Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Helios & Matheson Analytics Inc. | f8k101717_heliosandmathes.htm |

Exhibit 99.1

For Informational Purposes Only/ Not For Red istribut ion THE FUTURE OF MOVIE GOING Corporate Presentation October 2017

2 Disclaimer and Notices Cautionary Statement on Forward - looking Information Certain information in this presentation contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 or under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (collectively, “forward - looking statements”) that may not be based on historical fact, but instead relate to future events, including without limitation statements containing the words “believe”, “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “project" and similar expressions. All statements other than statements of historical fact included in this presentation are forward - looking statements, including statements regarding industry growth and the expected benefits of the MoviePass technology. Statements regarding future events are based on MoviePass’ current expectations and are necessarily subject to associated risks related to, among other things, conditions to the closing of the pending transaction between Helios and Matheson Analytics Inc. (NASDAQ:HMNY) (“HMNY”) and MoviePass under which HMNY proposes to acquire a majority stake in MoviePass ( the “Transaction”) that may not be satisfied, the occurrence of any event, change or other circumstances that could give rise to the termination of such T ransaction prior to closing, risks associated with MoviePass’ business and general economic conditions. Such forward - looking statements are based on a number of assumptions. Although management of MoviePass believe s that the assumptions made and expectations represented by such statements are reasonable, there can be no assurance that a forward - looking statement contained herein will prove to be accurate. Actual results and developments may differ materially from those expressed or implied by the forward - looking statements contained herein and even if such actual results and developments are realized or substantially realized, there can be no assurance that they will have the expected consequences or effects. Risk factors and other material information concerning HMNY are described in its periodic and current reports, information statements and registration statements filed with the U.S. Securities and Exchange Commission (the “SEC”). You are encouraged to review such reports and other filings at www.sec.gov. Given these risks, uncertainties and factors, you are cautioned not to place undue reliance on such forward - looking statements and information, which are qualified in their entirety by this cautionary statement. All forward - looking statements and information made herein are based on MoviePass’ current expectations and neither HMNY nor MoviePass undertakes an obligation to revise or update such forward - looking statements and information to reflect subsequent events or circumstances, except as required by law. Additional Information for Stockholders of HMNY about the Proposed Transaction and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. HMNY plans to file with the SEC and furnish its stockholders with a proxy statement in connection with the proposed transaction with MoviePass and security holders of HMNY are urged to read the proxy statement and the other relevant materials when they become available because such materials will contain important information about HMNY, MoviePass and their respective affiliates and the proposed T ransaction. The proxy statement and other relevant materials (when they become available), and any and all other documents filed by HMNY with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the proxy statement, once it is filed, from HMNY by accessing HMNY’s website at www.hmny.com or upon written request to: Helios and Matheson Analytics Inc., Attn: Secretary, Empire State Building, 350 Fifth Avenue, Suite 7520, New York, New York 10118, (212) 979 - 8228. Participants in the Solicitation HMNY and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the security holders of HMNY in connection with the proposed transaction. Information about those directors and executive officers of HMNY, including their ownership of HMNY securities, is set forth in the annual report on Form 10 - K for the year ended December 31, 2016, which was filed with the SEC on April 14, 2017 , and its definitive proxy statement on Schedule 14A filed with the SEC on October 3, 2017 . Investors and security holders may obtain additional information regarding the direct and indirect interests of HMNY and its directors and executive officers in the proposed T ransaction by reading the proxy statement and other public filings referred to above.

» CEO and Management – Mitch Lowe - joined June 2016 • Track Record of Success – Co - Founding Vice President at Netflix and President/COO at Redbox • Committed and Experienced Management Team • Focused on Building Team – CMO, Biz Dev, CFO, Head of Exhibitor Relations » Total Addressable Market = 284mn Total Movie Goers • 36mn Avid Movie Goers + 246mn Casual Movie Goers • $11bn in Annual Box Office Ticket Spend • $5 - 7bn annual concession spend » Ecosystem • Moviegoers – With subscription inspired to see more movies and movies not otherwise seen • Exhibitors – Increase attendance and concession spend • Studios – Increase box office receipts for sub $100mn films Corporate Highlights 3

4 Market Opportunity 36M Avid Moviegoers + = 246M Casual Moviegoers 284M Moviegoers MoviePass Previous TAM • 11% of the Moviegoing Market • $5.5bn in Spending at the Box Office in 2016 MoviePass $9.95 Unlimited Subscription New TAM • 71% of the Moviegoing Market • $5.9bn in Spending at the Box Office in 2016 • 82% of the Moviegoing Market • $11.4bn in Spending at the Box Office in 2016 *TAM = Total Addressable Market, Source: MPAA 2016 Report

