Attached files

| file | filename |

|---|---|

| EX-23.1 - EvaMedia Corp | ex23-1.htm |

| EX-5.1 - EvaMedia Corp | ex5-1.htm |

As filed with the Securities and Exchange Commission October 3, 2017 |

Registration Statement No. __________ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENT ON

FORM S-1

UNDER

THE SECURITIES ACT OF 1933

EVAMEDIA CORP.

(Exact name of registrant as specified in its charter)

EVERYTHINGAMPED CORPORATION

(Former Name of Registrant as Specified in its Charter)

| Delaware | 47-3165462 | 6770 | ||

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Primary

Standard Industrial Classification Code Number) |

75 Broadway, Suite 202

San Francisco, CA 94111

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: 415-361-4046

David Boulette

75 Broadway Suite 202

San Francisco, CA 94111

Telephone 415-361-4046

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Jolie Kahn, Esq.

33 Edgewood

Locust Valley, NY 11560

Telephone (516) 217-6379

Approximate Date of Commencement of Proposed Sale to the Public: At such time or times after the effective date of this registration statement as the company determines.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Emerging growth company [X]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (3) | ||||||||||||

| Common Stock, par value $0.0001 per share (1) | 472,491 | $ | 0.45 | $ | 212,621 | $ | 26.47 | |||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, the securities being registered hereunder as to include such indeterminate number of additional shares of common stock as may be issuable as a result of stock splits, stock dividends, and similar transactions. |

| (2) | The selling stockholders may offer their shares from time to time directly or through one or more underwriters, broker-dealers or agents, in the over-the-counter market at market prices prevailing at the time of sale, in one or more privately negotiated transactions at prices acceptable to the selling stockholders, or otherwise, if and when our common stock is trading on the OTCQB, the OTCQX or a listed exchange, and if not, sales may only take place at fixed prices. |

| (3) | Calculated pursuant to Rule 457(a) based on the Amount of Securities to be Registered multiplied by the Proposed Maximum Offering Price per Unit. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion, dated October 3, 2017

PRELIMINARY PROSPECTUS

EVAMEDIA CORP.

INFORMATION CONTAINED HEREIN IS SUBJECT TO COMPLETION OR AMENDMENT. A REGISTRATION STATEMENT RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT BECOMES EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL AND IS NOT A SOLICITATION OF AN OFFER TO BUY IN ANY STATE IN WHICH AN OFFER, SOLICITATION OR SALE IS NOT PERMITTED

472,491 Shares of Common Stock

This prospectus relates to the offer and sale of up to 472,491 shares of common stock of EvaMedia Corp, a Delaware corporation, issued to certain selling stockholders, which are signatories on the below listed securities purchase agreement dated February 16, 2017, between the selling stockholders and us, and that may be offered and sold from time to time by the selling stockholders.

This prospectus covers any additional shares of common stock that may become issuable by reason of stock splits, stock dividends, and other events described therein. The shares of common stock offered hereunder were acquired by the selling stockholders in a private placement with us that closed on February 16, 2017. We are registering shares for resale which were sold to the selling stockholders in the February 16, 2017 private placement.

Unless otherwise noted, the terms “the Company,” “our Company,” “EverythingAmped,” “EvaMedia,” “we,” “us” and “our” refer to EvaMedia Corp. and its subsidiaries.

The selling stockholders may offer their shares from time to time directly or through one or more underwriters, broker-dealers or agents, in the over-the-counter market at market prices prevailing at the time of sale, in one or more privately negotiated transactions at prices acceptable to the selling stockholders, or otherwise.

We are registering these shares of our common stock for resale by the selling stockholders named in this prospectus, or their transferees, pledgees, donees or assigns or other successors-in-interest that receive any of the shares as a gift, distribution, or other non-sale related transfer. We will not receive any proceeds from the sale of shares by the selling stockholders. These shares are being registered to permit the selling stockholders to sell shares from time to time, in amounts, at prices and on terms determined at the time of offering. The selling stockholders may sell this common stock through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “PLAN OF DISTRIBUTION” beginning of page 45. In connection with any sales of the common stock offered hereunder, the selling stockholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

We will pay the expenses related to the registration of the shares covered by this prospectus. The selling stockholders will pay any commissions and selling expenses they may incur.

There is currently no public market for the Company’s securities. Once and if a business combination is effected, the Company may wish to cause the Company’s common stock to trade in one or more United States securities markets. The Company anticipates that it will take the steps required for such admission to quotation following the business combination or at some later time. At such time as it qualifies, the Company may choose to apply for quotation of its securities on the OTCQB.

Our principal executive offices are located at 75 Broadway Suite 202, San Francisco, CA 94111. Our telephone number at that address is 415-361-4046.

Investing in the common stock offered by this prospectus is speculative and involves a high degree of risk. See “Risk Factors” beginning on page 4.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 3, 2017.

TABLE OF CONTENTS

| PROSPECTUS SUMMARY | 1 |

| RISK FACTORS | 4 |

| USE OF PROCEEDS | 16 |

| MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 20 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 22 |

| CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2016 AND THREE MONTHS ENDED MARCH 31, 2017 | |

| BUSINESS | 29 |

| LEGAL PROCEEDINGS | 41 |

| MANAGEMENT | 42 |

| EXECUTIVE COMPENSATION | 43 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 43 |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 44 |

| DESCRIPTION OF PRIVATE PLACEMENT AND CONVERTIBLE NOTES | |

| DESCRIPTION OF SECURITIES | 44 |

| LEGAL MATTERS | 46 |

| EXPERTS | 46 |

| WHERE YOU CAN FIND MORE INFORMATION | 46 |

| PART II – INFORMATION NOT REQUIRED IN PROSPECTUS | 46 |

| SIGNATURES | 50 |

You should rely only on the information contained in this prospectus and any related free writing prospectus that we may provide to you in connection with this offering. We have not, and the underwriter has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriter is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

| i |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission using the Securities and Exchange Commission’s registration rules for a delayed or continuous offering and sale of securities. Under the registration rules, using this prospectus and, if required, one or more prospectus supplements, we may distribute the shares of common stock covered by this prospectus. This prospectus also covers any shares of common stock that may become issuable as a result of stock splits, stock dividends or similar transactions.

A prospectus supplement may add, update or change information contained in this prospectus. We recommend that you read carefully this entire prospectus, especially the section entitled “Risk Factors” beginning on page 4, and any supplements before making a decision to invest in our common stock.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from the information contained in this prospectus. The common stock is not being offered in any jurisdiction where offers and sales are not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of when this prospectus is delivered or when any sale of our securities occurs.

