Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FUEL TECH, INC. | ftiinvestordeckregulationf.htm |

1

September 2017 Investor Presentation

2

Safe Harbor

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This presentation contains “forward-looking statements” as defined in Section 21E of the Securities Exchange

Act of 1934, as amended, which are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and reflect Fuel Tech’s current expectations regarding future growth, results of

operations, cash flows, performance and business prospects, and opportunities, as well as assumptions made

by, and information currently available to, our management. Fuel Tech has tried to identify forward-looking

statements by using words such as “anticipate,” “believe,” “plan,” “expect,” “estimate,” “intend,” “will,” and

similar expressions, but these words are not the exclusive means of identifying forward-looking statements.

These statements are based on information currently available to Fuel Tech and are subject to various risks,

uncertainties, and other factors, including, but not limited to, those discussed in Fuel Tech’s Annual Report on

Form 10-K in Item 1A under the caption “Risk Factors,” and subsequent filings under the Securities Exchange Act

of 1934, as amended, which could cause Fuel Tech’s actual growth, results of operations, financial condition,

cash flows, performance and business prospects and opportunities to differ materially from those expressed in,

or implied by, these statements. Fuel Tech undertakes no obligation to update such factors or to publicly

announce the results of any of the forward-looking statements contained herein to reflect future events,

developments, or changed circumstances or for any other reason. Investors are cautioned that all forward-

looking statements involve risks and uncertainties, including those detailed in Fuel Tech’s filings with the

Securities and Exchange Commission.

3

Air Pollution Control

Low capital, high efficiency

emissions control solutions.

Installed worldwide on

combustion units, primarily

coal-fired utility and industrial.

Capital project sale, typically

fixed-price and turn-key.

FUEL CHEM®

Improves combustion

efficiency, reliability, heat rate,

and environmental status.

Decreases unit maintenance.

Allows fuel flexibility:

customers can burn cheaper,

lower quality coal without

sacrificing performance.

Diverse, customizable portfolio of low cap-ex emissions control solutions to enable clean efficient energy

Addressing a Fundamental, Structural Shift in

Power Generation Industry

62%

38%

2016 Revenues

$55.2 M

4

2017 Overview

Coming off one of the most challenging periods in

Fuel Tech’s recent history…

Legislative inertia

Declining energy demand

Ongoing shift in fuel sources

…we continued to execute against a series of multi-year,

proactive initiatives driven by three primary mandates:

Global business development

Positive cash flow from base businesses,

leveraging reduced SG&A

R&D investment

Fuel Tech has installed

~ 25%

of all NOx reduction systems

in the US and

~ 85%

of all US SNCR equipment

>1,000 Installations in 26 Countries

Improving backlog

~ $30 M of new contracts thus far in 2017

Higher revenues

~50% increase expected in 2H 2017 from 1H 2017

Lower expense profile

~ $19 M in costs removed (YE 2014 – 2017 F)

Strong balance sheet: $0 LTD

Expect improved operating results in 2H 2017

5

Investment Overview

Backlog

~ $30 M of new contracts

announced thus far in 2017

Focusing on Business Development, Positive Cash Flow, and R&D

$30.9

$25.6

$11.1

$22.2

$8.0

$22.5

$1.5

$4.3

$4.6

SG&A

Expect ~40% decline for

2017 from 2014

R&D

Focus on technologies that will

help define our future, in wake of

Fuel Conversion suspension

$35.4

2014 2015 2016 1H

2016

Proactively Managing Business and Financial Assets

2015 2016 3/31

2017

6/30

2017

~$30.0

$ in MMs

2014 2015 2016

1H

2017

$0.6

$21.4

pf = includes $8M of

contracts announced

after 6/30

1H

2017

$13.9

$0.8

1H

2016

Pro forma

6/30

2017

6

Maintaining a Strong Financial Position

Investment Overview

$35.9

$26.6 $17.8

2014 2015 2016 6/30

2017

$39.7

2014 2015

$12.6

$18.6

2014 2016

$21.7

6/30

2017

2015 2016

0

$

Cash and Cash Equivalents Working Capital Long-Term Debt

Continue to manage cash position, which should begin to trend higher due to

growing backlog and elimination of losses associated with Fuel Conversion

Through the implementation of corporate initiatives, we expect to sustain a

working capital profile that ensures our ability to meet near-term operating and

investment requirements

$0 long-term balance despite significant investments in R&D

6/30

2017

$18.1

$ in MMs

$0.53

p/s

$0.76

p/s

7

Recent Developments

Corporate Initiatives

» Engaged third-party consultant to review operating model and organizational design

– prioritize resource allocation

– further reduce cost structure

– improve operational efficiencies

– strengthen balance sheet and cash flow generation capabilities

– catalyze business development

» Suspend pre-revenue Fuel Conversion initiative effective June 28, 2017

– staff reductions

– discussions with suppliers and partners to support orderly suspension of Fuel Conversion

– exploring potential monetization of certain Fuel Conversion assets

» Re-direct cash flow from Fuel Conversion suspension and prior initiatives

– develop new markets and applications for APC and FUEL CHEM®

– pursue complementary technology applications in the water treatment and renewables markets

“The combination of a refreshed business focus, lower operating costs and improved business

activity will enhance our competitiveness and position us to deliver the long-term value that our

stockholders expect and deserve.”

