Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Monotype Imaging Holdings Inc. | d456120d8k.htm |

Exhibit 99.1

Monotype

Investor Update

September 2017

Safe Harbor

This

presentation contains forward—looking statements, including those related to our investment thesis, including scale and expansion, the growth of our brand engagement platforms, our total addressable market and target revenue growth rates, our

ability to bridge our customers’ design and marketing needs, our annual customer opportunity revenue amounts, our ability to sustain long—term success based on our unique assets, our ability to generate shareholder returns and our future

growth opportunities in our products and services and long term models that involve significant risks and uncertainties, including those discussed in the “Risk Factors” section of Monotype Imaging Holdings Inc.’s Form 10—K and

subsequent filings with the SEC. We are providing this information as of today’s date and do not undertake any obligation to update any forward—looking statements contained in this document as a result of new information, future events or

otherwise. No forward—looking statement can be guaranteed and actual results may differ materially from those that are projected . Unless otherwise noted herein, all numeric references made in this presentation, including but not limited to

Total Addressable Market (TAM), Compounded Annual Growth Rates (CAGR); addressed or addressable markets, market segments, brands, corporations, firms, users or professionals; transaction sizes; the Global 2000; are Monotype Imaging Holdings Inc.

internal estimates or market descriptions, as applicable.

Who We Are

Empower expression & engagement Our Vision

Monotype at a Glance — Revenues of over $200 million in 2016 — Generated approximately $60 million of EBITDA in 2016 — History of strong shareholder returns — More than 900 employees globally — Trades on NASDAQ under Ticker TYPE — Headquartered in Woburn, MA Our mission is to be the first place to turn for the design assets, technology and expertise that empower brand engagement, self expression and the best user experiences.

Compelling Investment Thesis Strategy – Extending value proposition to Brands and Creatives by adding creative assets and technology to well—positioned font foundation Scale & Expansion – Targeting large and growing markets Products – Designing solutions to solve critical customer pain points Customers & Partners – Expanding leadership position with Global 2000 Brands Position – Highly differentiated assets create large competitive moat Financials – Prioritizing strong balance sheet and shareholder returns Leadership – Experienced and proven team

What We Do

Marketing Design Brand noun_600357.eps noun_1023.eps noun_526201.eps Our Value Define an impactful visual expression of your brand. Differentiate through authentic, on—brand content. Express your brand consistently across all channels and media. Engage with your best customers with meaningful content. Analyze and draw insight from interactions with your customers. Calibrate your content and communications using this insight.

Image result for nike logo #mypotterybarn Image result for times of london font We Empower Brands with Differentiated Design and Marketing Assets Our Value in Action Consistently expressing the brand across all communications channels with beautiful, relevant and impactful content Finding authentic content from best customers and most passionate advocates, and using insights to improve all expressions of the brand

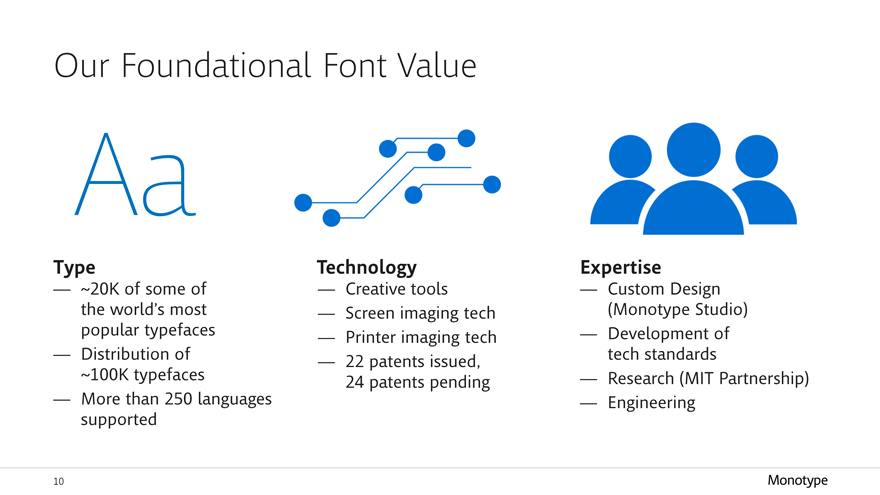

Type — ~20K of some of the world’s most popular typefaces — Distribution of ~100K typefaces — More than 250 languages supported Technology — Creative tools — Screen imaging tech — Printer imaging tech — 22 patents issued, 24 patents pending Expertise — Custom Design (Monotype Studio) — Development of tech standards — Research ( MIT Partnership) — Engineering Our Foundational Font Value Aa noun_28734.eps noun_95828.eps

