Attached files

| file | filename |

|---|---|

| 8-K - 8-K 09.14.17 - COLUMBUS MCKINNON CORP | a8k091417.htm |

Gregory P. Rustowicz

Vice President – Finance & Chief Financial Officer

Jon Adams

Treasurer

Sept

2017

Investor Presentation

Mark D. Morelli

President and Chief Executive Officer

Gregory P. Rustowicz

Vice President – Finance & Chief Financial Officer

Sept 14, CL King Best Ide s Conference

2© 2017 Columbus McKinnon Corporation

Safe Harbor Statement

These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks,

uncertainties and other factors that could cause the actual results of the Company to differ materially from the

results expressed or implied by such statements, including general economic and business conditions, conditions

affecting the industries served by the Company and its subsidiaries, conditions affecting the Company’s customers

and suppliers, competitor responses to the Company’s products and services, the overall market acceptance of

such products and services, the integration of acquisitions and other factors disclosed in the Company’s periodic

reports filed with the Securities and Exchange Commission. Consequently such forward looking statements should

be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and

specifically declines any obligation to publicly release the results of any revisions to these forward-looking

statements that may be made to reflect any future events or circumstances after the date of such statements or

to reflect the occurrence of anticipated or unanticipated events.

This presentation will discuss some non-GAAP financial measures, which we believe are useful in evaluating

our performance. You should not consider the presentation of this additional information in isolation or as a

substitute for results compared in accordance with GAAP. We have provided reconciliations of comparable

GAAP to non-GAAP measures in tables found in the Supplemental Information portion of this presentation.

3© 2017 Columbus McKinnon Corporation

NASDAQ: CMCO

Market Capitalization $739.8 Million

52-Week Price Range $33.22 - $16.86

Recent Price $32.70

Average Volume (3 mo.) 141,000

Common Shares Outstanding 22.6 Million

Ownership: Institutions 95%

Insiders 5%

Leading global designer, manufacturer and marketer of

material handling products, technologies and solutions

Founded in 1875, large installed base

Premium, well respected brands

Leading market share in the U.S.

Leader in highly engineered lifting solutions and explosion-protected

hoists

Market data as of 09/08/17 (Source: Bloomberg); shares outstanding as of 7/27/17; Institutional and insider ownership as of most recent filing

4© 2017 Columbus McKinnon Corporation

58%

11%

5%

10% 12%

HOISTS CHAIN & RIGGING JIB CRANES ACTUATORS DIGITAL POWER

CONTROL

$691.8 Million

Q1 FY18 TTM Revenue

Broad Product Mix

#1 in U.S.

Hoists, Trolleys and

Components

#1 in U.S.

Jib Cranes

#1 in U.S.

Screw Jacks

#1 in U.S.

AC and DC Material

Handling Drives,

and Elevator

DC Drives

5© 2017 Columbus McKinnon Corporation

Complex Applications

6© 2017 Columbus McKinnon Corporation

Diverse End Markets

(pro forma with STAHL)

General Industrial

Metals Processing

/ Steel / Concrete

Oil & Gas

Energy/

Utilities

Automotive

Rail / Aerospace /

Transport

Construction

Pulp Paper/Chemical/

Pharma

Heavy OEM

Elevators

Entertainment

Mining Government / Others

~25%

~10%

~10%

~10%

~10%

~10%

~5%

~5%

~5%

~3%

~3%

~3% ~3%

7© 2017 Columbus McKinnon Corporation

CONSTRUCTION MINING ENTERTAINMENT OIL & GAS

POWER /

UTILITIES

TRANSPORTATION AUTOMOTIVE HEAVY

EQUIPMENT

MANUFACTURING

Key Vertical Markets

8© 2017 Columbus McKinnon Corporation

Extensive Market Channels

(pro forma with STAHL)

US General Line

Distributors

International General Line

Distributors

Pfaff International

Direct

EPC

OEM/Government

Specialty

Distributors

Crane End Users

~29%

~23%

~12%

~10%

~10%

~11%

~5%

9© 2017 Columbus McKinnon Corporation

International Diversification

U.S.

