Attached files

| file | filename |

|---|---|

| EX-10.1 - FORM OF PURCHASE AGREEMENT, DATED AS OF SEPTEMBER 20, 2017 AMONG DELMAR PHARMACE - Kintara Therapeutics, Inc. | f8k0917ex10-1_delmarpharma.htm |

| EX-99.1 - PRESS RELEASE OF DELMAR PHARMACEUTICALS, INC. ISSUED SEPTEMBER 20, 2017 - Kintara Therapeutics, Inc. | f8k0917ex99-1_delmarpharma.htm |

| EX-10.2 - ENGAGEMENT LETTER, DATED SEPTEMBER 17, 2017 BETWEEN DELMAR PHARMACEUTICALS, INC. - Kintara Therapeutics, Inc. | f8k0917ex10-2_delmarpharma.htm |

| EX-5.1 - OPINION OF FENNEMORE CRAIG, P.C - Kintara Therapeutics, Inc. | f8k0917ex5-1_delmarpharma.htm |

| EX-4.1 - FORM OF WARRANT - Kintara Therapeutics, Inc. | f8k0917ex4-1_delmarpharma.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 20, 2017

DELMAR PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 000-54801 | 99-0360497 | ||

| (State

or other jurisdiction of incorporation) |

(Commission

File Number) |

(I.R.S.

Employer Identification Number) |

Suite 720-999 West Broadway

Vancouver, British Columbia

Canada V5Z 1K5

(Address of principal executive offices) (zip code)

(604) 629-5989

(Registrant's telephone number, including area code)

(Former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

On September 20, 2017, DelMar Pharmaceuticals, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional investors for the sale by the Company of shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) and warrants to purchase shares of Common Stock, in a registered direct offering. The investors in this offering have agreed to purchase, and the Company has agreed to sell, an aggregate of 8,000,000 shares of the Common Stock and warrants to purchase an aggregate of 8,000,000 shares of Common Stock (the “Warrants”), at a purchase price of $1.25 per share and related warrant. Subject to certain ownership limitations, the Warrants will be exercisable commencing on the issuance date at an exercise price equal to $1.25 per whole share of Common Stock, subject to adjustments as provided under the terms of the Warrants. The Warrants are exercisable for five years from the date of issuance. The aggregate gross proceeds for the sale of the shares of Common Stock and Warrants will be approximately $10,000,000. The closing of the sales of the shares of Common Stock and Warrants is expected to occur on or about September 22, 2017 and is subject to customary closing conditions.

H.C. Wainwright & Co, LLC (the “Placement Agent”), acted as the exclusive placement agent in connection with the offering.

The net proceeds to the Company from the transaction, after deducting the placement agent’s fees and expenses (not including the Placement Agent Warrants, as defined below), and the Company’s estimated offering expenses, and excluding the proceeds, if any, from the exercise of the Warrants, are expected to be approximately $9.0 million. The Company intends to use the net proceeds of this offering for its clinical trials and for general corporate purposes, which may include working capital, capital expenditures, research and development and other commercial expenditures. In addition, the Company may use the net proceeds from this offering for acquisitions or investments in businesses, products or technologies that are complementary to its business.

The securities sold in the offering were offered and sold by the Company pursuant to an effective shelf registration statement on Form S-3, which was filed with the Securities and Exchange Commission (the “SEC”) on September 13, 2016 and subsequently declared effective on September 27, 2016 (File No. 333-213601) (the “Registration Statement”), and the base prospectus dated as of September 27, 2016 contained therein. The Company will file a prospectus supplement with the SEC in connection with the sale of the securities.

The representations, warranties and covenants contained in the Purchase Agreement were made solely for the benefit of the parties to the Purchase Agreement. In addition, such representations, warranties and covenants (i) are intended as a way of allocating the risk between the parties to the Purchase Agreement and not as statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by stockholders of, or other investors in, the Company. Accordingly, the Purchase Agreement is included with this filing only to provide investors with information regarding the terms of transaction, and not to provide investors with any other factual information regarding the Company. Stockholders should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public disclosures.

The Company also entered into an exclusive engagement letter (the “Engagement Letter”) with the Placement Agent. The engagement letter expires October 17, 2017. The Company has agreed to pay the Placement Agent an aggregate fee equal to 7% of the aggregate gross proceeds received by the Company from the sale of the shares of Common Stock and Warrants in the transactions plus a management fee equal to 1% of the gross proceeds from the offering. In addition, the Company will also pay the Placement Agent a $10,000 non-accountable expense allowance and reimburse the Placement Agent’s legal expenses up to $70,000. Pursuant to the Engagement Letter, the Company also agreed to issue to the Placement Agent, or its designees, warrants to purchase that number of shares of Common Stock equal to 5% of the aggregate number of shares of Common Stock placed in this offering (but not with respect to any shares of common stock issuable upon exercise of Warrants issued in this offering) at an exercise price of $1.25 per share (the “Placement Agent Warrants”). The Placement Agent Warrants are being issued in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and will be restricted from transfer for 180 days pursuant to FINRA Rule 5110(g), but are otherwise identical to the Warrants offered to investors. The Engagement Letter provides for a tail period through January 31, 2018 and right of first refusal period for up to five months, indemnity and other customary provisions for transactions of this nature.

2

The forms of the Purchase Agreement, the Warrant and the Engagement Letter are filed as Exhibits 10.1, 4.1 and 10.2, respectively, to this Current Report on Form 8-K. The foregoing summaries of the terms of these documents are subject to, and qualified in their entirety by, such documents, which are incorporated herein by reference.

A copy of the opinion of Fennemore Craig, P.C. relating to the legality of the securities offered by us is attached as Exhibit 5.1 hereto.

| Item 2.02 | Results of Operations and Financial Condition. |

At June 30, 2017, the Company had cash on hand of approximately $6.6 million (unaudited) and as of September 20, 2017, the Company had cash on hand of approximately $4.3 million (unaudited), not including the net proceeds from this offering.

On September 20, 2017, the Company issued a press release announcing the offering. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in this Current Report on Form 8-K under Item 2.02, including the information contained in Exhibit 99.1, is being furnished to the Securities and Exchange Commission, and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by a specific reference in such filing.

| Item 3.02 | Unregistered Sale of Equity Securities. |

Reference is made to the disclosure set forth in Item 1.01 above as to the Placement Agent Warrants. The Placement Agent Warrants and the shares issuable upon exercise of the Placement Agent Warrants will be issued in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering and in reliance on similar exemptions under applicable state laws.

| Item 7.01 | Regulation FD Disclosure. |

On September 20, 2017, the Company issued a press release announcing the offering. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in this Current Report on Form 8-K under Item 7.01, including the information contained in Exhibit 99.1, is being furnished to the Securities and Exchange Commission, and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by a specific reference in such filing.

| Item 8.01 | Other Information. |

Business Update

Background

DelMar Pharmaceuticals, Inc. (the “Company”) is a clinical stage drug development company with a focus on the treatment of cancer. Our mission is to benefit patients and create shareholder value by developing and commercializing anti-cancer therapies for patients whose tumors exhibit features that make them resistant to, or unlikely to respond to, currently available therapies, particularly for orphan cancer indications where patients have failed, or are unlikely to respond to, modern therapy.

3

Our lead product candidate, VAL-083, is a first-in-class DNA-targeting chemotherapeutic that demonstrated activity against a range of tumor types on prior Phase 1 and Phase 2 clinical trials sponsored by the US National Cancer Institute (“NCI”). Our research suggests that VAL-083’s mechanism of action is different than other agents targeting DNA that are widely used in the treatment of cancer such as temozolomide, nitrosoureas, platinum-based drugs, topoisomerase inhibitors and PARP inhibitors. NCI clinical research and data from our own clinical trials suggest that VAL-083 may offer a superior safety profile to these other agents.

We have recently initiated a pivotal randomized Phase 3 clinical trial with VAL-083 for recurrent glioblastoma multiforme (“GBM”). The trial, entitled VAL-083 Phase 3 Study in Temozolomide-Avastin (bevacizumab) Recurrent GBM (“STAR-3”) is intended to enroll approximately 180 patients at approximately 25 centers in the United States. Patients in the trial will have GBM that has recurred following surgery, chemo-radiation with temozolomide, and bevacizumab (Avastin™). The trial will compare the overall survival of these patients following treatment with VAL-083 versus standard-of-care chemotherapy. If successful, the results of this trial will position us to file a new drug application (“NDA”) for the approval of VAL-083 in the United States for the treatment of recurrent GBM. Subject to the availability of capital, we anticipate that the trial will take approximately two years from first enrollment.

