Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSURANT, INC. | d396844d8k.htm |

| EX-99.1 - EX-99.1 - ASSURANT, INC. | d396844dex991.htm |

| EX-10.2 - EX-10.2 - ASSURANT, INC. | d396844dex102.htm |

| EX-10.1 - EX-10.1 - ASSURANT, INC. | d396844dex101.htm |

| EX-4.2 - EX-4.2 - ASSURANT, INC. | d396844dex42.htm |

| EX-4.1 - EX-4.1 - ASSURANT, INC. | d396844dex41.htm |

| EX-2.1 - EX-2.1 - ASSURANT, INC. | d396844dex21.htm |

Assurant and The Warranty Group: Creating a Leading Global Lifestyle Provider Exhibit 99.2

Safe Harbor Statement Some of the statements included in this presentation, particularly those with respect to the proposed transaction, the benefits and synergies of the transaction, including operating synergies, future opportunities for the combined company and any statements regarding the combined company’s future results, financial condition and operations, anticipated business levels and offerings, planned activities, anticipated growth, market presence and opportunities, strategies, competition and other expectations, targets and financial metrics for future periods, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these statements by the use of words such as “outlook,” “will,” “may,” “can,” “anticipates,” “expects,” “estimates,” “projects,” “intends,” “plans,” “believes,” “targets,” “forecasts,” “potential,” “approximately,” or the negative version of those words and other words and terms with a similar meaning. Any forward-looking statements contained in this presentation are based upon historical performance and current plans, estimates and expectations and are subject to significant uncertainties. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Actual results might differ materially from those projected in the forward-looking statements. Assurant undertakes no obligation to update or review any forward-looking statements in this presentation, whether as a result of new information, future events or other developments. For a detailed discussion of the general risk factors that could affect Assurant’s actual results, please refer to the risk factors identified in Assurant’s annual and periodic reports filed with the Securities and Exchange Commission (the “SEC”). In addition, this presentation sets forth certain financial data of TWG Holdings Limited (together with its subsidiaries “The Warranty Group”), which has been derived from The Warranty Group’s financial statements and records and other information made available to Assurant’s management. These financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The Warranty Group’s auditors have not (nor have any other auditors) audited, reviewed, compiled or performed procedures with respect to such financial data, nor expressed or provided an opinion with respect thereto. This financial data does not purport to reflect what such financial results would have been if the transaction had been completed on or for the periods indicated, nor may be indicative of what the results may be following the transaction. Assurant is in the process of reviewing the accounting policies of The Warranty Group and has determined that, in certain cases, those accounting policies do not conform to Assurant’s accounting policies. In particular, The Warranty Group’s accounting for a portion of its revenue is presented net of certain costs as compared to Assurant’s accounting, which generally presents such revenues and related offsetting costs on a gross basis. This difference in recording revenues and costs and related effect on assets and liabilities is not expected to affect net income. Additional differences in accounting policies could be identified. The full set of audited annual financial statements and interim financial information of The Warranty Group, along with pro forma financial information, that complies with SEC rules and regulations is expected to be included in the joint proxy statement/prospectus as part of a registration statement on Form S-4, and there could be material differences from the financial data included herein. The presentation for the combined company will conform to Assurant’s accounting policies. Therefore, the financial statements of the combined company may have material differences from the financial data included herein.

Presenters Alan Colberg President & Chief Executive Officer Richard Dziadzio Executive Vice President, Chief Financial Officer Keith Demmings President, Global Lifestyle

Agenda Strategic Benefits The Warranty Group Overview Lifestyle Market Opportunity Combined Company Financial Snapshot Transaction Structure Expected Timeline Conclusion

