Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sabra Health Care REIT, Inc. | a8-kbamlpresentationsep2017.htm |

Bank of America Merrill Lynch

Real Estate Conference

September 12, 2017

Relationship driven.

Investor focused.

.

2

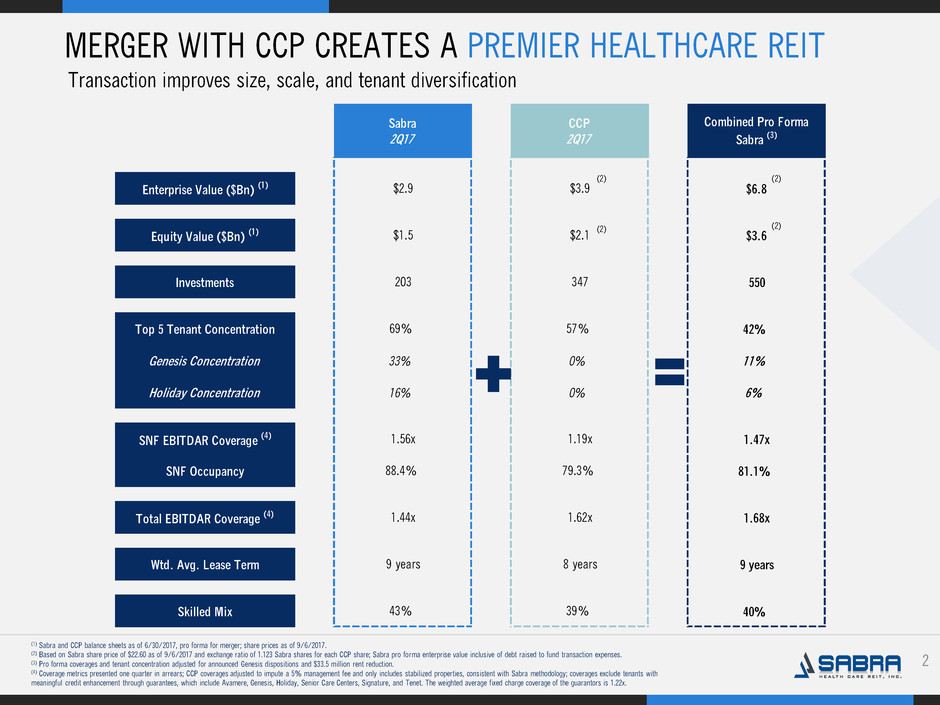

Sabra

2Q17

CCP

2Q17

Combined Pro Forma

Sabra (3)

Enterprise Value ($Bn) (1) $2.9 $3.9 $6.8

Equity Value ($Bn) (1) $1.5 $2.1 $3.6

Investments 203 347 550

Top 5 Tenant Concentration 69% 57% 42%

Genesis Concentration 33% 0% 11%

Holiday Concentration 16% 0% 6%

SNF EBITDAR Coverage (4) 1.56x 1.19x 1.47x

SNF Occupancy 88.4% 79.3% 81.1%

Total EBITDAR Coverage (4) 1.44x 1.62x 1.68x

Wtd. Avg. Lease Term 9 years 8 years 9 years

Skilled Mix 43% 39% 40%

MERGER WITH CCP CREATES A PREMIER HEALTHCARE REIT

Transaction improves size, scale, and tenant diversification

(1) Sabra and CCP balance sheets as of 6/30/2017, pro forma for merger; share prices as of 9/6/2017.

(2) Based on Sabra share price of $22.60 as of 9/6/2017 and exchange ratio of 1.123 Sabra shares for each CCP share; Sabra pro forma enterprise value inclusive of debt raised to fund transaction expenses.

(3) Pro forma coverages and tenant concentration adjusted for announced Genesis dispositions and $33.5 million rent reduction.

(4) Coverage metrics presented one quarter in arrears; CCP coverages adjusted to impute a 5% management fee and only includes stabilized properties, consistent with Sabra methodology; coverages exclude tenants with

meaningful credit enhancement through guarantees, which include Avamere, Genesis, Holiday, Senior Care Centers, Signature, and Tenet. The weighted average fixed charge coverage of the guarantors is 1.22x.

(2) (2)

(2) (2)

.

3

14.9%

16.9%

20.6%

21.7% 22.1%

23.6%

0%

5%

10%

15%

20%

25%

0

20,000

40,000

60,000

80,000

100,000

120,000

2015 2020 2030 2040 2050 2060

(00

0s)

65+ % of Total

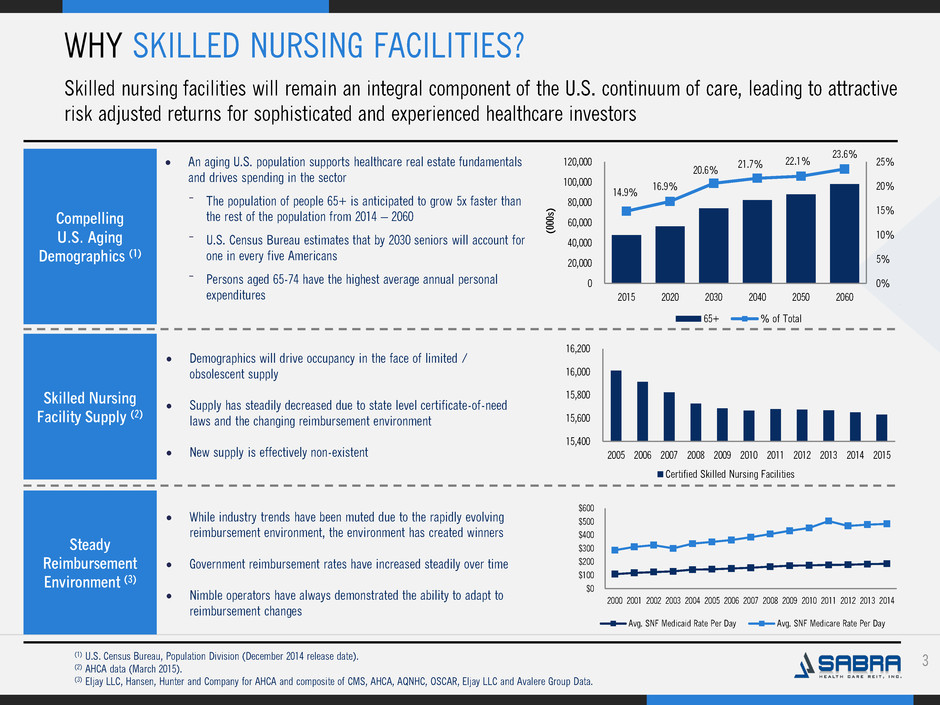

WHY SKILLED NURSING FACILITIES?

Skilled nursing facilities will remain an integral component of the U.S. continuum of care, leading to attractive

risk adjusted returns for sophisticated and experienced healthcare investors

Compelling

U.S. Aging

Demographics (1)

An aging U.S. population supports healthcare real estate fundamentals

and drives spending in the sector

⁻ The population of people 65+ is anticipated to grow 5x faster than

the rest of the population from 2014 – 2060

⁻ U.S. Census Bureau estimates that by 2030 seniors will account for

one in every five Americans

⁻ Persons aged 65-74 have the highest average annual personal

expenditures

Skilled Nursing

Facility Supply (2)

Steady

Reimbursement

Environment (3)

While industry trends have been muted due to the rapidly evolving

reimbursement environment, the environment has created winners

Government reimbursement rates have increased steadily over time

Nimble operators have always demonstrated the ability to adapt to

reimbursement changes

15,400

15,600

15,800

16,000

16,200

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Certified Skilled Nursing Facilities

$0

$100

$200

$300

$400

$500

$600

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Avg. SNF Medicaid Rate Per Day Avg. SNF Medicare Rate Per Day

(1) U.S. Census Bureau, Population Division (December 2014 release date).

