Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ashford Inc. | aincinvestorpresentation8-.htm |

ASHFORD INC.

(NYSE American: AINC)

W Atlanta Downtown – Atlanta, GA

AINC COMPANY PRESENTATION – SEPTEMBER 2017

Safe Harbor

Page 2 Ashford Company Presentation – September 2017

In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be

considered forward-looking and subject to certain risks and uncertainties that could cause results to differ

materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate,"

"should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements.

Such forward-looking statements include, but are not limited to, our business and investment strategy, our

understanding of our competition, current market trends and opportunities, projected operating results, and

projected capital expenditures.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause

actual results to differ materially from those anticipated including, without limitation: general volatility of the

capital markets and the market price of our common stock; changes in our business or investment strategy;

availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the

market in which we operate, interest rates or the general economy, and the degree and nature of our competition.

These and other risk factors are more fully discussed in each company's filings with the Securities and Exchange

Commission.

EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as

trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the

property's net operating income by the purchase price. Net operating income is the property's funds from

operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is

the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms

are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with

the SEC.

This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or

sell, any securities of Ashford Hospitality Trust, Inc., Ashford Hospitality Prime, Inc., Ashford Inc., or any of their

respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security.

Company Overview

Focus on Hotels

The only publicly-traded asset manager focused solely on hospitality

40+ years as a hotel owner, operator, and investor

$6.3 billion hotel AUM managed via two public lodging REITs

$66.4 million of advisory fees in the trailing 12-month period

Ritz-Carlton – St. Thomas, V.I.

Proven Performance

Best-in-class hotel operational track record

Long history of accessing capital to fuel accretive growth

Outperformed peers in total shareholder returns

Strong alignment of interest with high insider ownership

Sofitel – Chicago, IL

Expand existing platforms accretively & accelerate performance for incentive fees

Start new investment platforms for additional base and incentive fees

Invest in or incubate strategic businesses that can achieve accelerated growth

through Ashford, especially by leveraging our deep knowledge and extensive

relationships within the hospitality sector

Multiple Paths to Growth

Bardessono – Napa Valley, CA

Hospitality asset

management

Core platform with high

growth potential

Growth-focused

business model

Long-term value

creation

Page 3 Ashford Company Presentation – September 2017 Data as of 6/30/2017

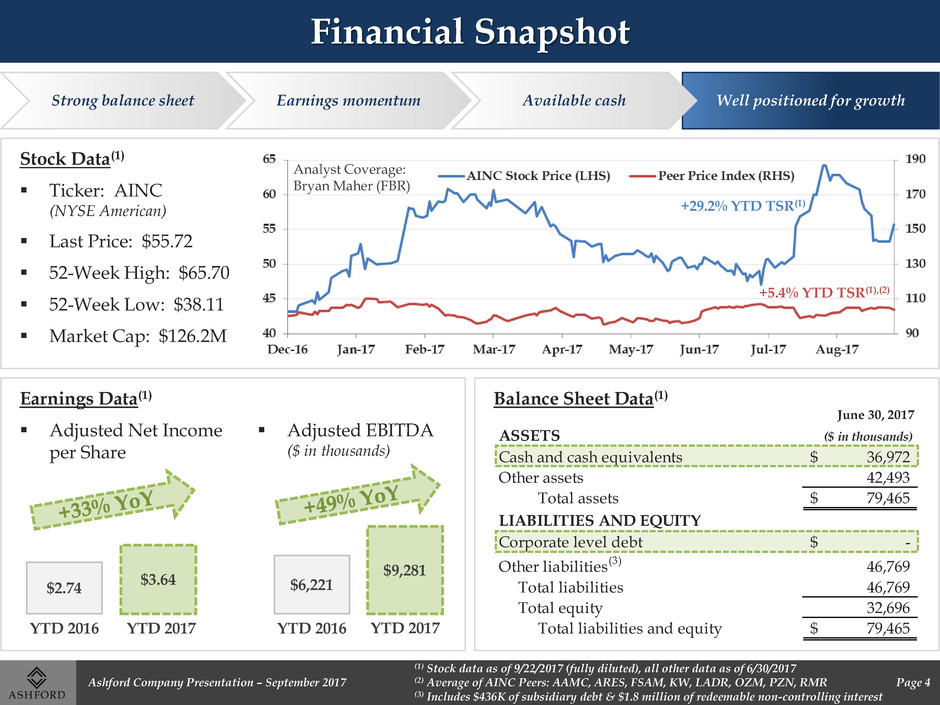

Financial Snapshot

Page 4 Ashford Company Presentation – September 2017

(1) Stock data as of 9/22/2017 (fully diluted), all other data as of 6/30/2017

(2) Average of AINC Peers: AAMC, ARES, FSAM, KW, LADR, OZM, PZN, RMR

(3) Includes $436K of subsidiary debt & $1.8 million of redeemable non-controlling interest

