Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - ITRON, INC. | d458982dex992.htm |

| 8-K - FORM 8-K - ITRON, INC. | d458982d8k.htm |

SEPTEMBER 18, 2017 Itron to Acquire Silver Spring Networks Philip Mezey, President and Chief Executive Officer Tom Deitrich, Executive Vice President and Chief Operating Officer Joan Hooper, Senior Vice President and Chief Financial Officer Barbara Doyle, Vice President - Investor Relations Exhibit 99.1

Forward looking statements Statements in this communication that are not historical facts, including statements about beliefs, plans and expectations are forward-looking statements. Statements that include words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “potential,” “continue,” “goals,” “targets” and variations of these words (or negatives of these words) or similar expressions of a future or forward-looking nature identify forward-looking statements. In addition, any statements that refer to projections or other characterizations of future events or circumstances, including any underlying assumptions are forward-looking statements. Forward-looking statements are based on current expectations and are subject to a number of risks, factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Important factors and uncertainties that could cause actual results to differ materially from those described in these forward-looking statements include, without limitation: the risk that Silver Spring’s stockholders do not approve the transaction; uncertainties as to the timing of the transaction; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate Silver Spring Networks’ operations into those of Itron; such integration may be more difficult, time-consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the transaction; the retention of certain key employees at Silver Spring Networks; risks associated with the disruption of management’s attention from ongoing business operations due to the transaction; the conditions to the completion of the transaction may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the merger; the impact of indebtedness incurred by Itron in connection with the transaction and the potential impact on the rating of indebtedness of Itron; legal proceedings that may be instituted against Itron or Silver Spring Networks and others following announcement of the proposed transaction; the effects of the business combination of Itron and Silver Spring Networks, including the combined company’s future financial condition, operating results, strategy and plans; other factors detailed in Silver Spring Networks’ Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) for the fiscal year ended December 31, 2016 and Silver Spring Networks’ Silver Spring’s Quarterly Report on Form 10-Q filed with the SEC on August 9, 2017, which are available at http://www.sec.gov and on Silver Spring’s website at www.ssni.com; and other factors discussed in Itron’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2016 and Itron’s other filings with the SEC, which are available at http://www.sec.gov and on Itron’s website at www.itron.com. Itron and Silver Spring assume no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. Itron Acquires Silver Spring |

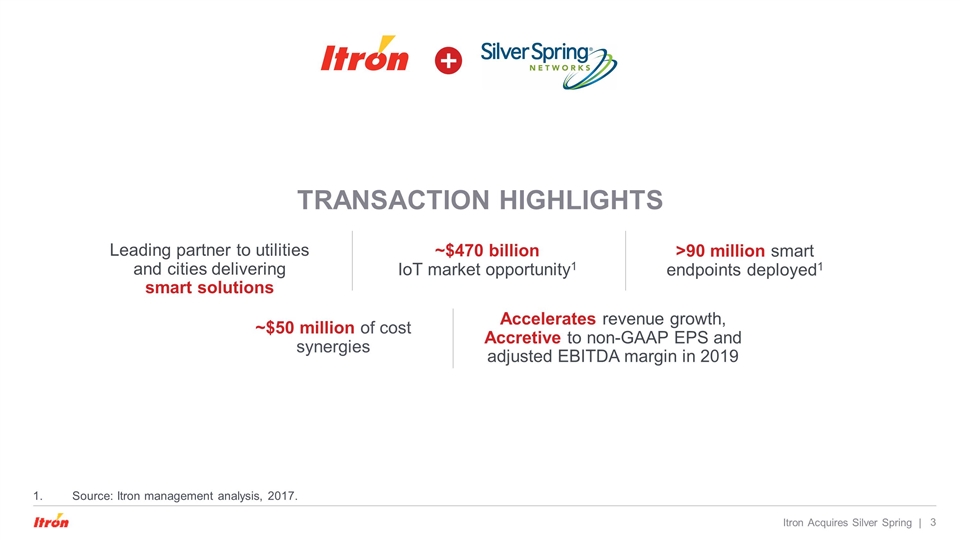

~$470 billion IoT market opportunity1 Leading partner to utilities and cities delivering smart solutions >90 million smart endpoints deployed1 Accelerates revenue growth, Accretive to non-GAAP EPS and adjusted EBITDA margin in 2019 ~$50 million of cost synergies Source: Itron management analysis, 2017. Itron Acquires Silver Spring | TRANSACTION HIGHLIGHTS

