Attached files

| file | filename |

|---|---|

| EX-10.9 - EX-10.9 - Vivint Smart Home, Inc. | d639659dex109.htm |

| EX-99.1 - EX-99.1 - Vivint Smart Home, Inc. | d639659dex991.htm |

| EX-23.1 - EX-23.1 - Vivint Smart Home, Inc. | d639659dex231.htm |

| EX-10.6 - EX-10.6 - Vivint Smart Home, Inc. | d639659dex106.htm |

| EX-10.5 - EX-10.5 - Vivint Smart Home, Inc. | d639659dex105.htm |

| EX-10.3 - EX-10.3 - Vivint Smart Home, Inc. | d639659dex103.htm |

| EX-10.2 - EX-10.2 - Vivint Smart Home, Inc. | d639659dex102.htm |

| EX-10.1 - EX-10.1 - Vivint Smart Home, Inc. | d639659dex101.htm |

| EX-5.1 - EX-5.1 - Vivint Smart Home, Inc. | d639659dex51.htm |

| EX-4.4 - EX-4.4 - Vivint Smart Home, Inc. | d639659dex44.htm |

| EX-4.3 - EX-4.3 - Vivint Smart Home, Inc. | d639659dex43.htm |

| EX-4.2 - EX-4.2 - Vivint Smart Home, Inc. | d639659dex42.htm |

| EX-4.1 - EX-4.1 - Vivint Smart Home, Inc. | d639659dex41.htm |

| EX-3.2 - EX-3.2 - Vivint Smart Home, Inc. | d639659dex32.htm |

| EX-3.1 - EX-3.1 - Vivint Smart Home, Inc. | d639659dex31.htm |

| S-1 - S-1 - Vivint Smart Home, Inc. | d639659ds1.htm |

Exhibit 5.2

Mosaic Acquisition Corp.

375 Park Avenue

New York, NY 10152

Registration Statement on Form S-1

(CIK No. 0001713952)

Ladies and Gentlemen:

We have acted as special counsel to Mosaic Acquisition Corp., a Cayman Islands company (the “Company”), in connection with the Registration Statement on Form S-1 (the “Registration Statement”) of the Company, filed with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended (the “Act”), and the rules and regulations thereunder (the “Rules”). You have asked us to furnish our opinion as to the legality of the securities being registered under the Registration Statement. The Registration Statement relates to the registration under the Act of (i) 34,500,000 units (the “Units”) of the Company, each such unit consisting of one Class A ordinary share of the Company (including Units issuable by the Company upon exercise of the underwriters’ over-allotment option), par value $0.001 per share (the “Class A Shares”), and one-third of one warrant of the Company (each whole warrant, a “Warrant”) to purchase a Class A Share and (ii) all Class A Shares and all Warrants issued as part of the Units as specified in the Registration Statement.

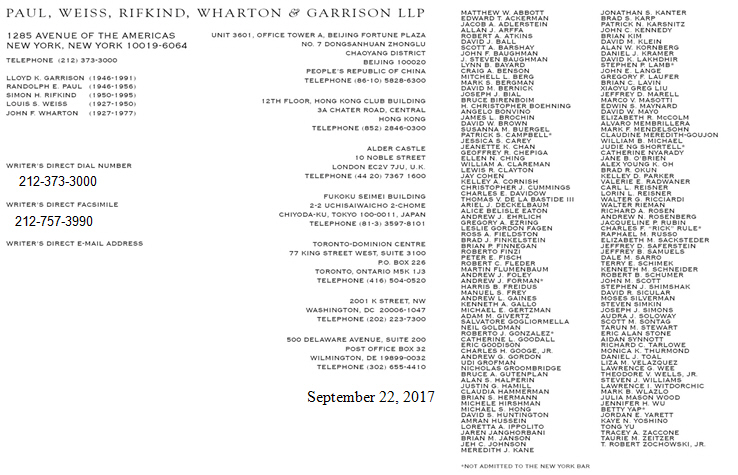

PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP

Mosaic Acquisition Corp.

