Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Gogo Inc. | d436148dex991.htm |

| 8-K - 8-K - Gogo Inc. | d436148d8k.htm |

September 2017 Investor Presentation Exhibit 99.2 GOGOAIR.COM | ©2017 Gogo Inc. and Affiliates. Proprietary & Confidential.

Safe harbor statement This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are based on management’s beliefs and assumptions and on information currently available to management. Most forward-looking statements contain words that identify them as forward-looking, such as “anticipates,” “believes,” “continues,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms that relate to future events. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Gogo’s actual results, performance or achievements to be materially different from any projected results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent the beliefs and assumptions of Gogo only as of the date of this presentation and Gogo undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. As such, Gogo’s future results may vary from any expectations or goals expressed in, or implied by, the forward-looking statements included in this presentation, possibly to a material degree. Gogo cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial or operational goals and targets will be realized. In particular, the availability and performance of certain technology solutions yet to be implemented by the Company set forth in this presentation represent aspirational long-term goals based on current expectations. For a discussion of some of the important factors that could cause Gogo’s results to differ materially from those expressed in, or implied by, the forward-looking statements included in this presentation, investors should refer to the disclosure contained under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s filings with the SEC, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Note to Certain Operating and Financial Data In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), Gogo also discloses in this presentation certain non-GAAP financial information, including Adjusted EBITDA. This financial measure is not a recognized measure under GAAP, and when analyzing our performance, investors should use Adjusted EBITDA in addition to, and not as an alternative to, net loss attributable to common stock as a measure of operating results. In addition, this presentation contains various customer metrics and operating data, including numbers of aircraft or units online, that are based on internal company data, as well as information relating to the commercial and business aviation market, and our position within those markets. While management believes such information and data are reliable, they have not been verified by an independent source and there are inherent challenges and limitations involved in compiling data across various geographies and from various sources.

Today’s speakers GOGOAIR.COM | Michael Small President and Chief Executive Officer Barry Rowan Executive Vice President and Chief Financial Officer Varvara Alva Vice President, Investor Relations and Treasurer

GOGOAIR.COM | Transaction Overview Who We Are Strong Execution And Path To Profitability Why Invest In Gogo

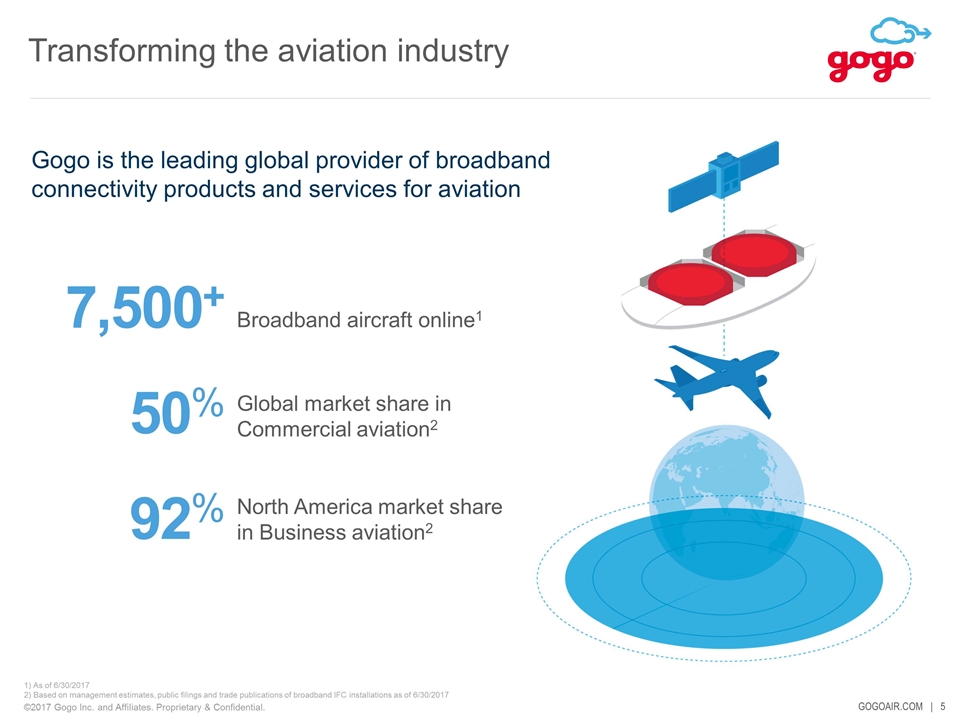

Transforming the aviation industry 1) As of 6/30/2017 2) Based on management estimates, public filings and trade publications of broadband IFC installations as of 6/30/2017 7,500+ 50% 92% North America market share in Business aviation2 Broadband aircraft online1 Global market share in Commercial aviation2 Gogo is the leading global provider of broadband connectivity products and services for aviation