Win - Win: Consumers, Exhibitors, Studios Consumers Consumers reduce risk of wasting money on a bad movie Exhibitors Exhibitors increase attendance and concession revenue Studios Studios increase Box Office revenue and improve marketing efficiency 5

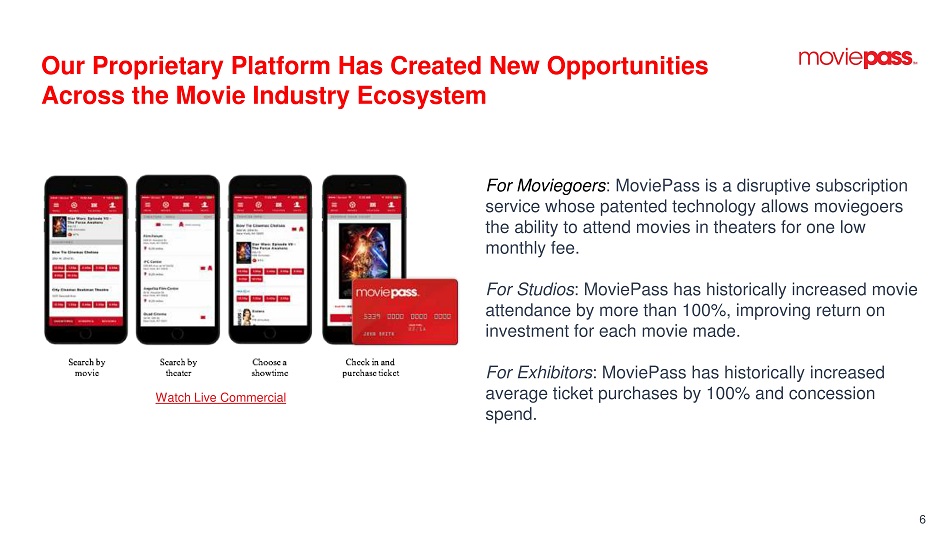

6 Our Proprietary Platform Has Created New Opportunities Across the Movie Industry Ecosystem For Moviegoers : MoviePass is a disruptive subscription service whose patented technology allows moviegoers the ability to attend movies in theaters for one low monthly fee. For Studios : MoviePass has historically increase d movie attendance by more than 100%, improving return on investment for each movie made. For Exhibitors : MoviePass has historically increase d average ticket purchases by 100% and concession spend . Watch Live Commercial

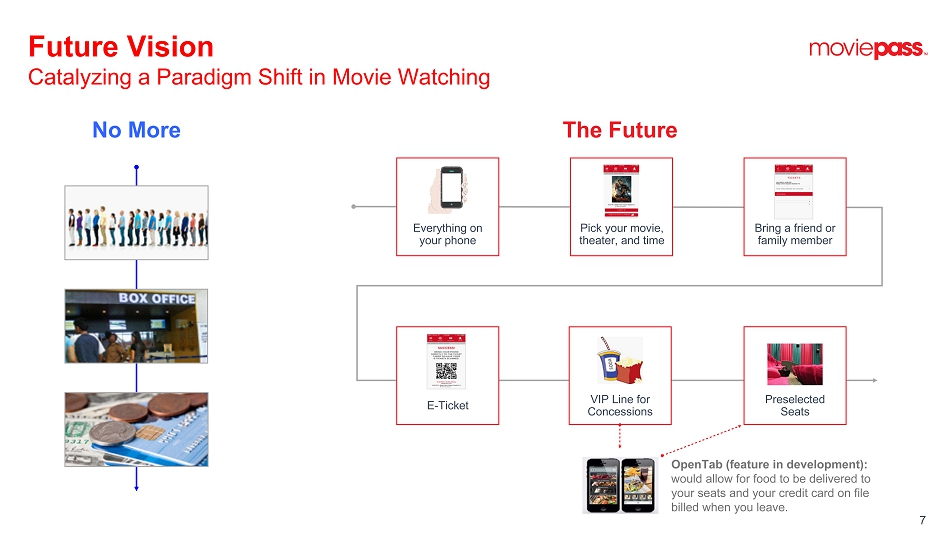

7 Future Vision Catalyzing a Paradigm Shift in Movie Watching No More The Future Everything on your phone Pick your movie, theater, and time Bring a friend or family member E - Ticket VIP Line for Concessions Preselected Seats Open Tab (feature in development): would allow for food to be delivered to your seats and your credit card on file billed when you leave.