We have also initiated two open-label, bio-marker driven Phase 2 trials in MGMT-unmethylated GBM. MGMT is a DNA-repair enzyme that is associated with resistance to temozolomide, the current standard-of-care chemotherapy used in the treatment of GBM. Approximately two out of three GBM patients have MGMT-unmethylated tumors and exhibit a high expression of MGMT, which is correlated with temozolomide treatment failure and poor patient outcomes. Our research demonstrates that VAL-083’s anti-tumor activity is independent of MGMT expression. In these studies, we are using MGMT as a biomarker to identify patients for treatment with VAL-083. If successful, the result of these trials will position VAL-083 for advancement to pivotal clinical trials as a potential replacement for temozolomide in MGMT-unmethylated GBM. Funding for both of these trials is substantially supported through collaborations. We anticipate presenting interim data from these trials at peer reviewed scientific meetings during calendar 2018.

We have received notice of allowance from the FDA for a Phase 1/2, Open-Label, Multicenter, Study of VAL-083 in Patients with Recurrent Platinum Resistant Ovarian Cancer (“REPROVe”). Platinum-based chemotherapy is standard-of-care in the treatment of ovarian cancer. Nearly all ovarian cancer patients eventually become resistant to platinum (“Pt”) -based chemotherapy leading to treatment failure and poor patient outcomes. We have demonstrated that VAL-083 is active against Pt-resistant ovarian cancer in vitro. The Phase 1 portion of the REPROVe trial will enroll approximately 24 patients with Pt-resistant ovarian cancer to evaluate the overall response rate (“ORR”) following treatment with VAL-083. We plan to request a meeting with the FDA following completion of the Phase 1 portion of the REPROVe trial. If successful, data from this trial would lead to a confirmatory Phase 2 study of approximately 60 patients, which if successful, and subject to feedback from FDA may position us to potentially file an application for accelerated approval or to advance to a pivotal Phase 3 trial. Subject to availability of capital, we anticipate completing the Phase 1 portion of the VAL-083 REPROVe trial in approximately 18 months from the initiation of patient recruitment and we will present updates on the progress of the trial at peer reviewed scientific meetings.

In addition to our clinical development activities in the United States, pursuant to our collaboration with Guangxi Wuzhou Pharmaceutical Company, we have obtained certain exclusive commercial rights to VAL-083 in China where it is approved as a chemotherapy for the treatment of chronic myelogenous leukemia (“CML”) and lung cancer. We have entered into a collaboration agreement with the only manufacturer presently licensed by the China Food and Drug Administration (“CFDA”) to produce the product for the China market. This agreement potentially positions us to generate future royalty revenue through product sales or royalties for its approved indications in China while we seek global approval in new indications. To date, we have received no revenue from this collaboration.

We have filed a broad portfolio of patent applications to protect our intellectual property. Our patent applications claim compositions and methods of use of VAL-083 and related compounds, synthetic methods, and quality controls for the manufacturing process of VAL-083. We believe that our portfolio of intellectual property rights provides a defensible market position for the commercialization of VAL-083. In addition, VAL-083 has been granted protection under the Orphan Drug Act by the FDA and the European Medicines Agency (“EMA”) for the treatment of glioma, including GBM. In 2016, the FDA also granted Orphan Drug protection to VAL-083 for the treatment of medulloblastoma and ovarian cancer.

4

Our drug discovery research focuses on identifying well-validated preclinical, clinical and commercial-stage compounds and establishing a scientific rationale for development in cancer indications for patients whose tumors exhibit features that make them resistant to, or unlikely to respond to, currently available therapies. Through our relationship with Valent Technologies, LLC (“Valent”), a company owned by Dr. Dennis Brown, our Chief Scientific Officer, we are able to utilize Valent’s proprietary ChemEstate bioinformatics tools to screen and identify potential candidates. Promising candidates are further researched through our network of consultants, academic centers, and contract research organizations. This approach allows us to identify and advance potential drug candidates without significant investment in “wet lab” infrastructure. Based on this strategy, we acquired the initial VAL-083 intellectual property and prototype drug product from Valent and advanced into Phase 2 and 3 clinical trials and have also identified additional drug candidates that we may have the opportunity to license or acquire in the future.

Our corporate development strategy is to advance our lead candidate into a Phase 3 registration-directed clinical trial and then to consider licensing or acquiring additional product candidates in order to establish a product pipeline and position for long-term sustainability and growth of shareholder value. We believe the experience of our clinical development team will position us to efficiently develop drug candidates that we may acquire, or license in the future.

We plan to seek marketing partnerships to supplement our own commercialization efforts and potentially generate future royalty revenue.

Recent Highlights

| ● | In April 2017, we completed a public offering of common stock and warrants for gross proceeds of approximately $9.0 million. In addition, during the year ended June 30, 2017 we received $545,026 in proceeds from the exercise of warrants. We plan to use these funds to support the initiation of the STAR-3 pivotal clinical trial of VAL-083 in refractory GBM, and for general corporate and research purposes. |

| ● | In July 2017, we initiated patient recruitment for the STAR-3 pivotal Phase 3 clinical trial of VAL-083 in refractory GBM and hope to enroll our first patient in September or October 2017. |

| ● | In September 2017, we initiated patient recruitment for an open label Phase 1 - 2 clinical trial of VAL-083 in newly diagnosed patients MGMT-unmethylated GBM, which is being conducted with funding support through our collaboration with Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. This trial complements our ongoing open label Phase 2 clinical trial in patients with MGMT-unmethylated GBM whose tumors have recurred following treatment with temozolomide (bevacizumab naïve), which is being conducted in collaboration with the University of Texas MD Anderson Cancer Center. |

| ● | In September 2017, we received notice of allowance from the FDA for our Phase 1-2 VAL-083 REPROVe clinical trial in Pt-resistant ovarian cancer. |

| ● | We presented promising research results supporting the potential of VAL-083 in the treatment of a broad range of cancers for patients whose tumors exhibit features making them resistant or unlikely to currently available therapies. For example: |

| o | We presented data supporting the effectiveness of VAL-083 in the treatment of GBM at the Annual meetings of the American Society for Clinical Oncology (“ASCO”), the American Association of Cancer Research (“AACR”), the World Federation of NeuroOncology Societies (“WFNOS”), the European Association for NeuroOncology and the Society for NeuroOncology (“SNO”); |

5

| o | We presented data supporting the effectiveness of VAL-083 in the treatment of lung cancer at the AACR Annual Meeting, the 17th World Congress on Lung Cancer and the AACR New Horizons in Cancer Research Conference; |

| o | We presented data supporting the activity of VAL-083 in treatment-resistant medulloblastoma both as a single agent and in combination with topoisomerase inhibitors at the SNO Pediatric Oncology Symposium and at the AACR Advances in Pediatric Research: From Mechanisms and Models to Treatment and Survivorship Conference; and |

| o | We presented data supporting the effectiveness of VAL-083 against chemotherapy-resistant ovarian cancers at the 11th Biennial Ovarian Cancer Research Symposium. |

| ● | We continued to strengthen and expand our network of research collaborations with leading academic institutions including the announcement of a major sponsored research agreement with Duke University to evaluate VAL-083 as a front-line treatment for newly diagnosed patients with GBM. |

| ● | We continued to strengthen our intellectual property portfolio. DelMar now holds eight issued US patents and eight issued patents outside of the US. We have fourteen patent families in various stages of prosecution, and over 100 patent filings in total. |

| ● | We strengthened our Board of Directors and corporate governance with the addition of Saiid Zarrabian and the appointment of Dr. Erich Mohr as independent chairman. |

VAL-083

Our product candidate, VAL-083, is a “first-in-class” small molecule chemotherapeutic, which means that the molecular structure of VAL-083 is not an analogue or derivative of a product approved, or in development for the treatment of cancer. VAL-083 is a DNA-targeting agent that was originally discovered in the 1960’s. It was assessed in more than 40 NCI-sponsored Phase 1 and Phase 2 clinical trials as a treatment against various cancers including lung, brain, cervical, ovarian tumors and leukemia. Published preclinical and clinical data suggest that VAL-083 may be active against a range of tumor types. VAL-083 is approved as a cancer chemotherapeutic in China for the treatment of CML and lung cancer. VAL-083 has not been approved for any indications outside of China.

