Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NRG ENERGY, INC. | a17-22951_1ex99d1.htm |

| EX-10.2 - EX-10.2 - NRG ENERGY, INC. | a17-22951_1ex10d2.htm |

| EX-10.1 - EX-10.1 - NRG ENERGY, INC. | a17-22951_1ex10d1.htm |

| 8-K - 8-K - NRG ENERGY, INC. | a17-22951_18k.htm |

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

|

|

) |

|

|

In re: |

) |

Chapter 11 |

|

|

) |

|

|

GENON ENERGY, INC., et al.,(1) |

) |

Case No. 17-33695 (DRJ) |

|

|

) |

|

|

Debtors. |

) |

(Jointly Administered) |

|

|

) |

|

DISCLOSURE STATEMENT FOR THE SECOND AMENDED JOINT CHAPTER 11 PLAN

OF REORGANIZATION OF GENON ENERGY, INC. AND ITS DEBTOR AFFILIATES

|

James H.M. Sprayregen, P.C. (admitted pro hac vice) |

Zack A. Clement (Texas Bar No. 04361550) | ||

|

David R. Seligman, P.C. (admitted pro hac vice) |

ZACK A. CLEMENT PLLC | ||

|

Steven N. Serajeddini (admitted pro hac vice) |

3753 Drummond Street | ||

|

W. Benjamin Winger (admitted pro hac vice) |

Houston, Texas 77025 | ||

|

Christopher M. Hayes (admitted pro hac vice) |

Telephone: |

(832) 274-7629 | |

|

KIRKLAND & ELLIS LLP |

| ||

|

KIRKLAND & ELLIS INTERNATIONAL LLP |

| ||

|

300 North LaSalle |

| ||

|

Chicago, Illinois 60654 |

| ||

|

Telephone: |

(312) 862-2000 |

| |

|

Facsimile: |

(312) 862-2200 |

| |

|

|

| ||

|

-and- |

| ||

|

|

| ||

|

AnnElyse Scarlett Gibbons (admitted pro hac vice) |

| ||

|

KIRKLAND & ELLIS LLP |

| ||

|

KIRKLAND & ELLIS INTERNATIONAL LLP |

| ||

|

601 Lexington Avenue |

| ||

|

New York, New York 10022 |

| ||

|

Telephone: |

(212) 446-4800 |

| |

|

Facsimile: |

(212) 446-4900 |

| |

|

|

| ||

|

Co-Counsel to the Debtors and Debtors in Possession |

| ||

|

Dated: October 2, 2017 |

| ||

(1) The Debtors in these chapter 11 cases, along with the last four digits of each debtor’s federal tax identification number, are: GenOn Energy, Inc. (5566); GenOn Americas Generation, LLC (0520); GenOn Americas Procurement, Inc. (8980); GenOn Asset Management, LLC (1966); GenOn Capital Inc. (0053); GenOn Energy Holdings, Inc. (8156); GenOn Energy Management, LLC (1163); GenOn Energy Services, LLC (8220); GenOn Fund 2001 LLC (0936); GenOn Mid-Atlantic Development, LLC (9458); GenOn Power Operating Services MidWest, Inc. (3718); GenOn Special Procurement, Inc. (8316); Hudson Valley Gas Corporation (3279); Mirant Asia-Pacific Ventures, LLC (1770); Mirant Intellectual Asset Management and Marketing, LLC (3248); Mirant International Investments, Inc. (1577); Mirant New York Services, LLC (N/A); Mirant Power Purchase, LLC (8747); Mirant Wrightsville Investments, Inc. (5073); Mirant Wrightsville Management, Inc. (5102); MNA Finance Corp. (8481); NRG Americas, Inc. (2323); NRG Bowline LLC (9347); NRG California North LLC (9965); NRG California South GP LLC (6730); NRG California South LP (7014); NRG Canal LLC (5569); NRG Delta LLC (1669); NRG Florida GP, LLC (6639); NRG Florida LP (1711); NRG Lovett Development I LLC (6327); NRG Lovett LLC (9345); NRG New York LLC (0144); NRG North America LLC (4609); NRG Northeast Generation, Inc. (9817); NRG Northeast Holdings, Inc. (9148); NRG Potrero LLC (1671); NRG Power Generation Assets LLC (6390); NRG Power Generation LLC (6207); NRG Power Midwest GP LLC (6833); NRG Power Midwest LP (1498); NRG Sabine (Delaware), Inc. (7701); NRG Sabine (Texas), Inc. (5452); NRG San Gabriel Power Generation LLC (0370); NRG Tank Farm LLC (5302); NRG Wholesale Generation GP LLC (6495); NRG Wholesale Generation LP (3947); NRG Willow Pass LLC (1987); Orion Power New York GP, Inc. (4975); Orion Power New York LP, LLC (4976); Orion Power New York, L.P. (9521); RRI Energy Broadband, Inc. (5569); RRI Energy Channelview (Delaware) LLC (9717); RRI Energy Channelview (Texas) LLC (5622); RRI Energy Channelview LP (5623); RRI Energy Communications, Inc. (6444); RRI Energy Services Channelview LLC (5620); RRI Energy Services Desert Basin, LLC (5991); RRI Energy Services, LLC (3055); RRI Energy Solutions East, LLC (1978); RRI Energy Trading Exchange, Inc. (2320); and RRI Energy Ventures, Inc. (7091). The Debtors’ service address is: 804 Carnegie Center, Princeton, New Jersey 08540.

TABLE OF CONTENTS

|

|

|

Page | |

|

|

|

| |

|

I. |

INTRODUCTION |

3 | |

|

|

|

| |

|

II. |

PRELIMINARY STATEMENT |

3 | |

|

|

|

| |

|

III. |

OVERVIEW OF THE PLAN |

4 | |

|

|

|

| |

|

|

A. |

Substantial Debt-for-Equity Exchange |

4 |

|

|

B. |

New Common Stock |

4 |

|

|

C. |

Third-Party Sale Transactions |

5 |

|

|

D. |

Liquidating Trust |

5 |

|

|

E. |

Exit Financing |

5 |

|

|

F. |

NRG Settlement |

6 |

|

|

G. |

Transition Services Agreement |

6 |

|

|

H. |

Employee Matters Agreement |

7 |

|

|

I. |

Tax Matters and Tax Matters Agreement |

7 |

|

|

J. |

Releases |

7 |

|

|

|

|

|

|

IV. |

QUESTIONS AND ANSWERS REGARDING THIS DISCLOSURE STATEMENT AND PLAN |

8 | |

|

|

|

|

|

|

|

A. |

What is chapter 11? |

8 |

|

|

B. |

Why are the Debtors sending me this Disclosure Statement? |

8 |

|

|

C. |

Am I entitled to vote on the Plan? |

9 |

|

|

D. |

What will I receive from the Debtors if the Plan is consummated? |

9 |

|

|

E. |

When will I receive my New Common Stock distribution under the Plan if I hold an Allowed GenOn Notes Claim? |

13 |

|

|

F. |

What will I receive from the Debtors if I hold an Allowed Administrative Claim or a Priority Tax Claim? |

14 |

|

|

G. |

Are any regulatory approvals required to consummate the Plan? |

14 |

|

|

H. |

What happens to my recovery if the Plan is not confirmed or does not go effective? |

14 |

|

|

I. |

If the Plan provides that I get a distribution, do I get it upon Confirmation or when the Plan goes effective, and what is meant by “Confirmation,” “Effective Date,” and “Consummation?” |

14 |

|

|

J. |

What are the sources of Cash and other consideration required to fund the Plan? |

14 |

|

|

K. |

Are there risks to owning the New Common Stock upon emergence from chapter 11? |

14 |

|

|

L. |

Will the final amount of Allowed General Unsecured Claims affect my distribution under the Plan? |

14 |

|

|

M. |

How will certain litigation matters be treated under the Plan? |

15 |

|

|

N. |

How will power plant deactivation obligations, including environmental obligations, be treated under the Plan? |

15 |

|

|

O. |

Will there be releases and exculpation granted to parties in interest as part of the Plan? |

15 |

|

|

P. |

What is the deadline to vote on the Plan? |

18 |

|

|

Q. |

How do I vote for or against the Plan? |

18 |

|

|

R. |

Why is the Bankruptcy Court holding a Confirmation Hearing? |

19 |

|

|

S. |

When is the Confirmation Hearing set to occur? |

19 |

|

|

T. |

What is the purpose of the Confirmation Hearing? |

20 |

|

|

U. |

What is the effect of the Plan on the Debtors’ ongoing business? |

20 |

|

|

V. |

Will any party have significant influence over the corporate governance and operations of the Reorganized Debtors? |

20 |

|

|

W. |

Who do I contact if I have additional questions with respect to this Disclosure Statement or the Plan? |

