Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SOUTH JERSEY INDUSTRIES INC | s001921x1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - SOUTH JERSEY INDUSTRIES INC | s001921x1_ex2-1.htm |

| 8-K - FORM 8-K - SOUTH JERSEY INDUSTRIES INC | s001921x1_8k.htm |

Exhibit 99.2

Acquisition of Elizabethtown Gas and Elkton Gas October 16, 2017 South Jersey Industries Color of title & subheading: Red: 32Green: 56Blue: 100

2 Forward Looking Statements Certain statements contained in this presentation may qualify as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this Report should be considered forward-looking statements made in good faith by South Jersey Industries (SJI or the Company) and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. When used in this presentation, or any other of the Company's documents or oral presentations, words such as “anticipate,” “believe,” “expect,” “estimate,” “forecast,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the statements. These risks and uncertainties include, but are not limited to the risks set forth under “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K. These cautionary statements should not be construed by you to be exhaustive and they are made only as of the date of this Report. While the Company believes these forward-looking statements to be reasonable, there can be no assurance that they will approximate actual experience or that the expectations derived from them will be realized. Further, SJI undertakes no obligation to update or revise any of its forward-looking statements whether as a result of new information, future events or otherwise.

3 Agenda Transaction HighlightsElizabethtown / Elkton ProfilesFinancing PlanPro Forma Business ProfileA Strategic Acquisition 1 2 3 4 5

4 Transaction Highlights Enhanced Utility Investment Opportunity:Incremental long-term investment of ~$800 million through 2026 to replace aging infrastructure Improved Business Mix Profile:Increase in utility earnings contribution to over 80% from ~70% today Strong Combined Credit Profile:Combined entity expected to maintain SJI’s existing strong investment grade credit rating Growth and Earnings Accretion: Accretive to SJI earnings per share beginning in 2020 post-transaction impacts Scale-building Transaction: Expands gas utility rate base by ~50%(1) and customer base by ~77% Commitment to New Jersey:Elizabethtown will become a 100% New Jersey owned company and benefit from SJI’s commitment to the state and local communities it serves 1 Based on currently-authorized rate base

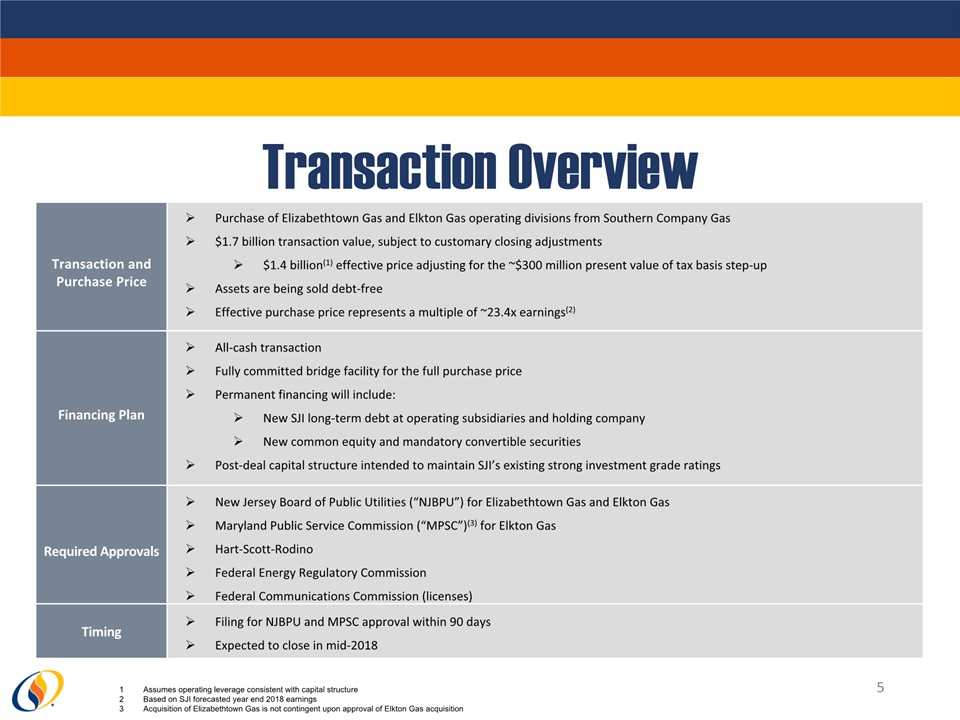

5 Transaction Overview Transaction and Purchase Price Purchase of Elizabethtown Gas and Elkton Gas operating divisions from Southern Company Gas $1.7 billion transaction value, subject to customary closing adjustments$1.4 billion(1) effective price adjusting for the ~$300 million present value of tax basis step-up Assets are being sold debt-freeEffective purchase price represents a multiple of ~23.4x earnings(2) Financing Plan All-cash transactionFully committed bridge facility for the full purchase price Permanent financing will include:New SJI long-term debt at operating subsidiaries and holding companyNew common equity and mandatory convertible securities Post-deal capital structure intended to maintain SJI’s existing strong investment grade ratings Required Approvals New Jersey Board of Public Utilities (“NJBPU”) for Elizabethtown Gas and Elkton GasMaryland Public Service Commission (“MPSC”)(3) for Elkton GasHart-Scott-RodinoFederal Energy Regulatory CommissionFederal Communications Commission (licenses) Timing Filing for NJBPU and MPSC approval within 90 daysExpected to close in mid-2018 Assumes operating leverage consistent with capital structureBased on SJI forecasted year end 2018 earnings Acquisition of Elizabethtown Gas is not contingent upon approval of Elkton Gas acquisition