Our research demonstrates that the mechanism of action of VAL-083 is distinct from other DNA-targeting agents used in the treatment of cancer. VAL-083 exhibits its anti-cancer activity by forming DNA-cross links leading to DNA double strand breaks, cell-cycle arrest and cancer cell death, DNA-targeting agents are among the most widely used treatments for cancer. They exhibit anti-cancer effects by binding to DNA and interfering with normal processes within the cancer cell which prevents the cell from making the proteins needed to grow and survive. We have presented research at peer-reviewed scientific meetings demonstrating that VAL-083 is active in patient-derived tumor cell lines and cancer stem cells that are resistant to other chemotherapies. These data, combined with clinical activity demonstrated against various cancers in prior NCI-sponsored clinical trials gives us confidence that VAL-083 may offer an opportunity as a new treatment option for patients whose tumors are resistant to currently available chemotherapies.

We are currently studying VAL-083 in clinical trials for the treatment of GBM, the most common and aggressive form of brain cancer. We have also recently received notice of allowance from the FDA for an IND to initiate clinical trials with VAL-083 in the treatment of ovarian cancer. Upon obtaining regulatory approval, we intend to commercialize VAL-083 for the treatment of orphan cancer indications such as refractory GBM. We also plan to seek collaborative development and commercialization partnerships to accelerate and expand the development of VAL-083 in newly diagnosed GBM and other non-orphan cancer indications.

The FDA Office of Orphan Products Development (“OOPD”) has granted orphan drug designations to VAL-083 for the treatment of glioma, ovarian cancer and medulloblastoma. VAL-083 has also been granted an orphan drug designation for in the treatment of glioma in Europe. Orphan diseases are defined in the United States under the Rare Disease Act of 2002 as “any disease or condition that affects fewer than 200,000 persons in the United States”. The Orphan Drug Act of 1983 is a federal law that provides financial and other incentives including a seven-year period of market exclusivity in the United States to encourage the development of new treatments for orphan diseases.

6

VAL-083 Mechanism of Action and the Opportunity in the Treatment of Cancer

Chemotherapy forms the basis of treatment in nearly all cancers. We believe that VAL-083 may be effective in treating cancer patients whose tumors exhibit features that cause resistance to currently available chemotherapy or that have failed, or become resistant to, other chemotherapies.

Our research suggests that VAL-083 attacks cancer cells via a unique mechanism of action which is distinct from other chemotherapies used in the treatment of cancer. Our data indicate that VAL-083 forms a crosslink at the N7 position of guanine on the DNA of cancer cells. Our data also indicate that this crosslink forms rapidly and is not easily repaired by the cancer cell resulting in cell-cycle arrest and lethal double-strand DNA breaks in cancer cells. VAL-083 readily crosses the blood brain barrier where it maintains a long half-life in comparison to the plasma. Published preclinical and clinical research demonstrate that VAL-083 is absorbed more readily in tumor cells versus normal cells.

Based on published research and our own data, the cytotoxic functional groups and the mechanism of action of VAL-083 are understood to be functionally different from alkylating agents commonly used in the treatment of cancer. VAL-083 has previously demonstrated activity in cell-lines that are resistant to other types of chemotherapy. No evidence of cross-resistance has been reported in published clinical studies.

Our data also demonstrate that VAL-083’s mechanism is distinct from current standard-of-care chemotherapy and is able to overcome drug resistance against a range of cancers in vitro. For example, VAL-083 is active against MGMT-unmethylated GBM cells which are resistant to treatment with temozolomide and nitrosoureas. VAL-083 also retains a high level of activity in p53 mutated non-small cell lung cancer (“NSCLC”), ovarian cancer and medulloblastoma cell lines that are resistant to platinum-based chemotherapy.

Importantly, clinical activity against each of the tumors mentioned above was established in prior NCI-sponsored Phase 2 clinical trials. We believe that these historical clinical data and our own research support the development of VAL-083 as a potential new treatment for multiple cancers.

The main dose-limiting toxicity (“DLT”) related to the administration of VAL-083 in previous NCI-sponsored clinical studies and our own clinical trials is myelosuppression. Myelosuppression is the decrease in cells responsible for providing immunity, carrying oxygen, and those responsible for normal blood clotting. Myelosuppression is a common side effect of chemotherapy. There is no evidence of lung, liver or kidney toxicity even with prolonged treatment by VAL-083. Commercial data from the Chinese market where the drug has been approved for more than 15 years supports the safety findings of the NCI studies.

Modern medicine allows for better management of myelosuppressive side effects. We believe this offers the potential opportunity to improve upon the drug’s already established efficacy profile by substantially increasing the dose of VAL-083 that can be safely administered to cancer patients.

Gliomas and Glioblastoma Multiforme (“GBM”)

Worldwide, there are an estimated 240,000 new cases of brain and central nervous system (“CNS”) tumors each year. Gliomas are a type of CNS tumor that arises from glial cells in the brain or spine. Glial cells are the cells surrounding nerves. Their primary function is to provide support and protection for neurons in the CNS.

GBM is the most common and the most lethal form of glioma. According to the World Health Organization, GBM occurs with an incidence of 3.17 per 100,000 person-years. Approximately 18,000 new cases of GBM are expected to be diagnosed in the United States and 26,000 in Europe during 2017.

GBM progresses quickly and patients’ conditions deteriorate rapidly progressing to death in less than two years for most patients. Common symptoms include headaches, seizures, nausea, weakness, paralysis and personality or cognitive changes such as loss of speech or difficulty in thinking clearly. The median survival in newly diagnosed patients with best available treatments is less than 15 months.

7

Standard treatment following diagnosis includes surgical resection to remove as much of the tumor as possible (“debulking”) followed by radiotherapy with concomitant and adjuvant chemotherapy with Temodar® (temozolomide “TMZ”). Nearly all patients diagnosed with GBM will relapse following first-line treatment, with a 1-year survival rate of approximately 25% following failure of front-line therapy, and with an average 5-year survival rate of less than 3%.

Avastin® (bevacizumab, an anti-VEGF antibody) is approved as a single agent for patients with recurrent GBM following prior therapy as an alternative to corticosteroids to relieve disease symptoms in the US, Canada, Australia and Japan. Avastin® carries a “black-box warning” related to severe, sometimes fatal, side effects such as gastrointestinal perforations, wound healing complications and hemorrhage. There are no data demonstrating an improvement in disease-related symptoms or increased survival in refractory GBM with Avastin®.

TMZ and the nitrosoureas, including carmustine, lomustine, and nimustine, are alkylating agents that readily cross the blood-brain-barrier and are used in the treatment of CNS cancers, including GBM. Alkylating agents are among the oldest type of cancer chemotherapies in use today. Alkylating agents bind to DNA to cause damage to cancer cells. Their anti-tumor mechanism is via alkylation of DNA resulting in base-pair mismatch or strand-mediated crosslinks between base pairs. The DNA damage caused by alkylating agents mimics naturally occurring errors, resulting in apoptosis and tumor cell death.

The primary anti-cancer mechanism of TMZ and the nitrosoureas is to attack the tumor’s DNA via alkylation of the O6-position of the DNA base residue, guanine. TMZ treatment causes DNA damage mainly by methylation at the O6-position of guanine resulting in guanine-thymine base pair mismatches during replication. Nitrosoureas mediate their cytotoxic effect by methylation at the O6-position of guanine which produces a cross-link to cytosine residues resulting in double-strand DNA breaks during mitosis.

A majority of GBM patients’ tumors are resistant to TMZ or nitrosourea therapy due to high expression of a naturally occurring enzyme called O6-DNA methylguanine methyl-transferase (“MGMT”) which repairs O6-guanine lesions. MGMT repair in turn inhibits the activity of TMZ and nitrosoureas and allows a patients’ GBM tumor to continue to grow in spite of treatment.

Consistent with the importance of its repair activity, high expression of MGMT is strongly correlated with poor patient outcomes. Several clinical studies have established that MGMT is an important prognostic biomarker of response to TMZ and patient survival.

8

Probability of GBM Patient Survival Correlated to Expression of MGMT Enzyme

(Unmethylated promoter = High MGMT Expression and Significantly Shorter Survival)

VAL-083 in GBM

VAL-083 is first-in-class DNA targeting agent which readily crosses the blood-brain-barrier. Data from prior NCI-sponsored clinical trials with VAL-083 demonstrate activity against GBM and other central nervous system tumors. In general, historical NCI-sponsored trials demonstrate tumor regression in brain cancer was achieved in 40% of patients treated and stabilization was achieved in an additional 20% to 30% of brain tumor patients following treatment with VAL-083.