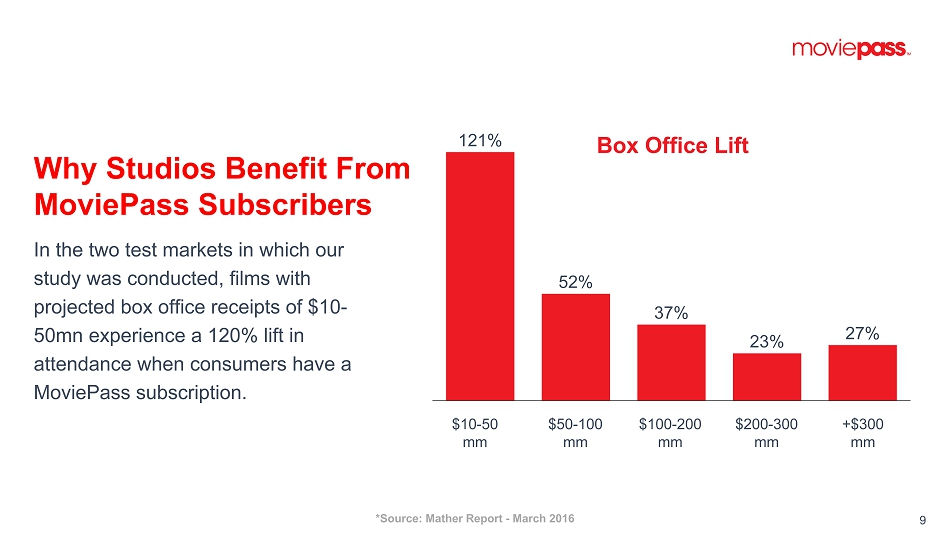

8 • Studio Movie Grill, an early adopter of MoviePass’ integrated app, saw a 400% lift in overall attendance by MoviePass subscribers from Aug - Oct 2017 . • In the two test markets in which our study was conducted, films with projected box office receipts of $10 - 50mn experience a +1 2 0% lift in attendance when consumers have a MoviePass subscription. • In a survey of MoviePass subscribers conducted over the 2017 Labor Day weekend, 75% of our subscribers said they would not have seen a movie if they had not been MoviePass subscribers. • MoviePass has received as much as a 20% discount on ticket purchases from a small group of its exhibitor partners and will try to receive a similar percentage from the share of revenue of concession sales from certain theater chains in the future . • According to MPAA, there were 718 films released in 2016 in the US and Canada. Over the 2017 Labor Day weekend, MoviePass subscribers saw approximately 200 different movies. • MoviePass available in +90% of theaters MoviePass - Key Findings

9 Why Studios Benefit From MoviePass Subscribers In the two test markets in which our study was conducted, films with projected box office receipts of $10 - 50mn experience a 120% lift in attendance when consumers have a MoviePass subscription. 121% 52% 37% 23% 27% Box Office Lift $10 - 50 mm $50 - 100 mm $100 - 200 mm $200 - 300 mm +$300 mm *Source: Mather Report - March 2016

10 Actual and Projected MoviePass Subscribers 2,100,000 August 2018 Sep. 14 2017 Aug. 31 2017 Aug. 18 2017 Aug. 14 2017 +400,000 +300,000 +150,000 12,708 Current Subscribers Estimated Future Subscribers Note: projected subscribers are based on MoviePass’ current assumptions, but no assurances can be given that such projections wi ll be achieved.

