Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - TGS International Ltd. | tgs_ex322.htm |

| EX-32.1 - CERTIFICATION - TGS International Ltd. | tgs_ex321.htm |

| EX-31.2 - CERTIFICATION - TGS International Ltd. | tgs_ex312.htm |

| EX-31.1 - CERTIFICATION - TGS International Ltd. | tgs_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended August 31, 2017

or

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||||||||||

For the transition period from ____________ to ____________

Commission File Number 333-217451

| TGS INTERNATIONAL LTD. | ||||||||||||||||||||

| (Exact name of registrant as specified in its charter) |

| NEVADA |

| n/a | ||||||||||||||||||

| (State or other jurisdiction of incorporation or organization) |

| (IRS Employer Identification No.) | ||||||||||||||||||

|

|

|

| ||||||||||||||||||

| Unit 3, 6420 - 4 Street NE, Calgary, Alberta, Canada T2K 5M8 |

| T2K 5M8 | ||||||||||||||||||

| (Address of principal executive offices) |

| (Zip Code) | ||||||||||||||||||

| (403) 616 - 9226 | ||||||||||||||||||||

| (Registrant’s telephone number, including area code) | ||||||||||||||||||||

|

| ||||||||||||||||||||

| N/A | ||||||||||||||||||||

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x YES o NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ YES ¨ NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a small reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o | ||

| Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | x | |

|

| Emerging growth company | x | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

o YES x NO

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court.

o YES o NO

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

13,530,000 common shares issued and outstanding as of October 14, 2017.

|

|

FORM 10-Q

TABLE OF CONTENTS

Contents

|

| 4 |

| ||

|

|

| |||

|

| 4 |

| ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 5 |

| |

|

| 11 |

| ||

|

| 11 |

| ||

|

|

| |||

|

| 11 |

| ||

|

|

| |||

|

| 11 |

| ||

|

| 12 |

| ||

|

| 12 |

| ||

|

| 12 |

| ||

|

| 12 |

| ||

|

| 12 |

| ||

|

| 12 |

| ||

|

|

|

|

|

|

|

| 14 |

| ||

| 2 |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

Our unaudited consolidated interim financial statements for the six month period ended August 31, 2017 form part of this quarterly report. They are stated in United States Dollars (US$) and are prepared in accordance with generally accepted accounting principles in the United States.

| 3 |

| Table of Contents |

| TGS International Ltd. | |||||

| Consolidated Statements of Financial Position | |||||

| Stated in US dollars | |||||

| As at |

|

|

| August 31, 2017 |

|

| February 28, 2017 |

| ||

|

|

| (Unaudited) |

|

| (Audited) |

| ||

| ASSETS |

| |||||||

| Current |

|

|

|

|

|

| ||

| Cash and cash equivalents |

| $ | 10,070 |

|

| $ | 20,867 |

|

| Prepaid expenses |

|

| 10,340 |

|

|

| 7,548 |

|

| Trades receivable |

|

| - |

|

|

| 1,490 |

|

|

|

|

| 20,410 |

|

|

| 29,905 |

|

| Long-term |

|

|

|

|

|

|

|

|

| Equipment & Fixture |

|

| 9,918 |

|

|

| 9,918 |

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

| $ | 30,328 |

|

| $ | 39,823 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES | ||||||||

| Current |

|

|

|

|

|

|

|

|

| Trades and other payables |

| $ | 11,812 |

|

| $ | 19,955 |

|

| Due to related parties (Note 4) |

|

| 20,358 |

|

|

| - |

|

|

|

|

| 32,170 |

|

|

| 19,955 |

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

| 32,170 |

|

|

| 19,955 |

|

|

|

|

|

|

|

|

|

|

|

| STOCKHOLDERS' DEFICIENCY | ||||||||

|

|

|

|

|

|

|

|

|

|

| Capital Stock |

|

|

|

|

|

|

|

|

| Authorized |

|

|

|

|

|

|

|

|

| 200,000,000 common stock, voting, par value $0.0001 each |

|

|

|

|

|

|

|

|

| 100,000,000 preferred stock, non-voting, par value $0.0001 each |

|

|

|

|

|

|

|

|

| Issued |

|

|

|

|

|

|

|

|

| 13,530,000 common stock (Note 5) |

|

| 1,353 |

|

|

| 1,353 |

|

| Additional paid in capital (Note 5) |

|

| 33,094 |

|

|

| 33,094 |

|

| Deficit |

|

| (35,556 | ) |

|

| (14,327 | ) |

| Accumulated other comprehensive income |

|

| (733 | ) |

|

| (252 | ) |

|

|

|

|

|

|

|

|

|

|

| Total Stockholders' Deficiency |

|

| (1,842 | ) |

|

| 19,868 |

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders' Deficiency |

| $ | 30,328 |

|

| $ | 39,823 |

|

|

|

|

|

|

|

|

|

|

|

| Going Concern (Note 1) |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements

| 4 |

| Table of Contents |

| TGS International Ltd. | |||||

| Consolidated Statements of Comprehensive Loss | |||||

| Stated in US dollars | |||||

| For the period ended August 31, 2017 | |||||

| (Unaudited) |

|

|

| Three months ended August 31, |

|

| Six months ended August 31, |

| ||

|

|

| 2017 |

|

| 2017 |

| ||

|

|

|

|

|

|

|

| ||

| Revenue |

| $ | 6,708 |

|

| $ | 14,525 |

|

| Cost of goods sold |

|

| (3,409 | ) |

|

| (8,161 | ) |

| Gross profit |

|

| 3,299 |

|

|

| 6,364 |

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

| Filing fees |

|

| 508 |

|

|

| 1,753 |

|

| General & administration |

|

| 1,926 |

|

|

| 4,561 |

|

| Management fee |

|

| 3,305 |

|

|

| 4,786 |

|

| Professional fees |

|

| 6,140 |

|

|

| 16,493 |

|

|

|

|

| (11,879 | ) |

|

| (27,593 | ) |

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

| (8,580 | ) |

|

| (21,229 | ) |

|

|

|

|

|

|

|

|

|

|

| Other comprehensive loss |

|

|

|

|

|

|

|

|

| Foreign currency adjustment |

|

| (317 | ) |

|

| (481 | ) |

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss |

| $ | (8,897 | ) |

| $ | (21,710 | ) |

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per stock |

| $ | (0.001 | ) |

| $ | (0.002 | ) |

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding |

|

| 13,350,000 |

|

|

| 13,530,000 |

|

The accompanying notes are an integral part of these consolidated financial statements