20 |

|

|

X. |

Do the Debtors recommend voting in favor of the Plan? |

21 |

|

|

Y. |

Who supports the Plan? |

21 |

|

V. |

IMPORTANT INFORMATION ABOUT THIS DISCLOSURE STATEMENT |

21 | |

|

|

|

|

|

|

|

A. |

Certain Key Terms Used in this Disclosure Statement |

21 |

|

|

B. |

Additional Important Information |

22 |

|

|

|

|

|

|

VI. |

THE DEBTORS’ BUSINESS OPERATIONS AND CAPITAL STRUCTURE |

24 | |

|

|

|

|

|

|

|

A. |

The Debtors’ Corporate Structure and History |

24 |

|

|

B. |

The Debtors’ Assets and Operations |

24 |

|

|

C. |

Regulatory Matters |

27 |

|

|

D. |

Environmental Matters |

27 |

|

|

E. |

The Debtors’ Employees |

28 |

|

|

F. |

The Debtors’ Prepetition Capital Structure |

28 |

|

|

|

|

|

|

VII. |

EVENTS LEADING TO THE DEBTORS’ FINANCIAL DIFFICULTIES AND COMMENCEMENT OF THE CHAPTER 11 CASES |

29 | |

|

|

|

|

|

|

|

A. |

Challenges Facing the Debtors’ Business |

29 |

|

|

B. |

Operational Responses |

30 |

|

|

C. |

Financial Responses |

30 |

|

|

D. |

NRG and Noteholder Committee Negotiations |

31 |

|

|

E. |

Noteholder Litigation and Claims Investigation |

31 |

|

|

F. |

The Restructuring Support and Lock-Up Agreement |

32 |

|

|

G. |

The Backstop Commitment |

33 |

|

|

|

|

|

|

VIII. |

EVENTS OF THE CHAPTER 11 CASES |

33 | |

|

|

|

|

|

|

|

A. |

Corporate Structure upon Emergence |

33 |

|

|

B. |

Expected Timetable of the Chapter 11 Cases |

33 |

|

|

C. |

First Day Relief |

34 |

|

|

D. |

Retention Applications |

34 |

|

|

E. |

Estimation of Owner Lessor Plaintiffs’ Claims |

34 |

|

|

F. |

Post-Petition Letter of Credit Facility |

34 |

|

|

G. |

The MDL Litigation |

35 |

|

|

H. |

The Marketing Process Procedures |

35 |

|

|

I. |

The Cash Incentive Plan |

36 |

|

|

J. |

Deferred Compensation Plan Termination |

36 |

|

|

|

|

|

|

IX. |

PROJECTED FINANCIAL INFORMATION |

37 | |

|

|

|

| |

|

X. |

RISK FACTORS |

37 | |

|

|

|

|

|

|

|

A. |

Risks Related to the Restructuring |

37 |

|

|

B. |

Risks Related to Recoveries Under the Plan |

47 |

|

|

C. |

Risks Related to the Business Operations of the Debtors and Reorganized Debtors |

48 |

|

|

D. |

Miscellaneous Risk Factors and Disclaimers |

53 |

|

|

|

|

|

|

XI. |

SOLICITATION AND VOTING PROCEDURES |

54 | |

|

|

|

|

|

|

|

A. |

Holders of Claims Entitled to Vote on the Plan |

54 |

|

|

B. |

Voting Record Date |

54 |

|

|

C. |

Voting Deadline |

54 |

|

|

D. |

Solicitation Procedures |

55 |

|

|

E. |

Voting Procedures |

55 |

|

|

F. |

Voting Tabulation |

58 |

|

|

G. |

Ballots Not Counted |

59 |

|

|

|

|

|

|

XII. |

CONFIRMATION OF THE PLAN |

59 | |

|

|

|

|

|

|

|

A. |

Requirements of Section 1129(a) of the Bankruptcy Code |

59 |

|

|

B. |

The Debtor Release, Third-Party Release, Exculpation, and Injunction Provisions |

60 |

|

|

C. |

Best Interests of Creditors—Liquidation Analysis |

61 |

|

|

D. |

Feasibility/Financial Projections |

62 |

|

|

E. |

Acceptance by Impaired Classes |

62 |

|

|

F. |

Confirmation Without Acceptance by All Impaired Classes |

62 |

|

|

G. |

Valuation of the Debtors |

63 |

|

|

|

|

|

|

XIII. |

IMPORTANT SECURITIES LAWS DISCLOSURES |

64 | |

|

|

|

|

|

|

|

A. |

Plan Securities |

64 |

|

|

B. |

Issuance and Resale of Plan Securities Under the Plan |

64 |

|

|

|

|

|

|

XIV. |

CERTAIN U.S. FEDERAL TAX CONSEQUENCES OF THE PLAN |

66 | |

|

|

|

|

|

|

|

A. |

Introduction |

66 |

|

|

B. |

Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors and the Reorganized Debtors |

67 |

|

|

C. |

Certain U.S. Federal Income Tax Consequences of the Plan to Holders of Allowed Claims |

71 |

|

|

D. |

Limitations on Use of Capital Losses |

79 |

|

|

E. |

Medicare Tax |

79 |

|

|

F. |

Certain U.S. Federal Income Tax Consequences of the Plan to Non-U.S. Holders of Allowed Claims |

79 |

|

|

G. |

Withholding and Reporting |

82 |

|

|

|

|

|

|

XV. |

RECOMMENDATION OF THE DEBTORS |

84 | |

EXHIBITS

|

EXHIBIT A |

Plan of Reorganization |

|

|

|

|

EXHIBIT B |

Corporate Structure of the Debtors |

|

|

|

|

EXHIBIT C |

Restructuring Support Agreement |

|

|

|

|

EXHIBIT D |

Financial Projections |

|

|

|

|

EXHIBIT E |

Valuation Analysis |

|

|

|

|

EXHIBIT F |

Liquidation Analysis |

|

|

|

|

EXHIBIT G |

Disclosure Statement Order |

THE DEBTORS ARE PROVIDING THE INFORMATION IN THIS DISCLOSURE STATEMENT TO HOLDERS OF CLAIMS AND INTERESTS FOR PURPOSES OF SOLICITING VOTES TO ACCEPT OR REJECT THE JOINT PLAN OF REORGANIZATION OF GENON ENERGY, INC. AND ITS DEBTOR AFFILIATES PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE RELIED UPON OR USED BY ANY ENTITY FOR ANY OTHER PURPOSE. BEFORE DECIDING WHETHER TO VOTE FOR OR AGAINST THE PLAN, EACH HOLDER ENTITLED TO VOTE SHOULD CAREFULLY CONSIDER ALL OF THE INFORMATION IN THIS DISCLOSURE STATEMENT, INCLUDING THE RISK FACTORS DESCRIBED IN ARTICLE X HEREIN.

THE PLAN IS SUPPORTED BY THE DEBTORS AND CERTAIN PARTIES TO THE RESTRUCTURING SUPPORT AGREEMENT. ALL SUCH PARTIES URGE HOLDERS OF CLAIMS WHOSE VOTES ARE BEING SOLICITED TO ACCEPT THE PLAN.

THE DEBTORS URGE EACH HOLDER OF A CLAIM TO CONSULT WITH ITS OWN ADVISORS WITH RESPECT TO ANY LEGAL, FINANCIAL, SECURITIES, TAX, OR BUSINESS ADVICE IN REVIEWING THIS DISCLOSURE STATEMENT, THE PLAN, AND THE PROPOSED TRANSACTIONS CONTEMPLATED THEREBY. FURTHERMORE, THE BANKRUPTCY COURT’S APPROVAL OF THE ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE THE BANKRUPTCY COURT’S APPROVAL OF THE PLAN.

THIS DISCLOSURE STATEMENT CONTAINS, AMONG OTHER THINGS, SUMMARIES OF THE PLAN, CERTAIN STATUTORY PROVISIONS, AND CERTAIN ANTICIPATED EVENTS IN THE DEBTORS’ CHAPTER 11 CASES. ALTHOUGH THE DEBTORS BELIEVE THAT THESE SUMMARIES ARE FAIR AND ACCURATE, THESE SUMMARIES ARE QUALIFIED IN THEIR ENTIRETY TO THE EXTENT THAT THEY DO NOT SET FORTH THE ENTIRE TEXT OF SUCH DOCUMENTS OR STATUTORY PROVISIONS OR EVERY DETAIL OF SUCH ANTICIPATED EVENTS. IN THE EVENT OF ANY INCONSISTENCY OR DISCREPANCY BETWEEN A DESCRIPTION IN THIS DISCLOSURE STATEMENT AND THE TERMS AND PROVISIONS OF THE PLAN OR ANY OTHER DOCUMENTS INCORPORATED HEREIN BY REFERENCE, THE PLAN OR SUCH OTHER DOCUMENTS WILL GOVERN FOR ALL PURPOSES. FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS BEEN PROVIDED BY THE DEBTORS’ MANAGEMENT EXCEPT WHERE OTHERWISE SPECIFICALLY NOTED. THE DEBTORS DO NOT REPRESENT OR WARRANT THAT THE INFORMATION CONTAINED HEREIN OR ATTACHED HERETO IS WITHOUT ANY MATERIAL INACCURACY OR OMISSION.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND BANKRUPTCY RULE 3016(B) AND IS NOT NECESSARILY PREPARED IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER SIMILAR LAWS.