June 30, 2017

ASSETS ($ in thousands)

Cash and cash equivalents 36,972$

Other assets 42,493

Total assets 79,465$

LIABILITIES AND EQUITY

Corporate level debt -$

Other liabilities

(3)

46,769

Total liabilities 46,769

Total equity 32,696

Total liabilities and equity 79,465$

Balance Sheet Data(1)

Stock Data(1)

Ticker: AINC

(NYSE American)

Last Price: $55.72

52-Week High: $65.70

52-Week Low: $38.11

Market Cap: $126.2M

YTD 2016 YTD 2017

$9,281

YTD 2016

$2.74

YTD 2017

$3.64 $6,221

Analyst Coverage:

Bryan Maher (FBR)

Earnings Data(1)

Adjusted Net Income

per Share

Adjusted EBITDA

($ in thousands)

+29.2% YTD TSR(1)

+5.4% YTD TSR(1),(2)

Strong balance sheet Well positioned for growth Earnings momentum Available cash

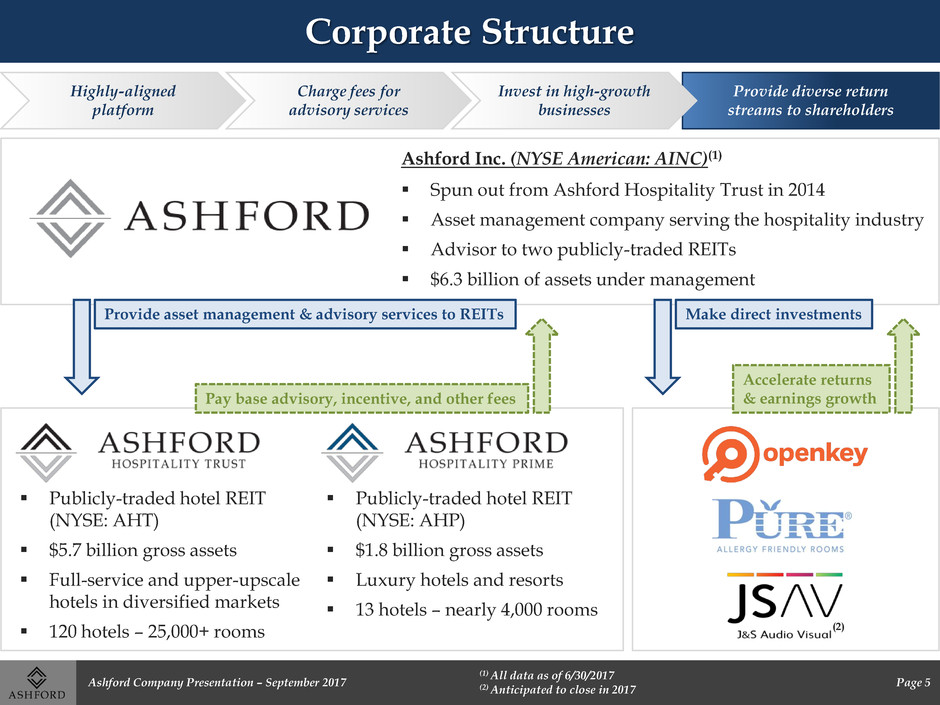

Corporate Structure

Highly-aligned

platform

Provide diverse return

streams to shareholders

Charge fees for

advisory services

Invest in high-growth

businesses

Spun out from Ashford Hospitality Trust in 2014

Asset management company serving the hospitality industry

Advisor to two publicly-traded REITs

$6.3 billion of assets under management

Ashford Inc. (NYSE American: AINC)(1)

Publicly-traded hotel REIT

(NYSE: AHP)

$1.8 billion gross assets

Luxury hotels and resorts

13 hotels – nearly 4,000 rooms

Publicly-traded hotel REIT

(NYSE: AHT)

$5.7 billion gross assets

Full-service and upper-upscale

hotels in diversified markets

120 hotels – 25,000+ rooms

Provide asset management & advisory services to REITs

Pay base advisory, incentive, and other fees

Make direct investments

Accelerate returns

& earnings growth

Page 5 Ashford Company Presentation – September 2017

(1) All data as of 6/30/2017

(2) Anticipated to close in 2017

(2)

Expansive Footprint

Large, public company

presence

Institutional quality

investment platform

Robust operational

infrastructure

Broad geographic

asset diversity

Page 6 Ashford Company Presentation – September 2017 Data as of 6/30/2017

Diverse Markets & Segments

Headquarters in Dallas, TX with over 100 corporate employees

One of the largest North American hotel portfolios with close to 30,000 rooms

and 130+ hotels

Geographic diversity in 32 states, Washington D.C., and U.S. Virgin Islands

Park Hyatt – Beaver Creek, CO

Marriott – Beverly Hills, CA

The Churchill – Washington D.C.