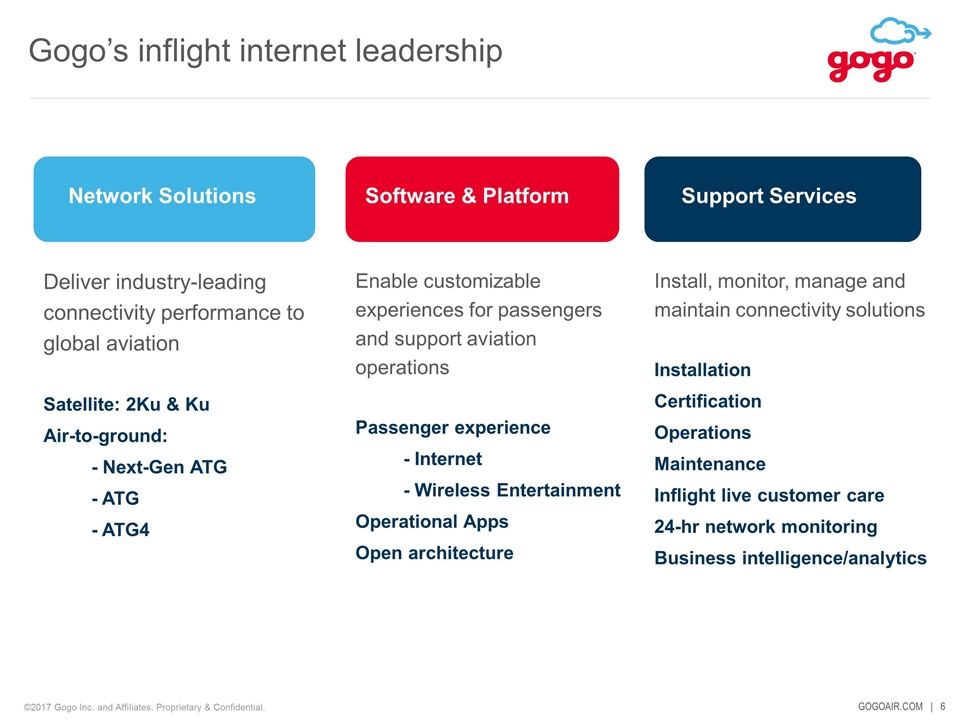

Gogo’s inflight internet leadership Network Solutions Software & Platform Support Services Deliver industry-leading connectivity performance to global aviation Satellite: 2Ku & Ku Air-to-ground: - Next-Gen ATG - ATG - ATG4 Enable customizable experiences for passengers and support aviation operations Passenger experience - Internet - Wireless Entertainment Operational Apps Open architecture Install, monitor, manage and maintain connectivity solutions Installation Certification Operations Maintenance Inflight live customer care 24-hr network monitoring Business intelligence/analytics

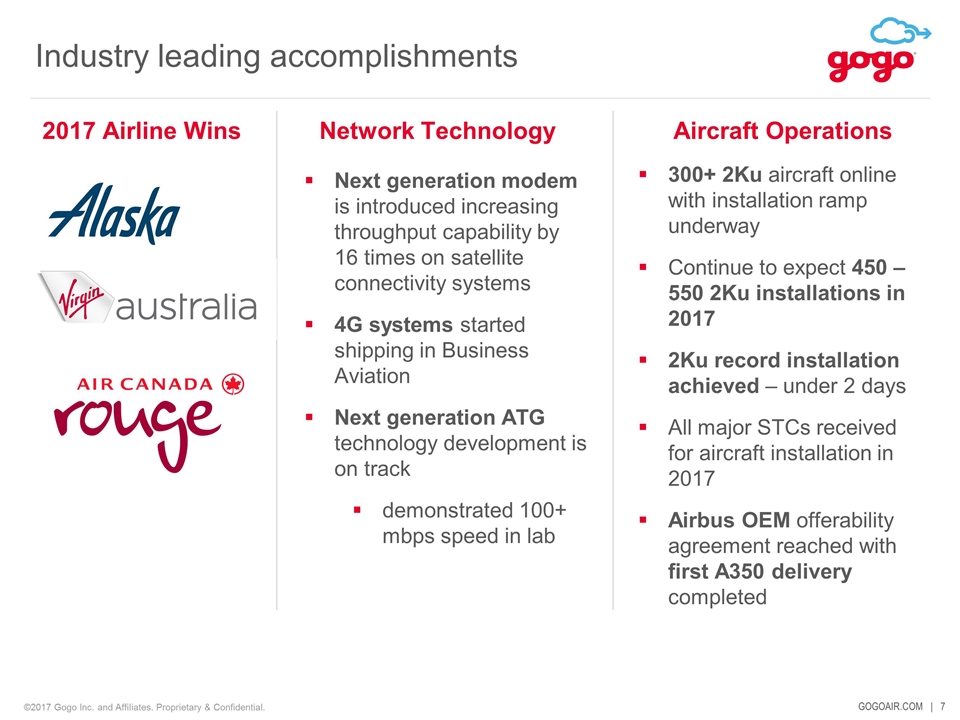

Industry leading accomplishments Network Technology Aircraft Operations 2017 Airline Wins Next generation modem is introduced increasing throughput capability by 16 times on satellite connectivity systems 4G systems started shipping in Business Aviation Next generation ATG technology development is on track demonstrated 100+ mbps speed in lab 300+ 2Ku aircraft online with installation ramp underway Continue to expect 450 – 550 2Ku installations in 2017 2Ku record installation achieved – under 2 days All major STCs received for aircraft installation in 2017 Airbus OEM offerability agreement reached with first A350 delivery completed

