Attached files

| file | filename |

|---|---|

| EX-10.6 - EXHIBIT 10.6 - NextSource Materials Inc. | ex_95889.htm |

| EX-32.2 - EXHIBIT 32.2 - NextSource Materials Inc. | ex_95766.htm |

| EX-32.1 - EXHIBIT 32.1 - NextSource Materials Inc. | ex_95765.htm |

| EX-31.2 - EXHIBIT 31.2 - NextSource Materials Inc. | ex_95764.htm |

| EX-31.1 - EXHIBIT 31.1 - NextSource Materials Inc. | ex_95763.htm |

| EX-21 - EXHIBIT 21 - NextSource Materials Inc. | ex_95767.htm |

| EX-10.7 - EXHIBIT 10.7 - NextSource Materials Inc. | ex_95890.htm |

| EX-10.5 - EXHIBIT 10.5 - NextSource Materials Inc. | ex_95888.htm |

| EX-10.4 - EXHIBIT 10.4 - NextSource Materials Inc. | ex_95887.htm |

| EX-4.8 - EXHIBIT 4.8 - NextSource Materials Inc. | ex_95894.htm |

| EX-4.7 - EXHIBIT 4.7 - NextSource Materials Inc. | ex_95893.htm |

| EX-4.6 - EXHIBIT 4.6 - NextSource Materials Inc. | ex_95892.htm |

| EX-4.5 - EXHIBIT 4.5 - NextSource Materials Inc. | ex_95891.htm |

| EX-4.4 - EXHIBIT 4.4 - NextSource Materials Inc. | ex_95886.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 30, 2017

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-51151

NEXTSOURCE MATERIALS INC.

(Exact name of registrant as specified in its charter)

|

Minnesota |

|

20-0803515 |

|

(State or other jurisdiction of Incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

1001–145 Wellington Street West, Toronto, Ontario |

|

M5J 1H8 |

|

(Address of principal executive offices) |

|

(Zip Code) |

_______________________

(416) 364-4911

(Registrant’s telephone number, including area code)

_______________________

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $0.001 par value per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated file ☐ Accelerated filer ☐ Non-Accelerated filer ☐

Smaller reporting company ☒ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X]

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of December 31, 2016, based upon the closing price of the common stock as reported on the OTCQB on such date: $22,995,535

As of September 27, 2017, there were 460,995,711 shares of the Registrant's common stock issued and outstanding.

Documents Incorporated by Reference: None

NextSource Materials Inc.

FORWARD-LOOKING STATEMENTS

This Annual Report contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA") regarding management’s plans and objectives for future operations including plans and objectives relating to our planned marketing efforts and future economic performance.

Any statement in this report that is not a statement of an historical fact constitutes a “forward-looking statement”. Further, when we use the words “may”, “expect”, “anticipate”, “plan”, “believe”, “seek”, “estimate”, and similar words, we intend to identify statements and expressions that may be forward-looking statements. We believe it is important to communicate certain of our expectations to our investors. Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions that could cause our future results to differ materially from those expressed in any forward-looking statements. Many factors are beyond our ability to control or predict. You are accordingly cautioned not to place undue reliance on such forward-looking statements. Important factors that may cause our actual results to differ from such forward-looking statements include, but are not limited to, the risks outlined under “Risk Factors” herein.

The forward-looking statements herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking statements are based on assumptions described herein. The assumptions are based on judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no assurance that the results contemplated in forward-looking statements will be realized. In addition, as disclosed in “Risk Factors”, there are a number of other risks inherent in our business and operations, which could cause our operating results to vary markedly, and adversely from prior results or the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which may cause us to alter marketing, capital investment and other expenditures, which may also materially adversely affect our results of operations. In light of the significant uncertainties inherent to forward-looking information included in the report statement, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

The forward-looking statements and associated risks set forth in this Report include or relate to, among other things: (a) our growth strategies, (b) anticipated trends in the mining industry, (c) currency fluctuations, (d) our ability to obtain and retain sufficient capital for future operations, and (e) our anticipated needs for working capital. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business”.

Our future financial results are uncertain due to a number of factors, some of which are outside the Company’s control. These factors include, but are not limited to: (a) our ability to raise additional funding; (b) the market price for graphite, vanadium and other minerals and materials; (c) the results of the exploration programs and metallurgical analysis of our mineral properties; (d) the political instability and/or environmental regulations that may adversely impact costs and ability to operate in Madagascar; and (e) our ability to find joint venture and/or off-take partners in order to advance the development of our mineral properties. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors”. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur.

The reader is cautioned that our Company does not have a policy of updating or revising forward-looking statements and thus the reader should not assume that silence by management of our Company over time means that actual events are bearing out as estimated in such forward-looking statements.

All references to “dollars”, “$” or “US$” are to United States dollars and all references to “CAD$” are to Canadian dollars. United States dollar equivalents of Canadian dollar figures are based on the daily average exchange rate as reported by the Bank of Canada on the applicable date. All references to “common shares” refer to the common shares in our capital stock.

All references to “tpa” refer to tonnes per annum.

NextSource Materials Inc.

|

PART I |

||

|

ITEM 1 |

Business |

3 |

|

ITEM 1A. |

Risk Factors |

30 |

|

ITEM 1B |

Unresolved Staff Comments |

38 |

|

ITEM 2. |

Properties |

39 |

|

ITEM 3. |

Legal Proceedings |

40 |

|

ITEM 4 |

Mine Safety Disclosures |

40 |

|

PART II |

||

|

ITEM 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

41 |

|

ITEM 6. |

Selected Financial Data |

42 |

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 |

|

ITEM 7.A |

Quantitative and Qualitative Disclosures about Market Risk |

49 |

|

ITEM 8 |

Financial Statements |

50 |

|

ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

51 |

|

ITEM 9A. |

Controls and Procedures |

51 |

|

ITEM 9B. |

Other Information |

52 |

|

PART III |

||

|

ITEM 10. |

Directors, Executive Officers, and Corporate Governance |

53 |

|

ITEM 11. |

Executive Compensation |

57 |

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

61 |

|

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

62 |

|

ITEM 14. |

Principal Accounting Fees and Services |

63 |

|

PART IV |

||

|

ITEM 15. |

Exhibits |

64 |

|

ITEM 16. |

Form 10-K Summary | 64 |

|

SIGNATURES |

||

|

Report Signatures |

65 | |

|

APPENDIX |

||

|

Financial Statements |

66 | |

|

CERTIFICATIONS |

||

|

Exhibit 31 |

Management certifications |

|

|

Exhibit 32 |

Sarbanes-Oxley Act |

|

FINANCIAL INFORMATION

As used in these footnotes, “we”, “us”, “our”, “NextSource Materials ”, “NextSource”, “Company” or “our company” refers to NextSource Materials Inc. and all of its subsidiaries.

All references to “dollars”, “$” or “US$” are to United States dollars and all references to “CAD$” are to Canadian dollars. United States dollar equivalents of Canadian dollar figures are based on the daily average exchange rate as reported by the Bank of Canada on the applicable date. All references to “common shares” refer to the common shares in our capital stock.

All references to “tpa” refer to tonnes per annum.

ITEM 1. – BUSINESS

Company Overview

Our principal business is the acquisition, exploration and development of mineral resources. We are primarily focused on the development of the Molo Graphite Project into a fully operational and sustainable graphite mine.

The Molo Graphite Project currently consists of a commercially minable graphite deposit situated in the African country of Madagascar. No mine infrastructure currently exists at the Molo Graphite Project site. We have additional exploration-stage mineral properties situated in Madagascar, including the Green Giant Property.

We have not generated operating revenues or paid dividends since inception on March 1, 2004 to the period ended June 30, 2017 and we are unlikely to do so in the immediate future. Our business activities have been entirely financed from the proceeds of securities subscriptions.

