Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MERCER INTERNATIONAL INC. | d453393d8k.htm |

Exhibit 99.1

Exhibit 99.1

Driving

Profitable Growth

2017 TD Forest Products Forum

September 20, 2017

David K. Ure

Senior Vice

President,

Chief Financial Officer & Secretary

The Private

Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information included in this presentation contains statements that are forward-looking, such as statements relating to results of

operations and financial conditions and business development activities, as well as capital spending and financing sources. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated

results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of Mercer. For more information regarding these risks and uncertainties, review Mercer’s

filings with the United States

Securities and Exchange Commission. Unless required by law, we do not assume any obligation to update forward-looking statements

based on unanticipated events or changed expectations.

2

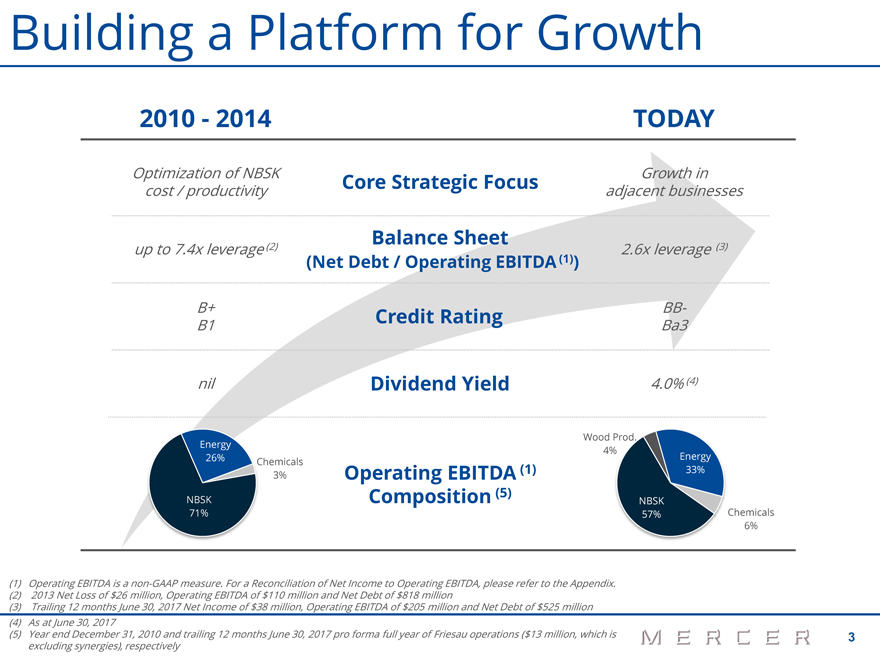

Building a Platform for Growth

2010—2014 TODAY

Optimization of NBSK Core Strategic Focus Growth in cost / productivity

adjacent businesses

Balance Sheet

up to 7.4x leverage (2) / Operating (1)

2.6x leverage (3)

(Net Debt EBITDA )

B+ Credit Rating BB-

B1 Ba3

nil Dividend Yield 4.0% (4)

Wood Prod.

Energy

4%

26% Energy Chemicals

(1) 33%

3% Operating EBITDA

(5)

NBSK Composition NBSK

71% 57% Chemicals

6%

(1) Operating EBITDA is a non-GAAP measure. For a Reconciliation of Net Income to Operating EBITDA, please refer to

the Appendix. (2) 2013 Net Loss of $26 million, Operating EBITDA of $110 million and Net Debt of $818 million (3) Trailing 12 months June 30, 2017 Net Income of $38 million,

Operating EBITDA of $205 million and Net Debt of $525 million (4) As at June 30, 2017

(5) Year end

December 31, 2010 and trailing 12 months June 30, 2017 pro forma full year of Friesau operations ($13 million, which is 3 excluding synergies), respectively