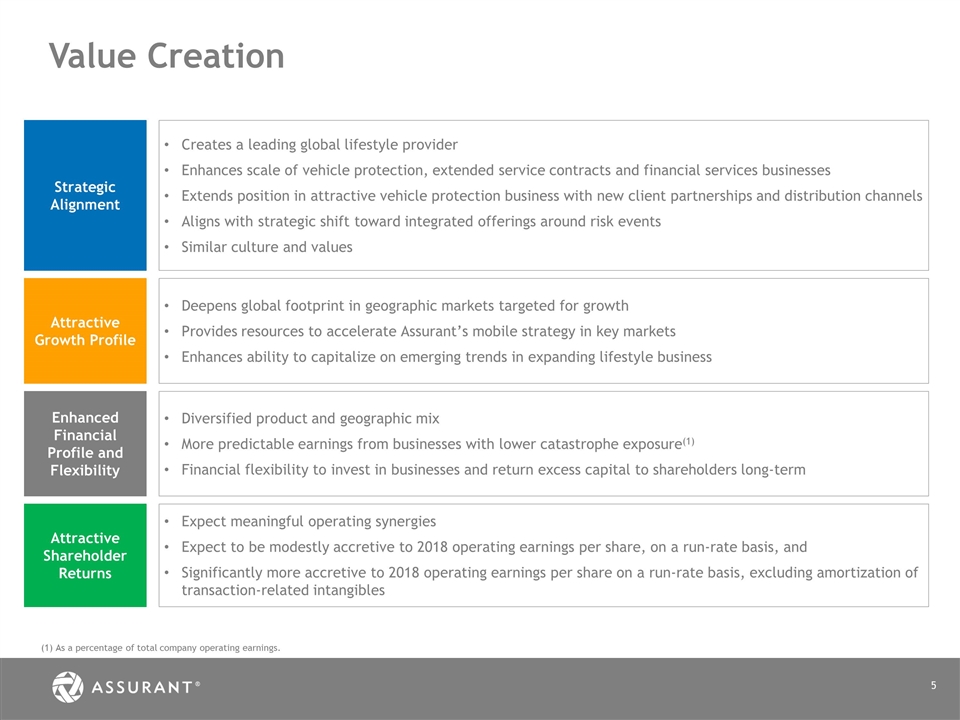

Value Creation Strategic Alignment Creates a leading global lifestyle provider Enhances scale of vehicle protection, extended service contracts and financial services businesses Extends position in attractive vehicle protection business with new client partnerships and distribution channels Aligns with strategic shift toward integrated offerings around risk events Similar culture and values Attractive Growth Profile Deepens global footprint in geographic markets targeted for growth Provides resources to accelerate Assurant’s mobile strategy in key markets Enhances ability to capitalize on emerging trends in expanding lifestyle business Enhanced Financial Profile and Flexibility Diversified product and geographic mix More predictable earnings from businesses with lower catastrophe exposure(1) Financial flexibility to invest in businesses and return excess capital to shareholders long-term Attractive Shareholder Returns Expect meaningful operating synergies Expect to be modestly accretive to 2018 operating earnings per share, on a run-rate basis, and Significantly more accretive to 2018 operating earnings per share on a run-rate basis, excluding amortization of transaction-related intangibles (1) As a percentage of total company operating earnings.

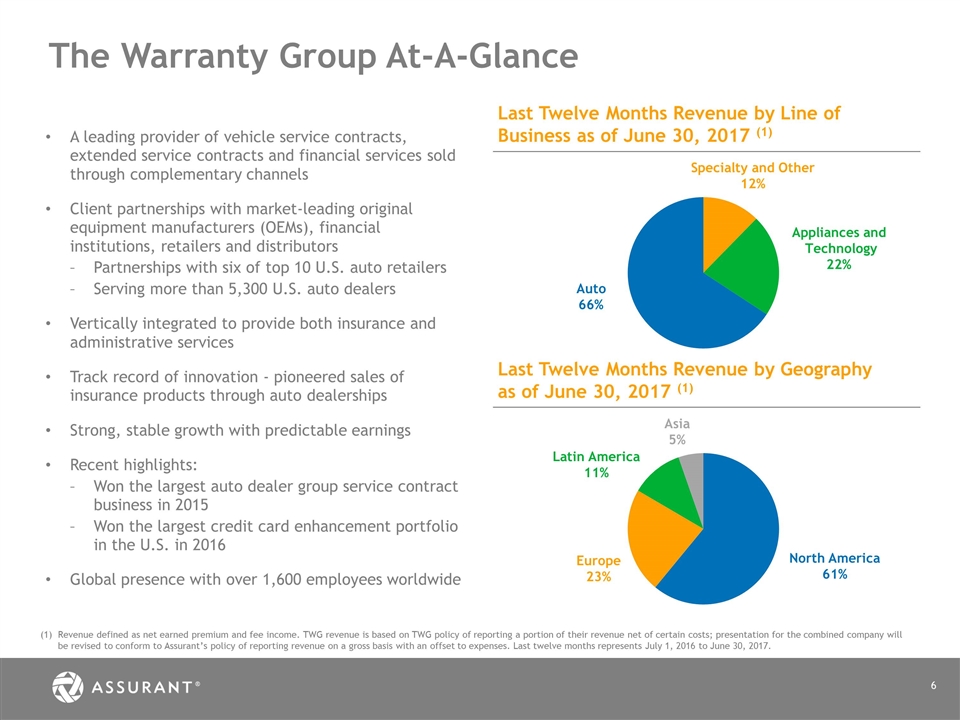

The Warranty Group At-A-Glance Revenue defined as net earned premium and fee income. TWG revenue is based on TWG policy of reporting a portion of their revenue net of certain costs; presentation for the combined company will be revised to conform to Assurant’s policy of reporting revenue on a gross basis with an offset to expenses. Last twelve months represents July 1, 2016 to June 30, 2017. A leading provider of vehicle service contracts, extended service contracts and financial services sold through complementary channels Client partnerships with market-leading original equipment manufacturers (OEMs), financial institutions, retailers and distributors Partnerships with six of top 10 U.S. auto retailers Serving more than 5,300 U.S. auto dealers Vertically integrated to provide both insurance and administrative services Track record of innovation - pioneered sales of insurance products through auto dealerships Strong, stable growth with predictable earnings Recent highlights: Won the largest auto dealer group service contract business in 2015 Won the largest credit card enhancement portfolio in the U.S. in 2016 Global presence with over 1,600 employees worldwide Last Twelve Months Revenue by Line of Business as of June 30, 2017 (1) Last Twelve Months Revenue by Geography as of June 30, 2017 (1)