- Vincent J. Arnone, President and CEO

8

Products and Services

FGC

= Fuel Tech Products and Services

9

Geographies and End Markets

SNCR

570+ / 51,300

FUEL CHEM®

110+ / 21,900

ULTRA®

250+ / 27,700

Combustion Modifications

110+ / 16,400

SCR, ASCR,

Catalyst Management

Services

150+ / 63,200

U.S. China

57%

29%

14%

84%

16%

77%

89%

81%

Utility Industrial ROW

68%

32%

67%

33%

87%

13%

74%

26%

68%

32%

FTEK Solution Geography End Market

Deployments/MW

6%

6%

9%

2%

17%

13%

10

Blue Chip Client Base

U

T

I

L

I

T

Y

I

N

D

U

S

T

R

Y

G

L

O

B

A

L

11

Air Pollution Control Segment

» Environment remains challenging, with lingering regulatory

uncertainty despite “coal-friendly” posture of new

administration

» $150 M global sales pipeline

» 2017 booking level highest in three years

($ in MMs)

($ in MMs)

APC Revenues

APC Gross Profit

$42.0

$34.0

$43.5

2014 2015 2016 1H

2017

2014 2015 2016 1H

2017

$15.4

$12.9

$8.7

37%

30%

25%

Overview and U.S. Market Drivers

Domestic Market Drivers

» Focus on Boiler MACT and maintenance drivers for ESP upgrades

» Industrial project activity encouraging

– ULTRA and SCRs for industrial applications (gas-fired turbines) and

SNCR for units requiring compliance with latest round of CSAPR

– Establishing relationships with multi-national industrial end users

$9.5

$2.9

I-NOx Integrated NOx Reduction System

Low Nox Burners

Over-Fire Air Systems

Urea SNCR Systems - NoxOUT and HERT

ASCR Advanced SCR

SCR Systems – Industrial

Static Mixers

®

®

Our APC Solutions Include

™

®

®

®

GSG Graduated Straightening Grid

Ammonia Injection Grid (AIG)

ULTRA and ULTRA-5

Flue Gas Conditioning

Electrostatic Precipitators (ESP)

SCR Services

IMPULSE Cleaning Technology

™

™ 31%

12

Air Pollution Control Segment

International Market Drivers

» Europe

– $5 M of new contracts thus far in 2017 for SCR and ULTRA

– EU Industrial Emissions Directive (effective Jan. 2016)

• Covers 28 European Union member states

• Installed Advanced SNCR systems on 7 units to date

– Benefitting from strategic partnerships: Spain, Turkey, Poland, Czech Republic

» China

– $6 M of new contracts thus far in 2017, with an improving sales trend

– Still a challenging market; new plant construction decreasing - 100 coal-fired

projects in 11 provinces canceled in January 2017

– More stringent NOx reduction standards will lead to either:

• SCR upgrades, which would require enhanced ammonia production and

delivery technology (ULTRA); or

• Require SNCR to increase NOx reduction

» India

– Licensed SNCR Technology to India’s ISGEC Heavy Engineering Ltd. (June ‘16)

– Focusing on cement industry (SNCR)

– India government will likely adopt a phased-in compliance program

– Demand for urea to ammonia conversion should grow, similar to China

G

R

O

W

T

H

D

R

I

V

E

R

S

13

FUEL CHEM® Segment

» Declining revenues due to low-priced natural gas and

coal-to-gas conversions

» Revenues will likely decline in 2017 vs. 2016, with consistent

gross margin (48% - 52%)

» In U.S. market, technology to utilities as a means to:

– Combat effects of reduced load profiles

– Support coal blending as a cost reduction strategy

» In Europe, offer technology to:

– Operators of biomass and MSW units to combat slagging and

fouling issues

– Two demonstrations in progress and performing well

» Globally expand industrial reach into pulp and paper industry

– Licensed RECOVERY CHEM® technology to Amazon Papyrus, a

leading supplier of specialty chemicals to the pulp and paper

industry in Asia

($ in MMs)

($ in MMs)

