Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - NORTHROP GRUMMAN CORP /DE/ | ex99-1.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - NORTHROP GRUMMAN CORP /DE/ | ex2-1.htm |

| 8-K - 8-K - NORTHROP GRUMMAN CORP /DE/ | form8k.htm |

Exhibit 99.2

Northrop Grumman CorporationAcquisition of Orbital ATK September 18, 2017 Webcast

Forward Looking Statements This communication may contain statements, other than statements of historical fact that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expect,” “intend,” “may,” “could,” “plan,” “project,” “forecast,” “believe,” “estimate,” “outlook,” “anticipate,” “trends,” “goals” and similar expressions generally identify these forward-looking statements. Forward-looking statements include, among other things, statements relating to the Company’s future financial condition, results of operations and/or cash flows, expected benefits of the proposed acquisition, the timing of the proposed acquisition and financing the proposed acquisition. Forward-looking statements are based upon assumptions, expectations, plans and projections that the Company believes to be reasonable when made, but which may change over time. These statements are not guarantees of future performance and inherently involve a wide range of risks and uncertainties that are difficult to predict. Specific risks that could cause actual results to differ materially from those expressed or implied in these forward-looking statements include, but are not limited to: those discussed in this communication, those identified under “Risk Factors” and other important factors disclosed in the Company’s Annual Report on Form 10-K and from time to time in the Company’s other filings with the SEC; the possibility that Orbital ATK stockholders may not approve the proposed acquisition; the possibility that the closing conditions of the proposed acquisition may not be satisfied; the possibility that regulatory approvals required for the proposed acquisition may not be obtained on acceptable terms, on the anticipated schedule, or at all; the possibility that long-term financing for the proposed acquisition may not be available on favorable terms, or at all; the risk that closing of the proposed acquisition may not occur or may be delayed, either as a result of litigation or otherwise; the occurrence of an event that could give rise to termination of the proposed acquisition; the risk that stockholder litigation in connection with the proposed acquisition may affect the timing or occurrence of the proposed acquisition or result in significant costs of defense, indemnification and liability; the possibility that anticipated benefits of the proposed acquisition may not be realized or may take longer to realize than expected; the possibility that costs related to the Company’s integration of Orbital ATK’s operations may be greater than expected and/or that revenues following the proposed acquisition may be lower than expected; the effect of the transaction on the ability of the Company and Orbital ATK to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers, including the U.S. Government; responses from customers and competitors to the proposed acquisition; the possibility that the Company’s business or Orbital ATK’s business may be disrupted due to transaction-related uncertainty; the risk that the proposed acquisition may distract the Company’s management from other important matters; the impact of legislative, regulatory and competitive changes; results from the proposed acquisition different than those anticipated; and the other risks and uncertainties detailed in Orbital ATK’s filings, including its Annual Report on Form 10-K, with the SEC.You are urged to consider the limitations on, and risks associated with, forward-looking statements and not unduly rely on the forward-looking statements including the accuracy thereof. Forward-looking statements are based on information, plans and estimates as of the date they are made and there may be other factors that may cause actual results to differ materially from these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by applicable law. 2

