Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - TEXAS CAPITAL BANCSHARES INC/TX | a10182017exhibit991.htm |

| 8-K - 8-K - TEXAS CAPITAL BANCSHARES INC/TX | a10182017-8k.htm |

TCBI Q3 2017

Earnings

October 18, 2017

Certain matters discussed within or in connection with these materials may contain “forward-looking statements” as defined in federal

securities laws, which are subject to risks and uncertainties and are based on Texas Capital’s current estimates or expectations of future

events or future results. These statements are not historical in nature and can generally be identified by such words as “believe,”

“expect,” “estimate,” “anticipate,” “plan,” “may,” “will,” “intend” and similar expressions. A number of factors, many of which are

beyond our control, could cause actual results to differ materially from future results expressed or implied by such forward-looking

statements. These risks and uncertainties include, but are not limited to, the credit quality of our loan portfolio, general economic

conditions in the United States and in our markets, including the continued impact on our customers from declines and volatility in oil

and gas prices, the impact on our loan and deposit portfolios as a result of Hurricanes Harvey and Irma, rates of default or loan losses,

volatility in the mortgage industry, the success or failure of our business strategies, future financial performance, future growth and

earnings, the appropriateness of our allowance for loan losses and provision for credit losses, the impact of increased regulatory

requirements and legislative changes on our business, increased competition, interest rate risk, the success or failure of new lines of

business and new product or service offerings and the impact of new technologies. These and other factors that could cause results to

differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties that may

affect our business, can be found in our Annual Report on Form 10-K and in other filings we make with the Securities and Exchange

Commission. Forward-looking statements speak only as of the date of this presentation. Texas Capital is under no obligation, and

expressly disclaims any obligation, to update, alter or revise its forward-looking statements, whether as a result of new information,

future events or otherwise.

2

3

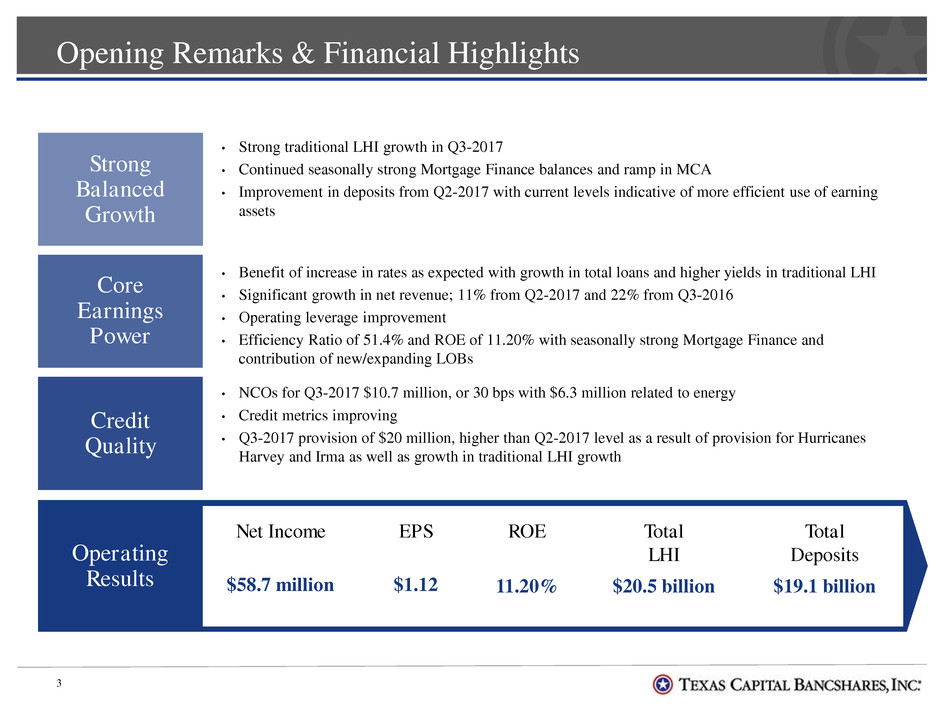

Opening Remarks & Financial Highlights

Core

Earnings

Power

Strong

Balanced

Growth

Credit

Quality

• Strong traditional LHI growth in Q3-2017

• Continued seasonally strong Mortgage Finance balances and ramp in MCA

• Improvement in deposits from Q2-2017 with current levels indicative of more efficient use of earning

assets

• Benefit of increase in rates as expected with growth in total loans and higher yields in traditional LHI

• Significant growth in net revenue; 11% from Q2-2017 and 22% from Q3-2016

• Operating leverage improvement

• Efficiency Ratio of 51.4% and ROE of 11.20% with seasonally strong Mortgage Finance and

contribution of new/expanding LOBs

• NCOs for Q3-2017 $10.7 million, or 30 bps with $6.3 million related to energy

• Credit metrics improving

• Q3-2017 provision of $20 million, higher than Q2-2017 level as a result of provision for Hurricanes

Harvey and Irma as well as growth in traditional LHI growth

Operating

Results

Net Income

$58.7 million

EPS

$1.12

ROE

CE

11.20%

Total

LHI

$20.5 billion

Total

Deposits

$19.1 billion

4

Hurricane, Energy and Retail Update

Hurricane Exposure

• Provision of $4.5 million and incremental expenses of approximately $700,000 included in Q3-2017

• Traditional LHI client impact has been minimal, but continuing to monitor as some grade migrations could occur

• Mortgage Finance exposure minimal, with more precise determinations still underway on MCA

• For MCA, less than $4 million related to Harvey that may have damage or have requested payment deferral, and total Irma

exposure of less than $7 million but still being evaluated

Energy Exposure

• Outstanding energy loans represented 6% of total loans, or $1.2 billion, at Q3-2017 compared to $1.1 billion at Q2-2017