| 5 |

| Table of Contents |

TGS International Ltd. Consolidated Statements of Changes in Equity Stated in US dollars (Unaudited)

|

|

| Common Stock |

|

| Additional Paid in |

|

| Accumulated Other Comprehensive |

|

|

|

|

|

|

| |||||||||

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| Income (Loss) |

|

| Deficit |

|

| Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Balance, December 1, 2016 |

|

| - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| Common stock issued |

|

| 13,530,000 |

|

|

| 1,353 |

|

|

| 30,103 |

|

|

| - |

|

|

| - |

|

|

| 31,456 |

|

| Stockholder contribution on acquisition |

|

| - |

|

|

| - |

|

|

| 2,991 |

|

|

| - |

|

|

| - |

|

|

| 2,991 |

|

| Net loss for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (14,327 | ) |

|

| (14,327 | ) |

| Other comprehensive loss for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (252 | ) |

|

| - |

|

|

| (252 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, February 28, 2017 |

|

| 13,530,000 |

|

|

| 1,353 |

|

|

| 33,094 |

|

|

| (252 | ) |

|

| (14,327 | ) |

|

| 19,868 |

|

| Net loss for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (21,229 | ) |

|

| (21,229 | ) |

| Other comprehensive loss for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (481 | ) |

|

| - |

|

|

| (481 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, August 31, 2017 |

|

| 13,530,000 |

|

| $ | 1,353 |

|

| $ | 33,094 |

|

| $ | (733 | ) |

| $ | (35,556 | ) |

| $ | (1,842 | ) |

The accompanying notes are an integral part of these consolidated financial statements

| 6 |

| Table of Contents |

| TGS International Ltd. | |||

| Consolidated Statements of Cash Flows | |||

| Stated in US dollars | |||

| For the period ended August 31, 2017 | |||

| (Unaudited) |

|

|

| Six months ended August 31, |

| |

|

|

| 2017 |

| |

| Operating activities |

|

|

| |

| Net loss for the period |

| $ | (21,229 | ) |

|

|

|

|

|

|

| Changes in non-cash working capital: |

|

|

|

|

| Trades receivable |

|

| 1,500 |

|

| Prepaid expenses |

|

| (2,251 | ) |

| Trade and other payables |

|

| (8,838 | ) |

| Due to related parties |

|

| 19,391 |

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

| (11,427 | ) |

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

|

| 630 |

|

|

|

|

|

|

|

| Net cash decrease for period |

|

| (10,797 | ) |

|

|

|

|

|

|

| Cash and cash equivalents, beginning of the period |

|

| 20,867 |

|

|

|

|

|

|

|

| Cash and cash equivalents, end of the period |

| $ | 10,070 |

|

The accompanying notes are an integral part of these consolidated financial statements

| 7 |

| Table of Contents |

NOTE 1 - NATURE AND CONTINUANCE OF OPERATIONS

TGS International Ltd. (“TGS” or the “Corporation”) was incorporated in the state of Nevada, United States on December 1, 2016. On December 21, 2016, the Corporation entered into a business combination by acquiring TGS Building Products Ltd., (“TGS Alberta”) (Note 3). TGS Alberta, which was incorporated on March 8, 2016 specializes in the sale and distribution and installation of building materials and is focused in the North American market.

These condensed interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Corporation and its subsidiaries will be able to meet its obligations and continue its operations for next fiscal year. Realization values may be substantially different from carrying values as shown and these consolidated financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Corporation be unable to continue as a going concern. At August 31, 2017, the Corporation had not yet achieved profitable operations and has a negative working capital of $11,760 and accumulated losses of $35,556 since its inception. The Corporation expects to incur further losses in the development of its business, all of which casts substantial doubt about the Corporation’s ability to continue as a going concern. The Corporation’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management anticipates that additional funding will be in the form of equity financing from the sale of common stock. Management may also seek to obtain short-term loans from the directors of the Corporation. There are no current arrangements in place for equity funding or short-term loans.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

This summary of significant accounting policies is presented to assist in understanding the condensed interim consolidated financial statements. The condensed interim consolidated financial statements and notes are the representations of the Corporation’s management, who is responsible for their integrity and objectivity. The condensed interim consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and Article 210 8-03 of Regulation S-X, and therefore do not include all the information necessary for a fair presentation of financial position, results of operations and cash flows in conformity with generally accepted accounting principles. These condensed interim consolidated financial statements should be read in conjunction with the annual consolidated financial statements and footnotes for the year ended February 28, 2017 included in the Corporation’s filed Form S-1.

Basis of Presentation

The Corporation’s condensed interim consolidated financial statements included herein are prepared under the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America. These condensed interim consolidated financial statements include the Corporation’s wholly owned subsidiary, TGS Building Products Ltd., and 100 percent of its assets, liabilities and net income or loss. All inter-company accounts and transactions have been eliminated.

| 8 |

| Table of Contents |

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.)

