Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS RELEASE - OMNICOM GROUP INC. | e76069ex99-1.htm |

| 8-K - CURRENT REPORT - OMNICOM GROUP INC. | e76069_8k.htm |

Exhibit 99.2

Third Quarter 2017 Results

October 17, 2017

Investor Presentation

2017 vs. 2016 P&L Summary Third Quarter

Third Quarter 2017 2016

Revenue $ 3,719.5 $ 3,791.1

Operating Expenses (a) 3,255.3 3,338.0

Operating Profit 464.2 453.1

Net Interest Expense 46.4 42.0

(b)

Income Tax Expense (b) 132.0 134.3

(b)

Tax Rate % (b) 31.6% 32.7%

Income from Equity Method Investments 1.1 1.4

Net Income Attributed To Noncontrolling Interests 23.3 24.4

Net Income - Omnicom Group Inc. $ 263.6 $ 253.8

(a) Additional information on our operating expenses can be found on page 23.

(b) On January 1, 2017, we adopted FASB Accounting Standards Update 2016-09, “Compensation – Stock Compensation: Improvements to Employee Share-Based Payment Accounting” (ASU 2016-09), which requires all additional tax benefits or deficiencies related to share-based compensation to be recognized in results of operations on the restricted stock vesting date or on the exercise date for stock options. ASU 2016-09 is required to be adopted on a prospective basis and retroactive restatement is not permitted. As a result, income tax expense for the three months ended September 30, 2017 reflects a reduction of $4.8 million arising from a larger cash tax deduction as compared to the book tax deduction resulting from the vesting of restricted stock and stock options that were exercised in the three months ended September 30, 2017. The reduction of our income tax expense impacted our tax rate, reducing our effective tax rate by 1.1% to 31.6% for the three months ended September 30, 2017. The larger tax deduction is primarily due to the increase in the intrinsic value of these awards that resulted from an increase in the price of our common stock since the grant date of the awards.

October 17, 2017 1

2017 vs. 2016 Earnings per Share – Diluted Third Quarter

Third Quarter 2017 2016

Net Income - Omnicom Group Inc. $ 263.6 $ 253.8

Net Income allocated to participating securities (0.3) (1.2)

Net Income available for common shares (a) $ 263.3 $ 252.6

Diluted Shares (millions) 232.7 238.7

Earnings per Share - Diluted $ 1.13 $ 1.06

Dividends Declared per Common Share $ 0.55 $ 0.55

(a) On January 1, 2017, we adopted ASU 2016-09, as described on page 1. The impact of the adoption of ASU 2016-09 increased net income available for common shares for the three months ended September 30, 2017 by $4.8 million.

October 17, 2017 2

2017 vs. 2016 P&L Summary Year to Date

Year to Date 2017 2016

Revenue $ 11,097.1 $ 11,175.1

Operating Expenses (a) 9,657.5 9,768.1

Operating Profit 1,439.6 1,407.0

Net Interest Expense 131.2 127.0

(b)

Income Tax Expense (b) 406.7 417.7

(b)

Tax Rate % (b) 31.1% 32.6%

Income from Equity Method Investments 2.7 4.0

Net Income Attributed To Noncontrolling Interests 70.4 68.0

Net Income - Omnicom Group Inc. $ 834.0 $ 798.3

(a) Additional information on our operating expenses can be found on page 23.

(b) On January 1, 2017, we adopted ASU 2016-09 as described on page 1. As a result, income tax expense for the nine months ended September 30, 2017 reflects a reduction of $19.5 million arising from a larger cash tax deduction as compared to the book tax deduction resulting from the vesting of restricted stock and stock options that were exercised in the first nine months of 2017 The reduction of our income tax expense impacted our tax rate, reducing our effective tax rate by 1.5% to 31.1% for the nine months ended September 30, 2017. The larger tax deduction is primarily due to the increase in the intrinsic value of these awards that resulted from an increase in the price of our common stock since the grant date of the awards.

October 17, 2017 3

2017 vs. 2016 Earnings per Share – Diluted Year to Date

Year to Date 2017 2016

Net Income - Omnicom Group Inc. $ 834.0 $ 798.3

Net Income allocated to participating securities (1.4) (4.8)

Net Income available for common shares (a) $ 832.6 $ 793.5

Diluted Shares (millions) 234.4 239.6

Earnings per Share - Diluted $ 3.55 $ 3.31

Dividends Declared per Common Share $ 1.65 $ 1.60

(a) On January 1, 2017, we adopted ASU 2016-09, as described on page 1. The impact of the adoption of ASU 2016-09 increased net income available for common shares for the nine months ended September 30, 2017 by $19.5 million.

