories.

$24.8

$25.5

$26.5

$27.2

$28.5

9.5 10.2

10.7 10.5 11.0

7.7

8.2 8.0 8.2

7.9

5.8

5.9 6.1

6.4 6.6

5.6

5.6

5.8 6.1

5.8

0%

20%

40%

60%

80%

$0

$7

$14

$21

$28

$35

3Q16 4Q16 1Q17 2Q17 3Q17

$

in

b

il

li

o

n

s

Total Deposits

DDA MMDA IB checking & Savings

Time LQA growth rate

3Q17 Record Deposits of $31.3 billion

6

DDA = Noninterest-bearing checking deposits. MMDA = Money market deposits. IB checking = Interest-bearing checking deposits.

$29.9

$30.5

$28.6

Q-o-Q Difference

Total deposits increased $157mm (+2% LQA).

DDA: +5.1%, or +20% LQA.

IB checking & savings: +2.5%, or +10% LQA.

MMDA: -3.1%, or -12% LQA.

Time deposit: -4.6%, or -18% LQA.

Average deposit growth of 2.9% (+11% LQA).

DDAs comprised 35% of total deposits as of

09.30.17, similar to 34% as of 06.30.17.

Over past 5 quarters, share of DDAs in total deposits

ranged from 33% to 35%.

Over past 5 quarters, share of time deposits in total

deposits ranged from 19% to 20%.

$31.2

2%

$31.3

10.4 10.2 10.3 10.7 10.8

4.0 3.4 4.5 3.5 3.6

6.1

5.4

5.0 5.9 6.0

10.9 14.4 11.1

12.0 10.2

5.8

7.0

2.5

3.8 6.7

7.7

7.1

5.4

6.2 3.6

$0

$10

$20

$30

$40

$50

3Q16 4Q16 1Q17 2Q17 3Q17

$

in

m

il

li

o

n

s

Total Fees and Other Operating Income

Branch fees Wealth management fees

Ancillary loan fees & other income LC fees & FX income

Derivative fees & other income Other fees & operating income

Q-o-Q Difference

Excluding net gains on sale of loans,

securities, and fixed assets, fees and other

operating income of $41mm decreased by

$1.2mm or 3%.

Adjusted for credit valuation adjustments and

mark-to-market changes associated with

currency hedges, customer-related fee income

increased by 4% linked quarter and 10% year-

over-year.

Strong growth in fees from assisting customers

with interest rate swap transactions.

Decrease in other fees: $0.9mm decline in

insurance commissions due to the sale of

EWIS.

Decrease in other operating income: gains

from other investments were elevated in 2Q17.

3Q17 Fees & Other Operating Income

7

$44.9

$47.5

$38.8

$42.1

$40.9

3Q17 Summary Income Statement

8

% Change vs.

($ in millions, except per share data) 3Q17 2Q17 3Q16 3Q17 Comments

Adjusted net interest income (excl. accretion) $ 298.6 5% 21%

Reflects strong loan growth and NIM

expansion.

ASC 310-30 discount accretion income $ 4.5 (28)% (37)% .

Net interest income $ 303.2 5% 19%

Fees & operating income $ 40.9 (3)% (9)% Customer-related fee income increased.

Net gains on sales of fixed assets $ 1.0 0.1% 114.6%

Net gains on sale of business $ 3.8 NM NM Sale of insurance brokerage business.

Net gains on sales of loans & securities $ 3.9 (9)% (1)%

Total Noninterest income $ 49.6 4.7% 0.6%

Adjusted noninterest expense $ 138.9 (0.4)% 2%

Tax credit and other investments amortization $ 23.8 (14.5)% (27.0)% Expecting similar amount in 4Q.

Amortization of core deposit intangibles $ 1.7 (1.5)% (14.2)%

Total Noninterest expense $ 164.5 (2.7)% (3.5)%

Provision for credit losses $ 13.0 21.6% 36.4%

Income tax expense $ 42.6 8.3% 220% Effective tax rate of 24.3% in 3Q.

Net income $132.7 12% 20%

Diluted EPS $ 0.91 12% 20%

Note: See reconciliation of GAAP to non-GAAP financials on slides 15-18 and in the Company’s 3Q17 Earnings Press Release.