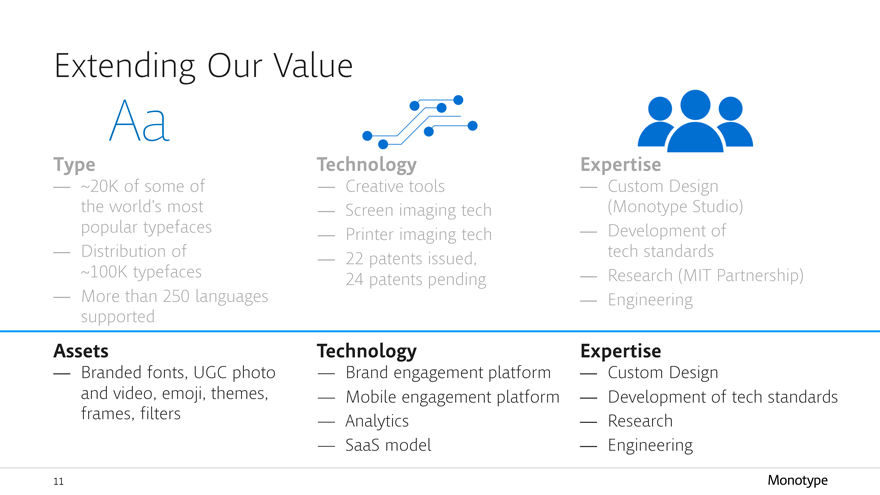

Type — ~20K of some of the world’s most popular typefaces — Distribution of ~100K typefaces — More than 250 languages supported Technology — Creative tools — Screen imaging tech — Printer imaging tech — 22 patents issued, 24 patents pending Expertise — Custom Design (Monotype Studio) — Development of tech standards — Research (MIT Partnership) — Engineering Extending Our Value Aa noun_28734.eps noun_95828.eps Assets — Branded fonts, UGC photo and video, emoji , themes , frames, filters Technology — Brand engagement platform — Mobile engagement platform — Analytics — SaaS model Expertise — Custom Design — Development of tech standards — Research — Engineering

2.5 Billion # of Consumer Devices Running Monotype Software 3.5 Million Relationships with Creative Professionals 45 Percent Of Global 2000 Brands Using Monotype IP

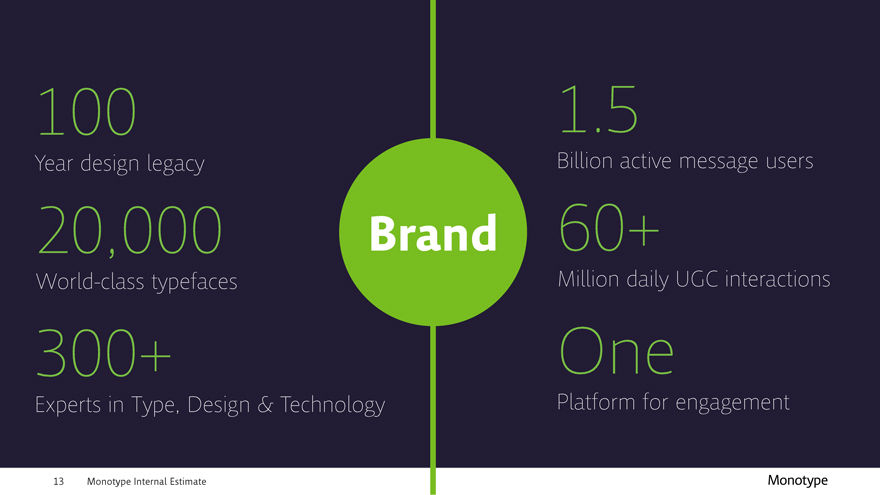

Brand 20,000 World—class typefaces 100 Year design legacy 300+ Experts in Type, Design & Technology 60+ M illion daily UGC interactions 1.5 Billion active message users One Platform for engagement