While the information presented in the accompanying condensed interim consolidated financial statements is unaudited, it includes all adjustments, which are, in the opinion of management, necessary to present fairly the financial position, results of operation and cash flows for the interim periods presented. All adjustments are of a normal recurring nature. Operating results for the period ended August 31, 2017 are not necessarily indicative of the results that can be expected for the year ended February 28, 2018.

Use of Estimates

The preparation of condensed interim consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Recent Accounting Pronouncements

The Corporation adopts new pronouncements relating to accounting principles generally accepted in the United States of America applicable to the Corporation as they are issued, which may be in advance of their effective date. Management does not believe that any recently issued, but not yet effective accounting standards, if currently adopted, would have a material effect on the accompanying consolidated financial statements.

In August 2016, the Financial Accounting Standards Board (“FASB) issued Accounting Standards Update (“ASU”) 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. This ASU addresses the classification of certain specific cash flow issues including debt prepayment or extinguishment costs, settlement of certain debt instruments, contingent consideration payments made after a business combination, proceeds from the settlement of certain insurance claims and distributions received from equity method investees. This ASU is effective for fiscal years beginning after December 15, 2017 (fiscal 2019), and interim periods within those fiscal years, with early adoption permitted. An entity that elects early adoption must adopt all of the amendments in the same period. The Corporation does not expect the adoption of this guidance will have a material impact on its consolidated financial statements.

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business. This ASU clarifies the definition of a business in order to assist companies in the evaluation of whether transactions should be accounted for as acquisitions or disposals of assets or businesses. The amended guidance also removes the existing evaluation of a market participant’s ability to replace missing elements and narrows the definition of output to achieve consistency with other topics. This ASU is effective for fiscal years beginning after December 15, 2016 (fiscal 2018), and interim periods within those fiscal years. The Corporation does not expect the adoption of this guidance will have a material impact on its consolidated financial statements.

| 9 |

| Table of Contents |

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.)

In January 2017, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. This ASU requires the Company to perform its annual, or applicable interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. An impairment charge must be recognized at the amount by which the carrying amount exceeds the fair value of the reporting unit; however, the charge recognized should not exceed the total amount of goodwill allocated to that reporting unit. Income tax effects resulting from any tax deductible goodwill should be considered when measuring the goodwill impairment loss, if applicable. This ASU is effective for annual or interim goodwill impairment tests in fiscal years beginning after December 15, 2019 (fiscal 2021). The Corporation does not expect the adoption of this guidance will have a material impact on its consolidated financial statements.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force) and the SEC did not or are not believed to have a material impact on the Corporation’s present or future consolidated financial statements.

NOTE 3 - BUSINESS ACQUISITION

On December 21, 2016, the Corporation acquired all of the issued and outstanding stock of TGS Alberta from related parties for cash of $154. This acquisition enables the company to operate in the Canadian market.

| Consideration: |

| $ |

| |

| Cash paid |

|

| 154 |

|

| Stockholder contribution |

|

| 2,991 |

|

|

|

|

| 3,145 |

|

| Net assets received: |

|

|

|

|

| Cash |

|

| (23 | ) |

| Trade receivables |

|

| 3,916 |

|

| Equipment |

|

| 9,783 |

|

| Trade and other payables |

|

| (10,570 | ) |

| Foreign exchange |

|

| 39 |

|

|

|

|

| 3,145 |

|

The acquisition constitutes a business combination and is accounted for in accordance with Accounting Standards Codification 805 - Business Combinations.

| 10 |

| Table of Contents |

NOTE 3 - BUSINESS ACQUISITION (CONT.)

The acquisition date fair value of consideration transferred in the transaction was $3,145 which approximates the fair value of the net assets received. All costs associated with the transaction were expensed as incurred. At the time of acquisition, gross contractual amounts receivable were $3,916, and were collected subsequent to the transaction.

NOTE 4 - DUE TO RELATED PARTIES

As at August 31, 2017, the Corporation was obligated to shareholders for funds advanced to the Corporation for working capital, in the amount of $20,358 (February 28, 2017 - $Nil). The advances are unsecured and no interest rate or payback schedule has been established.

NOTE 5 - COMMON STOCK

On December 1, 2016, the date of incorporation, the Corporation received $723 to issue 9,500,000 common stocks.

On January 28, 2017, the Corporation closed a private placement to issue 4,030,000 common stocks for gross proceeds of $30,733.

| 11 |

| Table of Contents |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

FORWARD LOOKING STATEMENTS

This quarterly report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our unaudited financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this quarterly report.

In this quarterly report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this quarterly report, the terms “we”, “us”, “our” or the “company” mean TGS International Ltd., a Nevada corporation, and our wholly owned subsidiary, TGS Building Products Ltd., an Alberta corporation, unless otherwise indicated.

General Overview

TGS International Ltd. (“TGS International”) was established on December 1, 2016 in Nevada, USA. On December 21, 2016, TGS International acquired TGS Building Products Ltd. of Alberta (“TGS Alberta”) as its wholly subsidiary. TGS Alberta was established in March, 2016 in Alberta, Canada with focus in the sale and installation of PVC wall and ceiling panels in addition to renovation business in North America. TGS Alberta has worked closely with a PVC products manufacturer in China to bring the Company’s newly-formulated PVC products into Canada. We are a development stage company; having entered into the development stage on December 21, 2016.

Our executive offices are located at Unit 3, 6420 – 4 Street NE, Calgary, Alberta, Canada T2K 5M8. Our telephone number is (403) 616 - 9226.