Ashford Properties

Strategic Rationale

Expand asset base Maximize platform value

Extend additional

services to REITs

Create growth with

“accelerator” investments

Strategic Fee-Based Businesses & Services

Investment Management – Cash management,

hedging & trading/execution services

Other Services – Debt brokerage, insurance claim

processing & other fee-based services

2. Value-add services beyond asset management

Asset Management Services (Core Platform)

Potential for Future Investment Platforms

AHP – $1.8 billion gross assets(2)

AINC Key Money – Helps REITs accretively

fuel asset growth

AHT – $5.7 billion gross assets(2)

1. Base and incentive fees from REIT platforms

OpenKey – Keyless entry mobile app

Pure Rooms – Hypoallergenic hotel rooms

J&S Audio Visual(1) – A/V, show & event services

3. “Accelerator” investments

MULTIPLE GROWING FEE STREAMS

ACCRETIVE ASSET GROWTH DRIVES FEES

70 bps base advisory fee on total market cap

High operating leverage + attractive margins

Page 7 Ashford Company Presentation – September 2017

(1) Anticipated to close in 2017

(2) Data as of 6/30/2017

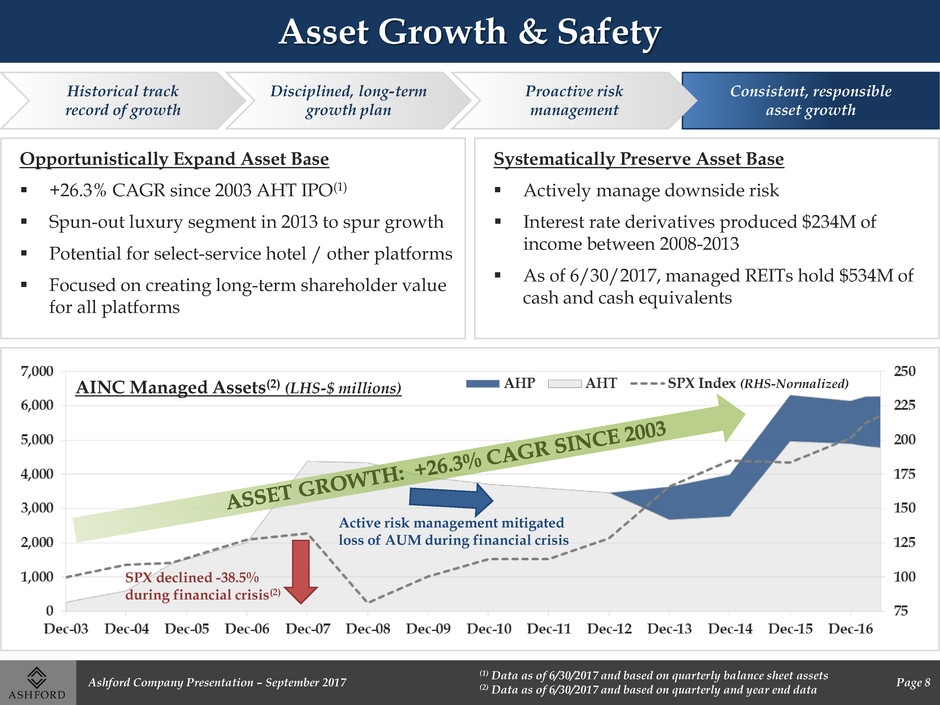

Asset Growth & Safety

Historical track

record of growth

Consistent, responsible

asset growth

Disciplined, long-term

growth plan

Proactive risk

management

Opportunistically Expand Asset Base

+26.3% CAGR since 2003 AHT IPO(1)

Spun-out luxury segment in 2013 to spur growth

Potential for select-service hotel / other platforms

Focused on creating long-term shareholder value

for all platforms

Active risk management mitigated

loss of AUM during financial crisis

Systematically Preserve Asset Base

Actively manage downside risk

Interest rate derivatives produced $234M of

income between 2008-2013

As of 6/30/2017, managed REITs hold $534M of

cash and cash equivalents

AINC Managed Assets(2) (LHS-$ millions)

SPX declined -38.5%

during financial crisis(2)

(RHS-Normalized)

