Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Carbonite Inc | a919178-kinvestorday.htm |

| EX-99.1 - EXHIBIT 99.1 - Carbonite Inc | ex991investorday.htm |

carbonite.com

September 19, 2017

Carbonite Inaugural

Financial Analyst and Investor Day

*The following are selected investor presentation slides. For the full set of presentation slides as

well as the accompanying audio webcast, please see the “Investors” section of Carbonite’s website.

Safe harbor and disclosures

Certain matters discussed in these slides and accompanying oral presentation have "forward-looking statements" intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements may generally be identified as such because the context of such

statements will include words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "will,"

"would" or words of similar import. Similarly, statements that describe the Company's future plans, objectives or goals are also forward-looking statements. Forward-

looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company's control. The

Company's actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including, but not limited to,

economic conditions and markets (including current financial conditions), exchange rate fluctuations, risks associated with debt prepayment, stock repurchases or

acquisitions in lieu of retaining such cash for future needs, and changes in regulatory conditions or other trends affecting the Internet and the information technology

industry. These and other important risk factors are discussed under the heading "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2016 filed with the Securities and Exchange Commission (the "SEC"), which is available on www.sec.gov, and elsewhere in any subsequent periodic or

current reports filed by us with the SEC. Except as required by applicable law, we do not undertake any obligation to update our forward-looking statements to reflect

future events, new information or circumstances.

This presentation contains non-GAAP financial measures including, but not limited to, Bookings, non-GAAP Revenue, non-GAAP Gross Margin, non-GAAP Net

Income and non-GAAP Net Income Per Share, and Adjusted Free Cash Flow. A reconciliation to GAAP can be found in the financial schedules included in our most

recent earnings press release located on Carbonite’s website, http://investor.carbonite.com, in Carbonite’s filings or with the SEC at www.sec.gov. The presentation of

non-GAAP financial information should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in

accordance with GAAP.

This presentation utilizes certain trademarks and service marks for reference purposes. All such trademarks and service marks are and remain the property of their

respective owners.

Any unreleased services or features referenced in this presentation are not currently available and may not be delivered or released on time or at all. Customers should

make their purchase decisions based upon features that are currently available.