Cautionary Note Regarding Forward-Looking Information

This prospectus, in particular the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing herein, contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; and the economy in general or the future of the electrical storage device industry, all of which are subject to various risks and uncertainties.

When used in this prospectus as well as in reports, statements, and information we have filed with the Securities and Exchange Commission, in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained in this prospectus that are not statements of historical fact may be deemed to be forward-looking statements. We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors.

| ii |

This summary highlights important information about this offering and our business. It does not include all information you should consider before investing in our common stock. Please review this prospectus in its entirety, including the risk factors and our financial statements and the related notes, before you decide to invest.

EvaMedia Corp. (formerly Brown Grotto Acquisition Corporation and then EverythingAmped Corporation) or the “Company” was incorporated on January 12, 2015 under the laws of the state of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions.

On September 15, 2015, the Company effected a change in control by the redemption of 19,500,000 shares of the then outstanding 20,000,000 shares of common stock. The then current officers and directors resigned and David Boulette was named the sole officer and director of the Company. Pursuant to the change in control the Company changed its name to EverythingAmped Corporation. On September 16, 2015, the Company issued 3,000,000 shares of common stock to Mr. Boulette. On April 28, 2017, the Company changed its name to EvaMedia Corp. by filing an amendment to its Certificate of Incorporation with the Secretary of State of the State of Delaware.

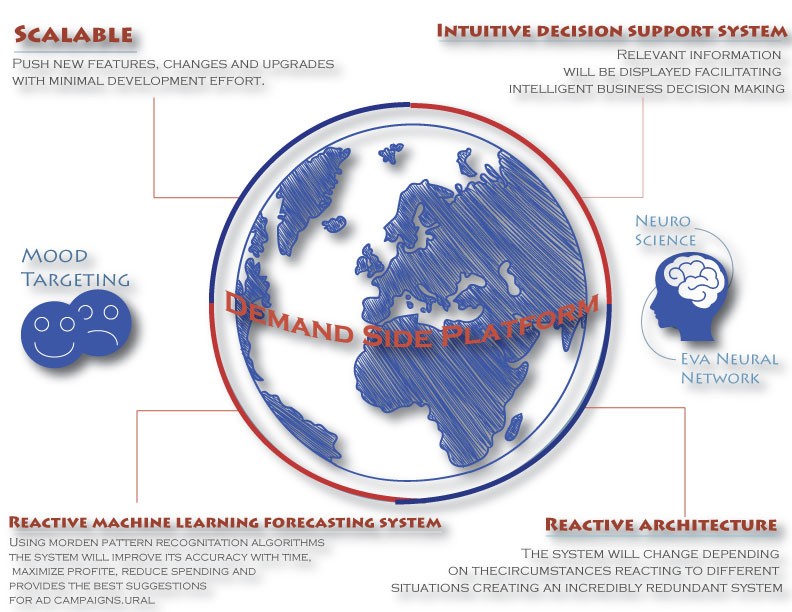

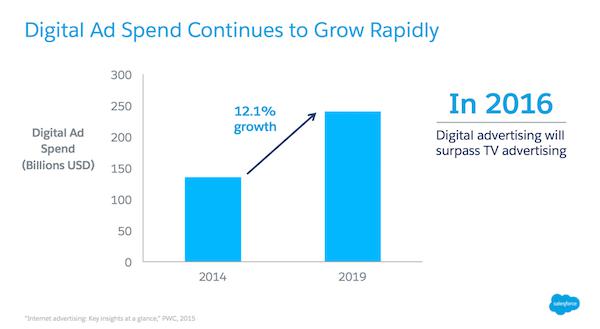

EvaMedia is a technology company that has created an advertising platform based on Big Data and Artificial Intelligence. Our technology is designed to address the needs of markets in which high volume advertisers want automated advertising purchases to have high conversion rates. We are focused on the large and growing digital advertising market that faces these challenges.

We believe that there are multiples of billions of daily trades across all digital advertising exchanges, as compared to the millions of daily trades executed by NASDAQ and the NYSE combined. Our system uses Artificial Intelligence, or AI, to match advertising campaigns to specific ad spots one at a time. Our system creates conversion mapping tables that allow us to consistently increase conversion rates by analyzing those trends which optimized historical conversion rates and further capitalize upon and improve those rates prospectively.

Our solution is designed to optimize brand campaigns which aim to create brand awareness as well as direct response campaigns that have a fixed conversion point. Members of our team have successfully run advertising campaigns for products and brands ranging from consumer products to clothing items to automobiles. We provide a differentiated solution that is simple, powerful, scalable and extensible across geographies, industry verticals and the display, mobile, social and video digital advertising channels.

We leverage “big data” as the research base for our focused ad campaigns. According to Merriam-Webster’s Dictionary (2014), “big data” is “an accumulation of data that is too large and complex for processing by traditional database management tools.” Increasingly, companies are attempting to leverage big data to make strategic business decisions. At EvaMedia, rather than focusing on team of people manually review this data, we have built automated tools that perform this analysis and feed the information back into our decision logic. This allows us to easily scale the number of campaigns we can run simultaneously. As the number of campaigns we are running increases, we simply scale up our technology and hardware rather than increasing our man power. This sets us up to quickly and easily grow operations as new clients come onboard.

The Company may also develop through a business combination with an ongoing company or otherwise an online company offering owned and operated web sites and hundreds of mobile apps integrated exclusively to build a custom Demand Side Platform which will provide unparalleled online advertising opportunities to companies of all sizes.

The Company will attempt to locate and negotiate with a business entity for the combination of that target company with EvaMedia. The combination will normally take the form of a merger, stock-for-stock exchange or stock-for-assets exchange.

In most instances, the target company will wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended. No assurances can be given that the Company will be successful in locating or negotiating with any target company. The Company has been formed to provide a method for a foreign or domestic private company to become a reporting company with a class of securities registered under the Securities Exchange Act of 1934.

| 1 |

The Offering

| Use of Proceeds: | We will not receive any proceeds from sales made under this registration statement. | |

| Common stock outstanding: | 3,972,491 shares as of October 2, 2017. | |

| Dividend policy: | Dividends on our common stock may be declared and paid when and as determined by our board of directors. We have not paid and do not expect to pay dividends on our common stock. | |

| Use of proceeds: | We will not receive any proceeds from the sale of the common stock registered hereunder for the selling shareholders. |

Risk Factors

See “Risk Factors” beginning on page 4 for a discussion of factors you should carefully consider before deciding to invest in our common stock.