• Addition of new loans improves composition and quality of total portfolio as problem assets are resolved

• Strong reserve position relative to criticized assets and total energy portfolio

‐ Allocated reserve of $52.7 million represents 4% of energy loans and 41% of criticized energy loans

‐ $6.3 million of energy net charge-offs in Q3-2017 previously reserved

• Decrease in energy non-accruals

‐ Non-accruals $81.6 million at Q3-2017 compared to $82.6 million at Q2-2017 and $129.3 million at Q3-2016

‐ Criticized energy loans decreased to 10% of energy loans at Q3-2017 from 12% at Q2-2017 and 25% at Q3-2016

‐ Total criticized energy loans at Q3-2017 $125.4 million, down from a high of $259.7 million at Q3-2016

Retail CRE and Commercial Exposure

• No significant changes in direct exposure levels since year-end, up $18 million to $787 million, split between C&I and CRE

• Focus is concentrated in strip centers and personal services in strong markets and sub-markets

• Loans are generally smaller transactions with modest advance rates

• Total criticized of $4.3 million, none of which are on non-accrual

9

,4

7

9

1

1

,9

4

7

6

,6

3

5

1

2

,4

4

7

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

Texas Regions National Businesses

$

M

il

li

on

s

Loans Deposits

5

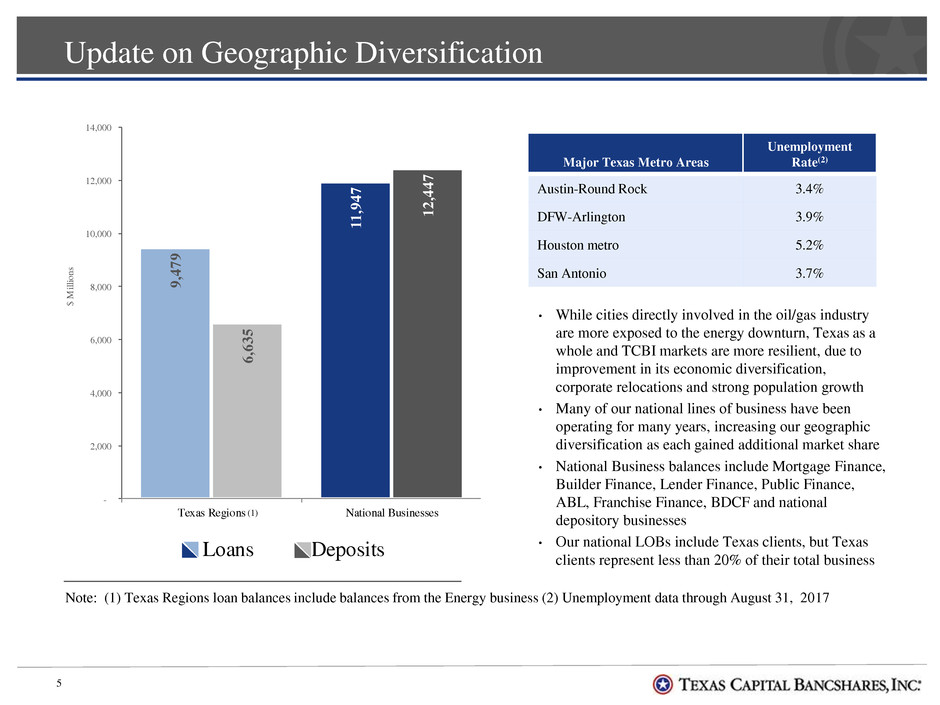

Update on Geographic Diversification

Note: (1) Texas Regions loan balances include balances from the Energy business (2) Unemployment data through August 31, 2017

• While cities directly involved in the oil/gas industry

are more exposed to the energy downturn, Texas as a

whole and TCBI markets are more resilient, due to

improvement in its economic diversification,

corporate relocations and strong population growth

• Many of our national lines of business have been

operating for many years, increasing our geographic

diversification as each gained additional market share

• National Business balances include Mortgage Finance,

Builder Finance, Lender Finance, Public Finance,

ABL, Franchise Finance, BDCF and national

depository businesses

• Our national LOBs include Texas clients, but Texas

clients represent less than 20% of their total business

Major Texas Metro Areas

Unemployment

Rate(2)

Austin-Round Rock 3.4%

DFW-Arlington 3.9%

Houston metro 5.2%

San Antonio 3.7%

(1)