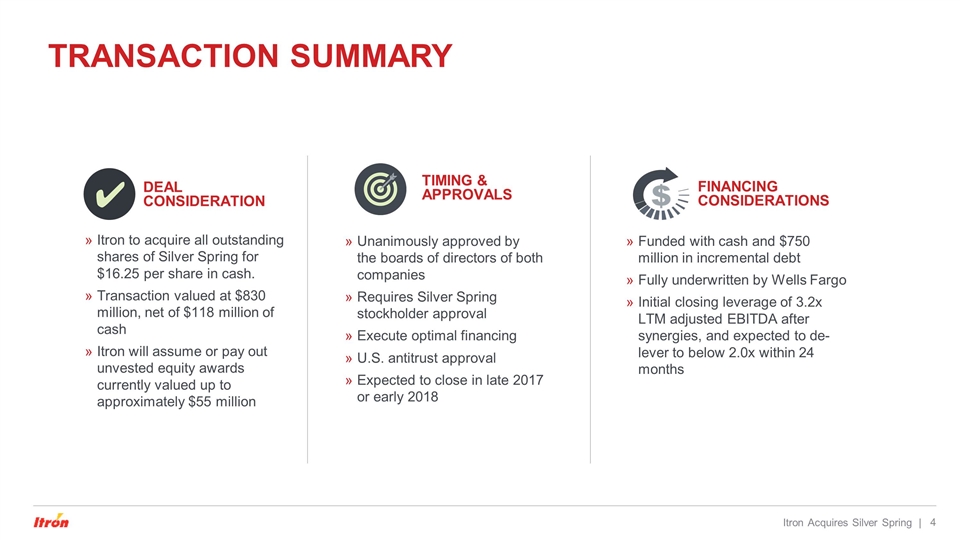

TRANSACTION SUMMARY Itron Acquires Silver Spring | Itron to acquire all outstanding shares of Silver Spring for $16.25 per share in cash. Transaction valued at $830 million, net of $118 million of cash Itron will assume or pay out unvested equity awards currently valued up to approximately $55 million DEAL CONSIDERATION Unanimously approved by the boards of directors of both companies Requires Silver Spring stockholder approval Execute optimal financing U.S. antitrust approval Expected to close in late 2017 or early 2018 TIMING & APPROVALS Funded with cash and $750 million in incremental debt Fully underwritten by Wells Fargo Initial closing leverage of 3.2x LTM adjusted EBITDA after synergies, and expected to de-lever to below 2.0x within 24 months FINANCING CONSIDERATIONS