Page 8 Ashford Company Presentation – September 2017

(1) Data as of 6/30/2017 and based on quarterly balance sheet assets

(2) Data as of 6/30/2017 and based on quarterly and year end data

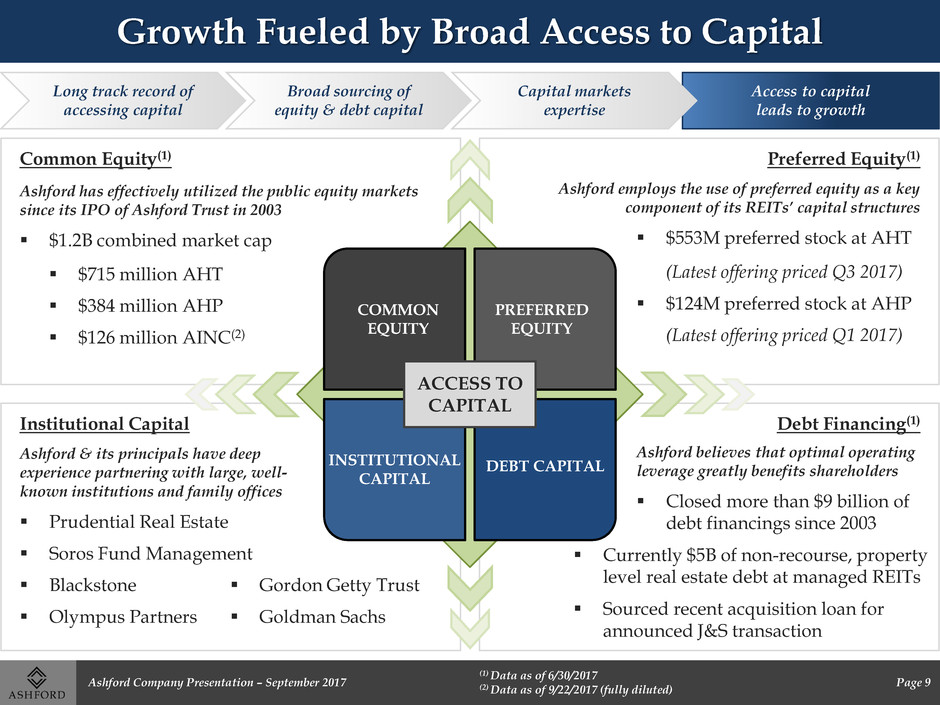

Growth Fueled by Broad Access to Capital

Long track record of

accessing capital

Access to capital

leads to growth

Broad sourcing of

equity & debt capital

Capital markets

expertise

$553M preferred stock at AHT

Preferred Equity(1)

Ashford employs the use of preferred equity as a key

component of its REITs’ capital structures

(Latest offering priced Q3 2017)

$124M preferred stock at AHP

(Latest offering priced Q1 2017)

COMMON

EQUITY

PREFERRED

EQUITY

DEBT CAPITAL INSTITUTIONAL

CAPITAL

ACCESS TO

CAPITAL

$715 million AHT

$1.2B combined market cap

$126 million AINC(2)

Common Equity(1)

Ashford has effectively utilized the public equity markets

since its IPO of Ashford Trust in 2003

$384 million AHP

Currently $5B of non-recourse, property

level real estate debt at managed REITs

Sourced recent acquisition loan for

announced J&S transaction

Ashford believes that optimal operating

leverage greatly benefits shareholders

Debt Financing(1)

Closed more than $9 billion of

debt financings since 2003

Institutional Capital

Ashford & its principals have deep

experience partnering with large, well-

known institutions and family offices

Prudential Real Estate

Gordon Getty Trust

Soros Fund Management

Blackstone

Olympus Partners Goldman Sachs

Page 9 Ashford Company Presentation – September 2017

(1) Data as of 6/30/2017

(2) Data as of 9/22/2017 (fully diluted)