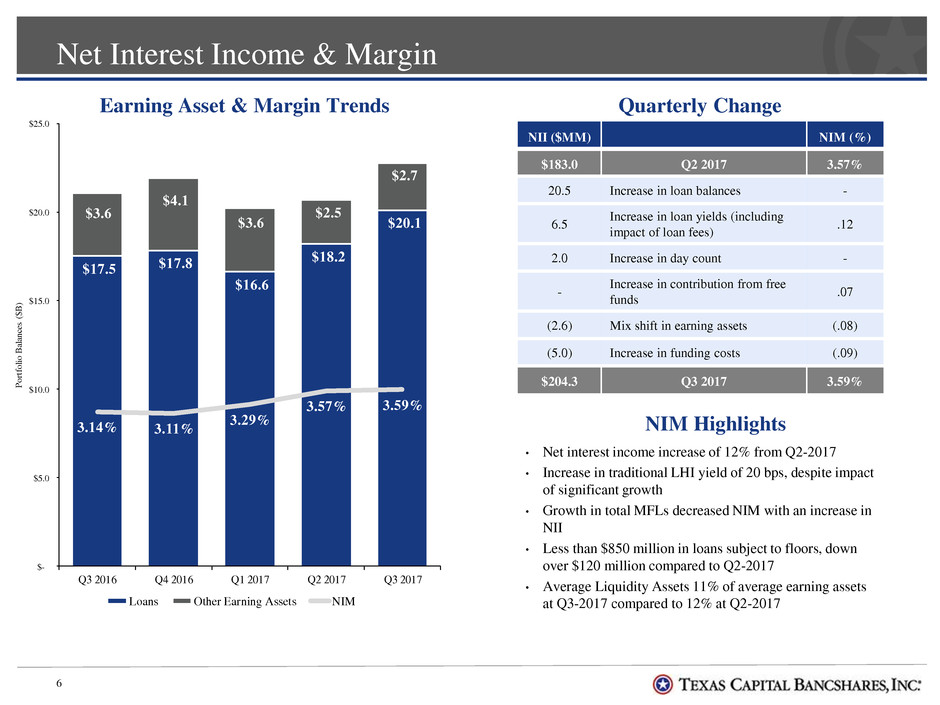

Net Interest Income & Margin

6

• Net interest income increase of 12% from Q2-2017

• Increase in traditional LHI yield of 20 bps, despite impact

of significant growth

• Growth in total MFLs decreased NIM with an increase in

NII

• Less than $850 million in loans subject to floors, down

over $120 million compared to Q2-2017

• Average Liquidity Assets 11% of average earning assets

at Q3-2017 compared to 12% at Q2-2017

Quarterly Change

NII ($MM) NIM (%)

$183.0 Q2 2017 3.57%

20.5 Increase in loan balances -

6.5

Increase in loan yields (including

impact of loan fees)

.12

2.0 Increase in day count -

-

Increase in contribution from free

funds

.07

(2.6) Mix shift in earning assets (.08)

(5.0) Increase in funding costs (.09)

$204.3 Q3 2017 3.59%

Earning Asset & Margin Trends

NIM Highlights

$17.5 $17.8

$16.6

$18.2

$20.1

$3.6

$4.1

$3.6

$2.5

$2.7

3.14% 3.11%

3.29%

3.57% 3.59%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

$-

$5.0

$10.0

$15.0

$20.0

$25.0

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

P

or

tfo

li

o B

al

an

ce

s

($B

)

Loans Other Earning Assets NIM

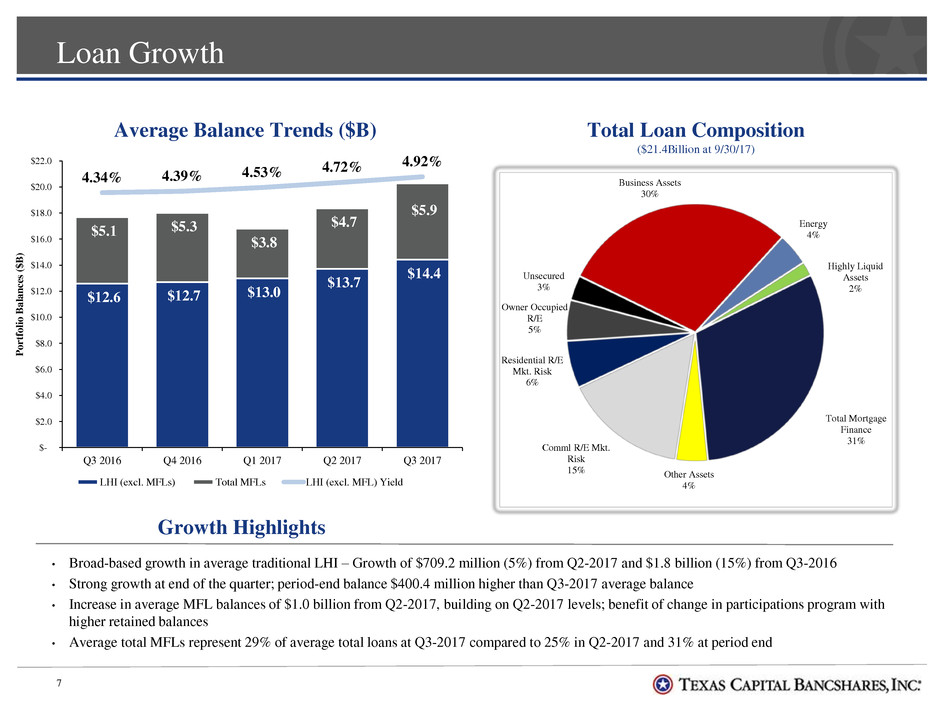

Loan Growth

7

• Broad-based growth in average traditional LHI – Growth of $709.2 million (5%) from Q2-2017 and $1.8 billion (15%) from Q3-2016

• Strong growth at end of the quarter; period-end balance $400.4 million higher than Q3-2017 average balance

• Increase in average MFL balances of $1.0 billion from Q2-2017, building on Q2-2017 levels; benefit of change in participations program with

higher retained balances

• Average total MFLs represent 29% of average total loans at Q3-2017 compared to 25% in Q2-2017 and 31% at period end

Growth Highlights

Average Balance Trends ($B) Total Loan Composition

($21.4Billion at 9/30/17)

$12.6 $12.7 $13.0

$13.7

$14.4

$5.1 $5.3

$3.8

$4.7

$5.9

4.34% 4.39% 4.53%

4.72% 4.92%

-5.00%

-3.00%

-1.00%

1.00%

3.00%

5.00%

$-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

$22.0

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

Po

rt

fo

lio

B

al

ances

($

B

)

LHI (excl. MFLs) Total MFLs LHI (excl. MFL) Yield

Business Assets

30%

Energy

4%

Highly Liquid

Assets

2%

Total Mortgage

Finance

31%

Other Assets

4%

Comml R/E Mkt.

