Attached files

| file | filename |

|---|---|

| EX-32.02 - EXHIBIT 32.02 - IONIX TECHNOLOGY, INC. | ex32_02.htm |

| EX-32.01 - EXHIBIT 32.01 - IONIX TECHNOLOGY, INC. | ex32_01.htm |

| EX-31.02 - EXHIBIT 31.02 - IONIX TECHNOLOGY, INC. | ex31_02.htm |

| EX-31.01 - EXHIBIT 31.01 - IONIX TECHNOLOGY, INC. | ex31_01.htm |

| EX-3.01 - EXHIBIT 3.01 - IONIX TECHNOLOGY, INC. | ex3_01.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

Amendment No.__

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to .

Commission File Number 000-54485

IONIX TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

45-0713638

|

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

4F, Tea Tree B Building, Guwu Sanwei Industrial Park, Xixiang Street, Baoan District, Shenzhen,

Guangdong Province, China 518000

Guangdong Province, China 518000

(Address of principal executive offices) (Zip Code)

Chengdong Industrial Park, Fenyi County, Xinyu City, Jiangxi Province, China 338000

(Former Address)

+86-138 8954 0873

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

1

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or, an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company”, in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☒

|

|

(Do not check if smaller reporting company)

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $273,270,800 based upon the price ($4.40) at which the common stock was last sold as of December 31, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, multiplied by the approximate number of shares of common stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an “affiliate” of the registrant for purposes of the federal securities laws.

As of October 11, 2017, there were 99,003,000 shares of common stock issued and outstanding, par value $0.0001 per share.

As of October 11, 2017, there were 5,000,000 shares of preferred stock issued and outstanding, par value $0.0001 per share.

Documents Incorporated By Reference: None

2

TABLE OF CONTENTS

|

|

|

|

Page No.

|

|

|

|

PART I

|

|

|

Item 1.

|

|

Business

|

5 |

|

Item 1A.

|

|

Risk Factors

|

14 |

|

Item 1B.

|

|

Unresolved Staff Comments

|

14 |

|

Item 2.

|

|

Properties

|

14 |

|

Item 3.

|

|

Legal Proceedings

|

15 |

|

Item 4.

|

|

Mine Safety Disclosures

|

15 |

|

|

|

PART II

|

|

|

Item 5.

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities |

16 |

|

Item 6.

|

|

Selected Financial Data

|

18 |

|

Item 7.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

18 |

|

Item 7A.

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

23 |

|

Item 8.

|

|

Financial Statements and Supplementary Data

|

24 |

|

Item 9.

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

25 |

|

Item 9A.

|

|

Controls and Procedures

|

25 |

|

Item 9B.

|

|

Other Information

|

26 |

|

|

|

PART III

|

|

|

Item 10.

|

|

Directors, Executive Officers and Corporate Governance

|

27 |

|

Item 11.

|

|

Executive Compensation

|

31 |

|

Item 12.

|

|

Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters |

33 |

|

Item 13.

|

|

Certain Relationships and Related Transactions, and Director Independence

|

34 |

|

Item 14.

|

|

Principal Accounting Fees and Services

|

36 |

|

|

|

PART IV

|

|

|

Item 15.

|

|

Exhibits and Financial Statement Schedules

|

37 |

|

|

|

Signatures

|

3

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

|

·

|

The availability and adequacy of our cash flow to meet our requirements;

|

|

|

·

|

Economic, competitive, demographic, business and other conditions in our local and regional markets;

|

|

|

·

|

Changes or developments in laws, regulations or taxes in our industry;

|

|

|

·

|

Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities;

|

|

|

·

|

Competition in our industry;

|

|

|

·

|

The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business;

|

|

|

·

|

Changes in our business strategy, capital improvements or development plans;

|

|

|

·

|

The availability of additional capital to support capital improvements and development; and

|

|

|

·

|

Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC.

|

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context, references in this Annual Report to the words "we," "our," "us," the "Company," "IINX," or “Ionix” refers to Ionix Technology, Inc. All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

4

| Item 1. |

Business

|

Corporate Background

Ionix Technology, Inc. (the “Company”), formerly known as Cambridge Projects Inc., is a Nevada corporation that was formed on March 11, 2011, and maintains its principal executive office at 3773 Howard Hughes Pkwy, Suite 500S, Las Vegas, Nevada, 89169. The Company was originally formed to pursue a business combination through the acquisition of, or merger with, an operating business. The Company filed a registration statement on Form 10 with the U.S. Securities and Exchange Commission (the “SEC”) on August 23, 2011, and focused its efforts to identify a possible business combination.

On November 20, 2015, the Company’s former majority shareholder and chief executive offer, Locksley Samuels (“Seller”), completed a private common stock purchase agreement (the “SPA”) to sell his entire 21,600,000 shares of the Company’s common stock to Shining Glory Investments Limited (“Purchaser”). In connection with the SPA, the Board appointed Ms. Doris Zhou as the Company’s Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and director on November 20, 2015, and Seller concurrently resigned from all positions with the Company. As a result of the SPA, a change in control occurred as (i) Purchaser acquired approximately 65.45% of the Company’s common stock, and (ii) the Company’s sole officer and director after the SPA is Ms. Zhou.

On November 30, 2015, the Company’s board of directors (the “Board”) and the majority of its shareholders approved that (i) the Company change its name from “Cambridge Projects Inc.” to “Ionix Technology, Inc.”, (ii) the Company voluntarily changed its ticker symbol in connection with the name change, and (iii) the Company execute a 3:1 forward stock split, which will increase the Company’s issued and outstanding shares of common stock from 33,001,000 to 99,003,000 (the “Corporate Actions). The Company filed an application with the Financial Industry Regulatory Authority (“FINRA”) to effectuate the Corporate Actions and filed a Form 8-K on December 10, 2015, in regards to the Corporate Actions. On February 3, 2016, FINRA approved the Corporate Actions, which took effect on the market on February 4, 2016. As a result, (i) the Company’s name is now “Ionix Technology, Inc.”, (ii) its new trading symbol is “IINX”, (iii) the 3:1 forward stock split is effective, payable upon surrender, and (iv) the Company’s new CUSIP number is 46222Q107.

On February 17, 2016, the Board ratified, approved, and authorized the Company’s acquisition of a wholly-owned subsidiary, Well Best International Investment Limited, a limited liability company formed under the laws of Hong Kong Special Administrative Region (“Well Best”)on September 14, 2015. Well Best was acquired by Qingchun Yang, its current director, on November 10, 2015. One hundred percent interest in Well Best was transferred to Ionix Technology on February 15, 2016.Well Best’s purpose is to (i) act as an investment holding company and hold the assets of Taizhou Ionix Technology Company Limited (as explained below), and (ii) pursue new business ventures conducted in the Asia Pacific region excluding China. Well Best has had no activities since inception.