Some of these risks include:

Our business is subject to numerous risks, some of these risks include:

| ● | our limited operating history makes it difficult to evaluate our business and prospects and may increase the risks associated with your investment; | |

| ● | if we do not manage our growth effectively, the quality of our solution or our relationships with our customers may suffer, and our operating results may be negatively affected; | |

| ● | if we fail to make the right investment decisions in our offerings and technology platform, we may not attract and retain advertisers and advertising agencies and our revenue and results of operations may decline; | |

| ● | we have a history of losses and may not achieve or sustain profitability in the future; | |

| ● | we may experience fluctuations in our operating results, which make our future results difficult to predict and could cause our operating results to fall below investors’ and analysts’ expectations; | |

| ● | if we are unable to attract new advertising customers and sell additional offerings to our existing customers, our revenue growth will be adversely affected; |

| 2 |

| ● | if the use of “third party cookies” is rejected by Internet users, restricted or otherwise subject to unfavorable regulation, our performance could decline and we could lose advertisers and revenue; | |

| ● | potential “Do Not Track” standards or government regulation could negatively impact our business by limiting our access to the anonymous user data that informs the advertising campaigns we run, and as a result could degrade our performance for our customers; and | |

| ● | our international expansion subjects us to additional costs and risks and may not yield returns, including anticipated revenue growth, in the foreseeable future, and our continued expansion internationally may not be successful; and we may not be able to compete successfully against current and future competitors because competition in our industry is intense, and our competitors may offer solutions that are perceived by our customers to be more attractive than ours, which could result in declining revenue, or inability to grow our business. |

Our Address

Our principal executive offices are located at 75 Broadway Suite 202, San Francisco, CA 94111.

Our telephone number at that address is 415-361-4046.

The number of shares of common stock that will be outstanding immediately after this offering is based on the 3,972,491 shares of our common stock outstanding as of October 2, 2017.

JOBS Act

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion or (c) in which we become a large accelerated filer, which means that we have been public for at least 12 months, have filed at least one annual report and the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last day of our then most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 as the “JOBS Act,” and references to “emerging growth company” have the meaning associated with such term in the JOBS Act.

In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

| 3 |

Investing in our common stock is very speculative and involves a high degree of risk and uncertainty. You should carefully consider all of the information in this prospectus before making an investment decision. The following are among the risks we face related to our business, assets and operations. They are not the only risks we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also arise. Any of these risks could materially and adversely affect our business, results of operations and financial condition, which in turn could materially and adversely affect the trading price of our common stock. You should not purchase our shares unless you can afford to lose your entire investment.

We have a history of operating losses and we may not achieve or maintain profitability in the future.

We incurred losses of $51,787 in fiscal 2016 and $111,166 in the six months ended June 30, 2017 as well as having working capital of $680 as of that date. We may not achieve or maintain profitability in the future. We expect that our operating expenses will increase substantially as we hire additional employees, increase our marketing efforts, expand our operations and continue to invest in the development of our platform, including new services and features for our members. These efforts may be more costly than we expect and our revenue may not increase sufficiently to offset these additional expenses. In addition, as a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. Further, our revenue growth may slow or our revenue may decline for a number of reasons, including those described in these Risk Factors.

Our quarterly operating results may fluctuate, which could cause our stock price to decline.

Our quarterly operating results may fluctuate for a variety of reasons, many of which are beyond our control. These reasons include those described in these Risk Factors as well as the following:

| ● | fluctuations in revenue generated from our business; |

| ● | our success in retaining existing members and attracting new members; |

| ● | the amount and timing of our operating expenses; |

| ● | the timing and success of new services and features we introduce; |

| ● | the impact of competitive developments and our response to those developments; |

| ● | our ability to manage our existing business and future growth; |

| ● | disruptions or defects in our marketplace, such as privacy or data security breaches; and |

| ● | economic and market conditions, particularly those affecting our industry. |

Fluctuations in our quarterly operating results may cause those results to fall below the expectations of analysts or investors, which could cause the price of our common stock to decline. Fluctuations in our results could also cause a number of other problems. For example, analysts or investors might change their models for valuing our common stock, we could experience short-term liquidity issues, our ability to retain or attract key personnel may diminish and other unanticipated issues may arise.

| 4 |

In addition, we believe that our quarterly operating results may vary in the future and that period-to-period comparisons of our operating results may not be meaningful. For example, our historical growth may have overshadowed the seasonal effects on our historical operating results. These seasonal effects may become more pronounced over time, which could also cause our operating results to fluctuate. You should not rely on the results of one quarter as an indication of future performance.

We are a new business with an unproven model and uncertain regulatory ramifications, and we cannot predict our results.

We are a new business in a new industry, and we cannot predict how this may impact our results. Some of the factors creating this uncertainty are:

| ● | our limited operating history makes it difficult to evaluate our business and prospects and may increase the risks associated with your investment; |

| ● | if we are unable to attract new advertising customers and sell additional offerings to our existing customers, our revenue growth will be adversely affected; |

| ● | if the use of “third party cookies” is rejected by Internet users, restricted or otherwise subject to unfavorable regulation, our performance could decline and we could lose advertisers and revenue; |

| ● | potential “Do Not Track” standards or government regulation could negatively impact our business by limiting our access to the anonymous user data that informs the advertising campaigns we run, and as a result could degrade our performance for our customers; |

| ● | we may not be able to compete successfully against current and future competitors because competition in our industry is intense, and our competitors may offer solutions that are perceived by our customers to be more attractive than ours, which could result in declining revenue, or inability to grow our business. |

Adherence to our values and our focus on long-term sustainability may negatively influence our short- or medium-term financial performance.

Our values are integral to everything we do, and accordingly, we intend to focus on the long-term sustainability of our business and our ecosystem. We may take actions that we believe will benefit our business and our ecosystem and, therefore, our stockholders over a period of time, even if those actions do not maximize short- or medium-term financial results. However, these longer-term benefits may not materialize within the timeframe we expect or at all. For example:

| ● | we may choose to prohibit the sale of items in our marketplace that we believe are inconsistent with our values even though we could benefit financially from the sale of those items; |

| ● | we may choose to revise our policies in ways that we believe will be beneficial to our members and our ecosystem in the long term even though the changes are perceived unfavorably among our existing members; or |

| ● | we may take actions, such as investing in alternative forms of shipping or locating our servers in low-impact data centers, that reduce our environmental footprint even though these actions may be more costly than other alternatives. |

Further expansion into markets outside of the United States is important to the growth of our business but will subject us to risks associated with operations abroad.