59%

Europe,

Middle

East &

Africa

28%

Canada 4%

Latin America 5%

APAC

4%

$691.8 million

Q1 FY18 TTM Revenue

Expanded presence in EMEA and

APAC with STAHL acquisition

Q1 FY 2018 mix:

U.S. 55%

EMEA 31%

APAC 6%

Strong growth with recovering

economics in APAC and LatAm

in first quarter

10© 2017 Columbus McKinnon Corporation

Evolving Business Model

Becoming an industrial technology company

Solutions based

Acquisitions increased product set with embedded technology and differentiators

Core products provide engineering advantages and market leadership

R&D as an engine for growth

Acquired January 2017

Enhanced engineering depth for

custom solutions

Explosion-protected hoist leader

Superior quality brand

Geographic complement

Acquired September 2015

Industry leading digital power

and motion control systems

Enables “Smart hoists”

Improves safety and efficiency

Creates a larger addressable

market

11© 2017 Columbus McKinnon Corporation

R&D: Renewed Emphasis

Leveraging technology and

experience to design “Smart Hoists”

Onboard diagnostics

Remote monitoring

Precision lifting

Load sensing

Preventative maintenance

Leads to improved safety and

reduced down time

Leveraging recent acquisitions to

deliver solution based products

12© 2017 Columbus McKinnon Corporation

Near-term Priorities

Integrate STAHL

On target for $5 million of synergies in FY2018

Standardize on wire rope hoist design – more cost effective and broader range

Capitalize on growth opportunities

Leverage Magnetek technology

Approximately 75% of powered hoists applicable

Validated value proposition with customers

Grow in EMEA

Strengthen the core

Focus on industrial products market – availability and simplification of product offering

Better bundling and kits

Pay down debt

Expect at least $50 million reduction in FY2018

Expect 3X net debt/EBITDA at fiscal year end

13© 2017 Columbus McKinnon Corporation

$1.34

$1.72

$1.47

$1.66

$0.96

$1.00

$1.81

FY15 FY16 FY 2017 Q1 FY18

TTM

$0.66

$1.04

$0.76

$0.43

$0.47

$181.6

$191.2

$201.8

$223.2

$1.7

$183.3

FY15 FY16 FY 2017 Q1 FY18

TTM

$192.9

$8.9

$214.2

$9.0

$187.3

$3.9

Improving Financial Performance

Non-GAAP Adjustments(1)Gross Profit

* Adjusted gross profit and operating income as % of sales

Adjusted Gross Profit(1)

(1) Adjusted figures are non-GAAP financial measures. Please see supplemental slides for a reconciliation from

GAAP to non-GAAP results and other important disclosures regarding the use of non-GAAP financial measures.

32.3%*31.7%*32.0%*

$579.6 $597.1

$637.1

$691.8

FY15 FY16 FY17 Q1 FY18

TTM

Sales

$54.6

$53.6

$49.5

$59.4

$2.4

$57.0

FY15 FY16 FY 2017 Q1 FY18

TTM

8.6%*7.8%*9.0%*

$26.0

$24.6

$34.8

$23.5

9.8%*

$13.0

$40.6

Non-GAAP Adjustments(1)Income from Operations

Adjusted Operating Income(1)

Non-GAAP EPS(1)GAAP EPS

Diluted EPS(1)

31.6%*

($ in millions)

14© 2017 Columbus McKinnon Corporation

Strong Cash Flow

(1) Operating free cash flow is defined as cash provided by operating activities minus capital expenditures

(2) Fiscal 2010 and fiscal 2011 include $10.8 million and $4.5 million of cash payments related to

restructuring charges, respectively

32.3%*31.7%*32.0%*

$48.0

$22.6

($9.3)

$9.8

$27.5

$8.7

$21.0

$30.3

$46.1

$55.7

FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 Q1 FY18

TTM

(2) (2)

Operating Free Cash Flow(1)

Strong operating free cash flow over cycle

Managing CapEx: working to improve return on invested capital

FY 2018 expected CapEx: ~$20 million(1)

($ in millions)