On August 19, 2016, the Board ratified, approved, and authorized the Company, as the sole member of Well Best, on the formation of XinyuIonix Technology Company Limited (“XinyuIonix”), a company formed under the laws of China on May 19, 2016. As a result XinyuIonix is a wholly-owned subsidiary of Well Best and an indirect wholly-owned subsidiary of the Company. Between May 19, 2016 and the date the Board ratified the incorporation, XinyuIonix conducted no business. XinyuIonix will focus on developing and designing lithium batteries as well as to act as an investment company that may acquire other businesses located in China.

On August 19, 2016, XinyuIonix, the Company’s indirect, wholly-owned subsidiary, entered into a manufacturing agreement with Jiangxi Huanming Technology Limited Company (“Jiangxi”) whereby Jiangxi would manufacture and produce lithium batteries for Xinyu on an as-needed basis, pursuant to XinyuIonix’s instructions and specifications, for 0.9 Renminbi (approximately $0.14 USD) per unit (the “Jiangxi Agreement”). The Jiangxi Agreement was filed as exhibit 10.2 to the Company’s current report on Form 8-K filed with the Commission on August 24, 2016.

5

On November 7, 2016, the Company’s Board of Directors approved and ratified the incorporation of Lisite Science Technology (Shenzhen) Co., Ltd (“Lisite Science”), a limited liability company formed under the laws of China on June 20, 2016. Well Best is the sole shareholder of Lisite Science. As a result, Lisite Science is an indirect, wholly-owned subsidiary of the Company. Lisite Science acts as a manufacturing base for the Company and shall focus on developing and producing high-end intelligent electronic equipment, specifically a power bank which is a 5 volt 2 amp, 20000mAh lithium ion battery powered portable device offering charging time of 12-18 hours that is intended to be utilized as a power source for electronic devices such as the iphone, ipad, mp3/mp4 players, PSP gaming systems, and cameras. Lisite Science commenced operations in September of 2016.

On November 7, 2016, the Company’s Board of Directors approved and ratified the incorporation of Shenzhen Baileqi Electronic Technology Co., Ltd. (“Baileqi Electronic”), a limited liability company formed under the laws of China on August 8, 2016. Well Best is the sole shareholder of Baileqi Electronic. As a result, Baileqi Electronic is an indirect, wholly-owned subsidiary of the Company. Baileqi Electronic acts as a manufacturing base for the Company and shall focus on development and production of the LCD and module for civil electronic products. The module of new energy power system refers to an LCD screen that is manufactured for small devices such as video capable baby monitors, electronic devices such as tablets and cell phones, and for use in televisions or computer monitors. Baileqi Electronics commenced operations in September of 2016.On September 1, 2016, Baileqi Electronics entered into a manufacturing agreement with Shenzhen Baileqi Science and Technology Co., Ltd. (“Shenzhen Baileqi S&T”) to manufacture products for Baileqi Electronics.

On December 29, 2016, the Company’s Board of Directors approved and ratified the acquisition of 99.9% of the issued and outstanding stock of Welly Surplus International Limited, a limited company formed under the laws of Hong Kong on January 18, 2016, in exchange for 99,999 HK dollars (the “Acquisition”). As a result of the Acquisition, the Company became the majority shareholder of Welly Surplus, owning 99.99% of the issued and outstanding stock of Welly Surplus, and Welly Surplus is now a majority owned subsidiary of the Company. As the closing of the Acquisition, Ms. Zhou was appointed as a member of the board of directors of Welly Surplus. Welly Surplus will act as the accounting and financial base for the Company and shall focus on assisting the Company with all of the Company’s financial affairs. Welly surplus had no activities since inception.

On April 7, 2017, Ben William Wong (“Wong”) and Yubao Liu, an individual (“Liu”) entered into a Stock Purchase Agreement (the “Agreement”) whereby Wong agreed to sell and Liu agreed to purchase 5,000,000 shares of the Company’s restricted preferred stock, representing 100% of the total issued and outstanding preferred stock (“Company Preferred Stock”). In consideration for the Company Preferred Stock, Liu agreed to pay to Wong a total of 5,000,000 RMB on or before April 30, 2017. The Agreement closed on April 20, 2017 (the “Closing”). Additionally, on April 5, 2017, Liu and Shining Glory Investments Limited, a British Virgin Islands company (“Shining Glory”), of which Wong is the sole officer and director, entered into a purchase agreement whereby Liu acquired 1 ordinary common stock share (the “Shining Glory Share”) representing approximately 100% of Shining Glory’s outstanding shares of common stock. In consideration for the Shining Glory Share, Liu paid to Wong a total of $1 USD and Wong resigned as a Director of Shining Glory. Concurrently, Liu was appointed as the sole director of Shining Glory. The agreement between Shining Glory and Liu closed on April 20, 2017.

On April 30, 2017, Well Best International Investment Limited (“Well Best”), a wholly-owned subsidiary of the Company, transferred all of its rights, title and interest to all 100% of the issued and outstanding common stock of XinyuIonix Technology Company Limited (“XinyuIonix”) to Zhengfu Nan for RMB 100($14.49 USD) pursuant to a Share Transfer Agreement dated April 30, 2017 (the “Agreement”). Pursuant to the Agreement the consideration shall be paid to Well Best within 15 working days after execution of the Agreement. Following the execution of the Agreement, Mr. Nan owns 100% of XinyuIonix and assumes all liabilities of XinyuIonix. As a result XinyuIonix is no longer a wholly-owned subsidiary of Well Best or an indirect wholly-owned subsidiary of the Company.

Prior Operations and Agreements

Taizhou Ionix

On February 17, 2016, the Board ratified, approved, and authorized the Company, as the sole member of Well Best, on the formation of Taizhou Ionix Technology Company Limited (“Taizhou Ionix”), a company formed under the laws of China on December 17, 2015, and a wholly-owned subsidiary of Well Best. Taizhou Ionix conducted no business between its date of incorporation and date approved by the Board. As a result, Taizhou Ionix is an indirect wholly-owned subsidiary of the Company. Taizhou Ionix was formed to (i) develop, design, and manufacture lithium-ion batteries for electric vehicles, and (ii) act as an investment holding company that may acquire other businesses located in China.

