Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Westlake Chemical Partners LP | d420558d8k.htm |

| EX-99.2 - EX-99.2 - Westlake Chemical Partners LP | d420558dex992.htm |

| EX-99.1 - EX-99.1 - Westlake Chemical Partners LP | d420558dex991.htm |

| EX-2.1 - EX-2.1 - Westlake Chemical Partners LP | d420558dex21.htm |

Investor Presentation September 2017 Westlake Chemical Partners LP Exhibit 99.3

Notices and Disclaimers This presentation contains certain forward-looking statements, including statements with respect to future growth, potential levers for distributable cash flow, growth for Westlake Chemical Partners and the timing and results of a scheduled debottleneck of ethylene cracking unit. Actual results may differ materially depending on factors such as general economic and business conditions; the cyclical nature of the chemical industry; the availability, cost and volatility of raw materials and energy; uncertainties associated with the United States, Europe and worldwide economies, including those due to political tensions in the Middle East, Ukraine and elsewhere; current and potential governmental regulatory actions in the United States and Europe and regulatory actions and political unrest in other countries; industry production capacity and operating rates; the supply/demand balance for our products; competitive products and pricing pressures; instability in the credit and financial markets; access to capital markets; terrorist acts; operating interruptions (including leaks, explosions, fires, weather-related incidents, mechanical failure, unscheduled downtime, labor difficulties, transportation interruptions, spills and releases and other environmental risks); changes in laws or regulations; technological developments; our ability to implement our business strategies; creditworthiness of our customers; the results of potential negotiations between Westlake Chemical Corporation and Westlake Chemical Partners and other factors described in our reports filed with the Securities and Exchange Commission. Many of these factors are beyond our ability to control or predict. Any of these factors, or a combination of these factors, could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. These forward-looking statements are not guarantees of our future performance, and our actual results and future developments may differ materially from those projected in the forward-looking statements. Management cautions against putting undue reliance on forward-looking statements. Every forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements. The acquisition by Westlake Chemical Partners of an additional limited partner interest in Westlake Chemical OpCo has received Westlake Chemical Partners board and conflicts committee approval, but has not closed and remains subject to customary closing conditions. Non-GAAP Financial Measures This presentation makes reference to certain “non-GAAP” financial measures, such as MLP distributable cash flow and EBITDA, as defined in Regulation G of the U.S. Securities Exchange Act of 1934, as amended. We report our financial results in accordance with U.S. generally accepted accounting principles ("GAAP"), but believe that certain non-GAAP financial measures, such as MLP distributable cash flow and EBITDA, provide useful supplemental information to investors regarding the underlying business trends and performance of our ongoing operations and are useful for period-over-period comparisons of such operations. These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the financial measures prepared in accordance with GAAP. A reconciliation of MLP distributable cash flow and EBITDA to net income and net cash provided by operating activities can be found in the financial schedules at the end of this presentation. We define distributable cash flow as net income plus depreciation and amortization, less contributions from turnaround reserves and maintenance capital expenditures. We define MLP distributable cash flow as distributable cash flow less distributable cash flow attributable to Westlake Chemical Corporation's noncontrolling interest in OpCo and distributions attributable to incentive distribution rights holder. MLP distributable cash flow does not reflect changes in working capital balances. We define EBITDA as net income before interest expense, income taxes, depreciation and amortization. Because MLP distributable cash flow and EBITDA may be defined differently by other companies in our industry, our definition of MLP distributable cash flow and EBITDA may not be comparable to similarly titled measures of other companies. Notice to Recipients We have filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates (File No. 333-216617). Before you invest, you should read the prospectus in that registration statement and other documents we have filed with the SEC for more complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, we, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting UBS Securities LLC, 1285 Avenue of the Americas, New York, New York 10019, Attention: Prospectus Dept., Telephone: (888) 827-7275. This presentation shall not be deemed an offer to sell or a solicitation of an offer to buy our securities in any jurisdiction in which such offer or solicitation is not permitted. The securities will be offered by means of a prospectus supplement and accompanying prospectus and only to such persons and in such jurisdictions as is permitted under applicable law. Available Information and Risk Factors We file annual, quarterly and current reports and other information with SEC. Our SEC filings are available to the public over the internet at our website, www.wlkpartners.com, and at the SEC’s website www.sec.gov. Our filings with the SEC contain important information which anyone considering the purchase of our limited partnership units should read. Our business faces many risks. We have described in our SEC filings some of the more material risks we face. There may be additional risks that we do not yet know or that we do not currently perceive to be material that may also impact our business. Each of the risks and uncertainties described in our SEC filings could lead to events or circumstances that may have a material adverse effect on our business, financial condition, results of operations or cash flows, including our ability to make distributions to our unitholders. Our common units are listed on the New York Stock Exchange under the trading symbol “WLKP.”