Risk

15%

Residential R/E

Mkt. Risk

6%

Owner Occupied

R/E

5%

Unsecured

3%

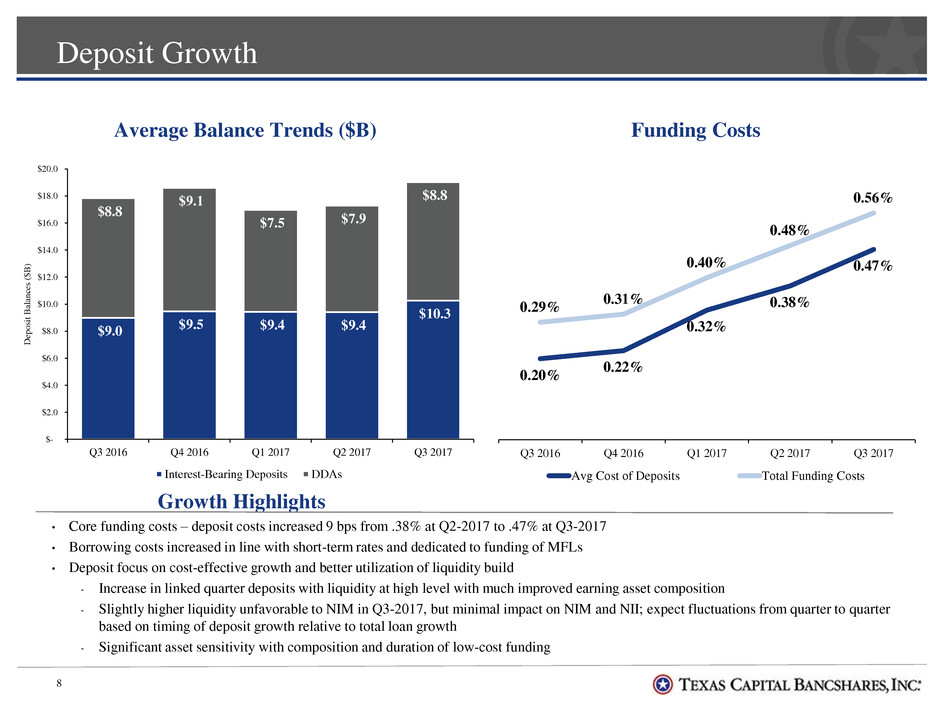

Deposit Growth

8

Average Balance Trends ($B) Funding Costs

• Core funding costs – deposit costs increased 9 bps from .38% at Q2-2017 to .47% at Q3-2017

• Borrowing costs increased in line with short-term rates and dedicated to funding of MFLs

• Deposit focus on cost-effective growth and better utilization of liquidity build

‐ Increase in linked quarter deposits with liquidity at high level with much improved earning asset composition

‐ Slightly higher liquidity unfavorable to NIM in Q3-2017, but minimal impact on NIM and NII; expect fluctuations from quarter to quarter

based on timing of deposit growth relative to total loan growth

‐ Significant asset sensitivity with composition and duration of low-cost funding

Growth Highlights

$9.0

$9.5 $9.4 $9.4

$10.3

$8.8

$9.1

$7.5 $7.9

$8.8

$-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

D

ep

osit

B

ala

nc

es (

$B

)

Interest-Bearing Deposits DDAs

0.20%

0.22%

0.32%

0.38%

0.47%

0.29%

0.31%

0.40%

0.48%

0.56%

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

0.70%

Q3 2016 Q4 2016 Q1 2017 Q2 2017

Avg Cost of Deposits Total Funding Costs

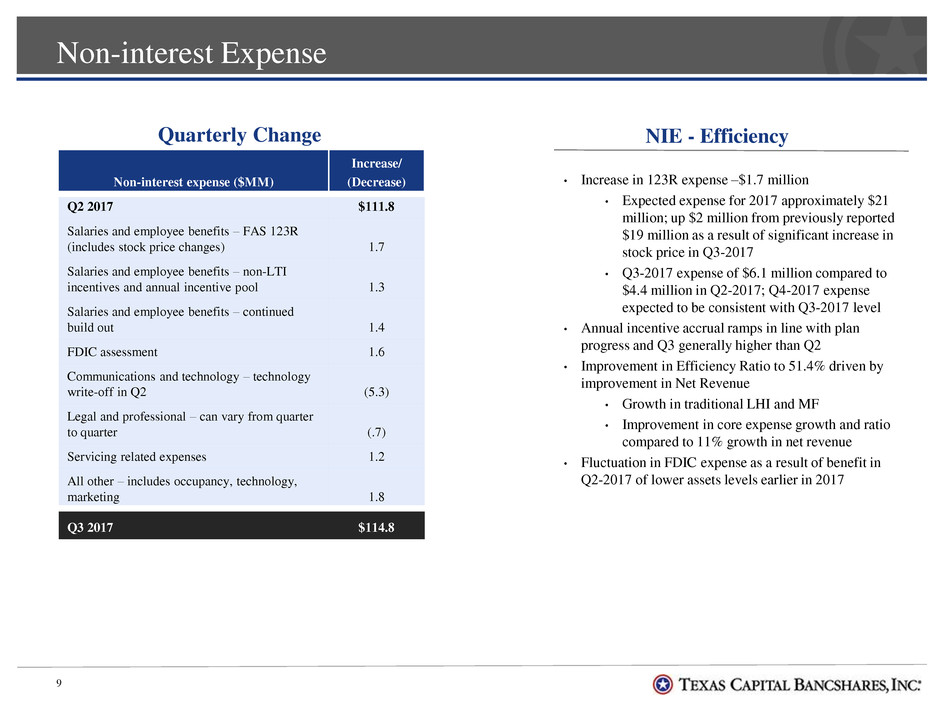

Non-interest Expense

9

Quarterly Change NIE - Efficiency

Non-interest expense ($MM)