October 17, 2017 4

2017 Total Revenue Change

Third Quarter Year to Date

$ % $ %

Prior Period Revenue $ 3,791.1 $ 11,175.1

Foreign exchange rate impact (a) 38.9 1.0% (59.2) -0.5%

Acquisition revenue, net of disposition

(216.4) -5.7% (412.8) -3.7% revenue (b)

Organic growth (c) 105.9 2.8% 394.0 3.5%

Current Period Revenue $ 3,719.5 -1.9% $ 11,097.1 -0.7%

(a) Foreign exchange rate impact: calculated by translating the current period’s local currency revenue using the prior period average exchange rates to derive current period constant currency revenue. The foreign exchange rate impact is the difference between the current period revenue in U.S. Dollars and the current period constant currency revenue.

(b) Acquisition revenue, net of disposition revenue: Acquisition revenue is calculated as if the acquisition occurred twelve months prior to the acquisition date by aggregating the comparable prior period revenue of acquisitions through the acquisition date. As a result, acquisition revenue excludes the positive or negative difference between our current period revenue subsequent to the acquisition date and the comparable prior period revenue and the positive or negative growth after the acquisition date is attributed to organic growth. Disposition revenue is calculated as if the disposition occurred twelve months prior to the disposition date by aggregating the comparable prior period revenue of disposals through the disposition date. The acquisition revenue and disposition revenue amounts are netted in the presentation above.

(c) Organic growth: calculated by subtracting the foreign exchange rate impact component and the acquisition revenue, net of disposition revenue component from total revenue growth.

October 17, 2017 5

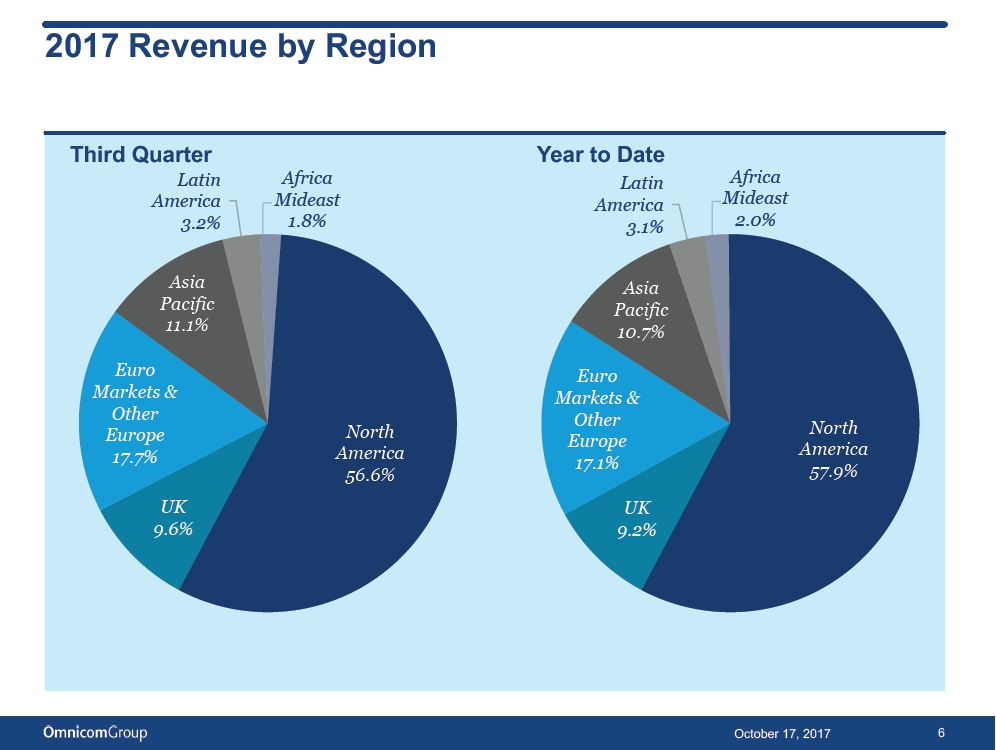

2017 Revenue by Region

Third Quarter Year to Date

Latin Africa Latin Africa America Mideast America Mideast 3.2% 1.8% 3.1% 2.0%

Asia Asia Pacific Pacific 11.1% 10.7%

Euro Euro Markets & Markets & Other Other

North North Europe Europe America America 17.7% 17.1% 56.6% 57.9% UK UK

9.6% 9.2%

October 17, 2017 6

2017 Revenue by Region

Third Quarter Year to Date

% Organic % Organic $ Mix % Growth Growth (a) $ Mix % Growth Growth (a)