6

On August 19, 2016, Well Best, a wholly-owned subsidiary of the Company entered into a share transfer agreement (the “Share Transfer Agreement”) whereby Well Best sold 100% of its equity interest in Taizhou Ionix, to Mr. GuoEn Li, the sole director and officer of Taizhou for approximately RMB 30,000 ($5,000USD)(the “Sale”). Well Best was the sole shareholder of Taizhou. The Board approved and authorized the Sale, and instructed Well Best to enter into and execute the Share Transfer Agreement due to the fact that the Company believed that Taizhou’s manufacturing contract with Taizhou Jiunuojie Electronic Technology Limited to produce lithium batteries was not beneficial to the Company. As a result of the Sale, (i) Taizhou is no longer an indirect, wholly-owned subsidiary of the Company, and (ii) Mr. Li is no longer affiliated with the Company. The Share Transfer Agreement was filed as exhibit 10.2 to the Company’s current report on Form 8-K filed with the Commission on August 24, 2016. Well Best recorded a loss of $18,890 on disposal of Taizhou Ionix which was included in the loss from disposal of discontinued operations on statements of comprehensive income (loss).

Business Summary

Since January 2016, the Company has shifted its focus to becoming an aggregator of energy cooperatives to achieve optimum price and efficiency in creating and producing technology and products that emphasize long life, high output, high energy density, and high reliability. By and through its wholly owned subsidiary, Well Best and the indirect subsidiaries, Baileqi Electronics, Lisite Science, and Welly Surplus, the Company has commenced its operation of high-end intelligent electronic equipment, such as portable power banks and LCD monitors in China.

The Company believes that owning and operating its own manufacturing plant would be too costly. Also by outsourcing manufacturing, the Company can devote its resources to research and development, design, and marketing of electronic control technologies, automotive battery technologies, and material and component technologies, including lithium-ion battery products for use in electric cars.

The Company, Well Best, Welly Surplus, Baileqi Electronics, and Lisite Science are actively seeking additional new prospects for technology enhancements, design, manufacturing and production of the Company’s operation of high-end intelligent electronic equipment, such as portable power banks and LCD products and future product development.

Products

Civil Electronics-

With the high-speed development in the new energy industry, the high-tech and relevant key accessories are today still playing an essential role in the energy industry chain. LCD displays are widely used in the end products of the new energy industry.

Since late 2016, the Company has expanded its focus to development and production of the LCD and module for civil electronic products and portable power packs. By and through its wholly owned subsidiary, Well Best and the indirect wholly owned subsidiary, Baileqi Electronics, the Company has commenced its operations in China. Baileqi is working on an upgrade to traditional LCD screens with display modules that use the crystal method (“TCM”) and control muddle system integration for professional manufacturing. Today, TCM is widely used in many areas, including electronic operation data displays for renewable energy vehicles, BMS information feedback, HD projectors, communication equipment, and particularly in intelligent robots.

The LCD screens are manufactured for small devices such as video capable baby monitors, electronic devices such as tablets and cell phones, and for use in televisions or computer monitors.

The Company is also manufacturing “new energy power systems” or power banks a through the Company’s indirect wholly-owned subsidiaries. The power banks range in size and capacity and are lithium ion battery powered, portable devices offering charging time of 12-18 hours that is intended to be utilized as a power source for electronic devices such as the iphone, ipad, mp3/mp4 players, PSP gaming systems, and cameras. The module of new energy power system refers to an LCD screen that is manufactured for small devices such as video capable baby monitors, electronic devices such as tablets and cell phones, and for use in televisions or computer monitors.

7

|

BAILEQI PRODUCTS

|

||

|

Module No: Y50029N00T

Size: 5.0”

Resolution: 800(H)*3(RGB)*480(V) TFT LCD

LCD Active Area: 108.00*64.80mm

Quline Dimensions: 120.70(H) x 75.80(V) x 4.25(T)

Interface Type: 24 BIT RGB Interface

Display Colors: 16.7M

Brightness: 300 cd/mm

Viewing Direction: 12 O’CLOCK

|

|

|

|

Module No:Y43001N04N

Size:4.3”

Resolution:480RGB×272

LCD Active Area:95.04(H)×53.86(V)

Qutline Dimensions: 105.4(H)× 67.10(V)×2.95(D)

Interface Type: RGB 24 BIT

Display Colors:16.7M

Brightness:480cd/mm(7S)

Viewing Direction:12 O’CLOCK

|

|

8

|

Module No:Y10108M00N

Size:10.1”

Resolution:1280RGB×800

LCD Active Area:216.96(H)×135.60(V)

Qutline Dimensions: 229.46(H)× 149.10(V)×3.00(D)

Interface Type: LVDS

Display Colors:16.7M

Brightness:300cd/mm(3S-13P)

Viewing Direction:6 O’CLOCK

|

|

|

|

LISITE SCIENCE PRODUCTS

|

||

|

K20000

Capacity: 20000mah capacity

Size: 167.2*85*23.5mm Type: 18650 2500mah*8 Input: MICRO 5/2A Output: USB 5/2A Color: White Materials: ABS+PC

|

|

|

|

QC01

Capacity:10000mah

Size:102x61x21.5mm Type:LG18650 3350mah*3 Input:MICRO 9/1.8A 5/2A

Output:USB 9V/1.8A 5/2A Color: Orange and Black Materials: Aluminum Alloy +PC Weight:350g |

|

9

|

T3

Capacity:10000mah

Size:100x62x21.5mm Type:805573 Input:MICRO 5/2A

Output:USB 5/2A Color: White

Materials: ABS + PC

Weight: 195g

|

|

|

|

T100CY

Capacity:10000mah

Size:139 * 59.8 * 23.4mm Type:18650 2000mah*5 Input:MICRO 5/2A Output:USB 5/2A Color: White Materials:ABS+PC

Weight:274.8g |

|

Lithium Ion Battery-

|

The Company’s products include 18650-2000mAh lithium ion batteries for use in lithium cell electronic bicycles, balance cars, scooters, electric vehicles, special vehicles at low speed, energy storage, and other products. The 18650 -200mAh battery cell is a commodity format cell based on standardized specifications for product dimensions, however, the Company is able to and provides custom solutions based on the needs of customers regarding capacity and performance. During the year ended June 30, 2017, the Company decided to focus its energies on the civil electronics portion of its business.