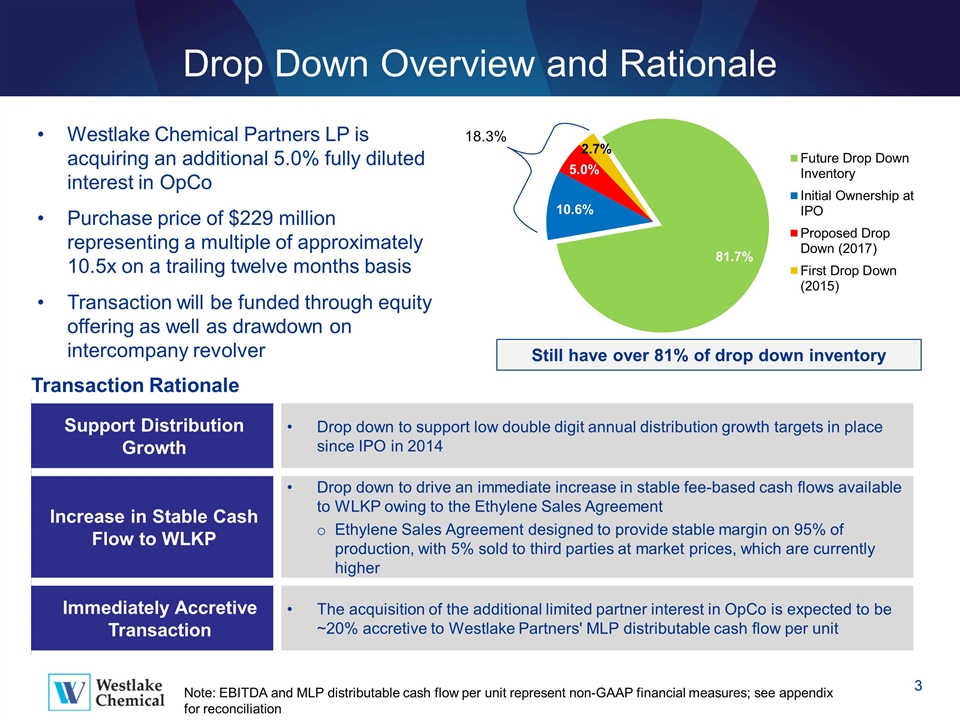

Drop Down Overview and Rationale Westlake Chemical Partners LP is acquiring an additional 5.0% fully diluted interest in OpCo Purchase price of $229 million representing a multiple of approximately 10.5x on a trailing twelve months basis Transaction will be funded through equity offering as well as drawdown on intercompany revolver Still have over 81% of drop down inventory 18.3% Support Distribution Growth Drop down to support low double digit annual distribution growth targets in place since IPO in 2014 Increase in Stable Cash Flow to WLKP Drop down to drive an immediate increase in stable fee-based cash flows available to WLKP owing to the Ethylene Sales Agreement Ethylene Sales Agreement designed to provide stable margin on 95% of production, with 5% sold to third parties at market prices, which are currently higher Immediately Accretive Transaction The acquisition of the additional limited partner interest in OpCo is expected to be ~20% accretive to Westlake Partners' MLP distributable cash flow per unit Transaction Rationale Note: EBITDA and MLP distributable cash flow per unit represent non-GAAP financial measures; see appendix for reconciliation

