Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ALTITUDE INTERNATIONAL HOLDINGS, INC. | ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: June 27, 2017

TITAN COMPUTER SERVICES, INC

(Exact name of Registrant as specified in its Charter)

|

New York

|

000-55639

|

13-3778988

|

|

(State or Other Jurisdiction of

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

Incorporation)

|

|

|

515 E. Las Olas Boulevard, Suite 120, Fort Lauderdale, FL 33301

(Address of Principal Executive Offices)

(954) 256-5120

(Registrant’s Telephone Number, including area code)

720 Monroe Street, Suite E210, Hoboken, NJ, 07030

(Former address)

Copy to:

Brunson Chandler & Jones, PLLC

175 South Main Street, Suite 1410

Salt Lake City, Utah 84111

(801)303-5721

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see general instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

The purpose of this amendment on Form 8-K is to include as Exhibit 99.1 certain pro forma financial statements as required.

FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this Current Report. We cannot assure you that the forward-looking statements in this Current Report will prove to be accurate, and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. You should read this Current Report completely, and it should be read and considered with other reports filed by us with the Securities and Exchange Commission (the “SEC”). Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

NAME REFERENCES

Except as otherwise indicated by context, references to the “Company,” “Titan”, “we,” “our,” “us” and words of similar import refer to “Titan Computer Services, Inc.”, a New York entity.

DOCUMENTS INCORPORATED HEREIN BY REFERENCE

See Item 9.01 for documents incorporated herein by reference, including our prior reports or registration statements that have been filed by us with the SEC and that contain information, as applicable, to the information required by Item 501(8) of Form 8-K.

Item 1.01 Entry into Definitive Material Agreement.

DESCRIPTION OF THE SHARE EXCHANGE AGREEMENT

On June 27, 2017, Titan Computer Services, Inc., a New York corporation (“Titan” or the “Company”), entered into a Share Exchange Agreement (“Share Exchange”) with Altitude International, Inc, a Wisconsin corporation (“Altitude”). Altitude was incorporated on May 18, 2017 under the laws of the state of Wisconsin. Altitude International specializes in creating properly engineered, membrane based designs for simulated altitude training equipment. The product line ranges from personal at home use machines to fully integrated environmental rooms and chambers.

The Exchange

Pursuant to the terms of the Share Exchange, the Company agreed to issue 6,102,000 shares of its common stock to the individual shareholders of Altitude on a pro rata basis in exchange for receive 100% of the shares of Altitude. Following the Share Exchange, Altitude will be a wholly-owned subsidiary of the Company.

Item 2.01 Completion of Acquisition or Disposition of Assets.

At the Closing of the Share Exchange Agreement on June 27, 2017, Titan acquired 100% ownership of Altitude International Inc., a wholly owned subsidiary. See above details in Item 1.01. Altitude is now operating as a wholly-owned subsidiary of the Company.

Item 3.02 Unregistered Sales of Equity Securities

Pursuant to the Share Exchange Agreement, the Corporation issued 6,102,000 shares of its restricted common stock to the shareholders in Altitude on a pro rata basis.

A condition to the closing of the Share Exchange Agreement was raising $100,000 in the Company. On June 27, 2017, the Company issued 500,000 shares of its common stock to an accredited investor pursuant to a Subscription Agreement for $100,000, or $0.20 per share. The Shares were offered and sold in a private placement to the Investor without registration under the Securities Act of 1933, as amended, or the securities laws of certain states, in reliance on the exemptions provided by Section 4(2) of the Securities Act and Regulation D promulgated thereunder, and in reliance on similar exemptions under applicable state laws

2

Form 10 Disclosure

Explanatory Note: While the Company was not a shell company prior to the Share Exchange, the Company has chosen to include all Form 10 information related to Altitude in this 8-K as part of its ongoing efforts in public disclosure.

As disclosed in this report, on June 27, 2017, we acquired Altitude International, Inc., a Wisconsin entity, in the athletic training industry, specifically altitude training. The Company will generate revenue through Northern, Central, and South America sales by way of its sole distribution agreement with Woodway Inc. Our objective is to be recognized as one of the upper tier specialty altitude training equipment providers.

The acquisition of Altitude International, Inc. was a material transaction to our existing operations.

Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of Altitude International, Inc., except that information relating to periods prior to the date of the acquisition of Altitude only relate to Titan Computer Services, unless otherwise specifically indicated.

BUSINESS

Corporate History

Altitude International, Inc. specializes in creating uniquely-engineered, membrane-based designs for simulated altitude training environments. The product line ranges from personal at home use machines to fully integrated environmental rooms and chambers. Through a license agreement with Sporting Edge UK Ltd, a brand well-established in the United Kingdom, the Company intends to expand its technology into the American marketplace, where the appetite for increasing performance in elite athletes, professional sports, equine sports, and universities and colleges is immense.