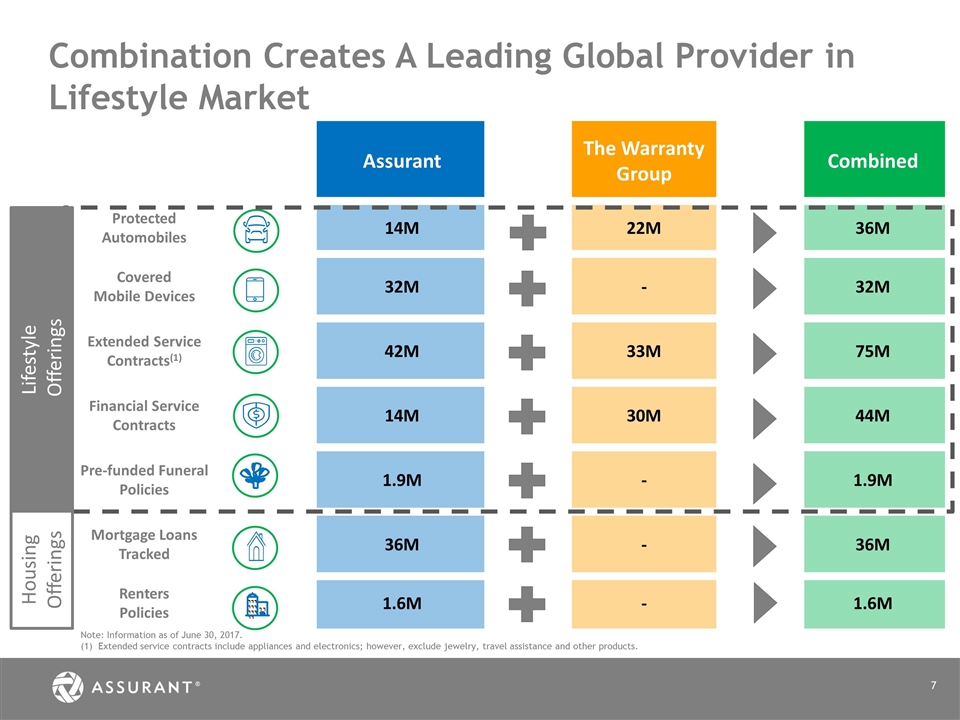

Combination Creates A Leading Global Provider in Lifestyle Market Assurant The Warranty Group Combined Protected Automobiles 14M 22M 36M Covered Mobile Devices 32M - 32M Extended Service Contracts(1) 42M 33M 75M Financial Service Contracts 14M 30M 44M Pre-funded Funeral Policies 1.9M - 1.9M Mortgage Loans Tracked 36M - 36M Renters Policies 1.6M - 1.6M Note: Information as of June 30, 2017. Extended service contracts include appliances and electronics; however, exclude jewelry, travel assistance and other products. Lifestyle Offerings Housing Offerings

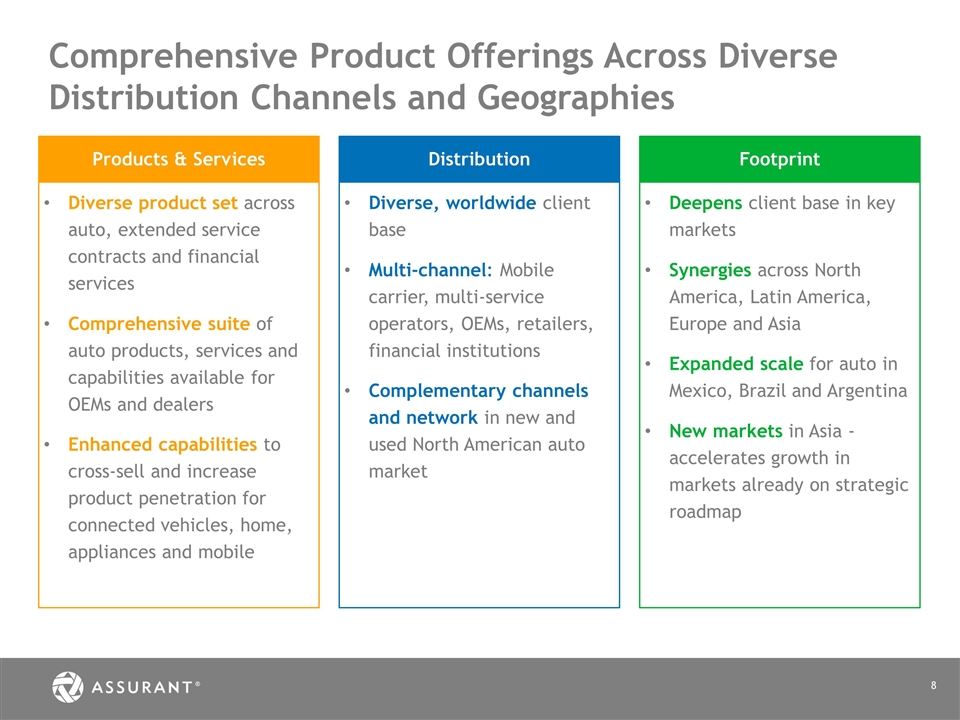

Comprehensive Product Offerings Across Diverse Distribution Channels and Geographies Deepens client base in key markets Synergies across North America, Latin America, Europe and Asia Expanded scale for auto in Mexico, Brazil and Argentina New markets in Asia - accelerates growth in markets already on strategic roadmap Footprint Diverse, worldwide client base Multi-channel: Mobile carrier, multi-service operators, OEMs, retailers, financial institutions Complementary channels and network in new and used North American auto market Distribution Diverse product set across auto, extended service contracts and financial services Comprehensive suite of auto products, services and capabilities available for OEMs and dealers Enhanced capabilities to cross-sell and increase product penetration for connected vehicles, home, appliances and mobile Products & Services

