Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WABCO Holdings Inc. | d439489d8k.htm |

WABCO’s Recent acquisitions SEPTember 22, 2017 JACQUES ESCULIER Chairman & Chief Executive Officer ALEXANDER DE BOCK Chief Financial Officer - Interim Exhibit 99.1

Forward looking statements and non-gaap financial measures Comments in this document contain certain forward-looking statements, which are based on management’s good faith expectations and beliefs concerning future developments. Actual results may differ materially from these expectations as a result of many factors. These factors include, but are not limited to, the risks and uncertainties described in the “Risk Factors” section and the “Forward Looking Statements” section of WABCO’s Form 10-K, as well as in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Information Concerning Forward Looking Statements” section of WABCO’s Form 10-K Report. WABCO does not undertake any obligation to update such forward-looking statements. All market and industry data are based on Company estimates. This presentation contains certain non-GAAP financial measures as that term is defined by the SEC. EBIT and EBITDA are non-GAAP financial measures. Additionally, EBIT, EBITDA, tax rate and net income attributable to company per diluted share (“EPS”) on a “performance basis” are non-GAAP financial measures that exclude items for separation, streamlining, acquisitions, discrete and one-time tax items, and other items that management believes may mask the underlying operating results of the company, as applicable. Reconciliations of the forward looking non-GAAP financial measures presented herein to the most comparable GAAP measures are not available prior to completion of the customary purchase price allocations for the related acquisitions. Management believes that presenting these non-GAAP measures is useful to shareholders because it enhances their understanding of how management assesses the operating performance of the Company's business. All of the non-GAAP financial measures presented herein should be considered in addition to, not as a substitute for, GAAP measures. These measures may not be comparable to similar measures of other companies as not all companies calculate these measures in the same manner.

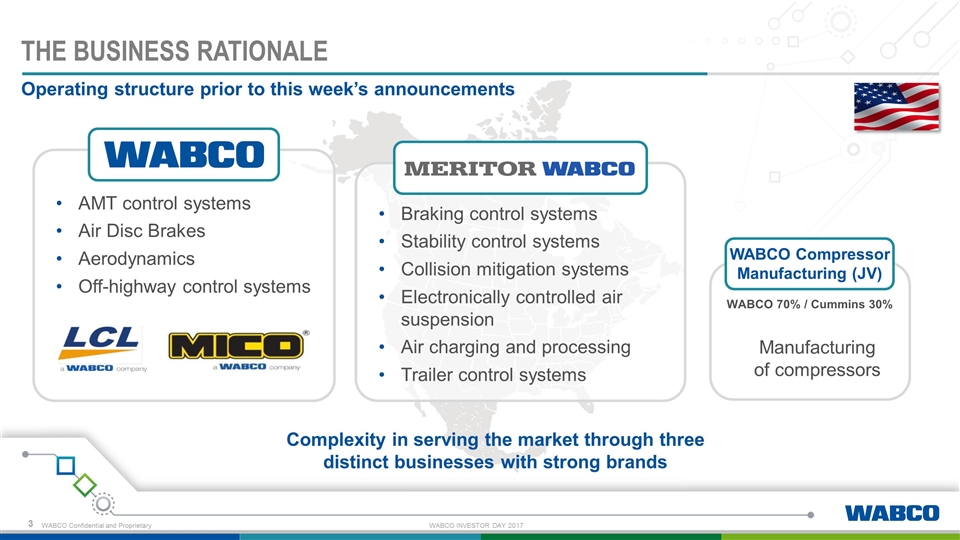

THE BUSINESS RATIONALE Operating structure prior to this week’s announcements Braking control systems Stability control systems Collision mitigation systems Electronically controlled air suspension Air charging and processing Trailer control systems AMT control systems Air Disc Brakes Aerodynamics Off-highway control systems Manufacturing of compressors Complexity in serving the market through three distinct businesses with strong brands WABCO 70% / Cummins 30% WABCO Compressor Manufacturing (JV)

WITH THE RECENTLY ANNOUNCED ACQUISITIONS Offering Global and North America customers ‘single-point’ access to our fully-integrated portfolio of advanced technology and control systems Braking and stability control AMT control systems Wheel-end solutions (ADB) Air charging and processing Aerodynamics Trailer control systems Off-highway control systems Steering control systems Manufacturing of compressors WABCO 70% / Cummins 30% WABCO Compressor Manufacturing (JV)