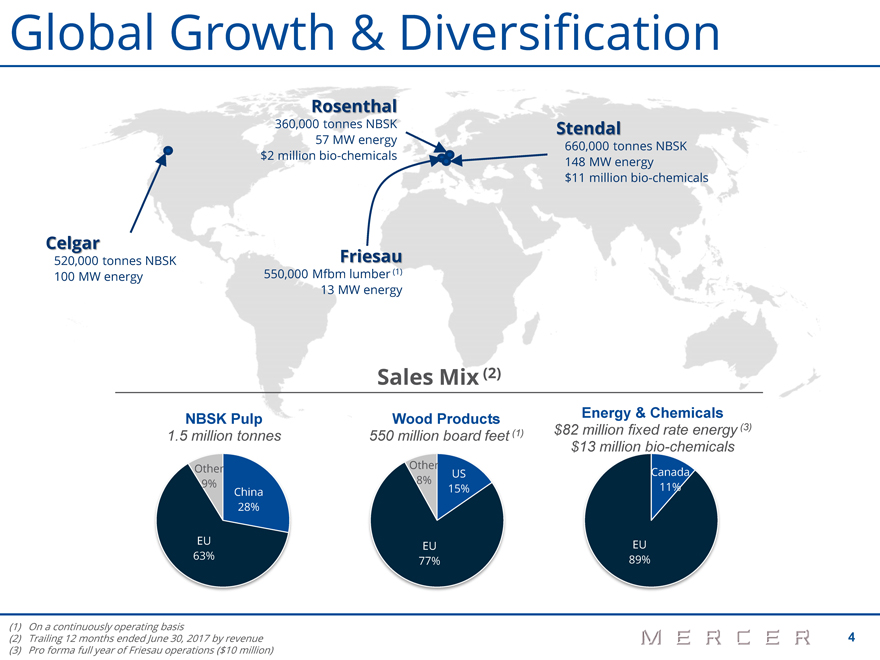

Global Growth & Diversification

Rosenthal

360,000 tonnes NBSK Stendal

57 MW energy 660,000 tonnes NBSK $2 million bio-chemicals 148 MW energy $11 million bio-chemicals

Celgar

520,000 tonnes NBSK

Friesau 100 MW energy 550,000 Mfbm lumber (1)

13 MW energy

Sales Mix (2)

NBSK Pulp Wood Products Energy & Chemicals $82 million fixed rate energy (3) 1.5 million tonnes 550 million board feet (1) $13 million

bio-chemicals

Other Other

US Canada

9% 8%

China 15% 11% 28%

EU EU EU 63% 77% 89%

(1) On a continuously operating basis 4

(2) Trailing 12 months ended June 30, 2017 by revenue (3) Pro forma full year of Friesau operations ($10 million)