Increase/

(Decrease)

Q2 2017 $111.8

Salaries and employee benefits – FAS 123R

(includes stock price changes) 1.7

Salaries and employee benefits – non-LTI

incentives and annual incentive pool 1.3

Salaries and employee benefits – continued

build out 1.4

FDIC assessment 1.6

Communications and technology – technology

write-off in Q2 (5.3)

Legal and professional – can vary from quarter

to quarter (.7)

Servicing related expenses 1.2

All other – includes occupancy, technology,

marketing 1.8

Q3 2017 $114.8

• Increase in 123R expense –$1.7 million

• Expected expense for 2017 approximately $21

million; up $2 million from previously reported

$19 million as a result of significant increase in

stock price in Q3-2017

• Q3-2017 expense of $6.1 million compared to

$4.4 million in Q2-2017; Q4-2017 expense

expected to be consistent with Q3-2017 level

• Annual incentive accrual ramps in line with plan

progress and Q3 generally higher than Q2

• Improvement in Efficiency Ratio to 51.4% driven by

improvement in Net Revenue

• Growth in traditional LHI and MF

• Improvement in core expense growth and ratio

compared to 11% growth in net revenue

• Fluctuation in FDIC expense as a result of benefit in

Q2-2017 of lower assets levels earlier in 2017

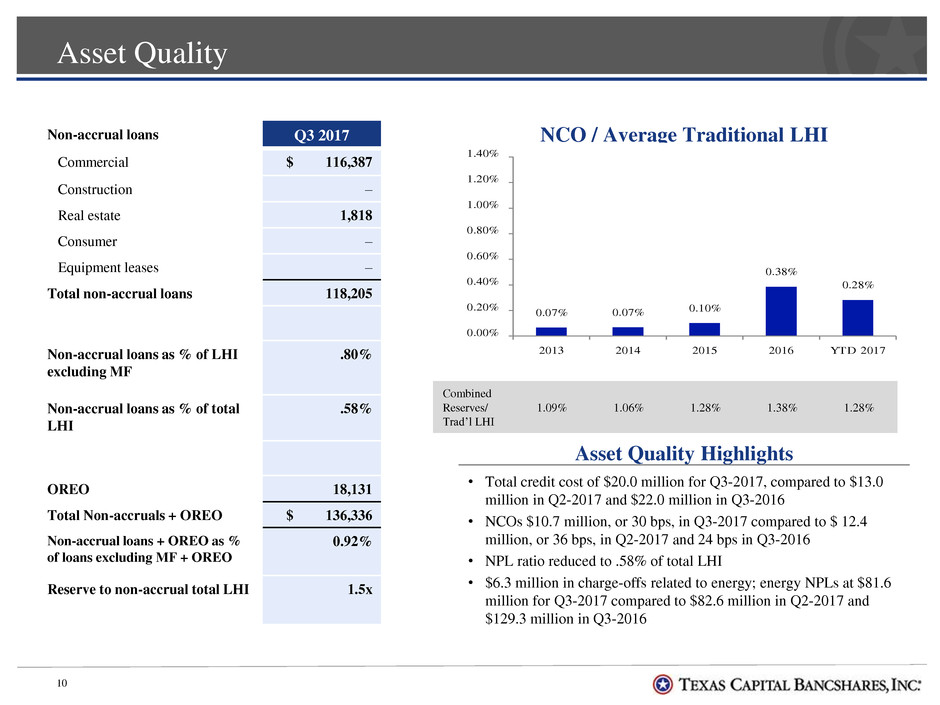

Asset Quality

10

• Total credit cost of $20.0 million for Q3-2017, compared to $13.0

million in Q2-2017 and $22.0 million in Q3-2016

• NCOs $10.7 million, or 30 bps, in Q3-2017 compared to $ 12.4

million, or 36 bps, in Q2-2017 and 24 bps in Q3-2016

• NPL ratio reduced to .58% of total LHI

• $6.3 million in charge-offs related to energy; energy NPLs at $81.6

million for Q3-2017 compared to $82.6 million in Q2-2017 and

$129.3 million in Q3-2016

Asset Quality Highlights

Non-accrual loans Q3 2017

Commercial $ 116,387

Construction –

Real estate 1,818

Consumer –

Equipment leases –

Total non-accrual loans 118,205

Non-accrual loans as % of LHI