$ 2,107.5 -6.5% 2.1% $ 6,422.5 -4.2% 1.1%

North America North America

357.6 2.8% 3.8% 1,017.2 -3.0% 7.1%

UK UK

660.1 11.7% 7.8% 1,900.6 7.2% 7.9%

Euro & Other Europe Euro & Other Europe

411.2 -1.8% 1.4% 1,191.5 1.5% 5.7%

Asia Pacific Asia Pacific

117.7 4.6% -5.4% 345.5 20.6% 1.0%

Latin America Latin America

65.4 -2.7% -1.6% 219.8 18.1% 17.8%

Africa Mid East Africa Mid East

$ 3,719.5 -1.9% 2.8% $ 11,097.1 -0.7% 3.5%

Total Total

(a) “Organic Growth” reflects the year-over-year increase or decrease in revenue from the prior period, excluding the foreign exchange rate impact and acquisition revenue, net of disposition revenue, as defined on page 5.

October 17, 2017 7

2017 Revenue by Discipline

Third Quarter Year to Date

Specialty Specialty 7.5% 7.6% PR PR

9.3% 9.2%

Advertising Advertising 52.3% 53.0% CRM CRM

30.9% 30.2%

% Organic % Organic $ Mix % Growth Growth (a) $ Mix % Growth Growth (a)

Advertising $ 1,946.1 -1.4% 4.7% Advertising $ 5,884.7 0.7% 5.0% CRM 1,149.4 -4.5% 0.1% CRM 3,352.4 -4.3% 1.9% PR 345.9 -0.5% -0.4% PR 1,013.8 -0.2% 0.3% Specialty 278.1 4.2% 5.1% Specialty 846.2 3.9% 3.5%

Total $ 3,719.5 -1.9% 2.8% Total $ 11,097.1 -0.7% 3.5%

(a) “Organic Growth” reflects the year-over-year increase or decrease in revenue from the prior period, excluding the foreign exchange rate impact and acquisition revenue, net of disposition revenue, as defined on page 5.

October 17, 2017 8

Revenue by Industry

Year to Date – 2017 Year to Date – 2016

T&E Auto T&E Auto

6% 10% 7% 8% Telcom Telcom

5% 5%

Consumer Consumer Products Products Tech Tech 10% 9%

9% 9%

Financial Financial Services Services Retail 7% Retail 7%

6% 6%

Food & Food & Pharma & Pharma & Beverage Beverage Health Health 13% 14% 12% 12%

Other Other 22% 23%

October 17, 2017 9

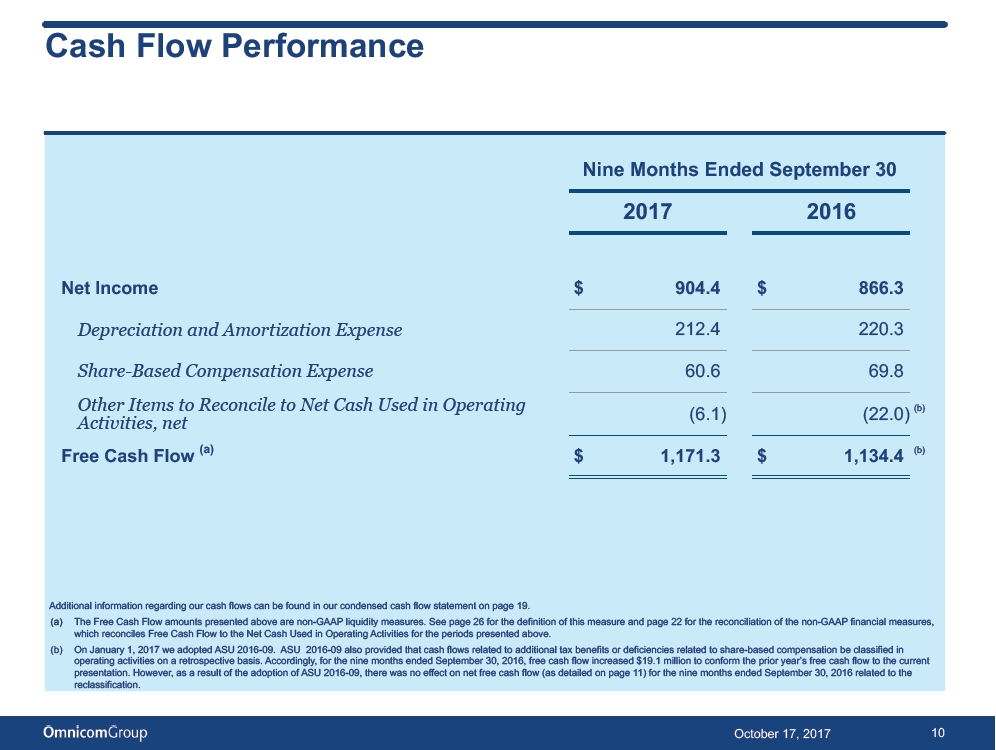

Cash Flow Performance

Nine Months Ended September 30

2017 2016

Net Income $ 904.4 $ 866.3

Depreciation and Amortization Expense 212.4 220.3

Share-Based Compensation Expense 60.6 69.8

Other Items to Reconcile to Net Cash Used in Operating

(6.1) (22.0) (b)