VAL-083 demonstrated statistically significant improvement in the median survival of high grade glioma brain tumors, including GBM when combined with radiation versus radiation alone (p value = <0.05) with results similar, or superior to, other chemotherapies approved for the treatment of GBM.

A Summary of Published Data adapted from Separate Sources Comparing the Efficacy of VAL-083

and Other Therapies in the Treatment of GBM

| Comparative Therapy | ||||||

| Chemotherapy | Radiation (XRT) Alone | Radiation + Chemotherapy | Median Survival Benefit vs. XRT alone | |||

VAL-083 (Eagan 1979) | 8.4 months | 16.8 months | 8.4 months | |||

Temozolomide (Temodar®) (Stupp 2005) | 12.1 months | 14.6 months | 2.5 months | |||

| Lomustine (CCNU) (Walker 1976) | 11.8 months | 13 months | 1.2 months | |||

| Carmustine (BCNU) (Reagan 1976) | 10 months | 12.5 months | 2.5 months | |||

| Semustine (ACNU) (Takakura 1986) | 12 months | 14 months | 2.0 months | |||

Our research demonstrates that VAL-083’s unique cytotoxic mechanism forms DNA cross-links at the N7 position of guanine and retains cytotoxic activity independent of MGMT expression in vitro. This mechanism is distinct from that of temozolomide and nitrosoureas, which are DNA-targeting agents commonly used in the treatment of GBM. Of particular importance is in the treatment of GBM resistance to temozolomide, or nitrosoureas, due to activity of the repair enzyme MGMT, which results in chemoresistance in many GBM patients.

9

We have presented data demonstrating that VAL-083 is active independent of MGMT resistance in laboratory studies. VAL-083 has more potent activity against brain tumor cells in comparison to TMZ and overcomes resistance associated with MGMT suggesting the potential to surpass the current standard-of-care in the treatment of GBM.

A

Summary of Our Data Demonstrating that VAL-083’s Anti-Tumor Mechanism is Distinct from, and can

Overcome, MGMT-Related Chemoresistance in the Treatment of GBM

In addition, historical NCI clinical trial data and our own research support the activity of VAL-083 as a potentiator of radiotherapy. Radiotherapy in combination with temozolomide is the current standard of care in the treatment of GBM. Our research demonstrates that temozolomide and radiotherapy are ineffective against GBM cells exhibiting a high expression of MGMT, whereas VAL-083 potentiates the tumor-killing effect of radiation in these cells. Furthermore, the combination of VAL-083 and radiation has been demonstrated to be active against GBM cancer stem cells (CSCs) in vitro. CSCs are often resistant to chemotherapy and form the basis for tumor recurrence and metastasis. GBM CSCs display strong resistance to TMZ, even where MGMT expression is low. However, our data demonstrates that GBM CSCs are susceptible to VAL-083 independent of MGMT expression.

We believe that VAL-083’s more potent activity against brain tumor cells in comparison to TMZ, the ability to overcome MGMT-mediated resistance, and activity against GBM cancer stem cells suggests the potential of VAL-083 to surpass the current standard-of-care in the treatment of GBM.

10

Based on our research demonstrating a novel anti-tumor mechanism and the historical clinical data demonstrating activity against GBM, we have initiated clinical trials in refractory GBM and in MGMT-unmethylated GBM. Our clinical trials in the United States are being conducted under an investigational new drug (“IND”) application with the FDA. If successful, we believe data from these trials will support a potential paradigm shift in the treatment of GBM where VAL-083 could become the chemotherapy of choice in the treatment of the majority of GBM patients.

Clinical Trials of VAL-083 in Refractory GBM

Phase 3: VAL-083 STAR-3 GBM Trial

We recently initiated VAL-083 STAR-3 GBM trial is an adaptive, randomized, controlled pivotal Phase 3 clinical trial in patients with refractory GBM. The trial is designed to assess the efficacy and safety of VAL-083 versus salvage therapy in GBM patients whose disease has progressed following prior treatment with temozolomide and bevacizumab. There is currently no approved standard-of-care therapy for these patients.

A total of up to 180 eligible patients will be randomized at approximately 25 centers in the United States to receive either the investigational drug (VAL-083) or "investigator's choice salvage therapy" in a 2:1 fashion. Up to 120 eligible patients will be randomized to receive intravenous VAL-083 at 40 mg/m2 on days 1, 2, and 3 of a 21-day treatment cycle, for up to 12 21-day treatment cycles or until they fulfill one of the criteria for study discontinuation.

Up to 60 patients will be randomized to "investigator's choice" control, limited to temozolomide, lomustine, or carboplatin, until they fulfill one of the criteria for study discontinuation.

The primary endpoint of the STAR-3 trial is overall survival. The statistical design between the two arms of the study is 90% power, and includes an interim analysis at 50% of events for futility and superiority with O’Brien-Fleming boundary and non-binding, gamma (-5) futility boundary. We have based our assumptions for outcomes for the STAR-3 control arm on published literature. We are also undertaking a review of recent patient data to validate our control arm assumptions. In the event that this analysis suggests that a more conservative assumption is required, we may consider revising the trial design to maintain 90% power for the primary endpoint.

The study is estimated to complete in approximately two years from initiation. A detailed description of the STAR-3 trial can be found at clinicaltrials.gov, Identifier Number: NCT03149575.

Based on our current working capital, we do not have sufficient funding to complete the STAR-3 trial. Until additional funds are available, we plan to initiate the first 8-10 sites and only enroll a subset of patients for whom our cash resources will allow for completion of treatment and follow-up. We believe this strategy will best allow us to maintain timelines for trial completion, NDA submission and FDA approval while seeking further funding through the capital markets, grant funding or strategic partnerships.

Phase 1 – 2 Clinical Trial Overview and Summary of Results

Forty-eight GBM patients were enrolled in our Phase 1/2 clinical trial at five centers: the Mayo Clinic in Rochester, Minnesota; the Brain Tumor Center at University of California, San Francisco; the Sarah Cannon Cancer Research Center in Nashville, Tennessee, Denver, Colorado; and the SCRI affiliate site at the Florida Cancer Specialist Research Institute in Sarasota, Florida.

The Phase 1/2 trial was an open-label, single arm dose-escalation study designed to evaluate the safety, tolerability, pharmacokinetics and anti-cancer activity of VAL-083 in patients with refractory GBM. The trial enrolled GBM patients whose disease has progressed following prior treatment with temozolomide and bevacizumab, unless either or both were contra-indicated.

The overall goal of our Phase 1/2 clinical trial was to determine a modernized dosing regimen for advancement into a pivotal registration-directed Phase 3 clinical trial.

Patients received VAL-083 on days 1,2 and 3 on a 21-day treatment cycle. The Phase 1 portion of the study involved dose escalation cohorts until a maximum tolerated dose (“MTD”) was established at 40mg/m2. A further 14-patient, Phase 2 expansion was then enrolled at the MTD to gather further safety data at our chosen therapeutic dose and to further explore the outcomes in this patient population.

11

In May 2016, we held an end of Phase 2 meeting with the FDA where design of a Phase 3, registration-directed clinical program for VAL-083 in refractory GBM was discussed. Based on the input we received from the FDA, the agency confirmed that it would consider the totality of data available, including data obtained from DelMar's other planned clinical trials in related GBM populations, when assessing the New Drug Application (“NDA”). The FDA also noted that DelMar can rely on prior NCI studies and historical literature to support nonclinical data required for an NDA filing and that DelMar will have the option to file under a 505(b)(2) strategy which allows a sponsor to rely on already established safety and efficacy data in support of an NDA.

We reported updated results of our Phase 1/2 clinical trial at the 2016 ASCO annual meeting. In summary, these data are as follows:

Tumor Response and Outcomes

GBM patients in our Phase 1/2 clinical trial were not re-resected prior to treatment with VAL-083 and therefore had a growing recurrent GBM tumor at the time of enrollment. Patients were monitored for tumor response by MRI.

Consistent with un-resected refractory GBM, median progression free survival (“PFS”) was short at 1.2 months (range: 0.2 – 20.1 months). Five GBM patients treated with VAL-083 were reported to have stable disease as their best response following treatment; the remainder reported progressive disease.