excluding MF

.80%

Non-accrual loans as % of total

LHI

.58%

OREO 18,131

Total Non-accruals + OREO $ 136,336

Non-accrual loans + OREO as %

of loans excluding MF + OREO

0.92%

Reserve to non-accrual total LHI 1.5x

NCO / Average Traditional LHI

Combined

Reserves/

Trad’l LHI

1.09% 1.06% 1.28% 1.38% 1.28%

0.07% 0.07% 0.10%

0.38%

0.28%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

2013 2014 2015 2016 YTD 2017

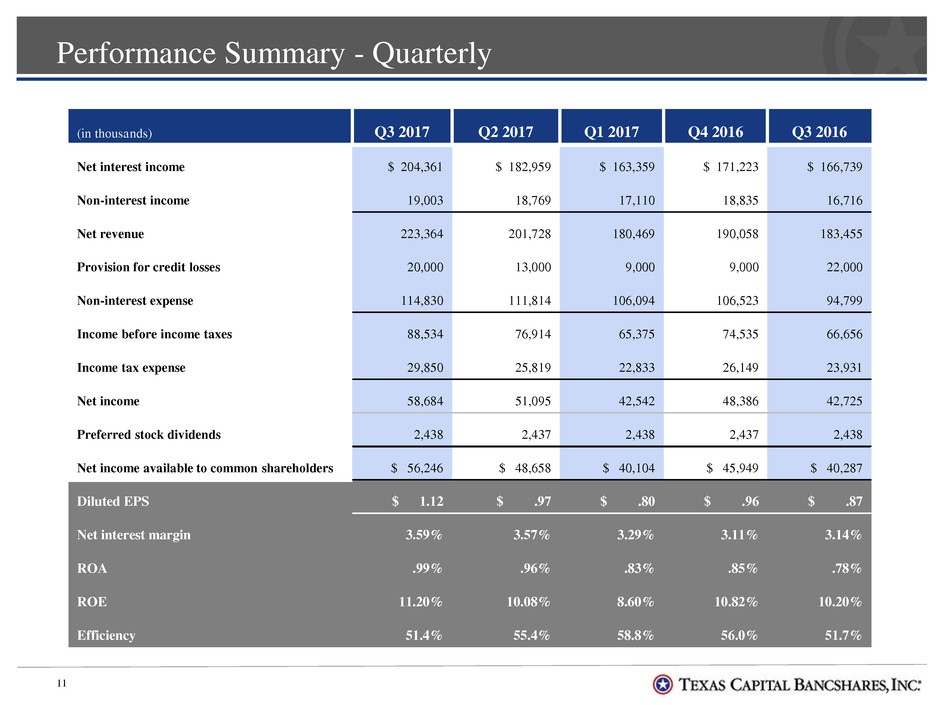

Performance Summary - Quarterly

11

(in thousands) Q3 2017 Q2 2017 Q1 2017 Q4 2016 Q3 2016

Net interest income $ 204,361 $ 182,959 $ 163,359 $ 171,223 $ 166,739

Non-interest income 19,003 18,769 17,110 18,835 16,716

Net revenue 223,364 201,728 180,469 190,058 183,455

Provision for credit losses 20,000 13,000 9,000 9,000 22,000

Non-interest expense 114,830 111,814 106,094 106,523 94,799

Income before income taxes 88,534 76,914 65,375 74,535 66,656

Income tax expense 29,850 25,819 22,833 26,149 23,931

Net income 58,684 51,095 42,542 48,386 42,725

Preferred stock dividends 2,438 2,437 2,438 2,437 2,438

Net income available to common shareholders $ 56,246 $ 48,658 $ 40,104 $ 45,949 $ 40,287

Diluted EPS $ 1.12 $ .97 $ .80 $ .96 $ .87

Net interest margin 3.59% 3.57% 3.29% 3.11% 3.14%

ROA .99% .96% .83% .85% .78%

ROE 11.20% 10.08% 8.60% 10.82% 10.20%

Efficiency 51.4% 55.4% 58.8% 56.0% 51.7%

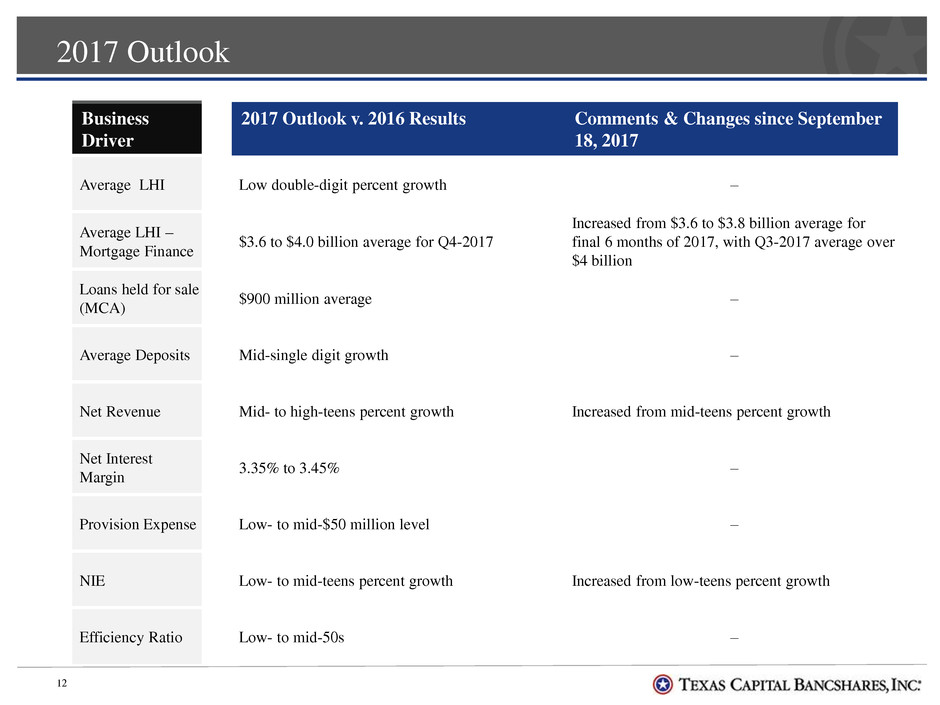

2017 Outlook

12

Business

Driver

2017 Outlook v. 2016 Results Comments & Changes since September

18, 2017

Average LHI Low double-digit percent growth –

Average LHI –

Mortgage Finance

$3.6 to $4.0 billion average for Q4-2017

Increased from $3.6 to $3.8 billion average for

final 6 months of 2017, with Q3-2017 average over

$4 billion

Loans held for sale

(MCA)

$900 million average –

Average Deposits Mid-single digit growth –

Net Revenue Mid- to high-teens percent growth Increased from mid-teens percent growth