Activities, net

Free Cash Flow (a) $ 1,171.3 $ 1,134.4 (b)

Additional information regarding our cash flows can be found in our condensed cash flow statement on page 19.

(a) The Free Cash Flow amounts presented above are non-GAAP liquidity measures. See page 26 for the definition of this measure and page 22 for the reconciliation of the non-GAAP financial measures, which reconciles Free Cash Flow to the Net Cash Used in Operating Activities for the periods presented above.

(b) On January 1, 2017 we adopted ASU 2016-09. ASU 2016-09 also provided that cash flows related to additional tax benefits or deficiencies related to share-based compensation be classified in operating activities on a retrospective basis. Accordingly, for the nine months ended September 30, 2016, free cash flow increased $19.1 million to conform the prior year’s free cash flow to the current presentation. However, as a result of the adoption of ASU 2016-09, there was no effect on net free cash flow (as detailed on page 11) for the nine months ended September 30, 2016 related to the reclassification.

October 17, 2017 10

Cash Flow Performance

Nine Months Ended September 30

2017 2016

Free Cash Flow (a) $ 1,171.3 $ 1,134.4 (b)

Primary Uses of Cash:

Dividends paid to Common Shareholders 387.9 374.2

Dividends paid to Noncontrolling Interest Shareholders 87.1 71.1

Capital Expenditures 108.3 100.5 Acquisition of Businesses and Affiliates, Acquisition of Additional Noncontrolling Interests, Contingent Purchase Price Payments, net of 87.1 438.3 Proceeds from Investments

Stock Repurchases, net of Proceeds from Stock Plans 513.7 441.6 (b)

Primary Uses of Cash (a) 1,184.1 1,425.7 (b)

Net Free Cash Flow (a) $ (12.8) $ (291.3)

Additional information regarding our cash flows can be found in our condensed cash flow statement on page 19.

(a) The Free Cash Flow, Primary Uses of Cash and Net Free Cash Flow amounts presented above are non-GAAP liquidity measures. See page 26 or the definition of these measures and page 22 for the reconciliation of non-GAAP financial measures, which reconciles Free Cash Flow to the Net Cash Used in Operating Activities and Net Free Cash Flow to the Net Decrease in Cash and Cash Equivalents for the periods presented above.

(b) On January 1, 2017 we adopted ASU 2016-09. ASU 2016-09 also provides that cash flows related to additional tax benefits or deficiencies related to share-based compensation be classified in operating activities on a retrospective basis. In the prior year the additional benefits or deficiencies were classified in financing activities (grouped with stock repurchases and proceeds from stock plans). As a result of the adoption of ASU 2016-09, for the nine months ended September 30, 2016 free cash flow increased by $19.1 million to conform to the current presentation, with a corresponding increase in primary uses of cash. However, as a result of the adoption of ASU 2016-09, there was no effect on net free cash flow for the nine months ended September 30, 2016 related to the reclassification.

October 17, 2017 11

Current Credit Picture

Twelve Months Ended September 30

2017 2016

EBITDA (a) $ 2,326.5 $ 2,275.1

Gross Interest Expense 221.3 204.7 EBITDA / Gross Interest Expense 10.5 x 11.1 x Total Debt / EBITDA 2.1 x 2.2 x Net Debt (b) / EBITDA 1.3 x 1.3 x

Debt

Bank Loans (Due Less Than 1 Year) $ 39 $ 25 CP & Borrowings Issued Under Revolver — —Senior Notes (c) 4,900 4,900 Other Debt 27 107

Total Debt $ 4,966 $ 5,032

Cash, Cash Equivalents and Short Term Investments 1,851 1,969

Net Debt (b) $ 3,115 $ 3,063

(a) EBITDA is a non-GAAP performance measure. See page 26 for the definition of this measure and page 21 for the reconciliation of non-GAAP financial measures. (b) Net Debt is a non-GAAP liquidity measure. See page 26 for the definition of this measure, which is reconciled in the table above.