(2) AHCA data (March 2015).

(3) Eljay LLC, Hansen, Hunter and Company for AHCA and composite of CMS, AHCA, AQNHC, OSCAR, Eljay LLC and Avalere Group Data.

Demographics will drive occupancy in the face of limited /

obsolescent supply

Supply has steadily decreased due to state level certificate-of-need

laws and the changing reimbursement environment

New supply is effectively non-existent

.

4

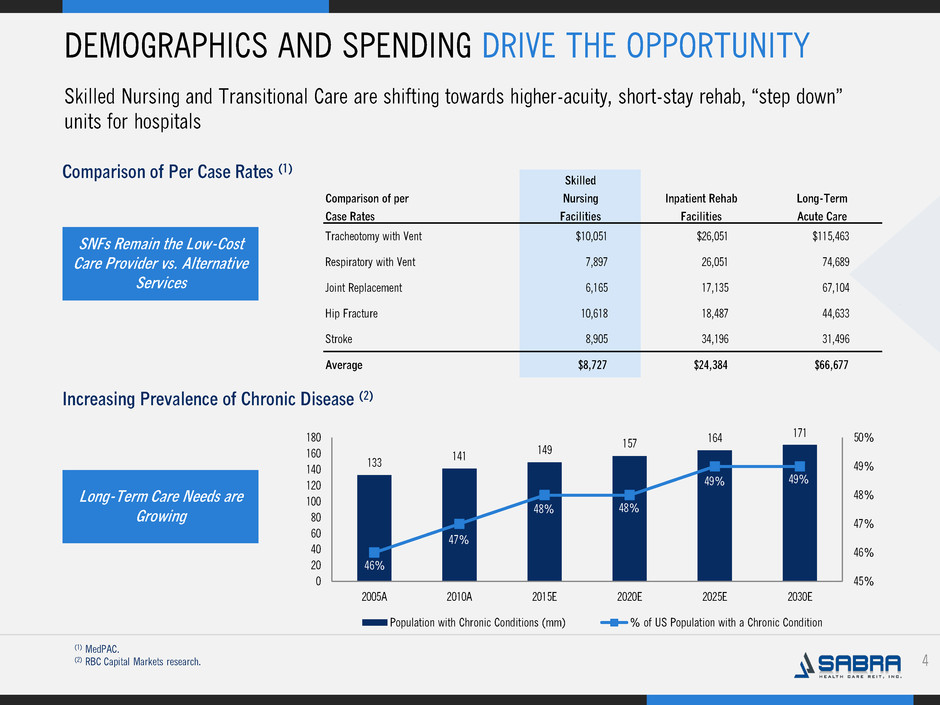

DEMOGRAPHICS AND SPENDING DRIVE THE OPPORTUNITY

(1) MedPAC.

(2) RBC Capital Markets research.

Skilled Nursing and Transitional Care are shifting towards higher-acuity, short-stay rehab, “step down”

units for hospitals

Comparison of Per Case Rates (1)

Increasing Prevalence of Chronic Disease (2)

Long-Term Care Needs are

Growing

SNFs Remain the Low-Cost

Care Provider vs. Alternative

Services

133

141

149

157 164

171

46%

47%

48% 48%

49% 49%

45%

46%

47%

48%

49%

50%

0

20

40

60

80

100

120

140

160

180

2005A 2010A 2015E 2020E 2025E 2030E

Population with Chronic Conditions (mm) % of US Population with a Chronic Condition

Skilled

Comparison of per Nursing Inpatient Rehab Long-Term

Case Rates Facilities Facilities Acute Care

Tracheotomy with Vent $10,051 $26,051 $115,463

Respiratory with Vent 7,897 26,051 74,689

Joint Replacement 6,165 17,135 67,104

Hip Fracture 10,618 18,487 44,633

Stroke 8,905 34,196 31,496

Average $8,727 $24,384 $66,677

.

5

HIGH QUALITY PORTFOLIO OF PRIMARILY SKILLED NURSING

AND SENIOR HOUSING ASSETS

.

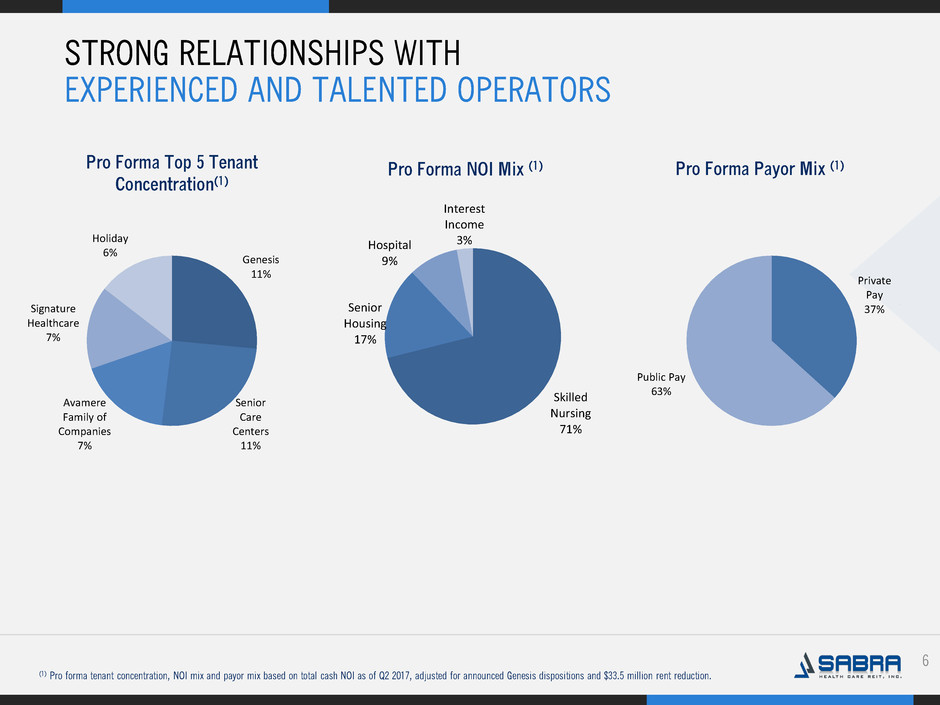

6

STRONG RELATIONSHIPS WITH

EXPERIENCED AND TALENTED OPERATORS

Pro Forma Top 5 Tenant

Concentration(1)

(1) Pro forma tenant concentration, NOI mix and payor mix based on total cash NOI as of Q2 2017, adjusted for announced Genesis dispositions and $33.5 million rent reduction.

Pro Forma NOI Mix (1) Pro Forma Payor Mix (1)

Genesis

11%

Senior

Care

Centers

11%

Avamere

Family of

Companies

7%

Signature

Healthcare

7%

Holiday

6%

Private

Pay

37%

Public Pay

63% Skilled

Nursing

71%

Senior

Housing

17%

Hospital

9%

Interest

Income

3%

.