Expanding our business into markets outside of the United States is an important part of our strategy. Although we have a significant number of members outside of the United States, we have limited experience in developing local markets outside the United States.

In addition, competition is likely to intensify in the international markets where we operate and plan to expand our operations. Local companies based in markets outside the United States may have a substantial competitive advantage because of their greater understanding of, and focus on, those local markets. Some of our competitors may also be able to develop and grow in international markets more quickly than we will.

| 5 |

Continued expansion in markets outside of the United States will also require significant financial investment. These investments include marketing to attract and retain new members, developing localized services, forming relationships with third-party service providers, supporting operations in multiple countries and potentially acquiring companies based outside the United States and integrating those companies with our operations.

Doing business in markets outside of the United States also subjects us to increased risks and burdens such as:

| ● | complying with different regulatory standards (including those related to the use of personal information, particularly in the European Union); |

| ● | managing and staffing operations over a broader geographic area with varying cultural norms and customs; |

| ● | adapting our platform to local cultural norms and customs; |

| ● | potentially heightened risk of fraudulent transactions; |

| ● | limitations on the repatriation of funds and fluctuations of foreign exchange rates; |

| ● | exposure to liabilities under anti-corruption, anti-money laundering and export control laws, including the U.S. Foreign Corrupt Practices Act of 1977, as amended, the UK Bribery Act of 2010, trade controls and sanctions administered by the U.S. Office of Foreign Assets Control, and similar laws and regulations in other jurisdictions; |

| ● | varying levels of Internet, e-commerce and mobile technology adoption and infrastructure; |

| ● | our ability to enforce contracts and intellectual property rights in jurisdictions outside the United States; and |

| ● | barriers to international trade, such as tariffs or other taxes. |

Finally, operating in markets outside of the United States requires significant management attention. If we invest substantial time and resources to expand our operations outside of the United States and cannot manage these risks effectively, the costs of doing business in those markets may be prohibitive or our expenses may increase disproportionately to the revenue generated in those markets.

We face intense competition and may not be able to compete effectively.

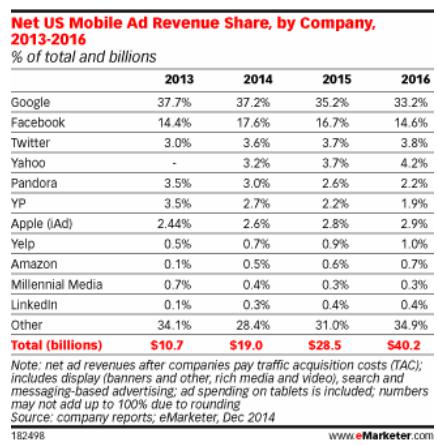

Competition for our advertisers’ advertising budgets is intense. We also expect competition to increase as the barriers to enter our market are low. Increased competition may force us to charge less for our solution, or offer pricing models that are less attractive to us and decrease our margins. Our principal competitors include companies that offer demand-side platforms that allow advertisers to purchase inventory directly from advertising exchanges or other third parties and manage their own consumer data, traditional advertising networks and advertising agencies themselves.

We also rely predominately on advertising agencies to purchase our solution on behalf of advertisers, and certain of those agencies or agency holding companies are creating competitive solutions, referred to as agency trading desks. If these agency trading desks are successful in leveraging their relationships with the advertisers we may be unable to compete even if our solution is more effective. Many agencies that we work with are also owned by large agency holding companies. For various reasons related to the agencies’ own priorities or those of their holding companies, they may not recommend our solution, even though it may be more effective, and we may not have the opportunity to demonstrate our value to advertisers.

We also compete with services offered through large online portals that have significant brand recognition, such as Yahoo!, Google, AOL and MSN. These large portals have substantial proprietary digital advertising inventory that may provide them with competitive advantages, including far greater access to Internet user data, and the ability to significantly influence pricing for digital advertising inventory. We also compete for a share of advertisers’ total advertising budgets with online search advertising, for which we do not offer a solution, and with traditional advertising media, such as direct mail, television, radio, cable and print. Some of our competitors have also established reputations for specific services, such as retargeting with dynamic creative, for which we do not have an established market presence. Many current and potential competitors have competitive advantages relative to us, such as longer operating histories, greater name recognition, larger client bases, greater access to advertising inventory on premium websites and significantly greater financial, technical, sales and marketing resources. Increased competition may result in reduced pricing for our solution, longer sales cycles or a decrease of our market share, any of which could negatively affect our revenue and future operating results and our ability to grow our business.

| 6 |

Our ability to recruit and retain employees is important to our success.

We strive to attract and motivate employees, from our office administrators to our management team, who share our dedication to our community and our mission.

Some of the challenges we face in attracting and retaining employees include:

| ● | preserving our company culture as we grow; |

| ● | continuing to attract and retain employees who share our values; |

| ● | promoting existing employees into leadership positions to help sustain and grow our culture; |

| ● | hiring employees in multiple locations globally; |

| ● | responding to competitive pressures and changing business conditions in ways that do not divert us from our values; and |

| ● | integrating new personnel and businesses from acquisitions. |

Our ability to attract, retain and motivate employees, including our management team, is important to our success. In general, our key personnel work for us on an at-will basis. Other companies, including our competitors, may be successful in recruiting and hiring our employees, and it may be difficult for us to find suitable replacements on a timely basis or on competitive terms.

Filling engineering, product management and other technical positions in the New York City area is particularly challenging, especially in light of our distinctive technology philosophy and engineering culture. Qualified individuals are limited and in high demand, and we may incur significant costs to attract, develop and motivate them. Even if we were to offer higher compensation and other benefits, people with suitable technical skills may choose not to join us or to continue to work for us. If we are not able to maintain our engineering culture and broader company culture, then our ability to recruit and retain employees could suffer and our business would be harmed.

Our business is subject to a large number of U.S. and non-U.S. laws, many of which are evolving.

We are subject to a variety of laws and regulations in the United States and around the world, including those relating to traditional businesses, such as employment laws and taxation, and newer laws and regulations focused on the Internet and online commerce, such as payment systems, privacy, anti-spam, data protection, electronic contracts and consumer protection. These laws and regulations are continuously evolving, and compliance is costly and can require changes to our business practices and significant management time and effort. Additionally, it is not always clear how existing laws apply to the Internet as many of these laws do not address the unique issues raised by the Internet or online commerce.