(c) See pages 16 and 17 for additional information on our Senior Notes.

October 17, 2017 12

Historical Returns

Return on Invested Capital (ROIC) (a) :

Twelve months ended September 30, 2017 20.2%

Twelve months ended September 30, 2016 19.4%

Return on Equity (b):

Twelve months ended September 30, 2017 48.9%

Twelve months ended September 30, 2016 47.1%

(a) Return on Invested Capital is After Tax Reported Operating Profit (a non-GAAP performance measure – see page 26 for the definition of this measure and page 22 for the reconciliation of non-GAAP financial measures) divided by the average of Invested Capital at the beginning and the end of the period (book value of all long-term liabilities and short-term interest bearing debt plus shareholders’ equity less cash, cash equivalents and short term investments).

(b) Return on Equity is Reported Net Income for the given period divided by the average of shareholders’ equity at the beginning and end of the period.

October 17, 2017 13

Net Cash Returned to Shareholders through Dividends and Share Repurchases

From 2007 through September 30, 2017, Omnicom distributed 106% of Net Income to shareholders through Dividends and Share Repurchases.

106% $12.0 106% $10.7 107% $9.9 $10.0 107% $8.7 3.6 102% $7.6 3.2 $8.0

Billions 2.7 105% $6.5 2.2 $6.0 99% $5.5 98% $4.5 1.8

In

1.5

$ 76% $3.6 $4.0

98% 1.1 7.7 $2.8 7.2 0.8 6.6 101% $2.0 5.9 4.4 4.9 $2.0 $1.0 0.6 3.5 2.7 1.6 $0.0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD 2017

Cumulative Cost of Net Shares Repurchased - Payments for repurchases of common stock less proceeds from stock plans. Cumulative Dividends Paid Cumulative Net Income - Omnicom Group Inc.

% of Cumulative Net Income Returned to Shareholders - Cumulative Dividends Paid plus Cumulative Cost of Net Shares Repurchased divided by Cumulative Net Income.

October 17, 2017 14

Supplemental Financial Information

October 17, 2017 15

Omnicom Debt Structure

Bank Loans $39

2019 Senior Notes $500

2026 Senior Notes $1,400 2020 Senior Notes $1,000

2024 Senior Notes 2022 Senior $750 Notes $1,250

The above chart sets forth Omnicom’s debt outstanding at September 30, 2017. The amounts reflected above for the 2019, 2020, 2022, 2024 and 2026 Senior Notes represent the principal amount of these notes at maturity on July 15, 2019, August 15, 2020, May 1, 2022, November 1, 2024 and April 15, 2026, respectively.

October 17, 2017 16

Omnicom Debt Maturity Profile

2026 Senior 2022 Notes

$1,400

Senior Notes

$1,200 2020

Senior Notes

$1,000

2024 Senior $800 Notes 2019 $600 Senior Notes

$400

$200

Other Borrowings

$0

17 18 18 19 19 - 20 20 21 21 - 22 22 - 23 - 23 - 24 24 25 - 25 - 26 - 26 -----------Dec Jun Dec Jun Dec Jun Dec Jun Dec Jun Dec Jun Dec Jun Dec Jun Dec Jun Dec

Other borrowings at September 30, 2017 include short-term borrowings of $39 million which are due in less than one year. For purposes of this presentation we have included these borrowings as outstanding through July 31, 2021, the date of expiration of our five-year credit facility.

October 17, 2017 17

2017 Acquisition Related Expenditures

Year to Date

Acquisition of Businesses and Affiliates (a) $ 27.3 Acquisition of Additional Noncontrolling Interests (b) 10.2 Contingent Purchase Price Payments (c) 107.7

Total Acquisition Expenditures (d) $ 145.2

(a) Includes acquisitions of a majority interest in agencies resulting in their consolidation, including additional interest in existing affiliate agencies resulting in majority ownership.

(b) Includes the acquisition of additional equity interests in already consolidated subsidiary agencies which are recorded to Equity – Noncontrolling Interest.

(c) Includes additional consideration paid for acquisitions completed in prior periods.

(d) Total Acquisition Expenditures figure is net of cash acquired.

