Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Healthcare Trust, Inc. | v475037_8k.htm |

Exhibit 99.1

HEALTHCARE TRUST, INC. 2 nd Quarter 2017 Investor Presentation

2 Important Information Risk Factors For a discussion of the risks which should be considered in connection with our company, see the section entitled “Risk Factors” in our most recent Annual Report on Form 10 - K filed with the SEC on March 21 , 2017 . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the Company’s Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q for a more complete list of risk factors, as well as a discussion of forward - looking statements .

3 Healthcare Trust, Inc. Healthcare Trust, Inc. (including, as required by context, Healthcare Trust Operating Partnership, L.P. and its subsidiaries, the “Company” or “HTI”) invests in healthcare real estate, focusing on seniors housing and medical office buildings (“MOB”), in the United States for investment purposes.

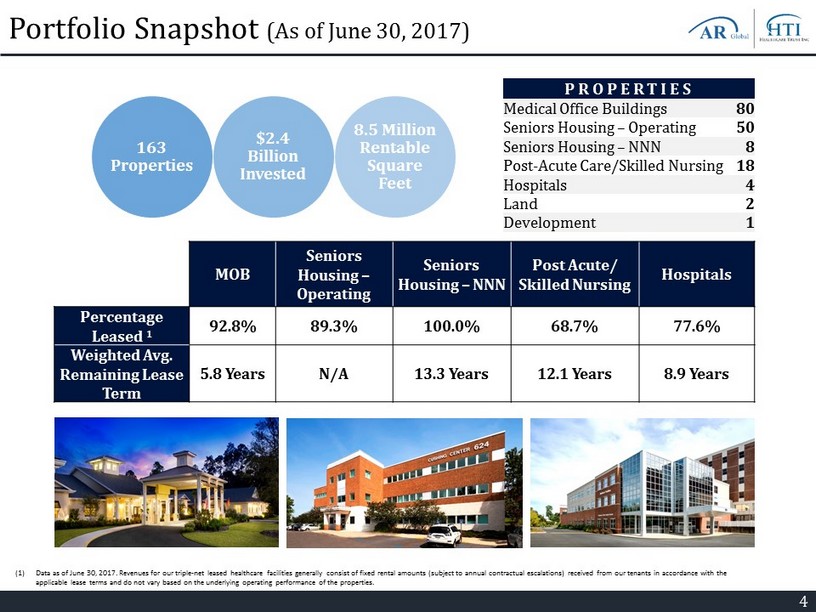

4 Portfolio Snapshot (As of June 30, 2017) PROPERTIES Medical Office Buildings 80 Seniors Housing – Operating 50 Seniors Housing – NNN 8 Post - Acute Care/Skilled Nursing 18 Hospitals 4 Land 2 Development 1 MOB Senior s Housing – Operating Senior s Housing – NNN Post Acute/ Skilled Nursing Hospitals Percentage Leased 1 92.8% 89.3% 100.0% 68.7% 77.6% Weighted Avg. Remaining Lease Term 5.8 Years N/A 13.3 Years 12.1 Years 8.9 Years 163 Properties $2.4 Billion Invested 8.5 Million Rentable Square Feet (1) Data as of June 30, 2017. Revenues for our triple - net leased healthcare facilities generally consist of fixed rental amounts (su bject to annual contractual escalations) received from our tenants in accordance with the applicable lease terms and do not vary based on the underlying operating performance of the properties.

5 Financial Overview • Low leverage provides what we believe to be ample opportunity to expand the balance sheet. • Additional acquisitions, which may require additional leverage, could assist in distribution coverage from cash flow from operations. • Estimated per - share net asset value as of December 31, 2016 of $21.45 was approved by the Company’s independent directors on March 30, 2017. The estimated per - share net asset value is used to determine the prices paid for repurchases pursuant to the share repurchase program (“SRP”) and is used as the offering price for shares sold pursuant to the distribution reinvestment plan (“DRIP”). Healthcare Trust, Inc. Balance Sheet Metrics – June 30, 2017 (all in $000s) Total Real Estate Investments, at Cost $2,333,477 Less: Accumulated Depreciation and Amortization (275,497) Total Real Estate Investments, Net 2,057,980 Cash and Cash Equivalents 158,127 Assets Held For Sale 37,822 Other Assets 53,671 Total Assets $2,307,600 Debt Outstanding: Mortgage Notes Payable (1) $392,638 Revolving Credit Facility 280,500 Master Credit Facilities 142,116 Total Debt Outstanding 815,254 Other Liabilities 64,342 Total Liabilities 879,596 Total Equity 1,428,004 Total Liabilities and Equity $2,307,600 Total Debt / Total Assets 35.3% (1) Mortgage Notes Payable reflects the gross payable balance; excludes $7.0 million of net deferred financing costs and approximately $413,000 of net mortgage premiums and discounts.