Disease progression is typical in a refractory GBM population with non-resected tumors. However, we believe that slowed progression may provide meaningful clinical benefit in this patient population through prolonged overall survival and improved quality of life. According to published literature, GBM patients failing bevacizumab have a poor prognosis with expected survival under five months.

Ad-hoc subgroup analysis of the Phase 1 dose-escalation data indicated a dose response trend. Increased survival was observed following initiation of treatment in a high dose (30 and 40mg/m2, n=9) sub-group vs. a low dose (≤5mg/m2, n=6) sub-group with median survival of >9 months vs. 4.4 months for the high and low dose groups, respectively.

Observed Survival Based on Phase 1 Sub-Group Analysis

An additional 14 patients were enrolled in an expansion cohort at the MTD (40mg/m2). Analysis of patients receiving an assumed therapeutic dose of VAL-083 (≥20mg/m2) demonstrated median survival of 8.35 months following bevacizumab failure. At the time of the analysis, more than half of patients receiving an assumed therapeutic dose survived more than six months following bevacizumab failure; more than 40% survived for nine months or are currently alive and more than 20% have survived for twelve months or more.

12

ASCO 2016: VAL-083 compared to published literature

| Reference | Post Avastin Salvage Therapy | Median Survival following Bevacizumab Failure | ||

| Shih (2016) | VAL-083 | 8.35 months | ||

| Rahman (2014) | nitrosourea | 4.3 months | ||

| Mikkelson (2011) | TMZ + irinotecan | 4.5 months | ||

| Lu (2011) | dasatinib | 2.6 months | ||

| Reardon (2011) | etoposide | 4.7 months | ||

| Reardon (2011) | TMZ | 2.9 months | ||

| Iwomoto (2009) | various | 5.1 months |

While recognizing these data are representative of a relatively small, non-controlled Phase 1/2 clinical trial, we believe these outcomes support the potential of VAL-083 to offer meaningful clinical benefit to GBM patients who have failed bevacizumab, compared to currently available therapy.

Safety and Tolerability

In the Phase 1 dose escalation regimen, no serious adverse events (“SAE”) related to VAL-083 were encountered at doses up to 40 mg/m2/day.

Increasing frequency of, and higher grade, hematologic toxicities were observed at doses above 40 mg/m2/day. Consistent with the published literature, the observed dose limiting toxicity for VAL-083 is primarily thrombocytopenia (low platelets). Observed platelet nadir occurred at approximately day 18, and recovery was rapid and spontaneous following treatment.

Based on Phase 1 observations, fourteen additional patients were enrolled in a Phase 2 expansion cohort at 40mg/m2, which was established at the MTD. Consistent with Phase 1, the dose of VAL-083 of 40 mg/m2 on days 1, 2 and 3 of a 21-day cycle was generally well tolerated in Phase 2. At this dose, one subject previously treated with CCNU, a nitrosourea agent, reported severe (Grade 4) thrombocytopenia. As a result of this observation, the protocol inclusion criterion for platelet count was increased from 100,000/μL to 150,000/μL for patients receiving prior nitrosoureas within 12 weeks preceding enrollment. No other dose limiting toxicities were observed in Phase 2.

VAL-083 Safety Observations From Phase 1/2 Clinical Trial

| Hematologic parameter and CTCAE grade | dose | ≤30 mg/m2 | 40 mg/m2 | 45 mg/m2 | 50 mg/m2 | |||||||||||||||||||||||||||||||

| n = | 20 | 17 | 4 | 7 |

| |||||||||||||||||||||||||||||||

| Anemia | ≤G2 | 11 | 55 | % | 2 | 12 | % | 2 | 50 | % | 6 | 86 | % | |||||||||||||||||||||||

| G3 | 2 | 10 | % | - | 0 | % | - | 0 | % | - | 0 | % | ||||||||||||||||||||||||

| G4 | - | 0 | % | - | 0 | % | - | 0 | % | - | 0 | % | ||||||||||||||||||||||||

| Leukopenia | ≤G2 | 5 | 25 | % | 2 | 12 | % | - | 0 | % | 5 | 71 | % | |||||||||||||||||||||||

| G3 | 1 | 5 | % | - | 0 | % | - | 0 | % | 3 | 43 | % | ||||||||||||||||||||||||

| G4 | - | 0 | % | - | 0 | % | 2 | 50 | % | - | 0 | % | ||||||||||||||||||||||||

| Neutropenia | ≤G2 | 4 | 20 | % | - | 0 | % | - | 0 | % | - | 0 | % | |||||||||||||||||||||||

| G3 | - | 0 | % | - | 0 | % | - | 0 | % | 3 | 43 | % | ||||||||||||||||||||||||

| G4 | - | 0 | % | - | 0 | % | 2 | 50 | % | 1 | 14 | % | ||||||||||||||||||||||||

| Thrombocytopenia | ≤G2 | 9 | 45 | % | 3 | 18 | % | - | 0 | % | 3 | 43 | % | |||||||||||||||||||||||

| G3 | - | 0 | % | - | 0 | % | 1 | 25 | % | 3 | 43 | % | ||||||||||||||||||||||||

| G4 | - | 0 | % | 1 | 6 | % | 2 | 50 | % | 1 | 14 | % | ||||||||||||||||||||||||

| DLT Observed | nil | 1 | 2 | 2 | ||||||||||||||||||||||||||||||||

13

Doses Achieved

We confirmed that we achieved doses of VAL-083 that are substantially higher than were utilized in the original published NCI-sponsored clinical trials. A summary in comparison to the NCI’s historical regimen is as follows:

Dosing Regimen & Study | Single Dose | Acute Regimen (single cycle) | Comparative Cumulative Dose (@ 35 days) | Dose Intensity (dose per week) | ||||||||

NCI GBM historical regimen (Eagan etal) daily x 5 q 5wks (cycle = 35 days) | 25 mg/m2 | x5 days = | 125 mg/m2 | 125 mg/m2 | 25mg/m2/wk | |||||||

| DelMar VAL-083 optimized regimen daily x 3 q 3wks (cycle = 21 days) | 40 mg/m2 | x3 days = | 120 mg/m2 | 240 mg/m 2 | 40mg/m2/wk | |||||||

Daily x 5 q 5wks refers to a dosing regimen of once per day for five consecutive days every five weeks (35-day cycle); while daily x 3 q 3wks refers to a dosing regimen of once per day for three consecutive days every three weeks (21-day cycle).

Our optimized dosing regimen increases the amount of VAL-083 delivered to the CNS by 60% over historical regimens without increased toxicity. Thus, the DelMar regimen achieves both a higher maximum concentration and higher overall exposure, which we believe may increase the likelihood of successful treatment outcomes in glioblastoma and other brain tumors.

Pharmacokinetics

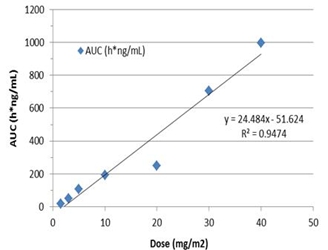

Pharmacokinetic (“PK”) analyses showed dose-dependent linear systemic exposure with a short (1-2h) plasma terminal half-life; average Cmax at 40 mg/m2/day was 781 ng/mL (5.3µM). The observed PK profile is comparable to published literature. Prior NCI-sponsored studies demonstrated that VAL-083 readily crosses the blood brain barrier and has a long (>20 hour) half-life in the central nervous system (“CNS”).

We believe that this PK profile is optimal for the treatment of brain tumors: A long CNS half-life is expected to maximize exposure of the drug in the brain increasing the likelihood of successful treatment outcomes, while a short plasma half-life is desirable to minimize systemic side effects.

14

Observed pharmacokinetics from VAL-083 Phase 1 clinical trial dose vs. AUC

Based on observed and previously published pharmacokinetics, DelMar believes that therapeutic doses equal to, or above, 20 mg/m2 daily on days 1, 2 and 3 of a 21-day cycle should deliver sufficient levels of VAL-083 to brain tumors to achieve a therapeutic benefit.

MGMT & IDH1

High expression of MGMT and wild-type form of the enzyme isocitrate dehydrogenase (“IDH1”) have been previously shown to be diagnostic markers that correlate with resistance to currently available chemotherapies (e.g. temozolomide or nitrosourea) in the treatment of GBM and poor patient outcomes. Measurement of these biomarkers has become routine in clinical practice.