October 17, 2017 18

Condensed Cash Flow

Nine Months Ended September 30 2017 2016 Net Income $ 904.4 $ 866.3

Share-Based Compensation 60.6 69.8 Depreciation and Amortization of Intangible Assets 212.4 220.3 Other Items to Reconcile to Net Cash Used in Operating Activities, net (6.1) (22.0) (a) Changes in Operating Capital (1,327.3) (798.7)

Net Cash (Used in)/Provided by Operating Activities (156.0) 335.7 (a)

Capital Expenditures (108.3) (100.5) Proceeds from/(Purchases of) Investments 58.1 (16.4) Acquisition of Businesses and Interest in Affiliates, net of cash acquired (27.3) (268.5)

Net Cash Used in Investing Activities (77.5) (385.4)

Dividends paid to Common Shareholders (387.9) (374.2) Dividends paid to Noncontrolling Interest Shareholders (87.1) (71.1) Proceeds from Short-term & Long-term Debt, net 7.5 388.4 Stock Repurchases, net of Proceeds from Stock Plans (513.7) (441.6) (a) Acquisition of Additional Noncontrolling Interests (10.2) (59.8) Payment of Contingent Purchase Price Obligations (107.7) (93.6) Other Financing Activities, net (22.8) (24.7)

Net Cash Used in Financing Activities (1,121.9) (676.6) (a) Effect of exchange rate changes on cash and cash equivalents 196.2 57.7 Net Decrease in Cash and Cash Equivalents $ (1,159.2) $ (668.6)

(a) On January 1, 2017 we adopted ASU 2016-09. ASU 2016-09 also provides that cash flows related to additional tax benefits or deficiencies related to share-based compensation be classified in operating activities on a retrospective basis. In the prior year the additional benefits or deficiencies were classified as net proceeds in financing activities (grouped with stock repurchases and proceeds from stock plans). Accordingly, for the nine months ended September 30, 2016, net cash provided by operating activities increased $19.1 million and net cash used in financing activities increased $19.1 million to conform to the current presentation. However there was no effect on the net decrease in cash and cash equivalents for the nine months ended September 30, 2016 related to the reclassification.

October 17, 2017 19

2017 vs. 2016 Non-GAAP Financial Measures –EBITA

Third Quarter Year to Date 2017 2016 2017 2016

Revenue $ 3,719.5 $ 3,791.1 $ 11,097.1 $ 11,175.1

Operating expenses (a) 3,255.3 3,338.0 9,657.5 9,768.1

Operating Profit 464.2 453.1 1,439.6 1,407.0

Operating Profit Margin % 12.5% 12.0% 13.0% 12.6%

Add back: Amortization of intangible assets 27.9 29.0 86.8 85.7

EBITA (b) $ 492.1 $ 482.1 $ 1,526.4 $ 1,492.7

EBITA Margin % (c) 13.2% 12.7% 13.8% 13.4%

(a) Additional information regarding our operating expenses can be found on page 23.

(b) EBITA is a non-GAAP financial performance measure. Please see page 26 for the definition of this measure and page 21 for the reconciliation of non-GAAP financial measures, which reconciles the EBITA figures presented above to net income for the periods presented above.

(c) EBITA Margin is a non-GAAP financial performance measure. Please see page 26 for the definition of this measure, which is calculated by dividing EBITA by revenue for the periods presented.

October 17, 2017 20

Reconciliation of Non-GAAP Financial Measures – EBITA and EBITDA

Three Months Ended Nine Months Ended Twelve Months Ended September 30 September 30 September 30

2017 2016 2017 2016 2017 2016

Net Income - Omnicom Group Inc. $ 263.6 $ 253.8 $ 834.0 $ 798.3 $ 1,184.3 $ 1,129.9

Net Income Attributed to Noncontrolling

Interests 23.3 24.4 70.4 68.0 100.5 100.7

Net Income 286.9 278.2 904.4 866.3 1,284.8 1,230.6

Income from Equity Method Investments 1.1 1.4 2.7 4.0 4.1 6.2

Income Tax Expense 132.0 134.3 406.7 417.7 589.5 594.4 Income Before Tax 417.8 411.1 1,308.4 1,280.0 1,870.2 1,818.8 Net Interest Expense 46.4 42.0 131.2 127.0 171.3 163.6 Operating Profit 464.2 453.1 1,439.6 1,407.0 2,041.5 1,982.4

Amortization of Intangible Assets 27.9 29.0 86.8 85.7 116.3 114.2

EBITA 492.1 482.1 1,526.4 1,492.7 2,157.8 2,096.6

Depreciation 40.7 44.1 125.6 134.6 168.7 178.5

EBITDA $ 532.8 $ 526.2 $ 1,652.0 $ 1,627.3 $ 2,326.5 $ 2,275.1

The above reconciles the GAAP financial measure of Net Income – Omnicom Group Inc. to the non-GAAP financial measures of EBITDA and EBITA for the periods presented.