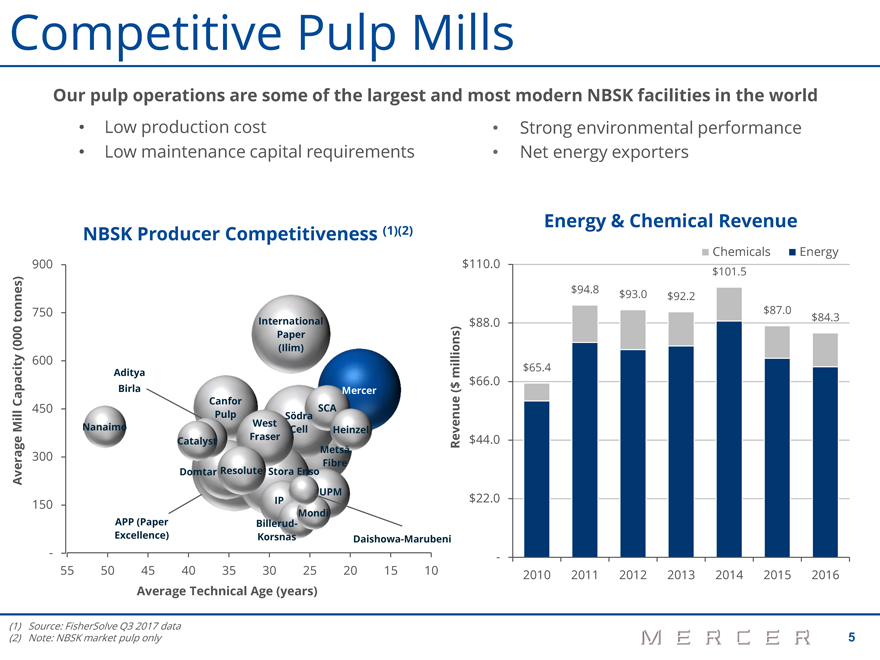

Competitive Pulp Mills

Our pulp operations are some of the largest and most modern NBSK facilities in the world

Low production cost

Low maintenance capital requirements

Strong environmental performance Net energy exporters

Average Mill Capacity (000 tonnes)

NBSK Producer Competitiveness (1)(2)

900

750

International

Paper

(Ilim)

600

Aditya

Birla Mercer

Canfor

450

SCA

Pulp Södra

Nanaimo West Cell

Heinzel

Catalyst

Fraser

300 Metsä

Domtar Resolute Stora Enso Fibre

UPM

150 IP Mondi

APP (Paper Billerud-

Excellence) Korsnas Daishowa-Marubeni

-

55 50 45 40 35 30 25 20 15 10

Average Technical Age (years)

Energy & Chemical Revenue

Chemicals Energy

$110.0 $101.5

$94.8 $93.0 $92.2

$87.0

$88.0 $84.3

$65.4

$66.0

$44.0

$22.0

-

2010 2011 2012 2013 2014 2015 2016

Revenue ($ millions)

(1) Source: FisherSolve Q3 2017 data

(2) Note:

NBSK market pulp only 5

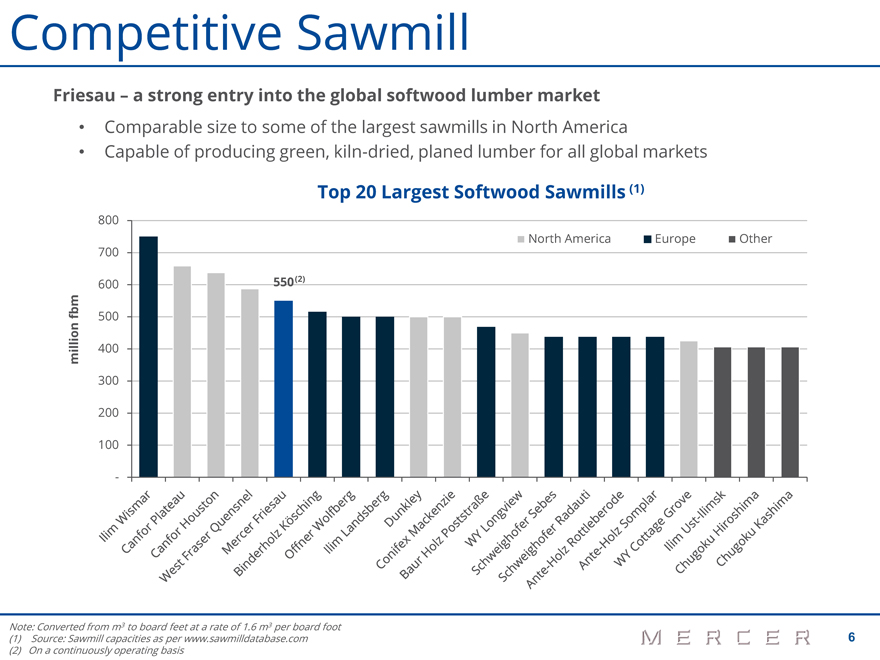

Competitive Sawmill

Friesau – a strong entry into the global softwood lumber market

Comparable size to some of the largest sawmills in North America

Capable of

producing green, kiln-dried, planed lumber for all global markets

Top 20 Largest Softwood Sawmills (1)

million fbm

800

700 North America Europe Other 600 550 (2) 500

400 300 200 100 -

Note: Converted from m3 to board feet at a rate of 1.6 m3 per board foot

(1) Source: Sawmill

capacities as per www.sawmilldatabase.com 6 (2) On a continuously operating basis