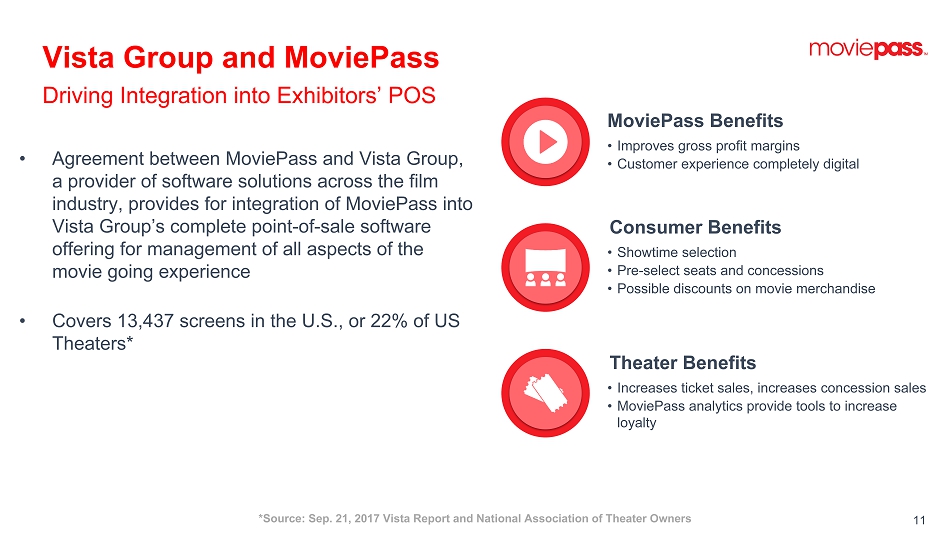

11 Vista Group and MoviePass Driving Integration into Exhibitors’ POS • Agreement between MoviePass and Vista Group, a provider of software solutions across the film industry, provides for integration of MoviePass into Vista Group’s complete point - of - sale software offering for management of all aspects of the movie going experience • Covers 13,437 s creens in the U.S., or 22% of US Theaters* MoviePass Benefits • Improves gross profit margins • Customer experience completely digital Consumer Benefits • Showtime selection • Pre - select seats and concessions • P ossible discounts on movie merchandise Theater Benefits • Increases ticket sales, increases concession sales • MoviePass analytics provide tools to increase loyalty *Source: Sep. 21, 2017 Vista Report and National Association of Theater Owners

12 Data Licensing Other Potential Revenue Opportunities Merchandise / E - Commerce Concession Partnerships International Joint Ventures + + + +

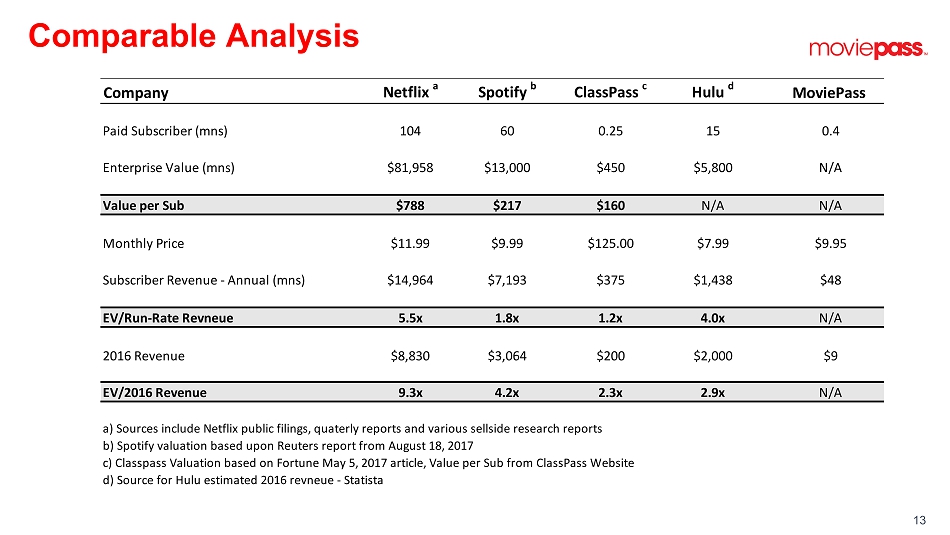

13 Comparable Analysis Company Netflix a Spotify b ClassPass c Hulu d MoviePass Paid Subscriber (mns) 104 60 0.25 15 0.4 Enterprise Value (mns) $81,958 $13,000 $450 $5,800 N/A Value per Sub $788 $217 $160 N/A N/A Monthly Price $11.99 $9.99 $125.00 $7.99 $9.95 Subscriber Revenue - Annual (mns) $14,964 $7,193 $375 $1,438 $48 EV/Run-Rate Revneue 5.5x 1.8x 1.2x 4.0x N/A 2016 Revenue $8,830 $3,064 $200 $2,000 $9 EV/2016 Revenue 9.3x 4.2x 2.3x 2.9x N/A a) Sources include Netflix public filings, quaterly reports and various sellside research reports b) Spotify valuation based upon Reuters report from August 18, 2017 c) Classpass Valuation based on Fortune May 5, 2017 article, Value per Sub from ClassPass Website d) Source for Hulu estimated 2016 revneue - Statista