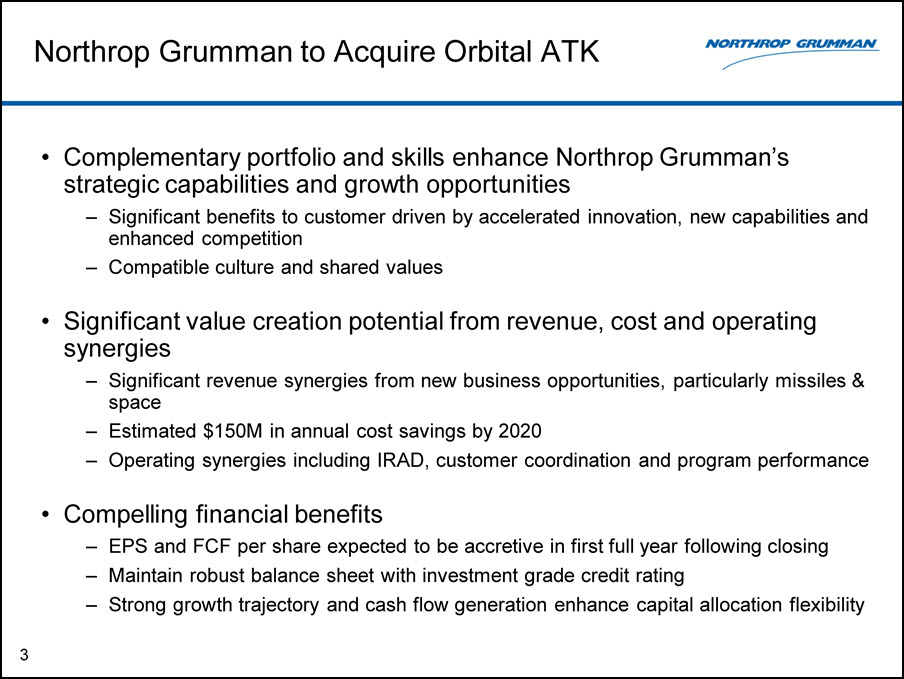

Northrop Grumman to Acquire Orbital ATK Complementary portfolio and skills enhance Northrop Grumman’s strategic capabilities and growth opportunitiesSignificant benefits to customer driven by accelerated innovation, new capabilities and enhanced competitionCompatible culture and shared valuesSignificant value creation potential from revenue, cost and operating synergiesSignificant revenue synergies from new business opportunities, particularly missiles & spaceEstimated $150M in annual cost savings by 2020Operating synergies including IRAD, customer coordination and program performanceCompelling financial benefitsEPS and FCF per share expected to be accretive in first full year following closingMaintain robust balance sheet with investment grade credit ratingStrong growth trajectory and cash flow generation enhance capital allocation flexibility 3

Orbital ATK – Highly Additive & Attractive Business Leading technologies and complementary capabilitiesAttractive portfolio of programs with minimal overlapStrong customer relationshipsIncreases international opportunitiesTechnically skilled employee population and compatible cultureHighly regarded leadership 4