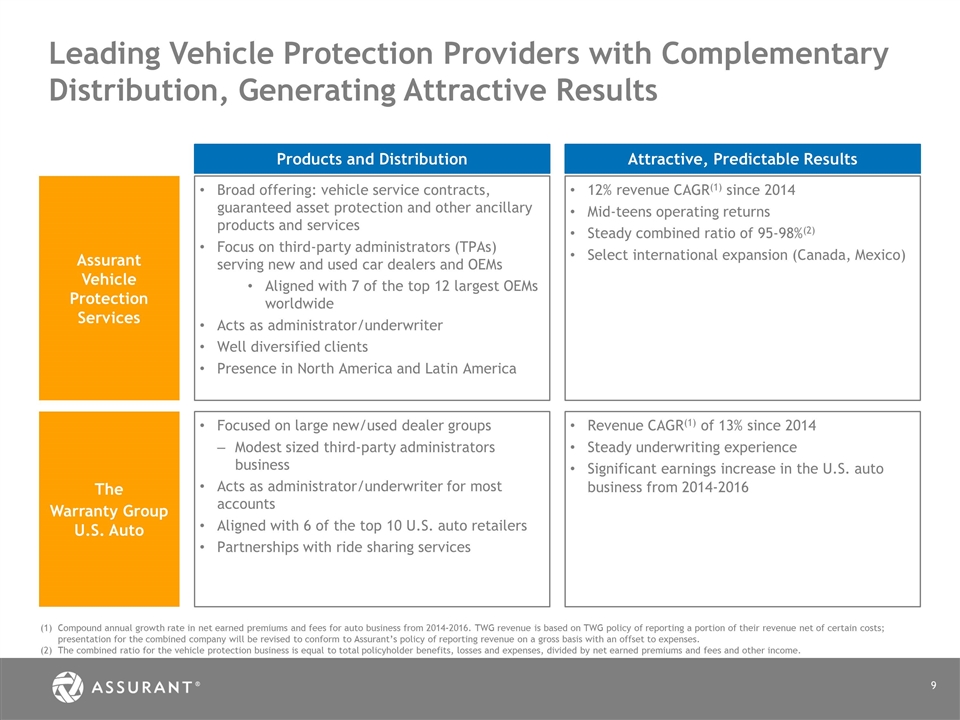

Products and Distribution Attractive, Predictable Results Assurant Vehicle Protection Services The Warranty Group U.S. Auto Broad offering: vehicle service contracts, guaranteed asset protection and other ancillary products and services Focus on third-party administrators (TPAs) serving new and used car dealers and OEMs Aligned with 7 of the top 12 largest OEMs worldwide Acts as administrator/underwriter Well diversified clients Presence in North America and Latin America Focused on large new/used dealer groups Modest sized third-party administrators business Acts as administrator/underwriter for most accounts Aligned with 6 of the top 10 U.S. auto retailers Partnerships with ride sharing services 12% revenue CAGR(1) since 2014 Mid-teens operating returns Steady combined ratio of 95-98%(2) Select international expansion (Canada, Mexico) Revenue CAGR(1) of 13% since 2014 Steady underwriting experience Significant earnings increase in the U.S. auto business from 2014-2016 Compound annual growth rate in net earned premiums and fees for auto business from 2014-2016. TWG revenue is based on TWG policy of reporting a portion of their revenue net of certain costs; presentation for the combined company will be revised to conform to Assurant’s policy of reporting revenue on a gross basis with an offset to expenses. The combined ratio for the vehicle protection business is equal to total policyholder benefits, losses and expenses, divided by net earned premiums and fees and other income. Leading Vehicle Protection Providers with Complementary Distribution, Generating Attractive Results

Deeper Global Footprint to Accelerate Profitable Growth Scale and new products in countries already on Assurant’s strategic roadmap Adds platform for vehicle and extended service contracts in Europe and Asia Establishes one of the broadest global networks of any automotive protection player Provides resources and infrastructure to support mobile expansion globally Creates distribution channels for cross-sell opportunities A world of experience enables us to tackle local challenges – whatever and wherever they may be. Total combined market presence in more than 35 countries Argentina Australia Belgium Brazil Canada Chile China France Germany Ireland Italy Japan Mexico Netherlands New Zealand Singapore South Korea Spain United Kingdom United States of America Select countries include:

New Pathways for Profitable Growth Combined excellence in service, technology and operations to support continued client growth Foothold across all major distribution channels, including emerging digital business models Favorable auto trends: shift from new to certified pre-owned, increasing vehicle service contract attachment rates International scale to capitalize on global growth in auto fleet New market for vehicle protection products within peer-to-peer pre-owned vertical Favorable Trends within Core Vehicle Service Contract Business Combined products, relationships and capabilities to capitalize on emerging connected car and connected home markets Connected, electric and autonomous cars present new coverage opportunities Potential growth in fleet ownership of vehicles given OEM and dealer relationships Financial Services Rewards: Single-source provider for bundled protection products designed to drive market share and increase adoption of digital products Attractive Opportunity in Connected Car, Smart Home and Financial Service Rewards

