Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF PARITZ & COMPANY, P.A. - JAKROO INC. | fs12017a1ex23-1_jakrooinc.htm |

| EX-5.2 - OPINION OF B&D LAW FIRM - JAKROO INC. | fs12017a1ex5-2_jakrooinc.htm |

| EX-5.1 - OPINION OF ELLENOFF GROSSMAN & SCHOLE LLP - JAKROO INC. | fs12017a1ex5-1_jakrooinc.htm |

| EX-3.3 - CERTIFICATE OF AMENDMENT TO ARTICLES OF INCORPORATION - JAKROO INC. | fs12017a1ex3-3_jakrooinc.htm |

As filed with the U.S. Securities and Exchange Commission on September 18, 2017

Registration No. 333-217412

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

To

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

JAKROO INC.

(Exact name of registrant as specified in its charter)

| Nevada | 3949 | 81-1565811 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5906 Stoneridge Mall Road

Pleasanton, CA 94588

800-485-7067

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mr. Weidong (Wayne) Du

Chief Executive Officer

5906 Stoneridge Mall Road

Pleasanton, CA 94588

800-485-7067

(Name, address including zip code, and telephone number, including area code, of agent for service)

Copies to:

Richard I. Anslow, Esq.

Lawrence A. Rosenbloom, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of Americas, 11th Floor

New York, NY 10105

Tel: 212-370-1300

Fax: 212-370-7889

APPROXIMATE DATE OF PROPOSED SALE TO PUBLIC: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box:☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act . ☐

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered(1) | Proposed maximum offering price per share | Proposed maximum aggregate offering price | Amount of registration fee | ||||||||||||

| common stock, par value $0.001 per share, offered by certain selling stockholders | 1,708,650 shares | (3) | $ | 0.22 | (2) | 381,599 | $ | 45.00 | ||||||||

| (1) | Pursuant to Rule 416 of the Securities Act of 1933, as amended (the “Securities Act”), also registered hereby are such additional and indeterminable number of shares of common stock of the registrant as may be issuable due to adjustments for changes resulting from stock dividends, stock splits and similar changes. |

| (2) | Estimated pursuant to Rule 457 under the Securities Act solely for the purpose of calculating the amount of the registration fee, based on the purchase price of the registrant’s common stock sold in a private placement which closed on January 24, 2017. Currently, there is no trading market for the registrant’s common stock. |

| (3) | The 1,708,650 shares of common stock are being registered for resale (the “Registered Shares”) by certain selling stockholders named in this registration statement. The Registered Shares were issued by the registrant (i) in connection with the sale of 1,466,880 shares of common stock to London Financial Group Ltd. at an offering price of $0.1636 per share; and (ii) in connection with a private placement of 241,770 shares of our common stock at an offering price of $0.22 per share. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission (“SEC”) is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| Preliminary Prospectus | Subject to Completion, dated September 18, 2017 |

1,708,650 Shares

Common Stock

This prospectus relates to the sale of up to a total of 1,708,650 shares of common stock, par value $0.001 per share, of Jakroo Inc., a Nevada corporation, that may be sold from time to time by the selling stockholders named in this prospectus and their successors and assigns. The shares of common stock subject to this prospectus were issued to the selling stockholders (i) in connection with the sale of 1,466,880 shares of our common stock to London Financial Group Ltd. as described in this prospectus; and (ii) in connection with a private placement of 241,770 shares of our common stock which closed on January 24, 2017.

Our common stock is not presently traded on any market or securities exchange, and we have not applied for listing or quotation on any exchange. We have submitted our application for the quotation of our common stock on the OTCQX Market and/or the OTCQB Market operated by OTC Markets Group, Inc. (which we refer to herein collectively as the OTC Market), which if approved would only occur following the effectiveness of the registration statement of which this prospectus forms a part. The 1,708,650 shares of common stock registered hereby can be sold by selling stockholders at a fixed price of $0.22 per share until our shares are quoted on the OTC Market and thereafter at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (referred to herein as FINRA), nor can we provide assurance that our shares will actually be quoted on the OTC Market or, if quoted, that a viable public market will materialize or be sustained.

Information regarding the selling stockholders and the time and manner in which they may offer and sell the shares under this prospectus is provided under “Selling Stockholders” and “Plan of Distribution” in this prospectus. We have agreed to pay all the costs and expenses of this registration. We will not receive any proceeds from the sale of shares by the selling stockholders.

We are an “emerging growth company” under the federal securities laws and are subject to reduced public company reporting requirements.

An investment in our securities is highly speculative, involves a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page 8 of this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017.

i

This prospectus is part of a registration statement we filed with the SEC. You should rely only on the information provided in this prospectus and incorporated by reference in this prospectus. We have not authorized anyone to provide you with information different from that contained in or incorporated by reference into this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. The selling stockholders are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where such offers and sales are permitted.

Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after such date. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock. The rules of the SEC may require us to update this prospectus in the future.

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes estimates of market share and industry data and forecasts that we obtained from industry publications and surveys and/or internal company sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such included information. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, while we believe our internal estimates with respect to our industry are reliable, our estimates have not been verified by any independent sources. Although we are not aware of any misstatements regarding any industry data presented in this prospectus, our estimates, in particular as they relate to market share and our general expectations, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” beginning on page 8. Unless otherwise noted, all market share data is based on net sales in the applicable market.

ii

This summary highlights certain information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including our financial statements and related notes, and especially the risks described under “Risk Factors” beginning at page 8. Readers are that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