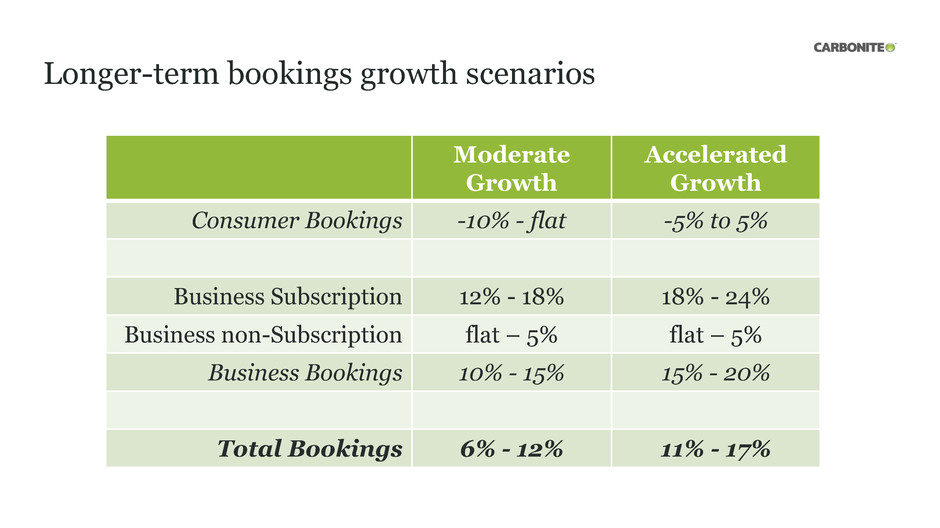

Longer-term bookings growth scenarios

Moderate

Growth

Accelerated

Growth

Consumer Bookings -10% - flat -5% to 5%

Business Subscription 12% - 18% 18% - 24%

Business non-Subscription flat – 5% flat – 5%

Business Bookings 10% - 15% 15% - 20%

Total Bookings 6% - 12% 11% - 17%

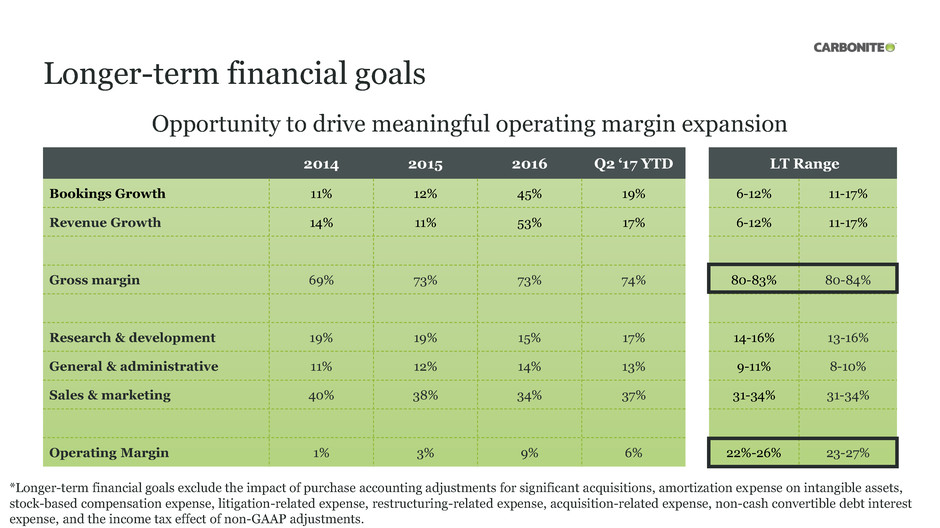

Longer-term financial goals

2014 2015 2016 Q2 ‘17 YTD LT Range

Bookings Growth 11% 12% 45% 19% 6-12% 11-17%

Revenue Growth 14% 11% 53% 17% 6-12% 11-17%

Gross margin 69% 73% 73% 74% 80-83% 80-84%

Research & development 19% 19% 15% 17% 14-16% 13-16%

General & administrative 11% 12% 14% 13% 9-11% 8-10%

Sales & marketing 40% 38% 34% 37% 31-34% 31-34%

Operating Margin 1% 3% 9% 6% 22%-26% 23-27%

Opportunity to drive meaningful operating margin expansion

*Longer-term financial goals exclude the impact of purchase accounting adjustments for significant acquisitions, amortization expense on intangible assets,

stock-based compensation expense, litigation-related expense, restructuring-related expense, acquisition-related expense, non-cash convertible debt interest

expense, and the income tax effect of non-GAAP adjustments.