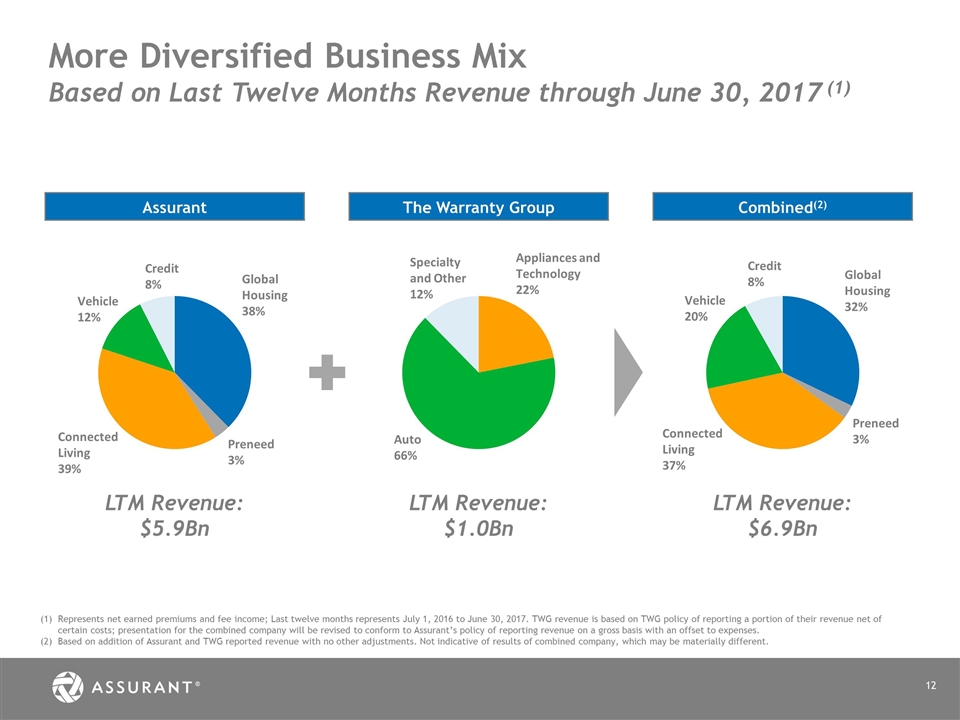

More Diversified Business Mix Based on Last Twelve Months Revenue through June 30, 2017 (1) Represents net earned premiums and fee income; Last twelve months represents July 1, 2016 to June 30, 2017. TWG revenue is based on TWG policy of reporting a portion of their revenue net of certain costs; presentation for the combined company will be revised to conform to Assurant’s policy of reporting revenue on a gross basis with an offset to expenses. Based on addition of Assurant and TWG reported revenue with no other adjustments. Not indicative of results of combined company, which may be materially different. Assurant LTM Revenue: $5.9Bn The Warranty Group LTM Revenue: $1.0Bn Combined(2) LTM Revenue: $6.9Bn Global Housing 38% Preneed 3% Connected Living 39% Vehicle 12% Credit 8% Appliances and Technology 22% Auto 66% Specialty and Other 12% Global Housing 32% Preneed 3% Connected Living 37% Vehicle 20% Credit 8%

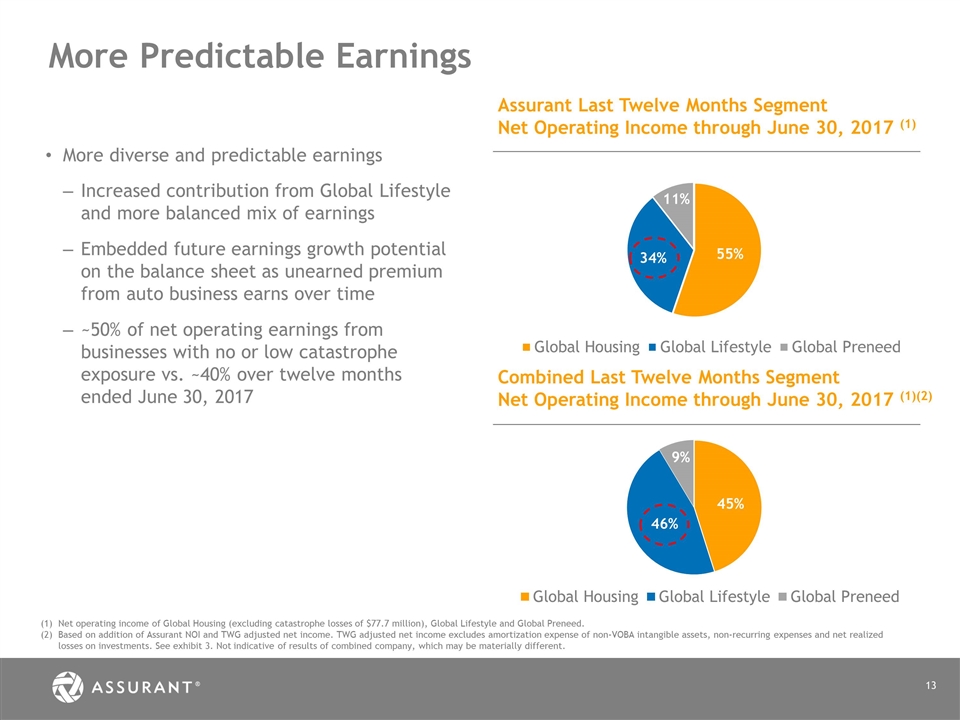

More Predictable Earnings Net operating income of Global Housing (excluding catastrophe losses of $77.7 million), Global Lifestyle and Global Preneed. Based on addition of Assurant NOI and TWG adjusted net income. TWG adjusted net income excludes amortization expense of non-VOBA intangible assets, non-recurring expenses and net realized losses on investments. See exhibit 3. Not indicative of results of combined company, which may be materially different. More diverse and predictable earnings Increased contribution from Global Lifestyle and more balanced mix of earnings Embedded future earnings growth potential on the balance sheet as unearned premium from auto business earns over time ~50% of net operating earnings from businesses with no or low catastrophe exposure vs. ~40% over twelve months ended June 30, 2017 Assurant Last Twelve Months Segment Net Operating Income through June 30, 2017 (1) Combined Last Twelve Months Segment Net Operating Income through June 30, 2017 (1)(2)

Expected to be modestly accretive to 2018 operating earnings per share on a run-rate basis Significantly more accretive if excluding amortization of transaction-related intangibles Expect $60 million of pre-tax operating synergies by the end of 2019 GAAP results to reflect transaction and other related costs as well as integration expenses [GAAP results to reflect transactions costs, integration expense] Acquisition Generates Attractive Economics Financially Attractive Transaction Potential revenue synergies not reflected in financial impact above Auto, service contracts and financial services businesses provide unique insights to capitalize on emerging trends Leverage global footprint to accelerate mobile growth Disciplined capital deployment Plan to complete return of $1.5 billion in capital to shareholders by year-end 2017 Over the long-term, strong free cash flow to invest in business and return excess capital to shareholders Future Value Drivers