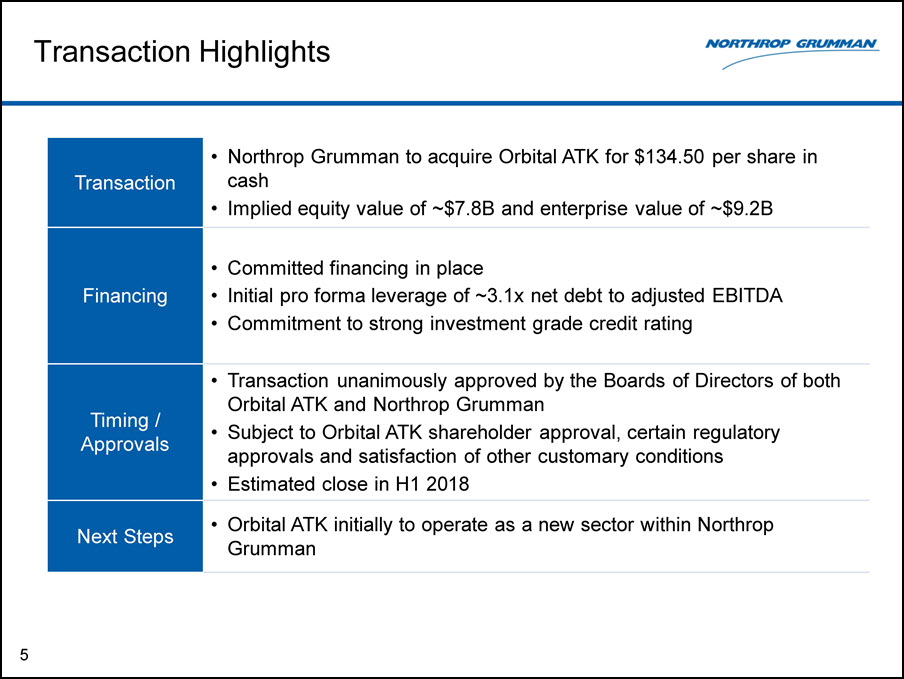

Transaction Highlights 5 Transaction Northrop Grumman to acquire Orbital ATK for $134.50 per share in cashImplied equity value of ~$7.8B and enterprise value of ~$9.2B Financing Committed financing in placeInitial pro forma leverage of ~3.1x net debt to adjusted EBITDACommitment to strong investment grade credit rating Timing / Approvals Transaction unanimously approved by the Boards of Directors of both Orbital ATK and Northrop GrummanSubject to Orbital ATK shareholder approval, certain regulatory approvals and satisfaction of other customary conditionsEstimated close in H1 2018 Next Steps Orbital ATK initially to operate as a new sector within Northrop Grumman

Orbital ATK 6 Created through 2015 merger of Orbital Sciences Corporation and ATK Aerospace and Defense~13,000 employees, including ~4,200 engineers and scientists$15.4B in total contract backlog2017 Financial GuidanceRevenue: $4.60 to $4.65 billion Operating Margin: 11.5% to 12.0%Free Cash Flow: $250 to $300 million

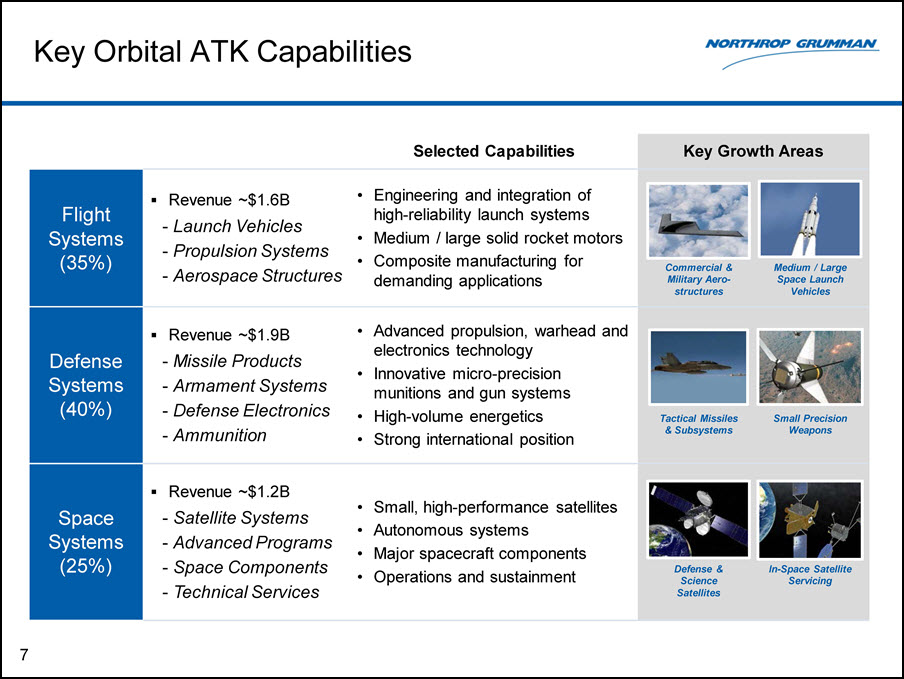

Selected Capabilities Key Growth Areas Flight Systems(35%) Revenue ~$1.6BLaunch VehiclesPropulsion SystemsAerospace Structures Engineering and integration of high-reliability launch systemsMedium / large solid rocket motorsComposite manufacturing for demanding applications Defense Systems (40%) Revenue ~$1.9BMissile ProductsArmament SystemsDefense ElectronicsAmmunition Advanced propulsion, warhead and electronics technologyInnovative micro-precision munitions and gun systemsHigh-volume energeticsStrong international position Space Systems (25%) Revenue ~$1.2BSatellite SystemsAdvanced ProgramsSpace ComponentsTechnical Services Small, high-performance satellitesAutonomous systemsMajor spacecraft componentsOperations and sustainment Key Orbital ATK Capabilities 7 Commercial & Military Aero-structures Medium / Large Space Launch Vehicles Tactical Missiles & Subsystems Small Precision Weapons Defense & Science Satellites In-Space Satellite Servicing