THIS DISCLOSURE STATEMENT WAS NOT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE AUTHORITY AND NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE AUTHORITY HAVE PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN.

IN PREPARING THIS DISCLOSURE STATEMENT, THE DEBTORS RELIED ON FINANCIAL DATA DERIVED FROM THE DEBTORS’ BOOKS AND RECORDS AND ON VARIOUS ASSUMPTIONS REGARDING THE DEBTORS’ BUSINESSES. WHILE THE DEBTORS BELIEVE THAT SUCH FINANCIAL INFORMATION FAIRLY REFLECTS THE FINANCIAL CONDITION OF THE DEBTORS AS OF THE DATE HEREOF AND THAT THE ASSUMPTIONS REGARDING FUTURE EVENTS REFLECT REASONABLE BUSINESS JUDGMENTS, NO REPRESENTATIONS OR WARRANTIES ARE MADE AS TO THE ACCURACY OF THE FINANCIAL INFORMATION CONTAINED HEREIN OR ASSUMPTIONS REGARDING THE DEBTORS’ BUSINESSES AND THEIR FUTURE RESULTS AND OPERATIONS. THE DEBTORS EXPRESSLY CAUTION READERS NOT TO PLACE UNDUE RELIANCE ON ANY FORWARD LOOKING STATEMENTS CONTAINED HEREIN.

THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE, AND MAY NOT BE CONSTRUED AS, AN ADMISSION OF FACT, LIABILITY, STIPULATION, OR WAIVER. THE DEBTORS MAY SEEK TO INVESTIGATE, FILE, AND PROSECUTE CLAIMS AND MAY OBJECT TO CLAIMS AFTER THE CONFIRMATION OR EFFECTIVE DATE OF THE PLAN IRRESPECTIVE OF WHETHER THIS DISCLOSURE STATEMENT IDENTIFIES ANY SUCH CLAIMS OR OBJECTIONS TO CLAIMS.

THE DEBTORS ARE MAKING THE STATEMENTS AND PROVIDING THE FINANCIAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT AS OF THE DATE HEREOF, UNLESS OTHERWISE SPECIFICALLY NOTED. ALTHOUGH THE DEBTORS MAY SUBSEQUENTLY UPDATE THE INFORMATION IN THIS DISCLOSURE STATEMENT, THE DEBTORS HAVE NO AFFIRMATIVE DUTY TO DO SO, AND EXPRESSLY DISCLAIM ANY DUTY TO PUBLICLY UPDATE ANY FORWARD LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE. HOLDERS OF CLAIMS REVIEWING THIS DISCLOSURE STATEMENT SHOULD NOT INFER THAT, AT THE TIME OF THEIR REVIEW, THE FACTS SET FORTH HEREIN HAVE NOT CHANGED SINCE THIS DISCLOSURE STATEMENT WAS FILED. INFORMATION CONTAINED HEREIN IS SUBJECT TO COMPLETION, MODIFICATION, OR AMENDMENT. THE DEBTORS RESERVE THE RIGHT TO FILE AN AMENDED OR MODIFIED PLAN AND RELATED DISCLOSURE STATEMENT FROM TIME TO TIME, SUBJECT TO THE TERMS OF THE PLAN AND CONSISTENT WITH THE RESTRUCTURING SUPPORT AGREEMENT.

THE DEBTORS HAVE NOT AUTHORIZED ANY ENTITY TO GIVE ANY INFORMATION ABOUT OR CONCERNING THE PLAN OTHER THAN THAT WHICH IS CONTAINED IN THIS DISCLOSURE STATEMENT. THE DEBTORS HAVE NOT AUTHORIZED ANY REPRESENTATIONS CONCERNING THE DEBTORS OR THE VALUE OF THEIR PROPERTY OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT.

IF THE PLAN IS CONFIRMED BY THE BANKRUPTCY COURT AND THE EFFECTIVE DATE OCCURS, ALL HOLDERS OF CLAIMS AND INTERESTS (INCLUDING THOSE HOLDERS OF CLAIMS WHO DO NOT SUBMIT BALLOTS TO ACCEPT OR REJECT THE PLAN, OR WHO ARE NOT ENTITLED TO VOTE ON THE PLAN) WILL BE BOUND BY THE TERMS OF THE PLAN AND THE RESTRUCTURING TRANSACTION CONTEMPLATED THEREBY.

I. INTRODUCTION

GenOn Energy, Inc. (“GenOn”) and certain of its direct and indirect subsidiaries, as debtors and debtors in possession (each, a “Debtor,” collectively, the “Debtors”), submit this disclosure statement (including all exhibits hereto, the “Disclosure Statement”) pursuant to sections 1125 and 1126 of the Bankruptcy Code to Holders of Claims against and Interests in the Debtors in connection with the solicitation of acceptances with respect to the Second Amended Joint Chapter 11 Plan of Reorganization of GenOn Energy, Inc. and its Debtor Affiliates (as may be amended or modified from time to time and including all exhibits and supplements thereto, the “Plan”). A copy of the Plan is attached hereto as Exhibit A and incorporated herein by reference.(2) The Plan constitutes a separate chapter 11 plan for each of the Debtors.

THE DEBTORS BELIEVE THAT THE COMPROMISES AND SETTLEMENTS CONTEMPLATED BY THE PLAN ARE FAIR AND EQUITABLE, MAXIMIZE THE VALUE OF THE DEBTORS’ ESTATES, AND MAXIMIZE RECOVERIES TO HOLDERS OF CLAIMS AND INTERESTS. THE DEBTORS BELIEVE THE PLAN IS THE BEST AVAILABLE ALTERNATIVE FOR IMPLEMENTING A RESTRUCTURING OF THE DEBTORS’ BALANCE SHEET. THE DEBTORS STRONGLY RECOMMEND THAT YOU VOTE TO ACCEPT THE PLAN.

II. PRELIMINARY STATEMENT

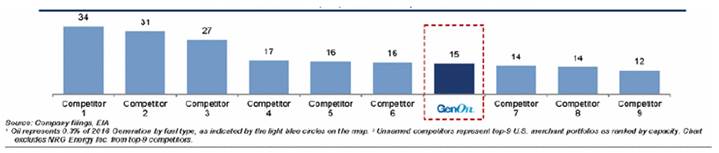

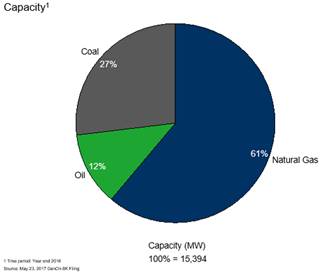

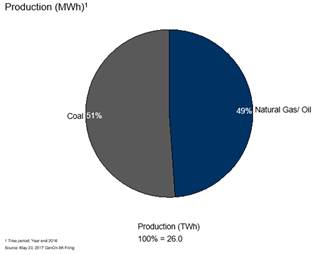

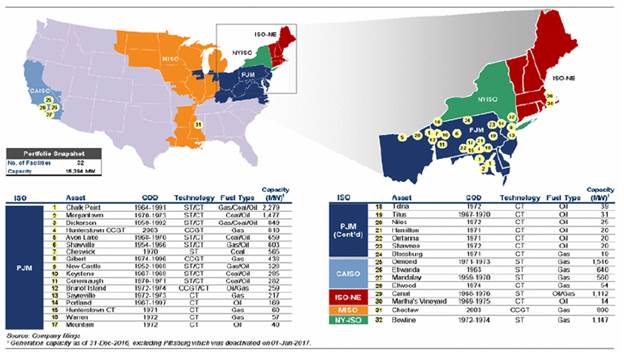

The Debtors, together with their controlled non-Debtor subsidiaries (collectively, the “Company”), are a power company with a principal focus on wholesale power generation activities in the Mid-Atlantic region of the United States, primarily in Pennsylvania and Maryland, and in California. The Debtors maintain additional power generation assets and operations in Florida, Massachusetts, Mississippi, New Jersey, New York, and Ohio. The Debtors also trade energy, capacity, and related products, and transact and trade fuel and transportation services to support and supplement their wholesale power generation activities. The Debtors are headquartered in Princeton, New Jersey, and employ approximately 1,600 individuals.

On June 14, 2017 (the “Petition Date”), the Debtors commenced these chapter 11 cases (the “Chapter 11 Cases”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) with overwhelming support from their key stakeholders. The restructuring support agreement, attached hereto as Exhibit C (together with all exhibits thereto, and as amended, restated, and supplemented from time to time, the “RSA”), features the support of the Debtors’ current equity holder, NRG Energy, Inc. (“NRG”), certain holders representing greater than 93% in aggregate principal amount of GenOn’s outstanding senior unsecured notes (the “GenOn Notes”) and certain holders representing greater than 93% in aggregate principal amount of GenOn Americas Generation, LLC (“GAG”)’s outstanding senior unsecured notes (the “GAG Notes”). The Plan pays all Holders of Allowed General Unsecured Claims in full. Through the restructuring, the Debtors will significantly delever their balance sheet by at least $1.75 billion and implement an orderly transition to a standalone power generation company better situated for success in the current market environment.