For example, laws relating to online privacy are evolving differently in different jurisdictions. Federal, state and non-U.S. governmental authorities, as well as courts interpreting the laws, continue to evaluate the privacy implications of the use of third-party “cookies,” “web beacons” and other methods of online tracking. The United States, the European Union and other governments have enacted or are considering legislation that could significantly restrict the ability of companies and individuals to collect and store user information, such as by regulating the level of consumer notice and consent required before a company can employ cookies or other electronic tracking tools.

| 7 |

In some cases, non-U.S. privacy, data protection, consumer protection and other laws and regulations are more restrictive than those in the United States. For example, the European Union traditionally has imposed stricter obligations under such laws than the United States. Consequently, the expansion of our operations internationally may require changes to the ways we collect and use consumer information.

Existing and future laws and regulations enacted by federal, state or non-U.S. governments could impede the growth or use of the Internet or online commerce. It is also possible that governments of one or more countries may seek to censor content available on our platform or may even attempt to block access to our platform. If we are restricted from operating in one or more countries, our ability to attract or retain members may be adversely affected and we may not be able to grow our business as we anticipate.

We strive to comply with all applicable laws, but they may conflict with each other, and by complying with the laws or regulations of one jurisdiction, we may find that we are violating the laws or regulations of another jurisdiction. Despite our efforts, we may not have fully complied in the past and may not in the future. If we become liable under laws or regulations applicable to us, we could be required to pay significant fines and penalties, and we may be forced to change the way we operate. That could require us to incur significant expenses or to discontinue certain services, which could negatively affect our business.

Additionally, if third parties with whom we work violate applicable laws or our policies, those violations could result in other liabilities for us and could harm our business.

We may be unable to protect our intellectual property adequately.

Our intellectual property is an essential asset of our business. To establish and protect our intellectual property rights, we rely on a combination of trade secret, copyright, trademark and, to a lesser extent, patent laws, as well as confidentiality procedures and contractual provisions. The efforts we have taken to protect our intellectual property may not be sufficient or effective. We generally do not elect to register our copyrights or the majority of our trademarks, relying instead on the laws protecting unregistered intellectual property, which may not be sufficient. In addition, our copyrights and trademarks, whether or not registered, and patents, may be held invalid or unenforceable if challenged. While we have obtained or applied for patent protection with respect to some of our intellectual property, we generally do not rely on patents as a principal means of protecting intellectual property. To the extent we do seek patent protection, any U.S. or other patents issued to us may not be sufficiently broad to protect our proprietary technologies.

In addition, we may not be effective in policing unauthorized use of our intellectual property. Even if we do detect violations, we may need to engage in litigation to enforce our intellectual property rights. Any enforcement efforts we undertake, including litigation, could be time-consuming and expensive and could divert our management’s attention. In addition, our efforts may be met with defenses and counterclaims challenging the validity and enforceability of our intellectual property rights or may result in a court determining that our intellectual property rights are unenforceable. If we are unable to cost-effectively protect our intellectual property rights, then our business could be harmed.

We may be subject to intellectual property claims, which are extremely costly to defend, could require us to pay significant damages and could limit our ability to use certain technologies in the future.

Companies in the Internet and technology industries are frequently subject to litigation based on allegations of infringement or other violations of intellectual property rights. We periodically receive notices that claim we have infringed, misappropriated or misused other parties’ intellectual property rights. To the extent we gain greater public recognition, we may face a higher risk of being the subject of intellectual property claims. Third-party intellectual property rights may cover significant aspects of our technologies or business methods or block us from expanding our offerings. Any intellectual property claim against us, with or without merit, could be time consuming and expensive to settle or litigate and could divert the attention of our management. Litigation regarding intellectual property rights is inherently uncertain due to the complex issues involved, and we may not be successful in defending ourselves in such matters.

In addition, some of our competitors have extensive portfolios of issued patents. Many potential litigants, including some of our competitors and patent holding companies, have the ability to dedicate substantial resources to enforcing their intellectual property rights. Any claims successfully brought against us could subject us to significant liability for damages and we may be required to stop using technology or other intellectual property alleged to be in violation of a third party’s rights. We also might be required to seek a license for third-party intellectual property. Even if a license is available, we could be required to pay significant royalties or submit to unreasonable terms, which would increase our operating expenses. We may also be required to develop alternative non-infringing technology, which could require significant time and expense. If we cannot license or develop technology for any allegedly infringing aspect of our business, we would be forced to limit our service and may be unable to compete effectively. Any of these results could harm our business.

| 8 |

We may be involved in litigation matters that are expensive and time consuming.

In addition to intellectual property claims, we may become involved in other litigation matters, including class action lawsuits. Any lawsuit to which we are a party, with or without merit, may result in an unfavorable judgment. We also may decide to settle lawsuits on unfavorable terms. Any such negative outcome could result in payments of substantial damages or fines, damage to our reputation or adverse changes to our offerings or business practices. Any of these results could adversely affect our business. In addition, defending claims is costly and can impose a significant burden on our management.

Our software is highly complex and may contain undetected errors.

The software underlying our platform is highly complex and may contain undetected errors or vulnerabilities, some of which may only be discovered after the code has been released. We rely heavily on a software engineering practice known as “continuous deployment,” meaning that we typically release software code many times per day. This practice may result in the more frequent introduction of errors or vulnerabilities into the software underlying our platform. Any errors or vulnerabilities discovered in our code after release could result in damage to our reputation, loss of members, loss of revenue or liability for damages, any of which could adversely affect our growth prospects and our business.

We are subject to the terms of open source licenses because our platform incorporates open source software.

The software powering our marketplace incorporates software covered by open source licenses. In addition, we regularly contribute source code to open source software projects and release internal software projects under open source licenses, and we anticipate doing so in the future. The terms of many open source licenses have not been interpreted by U.S. courts and there is a risk that the licenses could be construed in a manner that imposes unanticipated conditions or restrictions on our ability to operate our marketplace. Under certain open source licenses, we could be required to publicly release the source code of our software or to make our software available under open source licenses. To avoid the public release of the affected portions of our source code, we could be required to expend substantial time and resources to re-engineer some or all of our software. In addition, use of open source software can lead to greater risks than use of third-party commercial software because open source licensors generally do not provide warranties or controls on the origin of the software. Use of open source software may also present additional security risks because the public availability of such software may make it easier for hackers and other third parties to determine how to compromise our platform. Additionally, because any software source code we contribute to open source projects is publicly available, our ability to protect our intellectual property rights in such software source code may be limited or lost entirely, and we will be unable to prevent our competitors or others from using such contributed software source code. Any of these risks could be difficult to eliminate or manage and, if not addressed, could adversely affect our business, financial condition and results of operations.

Our business may be subject to sales and other taxes.