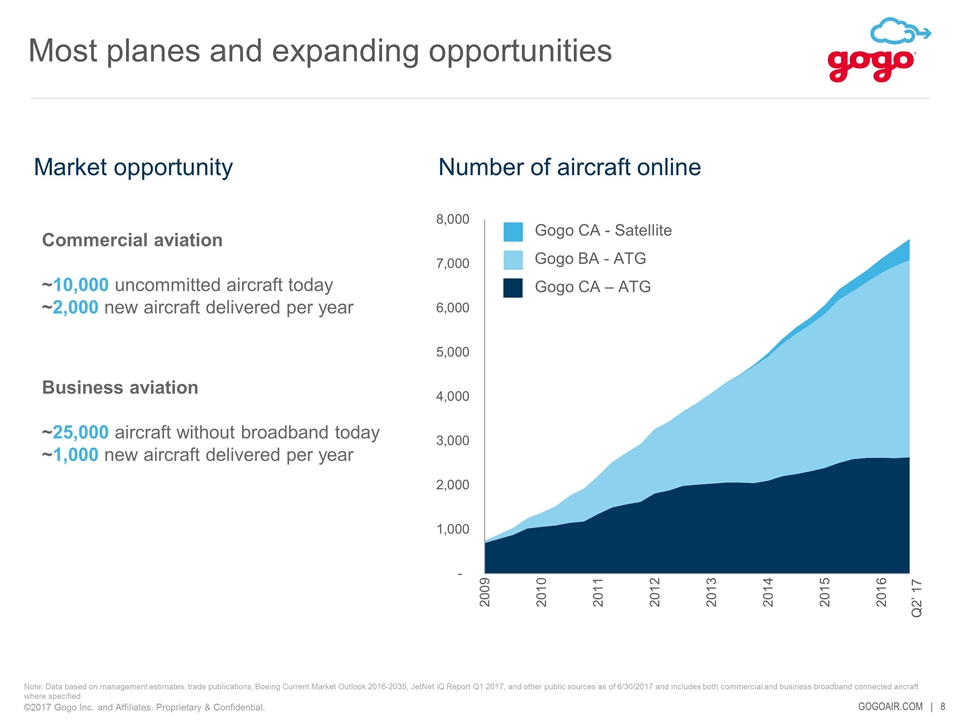

Most planes and expanding opportunities Gogo CA - Satellite Gogo BA - ATG Gogo CA – ATG Note: Data based on management estimates, trade publications, Boeing Current Market Outlook 2016-2035, JetNet iQ Report Q1 2017, and other public sources as of 6/30/2017 and includes both commercial and business broadband connected aircraft where specified Number of aircraft online Q2’ 17 Market opportunity Commercial aviation ~10,000 uncommitted aircraft today ~2,000 new aircraft delivered per year Business aviation ~25,000 aircraft without broadband today ~1,000 new aircraft delivered per year

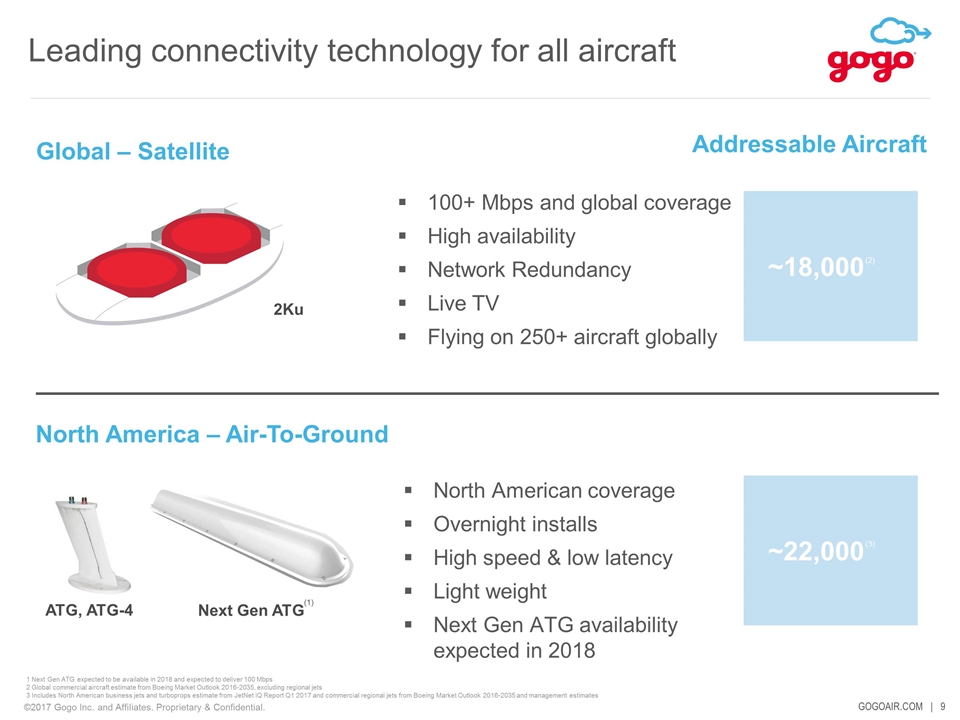

Leading connectivity technology for all aircraft (2) (3) 2Ku 100+ Mbps and global coverage High availability Network Redundancy Live TV Flying on 250+ aircraft globally Global – Satellite (2) Addressable Aircraft Next Gen ATG ATG, ATG-4 North American coverage Overnight installs High speed & low latency Light weight Next Gen ATG availability expected in 2018 North America – Air-To-Ground ~22,000 (1) (3) ~18,000 (2) 1 Next Gen ATG expected to be available in 2018 and expected to deliver 100 Mbps 2 Global commercial aircraft estimate from Boeing Market Outlook 2016-2035, excluding regional jets 3 Includes North American business jets and turboprops estimate from JetNet iQ Report Q1 2017 and commercial regional jets from Boeing Market Outlook 2016-2035 and management estimates