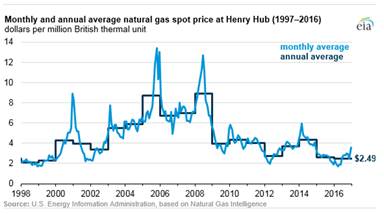

GenOn was acquired by NRG in December 2012. Since that time GenOn has become unable to generate profits sufficient to support its legacy capital structure. A challenging market environment exacerbated the Debtors’ financial distress. Over the past five years, demand for power in the United States has been generally flat with no expectation for growth. In the same time period, total generating capacity has grown as new generating capacity surpassed power plant retirements. The Debtors, in particular, have been hurt by the glut of new power sources with a lower marginal generating price than the Debtors’ older, less efficient fleet. Moreover, the prices for natural gas—which has been challenging coal as the leading fuel source for power generation in the United States—have dropped well below the expectations of NRG, GenOn, and the market in 2012. Indeed, in 2016 the average price of natural gas was at the lowest it had been since 1999 and the prices remain at these depressed levels. This combination has

(2) Capitalized terms used but not otherwise defined in this Disclosure Statement have the meaning ascribed to such terms in the Plan. Additionally, this Disclosure Statement incorporates the rules of interpretation located in Article I of the Plan. The summary provided in this Disclosure Statement of any documents attached to this Disclosure Statement, including the Plan, are qualified in their entirety by reference to the Plan, the exhibits, and other materials referenced in the Plan, the Plan Supplement, and the documents being summarized. In the event of any inconsistencies between the terms of this Disclosure Statement and the Plan, the Plan shall govern.

caused energy and capacity prices to fall and so, in turn, has the Debtors’ revenue and profitability. At current commodity prices, the Debtors could not afford to make their June 15, 2017 maturity payment and continue to service the interest and principal obligations on the remaining funded debt of approximately $1.96 billion thereafter.

Facing these challenges and having spent the past year analyzing their options to address the near- and long-term maturities on their senior unsecured notes, the Debtors concluded that commencing these Chapter 11 Cases now is their best path forward to implement a restructuring that will withstand current market challenges, maximize the value of their assets, and address liquidity needs. Notwithstanding these market pressures, the Debtors were able to build consensus for the global restructuring contemplated by the RSA and embodied in this Plan, which is supported by their current equity holder, NRG, certain holders representing greater than 93% in aggregate principal amount of GenOn Notes and certain holders representing greater than 93% in aggregate principal amount of GAG Notes (collectively, the “Consenting Noteholders,” and together with NRG, the “Consenting Parties”).

Through the Plan, the Debtors will, among other things: (a) equitize approximately $1.8 billion in debt; (b) pay cash to Holders of Allowed GAG Notes Claims at an agreed-upon discount to par; (c) transition to a standalone enterprise with a leaner capital and operating structure that is better suited for today’s market challenges; and (d) implement a global settlement of potential claims and causes of action against NRG. This settlement provides substantial cash and non-cash consideration, including a handover of NRG’s 100% equity position in GenOn, a $261.3 million cash contribution, a pension contribution worth approximately $13.2 million, a $27.8 million credit against amounts GenOn owes under the Shared Services Agreement (as defined herein), discounted services under the Shared Services Agreement, and certain tax-related concessions. Based on the milestones contained in the RSA, the Debtors intend to move expeditiously through chapter 11 with a target emergence before year’s end.

III. OVERVIEW OF THE PLAN

The Plan provides for the reorganization of the Debtors as a standalone entity separate from NRG and will significantly reduce long-term debt and annual interest payments and preserve the Debtors’ existing liquidity, resulting in a stronger, de-levered balance sheet. Moreover, through the NRG Settlement, it will resolve all potential claims against their non-Debtor parent, NRG, for substantial cash and non-cash consideration that will give the Reorganized Debtors a true “blank slate” upon emergence. Specifically, the Plan contemplates a restructuring of the Debtors through a debt-for-equity conversion, together with certain other forms of consideration and the possibility of a sale of some or all of the Debtors’ assets pursuant to a marketing process. The key terms of the Plan are as follows:

A. Substantial Debt-for-Equity Exchange.

A key element of the Plan is the agreement of the Consenting GenOn Noteholders to convert the GenOn Notes Claims into New Common Stock (along with, potentially, receiving other forms of consideration). Specifically, the Holders of GenOn Notes Claims will receive their Pro Rata share of 100 percent of the New Common Stock, subject to dilution by a Management Incentive Plan. As a result, GenOn (or a successor of GenOn) will emerge as a standalone entity, separate in all respects from NRG following the completion of its transition.

B. New Common Stock.

The issuance of Securities under the Plan, including the shares of the New Common Stock and options, or other equity awards, if any, reserved under a Management Incentive Plan, shall be authorized without the need for any further corporate action and without any further action by the Holders of Claims or Interests.

All of the shares of New Common Stock issued pursuant to the Plan, including any options for the purchase thereof and equity awards associated therewith, shall be duly authorized without the need for any further corporate action and without any further action by the Debtors or Reorganized Debtors, as applicable, validly issued, fully paid, and non-assessable. Each distribution and issuance of the New Common Stock under the Plan shall be governed by the terms and conditions set forth in the Plan applicable to such distribution or issuance and by the terms and conditions of the instruments evidencing or relating to such distribution or issuance, which terms and conditions shall bind each Entity receiving such distribution or issuance.

C. Third-Party Sale Transactions.

The Debtors have engaged Credit Suisse Securities (USA) LLC (“Credit Suisse”) to conduct a competitive marketing process to sell one or more of the Debtors’ assets, Interests in the Debtors owning such assets, or the New Common Stock to one or more third parties, as agreed to or consummated by the Debtors or Reorganized Debtors, as applicable, in consultation with the GenOn Steering Committee and NRG (the “Third-Party Sale Transactions,” and specifically with respect to any direct or indirect, sale, transfer, lease or similar disposition of one or more of the GAG Entities’ assets, or Interests in any GAG Entity, owning such assets, to third parties, as determined by the Debtors or Reorganized Debtors, as applicable, in consultation with the GAG Steering Committee, the “Third-Party GAG Sale Transactions”). Throughout the sale process, which may extend past the Effective Date, the Debtors will determine, in their business judgment and in consultation with the GenOn Steering Committee and NRG, and in the case of a Third-Party GAG Sale Transaction, in consultation with the GAG Steering Committee, whether any such Third-Party Sale Transactions will maximize value for the Debtors and their stakeholders.

If the Debtors determine to consummate any Third-Party GAG Sale Transaction prior to the Effective Date, all Sale Proceeds received in connection therewith, including any interest accrued thereon, will comprise the GAG Escrow Amount and may not be used for any purpose other than the payment of GAG Notes Claims until and unless the GAG Notes Claims have been fully satisfied as provided for in Article III of the Plan. No Third Party GAG Sale Transaction will be agreed to or consummated on or prior to the Effective Date, however, if reasonably objected to by (i) the GAG Steering Committee or (ii) Consenting GenOn Noteholders holding over fifty percent (50%) in principal amount of the GenOn Notes then held by all Consenting GenOn Noteholders.

If the Debtors determine to consummate any Third-Party Sale Transaction that is not a Third-Party GAG Sale Transaction, in consultation with the GenOn Steering Committee and NRG, they may do so either (a) on or before the Effective Date, if reasonably practicable, and use such Sale Proceeds to make payments or distributions pursuant to the Plan, or (b) after the Effective Date, and issue the New Subordinated Notes on the Effective Date in an aggregate amount to be determined, in part, by reference to any expected Sale Proceeds yet to be received by the Reorganized Debtors, with the expectation that the terms of such New Subordinated Notes will provide that such Sale Proceeds, when received, shall be used to repay any outstanding New Subordinated Notes as soon as reasonably practicable after the Effective Date. No Third Party Sale Transaction that is not a Third-Party GAG Sale Transaction will be agreed to or consummated on or prior to the Effective Date, however, if reasonably objected to by Consenting GenOn Noteholders holding over fifty percent (50%) in principal amount of the GenOn Notes then held by all Consenting GenOn Noteholders.