|

|

The product specifications for our 18650-2000mAH battery, pictured to the right, are set forth in the table below:

|

Items

|

Rated Performance

|

Remarks

|

|

Rated Capacity

|

2000mAh

|

1 C5Astandard charging

1 C5Astandard discharging

|

|

Minimum Capacity

|

2000mAh

|

|

|

Nominal Voltage

|

3.7V

|

working voltage

|

|

Discharge cut-off voltage

|

2.75V

|

10

|

Charge voltage

|

4.2V

|

|

|

AC Impedance

|

≤26mΩ

|

|

|

Standard Charging method

|

0.5 C5A CC(constant current) charge to 4.2V, then CV (constant voltage 4.2V) charge till charge current decline to 0.01 C5A

|

Charging time:Approximately 3.5h

|

|

Standard Discharge method

|

0.5 C5A. electric constant exile to 2.25V

|

|

|

Fast charging

|

Continuous ChargeCurrent:1 C5A

Continuous Chargevoltage:4.2V

Decline Charge voltage:0.01 C5A

|

Charging time:Approximately 90min

|

|

Maximum Continuous DischargeCurrent

|

3C5A

|

|

|

Max. Discharge Current

|

5C5A

|

|

|

Operation Temperature Range

|

Charge:0~45℃

|

60±25%R.H

Single cell storage humidity range

|

|

Discharge: -20~55℃

|

||

|

Storage T/H Range

|

Less than one year:-20~25℃

|

60±25%R.H

Shipment status humidity range for

|

|

Less than 3 month:-20~35℃

|

||

|

Weigh

|

Approximately:44g

|

|

|

Product Dimension

|

Height(Max):65.5mm

|

Initial dimension

|

What is a Lithium-Ion Battery?

A lithium-ion battery (“LIB”) is a rechargeable electric device within which lithium moves from a negative electrode to a positive electrode during the discharge and back charging. The four main materials typically used in LIB’s are cathode materials, anode materials, operators, and electrolytic solution. The performance and safety of an LIB depends heavily on the materials from which they are made as their operation is based on chemical reactions which can be directly affected by the materials used in production.

LIB’s are one of the most common types of rechargeable batteries as they are frequently used as the power supply for most consumer devices that people use every day such as mobile phones, digital cameras, and power tools. Additionally, LIB’s are also utilized in aerospace applications and automotive products such as electric and hybrid vehicles. The lithium-ion battery has become the more sought-after alternative to nickel-metal batteries for electric vehicles, partially due to its lighter weight and smaller size, and LIB’s have become a common replacement for the lead acid batteries used in golf carts and utility vehicles.

Industry Overview

The first lithium-ion battery was commercialized by Japan’s Sony in 1991. Since then, the LIB has become the most popular and advanced battery with its reach expanding more and more every day. Lithium-ion batteries are used in and influence nearly every aspect of our lives daily, both at home and at work, and innovation is sprinting forward at a rapid pace. The push for clean and renewable energy, from wind power to solar power, is a driving force in business today and a major reason why Lithium-batteries are and have been a major contender in storing renewable energy.

The global market for lithium-ion batteries has grown significantly and is expected to continue to grow as the need for high power and high capacity battery cells increase its penetration into broader forms of use. The power density, safety, recharge time, cost, and other aspects of its technology are expected to continue to improve with future developments in technology.

11

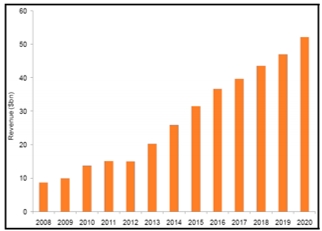

According to a report published by Allied Market Research titled, "Lithium-Ion Battery Market" the global lithium-ion battery market is expected to generate revenue of $46.21 billion by 2022, with a CAGR of 10.8% during the forecast period (2016-2022).1 As reported by Allied, the market for these batteries is expected to experience significant growth because of their increasing application in the automotive sector. Other key factors that may affect the growth of this market are the growing demand for smartphones, tablets, and other electronic devices; stringent government regulations aimed at reducing the increasing pollution levels; and enhanced efficiency of lithium-ion batteries.

Currently, the electronics industry has the highest demand for lithium-ion batteries, however, the automotive sector is forecast to have the highest rising demand for LIB for use in electric and plug-in hybrid vehicles. The number of electric/hybrid vehicles is expected to increase at an exponential rate in the coming years, which would further increase the demand for lithium ion batteries. For instance, in 2014, Tesla announced its plans to manufacture around 500,000 electric cars every year by around 2018, which would require a huge supply of lithium ion batteries.

The Asia-Pacific geographical region is currently the largest in LIB use and production due to burgeoning demand in China, Japan and India. North America and Europe are the second and third leading regions respectively, for lithium-ion battery market.2 Currently, the global market is highly concentrated as about 5 to 6 major players occupy around 50% market share in the overall lithium-ion battery market.3

The following figure shows the market size of lithium based batteries for the 2008-2013 period and expected market size for 2014-2020 forecast.

Figure: Revenues of the Global Lithium-based Battery Market (in USD Billion), 2008-20204

_________________________________

1Lithium-Ion Battery Market by Material Type.Allied Market Research, March 2016.https://www.alliedmarketresearch.com/lithium-ion-battery-market

2Id.

3Id.

4Global Market for Lithium-Ion batteries- Forecast, Trends, & Opportunies 2014-2020. Taiyou Research

12

Competition

Our competitors include large consumer electronic and manufacturing companies that offer products similar to ours such as Panasonic Sanyo, Samsung, Hitachi, Mitsubishi Chemical, and LG Chem Ltd., among others. Many of our competitors have substantially greater financial, technical, and human resources than we do, as well as greater experience in the discovery and development of products and the commercialization of those products. Our competitors’ products may be more effective, or more effectively marketed and sold, than any products we may commercialize and may render our products obsolete or non-competitive before we can recover the expenses of their development and commercialization. We anticipate that we will face intense and increasing competition as new products enter the market and advanced technologies become available. However, we believe that our products will offer key potential advantages over competitive products that could enable our products to capture meaningful market share from our competitors. We believe the principal methods of competition and primary competitive factors in our business include:

| · |

customer service,

|

| · |

product pricing, and

|

| · |

product performance, reliability and safety.

|

Distribution Methods of Products

The Company’s products are currently directly shipped from the manufacturers to the distributors and retailers. Marketing and sales departments were established in through the Company’s indirect subsidiaries during the year ended June 30, 2017 to cope with the growth of the Company. We explore potential customer bases using internal resources. Currently, we do not have any long term contracts with our customers and will manufacture according to the purchase orders received. In the future, we will continue to seek additional channels of distribution for our products to include wholesale stores and mass retailers. The Company plans to focus primarily on distributing its products regionally, starting in Greater China, and will then seek to expand its distribution channels across the U.S. and internationally.