Core Competencies

Innovation

Wood Merchandising

Large buyer of wood in central Europe

Buying full spectrum of pulpwood and sawlog

grades and selling grades surplus to our needs

Eastern Europe Reach

Source all wood grades from traditionally harder to

access countries in eastern Europe through

our JV

Optimized logistics in our procurement region

Mobilization of Waste

Wood

Negotiated contracts and constructed equipment

to recover wood in BC

previously left behind to be

burned after harvesting

Optimized logistics in

our procurement region

Wood Logistics

Maintain fleet of 300 railcars

200 patent-protected, custom, high volume log

railcars which allow us to

economically source fiber

from considerable distances

Dedicated Baltic Sea

port with a direct link to

Stendal and Friesau enables deep reach into

Scandinavia, Russia, Estonia, Latvia and UK

7

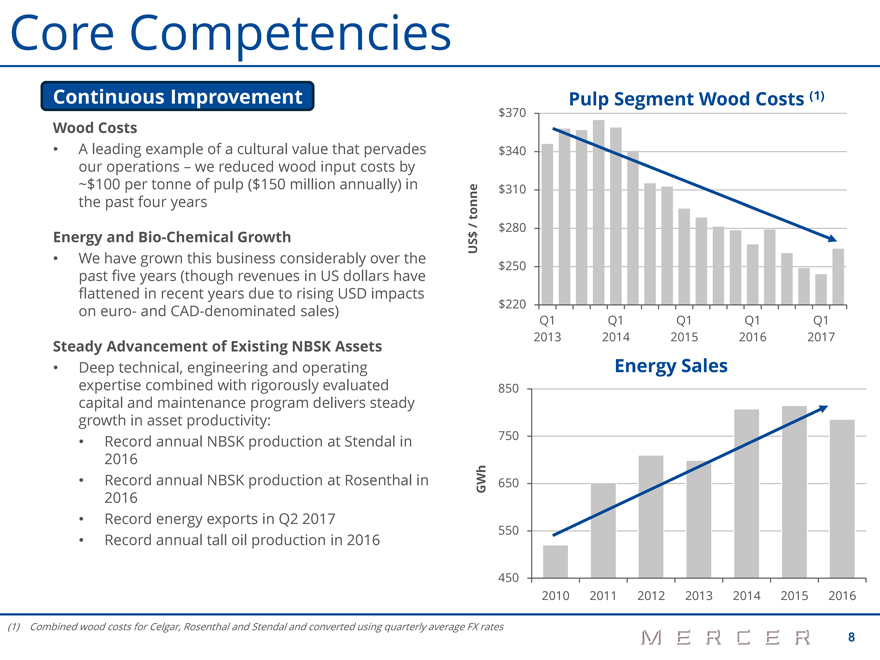

Core Competencies

Continuous Improvement

Wood Costs

A leading example of a cultural value that pervades

our operations – we reduced wood

input costs by

~$100 per tonne of pulp ($150 million annually) in

the

past four years

Energy and Bio-Chemical Growth

We have grown this business considerably over the

past five years (though revenues in US

dollars have

flattened in recent years due to rising USD impacts

on euro- and

CAD-denominated sales)

Steady Advancement of Existing NBSK Assets

Deep technical, engineering and operating

expertise combined with rigorously evaluated

capital and maintenance program delivers steady

growth in asset productivity:

Record annual NBSK production at Stendal in

2016

Record annual NBSK production at Rosenthal in

2016

Record energy exports in Q2 2017

Record annual tall oil production in 2016

US$ / tonne GWh

Pulp Segment Wood Costs (1)