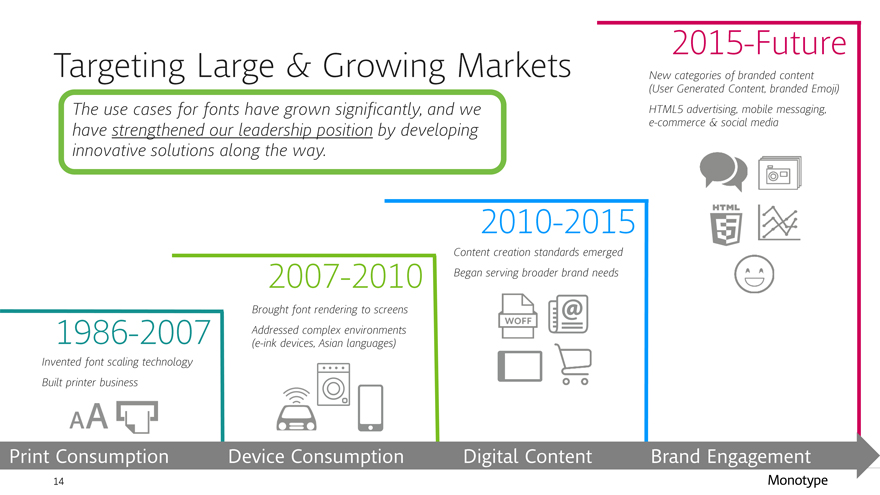

2015—Future Targeting Large & Growing Markets noun_32723.eps noun_693337.eps 2007—2010 noun_526201.eps noun_66561.eps noun_600357.eps noun_1023.eps 1986—2007 2010—2015 Print Consumption Device Consumption Digital Content Brand Engagement The use cases for fonts have grown significantly, and we have strengthened our leadership position by developing innovative solutions along the way. Invented font scaling technology Built printer business Brought font rendering to screens Addressed complex environments (e—ink devices, Asian languages) Content creation standards emerged Began serving broader brand needs New categories of branded content (User Generated Content, branded Emoji) HTML5 advertising, mobile messaging, e—commerce & social media

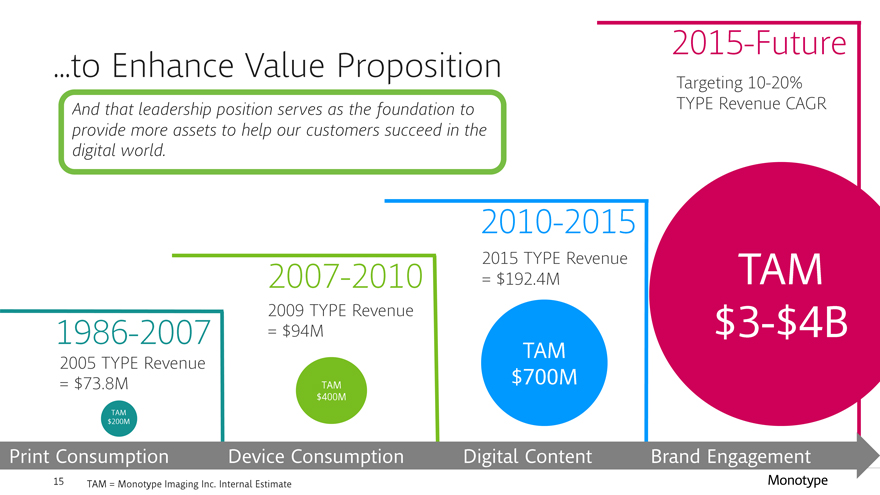

…to Enhance Value Proposition TAM $3—$4B 2005 TYPE Revenue = $73.8M 2007—2010 2015—Future 1986—2007 2010—2015 TAM $400M TAM $700M TAM $200M Print Consumption Device Consumption Digital Content Brand Engagement And that leadership position serves as the foundation to provide more assets to help our customers succeed in the digital world. 2009 TYPE Revenue = $94M 2015 TYPE Revenue = $192.4M Targeting 10—20% TYPE Revenue CAGR