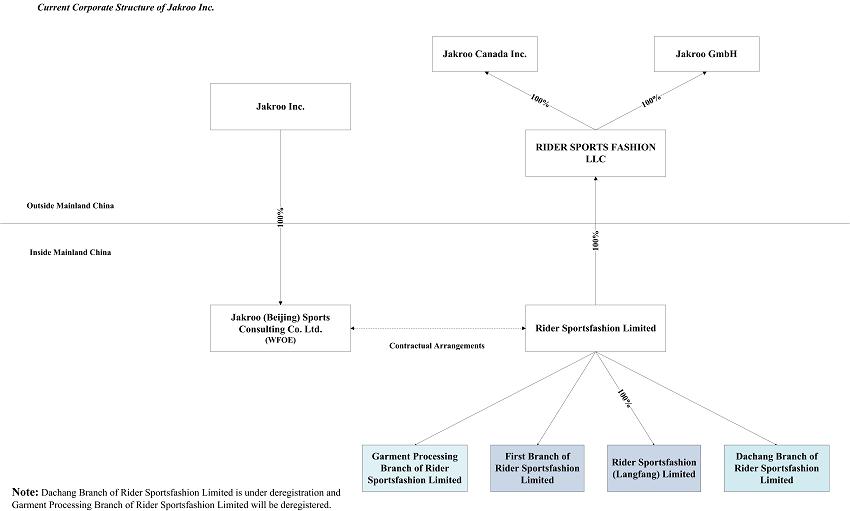

All references to “we,” “us,” “our,” the “Company” or similar terms used in this prospectus refer to Jakroo Inc., a Nevada corporation (“Jakroo”), including its consolidated subsidiaries and variable interest entities (“VIE”), unless the context indicates otherwise. We conduct our business through our operating entities Rider Sportsfashion Limited (“Rider Beijing”), First Branch of Rider Sportsfashion Limited (“First Branch”), Dachang Branch of Rider Sportsfashion Limited (“Dachang Branch”), Rider Sportsfashion (Langfang) Limited (“Rider Langfang”), Rider Sportsfashion LLC (“Rider US”), Jakroo Canada Inc. (“Rider Canada”) and Jakroo GmbH (“Rider Austria”). Rider US, First Branch and Dachang Branch are wholly owned subsidiaries of Rider Beijing. Rider Canada and Rider Austria are wholly owned subsidiaries of Rider US. Rider Beijing is controlled by our wholly owned subsidiary Jakroo (Beijing) Sports Consulting Co. Ltd. (“WFOE”) via certain contractual arrangements.

As used herein, the terms “PRC” or “China” refers to the People’s Republic of China, excluding, for purposes of this prospectus, Taiwan, Hong Kong and Macau. “RMB” or “Renminbi” refers to the legal currency of China and “$,” “US$” or “U.S. Dollars” refers to the legal currency of the United States.

Unless otherwise indicated, all share amounts and per share amounts in this prospectus have been presented on a pro-forma basis to reflect a forward stock split of the outstanding shares of our common stock at a ratio of 3-for-1 effected on August 9, 2017.

Our Business

We specialize in the design, manufacture and direct sale of customized technical endurance apparel for the cycling, triathlon, running and Nordic skiing markets across Asia, Europe and North America. Our made-to-order, just-in-time (“JIT”) process vertically integrates the design, sales and distribution of sporting apparel products.

Our global sporting apparel business is currently comprised of three core business units: inline retail, which consists of products produced and sold as part of a collection (“Inline Retail”), OEM contract manufacturing (“OEM”) and custom order retail (“Custom Order Retail”). Our Inline Retail, OEM and Custom Order Retail businesses for the year ended December 31, 2016 accounted for 21%, 12% and 67% of our sales revenue, respectively.

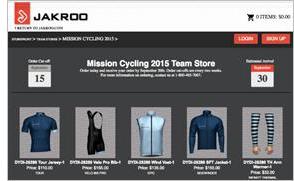

The two primary sales channels for our Inline Retail and Custom Order Retail businesses are direct sale and wholesale. Direct sale currently generates 75% of our worldwide sales revenues. Under the direct sale model, we sell our products directly to end users through our Jakroo e-commerce platform. The Jakroo platform allows customers to easily log into our platform, complete their design and place purchase orders. Wholesale currently represents 25% of our worldwide sales revenue. We act as both retailer and wholesalers of our products through our e-commerce platform and through large online retailers such as TMALL in China. Sales through both channels are executed with payments made to us online prior to production and shipment of products.

In order to target customers in major markets, we have set up sales offices in China, the United States, Canada and Austria that provide sales, marketing and customer service support to our regional markets. We currently lease a 64,000 square foot production facility located at the border of Beijing and Hebei Province in China. The facility has an annual capacity to produce 500,000 jerseys and manufactures all of our products. As of the date of this prospectus, we have approximately 193 employees worldwide.

Our Strategy

Customer Acquisition

We acquire the majority of our customers online through Search Engine Marketing (SEM) and display marketing campaigns on Google, Bing and social media websites such as Facebook and Twitter. In China, comprehensive platforms such as WeChat, QQ and Weibo play an important role in our customer acquisition, engagement and social media commerce strategies. We plan to continue to invest in advertising and marketing on our website to strengthen brand awareness in key markets.

| 1 |

Sponsorship of organized race events and charity rides has also played a key role in our customer acquisition, along with sponsorship of influential teams and athletes to establish brand credibility. We currently sponsor several large profile Gran Fondo cycling events and Triathlon events across Canada, California and Austria. We have also sponsored the Union Cycliste Internationale (“UCI”) Tour of Beijing and the UCI Tour of Hainan, both of which are high profile cycling events in China with international athlete participation and media exposure. As of January 2017, we became the exclusive race apparel sponsor of the UnitedHealthcare Pro Cycling Team, a U.S.-based pro-continental team with global recognition among the competitive cycling community. We will continue to seek sponsorship opportunities to expand our customer base and enhance brand recognition.

Lateral Expansion & Further Vertical Integration

We have experienced year over year profitable growth since 2011 and we plan to continue our international growth and expansion across Europe and the APAC regions through establishing subsidiaries and/or partnerships. Another aspect of our growth strategy is to pursue lateral expansion into related product or sport categories that can benefit from customization. Examples of such categories include apparel for high school and collegiate athletes, such as volleyball, soccer and wrestling teams. We also plan to continue investing in new product development while leveraging our self-design platform and streamlined production system to capture additional market share in these product categories.