The application of indirect taxes, such as sales and use tax, value-added tax, or VAT, provincial taxes, goods and services tax, business tax and gross receipt tax, to businesses like ours and to our members is a complex and evolving issue. For example, as of January 1, 2015, the European Union imposed an obligation on marketplaces to collect and remit VAT on sales of automatically-downloaded digital items, and we are in the process of implementing such collection and remittance procedures. Significant judgment is required to evaluate applicable tax obligations and as a result amounts recorded are estimates and could change

We may experience fluctuations in our tax obligations and effective tax rate.

We are subject to taxation in the United States and in numerous other jurisdictions. We record tax expense based on current tax payments and our estimates of future tax payments, which may include reserves for estimates of probable settlements of tax audits. At any one time, multiple tax years could be subject to audit by various taxing jurisdictions. As a result, we expect that throughout the year there could be ongoing variability in our quarterly tax rates as taxable events occur and exposures are re-evaluated. Further, our effective tax rate in a given financial statement period may be adversely impacted by changes in tax laws, changes in the mix of revenue among different jurisdictions, changes to accounting rules and changes to our ownership or capital structure. Fluctuations in our tax obligations and effective tax rate could adversely affect our business.

| 9 |

We rely on consumer discretionary spending and may be adversely affected by economic downturns and other macroeconomic conditions or trends.

Macroeconomic conditions may adversely affect our business. If general economic conditions deteriorate in the United States or other markets where we operate, consumer discretionary spending may decline and demand for the goods available in our marketplace may be reduced. This would cause sales in our marketplace to decline and adversely impact our business.

Even without changes in economic conditions, the demand for the goods listed in our marketplace is dependent on consumer preferences. Consumer preferences can change quickly and may differ across generations and cultures. Trends in socially-conscious consumerism and buying locally could also shift or slow to the detriment of our business. Our growth prospects would also be hampered if the shift to online and mobile commerce does not continue.

We may need additional capital, which may not be available to us on acceptable terms or at all.

We believe that our existing cash and cash equivalents and short-term investments, together with cash generated from operations and available borrowing capacity under our credit facility, will be enough to meet our anticipated cash needs for at least the next 12 months. However, we may require additional cash resources due to changed business conditions or other developments, such as acquisitions or investments we may decide to pursue. If our resources are insufficient to satisfy our cash requirements, we may seek to borrow funds under our credit facility or sell additional equity or debt securities. The sale of additional equity securities could result in dilution to our existing stockholders. Borrowing funds would result in increased debt service obligations and could result in additional operating and financial covenants that would limit our operations. It is also possible that financing may not be available to us in amounts or on terms acceptable to us, if at all.

If our insurance coverage is insufficient or our insurers are unable to meet their obligations, our insurance may not mitigate the risks facing our business.

We contract for insurance to cover a number of risks and potential liabilities. Our insurance policies cover areas such as general liability, errors and omissions liability, employment liability, business interruptions, data breach, crime, product liability and directors’ and officers’ liability. For certain types of business risk, we may not be able to, or may choose not to, acquire insurance. In addition, we may not obtain enough insurance to adequately mitigate the risks we face or we may have to pay high premiums and/or deductibles for the coverage we do obtain. Additionally, if any of our insurers becomes insolvent, it would be unable to pay any claims that we make.

We are an emerging growth company and the reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors.

We are an emerging growth company as defined in the JOBS Act. For as long as we continue to be an emerging growth company, we intend to take advantage of some of the exemptions from the reporting requirements applicable to other public companies. For example, we intend to take advantage of the exemption from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments. It is possible that investors will find our common stock less attractive as a result of our reliance on these exemptions. If so, there may be a less active trading market for our common stock and our stock price may be more volatile.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion or (c) in which we become a large accelerated filer, which means that we have been public for at least 12 months, have filed at least one annual report and the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last day of our then most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

| 10 |

Operating as a public company will require us to incur substantial costs and will require substantial management attention. In addition, our management team has limited experience managing a public company.

As a public company, we will incur substantial legal, accounting and other expenses that we did not incur as a private company. For example, we will be subject to the reporting requirements of the Securities Exchange Act of 1934 as amended, or the Exchange Act, the applicable requirements of the Sarbanes-Oxley Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations of the Securities and Exchange Commission, or the SEC. The rules and regulations of Nasdaq will also apply to us following this offering. As part of the new requirements, we will need to establish and maintain effective disclosure and financial controls and make changes to our corporate governance practices. We expect that compliance with these requirements will increase our legal and financial compliance costs and will make some activities more time-consuming.

Most of our management and other personnel have little experience managing a public company and preparing public filings. In addition, we expect that our management and other personnel will need to divert attention from other business matters to devote substantial time to the reporting and other requirements of being a public company. In particular, we expect to incur significant expense and devote substantial management effort to complying with the requirements of Section 404 of the Sarbanes-Oxley Act. We will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge.

Our management will not be required to evaluate the effectiveness of our internal control over financial reporting until the end of the fiscal year for which our second annual report is due. If we are unable to maintain effective internal control over financial reporting, investors may lose confidence in the accuracy of our financial reports.

As a public company, we will be required to maintain internal control over financial reporting and to report any material weaknesses in such internal controls. Section 404 of the Sarbanes-Oxley Act requires that we evaluate and determine the effectiveness of our internal control over financial reporting. Beginning with our second annual report following this offering, we will be required to provide a management report on internal control over financial reporting. When we are no longer an emerging growth company, our management report on internal control over financial reporting will need to be attested to by our independent registered public accounting firm. We do not expect to have our independent registered public accounting firm attest to our management report on internal control over financial reporting while we are an emerging growth company.

If we have a material weakness in our internal control over financial reporting, we may not detect errors on a timely basis and our financial statements may be materially misstated. In addition, our internal control over financial reporting will not prevent or detect all errors and fraud. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud will be detected.

If there are material weaknesses or failures in our ability to meet any of the requirements related to the maintenance and reporting of our internal controls, investors may lose confidence in the accuracy and completeness of our financial reports and that could cause the price of our common stock to decline. In addition, we could become subject to investigations by Nasdaq, the SEC or other regulatory authorities, which could require additional management attention and which could adversely affect our business.

Our business could be adversely affected by natural disasters, public health crises, political crises or other unexpected events.

Natural disasters and other adverse weather and climate conditions, public health crises, political crises, such as terrorist attacks, war and other political instability, or other unexpected events, could disrupt our operations, Internet or mobile networks, or the operations of one or more of our service providers. In addition, such events could negatively impact consumer spending in the affected regions. If any of these events occurs, our business could be adversely affected.