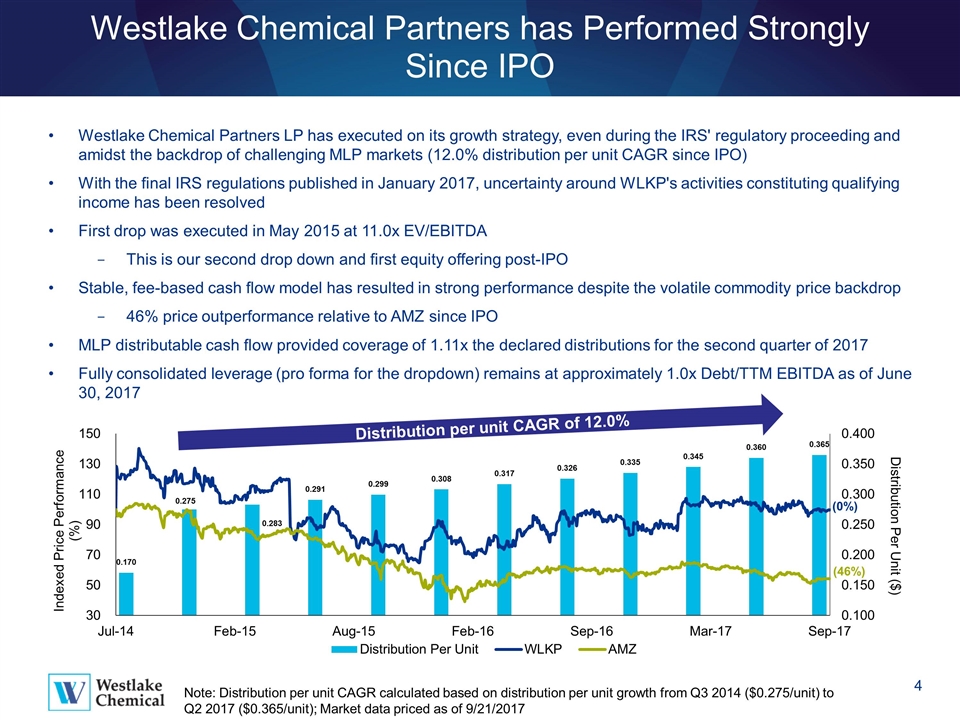

Westlake Chemical Partners has Performed Strongly Since IPO Westlake Chemical Partners LP has executed on its growth strategy, even during the IRS' regulatory proceeding and amidst the backdrop of challenging MLP markets (12.0% distribution per unit CAGR since IPO) With the final IRS regulations published in January 2017, uncertainty around WLKP's activities constituting qualifying income has been resolved First drop was executed in May 2015 at 11.0x EV/EBITDA This is our second drop down and first equity offering post-IPO Stable, fee-based cash flow model has resulted in strong performance despite the volatile commodity price backdrop 46% price outperformance relative to AMZ since IPO MLP distributable cash flow provided coverage of 1.11x the declared distributions for the second quarter of 2017 Fully consolidated leverage (pro forma for the dropdown) remains at approximately 1.0x Debt/TTM EBITDA as of June 30, 2017 Distribution per unit CAGR of 12.0% Note: Distribution per unit CAGR calculated based on distribution per unit growth from Q3 2014 ($0.275/unit) to Q2 2017 ($0.365/unit); Market data priced as of 9/21/2017

Stable and Predictable Cash Flows Ethylene Sales Agreement designed to provide stable 10 cents per pound margin on 95% of ethylene volumes, with 5% sold to third parties at market prices Strategic Relationship with Westlake Fosters Operational Alignment Completed expansions, plus a multi-year drop down inventory of high-quality, well-maintained assets, will drive WLKP’s growth Westlake Chemical’s joint venture with Lotte Chemical to build a new 2.2 billion pound ethylene cracker is expected to be eligible to be contributed to the MLP in 2019 Strategically Located Assets with Long History of Reliable Operations Reliable, efficient assets located near ample feedstock supply with high historical utilization and operating rates exceeding North American industry average (according to IHS Markit estimates) Positive Industry Fundamentals Shale gas plays are providing low cost ethane. IHS Markit forecasts continued advantaged feedstock to benefit North American ethane-based ethylene crackers Key Investment Highlights The partnership, through its contract structure, provides a predictable and stable level of cash flows. The strategies for growth are aligned with the partnership’s parent company, Westlake Chemical Corporation ("WLK"). 1 2 3 4