Our Competitive Strengths

We believe the following competitive strengths provide us with a strong market position:

| ● | Lean Manufacturing & Vertical Integration. We own and operate all facets of our design, manufacturing and sales process. Unlike many of our competitors who rely on contract manufacturing, our direct ownership of our manufacturing facility allows us to tightly control production timelines, quality control and delivery. This vertical integration helps to improve each customer’s user experience and enhance our brand image. |

| ● | Integrated Information Systems. Express by Jakroo, our comprehensive 3D design system, is one of the most advanced self-design platform in the industry. Express by Jakroo provides a rich user experience for our customers by allowing them to select the basic components of their designs while allowing our production team to improvise and improve back-end efficiencies during the design and manufacturing process. Our make-to-order production module further streamlines the item configuration process. With this system in place, we are able to capture and track all customer activity from the initial inbound lead through to product design and the final delivery of purchased products. This end-to-end product visibility allows us to quickly troubleshoot while enhancing efficiencies with raw material management, production scheduling and cost accounting. |

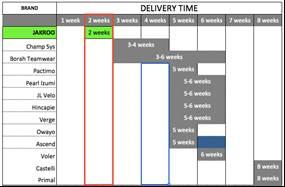

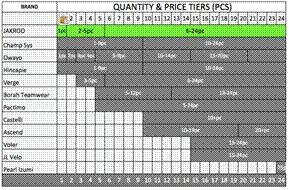

| ● | Shortest Delivery Time in the Industry. Our average delivery time is between two to three weeks from the time we receive customers’ purchase orders, which is significantly shorter than the delivery time of our competitors, whose average delivery time is five to six weeks. Based on sales data from 2015, 88% of our U.S. customer orders were shipped within three weeks. In 2016, we implemented our advance production module which further reduces our delivery time to one to two weeks for orders of up to 24 pieces. Our advance production module positions us as the custom apparel company with the shortest delivery time in the industry. |

| ● | Novel Design & Shopping Experience. With the use of proprietary and highly customized customer relationship management (CRM) and design applications, we are able to offer our customers two options for their design experience. Express by Jakroo, our proprietary do it yourself (DIY) application, allows customers to design on a 99% true to size 3D model. Designs created using Express by Jakroo are transferred directly to the production floor with minimal human interaction and the production process starts immediately upon placement of the purchase order. |

Alternatively, customers can use our Pro Custom service which allows customers to experience the benefits of having a trained professional designer create each customer’s design according to specification. Customers are able to participate in the design editing process through an interactive online review and approval system. We offer this service free of charge and provide the designs to customers within 48 hours of submission of the design request.

| 2 |

| ● | Global Presence. Most of our competitors in the endurance sports apparel market have limited geographic coverage. Many of the incumbent brands in the U.S. have minimal or no presence in the European or Asian markets. Very few Chinese domestic brands have any reasonable brand awareness in either Europe or North America. With an established presence in each of the key markets, Jakroo aims to provide superior localized support to our regional customers while simultaneously building brand loyalty. |

Corporate History and Structure

Jakroo, Inc. is a holding company and we operate through several operating subsidiaries. We began our operations in March 2003 when Rider Sports Fashion Limited (“Rider Beijing”) was incorporated as one of the first Chinese companies to engage in cycling apparel development, production and sales. In 2006 and 2007, we formed two branches of Rider Beijing, First Branch of Rider Sports Fashion Limited and Garment Processing Branch of Rider Sportsfashion Limited (which has recently been replaced with Rider Sportsfashion (Langfang) Limited (“Rider Langfang”) following our opening of a new factory), with the primary function of handling domestic Chinese sales and product manufacturing, respectively. In 2008, we formed Rider Sports Fashion LLC in the United States (“Rider US”) and subsequently formed subsidiaries Jakroo Canada Inc. (“Rider Canada”) and Jakroo GmbH (“Rider Austria”) in 2014 and 2015 as part of our continued international expansion.

In October 2016, we formed our wholly owned subsidiary Jakroo (Beijing) Sports Consulting Co. Ltd. (“WFOE”), a wholly foreign owned entity incorporated under the laws of the PRC which is 100% owned by Jakroo Inc. Through the contractual arrangement WFOE has with Rider Beijing’s shareholders, we control Rider Beijing, Rider US, Rider Canada and Rider Austria. These contractual arrangements allow us to effectively control and derive all of the economic interest from all of our operating entities.

The following diagram illustrates our corporate structure, including our subsidiaries and consolidated affiliated entities, as of the date of this prospectus:

| 3 |

Current Corporate Structure of Jakroo Inc.

| 4 |

Variable Interest Entity Arrangements

In establishing our business, we have used a variable interest entity, or VIE, structure. In the PRC, investment activities by foreign investors are principally governed by the Guidance Catalog of Industries for Foreign Investment, or the Catalog, which was promulgated and is amended from time to time by the PRC Ministry of Commerce, or MOFCOM, and the PRC National Development and Reform Commission, or NDRC. The Catalog divides industries into three categories: encouraged, restricted and prohibited. Industries not listed in the Catalog are generally open to foreign investment unless specifically restricted by other PRC regulations. Jakroo and the WFOE are considered as foreign investors or foreign invested enterprises under PRC law. Although the provision of designing, manufacturing and direct sale services of customized technical endurance apparel for the cycling, triathlon, running and Nordic skiing markets, which we conduct through our VIE, is not within the category in which foreign investment is currently restricted or prohibited, we intend to centralize our management and operation in the PRC without being restricted to conduct certain business activities which are important for our current or future business but are restricted or might be restricted in the future, we believe the agreements between WFOE and Rider Beijing will be essential for our business operation. These contractual arrangements with Rider Beijing and its shareholders enable us to exercise effective control over Rider Beijing and hence consolidate its financial results as our VIE.

In our case, the WFOE effectively assumed management of the business activities of Rider Beijing through a series of agreements which are referred to as the VIE Agreements. Through the VIE Agreements, the WFOE has the right to appoint all executives, senior management and the members of the board of directors of Rider Beijing. The VIE Agreements are comprised of a series of agreements, including an Equity Pledge Agreement, an Exclusive Technical Consulting and Service Agreement, a Business Operation Agreement, an Exclusive Call Option Agreement, and Powers of Attorney for each of Rider Beijing’s Shareholders. Through the VIE Agreements the WFOE has the right to advise, consult, manage and operate Rider Beijing for an annual consulting service fee in the amount of 90% of Rider Beijing’s operating revenue. The Shareholders of Rider Beijing (the “Rider Beijing Shareholders”) have each pledged all of their right, title and equity interests in Rider Beijing as security for the WFOE to collect consulting services fees provided to Rider Beijing through the Equity Pledge Agreement. In order to further reinforce the WFOE’s rights to control and operate Rider Beijing, the Rider Beijing Shareholders have granted the WFOE an exclusive right and option to acquire all of their equity interests in Rider Beijing through the Exclusive Call Option Agreement.