$ 370

$ 340

$ 310

$ 280

$ 250

$ 220 Germany

Q1 Q1 Q1 Q1 Q1

2013 2014 2015 2016 2017

Energy Sales

850

750

650

550

450

2010 2011 2012 2013 2014 2015 2016

(1) Combined wood costs for Celgar, Rosenthal and Stendal

and converted using quarterly average FX rates 8

Core Competencies

Execution Excellence

2013

Workforce reduction at Celgar – cost reduction

2014

Workforce reduction at Stendal – cost reduction

Project “Blue Mill” expansion

of pulp and energy

production at Stendal – higher pulp and energy

production

Tall oil plant at Rosenthal

2015

Upgraded evaporation plants at Stendal and

Rosenthal

Tall oil production optimization at Stendal and

Rosenthal

2016

New high capacity log rail car fleet – wood cost

reduction

Focus on high return upgrades at Celgar

Expansion of railway reload at Celgar – pulp

delivery cost reduction

New long log rail acceptance capabilities at

Rosenthal – more flexible wood fiber sourcing

New chip receiving

facility at Rosenthal

9

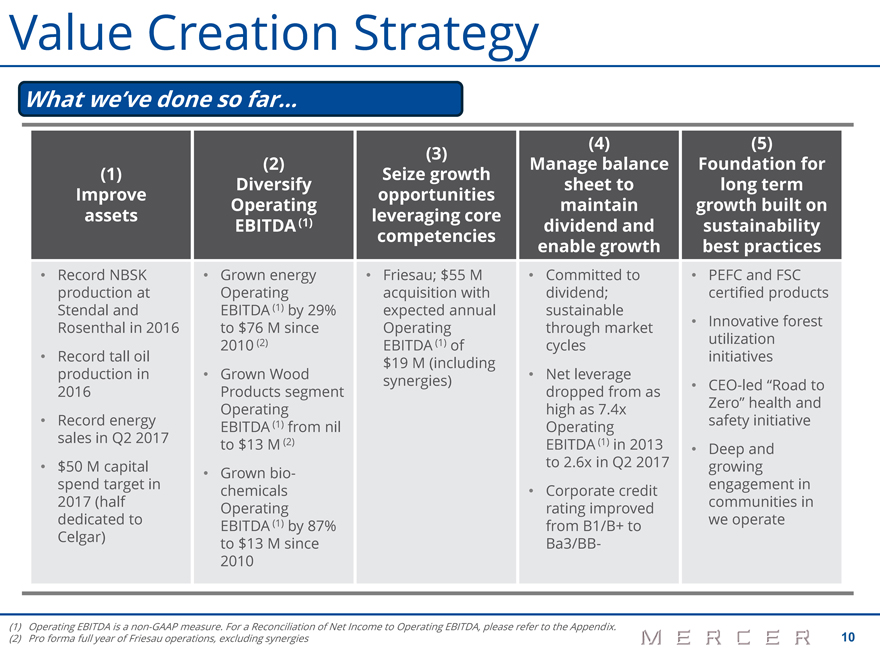

Value Creation Strategy

What we’ve done so far…

(1) Improve assets

Record NBSK production at Stendal and Rosenthal in 2016 Record tall oil production in 2016 Record energy sales in Q2 2017

$50 M capital spend target in 2017 (half dedicated to Celgar)

(2) Diversify Operating EBITDA

(1)

Grown energy Operating EBITDA (1) by 29% to $76 M since 2010 (2) Grown Wood Products segment Operating EBITDA (1) from nil to $13 M (2) Grown

biochemicals Operating EBITDA (1) by 87% to $13 M since 2010

(3) Seize growth opportunities leveraging core competencies

Friesau; $55 M acquisition with expected annual Operating EBITDA (1) of

$19 M (including

synergies)

(4) Manage balance sheet to maintain dividend and enable growth

Committed to dividend; sustainable through market cycles Net leverage dropped from as high as 7.4x Operating EBITDA (1) in 2013 to 2.6x in Q2 2017 Corporate

credit rating improved from B1/B+ to Ba3/BB-

(5) Foundation for long term growth built on sustainability best practices

PEFC and FSC certified products Innovative forest utilization initiatives

CEO-led “Road to Zero” health and safety initiative Deep and growing engagement in communities in we operate