Business Strategy

The Company will seek to set itself apart from other altitude training technology by introducing to elite athletes, health and fitness clubs, and profession sports teams novel training techniques proven to increase performance. The Company has developed technology and training protocols that make possible large improvements in fitness and performance in normal room environments. The well-financed sports market of North America offers the Company opportunities to manufacture and distribute its products to a welcoming customer base

Industry Operating Environment

Whether at the Olympic level or in professional and college teams – top level sports require individuals to perform at their maximum potential. Margins between success and failure are small – the difference between first and last in the Tour de France is three percent - and athletes constantly seek to close the gap between success and failure.

Many American athletes currently engage in altitude training by travelling to elevations of about 6,000ft to train in air with decreased oxygen levels. Though this type of training has its benefits, it does not come without costs. Traveling creates a disruption to an athlete’s normal training schedule as well as considerable economic costs to travel and train in those locations. Altitude’s licensed technology allows for all the benefits of altitude training without the disruptions of travel.

U.S. suppliers of altitude training equipment exist but they use an entirely different technology that almost entirely focuses on a mask based approach. This cumbersome approach is not favored by the athletes, and impedes normal breathing patterns. Altitude’s approach is to create room environments that are not only precisely controllable for simulated altitude level, but also for temperature and humidity – allowing the climate of almost any location on the planet to be replicated. This allows many combinations of altitude, heat and humidity stresses to be created and also provides for pre-acclimatization of players about to compete outside their normal climate zone. These additional stresses deliver increased benefits compared to altitude training alone.

Development

The product designs to be licensed from Sporting Edge UK Ltd are proven and cover a wide range of room sizes. The only requirement is to change from metric to imperial sizes where necessary.

3

There are three unique elements to the Altitude proposition:

|

·

|

Sophisticated Touch Screen control systems capable of integrating the control of simulated altitude, temperature and humidity.

|

|

·

|

A unique design of Air Separation Unit with only a single active part that provides for ultra-reliable operation and a design life of greater than fifteen years.

|

|

·

|

Proven training protocols that allow the desired training benefits to be achieved.

|

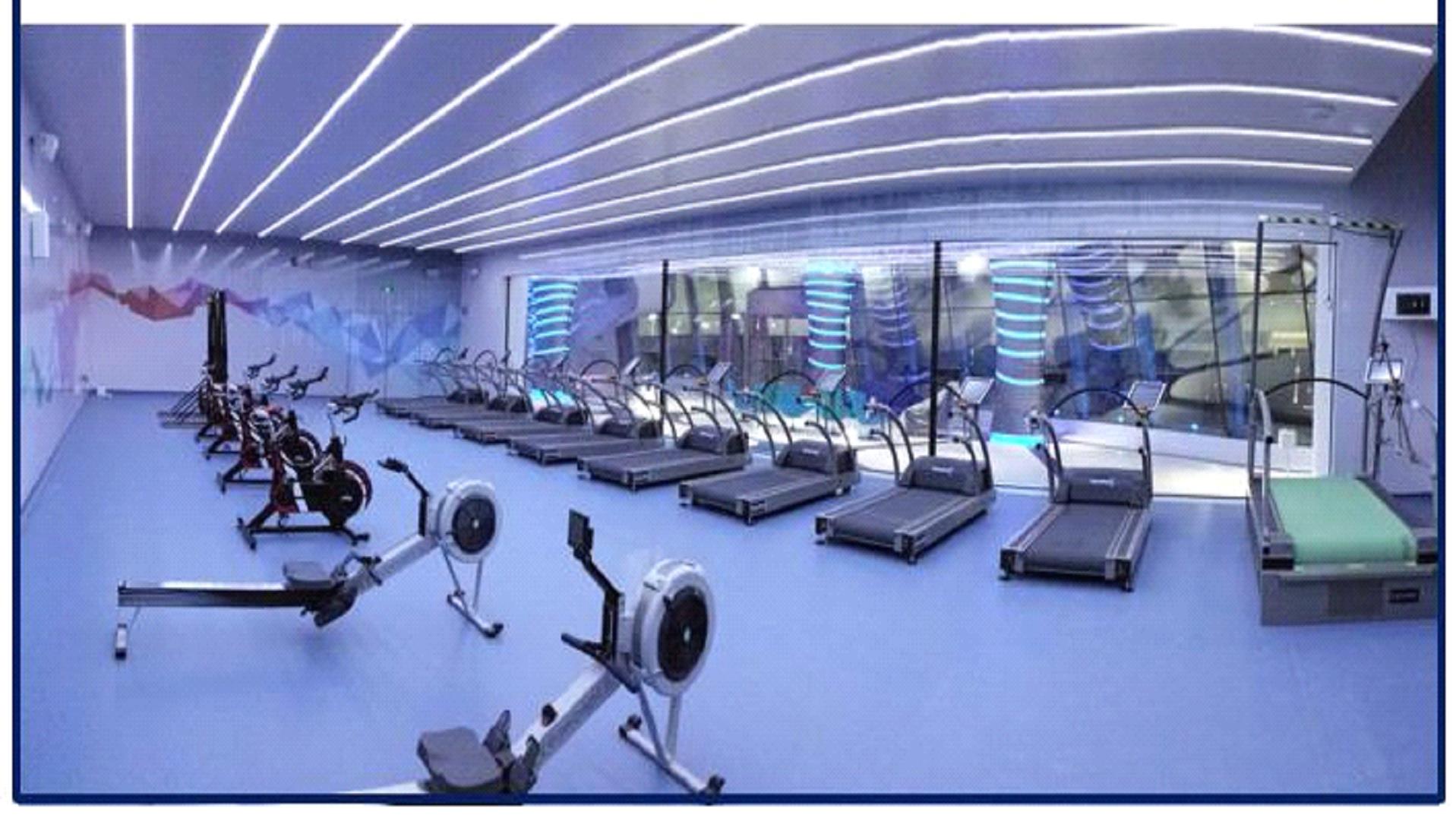

We have included some photos of what our systems will look like:

4

Altitude will lease space in the Woodway facility in Waukesha, Wisconsin to undertake the manufacture of systems. The work will primarily consist of the assembly of components into the unique licensed designs. Initial recruitment of technically-capable persons will be necessary, followed by short training blocks to pass on the required skills. At least one person is likely to visit the UK to see systems in operation and obtain hands-on experience of the manufacturing requirement. Woodway is an engineering-based company and provides the perfect environment to establish an operation which is in many ways similar to their own. In addition, many aspects of infrastructure – goods handling, welfare facilities, etc. – can be accessed immediately without expense to Altitude.

5

Competition

Currently, the membrane-based technology is not being well used in the United States. In North America, there exists some companies that provide altitude training masks but the equipment is on a much smaller scale intended for personal use. This type of equipment employs PSA technology, which has reliability issues and a restricted altitude capacity.

Marketing and Customers

As noted above, Altitude will focus its efforts on building a customer base with elite athletes, professional sports teams, universities, and health and fitness chains.

It is essential that potential customers can be accessed easily and quickly, but this is often difficult. Getting access to an organization can be difficult and getting to the right person even more so. Altitude has two strategies to achieve this:

|

·

|

A strategic partnership with Woodway, who will be the sole Distributor of Altitude products in all of North, Central and South America in all markets save Equestrian and Health & Fitness clubs. This gives immediate access, at the right level, to every university, college, hospital and professional sports team in the USA and many more in other parts of the territory. The traditional delays and costs associated with assembling a large and trained sales team are avoided as are the expenses associated with running such a large team. Altitude is pleased to be working with Woodway, a world leader in treadmill sales and a company that even has a special treadmill installed in the International Space Station.

|

|

·

|

A small network of Altitude ambassadors are associated with the Company, including:

|

|

•

|

Robert Kanuth

|

Businessman and ex -Harvard basketball star.

|

|

•

|

Landon Adler

|

Ex-professional basketball player.

|

|

•

|

Jonathan Goldfarb

|

Ex world top-50 tennis player.

|

|

•

|

Ron Turner

|

Football coach from a famous coaching family

|

|

•

|

Lesley Visser

|

Outstanding sportscaster and media icon.

|

|

•

|

Professor Greg Whyte

|

Internationally renowned Sports Physiologist.

|

We hope that our ambassadors will help us access decision makers at the highest level who are pre-disposed to listen to our message. We hope their work, alongside the marketing being undertaken by Woodway and our licensed Altitude technology and training protocols will help grow the business.

A demonstration facility is already installed in Wisconsin and a second such facility is planned for Florida, so that customers can experience the environment first hand

Principal Agreements Affecting Our Ordinary Business

Altitude has several agreements in place related to its business operations.

Sporting Edge UK Licensing Agreement

Altitude has a Licensing Agreement with Sporting Edge UK that grants a license to Altitude to use Sporting Edge’s proprietary technology related to properly engineered, membrane based designs for simulated altitude training equipment. The product line ranges from personal at home use machines to fully integrated environmental rooms and chambers. Altitude has the licensing rights to use all technology to manufacture the products and to sell them (directly or through distributors) in the following territories:

|

·

|

The Continent of North America, Central America, The Continent of South America.

|

|

·

|

Other Territories as may be agreed from time to time, on a temporary or permanent basis.

|

Woodway Agreement

Altitude and Woodway USA Inc. entered into an Amended and Restated Sole Distribution Agreement in June 2017. Pursuant to the terms of that Agreement, Woodway will be the sole Distributor of Altitude products in all of North, Central and South America in all markets save Equestrian and Health & Fitness clubs. As part of the Sole Distribution Agreement, Woodway will raise awareness and understanding of the Products in the Territory by way of seminars, briefings, demonstrations, presentations, advertising and other sales activities.

6

Existing and Probable Government Regulation to Our Current and Intended Business

Exchange Act

We are subject to the following regulations of the Exchange Act, and applicable securities laws, rules and regulations promulgated under the Exchange Act by the SEC. Compliance with these requirements of the Exchange Act increases our legal and accounting costs.

Smaller Reporting Company

We are subject to the reporting requirements of Section 13 of the Exchange Act, and subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K.