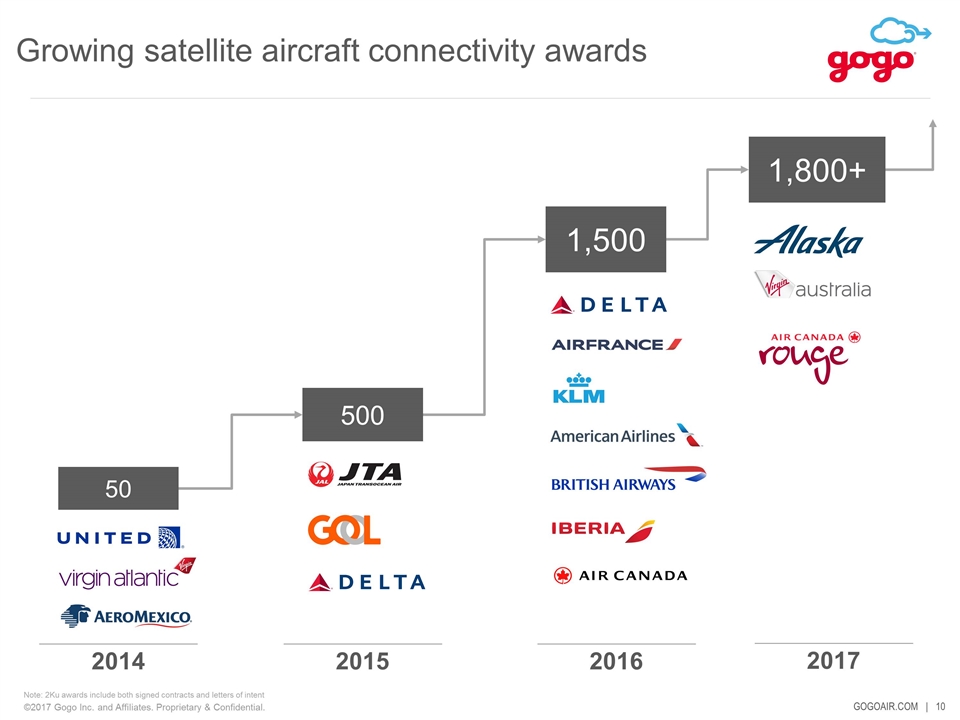

Growing satellite aircraft connectivity awards Note: 2Ku awards include both signed contracts and letters of intent 2015 2016 2014 50 500 1,500 1,800+ 2017

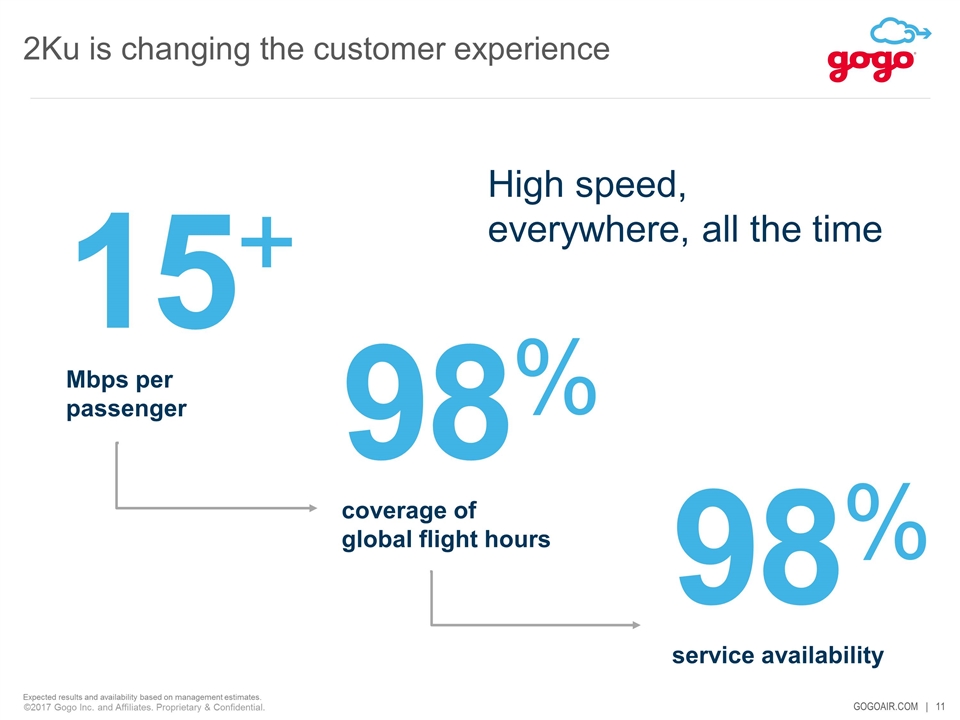

2Ku is changing the customer experience Expected results and availability based on management estimates. High speed, everywhere, all the time 15+ Mbps per passenger 98% coverage of global flight hours 98% service availability

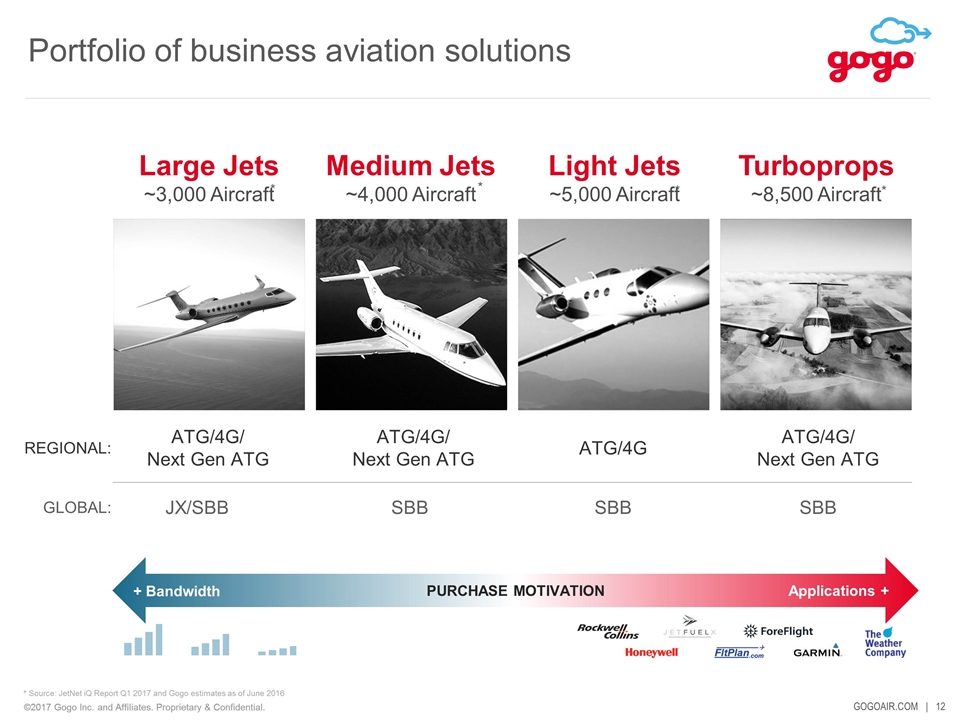

* Source: JetNet iQ Report Q1 2017 and Gogo estimates as of June 2016 Large Jets ~3,000 Aircraft * * * * PURCHASE MOTIVATION + Bandwidth Applications + GLOBAL: JX/SBB SBB SBB SBB REGIONAL: ATG/4G/ Next Gen ATG ATG/4G/ Next Gen ATG ATG/4G ATG/4G/ Next Gen ATG Medium Jets ~4,000 Aircraft Light Jets ~5,000 Aircraft Turboprops ~8,500 Aircraft Portfolio of business aviation solutions