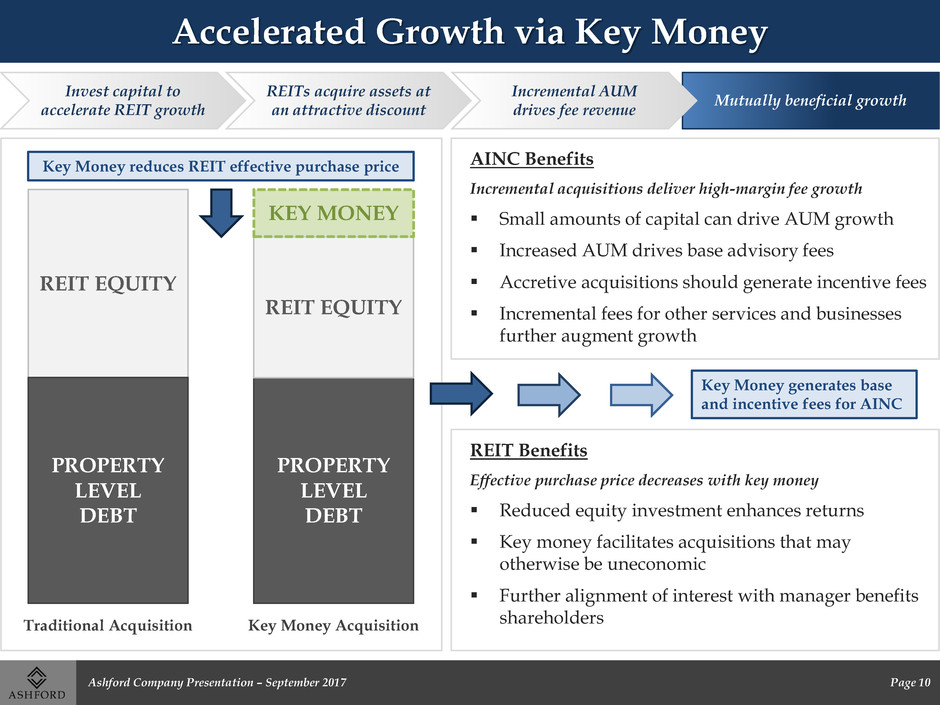

Accelerated Growth via Key Money

Invest capital to

accelerate REIT growth

Mutually beneficial growth

REITs acquire assets at

an attractive discount

Incremental AUM

drives fee revenue

REIT Benefits

Effective purchase price decreases with key money

Further alignment of interest with manager benefits

shareholders

Reduced equity investment enhances returns

Key money facilitates acquisitions that may

otherwise be uneconomic

AINC Benefits

Incremental acquisitions deliver high-margin fee growth

Accretive acquisitions should generate incentive fees

Increased AUM drives base advisory fees

Incremental fees for other services and businesses

further augment growth

Small amounts of capital can drive AUM growth

PROPERTY

LEVEL

DEBT

REIT EQUITY

PROPERTY

LEVEL

DEBT

REIT EQUITY

KEY MONEY

Key Money reduces REIT effective purchase price

Key Money generates base

and incentive fees for AINC

Traditional Acquisition Key Money Acquisition

Page 10 Ashford Company Presentation – September 2017

Attractive Value in Advisory Agreements

Total AHT AHP

Valuable, long-term

contracts

Excess value may

support stock

Intrinsic value helps

protect downside

Analyst estimate above

current market value

Advisory Agreements

Long-term advisory agreements lock in stable, recurring revenue stream from managed REIT platforms

70 bps base advisory fees on total market capitalization

Base fees cannot decrease more than 10% YoY

Additional incentive fees based on total shareholder return

outperformance

Cannot be terminated without substantial payment to AINC

10-year term with 5-year (AHT) and 10-year (AHP) renewals

Valued at

+402% of

Current

Mkt Cap

CURRENT AINC MARKET CAP $126M(3)

$154M(1),(2) $354M(1),(2)

Analyst estimate(2) of

termination fee for

advisory agreements

+ Analyst estimate(2) of AHT and AHP termination

fees is more than 4x AINC’s current market cap

$381M

Excess

Value

Page 11 Ashford Company Presentation – September 2017

(1) Canaccord estimate 8/7/2017 (AHT), Canaccord estimate 8/6/2017 (AHP)

(2) Canaccord Genuity suspended industry coverage on 9/8/2017

(3) Bloomberg data as of 9/22/2017 (fully diluted)

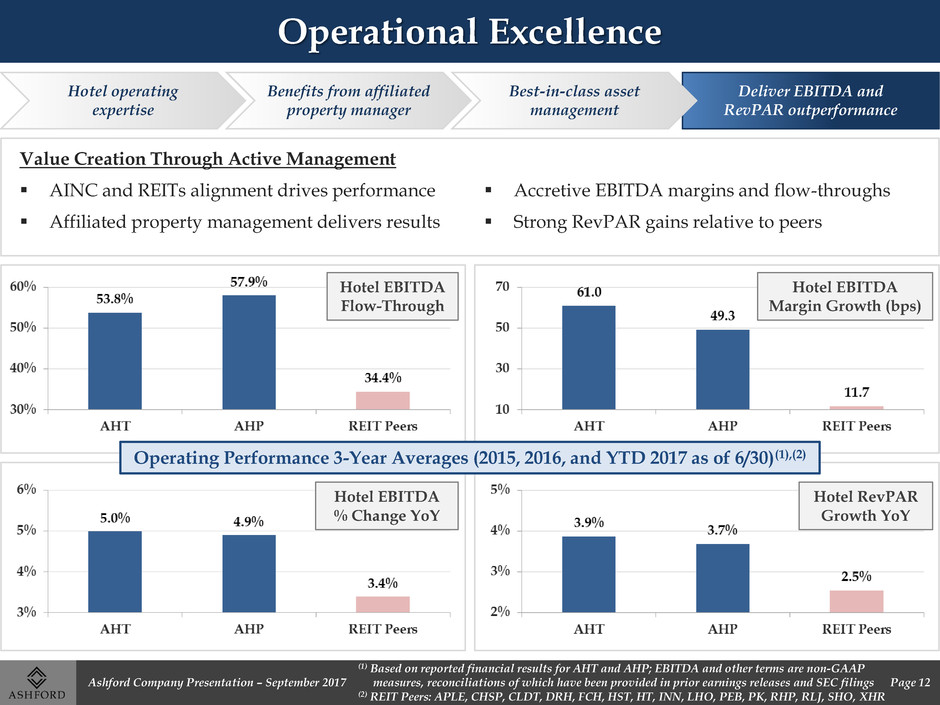

Operational Excellence

Hotel operating

expertise

Deliver EBITDA and

RevPAR outperformance

Benefits from affiliated

property manager

Best-in-class asset

management

Value Creation Through Active Management

AINC and REITs alignment drives performance

Affiliated property management delivers results

Accretive EBITDA margins and flow-throughs

Strong RevPAR gains relative to peers

Operating Performance 3-Year Averages (2015, 2016, and YTD 2017 as of 6/30)(1),(2)