Manufacturing

The Company outsources the manufacturing and packaging of our products to a third party located in China on an order-by-order basis. Baileqi Electronics entered into a manufacturing contract with Shenzhen Baileqi S&T to manufacture products for Baileqi Electronics.

The Company and Lisite Science are actively seeking new prospects for the manufacturing and production of the Company’s products. Further, when we do identify and engage a manufacturer we expect that that manufacturer would not work exclusively for the Company and may be limited in their ability to meet our production needs, however, we are considering this a top priority while trying to identify prospects.

Suppliers of Materials

The elements necessary for our products are and will be sourced from several different suppliers located primarily in China on an order-by-order basis. These materials include lithium manganite (Li-Mn) and lithium nickel manganese cobalt (Li-NiCoMn). Some of the materials in our products are not readily available in large quantities or are available on a limited basis only. Further, the limited availability of some of these materials could cause significant fluctuations in their costs.

The Company, Baileqi Electronics, and Lisite Science acquire materials from the following list of principal suppliers, dependent on availability and price points:

|

lithium manganate(Li-Mn)*

|

lithium nickel manganese cobalt(Li-NiCoMn)*

|

|

Anhui Aland New Energy Materials Co. ,Ltd.

|

Xinxiang Zhongtian Luminous Materials Co., Ltd.

|

|

Guangzhou Guanggang New Energy Technology Co., Ltd.

|

Xinxiang Jinrun Science and Technology Co., Ltd.

|

|

Zhejiang New Era Haichuang Lithium Battery Technology Co., Ltd.

|

Jiaozuo Banlv Na-No Material Engineering Company Limited

|

|

Long Power Systems (Suzhou) Co., Ltd.

|

|

*This list of suppliers is subject to change at any time.

Our management researches and develops our sources of materials used in the manufacturing of our products. The materials that we source are and will be sent to our manufacturer in China to create our products. The Company does not have any long-term contracts with our suppliers and we cannot be assured that they will be able to meet our demands.

13

Intellectual Property

As part of our business, we will seek to protect our intellectual property rights in various ways, including through trademarks, copyrights, trade secrets, including know-how, patents, patent applications, employee and third party nondisclosure agreements, intellectual property licenses and other contractual rights. We currently hold no intellectual property rights.

Government Regulations Affecting Our Business

At this stage in our business, we are unaware of any government regulations that are directly affecting our business, however, as we grow our business activities may become subject to various governmental regulations in different countries in which we operates, including regulations relating to: various business/investment approvals; trade affairs, including customs, import and export control; competition and antitrust; anti-bribery; advertising and promotion; intellectual property; broadcasting, consumer and business taxation; foreign exchange controls; personal information protection; product safety; labor; human rights; conflict; occupational health and safety; environmental; and recycling requirements.

Employees of the Company

The Company has no significant employees other than our officers and directors. As of June 30, 2017, the Company has no employees, however, our indirect subsidiary Baileqi has fifteen employees and Lisite Science has three employees. We intend to increase the size of our management team and hire additional employees in the future to manage the continued growth of our company and to increase our sales force and marketing efforts.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operations of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site, www.sec.gov.

| Item 1A. |

Risk Factors

|

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| Item 1B. |

Unresolved Staff Comments

|

None.

| Item 2. |

Properties

|

Our mailing address in the US is that of our registered agent, at 3773 Howard Hughes Pkwy, Suite 500S, Las Vegas, NV 89169. Our principal office in China consists of 2,298 square feet (701 square meters) of office and warehouse space located at 4F, Tea Tree B Building, Guwu Sanwei Industrial Park, Xixiang Street, Baoan District, Shenzhen, Guangdong Province, China 518000. This office is leased by Baileqi, our indirect subsidiary, for $2,510 (16,824RMB) per month. This lease expires on September 30, 2018. We believe that this space is adequate for our current and immediately foreseeable operating needs.

14

We previously maintained an office at Chengdong Industrial Park in Fenyi County, Jiangxi Province,China, however, on April 30, 2017, Well Best our wholly-owned subsidiary transferred all of its rights, title and interest to XinyuIonix. As such the Company no longer responsible for the lease at Chengdong Industrial Park

| Item 3. |

Legal Proceedings

|

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

| Item 4. |

Mine Safety Disclosure

|

Not applicable.

15

PART II

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities

|

Market Information

Our common stock is currently quoted on OTCQB. Our common stock commenced quotation on the OTCQB under the trading symbol “CPJT”. On February 4, 2016, our symbol was changed to “IINX” to reflect the Company’s name change to Ionix Technology, Inc. Our common stock began trading in April 2015. Because we are quoted on the OTCQB, our common stock may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if it were listed on a national securities exchange.

The following table sets forth the high and low bid prices for our Common Stock per quarter as reported by the OTCQB for the quarterly periods indicated below based on our fiscal year end June 30. These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission and may not represent actual transactions.

|

Fiscal Quarter

|

High

|

Low

|

||||||

|

First Quarter (Jul. 1, 2015 – Sept. 30, 2015)

|

$

|

0.55

|

$

|

0.25

|

||||

|

Second Quarter (Oct. 1, 2015 – Dec. 31, 2015)

|

$ |

0.55

|

$

|

0.55

|

||||

|

Third Quarter (Jan. 1, 2016 – Mar. 31, 2016)

|

$

|

6.00

|

$

|

0.10

|

||||

|

Fourth Quarter (Apr. 1, 2016 – Jun. 30, 2016)

|

$

|

5.00

|

$

|

5.00

|

||||

|

|

||||||||

|

First Quarter (Jul. 1, 2016 – Sept. 30, 2016)

|

$

|

5.00

|

$

|

3.60

|

||||

|

Second Quarter (Oct. 1, 2016 – Dec. 31, 2016)

|

$

|

4.40

|

$

|

3.60

|

||||

|

Third Quarter (Jan. 1, 2017 – Mar. 31, 2017)

|

$

|

4.40

|

$

|

4.00

|

||||

|

Fourth Quarter (Apr. 1, 2017– Jun. 30, 2017)

|

$

|

4.40

|

$

|

2.00

|

||||

Record Holders

As of June 30, 2017, the approximate number of registered holders of our common stock was 94. As of June 30, 2017, there were 99,003,000 shares of common stock issued and outstanding and there were 5,000,000 shares of preferred stock issued and outstanding. There were no shares of common stock subject to outstanding warrants, and there were no shares of common stock subject to outstanding stock options.

Dividends

On November 30, 2015, the Company’s board of directors and majority of its shareholders approved a 3:1forward stock split which increased the Company’s issued and outstanding shares of common stock from 33,001,000 to 99,003,000 (the “Forward Split”). The Forward Split was approved by FINRA and took effect on the market on February 4, 2016. The Forward Split shares are payable upon surrender of certificates to the Company’s transfer agent.