Notably, we have previously demonstrated that VAL-083’s anti-tumor mechanism is active independent from the MGMT status in vitro. While the science behind their importance in the disease pathway and their ultimate predictive value are still being explored, we believe we will ultimately be able to use such biomarkers in a prognostic fashion to select the patients most likely to respond to treatment as we expand the clinical development of VAL-083.

MGMT expression was characterized by PCR and/or ELISA for nineteen GBM patients enrolled in our Phase 1/2 study. IDH1 status was reported in eleven patients; both MGMT and IDH1 status were reported in four patients.

| Biomarker | Observation in Phase 1 /2 clinical trial | ||

| High MGMT (n=19) | 84% | ||

| IDH-WT (n=11) | 90% | ||

Notably, all patients whose samples were tested for both markers were MGMT-unmethylated by PCR and wild-type IDH1, a phenotype that is correlated with particularly poor prognosis.

Clinical Trials of VAL-083 in MGMT-unmethylated GBM

MGMT methylation status has been previously shown to be a diagnostic marker that correlates with patient outcomes and survival in GBM. GBM patients whose tumors are characterized as MGMT-unmethylated exhibit high expression of the DNA-repair enzyme MGMT. High MGMT levels have correlated resistance to currently available chemotherapies (e.g. temozolomide or nitrosourea) and significantly reduced survival. The development of new therapies for MGMT-unmethylated GBM is a significant unmet medical need.

15

Approximately two-thirds of newly diagnosed GBM patients have tumors assessed as MGMT-unmethylated. This represents a potential treatment population of approximately 12,000 patients in the United States and 18,000 patients in Europe annually.

Notably, we have previously demonstrated that VAL-083’s anti-tumor mechanism is active independent from the MGMT status in vitro. This suggests the potential of VAL-083 as a replacement for currently available chemotherapies in MGMT-unmethylated GBM.

Measurement of MGMT methylation status has become routine in clinical practice. We can therefore utilize MGMT-methylation status to identify newly diagnosed GBM patients who are least likely to respond to temozolomide and instead treat them with VAL-083.

We have initiated two Phase 2 clinical trials to explore the potential of VAL-083 in the treatment of MGMT-unmethylated GBM. Expenditures related to our ongoing clinical trials in MGMT-unmethylated GBM are substantially supported through collaborations, which allows us to implement these protocols with minimal impact to our own working capital balance.

Phase 2 Trial in Newly Diagnosed MGMT-unmethylated GBM

In September 2017, we initiated a single arm, biomarker driven open-label Phase 2 study in newly diagnosed MGMT-unmethylated GBM patients at Sun Yat-sen University Cancer Center in Guangzhou, China. The trial is being conducted in the context of our 2012 collaboration agreement with Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. Under the terms of this agreement, Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. is responsible for funding VAL-083 clinical trials that we conduct in China.

In this study, VAL-083 will be combined with radiotherapy as a potential replacement for temozolomide in patients with high expression of MGMT. The main goal of the trial will be to confirm the safety of DelMar’s optimized dosing regimen in combination with radiotherapy and to investigate outcomes of the combination of VAL-083 and radiotherapy in MGMT-unmethylated GBM patients.

Up to 30 newly diagnosed MGMT-unmethylated GBM patients will be enrolled in this trial. The primary efficacy endpoint is the determination of tumor response in patients measured by progression free survival. Assessments of safety and tolerability will be used to support further clinical development of VAL-083 in combination with radiotherapy. Pharmacokinetic assessments of VAL-083 in plasma and cerebral spinal fluid (“CSF”) will be used to correlate drug exposure in the central nervous system with patient outcomes.

Outcomes following treatment with VAL-083 will be compared to MGMT-unmethylated patients in the RTOG0525 trial. We anticipate obtaining safety data from the trial within nine months and top-line outcomes data within 18 months.

Data from the trial will be used to establish a dosing regimen and trial design for advanced registration-directed clinical trials with VAL-083 in newly diagnosed MGMT-unmethylated GBM. If successful, data from the trial will strongly position VAL-083 as a potential replacement for current standard-of-care chemotherapy in the treatment of GBM.

Phase 2 Study in Recurrent MGMT-unmethylated GBM in Collaboration with University of Texas MD Anderson Cancer Center

In January 2017, we initiated a biomarker driven, open-label single-arm Phase 2 study in collaboration with the University of Texas with MD Anderson Cancer Center. This trial will enroll up to 48 MGMT-unmethylated GBM patients whose tumors have recurred following treatment with temozolomide. These patients will not have been treated with prior bevacizumab.

The primary endpoint of the trial is overall survival. Outcomes following treatment with VAL-083 will be compared to the outcome of MGMT-unmethylated patients who had been treated with lomustine (CCNU) following temozolomide failure in the recently published EORTC20601 trial.

16

Safety data from this trial will become part of the overall safety dossier to support future filings with the FDA and other regulatory agencies. A positive outcome will establish a strong position for VAL-083 in the treatment of MGMT-unmethylated GBM.

We anticipate presenting interim data from this trial at peer reviewed meetings during calendar 2018.

Ovarian Cancer

Ovarian cancer is the fifth most common cancer in women and is the leading cause of death among women diagnosed with gynecological malignancies. In 2016, approximately 22,300 women in the US were diagnosed with ovarian cancer and 14,300 died from their disease. If detected early, ovarian cancer can often be cured with surgery. When detected early, up to 90% of patients are likely to survive for >5 years.

Unfortunately, the initial symptoms of ovarian cancer such as abdominal bloating, indigestion, pelvic pain or nausea are often attributed to symptoms caused by less a serious situation. Therefore, in most cases, ovarian cancer isn’t diagnosed until it has progressed to an advanced stage when it is no longer possible to surgically remove all tumor tissue.

Without treatment, ovarian cancer spreads within the pelvic region and metastasizes to distant sites such as the lungs, liver, spleen and, rarely, the brain. When diagnosed at an advanced stage the 5-year survival rate is less than 40%. Women with ovarian cancer receive chemotherapy following surgery to treat residual disease. Pt-based chemotherapy is the standard-of-care in the treatment of advanced ovarian cancer.

Ovarian cancer patients whose tumors are sensitive to Pt-based chemotherapy have the most favorable outcome. Recently, the introduction of PARP inhibitors in the treatment of ovarian cancer patients with Pt-sensitive disease demonstrated significant improvements in overall survival.

Unfortunately, the development of resistance to Pt-based agents is nearly inevitable, leading to disease recurrence and increased mortality. Ultimately, most women with advanced ovarian cancer develop recurrent disease with progressively shorter disease-free intervals. Those whose tumors recur within 6 months of Pt-based therapy are considered Pt-resistant/refractory and have a very poor prognosis.

Currently, there are no high-efficacy therapeutic options for Pt-resistant ovarian tumors, leaving these cancer patients with a very poor prognosis. The response rate to second line therapy for Pt-resistant ovarian cancer patients is in the 10-15% range and overall survival is approximately 12-months. The development of new chemotherapies and targeted agents to overcome Pt resistance in ovarian cancer is a significant unmet medical need.

Treatment Resistance to Pt-based Chemotherapy in Ovarian Cancer

Pt-based chemotherapy is employed in the treatment of nearly 50% of all cancer patients and forms the mainstay as part of the front-line treatment regimen against a range of solid tumors including testicular, ovarian, cervical, bladder, colorectal, head-and-neck, and lung cancer. Pt-based chemotherapy is used to treat nearly all advanced-stage ovarian cancer patients.

Pt-based chemotherapies function by causing extensive damage to a cancer cell’s DNA. When a cell is ready to divide, cellular mechanisms assess potential DNA damage, and if severe damage is identified, the cell will halt the division process and may even be directed to self-destruct. Thus, chemotherapies that target DNA are intended to be lethal to cancer cells, or at least prevent them from dividing to inhibit a tumor’s growth.

Unfortunately, cancer cells are adept at overcoming DNA damage or employing mechanisms to repair damaged DNA. These factors limit the damage that DNA-damaging drugs can do or allow cancer cells to become resistant to chemotherapy. One of the most common obstacles to DNA-damaging chemotherapy is mutations to a gene called p53. Cellular processes governed by the p53 gene are critical in assessing DNA damage and determining if a cell should cease from dividing or self-destruct. When p53 does not function properly, cancer cells continue to divide despite the treatment with DNA-damaging chemotherapy, making these drugs ineffective and leading to treatment resistance. This occurs in nearly all cases of the most difficult ovarian cancer to treat – high grade serous ovarian cancer (HGSOC) – which accounts for up to 70% of ovarian cancer cases and approximately 90% of ovarian cancer deaths. P53 mutations are associated with resistance to Pt-based chemotherapy, which leads to treatment failure and increased mortality. Solving this problem is a major goal in the development of new treatments for ovarian cancer.