The VIE Agreements are detailed below as follows:

| ● | Equity Pledge Agreement. The WFOE and the Rider Beijing Shareholders entered into the Equity Pledge Agreement, pursuant to which each shareholder pledges all of his or her shares in Rider Beijing to the WFOE in order to guarantee the performance of his or her obligations under the VIE Agreements. The Equity Pledge Agreement further entitles the WFOE to collect dividends from Rider Beijing during the term of the pledge. The Equity Pledge Agreement ends when all contractual obligations under the VIE Agreements have been fully performed and all liabilities of Rider Beijing and the Rider Beijing Shareholders have been discharged. |

| ● | Exclusive Technical Consulting and Service Agreement. Rider Beijing and the WFOE entered into an Exclusive Technical Consulting and Service Agreement, which provides that the WFOE will be the exclusive provider of technical consulting services to Rider Beijing, including but not limited to services related to the design, manufacture and sale of cycling apparel and other related customized endurance apparel products. Rider Beijing will pay 90% of its total operating revenue to the WFOE for such services. Any such payment from the Company to the WFOE would need to comply with applicable Chinese laws affecting payments from Chinese companies to non-Chinese companies. See “Risk Factors – Risks Associated With Doing Business in China.” The term of the Exclusive Technical Consulting and Service Agreement shall be 10 years unless terminated earlier. |

| ● | Exclusive Call Option Agreement. Pursuant to the Exclusive Call Option Agreement by and between the WFOE, Rider Beijing and each of the Rider Beijing Shareholders, Rider Beijing and the Rider Beijing Shareholders have granted the WFOE an exclusive option to acquire all assets of Rider Beijing and all of their equity interests in Rider Beijing. The WFOE has the absolute sole discretion to determine the specific time and method of exercising such options to the extent permitted under PRC law. The Exclusive Call Option Agreement terminates after all the assets and equity interests of Rider Beijing have been transferred pursuant to PRC law. | |

| ● | Business Operation Agreement. Pursuant to the Business Operations Agreement by and between the WFOE, Rider Beijing and each of the Rider Beijing Shareholders, the Rider Beijing Shareholders and Rider Beijing have agreed not to engage in any transactions that may have a material or adverse effect on the assets, businesses, employees, obligations, rights or operations of Rider Beijing without the WFOE’s prior consent. The Rider Beijing Shareholders and Rider Beijing have also agreed to accept and implement any proposal made by the WFOE regarding the business management and employment matters of Rider Beijing. The term of the Business Operation Agreement is 10 years. The WFOE may terminate the Business Operation Agreement at any time upon prior written notice to Rider Beijing and the Rider Beijing Shareholders. |

| 5 |

| ● | Powers of Attorney. Each of the Rider Beijing Shareholders has entered into a power of attorney (the “Power of Attorney”) pursuant to which each of the Rider Beijing Shareholders authorizes the WFOE to act on his or her behalf as the exclusive agent and attorney with respect to all rights of such individual as a shareholder, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under PRC law and the Articles of Association of Rider Beijing, including but not limited to the sale or transfer or pledge or disposition of the equity interests of Rider Beijing owned by such shareholder; and (c) designating and appointing on behalf of the shareholders the legal representative, chairperson, director, supervisor, chief executive officer and other senior management members of Rider Beijing.

In the opinion of our PRC counsel, our current ownership structure, the ownership structure of our PRC subsidiary and our VIEs, and the contractual arrangements among our PRC subsidiary, our VIEs, and their shareholders are in compliance with existing PRC laws, rules and regulations. There are, however, substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Thus, we cannot assure you that we will be able to effectively enforce these contracts. Although we believe we are in compliance with current PRC regulations, we cannot assure you that the PRC government would agree that these contractual arrangements comply with PRC licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that might be adopted in the future. PRC laws and regulations governing the validity of these contractual arrangements are uncertain and the relevant government authorities have broad discretion in interpreting these laws and regulations. If the PRC government determines that we are not in compliance with applicable laws and regulations, it could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our operations, impose additional conditions or requirements with which we might not be able to comply, levy fines, confiscate our income or the income of our PRC subsidiary or affiliated PRC entities, or take other regulatory or enforcement actions against us that could be harmful to our business. The imposition of any of these penalties would result in an adverse effect on our ability to conduct our business. See "Risk Factors—Risks Relating to the Our Corporate Structure" and "Risk Factors—Risks Associated With Doing Business in China-Uncertainties with respect to the PRC legal system could have a material adverse effect on us." |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to: (1) presenting only two years of audited financial statements and only two years of the related management’s discussion and analysis of financial condition and results of operations in this prospectus, (2) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (3) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, investors may find investing in our common stock less attractive as a result.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We elected to opt out of such extended transition period and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

We could remain an emerging growth company for up to five years or until the earliest of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months, or (3) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Corporate Information

Our principal executive offices are located at 5906 Stoneridge Mall Road Road, Pleasanton CA 94588. Our telephone number at this address is 1-800-485-7067. Our agent for service of process in the United States is Corporation Service Company located at 2215 Renaissance Dr., Las Vegas, NV 89119. To make inquiries, investors should contact our principal executive offices at the address and telephone number listed above.

Our website is www.jakroo.com. The information contained on our website is not a part of this prospectus.

| 6 |

THE OFFERING

| Common Stock Outstanding before the Offering | 30,808,650 shares | |

| Common Stock Offered by Selling Stockholders | Up to 1,708,650 shares of common stock held by the selling stockholders | |

| Common Stock to be Outstanding After the Offering | 30,808,650 shares | |

| Use of proceeds | We will not receive any proceeds from the sale of the common stock offered hereby. | |

| Quotation of Common Stock | Our common stock is not presently quoted either over the counter or on a national exchange. We have submitted our application for the quotation of our common stock on the OTC Market, which if approved would only occur following the effectiveness of the registration statement of which this prospectus forms a part. | |

| Rick Factors | An investment in our company is highly speculative and involves a significant degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 8 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| 7 |

An investment in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the following risk factors in evaluating our business before purchasing any shares of our common stock. No purchase of our common stock should be made by any person who is not in a position to lose the entire amount of his or her investment. The order of the following risk factors is presented arbitrarily. You should not conclude the significance of a risk factor based on the order of presentation. Our business and operations could be seriously harmed as a result of any of these risks.

Risks Related to Our Business

We are an early stage company with a limited operating history as a manufacturer and seller of sporting apparel products. Our limited operating history may not provide an adequate basis to judge our future prospects and results of operations.