Sarbanes/Oxley Act

We are also subject to the Sarbanes-Oxley Act of 2002 (the “Sarbanes/Oxley Act”). The Sarbanes/Oxley Act created a strong and independent accounting oversight board to oversee the conduct of auditors of public companies and strengthens auditor independence. It also requires steps to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; creates guidelines for audit committee members’ appointment, compensation and oversight of the work of public companies’ auditors; management assessment of our internal controls; prohibits certain insider trading during pension fund blackout periods; requires companies and auditors to evaluate internal controls and procedures; and establishes a federal crime of securities fraud, among other provisions. Compliance with the requirements of the Sarbanes/Oxley Act will substantially increase our legal and accounting costs.

Exchange Act Reporting Requirements

Section 14(a) of the Exchange Act requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act like we are to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in SEC Regulation 14A. Matters submitted to shareholders at a special or annual meeting thereof or pursuant to a written consent will require us to provide our shareholders with the information outlined in Schedules 14A (where proxies are solicited) or 14C (where consents in writing to the action have already been received or are anticipated to be received) of SEC Regulation 14, as applicable; and preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies are forwarded to our shareholders.

We are also required to file annual reports on Form 10-K and quarterly reports on Form 10-Q with the SEC on a regular basis, and will be required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in Current Reports on Form 8-K.

Number of Total Employees and Number of Full-Time Employees

As explained above, the relationship with Woodway Inc negates the requirement for a sales and marketing force as well as manufacturing infrastructure. Renting space at the Woodway manufacturing location in Waukesha means that all existing facilities such as staff welfare, mechanical aids, packing and handling areas, etc. can be utilized at minimal cost. In addition, it is not required to set up contracts with utility companies and access to local companies supplying support services and materials will be facilitated through the Distribution Agreement.

The numbers of employees will expand as the company grows, depending on Altitude’s financial condition and the receptiveness to our products in the market. Currently, market prospecting and sales development work is being carried out by the Board, our partners, and our Ambassadors, with no salaries being paid.

Reports to Security Holders

You may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may also find all the reports that we have filed electronically with the SEC at their Internet site www.sec.gov.

7

RISK FACTORS

As we are a “smaller reporting company” as defined by Rule 12b-2 of the Exchange Act, we are not required to provide the information under this item; however, we believe this information may be of value to our shareholders for this filing. We reserve the right not to provide risk factors in our future filings. Our primary risk factors and other considerations include:

Risks Related to the Company

Altitude International operates in an environment that involves many risks and uncertainties. The risks and uncertainties described in this section are not the only risks and uncertainties that we face. Additional risks and uncertainties that presently are not considered material or are not known to us, and therefore are not mentioned herein, may impair our business operations. If any of the risks described actually occur, our business, operating results and financial position could be adversely affected.

Our revenues and profitability can fluctuate from period to period and are often difficult to predict due to factors beyond our control.

Our results of operations in any particular period may not be indicative of results to be expected in future periods, and have historically been, and are expected to continue to be, subject to periodic fluctuations arising from a number of factors, including:

|

·

|

Introduction and market acceptance of new products and sales trends affecting specific existing products;

|

|

·

|

Variations in product selling prices and costs and the mix of products sold;

|

|

·

|

Size and timing of Retail customer orders, which, in turn, often depend upon the success of our customers’ businesses or specific products;

|

|

·

|

Changes in the market conditions for consumer fitness equipment;

|

|

·

|

Changes in macroeconomic factors;

|

|

·

|

Availability of consumer credit;

|

|

·

|

Timing and availability of products coming from our offshore contract manufacturing suppliers;

|

|

·

|

Seasonality of markets, which vary from quarter-to-quarter and are influenced by outside factors such as overall consumer confidence and the availability and cost of television advertising time;

|

|

·

|

Effectiveness of our media and advertising programs;

|

|

·

|

Customer consolidation in our Retail segment, or the bankruptcy of any of our larger Retail customers;

|

|

·

|

Restructuring charges;

|

|

·

|

Goodwill and other intangible asset impairment charges; and

|

|

·

|

Legal and contract settlement charges.

|

These trends and factors could adversely affect our business, operating results, financial position and cash flows in any particular period.

The loss of one or more of our large Retail customers, or the inability to gain any retail customers, could negatively impact our revenue and operating results.

We will derive a significant portion of our revenue from a small number of Retail customers. Other retail partners may in the future experience difficulties in their businesses that could prompt store closures or reorganizations. A loss of business from one or more of these large customers, if not replaced with new business, could negatively affect our operating results and cash flows.

A decline in sales of products without a corresponding increase in sales of other products would negatively affect our future revenues and operating results.

Our products are sold in highly competitive markets with limited barriers to entry. Introduction by competitors of comparable products at lower price-points, a maturing product lifecycle or other factors could result in a decline in our revenues derived from these products. A significant decline in our revenue of these products would have a material adverse effect on our operating results, financial position and cash flows.

Portions of our operating expenses and costs of goods sold are relatively fixed, and we may have limited ability to reduce expenses sufficiently in response to any revenue shortfalls.

Many of our operating expenses are relatively fixed. We may not be able to adjust our operating expenses or other costs sufficiently to adequately respond to any revenue shortfalls. If we are unable to reduce operating expenses or other costs quickly in response to any declines in revenue, it would negatively impact our operating results, financial condition and cash flows.

