Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TOYS R US INC | tru92020178-k.htm |

0.78.188

8.98.173

234.26.91

244.129.32

110.174.85

158.45.43

117.117.117

198.198.198

31

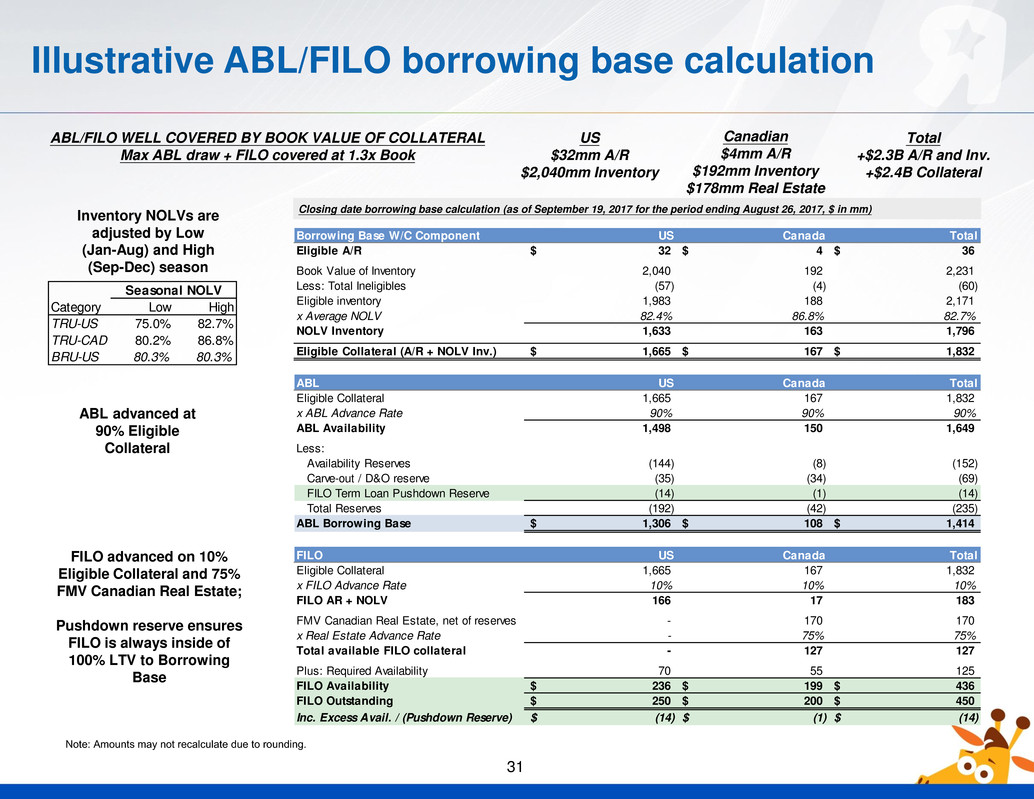

Illustrative ABL/FILO borrowing base calculation

ABL/FILO WELL COVERED BY BOOK VALUE OF COLLATERAL

Max ABL draw + FILO covered at 1.3x Book

US

$32mm A/R

$2,040mm Inventory

Canadian

$4mm A/R

$192mm Inventory

$178mm Real Estate

Total

+$2.3B A/R and Inv.

+$2.4B Collateral

Inventory NOLVs are

adjusted by Low

(Jan-Aug) and High

(Sep-Dec) season

Category Low High

TRU-US 75.0% 82.7%

TRU-CAD 80.2% 86.8%

BRU-US 80.3% 80.3%

Seasonal NOLV

ABL advanced at

90% Eligible

Collateral

Closing date borrowing base calculation (as of September 19, 2017 for the period ending August 26, 2017, $ in mm)

FILO advanced on 10%

Eligible Collateral and 75%

FMV Canadian Real Estate;

Pushdown reserve ensures

FILO is always inside of

100% LTV to Borrowing

Base

Borrowing Base W/C Component US Canada Total

Eligible A/R 32$ 4$ 36$

Book Value of Inventory 2,040 192 2,231

Less: Total Ineligibles (57) (4) (60)

Eligible inventory 1,983 188 2,171

x Average NOLV 82.4% 86.8% 82.7%

NOLV Inventory 1,633 163 1,796

Eligible Collateral (A/R + NOLV Inv.) 1,665$ 167$ 1,832$

ABL US Canada Total

Eligible Collateral 1,665 167 1,832

x ABL Advance Rate 90% 90% 90%

ABL Availability 1,498 150 1,649

Less:

Availability Reserves (144) (8) (152)

Carve-out / D&O reserve (35) (34) (69)

FILO Term Loan Pushdown Reserve (14) (1) (14)

Total Reserves (192) (42) (235)

ABL Borrowing Base 1,306$ 108$ 1,414$

FILO US Canada Total

Eligible Collateral 1,665 167 1,832

x FILO Advance Rate 10% 10% 10%

FILO AR + NOLV 166 17 183

FMV Cana ian Real Estate, net of reserves - 170 170

x R l Estate Advance Rate - 75% 75%

Total available FILO collateral - 127 127

Plus: Required Availability 70 55 125

FILO Availability 236$ 199$ 436$

FILO Outstanding 250$ 200$ 450$

Inc. Excess Avail. / (Pushdown Reserve) (14)$ (1)$ (14)$

Note: Amounts may not recalculate due to rounding.