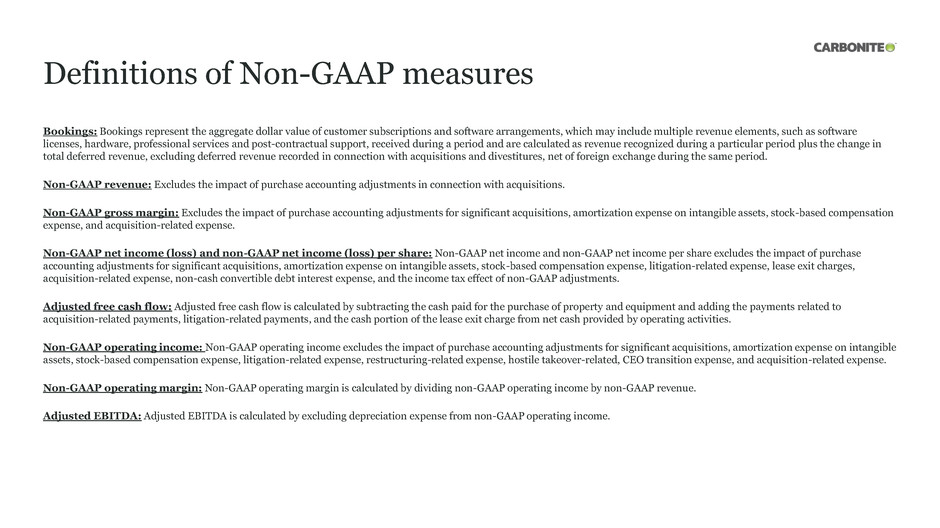

Definitions of Non-GAAP measures

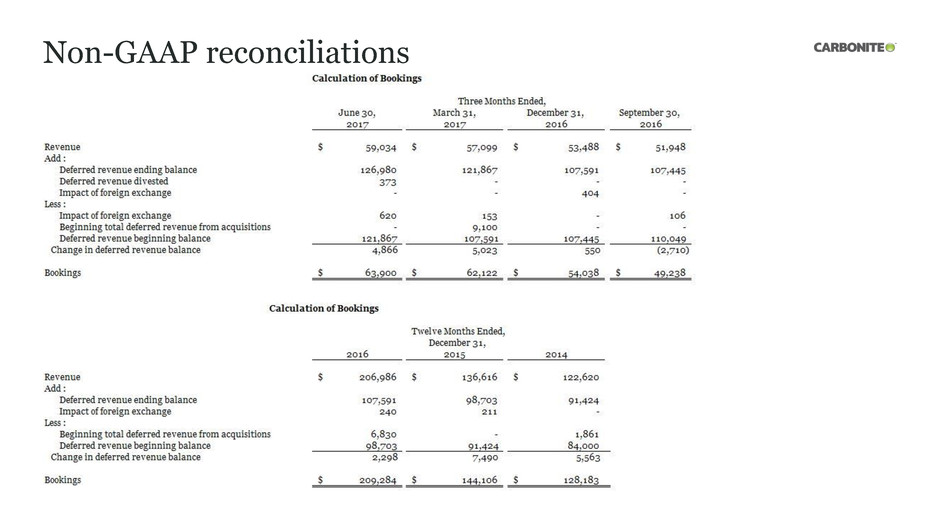

Bookings: Bookings represent the aggregate dollar value of customer subscriptions and software arrangements, which may include multiple revenue elements, such as software

licenses, hardware, professional services and post-contractual support, received during a period and are calculated as revenue recognized during a particular period plus the change in

total deferred revenue, excluding deferred revenue recorded in connection with acquisitions and divestitures, net of foreign exchange during the same period.

Non-GAAP revenue: Excludes the impact of purchase accounting adjustments in connection with acquisitions.

Non-GAAP gross margin: Excludes the impact of purchase accounting adjustments for significant acquisitions, amortization expense on intangible assets, stock-based compensation

expense, and acquisition-related expense.

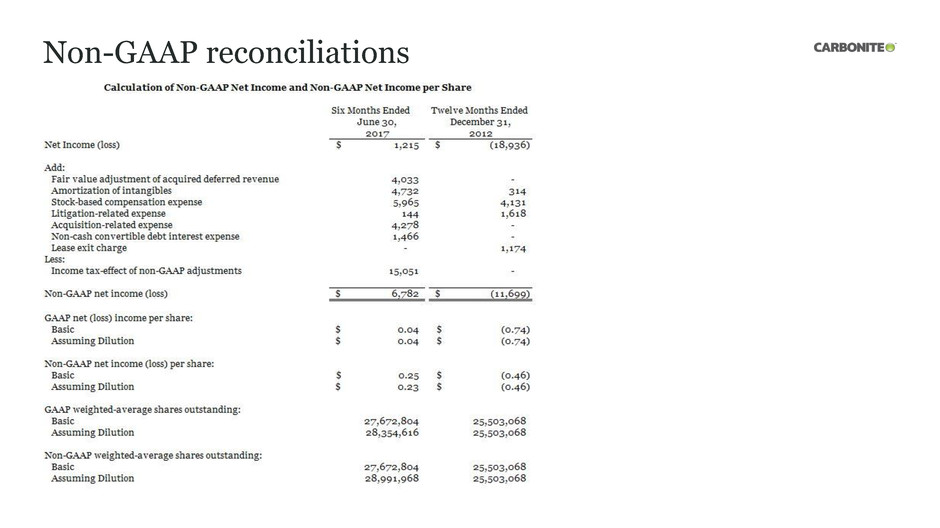

Non-GAAP net income (loss) and non-GAAP net income (loss) per share: Non-GAAP net income and non-GAAP net income per share excludes the impact of purchase

accounting adjustments for significant acquisitions, amortization expense on intangible assets, stock-based compensation expense, litigation-related expense, lease exit charges,

acquisition-related expense, non-cash convertible debt interest expense, and the income tax effect of non-GAAP adjustments.

Adjusted free cash flow: Adjusted free cash flow is calculated by subtracting the cash paid for the purchase of property and equipment and adding the payments related to

acquisition-related payments, litigation-related payments, and the cash portion of the lease exit charge from net cash provided by operating activities.

Non-GAAP operating income: Non-GAAP operating income excludes the impact of purchase accounting adjustments for significant acquisitions, amortization expense on intangible

assets, stock-based compensation expense, litigation-related expense, restructuring-related expense, hostile takeover-related, CEO transition expense, and acquisition-related expense.

Non-GAAP operating margin: Non-GAAP operating margin is calculated by dividing non-GAAP operating income by non-GAAP revenue.

Adjusted EBITDA: Adjusted EBITDA is calculated by excluding depreciation expense from non-GAAP operating income.