The Brand Opportunity

Travel Leisure Retail Sports Entertainment Food & Beverage News Food Online Technology Finance Automotive Design Consumer Packaged Goods Healthcare Insurance Manufacturing Media Online Real estate Religion Jewelry Telecommunications Electronics Travel Leisure Retail Sports Entertainment Food & Beverage News Technology Finance Online Leisure Automotive Design Consumer Packaged Goods Healthcare Insurance Manufacturing Retail Sports Media Online Real estate Religion Jewelry Insurance Telecommunications Electronics Travel Leisure Retail Travel Leisure Retail Sports Entertainment Food & Beverage News Technology Finance Automotive Design Consumer Packaged Goods Healthcare Insurance Travel Leisure Retail Manufacturing Media Online Real estate Religion Jewelry Telecommunications Electronics Travel Leisure Retail Sports Entertainment Food & Beverage News Technology Finance Automotive Design Consumer Packaged Goods Healthcare Insurance Manufacturing Media Online Real estate Religion Jewelry Telecommunications Electronics Travel Leisure Retail Sports Entertainment Food & Beverage News Sports Technology Finance Automotive Design Consumer Packaged Goods 45 Percent Of Global 2000 Brands Using Monotype IP

Brand #mypotterybarn Image result for nike logo Image result for times of london font Marketing Design As we bridge our customers’ design & marketing needs, we believe we can unlock holistic annual revenue opportunities of $200K – $500K Annual Customer Opportunity $100K – $200K Annual Customer Opportunity $100K – $300K Branded Marketing Content Desktop, Web Fonts, Apps, Ads Global 2000 Opportunity

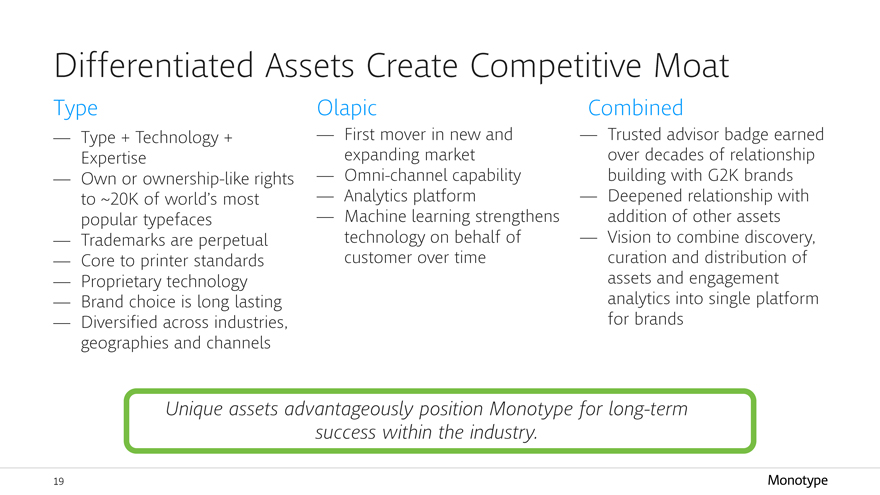

— Type + Technology + Expertise — Own or ownership—like rights to ~20K of world’s most popular typefaces — Trademarks are perpetual — Core to printer standards — Proprietary technology — Brand choice is long lasting — Diversified across industries, geographies and channels — First mover in new and expanding market — Omni—channel capability — Analytics platform — Machine learning strengthens technology on behalf of customer over time — Trusted advisor badge earned over decades of relationship building with G2K brands — Deepened relationship with addition of other assets — Vision to combine discovery, curation and distribution of assets and engagement analytics into single platform for brands Type Olapic Combined Unique assets advantageously position Monotype for long—term success within the industry. Differentiated Assets Create Competitive Moat