GOGOAIR.COM | Transaction Overview Who We Are Strong Execution And Path To Profitability Why Invest In Gogo

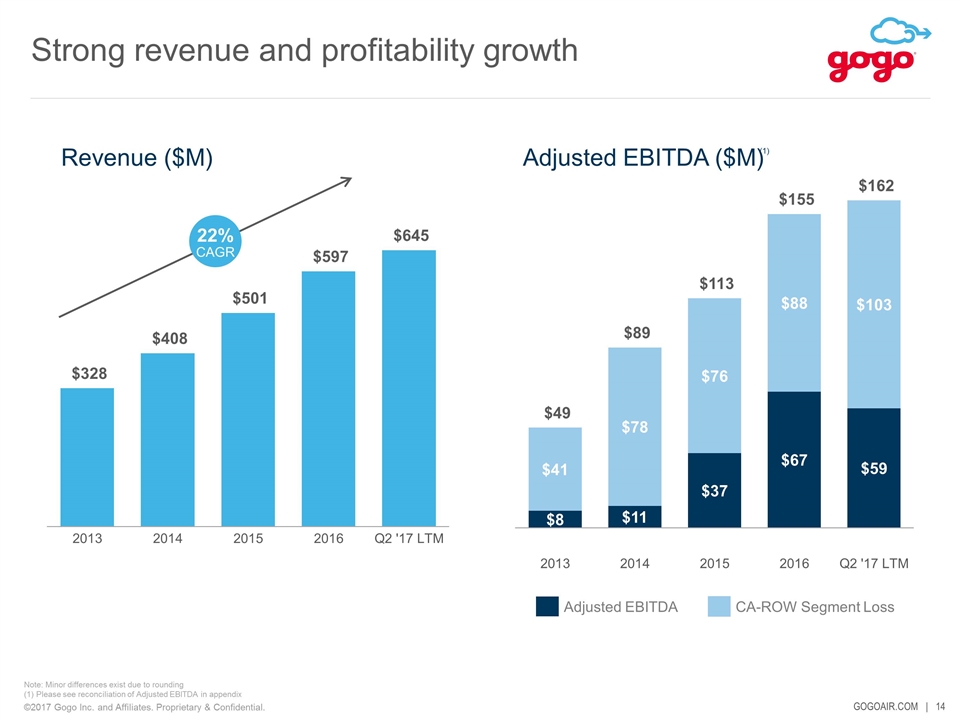

Strong revenue and profitability growth Note: Minor differences exist due to rounding (1) Please see reconciliation of Adjusted EBITDA in appendix 22% CAGR CA-ROW Segment Loss Adjusted EBITDA Revenue ($M) Adjusted EBITDA ($M) (1)

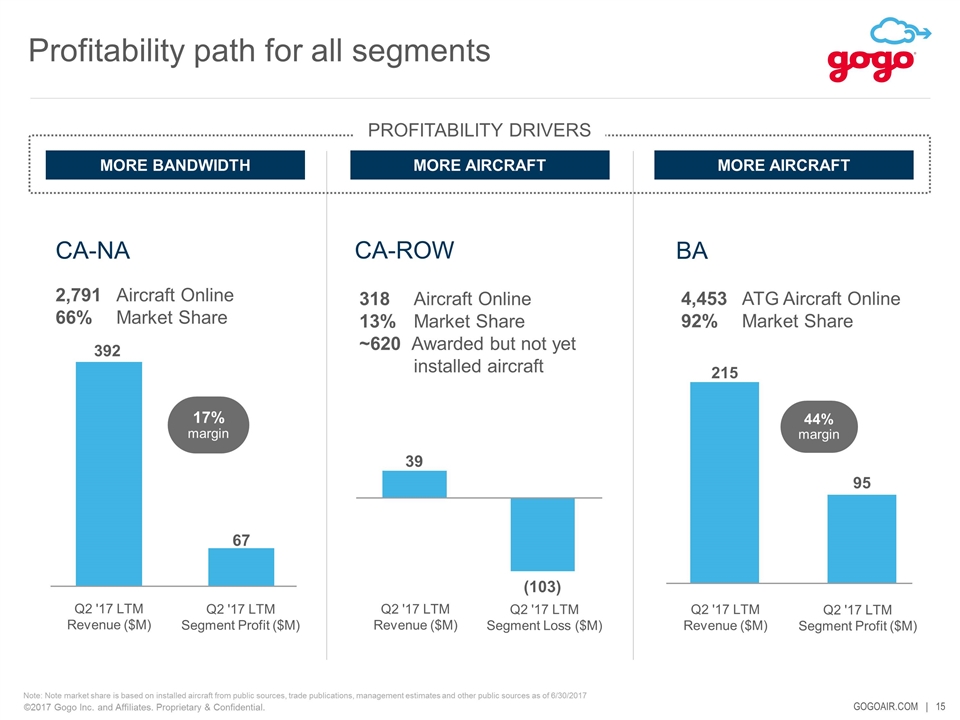

#1 MORE BANDWIDTH Profitability path for all segments 17% margin 44% margin Note: Note market share is based on installed aircraft from public sources, trade publications, management estimates and other public sources as of 6/30/2017 CA-NA CA-ROW BA 2,791 Aircraft Online 66% Market Share 318 Aircraft Online 13% Market Share ~620 Awarded but not yet installed aircraft 4,453 ATG Aircraft Online 92% Market Share MORE AIRCRAFT MORE AIRCRAFT Profitability Drivers Q2 '17 LTM Revenue ($M) Q2 '17 LTM Segment Profit ($M) Q2 '17 LTM Revenue ($M) Q2 '17 LTM Segment Loss ($M) Q2 '17 LTM Revenue ($M) Q2 '17 LTM Segment Profit ($M)