EBITDA and EBITA, which are defined on page 26, are non-GAAP financial measures within the meaning of applicable SEC rules and regulations. Our credit facility defines EBITDA as earnings before deducting interest expense, income taxes, depreciation and amortization. Our credit facility uses EBITDA to measure our compliance with covenants, such as interest coverage and leverage ratios, as presented on page 12 of this presentation.

October 17, 2017 21

Reconciliation of Non-GAAP Financial Measures

Nine Months Ended September 30 2017 2016

Net Cash (Used in)/Provided by Operating Activities $ (156.0) $ 335.7 (a) Operating Activities items excluded from Free Cash Flow:

Changes in Operating Capital (1,327.3) (798.7)

Free Cash Flow $ 1,171.3 $ 1,134.4 (a)

Nine Months Ended September 30 2017 2016 Net Decrease in Cash and Cash Equivalents $ (1,159.2) $ (668.6) Cash Flow items excluded from Net Free Cash Flow:

Changes in Operating Capital (1,327.3) (798.7) Proceeds from Short-term & Long-term Debt, net 7.5 388.4 Other Financing Activities, net (22.8) (24.7) Effect of exchange rate changes on cash and cash equivalents 196.2 57.7

Net Free Cash Flow $ (12.8) $ (291.3)

Twelve Months Ended September 30 2017 2016 Reported Operating Profit 2,041.5 1,982.4

Effective Tax Rate for the applicable period 31.5% (b) 32.7% Income Taxes on Reported Operating Profit 643.1 648.2

After Tax Reported Operating Profit $ 1,398.4 $ 1,334.2

(a) On January 1, 2017 we adopted ASU 2016-09. ASU 2016-09 also provided that cash flows related to additional tax benefits or deficiencies related to share-based compensation be classified in operating activities on a retrospective basis. In the prior year the additional benefits or deficiencies were classified in financing activities. Accordingly, for the nine months ended September 30, 2016, net cash provided by operating activities increased $19.1 million and free cash flow increased $19.1 million to conform to the current presentation.

(b) The annualized effective tax rate for the twelve months ended September 30, 2017 includes the impact of the reduction to income tax expense of $19.5 million arising from a larger cash tax deduction as compared to the book tax deduction taken on the share based awards that were vested and exercised in the nine months ended September 30, 2017 in connection with the adoption of ASU 2016-09 on January 1, 2017, as described on page 1.

October 17, 2017 22

Supplemental Information

Third Quarter Year to Date

2017 % of 2016 % of 2017 % of 2016 % of

Rev Rev Rev Rev

Revenue $ 3,719.5 $ 3,791.1 $ 11,097.1 $ 11,175.1

Operating expenses:

Salary and service costs 2,770.5 74.5 % 2,851.6 75.2 % 8,200.8 73.9 % 8,298.9 74.3 %

Occupancy and other expenses 316.7 8.5 % 309.2 8.2 % 915.7 8.3 % 925.8 8.3 %

Cost of services 3,087.2 83.0 % 3,160.8 83.4 % 9,116.5 82.2 % 9,224.7 82.5 %

Selling, general and administrative expenses 99.5 2.7 % 104.1 2.7 % 328.6 3.0 % 323.1 2.9 % Depreciation and amortization 68.6 1.8 % 73.1 1.9 % 212.4 1.9 % 220.3 2.0 %

Total operating expenses 3,255.3 87.5 % 3,338.0 88.0 % 9,657.5 87.0 % 9,768.1 87.4 % Operating Profit $ 464.2 $ 453.1 $ 1,439.6 $ 1,407.0

Net Interest expense:

Interest expense 59.0 52.9 169.2 157.6 Interest income 12.6 10.9 38.0 30.6 Net Interest expense $ 46.4 $ 42.0 $ 131.2 $ 127.0

October 17, 2017 23

Third Quarter Acquisition

Perceptive is a leading customer intelligence agency within the Australasia markets, providing technology-based research and insight for its clients.

Agency services include quantitative and qualitative research, transnational and behavioral data analytics, software development, data science, visualization and client service. Perceptive also provides customer experience program management services to its clients using its internally-developed Customer Monitor platform.

Located in Auckland, New Zealand, Perceptive will operate as a separate division of Clemenger Group within the BBDO Worldwide network.

October 17, 2017 24

Third Quarter Acquisition

Established in 2009 with a focus on Search Engine Optimization and Content Marketing & Outreach, Verve Search is a market leader providing multi-lingual SEO strategy, executing global SEO campaigns, and creating high-value content for clients.

Verve has been recognized as “Best Small SEO Agency” at the UK Search Awards for the past two years.

Based in Southwest London, United Kingdom, Verve will operate as a separate division of OMG UK within the Omnicom Media Group network.