Hotel EBITDA

Flow-Through

Hotel EBITDA

Margin Growth (bps)

Hotel EBITDA

% Change YoY

Hotel RevPAR

Growth YoY

Page 12 Ashford Company Presentation – September 2017

(1) Based on reported financial results for AHT and AHP; EBITDA and other terms are non-GAAP

measures, reconciliations of which have been provided in prior earnings releases and SEC filings

(2) REIT Peers: APLE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, PK, RHP, RLJ, SHO, XHR

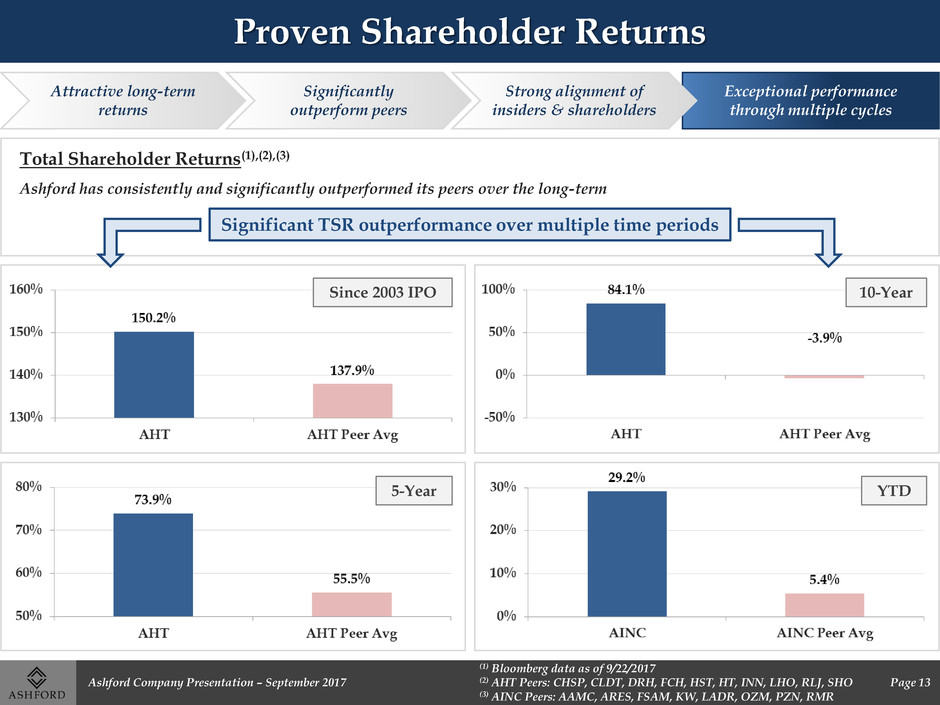

Proven Shareholder Returns

Significant TSR outperformance over multiple time periods

Since 2003 IPO

Attractive long-term

returns

Exceptional performance

through multiple cycles

Significantly

outperform peers

Strong alignment of

insiders & shareholders

Total Shareholder Returns(1),(2),(3)

Ashford has consistently and significantly outperformed its peers over the long-term