We have a limited operating history. Our first operating subsidiary, Rider Sports Fashion Limited (“Rider Beijing”) was established in Beijing in March 2003 to engage in cycling apparel development, production and sales. In 2007, we established our manufacturing subsidiary, which currently manufactures all of our products. As part of our international expansion and in response to international customer demands, we established our U.S. subsidiary in 2008 and our subsidiaries in Canada and Austria in 2014 and 2015, respectively. Despite our continuous growth, we have limited experience and operating history in the sporting apparel industry. Our limited history may not provide a meaningful basis for investors to evaluate our business, financial performance and prospects.

Any disruption of our supply chain could have an adverse impact on our net sales and profitability.

We rely on third party suppliers for fabrics, accessories and printing paper and machines that are essential to our product manufacturing. We cannot predict when, or the extent to which, we will experience a disruption in our supply chain. Any such disruption could negatively impact our ability to market and sell our products and serve our customers, which could adversely impact our net sales and profitability.

Based on our past business practice, we place purchase orders or enter into short term agreements with our raw material suppliers. Without long term supply agreements, any of our current suppliers may discontinue selling to us at any time. Changes in the commercial practices or financial condition of any of our key suppliers could also negatively impact our results. If we lose one or more key suppliers and are unable to promptly find alternative suppliers who are willing and able to provide equally appealing raw materials or manufacturing machines at comparable prices, we may not be able to deliver quality products that satisfy the requirements of our customers.

We also are subject to risks, such as the price and availability of raw materials and fabrics, labor disputes, union organizing activity, strikes, inclement weather, natural disasters, war and terrorism and adverse general, economic and political conditions that might limit our suppliers’ ability to provide us with quality merchandise on a timely and cost-efficient basis. We may not be able to develop relationships with new suppliers, and materials from alternative sources, if any, may be of a lesser quality and more expensive than those we currently purchase. Any delay or failure in offering products to our customers could have a material adverse impact on our net sales and profitability.

Our operating results can be adversely affected by changes in the cost or availability of raw materials.

Pricing and availability of raw materials for use in our businesses can be volatile due to numerous factors beyond our control, including general, domestic and international economic conditions, labor costs, production levels, competition, consumer demand, import duties and tariffs and currency exchange rates. This volatility can significantly affect the availability and cost of raw materials for us, and may therefore have a material adverse effect on our business, results of operations and financial condition.

During periods of rising prices of raw materials, there can be no assurance that we will be able to pass any portion of such increases on to customers. Conversely, when raw material prices decline, customer demands for lower prices could result in lower sales prices and, to the extent we have existing inventory, lower margins. We currently do not hedge against our exposure to changing raw material prices. As a result, fluctuations in raw material prices could have a material adverse effect on our business, results of operations and financial condition.

| 8 |

Supply shortages or changes in availability for any particular type of raw material can delay production or cause increases in the cost of manufacturing our products. We may be negatively affected by changes in availability and pricing of raw materials, which could negatively impact our results of operations.

Our sales may fluctuate and historical sales revenue may not be a meaningful indicator of future performance.

Our product sales may vary from quarter to quarter and year to year, and an unanticipated decline in net sales may cause the price of our common stock to fluctuate significantly. A number of factors have historically affected, and will continue to affect, our sales revenue, including:

| ● | consumer preferences, buying trends and overall economic trends; |

| ● | our ability to identify and respond effectively to local and regional trends and customer preferences; |

| ● | our ability to provide quality customer service that will increase our conversion of shoppers into paying customers; |

| ● | competition in any of the regional markets we operate; |

| ● | changes in our product mix; and |

| ● | changes in pricing. |

Our online retail custom order and inline retail segments are affected by general economic conditions in our markets and ongoing economic and financial uncertainties may cause a decline in consumer spending that may adversely affect our business, operations, liquidity, financial results and stock price.

Our custom order and internet retail segments are the core of our business, contributing to more than 80% of our sales revenue in fiscal year 2016. Both segments are retail-based and depend on consumer discretionary spending. As a result, we may be adversely affected if our customers reduce, delay or forego their purchases of our products as a result of continued job losses, bankruptcies, higher consumer debt and interest rates, higher energy and fuel costs, reduced access to credit, falling home prices, lower consumer confidence, uncertainty or changes in tax policies and tax rates and uncertainty due to national or international security concerns. Decreases in sales or online customer traffic will negatively affect our financial performance, and a prolonged period of depressed consumer spending could have a material adverse effect on our business. Promotional activities and decreased demand for consumer products could affect profitability and margins. In addition, adverse economic conditions may result in an increase in our operating expenses due to, among other things, higher costs of labor, energy, equipment and facilities. Any of the foregoing factors could have a material adverse effect on our business, results of operations and financial condition and could adversely affect our stock price.

Our results of operations could be materially harmed if we are unable to accurately forecast demand for our products.

We often place orders for raw materials with our suppliers before our customers’ orders are firm. Therefore, if we fail to accurately forecast customer demand, we may experience excess inventory levels or a shortage of product to deliver to our customers. Factors that could affect our ability to accurately forecast demand for our products include:

| ● | an increase or decrease in consumer demand for our products or for products of our competitors; |

| ● | our failure to accurately predict customer acceptance of new products; |

| ● | new product introductions by competitors; |

| 9 |

| ● | unanticipated changes in general market conditions or other factors, which may result in cancellations of orders or a reduction or increase in the rate of reorders placed by retailers; |

| ● | weak economic conditions or consumer confidence, which could reduce demand for discretionary items such as our products; and |

| ● | terrorism or acts of war, or the threat of terrorism or acts of war, which could adversely affect consumer confidence and spending or interrupt production and distribution of product and raw materials. |

Inventory levels in excess of customer demand may result in inventory write-downs and the sale of excess inventory at discounted prices, which could have an adverse effect on our business, results of operations, and financial condition. On the other hand, if we underestimate demand for our products, our manufacturing facilities may not be able to produce products to meet customer requirements, and this could result in delays in the shipment of products and lost revenues, as well as damage to our reputation and customer relationships. There can be no assurance that we will be able to successfully manage inventory levels to exactly meet future order and reorder requirements.

Expanding our brand into new territories may be difficult and expensive, and if we are unable to successfully expand into these territories as expected, our brand may be adversely affected, and we may not achieve our planned sales growth.