Elizabethtown Gas and Elkton Gas Profiles Elizabethtown Gas Elkton Gas Customers (2016A) 288,000 6,300 Rate Base ($ millions) $720(1) $9(2) Net Income (2016A) $35(3) $0.3 EBITDA (2016A) $101(3) $1.2 Cumulative 2017-2021E Capex $672 - Approved Equity Capitalization 46% - 2016 Throughput (MMdts) 61.5 11.6 Distribution Miles 3,207 100 Transmission Miles 15 - Based on currently-authorized rate baseAs of 12/31/2016Reflects add-back of $17.5 million in pre-tax rate credits provided to customers in accordance with the NJBPU approval of the Southern/AGL merger and other non-recurring adjustments Elizabethtown Gas and Elkton Gas are regulated gas LDCs that have operated as divisions of Pivotal Utility Holdings, a wholly owned subsidiary of Southern Company and Southern Company GasAcquired by Southern Company in AGL Resources acquisition (which closed in July 2016)Regulated by New Jersey Board of Public Utilities and Maryland Public Service Commission, respectively 6 South Jersey Gas Elizabethtown Gas Elkton Gas MD

Commitment to Customers, Communities and Employees Customers Transaction will be seamless to existing customers. They can expect to continue receiving safe, reliable, affordable natural gas serviceStrong culture of customer service will remain a priorityTargeted infrastructure improvements provide the opportunity to bring the benefits of natural gas service to unserved and underserved within the service territory Communities Building stronger communities through social investment will remain a priority in all service areasInfrastructure investments not only create jobs, but also promote economic development as service delivery and reliability is enhanced and expanded Employees Commitment to maintaining existing workforce for the utilities involved in this transactionAlignment of mission and priorities, including safety, customer growth and exceptional service provide the foundation for a successful transition 7

Pro Forma Organizational Structure South Jersey Energy Solutions Regulated Natural Gas Distribution Company FERC-Regulated Gas Pipelines/Projects SJ Energy Services SJ Energy Group Energy production portfolio (solar, CHP, landfill gas to electric) Fuel supply management servicesWholesale and retail natural gas and electric commodity marketing Regulated Non-Utility South Jersey Gas New Subsidiaries SJI Midstream Elizabethtown Gas Elkton Gas Regulated Natural Gas Distribution Companies 8

Pro Forma Business Mix and Investment Profile Pro Forma Utility Capex (2018-2021) (3) South Jersey Industries Elizabethtown/Elkton Pro Forma / Combined 2017E Economic Earnings Mix (1)(2) Total Regulated Utility = ~80% of combined economic earnings Illustrative business mix as if Elizabethtown and Elkton were already contributing to SJI earningsSJI uses the non-GAAP measure of Economic Earnings (EE.) EE eliminates all unrealized gains and losses on commodity and on the ineffective portion of interest rate derivative transactions; adjusts for realized gains and losses attributed to hedges on inventory transactions and for the impact of transactions or contractual arrangements where the true economic impact will be realized in a future period or was realized in a previous period. A full explanation and reconciliation of this non-GAAP measure is provided in our most recent Form 10Q on file with the SEC.Excludes capex related to FERC-regulated pipeline projects (including PennEast) 9

Acquisition Enhances Scale of SJI Source: Factset market prices as of October 13, 2017. Mid-Cap Utilities – Enterprise Value ($ billions) Gas LDCs – Enterprise Value ($ billions) 10

Financing Plan Transaction supported by fully committed bridge loan for the full purchase priceLed by Bank of America Merrill Lynch, TD Bank and financing sources arranged by Guggenheim SecuritiesExpected permanent transaction financing Financing mix targeted to maintain strong investment grade credit profilePermanent financing to be put in place before close:No existing target debt assumedPurchase price to be financed with:$850 – $900 million of SJI common equity and mandatory convertible securities$510 – $540 million of operating company secured debt, consistent with its existing capital structure$250 – $300 million of SJI senior unsecured notesCash on hand and/or revolver draw as neededFinancing structure consistent with SJI, Elizabethtown and Elkton’s existing credit metrics and capital structureExpect to largely mitigate interest rate risk 11

A Strategic Acquisition Scale-building TransactionExpands gas utility rate base by ~50% and customer base by ~77% Improved Business Mix ProfileIn line with our strategic shift to focus on regulated investmentsMeaningfully adds to our regulated business mix, achieving ~80% regulated Economic Earnings (EE) at close Enhanced Utility Investment OpportunityIncreases SJI’s near-term utility capital investment program to $1.5 billion over 2018-2021(1) Elizabethtown has ~$800 million of potential investment to replace aging infrastructure through 2026, plus additional investment opportunities totaling ~$450 million over the same period Growth and Earnings AccretionAccretive to SJI earnings per share beginning in 2020, post transaction impactsEnhances the path to long-term, high-quality growth beyond SJI’s existing goal of $150 million in Economic Earnings Strong Combined Credit ProfileCombined entity expected to maintain SJI’s strong investment grade credit ratings Commitment to New JerseyExpands SJI’s New Jersey service territory and leverages existing New Jersey regional expertiseCustomers will benefit from SJI’s commitment to the state and local communities it serves 12 Excludes capex related to FERC-regulated pipeline projects (including PennEast)

A Strategic Acquisition Grow Economic Earnings Improve Quality of Earnings Maintain Balance Sheet Strength Maintain Low to Moderate Risk Profile 13 This acquisition supports every tenet of our strategy