15© 2017 Columbus McKinnon Corporation

CAPITALIZATION

June 30,

2017

March 31,

2017

Cash and cash equivalents $ 64.6 $ 77.6

Total debt 408.0 421.3

Total net debt 343.4 343.7

Shareholders’ equity 364.0 341.4

Total capitalization $ 772.0 $ 762.7

Debt/total capitalization 52.9% 55.2%

Net debt/net total capitalization 48.5% 50.2%

De-levering Balance Sheet

Expected rate of debt reduction

Approximately $50 million in FY18

Targeting 3x Net Debt/EBITDA

by end of FY18

Additional $50 million to $55 million

in FY19

Covenant-lite

No leverage maintenance covenant

as long as revolver is undrawn

16© 2017 Columbus McKinnon Corporation

STAHL Acquisition

TRANSACTION CLOSE January 31, 2017

PURCHASE PRICE €224 million ($237 million); adjusted for cash and debt

TRANSACTION COSTS Fiscal 2017: $8.5 million

RESTRUCTURING COSTS Fiscal 2018: approximately $6 million

EXPECTED SYNERGIES

Fiscal 2018: approximately $ 5 million

Fiscal 2019: approximately $11 million

NET INCOME EXPECTATIONS

Accretive: Fiscal 2018 $0.15 to $0.20 EPS

Fiscal 2019 $0.30 to $0.35 EPS

PROFITABILITY

Q1 2018 Revenue $42.7 million; Gross Profit Margin 37.6%;

Operating Margin 13.1%; EBITDA Margin ~18%

17© 2017 Columbus McKinnon Corporation

Key Takeaways

Evolving to industrial technology company

Leading US market share, strong brands, key vertical markets

Extensive market channels & broad global presence

Lifting solutions focused on safety and productivity

Consistently strong cash, long-term margins

18© 2017 Columbus McKinnon Corporation

Supplemental

Information

19© 2017 Columbus McKinnon Corporation

Adjusted Gross Profit Reconciliation

Adjusted gross profit is defined as gross profit as reported, adjusted for unusual items. Adjusted gross profit is not a measure determined in

accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the

measure as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information such as adjusted gross

profit is important for investors and other readers of the Company’s financial statements, and assists in understanding the comparison of the current

quarter’s gross profit to the historical period’s gross profit.

Fiscal Year

FY 2015 FY 2016 FY 2017 Q1 FY18 TTM

Gross profit $181,607 $187,263 $192,932 $214,193

Add back:

Product liability costs for legal settlement — 1,100 — —

Building held for sale impairment charge — 429 — —

Acquisition inventory step-up expense 543 1,446 8,852 8,852

Acquisition amortization of backlog — 581 — —

STAHL integration costs — — — 169

Facility consolidation costs 1,176 346 — —

Non-GAAP adjusted gross margin $183,326 $191,165 $201,784 $223,214

Sales 579,643 597,103 637,123 691,836

Adjusted gross margin 31.6% 32.0% 31.7% 32.3%

($ in thousands)

20© 2017 Columbus McKinnon Corporation

Adjusted Income from Operations Reconciliation

Adjusted income from operations is defined as income from operations as reported, adjusted for certain items and to apply a normalized tax rate.

Adjusted income from operations is not a measure determined in accordance with generally accepted accounting principles in the United States,

commonly known as GAAP and may not be comparable to the measures as used by other companies. Nevertheless, Columbus McKinnon

believes that providing non-GAAP information, such as adjusted income from operations, is important for investors and other readers of the

Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's income from operations

to the historical periods' income from operations

Fiscal Year

FY 2015 FY 2016 FY 2017 Q1 FY18 TTM

Income (loss) from operations $54,648 $40,570 $25,973 $34,787

Add back:

Acquisition inventory step-up expense and real

estate transfer taxes

659 1,446 8,852 8,852

Acquisition deal, integration, and severance costs — 8,046 8,815 9,986

CEO retirement pay and search costs — — 3,085 3,085

Insurance recovery legal costs — — 1,359 1,588

Impairment of intangible asset — — 1,125 1,125

Canadian pension lump sum settlements — — 247 —

Product liability costs for legal settlement — 1,100 — —

Building held for sale impairment charge — 429 — —

Facility consolidation costs 1,726 1,444 — —

Magnetek acquisition amortization of backlog — 581 — —

Non-GAAP adjusted income from operations $57,033 $53,616 $49,456 $59,423

Sales 579,643 597,103 637,123 691,836

Adjusted operating margin 9.8% 9.0% 7.8% 8.6%

($ in thousands)

21© 2017 Columbus McKinnon Corporation

Adjusted Diluted EPS Reconciliation

Adjusted net income and diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items and to apply a normalized tax rate.

Adjusted net income and diluted EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly

known as GAAP, and may not be comparable to the measure as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP

information, such as adjusted net income and diluted EPS, is important for investors and other readers of the Company’s financial statements and assists in

understanding the comparison of the current quarter’s and current year’s net income and diluted EPS to the historical periods’ net income and diluted EPS.