Our growth strategy includes continuous expansion of our brand into new territories in North America, Europe and Asia. Products that we introduce into these new markets may not be successful with the consumers we target. Our brand may also fall out of favor with our current customer base as we expand our products into new markets. In addition, if we are unable to anticipate, identify or react appropriately to evolving consumer preferences, our sporting apparel sales may not grow as fast as we plan or may decline and our brand image may suffer.

Achieving market acceptance for new products will likely require us to exert substantial product development and marketing efforts, which could result in a material increase in selling, general and administrative expenses, both in absolute dollars and as a percentage of revenue. There can be no assurance that we will have the resources necessary to undertake these efforts or that these efforts will sufficiently increase our sporting apparel sales. Material increases in our selling and general and administrative expenses could adversely impact our results of operations.

Changes in the retail industry and markets for consumer products affecting our customers or retail practices could negatively impact existing customer relationships and our results of operations.

While the majority of our products are sold directly to consumers, a portion of our products are sold to resellers and distribution agents. A significant deterioration in the financial condition of these wholesale customers could have a material adverse effect on our sales and profitability. As a result, we periodically monitor and evaluate the credit status of these wholesale customers and attempt to adjust sales terms as appropriate. Despite these efforts, a bankruptcy filing by a key customer could have a material adverse effect on our business, results of operations, and financial condition. We do not monitor the credit status of our retail customers or direct customer database.

Failure to maintain our reputation and brand image could negatively impact our business.

Our brand has received a certain level of recognition in China, North America and Europe. Our success depends on our ability to maintain and enhance our brand image and reputation. We could be adversely affected if our brand is tarnished or receives negative publicity. In addition, adverse publicity about regulatory or legal action against us could damage our reputation and brand image, undermine consumer confidence in us, and reduce long-term demand for our products, even if the regulatory or legal action is unfounded or not material to our operations.

In addition, our success in maintaining, extending and expanding our brand image depends on our ability to adapt to a rapidly changing media and internet environment, including our reliance on online advertising. Negative posts or comments about us on social networking websites could seriously damage our reputation and brand image. If we do not maintain, extend and expand our brand image, our product sales, financial condition or results of operations could be materially and adversely affected.

Our core information technology platform is operated by a third party and any failure in maintenance or security of this platform could have adverse consequences on our business.

Our core information technology platform runs on Oracle’s NetSuite ERP platform. This includes, all customer management (CRM), manufacturing and esource planning (ERP) and e-commerce processes. All application data, and servers and functionality are outside of our direct ownership and control. As a global service provider, Oracle is fully responsible for the maintenance and security of their platform. Additionally, all related customer payment processing is managed by PCI compliant third party processors and payment gateways such as Merchante Solutions, Cybersource, Altapay and Alipay. As such, we do not store any customer data on our computer systems. Should any of those systems become compromised, our business would be adversely affected until remedied.

| 10 |

Failure to adequately protect or enforce our intellectual property rights could adversely affect our business.

We utilize trademarks on nearly all of our products and believe that having distinctive marks that are readily identifiable is an important factor in creating a market for our goods, in identifying us and in distinguishing our goods from the goods of others. We consider our “Jakroo®” series trademarks to be among our most valuable assets, and we have registered these trademarks in 19 countries and jurisdictions.

We believe that our trademarks, copyrights and other intellectual property rights are important to our brand, our success and our competitive position. In the future, we may encounter counterfeit reproductions of our products or that otherwise infringe on our intellectual property rights. If we are unsuccessful in challenging a party’s products on the basis of trademark or other intellectual property infringement, continued sales of these products could adversely affect our sales and our brand and result in the shift of consumer preference away from our products.

The actions we take to establish and protect trademarks and other intellectual property rights may not be adequate to prevent imitation of our products by others or to prevent others from seeking to block sales of our products as violations of proprietary rights.

In addition, the laws of certain foreign countries may not protect or allow enforcement of intellectual property rights to the same extent as the laws of the United States. We may face significant expenses and liabilities in connection with the protection of our intellectual property rights outside the United States, and if we are unable to successfully protect our rights or resolve intellectual property conflicts with others, our business or financial condition may be adversely affected.

Third parties may claim that we are infringing their intellectual property rights, and these claims may be costly to defend, may require us to pay licensing fees, damages, or other amounts, and may prevent, or otherwise impose limitations on the manufacture, distribution or sale of our products.

From time to time, third parties may claim that we are infringing on their intellectual property rights, and we may be found to infringe those intellectual property rights. While we do not believe that any of our products infringe the valid intellectual property rights of third parties, we may be unaware of the intellectual property rights of others that may cover some of our current or planned new products. If we are forced to defend against third party claims, whether or not the claims are resolved in our favor, we could encounter expensive and time consuming litigation which could divert our management and key personnel from business operations. If we are found to be infringing on the intellectual property rights of others, we may be required to pay damages or ongoing royalty payments, or comply with other unfavorable terms. Additionally, if we are found to be infringing on the intellectual property rights of others, we may not be able to obtain license agreements on terms acceptable to us, and this may prevent us from manufacturing, marketing or selling our products. Thus, these third party claims may significantly reduce the sales of our products or increase our cost of goods sold. Any reductions in sales or cost increases could be significant, and could have a material and adverse effect on our business.

Our products are used for inherently risky sports activities and could give rise to product liability or product warranty claims and other loss contingencies, which could affect our earnings and financial condition.

Many of our products are used in applications and situations that involve certain levels of risk of personal injury. As a result, we may be exposed to product liability claims by the nature of the products we produce. Exposure occurs if one of our products is alleged to have resulted in bodily injury or other adverse effects. Any such product liability claim may include allegations of defects in manufacturing, defects in design, a failure to warn of dangers inherent in the product or activities associated with the product, negligence, strict liability, and a breach of warranties. Although we maintain product liability insurance in amounts that we believe are reasonable, there can be no assurance that we will be able to maintain such insurance on acceptable terms, if at all, in the future or that product liability claims will not exceed the amount of insurance coverage. Additionally, we do not maintain product recall insurance. As a result, product recalls or product liability claims could have a material adverse effect on our business, results of operations and financial condition.

| 11 |

As a manufacturer and distributor of consumer products, we are subject to the Consumer Products Safety Act, which empowers the Consumer Products Safety Commission to exclude from the market products that are found to be unsafe or hazardous. Under certain circumstances, the Consumer Products Safety Commission could require us to repurchase or recall one or more of our products. Additionally, laws regulating certain consumer products exist in some cities and states, as well as in other countries in which we sell our products, and more restrictive laws and regulations may be adopted in any of these jurisdictions in the future. Any repurchase or recall of our products could be costly to us and could damage our reputation. If we were required to remove, or we voluntarily removed, our products from the market, our reputation could be tarnished and we might have large quantities of finished products that we could not sell.