17

VAL-083 in Ovarian Cancer

VAL-083 is a first-in-class, DNA-targeting agent that demonstrated activity in prior NCI-sponsored clinical trials. Activity against ovarian epithelial adenocarcinoma (OEA) and squamous cell carcinoma of the cervix (SCC) was reported in multiple studies. Importantly, NCI-researchers recommended VAL-083 for further advanced studies in the treatment of ovarian cancer.

We have presented data demonstrating that VAL-083’s distinct mechanism of action allows activity in tumors that are resistant to other therapies. We have shown that cytotoxicity of VAL-083 against ovarian cancer is independent of sensitivity to cisplatin or p53 status in vitro. We have demonstrated that VAL-083 is active in Pt-resistant ovarian cells harboring a range of p53-mutations. Similar results were observed comparing activity of VAL-083, cisplatin and oxaliplatin in Pt-sensitive and -resistant non-small cell lung cancer (NSCLC) cell lines.

Our research has demonstrated that VAL-083 not only overcomes Pt resistance, but the combination of VAL-083 with Pt-based chemotherapy displays synergy in multiple models in vitro and in vivo. This further suggests a distinct mechanism of action and potential use as part of a VAL-083/Pt-combination therapy.

The combination of VAL-083 with either cisplatin (A) or oxaliplatin (B) in the human H460 (WT p53) NSCLC model demonstrated significant superadditivity (p≤0.05) and/or synergism (CI<1) for both combinations. This cytotoxic effect of VAL-083 in combination with either platinum drug was observed also in A549 (WT p53) and H1975 (mutant p53) NSCLC cells, independently of p53 status (not shown). Data, where applicable, are shown as mean ± SE; N=7.

18

While Pt-based chemotherapy is the standard treatment for ovarian cancer, PARP inhibitors have recently provided a new treatment option for a subset of patients with platinum-sensitive recurrent ovarian cancer. VAL-083 also demonstrates synergistic activity with the PARP inhibitor olaparib in vitro, suggesting VAL-083 may have utility in the treatment of ovarian cancer in combination with PARP inhibitors.

We believe that these data demonstrate the potential of VAL-083 to treat platinum-resistant ovarian cancers as a single-agent against platinum-resistant tumors, combination with platinum-based chemotherapeutic regimens or in combination with PARP inhibitors.

In April 2016, the FDA granted orphan drug designation for the use of VAL-083 in the treatment of ovarian cancer.

We plan to work with our advisors to develop a strategy to advance VAL-083 into clinical trials for the treatment of ovarian cancer, either as a single-agent or in combination with other approved agents.

VAL-083 REPROVe Ovarian Cancer Trial

We have also recently received notice of allowance from the FDA of our IND for a Phase 1/2, Open-Label, Multicenter, Study of VAL-083 in Patients with Recurrent Platinum Resistant Ovarian Cancer (REPROVe).

The Phase 1 portion of the trial will enroll approximately 24 patients with Pt-resistant ovarian cancer to evaluate the response to treatment with VAL-083.

Ovarian cancer patients enrolled in the trial will have been previously treated with at least two lines of Pt-based chemotherapy and up to two other cytotoxic regimens, whose cancer has recurred within 6 months of prior Pt-based chemotherapy.

The primary efficacy of the trial will be overall response rate (“ORR”) based on Response Evaluation Criteria In Solid Tumors (RECIST) criteria. RECIST is a set of published rules that define when tumors in cancer patients improve ("respond"), stay the same ("stabilize"), or worsen ("progress") during treatment.

We plan to request a meeting with FDA following completion of the Phase 1 portion of the REPROVe trial. If successful, data from this trial would lead to a confirmatory Phase 2 study of approximately 60 patients, which if successful, and subject to feedback from the FDA may position us to potentially file an application for accelerated approval or to advance to a pivotal Phase 3 trial.

We anticipate completing the Phase 1 portion of the trial in approximately 18 months from the initiation of patient recruitment and presenting updates on the progress of this trial at peer reviewed meetings.

Based on our current working capital, we do not have sufficient funding to initiate patient enrollment in the REPROVe trial. We have identified sites and will complete certain contracting and site-initiation activities, but will not initiate patient enrollment until we can appropriately fund the treatment and follow-up of patients enrolled in the trial. We believe this strategy will best allow us to maintain timelines for trial completion, NDA submission and FDA approval while seeking further funding through the capital markets, grant funding or strategic partnerships.

Other Indications for VAL-083

VAL-083 in Lung Cancer

Lung cancer is a leading cause of cancer death around the world and effective treatment for lung cancer remains a significant global unmet need despite advances in therapy. In general, prognosis for lung cancer patients remains poor, with a 5-year survival rate of less than 14% among males and less than 18% among females in most countries.

Incidence of lung cancer in the United States is approximately 59 per 100,000 with the majority (52:100,000) being NSCLC. World Health Organization projects that the incidence of lung cancer in China is expected to exceed one million (1,000,000) new cases per year by 2025. Globally, the market for lung cancer treatment may exceed $24 billion by 2033 according to a report published by Evaluate Pharma.

19

The activity of VAL-083 against solid tumors, including lung cancer, has been established in both preclinical and human clinical trials conducted by the NCI. VAL-083 is approved for the treatment of lung cancer in China; however, sales of VAL-083 in China have been limited by a lack of modern data, poor distribution, and preference for targeted therapies such as tyrosine kinase inhibitors (“TKIs”) in the modern era.

Non-small cell lung cancer (“NSCLC”) is the most common type of lung cancer. There are three common forms of NSCLC: adenocarcinomas are often found in an outer area of the lung; squamous cell carcinomas are usually found in the center of the lung next to an air tube (bronchus); and large cell carcinomas, which can occur in any part of the lung and tend to grow and spread faster than adenocarcinoma. NSCLC accounts for 85% of all lung cancer cases in the United States and approximately 90% of lung cancer cases diagnosed in China.

Recently approved immunotherapy drugs such as nivolumab (Opdivo®) and pembrolizumab (Keytruda®) have shown benefit in a subset of patients with recurrent NSCLC whose tumors exhibit immunogenic targets such as PD-L1. Many NSCLC patients’ tumors do not express immunotherapy targets at sufficient levels to trigger an immunotherapy treatment response and the development of resistance to immunotherapy has begun to emerge.

DelMar has developed new nonclinical data to support the utility of VAL-083 in the modern treatment of lung cancer. We have announced results of preclinical studies designed to evaluate the activity of VAL-083 in models of drug-resistant NSCLC in comparison to cisplatin. In an established murine xenograft model of NSCLC, the activity of VAL-083 was compared to standard platinum-based therapy with cisplatin against human NSCLC cell lines A549 (TKI-sensitive) and H1975 (TKI-resistant). In the study, VAL-083 demonstrated superior efficacy and safety in the treatment of TKI-susceptible (A549) tumors and in TKI-resistant (H1975) tumors.

Based on these data, we believe VAL-083’s unique mechanism of action could make it a valuable drug of choice in NSCLC patients who are or become resistant to platinum-based chemotherapy and TKI therapy. In addition, VAL-083 readily crosses the blood brain barrier suggesting that it may be possible for VAL-083 to treat patients whose lung cancer has spread to the brain.

We have developed a clinical trial protocol to explore the activity of VAL-083 in recurrent lung cancer. If successful, we believe data from this trial would support the potential to establish global partnerships and collaborations with larger pharmaceutical companies who have the resources and commercial infrastructure to effectively develop and commercialize VAL-083 as a treatment for NSCLC on a worldwide basis.

It is our current intention to conduct this trial with leading investigators in China under the terms of our collaboration with Guangxi Wuzhou Pharmaceutical Group Co. Ltd. (“Guangxi Wuzhou Pharmaceuticals”), which would allow us to enhance the potential value of VAL-083 without significantly increasing our own planned cash expenditures.

We have determined, in consultation with Guangxi Wuzhou Pharmaceuticals, that initiation of a lung cancer trial should be delayed until our planned China-based MGMT-unmethylated GBM trial had received regulatory approval for initiation. In July 2017, the Human Genetic Resources Administration of China (“HGRAC”) approved the GBM trial, so it is now our intention to work with Guangxi Wuzhou Pharmaceuticals to determine the appropriate strategy and timing for initiation of VAL-083 in clinical trials in lung cancer.