247.0

261.1

268.9

283.8

298.6

7.1

11.6

3.2

6.3

4.6

$220

$240

$260

$280

$300

$320

3Q16 4Q16 1Q17 2Q17 3Q17

$

in

mi

llio

ns

Net Interest Income

Adj. net interest income* Accretion income

3.16% 3.17%

3.29%

3.41%

3.46%

4.05% 4.13% 4.17%

4.30% 4.35%

0.30% 0.31% 0.32% 0.36% 0.40%

3.00%

3.20%

3.40%

3.60%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

3Q16 4Q16 1Q17 2Q17 3Q17

NIM (ex. accretion) (RH axis) Loans yield (ex. accretion) (LH axis)

Total cost of deposits (LH axis)

Adjusted* NIM: Adj.* Loans Yield & Cost of Deposits

3Q17 NIM of 3.52% expanded by 3 bps Q-o-Q, and

excluding the impact of accretion, adjusted* NIM of 3.46%

expanded by 5 bps Q-o-Q.

NIM benefitted from expansion in investment securities yields

and other interest earning assets.

3Q17 loan yield of 4.42% expanded by 2 bps Q-o-Q, and

adjusted* loan yield of 4.35% expanded by 5 bps Q-o-Q.

3Q17 cost of deposits of 0.40% increased by 4 bps Q-o-Q.

3Q17 Net Interest Income & Net Interest Margin

9

$254.1

$272.7 $272.1

3Q17 NII of $303mm increased Q-o-Q by $13mm, or 5%.

Linked quarter ASC 310-30 discount accretion income

decrease of $1.7mm.

Remaining ASC 310-30 discount of $39mm as of 09.30.17.

Adjusted* NII, excluding accretion income, of $299mm

increased by 5% Q-o-Q.

* See reconciliation of GAAP to non-GAAP financials on slides 15-18 and in the Company’s 3Q17 Earnings Press Release.

$290.1

$303.2

3Q17 total noninterest expense: $165mm.

Excluding tax credit amortization and core deposit intangible

amortization, 3Q17 adjusted* noninterest expense of

$139mm decreased slightly by $0.6mm Q-o-Q.

3Q17 adj.* efficiency ratio of 39.8%.

Trailing twelve month adj.* efficiency ratio of 41.8%.

Revenue growth supports back-office and front-line

investment in the business.

3Q17 Efficiency and PTPP Profitability

10

Growing adjusted* pre-tax, pre-provision (PTPP) income.

3Q17 adj. PTPP income of $210mm grew by 6% Q-o-Q and

25% Y-o-Y.

NII growth driven by loan growth.

3Q17 adj.* PTPP profitability ratio of 2.32% increased by

5 bps Q-o-Q.

5-quarter adj.* PTPP profitability ratio range of 2.03% to

2.32%.

$167.6 $182.8 $179.6

$198.0 $210.0

2.03%

2.10% 2.09%

2.27% 2.32%

1.00%

1.30%

1.60%

1.90%

2.20%

2.50%

$0

$50

$100

$150

$200

$250

3Q16 4Q16 1Q17 2Q17 3Q17

$

in

mi

llio

ns

Adj. PTPP income* (LH axis) Adj. PTPP profitability ratio* (RH axis)

Adj.* PTPP Income & PTPP Profitability Ratio

* *

* See reconciliation of GAAP to non-GAAP financials on slides 15-18 and in the Company’s 3Q17 Earnings Press Release. 1Q17 adjusted for the impact of a commercial property sale; 3Q17 adjusted for the impact of the

gain on sale of business.