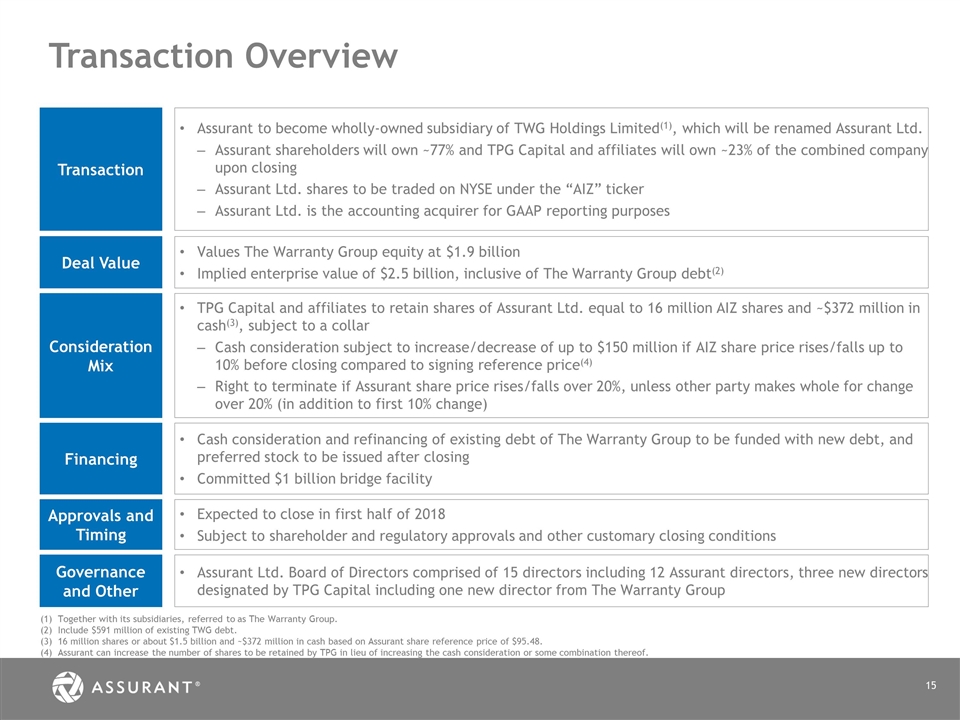

Transaction Overview Transaction Assurant to become wholly-owned subsidiary of TWG Holdings Limited(1), which will be renamed Assurant Ltd. Assurant shareholders will own ~77% and TPG Capital and affiliates will own ~23% of the combined company upon closing Assurant Ltd. shares to be traded on NYSE under the “AIZ” ticker Assurant Ltd. is the accounting acquirer for GAAP reporting purposes Deal Value Values The Warranty Group equity at $1.9 billion Implied enterprise value of $2.5 billion, inclusive of The Warranty Group debt(2) Consideration Mix TPG Capital and affiliates to retain shares of Assurant Ltd. equal to 16 million AIZ shares and ~$372 million in cash(3), subject to a collar Cash consideration subject to increase/decrease of up to $150 million if AIZ share price rises/falls up to 10% before closing compared to signing reference price(4) Right to terminate if Assurant share price rises/falls over 20%, unless other party makes whole for change over 20% (in addition to first 10% change) Financing Cash consideration and refinancing of existing debt of The Warranty Group to be funded with new debt, and preferred stock to be issued after closing Committed $1 billion bridge facility Approvals and Timing Expected to close in first half of 2018 Subject to shareholder and regulatory approvals and other customary closing conditions Governance and Other Assurant Ltd. Board of Directors comprised of 15 directors including 12 Assurant directors, three new directors designated by TPG Capital including one new director from The Warranty Group Together with its subsidiaries, referred to as The Warranty Group. Include $591 million of existing TWG debt. 16 million shares or about $1.5 billion and ~$372 million in cash based on Assurant share reference price of $95.48. Assurant can increase the number of shares to be retained by TPG in lieu of increasing the cash consideration or some combination thereof.