We have not declared or paid any cash dividends on our common stock nor do we anticipate paying any in the foreseeable future. Furthermore, we expect to retain any future earnings to finance our operations and expansion. The payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Securities Authorized for Issuance under Equity Compensation Plans

None.

16

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

The following sets forth certain information concerning securities which were sold or issued by us without the registration of the securities under the Securities Act of 1933 in reliance on exemptions from such registration requirements within the past three years:

On February 17, 2016, the Company entered into a subscription agreement to sell 5,000,000 preferred shares (the “Preferred Shares”) for $50,000 in cash ($0.01 per share). No commissions were paid to any broker or third party for this transaction.

Exemption From Registration. The shares of Common Stock and Preferred Stock referenced herein were issued in reliance upon one of the following exemptions:

(a)The shares of Common Stock referenced herein were issued in reliance upon the exemption from securities registration afforded by the provisions of Section 4(2) of the Securities Act of 1933, as amended, ("Securities Act"), based upon the following: (a) each of the persons to whom the shares of Common Stock were issued (each such person, an "Investor") confirmed to the Company that it or he is an "accredited investor," as defined in Rule 501 of Regulation D promulgated under the Securities Act and has such background, education and experience in financial and business matters as to be able to evaluate the merits and risks of an investment in the securities, (b) there was no public offering or general solicitation with respect to the offering of such shares, (c) each Investor was provided with certain disclosure materials and all other information requested with respect to the Company, (d) each Investor acknowledged that all securities being purchased were being purchased for investment intent and were "restricted securities" for purposes of the Securities Act, and agreed to transfer such securities only in a transaction registered under the Securities Act or exempt from registration under the Securities Act and (e) a legend has been, or will be, placed on the certificates representing each such security stating that it was restricted and could only be transferred if subsequently registered under the Securities Act or transferred in a transaction exempt from registration under the Securities Act.

(b)The shares of common stock referenced herein were issued pursuant to and in accordance with Rule 506 of Regulation D and Section 4(2) of the Securities Act. We made this determination in part based on the representations of the Investor(s), which included, in pertinent part, that such Investor(s) was an “accredited investor” as defined in Rule 501(a) under the Securities Act, and upon such further representations from the Investor(s) that (a) the Investor is acquiring the securities for his, her or its own account for investment and not for the account of any other person and not with a view to or for distribution, assignment or resale in connection with any distribution within the meaning of the Securities Act, (b) the Investor agrees not to sell or otherwise transfer the purchased securities unless they are registered under the Securities Act and any applicable state securities laws, or an exemption or exemptions from such registration are available, (c) the Investor either alone or together with its representatives has knowledge and experience in financial and business matters such that he, she or it is capable of evaluating the merits and risks of an investment in us, and (d) the Investor has no need for the liquidity in its investment in us and could afford the complete loss of such investment. Our determination is made based further upon our action of (a) making written disclosure to each Investor prior to the closing of sale that the securities have not been registered under the Securities Act and therefore cannot be resold unless they are registered or unless an exemption from registration is available, (b) making written descriptions of the securities being offered, the use of the proceeds from the offering and any material changes in the Company’s affairs that are not disclosed in the documents furnished, and (c) placement of a legend on the certificate that evidences the securities stating that the securities have not been registered under the Securities Act and setting forth the restrictions on transferability and sale of the securities, and upon such inaction of the Company of any general solicitation or advertising for securities herein issued in reliance upon Rule 506 of Regulation D and Section 4(2) of the Securities Act.

17

(c) The shares of Common Stock referenced herein were issued pursuant to and in accordance with Rule 903 of Regulation S of the Act. We completed the offering of the shares pursuant to Rule 903 of Regulation S of the Act on the basis that the sale of the shares was completed in an "offshore transaction", as defined in Rule 902(h) of Regulation S. We did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the shares. Each investor represented to us that the investor was not a "U.S. person", as defined in Regulation S, and was not acquiring the shares for the account or benefit of a U.S. person. The agreement executed between us and each investor included statements that the securities had not been registered pursuant to the Act and that the securities may not be offered or sold in the United States unless the securities are registered under the Act or pursuant to an exemption from the Act. Each investor agreed by execution of the agreement for the shares: (i) to resell the securities purchased only in accordance with the provisions of Regulation S, pursuant to registration under the Act or pursuant to an exemption from registration under the Act; (ii) that we are required to refuse to register any sale of the securities purchased unless the transfer is in accordance with the provisions of Regulation S, pursuant to registration under the Act or pursuant to an exemption from registration under the Act; and (iii) not to engage in hedging transactions with regards to the securities purchased unless in compliance with the Act. All certificates representing the shares were or upon issuance will be endorsed with a restrictive legend confirming that the securities had been issued pursuant to Regulation S of the Act and could not be resold without registration under the Act or an applicable exemption from the registration requirements of the Act.

Purchases of Equity Securities by the Small Business Issuer and Affiliated Purchasers

None.

| Item 6 |

Selected Financial Data

|

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation

The following discussion should be read in conjunction with our audited financial statements and notes thereto included herein. We caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or our behalf. We disclaim any obligation to update forward-looking statements.

Results of Operations for the Years Ended June 30, 2017 and 2016

Revenue

During the year ended June 30, 2017 and 2016, revenue was $6,816,908 and zero respectively. The difference can be attributed to the commencement of our business and generating revenue from the sale of portable power banks and LCD screens in the PRC.

In comparison, total revenue during the year ended June 30, 2016 was zero because the results of operations of Taizhou Ionix for the years ended June 30, 2017 and 2016 are included in the income from discontinued operations.

Cost of Revenue

During the year ended June 30, 2017, cost of revenue was $2,720,295 for non-related parties, and $3,762,550 for related parties. In the year ended June 30, 2017, cost of revenue included the cost of raw materials and finished products purchased and the sub- contracting processing fee paid to the processing factories which were owned by our shareholders, pursuant to the manufacturing agreement between the Company’s subsidiaries in PRC and processing factories.

Cost of revenue was zero for the year ended June 30, 2016, because the results of operations of Taizhou Ionix for the years ended June 30, 2017 and 2016 are included in the income from discontinued operations.

18

Gross Profit

During the years ended June 30, 2017 and 2016, gross profit was $334,063 and zero, respectively. Our gross profit margin maintained at 5% during the year ended June 30, 2017.