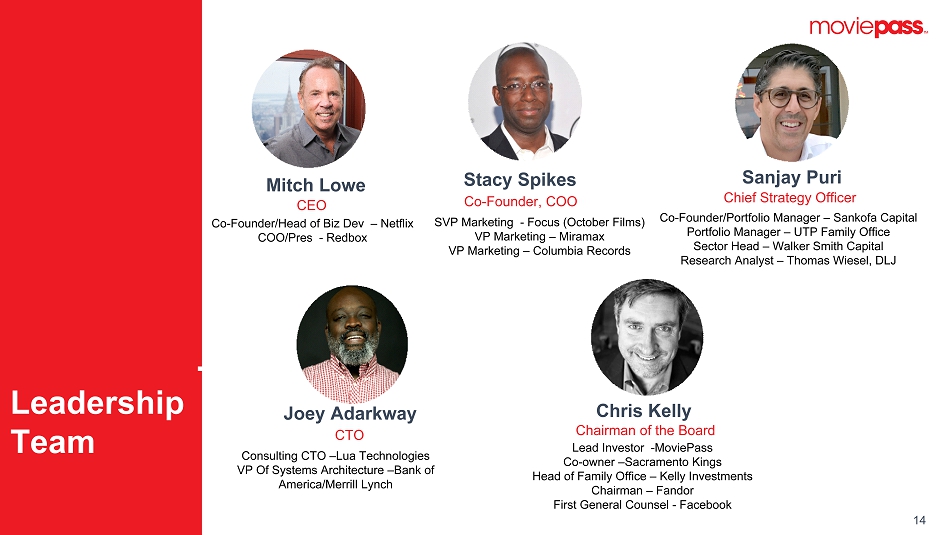

14 Leadership Team Mitch Lowe CEO Chris Kelly Chairman of the Board Sanjay Puri Chief Strategy Officer Stacy Spikes Co - Founder, COO Joey Adarkway CTO Co - Founder/Head of Biz Dev – Netflix COO/Pres - Redbox SVP Marketing - Focus (October Films) VP Marketing – Miramax VP Marketing – Columbia Records Co - Founder/Portfolio Manager – Sankofa Capital Portfolio Manager – UTP Family Office Sector Head – Walker Smith Capital Research Analyst – Thomas Wiesel, DLJ Lead Investor - MoviePass Co - owner – Sacramento Kings Head of Family Office – Kelly Investments Chairman – Fandor First General Counsel - Facebook Consulting CTO – Lua Technologies VP Of Systems Architecture – Bank of America/Merrill Lynch

15 Information Request / Follow Up Mitch Lowe mitch@moviepass.com 415 - 971 - 2994 Sanjay Puri sanjay@moviepass.com 917 - 371 - 4910

16 Appendix

• On August 15, 2017, Helios and Matheson Analytics Inc. (“HMNY”) entered into a Securities Purchase Agreement with MoviePass , as amended on Oct 6, 2017, whereby HMNY agreed to purchase shares of common stock of MoviePass amounting to 51 .71 % of the outstanding shares of MoviePass common stock on a post - transaction basis, for an aggregate purchase price of $2 8 , 5 00,000, payable as follows: ○ $ 11 , 5 00,000 already paid by HMNY to MoviePass as a loan pending the closing of the transaction; ○ 3,333,334 shares of HMNY common stock (valued at $10,000,000 for purposes of the transaction) issuable to MoviePass at the closing of the transaction; ○ A promissory note payable by HMNY to MoviePass in the principal amount of $ 5 ,000,000, payable in two equal tranches following the closing of the transaction; and ○ An additional 666,667 shares of HMNY common stock (valued at $2,000,000 for purposes of the transaction) issuable to MoviePass as a result of MoviePass having achieved at least 150,000 subscribers, which HMNY expects to issue to MoviePass upon the closing of the transaction. • HMNY has also agreed to purchase outstanding MoviePass convertible notes that will be automatically converted at the closing of the transaction which will increase HMNY’s ownership percentage by 2% for a total ownership percentage of 53.71%. • MoviePass also granted HMNY an option to purchase additional shares of MoviePass common stock for $20 million in cash based on the agreed $210 million pre - money valuation of MoviePass, pursuant to an option agreement, which, if exercised in full, would amount to an additional 8.7% ownership stake in MoviePass as of the date of the option agreement. If HMNY were to exercise the option in full prior to the closing of the transaction, its total ownership stake in MoviePass would be 62.41% as of the date of the option agreement. • MoviePass plans to apply to list its Common Stock on NASDAQ or NYSE in 2018 • Mitch Lowe to remain CEO of MoviePass • Ted Farnsworth, President and CEO of HMNY, to serve on MoviePass’ board • For further detail, please see the Current Report s on Form 8 - K filed by HMNY with the SEC on August 15 , 2017 and October 11, 2017 . 17 HMNY + MoviePass Transaction Highlights