(1) Operating EBITDA is a non-GAAP measure. For a Reconciliation of Net Income to Operating EBITDA,

please refer to the Appendix. 10 (2) Pro forma full year of Friesau operations, excluding synergies

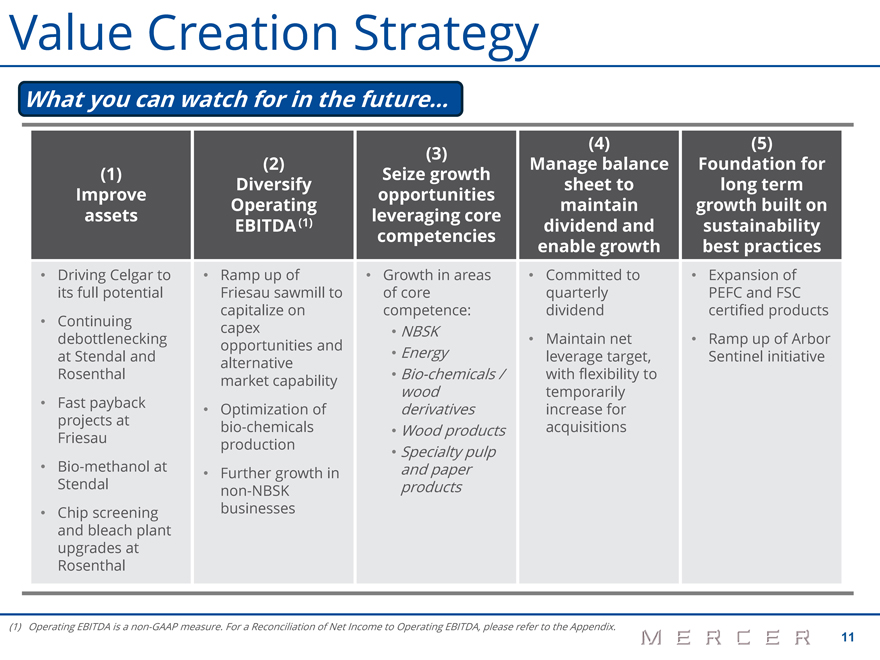

Value Creation Strategy

What you can watch for in the future…

(1) Improve assets

Driving Celgar to its full potential Continuing debottlenecking at Stendal and Rosenthal Fast payback projects at Friesau Bio-methanol at

Stendal Chip screening and bleach plant upgrades at Rosenthal

(2) Diversify Operating EBITDA (1)

Ramp up of Friesau sawmill to capitalize on capex opportunities and alternative market capability Optimization of bio-chemicals production

Further growth in non-NBSK businesses

(3) Seize growth opportunities leveraging core competencies

Growth in areas of core competence:

NBSK Energy Bio-chemicals / wood derivatives Wood products

Specialty pulp and paper products

(4) Manage balance sheet to maintain dividend and enable growth

Committed to quarterly dividend Maintain net leverage target, with flexibility to temporarily increase for acquisitions

(5) Foundation for long term growth built on sustainability best practices

Expansion of PEFC

and FSC certified products Ramp up of Arbor Sentinel initiative

(1) Operating EBITDA is a non-GAAP

measure. For a Reconciliation of Net Income to Operating EBITDA, please refer to the Appendix. 11