D. Liquidating Trust.

On the Effective Date, the Debtors, on their own behalf and on behalf of the the Holders of GenOn Notes Claims and such other Holders of Claims that are to be satisfied with post-Effective Date distributions from the Liquidating Trust Assets as determined by the Debtors with the consent of the GenOn Steering Committee, such consent not to be unreasonably withheld, and, as applicable, the Purchaser (the “Beneficiaries”), may, with the consent of the GenOn Steering Committee, such consent not to be unreasonably withheld, execute the Liquidating Trust Agreement and take all other steps necessary to establish the Liquidating Trust pursuant to the Liquidating Trust Agreement. The Liquidating Trust Assets may include such assets or Interests as determined by the Debtors prior to the Effective Date with the consent of the GenOn Steering Committee, such consent not to be unreasonably withheld, and, as applicable, in consultation with the Purchaser, provided that the Liquidating Trust Assets shall not include the Settled Claims or any other claims or Causes of Action released or exculpated pursuant to the Plan. On the Effective Date, and in accordance with and pursuant to the terms of the Plan, the Debtors may transfer to the Liquidating Trust all of their rights, title, and interests in all of the Liquidating Trust Assets, if any. However, for the avoidance of doubt, the Debtors may determine to not enter into the Liquidating Trust Agreement and not establish the Liquidating Trust.

E. Exit Financing.

On the Effective Date, the Reorganized Debtors, any Non-Debtor Subsidiaries agreed to by the Debtors and the Exit Financing Parties shall consummate the Exit Financing, subject to definitive documents acceptable to the Debtors and the Exit Financing Parties. The aggregate principal amount of the Exit Financing shall be in an amount reasonably determined by the Debtors and the Exit Financing Parties to be reasonably necessary to fund the Debtor’s

obligations under the Plan and other working capital needs of the Reorganized Debtors after giving effect to any Third-Party Sale Transactions. Any Backstop Financing may be decreased by the amount of excess cash on the balance sheet, as determined in good faith by the Debtors and the Group B Backstop Parties in accordance with the Backstop Commitment Letter and taking into account the future needs of Reorganized GenOn.

If, after following syndication undertaken in connection with the Exit Financing, an amount of the New Exit Credit Facility is not fully committed, the Backstop Parties shall provide Exit Financing in the form of New Senior Secured Notes in accordance with, and subject to, the terms and conditions of the Backstop Commitment Letter. The Exit Financing shall be issued, to the extent in the form of New Senior Secured Notes, without registration in reliance upon the exemption set forth in section 4(a)(2) or Regulation D of the Securities Act and will be “restricted securities.”

On and after the Effective Date, the New Exit Financing Documents and New Subordinated Notes Documents shall constitute legal, valid, and binding obligations of the Reorganized Debtors and be enforceable in accordance with their respective terms. Confirmation shall be deemed approval of the Exit Financing, the New Exit Financing Documents, New Subordinated Notes Documents and/or the Backstop Commitment Letter (including the transactions contemplated thereby, and all actions to be taken, undertakings to be made, and obligations to be incurred and fees paid by the Debtors or the Reorganized Debtors in connection therewith), to the extent not approved by the Bankruptcy Court previously, and the Reorganized Debtors will be authorized to execute and deliver any and all documents necessary or appropriate to consummate the Exit Financing and/or issue the New Subordinated Notes, if any, without further notice to or order of the Bankruptcy Court, act or action under applicable law, regulation, order, or rule or vote, consent, authorization, or approval of any Person, subject to such modifications as the Reorganized Debtors may deem to be necessary to consummate entry into the Exit Financing and/or issue the New Subordinated Notes, if any.

F. NRG Settlement.

The Debtors, Consenting Noteholders, and NRG have agreed upon a global settlement of the Settled Claims, as set forth in the NRG Settlement Agreement. Specifically, in exchange for the releases contained in Article VIII of the Plan, NRG will: (1) make the NRG Settlement Payment, which will fund certain distributions under the Plan; (2) enter into the Pension Indemnity Agreement, pursuant to which NRG will indemnify certain historic pension obligations relating to underfunded liability estimated at approximately $120 million and satisfy approximately $13.2 million in annual contribution obligations for 2017; (3) provide the Services Credit of approximately $27.8 million; (4) enter into the Cooperation Agreement, pursuant to which the Debtors, NRG, and the Consenting Noteholders will cooperate in good faith to maximize the value of facilities owned by GenOn and its direct and indirect subsidiaries at which NRG has begun the development of projects and the related facilities owned by NRG; (5) enter into the Tax Matters Agreement, pursuant to which NRG will agree to certain tax-related indemnification and tax return preparation responsibilities; (6) delay claiming a worthless stock deduction over GenOn’s stock until after GenOn emerges from bankruptcy; and (7) enter into the Transition Services Agreement, as discussed in more detail below.

G. Transition Services Agreement.

On the Effective Date, Reorganized GenOn and NRG shall enter into the Transition Services Agreement (including the transactions contemplated thereby, and all actions to be taken, undertakings to be made, and obligations to be incurred and fees paid by the Debtors or the Reorganized Debtors in connection therewith) to transition the Shared Services. Specifically, for two months after the Effective Date, NRG shall continue providing the Shared Services unless otherwise determined by Reorganized GenOn, and Reorganized GenOn shall have no obligation to pay and NRG shall not earn any Shared Services Fees during such period. Thereafter, Reorganized GenOn shall have the option, in its sole discretion, to extend the provision of Shared Services by NRG for an additional two months, in one-month increments, in exchange for payment of the prorated portion of the Shared Services Fee, and may further extend for such additional periods thereafter, as needed, subject to negotiation and further agreement by NRG and Reorganized GenOn.

To the extent GenOn has paid for Shared Services during the Chapter 11 Cases and the Services Credit has been earned but not exhausted or applied in full, NRG shall, upon request by GenOn, reimburse such payments in cash up to the amount of any unused Services Credit.

The Reorganized Debtors are authorized to execute and deliver those documents necessary or appropriate to consummate the Transition Services Agreement and continue the Shared Services, without further notice to or order of the Bankruptcy Court, act or action under applicable law, regulation, order, or rule or vote, consent, authorization, or approval of any Person.

H. Employee Matters Agreement.

On the Effective Date, GenOn and NRG shall enter into the Employee Matters Agreement in favor of Reorganized GenOn (including the transactions contemplated thereby, and all actions to be taken, undertakings to be made, and obligations to be incurred and fees paid by the Debtors or the Reorganized Debtors in connection therewith). The Reorganized Debtors are authorized to execute and deliver those documents necessary or appropriate to consummate the Employee Matters Agreement, without further notice to or order of the Bankruptcy Court, act or action under applicable law, regulation, order, or rule or vote, consent, authorization, or approval of any Person.

The Employee Matters Agreement shall provide that, from and after the Effective Date, employees of GenOn and its direct or indirect subsidiaries shall no longer accrue benefits under any benefit plans sponsored, maintained or contributed to by NRG and its subsidiaries and affiliates, which shall remain at NRG, and that all such employees shall participate in new employee benefit plans maintained by GenOn. In addition, the Employee Matters Agreement shall address any allocation of legacy employee benefit liabilities for GenOn employees and retirees as between the NRG and GenOn.

I. Tax Matters and Tax Matters Agreement

On the Effective Date, NRG and Reorganized GenOn shall enter into the Tax Matters Agreement and as more fully set forth in the Tax Matters Agreement, all Tax Attributes shall vest in Reorganized GenOn to the maximum extent permitted by applicable law. On and prior to the Effective Date, the Debtors and the Non-Debtor Subsidiaries are authorized to take any actions necessary to preserve such Tax Attributes.

NRG is permanently enjoined from taking any actions inconsistent with this Plan and the Confirmation Order relating to tax matters. To the extent permitted by applicable law, after the Effective Date, NRG shall be permitted to claim the Worthless Stock Deduction in the tax year of the Effective Date.

The Exit Structure shall be implemented in accordance with the Restructuring Transactions Memorandum and in such a manner that the Worthless Stock Deduction will not reasonably be expected to have a material adverse impact on the pro forma tax liabilities of Reorganized GenOn, under realistic assumptions regarding the operation of, or asset sales by, such entities in the future.

J. Releases.

The Plan contains certain releases (as described more fully in Article IX.E hereof), including mutual releases between Debtors, the Reorganized Debtors, and their Estates on the one hand, and (a) the Consenting Noteholders; (b) the GenOn Notes Trustee; (c) the GAG Notes Trustee; (d) the GenOn Steering Committee; (e) the GenOn Ad Hoc Group; (f) the GAG Steering Committee; (g) the GAG Ad Hoc Group; (h) the NRG Parties; (i) the Backstop Parties; (j) Citibank; (k) any Purchaser; (l) with respect to each of the Debtors, the Reorganized Debtors, and each of the foregoing entities in clauses (a) through (k), each such Entity’s current and former predecessors, successors, Affiliates (regardless of whether such interests are held directly or indirectly), subsidiaries, direct and indirect equity holders, funds, portfolio companies, management companies; (m) with respect to each of the foregoing Entities in clauses (a) through (l), each of their respective current and former directors, officers, members, employees, partners, managers, independent contractors, agents, representatives, principals, professionals, consultants, financial advisors, attorneys, accountants, trustees, investment bankers, and other professional advisors (with respect to clause (l), each solely in their capacity as such); and (l) all Holders of Claims and Interests not described in the foregoing clauses (a) through (k); provided, however, that any other such Holder of a Claim or Interest that opts out or otherwise objects to the releases in the Plan shall not be a “Releasing Party” or “Released Party.”