Our executive offices are situated at 1001–145 Wellington Street West, Toronto, Ontario, Canada, M5J 1H8 and the primary telephone number is (416) 364-4986. Our website is www.nextsourcematerials.com (which website is expressly not incorporated by reference into this filing).

We are incorporated in the State of Minnesota, USA and have a fiscal year end of June 30.

On April 19, 2017, the Company changed its name from Energizer Resources Inc. to NextSource Materials Inc. as part of our rebranding effort and to better reflect our evolution from an exploration-stage company into a mine-development company. Our new symbol on the Toronto Stock Exchange is “NEXT” and on the OTC Markets is “NSRC.”

During fiscal 2008, the Company incorporated Energizer (Mauritius) Ltd. (“ERMAU”), a Mauritius subsidiary, and Energizer Madagascar Sarl. (“ERMAD”), a Madagascar subsidiary of ERMAU. During fiscal 2009, the Company incorporated THB Ventures Ltd. (“THB”), a Mauritius subsidiary of ERMAU, and Energizer Minerals Sarl. (“ERMIN”), a Madagascar subsidiary of THB, which holds the 100% ownership interest of the Green Giant Property in Madagascar (see note 5). During fiscal 2012, the Company incorporated Madagascar-ERG Joint Venture (Mauritius) Ltd. (“ERGJVM”), a Mauritius subsidiary of ERMAU, and ERG (Madagascar) Sarl. (“ERGMAD”), a Madagascar subsidiary of ERGJVM, which holds the Malagasy Joint Venture Ground. During fiscal 2014, the Company incorporated 2391938 Ontario Inc., an Ontario, Canada subsidiary.

Our authorized capital is 650,000,000 shares, with a par value of $0.001 per share, of which 640,000,000 are deemed common shares and the remaining 10,000,000 are deemed eligible to be divisible into classes, series and types with rights and preferences as designated by our Board of Directors.

We have not had any bankruptcy, receivership or similar proceeding since incorporation. Except as described below, there have been no material reclassifications, mergers, consolidations or purchases or sales of any significant amount of assets not in the ordinary course of business since the date of incorporation.

Further details regarding each of our Madagascar properties, although not incorporated by reference, including the comprehensive feasibility studies prepared in accordance with Canada’s National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) for the Molo Graphite Project and separately the technical report on the Green Giant Property in Madagascar can be found on the Company’s website at www.nextsourcematerials.com (which website is expressly not incorporated by reference into this filing) or in the Company’s Canadian regulatory filings at www.sedar.com (which website and content is expressly not incorporated by reference into this filing).

We report mineral reserve estimates in accordance with the Securities and Exchange Commission’s Industry Guide 7 (“Guide 7”) under the Securities Act of 1933, as amended (the “U.S. Securities Act”). As a reporting issuer in Canada with our primary trading market in Canada, we are also required to prepare reports on our mineral properties in accordance with NI 43-101. The technical reports referenced in this document use the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource”. These terms are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under Guide 7 and are normally not permitted to be used in reports filed with the Securities and Exchange Commission. As a result, information in respect of our mineral resources determined in accordance with NI 43-101 is not contained in this document.

Cautionary Note

Based on the nature of our business, we anticipate incurring operating losses for the foreseeable future. We base this expectation, in part, on the fact that very few mineral properties in the exploration stage are ultimately developed into producing and profitable mines. Our future financial results are uncertain due to a number of factors, some of which are outside the Company’s control. These factors include, but are not limited to: (a) our ability to raise additional funding; (b) the market price for graphite, vanadium, gold and/or uranium; (c) the results of the exploration programs and metallurgical analysis of our mineral properties; (d) the political instability and/or environmental regulations that may adversely impact costs and ability to operate in Madagascar; and (e) our ability to find joint venture and/or off-take partners in order to advance the development of our mineral properties.

Any future equity financing will cause existing shareholders to experience dilution of their ownership interest in the Company. In the event the Company is not successful in raising additional financing, we anticipate the Company will not be able to proceed with its business plan. In such a case, the Company may decide to discontinue or modify its current business plan and seek other business opportunities in the resource sector.

During this period, the Company will need to maintain periodic filings with the appropriate regulatory authorities and will incur legal, accounting, administrative and listing costs. In the event no other such opportunities are available and the Company cannot raise additional capital to sustain operations, the Company may be forced to discontinue the business. The Company does not have any specific alternative business opportunities under consideration and have not planned for any such contingency.

Due to the present inability to generate revenues, accumulated losses, recurring losses and negative operating cash flows, the Company has stated its opinion in Note 1 of our audited financial statements, as included in this annual report, that there currently exists substantial doubt regarding the Company’s ability to continue as a going concern.

Summary of Milestones

In July 2016, we appointed UK-based HCF International Advisers Limited ("HCF") as advisor in negotiating and structuring strategic partnerships, off take agreements and debt financing for our Molo Graphite Project in Madagascar. Discussions in respect of these matters have been ongoing for the past 26 months and are expected to continue during the coming months with no assurances as to the conclusion or results of these discussions.

In August 2016, we initiated a Front-End Engineering Design Study (the “FEED Study”) and value engineering for our Molo Graphite Project in Madagascar. The FEED Study was undertaken in order to optimize the mine plan as envisioned in the technical report titled "Molo Feasibility Study – National Instrument 43-101 Technical Report on the Molo Graphite Project located near the village of Fotadrevo in the Province of Toliara, Madagascar", dated July 13, 2017, effective as of July 13, 2017 (the “Molo Feasibility Study”) and determine the optimal development path based on discussions with prospective strategic partners. All costing aspects were examined with the goal of providing a method to produce meaningful, multi-tonne test samples of Molo graphite concentrate to potential off-takers while reducing the CAPEX and time required to the commencement of commercial production.

On November 7, 2016, we outlined a phased mine development plan for the Molo Graphite Project based on the FEED Study and value engineering. The results supported the construction of a plant to test and verify the flow sheet design from the Molo Feasibility Study. Under the existing Exploration Permit, the Company is limited to an ore input of 20,000 cubic meters (or approximately 50,000 tonnes) of front-end feed into the demonstration plant. Upon approval of a full mining permit, the 20,000-cubic meter test limit would be removed and at full capacity, the demonstration plant would be capable of processing up to 240,000 tonnes of feed per annum, which equates to 30 tonnes per hour of ore feed and roughly 1 to 3 tonnes of flake graphite concentrate production per hour.

Phase 1

Phase 1 would consist of a fully operational and sustainable graphite mine with a permanent processing plant capable of producing, in our estimation, approximately 17,000 tpa of high-quality SuperFlake™ graphite concentrate with a mine life of 30 years (as discussed below). The fully-modularized mining operation in this phase will use a 100% owner-operated fleet that we believe will process an average of 240,000 tonnes of ore per year (or 30 tonnes per hour) of mill feed (ore) that will be processed on site. Phase 1 will provide “proof of concept” for the modular methodology and allow NextSource the flexibility to optimize further the process circuit while being capable of supplying a true “run-of-mine” flake concentrate to potential off-takers and customers for final product validation. All supporting infrastructure including water, fuel, power, dry-stack tailings and essential buildings will be constructed during Phase 1 to sustain the fully operational and permanent processing plant. The plant will utilize dry-stack tailings in order to eliminate the up-front capital costs associated with a tailings dam. NextSource’s existing camp adjacent to the nearby town of Fotadrevo will be used to accommodate employees and offices, with additional housing available within the town for additional employees.

Phase 2

Phase 2 would consist of a modular expansion to plant capable of producing approximately 50,000 tpa of high-quality SuperFlake™ graphite concentrate. Timing of the implementation of Phase 2 will be determined by market demand for SuperFlake™ graphite and will incorporate the unique full-modular build approach used in Phase 1. This phase will include the construction of additional on-site accommodation and offices, upgrading of road infrastructure, port facility upgrades, a wet tailings dam facility and further equipment purchases to provide redundancy within the processing circuit. The costs for these capital expenditures are unknown at this time, but will be assessed as part of an economic analysis completed in parallel with Phase 1 development.