FUEL CHEM® Revenues

FUEL CHEM® Gross Profit

2014 2015 2016 1H

2017

$37.0

$30.2

$21.1

2014 2015 2016 1H

2017

$19.7

$15.7

$10.1

53% 52%

48%

$8.7

51%

$4.4

FUEL CHEM provides plants with the flexibility to burn lower

cost fuels while adhering to strict emissions control mandates

Appalachian

Powder

River Basin

Illinois

Basin

Biomass

14

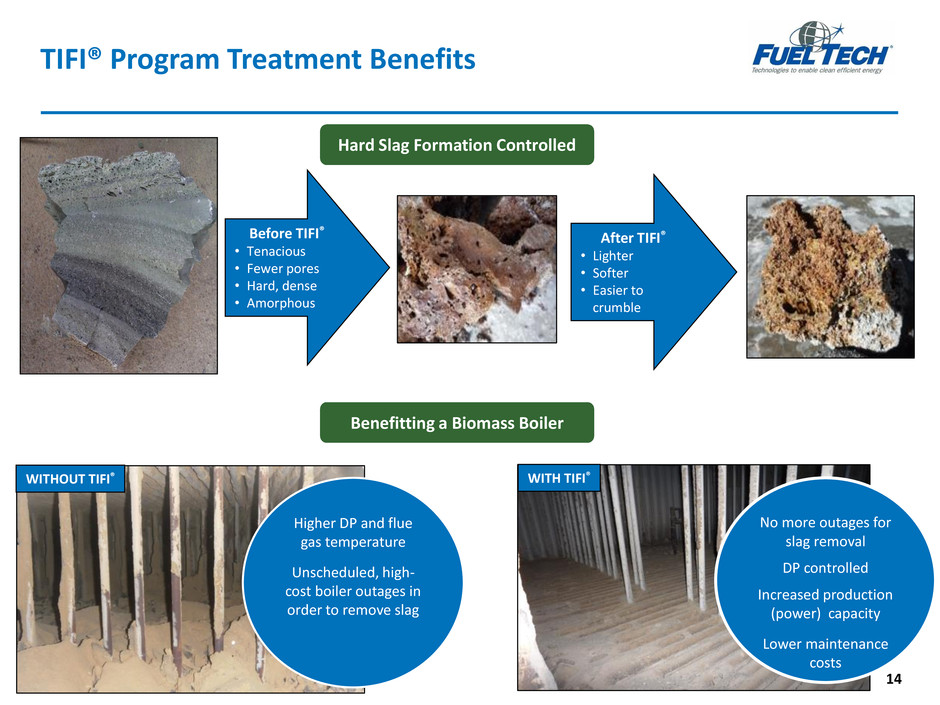

Before TIFI®

• Tenacious

• Fewer pores

• Hard, dense

• Amorphous

TIFI® Program Treatment Benefits

After TIFI®

• Lighter

• Softer

• Easier to

crumble

WITHOUT TIFI® WITH TIFI®

Higher DP and flue

gas temperature

Unscheduled, high-

cost boiler outages in

order to remove slag

No more outages for

slag removal

DP controlled

Increased production

(power) capacity

Lower maintenance

costs

Hard Slag Formation Controlled

Benefitting a Biomass Boiler

15

Operating Performance

(in MMs, except per share data)

Q2

2017

Q2

2016

First Half

2017

First Half

2016

Total Revenues $9.7 $15.2 $ 18.2 $33.0

Gross Profit $3.6 $5.6 $7.3 $11.6

Gross Margin % 37.2% 36.8% 40.3% 35.2%

SG&A $5.9 $6.8 $11.1 $13.9

Net Loss from Continuing Ops $(5.6) $(1.8) $ (7.4) $(3.8)

Net (Loss) Per Diluted Share

from Continuing Operations

$(0.24)

$(0.08)

$ (0.31)

$ (0.16)

Diluted Avg. Shares O/S 23.7 23.4 23.6 23.3

(1) Excludes $0.8 M in non-cash accelerated stock vesting charge

Results Excluding Charges

SG&A (1)

$5.1 M in Q2 2017

$10.3 M in 1H 2017

Net Loss From Continuing Operations (2)

$1.1 M, or $0.05 per diluted share, in Q2 2017

$2.9 M, or $0.12 per diluted share, in 1H 2017

(2) Excludes a total of $4.5 M in charges, consisting of: $3.0 M non-cash building impairment

charge; $0.8 M non-cash accelerated stock vesting charge; $0.4 M in accruals associated with

foreign operations; $0.2 M of incremental inventory reserves; and $0.1 M in severance.

16

Summary

Continue to evolve

business model to

address changing

energy environment

and global trends

At APC, focus on

global business

development,

including

international

expansion

Manage through

challenges at

FUEL CHEM via

focus on additional

market segments

and geographies

Leverage

~ $19M in annual

S,G & A savings

Maintain strong cash

+ working capital

positions

$0 LTD profile

Continue to

invest in and

develop promising

technologies

Expect to show

improved operating

results in 2H 2017