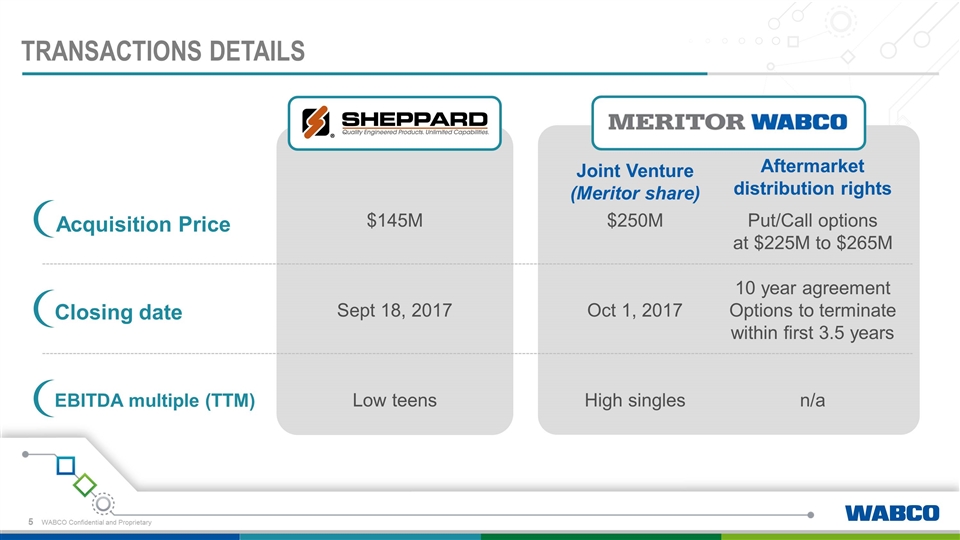

Transactions details Acquisition Price Closing date EBITDA multiple (TTM) $145M Sept 18, 2017 Low teens $250M Oct 1, 2017 High singles Put/Call options at $225M to $265M 10 year agreement Options to terminate within first 3.5 years n/a Joint Venture (Meritor share) Aftermarket distribution rights

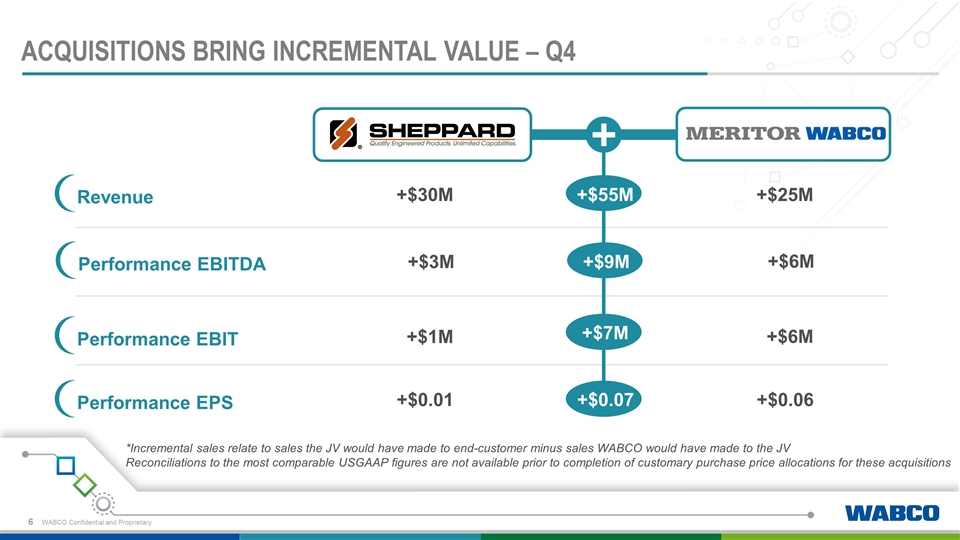

Acquisitions bring Incremental value – Q4 Revenue Performance EBIT Performance EBITDA Performance EPS +$30M +$3M +$1M +$0.01 +$25M +$6M +$6M +$0.06 +$55M +$9M +$7M +$0.07 *Incremental sales relate to sales the JV would have made to end-customer minus sales WABCO would have made to the JV Reconciliations to the most comparable USGAAP figures are not available prior to completion of customary purchase price allocations for these acquisitions