Central Nervous System Metastases of Solid Tumors

In June 2013, we split our Phase 1/2 clinical trial protocol into two separate studies: one focusing solely on refractory GBM and the other focusing on secondary brain cancers caused by other tumors that have spread to the brain. The successful management of systemic tumors by modern targeted therapies has led to increased incidence of mortality due to CNS metastases of lung cancer and other solid tumors.

Based on historical clinical activity and our own research, we believe that VAL-083 may be suitable for the treatment of patients with CNS metastases who currently have limited treatment options. Subject to the availability of financial and operating resources, we plan to develop a separate protocol for the continued exploration of VAL-083 in patients with secondary brain cancer caused by a solid tumor spreading to the brain.

20

Pediatric Brain Tumors

Tumors of the brain and spine make up approximately 20 percent of all childhood cancers and they are the second most common form of childhood cancer after leukemia.

The activity of VAL-083 against childhood and adolescent brain tumors has been established in both preclinical and human clinical trials conducted by the NCI. We have presented data indicating that VAL-083 offers potential therapeutic alternatives for the treatment of pediatric brain tumors including SHH-p53 mutated medulloblastoma. In March 2016, the FDA granted orphan drug designation for the use of VAL-083 in the treatment of medulloblastoma. Subject to the availability of resources, we intend to collaborate with leading academic researchers for the continued exploration of VAL-083 as a potential treatment of childhood brain tumors.

Additional Indications for VAL-083

In historical studies sponsored by the NCI in the United States, VAL-083 exhibited clinical activity against a range of tumor types including central nervous system tumors, solid tumors and hematologic malignancies. We have established new nonclinical data supporting the activity of VAL-083 in different types of cancer that are resistant to modern targeted therapies and we believe that the unique cytotoxic mechanism of VAL-083 may provide benefit to patients in a range of indications. We intend to continue to research these opportunities, and if appropriate, expand our clinical development efforts to include additional indications.

Other Product Opportunities

Through our relationship with Valent Technologies, LLC (“Valent”), a company owned by Dr. Dennis Brown, our Chief Scientific Officer, we have identified additional drug candidates that we may have the opportunity to license or acquire in the future.

VAL-083 Target Markets

DNA-targeting agents such as alkylating agents or platinum-based chemotherapy form the mainstay of chemotherapy treatments used in the treatment of cancers. Global sales of platinum-based chemotherapies reached nearly $2.5 billion in 2011 and declined to $600 million following the expiry of key patents. Alkylating agents such as temozolomide, bendamustine, nitrosoureas, and cyclophosphamide generated more than $1.3 billion in sales in 2016 after reaching a peak of $1.7 billion in 2014 (evaluate pharma).

Fig X: Peak sales of selected DNA-targeting Agents

Our lead product candidate, VAL-083, is a first-in-class DNA targeting agent with a novel mechanism of action. VAL-083’s anti-cancer activity was established in a range of tumor types in prior NCI-sponsored clinical trials. Based on this novel mechanism, we have demonstrated that the anti-cancer activity is maintained against tumor cells that are resistant to other DNA-targeting agents. We believe this positions VAL-083 as a potential chemotherapy-of-choice for patients whose tumors are resistant to current standard-of-care chemotherapy in orphan and major cancer indications.

21

Our ongoing research and development activities are focused on indications where VAL-083 demonstrated promising activity in prior NCI-sponsored trials and where our research suggests an opportunity to address significant unmet medical needs due to the failure of existing treatments.

| VAL-083 target markets | 2022 Estimated Global Sales | |

| Glioblastoma multiforme (GBM) | $1.5B | |

| Ovarian Cancer | $4.6 B | |

| Non-small cell lung cancer (NSCLC) | $24.8 B | |

| Source: Evaluate Pharma |

Glioblastoma Multiforme

GBM is the most common and the most lethal form of glioma. According to the World Health Organization, GBM occurs with an incidence of 3.17 per 100,000 person-years. Approximately 18,000 new cases of GBM are expected to be diagnosed in the United States and 26,000 in Europe during 2017.

Newly diagnosed patients suffering from GBM are initially treated through invasive brain surgery, although disease progression following surgical resection is nearly 100%. Temozolomide (Temodar®) in combination with radiation is the front-line therapy for GBM following surgery. Global revenues of branded Temodar reached $1.1 billion in 2009. Following patent expiry in 2013, global revenue for generic temozolomide exceeded $400 million in 2014 even though most patients fail to gain long-term therapeutic benefits. Approximately 60% of GBM patients treated with Temodar® experience tumor progression within one year.

Bevacizumab (Avastin®) has been approved for the treatment of GBM in patients failing Temodar®. In clinical studies, only about 20% of patients failing Temodar® respond to Avastin® therapy and no improvement in median survival was reported. In spite of these low efficacy results, Avastin revenues exceeded $600 million in 2014.

The market for refractory (Avastin-failed) GBM is limited to those jurisdictions where Avastin is approved for the treatment of GBM. The United States, Canada, Australia, Japan and Switzerland represent the major markets where Avastin is used in the treatment of GBM. Based on our estimates, we believe that VAL-083 could generate sales for the treatment of refractory GBM in the $100’s of millions annually.

The market for MGMT-unmethylated GBM represents approximately two-thirds of all GBM patients worldwide. Based on our estimates, we believe that sales of VAL-083 for the treatment of MGMT-unmethylated GBM could exceed $1 billion annually.

Ovarian Cancer

According to Evaluate Pharma, the annual market for ovarian cancer therapies is projected to exceed $4.6 billion in 2022. The American Cancer Society estimates that approximately 22,000 women will receive a new diagnosis of ovarian cancer and approximately 14,000 women will die from ovarian cancer in the United States each year. Ovarian cancer ranks fifth in cancer deaths among women, accounting for more deaths than any other cancer of the female reproductive system.

The potential of VAL-083 in the treatment of ovarian cancer has been established in prior NCI-sponsored clinical trials and by our recent research. The FDA has granted orphan drug status to VAL-083 as a potential treatment for ovarian cancer and we have recently received notice of allowance for our IND to initiate a Phase 1-2 clinical trial to investigate the safety and effectiveness of VAL-083 in patients with recurrent platinum resistant ovarian cancer (VAL-083 REPROVe trial).

Ovarian cancers are commonly treated with a platinum-based chemotherapy regimen. Initial tumor response rates are relatively high. However, the development of resistance to Pt-based chemotherapy in ovarian cancer patients is nearly inevitable. Our research suggests that VAL-083 may offer a potential treatment option for ovarian cancer patients who are resistant to platinum-based chemotherapy and as a potential combination therapy with other agents. We believe the profile of VAL-083 offers the potential to capture meaningful market share in the multi-billion ovarian cancer market.

22

Lung Cancer

According to Evaluate Pharma, the annual market for lung cancer therapies is projected to reach nearly $25 billion in 2022. Lung cancer is the most common cancer in the world with 1.8 million cases in 2012, representing 13% of all cancers according to a report published by the World Cancer Research Fund International. Lung cancer has a higher mortality rate than the next top three cancers combined and it is responsible for 1.6 million deaths annually, representing 19% of all cancer deaths. NSCLC represents approximately 90% of newly diagnosed lung cancers.

The potential of VAL-083 in the treatment of NSLSC has been established in both human clinical trials conducted by the NCI and by the drug’s commercial approval in China. We believe the profile of VAL-083 offers the potential to capture meaningful market share in the multi-billion NSCLC market.

VAL-083 Manufacturing

VAL-083 is a small-molecule chemotherapeutic. Chemical synthesis of the active pharmaceutical ingredient (“API”) was initially established by the NCI. We have made improvements to this process and have obtained patents on these improvements. The current manufacturing process involves fewer than five synthetic steps.

VAL-083 drug product is a lyophilized (freeze-dried) formulation that is reconstituted for intravenous injection. We anticipate that overall cost of goods for an eventual commercial product will be similar to other injectable, small-molecule pharmaceuticals.

For our Phase 3 clinical trial, we have engaged third-party contract manufacturers with the capabilities to establish the processes, procedures and quality systems necessary to meet U.S., Canadian, E.U. and other international manufacturing requirements in accordance with Good Manufacturing Practice (“cGMP”) regulations.