7

42%

69%69%69%

76%

89%

97%

25%

50%

75%

100%

Pro FormaYE 2016YE 2015YE 2014YE 2013YE 2012YE 2011

11%

32%34%

36%

51%

65%

76%

25%

50%

75%

100%

Pro FormaYE 2016YE 2015YE 2014YE 2013YE 2012YE 2011

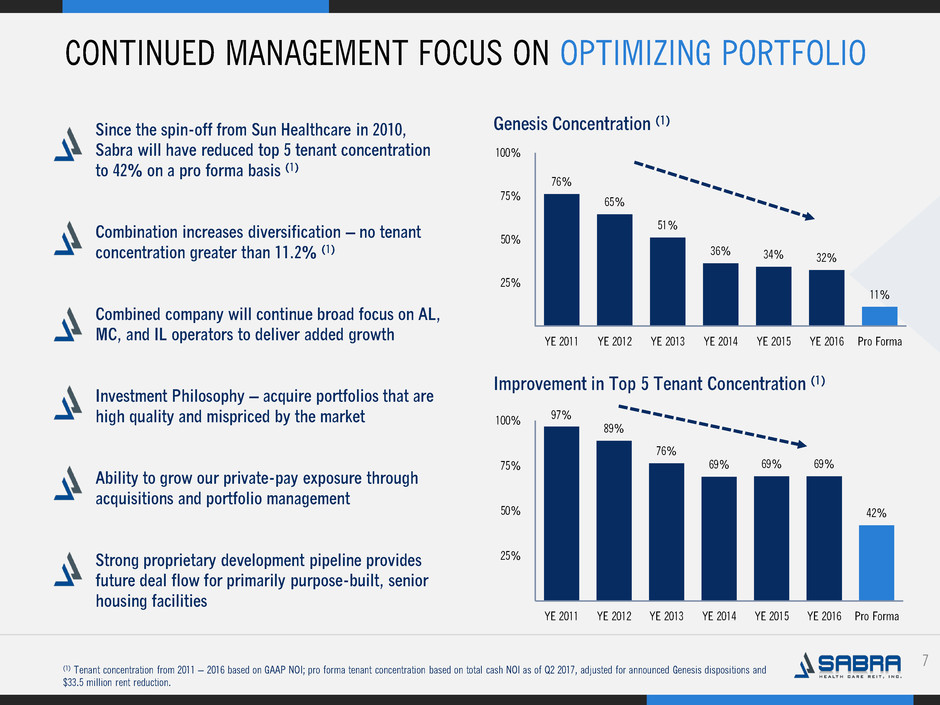

CONTINUED MANAGEMENT FOCUS ON OPTIMIZING PORTFOLIO

Genesis Concentration (1) Since the spin-off from Sun Healthcare in 2010,

Sabra will have reduced top 5 tenant concentration

to 42% on a pro forma basis (1)

Combination increases diversification – no tenant

concentration greater than 11.2% (1)

Combined company will continue broad focus on AL,

MC, and IL operators to deliver added growth

Investment Philosophy – acquire portfolios that are

high quality and mispriced by the market

Ability to grow our private-pay exposure through

acquisitions and portfolio management

Strong proprietary development pipeline provides

future deal flow for primarily purpose-built, senior

housing facilities

(1) Tenant concentration from 2011 – 2016 based on GAAP NOI; pro forma tenant concentration based on total cash NOI as of Q2 2017, adjusted for announced Genesis dispositions and

$33.5 million rent reduction.

Improvement in Top 5 Tenant Concentration (1)

.

8

82%

69%

53%

36%

42%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

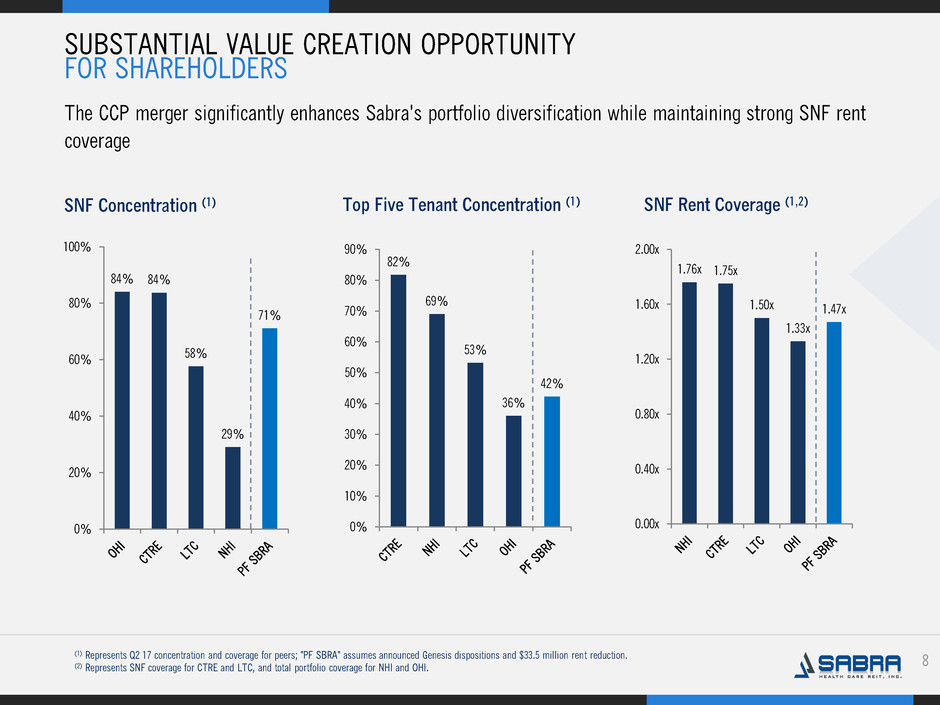

SUBSTANTIAL VALUE CREATION OPPORTUNITY

FOR SHAREHOLDERS

The CCP merger significantly enhances Sabra's portfolio diversification while maintaining strong SNF rent

coverage

SNF Concentration (1) SNF Rent Coverage (1,2) Top Five Tenant Concentration (1)

(1) Represents Q2 17 concentration and coverage for peers; "PF SBRA" assumes announced Genesis dispositions and $33.5 million rent reduction.

(2) Represents SNF coverage for CTRE and LTC, and total portfolio coverage for NHI and OHI.

84% 84%

58%

29%

71%

0%

20%

40%

60%

80%

100%

1.76x 1.75x

1.50x

1.33x

1.47x

0.00x

0.40x

0.80x

1.20x

1.60x

2.00x

.

9

FOCUSED APPROACH PROVIDES A CONDUIT FOR FUTURE GROWTH

Investment Thesis

Utilize operating and asset management expertise to identify

and capitalize on opportunities

Leverage Sabra's existing and new relationships leading to

significant external growth opportunities

Align with high-quality operators to assist in their strategic

goals

Focus on operators with local and regional expertise to

capitalize on favorable demographics

Pursue strategic development opportunities with attractive

risk-adjusted returns

Smaller initial investments in purpose-built facility

development projects lower Sabra’s development risk

Create a diversified portfolio that is well-positioned for the

future of healthcare delivery

Focus on investments where we identify off-market price

dislocation

Thinking Outside The Box

Operating expertise and deal structure flexibility drive competitive advantage

Traditional REIT

structures

- Sale/leasebacks

- Mortgage debt

Smaller

investments with

options to

purchase

Managed

properties

Preferred equity &

mezzanine debt

Development

agreements

Forward purchase

commitments

.