The Plan includes releases of claims held by the Debtors against the Debtors’ directors and officers. The Plan does not preserve any Claims or Causes of Action held by the Debtors against the Debtors’ directors and officers. The Debtors have analyzed and are not aware of any colorable Claims or Causes of Action against the Debtors’ directors and officers.

The Plan also provides that all Holders of Claims that (i) vote to accept or are deemed to accept the Plan or (ii) are in voting Classes who abstain from voting on the Plan and do not opt out of the release provisions contained in Article IX of the Plan will be deemed to have expressly, unconditionally, generally, individually, and collectively released and discharged all Claims and Causes of Action against the Debtors and the Released Parties.

Importantly, all Holders of Claims and Interests that are not in voting Classes that do not file an objection with the Bankruptcy Court in the Chapter 11 Cases that expressly objects to the inclusion of such Holder as a Releasing Party under the provisions contained in Article IX of the Plan will be deemed to have expressly, unconditionally, generally, individually, and collectively consented to the release and discharge of all Claims and Causes of Action against the Debtors and the Released Parties. The releases are an integral element of the Plan.

The Debtors believe that the releases, exculpations, and injunctions set forth in the Plan are appropriate because, among other things: (a) the releases, exculpations, and injunctions are specific; (b) the releases provide closure with respect to prepetition Claims and Causes of Action, which the Debtors determined is a valuable component of the overall restructuring under the circumstances and is integral to the Plan; (c) the releases are a condition to the global settlement and a necessary part of the Plan; and (d) each of the Released Parties and Exculpated Parties has afforded value to the Debtors and aided in the reorganization process, which facilitated the Debtors’ ability to propose and pursue confirmation of a value-maximizing restructuring. Further, the releases, exculpations, and injunctions have the support of the vast majority of the Debtors’ creditors, including NRG and substantial majorities of the Holders of the GenOn Notes Claims and GAG Notes Claims. The Debtors believe that each of the Released Parties and Exculpated Parties has played an integral role in formulating or enabling the Plan and has expended significant time and resources analyzing and negotiating the issues presented by the Debtors’ prepetition capital structure. The Debtors will be prepared to meet their burden to establish the basis for the releases, exculpations, and injunctions for each Released Party and Exculpated Party as part of Confirmation of the Plan.

IV. QUESTIONS AND ANSWERS REGARDING THIS DISCLOSURE STATEMENT AND PLAN

A. What is chapter 11?

Chapter 11 is the principal business reorganization chapter of the Bankruptcy Code. In addition to permitting debtor rehabilitation, chapter 11 promotes equality of treatment for creditors and similarly situated equity interest holders, subject to the priority of distributions prescribed by the Bankruptcy Code.

The commencement of a chapter 11 case creates an estate that comprises all of the legal and equitable interests of the debtor as of the date the chapter 11 case is commenced. The Bankruptcy Code provides that the debtor may continue to operate its business and remain in possession of its property as a “debtor in possession.”

Consummating a plan of reorganization is the principal objective of a chapter 11 case. A bankruptcy court’s confirmation of a plan binds the debtor, any person acquiring property under the plan, any creditor or equity interest Holder of the debtor, and any other entity as may be ordered by the bankruptcy court. Subject to certain limited exceptions, the order issued by a bankruptcy court confirming a plan provides for the treatment of the debtor’s liabilities in accordance with the terms of the confirmed plan.

B. Why are the Debtors sending me this Disclosure Statement?

The Debtors are seeking to obtain Bankruptcy Court approval of the Plan. Before soliciting acceptances of the Plan, section 1125 of the Bankruptcy Code requires the Debtors to prepare a disclosure statement containing adequate information of a kind, and in sufficient detail, to enable a hypothetical reasonable investor to make an informed judgment regarding acceptance of the Plan. This Disclosure Statement is being submitted in accordance with these requirements.

C. Am I entitled to vote on the Plan?

Your ability to vote on, and your distribution under, the Plan, if any, depends on what type of Claim or Interest you hold. Each category of Holders of Claims or Interests, as set forth in Article III of the Plan pursuant to section 1122(a) of the Bankruptcy Code, is referred to as a “Class.” Each Class’s respective voting status is set forth below.

|

Class |

|

Claims and Interests |

|

Status |

|

Voting Rights |

|

1 |

|

Other Secured Claims |

|

Unimpaired |

|

Not Entitled to Vote |

|

2 |

|

Other Priority Claims |

|

Unimpaired |

|

Not Entitled to Vote |

|

3 |

|

Revolving Credit Facility Claims |

|

Unimpaired |

|

Not Entitled to Vote |

|

4 |

|

GenOn Notes Claims |

|

Impaired |

|

Entitled to Vote |

|

5 |

|

GAG Notes Claims |

|

Impaired |

|

Entitled to Vote |

|

6 |

|

General Unsecured Claims |

|

Unimpaired |

|

Not Entitled to Vote |

|

7 |

|

Debtor Intercompany Claims and Interests |

|

Unimpaired / Impaired |

|

Not Entitled to Vote |

|

8 |

|

Section 510(b) Claims |

|

Impaired |

|

Not Entitled to Vote |

|

9 |

|

Interests in GenOn |

|

Impaired |

|

Not Entitled to Vote |

D. What will I receive from the Debtors if the Plan is consummated?

The following chart provides a summary of the anticipated recovery to Holders of Claims and Interests under the Plan. Any estimates of Claims and Interests in this Disclosure Statement may vary from the final amounts allowed by the Bankruptcy Court. Your ability to receive distributions under the Plan depends upon the ability of the Debtors to obtain Confirmation and meet the conditions necessary to consummate the Plan.

The proposed distributions and classifications under the Plan are based upon a number of factors, including the Debtors’ valuation and liquidation analyses. The valuation of the Reorganized Debtors as a going concern is based upon the value of the Debtors’ assets and liabilities as of an assumed Effective Date of December 31, 2017, and incorporates various assumptions and estimates, as discussed in detail in the Valuation Analysis prepared by the Debtors, together with their proposed investment banker Rothschild, Inc. (“Rothschild”). Accordingly, recoveries actually received by holders of Claims and Interests in a liquidation scenario may differ materially from the projected liquidation recoveries listed in the table below.

THE PROJECTED RECOVERIES SET FORTH IN THE TABLE BELOW ARE ESTIMATES ONLY AND THEREFORE ARE SUBJECT TO CHANGE. FOR A COMPLETE DESCRIPTION OF THE DEBTORS’ CLASSIFICATION AND TREATMENT OF CLAIMS AND INTERESTS, REFERENCE SHOULD BE MADE TO THE ENTIRE PLAN.

|

Class |

|

Claim or |

|

Treatment |

|

Projected |

|

N/A |

|

Administrative Claims |

|

Except with respect to Administrative Claims that are Professional Fee Claims or LC Facility Claims, and except to the extent that an Administrative Claim has already been paid during the Chapter 11 Cases or |

|

100% |

|

Class |

|

Claim or |

|

Treatment |

|

Projected |

|

|

|

|

|

a Holder of an Allowed Administrative Claim and the applicable Debtor(s) agree to less favorable treatment, each Holder of an Allowed Administrative Claim shall be paid in full in Cash on the unpaid portion of its Allowed Administrative Claim on the latest of: (a) on the Effective Date if such Administrative Claim is Allowed as of the Effective Date; (b) or as soon as reasonably practicable after the date such Administrative Claim is Allowed; and (c) the date such Allowed Administrative Claim becomes due and payable, or as soon thereafter as is reasonably practicable; provided that Allowed Administrative Claims that arise in the ordinary course of the Debtors’ businesses shall be paid in the ordinary course of business in accordance with the terms and subject to the conditions of any agreements and/or arrangements governing, instruments evidencing, or other documents relating to such transactions. Notwithstanding the foregoing, no request for payment of an Administrative Claim need to be filed with respect to an Administrative Claim previously Allowed by Final Order. |

|

|

|

N/A |

|

LC Facility Claims |

|

On the Effective Date, except to the extent that a Holder of an Allowed LC Facility Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of, and in exchange for, each Allowed LC Facility Claim, (a) each such Holder shall receive payment in full in Cash for all Allowed LC Facility Claims representing unreimbursed obligations in respect of drawn letters of credit issued under the applicable LC Facility and in respect of all accrued interest, fees and expenses, including all such accrued interest, fees, and expenses as approved by the Final LC Facility Order and (b) in respect of undrawn letters of credit issued or obtained by such Holder in accordance with the applicable LC Facility, such letters of credit shall be: (i) cancelled and/or replaced with new letters of credit and returned, (ii) deemed to have been issued as letters of credit under the New Exit Credit Facility pursuant to terms and conditions satisfactory to such Holder, the issuing bank under such letters of credit and the Lender Parties, (iii) cash collateralized at 103%, or (iv) continued pursuant to other arrangements satisfactory to such Holder at such time. Upon the payment or satisfaction of the Allowed LC Facility Claims in accordance with the Plan, on the Effective Date, all liens and security interests granted to secure such obligations (other than liens and security interests granted to secure letters of credit that remain outstanding on the Effective Date pursuant to arrangements satisfactory to the Holder of such |