On June 1, 2017, we released the results of a positive updated Molo Feasibility Study for Phase 1 of the mine development plan utilizing a fully modular build-out approach which was based on the FEED Study and subsequent detailed engineering studies. Phase 1 would consist of a fully operational and sustainable graphite mine with a permanent processing plant capable of producing, in our estimation, approximately 17,000 tpa of high-quality SuperFlake™ graphite concentrate per year with a mine life of 30 years. The Phase 1 production costs were estimated at $433 per tonne at the plant and $688 per tonne delivered CIF port of Rotterdam. The Phase 1 capital costs were estimated at $18.4 million with a construction projected but not guaranteed timeline of approximately 9 months. Based on an average selling cost of $1,014 per tonne, the Phase 1 was estimated to have a pre-tax NPV of $34 million using an 8% discount rate, a pre-tax internal rate of return (IRR) of 25.2%, and a post-tax IRR of 21.5%.

Summary of Future Plans

We have applied for a mining permit from the Government of Madagascar to begin construction of Phase 1 of the Molo Graphite Project. Although the Company believes it has complied with all permit requirements and has submitted all necessary documents, there can be no assurances as to the timing of the receipt of a mining permit.

In anticipation of receiving the mine permit and of eventual graphite production, we have continued to pursue negotiations in respect of potential off-take agreements with graphite end-users and intermediaries with the intention of securing project financing alternatives, which may include debt, equity and derivative instruments.

From the date of this report, and subject to availability of capital and unforeseen delays in receiving the mining permit for the Molo Graphite Project, our business plan during the next 12 months is to incur between $2,200,000 to $23,000,000 on further permitting, engineering, construction, professional fees, G&A and working capital costs to achieve initial production at the Molo Graphite Project by July 2018. No assurances can be provided that we will achieve our production objective by that date.

The following is a summary of the amounts budgeted to be incurred (presuming all $23,000,000 is required):

|

Professional Fees and General and Administrative |

$ | 1,500,000 | ||

|

Environmental and Permitting Fees |

$ | 700,000 | ||

|

Phase 1 Processing Plant CAPEX |

$ | 14,500,000 | ||

|

Phase 1 Infrastructure CAPEX |

$ | 400,000 | ||

|

Construction Financing Costs |

$ | 1,100,000 | ||

|

Construction Contingency Costs (10%) |

$ | 1,700,000 | ||

|

Working Capital for Mine Startup |

$ | 3,100,000 | ||

|

Total |

$ | 23,000,000 |

The above amounts may be updated based on actual costs and the timing may be delayed or adjusted based on several factors, including the availability of capital to fund the budget. We anticipate that the source of funds required to complete the budgeted items disclosed above will come from private placements in the capital markets, but there can be no assurance that financing will be available on terms favorable to the Company or at all.

We will also assess the addition of back-end value-added processing for lithium-ion battery and graphite foil applications in the classification portion of the plant. The costs for any value-added processing is unknown at this time, but will be assessed in parallel with the development of Phase 1.

Employees

As of the date of this annual report, we have 4 full-time employees and consultants based in Toronto and South Africa engaged in the management of the Company as well as several additional consultants in South Africa and Madagascar that serve managerial and non-managerial functions.

Competitive Conditions in our Industry

The mineral exploration and mining industry is competitive in all phases of exploration, development and production. We compete with a number of other entities and individuals in the search for, and acquisition of, attractive mineral properties. As a result of this competition, the majority of which is with companies with greater financial resources than us, we may not in the future be able to acquire attractive properties on terms our management considers acceptable. Furthermore, we compete with other resource companies, many of whom have greater financial resources and/or more advanced properties that are better able to attract equity investments and other capital. Factors beyond our control may affect the marketability of minerals mined or discovered by us.

Government Regulations and Permitting

The receipt of the exploitation permit is a critical step in the larger permitting and licensing regime. The permitting and licensing of the Molo Graphite Project requires dedicated attention to ensure momentum is maintained during the application for and delivery of all necessary permits and licenses.

The Molo Graphite Project exploration permit PR 3432 is currently held under the name of one of our Madagascar subsidiary ERG Madagascar SARLU. Our Madagascar subsidiaries have paid all taxes and administrative fees to the Madagascar government and its mining ministry with respect to all the mining permits held in country. These taxes and administrative fee payments have been acknowledged and accepted by the Madagascar government. In addition, we continue to diligently work with the Madagascar government to obtain the necessary permits as the country clears its backlog of applications and amendments.

We have applied to have the Molo Graphite Project exploration permit converted into an exploitation permit, which is expected to be completed in due course. The exploitation permit is required to advance the Molo Project into the developmental stage.

A comprehensive Environmental and Social Impact Assessment ("ESIA"), developed to local Malagasy, Equator Principles, World Bank and International Finance Corporation (IFC) standards, is nearing completion. This process was preceded by an Environmental Legal Review and an Environmental and Social Screening Assessment; both providing crucial information to align the project development and design with international best practice on sustainable project development.

Application for all necessary permits to construct and operate the mine, including water use, construction, mineral processing, transportation, export, and labour will be undertaken within the ESIA review period (6 months), which is expected to be from September 2017 till February 2018.

Security of land tenure is a process that is estimated to take 6-9 months to complete. Compilation of a comprehensive legal register will also be required.

The Company cannot provide any assurance as to the timing of the receipt of the required permits and licenses.

Graphite Prices

Graphite prices are highly variable depending on the flake size, carbon content and level of processing.

Natural flake graphite prices rose steeply in 2010 and 2011 before declining steadily until mid-2016. This price peak was the result of graphite consumer fears that Chinese consolidation in the flake graphite sector, coupled with bullish forecasts for demand growth for use in lithium-ion batteries, would create an eventual shortage of supply and encouraged producers to hoard stocks and traders to speculate on prices. Instead, Chinese flake graphite consolidation continued but at a slower than expected pace and lithium-ion-based electric vehicle (“EV”) adoption rates were also been slower than first predicted.

This is expected to change over the next decade as the market for lithium-ion battery components increases graphite demand, resulting in price increases for battery grades.

Larger flake sizes and higher carbon grades have always achieved the highest price. The jumbo flake price premium is justified because of the use of the larger fractions in specialist applications. The actual market size for these larger fractions is relatively small but is forecast to grow over the next ten years.

The 3-year historic average price for global flake graphite across different flake sizes were as follows:

|

Global Flake Graphite Weighted Average Selling Price |

||||||||||||||||

|

2014 |

2015 |

2016 |

3-Year Average |

|||||||||||||

|

Jumbo Flake |

$ | 1,821 | $ | 1,530 | $ | 1,470 | $ | 1,607 | ||||||||

|

Large Flake |

$ | 1,317 | $ | 1,183 | $ | 861 | $ | 1,120 | ||||||||

|

Medium Flake |

$ | 1,042 | $ | 1,025 | $ | 770 | $ | 946 | ||||||||

|

Fine Flake |

$ | 965 | $ | 846 | $ | 668 | $ | 826 | ||||||||

|

Source: Flake graphite average prices provided by Roskill Consulting Group Ltd. |

||||||||||||||||

The rapid uptake of lithium-ion batteries between 2017 and 2030 is expected to encourage growth in the demand for fine and medium size flake graphite. The future price of flake graphite from 2017 until 2030 will be influenced by several factors until 2030, including:

|

● |

Amount of graphite supply from new projects and expansions of existing projects in China and ROW |

|

● |

Curtailment of flake graphite production in China as the government imposes environmental controls |

|

● |

Demand and supply balance by graphite flake size |

|

● |

Growth of the lithium-ion battery market |

|

● |

Competition from synthetic graphite |

|

● |

Recycling of refractory graphite products |

Cautionary note to U.S. investors regarding estimates of measured, indicated and inferred resources and proven and probable reserves

As used in this Annual Report on Form 10-K, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)-CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (“CIM Definition Standards”).