Selling, General and Administrative Expenses

During the years ended June 30, 2017, and 2016, general and administrative expenses were $312,792, and $53,364, respectively. Our general and administrative expenses mainly comprised of payroll expenses, transportation, office expense, professional fees, freight and shipping costs, rent, and other miscellaneous expenses. The expenses were significantly more in 2017 as we have expanded the operation in the PRC during this period and the operating expenses from Taizhou Ionix and Xinyu Ionix were included in the income from discontinued operation.

Income (Loss) from Discontinued Operations

QI system business was terminated on November 15, 2015. The Company disposed of the ownership in Taizhou Ionix and Xinyu Ionix in August 2016 and April 2017 respectively.

Hence the Company has presented results of QI system, Taizhou Ionix and Xinyu Ionix operations as the discontinued operations in the consolidated statements of comprehensive income (loss).

During the years ended June 30, 2017 and 2016, income from discontinued operation was $39,847 and $8,933, respectively, all of which were revenue offset by cost of revenue and general and administrative expenses.

Net Income (Loss)

During the years ended June 30, 2017 and 2016, net income (loss) was $51,462 and $(44,431), respectively, which included net income (loss) from continuing operation of $61,620 and $(53,364), respectively, and net income (loss) from discontinued operation of $(10,158) and $8,933, respectively. The difference can be attributed to the commencement of our business in the field of portable power banks and LCD screens and generating revenue from the sale of portable power banks and LCD screens in the PRC during the year ended June 30, 2017.

Liquidity and Capital Resources

Cash Flow from Operating Activities

During the years ended June 30, 2017 and 2016, the Company received cash of $445 from operating activities compared with cash used in operating activities of $985,191, respectively. The change was mainly due to an increase in net income from continuing operation and an increase in accounts payable which were partially offset by an increase in accounts receivables.

Cash Flow from Investing Activities

During the years ended June 30, 2017 and 2016, the Company used $144,191 and $NIL in cash for investing activities, respectively. The Company’s subsidiary, Baileqi Electronic, made short-term advance to a third party for $149,191, which was repaid in full in September 2017. The advance was non-interest bearing and due on demand.

Cash Flow from Financing Activities

During the year ended June 30, 2017, the Company received $271,936 in cash from financing activities, which was all due to proceeds received from related party loans. In comparison, during the year ended June 30, 2016, the Company received $1,044,949 in cash from financing activities, including proceeds from related party loans of $53,510 and cash collected from issuance of preferred shares of $50,000.

As of June 30, 2017, we have a working capital of $62,054.

Our total current liabilities for the year ended June 30, 2017 was $747,158 and consists primarily of accounts and other payables of $351,083 and amount due to related parties of $323,599. Our Company’s President is committed to providing for our minimum working capital needs for the next 12 months, and we do not expect previous loan amounts to be payable for the next 12 months. However, we do not have a formal agreement that states any of these facts. The remaining balance of our current liabilities relates to audit and consulting fees and such payments are due on demand and we expect to settle such amounts on a timely basis based upon shareholder loans to be granted to us in the next 12 months.

19

We will require approximately $150,000 to fund our working capital needs as follows:

|

Audit and accounting

|

|

|

30,000

|

|

|

|

Legal Consulting fees

|

|

|

50,000

|

|

|

|

Salary and wages

|

30,000

|

|

|||

|

Edgar/XBRL filing, transfer agent and miscellaneous

|

|

|

40,000

|

|

|

|

Total

|

|

$

|

150,000

|

Future Financings

We will not consider taking on any long-term or short-term debt from financial institutions in the immediate future. We are dependent upon our director and the major shareholder to provide continued funding and capital resources. If continued funding and capital resources are unavailable at reasonable terms, we may not be able to implement our plan of operations. The financial statements do not include any adjustments related to the recoverability of assets and classification of liabilities that might be necessary should the Company be unable to continue in operation.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Policies

While our significant accounting policies are more fully described in Note 3 to our financial statements, we believe the following accounting policies are the most critical to aid you in fully understanding and evaluating this management discussion and analysis

Revenue recognition

In accordance with the ASC Topic 605, “Revenue Recognition”, the Company recognizes revenue when persuasive evidence of an arrangement exists, transfer of title has occurred or services have been rendered, the selling price is fixed or determinable and collectability is reasonably assured.

The Company recognizes revenue from the sale of finished products upon delivery to the customer, whereas the title and risk of loss are fully transferred to the customers. The Company records its revenues, net of value added taxes (“VAT”). The Company is subject to VAT which is levied on the majority of the products at the rate of 17% on the invoiced value of sales.

Comprehensive income

ASC Topic 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying consolidated statement of stockholders’ equity, consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

20

Accounts receivable

Accounts receivable are recorded at the invoiced amount and do not bear interest, which are due within contractual payment terms, generally 30 to 90 days from shipment. Credit is extended based on evaluation of a customer's financial condition, the customer’s credit-worthiness and their payment history. Accounts receivable outstanding longer than the contractual payment terms are considered past due. Past due balances over 90 days and over a specified amount are reviewed individually for collectability. At the end of each period, the Company specifically evaluates individual customer’s financial condition, credit history, and the current economic conditions to monitor the progress of the collection of accounts receivables. The Company will consider the allowance for doubtful accounts for any estimated losses resulting from the inability of its customers to make required payments. For the receivables that are past due or not being paid according to payment terms, the appropriate actions are taken to exhaust all means of collection, including seeking legal resolution in a court of law. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company does not have any off-balance-sheet credit exposure related to its customers. Based on the evaluation, the Company has determined that $NIL and $71,318 allowance for doubtful accounts is required as of June 30, 2017 and 2016 respectively. The $71,318 allowance for doubtful accounts was included in the current assets from discontinued operations.

Use of Estimates

The Company’s consolidated financial statements have been prepared in accordance with US GAAP. This requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of revenue and expenses during the reporting period. The significant areas requiring the use of management estimates include, but are not limited to, the allowance for doubtful accounts receivable, estimated useful life of intangible assets, provision for staff benefits, recognition and measurement of deferred income taxes and valuation allowance for deferred tax assets. Although these estimates are based on management’s knowledge of current events and actions management may undertake in the future, actual results may ultimately differ from those estimates and such differences may be material to our consolidated financial statements.

Foreign currencies translation

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statement of operations.

The reporting currency of the Company is the United States Dollar ("US$"). The Company's subsidiaries in the People’s Republic of China (“PRC”) maintain their books and records in their local currency, the Renminbi Yuan ("RMB"), which is the functional currency as being the primary currency of the economic environment in which these entities operate.