10

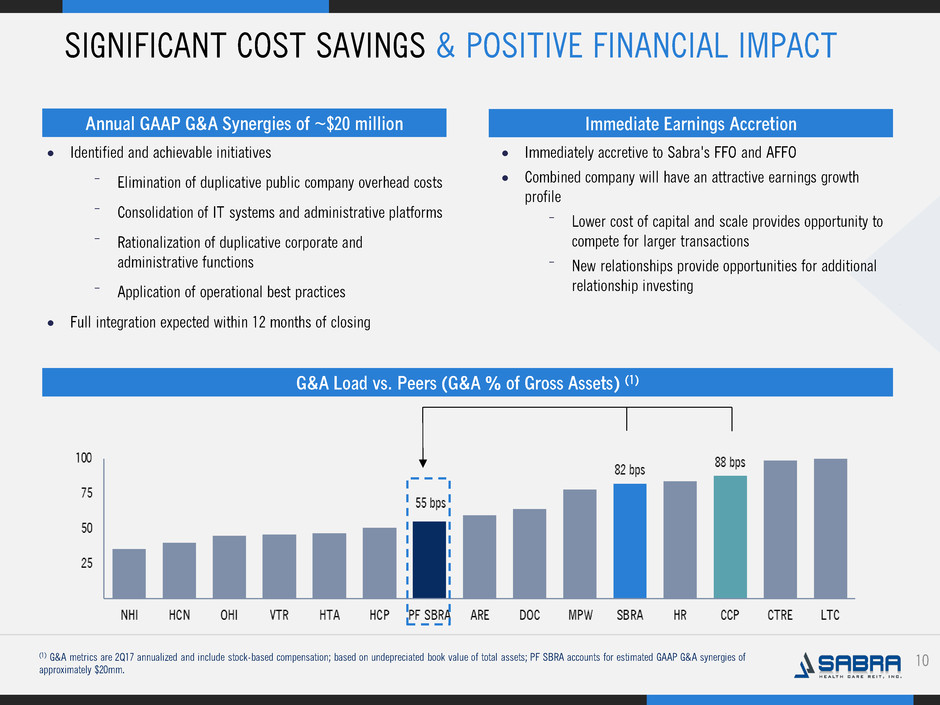

SIGNIFICANT COST SAVINGS & POSITIVE FINANCIAL IMPACT

(1) G&A metrics are 2Q17 annualized and include stock-based compensation; based on undepreciated book value of total assets; PF SBRA accounts for estimated GAAP G&A synergies of

approximately $20mm.

G&A Load vs. Peers (G&A % of Gross Assets) (1)

Annual GAAP G&A Synergies of ~$20 million

Identified and achievable initiatives

⁻ Elimination of duplicative public company overhead costs

⁻ Consolidation of IT systems and administrative platforms

⁻ Rationalization of duplicative corporate and

administrative functions

⁻ Application of operational best practices

Full integration expected within 12 months of closing

Immediate Earnings Accretion

Immediately accretive to Sabra's FFO and AFFO

Combined company will have an attractive earnings growth

profile

⁻ Lower cost of capital and scale provides opportunity to

compete for larger transactions

⁻ New relationships provide opportunities for additional

relationship investing

.

11

Equity

53%

Unsecured Debt

41%

Secured Debt

4%

Preferred Equity

2%

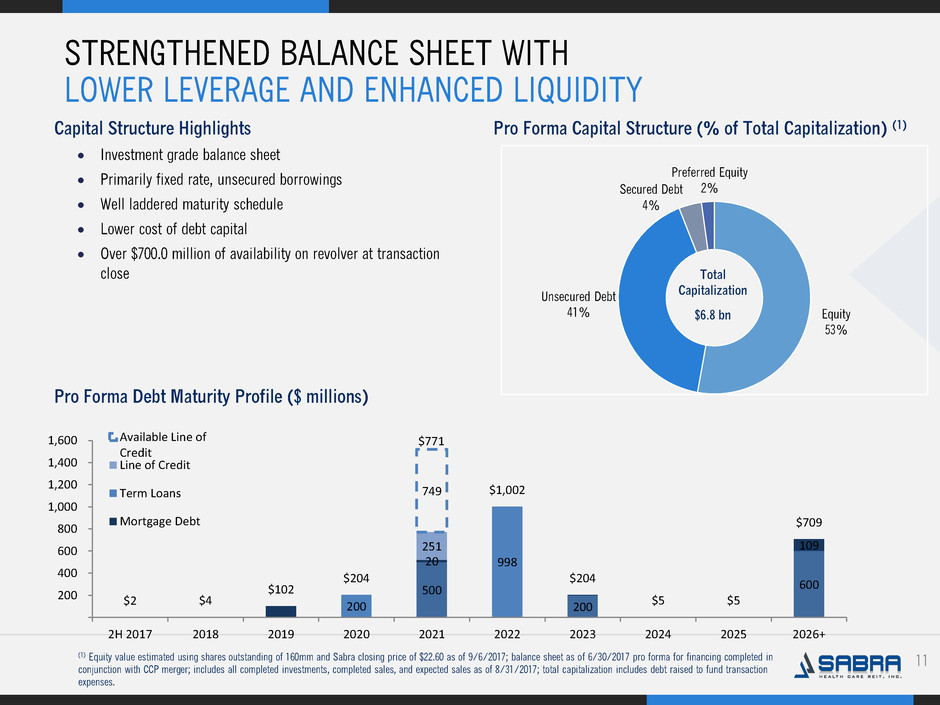

STRENGTHENED BALANCE SHEET WITH

LOWER LEVERAGE AND ENHANCED LIQUIDITY

Capital Structure Highlights Pro Forma Capital Structure (% of Total Capitalization) (1)

Investment grade balance sheet

Primarily fixed rate, unsecured borrowings

Well laddered maturity schedule

Lower cost of debt capital

Over $700.0 million of availability on revolver at transaction

close

Pro Forma Debt Maturity Profile ($ millions)

Total

Capitalization

$6.8 bn

(1) Equity value estimated using shares outstanding of 160mm and Sabra closing price of $22.60 as of 9/6/2017; balance sheet as of 6/30/2017 pro forma for financing completed in

conjunction with CCP merger; includes all completed investments, completed sales, and expected sales as of 8/31/2017; total capitalization includes debt raised to fund transaction

expenses.

500

200

600

20

109

200

998

251

749

$2 $4

$102

$204

$771

$1,002

$204

$5 $5

$709

200

400

600

800

1,000

1,200

1,400

1,600

2H 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026+

Available Line of

Credit

Line of Credit

Term Loans

Mortgage Debt

.