These definitions differ from the definitions in Guide 7 under the Securities Act. However, despite the differences in the definition between NI 43-101 and Guide 7:

|

● |

Erudite Strategies (Pty) Ltd. has stated that the Proven and Probable Reserves reported in the Molo Feasibility Study are equal to the proven and probable reserves which would have been reported had the reports been prepared pursuant to Guide 7 standards, and in such disclosures, the procedures and definitions employed in the estimation of proven and probable reserves is also consistent with Guide 7 definitions |

Proven and probable reserves are based on extensive drilling, sampling, mine modeling and metallurgical testing from which we determined economic feasibility. The term “proven reserves” means mineral reserves for which (i) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (ii) grade and/or quality are computed from the results of detailed sampling; and (iii) the sites for inspection, sampling and measurements are spaced so closely and the geologic character is sufficiently defined that size, shape, depth and mineral content of reserves are well established. The term “probable reserves” means mineral reserves for which quantity and grade are computed from information similar to that used for proven reserves, but the sites for sampling are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. The price sensitivity of reserves depends upon several factors including grade, metallurgical recovery, operating cost, waste-to-ore ratio and ore type. Metallurgical recovery rates vary depending on the metallurgical properties of each deposit and the production process used.

The proven and probable reserve figures presented herein are estimates based on information available at the time of calculation. No assurance can be given that the indicated levels of recovery of minerals will be realized. Minerals included in the proven and probable reserves are those contained prior to losses during metallurgical treatment. Reserve estimates may require revision based on actual production. Market fluctuations in the price of minerals, as well as increased production costs or reduced metallurgical recovery rates, could render certain proven and probable reserves containing lower grades of mineralization uneconomic to exploit and might result in a reduction of reserves

Mr. Craig Scherba, President and CEO of the Company, is designated as the “qualified person” who reviewed and approved the technical disclosure contained in this document.

Molo Graphite Project, Southern Madagascar, Africa

Madagascar has been a traditional producer of flake graphite for over a century but has never exceeded 12,000 tonnes of production annually. Currently, Madagascar’s annual production of flake graphite averages about 5,000 tonnes. The Molo Graphite Project deposit represents the first new and substantial graphite discovery in the country in over 50 years.

Project Timeline

The Molo Graphite Project is one of seven surficial graphite trends discovered and drill tested by NextSource in late 2011 and announced to the market in early January 2012. The Molo deposit itself occurs in a flat, sparsely populated and dry savannah grassland region that has easy access via a network of seasonal secondary roads.

The Molo Graphite Project graphitic zone consists of multi-folded graphitic strata with a surficially exposed strike length of over two kilometres. Outcrop mapping and trenching on the Molo Graphite Project has shown the surface geology to be dominated by resistant ridges of graphitic schist and graphitic gneiss, as well as abundant graphitic schist float. Geological modeling has shown that the Molo Graphite Project deposit consists of various zones of mineralized graphitic gneiss, with a barren footwall composed of garnetiferous gneiss. The host rock of the mineralized zones on the Molo Graphite Project is graphitic gneiss.

Resource delineation, drilling and trenching on the Molo Graphite Project took place between May and November of 2012, which resulted in a maiden mineral resource estimate to be released in early December of the same year. This maiden mineral resource estimate formed the basis for the Company’s Preliminary Economic Assessment (the “PEA”), which was undertaken by DRA Mineral Projects and released in 2013.

The positive outcome of the PEA led NextSource to undertake another phase of exploratory drilling and sampling in 2014 to upgrade the deposit and its contained mineral resources to mineral reserves. The process included an additional 32 diamond drill holes (totaling 2,063 metres) and 9 trenches (totaling 1,876 metres). The entire database upon which the upgraded resource estimate was based contained 80 drill holes (totaling 11,660 metres) and 35 trenches (totaling 8,492 metres). This new mineral resource formed the basis of the Molo Feasibility Study, which was originally released in February 2015.

In July 2016, we appointed HCF as advisor in negotiating and structuring strategic partnerships, off-take agreements and debt financing for its Molo Graphite Project.

In August 2016, we initiated the FEED Study and value engineering for our Molo Graphite Project in Madagascar. The FEED Study was undertaken in order to optimize the mine plan as envisioned in the Molo Feasibility Study and determine the optimal development path based on discussions with prospective strategic partners. All costing aspects were examined with the goal of providing a method to produce meaningful, multi-tonne test samples of Molo graphite concentrate to potential off-takers while reducing the CAPEX and time required to the commencement of commercial production.

On November 7, 2016, we outlined a phased mine development plan for the Molo Graphite Project based on the FEED Study and value engineering. The results supported the construction of a cost-effective demonstration plant to test and verify the flow sheet design from the Molo Feasibility Study. Under the Exploration Permit, the Company would initially be limited to an ore input of 20,000 cubic meters (or approximately 50,000 tonnes) of front-end feed into the demonstration plant. Upon approval of a full mining permit, the 20,000 cubic meter test limit would be removed and at full capacity, the demonstration plant would be capable of processing up to 240,000 tonnes of feed per annum, which equates to 30 tonnes per hour of ore feed and roughly 1 to 3 tonnes of flake graphite concentrate production per hour.

On June 1, 2017, we released the results of a positive updated Molo Feasibility Study for Phase 1 of the mine development plan utilizing a fully modular build-out approach and based on the FEED Study and subsequent detailed engineering studies. Phase 1 would consist of a fully operational and sustainable graphite mine with a permanent processing plant capable of producing approximately 17,000 tpa of high-quality SuperFlake™ graphite concentrate per year with a mine life of 30 years. The Phase 1 production costs were estimated at $433 per tonne at the plant and $688 per tonne delivered CIF port of Rotterdam. The Phase 1 capital costs were estimated at US$18.4 million with a construction timeline of approximately 9 months. Based on an average selling cost of $1,014 per tonne, the Phase 1 financials were estimated to have a pre-tax NPV of $34M using an 8% discount rate, a pre-tax internal rate of return (IRR) of 25.2%, and a post-tax IRR of 21.5%. The average selling price of $1,014 per tonne is the weighted average selling price for the different graphite sizes that we expect to sell. The average selling price is less than the comparable 3-year historic weighted average price.

Molo Feasibility Study

The following information is derived from the Molo Feasibility Study dated July 13, 2017 and prepared by J.K. de Bruin Pr.Eng of Erudite Strategies (Pty) Ltd., J. Hancox of Caracle Creek International Consulting (Pty) Ltd., D. Subrumani of Caracle Creek International Consulting (Pty) Ltd., D. Thompson of DRA Projects (Pty) Ltd., O. Peters of Metpro Management Inc., P. Harvey of Met63 (Pty) Ltd., H. Smit of Erudite Projects (Pty) Ltd., E.V. Heerden of EVH Consulting (Pty) Ltd., G. Pappagiorgio of Epoch Resources (Pty) Ltd. and A. Marais of GCS Consulting (Pty) Ltd., each of whom is a “qualified person” and “independent”, as such terms are defined in NI 43-101.

The information below does not purport to be a complete summary of the Molo Graphite Project and is subject to all the assumptions, qualifications and procedures set out in the Molo Feasibility Study and is qualified in its entirety with reference to the full text of the Molo Feasibility Study. It is advised that this summary should be read in conjunction with the Molo Feasibility Study (which is not incorporated by reference into this filing).

(See “Cautionary note to U.S. investors regarding estimates of measured, indicated and inferred resources and proven and probable reserves.”)

Overview

The Molo Feasibility Study was undertaken to reflect the Company’s decision to revise Phase 1 of its Molo Graphite Project mine plan from a demonstration plant to a fully operational and sustainable graphite mine with a permanent processing plant capable of producing, in our estimation, approximately 17,000 tpa of high-quality SuperFlake™ concentrate per year with a mine life of 30 years.