Our Company specializes in the design, procurement, marketing, sale, distribution, and installation of indoor PVC (polyvinyl chloride) wall and ceiling panels for residential, commercial, and industrial applications. Initially, the Company is focusing in the production and sale of white PVC wall and ceiling panels in standard width of 16 inches to better streamline its operations and to ensure a quality and timely delivery of its products to customers. Colored and textured panels will be offered as special custom orders on a per project basis.

| 12 |

| Table of Contents |

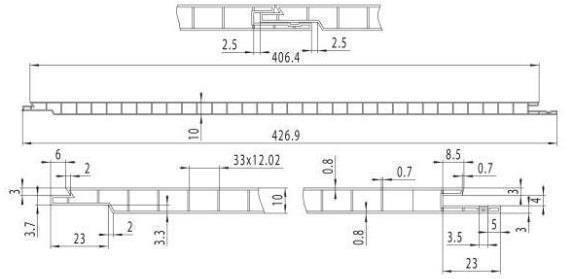

The Company has designed a mold for its PVC panels as shown below. The mold has been manufactured and placed with its manufacturer in China.

(dimensions in mm)

In addition to PVC wall and ceiling panels, the company also offers a selection of PVC floorings as a part of the company’s product line.

Plan of operation for the 12 months beginning September 1, 2017

We intend to continue to develop our PVC panel sales and distribution network during the twelve months beginning September 1, 2017. We estimate our operating expenses and working capital requirements for the twelve month period beginning September 1, 2017 to be as follows:

| Estimated Expenses For the Twelve Month Period Beginning |

| Planned |

| Anticipated |

| ||

| September 1, 2017 |

| Expenditures |

| Completion | |||

|

| |||||||

| Professional Fees (legal, accounting, audit) |

| $ | 40,000 |

| 12 months |

| |

| Inventory |

| $ | 50,000 |

| 12 months |

| |

| Website Design, Marketing, |

| 10,000 |

| 12 months |

| ||

| General & administrative |

| $ | 25,000 |

| 12 months |

| |

| Total |

| $ | 125,000 | ||||

At present, our cash requirements for the next 12 months (beginning September 1, 2017) outweigh the funds available to maintain or develop our business. Of the estimated $125,000 that we require for the 12 months, we had approximately $20,410 in cash and cash equivalents as at August 31, 2017, and $10,223in cash and cash equivalents as at October 14, 2017. In order to improve our liquidity, we plan to pursue additional equity financing from private investors or possibly a registered public offering. We do not currently have any definitive arrangements in place for the completion of any further private placement financings and there is no assurance that we will be successful in completing any further private placement financings. If we are unable to raise sufficient additional financial, we will be required to scale back our business plan to accommodate the funds available to us. This would involve the elimination of all non-essential expenditures, such as inventory purchases, marketing & web design, and administrative expenses not related to our public reporting requirements.

| 13 |

| Table of Contents |

If we are able to raise the required funds to fully implement our business plan, we plan to implement the business actions in the order provided below. If we are not able to raise all required funds, we will prioritize our corporate activities as chronologically as follows:

September 1, 2017 to August 31, 2018:

|

| · | Market our products and services to our various contacts |

|

| · | Establish a partnership or strategic relationship with builders, and other distribution companies. |

|

| · | Complete inventory purchases. |

|

| · | Design our website. |

|

| · | Design marketing materials. |

|

| · | Participate at trade shows. |

Results of Operations

Three Months and Six Months Ended August 31, 2017

|

|

| Three Months Ended August 31, 2017 |

|

| From Six Months Ended August 31, 2017 |

| ||

| Revenue |

| $ | 6,708 |

|

| $ | 14,525 |

|

| Gross Profit |

| $ | 3,299 |

|

| $ | 6,364 |

|

| Operating Expenses |

| $ | 11,879 |

|

| $ | 27,593 |

|

| Net Loss |

| $ | (8,580 | ) |

| $ | (21,229 | ) |

Revenues

We earned revenues of $6,708, gross profit of $3,299, and incurred a net loss of $8,580 for the period three months ended August 31, 2017. During the six months ended August 31, 2017, we earned revenues of $14,525, gross profit of $6,364, and incurred a net loss of $21,229.

The following table summarizes our expenses by category incurred during the three and six month periods ended August 31, 2017:

|

|

| Three Months Ended August 31, 2017 |

|

| Six Months Ended August 31, 2017 |

| ||

| Filing Fees |

| $ | 508 |

|

| $ | 1,753 |

|

| General and administrative |

|

| 1,926 |

|

|

| 4,561 |

|

| Management Fee |

|

| 3,305 |

|

|

| 4,786 |

|

| Professional Fees |

|

| 6,140 |

|

|

| 16,493 |

|

| Total Expenses |

| $ | (11,879 | ) |

| $ | (27,593 | ) |

Our expenses during the three and six months ended August 31, 2017 consisted primarily of professional fees (legal and audit fees), management fees, general & administrative fees, and filing fees incurred in the preparation and filing with the Securities and Exchange Commission of a Registration Statement on Form S-1 related to the resale to the public by certain selling shareholders of up to 4,030,000 shares of our common stock. The Registration Statement became effective on October 4, 2017

| 14 |

| Table of Contents |

Liquidity and Capital Resources

Our balance sheet as of August 31, 2017 reflects current assets of $20,410 consisting of cash and cash equivalents ($10,070) and prepaid expenses ($10,340), and a working capital deficit in the amount of $11,760. Our liabilities of $32,170 as at August 31, 2017 consisted of trades and other payables ($11,812), and $20,358 due to related parties. By comparison, as at February 28, 2017 we had current assets of $29,905 consisting of cash and cash equivalents ($20,867), prepaid expenses ($7,548) and trade receivable ($1,490). Our liabilities as at February 28, 2017 consisted entirely of trades and other payables. We have insufficient working capital to carry out our stated plan of operation for the next twelve months.