|

100% |

|

Class |

|

Claim or |

|

Treatment |

|

Projected |

|

|

|

|

|

Allowed LC Facility Claims in accordance with clause (b)(iv) above) shall be automatically terminated and of no further force and effect without any further notice to or action, order, or approval of the Bankruptcy Court or any other Entity. |

|

|

|

N/A |

|

Priority Tax Claim |

|

Except to the extent that a Holder of an Allowed Priority Tax Claim agrees to a less favorable treatment, in full and final satisfaction, settlement, release, and discharge of and in exchange for each Allowed Priority Tax Claim, each Holder of such Allowed Priority Tax Claim shall receive Cash in a manner consistent with section 1129(a)(9)(C) of the Bankruptcy Code. |

|

100% |

|

1 |

|

Other Secured Claims |

|

Except to the extent that a Holder of an Allowed Other Secured Claim agrees to a less favorable treatment of its Allowed Claim, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Allowed Other Secured Claim, each such Holder shall receive, at the option of the applicable Debtor and with the reasonable consent of the Required Consenting Noteholders, either: (i) payment in full in Cash; (ii) delivery of collateral securing any such Claim and payment of any interest required under section 506(b) of the Bankruptcy Code; (iii) Reinstatement of such Allowed Other Secured Claim; or (iv) such other treatment rendering its Allowed Other Secured Claim Unimpaired in accordance with section 1124 of the Bankruptcy Code. |

|

100% |

|

2 |

|

Other Priority Claims |

|

Except to the extent that a Holder of an Allowed Other Priority Claim agrees to a less favorable treatment of its Allowed Claim, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Allowed Other Priority Claim, each such Holder shall receive, at the option of the applicable Debtor(s) and with the reasonable consent of the Required Consenting Noteholders, either: (i) payment in full in Cash; or (ii) such other treatment rendering its Allowed Other Priority Claim Unimpaired in accordance with section 1124 of the Bankruptcy Code. |

|

100% |

|

3 |

|

Revolving Credit Facility Claims |

|

In full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Revolving Credit Facility Claim, each Holder shall receive payment in full in Cash in accordance with the NRG Settlement and, in respect of all undrawn letters of credit obtained by NRG in accordance with the Revolving Credit Agreement, such letters of credit shall be: (i) cancelled and/or replaced with new letters of credit and returned, (ii) deemed to have been issued as letters of credit under the New Exit Credit Facility pursuant to terms and conditions |

|

100% |

|

Class |

|

Claim or |

|

Treatment |

|

Projected |

|

|

|

|

|

satisfactory to NRG, the issuing bank under such letters of credit and the Lender Parties or (iii) continued pursuant to other arrangements satisfactory to NRG at such time. |

|

|

|

4 |

|

GenOn Notes Claims |

|

In full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each GenOn Notes Claim, each Holder shall receive, subject to the charging lien of the GenOn Notes Trustee, its Pro Rata share of: (i) unless sold in its entirety pursuant to a Third-Party Sale Transaction, the New Common Stock, subject to dilution by any Management Incentive Plan; (ii) the GenOn Notes Cash Pool; (iii) as determined no later than the Effective Date by the Debtors in consultation with the GenOn Steering Committee, any New Subordinated Notes; (iv) Cash in any amount due under the GenOn Notes Indentures to the GenOn Notes Trustee, and any applicable paying agent, on account of fees and expenses; and (v) payment of the Restructuring Expenses. On the Effective Date, all of the GenOn Notes shall be cancelled as set forth in Article IV.L of the Plan. |

|

61.6–77.6% |

|

5 |

|

GAG Notes Claims |

|

In full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each GAG Notes Claim, each Holder shall receive, subject to the charging lien of the GAG Notes Trustee: (i) Cash in an amount equal to 92% of the principal amount and accrued interest as of the Petition Date of such Allowed GAG Notes Claim; (ii) its Pro Rata share of the GAG Notes Cash Pool; (iii) Cash in an amount due under the GAG Notes Indenture to the GAG Notes Trustee, and any applicable paying agent, on account of fees and expenses; and (v) payment of the Restructuring Expenses. On the Effective Date, all of the GAG Notes shall be cancelled as set forth in Article IV.L of the Plan. |

|

94% |

|

6 |

|

General Unsecured Claims |

|

Except to the extent that a Holder of an Allowed General Unsecured Claim agrees to less favorable treatment of its Allowed Claim, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Allowed General Unsecured Claim, each Holder thereof shall receive: (i) payment in Cash in an amount equal to such Allowed General Unsecured Claim on the later of (a) the Effective Date, or (b) the date due in the ordinary course of business accordance with the terms and conditions of the particular transaction or agreement giving rise to such Allowed General Unsecured Claim; or (ii) such other treatment as may be required so as to render such Allowed General Unsecured Claim Unimpaired. |

|

100% |

|

Class |

|

Claim or |

|

Treatment |

|

Projected |

|

7 |

|

Debtor Intercompany Claims and Interests |

|

Unless otherwise provided for under the Plan, each Debtor Intercompany Claim and/or Intercompany Interest shall either be Reinstated or canceled and released at the option of the Debtors, with the consent of the GenOn Steering Committee, such consent not to be unreasonably withheld; provided, that to the extent the Restructuring Transactions Memorandum provides for a specific treatment with respect to any Debtor Intercompany Claim and/or Intercompany Interest, the treatment so provided shall control. |

|

0% / 100% |

|

8 |

|

Section 510(b) Claims |

|

Each Section 510(b) Claim shall be deemed canceled and released and there shall be no distribution to Holders of Section 510(b) Claims on account of such Claims. |

|

0% |

|

9 |

|

Interests in GenOn |

|

All Interests in GenOn will be cancelled, released, and extinguished, and will be of no further force or effect. |

|

0% |

E. When will I receive my New Common Stock distribution under the Plan if I hold an Allowed GenOn Notes Claim?

Certain Holders of Allowed GenOn Notes Claims may require certain regulatory approvals under applicable non-bankruptcy law prior to receiving a distribution of New Common Stock on account of their respective Allowed GenOn Notes Claims (the “Holdback Entities,” and with respect to the shares of New Common Stock that as of the Effective Date are not permitted to be distributed to such Holdback Entities because one or more Required Regulatory Approvals (as defined herein) are required but have not been obtained, the “Holdback Shares”). On the Effective Date, if there are any Holdback Shares, a new common stock reserve (the “New Common Stock Reserve”) shall be established by either the Debtors or the Reorganized Debtors (depending upon the applicable Exit Structure) for the distribution of Holdback Shares pursuant to the terms of the Plan. The Holdback Shares for each Holdback Entity will be issued on the Effective Date, and on behalf of such Holdback Entity, placed in the New Common Stock Reserve by the Debtors or the Reorganized Debtors, as applicable. Each of the Holdback Shares will be distributed from the New Common Stock Reserve to the applicable Holdback Entity in accordance with the terms of the Plan as soon as possible after (1) the required regulatory approvals of the Federal Energy Regulatory Commission (“FERC”) and/or the New York State Public Service Commission (“NYSPSC”) required for distribution of such shares to the Holdback Entity have been obtained, as more fully set forth in the Article VI.D.2 of the Plan (the “Required Regulatory Approvals”), or (2) the distribution of such shares to such Holdback Entity would no longer require any of the Required Regulatory Approvals. Each Holdback Entity shall at all times have the right to direct the New Common Stock Reserve Administrator to sell any of the Holdback Shares attributable to it and held in the New Common Stock Reserve, and the New Common Stock Reserve Administrator shall, as promptly as reasonably practical, use commercially reasonable efforts to sell such Holdback Shares in accordance with any such direction, subject to compliance with applicable law and any applicable contractual restrictions. The New Common Stock Reserve Administrator shall have no liability for the price received for such Holdback Shares. The net proceeds of such sale shall be promptly distributed to such Holdback Entity.

Those Holders of Allowed GenOn Notes Claims that are not Holdback Entities will receive a distribution of New Common Stock on or as soon as practicable after the Effective Date as more fully set forth in Article VI of the Plan.

To the extent that any Holder of GenOn Notes will hold New Common Stock in excess of the relevant reporting thresholds under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules

and regulations promulgated thereunder (the “HSR Act”) as a result of distributions to be made on the Effective Date and the acquisition of New Common Stock by such Holder either (i) is not eligible for an exemption under the HSR Act or (ii) is required to be notified to the U.S. antitrust agencies pursuant to the HSR Act and the relevant waiting period associated therewith has not expired or been terminated as of the Effective Date, then such Holder shall sell a sufficient amount of New Common Stock such that by the end of the day on the Distribution Date, such holder will hold New Common Stock valued at or below the relevant reporting threshold under the HSR Act.