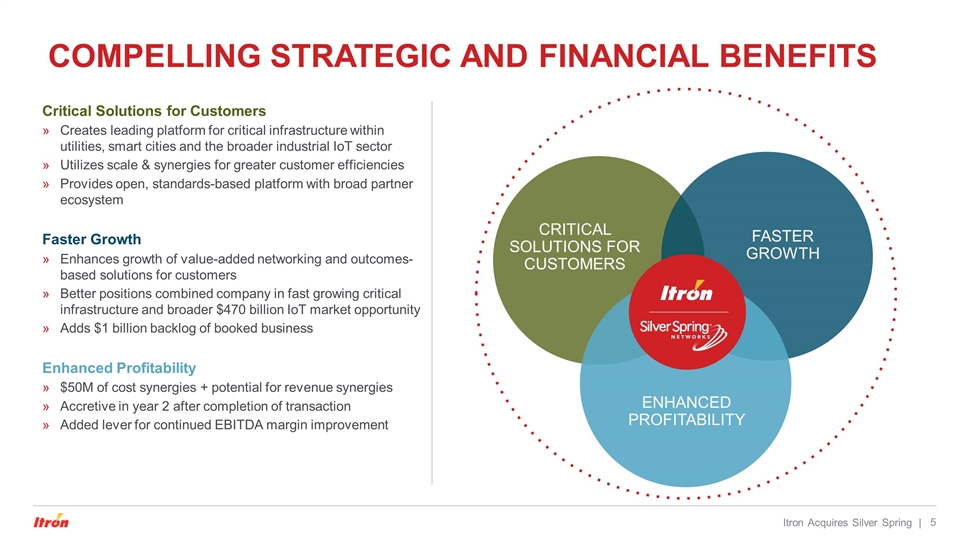

Itron Acquires Silver Spring | Critical Solutions for Customers Creates leading platform for critical infrastructure within utilities, smart cities and the broader industrial IoT sector Utilizes scale & synergies for greater customer efficiencies Provides open, standards-based platform with broad partner ecosystem Faster Growth Enhances growth of value-added networking and outcomes-based solutions for customers Better positions combined company in fast growing critical infrastructure and broader $470 billion IoT market opportunity Adds $1 billion backlog of booked business Enhanced Profitability $50M of cost synergies + potential for revenue synergies Accretive in year 2 after completion of transaction Added lever for continued EBITDA margin improvement FASTER GROWTH CRITICAL SOLUTIONS FOR CUSTOMERS ENHANCED PROFITABILITY COMPELLING STRATEGIC AND FINANCIAL BENEFITS

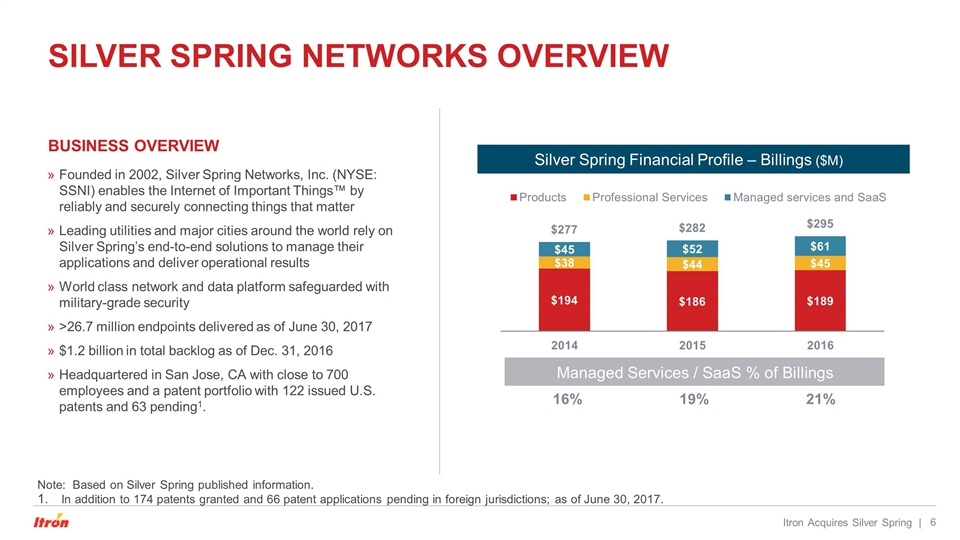

Silver Spring Networks Overview Itron Acquires Silver Spring | BUSINESS OVERVIEW Founded in 2002, Silver Spring Networks, Inc. (NYSE: SSNI) enables the Internet of Important Things™ by reliably and securely connecting things that matter Leading utilities and major cities around the world rely on Silver Spring’s end-to-end solutions to manage their applications and deliver operational results World class network and data platform safeguarded with military-grade security >26.7 million endpoints delivered as of June 30, 2017 $1.2 billion in total backlog as of Dec. 31, 2016 Headquartered in San Jose, CA with close to 700 employees and a patent portfolio with 122 issued U.S. patents and 63 pending1. Note: Based on Silver Spring published information. In addition to 174 patents granted and 66 patent applications pending in foreign jurisdictions; as of June 30, 2017. Silver Spring Financial Profile – Billings ($M) Managed Services / SaaS % of Billings 16% 19% 21%

Itron Acquires Silver Spring | Complementary combined solutions Significant benefits to customers Robust partner ecosystem Industrial IoT applications Distribution automation Metering & sensing devices Distributed energy management Open-standards networking Combined utility & smart city deployments Converged platform drives efficiencies for critical infrastructure Accelerates velocity of innovation Expands product and services offerings Enables customer IoT adoption path Large partner ecosystems Customer choice – multi-vendor “end-to-end” offering Vertical integration benefits – single point of accountability