Working Capital

|

|

| At August 31, 2017 |

|

| At February 28, 2017 |

| ||

| Current assets |

| $ | 20,410 |

|

| $ | 29,905 |

|

| Current liabilities |

|

| 32,170 |

|

|

| 19,955 |

|

| Working capital (deficit) |

| $ | (11,760 | ) |

| $ | 9,950 |

|

As of August 31, 2017, we had accumulated losses of $35,556 since inception, have not achieved profitable operations, and expect to incur additional losses in the development of our business, all of which casts substantial doubt about our ability to continue as a going concern.

Cash Flows

|

|

| Six Months Ended |

| |

|

|

| August 31, |

| |

|

|

| 2017 |

| |

| Net cash (used in) operating activities |

| $ | (9,176 | ) |

| Effect of exchange rate on cash |

|

| 630 |

|

| Net (decrease) in cash during period |

| $ | (10,797 | ) |

Operating Activities

Net cash used in operating activities during the six months ended August 31, 2017 was $11,427. During the same period we experienced a $630 cash gain resulting from exchange rate changes resulting in an aggregate cash loss of $10,797 for the period.

Financing Activities

We did not engage in any financing activities during the six months ended August 31, 2017.

| 15 |

| Table of Contents |

Future Financings

We anticipate continuing to rely on related party loans or equity sales of our common stock in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. Importantly, there is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing (whether from related parties or otherwise) to fund our planned business activities.

We presently do not have any arrangements or commitments for additional financing for the expansion of our operations, and no potential lines of credit or sources of financing are currently available for the purpose of proceeding with our plan of operations.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, and capital expenditures or capital resources that are material to stockholders.

Critical Accounting Policies

Basis of Presentation

The Corporation’s condensed interim consolidated financial statements included herein are prepared under the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America. These condensed interim consolidated financial statements include the Corporation’s wholly owned subsidiary, TGS Building Products Ltd., and 100 percent of its assets, liabilities and net income or loss. All inter-company accounts and transactions have been eliminated.

While the information presented in the accompanying condensed interim consolidated financial statements is unaudited, it includes all adjustments, which are, in the opinion of management, necessary to present fairly the financial position, results of operation and cash flows for the interim periods presented. All adjustments are of a normal recurring nature. Operating results for the period ended August 31, 2017 are not necessarily indicative of the results that can be expected for the year ended February 28, 2018.

Recent Accounting Pronouncements

The Corporation adopts new pronouncements relating to accounting principles generally accepted in the United States of America applicable to the Corporation as they are issued, which may be in advance of their effective date. Management does not believe that any recently issued, but not yet effective accounting standards, if currently adopted, would have a material effect on the accompanying consolidated financial statements.

In August 2014, the FASB issued amended standards No. 2014-15, Presentation of Financial Statements - Going Concern (''ASU 2014-15"), to provide guidance about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide related footnote disclosures requirement. The amendments (1) provide a definition of the term substantial doubt, (2) require an evaluation for each annual and interim reporting period, (3) provide principles for considering the mitigating effect of management’s plans, (4) require certain disclosures when substantial doubt is alleviated as a result of consideration of management’s plans, (5) require an express statement and other disclosures when substantial doubt is not alleviated, and (6) require an assessment for a period of one year after the date that the financial statements are issued (or available to be issued). ASU 2014-15 is effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. Early adoption is permitted. The Corporation does not expect the adoption of this guidance will have a material impact on its consolidated financial position.

| 16 |

| Table of Contents |

In July 2015, the FASB issued No. 2015-11, Inventory - Simplifying the Measurement of Inventory ("ASU 2015-11"). ASU 2015-11 is additional guidance regarding the subsequent measurement of inventory by requiring inventory to be measured at the lower of cost and net realizable value. This guidance is effective for fiscal years and interim periods beginning after December 15, 2016. Early adoption is permitted. The Corporation does not expect the adoption of this guidance will have a material impact on its consolidated financial position, results of operations or cash flows.

In November 2015, the FASB issued ASU 2015-17, Income Taxes (Topic 740). This ASU simplifies the presentation of deferred income taxes by requiring that deferred tax assets and liabilities be classified as non-current in a classified statement of financial position. This ASU may be applied either prospectively to all deferred tax assets and liabilities, or retrospectively to all periods presented for annual periods beginning after December 16, 2016 and interim periods thereafter (fiscal 2018), with early adoption permitted, and may require additional disclosure based on the application method selected. The Corporation prospectively early adopted this ASU, and the adoption of this guidance did not have a material impact on its consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This ASU amends guidance on reporting credit losses for assets held at amortized cost basis and available for sale debt securities. This ASU is effective for fiscal years beginning after December 15, 2019 (fiscal 2021), including interim periods within those fiscal years, with early adoption permitted. The Corporation does not expect the adoption of this guidance will have a material impact on its consolidated financial statements.

In August 2016, the Financial Accounting Standards Board (“FASB) issued Accounting Standards Update (“ASU”) 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. This ASU addresses the classification of certain specific cash flow issues including debt prepayment or extinguishment costs, settlement of certain debt instruments, contingent consideration payments made after a business combination, proceeds from the settlement of certain insurance claims and distributions received from equity method investees. This ASU is effective for fiscal years beginning after December 15, 2017 (fiscal 2019), and interim periods within those fiscal years, with early adoption permitted. An entity that elects early adoption must adopt all of the amendments in the same period. The Corporation does not expect the adoption of this guidance will have a material impact on its consolidated financial statements.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force) and the SEC did not or are not believed to have a material impact on the Corporation’s present or future consolidated financial statements.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 4. Controls and Procedures

Management’s Report on Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our president (our principal executive officer) and our chief financial officer (our principal financial officer and principle accounting officer) to allow for timely decisions regarding required disclosure.