$135.9

$138.7 $136.9

$139.5 $138.9

44.8%

43.2% 43.3%

41.3%

39.8%

20.0%

25.0%

30.0%

35.0%

40.0%

45.0%

$100

$120

$140

$160

3Q16 4Q16 1Q17 2Q17 3Q17

$ in

m

illi

on

s

Adj. noninter st expense* (LH axis) Adj. efficiency ratio* (RH axis)

Adj.* Noninterest Expense & Efficiency Ratio

* *

$130.8 $129.6

$144.8

$133.0

$117.0

0.39%

0.37%

0.41%

0.37%

0.32%

0.00%

0.20%

0.40%

0.60%

$100

$120

$140

$160

$180

$200

3Q16 4Q16 1Q17 2Q17 3Q17

$ i

n m

illi

on

s

Nonperforming Assets*

Nonperforming assets (LH axis) NPAs / Total assets (RH axis)

$24,732

$25,503

$26,461

$27,211

$28,525

1.03% 1.02% 0.99% 1.02% 1.00%

0.00%

1.00%

2.00%

3.00%

4.00%

$20,000

$22,500

$25,000

$27,500

$30,000

3Q16 4Q16 1Q17 2Q17 3Q17

$

in

mi

lio

ns

Allowance for Loan Losses

Gross loans HFI* (LH axis) ALLL / Gross loans HFI* (RH axis)

Allowance for loan losses to loans HFI was 1.00% as of

09.30.17.

Annualized net charge-offs ratio of 6 bps in 3Q17.

NPAs decreased by $16mm, or 12%, Q-o-Q to $117mm;

equivalent to 0.32% of total assets as of 09.30.17.

5-quarter NPA to total assets range of 0.32% to 0.41%.

3Q17 Asset Quality Metrics

11

* Nonperforming assets and net charge-offs exclude purchased credit impaired loans. HFI represents held-for-investment.

$9.5

$10.5

$7.1

$10.7

$13.0

0.37%

0.13%

0.08%

-0.04%

0.06%

-0.10%

0.00%

0.10%

0.20%

0.30%

0.40%

-$4

$0

$4

$8

$12

$16

3Q16 4Q16 1Q17 2Q17 3Q17

$ in

m

illi

on

s

Provision Expense and Net Charge-offs* Ratio

Provision expense (LH axis) Annualized NCOs (net recoveries) / Avg. loans HFI* (RH axis)

$20.27

$22.71

7.0%

8.5%

10.5%

4.0%

8.52%

10.9% 10.9%

12.4%

8.7%

9.17%

11.2% 11.2%

12.8%

9.4%

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

$5.00

$10.00

$15.00

$20.00

$25.00

Tangible equity

per share

Tangible equity to

tangible assets ratio

CET1 risk-based

capital ratio

Tier 1 risk-based

capital ratio

Total risk-based

capital ratio

Tier 1 leverage

capital ratio

EWBC's Solid Capital Position

Basel III Fully Phased-in Minimum Regulatory Requirement EWBC 12.31.16 EWBC 09.30.17