Financial Update

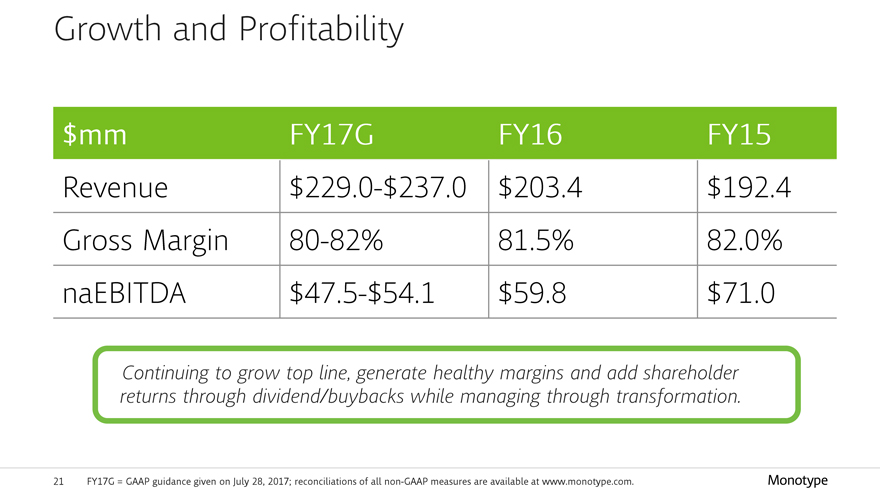

Growth and Profitability $mm FY17G FY16 FY15 Revenue $229.0—$237.0 $203.4 $192.4 Gross Margin 80—82% 81.5% 82.0% na EBITDA $47.5—$54.1 $59.8 $71.0 Continuing to grow top line, generate healthy margins and add shareholder returns through dividend/buybacks while managing through transformation.

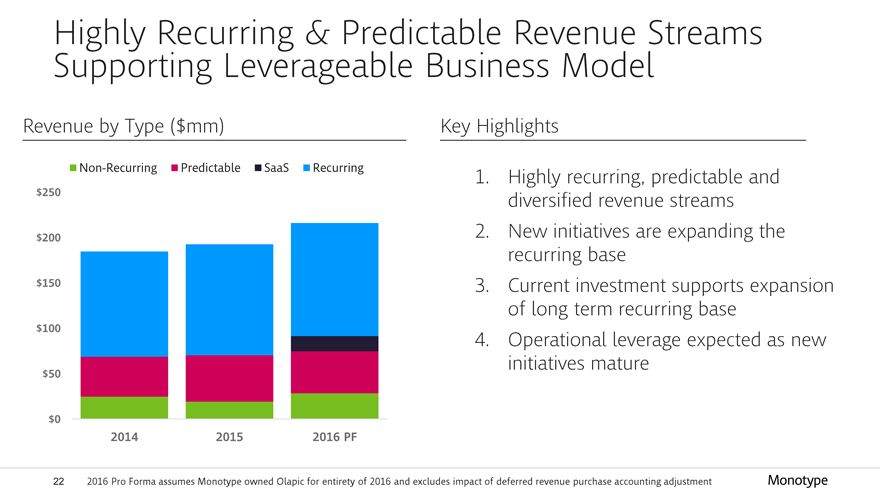

$0 $50 $100 $150 $200 $250 2014 2015 2016 PF Non-Recurring Predictable SaaS Recurring 1. Highly recurring, predictable and diversified revenue streams 2. New initiatives are expanding the recurring base 3. Current investment supports expansion of long term recurring base 4. Operational leverage expected as new initiatives mature Revenue by Type ($mm) Key Highlights FIX Highly Recurring & Predictable Revenue Streams Supporting Leverage able Business Model