8

If we are unable to anticipate consumer preferences or to effectively develop, market and sell future products, our future revenues and operating results could be adversely affected.

Our future success depends on our ability to effectively develop, market and sell new products that respond to new and evolving consumer preferences. Accordingly, our revenues and operating results may be adversely affected if we are unable to develop or acquire rights to new products that satisfy consumer preferences. In addition, any new products that we market may not generate sufficient revenues to recoup their acquisition, development, production, marketing, selling and other costs.

Decline in consumer spending would likely negatively affect our product revenues and earnings.

Success of each of our products depends substantially on the amount of discretionary funds available to our customers. Global credit and financial markets have experienced extreme disruptions in the recent past, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates and uncertainty about economic stability. There can be no assurance that similar disruptions will not occur in the future. Deterioration in general economic conditions may depress consumer spending, especially spending for discretionary consumer products such as ours. Poor economic conditions could in turn lead to substantial decreases in our net sales or have a material adverse effect on our operating results, financial position and cash flows.

Our business is affected by seasonality which results in fluctuations in our operating results.

We experience fluctuations in aggregate sales volume during the year. Sales are typically strongest in the first and fourth quarters, followed by the third quarter, and are generally weakest in the second quarter. However, the mix of product sales may vary considerably from time to time as a result of changes in seasonal and geographic demand for particular types of fitness equipment. In addition, our customers may cancel orders, change delivery schedules or change the mix of products ordered with minimal notice. As a result, we may not be able to accurately predict our quarterly sales. Accordingly, our results of operations are likely to fluctuate significantly from period to period.

Government regulatory actions could disrupt our marketing efforts and product sales.

Various international and U.S. federal, state and local governmental authorities, including the Federal Trade Commission, the Consumer Product Safety Commission, the Securities and Exchange Commission and the Consumer Financial Protection Bureau, regulate our product and marketing efforts. Our revenue and profitability could be significantly harmed if any of these authorities commence a regulatory enforcement action that interrupts our marketing efforts, results in a product recall or negative publicity, or requires changes in product design or marketing materials.

Our revenues could decline due to changes in credit markets and decisions made by credit providers.

A significant portion of our Direct sales have been financed for our customers under various programs offered by third-party consumer credit financing sources. Reductions in consumer lending and the availability of consumer credit could limit the number of customers with the financial means to purchase our products. Higher interest rates could increase monthly payments for consumer products financed through one of our financing partners or through other sources of consumer financing. In the past, we have partnered with financial service companies to assist our customers in obtaining financing to purchase our products. Our present agreements with our third-party consumer credit financing providers enable certain customers to obtain financing if they qualify for the provider’s private label revolving credit card. We cannot be assured that our third-party financing providers will continue to provide consumers with access to credit or that credit limits under such arrangements will not be reduced. Such restrictions or reductions in the availability of consumer credit could have a material adverse impact on our results of operations, financial position and cash flows.

A delay in getting non-U.S.-sourced products through port operations and customs in a timely manner could result in reduced sales, canceled sales orders and unanticipated inventory accumulation.

Our business depends on our ability to source and distribute products in a timely manner. As a result, we rely on the free flow of goods through open and operational ports worldwide. Labor disputes or other disruptions at ports create significant risks for our business, particularly if work slowdowns, lockouts, strikes or other disruptions occur during our peak importing seasons. Any of these factors could result in reduced sales, canceled sales orders and unanticipated inventory accumulation and have a material adverse effect on our operating results, financial position and cash flows.

9

Currency exchange rate fluctuations could result in higher costs, reduced margins or decreased international sales.

Some key components are manufactured outside of the U.S. and, therefore, currency exchange rate fluctuations could result in higher costs for our products, or could disrupt the business of independent manufacturers that produce our products, by making their purchases of raw materials more expensive and more difficult to finance. Our future financial results could be significantly affected by the value of the U.S. dollar in relation to the foreign currencies in which we, our customers or our suppliers conduct business. Past fluctuations in currency exchange rates versus the U.S. dollar have caused our costs for certain products to increase, reducing our margins and cash flows. Similar fluctuations and cost increases may occur in the future. If we are unable to increase our selling prices to offset such cost increases, or if such increases have a negative impact on sales of our products, our revenues and margins would be reduced and our operating results and cash flows would be negatively impacted. In addition, a portion of our revenue is derived from sales outside the U.S., primarily in Canada and Europe. Currency rate fluctuations could make our products more expensive for foreign consumers and reduce our revenue, which would negatively affect our operating results and cash flows.

We may face competition from providers of comparable products in categories where our patent protection is limited or reduced due to patent expiration. Increased competition in those product categories could negatively affect our future revenues and operating results.

The patents that cover the production of hypoxic environments in room situations have all expired and so no general patent protection is available. However, under the terms of the license with SE, Altitude will benefit from patents that have been filed that relate to improving membrane performance and improving the uniformity of climate in environmental chambers. These patents are pending in the UK.

We are subject to periodic litigation, product liability risk and other regulatory proceedings, which could result in unexpected expense of time and resources.