The Molo Feasibility Study for Phase 1 of the Molo Graphite Project was based on FEED Study and subsequent detailed engineering studies. The updated Molo Feasibility Study incorporates the procurement of all mining equipment, off-site modular fabrication and assembly, factory acceptance testing (“FAT”), module disassembly, shipping, plant infrastructure construction, onsite module re-assembly, commissioning, project contingencies and three months of capital. All capital and operating costs expressed below are considered to be accurate to +/- 10%.

The Molo Feasibility Study highlights are:

|

o |

Initial production of 17,000 tpa of SuperFlake™ graphite during Phase 1 |

|

o |

Phase 1 CAPEX estimated at $18.4 million using a modular assembly approach |

|

o |

Dry stack tailings can be utilized for Phase 1 production instead of cyclone deposition, which significantly reduces the CAPEX associated with a conventional tailings deposition facility |

|

o |

Total build and commissioning of the Molo Graphite Project mine is estimated at 9 months |

|

o |

Number of on-site personnel during construction is estimated at 50 people |

|

o |

Weighted averge selling price of $1,014 per tonne, which reflects current market conditions and is lower than the 3-year historic weighted average price for flake graphite |

|

o |

Total all-in OPEX of $433 per tonne at the plant and of $688 per tonne for CIF delivery to customer port Rotterdam |

|

o |

The financial results are based on 100% equity funding |

|

o |

Pre-tax NPV of $34 million and pre-tax IRR of 25.2% |

|

Updated Phase 1 Feasibility Study Results Highlights(1) |

Pre-Tax |

Post-Tax |

|

|

NPV at 8% Discount Rate |

$34.0 M |

$25.5 M |

|

|

Internal Rate of Return (IRR) |

25.2% |

21.6% |

|

|

Payback Period (years) |

4.2 |

4.8 |

|

|

Average annual graphite concentrate production |

17,000 tonnes |

||

|

Average production costs of graphite concentrate (at plant) |

$433 / tonne |

||

|

Average production costs of graphite concentrate (Delivered CIF Port of Rotterdam) |

$688 / tonne |

||

|

Weighted average selling price (in USD) |

$1,014 / tonne |

||

|

Direct CAPEX |

$14.5 M |

||

|

Indirect CAPEX |

$0.4 M |

||

|

Environmental and Permitting |

$0.7 M |

||

|

Owner’s Costs |

$1.1 M |

||

|

Contingency (10%) |

$1.7 M |

||

|

Sub Total CAPEX |

$18.4 M |

||

|

Working Capital (3 months) |

$3.1 M |

||

|

Total CAPEX |

$21.5 M |

||

|

Projected build period |

9 months |

||

|

(1) |

Unless otherwise noted, all monetary figures presented throughout this press release are expressed in US dollars (USD). The exchange rates used in the financial model are 12.85 South African Rand (ZAR) to US$1, moving in line with purchasing power parity |

|

(2) |

Direct CAPEX includes process equipment, civil & infrastructure, mining, buildings, electrical infrastructure, and project & construction services |

The weighted average selling price used in the Molo Feasibility Study is the volume weighted average sales price for the various flake sizes and grades of SuperFlake™ graphite concentrate that are expected to be produced from the Molo Graphite Project deposit. This price is based on current quotes and projected real (as opposed to nominal) estimates provided by UK-based Roskill Consulting Group Ltd (“Roskill”), who are recognized as a leader in providing independent and unbiased market research, pricing trends and demand and supply analysis for the natural flake graphite market.

|

Molo Feasibility Study Weighted Average Selling Price |

||||||||||||

|

Flake Sizes |

Graphite Sales Volume Weighting |

Forecast Average Price per Tonne |

Basket Price per Tonne |

|||||||||

|

Jumbo Flake |

15.7 | % | $ | 1,499 | $ | 235 | ||||||

|

Large Flake |

27.8 | % | $ | 1,094 | $ | 304 | ||||||

|

Medium Flake |

9.7 | % | $ | 920 | $ | 89 | ||||||

|

Fine Flake |

46.7 | % | $ | 824 | $ | 385 | ||||||

|

Feasibility Study Weighted Average Selling Price |

$ | 1,014 | ||||||||||

The weighted average selling price used in the Molo Feasibility Study is less than the 3-year historic weighted average selling price, which was $1,041 per tonne.

|

Global Graphite Average Selling Prices by Flake Size |

||||||||||||||||

|

Flake Sizes |

2014 |

2015 |

2016 |

3-Year Historic Average Price Per Tonne |

||||||||||||

|

Jumbo Flake |

$ | 1,821 | $ | 1,530 | $ | 1,470 | $ | 1,607 | ||||||||

|

Large Flake |

$ | 1,317 | $ | 1,183 | $ | 861 | $ | 1,120 | ||||||||

|

Medium Flake |

$ | 1,042 | $ | 1,025 | $ | 770 | $ | 946 | ||||||||

|

Fine Flake |

$ | 965 | $ | 846 | $ | 668 | $ | 826 | ||||||||

|

Source: Flake graphite average prices provided by Roskill Consulting Group Ltd. |

|

Weighted Average Selling Price Using 3-Year Historic Average Price |

|

Flake Sizes |

Graphite Sales Volume Weighting |

3-Year Historic Average Price per Tonne |

Basket Price per Tonne |

|||||||||

|

Jumbo Flake |

15.7 | % | $ | 1,607 | $ | 252 | ||||||

|

Large Flake |

27.8 | % | $ | 1,120 | $ | 311 | ||||||

|

Medium Flake |

9.7 | % | $ | 946 | $ | 91 | ||||||

|

Fine Flake |

46.7 | % | $ | 826 | $ | 386 | ||||||

|

3-Year Historic Weighted Average Selling Price |

$ | 1,041 | ||||||||||

No pricing premium for valued-added applications was applied on any sales. Furthermore, no financial or operational calculations and/or scenarios in the updated Molo Feasibility Study financial model with regards to downstream value-added processing of SuperFlake™ graphite concentrate were included. This includes purification, spherodization coating for battery-grade graphite and thermal expansion for specialty graphite applications, such as foils.

Project Description, Location and Access

Property and Site Description

The Molo Graphite Project deposit is situated 160 km southeast of the city of Toliara, in the Tulear region of south-western Madagascar, and about 220 km NW of Fort Dauphin. The deposit occurs in a sparsely populated, dry savannah grassland region, which has easy access via a network of seasonal secondary roads radiating outward from the village of Fotadrevo. Fotadrevo in turn has an all-weather airstrip and access to a road system that leads to the regional capital (and port city) of Toliara and the Port of Ehoala at Fort Dauphin via the RN10, or RN13.

The Project is centred on UTM coordinates 413,390 Easting 7,345,713 Northing (UTM 38S, WGS 84 datum). The Molo Graphite Project covers an area of 62.5 hectares (“ha”). The Government of Madagascar designates individual claims by a central LaBorde UTM location point, comprising a square with an area of 6.25 km2.

Geologically, the Molo Graphite Project is situated in the Bekikiy block (Tolagnaro-Ampanihy high grade metamorphic province) of southern Madagascar. The deposit is underlain predominantly by moderately to highly metamorphosed and sheared graphitic (biotite, chlorite and garnet- rich) quartzo-feldspathic schists and gneisses, which are variably mineralised. Near surface rocks are oxidised, and saprolitic to a depth, usually of less than 5m.