12

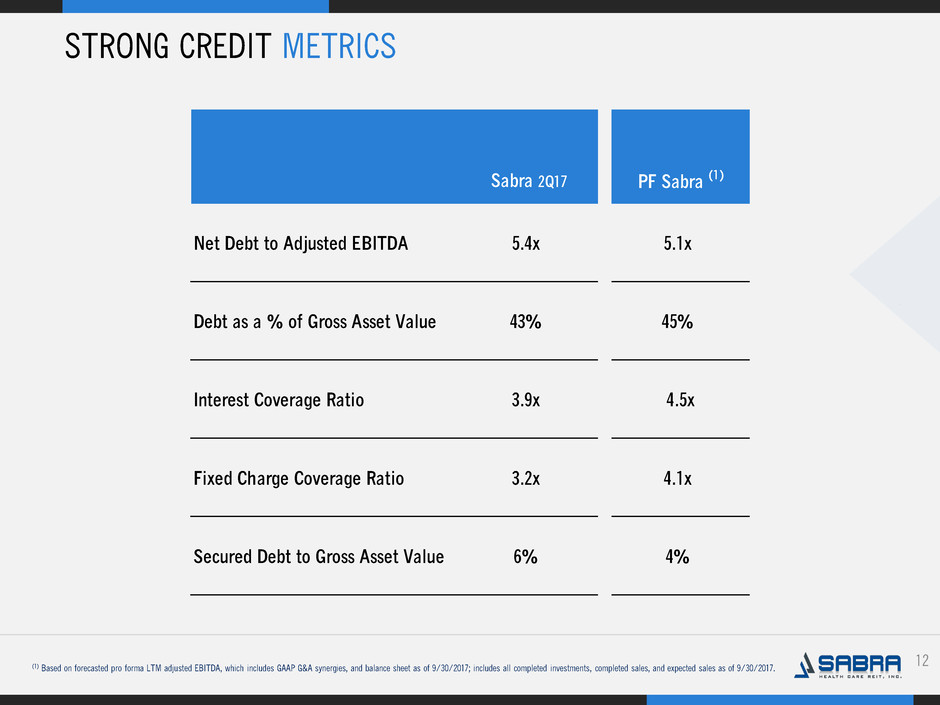

STRONG CREDIT METRICS

(1) Based on forecasted pro forma LTM adjusted EBITDA, which includes GAAP G&A synergies, and balance sheet as of 9/30/2017; includes all completed investments, completed sales, and expected sales as of 9/30/2017.

Sabra 2Q17 PF Sabra (1)

Net Debt to Adjusted EBITDA 5.4x 5.1x

Debt as a % of Gross Asset Value 43% 45%

Interest Coverage Ratio 3.9x 4.5x

Fixed Charge Coverage Ratio 3.2x 4.1x

Secured Debt to Gross Asset Value 6% 4%

.

13

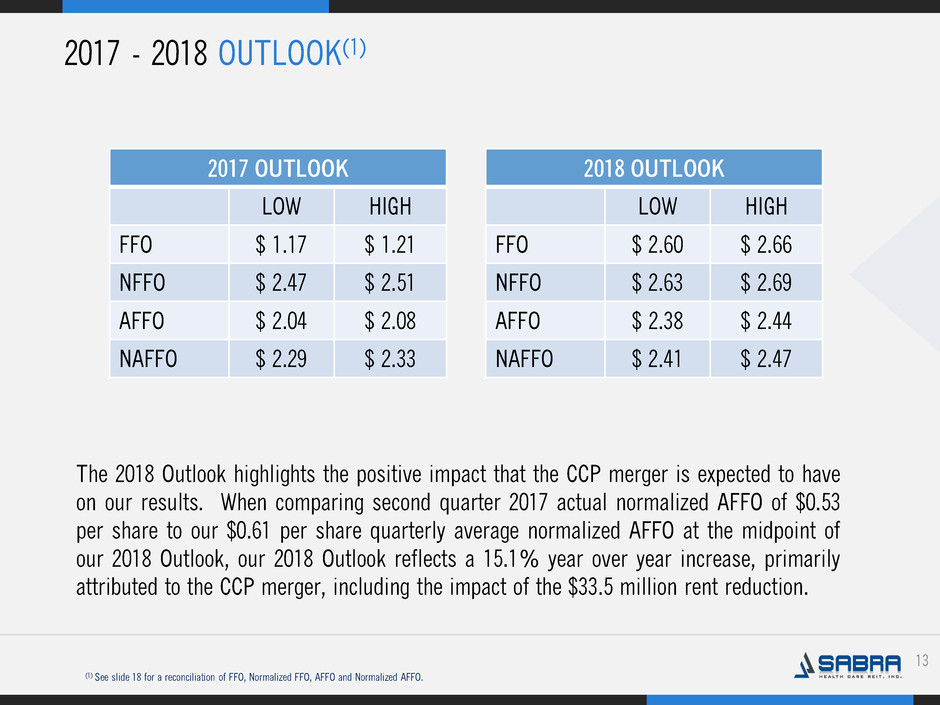

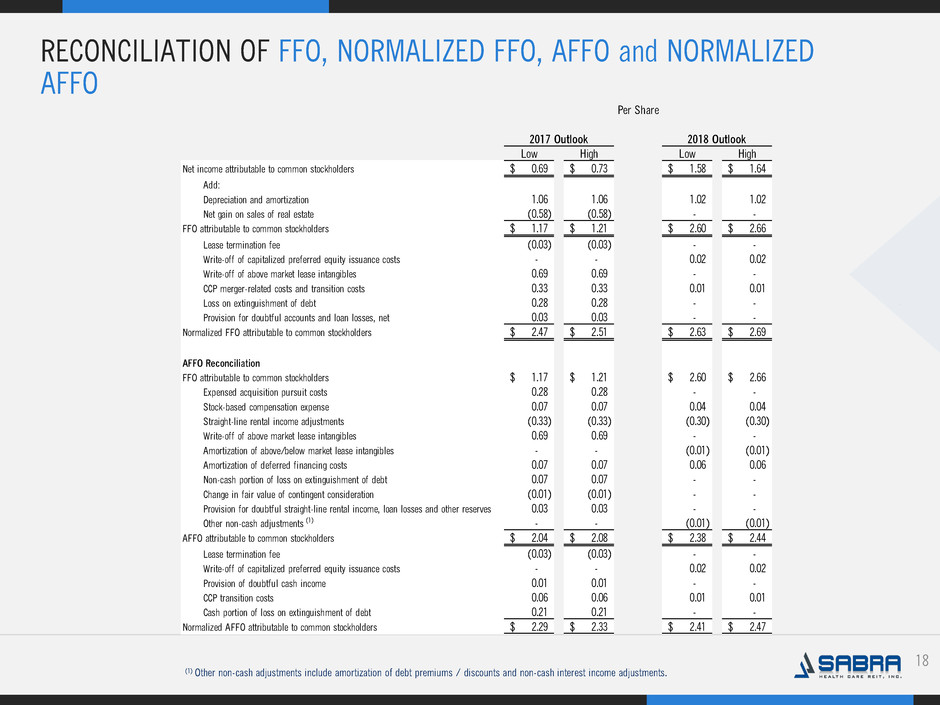

2017 - 2018 OUTLOOK(1)

2017 OUTLOOK

LOW HIGH

FFO $ 1.17 $ 1.21

NFFO $ 2.47 $ 2.51

AFFO $ 2.04 $ 2.08

NAFFO $ 2.29 $ 2.33

2018 OUTLOOK

LOW HIGH

FFO $ 2.60 $ 2.66

NFFO $ 2.63 $ 2.69

AFFO $ 2.38 $ 2.44

NAFFO $ 2.41 $ 2.47

The 2018 Outlook highlights the positive impact that the CCP merger is expected to have

on our results. When comparing second quarter 2017 actual normalized AFFO of $0.53

per share to our $0.61 per share quarterly average normalized AFFO at the midpoint of

our 2018 Outlook, our 2018 Outlook reflects a 15.1% year over year increase, primarily

attributed to the CCP merger, including the impact of the $33.5 million rent reduction.

(1) See slide 18 for a reconciliation of FFO, Normalized FFO, AFFO and Normalized AFFO.

.