6 Corporate Initiatives ▪ Deploy additional capital: HTI will continue to focus on the most attractive sectors in healthcare, particularly medical office and seniors housing, and is actively pursuing acquisitions. ▪ Complete the HT III acquisition: On June 16, HTI entered into a purchase agreement with ARC HT III in which HTI will acquire the ARC HT III portfolio for $120 million in cash. T he ARC HT III portfolio consists of 17 MOB properties, 1 Seniors Housing – Net Lease property and 1 Seniors Housing – Operating property. The acquisition is anticipated to close in 4Q17. ▪ Access additional debt sources: Total debt to total assets remains low at 35.3% as of June 30, 2017. ▪ During 2Q17, HTI completed a $250 million loan secured by 29 MOB properties. Additional leverage is expected to be used for future acquisitions, which are expected to improve cash flow and distribution coverage. ▪ Fannie Mae Master Credit Facilities: $142.1 million of aggregate borrowings outstanding as of June 30, 2017 on two separate master credit facility agreements wit h Fannie Mae . The Company may re quest additional advances under the Fannie Mae master credit facilities by adding additional properties to the collateral pool. ▪ Actively manage assets to optimize profitability: Management continues to actively manage the portfolio, which includes: incremental leasing; where possible, replacing under performing managers; and replacing tenants for improved earnings and value.

7 Portfolio Initiatives Medical Office Building and Hospital Portfolio: ▪ On July 13, 2017, the Company closed on a $13.5 million acquisition of an MOB in Canton, GA. The property comprises approximately 38,100 rentable square feet and is 100% leased, under two leases, to a single tenant. The leases expire in December 2028 and include one, five - year renewal option. ▪ Executed LOIs to increase occupancy in the hospital and MOB assets. ▪ Continue to negotiate and execute lease extensions with existing tenants and leases and LOIs with new tenants for the purpose of generating incremental net operating income. Seniors Housing Portfolio: ▪ Continuing to execute on the acquisition strategy. ▪ During 2Q17, converted twelve net - leased assets to RIDEA structure with a new operator. Currently, in the process of converting the final four properties with the former operator to RIDEA with a new operator in the near term. ▪ Continue to work with operators to improve performance of the seniors housing portfolio, including meetings with senior management. ▪ Evaluating properties for potential dispositions to create value. Skilled Nursing Portfolio: ▪ Continue focused management of skilled nursing assets (8.5% of Gross Asset Value) to maximize income and value. ▪ Eight Missouri properties are leased to a new operator with option to purchase. ▪ Seeking replacement tenants for six Illinois assets currently in receivership.

8 Healthcare is a $3.4 trillion industry projected to grow to over $5.5 trillion by 2025¹ Investing in Healthcare: Why Now? (1) National Health Expenditure Projections 2016 - 2025. Table 2: National Health Expenditure Amounts and Annual Percent Change by Ty pe of Expenditure: Calendar Years 2009 - 2025. Centers for Medicare & Medicaid Services, Office of the Actuary. Rising Demand Due to Aging Demographics Affordable Care Act Increased Access to Healthcare; Rise in Demand Significant Growth in Healthcare Industry & Employment Deeply Fragmented Industry