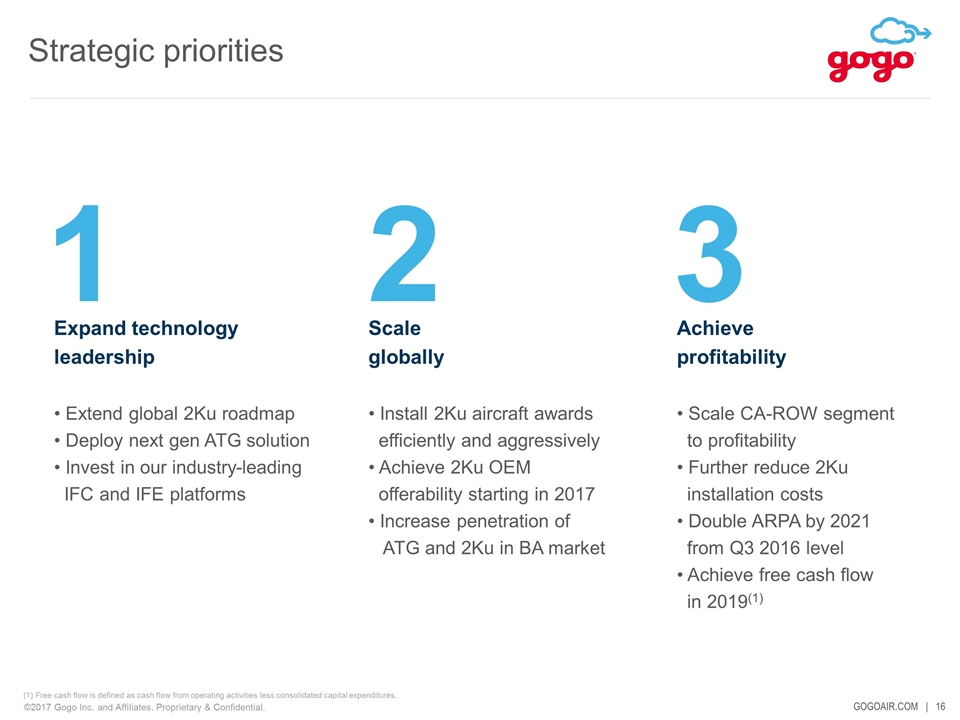

Strategic priorities (1) Free cash flow is defined as cash flow from operating activities less consolidated capital expenditures. Expand technology leadership • Extend global 2Ku roadmap • Deploy next gen ATG solution • Invest in our industry-leading IFC and IFE platforms Scale globally • Install 2Ku aircraft awards efficiently and aggressively • Achieve 2Ku OEM offerability starting in 2017 • Increase penetration of ATG and 2Ku in BA market Achieve profitability • Scale CA-ROW segment to profitability • Further reduce 2Ku installation costs • Double ARPA by 2021 from Q3 2016 level • Achieve free cash flow in 2019(1) 1 2 3

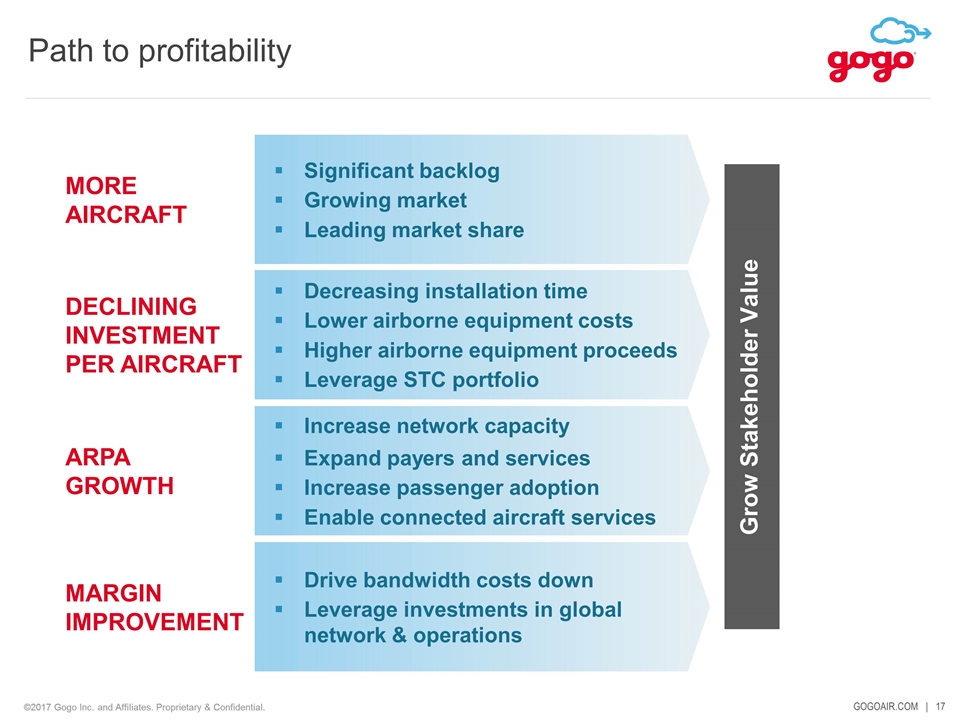

Grow Stakeholder Value MORE AIRCRAFT Significant backlog Growing market Leading market share DECLINING INVESTMENT PER AIRCRAFT ARPA GROWTH MARGIN IMPROVEMENT Decreasing installation time Lower airborne equipment costs Higher airborne equipment proceeds Leverage STC portfolio Increase network capacity Expand payers and services Increase passenger adoption Enable connected aircraft services Drive bandwidth costs down Leverage investments in global network & operations Path to profitability

GOGOAIR.COM | Transaction Overview Who We Are Strong Execution And Path To Profitability Why Invest In Gogo