Risks Related to This Offering and Ownership of Our Common Stock

| 11 |

The price of our common stock could be volatile and you may not be able to resell your shares at or above our initial public offering price. Declines in the price of common stock could subject us to litigation.

There has not been a public market for our common stock prior to this offering and an active trading market may not develop following this offering. Even if such a market does develop, it may not be sustainable. If trading in our common stock is not active, you may not be able to sell your shares quickly, at the market price or at all. The public offering price for the shares was determined by negotiations between us and the representative of the underwriters and may not be indicative of prices that will prevail in the trading market following this offering. In addition, the trading prices of the securities of technology companies have historically been highly volatile. Accordingly, the price of our common stock could be subject to wide fluctuations for many reasons, many of which are beyond our control, including those described in these Risk Factors and others such as:

| ● | variations in our operating results and other financial and operational metrics, including the key financial and operating metrics disclosed in this prospectus, as well as how those results and metrics compare to analyst and investor expectations; |

| ● | speculation about our operating results in the absence of our own financial projections; |

| ● | failure of analysts to initiate or maintain coverage of our company, changes in their estimates of our operating results or changes in recommendations by analysts that follow our common stock; |

| ● | announcements of new services or enhancements, strategic alliances or significant agreements or other developments by us or our competitors; |

| ● | announcements by us or our competitors of mergers or acquisitions or rumors of such transactions involving us or our competitors; |

| ● | changes in our board of directors, management or other key personnel; |

| ● | disruptions in our marketplace due to hardware, software or network problems, security breaches or other issues; |

| ● | the strength of the global economy or the economy in the jurisdictions in which we operate, and market conditions in our industry and those affecting our members; |

| ● | trading activity by our principal stockholders, including upon the expiration of contractual lock-up agreements; |

| ● | the performance of the equity markets in general and in our industry; |

| ● | the operating performance of other similar companies; |

| ● | changes in legal requirements relating to our business; |

| ● | litigation or other claims against us; |

| ● | the number of shares of our common stock that are available for public trading; and |

| ● | any other factors discussed in this prospectus. |

In addition, if the market for technology stocks or the stock market in general experiences a loss of investor confidence, the price of our common stock could decline for reasons unrelated to our business, results of operations or financial condition. The price of our common stock might also decline in reaction to events that affect other companies, even if those events do not directly affect us. Some companies that have experienced volatility in the trading price of their stock have been the subject of securities class action litigation. If we are the subject of such litigation, it could result in substantial costs and could divert our management’s attention and resources, which could adversely affect our business.

| 12 |

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

The principal purposes of this offering are to increase our visibility, create a public market for our common stock and facilitate our future access to the public equity markets. We currently intend to use the net proceeds from this offering for working capital and general corporate purposes, including continued investments in the growth of our business. We may use a portion of the net proceeds received by us from this offering for acquisitions of other complementary businesses, technologies or other assets. However, we have no current understandings, agreements or commitments for any specific material acquisitions at this time. As a result, our management will have broad discretion in the allocation and use of the net proceeds. See “Use of Proceeds.”

The failure by our management to allocate or use these funds effectively could harm our business. Pending their use, we may invest the net proceeds we receive from this offering in a manner that does not produce income or that loses value. Our ultimate use of the net proceeds from this offering may vary substantially from their currently intended use.

We do not intend to pay dividends on our capital stock, so any returns will be limited to increases in the value of our common stock.

We have never declared or paid any cash dividends on our capital stock. We currently anticipate that we will retain future earnings for the operation and expansion of our business. Accordingly, we do not anticipate declaring or paying any cash dividends for the foreseeable future. In addition, our ability to pay cash dividends on our capital stock is restricted by the terms of our credit facility and is likely to be restricted by

Our directors, executive officers and principal stockholders beneficially own a substantial percentage of our stock and will be able to exert significant control over matters subject to stockholder approval.

Our directors, executive officers, greater than 5% stockholders and their respective affiliates will hold in the aggregate approximately 82 % of the voting power of our outstanding capital stock following this offering, assuming no exercise of the underwriters’ option to purchase additional shares of our common stock in this offering. Therefore, these stockholders will continue to have the ability to influence us through their ownership position, even after this offering. If these stockholders act together, they may be able to determine all matters requiring stockholder approval. For example, these stockholders will be able to control elections of directors, amendments of our charter documents or approval of any merger, sale of assets or other major corporate transaction. This may prevent or discourage unsolicited acquisition proposals or offers for our capital stock that other stockholders may feel are in their best interests.

Sales of a substantial number of shares of our common stock in the public market by our existing stockholders following this offering could cause the price of our common stock to decline.

Sales of a substantial number of shares of our common stock in the public market, or the perception that these sales might occur, could depress the price of our common stock and could impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that sales may have on the prevailing price of our common stock.

Future sales and issuances of our common stock or rights to purchase common stock could result in additional dilution to our stockholders and could cause the price of our common stock to decline.

We may issue additional common stock, convertible securities or other equity following the completion of this offering. We also expect to issue common stock to our employees, directors and other service providers pursuant to our equity incentive plans. Such issuances could be dilutive to investors and could cause the price of our common stock to decline. New investors in such issuances could also receive rights senior to those of holders of our common stock.

If analysts do not publish research about our business or if they publish inaccurate or unfavorable research, our stock price and trading volume could decline.

The trading market for our common stock will depend in part on the research and reports that analysts publish about our business. We do not have any control over these analysts. If one or more of the analysts who cover us downgrade our common stock or publish inaccurate or unfavorable research about our business, the price of our common stock would likely decline. If few analysts cover us, demand for our common stock could decrease and our common stock price and trading volume may decline. Similar results may occur if one or more of these analysts stop covering us in the future or fail to publish reports on us regularly.

| 13 |

Anti-takeover provisions in our charter documents and under Delaware law could make an acquisition of our company more difficult, could limit attempts to make changes in our management and could depress the price of our common stock.