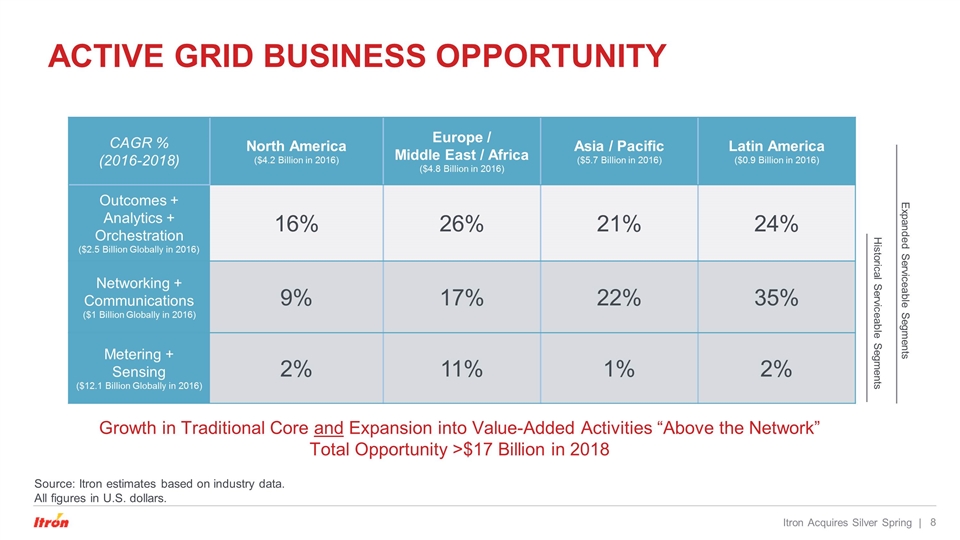

Active grid Business opportunity Itron Acquires Silver Spring | CAGR % (2016-2018) North America ($4.2 Billion in 2016) Europe / Middle East / Africa ($4.8 Billion in 2016) Asia / Pacific ($5.7 Billion in 2016) Latin America ($0.9 Billion in 2016) Outcomes + Analytics + Orchestration ($2.5 Billion Globally in 2016) 16% 26% 21% 24% Networking + Communications ($1 Billion Globally in 2016) 9% 17% 22% 35% Metering + Sensing ($12.1 Billion Globally in 2016) 2% 11% 1% 2% Historical Serviceable Segments Expanded Serviceable Segments Growth in Traditional Core and Expansion into Value-Added Activities “Above the Network” Total Opportunity >$17 Billion in 2018 Source: Itron estimates based on industry data. All figures in U.S. dollars.

Better positioned for attractive opportunities Itron Acquires Silver Spring | >90 million combined global smart endpoints Combined industry use-case expertise Accelerate delivery of solutions and services Broad ecosystem of partners for smart utilities and smart cities increase value to customers Well-positioned for broader IoT opportunities U.S. Energy Information Administration, Annual Electric Power Industry Report. Markets and Markets research. Navigant Research, July 2016. Itron Management Analysis, 2017. Smart Grid Stage: Developed U.S. Penetration: 43%1 Market Size2 2015: ~$10B 2020: ~$20B Smart City Stage: Begun/early accelerating adoption Penetration: Low Market Size3 2016: ~$37B 2025: ~$89B IoT Stage: Early adoptions with substantial opportunity Penetration: Very low Market Size4 2015: ~$60 2020: ~$470B COMBINED COMPANY WELL-POSITIONED SIGNIFICANT INDUSTRY OPPORTUNITY