We spend substantial resources ensuring compliance with governmental and other applicable standards. However, compliance with these standards does not necessarily prevent individual or class action lawsuits, which can entail significant cost and risk. We do not maintain insurance against many types of claims involving alleged defects in our products that do not involve personal injury or property damage. As a result, these types of claims could have a material adverse effect on our business, results of operations and financial condition.

Our success is dependent on retaining key personnel who would be difficult to replace.

Our success depends largely on the continued services of our key management members. In particular, our success depends on the continued efforts of Mr. Weidong Du, our Chief Executive Officer, President and Director, and Ms. Wei Tan, our Chief Financial Officer and Treasurer, who is also the wife of Mr. Du. Mr. Du and Ms. Tan have been instrumental in developing our business model and are crucial to our business development. There can be no assurance that Mr. Du and Ms. Tan will continue in their present capacities for any particular period of time. The loss of the services of Mr. Du and Ms. Tan could materially and adversely affect our business development. Derek Wiseman, our Chief Operating Officer, also plays an significant role in our business operations, particularly expansion of our customer base in North America and Europe. In addition, we rely on officers and directors of our operating subsidiaries such as Mr. Guichun Liu, Ms. Wen Li, and Mr. Hao Wang, for key aspects of our operations, including sales, product design, manufacturing and quality control. The loss of these key employees would negatively affect our ability to manufacture quality sporting apparel, maintain existing customers, capture new market share and generate sales revenue.

The legal requirements associated with being a public company, including those contained in and issued under the Sarbanes-Oxley Act, may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain listing of our common stock.

We may be unable to attract and retain qualified officers and directors necessary to provide for our effective management because of the rules and regulations that govern publicly listed companies, including, but not limited to, certifications by principal executive officers. Currently, our officers do not have extensive experience in operating a U.S. public company. Moreover, the actual and perceived personal risks associated with compliance with the Sarbanes-Oxley Act and other public company requirements may deter qualified individuals from accepting roles as directors and executive officers. At present, we do not maintain an independent board of directors. Further, the requirements for board or committee membership, particularly with respect to an individual’s independence and level of experience in finance and accounting matters, may make it difficult to attract and retain qualified board members going forward. If we are unable to attract and retain qualified officers and directors, the management of our business and our ability to obtain or retain the listing of our common stock on any stock exchange (assuming we are able to obtain such listing) could be adversely affected.

| 12 |

If we fail to establish and maintain an effective system of internal controls, we may not be able to report our financial results accurately or prevent fraud. Any inability to report and file our financial results accurately and timely could harm our business and adversely impact the trading price of our common stock.

We are required to establish and maintain internal controls over financial reporting, disclosure controls and to comply with other requirements of the Sarbanes-Oxley Act and the rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”) thereunder. Our senior management, which currently consists of Mr. Weidong Du, Ms. Wei Tan and Mr. Derek Wiseman, cannot guarantee that our internal controls and disclosure procedures will prevent all possible errors or all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a control system must reflect the fact that there are resource constraints and the benefit of controls must be relative to their costs. Because of the inherent limitations in all control systems, no system of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. Further, controls can be circumvented by individual acts of some persons, by collusion of two or more persons, or by management’s override of the controls. The design of any system of controls is also based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, a control may become inadequate because of changes in conditions or the degree of compliance with policies or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected.

Our compliance with complicated U.S. regulations concerning corporate governance and public disclosure will result in additional expenses. Moreover, our ability to comply with all applicable laws, rules and regulations is uncertain given our management’s relative inexperience with operating U.S. public companies.

As a public company, we will be faced with expensive, complicated and evolving disclosure, governance and compliance laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act and the Dodd–Frank Wall Street Reform and Consumer Protection Act. New or changing laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations and standards of a U.S. public company are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

Moreover, our officers and directors do not have extensive experience in operating a U.S. public company, which makes our ability to comply with applicable laws, rules and regulations uncertain. Our failure to comply with all laws, rules and regulations applicable to U.S. public companies could subject us or our management to regulatory scrutiny or sanction, which could harm our reputation and stock price.

As an “emerging growth company” under applicable law, we will be subject to lessened disclosure requirements, which could leave our shareholders without information or rights available to shareholders of more mature companies.

For as long as we remain an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (which we refer to herein as the JOBS Act), we have elected to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| ● | taking advantage of an extension of time to comply with new or revised financial accounting standards; |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

| 13 |

We expect to take advantage of these reporting exemptions until we are no longer an “emerging growth company.” Because of these lessened regulatory requirements, our shareholders would be left without information or rights available to shareholders of more mature companies.

Because we have elected to use the extended transition period for complying with new or revised accounting standards for an “emerging growth company,” our financial statements may not be comparable to companies that comply with public company effective dates.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates. Consequently, our financial statements may not be comparable to companies that comply with public company effective dates. As such, investors may have difficulty evaluating or comparing our business, performance or prospects in comparison to other public companies, which may have a negative impact on the value and liquidity of shares of our common stock.

Risks Related to Our Industry

Intense competition in the sporting goods industry could limit our growth and reduce our profitability.

The sporting goods manufacturing and retail market in general is highly fragmented and intensely competitive. In each of the three geographic areas in which we operate, we compete directly with a number of brand name cycling apparel manufacturers, some of whom are top ranking brands in their respective geographic markets. In particular, we primarily compete with domestic Chinese brands in the China market, including Champion System, Santic, Sobike and CCN, and we compete with top cycling apparel brands in the North America and European markets. Some of our competitors have a large base of direct consumer and reseller accounts, greater financial resources and mature commercial infrastructures. In addition, if our competitors reduce their prices, it may be difficult for us to reach our net sales goals without reducing our prices. As a result of this competitive environment, we may also need to spend more on advertising and promotion than we anticipate. If we are unable to compete effectively, our operating results will suffer.

Seasonal fluctuations in the sales of sporting goods could cause our annual operating results to suffer significantly.