As of the end of the quarter covered by this report, we carried out an evaluation, under the supervision and with the participation of our president (our principal executive officer) and our chief financial officer (our principal financial officer and principle accounting officer), of the effectiveness of the design and operation of our disclosure controls and procedures. Based on the foregoing, our management concluded that our internal controls are not effective. due to material weaknesses in our control environment and financial reporting process, lack of a functioning audit committee, a majority of independent members and a majority of outside directors on our Board of Directors, resulting in ineffective oversight in the establishment, and lack of monitoring of required internal control and procedures.

Changes in Internal Control Over Financial Reporting

During the period covered by this report there were no changes in our internal control over financial reporting that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 17 |

| Table of Contents |

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, executive officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Risks Associated with Our Business

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern.

We incurred cumulative net losses of $35,556 during the period from December 1, 2016 (inception) to August 31, 2017 and had cash (and cash equivalents) of $20,410 as at August 31, 2017. We are in the development stage and have yet to attain profitable operations and in their report on our financial statements for the fiscal year ended February 28, 2017, our independent auditors included an explanatory paragraph regarding the substantial doubt about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that led to this disclosure by our independent auditors.

Because our officers and directors have no experience in managing a public company our business may be at a competitive disadvantage.

Our President, Chief Executive Officer and director, Chung Szeto, and our Secretary, Treasurer, Chief Financial Officer and Director, Sau Chun Yu, lack public company experience and do not possess a sophisticated knowledge of the requirements of United States securities laws, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Neither Mr. Szeto nor Ms. Yu has ever had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our management may not be able to implement programs and policies in an effective and timely manner which adequately responds to our legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

If we are unable to obtain financing in the amounts and on terms and dates acceptable to us, we may not be able to expand or continue our operations and developments and so may be forced to scale back or cease operations or discontinue our business and you could lose your entire investment.

We require approximately $125,000 to carry out our planned business activities over the next 12 months and had approximately $20,410 in cash and cash equivalents on hand as of August 31, 2017 and $10,223in cash and cash equivalents as at October 14, 2017. We do not currently have any arrangements for additional financing. We will have to raise additional funds for the development of our business and the marketing of our products. Such additional funds may be raised through the sale of additional stock, stockholder and director advances and/or commercial borrowing. There can be no assurance that a financing will continue to be available if necessary to meet these continuing development costs or, if the financing is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us will result in a significant dilution in the equity interests of our stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may not be able to expand or continue our operations and developments and so may be forced to scale back or cease operations or discontinue our business and you could lose your entire investment.

We may not be able to compete effectively against other companies that have existed for a longer period and have greater financial resources.

We compete in a market that is highly competitive and expect competition to intensify in the future. We will seek to compete with a variety of developing and established companies, including those specialized exclusively in the sale of PVC panels, as well as those engaged in the sale of broader portfolios of hardware and building materials. Many of our prospective competitors have significantly greater financial, technical, and marketing resources than our company, and many have established consumer brands, preferential supplier relationship, and developed retail distribution networks, both traditional and online. We may not be able to compete successfully against these competitors. If we are unable to effectively compete in our chosen markets, our results would be negatively affected, we may be unable to implement our business plan, and our business may ultimately fail.

| 18 |

| Table of Contents |

Our products or our company may be subject to product liability claims which may be detrimental to our reputation and financial condition.

Although we are a distributor and not a manufacturer of products, and therefore not directly responsible for potential flaws or defects in any of the goods which we intend to sell, we may become implicated in product liability claims as a result of alleged or actual harm related to the use of our products by end users. Whether we are directly implicated as a named defendant in such a civil claim, or indirectly implicated by association as a product distributor, we may suffer reputational and economic harm to the extent that the safety or quality of our products is called into question. Additionally, if we are directly named as a defendant in such a civil claim, we expect to incur significant legal expense and, if we our held responsible for injury arising from any of our products, significant additional financial liability. Although we intend to carry product liability insurance to safeguard against potential claims, any such claims could irreparably harm our reputation, our financial condition, and ultimately cause our business to fail.

We depend on third parties for our product supply and therefore, if they fail to perform, we may not be able to effectively operate our business.

To generate significant customer traffic, volume of purchases and repeat purchases that we believe are crucial to obtaining sufficient revenues, we must develop and maintain customer trust in the quality of goods which we deliver, in the timeliness of our delivery and installation services, among other factors. If for any reason any of our suppliers fails to perform, we may not be able to service our customers (buyers) effectively and thereby may lose customers or damage our reputation. Furthermore, if we do not secure sufficient number of suppliers to supply our products, then we may not have a successful product offering and may not attract customers. In addition, the success of our business requires that we establish relationships with professionals in strategic regions around the world who can, through their expertise, source and nurture relationships to develop our business. If we are unable to establish such relationships, we may be unable to procure goods or on terms acceptable to us, and our business may fail.

Compliance with rules and requirements applicable to public companies will cause us to incur increased costs, which may negatively affect our results of operations.

We are subject to a numbers of laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act and related regulations implemented by the SEC. Unlike private companies, we must invest significant resources to comply with current and future securities laws, regulations and standards. This investment will result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities in favor of compliance related activities. In that regard, we estimate that, based on our anticipated public reporting obligations, we must dedicate approximately $40,000 per year in respect of legal, auditing, accounting and filing costs. Furthermore, the laws, regulations and standards that are applicable to our Company are subject to change, which could result in continuing uncertainty regarding compliance matters, and higher compliance and disclosure costs. If we are unable to benefit from our status as a reporting company by establishing a public market for our securities in order to attract investment, the ongoing costs of our public reporting obligations will have a material adverse effect on our financial condition and results of operations.

Because our principal assets and our sole director and officer are located outside of the United States, it may be difficult for you to enforce your rights based on U.S. Federal Securities Laws against us or our sole officer and director, or to enforce U.S. Court Judgments against us or our sole officer and director in Canada.