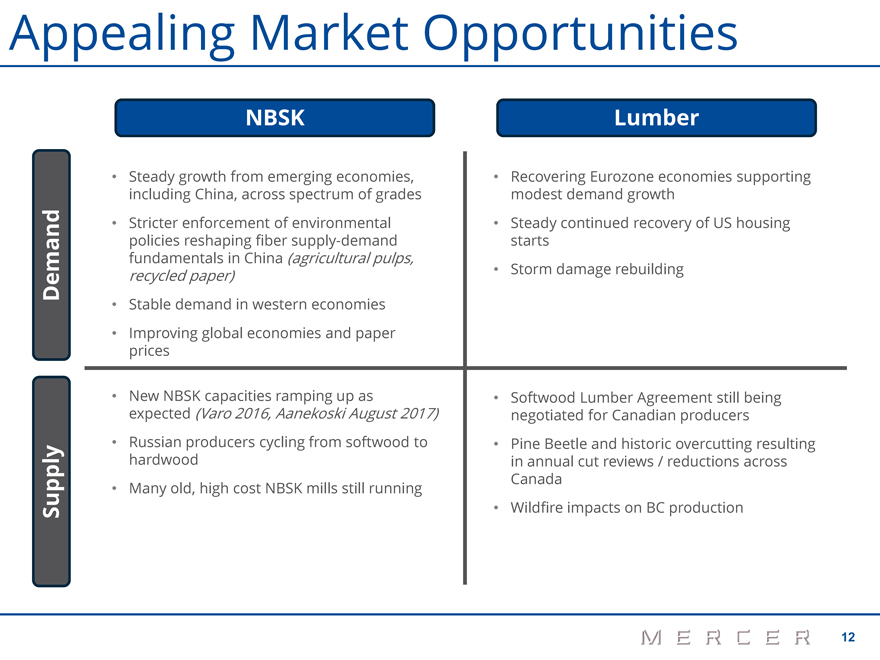

Appealing Market Opportunities

NBSK Lumber

Supply Demand

Steady growth from emerging economies, including China, across spectrum of grades Stricter enforcement of environmental policies reshaping fiber supply-demand fundamentals in China

(agricultural pulps, recycled paper)

Stable demand in western economies Improving global economies and paper prices

New NBSK capacities ramping up as expected (Varo 2016, Aanekoski August 2017)

Russian

producers cycling from softwood to hardwood Many old, high cost NBSK mills still running

Recovering Eurozone economies supporting modest demand growth Steady

continued recovery of US housing starts Storm damage rebuilding

Softwood Lumber Agreement still being negotiated for Canadian producers Pine Beetle and historic

overcutting resulting in annual cut reviews / reductions across Canada Wildfire impacts on BC production

12

Strong Profitable Growth Foundation

Attractive long-term fundamentals in key markets

Management committed to growth, in spaces

where we have clear competencies

Consistent investor return, commitment to the dividend

Strong balance sheet discipline, within solid parameters

Commitment to best practices, CSR and

operational excellence a strong foundation for long term value creation

13

MERCER

MERCER

Appendix

Reconciliation of Net Income to

Operating EBITDA

15

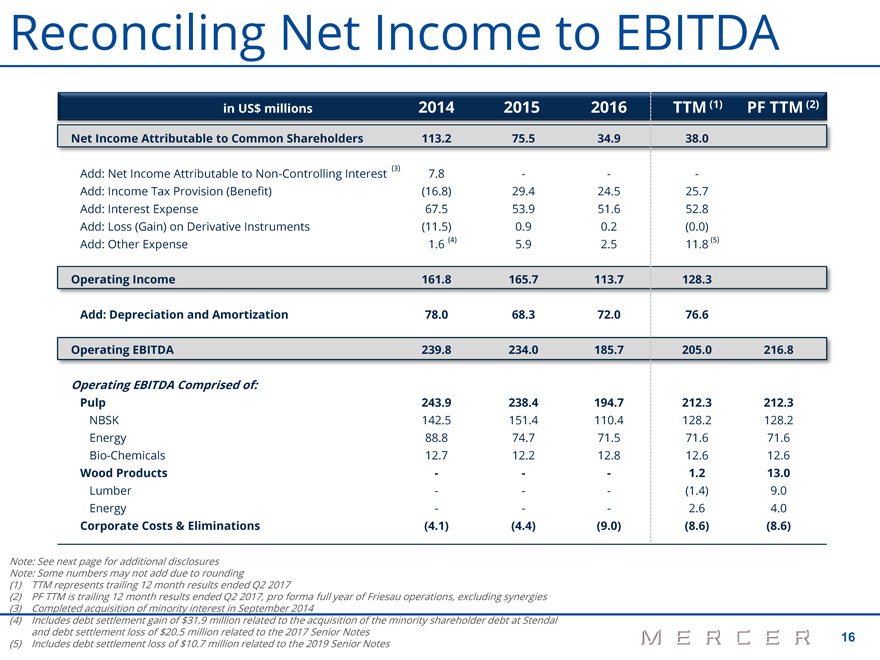

Reconciling Net Income to EBITDA

in US$ millions 2014 2015 2016 TTM (1) PF TTM (2)