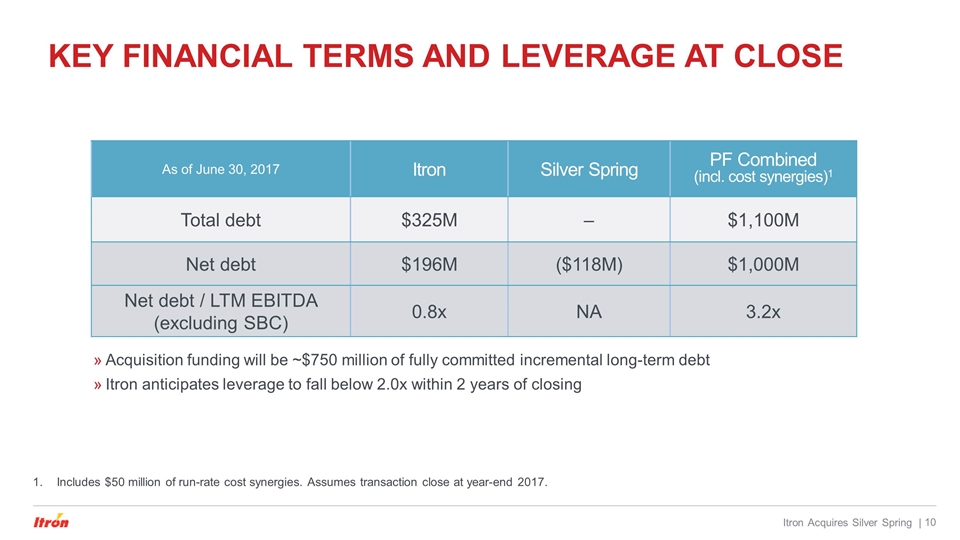

Key Financial terms and Leverage at close Includes $50 million of run-rate cost synergies. Assumes transaction close at year-end 2017. Acquisition funding will be ~$750 million of fully committed incremental long-term debt Itron anticipates leverage to fall below 2.0x within 2 years of closing As of June 30, 2017 Itron Silver Spring PF Combined (incl. cost synergies)1 Total debt $325M – $1,100M Net debt $196M ($118M) $1,000M Net debt / LTM EBITDA (excluding SBC) 0.8x NA 3.2x Itron Acquires Silver Spring |

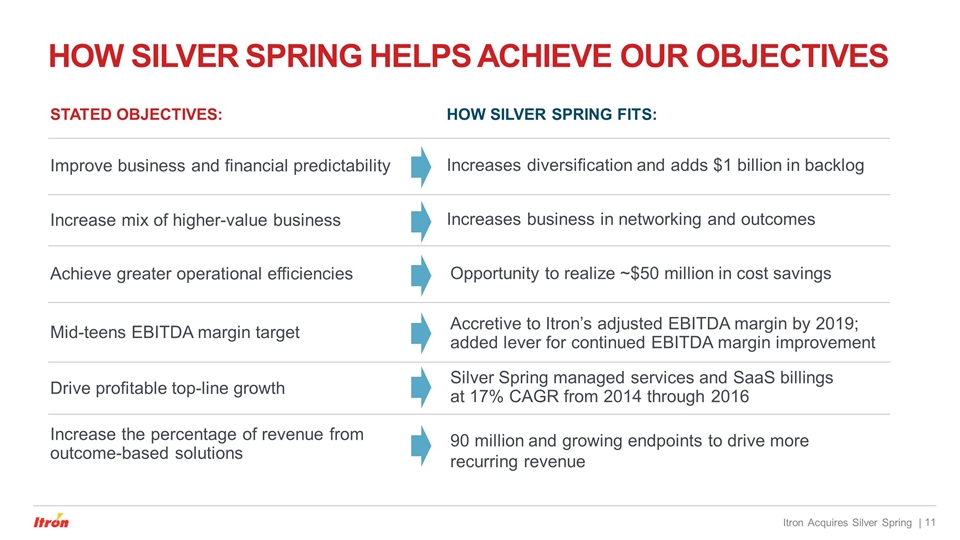

How Silver Spring helps achieve our objectives Itron Acquires Silver Spring | STATED OBJECTIVES: HOW SILVER SPRING FITS: Mid-teens EBITDA margin target Improve business and financial predictability Increase mix of higher-value business Achieve greater operational efficiencies Drive profitable top-line growth Increase the percentage of revenue from outcome-based solutions Increases diversification and adds $1 billion in backlog Increases business in networking and outcomes Opportunity to realize ~$50 million in cost savings Silver Spring managed services and SaaS billings at 17% CAGR from 2014 through 2016 Accretive to Itron’s adjusted EBITDA margin by 2019; added lever for continued EBITDA margin improvement 90 million and growing endpoints to drive more recurring revenue