12

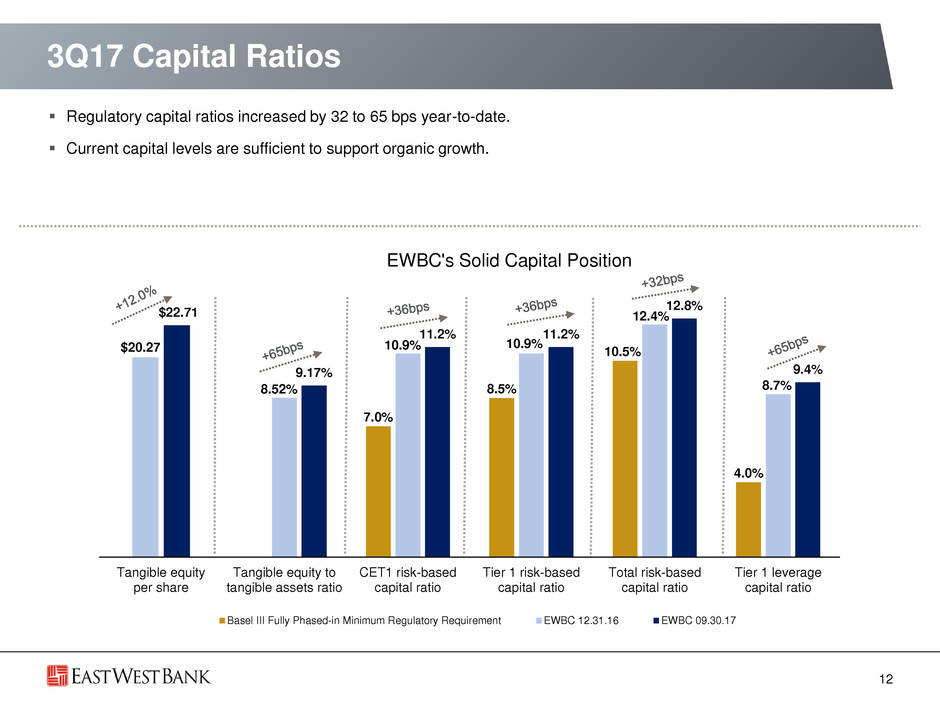

3Q17 Capital Ratios

Regulatory capital ratios increased by 32 to 65 bps year-to-date.

Current capital levels are sufficient to support organic growth.

Updated Management Outlook: Full Year 2017

13

Earnings drivers Revised full year 2017

outlook

(after 3Q17)

Change from prior

outlook

(after 2Q17)

2016 FY actual 2017 YTD

actual

End of Period Loans Increase at a percentage rate in

low double digits.

Unchanged $25.5 billion,

+8% Y-o-Y

$28.5 billion,

+16% YTD

NIM

(excl. impact of ASC

310-30 discount

accretion)

In the range of 3.40% to 3.45%. Tightened from

3.35% to 3.45%

3.15% 3.39%

Noninterest Expense

(excl. tax credit

investment & core

deposit intangible

amortization)

Increase at a percentage rate in

the low single digits.

Unchanged $538 million,

+14% Y-o-Y

$415 million,

+4% Y-o-Y

Provision for Credit

Losses

In the range of $40mm to

$50mm.

Unchanged $27 million $31 million

Tax Items

(renewable energy &

historical tax credits)

Tax credit investments of

$113mm.

Associated tax credit amortization

of $23mm in 4Q17.

Effective tax rate of 25%.

Prior effective tax rate:

26%

Effective tax rate:

24.6%

Effective tax rate:

25.0%

Interest Rates Outlook incorporates the current

forward rate curve.

Anticipates one more Fed Funds

rate increase in Dec. 2017.

Unchanged Fed Funds increased

+25bps in Dec. 2016.

Fed Funds increased

+25bps each in Mar.

& Jun. 2017.

APPENDIX

Appendix: GAAP to Non-GAAP Reconciliation

15

As previously disclosed on the March 30, 2017 Form 8-K, the Company consummated a sale and leaseback transaction on a commercial property and recognized a pre-tax gain on sale of $71.7

million during the first quarter of 2017. In the third quarter of 2017, the Company sold its insurance brokerage business, East West Insurance Services, Inc. (“EWIS”). The table below shows the

computations of the diluted earnings per common share, return on average assets and return on average equity, all of which exclude the after-tax effects of the gains on sales of the commercial

property and EWIS business (where applicable). Management believes that by excluding the after-tax effects of the gains on sales of the commercial property and EWIS business from the metrics

below, this provides clarity to financial statement users regarding the ongoing performance of the Company and allows comparability to prior periods.

(1) Applied statutory tax rate of 42.05%.

(2) Annualized.

Three Months Ended

September 30, 2017 June 30, 2017 September 30, 2016

Net income (a) $ 132,660 $ 118,330 $ 110,143

Less: Gain on sale of business, net of tax (1) (c) (2,206 ) — —

Adjusted net income (d) $ 130,454 $ 118,330 $ 110,143

Diluted weighted average number of shares outstanding (e) 145,882 145,740 145,238

Diluted EPS (a)/(e) $ 0.91 $ 0.81 $ 0.76

Diluted EPS impact of gain on sale of business, net of tax (c)/(e) (0.02 ) — —

Adjusted diluted EPS $ 0.89 $ 0.81 $ 0.76

Average total assets (f) $ 35,937,567 $ 34,994,935 $ 32,906,533

Average stockholders’ equity (g) $ 3,756,207 $ 3,637,695 $ 3,349,241

Return on average assets (2) (a)/(f) 1.46 % 1.36 % 1.33 %

Adjusted return on average assets (2) (d)/(f) 1.44 % 1.36 % 1.33 %

Return on average equity (2) (a)/(g) 14.01 % 13.05 % 13.08 %

Adjusted return on average equity (2) (d)/(g) 13.78 % 13.05 % 13.08 %

16

Adjusted pre-tax, pre-provision profitability ratio represents the aggregate of adjusted revenue less adjusted noninterest expense, divided by average total assets. Adjusted revenue represents the

aggregate of net interest income and adjusted noninterest income, where adjusted noninterest income excludes the gains on sales of the commercial property and EWIS business (where applicable).