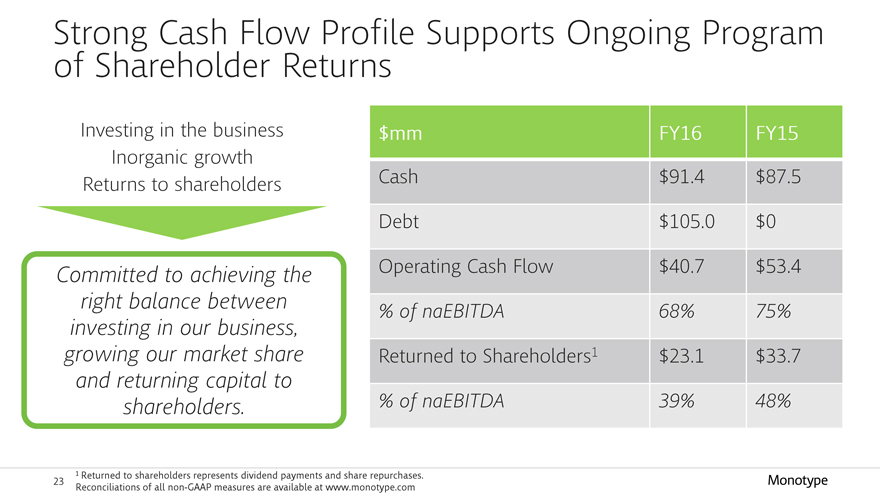

Investing in the business Inorganic growth Returns to shareholders Committed to achieving the right balance between investing in our business, growing our market share and returning capital to shareholders. $mm FY16 FY15 Cash $91.4 $87.5 Debt $105.0 $0 Operating Cash Flow $40.7 $53.4 % of na EBITDA 68% 75% Returned to Shareholders 1 $23.1 $33.7 % of na EBITDA 39% 48% Strong Cash Flow Profile Supports Ongoing Program of Shareholder Returns

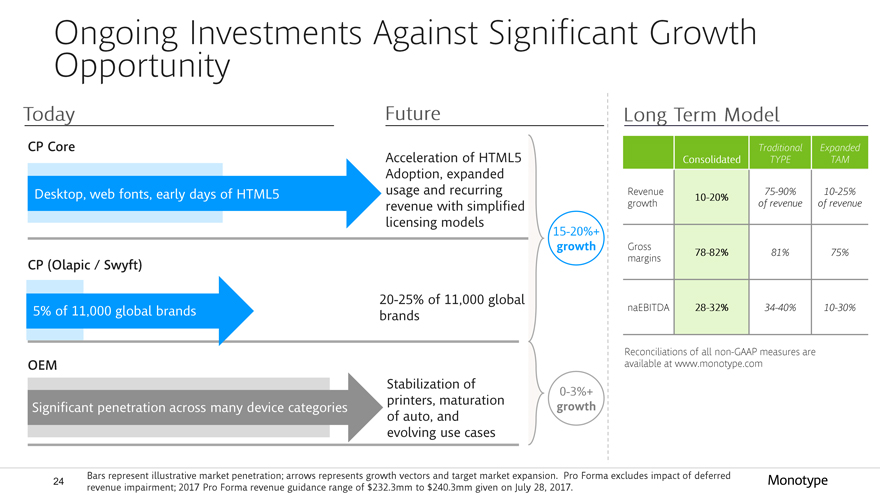

Ongoing Investments Against Significant G rowth Opportunity CP Core Acceleration of HTML5 Adoption, expanded usage and recurring revenue with simplified licensing models Desktop, web fonts, early days of HTML5 Today Future 20—25% of 11,000 global brands 15—20%+ growth CP ( Olapic / Swyft ) Stabilization of printers, maturation of auto, and evolving use cases Significant penetration across many device categories OEM 0—3%+ growth Consolidated Traditional TYPE Expanded TAM Revenue growth 10—20% 75—90% of revenue 10—25% of revenue Gross margins 78—82% 81% 75% naEBITDA 28—32% 34—40% 10—30% Long Term Model Reconciliations of all non—GAAP measures are available at www.monotype.com 5% of 11,000 global brands