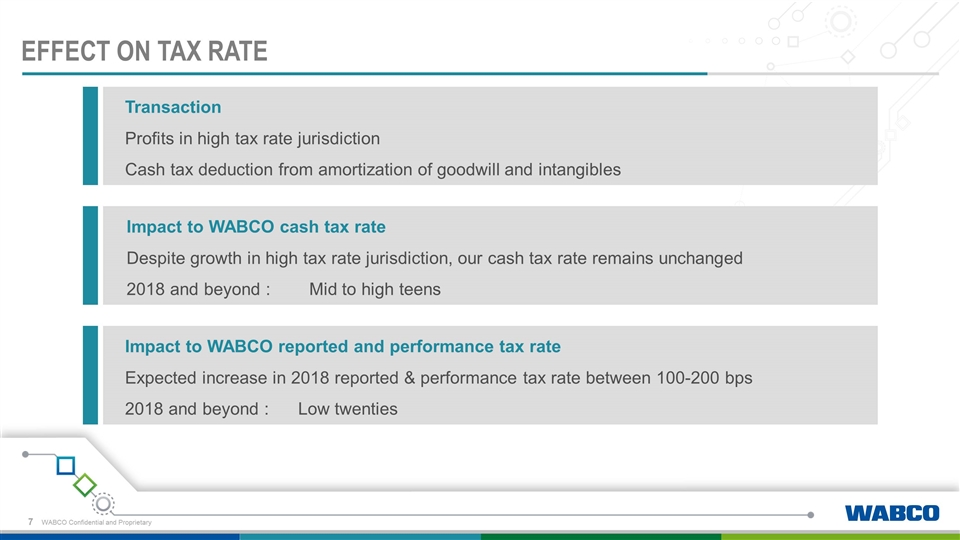

Effect on tax rate Transaction Profits in high tax rate jurisdiction Cash tax deduction from amortization of goodwill and intangibles Impact to WABCO cash tax rate Despite growth in high tax rate jurisdiction, our cash tax rate remains unchanged 2018 and beyond : Mid to high teens Impact to WABCO reported and performance tax rate Expected increase in 2018 reported & performance tax rate between 100-200 bps 2018 and beyond : Low twenties

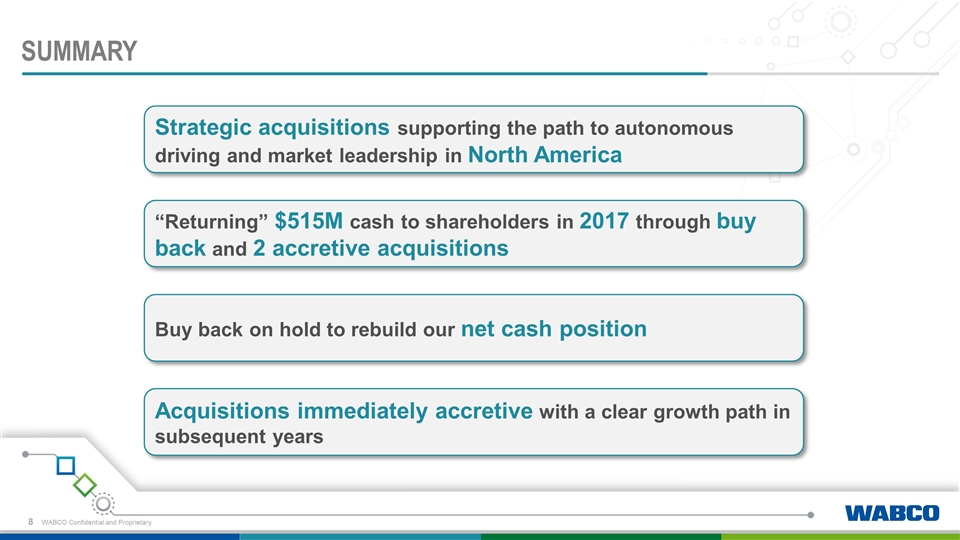

summary Strategic acquisitions supporting the path to autonomous driving and market leadership in North America “Returning” $515M cash to shareholders in 2017 through buy back and 2 accretive acquisitions Buy back on hold to rebuild our net cash position Acquisitions immediately accretive with a clear growth path in subsequent years

Thank you