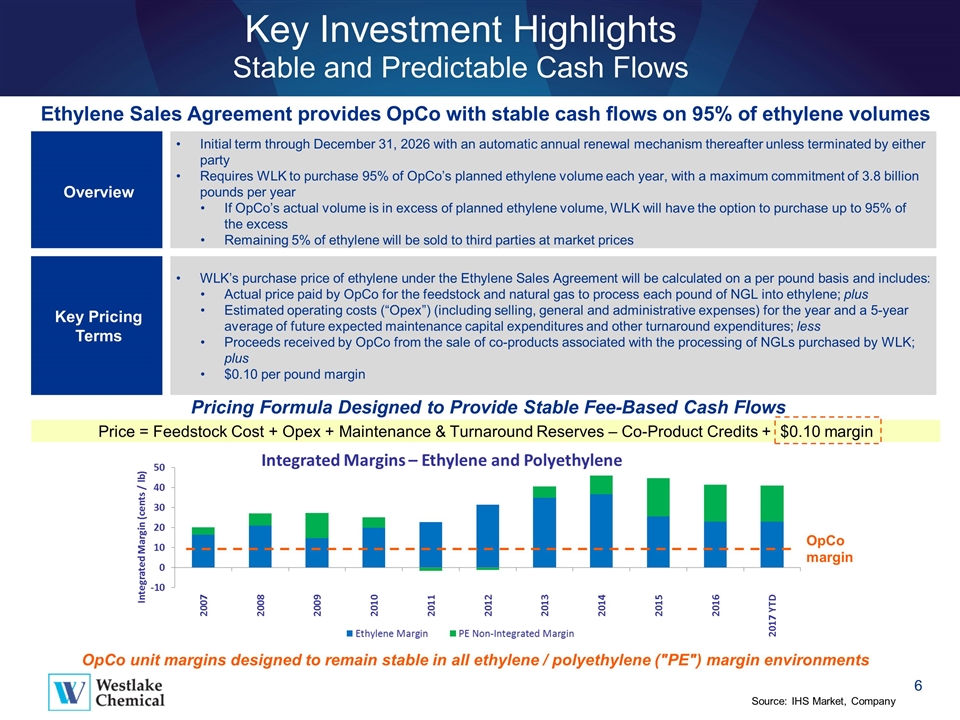

Overview Initial term through December 31, 2026 with an automatic annual renewal mechanism thereafter unless terminated by either party Requires WLK to purchase 95% of OpCo’s planned ethylene volume each year, with a maximum commitment of 3.8 billion pounds per year If OpCo’s actual volume is in excess of planned ethylene volume, WLK will have the option to purchase up to 95% of the excess Remaining 5% of ethylene will be sold to third parties at market prices Key Pricing Terms WLK’s purchase price of ethylene under the Ethylene Sales Agreement will be calculated on a per pound basis and includes: Actual price paid by OpCo for the feedstock and natural gas to process each pound of NGL into ethylene; plus Estimated operating costs (“Opex”) (including selling, general and administrative expenses) for the year and a 5-year average of future expected maintenance capital expenditures and other turnaround expenditures; less Proceeds received by OpCo from the sale of co-products associated with the processing of NGLs purchased by WLK; plus $0.10 per pound margin Price = Feedstock Cost + Opex + Maintenance & Turnaround Reserves – Co-Product Credits + $0.10 margin Key Investment Highlights Stable and Predictable Cash Flows Pricing Formula Designed to Provide Stable Fee-Based Cash Flows Ethylene Sales Agreement provides OpCo with stable cash flows on 95% of ethylene volumes OpCo unit margins designed to remain stable in all ethylene / polyethylene ("PE") margin environments OpCo margin Source: IHS Market, Company