Provisions in our certificate of incorporation and bylaws may have the effect of delaying or preventing a change in control of our company or limiting changes in our management. Among other things, these provisions:

| ● | establish a classified board of directors so that not all members of our board of directors are elected at one time; |

| ● | permit our board of directors to establish the number of directors and fill any vacancies and newly created directorships; |

| ● | provide that directors may only be removed for cause; |

| ● | require super-majority voting to amend some provisions in our certificate of incorporation and bylaws; |

| ● | authorize the issuance of “blank check” preferred stock that our board of directors could use to implement a stockholder rights plan; |

| ● | eliminate the ability of our stockholders to call special meetings of stockholders; |

| ● | prohibit stockholder action by written consent, which means all stockholder actions must be taken at a meeting of our stockholders; |

| ● | provide that our board of directors is expressly authorized to amend or repeal any provision of our bylaws; |

| ● | restrict the forum for certain litigation against us to Delaware; and |

| ● | establish advance notice requirements for nominations for election to our board of directors or for proposing matters that can be acted upon by stockholders at annual stockholder meetings. |

These provisions may delay or prevent attempts by our stockholders to replace members of our management by making it more difficult for stockholders to replace members of our board of directors, which is responsible for appointing the members of our management. In addition, Section 203 of the Delaware General Corporation Law may delay or prevent a change in control of our company. Section 203 imposes certain restrictions on mergers, business combinations and other transactions between us and holders of 15% or more of our common stock. Anti-takeover provisions could depress the price of our common stock by acting to delay or prevent a change in control of our company.

For information regarding these and other provisions, see “Description of Capital Stock.”

Historically, we have not paid dividends on our common stock, and we do not anticipate paying any cash dividends in the foreseeable future.

We have never paid cash dividends on our common stock. We intend to retain our future earnings, if any, to fund operational and capital expenditure needs of our business, and we do not anticipate paying any cash dividends in the foreseeable future. Furthermore, future financing instruments may do the same. As a result, capital appreciation, if any, of our common stock will be the sole source of gain for our common stockholders in the foreseeable future.

Our stock price is speculative and there is a risk of litigation.

The trading price of our common stock has in the past and may in the future be subject to wide fluctuations in response to factors such as the following:

| 14 |

| ● | revenue or results of operations in any quarter failing to meet the expectations, published or otherwise, of the investment community; | |

| ● | reduced investor confidence in equity markets, due in part to corporate collapses in recent years; | |

| ● | speculation in the press or analyst community; | |

| ● | wide fluctuations in stock prices, particularly with respect to the stock prices for other technology companies; | |

| ● | announcements of technological innovations by us or our competitors; | |

| ● | new products or the acquisition of significant customers by us or our competitors; | |

| ● | changes in investors’ beliefs as to the appropriate price-earnings ratios for us and our competitors; | |

| ● | changes in recommendations or financial estimates by securities analysts who track our common stock or the stock of other battery companies; | |

| ● | changes in management; | |

| ● | sales of common stock by directors and executive officers; | |

| ● | rumors or dissemination of false or misleading information, particularly through Internet chat rooms, instant messaging, and other rapid-dissemination methods; | |

| ● | conditions and trends in the battery industry generally; | |

| ● | the announcement of acquisitions or other significant transactions by us or our competitors; | |

| ● | adoption of new accounting standards affecting our industry; | |

| ● | general market conditions; | |

| ● | domestic or international terrorism and other factors; and | |

| ● | the other factors described in this section. |

Fluctuations in the price of our common stock may expose us to the risk of securities class action lawsuits. Although no such lawsuits are currently pending against us and we are not aware that any such lawsuit is threatened to be filed in the future, there is no assurance that we will not be sued based on fluctuations in the price of our common stock. Defending against such suits could result in substantial cost and divert management’s attention and resources. In addition, any settlement or adverse determination of such lawsuits could subject us to significant liability.

Future sales of our common stock could depress our stock price.

Sales of a large number of shares of our common stock, or the availability of a large number for sale, could materially adversely affect the per share market price of our common stock and could impair our ability to raise funds in addition offering of our debt or equity securities. In the event that we propose to register shares of common stock under the Securities Act for our own account, certain shareholders are entitled to receive notice of that registration to include their shares in the registration, subject to limitations described in the agreements granting these rights.

| 15 |

We will not receive any proceeds from the sale of the shares of stock registered hereunder by the selling shareholders.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our common stock. We currently anticipate that we will retain all future earnings for the expansion and operation of our business and do not anticipate paying cash dividends in the foreseeable future. Otherwise, the payment of dividends on common stock, if any, in the future is within the discretion of our Board and will depend on its earnings, capital requirements and financial condition and other relevant facts.

SELLING STOCKHOLDERS

The following table sets forth as of October 2, 2017 information regarding the beneficial ownership of our common stock for our selling stockholders and the shares to be registered hereunder and thus offered for resale.

In February 2017, we entered into an agreement containing registration rights with the selling stockholders pursuant to which we were obligated to prepare and file a registration statement to permit the resale of certain common stock held by the selling stockholders from time to time as permitted by Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act. We are registering the common stock described in this prospectus pursuant to this agreement. The following table also sets forth the maximum number of shares of our common stock to be sold by the selling stockholders, the name of each selling stockholder, the nature of any position, office, or other material relationship which the selling stockholder has had, within the past three years, with us or with any of our predecessors or affiliates, and the number of shares and percentage of our common stock to be owned by such stockholders after completion of the offering, assuming the sale of all shares of common stock offered hereby.

Additionally, the selling stockholders may have sold or transferred some or all of their shares of our common stock in transactions exempt from the registration requirements of the Securities Act since the date on which the information in the table was provided to us. Other information about the selling stockholders may also change over time.

Except as otherwise indicated, each selling stockholder has sole voting and dispositive power with respect to such shares.

All information with respect to beneficial ownership has been furnished by the respective 5% or more stockholders, selling stockholders, directors or named executive officers, as the case may be. We have not sought to verify such information.

| 16 |

| Shares

of Common Stock Beneficially Owned Prior to the Offering(1) | Number

of Shares of Common Stock Being Offered | Shares

of Common Stock Beneficially Owned After Completion of the Offering | ||||||||||

| Number | Hereby | Number | ||||||||||

| Selling shareholders: | ||||||||||||

| Joseph

O’Hanlon 4 Kenwood Drive Norwood Massachusetts 02062 | 11,111 | 11,111 | 0 | |||||||||

| Karen

O’Hanlon 4 Kenwood Drive Norwood Massachusetts 02062 | 11,111 | 11,111 | 0 | |||||||||

| Brendan

Hoarty 289 Common St. Watertown, Ma 02472 | 44,444 | 44,444 | 0 | |||||||||

| Richard

Forde Crumlin Ballgghonin Tuam Ireland | 8,889 | 8,889 | —0 | |||||||||

| Liam

McGettigan Glebe Killmacrennen Ireland | 63,329 | 63,329 | 0 | |||||||||

| John

David O’Loughlin 2 Mount Vincent Tce. O’Connell Ave | 97,007 | 97,007 | 0 | |||||||||

| Randy

Jackson 234 Cedarhill Cres N2E 2H4 Kitchener Ontario, Canada | 236,600 | 236,600 | 0 | |||||||||