October 17, 2017 25

Disclosure

The preceding materials have been prepared for use in the October 17, 2017 conference call on Omnicom’s results of operations for the period ended September 30, 2017. The call will be archived on the Internet at http://investor.omnicomgroup.com/investor-relations/news-events-and-filings/.

Forward-Looking Statements

Certain statements in this presentation constitute forward-looking statements, including statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, from time to time, the Company or its representatives have made, or may make, forward-looking statements, orally or in writing. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the Company’s management as well as assumptions made by, and information currently available to, the Company’s management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “should,” “would,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include: international, national or local economic conditions that could adversely affect the Company or its clients; losses on media purchases and production costs incurred on behalf of clients; reductions in client spending, a slowdown in client payments and a deterioration in the credit markets; ability to attract new clients and retain existing clients in the manner anticipated; changes in client advertising, marketing and corporate communications requirements; failure to manage potential conflicts of interest between or among clients; unanticipated changes relating to competitive factors in the advertising, marketing and corporate communications industries; ability to hire and retain key personnel; currency exchange rate fluctuations; reliance on information technology systems; changes in legislation or governmental regulations affecting the Company or its clients; risks associated with assumptions the Company makes in connection with its critical accounting estimates and legal proceedings; and the Company’s international operations, which are subject to the risks of currency repatriation restrictions, social or political conditions and regulatory environment. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that may affect the Company’s business, including those described in the “Risk Factors” in Omnicom’s Annual Report on Form 10-K for the year ended December 31, 2016. Except as required under applicable law, the Company does not assume any obligation to update these forward-looking statements.

Non-GAAP Financial Measures

We present financial measures determined in accordance with generally accepted accounting principles in the United States (“GAAP”) and adjustments to the GAAP presentation (“Non-GAAP”), which we believe are meaningful for understanding our performance. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP. Non-GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported by other companies. We provide a reconciliation of non-GAAP measures to the comparable GAAP measures on pages 20, 21 and 22.

The Non-GAAP measures used in this presentation include the following:

Free Cash Flow, defined as net income plus depreciation, amortization, share based compensation expense plus/(less) other items to reconcile to net cash provided by operating activities. We believe Free Cash Flow is a useful measure of liquidity to evaluate our ability to generate excess cash from our operations.

Primary Uses of Cash, defined as dividends to common shareholders, dividends paid to non-controlling interest shareholders, capital expenditures, cash paid on acquisitions, payments for additional interest in controlled subsidiaries and stock repurchases, net of the proceeds and excess tax benefit from our stock plans, and excludes changes in operating capital and other investing and financing activities, including commercial paper issuances and redemptions used to fund working capital changes. We believe this liquidity measure is useful in identifying the significant uses of our cash.

Net Free Cash Flow, defined as Free Cash Flow less the Primary Uses of Cash. Net Free Cash Flow is one of the metrics used by us to assess our sources and uses of cash and was derived from our consolidated statements of cash flows. We believe that this liquidity measure is meaningful for understanding our primary sources and primary uses of that cash flow.

EBITDA, defined as operating profit before interest, taxes, depreciation and amortization. We believe EBITDA is meaningful operating performance measure because the financial covenants in our credit facilities are based on EBITDA.

EBITA, defined as operating profit before interest, taxes and amortization and EBITA margin, defined as EBITA divided by revenue. We use EBITA and EBITA margin as additional operating performance measures, which excludes the non-cash amortization expense of intangible assets (primarily consisting of amortization arising from acquisitions). Accordingly, we believe it is a useful measure for investors to evaluate the performance of our businesses.

Net Debt, defined as total debt less cash, cash equivalents and short-term investments. We believe net debt, together with the comparable GAAP measures, reflects one of the liquidity metrics used by us to assess our cash management.

After Tax Reported Operating Profit, defined as reported operating profit less income taxes calculated using the effective tax rate for the applicable period. Management uses after tax operating profit as a measure of after tax operating performance as it excludes the after tax effects of financing and investing activities on results of operations.

Other Information

All dollar amounts are in millions except for per share amounts and figures shown on pages 2 and 4 and the net cash returned to shareholders figures on page 14. The information contained in this document has not been audited, although some data has been derived from Omnicom’s historical financial statements, including its audited financial statements. In addition, industry, operational and other non-financial data contained in this document have been derived from sources that we believe to be reliable, but we have not independently verified such information, and we do not, nor does any other person, assume responsibility for the accuracy or completeness of that information. Certain amounts in prior periods have been reclassified to conform to our current presentation.

The inclusion of information in this presentation does not mean that such information is material or that disclosure of such information is required.

October 17, 2017 26