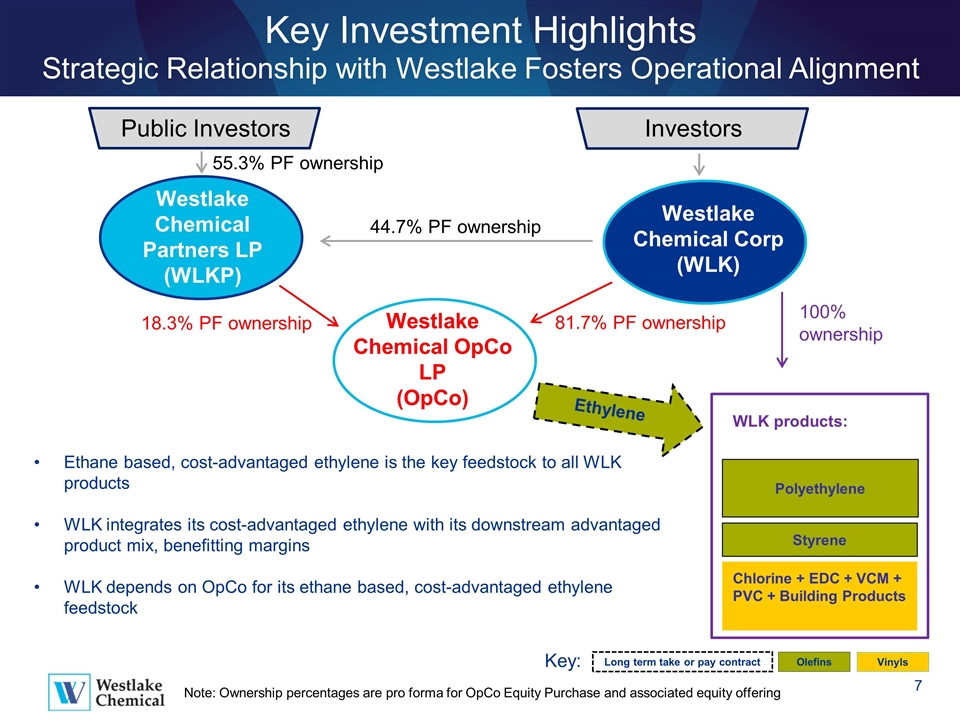

Westlake Chemical Corp (WLK) 100% ownership Key Investment Highlights Strategic Relationship with Westlake Fosters Operational Alignment Polyethylene Styrene Olefins Vinyls Westlake Chemical Partners LP (WLKP) 18.3% PF ownership 81.7% PF ownership Chlorine + EDC + VCM + PVC + Building Products Ethane based, cost-advantaged ethylene is the key feedstock to all WLK products WLK integrates its cost-advantaged ethylene with its downstream advantaged product mix, benefitting margins WLK depends on OpCo for its ethane based, cost-advantaged ethylene feedstock Public Investors Investors 55.3% PF ownership 44.7% PF ownership Westlake Chemical OpCo LP (OpCo) Ethylene Long term take or pay contract Key: WLK products: Note: Ownership percentages are pro forma for OpCo Equity Purchase and associated equity offering

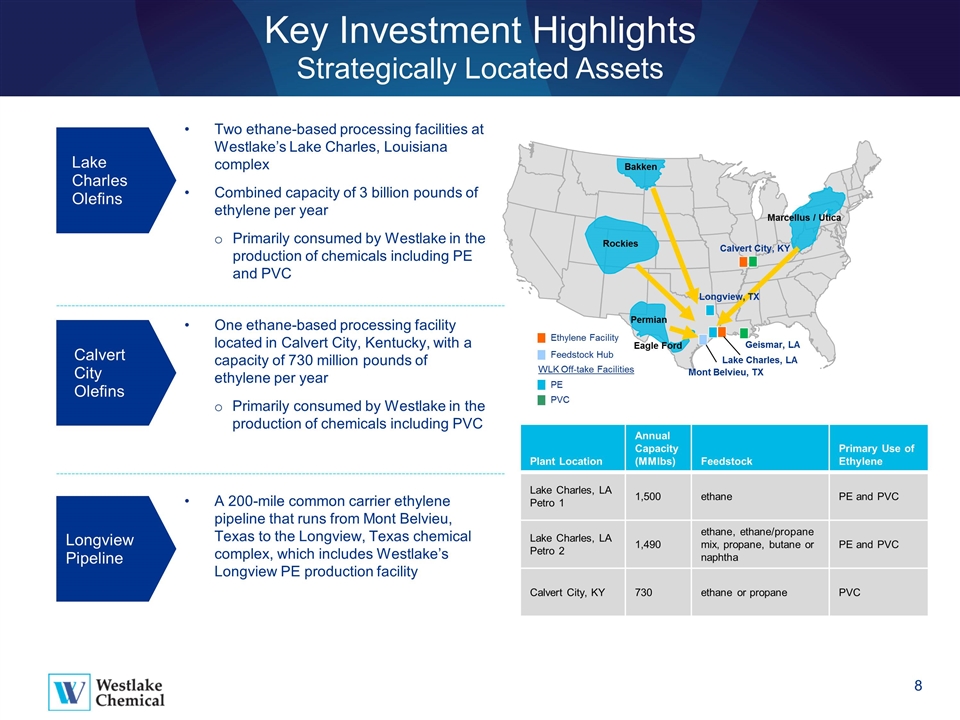

Lake Charles Olefins Two ethane-based processing facilities at Westlake’s Lake Charles, Louisiana complex Combined capacity of 3 billion pounds of ethylene per year Primarily consumed by Westlake in the production of chemicals including PE and PVC One ethane-based processing facility located in Calvert City, Kentucky, with a capacity of 730 million pounds of ethylene per year Primarily consumed by Westlake in the production of chemicals including PVC A 200-mile common carrier ethylene pipeline that runs from Mont Belvieu, Texas to the Longview, Texas chemical complex, which includes Westlake’s Longview PE production facility Calvert City Olefins Longview Pipeline Plant Location Annual Capacity (MMlbs) Feedstock Primary Use of Ethylene Lake Charles, LA Petro 1 1,500 ethane PE and PVC Lake Charles, LA Petro 2 1,490 ethane, ethane/propane mix, propane, butane or naphtha PE and PVC Calvert City, KY 730 ethane or propane PVC Key Investment Highlights Strategically Located Assets Ethylene Facility PE PVC Feedstock Hub WLK Off-take Facilities Eagle Ford Rockies Bakken Calvert City, KY Permian Lake Charles, LA Geismar, LA Marcellus / Utica Mont Belvieu, TX Longview, TX