Better together: Critical solutions for customers. Faster growth. Enhanced profitability. Itron Acquires Silver Spring | Robust partner ecosystem Industrial IoT applications Distribution automation Metering & sensing devices Distributed energy management Open-standards networking Combined utility & smart city deployments

non-gaap financial measures To supplement our consolidated financial statements presented in accordance with GAAP, we use certain non-GAAP financial measures, including non-GAAP operating expense, non-GAAP operating income, non-GAAP net income, non-GAAP diluted EPS, adjusted EBITDA, constant currency and free cash flow. We provide these non-GAAP financial measures because we believe they provide greater transparency and represent supplemental information used by management in its financial and operational decision making. We exclude certain costs in our non-GAAP financial measures as we believe the net result is a measure of our core business. The company believes these measures facilitate operating performance comparisons from period to period by eliminating potential differences caused by the existence and timing of certain expense items that would not otherwise be apparent on a GAAP basis. Non-GAAP performance measures should be considered in addition to, and not as a substitute for, results prepared in accordance with GAAP. Our non-GAAP financial measures may be different from those reported by other companies. A more detailed discussion of why we use non-GAAP financial measures, the limitations of using such measures, and reconciliations between non-GAAP and the nearest GAAP financial measures are included in the quarterly earnings press release. Q2 2016 Earnings Presentation Q2 2017 Earnings Conference Call |

Important Additional Information & Where to Find It This communication relates to the proposed merger transaction in which Itron will acquire Silver Spring Networks. In connection with the proposed transaction, Itron and Silver Spring intend to file relevant materials with the SEC, including Silver Spring ’s proxy statement on Schedule 14A. This communication does not constitute a solicitation of a proxy, an offer to purchase or a solicitation of an offer to sell any securities and is not a substitute for the proxy statement or any other document that Silver Spring may file with the SEC or send to its stockholders. Following the filing of the definitive proxy statement with the SEC, Silver Spring will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the Silver Spring special meeting relating to the proposed transaction. INVESTORS AND SECURITY HOLDERS OF Silver Spring ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND THESE OTHER MATERIALS IN THEIR ENTIRETY (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ITRON, SILVER SPRING AND THE PROPOSED TRANSACTION. The proxy statement and other documents filed by Silver Spring with the SEC may be obtained free of charge at Silver Spring’s website at www.ssni.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Silver Spring by requesting them by mail at Silver Spring, 230 W Tasman Drive, San Jose, California 95134, Attention: Investor Relations, or by telephone at (669) 770-4333. The documents filed by Itron with the SEC may be obtained free of charge at Itron’s website at www.itron.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Itron by requesting them by mail at 2111 N Molter Road, Liberty Lake, Washington 99019, Attention: Investor Relations, or by telephone at (509) 891-3283. Itron Acquires Silver Spring |

Certain Participants in the Solicitation Itron, Silver Spring Networks and certain of their directors, officers and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Silver Spring in connection with the proposed transaction. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Silver Spring’s stockholders in connection with the proposed transaction, and any direct or indirect interests, by security holdings or otherwise, they have in the proposed transaction, will be set forth in Silver Spring’s definitive proxy statement when it is filed with the SEC. Information regarding Silver Spring’s directors and executive officers and their ownership of Silver Spring’s securities is set forth in the definitive proxy statement for Silver Spring’s 2017 Annual Meeting of Stockholders, which was filed with the SEC on April 14, 2017, and its Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2016, which was filed with the SEC on March 10, 2017. To the extent holdings of such participants in Silver Spring securities are not reported, or have changed since the amounts described in the proxy statement for the 2017 Annual Meeting of Stockholders, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed transaction will be included in the proxy statement relating to such acquisition when it is filed with the SEC. These documents may be obtained free of charge at the SEC’s website at www.sec.gov. Itron Acquires Silver Spring |

INVESTOR RELATIONS CONTACTS THANK YOU Barbara Doyle, Vice President - Investor Relations 509-891-3443 barbara.doyle@itron.com Rebecca Hussey Program Manager, Investor Relations 509-891-3574 rebecca.hussey@itron.com