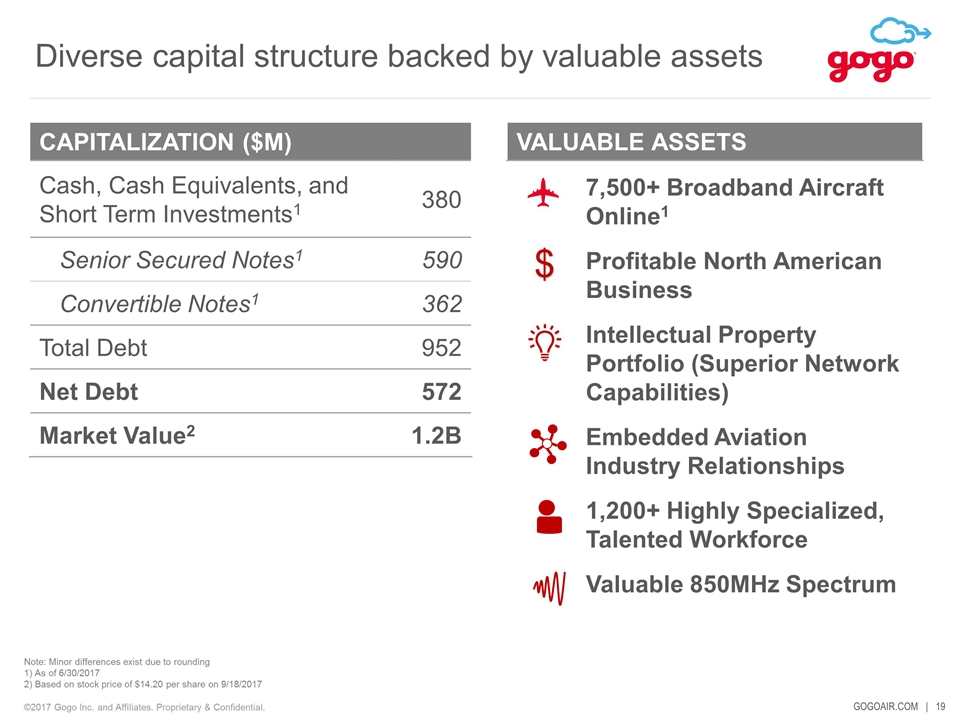

Diverse capital structure backed by valuable assets Note: Minor differences exist due to rounding 1) As of 6/30/2017 2) Based on stock price of $14.20 per share on 9/18/2017 CAPITALIZATION ($M) Cash, Cash Equivalents, and Short Term Investments1 380 Senior Secured Notes1 590 Convertible Notes1 362 Total Debt 952 Net Debt 572 Market Value2 1.2B 7,500+ Broadband Aircraft Online1 Profitable North American Business Intellectual Property Portfolio (Superior Network Capabilities) Embedded Aviation Industry Relationships 1,200+ Highly Specialized, Talented Workforce Valuable 850MHz Spectrum VALUABLE ASSETS $

Positioned for success Leading position, experience & scale Large opportunities for growth Technology leadership Clear path to free cash flow

Appendix

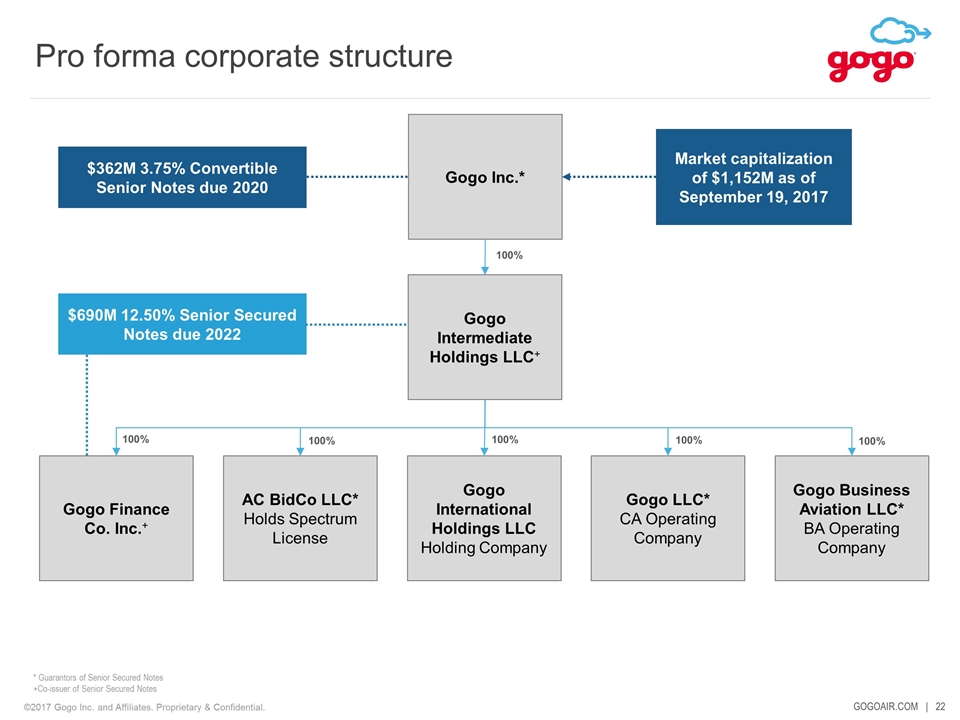

Pro forma corporate structure Gogo Intermediate Holdings LLC+ Gogo Inc.* Gogo International Holdings LLC Holding Company AC BidCo LLC* Holds Spectrum License 100% 100% 100% 100% 100% 100% Market capitalization of $1,152M as of September 19, 2017 $362M 3.75% Convertible Senior Notes due 2020 Gogo Finance Co. Inc.+ Gogo LLC* CA Operating Company Gogo Business Aviation LLC* BA Operating Company $690M 12.50% Senior Secured Notes due 2022 * Guarantors of Senior Secured Notes +Co-issuer of Senior Secured Notes