From time to time, we may be a defendant in lawsuits and regulatory actions relating to our business or the former operations of our discontinued Commercial business segment. Due to the inherent uncertainties of litigation and regulatory proceedings, we cannot accurately predict the ultimate outcome of any such proceedings. An unfavorable outcome could have a material adverse impact on our business, financial condition and results of operations. In addition, any significant litigation in the future, regardless of its merits, could divert management’s attention from our operations and may result in substantial legal costs.

We are subject to warranty claims for our products, which could result in unexpected expense.

Many of our products carry warranties for defects in quality and workmanship. We may experience significant expense as the result of product quality issues, product recalls or product liability claims which may have a material adverse effect on our business. We maintain a warranty reserve for estimated future warranty claims. However, the actual costs of servicing future warranty claims may exceed the reserve and have a material adverse effect on our results of operations, financial condition and cash flows.

Disruption to our information and communication systems could result in interruptions to our business and potential implementation of new systems for critical business functions may heighten the risk of disruption.

Our business is reliant on information and communication technology, and a substantial portion of our revenues are generated with the support of information and communication systems. The success of our Direct business is heavily dependent on our ability to respond to customer sales inquiries and process sales transactions using our call center communication systems, Internet websites and similar data monitoring and communication systems provided and supported by third-parties. If such systems were to fail, or experience significant or lengthy interruptions in availability or service, our revenues could be materially affected. We also rely on information systems in all stages of our product cycle, from design to distribution, and we use such systems as a method of communication between employees, suppliers and customers. In addition, we use information systems to maintain our accounting records, assist in trade receivables collection and customer service efforts, and forecast operating results and cash flows.

System failures or service interruptions may occur as the result of many factors, including: computer viruses; hacking or other unlawful activities by third parties; disasters; equipment, hardware or software failures; ineffective design or implementation of new systems or systems upgrades; cable outages, extended power failures, or our inability or failure to properly protect, repair or maintain our communication and information systems. To mitigate the risk of business interruption, we have in place a disaster recovery program that targets our most critical operational systems. If our disaster recovery system is ineffective, in whole or in part, or efforts conducted by us or third-parties to prevent or respond to system interruptions in a timely manner are ineffective, our ability to conduct operations would be significantly affected. If we do not consider the potential impact of critical decisions related to systems or process design and implementation, this could lead to operational challenges and increased costs. Any of the factors could have a material adverse effect on our operating results, financial position and cash flows.

10

System security risks, data protection breaches and cyber-attacks could disrupt our operations.

We manage and store various proprietary information and sensitive or confidential data relating to our business, including sensitive and personally identifiable information. Breaches of our security measures or the accidental loss, inadvertent disclosure or unapproved dissemination of proprietary information or sensitive or confidential data about us, or our customers, including the potential loss or disclosure of such information or data as a result of fraud, trickery or other forms of deception, could expose us, our customers or the individuals affected to a risk of loss or misuse of this information, result in litigation and potential liability for us, damage our brand and reputation or otherwise harm our business. In addition, the cost and operational consequences of implementing further data protection measures could be significant.

Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of third parties, create system disruptions or cause shutdowns. Computer programmers and hackers also may be able to develop and deploy viruses, worms and other malicious software programs that attack or otherwise exploit any security vulnerabilities of our systems. In addition, sophisticated hardware and operating system software and applications that we procure from third parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the system. The costs to us to eliminate or alleviate cyber or other security problems, bugs, viruses, worms, malicious software programs and security vulnerabilities could be significant, and our efforts to address these problems may not be successful and could result in interruptions, delays, cessation of service and loss of existing or potential customers that may impede our revenue, manufacturing, distribution or other critical functions.

Risks Related to our Securities

Our Stock Price May be Volatile, which May Result in Losses to Our Shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the over-the-counter Bulletin Board quotation system in which shares of our common stock are listed, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

|

·

|

variations in our operating results;

|

|

·

|

changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

|

|

·

|

changes in operating and stock price performance of other companies in our industry;

|

|

·

|

additions or departures of key personnel; and

|

|

·

|

future sales of our common stock.

|

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our Common Shares May Become Thinly Traded and You May be Unable to Sell at or Near Ask Prices, or at All.

We cannot predict the extent to which an active public market for trading our common stock will be sustained.

This situation is attributable to many factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until we become more seasoned and viable. Consequently, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

11

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be able to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

Because the SEC Imposes Additional Sales Practice Requirements on Brokers Who Deal in Shares of Penny Stocks, Some Brokers May be Unwilling to Trade Our Securities. This Means that You May have Difficulty Reselling Your Shares, which May Cause the Value of Your Investment to Decline.

Our shares are classified as penny stocks and are covered by Section 15(g) of the Exchange Act which imposes additional sales practice requirements on brokers-dealers who sell our securities. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement prior from you to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

Financial Industry Regulatory Authority (FINRA) Sales Practice Requirements May Limit Your Ability to Buy and Sell Our Common Stock, which Could Depress the Price of Our Shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

Volatility in Our Common Share Price May Subject Us to Securities Litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

Our Business is Subject to Changing Regulations Related to Corporate Governance and Public Disclosure that have Increased Both Our Costs and the Risk of Noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

12

We Will Incur Increased Costs and Compliance Risks as a Result of Becoming a Public Company.