Net Income Attributable to Common

Shareholders 113.2 75.5 34.9 38.0

Add: Net Income Attributable to Non-Controlling Interest (3) 7.8 - - -

Add: Income Tax Provision (Benefit) (16.8) 29.4 24.5 25.7

Add: Interest Expense 67.5 53.9 51.6

52.8

Add: Loss (Gain) on Derivative Instruments (11.5) 0.9 0.2 (0.0)

Add:

Other Expense 1.6 (4) 5.9 2.5 11.8 (5)

Operating Income 161.8 165.7 113.7 128.3

Add: Depreciation and Amortization 78.0 68.3 72.0 76.6

Operating EBITDA 239.8

234.0 185.7 205.0 216.8

Operating EBITDA Comprised of:

Pulp 243.9 238.4 194.7

212.3 212.3

NBSK 142.5 151.4 110.4 128.2 128.2

Energy 88.8 74.7 71.5 71.6

71.6

Bio-Chemicals 12.7 12.2 12.8 12.6 12.6

Wood Products - - - 1.2 13.0

Lumber - - - (1.4) 9.0

Energy - - - 2.6 4.0

Corporate Costs & Eliminations (4.1) (4.4) (9.0) (8.6) (8.6)

Note: See next page for additional disclosures

Note: Some numbers may not add

due to rounding

(1) TTM represents trailing 12 month results ended Q2 2017

(2) PF TTM is trailing 12 month results ended Q2 2017, pro forma full year of Friesau operations, excluding synergies (3) Completed acquisition of minority

interest in September 2014 (4) Includes debt settlement gain of $31.9 million related to the acquisition of the minority shareholder debt at Stendal and debt settlement loss of $20.5 million related to the 2017 Senior Notes 16 (5) Includes

debt settlement loss of $10.7 million related to the 2019 Senior Notes

Reconciling Net Income to EBITDA

Note: For other reconciliations of Net Income (Loss) to Operating EBITDA in periods not shown, please refer to that period’s respective Form

10-Q or 10-K, which can be found on our website (www.mercerint.com)

Operating

EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. Management uses Operating EBITDA as a benchmark measurement of its own

operating results, and as a benchmark relative to its competitors. Management considers it to be a meaningful supplement to operating income (loss) as a performance measure primarily because depreciation expense and

non-recurring capital asset impairment charges are not an actual cash cost, and depreciation expense varies widely from company to company in a manner that management considers largely independent of the

underlying cost efficiency of their operating facilities. In addition, we believe Operating EBITDA is commonly used by securities analysts, investors and other interested parties to evaluate our financial performance. Operating EBITDA does not

reflect the impact of a number of items that affect our net income (loss) attributable to common shareholders, including financing costs and the effect of derivative instruments. Operating EBITDA is not a measure of financial performance under the

accounting principles generally accepted in the United States of America

(“GAAP”), and should not be considered as an alternative to net income (loss) or

income (loss) from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of liquidity.

Operating EBITDA

has significant limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Operating EBITDA should only be considered as a supplemental performance measure and

should not be considered as a measure of liquidity or cash available to us to invest in the growth of our business. Because all companies do not calculate Operating EBITDA in the same manner, Operating EBITDA as calculated by us may differ from

Operating EBITDA or EBITDA as calculated by other companies. We compensate for these limitations by using Operating EBITDA as a supplemental measure of our performance and by relying primarily on our GAAP financial statements.

17