The Molo Graphite Project is one of several surficial graphite trends discovered by the Company in late 2011 and announced in early January 2012. The deposit was originally drill tested in 2012, with an initial seven holes being completed. Resource delineation, drilling and trenching on the Molo Graphite Project took place between May and November of 2012, and allowed for a maiden mineral resource estimates to be stated in early December of the same year. This maiden mineral resource estimate formed the basis for the PEA, which was undertaken by DRA Mineral Projects in 2013. The positive outcome of the PEA led the Company to undertake another phase of exploratory drilling and sampling in 2014, which was done under the supervision of Caracle Creek International Consulting (Proprietary) Limited (“Caracle Creek”). This phase of exploration was aimed at improving the geological confidence of the deposit and the contained mineral resources, and included an additional 32 diamond drill holes (totalling 2,063 metres) and 9 trenches (totalling 1,876 metres). Caracle Creek were subsequently engaged to update the geological model and mineral resource estimate. The entire database on which this new model and mineral resource estimate is based contains 80 drill holes (totalling 11,660 metres) and 35 trenches (totalling 8,492 metres). This new mineral resource forms the basis for the original feasibility study completed on the Molo Graphite Project in 2015 which targeted 860ktpa of ore processing capacity.

The Molo Feasibility Study utilises the knowledge base of the original feasibility study completed on the Molo Graphite Project in 2015 on a smaller scale low capital cost 240ktpa process capacity option.

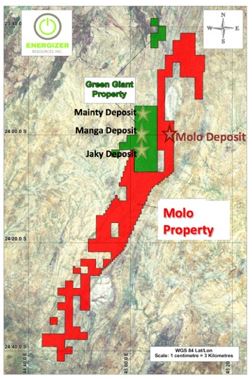

Figure 1: Project Location

Figure 2.1: Exploration Area

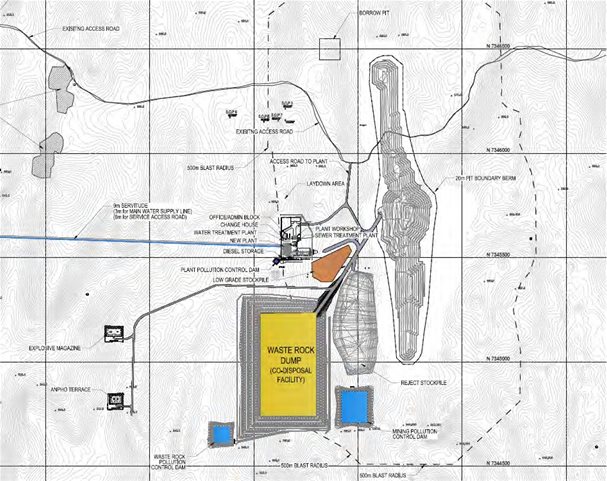

The proposed development of the Molo graphite project includes the construction of a green fields open pit mine, a processing plant with a capacity of 240,000 tonnes of ore per annum and all supporting infrastructure including water, fuel, power, tailings, buildings and permanent accommodation.

Figure 2.2: Site Layout

Ownership

On December 14, 2011, we entered into a Definitive Joint Venture Agreement ("JVA") with Malagasy Minerals Limited ("Malagasy"), a public company on the Australian Stock Exchange, to acquire a 75% interest to explore and develop a group of industrial minerals, including graphite, vanadium and approximately 25 other minerals at the Molo Graphite Project. The land position covers 2,119 permits and 827.7 square kilometres and is mostly adjacent to the south and east of the Company's 100% owned Green Giant Property. We paid $2,261,690 and issued 7,500,000 common shares valued at $1,350,000 to Malagasy.

On April 16, 2014, we signed a Sale and Purchase Agreement and a Mineral Rights Agreement with Malagasy to acquire the remaining 25% interest in the Molo Graphite Project. We made the following payments at that time: $364,480 (CAD$400,000); issued 2,500,000 common shares subject to a 12 month voluntary vesting period and valued at $325,000; and issued 3,500,000 common share purchase warrants, valued at $320,950 using the Black Scholes pricing model with an exercise price of $0.14 and an expiry date of April 15, 2019.

On May 20, 2015 we paid $546,000 (CAD$700,000), and issued 1,000,000 common shares due to the completion of a bankable feasibility study (“BFS”) for the Molo Graphite Project. Further, a cash payment of $801,584 (CAD$1,000,000) will be due within five days of the commencement of commercial production. Malagasy retains a 1.5% net smelter return royalty ("NSR") on the Molo Graphite Project. We also acquired a 100% interest to the industrial mineral rights on approximately 1 1/2 additional claim blocks comprising 10,811 hectares to the east and adjoining the Molo Graphite Project.

Royalties

Malagasy retains a 1.5% net smelter return royalty on the Molo Graphite Project.

Government Regulations and Permitting

The Molo Graphite Project is located within Exploration Permit #3432 (the “Exploration Permit” or “PR 3432”) as issued by the Bureau de Cadastre Minier de Madagascar (“BCMM”) pursuant to the Mining Code 1999 (as amended) and its implementing decrees.

Carracle Creek International Consulting (Pty) Ltd., which was a consultant for the Molo Feasibility Study, has had sight of and reviewed a copy of the “Contrat d’amodiation” pertaining to this right and are satisfied that the rights to explore this Exploration Permit have been ceded to the Company or one of its Madagascar subsidiaries.

The Company holds the exclusive right to explore for a defined group of industrial minerals within the Exploration Permit listed above. These industrial minerals include the following: Vanadium, Lithium, Aggregates, Alunite, Barite, Bentonite, Vermiculite, Carbonatites, Corundum, Dimensional stone (excluding labradorite), Feldspar (excluding labradorite), Fluorspar, Granite, Graphite, Gypsum, Kaolin, Kyanite, Limestone / Dolomite, Marble, Mica, Olivine, Perlite, Phosphate, Potash–Potassium minerals, Pumice Quartz, Staurolite, and Zeolites.

Reporting requirements of exploration activities carried out by the titleholder on an Exploration Permit are minimal. A titleholder must maintain a diary of events and record the names and dates present of persons active on the project. In addition, a site plan with a scale between 1/100 and 1/10,000 showing “a map of the work completed” must be presented. Upon establishment of a mineral resource, Exploration Permits may be converted into Exploitation Permits by application. Carracle Creek is of the opinion that the Company is compliant in terms of its commitments under these reporting requirements.

The Molo Graphite Project has not been legally surveyed; however, since all claim boundaries conform to the predetermined rectilinear LaBorde Projection grid, these can be readily located on the ground by use of Global Positioning System (“GPS”) instruments. Most current GPS units and software packages do not however offer LaBorde among their available options, and therefore defined shifts have to be employed to display LaBorde data in the WGS 84 system. For convenience, all Company positional data is collected in WGS 84, and if necessary converted back to LaBorde Royalties.

The receipt of the exploitation permit is a critical step in the larger permitting and licensing regime. The permitting and licensing of the Molo Graphite Project requires dedicated attention to ensure momentum is maintained during the application for and delivery of all necessary permits and licenses.

The Molo Graphite Project exploration permit PR 3432 is currently held under the name of one of our Madagascar subsidiary ERG Madagascar SARLU. Our Madagascar subsidiaries have paid all taxes and administrative fees to the Madagascar government and its mining ministry with respect to all the mining permits held in country. These taxes and administrative fee payments have been acknowledged and accepted by the Madagascar government. In addition, we continue to diligently work with the Madagascar government to obtain the necessary permits as the country clears its backlog of applications and amendments.

We have applied to the BCMM to have the Molo Graphite Project exploration permit converted into an exploitation permit, which is expected to be completed in due course. The exploitation permit is required to advance the Molo Project into the developmental stage.

A comprehensive Environmental and Social Impact Assessment ("ESIA"), developed to local Malagasy, Equator Principles, World Bank and International Finance Corporation (IFC) standards, is nearing completion. This process was preceded by an Environmental Legal Review and an Environmental and Social Screening Assessment; both providing crucial information to align the project development and design with international best practice on sustainable project development.

Application for all necessary permits to construct and operate the mine, including water use, construction, mineral processing, transportation, export, and labour will be undertaken within the ESIA review period (6 months), which is expected to be from September 2017 till February 2018.

Security of land tenure is a process that is estimated to take 6-9 months to complete. Compilation of a comprehensive legal register will also be required.

The Company cannot provide any assurance as to the timing of the receipt of the required permits and licenses.