14

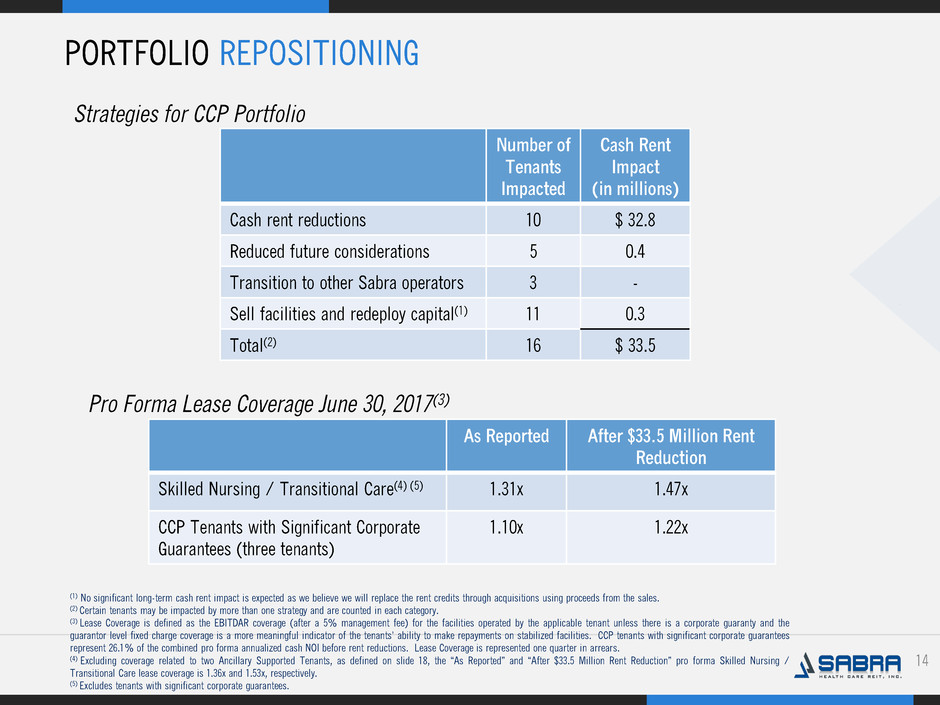

PORTFOLIO REPOSITIONING

(1) No significant long-term cash rent impact is expected as we believe we will replace the rent credits through acquisitions using proceeds from the sales.

(2) Certain tenants may be impacted by more than one strategy and are counted in each category.

(3) Lease Coverage is defined as the EBITDAR coverage (after a 5% management fee) for the facilities operated by the applicable tenant unless there is a corporate guaranty and the

guarantor level fixed charge coverage is a more meaningful indicator of the tenants’ ability to make repayments on stabilized facilities. CCP tenants with significant corporate guarantees

represent 26.1% of the combined pro forma annualized cash NOI before rent reductions. Lease Coverage is represented one quarter in arrears.

(4) Excluding coverage related to two Ancillary Supported Tenants, as defined on slide 18, the “As Reported” and “After $33.5 Million Rent Reduction” pro forma Skilled Nursing /

Transitional Care lease coverage is 1.36x and 1.53x, respectively.

(5) Excludes tenants with significant corporate guarantees.

Number of

Tenants

Impacted

Cash Rent

Impact

(in millions)

Cash rent reductions 10 $ 32.8

Reduced future considerations 5 0.4

Transition to other Sabra operators 3 -

Sell facilities and redeploy capital(1) 11 0.3

Total(2) 16 $ 33.5

As Reported After $33.5 Million Rent

Reduction

Skilled Nursing / Transitional Care(4) (5) 1.31x 1.47x

CCP Tenants with Significant Corporate

Guarantees (three tenants)

1.10x 1.22x

Pro Forma Lease Coverage June 30, 2017(3)

Strategies for CCP Portfolio

.

15

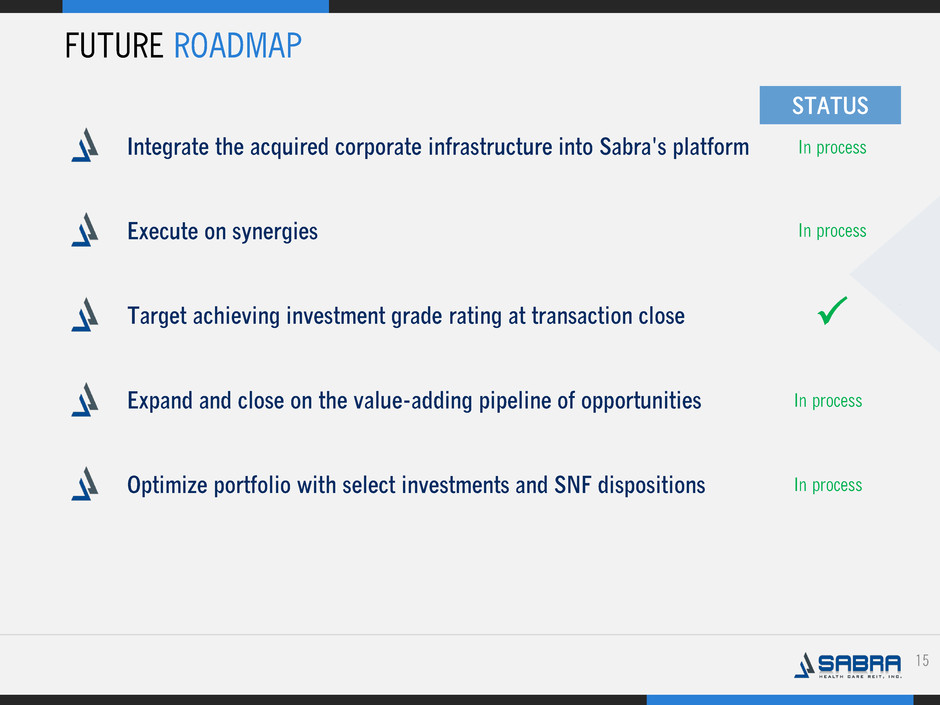

FUTURE ROADMAP

Integrate the acquired corporate infrastructure into Sabra's platform

Execute on synergies

Target achieving investment grade rating at transaction close

Expand and close on the value-adding pipeline of opportunities

Optimize portfolio with select investments and SNF dispositions

STATUS

In process

In process

In process

In process

.