9 Healthcare Market Overview ▪ Medical office fundamentals are steady, leading to a further decline in cap rates . Green Street expects 2 . 4 % annual NOI growth for medical office properties between 2017 and 2021 . 1 ▪ Medical office remains an attractive sector due to stable cap rates, no direct government reimbursement exposure and growing demand from tenants and investors . ▪ Seniors housing NOI growth under pressure due to the impact of new supply . Growth in supply is expected to peak in 2018 . We continue to focus on local markets where supply/demand fundamentals are attractive . ▪ We remain cautious on skilled nursing facilities as many operators are struggling with Medicaid reimbursement . 1 Exhibit and footnoted bullet points are from Green Street Advisors: Health Care Sector Update, August 29, 2017

10 Healthcare Market Opportunity Hospital - Based Outpatient $42B Medical Office $250B Seniors Housing $163B Inpatient Rehab Facility $15B Skilled Nursing $104B LTAC Hospitals $18B Hospitals $304B Hospital - Based Outpatient $45B Small Physician Clinics $220B MOB / Outpatient $250B Residential Care Outpatient Care Recovery & Rehabilitation Acute Care Service Intensity (Acuity ) Care Setting Source: Sg2 and Stifel Nicolaus (presented in the Healthcare Realty Trust (NYSE: HR) Investor Presentation, February 2016). Healthcare Landscape – More than $1 Trillion of Healthcare Real Estate Value

11 Organizational Leadership Leslie D. Michelson | Non - Executive Chairman, Audit Committee Chair Mr. Michelson has served as the chairman and chief executive officer of Private Health Management, a retainer - based primary care medical practice management company since April 2007. Mr. Michelson served as Vice Chairman and Chief Executive Officer of the Prosta te Cancer Foundation, the world’s largest private source of prostate cancer research funding, from April 2002 until December 2006 and s erv ed on its board of directors from January 2002 until April 2013. Mr. Michelson received his B.A. from The Johns Hopkins University in 197 3 and a J.D. from Yale Law School in 1976. W. Todd Jensen | Chief Executive Officer and President Mr. Jensen currently serves as Chief Executive Officer and President of the Company. He is also Chief Executive Officer, Chief Investment Officer and President of our advisor, Healthcare Trust Advisors, LLC (the “Advisor”). He has over 25 years of executive experience in healthcare real estate and has acquired, developed, financed, leased or managed more than $5 billion of healthcare property. He earned an MBA in Finance from the Wharton Graduate School of the University of Pennsylvania and a B.A. from Kalamazoo College. Ms. Kurtz currently serves as the Chief Financial Officer, Treasurer and Secretary of the Company and the Advisor. Ms. Kurtz is also Senior Vice President, Finance for AR Global Investments, LLC (“AR Global”), the parent of the Company’s sponsor. She is a certified publ ic accountant in New York State, holds a B.S. in Accountancy and a B.A. in German from Wake Forest University and a Master of Science in Accountan cy from Wake Forest University. Katie P. Kurtz | Chief Financial Officer, Secretary and Treasurer Ms. Pirrello currently serves as Senior Vice President with a primary focus on asset management of the seniors housing portfo lio . Ms. Pirrello brings to the Company over 25 years of real estate experience, with a particular emphasis on seniors housing properties. Rece nt positions held include Managing Director of Blue Moon Capital Partners LLC, a strategic capital source to seniors housing operating partners , a nd Senior Vice President for Bay North Capital. She holds a B.S from Bentley University. Janet Pirrello | Senior Vice President, Asset Management Mr. Leahy currently serves as Vice President with a focus on asset management of the medical office portfolio. Mr. Leahy serv ed as a member of the management team of American Realty Capital Healthcare Trust, Inc., which was sold to Ventas, Inc. (NYSE: VTR) in January 2015 . Prior to joining AR Global, Mr. Leahy was a Regional Vice President of Asset Management for Healthcare Trust of America, Inc. and Director of Por tfolio Management and Director of Real Estate for Cole Real Estate Investments. Sean Leahy | Senior Vice President, Asset Management