Geological Setting, Mineralization and Deposit Types

Regional Geology

Madagascar comprises a fragment of the African Plate, which rifted from the vicinity of Tanzania at the time of the breakup of Gondwana, some 180 million years ago. At that time Madagascar remained joined with India, moving east-by-south until the late Cretaceous (approximately 70 million years ago), whereupon the two land masses split apart. On a regional scale Madagascar can be described as being formed by two geological entities, a Precambrian crystalline basement, and a much younger Phanerozoic sedimentary cover Figure 12 that hosts potentially economic coal deposits. The central and eastern two thirds of the island are mainly composed of Neoproterozoic-aged, crystalline basement rocks, composed of a complex mélange of metamorphic schist and gneiss intruded by younger granitic and basic igneous Carboniferous to Permian-Triassic. These rocks correlate with the Karoo Super group successions of sub-Saharan Africa, which was widespread in the former supercontinent of Gondwana.

The geology of the basement of Madagascar is composed of intercontinental tectonic blocks made up of ancient poly-deformed, high-grade metamorphic rocks and later igneous intrusions. The tectonic and metallogenic basement framework was originally subdivided into four blocks (Besarie, 1967), these beingthe: northern Bemarivo Block; northeastern Antongil Block; central Antananarivo Block; and the southern Bekily Block. The Molo Graphite Project lies entirely within the bounds of the Bekily Block.

Molo Graphite Project Geology

The Molo Graphite Project graphitic zone consists of multi-folded graphitic strata with a surficially exposed strike length of over two kilometres. Outcrop mapping and trenching on Molo Graphite Project has shown the surface geology to be dominated by resistant ridges of graphitic schist and graphitic gneiss, with fracture-lined vanadium mineralisation, as well as abundant graphitic schist float. Geological modelling has shown that the deposit consists of various zones of mineralised graphitic gneiss, with a barren footwall composed of garnetiferous gneiss. The host rock of the mineralised zones is graphitic gneiss.

No academic studies have been undertaken on the graphitic schists and gneisses of the Molo Graphite Project deposit and at present the deposit is still not fully understood. There is, however, no indication of secondary hydrothermal, or other transported, post-metamorphic graphitic mineralisation or upgrading and the present distribution and crystallinity of the graphite zones seem to be primarily due to regional metamorphic and structural events.

Deposit Types

The Molo Graphite Project primarily hosts at least two different deposit types: (i) metamorphosed black shale/roll front redox vanadium deposits, and deposit types; and (ii) flake graphite deposits.

Exploration History

The region around the Molo Graphite Project has primarily been explored for base metal type occurrences, although colonial geologic services were alert to all kinds of mineral potential in the region. In 1985 the Bureau de Recherches Géologiques et Minières (“BRGM”) produced a three-volume country scale compilation of all exploration and mineral inventory data in their files. Relatively little exploration and development work has been completed in south-western Madagascar after that of BRGM, and therefore these volumes are key to retracing any historical data. Archival research by the Company has not revealed evidence of mineral exploration in the past fifty years within the Molo Graphite Project area.

Prior to the exploration work completed by the Company in 2007, there is no record of any previous exploration activity within the Molo Graphite Project area and no historical resource estimates exist for the area. Between 2007 and 2011 the Company retained Taiga Consultants Limited (“Taiga”) to manage exploration activities on the Molo Graphite Project.

The identification of graphite as a potential credit to the the Company’s NI 43-101 compliant vanadium resources led to a reconnaissance exploration programme being undertaken on the Molo Graphite Project in September 2011, with the goal of delineating new graphitic trends. Activities during this phase of exploration included prospecting, grab and trench sampling, and diamond drilling.

Based on the results of this programme, the Company launched a second phase of exploration in November 2011. The objective of this second programme was to use geophysical techniques to delineate additional graphite mineralisation, as well as to drill test the known graphitic. The signing of the JVA with Malagasy in November, 2011 prompted additional exploration to ascertain the industrial mineral potential of the Molo Graphite Project area. Exploration activities consisted of, geologic mapping, prospecting and sampling, (including metallurgical), ground geophysical surveying (EM-31), trenching, and diamond drilling. As a consequence of the work undertaken during 2011, the Molo Graphite Project was identified and targeted for additional work, which was undertaken between May 2012 and June 2014.

As at the effective date of the Molo Feasibility Study, no further exploration work is currently planned.

Drilling

The Molo Graphite Project is one of seven surficial graphite trends discovered and drill tested by the Company in late 2011 and announced to the market in early January 2012.

Resource delineation, drilling and trenching on the Molo Graphite Project took place between May and November of 2012, and allowed for a maiden mineral resource estimates to be stated in early December of the same year. This maiden mineral resource estimate formed the basis for the Company’s Preliminary Economic Assessment (the “PEA”), which was undertaken by DRA Mineral Projects and released to the market in 2013.

The positive outcome of the PEA led NextSource to undertake another phase of exploratory drilling and sampling in 2014 to upgrade the deposit and its contained mineral resources to mineral reserves. The process included an additional 32 diamond drill holes (totaling 2,063 metres) and 9 trenches (totaling 1,876 metres). The entire database upon which the upgraded resource estimate was based contained 80 drill holes (totaling 11,660 metres) and 35 trenches (totaling 8,492 metres). This new mineral resource formed the basis of the Molo Feasibility Study, which was originally released in February 2015.

Sampling, Analysis and Data Verification

At all times during sample collection, storage, and shipment to the laboratory facility, the samples are in the control of the Company, or our agents. When sufficient sample material (grab, trench, or core) has been collected, the samples are trucked, or flown to the Company’s storage location in Antananarivo, at all times accompanied by an employee of the Company.

From there, samples are further shipped to either South Africa (Mintek, or Genalysis), or Canada (Activation Labs) for ICP-MS analysis. Drill core samples collected during 2011 were directed to two major laboratories. All samples collected during Phase I of 2011 were sent to Mintek, South Africa. Samples were then tested for Carbon content (Total Organic Carbon and Overall Carbon content), as well as the full range of elements available through ICP-OES (Mintek code FA5) and XRF analysis.

The remainder of samples collected during Phase II of the 2011 exploration programme were submitted for analysis to Activation Labs, Canada. Samples were again submitted for analysis of Carbon content, as well as for a large range of elemental analysis. During 2012 all samples were submitted to Intertek Genalysis. All work undertaken by Intertek is performed in accordance with the Intertek Minerals Standard Terms and Conditions of which can be downloaded from their web page. All analytical results were e-mailed directly by both Genalysis and Mintek to the Project Manager, as well as the Company’s executive staff, and were posted on a secure website and downloaded by Company personnel using a secure username and password. Following the site inspection in May 2012, all analytical results were also e-mailed directly to Dr. Hancox (Carracle Creek) and these were compared against the final data set as presented by the Company.

All of the laboratories that carried out the sampling and analytical work are independent of the Company.

Quality Control Measures

In order to carry out QA/QC protocols on the assays, blanks, standards and duplicates were inserted into the sample streams. This was done once in every 30 samples, representing an insertion rate of 3.33% of the total.

Data Verification

Prior to Carracle Creek’s involvement with the Company and the Molo Graphite Project, all information published regarding the 2011 exploration programme was reviewed by an independent Qualified Person as it became available.

The database received by Carracle Creek from the Company contained 80 drill holes totalling 11,660 m and data from 35 trenches totalling 8,492m. With regards to the database, Carracle Creek performed various tests to verify the integrity of the collar co-ordinates, logging and sampling procedures, and assay results. Leapfrog™ Geo software was used for most of the checks.

Metallurgical Test Work

The Molo Feasibility Study is based on a full suite of metallurgical test work performed by SGS Canada Metallurgical Services Inc. in Lakefield, Ontario, Canada. These tests included laboratory scale metallurgical work and a 200 tonne bulk sample / pilot plant program. The laboratory scale work included comminution tests, process development and optimization tests, variability flotation, and concentrate upgrading tests.