10-Year

5-Year YTD

Page 13 Ashford Company Presentation – September 2017

(1) Bloomberg data as of 9/22/2017

(2) AHT Peers: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, RLJ, SHO

(3) AINC Peers: AAMC, ARES, FSAM, KW, LADR, OZM, PZN, RMR

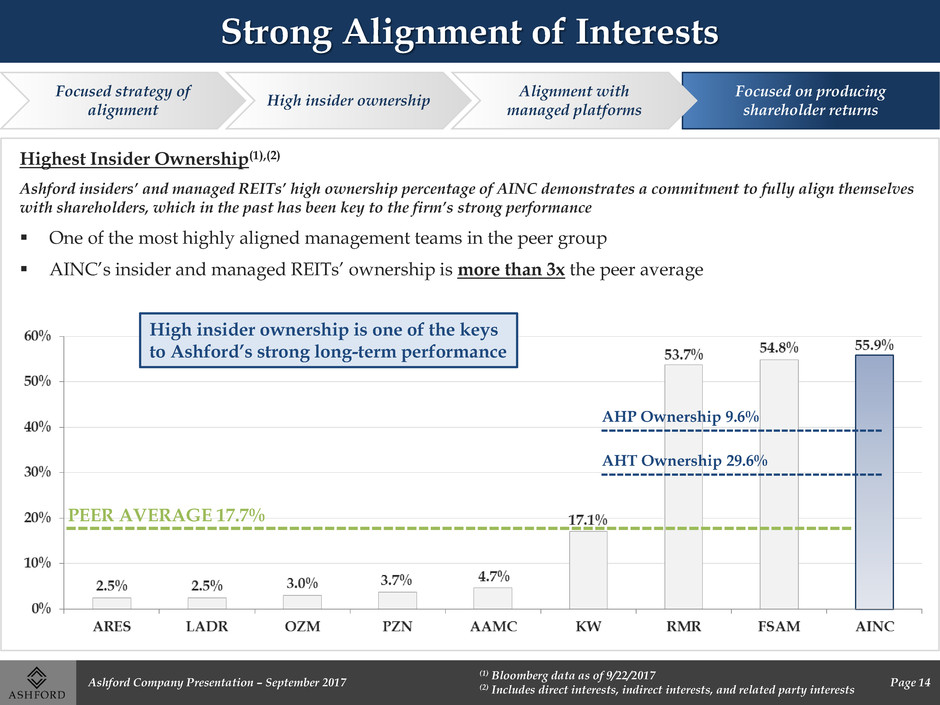

Strong Alignment of Interests

PEER AVERAGE 17.7%

Focused strategy of

alignment

Focused on producing

shareholder returns

High insider ownership

Alignment with

managed platforms

Highest Insider Ownership(1),(2)

Ashford insiders’ and managed REITs’ high ownership percentage of AINC demonstrates a commitment to fully align themselves

with shareholders, which in the past has been key to the firm’s strong performance