F. What will I receive from the Debtors if I hold an Allowed Administrative Claim or a Priority Tax Claim?

In accordance with section 1123(a)(1) of the Bankruptcy Code, Administrative Claims and Priority Tax Claims have not been classified and, thus, are excluded from the Classes of Claims and Interests set forth in Article III of the Plan. Administrative Claims will be satisfied as set forth in Article II.A of the Plan, and Priority Tax Claims will be satisfied as set forth in Article II.D of the Plan.

G. Are any regulatory approvals required to consummate the Plan?

Yes, the Debtors have filed and/or will file applications with FERC and the NYSPSC seeking approval of the Restructuring Transactions contemplated by the Plan, as well as make any filings required by the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the “HSR Act”).

H. What happens to my recovery if the Plan is not confirmed or does not go effective?

In the event that the Plan is not confirmed or does not go effective, there is no assurance that the Debtors will be able to reorganize their businesses. It is possible that any alternative transaction may provide Holders of Claims and Interests with less than they would have received pursuant to the Plan. For a more detailed description of the consequences of an extended chapter 11 case, or of a liquidation scenario, see Art. VIII.D.3 of this Disclosure Statement, and the liquidation analysis attached hereto as Exhibit F (the “Liquidation Analysis”).

I. If the Plan provides that I get a distribution, do I get it upon Confirmation or when the Plan goes effective, and what is meant by “Confirmation,” “Effective Date,” and “Consummation?”

“Confirmation” of the Plan refers to approval of the Plan by the Bankruptcy Court. Confirmation of the Plan does not guarantee that you will receive the distribution indicated under the Plan. After Confirmation of the Plan by the Bankruptcy Court, there are conditions that need to be satisfied or waived so that the Plan can go effective. Initial distributions to Holders of Allowed Claims will only be made on the date the Plan becomes effective—the “Effective Date”—or as soon as practicable thereafter, as specified in the Plan. See Article VIII of this Disclosure Statement for a discussion of the conditions precedent to consummation of the Plan.

J. What are the sources of Cash and other consideration required to fund the Plan?

The Plan and distributions thereunder will be funded by or consist of the following sources of consideration: (a) the Cash proceeds of the Exit Financing; (b) the New Common Stock; (c) the NRG Settlement Payment; (d) the Debtors’ encumbered and unencumbered Cash on hand; (e) the Sale Proceeds; and (f) the New Subordinated Notes.

K. Are there risks to owning the New Common Stock upon emergence from chapter 11?

Yes. See Article X of this Disclosure Statement.

L. Will the final amount of Allowed General Unsecured Claims affect my distribution under the Plan?

No. Allowed General Unsecured Claims are unimpaired under the Plan and, therefore, the aggregate final amount of all Allowed General Unsecured Claims will not affect the distributions to Holders of Claims in Class 4 or Class 5.

M. How will certain litigation matters be treated under the Plan?

The Plan treats any Claims against the Debtors arising from prepetition litigation matters as General Unsecured Claims. These prepetition litigation matters include In re Western States Wholesale Natural Gas MDL Litigation, MDL 1566, Case No. 2:03-CV-01431 (D. Nev.), and all cases consolidated in MDL 1566 (the “Natural Gas Litigation”), Arandell Corp. et al. v. Cantera Resources, Inc., et al., Case No. 17-16227 (9th Cir.) and Arandell Corp., et al. v. Center Point Energy Services, Inc., Case No. 16-17099 (9th Cir.) (the “Natural Gas Appeals”), and Reorganized FLI v. ONEOK, Inc., Case No. CV-05-1331-RCJ-PAL (D. Nev.) and Reorganized FLI Inc. v. Oeneok Inc., et al., Case No. 16-17279 (9th Cir.) (the “Farmland Litigation,” and together with the Natural Gas Litigation and Natural Gas Appeals, the “MDL Litigation”). In other words, any Allowed Claims arising from the MDL Litigation are General Unsecured Claims, and therefore entitled to such treatment as will render them unimpaired under the Plan.

Article IX.B of the Plan provides the distributions, rights, and treatment that are provided in the Plan shall be in complete satisfaction, discharge, and release of Claims. As set forth herein, the Plan provides that Holders of General Unsecured Claims, including plaintiffs in the MDL Litigation, will receive (i) payment in Cash in an amount equal to such Allowed General Unsecured Claim on the later of (a) the Effective Date, or (b) the date due in the ordinary course of business (i.e., if final judgments are entered in the MDL Litigation after the Effective Date); or (ii) any such other treatment as may be required so as to render such Allowed General Unsecured Claim unimpaired.

N. How will power plant deactivation obligations, including environmental obligations, be treated under the Plan?

To the extent they are Claims, power plant deactivation obligations of a Debtor, including environmental obligations under applicable law, are classified as Class 6 General Unsecured Claims. As set forth herein, the Plan provides that Holders of Allowed General Unsecured Claims will receive such treatment as may be required so as to render such Allowed General Unsecured Claims Unimpaired. To the extent power plant deactivation obligations of a Debtor, including environmental obligations, are not considered Claims under section 101(5) of the Bankruptcy Code such obligations shall not be discharged. The Debtors reserve all rights with respect to whether a particular power plant deactivation or other environmental obligation is or is not a Claim for purposes of discharging such obligation.

O. Will there be releases and exculpation granted to parties in interest as part of the Plan?

Yes, Article IX of the Plan proposes to release the Released Parties and to exculpate the Exculpated Parties. The Debtors’ releases, third-party releases, and exculpation provisions included in the Plan are an integral part of the Debtors’ overall restructuring efforts and were an essential element of the negotiations between the Debtors and the Consenting Parties in obtaining their support for the Plan pursuant to the terms of the RSA.(3)

All of the Released Parties and the Exculpated Parties have made substantial and valuable contributions to the Debtors’ restructuring through efforts to negotiate and implement the Plan, which will maximize and preserve the going-concern value of the Debtors for the benefit of all parties in interest. Accordingly, each of the Released Parties and the Exculpated Parties warrants the benefit of the release and exculpation provisions.

All Holders of Claims or Interests that (i) vote to accept or are deemed to accept the Plan or (ii) are in voting Classes who abstain from voting on the Plan and do not opt out of the release provisions contained in Article IX of the Plan will be deemed to have expressly, unconditionally, generally, individually, and collectively released and discharged all Claims and Causes of Action against the Debtors and the Released Parties.

All Holders of Claims and Interests that are not in voting Classes that do not file an objection with the Bankruptcy Court in the Chapter 11 Cases that expressly objects to the inclusion of such Holder as a Releasing Party

(3) For avoidance of doubt, nothing in the Plan is intended to release, discharge, modify, or otherwise affect in anyway any defense, right, privilege, right of setoff or recoupment, or counterclaim of non-Debtor REMA (as defined herein) relating to any Cause of Action against REMA that is preserved under the Plan.

under the provisions contained in Article IX of the Plan will be deemed to have expressly, unconditionally, generally, individually, and collectively consented to the release and discharge of all Claims and Causes of Action against the Debtors and the Released Parties. The releases are an integral element of the Plan.

Based on the foregoing, the Debtors believe that the releases and exculpations in the Plan are necessary and appropriate and meet the requisite legal standard promulgated by the United States Court of Appeals for the Fifth Circuit. Moreover, the Debtors will present evidence at the Confirmation Hearing to demonstrate the basis for and propriety of the release and exculpation provisions.

1. Release of Liens

Except (1) with respect to the Liens securing the Exit Financing, including the New Exit Credit Facility, the New Senior Secured Notes, and any other Exit Financing created pursuant to the New Exit Financing Documents, (2) with respect to any liens and security interests granted to secure letters of credit that remain outstanding under the LC Facility or Revolving Credit Facility on the Effective Date, (3) with respect to any Liens or security interests securing the New Subordinated Notes, if any, and (4) as otherwise provided in the Plan or in any contract, instrument, release, or other agreement or document created pursuant to the Plan, on the Effective Date (or the Sale Closing Date with respect to any assets or properties that are transferred by Debtors under such a Third-Party Sale Transaction and with respect to assets or properties of Debtors whose equity is transferred under a Third-Party Sale Transaction), all mortgages, deeds of trust, Liens, pledges, or other security interests against any property of the Estates and, subject to the consummation of the applicable distributions contemplated in the Plan, shall be fully released and discharged, and the Holders of such mortgages, deeds of trust, Liens, pledges, or other security interests shall execute such documents as may be reasonably requested by the Debtors or the Reorganized Debtors, as applicable, to reflect or effectuate such releases, and all of the right, title, and interest of any Holders of such mortgages, deeds of trust, Liens, pledges, or other security interests shall revert to the Reorganized Debtor and its successors and assigns.

2. Debtor Release