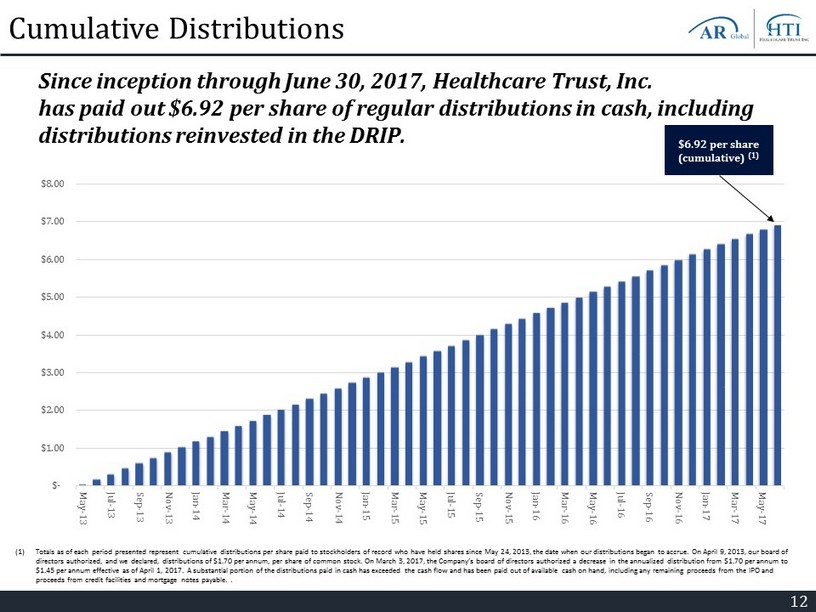

12 Cumulative Distributions Since inception through June 30, 2017, Healthcare Trust, Inc. has paid out $6.92 per share of regular distributions in cash, including distributions reinvested in the DRIP. $6.92 per share (cumulative) (1) $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 May-13 Jul-13 Sep-13 Nov-13 Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar-17 May-17 (1) Totals as of each period presented represent cumulative distributions per share paid to stockholders of record who have held sha res since May 24, 2013, the date when our distributions began to accrue. On April 9, 2013, our board of directors authorized, and we declared, distributions of $1.70 per annum, per share of common stock. On March 3, 2017, the Com pan y’s board of directors authorized a decrease in the annualized distribution from $1.70 per annum to $1.45 per annum effective as of April 1, 2017. A substantial portion of the distributions paid in cash has exceeded the cash fl ow and has been paid out of available cash on hand, including any remaining proceeds from the IPO and proceeds from credit facilities and mortgage notes payable. .

13 Supplemental Information Distribution Rate: ▪ On March 9, 2017, HTI filed a current report on Form 8 - K to announce that the Board had authorized a reduction in the distribution rate from $1.70 per share on an annualized basis to $1.45 per share on an annualized basis. This represents a change in the annualized distribution yield, based on the original purchase price of $25.00 per share, from 6.8% to 5.8%. Share Repurchase Program (“SRP”): ▪ On June 14, 2017, the Company announced that its Board had adopted an amendment and restatement of the SRP that superseded and replaced the existing SRP effective as of July 14, 2017. Under the amended and restated SRP, subject to certain conditions, only repurchase requests made following the death or qualifying disability of stockholders that purchased shares of the Company’s common stock or received their shares from the Company (directly or indirectly) through one or more non - cash transactions would be considered for repurchase. In cases of requests for death and disability, the repurchase price is equal to then - current estimated per - share net asset value at the time of repurchase. Under the SRP, repurchases of shares of the Company's common stock, when requested, are at the sole discretion of the Board and generally are made semiannually at the end of each six - month period ending June 30 or December 31. ▪ In July 2017, following the effectiveness of the amendment and restatement of the SRP, the Board approved 100% of the repurchase requests made following the death or qualifying disability of stockholders during the period from January 1, 2017 to June 30, 2017, which was equal to 263,460 shares repurchased for approximately $5.7 million at an average price per share of $21.46.