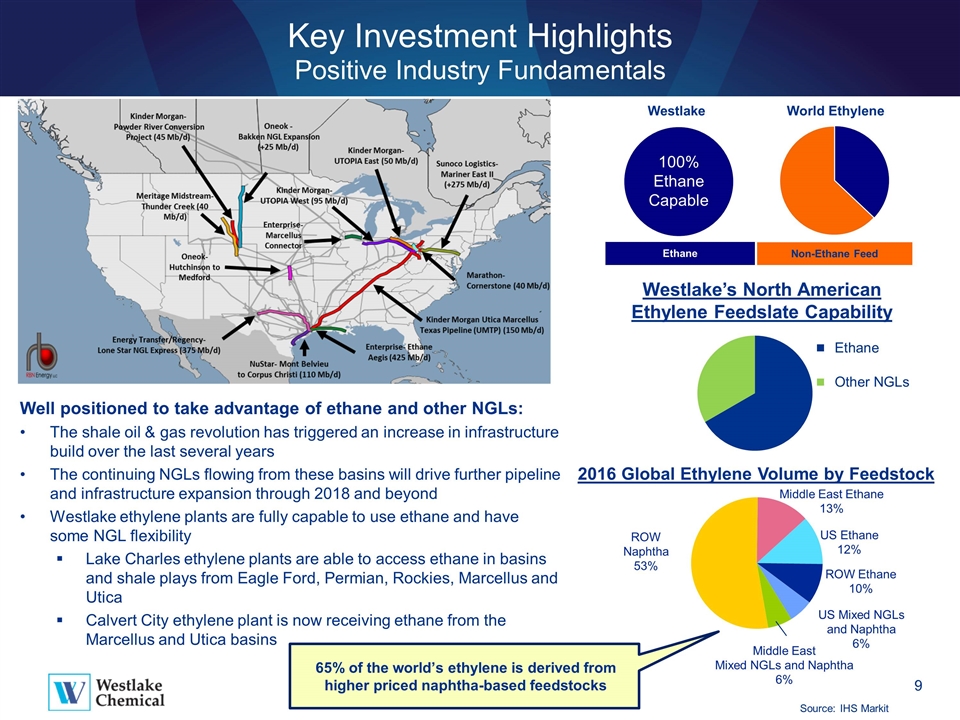

Key Investment Highlights Positive Industry Fundamentals Well positioned to take advantage of ethane and other NGLs: The shale oil & gas revolution has triggered an increase in infrastructure build over the last several years The continuing NGLs flowing from these basins will drive further pipeline and infrastructure expansion through 2018 and beyond Westlake ethylene plants are fully capable to use ethane and have some NGL flexibility Lake Charles ethylene plants are able to access ethane in basins and shale plays from Eagle Ford, Permian, Rockies, Marcellus and Utica Calvert City ethylene plant is now receiving ethane from the Marcellus and Utica basins Source: IHS Markit Westlake’s North American Ethylene Feedslate Capability 100% Ethane Capable Ethane Non-Ethane Feed World Ethylene Westlake 2016 Global Ethylene Volume by Feedstock 65% of the world’s ethylene is derived from higher priced naphtha-based feedstocks ROW Ethane 10% US Ethane 12% US Mixed NGLs and Naphtha 6% Middle East Mixed NGLs and Naphtha 6% ROW Naphtha 53% Middle East Ethane 13%