In connection with the furnishing of this opinion, we have examined originals, or copies certified or otherwise identified to our satisfaction, of the following documents (collectively, the “Documents”):

1. the Registration Statement;

2. the form of the Underwriting Agreement (the “Underwriting Agreement”), proposed to be entered into between the Company and the underwriters named in the Registration Statement;

3. the Specimen Unit Certificate, included as Exhibit 4.1 to the Registration Statement;

4. the Specimen Class A Share Certificate, included as Exhibit 4.2 to the Registration Statement;

5. the Specimen Warrant Certificate, included as Exhibit 4.3 to the Registration Statement; and

6. the form of warrant agreement proposed to be entered into by and between Continental Stock Transfer & Trust Company (the “Warrant Agent”) and the Company, included as Exhibit 4.4 to the Registration Statement (the “Warrant Agreement”).

2

PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP

Mosaic Acquisition Corp.

We have relied upon the factual matters contained in the representations and warranties of the Company made in the Documents and upon certificates of public officials and the officers of the Company.

In our examination of the documents referred to above, we have assumed, without independent investigation, the genuineness of all signatures, the legal capacity of all individuals who have executed any of the documents reviewed by us, the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as certified, photostatic, reproduced or conformed copies of valid existing agreements or other documents, the authenticity of all the latter documents and that the statements regarding matters of fact in the certificates, records, agreements, instruments and documents that we have examined are accurate and complete. We have also assumed, without independent investigation, (i) that the Company is validly existing and in good standing under the laws of its jurisdiction of organization, (ii) that the Company has all necessary corporate power to execute, deliver and perform its obligations under the Units, the Warrants and the Warrant Agreement, (iii) that the execution, delivery and performance of the Units, the Warrants and the Warrant Agreement have been duly authorized by all necessary corporate action and do not violate the Company’s organizational documents or the laws of its jurisdiction of organization and (iv) the due execution and delivery of the Units, the Warrants and the Warrant Agreement by the Company, under the laws of its jurisdictions of organization. We have also assumed that the Warrant Agreement constitutes a legal, valid and binding obligation of the Warrant Agent.

3

PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP

Mosaic Acquisition Corp.

Based upon the above, and subject to the stated assumptions, exceptions and qualifications, we are of the opinion that:

1. The Units, when duly issued and delivered by the Company against payment as contemplated by the Registration Statement, and assuming the due authorization, execution and delivery thereof by Continental Stock Transfer & Trust Company, as transfer agent, will constitute the legal, valid and binding obligations of the Company enforceable against the Company in accordance with their terms, except that the enforceability of the Units may be subject to bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting creditors’ rights generally and possible judicial action giving effect to governmental actions relating to persons or transactions or foreign laws affecting creditors’ rights and subject to general principles of equity (regardless of whether enforceability is considered in a proceeding in equity or at law).

2. The Warrants included in the Units, when the Units are duly issued and delivered by the Company against payment as contemplated by the Registration Statement and the Warrant Agreement, and assuming the due authorization, execution and delivery of the Warrants by the Warrant Agent, will constitute the legal, valid and binding obligations of the Company enforceable against the Company in accordance with their terms, except that (i) the enforceability of the Warrants may be subject to bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting creditors’ rights generally and possible judicial action giving effect to governmental actions relating to persons or transactions or foreign laws affecting

4

PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP

Mosaic Acquisition Corp.

creditors’ rights and subject to general principles of equity (regardless of whether enforceability is considered in a proceeding in equity or at law), (ii) we express no opinion as to the validity, legally binding effect or enforceability of the second proviso in Section 4.4 of the Warrant Agreement or any related provision in the Warrants that requires or relates to adjustments to the conversion rate in an amount that a court would determine in the circumstances under applicable law to be commercially unreasonable or a penalty or forfeiture and (iii) we express no opinion as to the enforceability of any indemnity provisions in the Warrant Agreement to the extent that such provisions may be limited by (a) federal or state securities laws and the public policy underlying such laws and (b) laws limiting the enforceability of provisions exculpating or exempting a party from, or requiring indemnification of a party for, its own action or inaction, to the extent such action or inaction involves gross negligence, recklessness or willful or unlawful conduct.

The opinions expressed above are limited to the laws of the State of New York. Our opinion is rendered only with respect to the laws, and the rules, regulations and orders under those laws, that are currently in effect.

5

PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP

Mosaic Acquisition Corp.

We hereby consent to use of this opinion as an exhibit to the Registration Statement and to the use of our name under the heading “Legal Matters” contained in the prospectus included in the Registration Statement. In giving this consent, we do not thereby admit that we come within the category of persons whose consent is required by the Act or the Rules.

| Very truly yours, |

||||

|

/s/ PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP |

||||

| PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP |

||||

6