Comminution test results place the Molo Graphite Project ore into the very soft to soft category with low abrasivity. A simple reagent regime consists of fuel oil number 2 and methyl isobutyl carbinol at dosages of approximately 120 g/t and 195 g/t, respectively. A total of approximately 150 open circuit and locked cycle flotation tests were completed on almost 70 composites as part of the process development, optimization, and variability flotation program. The metallurgical programs culminated in a process flowsheet that is capable of treating the ore using proven mineral processing techniques and its robustness has been successfully demonstrated in the laboratory and pilot plant campaigns.

The metallurgical programs indicated that variability exists with regards to the metallurgical response of the ore across the deposit, which resulted in a range of concentrate grades between 88.8% total carbon and 97.8% total carbon. Optical mineralogy on representative concentrate samples identified interlayered graphite and non-sulphide gangue minerals as the primary source of impurities. The process risk that was created by the ore variability was mitigated with the design of an upgrading circuit, which improved the grade of a concentrate representing the average mill product of the first five years of operation from 92.1% total carbon to 97.1% total carbon.

The overall graphitic carbon recovery into the final concentrate is 87.8% based on the metallurgical response of composites using samples from all drill holes within the five year pit design of the original feasibility study at the higher concentrate production rate of 53,000 tpa. The average composition of the combined concentrate grade is presented in the table below entitled “Metallurgical Data - Flake Size Distribution and Product Grade”. The size fraction analysis results were converted into a grouping reflecting a typical pricing matrix, which is shown in table below entitled “Pricing Matrix - Flake Size Distribution Grouping and Product Grade”.

All assays were completed using control quality analysis and cross checks were completed during the mass balancing process to verify that the results were within the estimated measurement uncertainly of up to 1.7% relative for graphite concentrate grades greater than 90% total carbon.

Metallurgical Data - Flake Size Distribution and Product Grade

|

Product Size |

% Distribution |

Product Grade (%) Carbon |

||||||

|

+48 mesh (jumbo flake) |

23.6 | 96.9 | ||||||

|

+65 mesh (coarse flake) |

14.6 | 97.1 | ||||||

|

+80 mesh (large flake) |

8.2 | 97.0 | ||||||

|

+100 mesh (medium flake) |

6.9 | 97.3 | ||||||

|

+150 mesh (medium flake) |

15.5 | 98.1 | ||||||

|

+200 mesh (small flake) |

10.1 | 98.1 | ||||||

|

-200 mesh (fine flake) |

21.1 | 97.5 | ||||||

Pricing Matrix - Flake Size Distribution Grouping and Product Grade

|

Product Size |

% Distribution |

Product Grade (%) Carbon |

||||||

|

>50 mesh |

23.6 | 96.9 | ||||||

|

-50 to +80 mesh |

22.7 | 97.1 | ||||||

|

-80 to +100 mesh |

6.9 | 97.2 | ||||||

|

-100 mesh |

46.8 | 97.6 | ||||||

Vendor testing including solid-liquid separation of tailings and concentrate, screening and dewatering of concentrate, and drying of concentrate was completed successfully.

Mineral Reserve Estimate

As at the date of the Molo Feasibility Study, the following proven and probable mineral reserves are declared:

Mineral Reserves

|

Category |

Tonnes |

C Grade (%) |

||||||

|

Proven |

5,881,243 | 8.04 | ||||||

|

Probable |

1,278,757 | 8.07 | ||||||

|

Proven and Probable |

7,160,000 | 8.05 | ||||||

Proven reserves are reported as the measured resources inside the designed open pit and above the grade cut off of 5.5% C. Similarly, the probable reserves are reported as the indicated resources inside the designed open pit and above the grade cut-off of 5.5% C.

Mining Methods

The surficial, lateral expanse and the massive nature of the Molo Graphite Project deposit make it suitable for open-pit mining methods. It is a typical pipe-shaped and steeply dipping ore body, with extended mineral outcrop along the strike (north-south direction) of the deposit. In this mining method, the following activities are executed:

|

● |

The land is cleared, topsoil is removed and stockpiled at designated sites for use in the future land rehabilitation. Depending on the extent of the abse of weathering, any further waste or ore that can be removed by free-digging is removed and stockpiled accordingly. The topsoil is planned to be used as a berm around the pit to prevent water flow into the pit and minimize transportation costs |

|

● |

In a number of cyclic processes the waste and/or ,mineralized material is drilled, charged with explosives and blasted, excavated, hauled and dumped in designated sites |

|

● |

At strategically planned periods the waste around the boundary of the pit is removed in order to mine out deeper ore |

The conventional open-pit mining activities are carried out with small to medium sized mining equipment including 30t dump trucks, an excavator and a front end loader.

Detailed geotechnical and hydro-geological studies have been conducted and the reports indicated that there are no fatal flaws regarding the adoption of the open-pit mining as the preferred mining method.

Processing and Recovery Methods

The process design is based on an annual feed plant throughput capacity of 240 kilotonnes at a nominal head grade of 7.04% C(t) producing an estimated average of 15-17 kilotonnes per annum (“ktpa”) of final concentrate.

The ore processing circuit consists of three stages of crushing which comprises jaw crushing in the primary circuit, followed by secondary cone crushing and tertiary cone crushing; the secondary and tertiary crushers operate in closed circuit with a double deck classification screen. Crushing is followed by primary milling and screening, graphite recovery by froth flotation and concentrate upgrading circuit, and graphite product and tailings effluent handling unit operations. The crusher circuit is designed to operate 365 days per annum for 24 hours per day at ±55% utilization. The crushed product (P80 of approximately 13 mm) passes through a surge bin from where it is fed to the milling circuit.

The milling and flotation circuits are designed to operate 365 days per annum for 24 hours per day at 92% utilization. A single stage primary ball milling circuit is employed, incorporating a closed circuit classifying screen and a scalping screen ahead of the mill. The scalping screen undersize feeds into a flash flotation cell before combining with the mill discharge material. Scalping and classification screen oversize are the fed to the primary mill.

Primary milling is followed by rougher flotation which, along with flash flotation, recovers graphite to concentrate from the main stream. Rougher flotation employs six forced-draught trough cells. The primary, fine-flake and attritioning cleaning circuits upgrade the concentrate to the final product grade of above 94% C(t). Concentrate from the main stream feeds into the primary cleaning circuit consisting essentially of a dewatering screen, a polishing ball mill, a column flotation cell and flotation cleaner/cleaner scavenger trough cells.

The primary cleaner column cell concentrate gravitates to a 212 µm classifying screen, from where the large-flake oversize stream is pumped to a high rate thickener located in the concentrate attritioning circuit whilst the undersize is pumped to the fine-flake cleaning circuit.

The fine flake cleaning circuit consists primarily of a dewatering screen, a polishing ball mill, a column flotation cell and flotation cleaner/cleaner scavenger trough cells. The attritioning cleaning circuit employs a high rate thickener, an attritioning stirred media mill, a column flotation cell and flotation cleaner/cleaner scavenger trough cells. Fine flake column concentrate is combined with the +212 µm primary cleaner classifying screen oversize as it feeds the attritioning circuit thickener. Concentrate from the attrition circuit is pumped to the final concentrate thickener.

The combined fine flake cleaner concentrate and the +212 µm may also be processed through the secondary attrition circuit which consists of a dewatering screen, an attrition scrubber, column flotation cell and cleaner/cleaner scavenger trough cells. Concentrate from this circuit is pumped to the final concentrate. The secondary attrition circuit is optimal.

Combined rougher and cleaner flotation final tailings are pumped to the final tailings thickener. Thickened final concentrate is pumped to a filter press for further dewatering before the filter cake is stockpiled prior to load and haul.

The concentrate thickener underflow is pumped to a linear belt filter for further dewatering and fed to a diesel-fired rotary kiln for drying. The dried concentrate is then screened into four size fractions:

|

• |

+48 mesh |

|