Our sole officer and directors resides in Canada. In addition, although we are a Nevada corporation, our primary assets, which include cash, trade receivables, and any inventory we may acquire, will be located outside of the United States. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the U.S. Federal securities laws against us in the courts of either the U.S. or in Canada and, even if civil judgments are obtained in U.S. courts, to enforce such judgments against our sole officer and director in courts of Canada. Further, it is unclear whether extradition treaties now in effect between the United States and Canada would permit effective enforcement against us or our sole officer and director of criminal penalties, under the U.S. Federal securities laws or otherwise.

| 19 |

| Table of Contents |

Our officers are engaged as consultants instead of employees of our company.

Having our officers engaged as consultants instead of employees poses the risk to our company that, perhaps, our consultant may not always be available. If one of our consultants has other clients, we may be at a lower priority until we are fit into their schedule. Additionally, most business decisions that need additional consultation are top priority and have an upcoming and hard-set deadline.

Further, when we engage consultants rather than employees, we do not have the advantages of an employee, such as consistency, dependability, and availability. If we need our employee to work on a project, all we have to do is assign it and wait for it to be completed. As the business owner, we won’t be lowly prioritized as we would with a consultant. Contrary to a consultant, an employee will maintain focus on our objective, rather than furthering his/her career by taking on additional clients. Many consultants will leave clients behind once they secure higher-paying clients.

Unlike employees, whom we can closely supervise and monitor, independent contractors enjoy certain autonomy to decide how best to do the task for which we hired them. We may be liable for injuries a consultant suffers on the job. Employees who are injured on the job are usually covered by workers' compensation insurance. In exchange for the benefits they receive for their injuries, these employees give up the right to sue their employer for damages. Consultants are not covered by workers’ compensation, which means that if they are injured on the job, they might be able to sue us and recover damages.

We expect to be directly affected by fluctuations in the general economy.

Demand for goods is affected by the general global economic conditions. When economic conditions are favorable,, commercial and residential construction increase. Under such circumstances, purchases of building and renovation materials, such as PVC panels, generally increase. When economic conditions are less favorable, sales of building and renovation materials are generally lower. In addition, we may experience more competitive pricing pressure during economic downturns. Therefore, any significant economic downturn or any future changes in consumer spending habits could have a material adverse effect on our financial condition and results of operations.

We expect our products to be subject to changes in customer taste.

The markets for our products are subject to changing customer tastes and the need to create and market new products. Demand for construction finishing materials, such as wall and ceiling paneling, is influenced by the popularity of certain aesthetics, cultural and demographic trends, marketing and advertising expenditures and general economic conditions. Because these factors can change rapidly, customer demand also can shift quickly. Some goods appeal to customers for only a limited time. The success of new product introductions depends on various factors, including product selection and quality, sales and marketing efforts, timely production and delivery and customer acceptance. We may not always be able to respond quickly and effectively to changes in customer taste and demand due to the amount of time and financial resources that may be required to bring new products to market. The inability to respond quickly to market changes could have a material adverse effect on our financial condition and results of operations.

If we are unable to successfully manage growth, our operations could be adversely affected, and our business may fail.

Our progress is expected to require the full utilization of our management, financial and other resources. Our ability to manage growth effectively will depend on our ability to improve and expand operations, including our financial and management information systems, and to recruit, train and manage sales personnel. There can be no assurance that management will be able to manage growth effectively.

Because we do not have sufficient insurance to cover our business losses, we might have uninsured losses, increasing the possibility that you may lose your investment.

We may incur uninsured liabilities and losses as a result of the conduct of our business. We do not currently maintain any comprehensive liability or property insurance. Even if we obtain such insurance in the future, we may not carry sufficient insurance coverage to satisfy potential claims. We do not carry any business interruption insurance.

| 20 |

| Table of Contents |

We may have liabilities to affiliated or unaffiliated third parties incurred in the regular course of our business.

We regularly do business with third party vendors, customers, suppliers and other third parties and thus we are always subject to the risk of litigation from customers, employees, suppliers or other third parties because of the nature of our business. Litigation could cause us to incur substantial expenses and, negative outcomes of any such litigation could add to our operating costs which would reduce the available cash from which we could fund our ongoing business operations.

The loss of the services of our executive officers would disrupt our operations and interfere with our ability to compete.

We depend upon the continued contributions of our executive officers. Our executive officers handle all of the responsibilities in the area of corporate administration and business development. We do not carry key person life insurance on any of their lives and the loss of services of any of these individuals could disrupt our operations and interfere with our ability to compete with others.

Risks Associated with Our Common Stock

There is no active trading market for our common stock and if a market for our common stock does not develop, our investors will be unable to sell their shares.

There has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop or be sustained after this Offering. Since we have completed a registration of our common shares on Form S-1, effective October 4, 2017, we intend to identify a market maker to file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTCQB tier of the OTC Markets electronic quotation system. We must satisfy certain criteria in order for our application to be accepted. We do not currently have a market maker willing to participate in this application process, and even if we identify a market maker, there can be no assurance as to whether we will meet the requisite criteria or that our application will be accepted. Our common stock may never be quoted on the OTCQB or a public market for our common stock may not materialize if it becomes quoted.

If our securities are not eligible for initial or continued quotation on the OTCQB or if a public trading market does not develop, purchasers of the common stock in this Offering may have difficulty selling or be unable to sell their securities should they desire to do so, rendering their shares effectively worthless and resulting in a complete loss of their investment.

If we do not file a Registration Statement on Form 8-A to become a mandatory reporting company under Section 12(g) of the Securities Exchange Act of 1934, we will continue as a reporting company and will not be subject to the proxy statement requirements, and our officers, directors and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity, all of which could reduce the value of your investment and the amount of publicly available information about us.