We experience seasonal fluctuations in our net sales and operating results. Summer and fall are the peak selling season of our products during which time we generate more sales revenue. If we miscalculate the demand for our products generally or for our product mix during the peak season, our net sales could decline, resulting in excess inventory, which could harm our financial performance. Because a substantial portion of our operating income is derived from our net sales during the peak season, a shortfall in expected net sales during that time could cause our annual operating results to suffer significantly.

If we fail to anticipate changes in consumer preferences, we may experience lower net sales, higher inventory markdowns and lower margins.

Our products must appeal to a broad range of consumers whose preferences can only be predicted to a certain degree. These preferences are also subject to change. Our success depends upon our ability to anticipate and respond in a timely manner to trends in sporting apparel and accessories in general and cycling apparel in particular. If we fail to identify and respond to these changes, our net sales may decline.

| 14 |

Risks Associated with Our International Operations

Our operations in international markets, and earnings in those markets, may be affected by legal, regulatory, political and economic risks.

Our operations in international markets, and earnings in those markets, may be affected by legal, regulatory, political and economic risks. Our ability to maintain the current level of operations in our existing international markets and to capitalize on growth in existing and new international markets is subject to risks associated with international operations. These include the burdens of complying with a variety of foreign laws and regulations, unexpected changes in regulatory requirements, new tariffs or other barriers to some international markets.

We cannot predict whether quotas, duties, taxes, exchange controls or other restrictions will be imposed by the United States, China, the European Union or other countries upon the import or export of our products in the future, or what effect any of these actions would have on our business, financial condition or results of operations. We cannot predict whether there might be changes in our ability to repatriate earnings or capital from international jurisdictions. Changes in regulatory and geopolitical policies and other factors may adversely affect our business or may require us to modify our current business practices.

Approximately 42% of our sales for the year ended December 31, 2015 were earned in international markets. We are exposed to risks of changes in U.S. policy for companies having business operations outside the United States, which could have a material adverse effect on our business, results of operations and financial condition.

We use foreign suppliers for a significant portion of our raw materials and our manufacturing facility is located in China, which poses risks to our business operations.

Our products are manufactured at our facility in China. Any of the following could materially and adversely affect our ability to produce or deliver our products and, as a result, have a material adverse effect on our business, financial condition and results of operations:

| ● | political or labor instability in countries where our facilities, contractors, and suppliers are located; |

| ● | political or military conflict, which could cause a delay in the transportation of raw materials and products to us and an increase in transportation costs; |

| ● | heightened terrorism security concerns, which could subject imported or exported goods to additional, more frequent or more lengthy inspections, leading to delays in deliveries or impoundment of goods for extended periods or could result in decreased scrutiny by customs officials for counterfeit goods, leading to lost sales, increased costs for our anti-counterfeiting measures and damage to the reputation of our brands; |

| ● | imposition of regulations and quotas relating to imports and our ability to adjust timely to changes in trade regulations, which, among other things, could limit our ability to produce products in cost-effective countries that have the labor and expertise needed; |

| ● | imposition of duties, taxes and other charges on imports; and |

| ● | imposition or the repeal of laws that affect intellectual property rights. |

Our business is subject to foreign, national, state and local laws and regulations for environmental, employment, safety and other matters. The costs of compliance with, or the violation of, such laws and regulations by us could have an adverse effect on our business, results of operations and financial condition.

Numerous governmental agencies in the United States and in other countries in which we have operations, enforce comprehensive national, state, and local laws and regulations on a wide range of environmental, employment, health, safety and other matters. We could be adversely affected by costs of compliance or violations of those laws and regulations. In addition, the costs of raw materials purchased by us from our suppliers could increase due to the costs of compliance by those entities. Further, violations of such laws and regulations could affect the availability of inventory, thereby affecting our net sales.

| 15 |

Changes in foreign, cultural, political, and financial market conditions could impair our international operations and financial performance.

The economies of foreign countries important to our operations, including countries in Asia and Europe, could suffer slower economic growth or economic, social and/or political instability or hyperinflation in the future. International operations, including manufacturing and sales (and the international operations of our customers), are subject to inherent risks which could adversely affect us, including, among other things:

| ● | protectionist policies restricting or impairing the manufacturing, sales or import and export of our products; |

| ● | new restrictions on access to markets; |

| ● | lack of developed infrastructure; |

| ● | inflation or recession; |

| ● | devaluations or fluctuations in the value of currencies; |

| ● | changes in and the burdens and costs of compliance with a variety of foreign laws and regulations, including tax laws, accounting standards, environmental laws and occupational health and safety laws; |

| ● | social, political or economic instability; |

| ● | acts of war and terrorism; |

| ● | natural disasters or other crises; |

| ● | reduced protection of intellectual property rights in some countries; |

| ● | increases in duties and taxation; and |

| ● | restrictions on transfer of funds and/or exchange of currencies; expropriation of assets; and other adverse changes in policies, including monetary, tax and/or lending policies, relating to foreign investment or foreign trade by our host countries. |

Should any of these risks occur, our ability to sell our products or repatriate profits could be impaired and we could experience a loss of sales and profitability from our international operations, which could have a material adverse impact on our business and financial conditions.

Risks Associated With Doing Business in China

Changes in the political and economic policies of the PRC government may materially and adversely affect our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies.

Most of our operations are conducted in the PRC and a significant percentage of our revenue is sourced from the PRC. Accordingly, our financial condition and results of operations are affected to a significant extent by economic, political and legal developments in the PRC.

| 16 |

The PRC economy differs from the economies of most developed countries in many respects, including the extent of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth by allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, regulating financial services and institutions and providing preferential treatment to particular industries or companies.

While the PRC economy has experienced significant growth in the past three decades, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall PRC economy, but may also have a negative effect on us. Our financial condition and results of operation could be materially and adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. In addition, the PRC government has implemented in the past certain measures, including interest rate increases, to control the pace of economic growth. These measures may cause decreased economic activity, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our businesses, financial condition and results of operations.

If relations between the United States and China worsen, investors may be unwilling to hold or buy our stock and our stock price may decrease.

At various times during recent years, the U.S and China have had significant disagreements over political and economic issues. Controversies may arise in the future between these two countries that may affect our economic outlook both in the U.S and in China. Any political or trade controversies between the U.S and China, whether or not directly related to our business, could reduce the price of our common stock.

Future inflation in China may inhibit the profitability of our business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our services and products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may have an adverse effect on profitability. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China and thereby harm the market for our services and products.

The fluctuation of the Renminbi may have a material adverse effect on your investment.