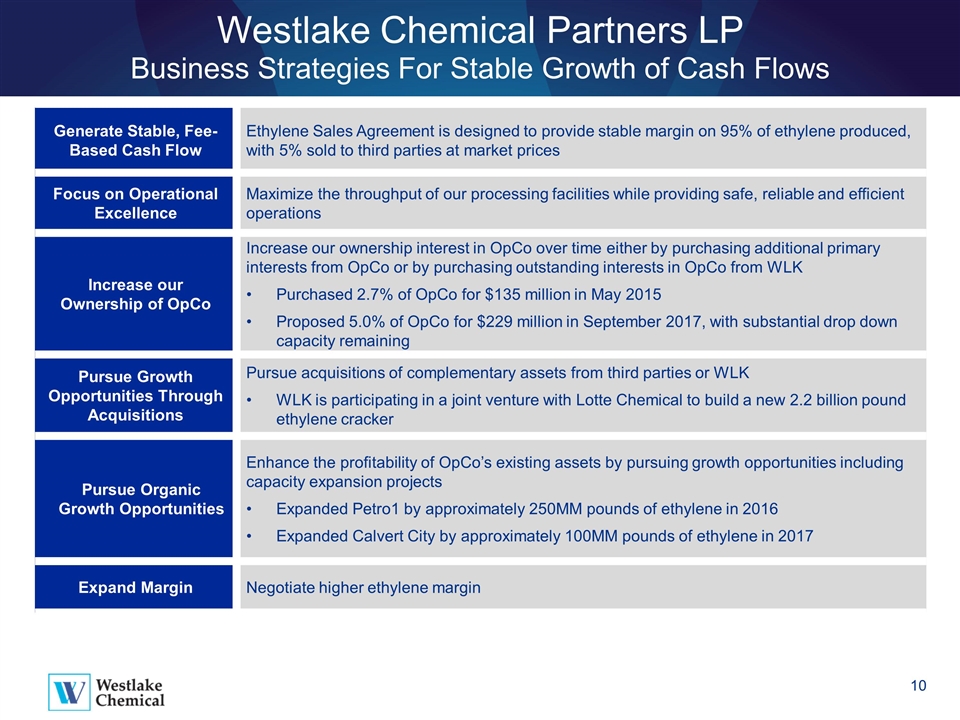

Generate Stable, Fee-Based Cash Flow Ethylene Sales Agreement is designed to provide stable margin on 95% of ethylene produced, with 5% sold to third parties at market prices Focus on Operational Excellence Maximize the throughput of our processing facilities while providing safe, reliable and efficient operations Increase our Ownership of OpCo Increase our ownership interest in OpCo over time either by purchasing additional primary interests from OpCo or by purchasing outstanding interests in OpCo from WLK Purchased 2.7% of OpCo for $135 million in May 2015 Proposed 5.0% of OpCo for $229 million in September 2017, with substantial drop down capacity remaining Pursue Growth Opportunities Through Acquisitions Pursue acquisitions of complementary assets from third parties or WLK WLK is participating in a joint venture with Lotte Chemical to build a new 2.2 billion pound ethylene cracker Pursue Organic Growth Opportunities Enhance the profitability of OpCo’s existing assets by pursuing growth opportunities including capacity expansion projects Expanded Petro1 by approximately 250MM pounds of ethylene in 2016 Expanded Calvert City by approximately 100MM pounds of ethylene in 2017 Expand Margin Negotiate higher ethylene margin Westlake Chemical Partners LP Business Strategies For Stable Growth of Cash Flows