We will incur costs associated with our public company reporting requirements. We also anticipate that we will incur costs associated with recently adopted corporate governance requirements, including certain requirements under the Sarbanes-Oxley Act of 2002, as well as new rules implemented by the SEC and FINRA. We expect these rules and regulations, in particular Section 404 of the Sarbanes-Oxley Act of 2002, to significantly increase our legal and financial compliance costs and to make some activities more time-consuming and costly. Like many smaller public companies, we face a significant impact from required compliance with Section 404 of the Sarbanes-Oxley Act of 2002. Section 404 requires management of public companies to evaluate the effectiveness of internal control over financial reporting and the independent auditors to attest to the effectiveness of such internal controls and the evaluation performed by management. The SEC has adopted rules implementing Section 404 for public companies as well as disclosure requirements. The Public Company Accounting Oversight Board, or PCAOB, has adopted documentation and attestation standards that the independent auditors must follow in conducting its attestation under Section 404. We are currently preparing for compliance with Section 404; however, there can be no assurance that we will be able to effectively meet all of the requirements of Section 404 as currently known to us in the currently mandated timeframe. Any failure to implement effectively new or improved internal controls, or to resolve difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet reporting obligations or result in management being required to give a qualified assessment of our internal controls over financial reporting or our independent auditors providing an adverse opinion regarding management’s assessment. Any such result could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

We also expect these new rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our Board of Directors or as executive officers. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Sales of Our Currently Issued and Outstanding Stock May Become Freely Tradable Pursuant to Rule 144 and May Dilute the Market for Your Shares and have a Depressive Effect on the Price of the Shares of Our Common Stock.

A majority of the outstanding shares of our common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) (“Rule 144”). As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Securities Act and as required under applicable state securities laws. A sale under Rule 144 or under any other exemption from the Securities Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may develop.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth certain information concerning the number of shares our common stock owned beneficially as of September 12, 2017 (after the Exchange and Closing) by: (i) our directors and executive officer; and (ii) each person or group of persons known by us to beneficially own more than 5% of our outstanding shares of common stock. Unless otherwise indicated, the shareholders listed below possess sole voting and investment power with respect to the shares they own.

|

5% Shareholders

|

|||

|

Name and Address of Beneficial Owner

|

Title of Class

|

Amount and Nature

of Beneficial

Ownership

|

Percent of Class

after the Merger

(%)

|

|

David Vincent

|

Common stock

|

11,350,000

|

51.7%

|

|

Robert Kanuth

|

Common stock

|

300,000

|

1.4%

|

|

Rosenweiss Capital

|

Common Stock

|

3,000,000

|

13.807%

|

SEC Rule 13d‑3 generally provides that beneficial owners of securities include any person who, directly or indirectly, has or shares voting power and/or investment power with respect to such securities, and any person who has the right to acquire beneficial ownership of such security within 60 days. Any securities not outstanding which are subject to such options, warrants or conversion privileges exercisable within 60 days are treated as outstanding for the purpose of computing the percentage of outstanding securities owned by that person. Such securities are not treated as outstanding for the purpose of computing the percentage of the class owned by any other person.

13

DIRECTORS AND EXECUTIVE OFFICERS

There have been several significant changes to the Company’s Board of Directors since the filing of our last Annual Report on Form 10-K. On June 27, 2017, pursuant to the Closing of the Share Exchange Agreement, a new officer and two new directors were appointed and our former officer and one of our directors resigned. The following sets forth information about our directors and executive officers as of the date of this report, immediately following the Share Exchange.

|

NAME

|

|

AGE

|

|

POSITION

|

|

David Vincent

|

|

67

|

|

CEO, CFO, Director

|

|

Robert Kanuth

|

|

70

|

|

Chairman

|

|

Abraham Rosenblum

|

|

37

|

|

Director

|

Background of Executive Officer and Directors

David Peter Vincent, President and CEO

David Vincent, a Chartered Engineer, is the pioneer of high performance membrane technology for both altitude training and fire protection markets. For the past thirteen years, David has been the Managing Director at Sporting Edge UK with previous senior management positions at In BT, Andrew Corporation, Scientific Atlanta Inc, and Amstrad plc. He was educated to BSc level in Electrical and Electronic Engineering in Plymouth, England, and at 25 became one of the youngest Chartered Engineers in the country. He has since served on Technical Committees at the British Standards Institute and has registered several patents that improve the performance of simulated altitude systems.

Robert Kanuth, Chairman

Robert Kanuth, a Harvard graduate, is an owner of Pelican Bay Suites, a hotel on Grand Bahama Island. Robert Cranston Kanuth, Jr., is a distinguished investment banker who founded and directed the highly successful Cranston Securities in the mid-1970’s. Based in his hometown of Columbus, Ohio, Bob added headquarters in Washington, D.C., while doing large scale transactions throughout the United States. The company was sold to insurance giant Kemper Corporation in 1987. He then founded Cranston Development, funding projects which restored and revitalized such cities as Richmond, VA., Savannah, GA., and Pittsburgh, PA. A Harvard alumnus, Kanuth went on to serve in the Army National Guard before launching his compelling financial career. Kanuth is married to Hall of Fame Sportscaster Lesley Visser.