Adjusted noninterest expense excludes the amortization of tax credit and other investments and the amortization of core deposit intangibles. The ratios presented below provide clarity to financial

statement users regarding the ongoing performance of the Company and allow comparability to prior periods.

Appendix: GAAP to Non-GAAP Reconciliation (cont’d)

(1) Annualized.

Adjusted efficiency ratio represents adjusted noninterest expense divided by adjusted revenue. The Company believes that presenting the adjusted efficiency ratio shows the trend in recurring

overhead-related noninterest expense relative to recurring revenue. This provides clarity to financial statement users regarding the ongoing performance of the Company and allows comparability to

prior periods.

Three Months Ended

September 30, 2017 June 30, 2017 September 30, 2016

Net interest income before provision for credit losses (a) $ 303,155 $ 290,091 $ 254,148

Total noninterest income 49,624 47,400 49,341

Less: Gain on sale of business (3,807 ) — —

Adjusted noninterest income (b) $ 45,817 $ 47,400 $ 49,341

Adjusted revenue (a)+(b) = (c) $ 348,972 $ 337,491 $ 303,489

Total noninterest expense $ 164,499 $ 169,121 $ 170,500

Less: Amortization of tax credit and other investments (23,827 ) (27,872 ) (32,618 )

Amortization of core deposit intangibles (1,735 ) (1,762 ) (2,023 )

Adjusted noninterest expense (d) $ 138,937 $ 139,487 $ 135,859

Adjusted pre-tax, pre-provision income (c)-(d) = (e) $ 210,035 $ 198,004 $ 167,630

Average total assets (f) $ 35,937,567 $ 34,994,935 $ 32,906,533

Adjusted pre-tax, pre-provision profitability ratio (1) (e)/(f) 2.32 % 2.27 % 2.03 %

Adjusted noninterest expense (1)/average assets (d)/(f) 1.53 % 1.60 % 1.64 %

Three Months Ended

September 30, 2017 June 30, 2017 September 30, 2016

Adjusted noninterest expense (m) $ 138,937 $ 139,487 $ 135,859

djusted revenue (n) $ 348,972 $ 337,491 $ 303,489

Adjusted efficiency ratio (m)/(n) 39.81 % 41.33 % 44.77 %

17

The Company believes that presenting the adjusted average loan yield and adjusted net interest margin that exclude the ASC 310-30 discount accretion impact provides clarity to financial statement

users regarding the change in loan contractual yields and allows comparability to prior periods.

Appendix: GAAP to Non-GAAP Reconciliation (cont’d)

(1) Annualized.

Three Months Ended Nine Months Ended

Yield on Average Loans

September 30,

2017

June 30,

2017

September 30,

2016

September 30,

2017

September 30,

2016

Interest income on loans (a) $ 306,939 $ 293,039 $ 255,316 $ 872,039 $ 763,189

Less: ASC 310-30 discount accretion income (4,534 ) (6,261 ) (7,164 ) (14,029 ) (33,823 )

Adjusted interest income on loans (b) $ 302,405 $ 286,778 $ 248,152 $ 858,010 $ 729,366

Average loans (c) $ 27,529,779 $ 26,698,787 $ 24,309,313 $ 26,783,082 $ 24,006,926

Add: ASC 310-30 discount 41,875 45,398 60,091 45,255 67,567

Adjusted average loans (d) $ 27,571,654 $ 26,744,185 $ 24,369,404 $ 26,828,337 $ 24,074,493