(1) Applies normalized tax rate of 22% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax.

Fiscal Year

FY 2015 FY 2016 FY 2017 Q1 FY18 TTM

Net income (loss) $27,190 $19,579 $8,984 $14,239

Add back:

Acquisition inventory step-up expense and real estate

transfer taxes

659 1,446 8,852 8,852

Acquisition deal, integration, and severance costs — 8,046 8,815 9,986

CEO retirement pay and search costs — — 3,085 3,085

Insurance recovery legal costs — — 1,359 1,588

Impairment of intangible asset — — 1,125 1,125

Loss on extinguishment of debt — — 1,303 1,303

(Gain) loss on foreign exchange option for acquisition — — 1,590 1,590

Canadian pension lump sum settlements — — 247 —

Product liability costs for legal settlement — 1,100 — —

Building held for sale impairment charge — 429 — —

Facility consolidation costs 1,726 1,444 — —

Magnetek acquisition amortization of backlog — 581 — —

Debt refinancing costs 8,567 — — —

Normalize tax rate (1) (1,508) 2,218 (4,626) (6,028)

Non-GAAP adjusted net income $36,634 $34,843 $30,734 $35,740

Average diluted shares outstanding 20,224 20,315 20,888 21,522

Diluted income per share - GAAP $1.34 $0.96 $0.43 $0.66

Diluted income per share - Non-GAAP $1.81 $1.72 $1.47 $1.66

($ in thousands, except per share data)

22© 2017 Columbus McKinnon Corporation

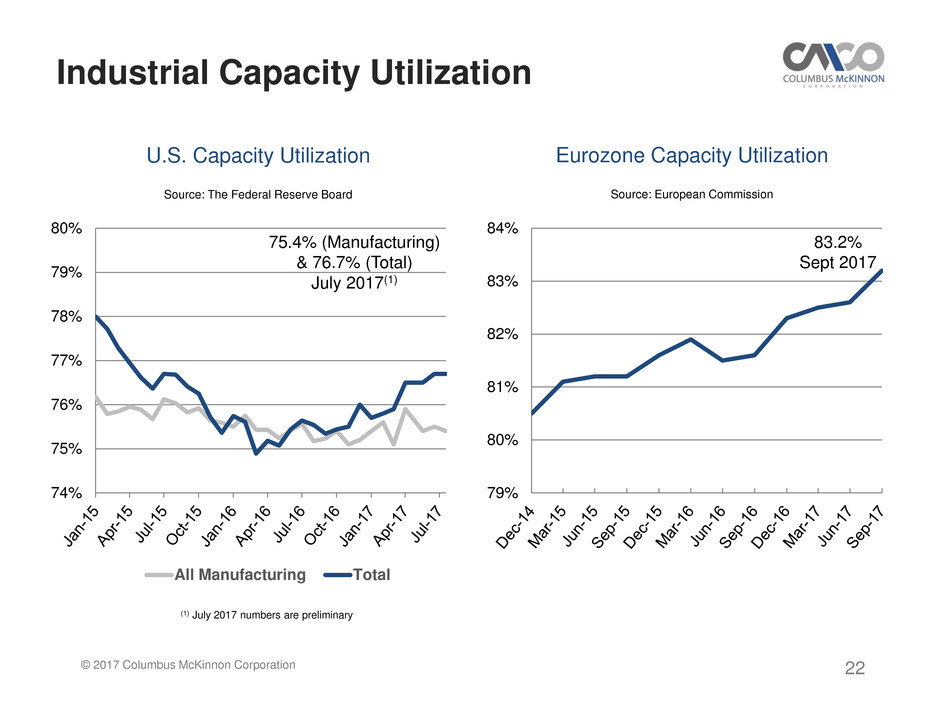

79%

80%

81%

82%

83%

84%

74%

75%

76%

77%

78%

79%

80%

All Manufacturing Total

Source: The Federal Reserve Board

Eurozone Capacity UtilizationU.S. Capacity Utilization

Source: European Commission

83.2%

Sept 2017

75.4% (Manufacturing)

& 76.7% (Total)

July 2017(1)

Industrial Capacity Utilization

(1) July 2017 numbers are preliminary

23© 2017 Columbus McKinnon Corporation

Established Global PresenceGlobal Presence