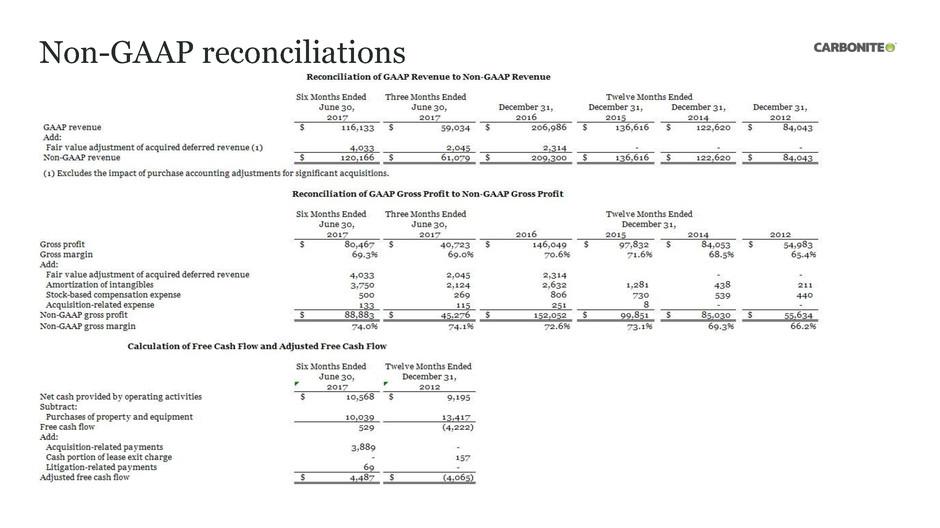

Non-GAAP reconciliations

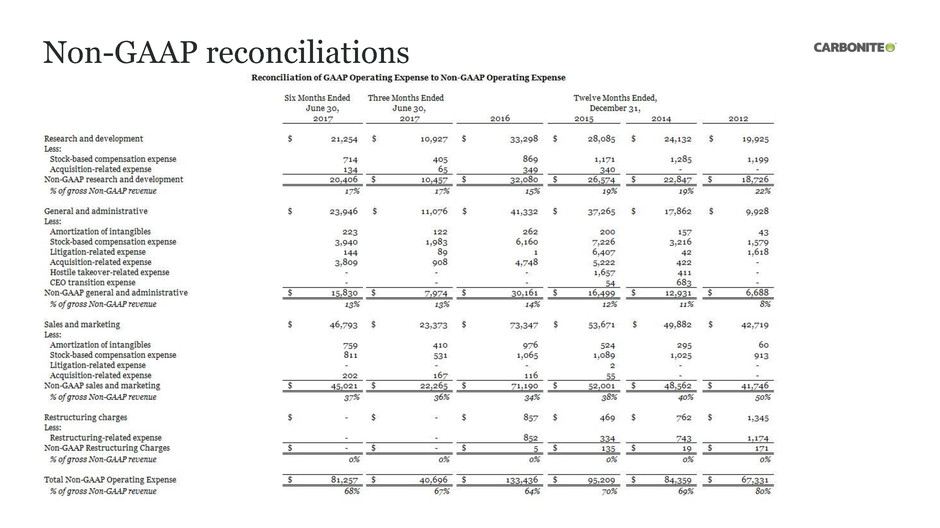

Non-GAAP reconciliations

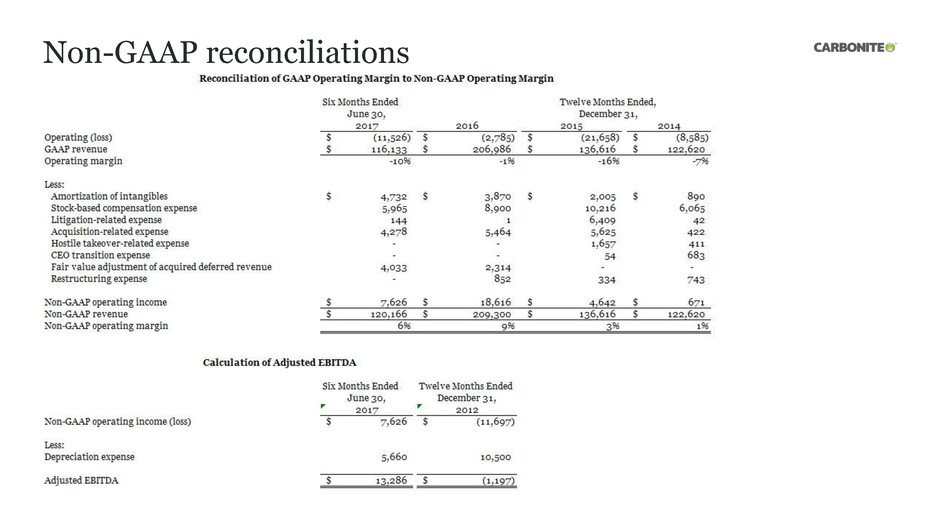

Non-GAAP reconciliations

Non-GAAP reconciliations

Non-GAAP reconciliations