One of the most highly aligned management teams in the peer group

AINC’s insider and managed REITs’ ownership is more than 3x the peer average

High insider ownership is one of the keys

to Ashford’s strong long-term performance

AHT Ownership 29.6%

AHP Ownership 9.6%

Page 14 Ashford Company Presentation – September 2017

(1) Bloomberg data as of 9/22/2017

(2) Includes direct interests, indirect interests, and related party interests

Hotel industry experts

Seasoned veterans with

excellent long-term returns

Decades working

together

Experience throughout

market cycles

Executive Leadership

Page 15 Ashford Company Presentation – September 2017 Data as of 6/30/2017

Monty Bennett – CEO

28 years of hospitality

experience

28 years with Ashford

and predecessor

Cornell School of Hotel

Administration, BS

Cornell S.C. Johnson

School, MBA

David Brooks – COO and General Counsel

32 years of hospitality & legal experience

25 years with Ashford and predecessor

University of North Texas, BS

University of Houston, JD

Mark Nunneley, CPA – CAO

32 years of hospitality experience

32 years with Ashford and predecessor

Pepperdine University, BS

University of Houston, MS

Deric Eubanks, CFA – CFO

17 years of hospitality experience

14 years with Ashford

3 years with ClubCorp

Southern Methodist University, BBA

Rob Hays – CSO

12 years of hospitality experience

12 years with Ashford

3 years M&A at Dresser Inc. & Merrill Lynch

Princeton University, AB

Jeremy Welter – EVP of Asset Management

11 years of hospitality experience

11 years with Ashford

5 years with Stephens Investment Bank

Oklahoma State University, BS

Douglas Kessler – President

33 years of real estate & hospitality experience

15 years with Ashford and predecessor

10 years with Goldman Sachs Whitehall Funds

Stanford University, BA & MBA

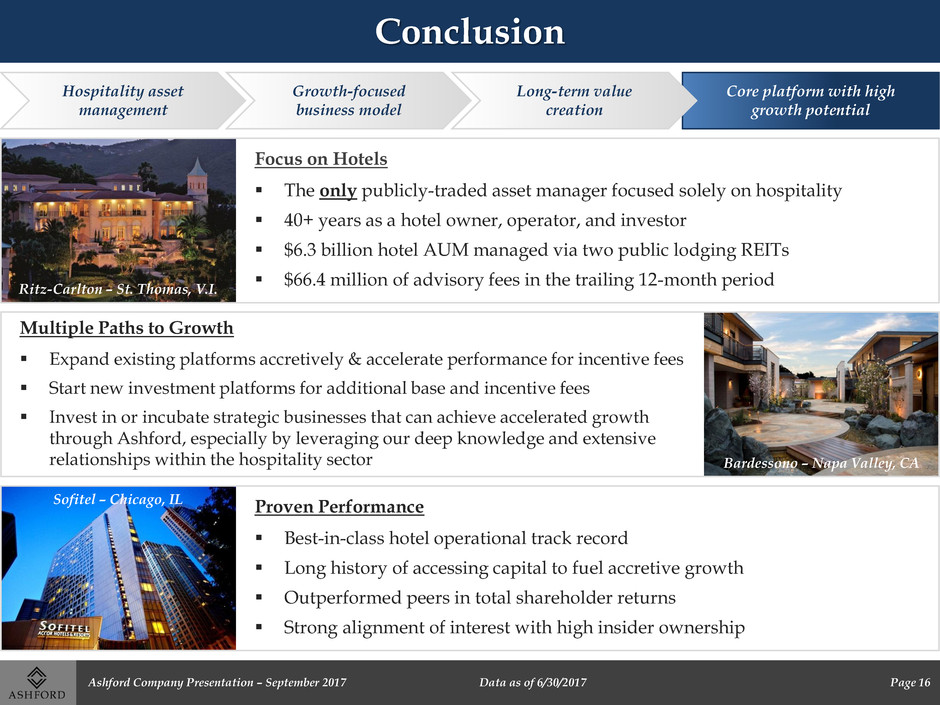

Conclusion

Focus on Hotels

The only publicly-traded asset manager focused solely on hospitality

40+ years as a hotel owner, operator, and investor

$6.3 billion hotel AUM managed via two public lodging REITs

$66.4 million of advisory fees in the trailing 12-month period

Ritz-Carlton – St. Thomas, V.I.

Proven Performance

Best-in-class hotel operational track record

Long history of accessing capital to fuel accretive growth

Outperformed peers in total shareholder returns

Strong alignment of interest with high insider ownership

Sofitel – Chicago, IL

Expand existing platforms accretively & accelerate performance for incentive fees

Start new investment platforms for additional base and incentive fees

Invest in or incubate strategic businesses that can achieve accelerated growth

through Ashford, especially by leveraging our deep knowledge and extensive

relationships within the hospitality sector

Multiple Paths to Growth

Bardessono – Napa Valley, CA

Hospitality asset

management

Core platform with high

growth potential

Growth-focused

business model

Long-term value

creation

Page 16 Ashford Company Presentation – September 2017 Data as of 6/30/2017

Ashford Inc.

(NYSE American: AINC)

14185 Dallas Parkway, Suite 1100 ● Dallas, TX 75254

P: 972-490-9600 ● www.ashfordinc.com

Park Hyatt Beaver Creek Resort & Spa – Beaver Creek, CO

AINC COMPANY PRESENTATION – SEPTEMBER 2017

APPENDIX: STRATEGIC INVESTMENTS

Pier House Resort & Spa – Key West, FL

AINC COMPANY PRESENTATION – SEPTEMBER 2017

Strategic Investments - OpenKey

Unprecedented Industry Growth

OpenKey is now one of the largest universal mobile key

platforms in the world, growing 300% year-over-year in its

hotel subscriber base

Expected to have 35,000 hotel rooms under contract over the

next 12-18 months

Currently servicing hotels in 8 countries

Mobile platform that provides customers with digital room

keys prior to arrival

Allows guest to go straight to their room, bypassing front

desk check-in

Notifies hotel management of guest’s arrival when guests

unlock their door

Provides hotels with rich customer data that enables them to

optimize marketing and sales initiatives

Innovative Front-End Mobile Check-in Technology Platform

Page 19 Ashford Company Presentation – September 2017

Strategic Investments – PURE Rooms

PURE Room Solutions

Leading provider of hypo-allergenic rooms in the

hospitality industry

7-step process that eliminates and protects against 98-

100% of viruses, bacteria and other irritants

Currently serves more than 2,400 rooms throughout the

United States in 160+ hotels

Revenue on Multiple Fronts

Allergy friendly rooms are increasingly demanded

Hotels can charge a premium for each room booked utilizing PURE technology, thus increasing a property’s

ADR and bottom line

Ashford can leverage its industry relationships to push PURE in other platforms, thus increasing fee

generation back to PURE and Ashford

After inclusion of all Trust and Prime hotels, net income and adjusted EBITDA are expected to increase by

$434,000 and $257,000 respectively

Page 20 Ashford Company Presentation – September 2017

Strategic Investments – J&S Audio Visual

Leading Provider of Audio Visual Services

J&S is one of the largest independent

providers of audio visual services,

including:

Hospitality Services

Show and Event Services

Creative Services

Design and Integration

Operates throughout the U.S., Mexico, and

the Dominican Republic

Multi-year contracts in place with 55 hotel

and convention centers comprising over

2,500 annual events, 500 venues, and 650

clients

Synergistic Relationship

After inclusion as Ashford’s preferred audio visual

service provider, net income and adjusted EBITDA

are expected to increase by $2.5 million and $5.2

million respectively

J&S will become the preferred audio visual

provider for Ashford’s REIT platforms

Ashford will acquire an 85% controlling interest

Anticipated to close before end of 2017

Page 21 Ashford Company Presentation – September 2017