Director Compensation

Directors received shares in Altitude and received shares of Company common stock upon the closing of the Share Exchange. It is expected that further allocations or compensation arrangements will be made on an annual basis, based on the success achieved by the company, although no formal agreements exist.

Directors will receive reimbursement of expenses properly incurred in their duties as Board members or in the seeking of sales via their existing contact networks. Such expenses to be pre-approved by the CEO.

Term of Office

The Company does not have a set term of office.

The Company’s President is Dave Vincent, who is also the Managing Director of Sporting Edge UK.

Family Relationships

We currently do not have any officers or directors of our Company who are related to each other, with the exception of Leslie Visser and Bob Kanuth, who are married.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Director Independence

We currently do not have any independent directors as the term “independent” is defined by the rules of the American Stock Exchange.

14

LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, executive officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

MARKET PRICE OF AND DIVIDEND ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Prices for our common stock are quoted on the OTCQB. Since September 26, 2016, our common stock has accepted for listing under the symbol “TTNC”.

Rule 144

The following is a summary of the current requirements of Rule 144:

|

|

Affiliate or Person Selling on Behalf of an Affiliate

|

Non-Affiliate (and has not been an Affiliate During the Prior Three Months)

|

|

Restricted Securities of Reporting Issuers

|

During six-month holding period – no resales under Rule 144 Permitted.

After Six-month holding period – may resell in accordance with all Rule 144 requirements including:

· Current public information,

· Volume limitations,

· Manner of sale requirements for equity securities, and

· Filing of Form 144.

|

During six- month holding period – no resales under Rule 144 permitted.

After six-month holding period but before one year – unlimited public resales under Rule 144 except that the current public information requirement still applies.

After one-year holding period – unlimited public resales under Rule 144; need not comply with any other Rule 144 requirements.

|

|

Restricted Securities of Non-Reporting Issuers

|

During one-year holding period – no resales under Rule 144 permitted.

After one-year holding period – may resell in accordance with all Rule 144 requirements including:

· Current public information,

· Volume limitations,

· Manner of sale requirements for equity securities, and

· Filing of Form 144.

|

During one-year holding period – no resales under Rule 144 permitted.

After one-year holding period – unlimited public resales under Rule 144; need not comply with any other Rule 144 requirements.

|

Warrants

We have no warrant holders

Dividends

To date, the Company has not declared or paid cash dividends on its common stock.

Securities Authorized for Issuance under Equity Compensation Plans

None.

15

DESCRIPTION OF REGISTRANT’S SECURITIES

We have an authorized capital of 75,000,000 shares divided into 70,000,000 shares of common stock with no par value and 5,000,000 shares of preferred stock with no par value.

Common Stock

Prior to the Share Exchange Agreement, there were 29,826,659 shares of common stock of the Company issued and outstanding, 14,600,000 of which were cancelled on June 27, 2017. As consideration for the Share Exchange Agreement, the shareholders of Altitude International, Inc., received a total of 6,102,000 restricted shares of TTNC proportionate to their shareholdings in Altitude International. Immediately following the Share Exchange agreement, there will are 21,728,659 shares of common stock issued and outstanding and no shares of preferred stock outstanding.

Preferred Stock

The Company has no preferred stock.

Stock Options

The Company has no stock options.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our directors and officers are indemnified as provided by the New York Business Corporation Law (“Section 722”) and our bylaws. We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under the Securities Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event of a claim for indemnification against such liabilities is asserted by one of our directors, executive officers or controlling persons, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court’s decision.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

Item 5.01 Changes in Control of the Registrant.

On June 27, 2017, after the closing of certain Stock Purchase Agreements in private sale transaction and the Share Exchange Agreement, a change of control of the Company occurred. Dave Vincent is now the majority shareholder of the Company, owning 51.3 % of the issued and outstanding common shares.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 27, 2017, pursuant to the Closing of the Share Exchange Agreement, Dave Vincent was appointed as the Company’s new CEO and Abraham Rosenblum resigned. Additionally, Mr. Vincent and Robert Kanuth were appointed as directors of the Company and Robert Klein resigned.

16

Item 9.01 Financial Statements and Exhibits.

|

Exhibit

|

|

|

|

Number

|

|

Description of Exhibit

|

|

3.1

|

|

|

|

3.2

|

|

|

|

10.1

|

|

|

|

10.2

|

|

|

|

99.1

|

*Previously filed on Form 8-K filed July 3, 2017 and incorporated herein by reference.

17

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

TITAN COMPUTER SERVICES, INC.

|

Date:

|

September 12, 2017

|

|

By:

|

/s/ David Vincent

|

|

|

|

|

|

David Vincent

|

|

|

|

|

|

Chief Executive Officer, Chief Financial Officer and Director

|

18