Average loan yield (1) (a)/(c) 4.42 % 4.40 % 4.18 % 4.35 % 4.25 %

Adjusted average loan yield (1) (b)/(d) 4.35 % 4.30 % 4.05 % 4.28 % 4.05 %

Net Interest Margin

Net interest income (e) $ 303,155 $ 290,091 $ 254,148 $ 865,368 $ 759,936

Less: ASC 310-30 discount accretion income (4,534 ) (6,261 ) (7,164 ) (14,029 ) (33,823 )

Adjusted net interest income (f) $ 298,621 $ 283,830 $ 246,984 $ 851,339 $ 726,113

Average interest-earning assets (g) $ 34,208,533 $ 33,295,012 $ 31,055,354 $ 33,542,941 $ 30,813,307

Add: ASC 310- 0 dis u t 41,875 45,398 60,091 45,255 67,567

Adjusted average interest-earning assets (h) $ 34,250,408 $ 33,340,410 $ 31,115,445 $ 33,588,196 $ 30,880,874

Net interest margin (1) (e)/(g) 3.52 % 3.49 % 3.26 % 3.45 % 3.29 %

Adjusted net interest margin (1) (f)/(h) 3.46 % 3.41 % 3.16 % 3.39 % 3.14 %

18

The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Tangible equity and tangible equity to tangible assets ratio are

non-GAAP measures. Tangible equity and tangible assets represent stockholders’ equity and total assets, respectively, which have been reduced by goodwill and other intangible assets. Given that

the uses of such measures and ratios are more prevalent in the banking industry, and used by banking regulators and analysts, the Company has included them for discussion.

Appendix: GAAP to Non-GAAP Reconciliation (cont’d)

Adjusted return on average tangible equity represents adjusted tangible net income divided by average tangible equity. Adjusted tangible net income excludes the after-tax effects of the amortization

of core deposit intangibles and mortgage servicing assets, and the after-tax effects of the gains on sales of the commercial property and EWIS business (where applicable). Given that the uses of such

measures and ratios are more prevalent in the banking industry, and used by banking regulators and analysts, the Company has included them for discussion.

(1) Includes core deposit intangibles and mortgage servicing assets.

(2) Applied statutory tax rate of 42.05%.

(3) Annualized.

September 30, 2017 June 30, 2017 September 30, 2016

Stockholders’ equity $ 3,781,896 $ 3,670,261 $ 3,378,054

Less: Goodwill (469,433 ) (469,433 ) (469,433 )

Other intangible assets (1) (30,245 ) (32,012 ) (37,195 )

Tangible equity (a) $ 3,282,218 $ 3,168,816 $ 2,871,426

Total assets $ 36,307,966 $ 35,917,617 $ 33,255,275

Less: Goodwill (469,433 ) (469,433 ) (469,433 )

Other intangible assets (1) (30,245 ) (32,012 ) (37,195 )

Tangible assets (b) $ 35,808,288 $ 35,416,172 $ 32,748,647

Tangible equity to tangible assets ratio (a)/(b) 9.17 % 8.95 % 8.77 %

Three Months Ended

September 30, 2017 June 30, 2017 September 30, 2016

Net Income $ 132,660 $ 118,330 $ 110,143

dd: A ortization of core deposit intangibles, net of tax (2) 1,006 1,021 ,173

Am rtizati (accretion) of mortgage servicing assets, net of tax (2) 307 241 (528 )

Tangible net income (c) $ 133,97 $ 11 ,592 $ 110,788

Less: Gain o sale of business, net of tax (2) (2,206 — —

Adjusted tangible net income (d) $ 131,767 $ 119,592 $ 110,788

Average stockholders’ equity $ 3,756,207 $ 3,637,695 $ 3,349,241

Less: Average goodwill (469,433 ) (469,433 ) (469,433 )

Average other intangible assets (1) (31,408 ) (33,101 ) (37,412 )

Average tangible equity (e) $ 3,255,366 $ 3,135,161 $ 2,842,396

Return on average tangible equity (3) (c)/(e) 16.33 % 15.30 % 15.51 %

Adjusted return on average tangible equity (3) (d)/(e) 16.06 % 15.30 % 15.51 %