As a result of the registration of our common shares on Form S-1 effective October 4, 2017, as required under Section 15(d) of the Securities Exchange Act of 1934, we will file periodic reports with the Securities and Exchange Commission through October, 2018, including a Form 10-K for the year ended February 28, 2017 and a Form 10-Q for the six months ended August 31, 2018. At or prior to February 28, 2017, we intend voluntarily to file a registration statement on Form 8-A which will subject us to all of the reporting requirements of the 1934 Act. This will require us to file quarterly and annual reports with the SEC and will also subject us to the proxy rules of the SEC. In addition, our officers, directors and 10% stockholders will be required to submit reports to the SEC on their stock ownership and stock trading activity. We are not required under Section 12(g) or otherwise to become a mandatory 1934 Act filer unless we have more than 2,000 shareholders (of which 500 may be unaccredited) and total assets of more than $10 million on February 28, 2018 If we do not file a registration statement on Form 8-A at or prior to February 28, 2018, we will continue as a reporting company and will not be subject to the proxy statement requirements of the 1934 Act, and our officers, directors and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity.

| 21 |

| Table of Contents |

We will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate that our common stock will be a “penny stock”, and we will become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our common shares and may affect the ability of purchasers to sell any of our common shares in the secondary market.

For any transaction (other than an exempt transaction) involving a penny stock, the rules require delivery, prior to such transaction, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made regarding sales commissions payable to both the broker-dealer and the registered representative, and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

We do not anticipate that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock is exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

Financial Industry Regulatory Authority (FINRA) sales practice requirements may also limit your ability to buy and sell our stock, which could depress our share price.

FINRA rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares, depressing our share price.

State securities laws may limit secondary trading, which may restrict the states in which you can sell the shares offered by this prospectus.

If you purchase shares of our common stock sold pursuant to this Offering, you may not be able to resell the shares in a certain state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and a stockholder’s ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder’s risk of losing some or all of their investment.

If quoted, the price of our common stock may be volatile, which may substantially increase the risk that you may not be able to sell your shares at or above the price that you may pay for the shares.

Even if our shares are quoted for trading on the OTCQB following this Offering and a public market develops for our common stock, the market price of our common stock may be volatile. It may fluctuate significantly in response to the following factors:

|

| · | variations in quarterly operating results; |

|

| · | our announcements of significant contracts and achievement of milestones; |

|

| · | our relationships with other companies or capital commitments; |

|

| · | additions or departures of key personnel; |

|

| · | sales of common stock or termination of stock transfer restrictions; |

|

| · | changes in financial estimates by securities analysts, if any; and |

|

| · | fluctuations in stock market price and volume. |

Your inability to sell your shares during a decline in the price of our stock may increase losses that you may suffer as a result of your investment.

| 22 |

| Table of Contents |

We arbitrarily determined the price of the shares of our common stock to be sold pursuant to this prospectus, and such price does not reflect the actual market price for the securities. Consequently, there is an increased risk that you may not be able to re-sell our common stock at the price you bought it for.

The Selling shareholders may sell their shares at the fixed price of $0.05 per share until our common stock is quoted on the OTCQB tier of the OTC Markets electronic quotation system, and thereafter at prevailing market prices or privately negotiated prices. However, our stock may not become quoted on the OTCQB. The initial offering price of $0.05 per share of the common stock offered pursuant to this prospectus was determined by us arbitrarily. The price is not based on our financial condition or prospects, on the market prices of securities of comparable publicly traded companies, on financial and operating information of companies engaged in similar activities to ours, or on general conditions of the securities market. The price may not be indicative of the market price, if any, for our common stock in the trading market after this Offering. If the market price for our stock drops below the price which you paid, you may not be able to re-sell out common stock at the price you bought it for.

Because we do not intend to pay any dividends on our common stock; holders of our common stock must rely on stock appreciation for any return on their investment.

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future. Accordingly, holders of our common stock will have to rely on capital appreciation, if any, to earn a return on their investment in our common stock.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any December 31.

Our status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company”, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

| 23 |

| Table of Contents |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

None.

| 24 |

| Table of Contents |

| Exhibit Number |

| Description |

| (3) |

| Articles of Incorporation and Bylaws |

|

| ||

|

| Bylaws (incorporated by reference to our Registration Statement on Form S-1 filed April 25, 2017) | |

|

| ||

| (10) |

| Material Contracts |

|

| ||

| 21 |

| List of Subsidiaries (TGS Building Supplies Ltd., an Alberta corporation) |

| (31) |

| Rule 13a-14 (d)/15d-14d) Certifications |

|

| Section 302 Certification by the Principal Executive Officer | |

|

| Section 302 Certification by the Principal Financial Officer and Principal Accounting Officer | |

| (32) |

| Section 1350 Certifications |

|

| Section 906 Certification by the Principal Executive Officer | |

|

| Section 906 Certification by the Principal Financial Officer and Principal Accounting Officer | |

| 101* |

| Interactive Data File |

| 101.INS |

| XBRL Instance Document |

| 101.SCH |

| XBRL Taxonomy Extension Schema Document |

| 101.CAL |

| XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF |

| XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB |

| XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE |

| XBRL Taxonomy Extension Presentation Linkbase Document |

_________

*Filed herewith.

| 25 |

| Table of Contents |

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| TGS INTERNATIONAL LTD. | ||

| Dated: October 16, 2017 | By: | /s/ Chung Szeto | |

|

| Chung Szeto | ||

|

| President, Chief Executive Officer and Director | ||

|

| Principal Executive Officer | ||

| Dated: October 16, 2017 | By: | /s/ Sau Chun Yu | |

|

| Sau Chun Yu | ||

|

| Secretary, Treasurer, Chief Financial Officer, Director, | ||

|

| Principal Accounting Officer, Principal Financial Officer | ||

| 26 |