16

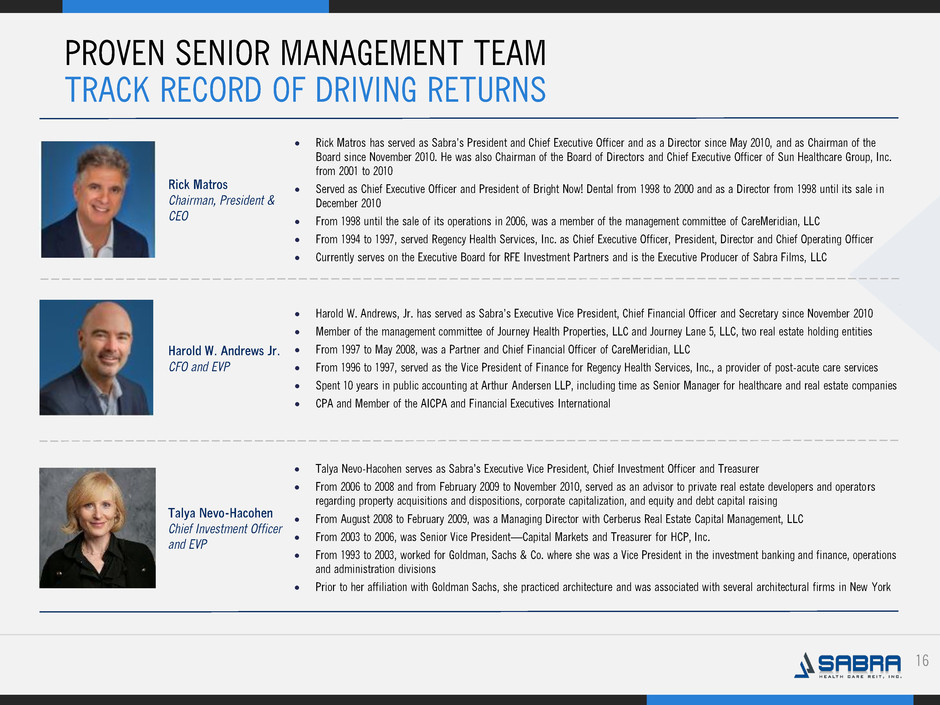

PROVEN SENIOR MANAGEMENT TEAM

TRACK RECORD OF DRIVING RETURNS

Rick Matros

Chairman, President &

CEO

Rick Matros has served as Sabra’s President and Chief Executive Officer and as a Director since May 2010, and as Chairman of the

Board since November 2010. He was also Chairman of the Board of Directors and Chief Executive Officer of Sun Healthcare Group, Inc.

from 2001 to 2010

Served as Chief Executive Officer and President of Bright Now! Dental from 1998 to 2000 and as a Director from 1998 until its sale in

December 2010

From 1998 until the sale of its operations in 2006, was a member of the management committee of CareMeridian, LLC

From 1994 to 1997, served Regency Health Services, Inc. as Chief Executive Officer, President, Director and Chief Operating Officer

Currently serves on the Executive Board for RFE Investment Partners and is the Executive Producer of Sabra Films, LLC

Harold W. Andrews Jr.

CFO and EVP

Harold W. Andrews, Jr. has served as Sabra’s Executive Vice President, Chief Financial Officer and Secretary since November 2010

Member of the management committee of Journey Health Properties, LLC and Journey Lane 5, LLC, two real estate holding entities

From 1997 to May 2008, was a Partner and Chief Financial Officer of CareMeridian, LLC

From 1996 to 1997, served as the Vice President of Finance for Regency Health Services, Inc., a provider of post-acute care services

Spent 10 years in public accounting at Arthur Andersen LLP, including time as Senior Manager for healthcare and real estate companies

CPA and Member of the AICPA and Financial Executives International

Talya Nevo-Hacohen

Chief Investment Officer

and EVP

Talya Nevo-Hacohen serves as Sabra's Executive Vice President, Chief Investment Officer and Treasurer

From 2006 to 2008 and from February 2009 to November 2010, served as an advisor to private real estate developers and operators

regarding property acquisitions and dispositions, corporate capitalization, and equity and debt capital raising

From August 2008 to February 2009, was a Managing Director with Cerberus Real Estate Capital Management, LLC

From 2003 to 2006, was Senior Vice President—Capital Markets and Treasurer for HCP, Inc.

From 1993 to 2003, worked for Goldman, Sachs & Co. where she was a Vice President in the investment banking and finance, operations

and administration divisions

Prior to her affiliation with Goldman Sachs, she practiced architecture and was associated with several architectural firms in New York

.

17

APPENDIX

.

18

RECONCILIATION OF FFO, NORMALIZED FFO, AFFO and NORMALIZED

AFFO

Option One

Option

Three

Ma

(1) Other non-cash adjustments include amortization of debt premiums / discounts and non-cash interest income adjustments.

Low High Low High

Net income attributable to common stockholders 0.69$ 0.73$ 1.58$ 1.64$

Add:

Depreciation and amortization 1.06 1.06 1.02 1.02

Net gain on sales of real estate (0.58) (0.58) - -

FFO attributable to common stockholders 1.17$ 1.21$ 2.60$ 2.66$

Lease termination fee (0.03) (0.03) - -

Write-off of capitalized preferred equity issuance costs - - 0.02 0.02

Write-off of above market lease intangibles 0.69 0.69 - -

CCP merger-related costs and transition costs 0.33 0.33 0.01 0.01

Loss on extinguishment of debt 0.28 0.28 - -

Provision for doubtful accounts and loan losses, net 0.03 0.03 - -

Normalized FFO attributable to common stockholders 2.47$ 2.51$ 2.63$ 2.69$

AFFO Reconciliation

FFO attributable to common stockholders 1.17$ 1.21$ 2.60$ 2.66$

Expensed acquisition pursuit costs 0.28 0.28 - -

Stock-based compensation expense 0.07 0.07 0.04 0.04

Straight-line rental income adjustments (0.33) (0.33) (0.30) (0.30)

Write-off of above market lease intangibles 0.69 0.69 - -

Amortization of above/below market lease intangibles - - (0.01) (0.01)

Amortization of deferred financing costs 0.07 0.07 0.06 0.06

Non-cash portion of loss on extinguishment of debt 0.07 0.07 - -

Change in fair value of contingent consideration (0.01) (0.01) - -

Provision for doubtful straight-line rental income, loan losses and other reserves 0.03 0.03 - -

Other non-cash adjustments (1) - - (0.01) (0.01)

AFFO attributable to common stockholders 2.04$ 2.08$ 2.38$ 2.44$

Lease termination fee (0.03) (0.03) - -

Write-off of capitalized preferred equity issuance costs - - 0.02 0.02

Provision of doubtful cash income 0.01 0.01 - -

CCP transition costs 0.06 0.06 0.01 0.01

Cash portion of loss on extinguishment of debt 0.21 0.21 - -

Normalized AFFO attributable to common stockholders 2.29$ 2.33$ 2.41$ 2.47$

2017 Outlook 2018 Outlook

Per Share

.

19

NON-GAAP FINANCIAL MEASURES

Option One

Option

Three

Ma

This presentation includes the following financial measures defined as non-GAAP financial measures by the SEC: funds from operations attributable to common stockholders (“FFO”),

Normalized FFO, Adjusted FFO (“AFFO”) and Normalized AFFO. These measures may be different than non-GAAP financial measures used by other companies and the presentation of these

measures is not intended to be considered in isolation or as a substitute for financial information prepared and presented in accordance with U.S. generally accepted accounting principles.

FFO is calculated in accordance with The National Association of Real Estate Investment Trusts’ definition of “funds from operations,” and is defined as net income attributable to common

stockholders (computed in accordance with GAAP), excluding gains or losses from real estate dispositions, plus real estate depreciation and amortization and real estate impairment charges.

Normalized FFO and normalized AFFO represent FFO and AFFO, respectively, adjusted for certain income and expense items that the Company does not believe are indicative of its ongoing

operating results. The Company considers normalized FFO and normalized AFFO to be useful measures to evaluate the Company’s operating results excluding these income and expense

items. AFFO is defined as FFO excluding straight-line rental income adjustments, stock-based compensation expense, amortization of deferred financing costs, expensed acquisition pursuit

costs, as well as other non-cash revenue and expense items (including provisions and write-offs related to straight-line rental income, provision for loan losses, changes in fair value of

contingent consideration, amortization of debt premiums/discounts and non-cash interest income adjustments).

Reconciliations of these non-GAAP financial measures to the GAAP financial measures we consider most comparable are provided in the reconciliations found on slide 18 of this presentation.

.