Appendix

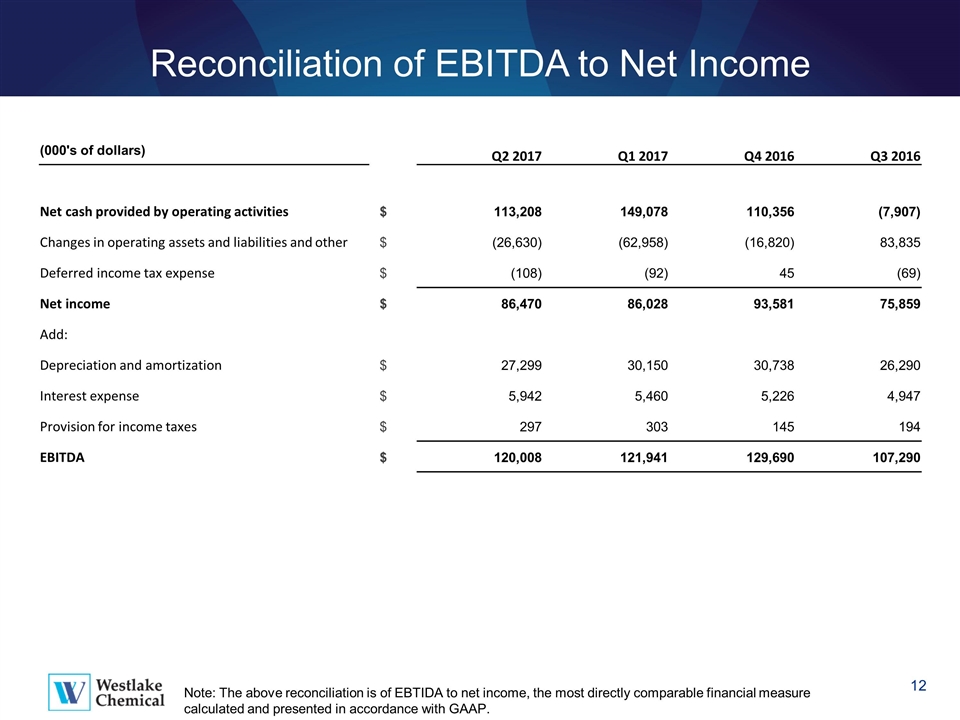

Reconciliation of EBITDA to Net Income (000's of dollars) Q2 2017 Q1 2017 Q4 2016 Q3 2016 Net cash provided by operating activities $ 113,208 149,078 110,356 (7,907) Changes in operating assets and liabilities and other $ (26,630) (62,958) (16,820) 83,835 Deferred income tax expense $ (108) (92) 45 (69) Net income $ 86,470 86,028 93,581 75,859 Add: Depreciation and amortization $ 27,299 30,150 30,738 26,290 Interest expense $ 5,942 5,460 5,226 4,947 Provision for income taxes $ 297 303 145 194 EBITDA $ 120,008 121,941 129,690 107,290 Note: The above reconciliation is of EBTIDA to net income, the most directly comparable financial measure calculated and presented in accordance with GAAP.

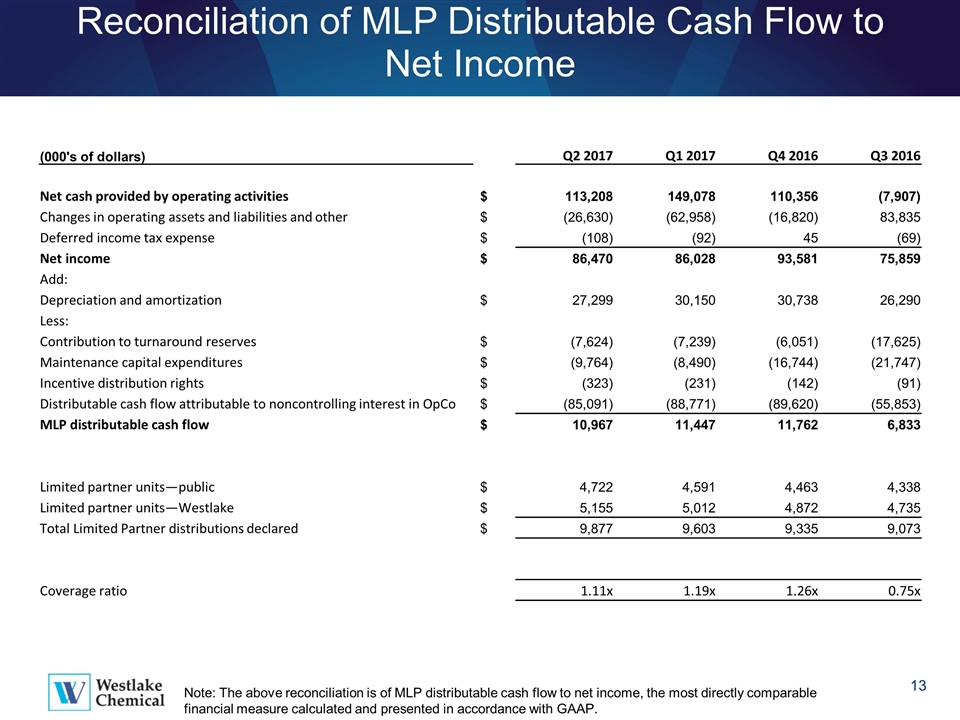

Reconciliation of MLP Distributable Cash Flow to Net Income (000's of dollars) Q2 2017 Q1 2017 Q4 2016 Q3 2016 Net cash provided by operating activities $ 113,208 149,078 110,356 (7,907) Changes in operating assets and liabilities and other $ (26,630) (62,958) (16,820) 83,835 Deferred income tax expense $ (108) (92) 45 (69) Net income $ 86,470 86,028 93,581 75,859 Add: Depreciation and amortization $ 27,299 30,150 30,738 26,290 Less: Contribution to turnaround reserves $ (7,624) (7,239) (6,051) (17,625) Maintenance capital expenditures $ (9,764) (8,490) (16,744) (21,747) Incentive distribution rights $ (323) (231) (142) (91) Distributable cash flow attributable to noncontrolling interest in OpCo $ (85,091) (88,771) (89,620) (55,853) MLP distributable cash flow $ 10,967 11,447 11,762 6,833 Limited partner units—public $ 4,722 4,591 4,463 4,338 Limited partner units—Westlake $ 5,155 5,012 4,872 4,735 Total Limited Partner distributions declared $ 9,877 9,603 9,335 9,073 Coverage ratio 1.11x 1.19x 1.26x 0.75x Note: The above reconciliation is of MLP distributable cash flow to net income, the most directly comparable financial measure calculated and presented in accordance with GAAP.