Benefits to Orbital ATK – Enhanced Technologies and Capabilities Greater access to and coordination of investment resourcesIncreased competitiveness in select mission areasEnhanced ability to meet customer needsReach-back capabilities from current Northrop Grumman sectorsRetention of merchant supplier and supply chain relationships 8

Complementary Core Capabilities Key Capabilities Northrop Grumman2017E Sales: Low $25B Orbital ATK2017E Sales: $4.60B to $4.65B Aircraft ü Large Space Systems ü Small Space Systems ü Launch Vehicles & Propulsion ü Missiles & Munitions ü Radars, Sensors & Processing ü Cyber Systems ü Large Scale Logistics & Sustainment ü 9

Significant Shareholder Value Creation Opportunities 10 Revenue Synergies New business opportunitiesMissile and missile defenseSpaceRestricted Cost Savings Estimated to achieve $150M run rate by 2020Corporate and back-office integrationFacility optimizationOrganizational alignment Operating Synergies IRADCustomer coordinationProgram performance Cash flowCap ExManufacturing and supply chain

Capital Deployment Priorities Northrop Grumman will continue to invest for profitable growthContinued robust Cap Ex and IRADCapital StructureCommitted to solid investment grade credit ratingStrong cash flow generation supports near-term focus on debt reductionShareholdersCommitted to dividend payout ratio of 30% to 40% of economic net earningsShare repurchases remain an important component of capital deployment 11 Strong cash generation enables value creating capital deployment

Key Takeaways Orbital ATK represents a strategic acquisition that benefits all key stakeholdersEnhances capabilities and growth potential in multiple marketsMeaningful value creation opportunity driven by strategic fit and synergiesStrong, complementary and diverse capabilities provide near- and long-term growth and enhanced competitionTransaction expected to be accretive to EPS and free cash flow per share in first full year of ownershipStrong combined cash flow generation supports Northrop Grumman’s strategic priorities and financial flexibility 12

Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed acquisition of Orbital ATK by the Company. In connection with the proposed acquisition, Orbital ATK intends to file relevant materials with the SEC, including a proxy statement in preliminary and definitive form. Following the filing of a definitive proxy statement with the SEC, Orbital ATK will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Stockholders of Orbital ATK are urged to read these materials (including any amendments or supplements thereto) and any other relevant documents Orbital ATK will file with the SEC in connection with the proposed acquisition when such documents become available, including Orbital ATK’s definitive proxy statement, because they will contain important information about the proposed acquisition. Investors and security holders are able to obtain the documents (once available) free of charge at the SEC’s web site, http://www.sec.gov, and from Orbital ATK by going to its investor relations web site at www.orbitalatk.com/investors. Such documents are not currently available. Participants in Solicitation The Company and its directors and executive officers, and Orbital ATK and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Orbital ATK shares of common stock in respect of the proposed acquisition. Information about the directors and executive officers of the Company is set forth in the proxy statement for the Company’s 2017 Annual Meeting of Shareholders, which was filed with the SEC on March 31, 2017. Information about the directors and executive officers of Orbital ATK is set forth in the proxy statement for Orbital ATK’s 2017 Annual Meeting of Stockholders, which was filed with the SEC on June 23, 2017. Information regarding the identity of the potential participants, and their direct or indirect interests in the proposed acquisition, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the proposed acquisition.

THE VALUE OF PERFORMANCE. NORTHROP GRUMMAN