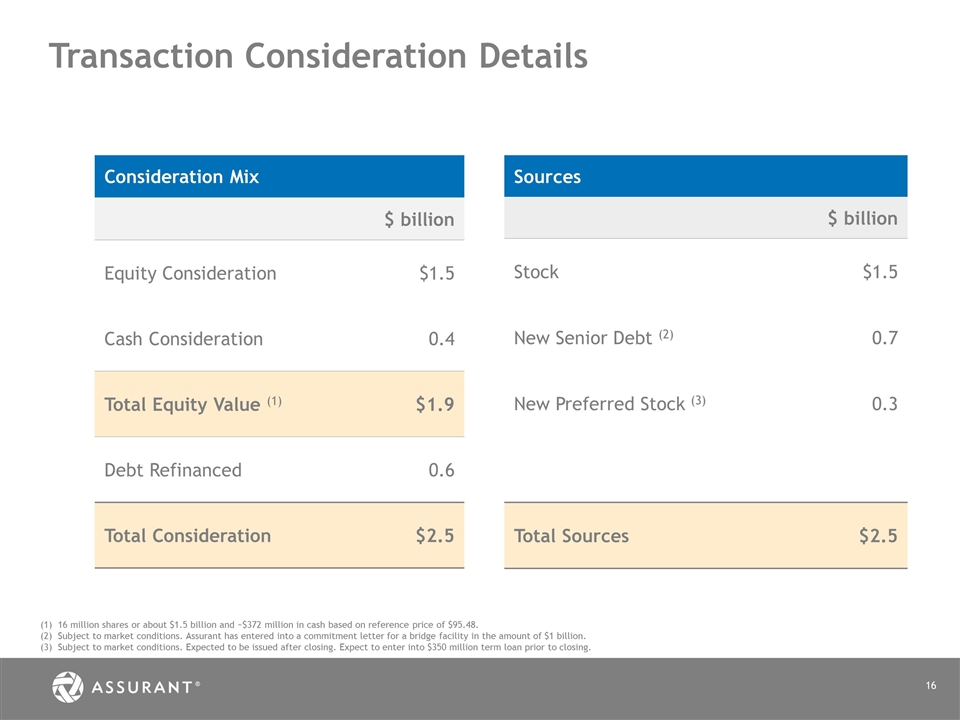

Transaction Consideration Details 16 million shares or about $1.5 billion and ~$372 million in cash based on reference price of $95.48. Subject to market conditions. Assurant has entered into a commitment letter for a bridge facility in the amount of $1 billion. Subject to market conditions. Expected to be issued after closing. Expect to enter into $350 million term loan prior to closing. Consideration Mix $ billion Equity Consideration $1.5 Cash Consideration 0.4 Total Equity Value (1) $1.9 Debt Refinanced 0.6 Total Consideration $2.5 Sources $ billion Stock $1.5 New Senior Debt (2) 0.7 New Preferred Stock (3) 0.3 Total Sources $2.5

Path to Closing Proxy Mailing By second quarter 2018 Shareholder Vote Closing of Transaction Expected to close in first half of 2018, subject to shareholder and regulatory approvals and other customary closing conditions

Creating Shareholder Value A leading provider in lifestyle businesses delivering operating synergies, scale efficiencies and deepened global footprint for profitable growth Well-positioned to capitalize on growth opportunities Enhanced financial profile with more predictable and diversified earnings Expect to generate attractive shareholder returns

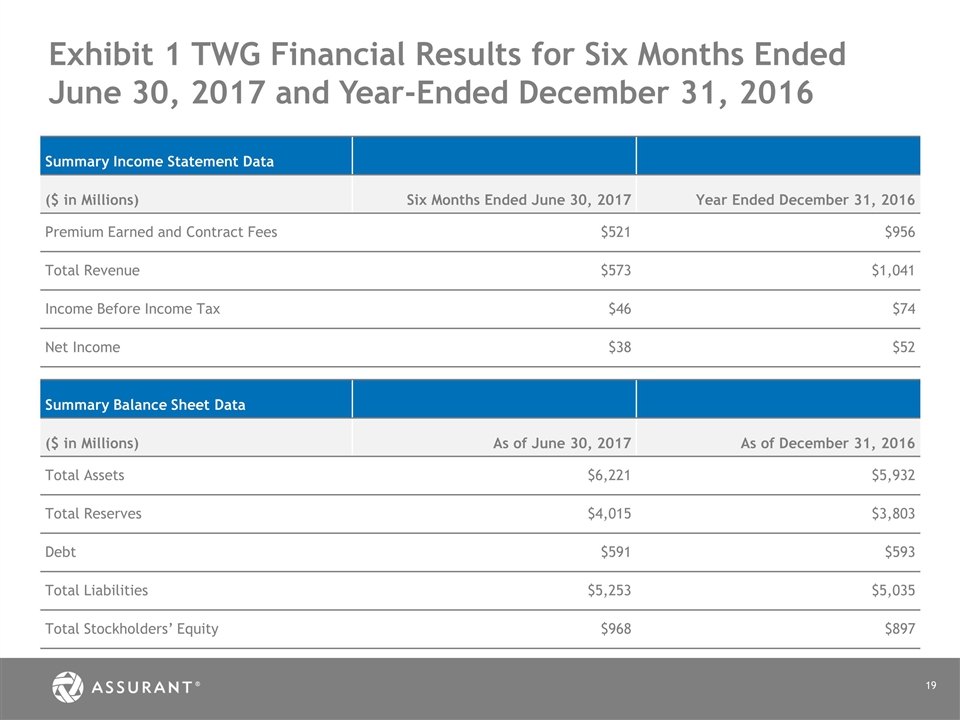

Exhibit 1 TWG Financial Results for Six Months Ended June 30, 2017 and Year-Ended December 31, 2016 Summary Income Statement Data ($ in Millions) Six Months Ended June 30, 2017 Year Ended December 31, 2016 Premium Earned and Contract Fees $521 $956 Total Revenue $573 $1,041 Income Before Income Tax $46 $74 Net Income $38 $52 Summary Balance Sheet Data ($ in Millions) As of June 30, 2017 As of December 31, 2016 Total Assets $6,221 $5,932 Total Reserves $4,015 $3,803 Debt $591 $593 Total Liabilities $5,253 $5,035 Total Stockholders’ Equity $968 $897

