Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Griffin Realty Trust, Inc. | pressreleasegceariifollo.htm |

| EX-4.3 - EXHIBIT 4.3 - Griffin Realty Trust, Inc. | classtclasssclassdclassish.htm |

| EX-4.2 - EXHIBIT 4.2 - Griffin Realty Trust, Inc. | iposhareredemptionprogram.htm |

| 8-K - 8-K - Griffin Realty Trust, Inc. | form8-krenavofferingsept20.htm |

? ? ? ? ? ? ?? ? ? ? ? ? ? ? ? ? ? ? ? 1

September 20, 2017

Dear Fellow Stockholder:

I am pleased to announce that today, September 20, Griffin Capital Essential Asset REIT II (“GCEARII”)

commenced a follow-on offering of its common stock in an effort to raise additional equity and acquire more

properties to add to our already strategically diversified portfolio. As you are aware, to date we have built an

outstanding portfolio comprised of 27 properties representing 7.34 million square feet of space and totaling

$1.12 billion of acquisition cost. Our properties have a weighted average lease duration of nearly 11 years

and approximately 80% of our net income is generated by tenants and/or a ‘parent’ with an investment

grade rating. Though we are pleased with the portfolio we have assembled, both the GCEARII management

team and board of directors believe that in order to maximize stockholder value and enhance monetization

optionality (for example, a listing or a merger), we need more breadth, depth and scale to the portfolio, hence,

the follow-on offering.

This letter is intended to notify you of the launch of the follow-on offering, highlight certain of the changes in

share structure we believe will benefit existing stockholders and further explain our rationale relating to the

same. NO ACTION IS REQUIRED BY YOU.

In our initial offering for GCEARII we provided investors three alternative classes of shares, Class A, T and I, and

we are required by regulators to update our net asset value (or NAV) per share on an annual basis. By contrast,

the follow-on offering will deploy share class structures commonly referred to as ‘Daily NAV’ share classes,

which structure requires us to establish a new NAV per share on a daily basis. This daily frequency now applies

to all share classes and provides all stockholders significantly greater visibility and transparency to our net asset

value per share.

The new Daily NAV share classes allow for redemptions on a quarterly basis at a recently determined NAV after

being held for one year. The existing stockholders, however, are still subject to the share redemption program

as outlined in the prospectus when you acquired your shares. In short, there is a one-year lock out period from

the date of your purchase and, subsequently, you may redeem at the lesser of your per share purchase price or

the per share NAV at 90% in year two, 95% in year three and 97.5% in year four. Thereafter, you will have the

same share redemption options as provided to the Daily NAV stockholders which is the ability to redeem at

100% of the then NAV per share.

Whereas you will not have the same degree of liquidity in the short term relative to the new Daily NAV

brokerage share classes, you will earn an effectively higher distribution.

Exhibit 99.1

? ? ? ? ? ? ?? ? ? ? ? ? ? ? ? ? ? ? ? 2

We also included other structural enhancements that will inure to all stockholders including:

• A reduction in the asset management fees paid to the advisor, which fee percentage is now a function of

equity under management as opposed to assets under management

• Elimination of fees paid to the advisor to acquire and/or dispose of properties

• A restructured performance fee that aligns the advisor’s interests with GCEARII’s overall financial performance

The combination of reduced fees and meaningfully reduced operating expenses will, on a relative basis, improve

the overall financial performance of GCEARII. We believe that this will, in turn, drive a more favorable

stockholder outcome.

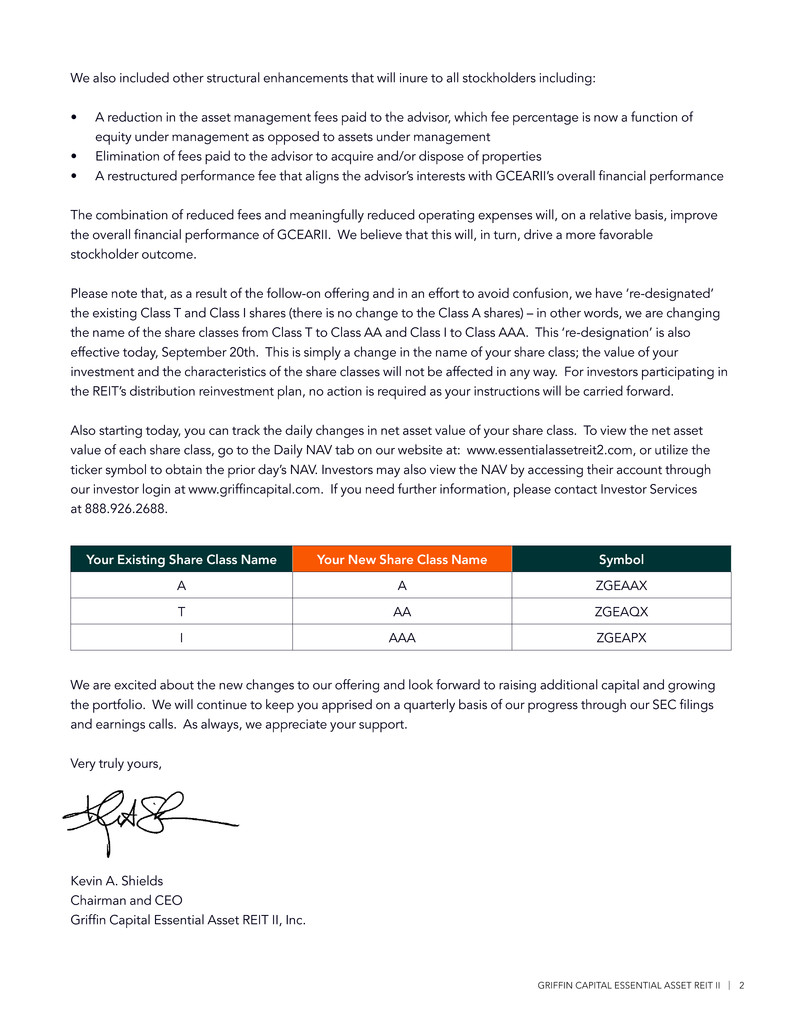

Please note that, as a result of the follow-on offering and in an effort to avoid confusion, we have ‘re-designated’

the existing Class T and Class I shares (there is no change to the Class A shares) – in other words, we are changing

the name of the share classes from Class T to Class AA and Class I to Class AAA. This ‘re-designation’ is also

effective today, September 20th. This is simply a change in the name of your share class; the value of your

investment and the characteristics of the share classes will not be affected in any way. For investors participating in

the REIT’s distribution reinvestment plan, no action is required as your instructions will be carried forward.

Also starting today, you can track the daily changes in net asset value of your share class. To view the net asset

value of each share class, go to the Daily NAV tab on our website at: www.essentialassetreit2.com, or utilize the

ticker symbol to obtain the prior day’s NAV. Investors may also view the NAV by accessing their account through

our investor login at www.griffincapital.com. If you need further information, please contact Investor Services

at 888.926.2688.

We are excited about the new changes to our offering and look forward to raising additional capital and growing

the portfolio. We will continue to keep you apprised on a quarterly basis of our progress through our SEC filings

and earnings calls. As always, we appreciate your support.

Very truly yours,

Kevin A. Shields

Chairman and CEO

Griffin Capital Essential Asset REIT II, Inc.

Your Existing Share Class Name Your New Share Class Name Symbol

A A ZGEAAX

T AA ZGEAQX

I AAA ZGEAPX