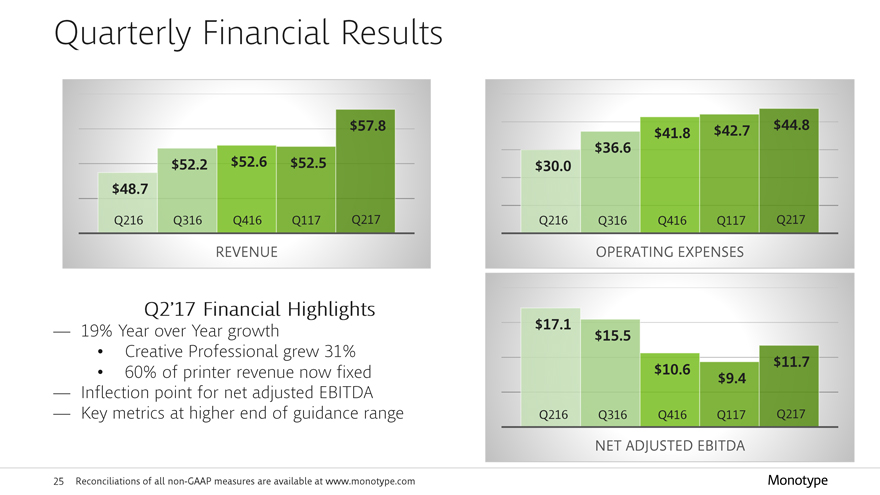

Quarterly Financial Results Q2’17 Financial Highlights — 19% Year over Year growth Creative Professional grew 31% 60% of printer revenue now fixed — Inflection point for net adjusted EBITDA — Key metrics at higher end of guidance range $48.7 $52.2 $52.6 $52.5 $57.8 REVENUE Q216 Q316 Q416 Q117 Q217 $30.0 $36.6 $41.8 $42.7 $44.8 OPERATING EXPENSES Q216 Q316 Q416 Q117 Q217 $17.1 $15.5 $10.6 $9.4 $11.7 NET ADJUSTED EBITDA Q216 Q316 Q416 Q117 Q217

Measuring Success with a Recurring and Leverage able Business Model Continued Creative Professional Momentum OEM Stabilization Olapic ARR Global 2000 Penetration Building upon Monotype’s strong core with a transformation plan to fuel growth and value for shareholders.

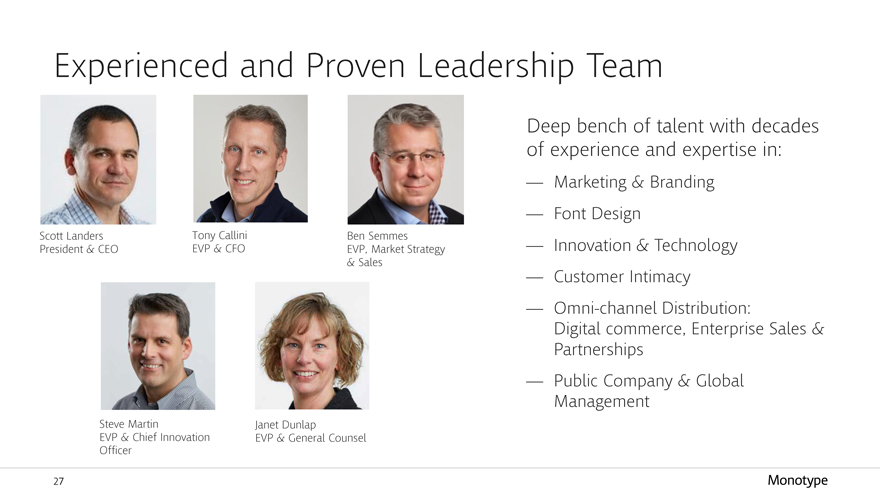

Experienced and Proven Leadership Team Deep bench of talent with decades of experience and expertise in: — Marketing & Branding — Font Design — Innovation & Technology — Customer Intimacy — Omni—channel Distribution: Digital commerce, Enterprise Sales & Partnerships — Public Company & Global Management Ben Semmes EVP, Market Strategy & Sales Scott Landers President & CEO Steve Martin EVP & Chief Innovation Officer Janet Dunlap EVP & General Counsel Tony Callini EVP & CFO

Compelling Investment Thesis Strategy – Extending value proposition to Brands and Creatives by adding creative assets and technology to well—positioned font foundation Scale & Expansion – Targeting large and growing markets Products – Designing solutions to solve critical customer pain points Customers & Partners – Expanding leadership position with Global 2000 Brands Position – Highly differentiated assets create large competitive moat Financials – Prioritizing strong balance sheet and shareholder returns Leadership – Experienced and proven team

Thank You