14 Risk Factors Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Rep ort on Form 10 - K for the year ended December 31, 2016 and updated in our Quarterly Reports on Form 10 - Q from time to time. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual res ult s to differ materially from those presented in our forward looking statements: ▪ Certain of our executive officers and directors are also officers, managers or holders of a direct or indirect controlling in ter est in Healthcare Trust Advisors, LLC (our "Advisor") and other entities affiliated with AR Global, the parent of our sponsor, Ameri can Realty Capital VII, LLC (the "Sponsor"). As a result, certain of our executive officers and directors, our Advisor and its affiliate s f ace conflicts of interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment pro gra ms advised by affiliates of AR Global and conflicts in allocating time among these investment programs and us. These conflicts c oul d result in unanticipated actions that adversely affect us. ▪ Our acquisition of all or substantially all of the assets of ARC HT III, which is sponsored and advised by an affiliate of ou r A dvisor, is subject to conditions. Failure to complete this transaction could have adverse consequences for us. At the closing of this tr ans action, we expect to simultaneously add qualifying properties to the borrowing base of our revolving credit facility, thereby increasing th e borrowing capacity thereunder and allowing us to draw funds from our revolving credit facility to pay a portion of the purcha se price and other costs associated with the closing. We expect to utilize a combination of availability under our revolving credit fa cil ity and cash on hand to fund the closing of the transaction. Adding any property to the borrowing base of our revolving credit facility is su bject to conditions, including consent of the agent thereunder, and there can be no assurance these conditions will be met. If we are not able to meet these conditions, we will be required to use more cash on hand than would be optimal for our future capital plans, which co uld adversely affect us. ▪ Because investment opportunities that are suitable for us may also be suitable for other investment programs advised by affil iat es of AR Global, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other investm ent s and such conflicts may not be resolved in our favor, meaning that we could invest in less attractive assets, which could reduce the in ves tment return to our stockholders. ▪ Although we intend to seek a listing of our shares of common stock on a national stock exchange when we believe market condit ion s are favorable to do so, there is no assurance that our shares of common stock will be listed. No public market currently exis ts, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid. ▪ We focus on acquiring and owning a diversified portfolio of healthcare - related assets located in the United States and are subje ct to risks inherent in concentrating investments in the healthcare industry. ▪ If our Advisor loses or is unable to obtain qualified personnel, our ability to continue to achieve our investment strategies co uld be delayed or hindered.

15 Risk Factors (Continued) ▪ The healthcare industry is heavily regulated, and new laws or regulations, changes to existing laws or regulations, loss of l ice nsure or failure to obtain licensure could result in the inability of tenants to make lease payments to us. ▪ We are depending on our Advisor to select investments and conduct our operations. Adverse changes in the financial condition of our Advisor and its affiliates or our relationship with our Advisor could adversely affect us. ▪ We may be unable to fund distributions from cash flows from operations, or maintain cash distributions or increase distributi ons over time. ▪ We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates. ▪ We depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of ou r t enants. ▪ We may not be able to achieve our rental rate objectives on new and renewal leases and our expenses could be greater, which m ay impact our results of operations. ▪ Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions. ▪ Any distributions, especially those not covered by our cash flows from operations, may reduce the amount of capital available fo r other purposes included investment in properties and other permitted investments and may negatively impact the value of our stockho lde rs' investment. ▪ We have not and may not in the future generate cash flows sufficient to pay our distributions to stockholders and, as such, w e m ay be required to fund distributions from borrowings, which may be at unfavorable rates and could restrict the amount we can borrow fo r investments and other purposes, or depend on our Advisor or our property manager, Healthcare Trust Properties, LLC to waive f ees or reimbursement of certain expenses and fees to fund our operations. There is no assurance these entities will waive such amoun ts or that we will be able to borrow funds at all. ▪ We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit marke ts of the United States from time to time. ▪ We are subject to risks associated with changes in general economic, business and political conditions including the possibil ity of intensified international hostilities, acts of terrorism, and changes in conditions of United States or international lending , c apital and financing markets. ▪ We may fail to continue to qualify to be treated as a real estate investment trust for U.S. federal income tax purposes ("REI T") , which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common s toc k and the cash available for distributions. ▪ We may be deemed to be an investment company under the Investment Company Act of 1940, as amended, and thus subject to regula tio n under the Investment Company Act. ▪ The offering price and repurchase price for our shares, including shares sold pursuant to our DRIP may not, among other thing s, accurately reflect the value of our assets and may not represent what a stockholder may receive on a sale of the shares, what th ey may receive upon a liquidation of our assets and distribution of the net proceeds or what a third party may pay to acquire the Co mpa ny.

HealthcareTrustInc.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com