Net Interest

Margin

3.35% to 3.45% –

Provision Expense Low- to mid-$50 million level –

NIE Low- to mid-teens percent growth Increased from low-teens percent growth

Efficiency Ratio Low- to mid-50s –

Closing Comments

• Exceptional earnings and improved profitability metrics

• Positive start for Q4-2017 loan growth and in line with full year guidance

• Deposit growth improving and more balanced with loan growth; more effective utilization of liquidity and capital

• Strong asset sensitivity even with prospect of shift in deposit composition with rising rates

• Credit metrics improving and especially good on non-energy portfolio; we remain comfortable with energy portfolio

and reserve position

• Modest provision related to Hurricanes as some grade migration could occur

• Provision guidance based on pace of growth and no adverse change in economic outlook

• Focus on ROE

• Increase in contribution from new/expanded businesses

• Slowing in pace of NIE growth

• Increase in operating leverage with reduction in Efficiency Ratio in 2018

• Contributions of new/expanding LOBs with emphasis on top quartile, risk-adjusted returns

13

Q&A

14

Appendix

15

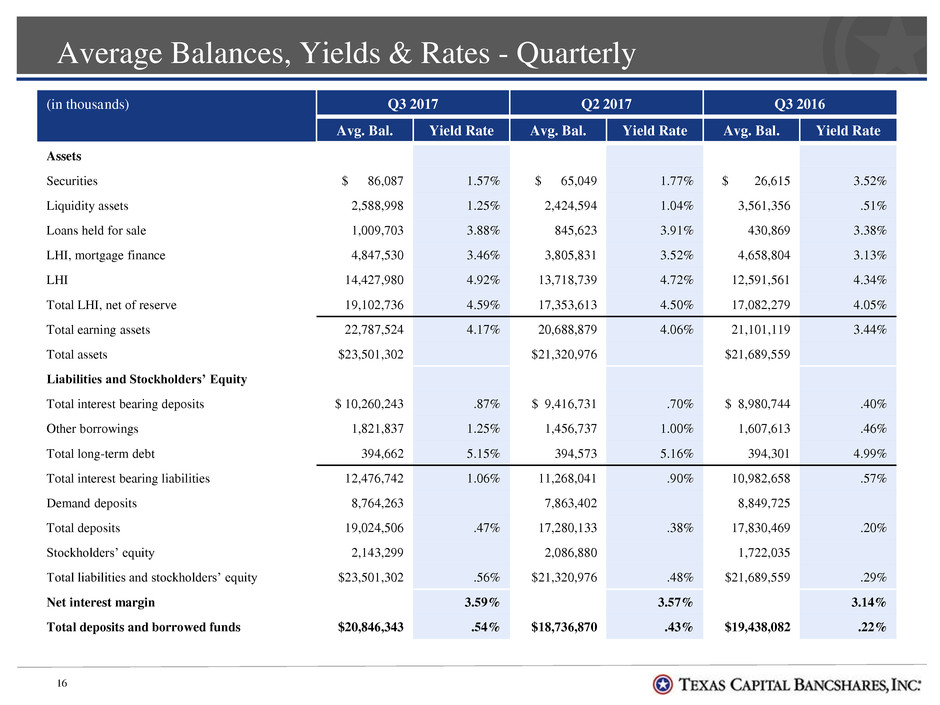

Average Balances, Yields & Rates - Quarterly

16

(in thousands) Q3 2017 Q2 2017 Q3 2016

Avg. Bal. Yield Rate Avg. Bal. Yield Rate Avg. Bal. Yield Rate

Assets

Securities $ 86,087 1.57% $ 65,049 1.77% $ 26,615 3.52%

Liquidity assets 2,588,998 1.25% 2,424,594 1.04% 3,561,356 .51%

Loans held for sale 1,009,703 3.88% 845,623 3.91% 430,869 3.38%

LHI, mortgage finance 4,847,530 3.46% 3,805,831 3.52% 4,658,804 3.13%

LHI 14,427,980 4.92% 13,718,739 4.72% 12,591,561 4.34%

Total LHI, net of reserve 19,102,736 4.59% 17,353,613 4.50% 17,082,279 4.05%

Total earning assets 22,787,524 4.17% 20,688,879 4.06% 21,101,119 3.44%

Total assets $23,501,302 $21,320,976 $21,689,559

Liabilities and Stockholders’ Equity

Total interest bearing deposits $ 10,260,243 .87% $ 9,416,731 .70% $ 8,980,744 .40%

Other borrowings 1,821,837 1.25% 1,456,737 1.00% 1,607,613 .46%

Total long-term debt 394,662 5.15% 394,573 5.16% 394,301 4.99%

Total interest bearing liabilities 12,476,742 1.06% 11,268,041 .90% 10,982,658 .57%

Demand deposits 8,764,263 7,863,402 8,849,725

Total deposits 19,024,506 .47% 17,280,133 .38% 17,830,469 .20%

Stockholders’ equity 2,143,299 2,086,880 1,722,035

Total liabilities and stockholders’ equity $23,501,302 .56% $21,320,976 .48% $21,689,559 .29%

Net interest margin 3.59% 3.57% 3.14%

Total deposits and borrowed funds $20,846,343 .54% $18,736,870 .43% $19,438,082 .22%