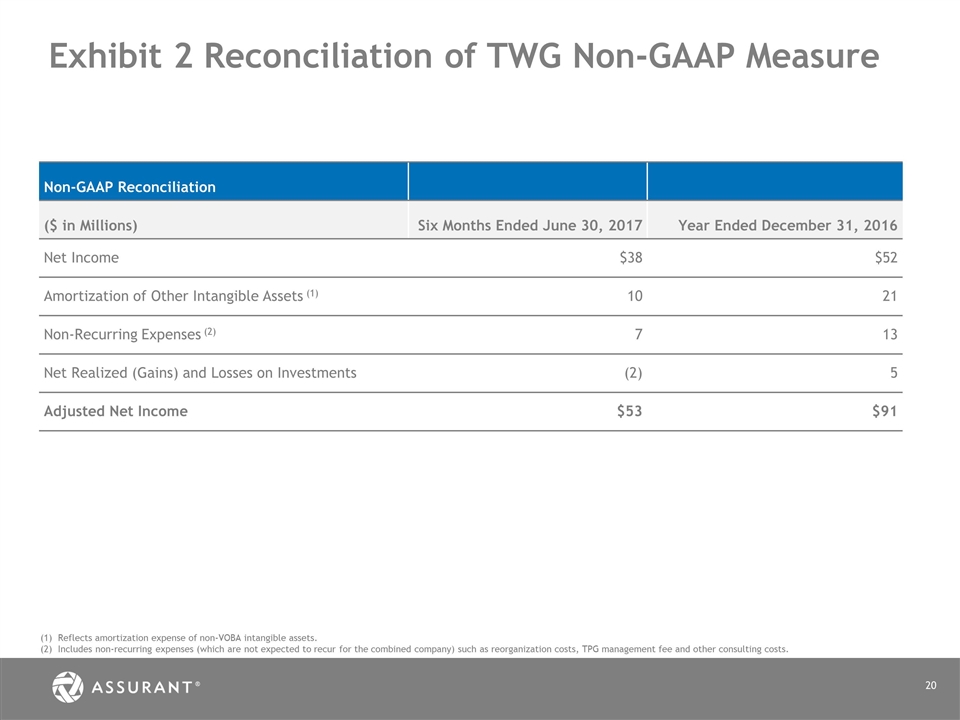

Exhibit 2 Reconciliation of TWG Non-GAAP Measure Non-GAAP Reconciliation ($ in Millions) Six Months Ended June 30, 2017 Year Ended December 31, 2016 Net Income $38 $52 Amortization of Other Intangible Assets (1) 10 21 Non-Recurring Expenses (2) 7 13 Net Realized (Gains) and Losses on Investments (2) 5 Adjusted Net Income $53 $91 Reflects amortization expense of non-VOBA intangible assets. Includes non-recurring expenses (which are not expected to recur for the combined company) such as reorganization costs, TPG management fee and other consulting costs.

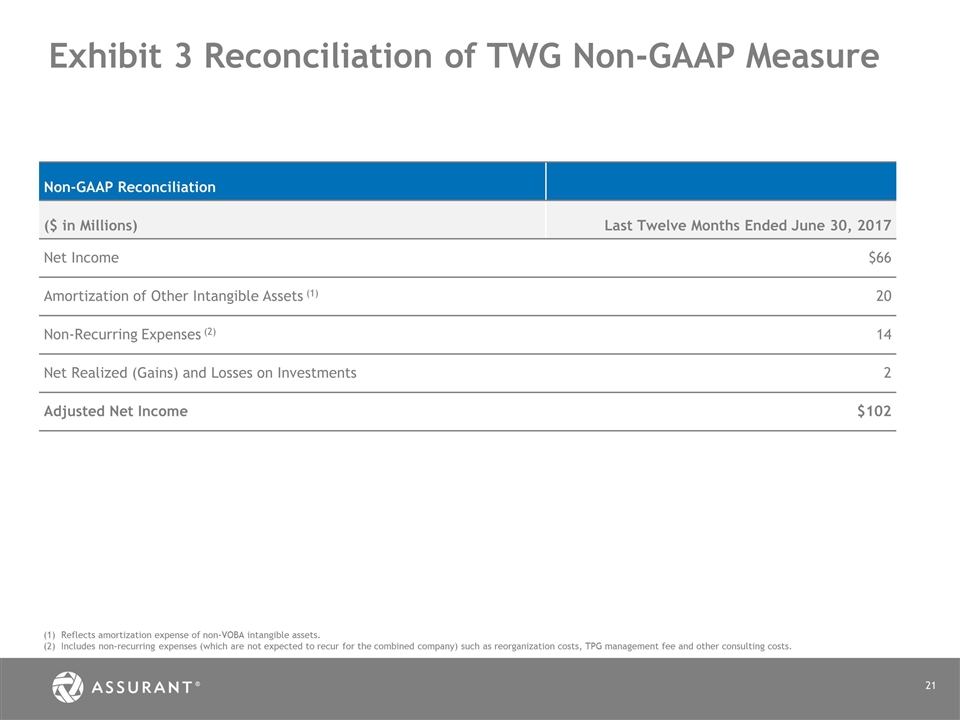

Exhibit 3 Reconciliation of TWG Non-GAAP Measure Non-GAAP Reconciliation ($ in Millions) Last Twelve Months Ended June 30, 2017 Net Income $66 Amortization of Other Intangible Assets (1) 20 Non-Recurring Expenses (2) 14 Net Realized (Gains) and Losses on Investments 2 Adjusted Net Income $102 Reflects amortization expense of non-VOBA intangible assets. Includes non-recurring expenses (which are not expected to recur for the combined company) such as reorganization costs, TPG management fee and other consulting costs.

Additional Information Additional Information and Where to Find It This communication relates to a proposed transaction between Assurant and The Warranty Group that will become the subject of a registration statement, which will include a joint proxy statement/prospectus, to be filed with the U.S. Securities and Exchange Commission (the “SEC”) that will provide full details of the proposed transaction and the attendant benefits and risk. This communication is not a substitute for the joint proxy statement/prospectus or any other document that Assurant or The Warranty Group may file with the SEC or send to their stockholders in connection with the proposed transaction. Investors are urged to carefully read the registration statement on Form S-4, including the definitive proxy statement/prospectus and any other relevant documents filed with the SEC when they become available because they will contain important information. Investors will be able to obtain the joint proxy statement/prospectus and all relevant documents filed by Assurant with the SEC free of charge at the SEC’s website www.sec.gov or through the Investor Relations page of Assurant’s website at http://ir.assurant.com/ as soon as reasonable practicable after the filing. Other information found on Assurant’s website is not part of this or any other report filed with or furnished to the SEC. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy the securities, or a solicitation of any vote of approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in the Solicitation The directors, executive officers and other members of management and employees of Assurant may be deemed participants in the solicitation of proxies from its stockholders in favor of the transactions. Information concerning persons who may be considered participants in the solicitation of Assurant’s stockholders under the rules of the SEC is set forth in public filings filed by Assurant with the SEC and will be set forth in the joint proxy statement/prospectus when it is filed with the SEC.