20

FORWARD LOOKING STATEMENTS

Option One

Option

Three

Ma

This presentation contains “forward-looking” statements that may be identified, without limitation, by the use of “expects,” “believes,” “intends,” “should” or comparable terms or

the negative thereof. Forward-looking statements in this presentation include, but are not limited to, statements about our merger with CCP, the expected impact of the merger on

our financial results, our ability to achieve the synergies and other benefits of the merger with CCP, and our strategic and operational plans, as well as all statements regarding

expected future financial position, results of operations, cash flows, liquidity, financing plans, business strategy, the expected amounts and timing of dividends, projected expenses

and capital expenditures, competitive position, growth opportunities and potential investments, plans and objectives for future operations and compliance with and changes in

governmental regulations. These statements are made as of the date hereof and are subject to known and unknown risks, uncertainties, assumptions and other factors—many of

which are out of the Company’s control and difficult to forecast—that could cause actual results to differ materially from those set forth in or implied by our forward-looking

statements. These risks and uncertainties include but are not limited to: the potential adverse effect on tenant and vendor relationships, operating results and business generally

resulting from the CCP merger; changes in healthcare regulation and political or economic conditions; the anticipated benefits of the merger with CCP may not be realized; the

anticipated and unanticipated costs, fees, expenses and liabilities related to the merger; the outcome of any legal proceedings related to the merger; our dependence on the

operating success of our tenants; the significant amount of and our ability to service our indebtedness; covenants in our debt agreements that may restrict our ability to pay

dividends, make investments, incur additional indebtedness and refinance indebtedness on favorable terms; increases in market interest rates; changes in foreign currency

exchange rates; our ability to raise capital through equity and debt financings; the impact of required regulatory approvals of transfers of healthcare properties; the relatively illiquid

nature of real estate investments; competitive conditions in our industry; the loss of key management personnel or other employees; the impact of litigation and rising insurance

costs on the business of our tenants; the effect of our tenants declaring bankruptcy or becoming insolvent; uninsured or underinsured losses affecting our properties and the

possibility of environmental compliance costs and liabilities; the ownership limits and anti-takeover defenses in our governing documents and Maryland law, which may restrict

change of control or business combination opportunities; the impact of a failure or security breach of information technology in our operations; our ability to find replacement

tenants and the impact of unforeseen costs in acquiring new properties; our ability to maintain our status as a REIT; and compliance with REIT requirements and certain tax and tax

regulatory matters related to our status as a REIT.

Additional information concerning risks and uncertainties that could affect our business can be found in our filings with the Securities and Exchange Commission (the “SEC”),

including Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2016 and Item 1A of our Quarterly Report on Form 10-Q for the quarter ended March 31,

2017. Forward-looking statements made in this presentation are not guarantees of future performance, events or results, and you should not place undue reliance on these forward-

looking statements, which speak only as of the date hereof. The Company assumes no, and hereby disclaims any, obligation to update any of the foregoing or any other forward-

looking statements as a result of new information or new or future developments, except as otherwise required by law.

TENANT AND BORROWER INFORMATION

This presentation includes information (e.g., EBITDAR coverage, EBITDARM coverage and occupancy percentage) regarding certain of our tenants that lease properties from us and

our borrowers, most of which are not subject to SEC reporting requirements. Genesis is subject to the reporting requirements of the SEC and is required to file with the SEC annual

reports containing audited financial information and quarterly reports containing unaudited financial information. The information related to our tenants and borrowers that is

provided in this presentation has been provided by such tenants and borrowers. We have not independently verified this information. We have no reason to believe that such

information is inaccurate in any material respect. We are providing this data for informational purposes only. Genesis’s filings with the SEC can be found at www.sec.gov.

.

21

DEFINITIONS

Option One

Option

Three

Ma

Ancillary Supported Tenants. A tenant, or one of its affiliates, owns an ancillary business that depends on providing services to the residents of the properties leased by the affiliated operating

company (Sabra’s tenant) for a meaningful part of the ancillary business’s profitability.

Cash NOI. The Company considers cash net operating income (“NOI”) an important supplemental measure because it allows investors, analysts and our management to evaluate the operating

performance of our investments. We define cash NOI as total revenues less operating expenses and non-cash revenues.

EBITDA. Earnings before interest, taxes, depreciation and amortization ("EBITDA") excluding the impact of stock-based compensation expense under the Company's long-term equity award program,

asset specific loan loss reserves, significant out of period revenues and expenses, and further adjusted to give effect to acquisitions and dispositions as though such acquisitions and dispositions

occurred at the beginning of the period ("Adjusted EBITDA") is an important non-GAAP supplemental measure of operating performance.

EBITDAR Coverage. Represents the ratio of EBITDAR to contractual rent for owned facilities (excluding Managed Properties). EBITDAR Coverage is a supplemental measure of an operator/tenant's

ability to meet their cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDAR.

EBITDARM Coverage. Represents the ratio of EBITDARM to contractual rent for owned facilities (excluding Managed Properties). EBITDARM coverage is a supplemental measure of a property's

ability to generate cash flows for the operator/tenant (not the Company) to meet the operator's/tenant's related cash rent and other obligations to the Company. However, its usefulness is limited by,

among other things, the same factors that limit the usefulness of EBITDARM.

Fixed Charge Coverage Ratio. EBITDAR (including adjustments for one-time and pro forma items) for the period indicated for all operations of any entities that guarantee the tenants' lease

obligations to the Company divided by the same period cash rent expense, interest expense and mandatory principal payments for operations of any entity that guarantees the tenants' lease obligation

to the Company. Fixed Charge Coverage is a supplemental measure of a guarantor's ability to meet the operator/tenant's cash rent and other obligations to the Company should the operator/tenant be

unable to do so itself. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDAR.

Occupancy Percentage. Occupancy Percentage represents the facilities’ average operating occupancy for the period indicated. The percentages are calculated by dividing the actual census from the

period presented by the available beds/units for the same period. Occupancy for independent living facilities can be greater than 100% for a given period as multiple residents could occupy a single

unit.

Senior Housing. Senior housing facilities include independent living, assisted living, continuing care retirement community and memory care facilities.

Skilled Mix is defined as the total Medicare and non-Medicaid managed care patient revenue at Skilled Nursing/Transitional Care facilities divided by the total revenues at Skilled

Nursing/Transitional Care facilities for the period indicated.

Skilled Nursing/Transitional Care. Skilled nursing/transitional care facilities include skilled nursing, transitional care, multi-license designation and mental health facilities.

Stabilized Facility. At the time of acquisition, the Company classifies each facility as either stabilized or pre-stabilized. In addition, the Company may classify a facility as pre-stabilized after

acquisition. Circumstances that could result in a facility being classified as prestabilized include newly completed developments, facilities undergoing major renovations or additions, facilities being

repositioned or transitioned to new operators, and significant transitions within the tenants’ business model. Such facilities will be reclassified to stabilized upon maintaining consistent occupancy

(85% for Skilled Nursing/Transitional Care and 90% for Senior Housing Facilities) but in no event beyond 24 months after the date of classification as pre-stabilized. Stabilized Facilities exclude (i)

Managed Properties, (ii) facilities held for sale, (iii) facilities being positioned to be sold, (iv) facilities being transitioned from being leased by the Company to being operated by the Company, and (v)

facilities acquired during the three months preceding the period presented.

Note: All facility financial performance data were derived solely from information provided by operators/tenants and relevant guarantors without independent verification by the Company.