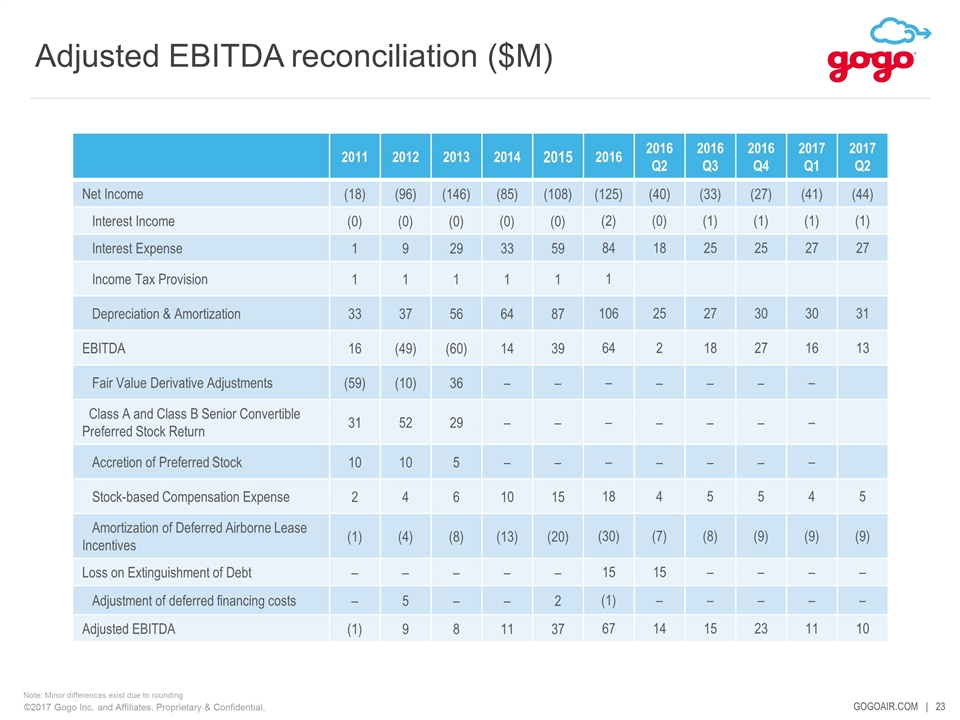

Adjusted EBITDA reconciliation ($M) 2011 2012 2013 2014 2015 2016 2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2 Net Income (18) (96) (146) (85) (108) (125) (40) (33) (27) (41) (44) Interest Income (0) (0) (0) (0) (0) (2) (0) (1) (1) (1) (1) Interest Expense 1 9 29 33 59 84 18 25 25 27 27 Income Tax Provision 1 1 1 1 1 1 Depreciation & Amortization 33 37 56 64 87 106 25 27 30 30 31 EBITDA 16 (49) (60) 14 39 64 2 18 27 16 13 Fair Value Derivative Adjustments (59) (10) 36 – – – – – – – Class A and Class B Senior Convertible Preferred Stock Return 31 52 29 – – – – – – – Accretion of Preferred Stock 10 10 5 – – – – – – – Stock-based Compensation Expense 2 4 6 10 15 18 4 5 5 4 5 Amortization of Deferred Airborne Lease Incentives (1) (4) (8) (13) (20) (30) (7) (8) (9) (9) (9) Loss on Extinguishment of Debt – – – – – 15 15 – – – – Adjustment of deferred financing costs – 5 – – 2 (1) – – – – – Adjusted EBITDA (1) 9 8 11 37 67 14 15 23 11 10 Note: Minor differences exist due to rounding

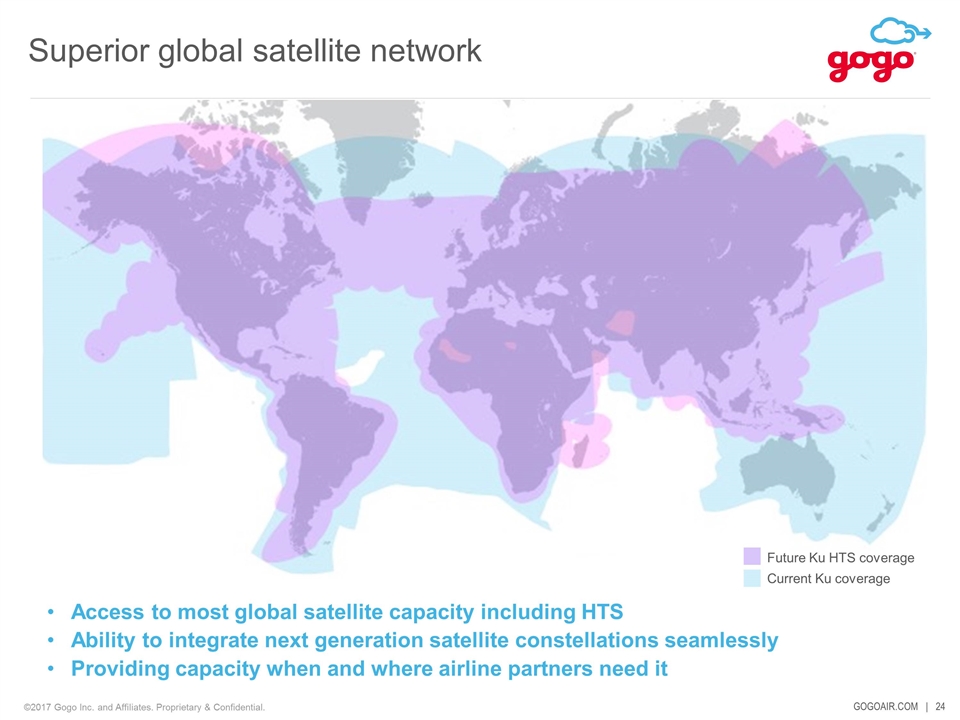

Superior global satellite network Future Ku HTS coverage Current Ku coverage Access to most global satellite capacity including HTS Ability to integrate next generation satellite constellations seamlessly Providing capacity when and where airline partners need it