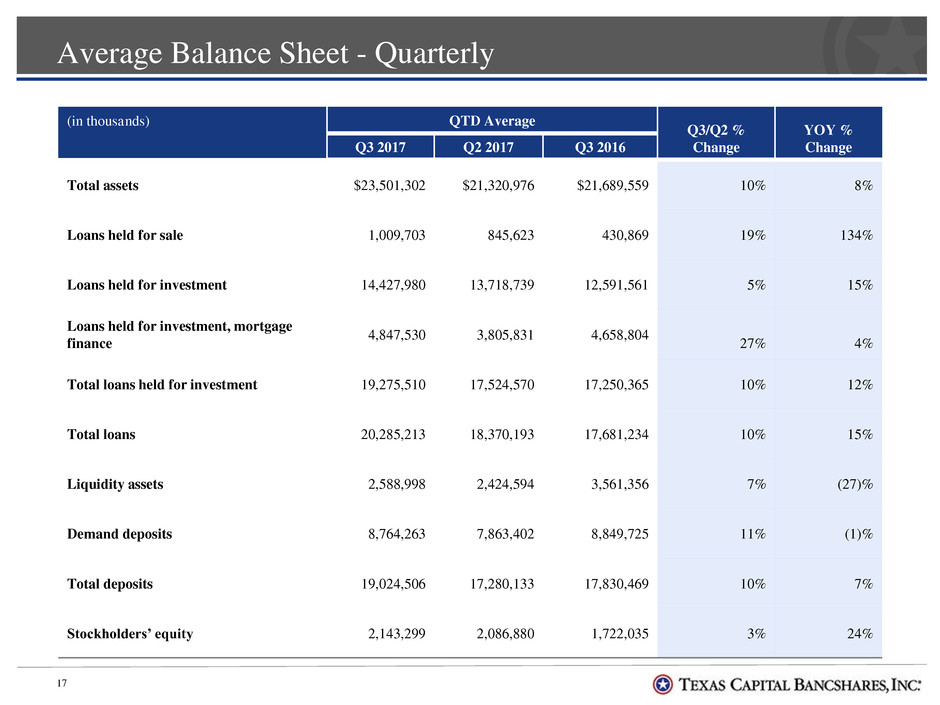

Average Balance Sheet - Quarterly

17

(in thousands) QTD Average

Q3/Q2 %

Change

YOY %

Change Q3 2017 Q2 2017 Q3 2016

Total assets $23,501,302 $21,320,976 $21,689,559 10% 8%

Loans held for sale 1,009,703 845,623 430,869 19% 134%

Loans held for investment 14,427,980 13,718,739 12,591,561 5% 15%

Loans held for investment, mortgage

finance

4,847,530 3,805,831 4,658,804

27%

4%

Total loans held for investment 19,275,510 17,524,570 17,250,365 10% 12%

Total loans 20,285,213 18,370,193 17,681,234 10% 15%

Liquidity assets 2,588,998 2,424,594 3,561,356 7% (27)%

Demand deposits 8,764,263 7,863,402 8,849,725 11% (1)%

Total deposits 19,024,506 17,280,133 17,830,469 10% 7%

Stockholders’ equity 2,143,299 2,086,880 1,722,035 3% 24%

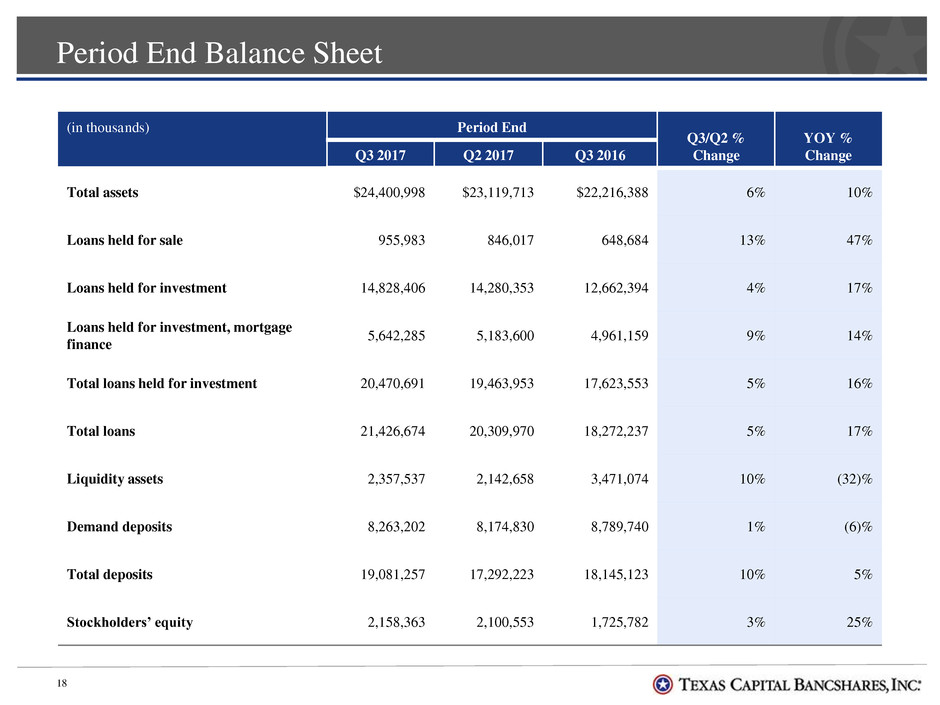

Period End Balance Sheet

18

(in thousands) Period End

Q3/Q2 %

Change

YOY %

Change Q3 2017 Q2 2017 Q3 2016

Total assets $24,400,998 $23,119,713 $22,216,388 6% 10%

Loans held for sale 955,983 846,017 648,684 13% 47%

Loans held for investment 14,828,406 14,280,353 12,662,394 4% 17%

Loans held for investment, mortgage

finance

5,642,285 5,183,600 4,961,159 9% 14%

Total loans held for investment 20,470,691 19,463,953 17,623,553 5% 16%

Total loans 21,426,674 20,309,970 18,272,237 5% 17%

Liquidity assets 2,357,537 2,142,658 3,471,074 10% (32)%

Demand deposits 8,263,202 8,174,830 8,789,740 1% (6)%

Total deposits 19,081,257 17,292,223 18,145,123 10% 5%

Stockholders’ equity 2,158,363 2,100,553 1,725,782 3% 25%