In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not the US$ are translated into US$, in accordance with ASC Topic 830-30, “ Translation of Financial Statement ”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. Stockholders’ equity is translated at historical rates. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the consolidated financial statements are as follows:

|

2016

|

2017

|

|||||||

|

Balance sheet items, except for equity accounts

|

6.6312

|

6.7744

|

||||||

|

Items in statements of income and cash flows

|

6.3120

|

6.7028

|

||||||

21

Recently Issued Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued, ASU 2014-09, “Revenue from Contracts with Customers (Topic 606).” The guidance substantially converges final standards on revenue recognition between the FASB and the International Accounting Standards Board providing a framework on addressing revenue recognition issues and, upon its effective date, replaces almost all exiting revenue recognition guidance, including industry-specific guidance, in current U.S. generally accepted accounting principles. In April 2015, the FASB proposed a one-year delay in the effective date and companies will be allowed to early adopt as of the original effective date. Accordingly, this guidance will be effective for the Company beginning the first quarter of fiscal year 2018. The Company plans to adopt the new revenue guidance in the fiscal year of 2018 and is currently in the process of evaluating the impact on the Company’s consolidated financial statements.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. The amendments in this ASU clarify and include specific guidance to address diversity in how certain cash receipts and cash payments are presented and classified in the statement of cash flows. The amendments will be effective beginning the first quarter of fiscal year 2018. Early adoption of the amendments is permitted. The amendments in this ASU should be applied using a retrospective transition method to each period presented. The Company will adopt the amendments in the fiscal year of 2018. No significant impacts on the consolidated financial statements from the amendments were expected.

In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. The amendments in this ASU require that a statement of cash flows explain the change during the period in the total of cash, cash equivalents and amounts generally described as restricted cash. Therefore, amounts generally described as restricted cash should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. The amendments will be effective beginning the first quarter of fiscal year 2018. Early adoption of the amendments is permitted. The amendments should be applied using a retrospective transition method to each period presented. The Company plans to adopt the amendments in the first quarter of fiscal year 2018. Since then, the changes in restricted cash in the consolidated cash flow are no longer presented within investing activities and will be retrospectively included in the changes of cash, cash equivalents and restricted cash as required.

In January 2017, the FASB issued ASU No. 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business. The amendments in this ASU clarify the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions or disposals of assets or businesses. The amendments will be effective beginning the first quarter of fiscal year 2018. Early application is permitted. The amendments should be applied prospectively on or after the effective date. No disclosures are required at transition. The Company is currently evaluating the impact the amendments will have on the consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. The amendments in this ASU simplify the subsequent measurement of goodwill by eliminating Step 2 from the goodwill impairment test. Under the amendments, an entity should perform its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying value, which eliminates the current requirement to calculate a goodwill impairment charge by comparing the implied fair value of goodwill with its carrying amount. The amendments will be effective beginning the first quarter of fiscal year 2020. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The amendments should be applied on a prospective basis. The Company is currently evaluating the impact the amendments will have on the consolidated financial statements.

In February 2017, the FASB issued ASU No. 2017-05, Derecognition and Partial Sales of Nonfinancial Assets. The amendments in this ASU clarify the scope of guidance on nonfinancial asset derecognition (ASC 610-20) as well as the accounting for partial sales of nonfinancial assets. The amendments will be effective beginning the first quarter of fiscal year 2018. Early adoption is permitted but is conditioned upon the early adoption of the new revenue standard (ASC 606). The amendments should be applied on a full or modified retrospective basis. The Company is currently evaluating the impact the amendments will have on the consolidated financial statements.

22

Contractual Obligations

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| Item 7A. |

Quantitative and Qualitative Disclosure About Market Risk

|

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

23

| Item 8. |

Financial Statements and Supplementary Data

|

IONIX TECHNOLOGY, INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

Financial Statements

|

|

Page

|

|

Reports of Independent Registered Public Accounting Firm

|

|

F-1

|

|

Consolidated Balance Sheets as of June 30, 2017 and 2016

|

|

F-2

|

|

Consolidated Statements of Comprehensive Income (Loss) for the years ended June 30, 2017 and 2016

|

|

F-3

|

|

Consolidated Statements of Stockholders’ Equity for the years ended June 30, 2017 and 2016

|

|

F-4

|

|

Consolidated Statements of Cash Flows for the years ended June 30, 2017 and 2016

|

|

F-5

|

|

Notes to Consolidated Financial Statements

|

|

F-6

|

24

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To Board of Directors and the Stockholders of

Ionix Technology, Inc.

We have audited the accompanying consolidated balance sheets of Ionix Technology, Inc. (“the Company”) as of June 30, 2017 and 2016 and the related consolidated statements of comprehensive income (loss), stockholders’ equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Ionix Technology, Inc. as of June 30, 2017 and 2016, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company had an accumulated deficit of $183,441 at June 30, 2017 and has not generated sufficient cash flow from its operations for the past two years. These circumstances, among others, raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are described in note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Paritz & Company, P.A.

Hackensack, New Jersey

October 13, 2017

F-1

IONIX TECHNOLOGY, INC.

|

|

June 30, 2017

|

June 30, 2016

|

||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash

|

$

|

186,767

|

$

|

59,758

|

||||

|

Accounts receivable

|

292,265

|

-

|

||||||

|

Inventory

|

53,163

|

-

|

||||||

|

Advances to suppliers

|

118,647

|

-

|

||||||

|

Other receivables

|

147,615

|

-

|

||||||

|

Prepaid expenses and other current assets

|

10,755

|

103

|

||||||

|

Current asset of discontinued operation

|

-

|

2,129,360

|

||||||

|

Total Current Assets

|

809,212

|

2,189,221

|

||||||

|

Total Assets

|

$

|

809,212

|

$

|

2,189,221

|

||||

|

|

||||||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable-- non-related parties

|

$

|

96,378

|

$

|

-

|

||||

|

- related parties

|

159,861

|

-

|

||||||

|

Advance from customers

|

72,476

|

-

|

||||||

|

Due to related parties

|

323,599

|

53,510

|

||||||

|

Accrued expenses and other current liabilities

|

94,844

|

9,080

|

||||||

|

Current liability of discontinued operation

|

-

|

2,113,533

|

||||||

|

Total Current Liabilities

|

747,158

|

2,176,123

|

||||||

|

|

||||||||

|

COMMITMENT AND CONTINGENCIES

|

||||||||

|

|

||||||||

|

Stockholders’ Equity :

|

||||||||

|

Preferred stock,5,000,000 shares authorized,

$.0001 par value; 5,000,000 shares issued and

outstanding |

500

|

500

|

||||||

|

Common stock, 195,000,000 shares authorized,